Welcome to the 142 nd issue of The Aussie Painting Contractor Magazine.

What an amazing month we have had here at APN. We have hosted the South West Worldskills Event, Congratulations to all involved. We have had over 170 people through our training centre this month from apprentices, Painting Your Career Program and the Skilling Queenslanders for Work Program we are running with MEGT and Everthought Education.

I would like to welcome Tiana to the team, she has come in this month and hit the ground running. If you are looking for an apprentice or staff, reach out and we should be able to help.

Now talking of recruitment, we currently have a large list of potential apprentices, we have 51 applications and 6 that have gone into trials this week. We also attended the Jobs Now Expo yesterday and have another 10 resumes from keen people looking at painting as a career.

If your business is growing NOW is the time to get in and trial an apprentice for your business. 'Til next month, Happy Painting!!

Nigel Gorman

nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Amelia Mardon

• Caroline Miall

• Danielle Howe

• Helen Kay

• Jeannie Marie Paterson

• Jim Baker

• Leo Babauta

• Michelle O'Shea

• Mike Armour

• Nicola Howell

• Nigel Gorman

• Robert Bauman

• Sandra Price

EDITOR

Nigel Gorman GRAPHIC DESIGNER

J. Anne Delgado

Expanding Beyond Our Old Self-View

Unlocking Growth: How Your Business Lawyer Can Propel Your Small Business Forward

"PAINTING YOUR CAREER": Bridging School to Work Transitions for Tomorrow's Painters

Celebrating Women’s Success and Excellence at WorldSkills Regional Competition at Aussie Painters Network Rollin Rollin Rollin

10 WAYS TO SIMPLIFY Your QBCC Financial Reporting

Success Formula for Networking

10 Tips to Save Money on Tradies Insurance

Separating Personal and Business Expense

Could a recent ruling change the GAME FOR SCAM VICTIMS? Here’s why the banks will be watching closely

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you October incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited.

When we’re looking to grow, what we’re really trying to do is step into a new, expanded view of ourselves.

For example, if you want to be more mindful, or live more simply, or be more compassionate with yourself or others, or be more disciplined about your meaningful work … these are all new versions of you. They’re expanded beyond your old way of seeing yourself.

We’re constantly trying to expand beyond an old identity: when we try something new, or try to grow in our relationships, or try to quit a bad habit … what we’re really doing is trying to shed our old self-view.

Unfortunately, the old self-view has a gravity to it, that tries to constantly pull us back into the old way.

So in some of the examples, you might see:

• Be more mindful — the old way of going through your life mindlessly pulls you back in by having you get pulled into distractions, habitual patterns, etc.

• Be more disciplined — your old procrastinator self will put up resistance to that discipline, and have you want to avoid anything difficult or overwhelming.

• Try something new — your old comfortable self will throw up lots of resistance and thoughts to have you put off trying the new thing and feeling bad or awkward at it.

• Quit a bad habit — your old self will tell you, “Just this once won’t hurt” or “Why are you making yourself suffer” or “You deserve this reward” so that you stay in the comfort of the bad habit.

• So the old identity tries to keep us in what we know. How do we expand beyond it?

Here’s what I’ve found.

1: Set the intention of an expanded self Let’s imagine that you weren’t limited by your old identity — who do you want to be? What would you like to do that feels a bit impossible? It can be something small (“I want to wake up a little earlier”), or it can be a massive shift for you (“I want to put my creative work out into the world in a bold way”).

• Living simply — the old way of living a cluttered life tries to keep you there by having fear stop you from decluttering, or by having fear try to have you shop on impulse.

Set this intention. Get clear on why this matters to you.

Then commit yourself to the actions that this expanded self would take.

2: Practice the actions and being

The shift in your self-view will come as you take actions that are outside of the old limited self-view. If your old identity is that you are an introvert, but now you’re talking to strangers every day … the old identity can’t survive.

So commit to taking the actions every day — or at least, most days, because it’s OK to give yourself breaks. The practice the expanded self-view by taking those actions as much as possible.

It will likely be hard, because you’ll be pulled back by your old identity (see next section) … but practice doing them anyway! And as you do the actions, practice the expanded way of being as an inner state. For example, maybe you want to be more joyful as you do your work — then practice that joyfulness!

3: Notice when & how you’re getting pulled back

The old identity will try to pull you back every time you step outside of how you’ve always known yourself. If you want to speak in public, each time you sign up to do a talk, your mind will give you a bunch of reasons why you should cancel.

This is fear in action. It’s a bodily sensation of fear, resistance, dread, overwhelm. It’s also a series of thoughts — rationalizations (“It’s OK to skip it this once”) and mental gymnastics (“Life is too short to put yourself through this”).

Just notice all of this. Take notes! Get curious.

4: Give yourself compassion, but keep practicing

When you notice all of this, it’s simply fear in action. Just give your fear a bit of compassion. Breathe. Be understanding and loving.

Then take a small action, if you can. Just a tiny bit. Even that will create an opening for a new way of seeing yourself.

Leo Babauta ZEN HABITS

Women make up barely 3% of tradespeople. Aussie Painters Network is proud of the fact that 30% of the apprentices that come though our training facility are female.

Recently, our Salisbury facility was thrilled to host the WorldSkills Regional Competition, an event that showcased exceptional talent and skill in the industry and highlighted the remarkable presence and success of women competitors. This competition not only brought together the brightest young professionals at our homebase, but also underscored the strides women are making in traditionally male-dominated fields like ours.

Throughout the competition, each participant displayed incredible talent, commitment, and attention to detail. The women competitors stood out, delivering stellar performances and bringing an inspiring level of energy and craftsmanship to the event. The global Worldskills competition serves as a reminder of how integral diversity is to our industry, enriching it with new perspectives and driving standards of excellence. With more women entering and excelling in the trades, they bring both innovation and passion, strengthening the future of our industry as a whole.

Congratulations to Ali Maher who took out first place in this heat! Ali is a Worldskills veteran so to speak, who placed fourth nationals last time around but wasn’t content to leave it at that! She will once again take her skills onto the state comp and work towards nailing the title of the country’s number one.

We extend our heartfelt congratulations to all the participants for their incredible performances, and we thank each one for contributing to a successful and inspiring event. The dedication, hard work, and expertise demonstrated by each competitor were truly outstanding, making the competition memorable and leaving an indelible mark on everyone who attended.

Ongoing Support for Women’s Success in the Painting Industry

As we look forward to future competitions, we’re proud to see more women participating and excelling in trade skills. Events like WorldSkills remind us of the importance of inclusivity in developing a vibrant, skilled workforce that reflects the diversity of talent available. The remarkable achievements of our female competitors at the Salisbury competition inspire us to continue supporting and encouraging women to pursue, grow, and lead in their chosen trades.

Congratulations again to all the participants for their dedication and achievements, and here’s to many more successful WorldSkills competitions ahead!

Caroline Miall

info@WomenInPainting.com.au www.WomenInPainting.com.au 0413 345 595

If you’re singing these words now, then you are just as old as I am. It is the theme song, (sung by Frankie Lane) for the 1960’s black and white TV series, ‘Rawhide’, starring Clint Eastward. This brought me to thinking of one of the best innovations in the paint industry, and an item that painters cannot do without; the humble ‘paint roller’.

When I began my trade with my father, we painted the ceilings and walls with six-inch brushes (called Blockbusters). They were also an inch thick, so when loaded up with paint, it made them quite heavy, especially when you were painting above your head. So, when the ‘paint roller’ came onto the market, it was like ‘sliced bread’. It was fantastic. You can imagine the time saved in painting this way than doing it by brush. Funny enough though (at the time), no one thought of having a pole attachment to it; that came a few months later.

I thought that this simple piece of equipment deserved expanding on, so I want to tell you how and when the ‘paint roller’ came to be.

Prior to the invention of the paint roller, house painting was a chore best left to professionals who had the time and dexterity to create a smooth finish with their brushes. In the 1940’s, a comical explanation of how to paint a ceiling by brush was outlined in the ‘Canadian Inventions Book’.

‘Take a paint brush in your right hand, or your left hand if you are left-handed (or both hands if it is a big brush). Dip the brush into a can of paint and raise

it above your head, being careful not to let the paint roll down your arm. Dab it on the ceiling, repeat the process hundreds of times. Then—take a bath.’

As I was searching the internet to find out who actually invented the roller, two articles showed different inventors.

One was David Welt, son of Morris Welt who was a painting contractor in New York City. In 1938, David went to a print shop to have some business cards made so he could promote his father's work. David saw the printer rolling ink on to metal type. This gave him the idea that paint could be rolled. In the basement of their apartment, David Welt created the first paint roller using bent steel for the frame and carpet glued on to a wooden dowel to make the roller cover. The initial handmade rollers were not very good at applying paint but did a great job of ‘stippling’ (covering brush strokes and surface imperfections). Morris and David named their company ‘ARSCO’ which stood for ‘American Roller Stippler Company’. As they found better fabrics for the roller cores, the business grew and they began supplying to ‘Sherwin-Williams’, ‘Glidden Paints’ and many others around the world. In 1956 the small ARSCO Paint Roller factory moved from a small New York warehouse to a block long factory in Florida.

Then in 1974, David Welt's son Glen, joined Arsco and later purchased the paint roller business from his father. He renamed the company to ‘Arsco International’ and continued manufacturing paint rollers and accessories until 2017.

The second inventor made for a sad story.

Around 1940, a Torontonian named Norman Breakey devised a time saving painting tool that allowed anyone to produce a smooth finish. Breakey devised a cylinder covered in fabric that picked up more paint than a brush. He approached ‘A.B. Caya Fabrics’ executive, Tom Hamilton for advice on what type of fabric to use, an encounter Hamilton recalled for the Globe and Mail in 1984:

‘He was a white-haired gent who was full of purpose. He wanted my opinion on the best kind of fabric that offered a stiff bristly nap. I asked for what purpose, and he said, “For rolling paint.” I scratched my head at that, but he resolutely went on and described to me something with a handle shaped like a ‘7’ that would hold a cardboard, fabric-covered cylinder. “If my theory is right this thing will revolutionize painting in Canada,” he said.

Well, the best thing I could think of was that bristly green mohair velour that was used to cover railway touring coaches in those days. So I sold him a bolt of that, told him how to cut it on the bias, suggested some glues and away he went, beaming out the door. Later he came by and thanked me for my advice. He gave me one of his original rollers and a tray that had been hammered out by a local tinsmith. Neither of us knew then how big his invention would get to be’. Breakey peddled his invention to local hardware stores and painters but neglected to patent it. The result: plenty of imitations, patents that benefitted others, and the disappearance of Mr. Breakey into the mists of time.

Unfortunately, Breakey lacked the money to produce a significant supply of rollers on his own. Attempts to persuade investors to back him failed. Meanwhile, other manufacturers seized on the idea and produced their own versions of the product. Other i nventors who tinkered with Breakey’s design secured patents.

At least one account claims Breakey, a Manitoba native who moved to Toronto as a child, died poor and unsung. No histories of the paint roller list the date of his death. He went without public recognition until 1967, when he was listed in both the inventors volume of McClelland & Stewart’s ‘Canadian Centennial Library’ and a Maclean’s feature called “Who’s Who of Canadian What’s His Names.”

There have been many innovations related to the paint industry that I have personally been witness to. The major ones have been, ‘No-More-Gaps’, Nylon Bristles, Spray-guns, Aluminium Trestles and Planks and Gloss Acrylic, but to me, I think the Roller has been the biggest advancement in my lifetime as a painter.

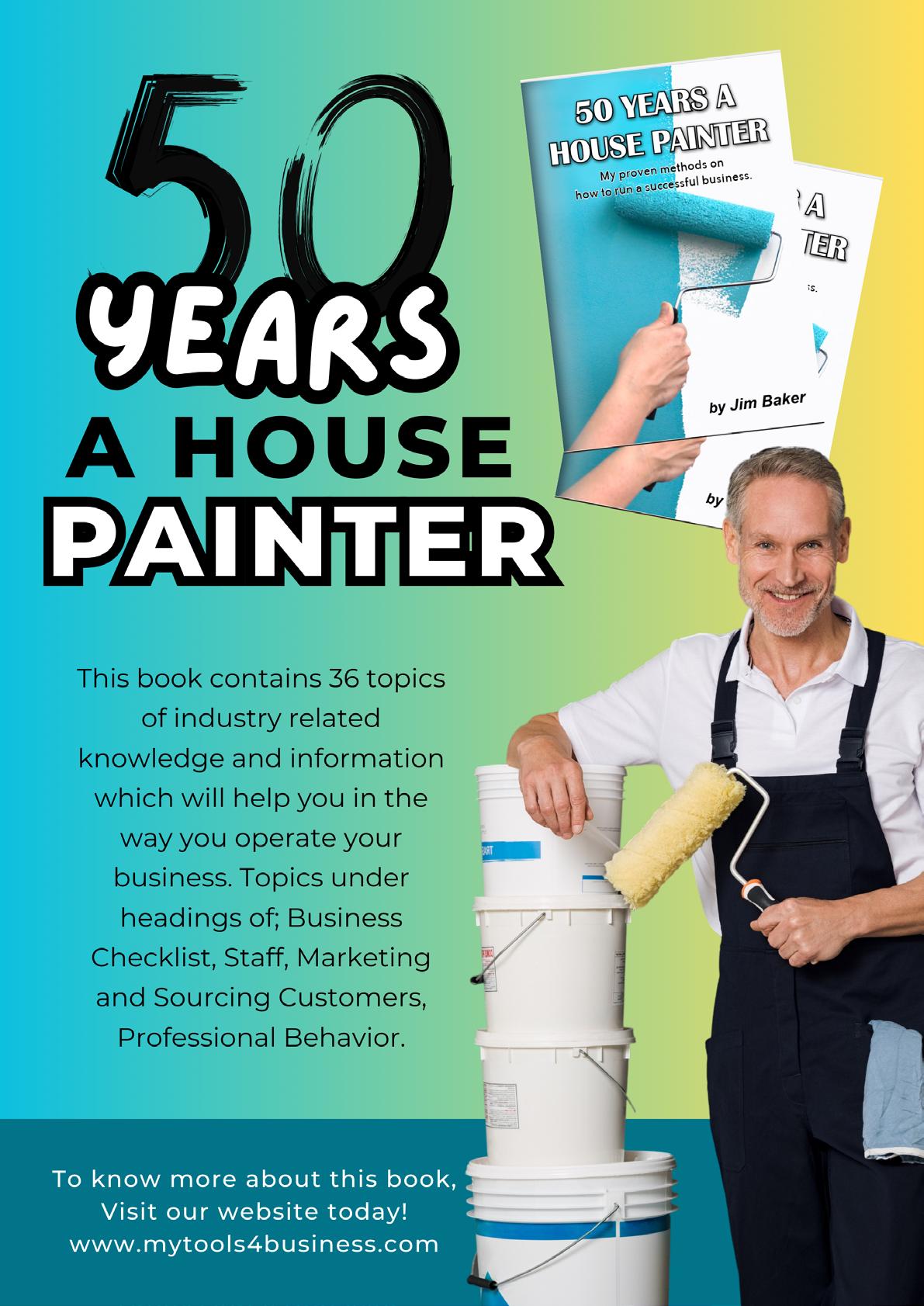

Jim Baker www.mytools4business.com

Time off work to deal with IVF, menopause, gender transition treatments, vasectomies and other reproductive health issues would be enshrined in all workplace awards if a national union campaign succeeds.

Using the line, “It’s for every body”, the Australian Council of Trade Unions (ACTU) is in Canberra this week lobbying federal politicians to agree to ten days paid leave so workers can have time to deal with reproductive health.

The call for recognised leave coincides with our research which found symptoms of menstruation, menstrual disorders, menopause and chronic conditions such as endometriosis significantly affect women’s engagement in paid work.

Our review examined 66 articles globally on workplace policies and practices relating to supporting workers with reproductive health needs.

We found employers should foster a workplace culture encouraging communication and understanding around menstruation, menstrual disorders, and menopause.

This week’s national push, led by the ACTU, has been buoyed by not-for-profit disability service provider Scope agreeing to provide 12 days reproductive

leave to its 7,000 workers. They were the first employer in the country to do so. Earlier this year, the Queensland government also introduced reproductive health leave, giving public sector workers access to ten days a year.

While unions representing health care, banking, community and education sectors have had similar success for many of their members, the ACTU now wants the National Employment Standards expanded to include the leave for all workers.

Unions representing health care, banking, community and education sectors have had similar success for many of their members.

Now the ACTU wants the National Employment Standards - the minimum employment entitlements for all employees covered by the Fair Work Act - expanded to include the leave for all workers.

Reproductive health leave is a workplace entitlement acknowledging the need for paid time and work flexibility to treat or manage reproductive health conditions.

These conditions could include menstruation, perimenopause, menopause, polycystic ovarian syndrome, endometriosis, IVF treatments, vasectomy, hysterectomy and terminations.

It differs from other leave entitlements such as personal/carer’s leave, compassionate leave and the more recently enacted family and domestic violence leave because it is not a national standard in the Fair Work Act 2009.

Figures included in the Australian Benefits Review 2023 of consultancy firm Mercer suggested businesses and governments have been slow to adopt this type of leave.

They reported only 11% of employers offered paid leave for fertility treatments, while a further 4% gave workers unpaid leave.

The number of Australians needing fertility help to become pregnant is increasing. Current statistics show fertility issues affect about one in nine couples.

The impact of menstruation, menstrual disorders, menopause and chronic conditions, such as endometriosis have received much needed attention.

The current federal parliamentary inquiry into menopause and perimenopause further recognises the significance of reproductive health.

Why reproductive health is a work issue

As our research showed, the effects of reproductive health issues ripple through workplaces and extend to the Australian economy.

Workplace rights in Australia are typically grounded in men’s experience of life and work. The “ideal” worker is an individual, typically a male, who has no external obligations or bodily demands outside their work.

Women’s bodies in the workplace are often seen as problematic, unreliable and weaker because they can menstruate, be affected by disorders of the menstrual cycle, and can experience menopause.

Due to their health needs, many women report experiencing harassment, career derailment, lack of career progression and underemployment. Some retire prematurely due to health problems.

An increasing number of Australians are experiencing fertility problems. BaLL LunLA/Shutterstock

A National Action Plan for Endometriosis has set out a productive blueprint focused on improved awareness, education, diagnosis, treatment and research to address the condition’s insidious effects.

Some women experiencing endometriosis and chronic pelvic pain reported extra leave, while important, was not necessarily their top priority. Instead, they preferred a focus on improving workplace culture, awareness and support.

Education and training of senior leaders was highly valued. Allowing workers to take bathroom breaks when needed together with quiet/rest areas were identified as ways to manage symptoms and remain engaged and productive in the workplace.

The inclusion of male specific issues, such as vasectomy and prostate screening, highlights the importance of inclusively of gender and sex in policy, however extra leave was unlikely to reduce barriers for these procedures.

Very few men report taking time off work was a barrier to getting a prostate screening, or for having a vasectomy.

Instead, barriers were mostly related to other factors. In the case of vasectomy this was often related to perceptions about lowered libido or the pain of the procedure itself.

Many employees go to significant lengths to conceal their reproductive health issues.

They remain at work “pushing through the pain”, choosing not to disclose their conditions, given the stigma and taboo associated with reproductive health issues.

A recent study found young people aged 13 to 25, in particular, are significantly affected by reproductive health issues.

While they report missing more days of work due to menstrual symptoms than their older counterparts, younger workers are less likely to be entitled to reproductive health leave because they are often employed in casual roles.

The most important consideration when assessing the value of a national plan for reproductive health leave, is there has been little research on its impact.

Our research showed there was a growing body of evidence aimed at understanding women’s experiences managing their menstrual and reproductive health in the workplace and how this affected their work/career trajectories.

However, we found a dearth of research centred on understanding interventions, and most research simply reported on menopause guidelines and focused on the United Kingdom and European Union member countries.

We currently don’t know how beneficial these entitlements may be, if they have unintended negative consequences or if people will feel like they can access them.

Before we enshrine reproductive health leave in the national employment standards, we must assess the impact this and similar leave has had in workplaces where it’s already available.

Michelle O'Shea

Senior Lecturer, School of Business, Western Sydney University

Amelia Mardon

Postdoctoral research fellow, Western Sydney University

Danielle Howe

PhD Candidate, Western Sydney University

Mike Armour

Associate Professor at NICM Health Research Institute, Western Sydney University

Mastering financial statements may seem overwhelming, but it’s essential for small business owners to thrive. Each report provides a unique perspective on your company’s financial health. This guide will simplify the process, empowering you to make smart decisions and drive your business toward success.

What is it?

A balance sheet gives a snapshot of your company’s financial status at a given moment. It lists assets, liabilities, and shareholder equity, showing what the business owns and owes.

Why it matters

Assess net worth: Knowing your assets and liabilities helps you calculate your company’s net worth. Evaluate financial stability: It indicates whether your business is stable or overly dependent on borrowed funds.

Tip : Review your balance sheet regularly to make in-

formed decisions. For example, if liabilities exceed assets, consider strategies to reduce debt and improve financial health.

What is it?

Also called the Profit and Loss Statement, it details your company’s revenues and expenses over a specific time, revealing whether you’re profitable.

Why it matters

Operational efficiency: It helps identify how effectively your business operates and what your receiving and spending

Profitability: The income statement shows how well you generate profits by managing costs or increasing revenues.

Tip : Monitor trends in expenses and revenue. Review your expenses quarterly and make adjustments where needed.

What is it?

This statement tracks cash entering and leaving your business. Divided into operating, investing, and financing activities, it shows how well you manage cash flow.

Why it matters

Liquidity: It reflects your ability to cover short-term obligations.

Expense management: A clear view of cash flow aids in budgeting and spending decisions.

Tip : Pay special attention to cash from operations. Regular negative cash flow might mean your operational efficiency or pricing needs adjustment.

What is it?

This report explains the changes in shareholders’ equity over a period, including contributions and retained earnings.

Why it matters

Investment decisions: Investors use it to gauge how their investment is performing. Profit reinvestment: It shows how profits are being reinvested in the business.

Tip : Use this to attract potential investors, showcasing how you reinvest in growth and long-term stability.

What are they?

Financial ratios, derived from your financial statements, provide deeper insights into performance. Common types include profitability, liquidity, and solvency ratios.

Why they matter

Quick insights: Ratios provide a snapshot of financial health.

Benchmarking: Compare your ratios with industry standards to measure performance.

Tip : Regularly calculate the current ratio (current assets ÷ current liabilities) to assess short-term financial health. A ratio over 1 suggests good liquidity.

What are they?

These notes explain how the financial statements were prepared, providing additional details about the methods and data used. Why they matter

Transparency: They improve the clarity and transparency of your financial reporting.

Clarity: Stakeholders can make better decisions when they fully understand the numbers.

Tip : Ensure your notes are clear and detailed. Transparency builds trust with investors and stakeholders.

Understanding financial statements isn’t just about meeting legal requirements—it’s about gaining valuable insights to guide your business. From assessing net worth via the balance sheet to managing liquidity with the cash flow statement, each report is a powerful tool for strategic decision-making.

Ready to take control of your financial health? If you need advice or assistance, reach out to our team. We’re here to help.

Legal matters can be a maze for small business owners to navigate, but having a dedicated business lawyer by your side can be the key to unlocking growth and success. Whether you’re a start-up, franchise business owner, or expanding business, the expertise and guidance of a commercial lawyer can propel your business forward. In this blog, we will explore how finding the right small business lawyer can not only provide legal support but also serve as a trusted adviser committed to your satisfaction. Dive into this insightful journey to discover how your business lawyer can be a valuable asset in propelling your business to new heights.

A small business lawyer acts as a cornerstone for laying the robust foundation your business needs to thrive. When you’re building a business, every decision counts, and a misstep, especially in legal matters, can hinder your growth. This is where looking for “a business lawyer near me” becomes invaluable. They can guide you through the complexities of busi-

ness formation, help you understand contracts, and ensure that you’re compliant with all applicable laws and regulations. By safeguarding your business from legal pitfalls, a commercial lawyer not only protects what you’ve already built but also clears the path for future expansion. Their expertise allows you to focus on what you do best – running your business – while they handle the legal intricacies that support your growth. With a trusted legal adviser, you can confidently make strategic decisions that propel your business forward.

Understanding local laws and regulations is critical for any small business, and this is where the importance of a local business lawyer becomes clear. A commercial lawyer who is well-versed in your region’s legal landscape can offer tailored advice that’s relevant to your business’s location. They can navigate State laws, and industry-specific regulations, ensuring that you avoid costly penalties and fines. They also tend to have connections with local authorities and other local business professionals, which can be beneficial for your business networking.

Your Business Lawyer: A Commercial Boost

A business lawyer is more than just a legal adviser; they are a catalyst for commercial success. As an entrepreneur, searching for a business lawyer can lead you to a partner who understands your business environment and is invested in your growth. They can assist with a variety of tasks that drive your business forward, such as negotiating contracts, drafting shareholder agreements, and protecting intellectual property. Furthermore, they can help identify opportunities for growth, such as potential partnerships or new markets to enter. Their expertise in commercial law means they are adept at foreseeing challenges and mitigating risks before they become obstacles to your success. By providing strategic legal advice, a small business lawyer ensures your company is not just protected legally but is also positioned to take advantage of opportunities that contribute to your growth and profitability.

Choosing the right business lawyer means finding someone who is not only proficient at the law but also committed to becoming a trusted adviser for your business. This type of lawyer goes beyond the

call of duty, taking the time to understand your business goals and aligning their legal strategies accordingly. They provide advice on the risks and benefits of various business decisions, acting as a sounding board for your ideas. This relationship can be particularly advantageous during periods of change or uncertainty when having a steady hand to guide you can make all the difference. Whether it’s a business expansion or navigating a tricky legal situation, your lawyer’s insights can be the key to making informed decisions. In essence, they become an extension of your team, someone who’s just as invested in your business’s success as you are, proving that their role transcends the legal realm and touches the very heart of your business strategy.

Why Choose Rise Legal: Expertise and Commitment to Client Satisfaction

Selecting Rise Legal as your business lawyer means opting for a law firm that combines expertise with unwavering commitment to client satisfaction. Our team is not only well-versed in commercial law but is also dedicated to understanding your business inside and out. This dual focus allows us to provide personalised commercial legal solutions that align with your specific needs and objectives.

We take pride in being proactive, anticipating potential legal issues before they arise and addressing them efficiently. Our commitment extends to clear communication, ensuring you understand the nuances of legal matters that impact your business. Moreover, we measure our success by your satisfaction and the smooth operation of your business. By entrusting us with your legal affairs, you gain a partner whose expertise propels your business forward, while our dedication to your satisfaction fosters a long-term relationship built on trust and mutual respect.

Our team of commercial lawyers have been instrumental in the success stories of numerous clients. Take, for example, a local start-up that approached us with a brilliant business idea but little knowledge of the legal intricacies involved in setting up their company. We provided comprehensive guidance on their business structure, intellectual property protection, and contract law, which laid the groundwork for their successful launch. Another client, a growing franchise, faced complex licensing agreements and franchise laws. Our expertise enabled them to navi-

gate these challenges with confidence, resulting in a seamless expansion. Our clients appreciate that we’re more than just their lawyers — we’re partners who are genuinely invested in their success. Every testimonial we receive is a testament to our client-focused approach and our role in helping businesses flourish amidst a myriad of legal challenges.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a free Discovery Call.

Helen Kay

P: 1300 064 707 | E: helen.kay@riselegal.com.au

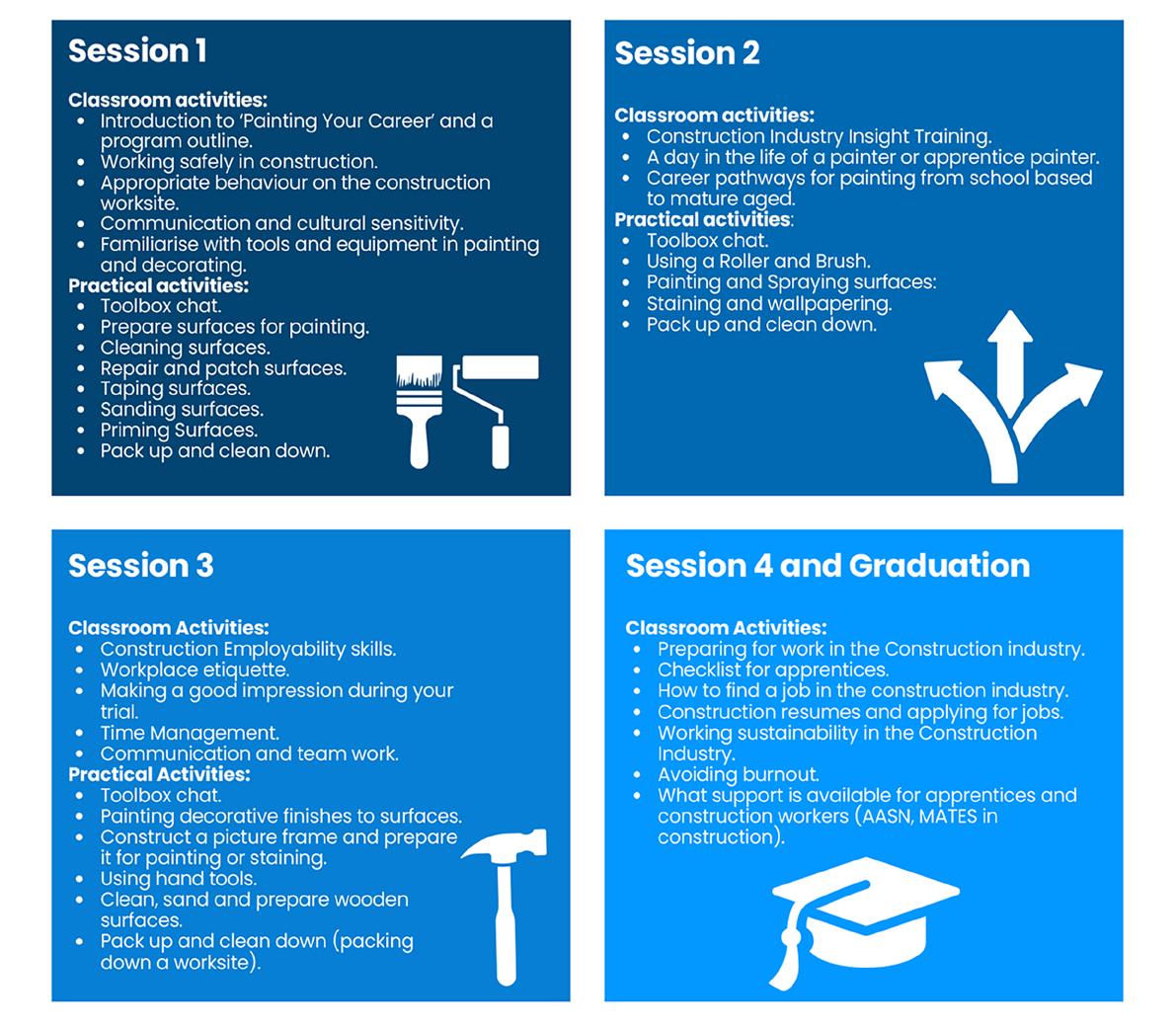

In an industry where skills, creativity, and opportunity intertwine, fostering the next generation of painting professionals is crucial. Through the Painting Your Career School to Work Transitions program, students from YMCA Junior and Senior Schools in Ipswich and The BUSY School campuses at Shailer Park and Ipswich are experiencing firsthand the paths available in the painting and decorating trade. This initiative, powered by the Queensland Government’s Queensland Workforce Strategy 2022–2032 is part of a broader commitment to workforce readiness and industry awareness, opening doors for young students to explore a promising career in painting while equipping them with essential skills and insights.

The Painting Your Career program is designed to provide students with practical exposure, guidance, and industry knowledge to ease their transition from school into the workforce. By targeting schools with a flexible approach and a VET focus, the program reaches diverse groups of students, many of whom may not have previously considered a trade career.

Students participate in hands-on workshops, talks, and interactive sessions led by experienced painting professionals. Each experience gives students insights

into the skills required, the tools of the trade, and the business dynamics of painting and decorating. They gain valuable mentorship from industry experts, offering them a clearer picture of how a career in painting can be not only viable but also rewarding.

With strong collaboration between educational institutions and industry partners, the Painting Your Career program bridges gaps that often prevent young people from considering or succeeding in trade careers. Schools like The BUSY School and YMCA have longstanding commitments to providing pathways to career development for their students. This program enriches these efforts by aligning with the curriculum and extending practical training and mentorship opportunities that help students envision real-world applications of their skills.

These partnerships with schools support the mission of preparing young people to make informed career decisions, opening up diverse options in a supportive environment. The role of the Aussie Painters Network and other industry mentors further strengthens this mission by bringing in real-life perspectives, providing a well-rounded introduction to the painting industry.

As the demand for skilled painters continues, creating an industry environment that is both inclusive and accessible for young talent is key. Programs like Painting Your Career are critical in meeting this need, ensuring students can step into the workforce equipped with both the skills and confidence necessary for success. Moreover, by involving students early in their educational journeys, the program helps demystify the painting profession and presents it as a fulfilling, achievable career option.

For participating students, the program's impact is evident. Beyond the development of hands-on skills, they are gaining awareness of a stable, financially rewarding career path, one with ample opportunities for growth and specialisation.

The Painting Your Career School to Work Transitions program serves as an inspiring example of how collaboration between educational institutions and the painting industry can transform the outlook for young people. By connecting students to experienced professionals and valuable resources, it builds a foundation for the next generation of painters and decorators in Australia. This program is not only about developing skills but about inspiring young people to build a future in an industry that values craftsmanship, creativity, and commitment.

Aussie Painters Network is still open to EOI’s from VET focussed schools that would like to participate up until July 2025. For further information, please contact caroline@aussiepaintersnetwork.com.au

Caroline Miall www.aussiepaintersnetwork.com.au

0413 345 595

Simplifying the financial reporting process for the Queensland Building and Construction Commission (QBCC) is essential for ensuring compliance while minimizing administrative burdens on businesses. From an accounting perspective, this can be achieved by adopting streamlined processes, leveraging digital tools, and ensuring a clear understanding of the requirements. Here’s a detailed guide on how to simplify QBCC financial reporting:

Before simplifying the process, it’s crucial to have a deep understanding of the QBCC’s Minimum Financial Requirements (MFR). These are the guidelines used to assess the financial viability of licensed contractors, focusing on solvency, liquidity, and working capital. Key documents include:

• Annual financial statements

• Net tangible asset calculations

• Revenue forecasts

Understanding these requirements will ensure that your reporting remains compliant and accurate.

2. Adopt Cloud-Based Accounting Software

Cloud-based accounting systems such as Xero, QuickBooks, or MYOB can significantly simplify the financial reporting process for QBCC. These tools:

• Automate transaction entries

• Provide real-time financial data

• Generate financial reports (profit & loss, balance sheet) instantly

• Help in tracking revenue and expenses, ensuring accurate financial forecasts

• Allow access to data from anywhere, making colla-boration easier for accountants and business owners.

3. Create a Reporting Template for QBCC Needs

Develop a standardized reporting template specifically tailored for QBCC compliance. This could include:

• A clear breakdown of assets and liabilities

• Detailed profit and loss statements

• Cash flow summaries

• MFR-specific reporting requirements

Having a template will speed up the process and ensure consistency in reporting year after year.

4. Automate Data Collection and Entry

Manual data entry can lead to errors and is time consuming. Automation can streamline the QBCC reporting process:

• Bank Feeds: Most cloud-based accounting systems allow for direct bank feeds, which import transaction data automatically.

• Automated Invoice Tracking: Use tools that can match invoices to payments automatically, reducing manual reconciliation.

• Expense Management: Leverage receipt scanning apps like Hubdoc or Receipt Bank, which automatically categorize expenses.

5. Regular Financial Monitoring

QBCC’s financial reporting isn’t just a once-a-year task. Regular monitoring of financial health is key to staying compliant and avoiding end-of-year panic. Establish monthly or quarterly financial check-ins to:

• Track liquidity and ensure the business meets solvency requirements

• Monitor working capital and ensure it's sufficient according to QBCC standards

• Review revenue forecasts and compare them with actual results

By doing this, you can address any discrepancies or issues throughout the year, rather than scrambling at the end of the reporting period.

If managing QBCC financial reporting in-house is too cumbersome, consider outsourcing to accounting firms that specialize in QBCC compliance. These professionals are well-versed in the specific requirements and can:

• Provide timely financial reports that meet QBCC standards

• Assist with MFR compliance calculations

• Offer advice on financial structuring to maximize compliance and minimize tax obligations

Outsourcing can be a cost-effective solution, especially for small and medium-sized businesses that lack in-house accounting resources.

Many construction and tradie businesses use project management software to track individual project costs. Integrating these tools with your accounting software can ensure:

• Accurate tracking of project-related expenses and revenue

• Real-time cost analysis and profit margins

• Seamless import of project data into your accounting software, minimizing manual data entry and reducing errors

This integration ensures that your QBCC financial reports accurately reflect the performance of your business.

QBCC’s financial reporting requirements can change over time. It’s important to stay informed about any updates or amendments to the MFR or other regulations. This can be done by:

• Subscribing to QBCC newsletters

• Attending relevant workshops or webinars

• Regularly consulting with an accounting professional who specializes in QBCC compliance

Being proactive about regulatory changes ensures that your reporting processes are always up-to-date, preventing any last-minute compliance issues.

QBCC requires businesses to maintain various financial documents for several years. Simplify the retention process by:

• Storing documents digitally using cloud storage solutions such as Google Drive or Dropbox

• Categorizing and tagging documents based on QBCC requirements (e.g., financial statements, asset valuations)

• Regularly backing up financial records to ensure data is not lost

Digital storage solutions not only make it easier to retrieve documents during QBCC audits but also reduce the time spent managing paperwork.

Finally, ensuring that your financial reporting remains compliant and streamlined means regularly seeking feedback from professionals. This could be in the form of:

• Quarterly meetings with accountants to review the business’s financial health

• Engaging an auditor or external accountant to conduct a review of your QBCC financial reports before submission

• Implementing any suggestions for improving accuracy, efficiency, and compliance in your reporting processes

Simplifying QBCC financial reporting from an accounting perspective revolves around automation,regular financial monitoring, and a deep understanding of the QBCC’s requirements. By leveraging modern accounting software, creating standardized templates, and seeking professional guidance when necessary, businesses can ensure they meet compliance standards without unnecessary administrative burdens.

Interested to find out more about how to make meeting your QBCC reporting requirements a breeze? Then call my office on (07) 3399 8844, or just visit our website at www.straighttalkat.com.au and complete your details on our Home page to request an appointment.

Please Note: Many of the comments in this article are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

Copyright © 2024 Robert Bauman.

The most obvious thing as a networker I notice when going to networking events is that most event goers are not aware of how they can make networking work successfully for themselves and their business.

I believe that there are four things you need to do and understand before networking will reach your expectations.

The first being is to know what, where, why and who your niche market is. What are you looking to achieve when you are going to events? Are you aware of who you are needing to meet for your future success? Why do you want to be in that marketplace? Do you know where you need to be to meet those business people?

These are really crucial questions if you want to get your networking right! Once you are aware of these four questions you can then set out to achieve what you want in the most cost and time effective way. Word of mouth marketing is not a ‘hit and miss’ experience. There is a formula that I believe will bring

success once you know your niche and move to that area for your connections.

Prior to going to any event you need to have goals on what you wish to achieve during the time you are there. Are you setting goals and making sure that they come to fruition. It is important that you accomplish what you set out to do and do not leave the event until you have achieved it.

Socialising is very important and you are there to meet new people, so don’t spend the time with people you already know and have developed a relationship with already. Your time with people you know needs to be limited to at least a third of your event time. Be aware of people who appear not to know anyone and support them to meet others. This will help you move into new circles of attendees. Do not leave the event until you have achieved what you went there to do! Don’t be pushy in regards to your business, you are there to learn about the other attendees firstly!

The most important part of any event is what you do after you leave and go back to your office. Make sure you email people you have met that you feel you would like to know better and see again. It is very important that you send a nice friendly email WITHOUT

any promotion on what you do in your business. One of the first turn off’s is when someone emails to say ‘nice to meet you, here is what I do’. That type of email gives you the license to hit the delete button!

Networking is all about relationship building and giving without expectation on return. Your first priority is to learn as much as you can about the person you are making contact with, asking them for more and deciding if you wish to meet them again on a oneon-one basis or at a future event. It is important that the email you send states what your intentions are in regards to learning about them. Remember, you do not know who they know or you may be looking for someone for your network who does what they are doing or you may just want to know them better and develop a personal business relationship with them. We all have different reasons for our networking and it is very easy to just turn up and expect things to happen. Networking is all about the ACTION you take to make it worthwhile for you and your business future.

There are plenty of tradie memes about clients who choose the lowest quote. Typically it involves a picture of terrible building work!

But the fact is that most people are looking for a cheap quote, and that includes tradies looking for business insurance.

What’s important of course is to find the most competitive quote for quality insurance cover that suits your business.

Whether you have Trade Risk do this for you, or you choose to go DIY and shop around yourself, these ten tips should help you to save money on your trade insurance.

The first five tips relate to starting a new policy, and the next five relate to existing policies and renewals. When starting a new policy

If you’re starting a new business insurance policy, chances are you’re starting a new trades business.

Cashflow is so important at this point, so saving money on your insurance is vital. These five tips should help get you started.

This is probably the biggest mistake that tradies make when trying to save money on insurance.

They assume that going direct to a big brand insurance company, like NRMA or AAMI for example, will get them the cheapest quote.

We’re so used to doing this with our home and car insurance, that it just seems to make sense. You get a few quotes from the big guys, choose the cheapest and you’re good to go.

Business insurance can be more complex in terms of pricing, and the big guys with their online quotes and call centres aren’t necessarily the cheapest.

Extend your search to some of the smaller players, and especially the trade specialist providers.

We can provide instant online quotes for standard trade businesses with up to five staff, and you’ll find the rates are typically more competitive than the big name brands for similar (if not better) cover.

PS. We help plenty of trade businesses with more than five staff, it’s just that we provide more tailored quotes for these clients rather than quoting them instantly online.

4. Pay annually if you can

Whether you go direct to an insurance company or via an insurance broker, paying monthly will generally cost you more.

Sometimes it’s worth it, especially with cashflow being a constant challenge for many trade businesses, but keep in mind that the overall cost will be higher.

With the direct insurers, generally they just increase the overall premium. So if you multiply the monthly payment by twelve, the total would be higher than the annual premium.

If you use a broker, generally the premium will stay the same, but you’ll be charged interest via a structure known as premium funding, or premium financing.

In this case the funder (typically a third party) is essentially lending you the money to pay the premium, and you then pay them back over 10-12 months depending on the setup.

Either way, if you can pay the full premium for your trade insurance you’ll generally pay less.

3. Know what you’re paying for

This one’s a little trickier to explain, but it’s so important to understand what you need and what you’re paying for.

A classic example is tradies, and especially handymen, undertaking work for real estate agencies and property managers.

The standard paperwork will state that you need a range of insurances including public liability and professional indemnity.

If you don’t know what you really need, you’ll just go off and buy both policies, but in reality, you most probably don’t need professional indemnity insurance.

As brokers we have to explain this to handymen on a weekly basis, and we’ve even written an article about it!

Knowing what you need, and what you’re paying for, can help you save money by not paying for insurance that isn’t even relevant for your business.

Tip: A good insurance broker will be able to tell you all of this!

2. Package your policies

If you have multiple policies you might be able to save money by combining them.

Most trade businesses, even if you’re just one person, will have a need for at least three policies. Your public liability, your tools and your vehicle.

You can probably include personal accident insurance too.

Combining them can mean one of two things. It could mean combining them into a single policy with the same insurer, or it could mean having multiple policies with multiple insurers but managed via a single insurance broker.

Combining or packaging your policies is no guarantee of saving money. Sometimes spreading your policies across insurers can actually work in your favour, as a single insurance company isn’t necessarily going to be the cheapest across all of the covers you need.

For example Company 1 might be cheapest for public liability and tools, Company 2 might be cheapest for your vehicle and Company 3 might be cheapest for your personal accident cover.

Never assume that having everything on a single policy will be the cheapest option!

1.

We are an insurance broker, so of course we’re going to list this as one of our tips!

But we can back it up…

We save tradies money by doing the shopping around for them. You tell us all about your business, and we’ll use our knowledge and experience to find the most competitive premiums to suit your needs.

In many cases we’ll be able to find you a better premium than you could on your own, simply because of our size and experience in having helped over 10,000 tradies with their insurance needs.

One of the first mistakes that a tradie can make with business insurance is assuming that using a broker will cost them more. In most cases, a good broker will actually cost you less.

Existing policies and renewals

Once your business insurance is in place it can be easy to get lazy and let it roll over each year without shopping around or making changes.

The is especially true for tradies, as you have so much else going on trying to juggle work on site as well as all the paperwork.

But if you can spare an hour or two each year to look at your renewal properly, you could definitely save yourself some good money on your trade insurance.

5. Advise us if your business shrinks

Most public liability insurance policies are priced based on the size of the business. It’s not the only factor, but it is one of the big ones.

Size is measured differently by different insurers. Some look at the size in terms of staff numbers, and other look at the size of your annual revenue.

Often we’ll ask for both measures, which allows us to obtain quotes from different insurers regardless of how they measure size.

A trade business can grow and shrink in size from year to year depending on many factors, including the timing of completion on larger projects.

If your revenue was $1 million last year and you don’t provide any updated figures for this year, your policy will be renewed assuming the same revenue.

But if you have fewer projects being completing this year, or perhaps you’ve just downsized, you’ll be paying more for your insurance than you need to.

So if you’re expecting reduced revenue in the upcoming renewal period, make sure you let us or your insurance company/broker know.

The same applies to staff numbers if that’s how your insurer rates your policy. If you’re expecting to have fewer staff this year because you have fewer projects on the go, make sure you update your policy.

Some insurers take into account the percentage of your revenue that goes to subcontractors.

The higher your use of subcontractors, the higher the cost of your public liability could be.

If you’ve reduced your usage of subbis from one year to the next, make sure you let us know as this could result in a significant saving on your public liability insurance.

Another factor that the insurance companies use to calculate your public liability insurance cost is the activities you undertake.

Not just what trade you do (although that is part of) but any higher-risk activities you undertake.

For example, an electrician would be considered a standard trade under a liability policy, but if you’re doing work at power stations or airports, you’re now in the higher-risk category.

If you were undertaking this type of work when you took out your policy, you’d be paying considerably more than a standard policy.

You will continue to pay that higher amount until you tell your insurer or your broker that you’ve stopped.

If you don’t tell us, you could be paying hundreds (or thousands) more for your insurance each year than you need to.

The reverse is also true though… If you’ve started undertaking higher-risk activities and don’t tell us, you’ll be paying less for your insurance, but any claim relating to those activities will be declined.

So whether you’ve stopped or started undertaking higher-risk activities, make sure you tell us!

3. Pay annually if you can

We’ve already covered this in the new policy section, but the same applies to renewals.

Paying monthly will almost always cost you more than paying annually. This is regardless of whether you’re going through a broker or direct to an insurance company.

But before you curse the monthly option for being more expensive, you need to consider the value of managing your cashflow.

Spreading the cost of your trade insurance across the year might cost you more, but it could also free up cashflow that you can spend in other areas to help grow your business, rather than having to pay the full amount on day one of your policy.

And don’t think that financing your insurance through a premium funding company is just for companies that can’t afford the full premium. Large companies with tens of millions in revenue often fund their insurance with premiums in the hundreds of thousands.

2. Package your policies

This is another tip that we already shared in the section on new policies.

Packaging your policies can be done two different ways. If you’re dealing directly with an insurance company, it would mean having all of your covers with a single insurer.

This rarely works out for the best, as the cheapest company for public liability mightn’t be competitive on tool insurance or vehicle insurance.

The other option is to have all of the policies with a single insurance broker, such as Trade Risk.

We can have multiple policies spread across multiple insurers to ensure we’re getting the best deal on each one, but you still have a single point of contact, being us.

If you’re paying monthly we can combine them all into a single monthly payment, even when the policies are with different insurers.

We recently helped an electrical contractor who had most of his business insurance with us, but his five vehicles were insured elsewhere. He had them with the same big name car insurance company, but each vehicle was on a separate policy.

He thought he was doing the right thing, but we combined the five vehicles onto a fleet policy and managed to save him $250 a month!

1. Use an insurance broker

Last but not least, use a broker!

A good broker (like us, with over 600 five-star reviews!) will not only help you when first setting up your insurance, but also at renewal time.

Every renewal we’ll look around to see if we can find a more competitive deal for you, along with ensuring your cover is still appropriate for your trade business.

We’ll ask you the right questions to help us to shop around, which saves you having to do the running around. So not only will a good broker help you to save money, but also time. And in any business, especially a trade business, time is money!

There are some things in life that go together well and others that definitely do not. Business and personal finances are in the category of items that should not be mixed. Although it may seem like a headache to keep them separate—who wants to manage all those bank accounts?—your life will be greatly simplified once you separate your personal and your business finances, especially your expenses.

Paperwork and taxes will be easier to manage and you’ll have a better idea of how much money you spend on your business. Here are some tips to keep your personal and your business expenses separate

Understand the difference between personal and business expenses

Most times, the line between personal and business expenses is clear. Any expense that is directly linked to your business earning an income is a business expense. If you buy something to be used for your business, it’s a deductible business expense. If you buy something to use privately, that’s a personal expense.

If something is mixed between business and personal, such as a laptop that you use partially for business and partially for personal use, you can only claim a deduction for the amount that you use for business. So if you use the laptop for business 75 percent of the time and for personal use 25 percent of the time, you can only deduct 75 percent of the laptop. Whether you use something entirely or partially for business, you need to have a record of the purchase.

Open a business credit card and/or bank account

Having a business credit card and/or bank account provides you with an easy way to not only keep your private and business expenses apart, it also gives you an easy way to track your expenses. When you use the same accounts for business and personal use, everything is mixed on the same statement and it can be difficult to determine—or remember—which transactions were related to your business and which were for your private life.

With business accounts you know that every transaction is related to your business and should therefore be deductible. You don’t have to search through every statement at tax time to highlight the deductible expenses because every transaction is business related.

You can also easily check your statements to see how much money your business is spending. That’s incredibly difficult to do if your business and personal transactions are all linked to one account.

Depending on how small your business is, you may not be able to keep all items separate, but buying devices that are used for both business and personal use gets complicated. In an ideal world, you have a separate computer for home and work, a separate work and personal cell phone and even separate vehicles.

Having duplicate items for work and personal use makes it much easier to track expenses. Rather than determining how much of your cell phone bill you can deduct for business, you know that your business phone is 100 percent deductible. Same with your computer and your vehicle. It costs more—especially the separate vehicle—but it keeps your personal life separate from your business life.

It can be tempting to try to write everything off as a business expense but don’t fall into that trap. Open separate accounts, buy duplicate items where you can and keep receipts of your business expenses.

Talk to a financial advisor about what activities count as a tax deduction and which do not if you are unsure. An advisor will answer your questions and can even help you come up with a system to track your expenses.

If you need some guidance for your business, feel free to drop us a message so we can schedule a one-on-one consultation.

In Australia, it’s scam victims who foot the bill for the overwhelming majority of the money lost to scams each year.

A 2023 review by the Australian Securities and Investments Commission (ASIC) found banks detected and stopped only a small proportion of scams. The total amount banks paid in compensation paled in comparison to total losses.

So, it was a strong statement this week when it was revealed the Australian Financial Conduct Authority (AFCA) had ordered a bank – HSBC – to compensate a customer who lost more than $47,000 through a sophisticated bank impersonation or “spoofing” scam.

This decision was significant. An AFCA determination is binding on the relevant bank or other financial institution, which has no direct right of appeal. It could have implications for the way similar cases are treated in future.

The ruling comes amid a broader push for sector-wide reforms to give banks more responsibility for detecting, deterring and responding to scams, as opposed to simply telling customers to be “more careful”.

Here’s what you should know about this landmark ruling, and what it might mean for consumers.

Read more: Australia’s new scam prevention draft is welcome – but it needs to be broader in scope

You might be familiar with “push payment” scams that trick the victim into paying money to a dummy account. These include the “mum I’ve lost my phone” scam and some romance scams.

The recent case concerned an equally noxious “bank impersonation” or “spoofing” scam. The complainant – referred to as “Mr T” – was tricked into giving the scammer access to his HSBC account, from which an unauthorised payment was made. The victim was duped into

The scammer sent Mr T a text message, purportedly asking him to investigate an attempted Amazon transaction.

In an effort to respond to the (fake) unauthorised Amazon purchase, Mr T revealed security passcodes to the scammer, enabling them to transfer $47,178.54 from his account and disappear with it.

The fact Mr T was dealing with scammers was far from obvious – scammers had information about him one might reasonably expect only a bank would know, such as his bank username.

On top of this, the scam text message appeared in a thread of other legitimate text messages that had previously been sent by the real HSBC.

AFCA’s ruling

HSBC argued to AFCA that having to pay compensation should be ruled out under the ePayments Code, a voluntary code of practice administered by ASIC.

Under this code, a bank is not required to compensate a customer for an unauthorised payment if that customer has disclosed their passcode. The bank argued the complainant had voluntarily disclosed these codes to the scammer, meaning the bank didn’t need to pay.

AFCA disagreed. It noted the very way the scam had worked was by creating a sense of urgency and crisis. AFCA considered that the complainant had been manipulated into disclosing the passcodes and had not acted voluntarily.

AFCA awarded compensation covering the vast majority of the disputed transaction amount, lost interest charged to a home loan account, and $5,000 towards Mr T’s legal costs.

It also ordered the bank to pay compensation of $1,000 for poor customer service in dealing with the matter, including communication delays.

Other cases may be more complex

In this case, the determination was relatively straightforward. It found Mr T had not voluntarily disclosed his account information, so was not excluded from being compensated under the ePayments Code.

However, many payment scams fall outside the ePayments Code because they involve the customer directly sending money to the scammer (as opposed to the scammer accessing the customer’s account). That means there is no code to direct compensation.

Still, AFCA’s jurisdiction is broader than merely applying a code. In considering compensation for scam losses, AFCA must consider what is “fair in all the circumstances”. This means taking into account:

• legal principles

• applicable industry codes

• good industry practice

• previous AFCA decisions

Relevant factors might well include whether the bank was proactive in responding to known scams, as well as the challenges for individual customers in identifying scams.

At the heart of this determination by AFCA is a recognition that, increasingly, detecting sophisticated scams can be next to impossible for customers, which can mean they don’t act voluntarily in making payments to scammers.

Similar reasoning has informed a range of recent reform initiatives that put more responsibility for detecting and responding to scams on the banks, rather than their customers.

In 2023, Australia’s banking sector committed to a new “Scam-Safe Accord”. This is a commitment to implement new measures to protect customers, including a confirmation of payee service, delays for new payments, and biometric identity checks for new accounts.

Changes on the horizon could be more ambitious and significant.

The proposed Scams Prevention Framework legislation would require Australian banks, telcos and digital platforms to take reasonable steps to prevent, detect, report, disrupt and respond to scams.

It would also include a compulsory external dispute resolution process, like AFCA’s, for consumers seeking compensation for when any of these institutions fail to comply.

Addressing scams is not just an Australian issue. In the United Kingdom, newly introduced rules make paying and receiving banks responsible for compensating customers, for scam losses up to £85,000 (A$165,136), unless the customer is grossly negligent.

Jeannie Marie Paterson Professor of Law, The University of Melbourne

Nicola Howell Senior lecturer, Queensland University of Technology

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD

WorkSafe Victoria

SafeWork NSW

SafeWork SA

WorkSafe WA NT WorkSafe

WorkSafe Tasmania

Cancer Council Australia

Ph. 0430 399 800

Ph. 1300 319 790

Ph. 13 72 26 / Ph. 13 28 65 Ph. 13 13 94 Ph. 1800 003 338 Ph. 1300 642 111

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au www.worksafe.vic.gov.au www.safework.nsw.gov.au www.safework.sa.gov.au commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

actcancer.org cancercouncil.com.au cancercouncilnt.com.au cancerqld.org.au cancersa.org.au cancervic.org.au

cancerwa.asn.au

(02) 6257 9999 (02) 9334 1900 (08) 8927 4888 (07) 3634 5100 (08) 8291 4111 (03) 9635 5000 (08) 9212 4333