Welcome to the 140 th issue of The Aussie Painting Contractor Magazine.

It’s been another big month with lots of activities that the APN staff and I have been involved in.

For all our Members, you should have had a call from Meigen who has taken on the position this month of Membership and Marketing Consultant. If she hasn’t spoken to you already expect a call. She will also be reaching out to non-members as we have quite a few applicants looking for apprenticeships all over the country.

Caroline caught up with Sussan Ley, the Deputy Opposition Leader to discuss Women in Painting and where our industry is at. She also attended multiple NAWIC events on behalf of the painting industry. She is now sitting on the Wivenhoe Local Jobs Council and assisting them with an industry perspective.

We were involved in 3 Worldskills Events in collaboration with Ashmore Tafe, TAFE Qld SkillsTech and CQ University in Rockhampton. These 3 events were highly competitive with some fabulous skills from all competitors on display. There is still 1 more to go and I will add an article in next months edition showcasing the events.

I can not emphasise enough to you all, since I had my heart attack I have had many calls from others that have had the same issues and not shared with others. If you just need a chat about your experiences reach out. If you have any kind of chest pains, call 000 straight away.

'Til next month, Happy Painting!!

Nigel Gorman

nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Caroline Miall

• Chelsea Reynolds

• Jim Baker

• Leo Babauta

• Leonora Risse

• Nigel Gorman

• Oliver Kay

• Robert Bauman

• Sandra Price

EDITOR

Nigel Gorman GRAPHIC DESIGNER

J. Anne Delgado

Protecting Your Tradie Business with Effective Credit Applications

Streamlining your supply chain: How technology can make it easier for Small Business Owners

Forcing Yourself to Do a Task vs. Letting Yourself Off the Hook

Australia’s gender pay gap has hit a record low – but we still have work to do

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine do not necessarily represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related parties. The publisher, Aussie Painters Network and Aussie Painting Contractor Magazine personnel are not liable for any mistake, misprint or omission. Information contained in the Aussie Painting Contractor Magazine is intended to inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you September incur directly or indirectly as a result of

or

of the

As a commercial lawyer who frequently assists tradie business owners, one of the most common requests we receive is to prepare credit applications that allow clients to offer payment terms. Extending credit can be a valuable tool for growing your business, but it also comes with risks. Ensuring you have comprehensive business protection documents is crucial to safeguard your interests. Here’s what you need to consider and how a lawyer can help.

Clearly outline the payment terms, including the due date, interest on overdue accounts, and any early payment discounts. This sets clear expectations for your clients and provides a legal basis for collecting payments. Here’s a detailed look at what should be included:

Due Date: Specify the exact due date for payments. This could be a set number of days from the invoice date (e.g., 30 days net) or a specific date each month. Clearly stating the due date helps prevent confusion and ensures clients understand when payments are expected.

Payment Methods: Detail the accepted payment methods, such as bank transfer, credit card, or cheque. Offering multiple payment options can make it easier for clients to pay on time.

Invoice Frequency: Indicate how often invoices will be issued (e.g., weekly, monthly). Consistent invoicing helps clients plan their payments and improves your cash flow management.

Interest Rate: Clearly state the interest rate applied to overdue accounts. This could be a monthly or annual rate (e.g., 2% per month on overdue amounts). Charging interest on late payments incentives timely payments and compensates you for the delay.

Calculation Method: Explain how the interest will be calculated (e.g., daily or monthly). Providing a clear formula helps clients understand the potential costs of late payments.

Discount Percentage: Offer a specific discount percentage for early payments (e.g., 2% discount if paid within 10 days). Early payment discounts encourage clients to pay ahead of schedule, improving your cash flow.

Eligibility Criteria: Define the criteria for qualifying for the discount, ensuring it’s clear and straightforward. This might include paying the full amount within the specified period without any outstanding disputes.

Fixed Fees: In addition to interest, consider applying a fixed late payment fee (e.g., $50 for each late payment). This adds an additional deterrent against late payments.

Escalation Procedures: Outline the steps you will take if payments remain overdue, such as sending reminder notices, applying additional fees, or escalating to collections. Clear procedures ensure clients are aware of the consequences of late payments.

Terms Clarity: Use straightforward and unambiguous language to describe all terms and conditions. Avoid legal jargon to ensure clients fully understand their obligations.

Documentation: Provide written documentation of the terms and conditions that clients can refer to. This could be included in contracts, invoices, and the credit application itself.

Enforceability: Ensure that your terms and conditions are legally enforceable. This might involve including specific clauses that comply with relevant laws and regulations.

Dispute Resolution: Include a clause that outlines the process for resolving disputes related to payment terms. This could involve mediation or arbitration before legal action, helping to maintain professional relationships and avoid costly litigation.

Periodic Review: Regularly review and update your credit terms and conditions to reflect changes in your business environment, economic conditions, and legal requirements. Keeping terms up-to-date ensures they remain relevant and effective.

Client Communication: Communicate any changes to clients in advance, providing ample notice and explaining the reasons for the updates. Transparency in communication helps maintain trust and compliance.

By incorporating these detailed elements into your credit terms and conditions, you create a robust framework that promotes timely payments, reduces disputes, and enhances your business’s financial stability. Partnering with a commercial lawyer can further ensure that your terms are comprehensive, enforceable, and tailored to your specific needs, providing peace of mind and protecting your tradie business from potential financial risks.

To protect your business, consider requiring personal guarantees from the directors or owners of the client company. This ensures that you have recourse to personal assets if the business fails to pay. Here’s why personal guarantees are crucial and how they work:

Increased Accountability: By requiring a personal guarantee, you hold the directors or owners personally accountable for the debt. This personal accountability motivates them to ensure timely payments, as their personal assets are at risk. It creates a sense of responsibility that goes beyond the business entity, making defaults less likely.

Enhanced Security: A personal guarantee provides an additional layer of security for your business. If the client company faces financial difficulties or insolvency, you have the legal right to pursue the guarantor’s personal assets to recover the debt. This security measure can be the difference between recovering your money and facing a total loss.

Risk Mitigation: Personal guarantees help mitigate the risk associated with extending credit. They act as a safety net, ensuring that even if the business fails, you have a recourse to recover the owed amount. This reduces the overall financial risk and provides peace of mind when offering credit terms.

Improved Credit Management: When clients know that their personal assets are on the line, they are more likely to manage their credit responsibly. This leads to better credit management practices, reducing the likelihood of late payments or defaults. It encourages clients to prioritize your invoices, enhancing your cash flow.

Drafting the Guarantee: A personal guarantee is a legally binding document that should be carefully drafted to ensure it is enforceable. It should clearly outline the extent of the guarantor’s liability, specifying that they are personally responsible for the debt if the business fails to pay. Working with a commercial lawyer ensures that the guarantee is comprehensive and legally sound.

Identifying the Guarantor: Typically, the guarantors are the directors or owners of the client company. It’s important to verify their personal financial standing before accepting them as guarantors. Conducting credit checks and assessing their assets can provide insight into their ability to fulfil the guarantee if necessary.

Securing the Guarantee: Once the guarantee is drafted and the guarantor identified, the document should be signed and witnessed to ensure its validity. It’s crucial to maintain accurate records of the signed

guarantee and any related documentation. This ensures that you have all necessary evidence in case you need to enforce the guarantee.

Enforcing the Guarantee: If the client company defaults on its payment obligations, you can enforce the personal guarantee. This involves legal proceedings to claim the debt from the guarantor’s personal assets. Having a well-drafted and properly executed guarantee simplifies this process and increases the likelihood of successful recovery.

Compliance with Laws: Personal guarantees must comply with relevant laws and regulations to be enforceable. A commercial lawyer can ensure that your guarantees meet all legal requirements, reducing the risk of disputes or invalid guarantees. Compliance is critical to protect your rights and ensure you can effectively enforce the guarantee.

Clear Terms and Conditions: The terms and conditions of the personal guarantee should be clearly defined, including the extent of liability, conditions for enforcement, and any limitations. Clear terms help prevent misunderstandings and provide a solid legal foundation for enforcement.

Regular Review: Personal guarantees should be reviewed regularly to ensure they remain valid and enforceable. Changes in the client’s business structure or the guarantor’s financial situation can impact the effectiveness of the guarantee. Regular reviews and updates by a commercial lawyer keep your guarantees current and effective.

Requiring personal guarantees is a powerful strategy for protecting your tradie business when extending credit. By holding directors or owners personally accountable, you enhance your security, mitigate risk, and improve credit management practices. With the expertise of a commercial lawyer, you can ensure that your personal guarantees are legally sound, clear, and enforceable, providing you with the peace of mind that your business interests are protected. Don’t leave your business vulnerable—implement personal guarantees in your credit applications and secure your financial future.

Define a credit limit for each client and set up regular reviews of their creditworthiness. This helps manage your exposure to risk and allows you to adjust terms as needed based on the client’s financial situation.

Establishing a credit limit is a critical step in managing the financial exposure of your tradie business. This limit should be based on a thorough assessment of the client’s financial health, payment history, and the nature of your business relationship. By setting a credit limit, you cap the maximum amount of credit you are willing to extend, thereby protecting your business from potential overextension and financial strain.

Assess Client Financial Health: Conduct a comprehensive financial assessment of your clients before extending credit. This can include reviewing financial statements, credit reports, and bank references. Look for indicators of financial stability such as consistent revenue, profitability, and positive cash flow.

Review Payment History: Evaluate the client’s payment history with your business and other suppliers. A history of timely payments is a good indicator of creditworthiness, while frequent late payments or defaults signal potential risks.

Consider Business Relationship: Take into account the length and nature of your relationship with the client. Long-standing clients with a history of reliable transactions may warrant higher credit limits compared to new or less familiar clients.

Creditworthiness is not static: it can change over time due to various factors such as economic conditions, industry trends, and the client’s internal business dynamics. Regularly reviewing your clients’ creditworthiness helps you stay informed about their financial status and allows you to adjust credit terms proactively.

Scheduled Reviews: Implement a schedule for regular credit reviews, such as quarterly or bi-annually. This ensures that you consistently monitor the financial health of your clients and adjust credit limits as needed. Monitor Financial Indicators: Keep an eye on key financial indicators such as changes in revenue, profit margins, and cash flow. Sudden declines in these metrics could signal financial trouble and prompt a review of the client’s credit terms.

Update Credit Reports: Obtain updated credit reports from credit bureaus to check for any changes in the client’s credit score or payment behaviour. This provides an objective measure of their current creditworthiness.

Client Communication: Maintain open communication with your clients about their financial situation. Encourage them to share any significant changes in their business that could impact their ability to meet credit terms. This transparency helps build trust and enables you to make informed decisions.

Adjusting Credit Terms Based on Reviews: Based on the findings from your regular reviews, you may need to adjust the credit terms to better manage your risk exposure. This could involve increasing or decreasing the credit limit, shortening payment terms, or requiring additional guarantees.

Increase Credit Limit: If a client’s financial health has improved and they have a history of timely payments, consider increasing their credit limit. This can strengthen your business relationship and potentially increase sales.

Decrease Credit Limit: If a client’s financial health has deteriorated or they have been late with payments, it may be prudent to lower their credit limit to mitigate risk.

Shorten Payment Terms: Reducing the payment terms for clients with declining creditworthiness can help you receive payments faster and reduce exposure to potential defaults.

Require Additional Guarantees: For clients with higher risk, consider requesting additional security measures such as personal guarantees or collateral to protect your interests.

By defining a credit limit for each client and conducting regular reviews of their creditworthiness, you can effectively manage your exposure to risk and ensure your tradie business remains financially stable. This proactive approach not only protects your business but also helps maintain strong and sustainable client relationships.

Registering a security interest under the Personal Property Securities Act (PPSA) can provide an additional layer of protection. This can give you priority over other creditors if the client becomes insolvent.

When offering credit to clients, it is crucial to protect your business from potential financial losses. One of the most effective ways to do this is by registering a security interest. Here’s a detailed look at how security interests work and why they are vital for tradie businesses:

Understanding Security Interests: A security interest is a legal claim on assets that a borrower offers to a lender as collateral for a loan or credit. Under the PPSA, a security interest can be registered on the Personal Property Securities Register (PPSR). This registration is essential as it establishes your priority as a creditor over the specified assets.

Benefits of Registering a Security Interest

Priority in Insolvency: If a client becomes insolvent, secured creditors with registered interests have a higher claim on the client’s assets compared to unsecured creditors. This increases the likelihood of recovering the owed amounts.

Reduced Risk: By having a registered security interest, you significantly reduce the risk associated with extending credit. This legal claim on assets acts as a safeguard, ensuring that you have a recourse if the client defaults.

Legal Protection: Registering a security interest provides a clear legal framework for enforcing your rights. It ensures that your claim is recognised and can be enforced in case of a dispute or insolvency.

Types of Security Interests

PMSIs (Purchase Money Security Interests): These are interests that give priority over other secured interests. They can be claimed on goods purchased with the credit provided.

General Security Agreements (GSAs): These cover all present and future assets of the client, providing broad protection.

Identify Collateral: Determine the assets that will be used as collateral. This can include equipment, inventory, receivables, or other valuable property.

Prepare Documentation: Draft a security agreement that outlines the terms and conditions of the security interest. Ensure this document complies with PPSA requirements.

Register on PPSR: Submit the details of the security interest on the PPSR. This includes information about the secured party (you), the grantor (client), and the collateral.

Maintain and Update Registration: Regularly review and update the registration to ensure it remains valid and reflects any changes in the collateral or the terms of the credit.

Enforcement of Security Interests: If a client defaults on their payment obligations, you can enforce the security interest. This might involve repossessing the collateral, selling it to recover the owed amount, or taking legal action to claim the assets. The PPSA provides a structured process for enforcement, ensuring your rights are protected.

Legal Assistance in Registering Security Interests: Navigating the complexities of the PPSA and registering security interests can be challenging. A commercial lawyer can assist you in:

• Drafting and Reviewing Agreements: Ensuring that all security agreements are legally sound and comprehensive.

• Registration Process: Guiding you through the PPSR registration process to ensure accuracy and compliance.

• Enforcement: Providing legal support in enforcing security interests and recovering debts.

By incorporating security interests into your credit applications, you significantly enhance the protection of your tradie business. It ensures that you have a legal claim to assets, reduces financial risks, and provides a clear framework for recovering debts in case of client insolvency. Partnering with a knowledgeable commercial lawyer can further ensure that your security interests are effectively managed and enforced, giving you peace of mind and robust protection for your business.

Include clear clauses outlining what constitutes a default and the actions you can take, such as suspending services or accelerating the debt (requiring immediate payment of all outstanding amounts). These clauses serve as a safeguard, outlining what constitutes a default and the actions you can take to protect your business interests. Here’s an in-depth look at the key aspects of default clauses:

Clearly define what constitutes a default in your credit application. Common default triggers include:

Missed Payments: Specify that failure to make a payment by the due date constitutes a default. Include any grace periods and the consequences of missing multiple payments.

Breach of Agreement: Any violation of the terms and conditions outlined in the credit application, such as exceeding the credit limit or failing to adhere to agreed-upon terms, should be considered a default.

Insolvency: If the client declares bankruptcy or insolvency, it should automatically trigger a default. This allows you to take immediate action to protect your interests.

Adverse Credit Changes: Significant negative changes in the client’s financial status, such as a substantial drop in their credit score or financial standing, should be grounds for default.

Outline the specific actions you can take if a default occurs. This not only sets clear expectations for your clients but also provides you with legal avenues to mitigate risks. Common actions include:

Suspending Services: Include a clause that allows you to suspend all services immediately upon default. This prevents further losses and incentivises the client to rectify the default promptly.

Accelerating the Debt: State that in the event of a

default, you have the right to demand immediate payment of all outstanding amounts. This acceleration clause helps you recover owed funds quickly, reducing your exposure to risk.

Imposing Late Fees and Interest: Specify any late fees and interest rates that will apply to overdue amounts. This not only compensates you for the delay but also encourages timely payments.

Seeking Legal Remedies: Clearly mention that you reserve the right to seek legal remedies, including initiating legal proceedings to recover the debt. This demonstrates the seriousness of the default clauses and the potential consequences of non-compliance.

Ensure your default clauses include a process for notifying the client of the default and the actions you intend to take. This should involve:

Notice Period: Provide a specified notice period (e.g., 7 or 14 days) within which the client can rectify the default before further actions are taken.

Formal Notification: Outline the method of formal notification, such as written notice via email or registered mail, to ensure there is a record of communication.

Opportunity to Cure: Include a clause that allows the client an opportunity to cure the default within the notice period. This can help maintain business relationships and provide a clear path for resolution.

By incorporating well-defined default clauses in your credit application, you create a robust framework that protects your tradie business from potential risks associated with extending credit. These clauses not only provide clear guidelines for clients but also empower you to take swift and effective actions to safeguard your financial interests.

Specify how disputes will be handled, including any mediation or arbitration processes. This can prevent costly and time-consuming litigation.

Specifying how disputes will be handled in your credit application is crucial for maintaining smooth business operations and avoiding costly and timeconsuming litigation. Here’s an expanded look at this important element:

Definition: Clearly define mediation as the first step in resolving disputes. Mediation involves a neutral third party who facilitates discussions between you and your client to help reach a mutually acceptable resolution.

Advantages: Mediation is typically faster and less expensive than going to court. It also allows both parties to maintain a positive working relationship by encouraging cooperative problem-solving.

Procedure: Outline the steps for initiating mediation, including selecting a mediator, scheduling sessions, and sharing relevant information. Specify who will bear the costs of mediation, which can be shared or assigned to one party.

Confidentiality: Emphasise that mediation discussions are confidential and cannot be used in court if the mediation does not resolve the dispute. This encourages open and honest communication during the process.

Definition: Arbitration is a more formal dispute resolution process where an arbitrator, acting as a private judge, makes a binding decision on the dispute. This can be faster than litigation and allows for specialised arbitrators with industry-specific knowledge.

Advantages: Arbitration provides a definitive resolution and can be less adversarial than court proceedings. It’s also private, keeping sensitive business information out of the public domain.

Procedure: Detail the steps for initiating arbitration, including how arbitrators are chosen, the rules governing the arbitration process, and timelines for

proceedings. Specify whether the arbitration will be binding or non-binding.

Cost Allocation: Clarify how the costs of arbitration, including arbitrator fees and administrative costs, will be allocated between the parties.

Initial Negotiation: Encourage parties to first attempt to resolve disputes through direct negotiation. Specify a timeframe for these negotiations to prevent prolonged uncertainty.

Mediation: If direct negotiation fails, the parties should proceed to mediation. Provide details on how to initiate mediation, select a mediator, and the expected timeline for resolution.

Arbitration: If mediation does not resolve the dispute, the next step is arbitration. Specify the arbitration body to be used, the rules of arbitration, and how the arbitrator will be selected.

Governing Law: State which laws will govern the credit application and any disputes arising from it. This provides clarity and ensures that both parties are aware of the legal framework that applies.

Jurisdiction: Specify the jurisdiction where any arbitration or litigation will take place. This is particularly important for businesses dealing with clients in different states or countries, as it reduces uncertainty about where disputes will be resolved.

Cost Savings: Clearly defined dispute resolution processes can save both parties significant legal costs by avoiding lengthy litigation.

Time Efficiency: Mediation and arbitration can resolve disputes faster than the court system, allowing you to focus on running your business.

Relationship Preservation: By promoting cooperative resolution methods like mediation, you can preserve business relationships and avoid the adversarial nature of court battles.

Predictability and Control: Specifying the dispute resolution process provides predictability and control over how disputes will be handled, reducing stress and uncertainty.

By including comprehensive dispute resolution clauses in your credit application, you create a structured approach for handling conflicts that protect your tradie business from unnecessary costs and disruptions. Ensuring these processes are clear and well-defined enhances your ability to manage disputes effectively, maintaining the smooth operation of your business.

Rise Legal can play a vital role in ensuring your credit applications are robust and enforceable. Here’s how we can assist:

Tailored to Your Business Needs: At Rise Legal, we draft credit applications specifically tailored to the unique needs and operational procedures of your business. This ensures that all critical elements relevant to your industry and business model are comprehensively covered.

Industry Standards: By incorporating industry-specific terms and best practices, we ensure your credit applications are aligned with current industry standards. This not only enhances the professionalism of your documentation but also builds trust with your clients. Comprehensive Coverage: Our custom drafting process includes thorough coverage of all necessary clauses, such as payment terms, interest on overdue accounts, personal guarantees, and default clauses. This level of detail helps prevent potential disputes and misunderstandings.

Adherence to Laws and Regulations: We ensure that your credit applications comply with all relevant local, state, and federal laws and regulations. This includes compliance with the Personal Property Securities Act (PPSA) and other financial regulations that impact your business.

Regular Updates: Laws and regulations can change, and it’s crucial that your documents remain compliant. We provide regular updates and reviews of your credit applications to incorporate any legal changes, ensuring ongoing compliance and reducing the risk of legal challenges.

Minimising Legal Risks: By adhering to legal standards and ensuring all documentation is properly drafted, we minimise the risk of legal disputes and challenges. This proactive approach protects your business from potential legal issues and enhances your overall risk management strategy.

Identifying Potential Risks: We conduct a thorough analysis of your business operations and financial interactions to identify potential risks associated with extending credit. This allows us to incorporate specific protective measures tailored to mitigate these risks effectively.

Protective Measures: Our risk mitigation strategies include incorporating personal guarantees, registering security interests, and defining clear default clauses.

These measures provide a robust legal framework that safeguards your business against defaults and disputes. Proactive Approach: By addressing potential risks upfront and incorporating protective measures into your credit applications, we help you avoid costly disputes and financial losses. This proactive approach ensures your business is well-protected and prepared for any eventualities.

Continuous Legal Support: We offer ongoing legal support to review and update your credit applications as your business evolves. This ensures that your documents remain relevant and effective, reflecting any changes in your business operations or market conditions.

Periodic Reviews: Regular reviews of your credit applications allow us to identify any areas that need updating or improvement. This continuous improvement process ensures that your credit terms remain robust and enforceable.

Adaptability to Business Changes: As your business grows and changes, your credit application needs may also evolve. We provide adaptable legal support to ensure that your credit documentation keeps pace with your business’s development and changing requirements.

While extending credit can help grow your tradie business, it’s essential to protect yourself with welldrafted credit applications. By partnering with Rise Legal, you can ensure that your terms are clear, enforceable, and tailored to your business’s unique needs. Protect your business today and give yourself peace of mind knowing you have the right safeguards in place.

If you need assistance with preparing credit applications or any other business protection documents, don’t hesitate to reach out. Rise Legal is here to help you secure your business’s future.

By leveraging the expertise of Rise Legal, you can ensure that your credit applications are not only legally sound but also optimised to protect your business interests effectively.

Irrespective of your business’s size or industry, effective supply chain management is often a crucial component of achieving success.

For small business proprietors, handling the intricacies of the supply chain can be daunting and time-intensive, particularly when juggling numerous other responsibilities.

Thankfully, technology has introduced streamlined methods for enhancing supply chain management’s efficiency and efficacy. Here, we present the advantages and disadvantages of utilizing technology for this purpose.

Enhanced Transparency and Oversight One of the most significant merits of integrating technology into supply chain management is the capability to comprehensively observe the entire process, meticulously tracking the movement of merchandise from origin to final delivery. Technological tools empower you to monitor inventory levels, oversee orders, and even track shipments in real-time.

Augmented Efficiency and Productivity Furthermore, you can experience heightened efficiency and productivity. By employing automated systems and software, you can simplify supply chain procedures, minimize errors, and eliminate labor-intensive manual tasks. For instance, rather than manually inputting data into spreadsheets and subsequently placing orders by hand, inventory management software can oversee product levels and automatically initiate reorders when predefined thresholds are reached.

This not only conserves time but also mitigates the likelihood of human errors, ensuring consistent access to the necessary inventory when required.

Economical Benefits The application of technology in supply chain management can also lead to cost savings. Through process automation, error reduction, and heightened efficiency, potential savings could include reduced losses from expired stock, lowered inventory carrying expenses, and even improved negotiations for better supplier pricing. Moreover, supply chain management software can identify areas for cost reduction and operational enhancement, optimizing efficiency.

Initial Investment Although technology adoption for supply chain management can yield long-term cost savings, the initial implementation entails expenditures. Investment in software, hardware, and possibly professional assistance for setup and maintenance may be necessary. Particularly for small businesses with limited budgets, this initial financial outlay might appear substantial.

Nonetheless, the long-term savings will ultimately offset these initial expenses.

Employee Training Integrating novel technology into your business operations usually mandates training for your staff. Devoting time and resources to educate employees on adept utilization of these fresh tools and systems is probable. Despite this initial commitment, the subsequent time savings and error reduction will be noteworthy.

Supply chain technology can significantly enhance your business operations, cut costs, and amplify efficiency. Due to the inherent scalability of technology, it will also seamlessly grow with your enterprise, negating the constant need for novel supply chain expansion strategies.

If you’re a small business owner keen on refining your supply chain management processes and harnessing technology’s potential, we are at your service. Our array of services is tailored to help small business proprietors streamline operations, decrease costs, and attain their objectives. Connect with us today.

People often think, when they’re tired or don’t feel like doing a task (or a habit), that there are really only two choices:

1. Force yourself to do the task anyway; or 2. Let yourself off the hook

And while there isn’t anything wrong with either of these choices, I’m here to remind you that they are choices. And they’re not the only choices.

What else can you do in that situation? Well, here are just a few other possibilities off the top of my head:

• Choose to take care of yourself, and then come back to the task when you’re more replenished

• Find a reason to do the task that inspires you to do it, even if you’re tired — for example, if you knew that doing a task would save a million people’s lives, you probably wouldn’t say, “Oh, but I’m too tired right now”

• Ask for other people’s help

• Find a creative approach that has you bringing play to the task while also honoring your tiredness

As you can see, there are choices, when we get beyond the only two choices that occur to most of us.

Let’s talk about our tendencies, then talk about how to pursue other options than the two main ones we’ve mentioned at the beginning.

The thing is, most people will default to one of the two choices by habit — if you normally let yourself off the hook, that’s probably a tendency (you might add some self-judgment and self-criticism to that tendency). If you are good at forcing yourself to do work, you probably do that as a tendency.

So become aware of your tendency — which one do you lean towards? There isn’t anything wrong with this tendency, but it will always get you the same results: avoidance gets you stuckness and self-judgment, while forcing yourself gets you a sense of burden, overwhelm, exhaustion and apathy.

Once you’re aware of the tendency, you can ask yourself whether you’d like to try something different. If so, read on!

So first, let’s say you decide that self-care is your priority. That doesn’t mean you’re going to avoid the hard things, but you’re going to make sure you’re not going towards burnout, and take responsibility for making sure you’re getting enough rest, nourishment, mental breaks, and movement.

So that is a given. Now what? Well, now you can move towards the tasks you’re resisting — hard, scary tasks you want to put off.

But instead of forcing yourself, you want to try something different, that doesn’t feel like coercion and doesn’t make you feel so burdened and apathetic.

How do we do that? There isn’t a right answer, but here are some things to consider:

• Connect with your deeper Why. Something that inspires you to take action, instead of having to avoid or force yourself. What would have you excited to tackle this?

• Let yourself play. Why does this have to feel like work, or a “nose to the grindstone” kind of thing? Why are we trying to just “get through” all of our work tasks and emails and meetings? What if all of this could be a playground?

• Let it feel alive. We don’t have a lot of time on this Earth. Let’s let ourselves feel more alive in each moment, whenever we can remember. What would it be like to feel alive right now, as you read this?

• Don’t be ashamed to ask for help. Sometimes the resistance or overwhelm is too much. How can others be invited to help us face it, or to make it more like play, or to help shoulder the burden? We don’t have to be so alone.

These are some ideas to play with. How can you feel more alive in the tasks you have in front of you today?

Leo Babauta ZEN HABITS

Australia’s gender pay gap has hit a record low – but we still have work to do

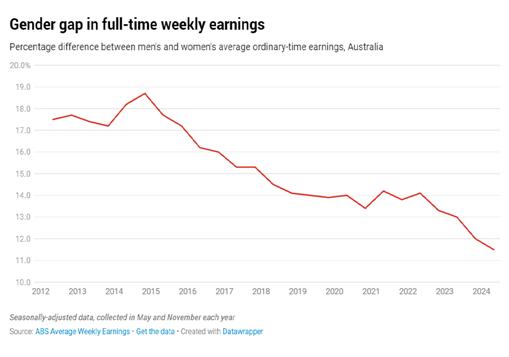

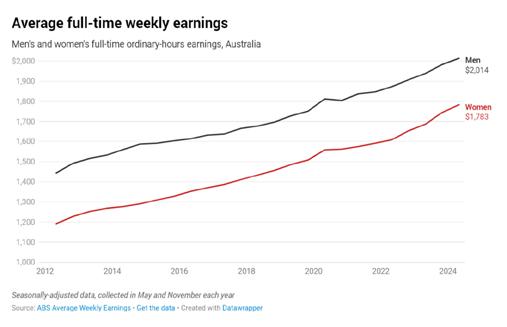

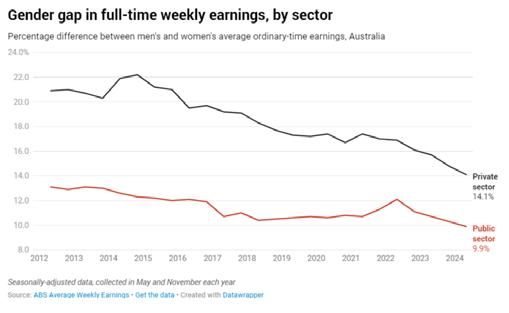

Australia’s gender pay gap – a key measure of economic inequality between men and women – has fallen to a record low of 11.5%.

That’s down from 13% this time last year, the steepest annual fall since 2016. Ten years ago, it was almost 19%.

The latest figures are great news for our economy and our society – evidence we’re getting better at recognising and fairly valuing women’s capabilities and contributions.

More opportunities are now open to women in the workforce, helping them gain and retire with greater financial independence than in previous decades.

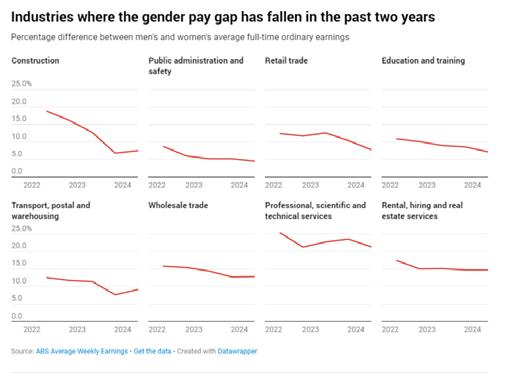

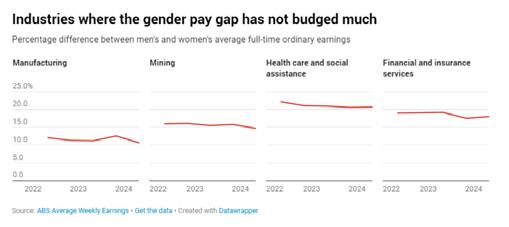

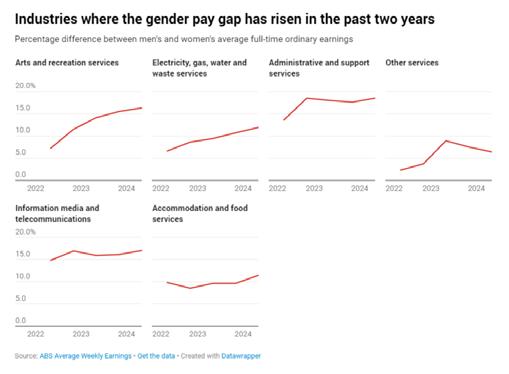

But national averages don’t tell the whole story. While gender pay gaps have fallen in some industries, they’ve also been rising in others.

Today, August 19, is equal pay day. This marks the 50 extra days past the end of the last financial year that Australian women would need to work for their earnings to match those of their male colleagues.

This offers us a timely opportunity to reflect on what exactly has driven this year’s improvement – and where we still have work to do.

Women’s earnings picking up pace

We calculate the gender pay gap by comparing the average weekly ordinary-time, full-time earnings for men and women.

In dollar terms, women are now earning $231.50, or 11.5%, less than men, on average, in their weekly full-time pay packet.

The recent narrowing is being driven by women’s average earnings growth picking up pace. This contrasts with earlier periods in which the narrowing of the gap tended to be due to a slowdown in the growth of men’s earnings.

While changes in the gender pay gap reflect a range of economy-wide factors, the Albanese government has been quick to attribute the recent fall to the various targeted actions it has taken since coming to office.

Let’s look at whether and how these actions have played a role.

First, the government sought to make wage information more transparent. It banned pay secrecy clauses and now requires the gender pay gaps of all large companies in Australia to be publicly reported.

These reforms took effect from 2023, targeting private companies. The gender pay gap in the private sector, though higher to begin with, has fallen more swiftly than that of the public sector, suggesting these actions have had an effect.

Second, the government targeted gender-patterned biases in industrial relations – including the legacy ef-

fects of past decisions – and instilled gender equity as a new objective of Australia’s Fair Work Act.

The Fair Work Commission is now required to take gender equity into account in its wage deliberations, including its minimum wage decision.

The government also introduced multi-employer bargaining in an attempt to strengthen workers’ bargaining capacity in female-concentrated sectors.

The effects of these changes will continue to flow across the workforce as the Fair Work Commission undertakes its review of modern awards, prioritising those affecting female-concentrated industries.

\

Recent reforms have targeted the historic undervaluation of women’s work. StockLite/Shutterstock

And third, further addressing the historical undervaluation of “women’s work”, the government directly addressed low pay in female-concentrated sectors by supporting a pay rise for aged care workers.

Targeting the low pay and under-valuation of an industry that is about 87% female helped fuel the downward momentum in the overall gender pay gap.

The government’s recently announced pay rise for early childhood education and care workers – a work force that is around 95% female – will also target gender patterns in low pay once they come into effect.

These government actions have been essential for undoing the gender biases embedded in existing systems. And they have complemented other initiatives that have taken effect in the past year, such as the Respect At Work Act, requiring employers to proactively stamp out sexual harassment.

But there is still a way to go to keep closing the gender gaps across all parts of the workforce.

Breaking down the gender pay gap in earnings by sector paints a more varied picture.

In industries like construction, public administration and safety, and retail trade, it has fallen notably over the past two years.

But it remains high in industries like healthcare and social assistance, at over 20%, and finance and insurance at 18%.

In some industries, the gap has actually increased over the past two years. In arts and recreation services, as well as electricity, gas, waste and water services, it’s been continually rising.

That could reflect a bigger shift

It’s important to interpret these figures carefully. In some instances, a widening of the gender pay gap can reflect a positive shift in an industry’s makeup, if it reflects more women joining a male-dominated sector at entry level, and growing a pipeline of senior women for the future.

That’s why the Workplace Gender Equality Agency (WGEA) gives organisations a chance to explain these dynamics in their employer statements, which are published on the WGEA website alongside organisations’ gender pay gaps.

Over time, the entry of more women at the junior level can flow through to more gender balance as these women progress to senior and decision-making roles.

The real test will be to ensure – by fostering more gender equitable, inclusive and respectful work cultures and systems – that they do.

Read more: Why are child carers still paid less than retail workers? And how can we help fix it?

Leonora Risse Associate Professor in Economics, University of Canberra

In this article we’ll be looking at easy to implement business sales and marketing strategies, one of the three legs that any business stands on, the other two being Production and Finance.

Many of my clients shirk back when I use the term ‘marketing’. They may have had negative experiences with marketers they’ve engaged in the past and think of it as an expense that didn’t yield any increase in turnover, and therefore start to neglect this area.

Whichever way you might think about it, marketing is more than putting an ad in the local paper. It is rather a comprehensive business development strategy that includes many different facets, like referral programs, promotions, online visibility and giving away high value, free information to your prospective target market.

I’m going to make a bold statement here: Marketing is an investment in your business, not an expense. When you make this important shift in your thinking, you’ll approach marketing as an investment in your business that gives you Return on Investment (ROI). Remember though, the key to a successful marketing program is to ‘test and measure’!

Once you’ve decided on the marketing strategy you want to use, it is important to set marketing goals. For example, if you are implementing a referral program, you’ll need to put a mechanism in place that will help you evaluate the outcomes, ie how many referrals have been made to your business by who, and did the referral become a client etc.

Let’s stay with this example and consider what you’ll need to do, before you set up your referral program. You’ll need to ask yourself a few questions including:

• Who in my business community is best placed to make referrals to my business?

• How can I incentivise the making of referrals, ie how will you reward the people who refer business to you?

• How can I engage with business owners to let them know what’s in it for them when they make referrals to your business?

• How do I administer the referral program?

• How do I get the data to evaluate how good the program works?

Whether it’s a referral program or any other marketing strategy you have decided on, it is important to calculate your ROI. In essence, you’ll need to think of it in terms of cost vs revenue.

Consider the following example:

• Tesla Motors was giving away $1,000 as a referral reward.

• The most successful advocate, wei70644, made 188 referrals, costing Tesla $376,000 in referral rewards.

• Tesla made $15,980,000 in revenue from the referred sales.

That’s a 40x return on investment, and in anyone’s book it’s an impressive result.

So when you create your marketing program, you’ll need to get into the nitty gritty of costing the marketing strategy first, ie setting up a marketing budget.

Then you can set off the costs against the increase in turnover. When your ROI is higher than the cost of your marketing program and meets your marketing goals, you know you’ve got it nailed.

In summary, the corner stones of any marketing program are:

• Your target market focus. Who are you trying to attract?

• What are you trying to sell. What is your offer?

• Where you are going to promote (eg print advertising, online, business networks)?

• Documenting your program step-by-step.

• Creating a budget for your marketing strategies.

• Calculating ROI, including evaluation of program effectiveness through KPIs.

Once you are clear on that and have kicked off your marketing strategy you’ll need to schedule regular reviews for each individual marketing strategy or promotion to see if it works. Above all, don’t be discouraged if you’re not achieving the desired ROI at first. You have to test the market with your chosen marketing strategy to find out if it works. It’s a bit like the old saying ‘If you want to make an omelette, you’ll have to break some eggs.’

Look at what is working after each marketing strategy implementation or promotion. Examine why particular aspects of your marketing is not working and change your approach. Factors like timing, market trends and the perceived value of your offer all play a part in whether your marketing strategy is successful. Sometimes a different headline in an advertisement can completely change the results.

Testing and measuring is absolutely critical to find out what works best for your business. You definitely need to put some numbers to each strategy to see if works. Remember, the only way to know for sure is to test and measure. Once you find an idea that works, continue to use it until you’re no longer getting the result. I hope this article has inspired you to get out there and grab the market share you are looking for.

If you have any questions on how to set up a simple and effective marketing strategy monitoring system to increase your profits, feel free to arrange a FREE No-Obligation Meeting with me. Call me on 07 3399 8844 , or you can visit our website at www.straighttalkat.com.au and complete your details on our Home page to request an appointment.

Copyright © 2024 Robert Bauman.

The Women in Painting initiative, launched in September by the Aussie Painters Network, has made significant strides in its mission to support and empower women in the painting and decorating industry. Since its inception, the initiative has focused on building a strong community where female painters can connect, share experiences, and access valuable resources.

In our first weeks we’ve been well received by the industry and have begun to grow our base of Members, facebook followers and participants in the private facebook group. We’ve seen some awesome discussions, shared problem solving and camaraderie occupying these spaces already. We’re well on our way to creating a strong, inclusive community for women in painting, which has been missing from the industry to date.

We’ve already participated in NAWIC Speed Careering & Women on Tools breakfasts and have visited several schools to encourage the uptake of trades and have plenty of outreach events coming up.

We’ve had wonderful APN Members offer to be Mentors, reassure us they are as passionate about increasing female participation and some respond with comments such as: “I’ve said it once, I’ll say it again – women make THE BEST apprentices!” We believe that this is indicative of support from our existing APN community.

Please join our Membership as participants and allies, and encourage any women in your painting businesses, on and off the tools, to come join us on any or all the following platforms.

Membership: www.womeninpainting.com.au

Facebook page: www.facebook.com/profile. php?id=61561701424842

Facebook group: www.facebook.com/groups/ womeninpainting

Caroline Miall

info@WomenInPainting.com.au

www.WomenInPainting.com.au

0413 345 595

It takes a lot of time and effort to source a new client, so once they have contacted you, you want to make sure you do everything in your power to build a customer relationship with them. One of the main things they are looking for in a tradesperson is Trust.

Last week I went to see a past employee as he was working at a house belonging to a past client of mine. My first contact with the client was in 2009 when she was wanting a quote. I was successful in my bid and in the years following, was her only painter. Because she trusted me and my work, she never bothered getting any other quotes. When I retired in 2022, she now uses my past employee as she knows him well and fully trusts him, as she did me, to do all her future work.

From the example above, building customer trust can definitely benefit your company and help retain loyal customers. You can turn these customers into ‘free advertising agents’ for your business as they will speak positively about your company and recruit other customers. This allows your business to increase its customer base and improve its reputation at ‘no-cost-to-you’. By retaining customers and receiving referrals from them means that you are not wasting your hard-earned money on advertising.

Below are some points to consider when dealing with the public.

Be honest in your interactions with customers. Clearly mention your pricing, policies, and any relevant information about your products and services. I had a company ‘Commitment’ page that was included in my

quote. This detailed who I was, how long I had been in business, and what I guaranteed if they employed my services. On my website for a personal touch, I included a photo of myself to show customers who they will be dealing with.

If you have employees, mention them on your website also. Show how long they have been working for you and their job description. Include a photo as well as customers like to see who will be working at their property.

Even though you may not agree with a client, in your best interest it is best to listen and accept what they have to say and fix the problem. Arguing only causes friction between both parties and hence, lead to slow or non-payment and a loss of a future client. If it takes you a few extra hours, so be it! Look at the time, cost and stress of using a debt collector. It is simply not worth it! Swallow your pride, do what they want, and you will find they will appreciate the effort and recommend you to others. Take them to court and your name will travel quickly as someone not to recommend and not to be trusted.

Share positive reviews and testimonials. Consumers tend to trust their fellow customers more than the businesses they're buying from. Real customer experiences are often seen as more objective and hold more weight than a company's clear-cut marketing. For instance, when my wife and I are planning a holiday and searching for accommodation, we always look at the testimonials of other guests to see what they have to say and how they rate it.

Customer feedback and customer service

Let customers contribute to improve your operations by sending out surveys and asking for their feedback on jobs completed. This is one of the more effective ways for letting customers know you value them and what they have to say. If there is a concern, do something about it.

Go above and beyond to exceed their expectations and show customers that you value their business and are willing to ensure their satisfaction. Deliver on your promises and provide a reliable and dependable experience.

Showing your appreciation

This is a simple as giving them a small gift at the end of the job. It can either be flowers, a pot plant, bottle of champaign, chocolates or a gift basket. It is just a gesture of appreciation for working at their property. They have put up with you being in, or at their home for either a few days or a few weeks. Some feel it’s an invasion of privacy, so show some respect and appreciation for your intrusion of their space. It all adds to the trust process as they will understand your concern and be happy to have you back again or feel comfortable recommending you to a friend or relative.

Keep in touch with your customers well after the job is finished. This can be just a friendly call to see how they are doing and if they have any issues with the painting. Follow up by asking if they need any work done in the future or if they know someone that may require your services. Believe me this is very effective. I was working on new homes many years ago, and as you may know, you have no contact with the customer. Ten years after the job was completed, I sent a letter by post (that’s how long ago it was), introducing myself as the original painter. I received a phone call a few days later asking if I could give them a quote for the exterior. Because they were happy with my previous work, they accepted my quote straight away.

This is very important if you want to run a successful business. You need to know as much as you can about your client, not just their contact details. It is satisfying when a person remembers who you are, your family members names, (even the pets), and what work you did for them. My memory is not the best, but when a client contacted me out of the blue, I used to have time to get on the computer, bring up their details, and speak to them as it was only yesterday. I could tell by their reaction over the phone that they were amazed I remembered so much. It shows to the client that they are important to you, and when a client feels that; you will be remembered also.

Don’t just use trust as a means to gain more business but make sure you apply it in your ‘day-to-day’ life. Knowing that people trust you is very special and mentally, very rewarding.

Jim Baker www.mytools4business.com

When most people try to start a new habit — like exercise, meditation, waking early, journaling — they tend to try to go as hard as they can. And in doing so, they set themselves up for failure.

I have a friend who wanted to start running, for example. Every time they ran, they would do it as fast as they could, so they were always really winded. That’s Too Fast, Too Soon (title of my new action movie franchise). It’ll lead to failure for most people.

Another person I talked to wanted to start waking up at 5am, two hours earlier than they were usually awake. They said they were worried they wouldn’t be able to

stick to it for long. I agreed: you could probably do it for a few days, but you’ll crash and burn, most likely.

Now, going hardcore is possible, if you dedicate your entire life to this one change, and reduce all other commitments and stressors. You’d have to set up a lot of structure and support to make it work. But your odds of long term success go way down, just like a crash diet.

So I always recommend starting small. But there’s a more sophisticated technique, that I call “autoregulation” (borrowed from biology) that I’d like to share with you.

Here’s how it works, in brief:

1. Start the habit small — let’s say 15 minutes of easy exercise, or wake up just 5 minutes earlier than your normal time on Day 1.

2. Increase the next day, if you were successful. For the exercise example, increase by 2 minutes a day. For waking early, wake another 5 minutes earlier on Day 2.

3. Continue to increase the habit if you’re successful.

4. Decrease the habit if you miss a day. So if on Day 3 you wanted to wake up at 6:45am, but didn’t wake up until 7:30 … on Day 4, set your alarm for 6:50am. If you missed a day of exercise, decrease the exercise time by 2 minutes the next day. It’s important not to see this as a punishment for failure, but rather an adjustment for your longterm success.

5. Take a full day off if you’re tired, stressed, or too busy. Start the next day if at all possible, with a decrease in the habit (see #4).

If you follow this autoregulation method, you’ll make your habit easier when it’s needed, and make it more difficult when you have the capability to handle it.

Some days, you’re just busy, or tired, or stressed. On those days, take a break. Then come back the next day with a decreased habit goal (exercise 2 minutes shorter, wake 5 minutes later, etc.) to make it easier on yourself.

Some days, you have lots of energy and focus. On those days, it’s entirely appropriate to get to continue to increase the habit, slowly.

Using this method, you’ll increase your habit slowly, at a pace that’s appropriate for your capacity. If your body can’t handle increasing the exercise, take a break and then come back with an easier target.

This time-based approach works for a lot of habits: meditation, journaling, writing, learning a language. It doesn’t work as well if you’re changing your diet, but you can still use the same principles: slowly move closer to your target eating pattern each day, but give yourself breaks and slow down your progress as needed.

If you’re trying to procrastinate less, this can work too — start a daily habit of doing short focus sessions (start with 10 minutes, once a day) and increase by 10 minutes as long as you’re able to stick to the plan. For example, on Day 2, do a 20-minute focus session. On Day 3, do one 10-minute focus session and one 20-minute focus session. On Day 4, do two 20-minute focus sessions. Keep adding 10 minutes as long as you stick to it. If on Day 5 you don’t do the focus sessions, decrease by 10 minutes on Day 6.

At some point, you should stop increasing — perhaps when you get to your goal (waking at 5am, exercising for 40 minutes a day, etc.). But it’s possible your goal will change as you do this, and you can find the level that’s right for you to stop increasing through this method of slow change.

So that’s the autoregulation method for changing habits. It’s a compassionate approach that’s meant to increase your odds of long-term success. Give it a shot!

Btw, if you’d like to practice with others, I created The Practice in my Fearless Living Academy — to have our members practicing with this together, with structure, accountability and community.

Come join us!

Leo Babauta ZEN HABITS

Unfortunately, Scammers are everywhere. They want your money, your identity, or both, and they’re getting more sophisticated all the time. There’s a wealth of opportunity for scammers to take advantage of people because so much of what we do is now online. There are ways for you to protect yourself, both by taking action and being aware of what’s going on.

Here are 8 ways to protect yourself from personal financial fraud.

Getting someone’s identity is often the first step to running up enormous charges in their name. Scary as it is, you can go bankrupt if someone opens credit cards using your ID and maxes them out before you’re even aware anything has happened.

Dispose of any documents with your name or other information carefully. Shred your mail and dispose of records securely. It may take extra time, but these small steps can save you a world of headaches.

Whether its sent to you in an email or via text message – just don’t click! It’s a popular tactic for scammers to send a normal-looking link that’s harmful. Before you know it, you’re freely giving away your information.

Just don’t do it. Instead, take the extra step to visit a website through its legitimate homepage or call customer service if you suspect a link is a scam.

With so many bills offered online, it’s easy to forget to review them. Make sure to check your statements for accuracy every month. It’s the only way to identify fraudulent charges and correct them. If the bank account has changed , give the supplier a call to double check.

Think of this like putting the toothpaste back in the tube – it just can’t be done once you’ve squeezed it out. The same goes for putting your personal information online. Scammers can use something as innocuous as your birthdate or workplace to verify your identity and expose you to financial fraud.

The pandemic made us especially susceptible to being taken advantage of because so much was changing at once. Extra government programs were in place, vaccination campaigns were underway, and all of this administration meant more phone calls, text reminders, and emails.

Trustworthy institutions typically do not ask for your personal information in these ways. If you get a suspicious phone call or email, hang up, and call them directly. That extra step can save you a lot of money and stress. It’s too easy to fall victim to one of these scams, especially if the caller claims that a loved one is in trouble and needs help – a common tactic these days.

6. Be cautious when shopping online

Fraudsters are getting savvy when it comes to tricking us online. It’s not uncommon for a fraudulent website to appear exactly like a legitimate place to shop. Double-check web addresses and question deals that seem good to be true.

Be aware of spelling mistakes or awkward grammar on these websites. They’re often a giveaway that it’s a lookalike designed to trick you into handing over your information.

7. Check your credit report periodically

If you can get free credit reports that don’t harm your credit score, take advantage of this from time to time. It’s an excellent way to know if loans have been opened in your name or to be alerted to any other suspicious activity.

Most cards can be set up to alert you of purchases, and you can set the parameters of when that happens. If someone has your credit card information, it’s not uncommon for them to run through several smaller purchases as a sort of test to see if you’re paying attention. Set up spending alerts so you can stop them in their tracks.

It’s a big, connected world, but modern technology has also made us more susceptible to fraud. However, with a few good habits and suitable tools and practices, you can protect yourself from personal fraud and continue enjoying online life’s conveniences.

Need some help?

Book a strategy session HERE to see how we can improve your bottom line.

I hear you asking, what does she mean by being ‘totally authentic’ and having ‘awesome authenticity’? To be awesome is to be awe-inspiring and by being authentic in all you say and do, changes the way you are seen by others. It is important in today’s business world to be seen for who you really are, by being believable, trusted and sometimes vulnerable. I believe that there is no difference between who you are in business or in your personal life. The basics of ‘who you are’ needs to resonate in both.

In business today we need to be awe-inspiringly real … it is about being yourself and knowing your own self-worth. No-one really ever wants you to be someone other than who you really are.

Awesomeness comes from deep inside you, and for many people they are not even aware of their own awesomeness. We all have it and need to acknowledge it and allow the door to open to honesty by setting ourselves free so we can become truly authentic. To be authentic is to be really REAL and be who you WANT to be, not who you think you need to become. It is not about anyone else, it is about YOU! Your truth is what you project in every thought, word, feeling and action. Authenticity equals truth, the truth that you feel in every fibre of your being. It comes from your heart not your head. When you feel it, it resonates in you a good feeling. By understanding your own truth and authentic self, you will find who you really are. Allow others to see and know you … reveal yourself for you are unique and special.

We all have within us hidden fears, doubts and worries. By allowing the wise and powerful part of ourselves,

often called ‘the higher self’, the opportunity of showing our true unique passion, values, visions, talents, abilities and our sense of purpose, comes out.

Until you really understand your real purpose of why you are here and what you are to do in this life, you will be short changing yourself of showing the world your true unique identity. When you understand what you are here in this life to do and be, then you will know the importance of leaving a legacy behind you, when your time on earth is over.

I often say to my clients, what do you want people to say about you when you die and your name is mentioned? What was the dash (-) between your birth and death date? Did you make your mark? Were you memorable for the good work you did?

As we gain conscious awareness, we learn how to live a life of joy, peace, love, freedom, abundance, gratitude and all the other beautiful things life allows us to be, whilst being in tune with who we really are every moment of our day, every day.

I am not saying that you will not have times of worry and stress in your life. This is necessary for you to develop and become who you are. We only learn through the experiences we have so it is necessary to be pushed at times, sometimes further than we would like.

So, open the door and become who you really are by setting yourself free to be REAL! Become a master of your life and live on purpose and with passion.

Over the last couple of years we’ve noticed more tradies using drones as part of their business.

Some use them for inspecting hard-to-reach locations, but a lot use them for putting together footage of their work to be shared on social media.

Whatever you’re using drones for in your trade business, it’s important to understand the insurance implications.

We’re not just talking about insuring the drone itself, but more importantly, insuring yourself in the event that the drone causes damage or personal injury to a third party.

Please note that we don’t insure drones on their own. This article is more about how drones fit within a tradie or builder’s overall business insurance.

Damage or injury caused by your drone In any trade business there is always the risk of causing property damage or personal injury to a third party.

To protect yourself from this risk you have public liability insurance. This is the most common of all forms of trade insurance.

Whilst this will cover most “normal” activities of a trade business, operating a drone doesn’t always fall into this category.

Some insurers will cover a tradie for operating a drone as part of their business, whilst others will not. The difference could be worth thousands (or potentially millions) in the event of a claim.

Lets say you were flying a drone to get some footage of a newly finished project…

Say you lost control and it smashed into a vehicle parked next door. In this case you might be looking at a claim worth a couple of grand for repairs to the vehicle.

But what about the worst-case scenario… What if you lost control and the drone hit a motorcyclist, who then veered onto the footpath and killed a pedestrian. In that case you could be looking at a million dollar claim if it was found you were responsible.

That’s pretty extreme, but insurance is all about protecting yourself against those unlikely extreme events.

If you had a public liability policy which excluded coverage for drones, you’d be left exposed for a potentially huge payout.

But if you had a policy which did cover the use of a drone in your business, you’d be all good.

If you are using a drone in your trade business, we can’t stress enough the importance of checking your policy wording or letting us know so we can check for you.

Coverage for drones doesn’t always mean paying more for the extra cover. It’s simply that some policies exclude them and some don’t.

Keep in mind that we’re a broker and use a range of different insurance companies. So it’s not about whether Trade Risk covers drones – it’s about each different insurer we use.

Damage or loss of your drone

The other risk is that your drone is either damaged or stolen.

Some drones only cost a few hundred dollars and are hardly worth protecting, but increasingly we’re seeing the use of high-end drones worth thousands of dollars.

If you have tool insurance you may be able to include cover for the drone, but don’t just assume that your drone will be automatically covered.

Some insurers will cover the drone along with the rest of your tools as “unspecified” items, which essentially means they’re all pooled into the one overall amount.

Other insurers will require that the drone is specified on the policy. This just means listing it on the policy along with a specific dollar value.

Another consideration is the replacement value of the drone. Some policies require that individual items with a replacement value over a certain limit ($3,000 for example) are specified on the policy.

So a given insurer might be happy to include drones in the standard cover, but if the drone has a

replacement value exceeding $3,000 (for example) it will still need to be specified.

It can get a little confusing since different insurers have different rules, so the easiest option is to speak with us and we can tell you straight away what the deal is with your policy.

Remember that as insurance brokers we deal with lots of different insurance companies, so the answer will depend on which insurance company your policy is with.

More information

Using a drone in your trade or building business can be a great idea, but it’s vital to ensure you are properly protected in case anything goes wrong.

If you’re an existing client we can check your policy to see if you’re covered or not, or if you’re a new client we can put together some quotes and options for you. www.traderisk.com.au

It’s one of the most pervasive messages about technology and sleep. We’re told bright, blue light from screens prevents us falling asleep easily. We’re told to avoid scrolling on our phones before bedtime or while in bed. We’re sold glasses to help filter out blue light. We put our phones on “night mode” to minimise exposure to blue light.

But what does the science actually tell us about the impact of bright, blue light and sleep? When our group of sleep experts from Sweden, Australia and Israel compared scientific studies that directly tested this, we found the overall impact was close to meaningless. Sleep was disrupted, on average, by less than three minutes.

We showed the message that blue light from screens stops you from falling asleep is essentially a myth, albeit a very convincing one.

Instead, we found a more nuanced picture about technology and sleep.

What we did

We gathered evidence from 73 independent studies with a total of 113,370 participants of all ages exam-

ining various factors that connect technology use and sleep.

We did indeed find a link between technology use and sleep, but not necessarily what you’d think.

We found that sometimes technology use can lead to poor sleep and sometimes poor sleep can lead to more technology use. In other words, the relationship between technology and sleep is complex and can go both ways.

How is technology supposed to harm sleep?

Technology is proposed to harm our sleep in a number of ways. But here’s what we found when we looked at the evidence:

bright screen light – across 11 experimental studies, people who used a bright screen emitting blue light before bedtime fell asleep an average of only 2.7 minutes later. In some studies, people slept better after using a bright screen. When we were invited to write about this evidence further, we showed there is still no meaningful impact of bright screen light on other sleep characteristics including the total amount or quality of sleep

arousal is a measure of whether people become more alert depending on what they’re doing on their device. Across seven studies, people who engaged in more alerting or “exciting” content (for example, video games) lost an average of only about 3.5 minutes of sleep compared to those who engaged in something less exciting (for example, TV). This tells us the content of technology alone doesn’t affect sleep as much as we think

we found sleep disruption at night (for example, being awoken by text messages) and sleep displacement (using technology past the time that we could be

sleeping) can lead to sleep loss. So while technology use was linked to less sleep in these instances, this was unrelated to being exposed to bright, blue light from screens before bedtime.

Which factors encourage more technology use?

Research we reviewed suggests people tend to use more technology at bedtime for two main reasons:

• to “fill the time” when they’re not yet sleepy. This is common for teenagers, who have a biological shift in their sleep patterns that leads to later sleep times, independent of technology use.

• to calm down negative emotions and thoughts at bedtime, for apparent stress reduction and to provide comfort.

There are also a few things that might make people more vulnerable to using technology late into the night and losing sleep.

We found people who are risk-takers or who lose track of time easily may turn off devices later and sacrifice sleep. Fear of missing out and social pressures can also encourage young people in particular to stay up later on technology.

Last of all, we looked at protective factors, ones that can help people use technology more sensibly before bed.

The two main things we found that helped were selfcontrol, which helps resist the short-term rewards of clicking and scrolling, and having a parent or loved one to help set bedtimes.

Why do we blame blue light?

The blue light theory involves melatonin, a hormone that regulates sleep. During the day, we are exposed to bright, natural light that contains a high amount of blue light. This bright, blue light activates certain cells at the back of our eyes, which send signals to our brain that it’s time to be alert. But as light decreases at night, our brain starts to produce melatonin, making us feel sleepy.

It’s logical to think that artificial light from devices could interfere with the production of melatonin and so affect our sleep. But studies show it would require light levels of about 1,000-2,000 lux (a measure of the intensity of light) to have a significant impact.

Device screens emit only about 80-100 lux. At the other end of the scale, natural sunlight on a sunny day provides about 100,000 lux.

What’s the take-home message?

We know that bright light does affect sleep and alertness. However our research indicates the light from devices such as smartphones and laptops is nowhere near bright or blue enough to disrupt sleep.

There are many factors that can affect sleep, and bright, blue screen light likely isn’t one of them.

The take-home message is to understand your own sleep needs and how technology affects you. Maybe reading an e-book or scrolling on socials is fine for you, or maybe you’re too often putting the phone down way too late. Listen to your body and when you feel sleepy, turn off your device.

Chelsea Reynolds Casual Academic/Clinical Educator and Clinical Psychologist, College of Education, Psychology

and Social Work, Flinders University

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Comcare

WorkSafe ACT

Workplace Health and Safety QLD