8 minute read

Plot the route to success

Renewable energy investment is becoming better and cheaper by the day. This, of course, is great news for the planet, as it will encourage companies, governments, and private investors to contribute to this green infrastructure over the coming decades, in a bid to increase green energy consumption. The International Energy Agency (IEA) recently stated that, although slim, there is still a possibility of reaching net-zero emissions by 2050. Yet reaching these kinds of targets will require a huge amount of investment, and enticing investors to tap into these projects ultimately depends on their success and the return on that investment (ROI).

While competition is growing in the renewables sector, there are a whole host of different investment options to choose from. Multiple variables will drive the return of a renewable plant investment, which will define the outcome of the entire process. Here, the elements that will affect the ROI are explored.

Stakeholder alignment

Alignment among all the stakeholders involved in the project is paramount to enable a good quality project.

Availability and cost of financing

The project quality typically dictates the appetite of the lenders and the selection of a savvy cluster of technical, financial, and legal advisors is a prerequisite.

In particular, the selection of a good technical advisor or independent engineer is necessary to understand from the very beginning whether the project is aligned with the standards required for an operation that might last up to 30 or 40 years.

Access to bankable offtakers

The sale of the energy and how it will be utilised by the end offtaker will command the technical design of the plant. The pay-as-produced power purchase agreements (PPAs) are starting to disappear or their value is decreasing, hence plant design needs to adapt to more intelligent ways of exporting energy. Nowadays, the software components of plant design are increasing their importance because renewables plants are starting to contribute to grid stability.

Excellence in project development processes

The permitting risks must not be underestimated. To carry out a successful project it is extremely important that the local community is engaged, that the development has a low impact on the local environment, and that the technical project filed is designed for a real-life project. In addition to Matrix Renewables’ development expertise, its success comes from a special commitment to community values. The company recognises its projects have a long-term presence in the communities where they are located and seeks to foster long-term community partnerships to create a lasting, positive impact through the environmental and social policies it promotes. These

Luis Sabaté, Matrix Renewables, Spain, explains the technical and engineering aspects of ensuring a successful project and ROI, and why this is integral for encouraging future investment in renewable energy developments.

73

commitments are taken into consideration very early in the development process.

Elsewhere, developers often file technical projects which, in the end, cannot be built due to the rapid and continuous evolution of the technology. A continuous monitoring of the technology market is needed to accommodate the available technology at the time the construction is planned.

Establishing a stable grid connection

A stable grid connection application process goes hand in hand with permitting consent. An integrated and transparent approach with the transmission or distribution companies is a must.

Developments must be designed with the right grid capacities which will save time for all parties involved and save on connection costs, which may help with infrastructure upgrades. This not only ensures the project interconnection but reinforces local infrastructure for the long-term.

Appropriate technology selection and optimised design of plants

Matrix Renewables believes that innovation is the key differentiator among the different platforms existing in the market. The company wants to lead the early adoption of advanced technology which will, in turn, increase the efficiency of the invested capital.

The location and the environmental conditions of the project determine the choice of the most appropriate technology. Decisions need to be made on a whole host of possible options, such as: F Wind turbine selection according to the site class.

F Photovoltaic (PV) module: Mono or bifacial, multi crystalline, mono crystalline, or thin film. Here an agnostic approach is highly recommended.

F AC/DC inverter: Central or string inverters, outdoor or indoor solutions, capacity and performance.

F Fixed structure or tracker and tracker selection.

F Storage technology selection.

F Interconnection topology.

Of course, the ultimate goal is to optimise plant performance (kWh or kW installed) by enhancing the maximum energy produced per unit installed. For this purpose, the design needs to ensure the compatibility of the different components, so as to gain synergies among the different equipment, taking advantage of available space.

Projects must be designed to ensure the greatest efficiency, not just for today, but over the 30 or 40 years the plants will be in operation. Repowering or life extension concepts must be analysed to take into account the expected technology evolution over this time.

Design must also bear in mind the required operating and maintenance procedures. This means thinking ahead and ensuring that the long-term procedures are compatible with plant design. A good example is robotic cleaning solutions which have evolved very rapidly, and there are many areas globally that could benefit from reducing soiling losses in PV plants.

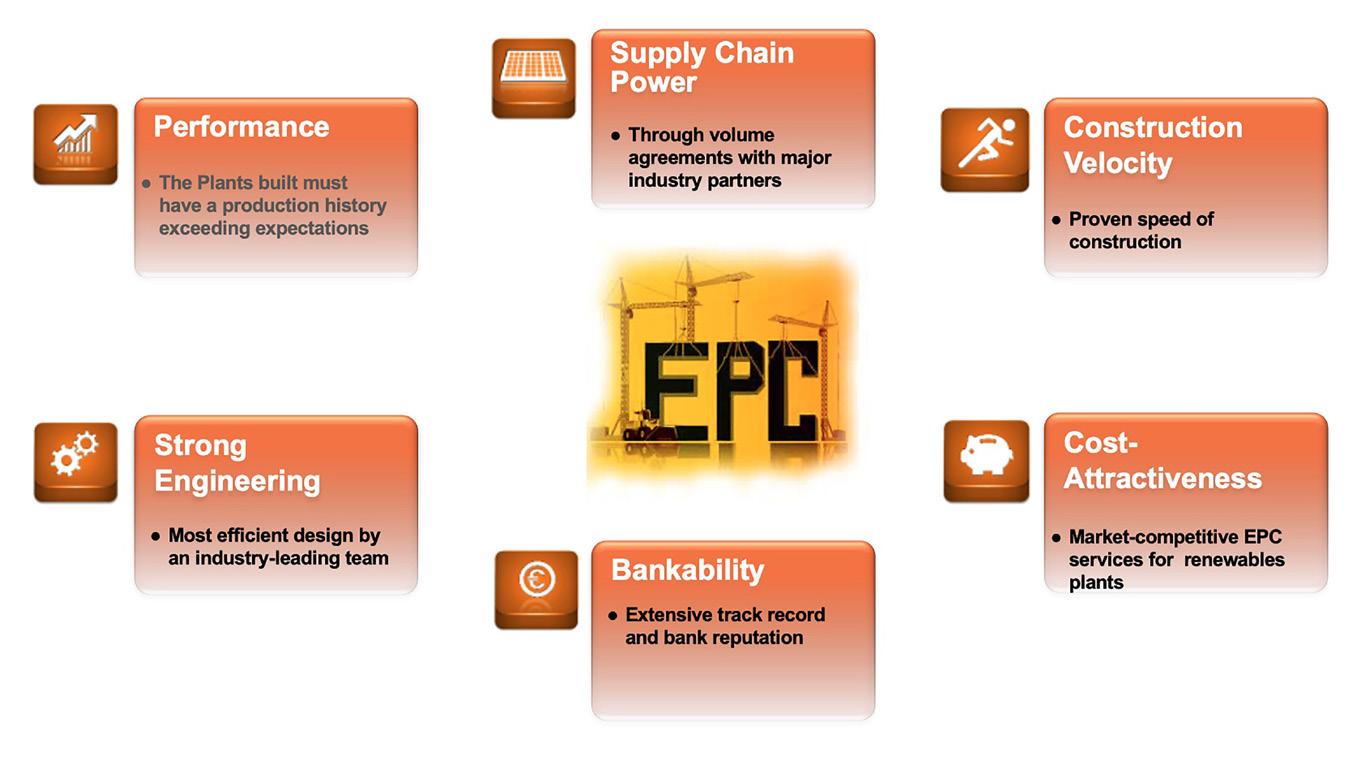

Adequate selection of the EPC contractor

Once the technology has been selected and the design has been optimised, the engineering, procurement and construction (EPC) company will play a fundamental role in the execution of the project. The selection of the EPC company must be undertaken using a thorough process. The variables which Matrix Renewables takes into account include the following: F Bankability: The EPC contractor must have an excellent track record and reputation in the industry. The largest EPC companies are not necessarily the best ones available in the market.

F Quality and performance – track record: Plants that are already built must have a production profile history exceeding performance expectations. Quality standards are reviewed and assessed before the deliveries of the components start.

F Strong engineering capabilities: As described earlier, the most efficient design has to be carried out by an industryleading engineering team which shall take innovation and advanced technologies into consideration, from both the hardware and software angles.

F Supply chain power: Equipment pricing for wind, solar, and battery storage projects fluctuates regularly, impacted by geopolitical considerations, raw materials constraints, and technological improvements, among other factors. The dynamic nature of the equipment market, which largely drives the overall cost of a project, demonstrates the importance of savvy procurement to a project’s success.

Expertise, relationships, and capabilities are critical to ensure realistic cost assumptions, to avoid fatal flaws, and appropriately price project energy output. Matrix

Renewables and its EPC contractors have a robust and diverse supply chain that ensures a broad selection of wind turbines, modules, and batteries are available, delivering the highest level of project viability by eliminating solesource risk and using bankable technology.

F Construction timeframe: The EPC contractor must have a proven adequate speed of construction.

F Cost attractiveness: The right price should be paid to the

EPC contractors to avoid the inherent risks of not achieving the cost levels needed to build and install the appropriate equipment.

Construction monitoring

The ability to prevent and solve execution problems by the EPC contractors is directly proportional to the earliest

detection of the potential issues. Matrix Renewables always appoints a dedicated team to monitor the execution on a daily basis, ensuring a healthy tension between the sponsor representatives and the EPC contactor team. Typically, a support team is also implemented to assist with the quality controls and the issuance of the progress reports. Early engagement in problem solving means that solutions are found more rapidly and problems are easier to correct.

Availability and cost of guarantees and insurances to cover all the years of operation

The main equipment installed and delivered to the renewables plant must have a long-term warranty package with the original equipment manufacturer (OEM). Some equipment usually has an original and standard limited product warranty, with the option to be extended throughout the duration of the plant. The main equipment to be considered is: wind turbines, solar modules, inverters, structures (trackers), and main electrical equipment (substation).

Long duration warranty packages attached to an operations and maintenance contract (O&M) is becoming more common nowadays, especially in the wind industry. The extension of life options are currently increasing the lifespan of wind assets, delivering very interesting results to plant profitability.

Figure 1. Adequate selection of the EPC contractor.

Figure 2. Stakeholder alignment.

Selecting appropriate services during the operational phase

Matrix Renewables’ trained asset management professionals develop customised O&M plans to ensure every project operates properly throughout its life. With a dedicated software – developed with one of the industry leaders – the company uses metering, sensing, and data analysis technologies to monitor, analyse, and respond to critical events that impact daily energy production.

By analysing production data against a rich set of production metrics, the company continuously verifies the production performance against performance baselines and financial models. The team also tracks outages and degradation and diagnoses root causes with the support of an externalised team.

Predictive and preventative maintenance is also prioritised, including frequent inspections and cleaning. These actions enable the output and revenue generated from projects to be maximised.

Matrix competitively sources O&M providers and holds them accountable for satisfying any third-party requirements, including lenders specifications, via well-established O&M agreements.

Conclusion

Matrix Renewables’ project pipeline growth is driven by the strength of its M&A and development teams, heavily supported by its technical team which follows a disciplined and targeted approach. The company actively filters for investment opportunities that minimise or eliminate environmental and permitting issues and have strong, low-cost interconnection options.

From a technical standpoint, a significant technical due diligence is invested early in the process to thoroughly screen projects for potential fatal flaws that would impede a project’s successful completion or may significantly erode the project’s financial returns: available land including setbacks restrictions, soil conditions, initial project layout, resource analysis, yield estimation, and an early technology selection are considered before an investment decision is made. These are all important fundamentals which Matrix Renewables believes lie in the optimisation of ROI in the renewables sector.