6 minute read

Argentina: geological potential attracts mining investment

Still today, Argentina is considered one of the most important mining investment destinations: legislative framework and high geological potential (more than 70% of Argentina’s areas with potential mineralization have not been subject to prospecting yet) accompanied by staunchly upheld state policies, many new deposits were uncovered or, where already known, got better defined, which led to their becoming busy operating centers or attaining significantly advanced stages. With a contribution of US$3.2 billion, mining turned out Argentina’s 6th export set in 2019. It is worth mentioning that 95% of these exports originate from just 4 provinces –San Juan, Santa Cruz, Catamarca and Jujuy- where the mining industry accounts for over 50% of exports.

According to reports of the National Mining Secretary (Secretaría de Minería de la Nación) during the last edition of the China Mining Conference held in October 2020, the various mining projects in Argentina stood at the following stages of development:

• 16 mines in production

• 7 projects under construction

(Includes 3 on going capacity expansions)

• 9 projects at feasibility (Includes Lama-Pascua, Potasio Río Colorado and Pachón with feasibility re-engineering)

• 7 projects at pre-feasibility

• 13 projects with preliminary economic assessment

• 26 projects at advanced exploration

• > 250 projects at initial exploration

Key topics of the mining industry in Argentina include:

- 1st Lithium Exploration Budget Worldwide

- Largest undeveloped copper world-class portfolio

- 2 of the world Top 30 Gold mines: Veladero and Cerro Negro

- Mineral Exports (2019): US$3.2 billion

- Exploration Budget (2019): US$240.7 million

- CAPEX Portfolio Advanced Projects (2020): US$27.3 billion

Exploration budget 2000-2019

As can be seen in Chart 1, exploration activities in Argentina have evolved in consonance with the price of commodities: the industry’s growth experienced strong deceleration since 2012, on account of a metal crisis, and started to regain momentum from 2015 on. In the period 2000-2019 an aggregate US$3.8 billion have been invested in exploration budgets, with Canadian and Australian companies mostly involved. The analysis of the 2015-2019 evolution of exploration budgets shows strong growth in gold participation but, more prominently, that of lithium, a commodity that became a big driver of Argentine mining development with significant prospects for the near future thanks to the multiplicity of its applications, mainly associated with green energy.

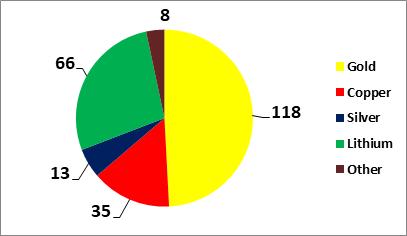

Over the past five years, the exploration budget in Argentina has grown 92%, and the most attractive commodities have been gold and lithium, as can be seen in Chart 2 and Chart 3, which explain exploration budget distribution by commodity for 2015 and 2019, respectively.

According to reports of the National Mining Secretary, the accumulated budget from 2015 to 2019 reveals that:

• Gold received 48% of the accumulated budget

• Lithium showed a sudden surge, accounting for 25% of the aggregate amount

• Copper represented 13% of the accumulated total; and

• Silver was present with 10%

A significant note to keep in mind: the most representative projects in terms of investment which are in the most advanced stages are all associated with copper. The above reported 13% has been essential for some copper projects to advance to stages close to definition.

Copper and green energies

Technology advance has allowed mankind obtaining benefits in different key areas, including infrastructure, health and education. It is in this field where various metals may play a key role in the present and near future of world population, given that we have already entered a new era of renewable, clean, green energies. In this respect, copper and lithium are among the metals bound to play decisive roles. The former, known to humans since many thousands of years ago, is used for countless applications and devices, including wind energy, tidal power, and electric vehicles; and, together with lithium, in solar panels, while at the same time they are strategic allies in assisting every resource for energy storage.

At October 2020, the National Mining Secretary has underscored the following distribution of advanced copper projects:

- Identified Resources: 65M tons

- Geological Potential: 350M tons

- 19 projects: The 10 larger scale add up to 99% of the identified resources

- Top 10 copper projects in Argen- tina:

• Pachón

• Agua Rica

• Josemaría

• Filo del Sol

• San Jorge

• Taca Taca

• Los Azules

• Altar

• Lama

• Bajo de la Alumbrera

- Productive Potential (8 projects):

• Copper: 1,219 kt/a

• Gold: 702 koz/a

• Silver: 15 Moz/a

• Molybdenum: 18 kt/a

Gold and silver: Precious Metals in Argentina

Charts 2 & 3 above show gold as the commodity with the largest presence in 2015 and 2019 exploration budgets, with more than 55% and 50%, respectively. Eight projects have been launched over the past decades, a fact that is testament to our country’s potential regarding gold. In most of these operating centers, silver appears as a highly coveted by-product significantly helping reduce production costs.

In addition to Lama project, a number of undertakings are placing their focus on the noticeable precious metals geological potential of Valle del Cura (San Juan) and El Deseado Massif (Santa Cruz) and their obvious interest to prospectors.

The National Mining Secretary offered the following details regarding gold mining undertakings:

- Identified Resources: 94 Moz

- Geological Potential: 378 Moz

- 43 projects: The 15 larger scale add up to 86% of the identified resources

- Top 15 gold projects in Argentina

• Agua Rica

• Cerro Vanguardia

• Josemaría

• Lama

• Veladero

• Taca Taca

• Suyai

• Lindero

• Altar

• Cerro Negro

• Bajo de la Alumbrera

• San Jorge

• Filo del Sol

• Los Azules

• Gualcamayo

- Productive Potential (5 projects):

• Gold: 481 koz/a

• Silver: 13.3 Moz/a

In relation to silver, fewer than half a dozen projects pivot around this metal as primary resource, and they lie at quite far apart areas. On the one hand, the Navidad project (Pan American Silver), located in the province of Chubut, and on the other, Diablillos (Abra Plata Resource) and El Quévar (Barrick), located in Salta, emerge as the big promises regarding silver metal. A change in state policies is needed for the Navidad project; only thus will the operation of one of the most attractive untapped silver projects in the world will be made possible.

- Identified Resources: 2,813 Moz

- Geological Potential: 6,400 Moz

- 40 projects: The 15 larger scale add up to 89% of the identified resources

- Top 15 silver projects in Argentina

• Agua Rica

• Cerro Vanguardia

• Josemaría

• Lama

• Veladero

• Cerro Moro

• San José

• Filo del Sol

• Los Azules

• Navidad

• Pachón

• Puna Operations (Pirquitas –Chinchillas)

• Diablillos

• Joaquín

• El Quévar

- Productive Potential (3 projects):

• Silver: 34.4 Moz/a

• Gold: 40 koz/a

Lithium world industry – The case of Argentina

Lithium is playing an ever more decisive role in electro mobility and clean energies. In the fast moving race of the last decades, Argentina has been quite adept at leveraging the momentum of lithium demand which is growing at a stunningly frenetic pace. Found in few countries, lithium abounds in Argentina –through its provinces Catamarca, Jujuy and Salta- which, together with Bolivia and Chile make up the so called “Lithium golden triangle,” one of the richest areas for lithium resource identification. For this reason, the Puna’s salt flats exhibit competitive advantages for speedy development and entry into production of operating centers associated with this metal.

- Identified Resources: 93M tons

- Geological Potential: 350M tons

- 21 projects: The 10 larger scale add up to 86% of the identified resources

- Top 10 lithium projects in Argentina

• Cauchari-Olaroz

• Centenario – Ratones

• Salar del Rincón

• Tres Quebradas (3Q)

• Salar de Olaroz

• Cauchari

• Sal de Vida

• Pastos Grandes

• Fénix

• Kachi

- Productive Potential (14 projects): 305,000 t/a

Conclusions

As we said above, mining was the 6th export cluster in 2019 accounting for 5% of total exports. The commissioning of new projects –particularly for copper mining— can not only sustain these values but has potential to more than triple current exports: 2/3 of those additional exports would originate from just 3 copper projects. Argentina still holds great potential for new deposit discoveries that may allow continuing its high mineral production. Over 70% of the national territory remains insufficiently explored, especially if new deposit models are considered. These natural endowments, together with public policies aimed at fostering mining development, continue to make Argentina one of the most attractive mining investment areas in the world.

Argentina has the potential to triple its mining exports (Source: National Mining Secretary - October 2020)