j our nal e

Echocardiography With Contrast

BillingAnd

Quest ion:

We read that CMSintends to deny services that are associated with OPD services (in this case, rhinoplasty and possibly implanted spinal neurostimulators), that require a PA as a condition of payment, and have received non-affirmation decisions, and/or have denied claims. Should we be getting PAs for these codes?

Answ er:

Medicare exempts Critical Access Hospitals from the prior auth requirement Exempt providers should not submit a prior authorization request

In their December 27, 2021, Frequently Asked Questions- Prior Authorization Process for Certain Hospital Outpatient Department (OPD) Services, Medicare states:

Quest ion:

We operate an anti-coagulation clinic which is managed by our pharmacists. Are we able to bill for the pharmacists' time and services? If yes, how do we accomplish this?What services are covered and what are the documentation and coding requirements? Also, do we use professional or facility billing forms?

Answ er:

We do not recommend billing an outpatient facility visit for the services of a pharmacist in evaluating PT/INRvalues of outpatients using anticoagulant medication

Attached is a Q&A we?ve published on the topic of billing hospital visits with pharmacists, as well as our ?Incident To?billing paper

Our updated paper on Coumadin Clinics appears in this issue.

A pharmacist may provide services in a ?freestanding?(not provider-based) clinic under the ?incident to?billing rules. In a non-facility (clinic) setting, it is permissible to report the services of a pharmacist under the NPI of a physician who was primarily responsible for the care of the patient seen on the date of service, provided that all of the following criteria are met:

- Any services performed by the pharmacist are within the State Scope of Practice laws applicable to the pharmacist?s licensure;

- The physician or the organization billing for the physician?s services must incur an expense for the services provided by the pharmacist (and billed under the physician?s NPI);

- The patient must be an established patient, and the diagnosis being treated is not new;

- The pharmacist?s services are in keeping with the treatment plan established by the physician for that particular patient;

- The physician whose NPI will be reported as the rendering provider is in the clinic and immediately accessible during the time the service is provided;

- The physician reported as the rendering provider reviews the progress note after the ?incident to?service, optimally adding a signature to the note to indicate s/he continues active involvement in the care of the patient.

The CPT® for reporting anticoagulant management in a freestanding clinic is 93793 ? note that under Medicare?s OPPSreimbursement methods for facility encounters, 93793 is not reportable on a facility fee claim

The American Society of Hospital Pharmacists (ASHP) offers an FAQ on its website addressing billing a pharmacist ?incident to?a physician in a non-hospital based clinic Here?s a link and an excerpt:

https://www.ashp.org/-/media/assets/ambulatory-care-practitioner/docs/sacppharmacist-billing-for-ambulatory-pharmacy-patient-care-services pdf

1 How does billing am bulat ory pharm acist pat ient care services in a physician-based clinic (nonhospit al based) differ from billing in a hospit al-based clinic?

?For Medicare patients, hospital-based outpatient services (including clinics) are governed by the Hospital Outpatient Prospective Payment System (HOPPS) regulations. rulings that can be found at

http://www.cms.gov/Regulations-and-Guidance/Regulations-and-Guidance.html. This site includes the Medicare Benefit Policy Manual which describes who can bill under Medicare Part B and the 1995 and 1997 Documentation Guidelines for Evaluation and Management Services which describes the documentation required for billing.

?The Medicare Benefit Policy Manual describes which providers may bill under Medicare Part B. Pharmacists are not recognized Medicare Part B providers except when providing immunizations. The Medicare Benefit Policy Manual, Chapter 15 Section 601 describes physician delegation to others working in their offices who provide care to Medicare patients and a mechanism for billing such services. The title of this Chapter is ?Services and Supplies Furnished Incident to a Physician?s/NPP?s Professional Service?and governs the services pharmacists provide in a non-institutional setting

?These services are often termed ?incident to ?Under these rules, pharmacists can bill for their services in a physician-based clinic. These rules differ in their processes from the HOPPS regulations.

?Non-institutional physician-based offices and clinics may negotiate specific contracts with private payers that may include a different mechanism for payment to enable pharmacist reimbursement for patient care services, 2 including utilizing a direct payment process incorporating the Medication Therapy Management (MTM) CPT® codes or another preferred mechanism 2, 3, 4 Alternatively, pharmacist-based services may be folded into a capitated payment model and or associated with pay for performance incentives. If there are no specific contracts with private payers, billing for pharmacy services defaults to Medicare regulations Medicare patients by law may not be treated differently than other patients In certain states, Medicaid rules and laws may allow payment for pharmacist-provided patient care services in the ambulatory setting.

Hospital outpatient departments must determine whether a patient is ?New?or ?Established? when billing Evaluation and Management (E/M) services. For hospital-based clinic visits, the facility fee (837i or UB04) and the professional fee (837p or CMS1500) require separate determinations. Different rules apply to code assignment for professional fees and facility fees; it is common and correct to assign different E/M codes to each claim for the same visit.

E/M coding for professional fee billing is discussed in the CPT® Guidelines, available on a link next to the CPT® Codes report on the PARA Data Editor Calculator tab:

New versus Est ablished Pat ient Coding:

E/M visit codes are selected according to a number of factors, including whether the patient is new or established from the perspective of the billing provider In a provider-based setting, the hospital may appropriately bill a new patient code when the physician bills an established patient code and vice versa.

For facilit y fee claim s (837i or UB04):

Use the following guide in selecting new versus established patient E/M codes:

- A ?new pat ient ?means a patient who has not received any face-to-face services, i e , E/M service or surgical procedure, from the facility within the previous 3 years

- An ?est ablished pat ient ? is one who has been registered as an inpatient or outpatient of the hospital within the 3 years prior to the visit

For Professional Fee claim submission (837p or CMS1500), the following defines a new vs established patient in selecting the appropriate E/M code:

- A ?new pat ient ?means a patient who has not been seen for face-to-face professional services by the provider or a provider of the same specialty in the same group within the previous 3 years An interpretation of a diagnostic test, reading an x-ray or EKG etc , in the absence of a face-to-face service does not affect the designation of a new patient

- An ?est ablished pat ient ? is one who has been seen for face-to-face services by a provider or a provider of the same specialty in the same group within the previous 3 years If a provider leaves a group practice, and practices elsewhere, and a patient follows him or her to the new site, the patient is still considered established if seen in the last 3 years.

Provider of t he Sam e Specialt y:

CMSdefines ?same specialty?as being within the same group of taxonomy codes Medicare has assigned to a specialty code The specialty group codes were previously published in a PDFfile, but now they are available in an online database at the link below:

https://data cms gov/ provider-characteristics/ medicare-providersupplier-enrollment/ medicare-provider-andsupplier-taxonomy -crosswalk

While Medicare offers significant differentiation in specialty codes assigned to physician specialties, all Nurse Practitioners are assigned to Specialty Code 50, regardless of the type of Nurse Practitioner taxonomy code. Here is an example of the data exported using the query:

Quest ion:

If we perform and echocardiogram with contrast 93306 (C8929) should we also report the contrast A9700 or Q9957, with a $1 00 charge?We have read that C8929 is bundled

Answ er:

Facilities should report C8929 for the technical component when performing a complete transthoracic echocardiography with contrast (including spectral and color flow doppler). The contrast material (e g , Q9957) should be reported separately at the full charge rate There is no NCCI edit for reporting A9700 or Q9957 with C8929:

The appropriate HCPCScode (as indicated below) should be reported for the type of contrast used. Most echo contrast is reported using one of the ?Q?codes listed below. A9700 is intended to be utilized for echo contrast materials that donothave a specific corresponding HCPCScode Most current echo contrast has an established HCPCScode, so A9700 would rarely be reported. Reporting of A9700 is per st udy, so only one unit of this code should be reported if utilized

Reporting of Q9950, Q9956, and Q9957 is per m l, so for these contrast agents, the number of units utilized/provided for the study should be reported. The payment for these contrast materials is packaged (status N) under Medicare?s hospital outpatient reimbursement methodology (OPPS), but the contrast should still be reported separately with the appropriate charge. As a critical access hospital, you will be reimbursed a percentage of your charges for the contrast HCPCScodes.

For additional information regarding reporting echocardiography and imaging contrast materials in the facility setting, please see the papers linked below (which are also available in the Advisor tab of the PARA Data Editor):

Facility Echocardiography Coding

Radiology Contrast Materials

The purpose of an Anticoagulation Management Program, also referred to as a Coumadin Clinic, is to effectively manage a patient?s oral anticoagulant therapy to produce positive outcomes and preventing embolic and bleeding events. Some common medical conditions that may require anticoagulation monitoring and management are atrial fibrillation, valve replacements, recent heart attack, cerebrovascular accidents (CVA), deep vein thrombosis (DVT) and pulmonary embolus

A typical visit will include a PT/INRlab test performed by a nurse (RN, not ARNP) or a pharmacist, by finger stick The results of the lab test are reviewed, and

- If t he PT/ INR values are w it hin norm al ranges, then no further action is required, and the visit is complete

- If t he PT/ INR result s are not w it hin norm al ranges, the nurse/PharmD will communicate with the patient?s physician to indicate an adjustment in medication should be considered. CPT® 93793 is available to report professional fees for Coumadin Clinic services, but it is not appropriate on an outpatient facility fee claim Under Medicare?s OPPSfacility payment system, 93793 is status B ? Non-allowed item or service

The limited nature of Coumadin Clinic services alone are insufficient to support an outpatient hospital evaluation and management facility fee charge.

This paper explores the compliant options for reimbursement under Medicare rules for both professional and facility fees.

When performed by a ?Qualified Healthcare Practitioners?(QHP) ? those providers eligible to bill a professional fee to Medicare, such as an MD, DO, ARNP, or PA ? the rendering professional may report CPT® 93793 (Anticoagulant management for a patient takingwarfarin, must includereview and interpretation of a newhome, office, or lab international normalized ratio (INR) test result, patient instructions, dosage adjustment (asneeded), and schedulingof additional test(s), when performed ) This CPT® code is reimbursed at the same professional fee rate in the facility and non-facility setting

?Incident To? billing? Coumadin Clinic services performed by qualified auxiliary personnel (i.e. RN, PharmD) in a freestandingclinicunder the supervision of a QHPmay be billed under the supervising practitioner?s NPI, even if the practitioner did not personally see the patient, provided that the service follows an established plan of care for the individual patient (not a new diagnosis or a first-time patient) and provided that the supervising practitioner is in the office suite and immediately available at the time the service was rendered (See also our guidance on ?Incident-To?Billing in the Clinic and Hospital Settings )

However, ?incident to?professional fee billing is not permitted in the facility setting, including provider-based clinics which operate as a department of a hospital. In the facility setting, only the services personally performed by the billing provider may be reported to Medicare.

Visit documentation of the face-to-face professional fee should include:

- A record of the patient?s need for anticoagulant therapy, current dose, Prothrombin Time (PT) and International Normalized Ratio (INR) results and target;

- Notes regarding the patient assessment, including signs and symptoms of bleeding/adverse effects due to anticoagulant therapy, changes in health status that may impact or account for fluctuations in laboratory results (e g ; new or changed medications);

- Notes describing any medically necessary education provided;

- Identity the referring QHP, the rendering staff/QHPor supervising physician, and/or any QHPwith whom test results or progress is reported.

In t he out pat ient facilit y set t ing, documentation of a Coumadin Clinic service alone will not support a facility fee charge for an outpatient visit (i.e. G0463 or 99202-99215.) However, if the patient has consented to a care management program under a facility-based Qualified Healthcare Practitioner, the time spent by facility staff in reviewing the PT/INRlab result and providing patient education may be counted toward the monthly time requirement for

Principal Care Management (PCM) or Chronic Care Management (CCM) (For detailed information on these options, see our paper onTransitional Care Management (TCM), Remote Physiologic Monitoring (RPM), Chronic Care Management (CCM), and Principal Care Management (PCM) )

In the absence of a care management program supervised by a facility-based provider, the facility is limited in claiming reimbursement because the documentation will fall short of a medically necessary outpatient hospital service

Here are the two most common scenarios:

1. If t he PT/ INR values are w it hin norm al ranges, then no further action is required, and the visit is complete.The hospital may bill for the PT/INRtest only (usually 85610 ? Prothrombin time) ?but not an outpatient visit

2. If t he PT/ INR result s are not w it hin norm al ranges, the nurse/PharmD will communicate with the patient?s physician to indicate an adjustment in medication should be considered Again, this does not constitute sufficient documentation to warrant an outpatient visit ? we do not recommend reporting a visit fee in the facility setting for reviewing a lab result and relaying that information to the patient?s physician/practitioner

Consequently, unless the medical evaluation is performed by an enrolled Qualified Healthcare Practitioner (MD, DO, ARNP, PA, etc ), visits to review the PT/INRresults for a patient on anticoagulant therapy are not billable as an outpatient facility fee ?hospit als should report only t he PT/ INR lab t est

Documentation of a Coumadin clinic service performed in the outpatient facility setting by non-QHPstaff, including nurses and pharmacists, will not support a charge for an outpatient facility visit, and therefore should not be reported with an outpatient facility fee such as G0463 - Hospital outpatient clinicvisit for theassessment and management of a patient,or the 99202-99215 Evaluation and Management code set used by Critical Access Hospitals

To support billing an outpatient facility charge for an encounter (such as G0463 or 99202-99215), the clinical documentation should include:

- An order from the referring physician/non-physician practitioner .

- Medical Necessit y ?if the patient?s PT/INRresults are normal, there is little to support the medical necessity of an outpatient visit.Report only the lab test.

- An evaluat ion by a qualified healt hcare pract it ioner (QHP),For professional fees, only ?Qualified Healthcare Practitioners?(QHP) are eligible for reimbursement QHP?s include:

- Physician Assistants (PA)

- Nurse Practitioners (NP)

- Clinical Nurse Specialist (CNS)

- Certified Nurse-Midwife (CNM)

Note:Although facilitiesmaychargefor evaluation and management servicesperformed by auxiliarypersonnel appropriateto their licensure/certification (e.g. ObstetricsNurse, Registered PolysomnographicTechnologist, Certified Wound and OstomyCareNurse), Medicare considers theservicesof pharmacistsasa component oft heoverall facilityfeebilled byhospitalsfor each patient visit.Wedo not recommend charginga facilityfee for a pharmacist?sevaluation.

Prothrombin time and International Normalized Ratio (PT/INR) testing must be performed regularly to monitor Coumadin clinic patients. The test is reported using HCPCS85610; if the test is performed at an independent clinic which operates under a CLIA ?certificate of waiver?, the QW modifier may be required.Most payers, including Medicare, will not reimburse for capillary specimen collection.

To qualify for reimbursement under Medicare, a PT/INRtest must meet certain medical necessity criteria as outlined below:

- The test must be ordered by a licensed medical practitioner (as allowed by the practitioner?s specific license)

- The test must be medically necessary

- The test results must be documented within the patient?s medical record

Medicare?s National Coverage Determination 190.17 outlines the complete requirements to support PT/INRlaboratory test billing

PT/ INR t est ing in Long Term Care Facilit ies (LTC) may be separately reimbursed if a Medicare beneficiary is not in a covered Medicare Part A stay. When coverage and payment for medically necessary PT/INRtesting provided in a LTCfacility is not bundled into the comprehensive facility service charge, the facility has the appropriate CLIA certification and the patient is enrolled in Medicare Part B, the test is eligible for coverage and payment under Medicare Part B The payment amounts will be based on the Medicare Part B Clinical Lab Fee Schedule (CLFS).

PT/ INR t est ing by a Hom e Healt h Agency is covered if the patient is under a certified plan of care (POC); the test must be ordered by the physician and performed in the patient?s home. The Home Health Agency (HHA) must own the PT/INRtesting equipment and supplies and use them in the patient?s home to perform the test

Medicare permits both free-standing clinics and outpatient hospital clinics to provide and be reimbursed for home PT/INRmonitoring service equipment and supplies Reimbursement is limited by the conditions of National Coverage Determination 190.11:

https://www cms gov/medicare-coverage-database/details/ncd-details aspx?NCDId= 269&ncdver=2&DocID=190.11&bc=gAAAAAgAAAAA&

Home PT/INRtesting supplies and equipment must be provided under the direction of a physician Reimbursement is made to the billing entity and differentiates between the technical and professional components of the diagnostic services.

CMShas designated 3 codes to report home PT/INRmonitoring:G0248, G0249, and G0250 All three codes are payable under the Medicare physician fee schedule for free-standing clinics, but hospitals may report only G0248 and G0249 as facility fees. G0250 is a professional fee code

- G0248 may only be billed once, as the long descriptor refers to initial training in the use of the home PT/INRtesting monitor

- G0249 includes all equipment and supplies necessary to provide home PT/INR monitoring The equipment and supplies may not be billed separately to Medicare Covered equipment and supplies may include, but are not limited to, the following:

- CoaguChek PSTSystem

- CoaguChek PSTStrips

- CoaguChek Controls

- Alcohol swabs

- Lancets

- Lancing device

- Software for analysis and reporting of test results

G0249 and G0250 may be billed only once for every four tests However, CMShas assigned a Medically Unlikely Edit (MUE) or 3 for G0249, therefore hospitals may report up to 3 units of G0249 on one claim, which allows coverage of up to 12 tests. The service is billable on a date when a patient would attend the clinic for a face to face visit

If a Coumadin Clinic is enrolled with Medicare as an Independent Diagnostic Testing Facility (IDTF), only codes G0248 and G0249 may be billed as technical components.

An IDTFcannot provide the professional component (G0250).Most Coumadin Clinics are enrolled as departments of a hospital or under a Medical Group enrollment, however.

When physician-directed, diagnostic services are rendered from an outpatient hospital clinic, the services are reimbursed under the payment guidelines of CMSOPPS.

This payment system affects which codes can be billed and how they will be paid

CorroHealt h invit es you t o check out t he m lnconnect s page available from t he Cent ers For Medicare and Medicaid (CMS) It 's chock full of new s and inform at ion, t raining opport unit ies, event s and m ore! Each w eek PARA w ill bring you t he lat est new s and links t o available resources Click each link for t he PDF!

Thursday, August 10, 2023

New s

- Immunization: Protect Your Patients

Claim s, Pricers, & Codes

- Outpatient Rehabilitation Claims with Reason Code W7072: Do You Need to Resubmit Claims?

MLN Mat t ers®Art icles

- HCPCSCodes Used for Skilled Nursing Facility Consolidated Billing

Enforcement: October 2023 Update

Publicat ions

- Expanded Home Health Value-Based Purchasing Model: New Resource & Updated FAQs

Mult im edia

- Skilled Nursing Facility: Minimum Data Set Resident Assessment Instrument Training Materials

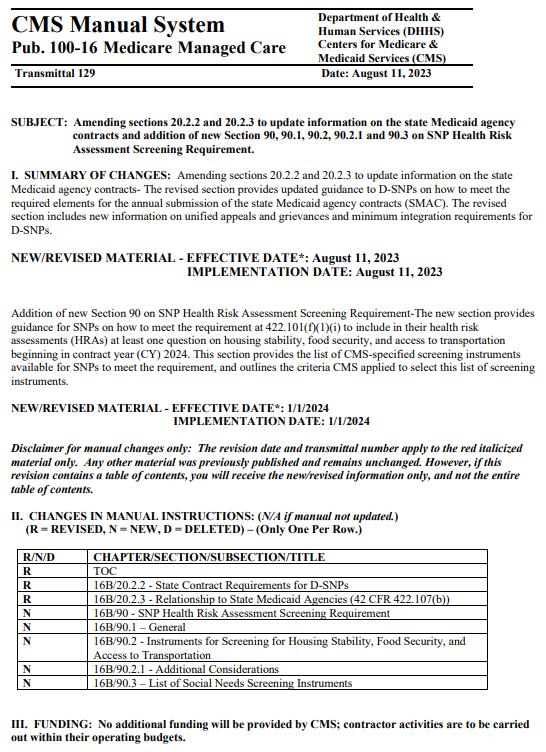

Therew ere12new or revised Transmittalsreleased thisw eek.

To go to thefull Transmittal document simply click on thescreen shot or thelink.

Therew asONEnew or revised MedLearn released thisw eek.

To go to thefull Transmittal document simply click on thescreen shot or thelink.

Theprecedingmaterialsare for instructional purposesonly. Theinformation ispresented "as-is"and to thebest of CorroHealth'sknowledgeisaccurateat thetimeof distribution. However, due to the ever-changinglegal/regulatory landscape, thisinformation issubject to modification asstatutes, laws, regulations, and/or other updatesbecome available. Nothingherein constitutes, isintended to constitute, or should berelied on aslegal advice. CorroHealth expresslydisclaimsanyresponsibilityfor anydirect or consequential damagesrelated in anywayto anything contained in thematerials, which areprovided on an "as-is"basisand should beindependentlyverified before beingapplied. You expresslyaccept and agree to thisabsoluteand unqualified disclaimer of liability. The information in thisdocument isconfidential and proprietaryto CorroHealth and isintended onlyfor thenamed recipient. No part of thisdocument maybereproduced or distributed without expresspermission. Permission to reproduceor transmit in anyform or byanymeanselectronicor mechanical, includingpresenting, photocopying, recording, and broadcasting, or byanyinformation storageand retrieval system must beobtained in writingfrom CorroHealth. Request for permission should bedirected to Info@Corrohealth.com.