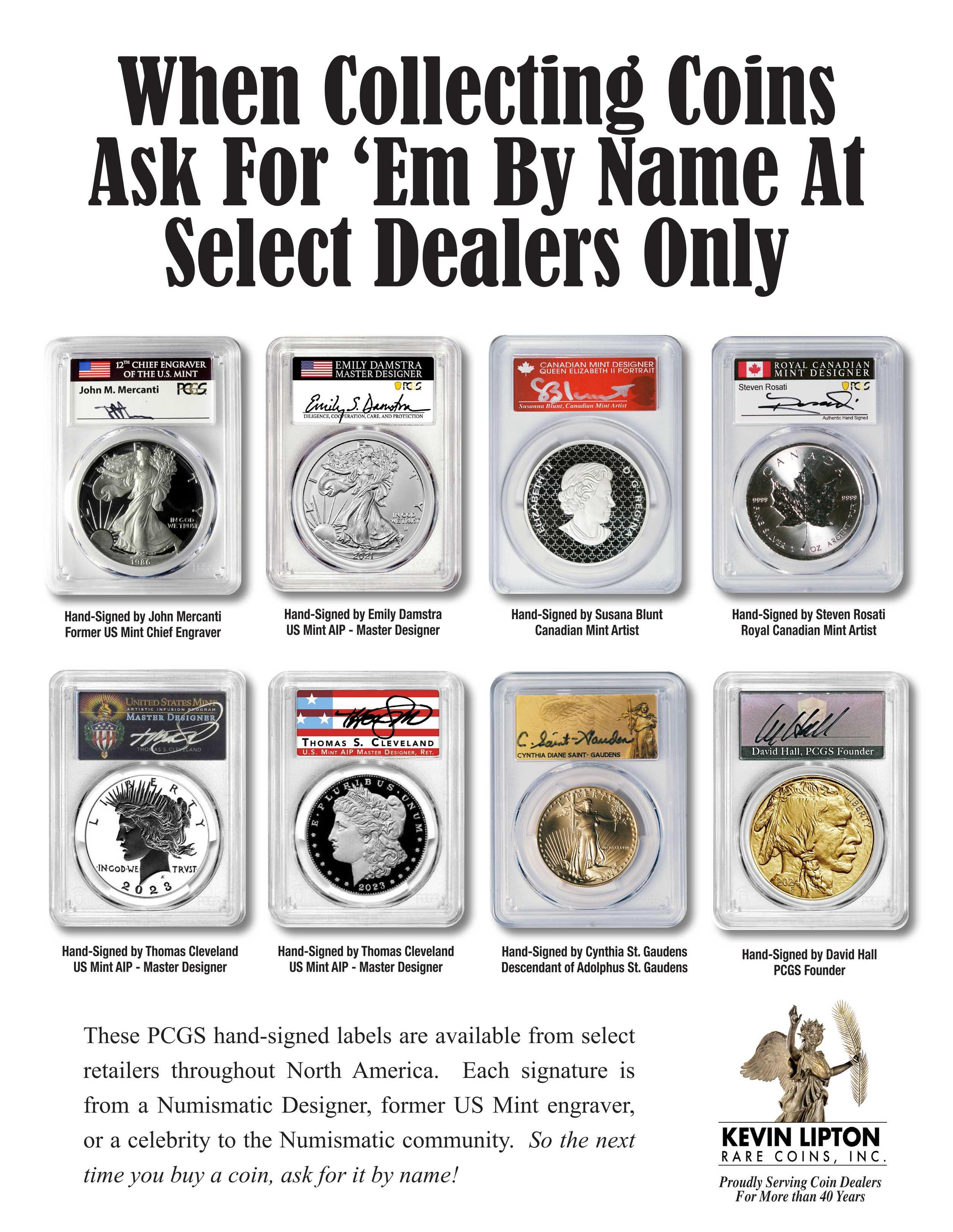

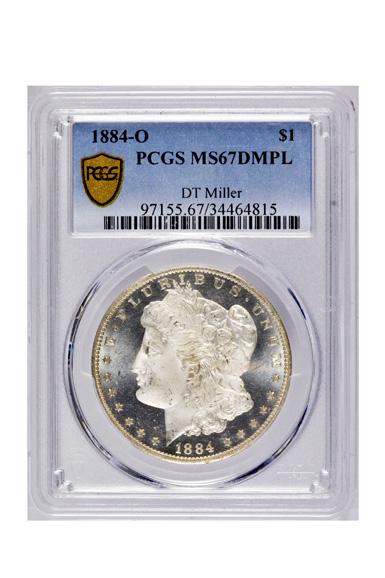

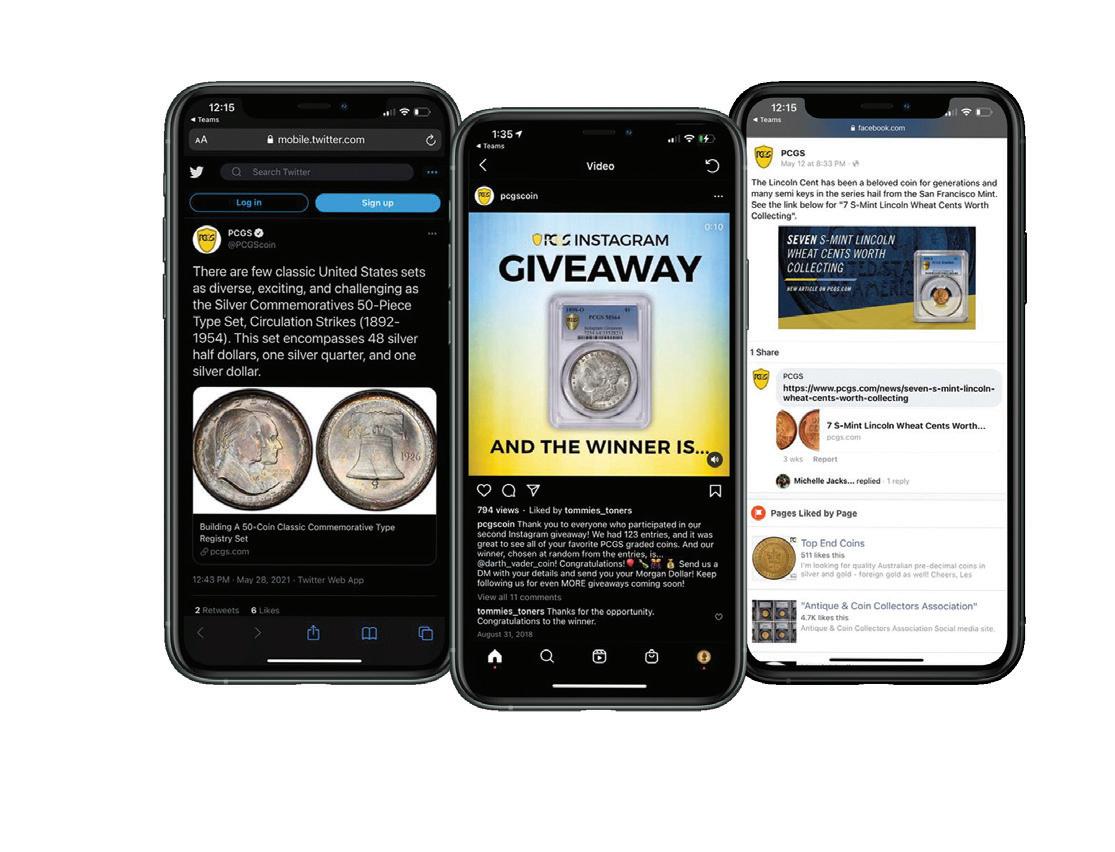

2,580 high-resolution coin photographs for comparisons and grade estimations

Price guide values and population statistics

NFC technology and barcode scanning for instant coin look-up

Real-time updates

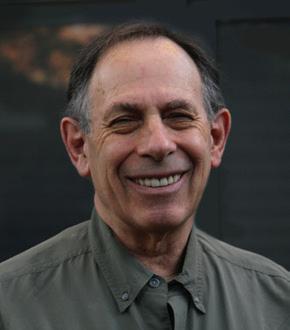

Editor-in-Chief Joshua McMorrow-Hernandez

Director of Advertising & Marketplace Taryn Warrecker

Content Manager Arianna Tortomasi

Lead Designer James Davis

Cover Artist James Davis

Distribution Coordinator Ronald Burnett

Subscriptions:

Single Issue:

$14.95

One-Year Subscription (6 Issues): $79.99

PCGS Market Report is offered as a premium to PCGS Authorized Dealers and PCGS Collectors Club members.

To become a PCGS Authorized Dealer, contact: Dealer@PCGS.com

To become a PCGS Collectors Club member, go to www.PCGS.com/join

Printed in the United States. Copyright 2024 Collectors Universe, Inc. All rights reserved. Reproduction of any kind without written permission of the publisher is prohibited by law. PCGS Market Report is published bi-monthly by Collectors Universe, Inc. at P.O. Box 9458, Newport Beach, CA 92658. Postmaster, send address change to Market Report c/o PCGS, Publication Department, P.O. Box 9458, Newport Beach, CA 92658.

Publication of this magazine is not a solicitation by the publisher, editor, or staff to buy or sell the coins listed herein.

Advertising, articles, and other contents of this magazine sometimes contain inadvertent typographical errors, a fact readers should bear in mind when encountering pricing quoted at a fraction of prevailing market values. The publisher is not responsible for actions taken by any person because of such errors. Advertising prices are subject to change without notice.

Have Questions or Feedback?

For advertising and content inquiries, please email us at PCGSAdvertising@collectors.com.

Think our coin prices are too low? Too high? Email us at CoinPrices@Collectors.com with the coin number, description, grade, published price, proposed price, reasoning, and supportive evidence (like auction results). We'll be happy to review it!

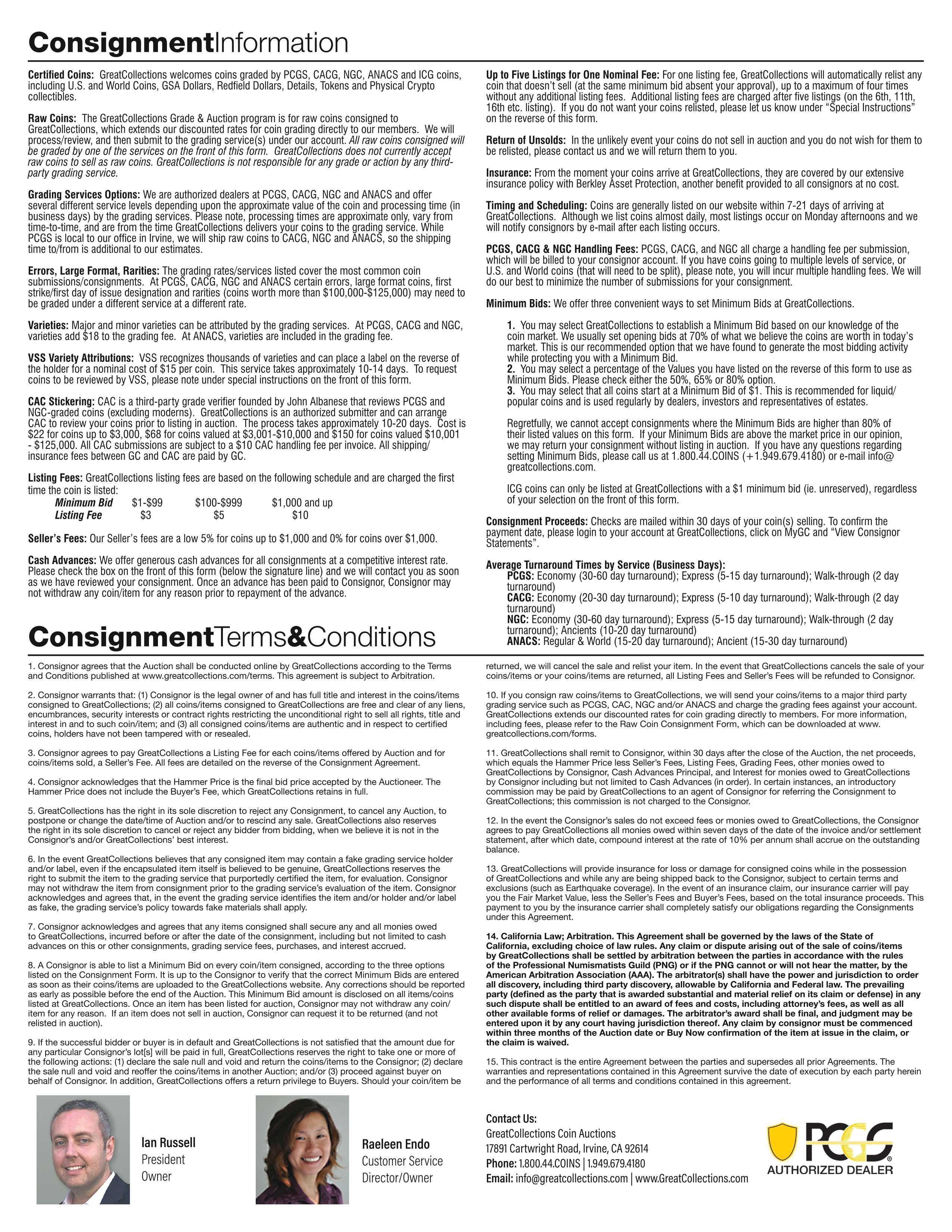

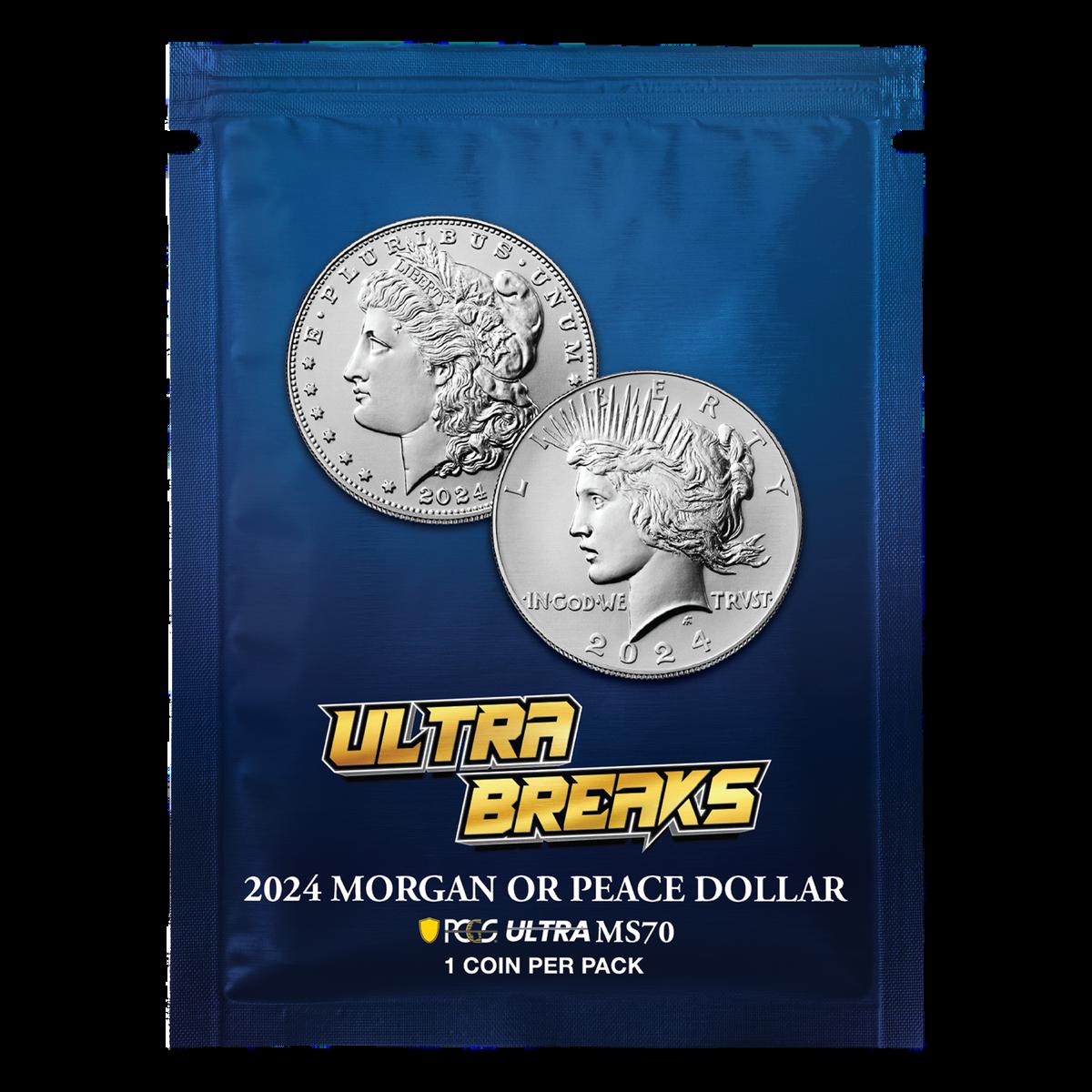

We’re now headlong into summer, and things are heating up in the numismatic world. The coin market is in full swing as the calendar fills up with many local, regional, and national shows, not to mention the PCGS Members Only Show at Park MGM in Las Vegas, Nevada, being held July 16-20, 2024. Meanwhile, we’re preparing for the final Long Beach Expo of its 60th anniversary year, with The Collectibles Show taking place at the Long Beach Convention Center September 5-7, 2024.

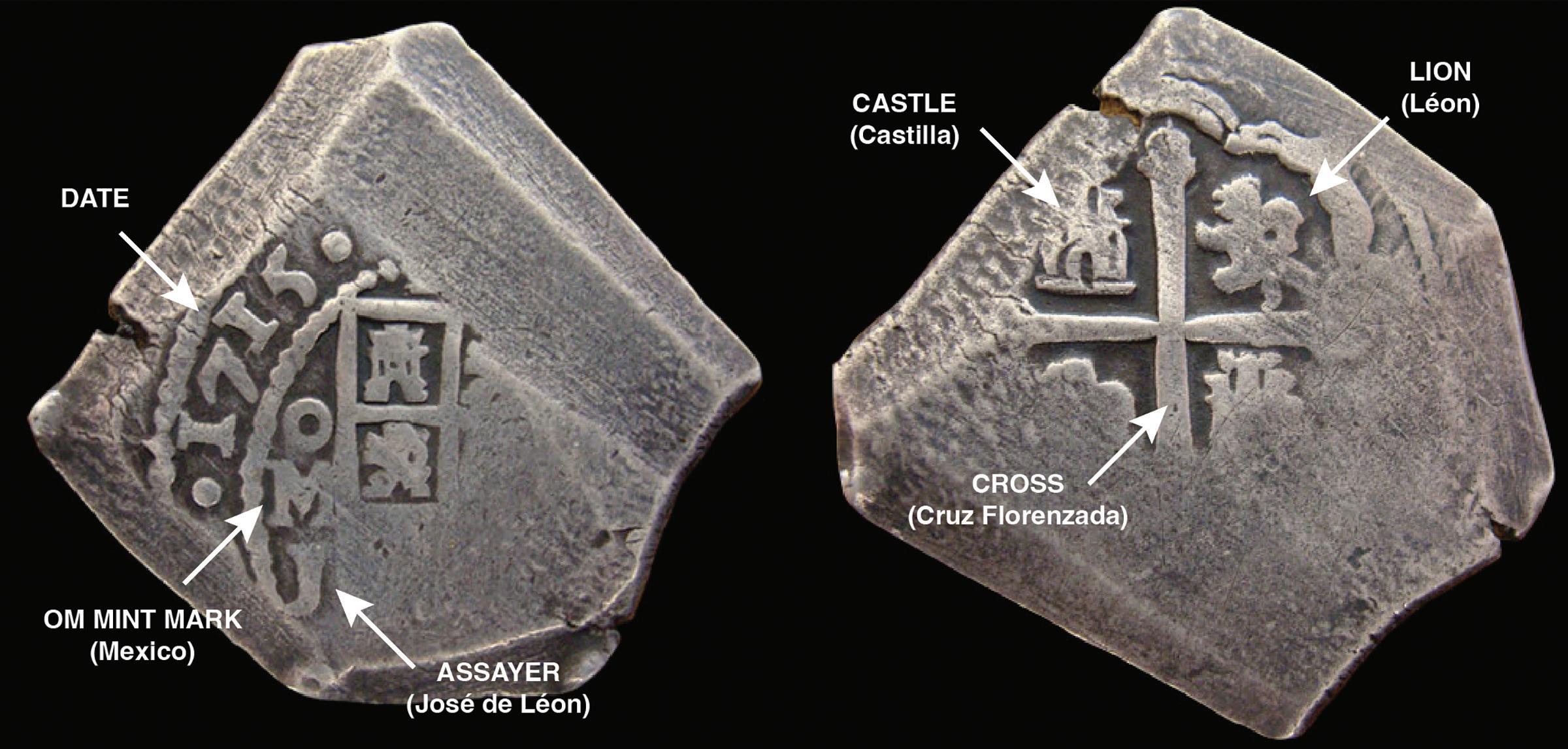

There’s much going on in the marketplace, and we’re covering many angles of the scene with articles on a diversity of topics. Shipwreck coin expert Ben Costello shares the joys of collecting silver treasure coins recovered from the legendary Spanish 1715 Fleet ships. Modern Chinese coin authority Peter Anthony explores the fascinating history of the Manchurian Mint. We meet collector Hugh J. Hillaker, a longtime PCGS Set Registry member who has built a knockout set of classic United States commemorative coins. We also hear from 18-year-old Joseph Ford, a young numismatist who turned his passion for coins into a thriving business.

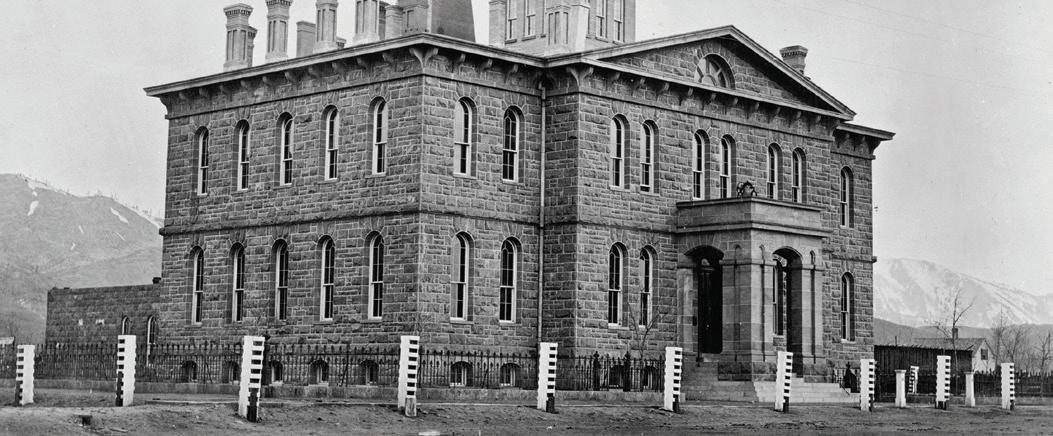

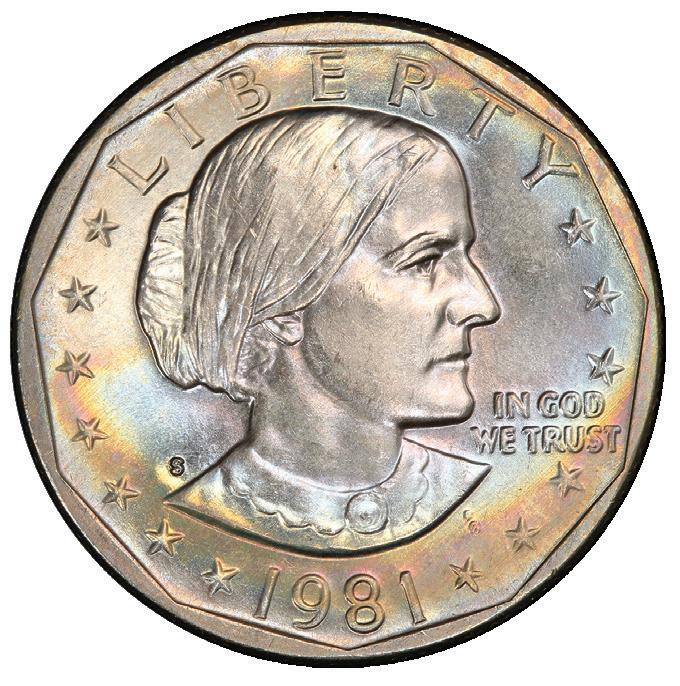

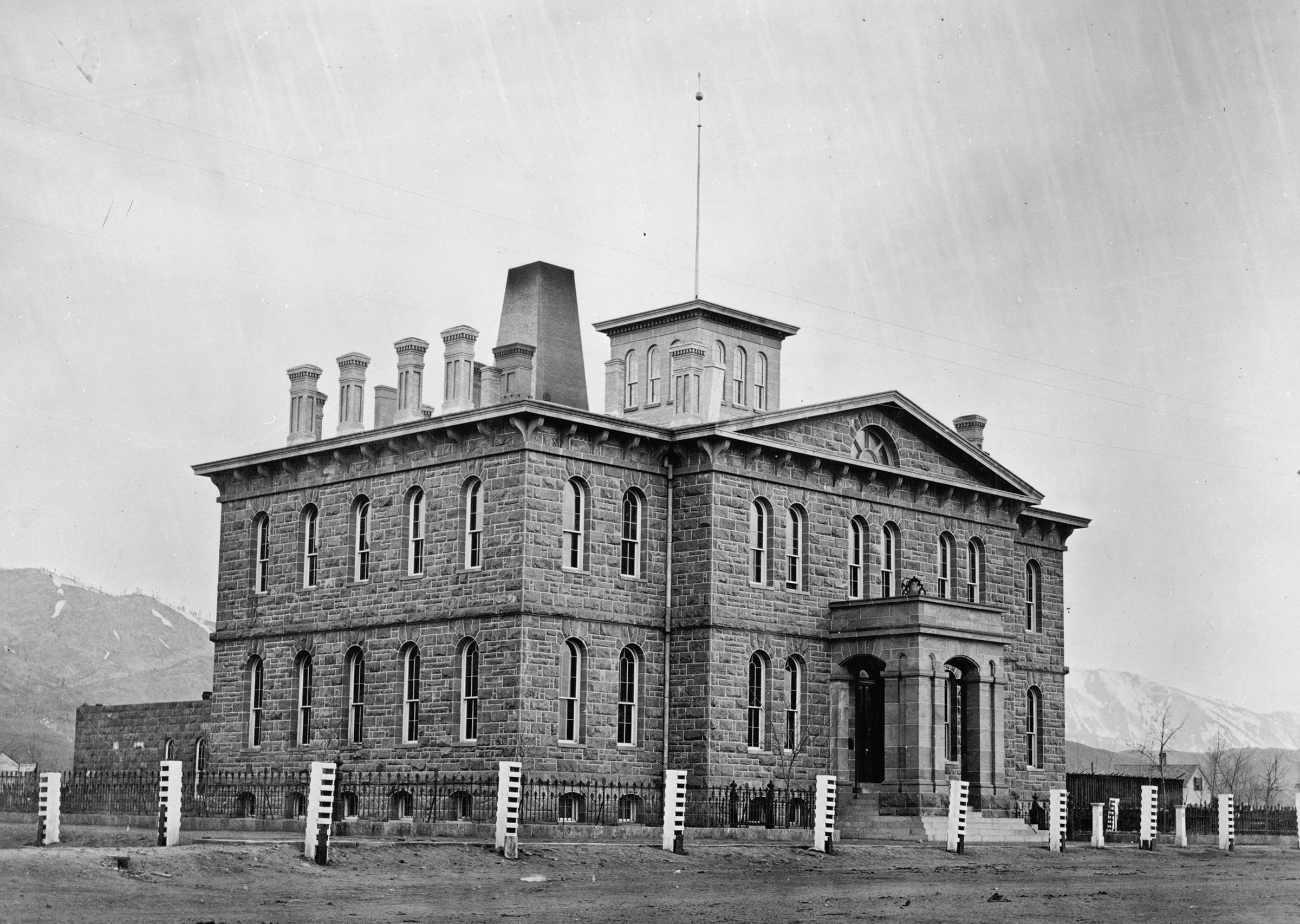

We cover a multitude of other topics, including Susan B. Anthony Dollars, the 1970s-era U.S. dollar coin that may finally be receiving the numismatic attention it deserves. And we are even going to take you to Carson City, Nevada, where one of the most romanticized U.S. branch mints now serves as a museum housing Coin Press No. 1 – a relic with a story you’re going to find out much more about. Then, we jet to the green hills of Ireland, an enchanting place with some most fascinating numismatic tales!

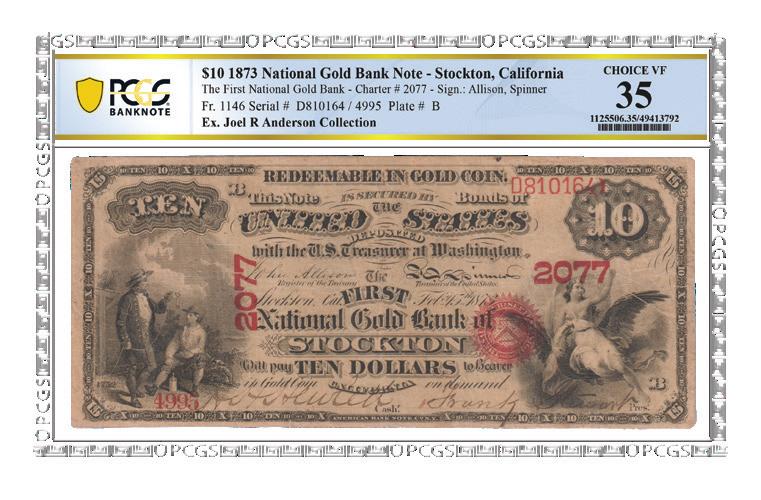

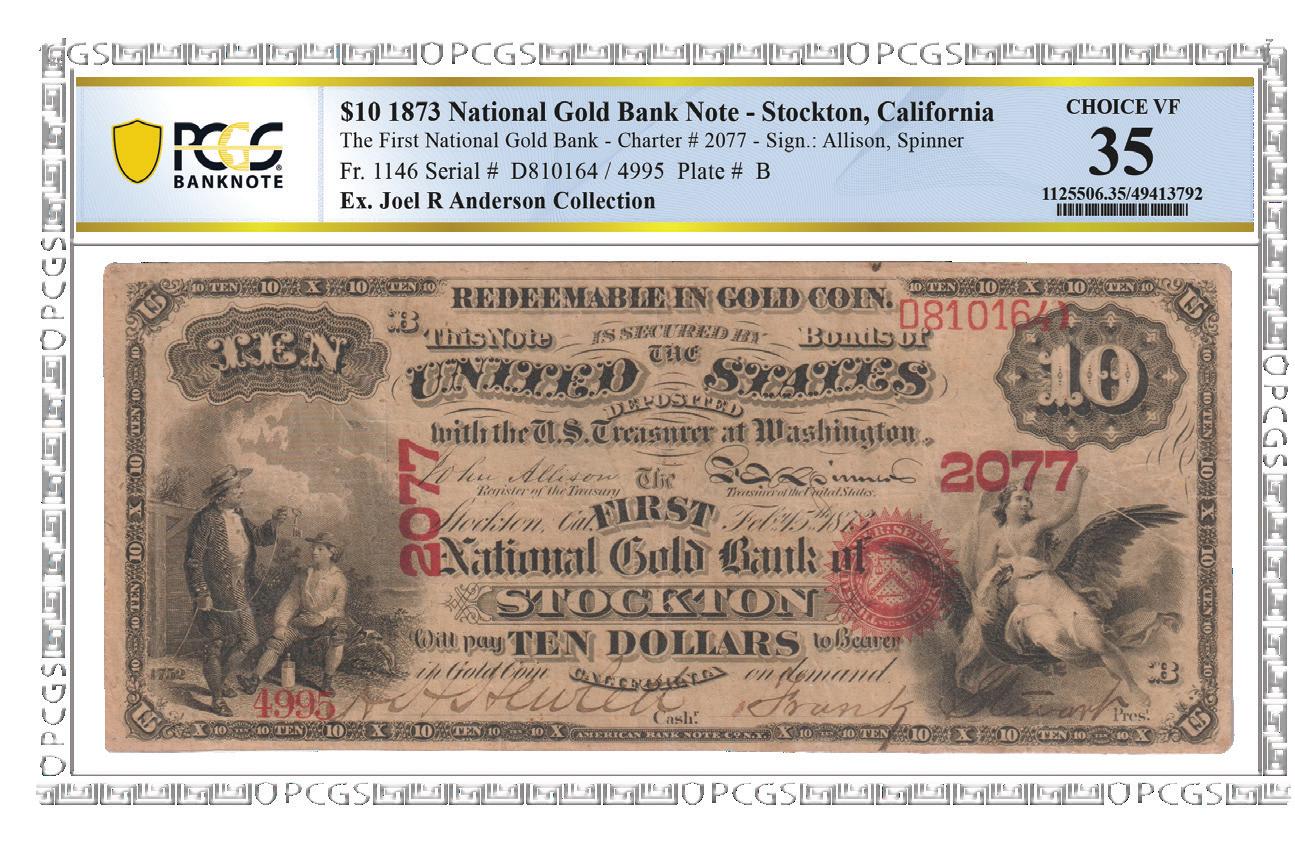

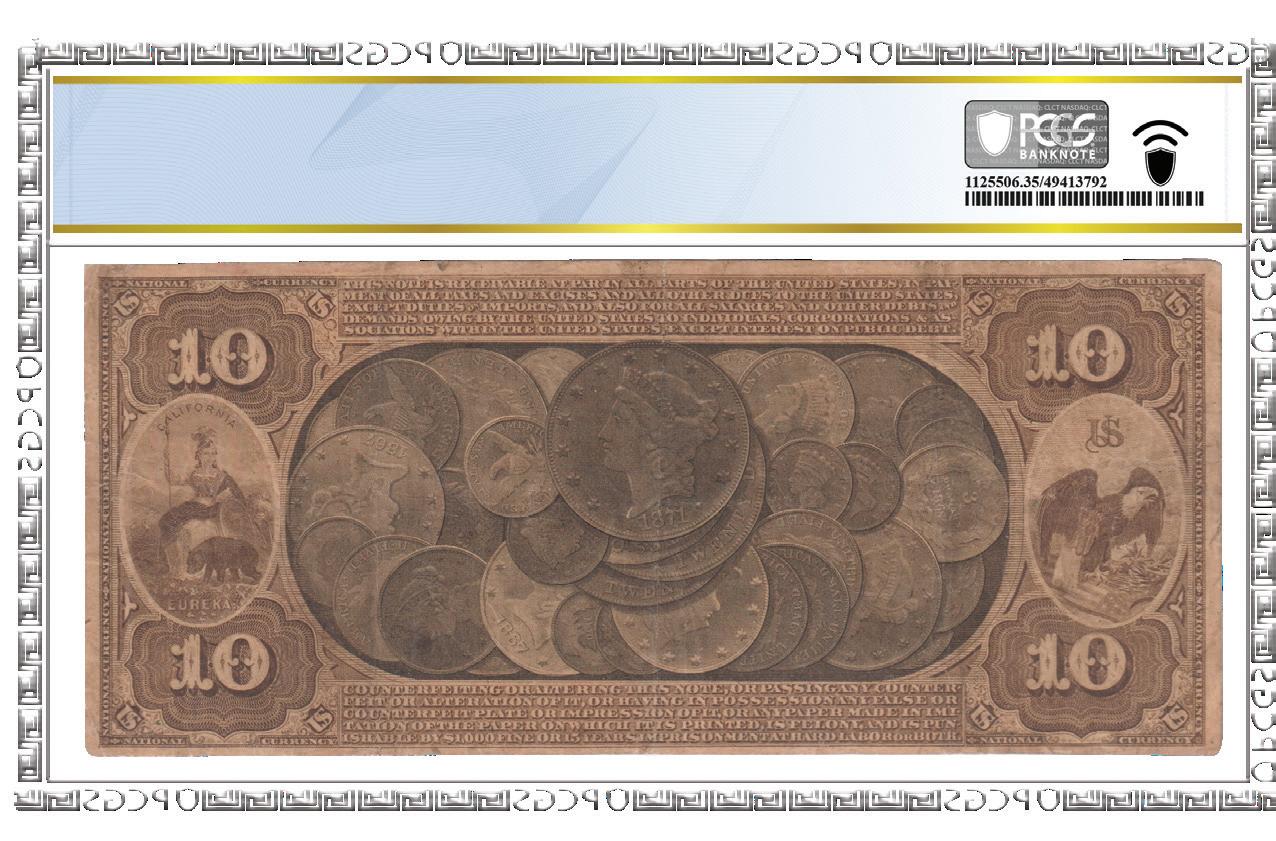

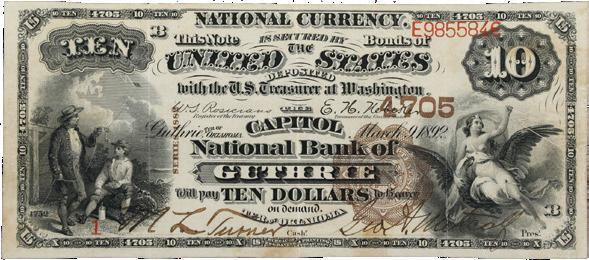

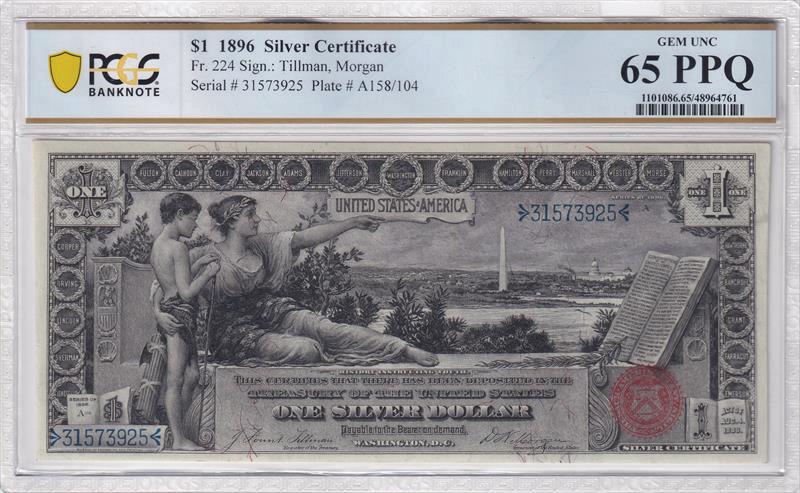

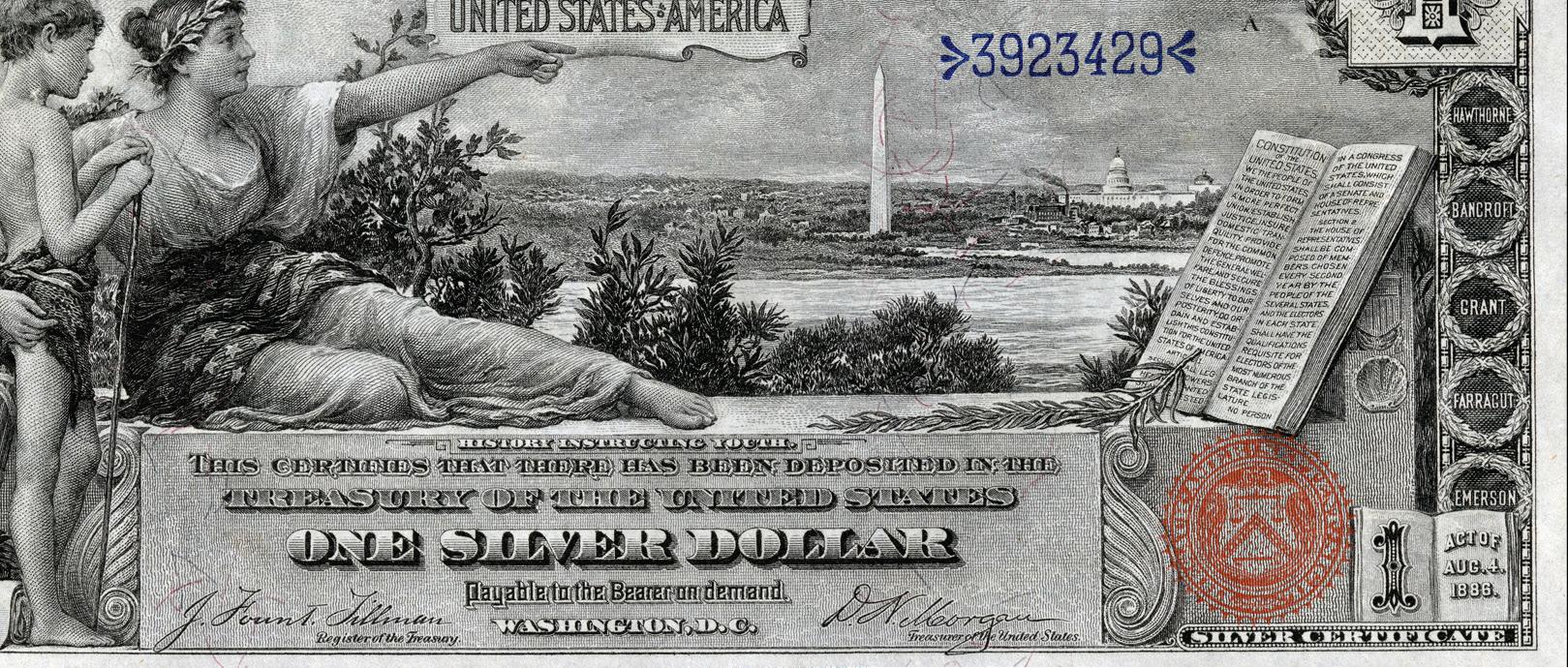

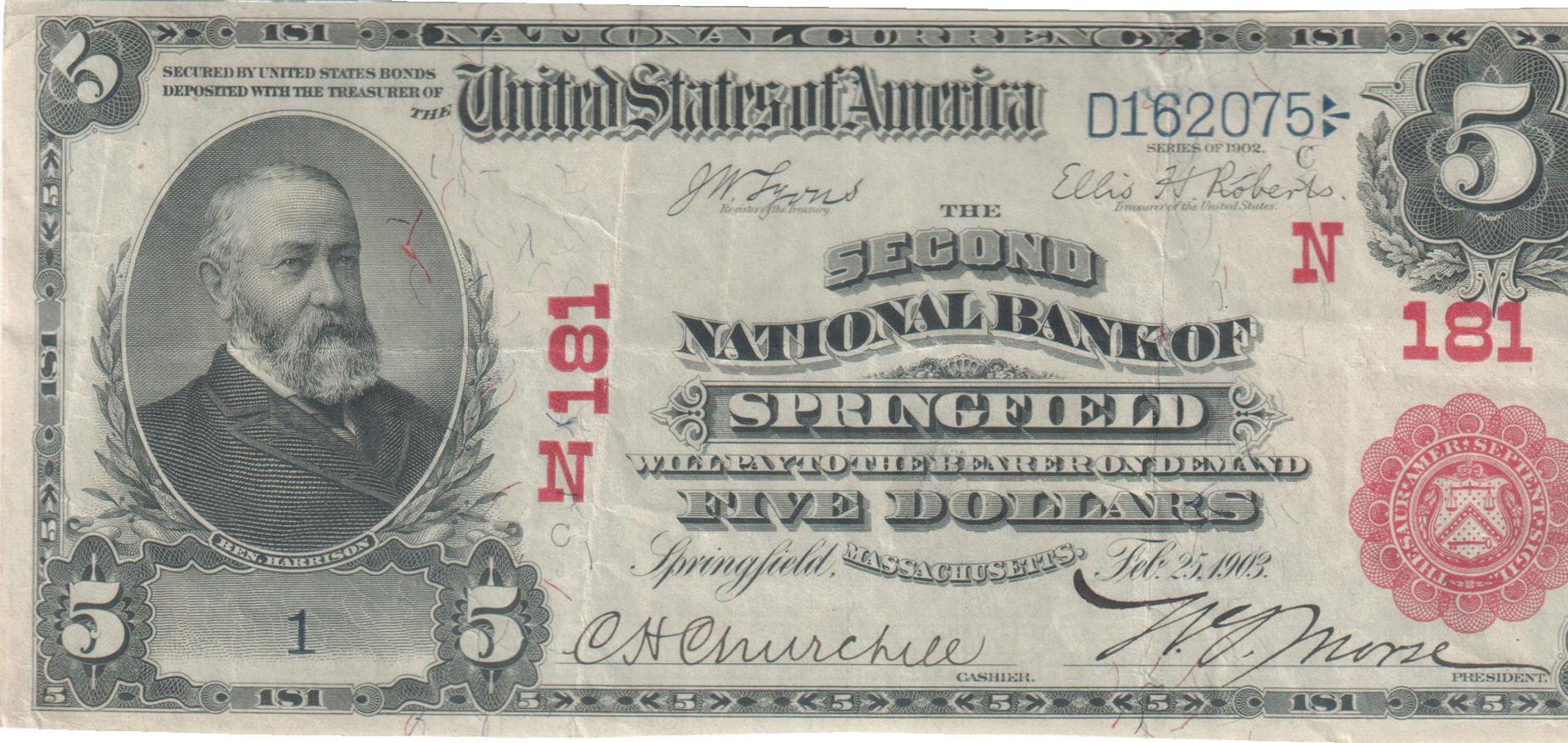

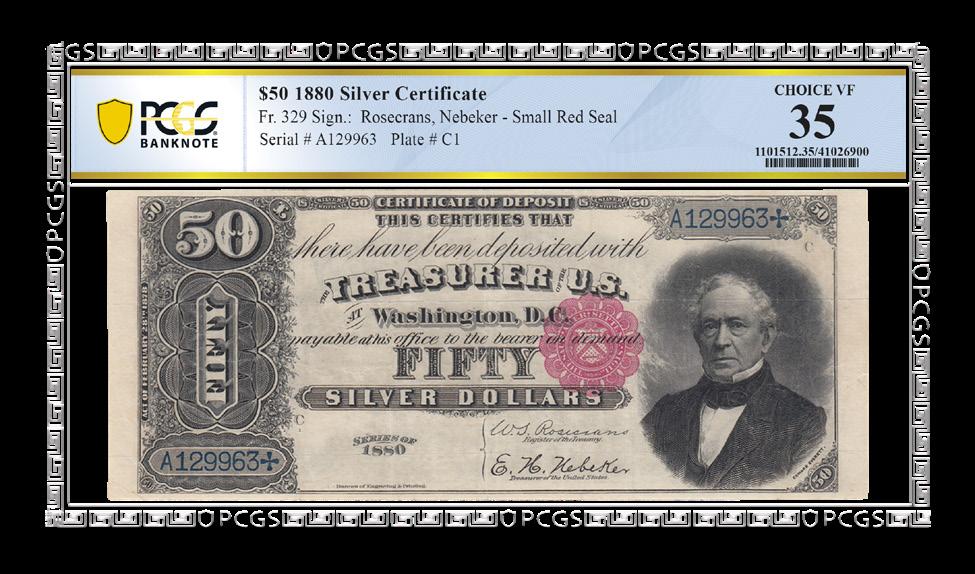

It’s not just about coins, though. PCGS has been leading the currency-grading sector since the debut of its banknote encapsulation services in 2020. Over the past few years, we have graded some of the rarest and most storied banknotes around, including the piece that becomes the first PCGS Banknote of the Issue – an 1873 $10 Stockton, California, note from The First National Gold Bank, Charter #2077. This historic relic, a vestige of the late California Gold Rush era, was graded PCGS Banknote Choice Very Fine 35 and is being curated by Stack’s Bowers Galleries.

All of this and more await among the pages of this PCGS Market Report. So, kick back in your favorite chair next to a refreshing fan or some frigid air-conditioning and chill out as we help you numismatically navigate your way through these warm days that lay ahead. Hopefully in between pages, you’ll seek some cool deals at the PCGS Members Only Show in July or at any of the other shows where we will be accepting submissions or offering onsite grading. If you stop in, please be sure to say “hello!”

Catch you later,

Joshua McMorrow-Hernandez, PCGS Editor-in-Chief

Read all about an 1873 $10 Stockton, California, note from The First National Gold Bank, Charter #2077 grading PCGS Banknote Choice Very Fine 35. It’s a true rarity now being curated by Stack’s Bowers Galleries. Page 6

B. Turns 45

Joshua McMorrow-Hernandez looks back at the life of the Susan B. Anthony Dollar, a coin that flopped soon after its debut in 1979 but that has since proven its worth.

PCGS Set Registry: The Coins of Ireland

Sanjay C. Gandhi explores the storied history of Irish coinage and the many opportunities it offers on the PCGS Set Registry.

The Manchurian Mint

Peter Anthony takes a compelling tour of China’s historic Manchurian Mint, exploring some of the relics – and modern Chinese coins – that help tell its story.

Collector Spotlight: Hugh J. Hillaker

Meet a longtime collector who has built one of the top collections of classic U.S. commemorative coins on the PCGS Set Registry.

YN Corner: 18-Year-Old Goes from Coin Collector to Shop Owner

Meet Joseph Ford, a young numismatist who parlayed his love for numismatics into a successful coin shop in South Carolina.

The Amazing Judd-115 1849 "Handmade" Gold Dollar Pattern

Douglas Winter shares the scoop on a rare 1849 Pattern Gold Dollar that became the only United States coin entirely engraved by hand at the United States Mint.

The Two Heroes of the Carson City Mint

Jeff Howard explains how a pioneering visionary and one mighty coin press helped create some of the most beloved coins around.

Starting a Collection of 1715 Fleet Silver Coins

Ben Costello shows how collectors can build an exciting collection of silver treasure coins recovered from the famous 1715 Spanish Fleet.

07082024

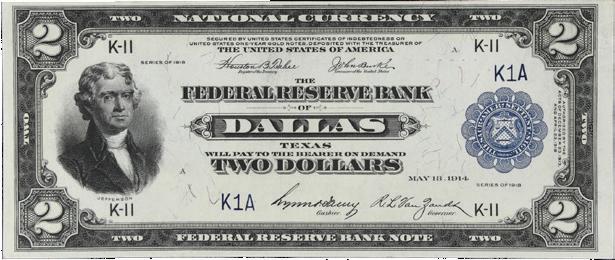

An image teeming with contemporary United States gold coins ornaments the reverse of this exemplary 1873 $10 note from the First National Gold Bank of Stockton, California. Courtesy of PCGS.

There was a time when physical gold was the most widely preferred form of currency in California. The state, which saw a population boom in the late 1840s and early 1850s due to the Gold Rush centered in the San Francisco area, continued to flourish even after gold discoveries slowed to a trickle as the 1850s melted into the 1860s.

Hundreds of thousands of people remained in the aptly named “Golden State” even after the Gold Rush had officially

ended. Many more followed as the state’s plethora of other perks, including sunny weather, beautiful terrain, Pacific views, and endless entrepreneurial opportunities called many from the East Coast. Gold remained the currency of the day even into the 1870s, especially in places like California’s Central Valley, where gold fever beckoned scores of new residents two decades earlier.

The Central Valley city of Stockton was founded during

the height of the California Gold Rush in 1849 with a seaport that was originally designed for trade and transportation to and from many of the area’s gold mines. Among the numerous businesses and financial institutions that emerged during the city’s earlier years is the First National Gold Bank of Stockton, which opened its doors on April 1, 1873. It was well capitalized and highly successful during its first years, and it issued a type of paper money known as National Gold Bank Notes.

The National Gold Bank Notes were authorized by the Currency Act of July 12, 1870. Redeemable for gold coins, these yellow-tinted banknotes prominently bearing the obverse phrase “Redeemable in Gold Coin” catered toward the preference for hard money in California and beyond. The reverse is anchored by a lush vignette of various contemporary gold coins.

The notes were issued by financial institutions such as First National Gold Bank of Stockton and others in various denominations ranging from $5 to $1,000, with lower denominations seeing much use in commerce. A busy life in circulation and the passage of time has left relatively few survivors today, with the vast majority of those in lower grades. Among notes tracing back to Charter #2077, there are just four dozen survivors recorded, mostly grading below Fine. Those grading Very Fine or better are extremely rare,

with many of those exhibiting signs of restorations or repairs. That’s part of what makes this 1873 $10 First National Gold Bank of Stockton note so special. Not only does it grade Choice Very Fine 35, but it’s also the finest such $10 note graded by PCGS Banknote. Beyond the incredible numismatic merits of this extraordinary banknote are the incredible connections this piece has to the legendary California Gold Rush and its sociocultural milieu.

“National Gold Bank notes epitomize a rare and fascinating allure for collectors, featuring distinct and captivating imagery of the era's coinage, exclusively from a select few California banks,” said Stack’s Bowers Galleries Vice President and Managing Director of Currency Peter Treglia. “Furthermore, this example stands as one of the finest examples across any denomination or issuing institution, exuding exceptional visual appeal and richness.”

Joshua McMorrow-Hernandez has won multiple awards from the NLG and ANA for his work as a numismatic journalist and editor. He has been a coin collector since 1992 and enjoys all areas of United States coinage and U.S. minting history.

Undated (1659) Maryland

“1781” (1783) Libertas Americana Medal. Original. Paris Mint. By Augustin Dupre. Adams-Bentley 15, Betts-615. Silver. MS-64+ (PCGS). 800-458-4646 (CA) • 800-566-5280 (NY)

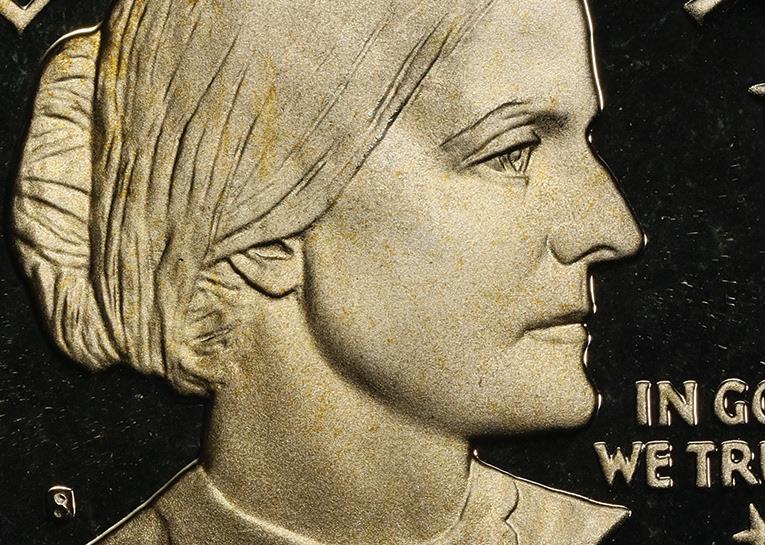

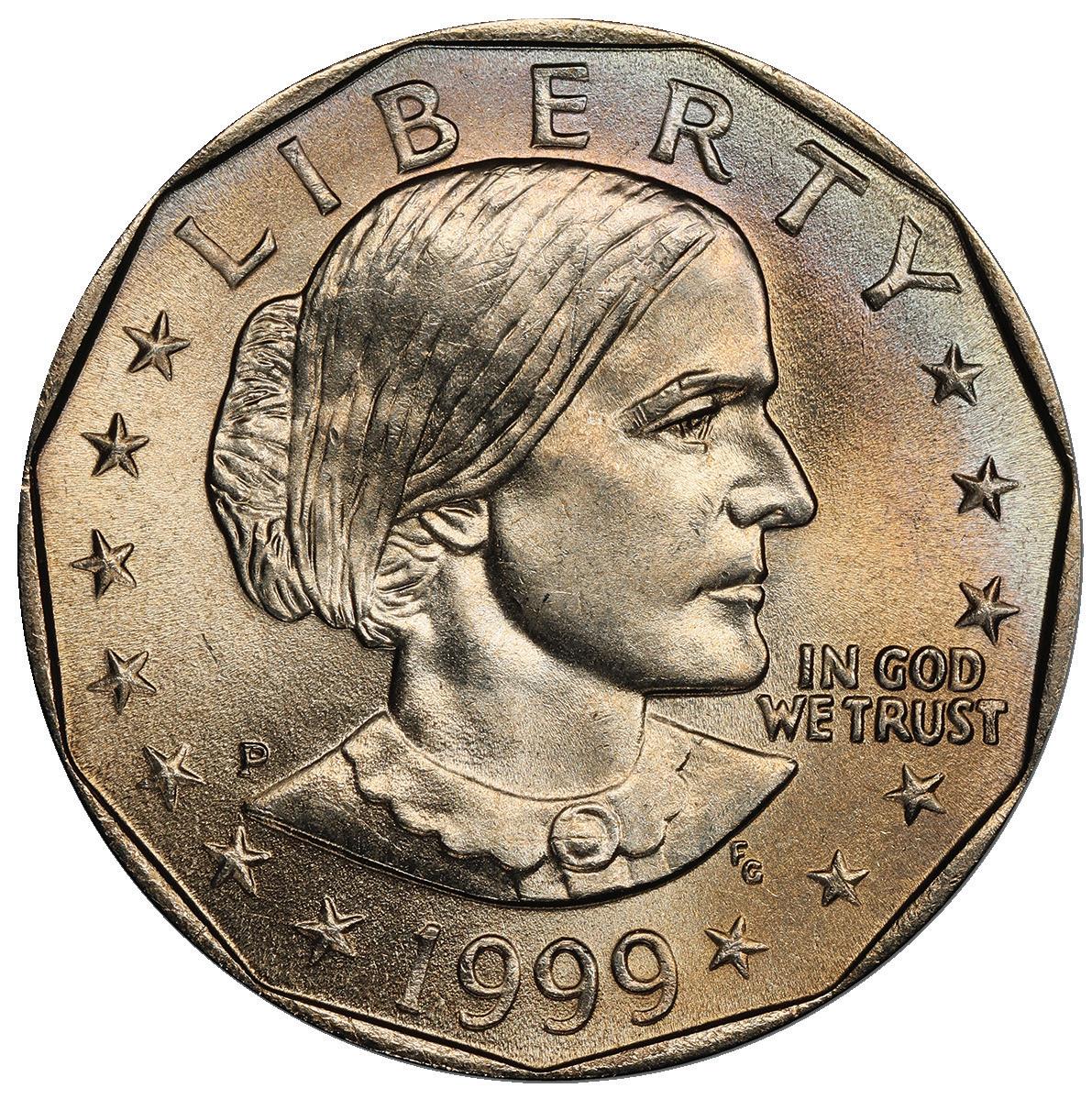

The Susan B. Anthony Dollar officially debuted to the public on July 2, 1979. Courtesy of PCGS TrueView.

Equal Rights Amendment was still on rounds collecting votes – if only failing to gain enough before it expired for consideration in 1982.

Coincidentally also off the radar by 1982, the Susan B. Anthony Dollar inspired high hopes upon its debut… Hopes that a new generation of women would finally see themselves on circulating U.S. coinage… Hopes that Americans would trade in their folding dollar bills for brand-new mini dollar coins… Hopes that the U.S. federal government would save millions of dollars over the course of time by swapping out short-lived dollar bills for dollar coins that could last decades in circulation.

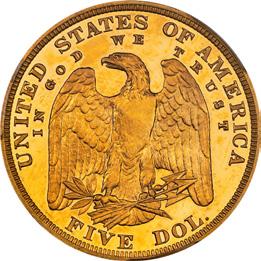

The U.S. has a long, if erratic, history of producing dollar coinage going back to 1794, when the first silver dollars rolled off the mint’s presses. Dollar coinage came and went over the next two centuries that followed, with Morgan and Peace Dollars the most popular, at least among U.S. coin collectors. Yet after the last Peace Dollars were struck in 1935, the U.S. Mint would abandon all official production of dollar coins for more than three decades. When the Eisenhower Dollar entered the scene in 1971, it became the first U.S. dollar piece

to be produced for circulation in a copper-nickel-clad format. There were also hopes the large-size coin might have a life beyond the slot machine circuit in Nevada.

The Eisenhower Dollar, which entered circulation in 1971, was failing to make much economic impact beyond the Nevada casino floors by the mid-1970s. Government officials knew it was time for a change when it came to the dollar coin. Courtesy of PCGS TrueView.

Unfortunately, that wasn’t meant to be. By the mid-’70s, it was evident that the Ike Dollar was seeing relatively little time in general circulation. In 1976, Research Triangle Institute conducted a study on U.S. coinage and concluded that, “A conveniently sized dollar coin would significantly broaden the capabilities of consumers for cash transactions, especially with machines. Members of the automatic merchandising industry have expressed a strong interest in a smaller dollar, indicating their willingness to adapt their machinery to its use.”

There was plenty of incentive to embark on a smaller-sized dollar coin. Government officials estimated nearly $20 million could be saved if even half of the issued dollar bills were replaced with a smaller-sized dollar coin. The cost savings came down to the longevity of paper dollar bills versus dollar coins, with the folding dollars lasting just 18 to 24 months and dollar coinage enduring an average of 30 years in circulation.

Before long, U.S. Mint officials began planning for production of the new mini dollar, even though formal legislation authorizing such a coin had yet to hit the floors of Congress. Treasury Secretary Michael Blumenthal threw his support behind the new small-sized dollar, even suggesting that the proposed coin sport an image of Miss Liberty.

United States Mint Chief Engraver Frank Gasparro was appointed to the project of designing the new mini dollar, crafting a model that depicted a young Miss Liberty on the obverse. The reverse showcased an eagle soaring above a mountain awash in the light of the rising Sun; as Gasparro told numismatic writer David Ganz in a 1976 COINage article, the design symbolized “a new day being born.” The pairing of Miss Liberty and the flying eagle earned blessings from Fine Arts Commission member J. Carter Brown, who wrote, “I believe this would be a superb design for United States Coinage, rooted as it is in a great tradition, being based on the Liberty Cap cent of 1794, following Augustin Dupré's Libertas Americana medal commemorating Saratoga and Yorktown (1777–1781).”

Frank Gasparro’s proposed design for the new mini dollar showed a modern take on Miss Liberty for the obverse and a soaring eagle for the reverse. Public domain images sourced from Wikimedia Commons.

Months later, in May 1978, a bill was introduced in the House of Representatives formally proposing the reduction in the size of the dollar coin from 38 millimeters in diameter to 26.5 millimeters, the weight of the coin paring down from 22.68 grams to just 8.5 grams. The Senate later revised the weight down to 8.1 grams and clarified the coin should be round in shape but carry an 11-sided inner border on its rim, the latter helping the coin feel more distinctive from other circulating coinage in the hands of someone with visual disabilities.

While the Treasury department championed Gasparro’s take on the mini dollar carrying likenesses of Miss Liberty

and the soaring eagle, others envisioned taking the new coin in a different direction. Amid the hopes for gender equality in the 1970s, there were many calls from the public to place a historical woman on the new mini dollar instead of an allegorical representation of Liberty. Many names were floated, but suffrage leader Susan B. Anthony was a top choice of many, including members of the National Organization for Women, the Congresswomen’s Caucus, the National Women’s Political Caucus, and the League of Women Voters.

Women’s rights leader Susan B. Anthony as seen in 1890. Public domain image sourced from Wikimedia Commons.

Wisconsin Senator William Proxmire filed legislation in May 1978 requiring the design of the mini dollar to feature Susan B. Anthony. As Susan B. Anthony Dollar legislation began wending its way through the halls of Congress, Gasparro set out on creating a motif for the new coin that captured the women’s rights leader in just the right way. Gasparro utilized the few available images of Anthony and insights from the social reformer’s great niece to create a portrait showcasing the leader at the peak of her influence, when she was about 50 years old.

This is one of Frank Gasparro’s design concepts for the obverse of the Susan B. Anthony Dollar. Public domain image sourced from Wikimedia Commons.

Gasparro’s intention was to pair the Susan B. Anthony obverse with the reverse showing his soaring eagle design, but that wasn’t meant to be. As the bill authorizing the new dollar coin was rounding its way to the finish line, Utah Senator Jake Garn added a late amendment requiring the reverse to carry the Apollo 11 insignia that had been seen on the reverse of the Eisenhower Dollar since 1971. Congress approved the legislation, and President Jimmy Carter signed the bill into law on October 10, 1978, saying, “I am particularly pleased that the new dollar coin will – for the first time in history – bear the image of a great American woman. The life of Susan B. Anthony exemplifies the ideals for which our country stands. The ‘Anthony dollar’ will symbolize for all American women the achievement of their unalienable right to vote. It will be a constant reminder of the continuing struggle for the equality of all Americans.”

Stepping Out

Government officials had every reason to believe the new mini dollar—the first widely circulating U.S. coin depicting a historical woman—would be a big hit with the public. Therefore, the U.S. Mint began striking some 500 million of the 1979-dated coins in December 1978, giving plenty of time for a head start on the anticipated release of the coins in the summer of 1979.

Production began in earnest at the Philadelphia Mint

during the holiday season of 1978; the Philadelphia emissions of the Susan B. Anthony Dollar carried the “P” mintmark, making them the first U.S. coins to do so since World War II, when Philly-struck 35% silver wartime Jefferson five-cent coins produced from 1942 through 1945 boasted a large “P” mintmark on the reverse. It was a harbinger of things to come, as all circulating Philadelphia-minted coins of denominations greater than one cent routinely began sporting the “P” mintmark in 1980.

A proof Susan B. Anthony Dollar from the year of the coin’s debut. Courtesy of PCGS TrueView.

As the U.S. Mint was ramping up production of the new coin in the early months of 1979, the Treasury Department launched a marketing campaign aimed at educating the public about the many benefits of the new coin, including its convenient size and the coin’s projected cost savings to taxpayers. Meanwhile, players in the vending machine industry began retrofitting machines to accommodate the new dollar coin.

The Susan B. Anthony Dollar was released on July 2, 1979, with much fanfare from coast to coast, including a special ceremony in Rochester, New York, where Anthony lived during her most prominent years as a women’s rights leader. But public enthusiasm for the new dollar coin quickly waned as those who were using it began noticing a major flaw: the coin too closely resembled the quarter. The discovery may not have come as a shock to those who realized that both the round, copper-nickel-clad coins had a difference in diameter of just barely more than two millimeters, with the quarter coming in at 24.3 millimeters and the dollar at 26.5 millimeters.

Confusion between the quarter and dollar drove public dissatisfaction with the Susie B., with many calling the coin the “Carter Quarter” due to its size and close association with President Carter, who had signed the mini dollar into law. By October 1979, a Gallup poll had shown that 66% of Americans disliked the Susan B. Anthony Dollar, with only 15% favoring it and 19% reserving judgment.

The U.S. Mint and U.S. Treasury considered a range of

ideas, including increasing the diameter of the coin, changing its color or shape, and even punching a hole in the middle of the coin. Funds were approved for a new educational and promotional campaign that hit the streets by 1980, but none of these efforts resulted in the coin winning the public over –especially given the fact that Americans still had the alternative of using the paper dollar, which concurrently remained in production with the Anthony Dollar.

This poster is one of many materials distributed by the U.S. government to educate the public on the benefits of the Susan B. Anthony Dollar. Courtesy of the National Archives.

The proof of the coin’s failure was reflected in the coin’s overall mintage figures year over year during its initial run, with 757,813,744 circulation strikes cumulatively produced by the Philadelphia, Denver, and San Francisco Mints in 1979 versus only 89,660,708 in 1980, and just 9,742,000 in 1981, with the latter reportedly struck only for numismatic purposes. By the end of the coin’s original outing in 1981, more than a half billion were deemed as surplus pieces with nowhere to go but vaults.

Encore!

The coin may have flopped during the disco era, but by the time the 1980s were running at full tilt, fortunes had changed for the coin. In 1984, the Baltimore Metro system began using the Susan B. Anthony Dollar as tokens that riders could use to buy tickets, eventually becoming the single-biggest user of the

coin. Other metro systems similarly adopted the use of Susie B. dollars, with the United States Postal Service introducing stamp-vending machines in the early 1990s that accepted and dispensed Susan B. Anthony Dollars. By the mid-1990s, the number of Susan B. Anthony Dollars in government vaults began dwindling, with only around 133 million remaining by the end of 1997.

By that time, legislation for the new “golden dollar” (to eventually bear the obverse portrait of Lemhi Shoshone woman Sacagawea) was already rounding the bend toward becoming law by the stroke of President Bill Clinton’s pen. But the incoming Sacagawea Dollar wouldn’t arrive until 2000 – too late to satisfy the more immediate needs of new dollar coinage. This necessitated a revival of the Susan B. Anthony Dollar in 1999, which was produced to the tune of 41,368,000 combined circulation strikes by the Philadelphia and Denver Mints.

The Susan B. Anthony Dollar came back for one more appearance in 1999. Courtesy of PCGS TrueView.

When the curtain officially fell on the coin after its swan song in 1999, the Susan B. Anthony Dollar had proven to be one of the shortest-lived series in American numismatics. Yet, it offers a story like none other and is unapologetically a product of its era, it being symbolic of new ideas, unconventional solutions, and the hope – in its own way – to afford a sense of social justice and representation to a large segment of the American public that had not seen itself on circulating U.S. coinage.

Many panned the seemingly incongruous pairing of an obverse portrait honoring a 19th-century women’s rights leader and a reverse motif depicting the landing of the first men on the Moon in 1969. Yet, Gasparro noted the historical

significance of the coin, calling it his “top achievement.” He said that the Susan B. Anthony Dollar had “become part of a social movement.” Gasparro concluded, “This new dollar's more than a coin; it's an issue.”

At first glance, collecting the Susan B. Anthony Dollar series might seem to be a relatively straightforward endeavor. There is the trinity of Philadelphia-Denver-San Francisco issues from 1979 through 1981, along with the binary of Philly and Denver strikes from 1999 and the four proofs from each year the series was minted. But look a little deeper and the surprising complexity of this modern series comes to light.

There are several major varieties counted among the Susan B. Anthony Dollar, including the relatively scarce 1979-P Wide Rim, not to mention the 1979-S and 1981-S Type I and Type II proofs. The 1979-P Wide Rim resulted from design modifications that the U.S. Mint made to the rim of the obverse die in late 1979. The changes impacted only the 1979P Dollars, with a relatively small but unknown sum seeing the wider-rim format. For example, some coins grading PCGS MS65 trade for around $65.

The 1979-S and 1981-S proof varieties stemmed from modifications to the “S” mintmark, which appears blobby on the 1979-S Type I proofs. Efforts to better clarify the shape of the “S” created the 1979-S Type II proofs, which came along later that year, are slightly scarcer than their Type I counterparts. While the 1979-S Type I proof retails for around $11 in PCGS PR68DCAM, the 1979-S Type II in that same grade takes closer to $40.

Comparisons of the 1979 Type I (Filled S) versus Type II Clear S proofs. Courtesy of PCGS.

The differences in price between the 1981-S Type I and Type II proofs, involving further refinements to the crispness of the “S” mintmark, with the Type II sporting more bulbous serifs than the Type I, are even more stark. The 1981-S Type I proof fetches about $11 in PCGS PR68DCAM, whereas the much scarcer 1981-S Type II proof is a $90 coin in that same grade.

A comparison of the 1979-P Wide Rim versus its more common counterpart, the 1979-P Narrow Rim. Courtesy of PCGS.

One 1981-S Susan B. Anthony Dollar grading PCGS MS67 sold at auction for nearly $4,500. Courtesy of PCGS TrueView.

PCGS Set Registry members who want to dominate the set ratings will find the Susan B. Anthony Dollar series to be both challenging and expensive to collect in top grades. Examples in the grades of PCGS MS67 or better routinely take substantial three-figure prices. Some auction records for the Susie B. traipse into four-figure territory. Auction records bear this out, with a PCGS MS68 specimen of the 1979-S notching $3,760 in a 2017 Heritage Auctions showing, a 1980-P in PCGS MS68 garnering $4,600 in a 2008 Heritage Auctions offering, and a 1981-S MS67 hammering at $4,465

in 2017 in yet another Heritage Auctions outing. Even the 1999 emissions are scarce in MS68, with a 1999-P going for $1,920 in a 2022 Heritage Auctions event.

What this boils down to for collectors is quite clear: the Susan B. Anthony Dollar is worth a look. As the series turns 45 years old and marches toward life as a truly vintage coin, numismatists have the opportunity to jump in on a series that, for too long, was underappreciated by many but has aged gracefully over time. More collectors who were born in the latter decades of the 20th century and remember the novelty of the Susan B. Anthony Dollar – perhaps receiving the coin as holiday gifts from parents or grandparents or finding the mini dollar left under the pillow by the Tooth Fairy – are returning to the coin they grew up with. While the Susan B. Anthony Dollar may never enjoy the numismatic fame of its silver predecessors, such as the Morgan and Peace Dollars of yore, it really doesn't have to. It’s finding a fanbase all its own and finally enjoying its well-deserved time in the spotlight.

Joshua McMorrow-Hernandez has won multiple awards from the NLG and ANA for his work as a numismatic journalist and editor. He has been a coin collector since 1992 and enjoys all areas of United States coinage and U.S. minting history.

patches to find a four-leaf clover.” I had never heard of such a thing. They showed me that most clovers had three leaves, and the four-leaf clover, if you find one, was lucky. Not so lucky for the clover, I think now... I searched with them and, within 30 seconds, I found my first four-leaf clover, and they were in awe. One of the kids said, “Let me see it just to make sure.” Sure enough, they confirmed my lucky green find.

The shamrock is the national symbol of Ireland, and Saint Patrick used it to convey his message of the Holy Trinity. He would state that the three leafs of the clover represented God, Jesus, and the Holy Spirit, which are one according to the Holy Trinity belief. Saint Patrick was of English-Roman descent, and accounts may vary about his birth year. He is credited for introducing Christianity to Ireland, where the majority of his missionary work was done. He wrote two books, one being titled Confessio. It’s written in Latin. Scholars have concluded from his writings he was an exceptionally humble, moral individual. One of the earliest coins that depicts Saint Patrick is a 1670s 1/2 Penny from the United States colonial era. The reverse of the coin shows him holding a shamrock, which is derived from the Irish word seamróg, meaning little clover. Patron Saint Patrick passed away on March 17, 461, and each year, he is honored on this day as St. Patrick’s Day.

Ireland has always been known for its beautiful green landscapes and breathtaking sea cliffs. Seafaring Vikings in neighboring European countries eventually made their way to the island nation to plunder. One of the first accounts as shared by the National Museum of Ireland notes, “The first recorded Viking raids on Ireland took place in 795 when islands off the north and west coasts were plundered.” About three years earlier, King Charlemagne had introduced the Carolingian monetary system within all of the European countries that were under his rule. The ratio of the monies were as follows: 1:12:240, one pound (libre), which contained 408 grams of silver, one shilling (solidus), and one penny (denarius), respectively. Some of these denominations are used in the present day for coinage.

Carolingian coinage made its way into the hands of the Vikings as they raided countries under the rule of Charlemagne. They also used coinage from the Islamic Dynasties and coinage from Arabic regions, mainly to create ornaments or decorations and not using the coins for currency. Their preferred currency was in the form of ingots, which could be used to buy, for example, 12 goats for 12 ounces of silver. In 841, The Vikings established a settlement with a city named Dublin, and this began their permanent residence within Ireland. It wasn’t until 995 that coinage was first struck in Dublin under King Sigtrygg II Silkbeard Olafsson. He was the first ruler to mint coins that are known today as Hiberno-Norse coins. Historical accounts vary about when the first part of his rule began from 989 to 995. His second rule was from 995 to 1036 until he was dethroned. Coins were posthumously struck under Silkbeard’s name for some years, and the minting of Hiberno-Norse coinage stopped being produced sometime in the mid-12th century. The Norman Conquest from England was just beginning when the Vikings ceased minting coins.

May 1, 1169, marked the first day of the Anglo-Norman Invasion, which was commissioned by King of England Henry II. Diarmait Mac Murchada, who was formerly the king of the region of Leinster in Ireland, led a group of mercenaries to the city of Wexford. He was joined by another commander from England, Robert FitzStephen, and the Skirmish of Duncormick took place with the local Norse-Gaels (Irish-

Vikings), who could not hold them off. Soon, the English invaders found their way to Wexford, and they raided the city. The townspeople surrendered, and a peace treaty was signed. Two land grants were made to FitzStephen as territories known as Bargy and Forth. These were the first established colonies of the Anglo-Norman Invasion. A year later, another invasion would follow, and more settlements were made throughout Ireland by the English.

The British Crown conquered much of Ireland, and sporadic wars were fought over the next few hundred years. It wasn’t until 1603 that Ireland was fully under the control of the British Empire, since Elizabeth I had died and her cousin King James VI of Scotland now became the ruler of the British Empire. He was now known as James I. In 1641, the Irish Confederate Wars began, lasting 11 years in total. These wars were fought between England, Ireland, and Scotland, which controlled the three kingdoms that existed within Ireland. A man by the name of James FitzThomas Butler was placed in charge of the Irish Royal Army that was based in Dublin. His rank was that of a lieutenant-general. In 1642, he became the Earl of Ormonde after his successful campaign against the rebel confederates. On November 17, 1643, he became lord lieutenant of Ireland and was sworn into office on the 21st of January following in 1644. Between 1643 and 1644, the Earl of Ormonde issued emergency coinage, which is known as Ormonde Money. Citizens of Ireland who were faithful to England were encouraged to bring in their silver to be coined

(1643-1644) Irish Ormonde Silver Crown, PCGS VF35. Courtesy of PCGS.

at the treasury, which would be equivalent to silver issued by England. A few denominations were produced, and one issue that is popular among coin collectors is the Ormond Crown, as shown above.

Milled- or machine-struck coinage first began to be produced in 1660 under Charles II, and in 1685, James II was crowned as king of England. His coinage was short-lived, and within three years, James II and the English Parliament were at odds. The king would not give up his Catholic faith and then named his newborn son as heir to the throne. This resulted in his daughter, Mary Tudor, being essentially cast aside as the heir to the throne, which upset Parliament, which were of the Protestant faith. William of Orange was summoned to England, who took over and ascended to the throne with little resistance from James II’s army. James II fled to France in December of 1688. In 1689, he landed in Ireland and Parliament declared him the king of Ireland. James II introduced token coinage consisting of base metals obtained from scrap items, such as old church bells, fencing, broken cannons, and guns, and thus, this coinage was dubbed Gunmoney. This type of coinage was introduced to Ireland in March of 1689 so James II could pay his newly formed army to support his strategic endeavors to regain the English throne, which was unsuccessful. PCGS offers a set titled Irish

Gunmoney Type Set, Circulation Strikes (1689-1690) for collectors to view and potentially start a PCGS Registry Set.

1690 May ½ Crown Irish Gunmoney, PCGS MS63. Courtesy of PCGS.

In 1816, England issued currency reforms known as the Coinage Act devalued the currency to stabilize the English economy after the Napoleonic wars. Large transactions that were over 40 shillings were prohibited to be transacted in silver and were only to be conducted in gold. England wanted to establish a gold standard throughout the empire. English coinage was widely circulated throughout Ireland and milled coinage continued to be struck in Ireland up until 1823. In 1826, all Irish currency was removed from circulation within the country. The British Pound became the official unit of

currency for a little over the next century within Ireland.

On April 24, 1916, seven men, known as the Irish Republican Brothers, organized a movement to stand up against England and become independent. This day is known as Easter Rising and was led by Patrick Pearce. The English sent reinforcements to Dublin, where the opposition was quickly halted. Pearce peacefully surrendered on Saturday, April 29, 1916, to stop the carnage. The day of the uprising was carefully planned for a little over a year, and martial law followed this demonstration. Although Ireland did not gain its independence immediately, this historic day unified Ireland further, and its pursuit for freedom intensified.

January 21, 1919, marks the day a new party was formed in Dublin called the Dáil Éireann, or Assembly of Ireland. This new revolutionary party issued a Declaration of Independence, called itself the Irish Republic, and sought to free itself from the United Kingdom. This day marked the beginning of the Irish War of Independence as The Irish Republican Army (IRA) killed two Royal Irish Constabulary (RIC) officers, and this incident is known as the Soloheadbeg Ambush. The IRA began attacking the British and RIC soldiers with intensity. Barracks were sabotaged, assaults took place on patrols, locals helped with the cause, and guerrilla warfare escalated. Fighting continued for many months, and on July 9, 1921, a ceasefire was put into effect. However, the following day,

homes were burned to the ground in Falls Road, Belfast, and weapons of all sorts reared their ugly heads in the streets in an event known as Bloody Sunday. This led to another ceasefire on July 11, 1921, paving the way for peace talks.

On December 6, 1921, The Anglo-Irish Treaty was signed, putting an end to colonialism in Ireland. Disagreements existed within the IRA and its leaders over the next few years, but the Irish Free State was established on December 6, 1922. Once Ireland became a free state in 1922, the Trinity College harp became the nation’s new symbol. It appears on the obverse of coinage struck for the free state of Ireland beginning in 1928. The reverse of the 1/2 crown displays the Irish sport horse, an animal developed by crossbreeding an Irish draught and a thoroughbred for show competitions. PCGS has listed a set titled 1928 Irish Proof Set, which displays the first proof coins struck under the Irish Free State. Irish year sets can be found, and another popular Registry Set is the Irish Florin Date Set, Circulation Strikes (1928-1968). This set includes the fabled 1943 Florin, of which less than 35 examples are known to exist. An example graded PCGS AU50 and sold in 2007 fetched just under $19,000! PCGS F15-graded examples currently bring about $10,000 in the marketplace.

For centuries the people of Ireland endured hardships due to colonialism, feudalism, classism, and barbarism. However, the people of Ireland, through unity and faith, persevered to become a free nation.

That sunny day way back, when I found that little green trophy, one of the kids took me to their home and said to their mom, “Sanjay found a four-leaf clover.” She warmly

replied with something like, “Well, that sure is lucky, Sanjay, and we need to save this moment.” She grabbed her scissors and an album that had adhesive, laminate-covered pages. She then cut a square, peeled back the laminate, wrote the date, carefully placed the clover on the sticky paper, and sealed the four sides with tape.

The odds of finding a four-leaf clover are one in 10,000. And in Ireland, the four-leaf clover represents faith, hope, love, and luck.

One night, I got lost in the city of Pittsburgh, Pennsylvania, and somebody was kind enough to give me directions to where I was going. Before departing, I opened my wallet, handed them my four-leaf clover, told them it brought me luck, thanked them, and headed home. Hopefully, it brought them luck.

Sanjay C. Gandhi is a senior content manager at PCGS. His knowledge base consists of a wide variety of world coinage, and he has a great appreciation for toned coins that display vibrant colors. In addition to contributing content to PCGS Market Report, he also assists collectors with the PCGS Set Registry.

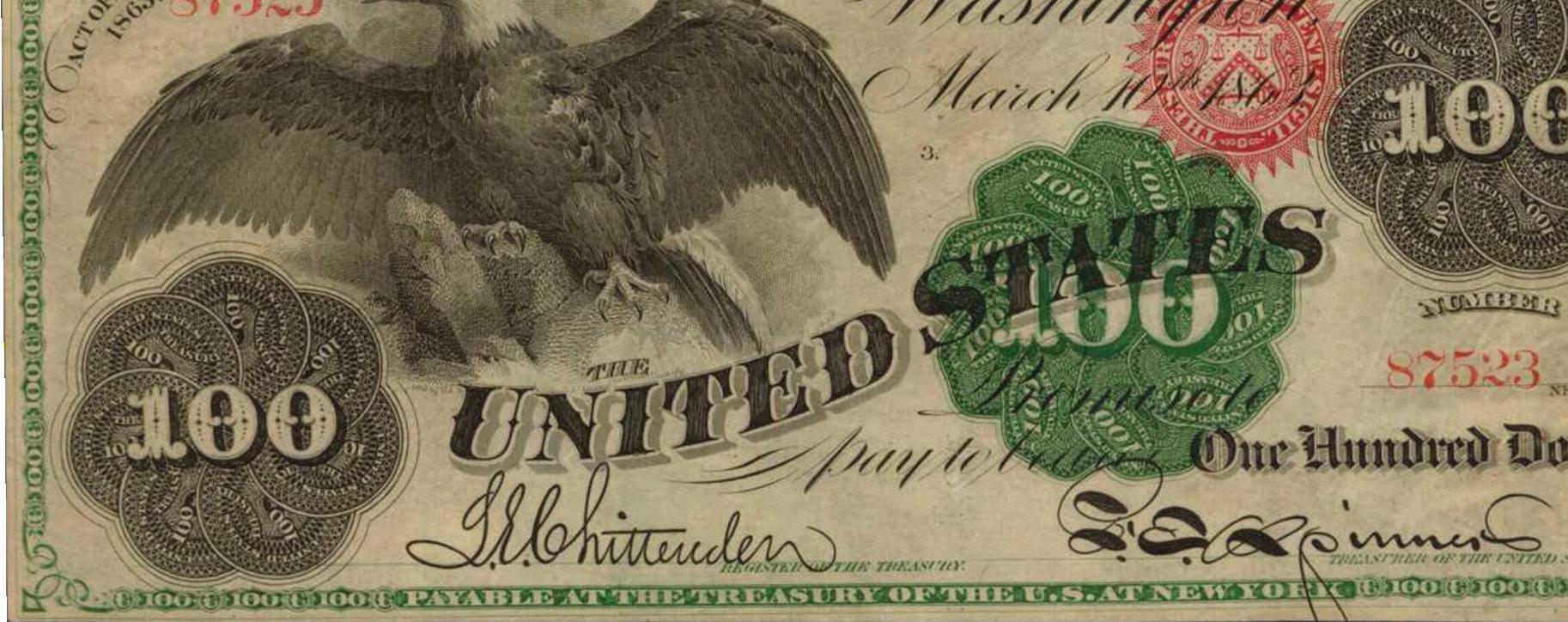

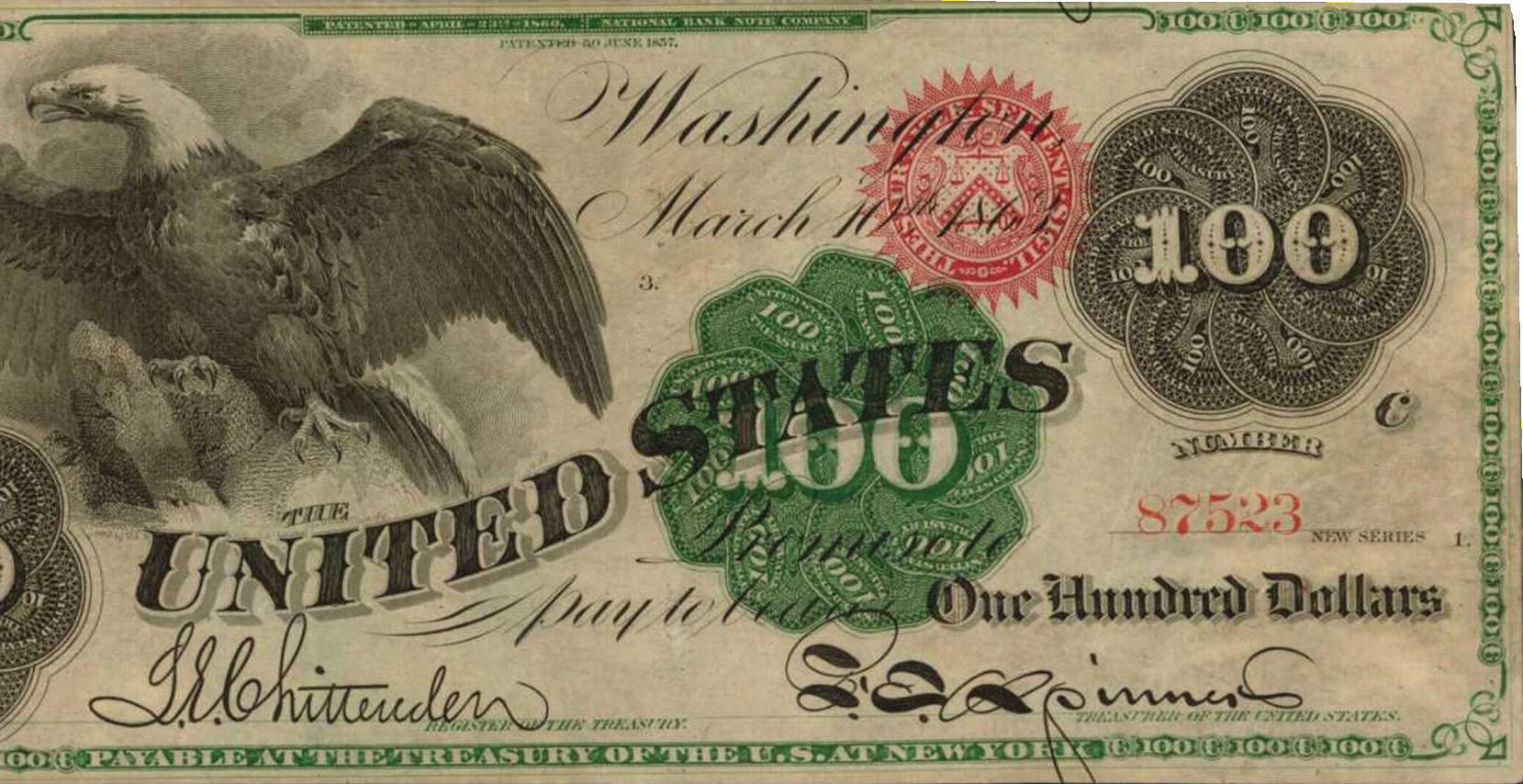

1896 $1 Educational Silver Certi cate PCGS Gem UNC 65 PPQ $7,000

1896 $1 Educational Silver Certi cate PCGS Gem UNC 65 PPQ $7,000

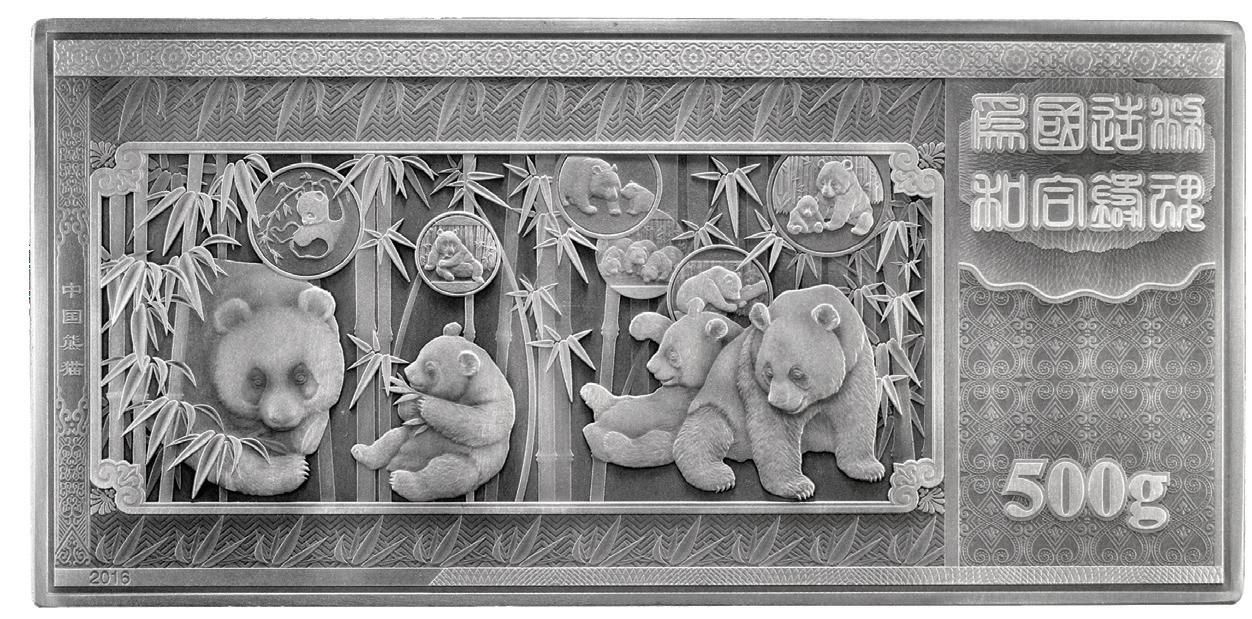

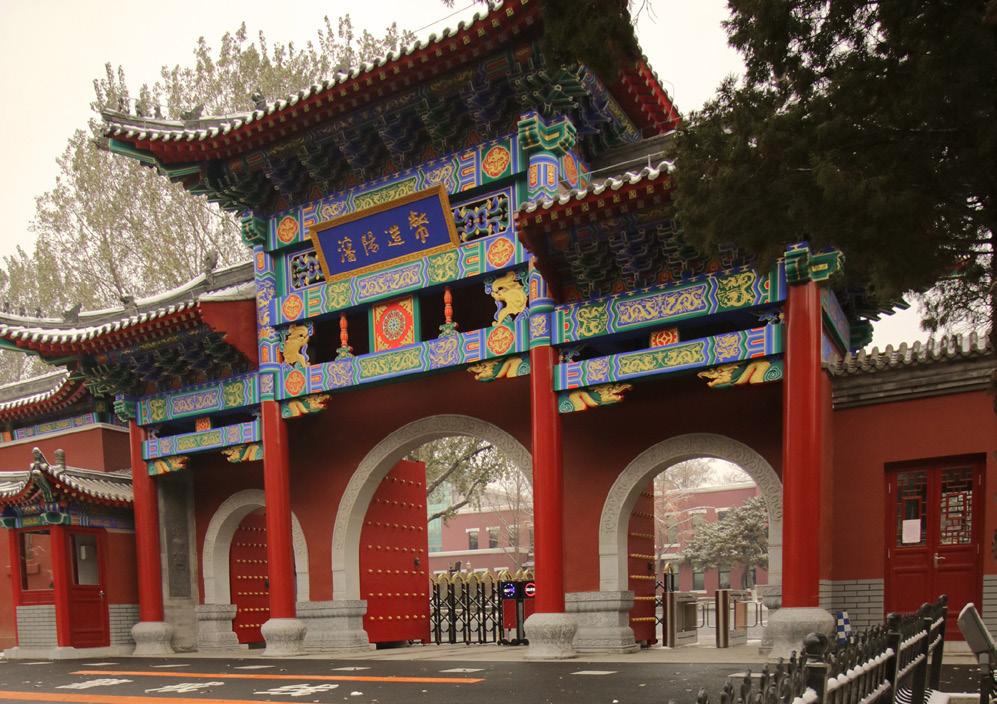

The 2016 gate to the Shenyang Mint that is modeled on the mint’s original 19th-century Qing Dynasty gate. The 2013 silver and gold Panda coins were released at the same time the gate was unveiled to celebrate the Shenyang Mint’s 120th anniversary. Courtesy of Peter Anthony.

“Look up!” my friend Min exclaims and points. I lift my head to the lamppost. A pair of glass globes is mounted right below the streetlamps. Floating inside one is a bright red Chinese knot. Inside the other, a sizzling hot pink hummingbird beats its wings. The unreal bird hovers for a few moments. Suddenly, it expands and transforms into a red rose, and a few seconds later it morphs into a Chinese lantern. A couple of other pedestrians on Dadong Road in Shenyang notice us staring. They, too, look up at the holographic projections.

Although fairly fascinated by this municipal decoration, neither Min nor I want to linger for too long. It’s an early March evening, the date of the vernal equinox, when days and nights are almost equal everywhere on Earth. This March, the wide Hun River that runs through the city is still frozen solid, and the night air is not much warmer than the river.

If you were in the mood to follow the trail of pink hummingbirds down Dadong Road, it will lead you to downtown Shenyang. I decide to come back this way in the daylight. As I do the next morning, a quartet of high school age boys walk alongside me. They chatter about whatever it is that high school aged boys discuss; probably studies, as they sound serious.

All four wear identical outfits; white shirts and black nylon pants. Whenever I have asked young people in China if they like wearing school uniforms they answer, “No.” but, they admit the uniforms serve a purpose. One is that it tamps

down fashion competition between students. For another, it makes it much easier for teachers to keep track of their pupils on field trips.

The students and I reach an intersection with a traffic light. Here, they turn while I continue straight on. On one corner there is a fruit and vegetable market, in front of which are bins loaded with red apples. Diagonally across the street from the market stands an office building. On each side of it are the high walls that surround the Shenyang Mint compound. The main entrance is just a short stroll further down the block.

Here stands an imposing three-arched gate almost as fantastic as the pink hummingbird. Built in 2016, this gate duplicates the 1896 portal that led into the mint. The current version is painted in royal blue and crimson red hues with gold accents. In 1896, China was still ruled by the Qing Dynasty, and Shenyang was called Mukden, a word rooted in local history and language. The province was named Fengtian, or sometimes Mukden, Province instead of Liaoning, and the mint company was called the Fengtian Machinery Bureau. Its first assignment was to produce small denomination coins.

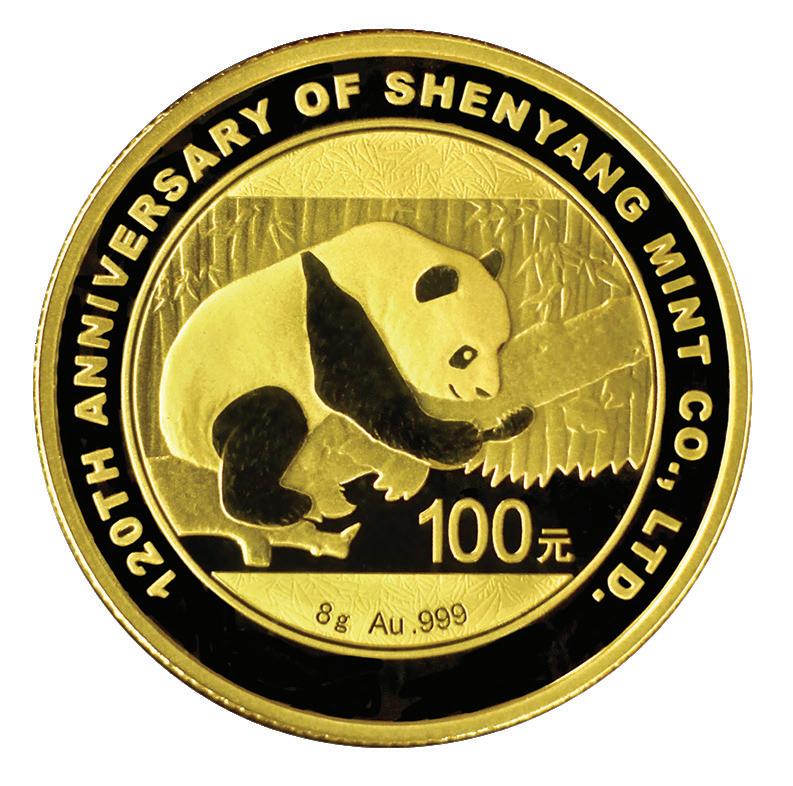

The architectural style of the 2016 gate recalls this past. It wasn’t the only thing. Being a coin company, the mint created several interesting numismatic items for its 120th anniversary celebration. By far the best known are two commemorative Panda coins. The words, “120th Anniversary of Shenyang Mint Co., Ltd.” form a circle around the standard 2016 Panda coin image. There is a gold 100 yuan commemorative that

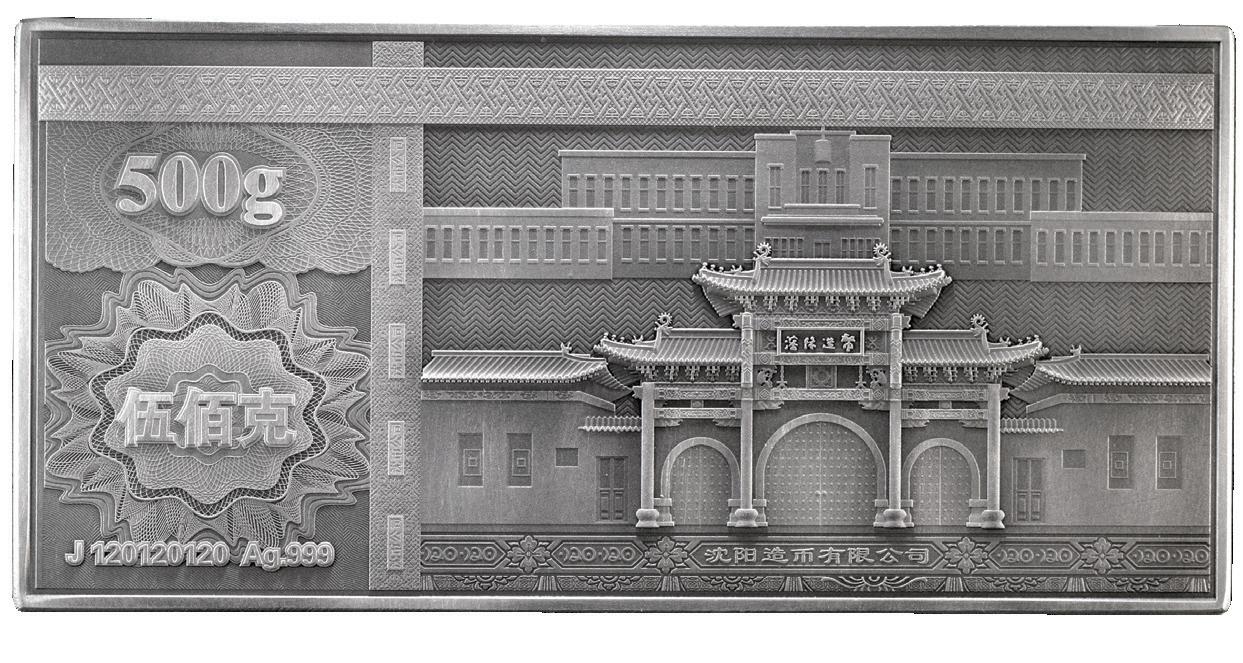

These are the two sides of the 500-gram silver bar that the Shenyang Mint struck for its 120th anniversary celebration. There were 1,000 total struck. These images show the more common “high contrast” luster variety. Courtesy of Peter Anthony.

weighs eight grams, with 10,000 pieces minted. The other is a 10 yuan silver Panda that weighs 30 grams. Both coins are legal tender in China. Every employee of the mint received a gift of one of the silver coins. The rest of the 30,000 silver Pandas that were struck were released to the public. As far as I could determine, the coins that the employees received are identical to the rest of the mintage. Move on folks, no varieties to see here!

The Shenyang Mint’s gate stands proudly as a connection to the past. Courtesy of Peter Anthony.

Interesting, but much less well-known, are a pair of 120th anniversary medals. One is semi-rectangular, made of brass, and notable for the red and green glazes on one side. The

image on this side is constructed around the number 120. The other face presents the history of the mint as a page in a book alongside representations of the mint’s main office building and the new gate. This theme continues onto a matching wood frame that the medal fits into. Really, the medal is incomplete without this intricately carved frame. 2,000 were minted.

A second 120th anniversary release may intrigue Panda collectors as it is not only beautiful, but also exists in two varieties. This is a 500-gram silver rectangular ingot. Its design is the work of Ms. Chang Huan, who headed the Shenyang Mint art department at that time. The design on this bar resembles a banknote with many finely engraved patterns. Like a banknote, there is a central panel. Within this panel is a bamboo forest. Visible through the forest are six years of Panda coins: 1985, 2011 through 2013, 2015, and 2016. Displaying the 1985 is significant, as this was the first Panda coin designed by a Shenyang Mint artist, Mr. Wang Fu De.

Additionally, there are three groups of Pandas with poses taken from other coin years: 2003, 2006, and 2010. The year 2010 opens the decade, 2003 and 2006 represent Shenyang Mint designs, and the 2006 emission comes from the hand of Chang Huan herself.

The bar mintage is listed as 1,000, but almost none were exported. This was a numismatic art project, not a bullion bar, and the new issue price was far above its silver value. There was initial interest among foreign coin dealers — until I told them the price. Accustomed to bars as bullion items, they were

This 1988 5 Yuan coin honors Li Qingzhao, an eminent poet of the Song Dynasty. It contains 22 grams of .900-fine silver and is proof in quality. Some 30,000 were minted. A statue of Ms. Li shows how she is believed to have looked, although no portraits of her made while she lived are known. The statue is inside a shrine dedicated to Li Qingzhao in Jinan City, Shandong Province, China. Courtesy of Peter Anthony.

shocked at the cost and told me these were unsellable.

There are two varieties of the silver bar. This came about because the Shenyang Mint struck a handful of samples to display to the news media at the anniversary celebration. These have a distinctive, lovely matte luster. The final version for public sales is brighter and more polished. My estimate for the number of samples that were sold is five to 10, at most.

The new Shenyang Mint gate in Qing Dynasty architectural style is part of the reverse designs of both medals. The two 120th anniversary medals seem to be its only presence on numismatic items. Facing Dadong Road, the gate is a reminder to passersby that this city and region played an important role in China’s past.

Meanwhile, far from the Shenyang Mint in place and time, events occurred that would shape its future.

…As day fades into night a line of camels placidly paces through the city gates of ancient Bianjing. From the opposite direction a horse-drawn cart approaches as the city’s famous nightlife awakens. These are scenes from the semidocumentary scroll painting Along the River During the Qing Ming Festival that depicts life in the Song Dynasty a thousand years ago.

In Bianjing’s clubs and taverns people gather to drink,

play cards, and tell stories. This city on the Silk Road, the capital of the Song Dynasty, far from Liaoning Province, is nonetheless connected to Shenyang’s future. In this place, culture and information trade back and forth among travelers from far-flung lands. Music fills the rooms and drinking establishments vie to hire popular musicians and dancers. Arts and cultural pursuits at all social levels blossom to an extent that few societies had ever experienced. The Song Dynasty is considered one of the high-water marks of Chinese cultural development. Moreover, Bianjing was the world’s largest city during the medieval era with around 600,000 to 700,000 inhabitants. At that time, Paris was Europe’s largest metropolis with 200,000 residents, while London was home to just 80,000.

During Song times, a style of poetry called ci that was sung to music rose in favor. Not only male poets gained followings; the ci poetry of more than a hundred women has been preserved. By far the most celebrated of these poets was Li Qingzhao, whose evocative work is still studied in Chinese schools for lines like this: “Still is the swing, quiet the street. The pear blossoms bathe in the radiance of the moon.”

Li lived from 1084 to around 1155. This includes the fateful year of 1127, when the Song Empire was overrun by a

northern people with nomadic roots called the Jurchen. While the Song Dynasty ruled over much of China, the Northeast always remained separate. It was the territory of a fierce, smaller empire called the Liao Dynasty that the Songs could never conquer.

In 1125, the Liao Dynasty was overthrown by a combined force of the Jurchens and a native Northeastern ethnic group, the Bohai (whose name lingers in the Bohai Sea). After this conquest the Jurchens, or Jin Dynasty, resumed their long running feud with the Song empire. In 1127, for complex and disputed reasons, the Song capital in Bianjing fell to them. The capture and sacking of Bianjing, called by some the Catastrophe of Jingkang, delivered a tremendous shock to Chinese culture.

Not everyone calls this event a catastrophe, though. I once mentioned it to a friend in America, who responded, “The Jurchen are my ancestors. I do not think it was a disaster.” Coin collectors may be grateful to the Jurchin, too. The Jin Dynasty introduced silver as legal tender to China. They also synthesized architectural styles from the Song and Liao

Dynasties with their own knowledge to advance the field.

The fall of the Northern Song Dynasty was a terrible blow to Li Qingzhao and the arts communities that flourished under the previous order. One thing leads to another, though, and a century later, the Jurchens were overthrown by the Mongols, who in turn succumbed to the Ming Dynasty. Centuries later, in 1616, the descendants of the Jurchen (renamed the Manchus) regrouped and reconquered China’s northeast, or Manchuria, and established a new dynasty with a capital in Mukden, today’s Shenyang. At first, it was known as the Later Jin, or Chin Dynasty. In 1635, that was changed to Qing and so began the Qing Dynasty that would rule China until 1911.

The Qing government built a palace that is a straight 30-minute walk from the gate of the Shenyang Mint. On this chilly March morning, the route down Dadong Road takes me past a giant tilted teapot. This is the centerpiece of a fountain that advertises the city’s tea market. Farther on, I pass a fine sculpture park that was installed in 2020. A few hundred meters from that, Dadong Lu meets a broad intersection with a traffic light.

On the far side of this crossing stands another large Qing era design gate. From this point on the road narrows, the buildings look older, and the street name changes to Shenyang Lu (road). Very soon the outer walls of the palace come into view. This is the original Forbidden City of the Qing Empire. It was completed in 1636 and is the only royal palace in China that still exists outside of Beijing. While it is very large, it covers only 1/12th the area as the palace complex in Beijing. Incidentally, everyone I have met in Shenyang calls this the Imperial Palace, not the Forbidden City.

The Beijing Forbidden City is the subject of two sets of coins: 10 coins issued in 1997 and seven coins released in 2020. Despite being a UNESCO World Heritage site no coins yet exist for the Imperial Palace in Shenyang. For numismatists, the city’s mint fills that gap slightly with two medals. Both show Dazheng Hall, the central place for grand ceremonies. One undated medal is gold and silver-plated and features a rose on the opposite side. The second dates from 2013 and was minted in three versions: silver, silver-plated, and bimetallic plated. The silver variety is 40 millimeters in diameter and

contains one ounce of .999-pure metal.

In front of Dazheng Hall is a plaza as big as a football field. Near its base are two hulking, fierce lion statues. A pair of gold dragons encircle the two red columns at the Hall’s entryway. On this morning, I watch lines of schoolchildren march by the lions and up the stairs past the dragons, each student sporting a sweatsuit in their school colors. Their joyful chatter wafts through the plaza and takes the chill off the air, and I think to myself, “Something like this could never have happened here 128 years ago when this city was forbidden, but today is just a public-school field trip.” And as they reflect the morning sun, the school colors shine brighter than the dragons.

Peter Anthony is a PCGS consultant on modern Chinese coins and is the author of The Gold and Silver Panda Coin Buyer's Guide 3, a two-time Numismatic Literary Guild winner. He is also the publisher of China Pricepedia , a monthly journal and price guide for modern Chinese coinage.

This 1938-D Oregon Trail Half Dollar, a specimen grading PCGS MS68+, is among Hugh J. Hillaker’s favorite coins. Courtesy of PCGS TrueView.

For Hugh J. Hillaker, the path that led to numismatics wasn’t originally strewn with coins but rather quilted with stamps. At the age of eight, he was a philatelist – a stamp collector. “I loved all of the colorful pictures and the unusual shapes,” he recalls. “But I soon realized that there were way too many stamps in the world.” He soon bought his first coin folders and began looking for the usual assortment of coins from circulation while attending get-togethers at his local coin club to catch glimpses of type coins and other unusual pieces he couldn’t find in pocket change.

“When I saw the classic commemoratives, I immediately fell in love with them.” He did what many kids of his generation did when they wanted to earn some extra money; he took on a newspaper delivery route, slinging copies of the Fort Worth Press and, later, the Fort Worth Star-Telegram to doorsteps around his neighborhood. Young Hugh’s collection soon began teeming with more of the commemorative coins he longed to own.

Fast-forward just a few years, and around 2000, Hillaker doubled down on building out a 144-coin set that encompasses all the various designs, dates, and varieties associated with the many different classic commemorative half dollars as well as the 1893 Isabella Quarter and 1900 Lafayette Dollar. “I began with just ‘hole fillers’ and then tried to gradually upgrade each hole as the budget would allow,” he remarks.

The help of mentors and fellow collectors helped him get closer and closer to his goal, which increasingly leaned toward acquiring examples with spectacular toning. By 2015, his commemorative coins had a presence on the PCGS Set Registry. His 144-coin set is 100% complete and, as of this

writing, holds a grade ranking of 66.19, putting it near the top of all competitors for that category. Subsets of coins from among his 144-coin set also perform well, with the Texas commemoratives ranking as his favorite. “I am probably prejudiced, too,” he jokes, noting his Texan heritage.

As for his favorite coins? "One of my favorites" is one that [mentor] Bonnie Sabel helped me with many years ago. It is the 1938-D Oregon Half Dollar. My other favorite is my 1938-S Texas Half Dollar,” he said, adding that, “God really wanted me to have it!”

He says collectors who hope to find success on the PCGS Set Registry need to focus on what they love and build from there. “As Mrs. Hillaker always tells me, ‘There will always be another beautiful coin.’ She is right, but you must make a choice sooner or later!”

Joshua McMorrow-Hernandez has won multiple awards from the NLG and ANA for his work as a numismatic journalist and editor. He has been a coin collector since 1992 and enjoys all areas of United States coinage and U.S. minting history.

Joseph Ford is an 18-year-old dealer who operates a coin shop in Myrtle Beach, South Carolina. Courtesy of Joseph Ford.

How does an 18-year-old collector end up owning his own coin shop? Let me share my journey from my first accidental numismatic discovery to becoming a young entrepreneur in the world of numismatics…

It all started somewhat disastrously when I was in kindergarten. I had taken a Confederate $10 note from my dad’s desk to school for show and tell, not realizing the historical treasure I had stuffed into my pocket. After the note accidentally went through the wash, my dad discovered its fragments. Surprised and curious, he asked me about the note, which led me to reveal my secret stash — a tackle box filled with assorted coins I had gathered. Rather than scolding me, my dad was intrigued by my interest in coins. This new curiosity led us to an antique shop where I began collecting Lincoln Wheat Cents, Buffalo Nickels, and a variety of small silver coins, igniting my lifelong passion for numismatics.

As I grew, so did my collection, nurtured by the change my grandma saved for me and my own relentless curiosity. This passion for coins eventually led my dad and I to explore opening a coin shop in Myrtle Beach, South Carolina, all while I was still deepening my numismatic knowledge and expertise.

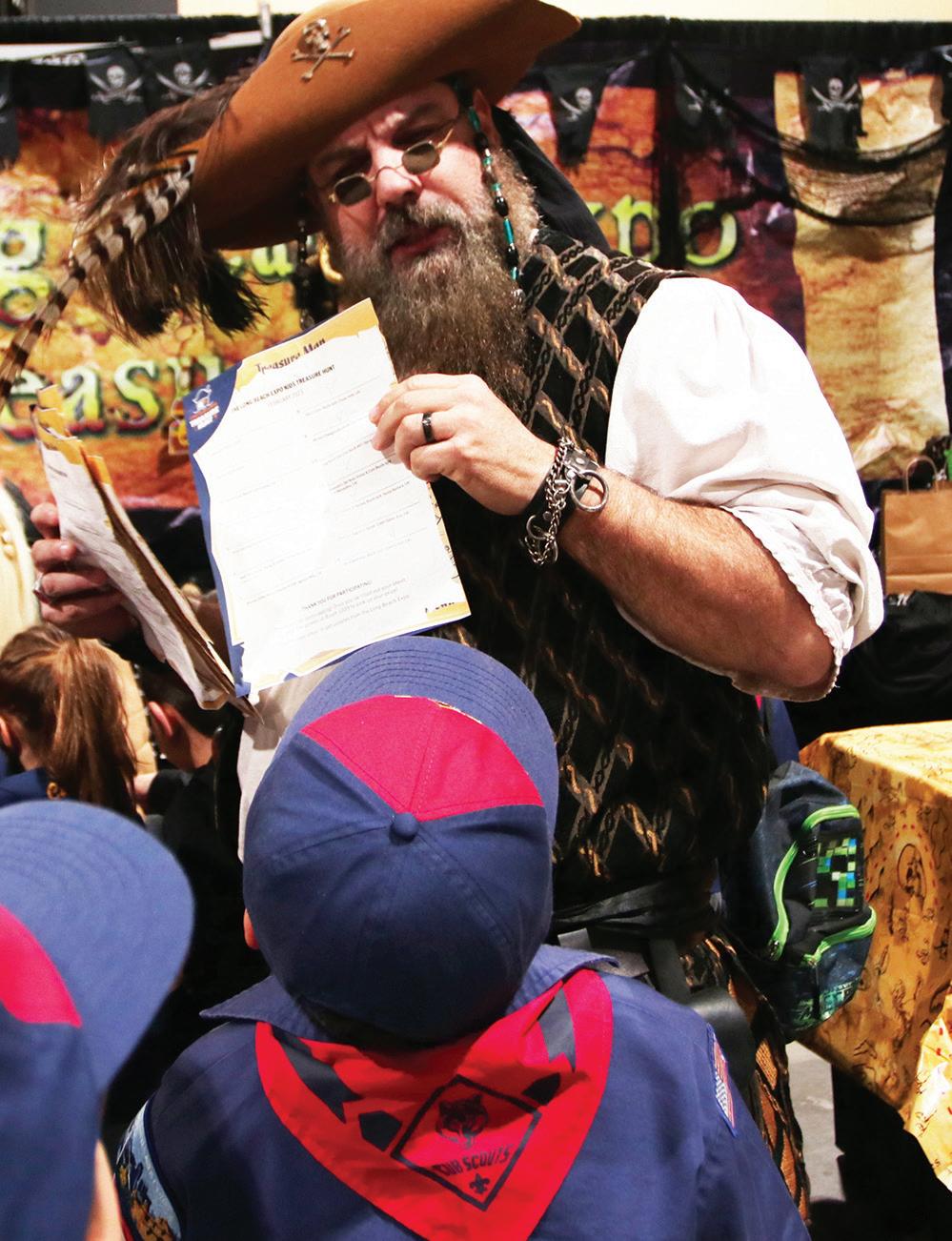

Two years ago, our shop became a reality, transforming my hobby into a flourishing business. Our shop, JP Ford Coin and Currency, is a hub for enthusiasts of all ages, where I handle everything from inventory management to customer relations. I take special pride in guiding young collectors, offering them a variety of affordable coins, and even letting them hold more valuable pieces to inspire their dreams.

The following year, seeking to enhance our business further, I attended the American Numismatic Association's Summer Seminar and took the “Business of Being a Coin Dealer” class. The insights I gained there not only boosted my confidence, but also significantly improved our shop operations.

What truly sets our shop apart isn’t just the transactions we handle but the community we've built. Being the youngestever vice-president of the Myrtle Beach Coin Club, I've focused on fostering a welcoming environment for all enthusiasts, especially the youth. We are exploring ways to bring back the Myrtle Beach Coin Show, aiming to include local schools, and provide goody bags of coins to spark interest among young collectors.

As a young coin shop owner, I believe that my journey demonstrates that with passion, guidance, and a bit of entrepreneurial spirit, anyone can turn their hobby into a successful career. As I prepare to dedicate even more time to the shop after graduating from high school, I look forward to the challenges and opportunities that will help us grow, possibly into a bigger location as demand increases.

So, to every young numismatist reading this, remember: the path may be unpredictable, but it is always paved with opportunities. My story began with a mistake and a handful of coins, and now, here I am – the proud 18-year-old owner of a successful coin shop. If I can do it, so can you. Keep collecting, keep dreaming, and let's keep the legacy of numismatics vibrant for generations to come!

The historic and unique Judd-115 1849 “Handmade” Gold Dollar pattern, with this piece eclipsing $100,000 in a January 2024 auction. Courtesy of PCGS TrueView.

Rare Coin Galleries 1979 auction catalog that contained this exact coin. I finally got to see this pattern issue live when two different examples were sold in a July 2008 Stack’s auction.

What makes this J-115 pattern so remarkable is that James Longacre, the chief engraver of the United States Mint at the time, hand cut each one. Because of this, each is unique. All four have different planchet alloys in as well. The piece I purchased is the only one which has not been metallurgically tested. At 23.4 grains, it is heavier than the other three and presumably contains more gold than the second heaviest, which has a recorded weight of 22.76 grains. It has been tested to show that it has an alloy of 90% gold, 3.5% silver, and 6.5% copper.

The reason for creating this issue was twofold: the U.S. Mint’s fears that the newly introduced Type One Gold Dollars, with a diameter of 13 millimeters, would be confused for half dimes, which had a diameter of 15.5 millimeters, and the ability to strike a coin this small (and thin) in a metal as soft as gold. The patterns were wider, at 16 millimeters, and this would also likely aid in better strikes for this brandnew design and denomination. This wider diameter for gold dollars was not adopted.

Why were these coins handmade and not struck with coin dies? One would have to assume that this was a rush job and that Longacre had to produce coins in a very short period. It would be interesting to go through U.S. Mint records from 1849 to see if there were problems with pre-production striking of gold dollars (as there were with the brand-new double eagles) and exactly who pointed out the unlikely possibility of this denomination being confused with half dimes.

In addition to the four known examples in gold, there are another four which are gold-plated silver (J-116). According to a noteworthy dealer who had handled J-115 and J-116 examples at one time and had done extensive research on these issues, four of five known “gold-plated silver” examples are, in fact, 14-karat gold and were almost certainly made on planchets which were likely cut from a pocket watch case(s).

Two examples, including the one I purchased, are distinctly heavier, and one that was metallurgically analyzed shows a composition that is 90% gold and 10% silver and copper. When the present coin is eventually analyzed, it is likely to show a similar composition.

My conclusion is that there are only two examples of J-115 that are struck using the proper composition, and these are the most desirable pieces, as the others are made with severely debased gold.

Doug is an award-winning author of over a dozen numismatic books and the recognized expert on U.S. gold. He can be reached at 214-675-9897, at dwn@ont.com or through his website, www.raregoldcoins.com.

The United States Mint created two outstanding overdate varieties with 1942/1 Mercury Dimes from both the Philadelphia and Denver Mints. Courtesy of PCGS TrueView.

Overdated coins are among the most sought-after varieties in American numismatics. The expensive and time-consuming process of creating new dies is why early issues, such as the 1796/5 Draped Bust Half Dime and 1802/0 Draped Bust Half Cent, were made by repunching the current year into a die of an earlier year. By the early 20th century, technological advancements in die production rendered the need to repunch dies unnecessary. However, a few overdated dies still managed to be created.

The evolution of die making is foundational to the field of varieties and essentially brought about the creation of two of the most famous (and valuable) 20th-century overdates: the 1942/1 and 1942/1-D Mercury Dimes.

But how did they come to be? We need to look back to diemaking practices of yore to better understand how the 1942 overdate dimes were born, and we start with looking at the design features of each 1793 Chain Cent obverse and reverse die, which were completely hand-engraved. But this method of die making was time-consuming and costly. In order to produce dies more efficiently for the 1793 Wreath Cents that came along, hubbing, which is the process of creating

numerous dies with the same design, was employed. This involved hand engraving the actual size of the coin’s obverse or reverse device (the bust or wreath) onto the end of a solid steel cylinder to create the master hub.

This hub was then pressed, or hubbed, into a steel blank multiple times to fully impress the incused image, creating the working dies from which coins would be struck. When mintages for future mint issues were expected to be exponentially higher, two more hubbing stages were employed

to accommodate the need for more working dies. The master hub was used to create, instead of working dies, numerous master dies (in incuse). Each master die was used to create working hubs (in relief), which in turn were used to press the working dies (in incuse).

To make the die creation process even more efficient for future mint issues, the other features of a die’s design, such as the stars, lettering, dentils, arrows, etc., were also directly engraved into the master hub. By 1909, the date was applied to the master dies, and in 1985, the mintmark began following suit.

This brings us to the 1942/1 and 1942/1-D Mercury Dimes. How did these happen if date repunching was a thing of the past?

For many years, all working dies produced at the United States Mint were hubbed at least twice in order to provide a strong impression of the image. During the final months of 1941, when both 1941 and 1942 dies were being prepared in Philadelphia, two Mercury Dime obverse working dies were pressed with a 1941-dated hub, then a 1942-dated hub. One

of the working dies was used to strike the 1942/1 issue, and the other was shipped to Denver to produce the 1942/1-D. Incidentally, this use of two different-dated working obverse hubs is precisely how the two other famous 20th-century overdates, the 1918/7-D Buffalo Nickel and 1918/7-S Standing Liberty Quarter, came to be.

Regardless of whether these overdated issues were made due to the intense wartime work loads of the mint’s engraving department or simply human error, the 1942/1 and 1942/1D Mercury Dimes are arguably among the most desired overdates in American numismatics.

Edward Van Orden was born and raised in Bergen County, New Jersey, and received a Bachelor of Science degree in accounting at Fordham University. He has played in numerous bands, worked in royalties and finance at Universal Music Group and The Walt Disney Company, and enjoys looking up on a dark evening.

Coin Advisor is a leading provider of PCGS-cer tified modern coins, of fering highly sought-af ter pieces with exceptional pedigrees at competitive prices. Each coin is meticulously evaluated by PCGS to guarantee authenticity and value. Our exper t advisors help collectors access and select the most prestigious and suitable coins for their collections. This dedication to quality and customer ser vice ensures that ever y collector's experience is both rewarding and per sonalized.

We of fer a diverse selection of cer tified coins with exclusive labels in the finest pedigrees, including many signed by renowned designers. These rare coins add unique value and appeal to any collection. Our commitment to quality ensures that collectors find only the most distinctive and desirable coins available.

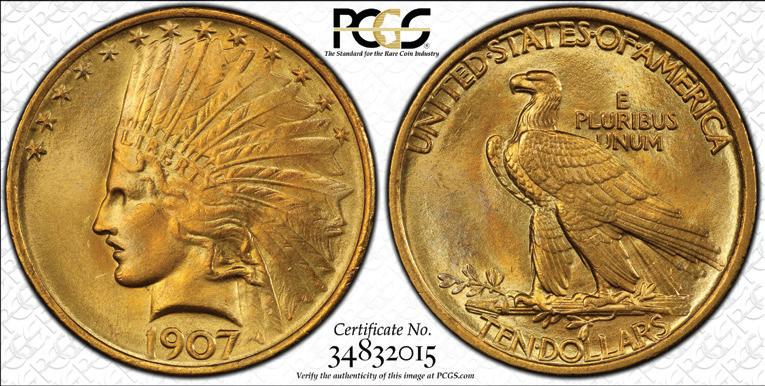

Welcome to this edition of Auction Highlights, where we share some very interesting coins and a banknote that were all recently sold at auction for big prices. As usual, it is extremely difficult to narrow down which items to spotlight, as there are so many great coins and banknotes to choose from. But here are the ones that made the selective cut!

The first item is a China 1907 Gold K’uping Tael pattern graded PCGS SP61. This coin recently made lots of noise when it sold on April 15, 2024, for an impressive $720,000 at a Stack’s Bowers Galleries auction. The China 1907 Gold K’uping Tael is an extremely rare pattern that was produced only as trials with hopes of introducing these gold coins for circulation. However, that plan eventually failed, and the intended circulation strikes never came to fruition. Very few pattern pieces remain, making this a great Chinese numismatic rarity that collectors highly desire.

This 1909-S Indian Cent grading PCGS MS67RD is a special coin since it is one of the key dates of its series. It saw a mintage of only 309,000, though thankfully, collectors preserved many examples over the past 115 years. Specimens grading up to MS65 are relatively plentiful but come with hefty price tags, with Red (RD) examples especially pricey. The coin is even scarcer in MS66RD and almost unheard of in MS67RD. In fact, PCGS has only graded three examples in MS67RD,

with none grading higher. In January 2024, GreatCollections offered a remarkable 1909-S Indian Cent graded PCGS MS67RD that realized an impressive $54,562.

$100 1861 Confederate States of America Military Endorsement Banknote, PCGS Banknote Choice Fine-15 Details

Last but not least is this outstanding 1861 $100 Confederate States of America Military Endorsement Banknote graded PCGS Banknote Choice Fine-15 Details. These notes are historically significant as they were issued during the Confederacy and can be traced to leaving New York in late April 1861. The front of the note has a beautiful design of “America” standing tall with a train and passengers in the background, along with large and elegant numerals of “100” to the lower-left and top-right corners. It sold at auction for $4,440 via Heritage Actions in 2023.

Jaime Hernandez is an editor for the PCGS Price Guide and has been a proud member of the PCGS team since 2005. By the time he reached his early 20s, Jaime was successfully buying and selling coins with some of the most prominent dealers and collectors in the country. Email: jhernandez@collectors.com

Hejaz AH1334//8 (1922) Dinar Malik Reverse, PCGS MS64. Courtesy of PCGS.

proclaimed independence for the Kingdom of Hejaz and ordered his supporters to attack the Ottoman garrisons in Mecca.

While the Arab Revolt has a complex history, it was promised to King Hussein bin Ali by the British government –a single independent Arab state that would include Hejaz and surrounding regions; today, this terrain is today Jordan, Iraq, and most of Syria and, with some ambiguous terms, possibly what was then British Palestine. Hussein Bin Ali succeeded in expelling the Ottoman Empire from the Arabian Peninsula. In June 1916, Hussein bin Ali declared himself King of Hejaz and malik bilad-al-Arab, or King of Arab lands.

When the first gold coin was issued for the Kingdom of Hejaz with King Hussein bin Ali, the coin included the text ملك البلاد العربية, which translates to “King of Arab Lands.” While Great Britain, France, and Russia had recognized him as king of Hejaz, the king of Arab Lands was not recognized, and this aggravated other Arab leaders, such as Abdulaziz ibn Saud King of Nejd. The Kingdom of Hejaz would later join with Nejd and become Saudi Arabia under King Ibn Saud and the family Saud, which still rules today.

The coin has a text-based design that in English reads “Hussein bin Ali, Hashimi, His Servant, and son of His Servant, King of Arab Lands” on the obverse; the reverse reads “Struck in the honored Mecca, Dinar, Year 8 Year 1334 Capital of the Arabic Government.” It is recorded that the

Today, the coins featuring the text malik bilad-al-Arab or “King of Arab Lands” are very desirable for collectors of Arabic and Saudi Arabian coinage. Some auctions have noted that as few as four examples may have survived, but more than that are currently documented. In the beginning of 2024, an example was sent to PCGS through its Paris office for grading. This specimen was verified as authentic and grades MS64.

Jay began collecting coins at the age of 13, when he inherited his uncle’s coin collection. Turner is proficient in U.S. and world coins, token and medal variety attribution, grading, and counterfeit detection. In 2017, Turner joined PCGS as a grader specializing in world coins. He is stationed at the PCGS U.S. headquarters and grades onsite for the Shanghai, Hong Kong, and Paris offices.

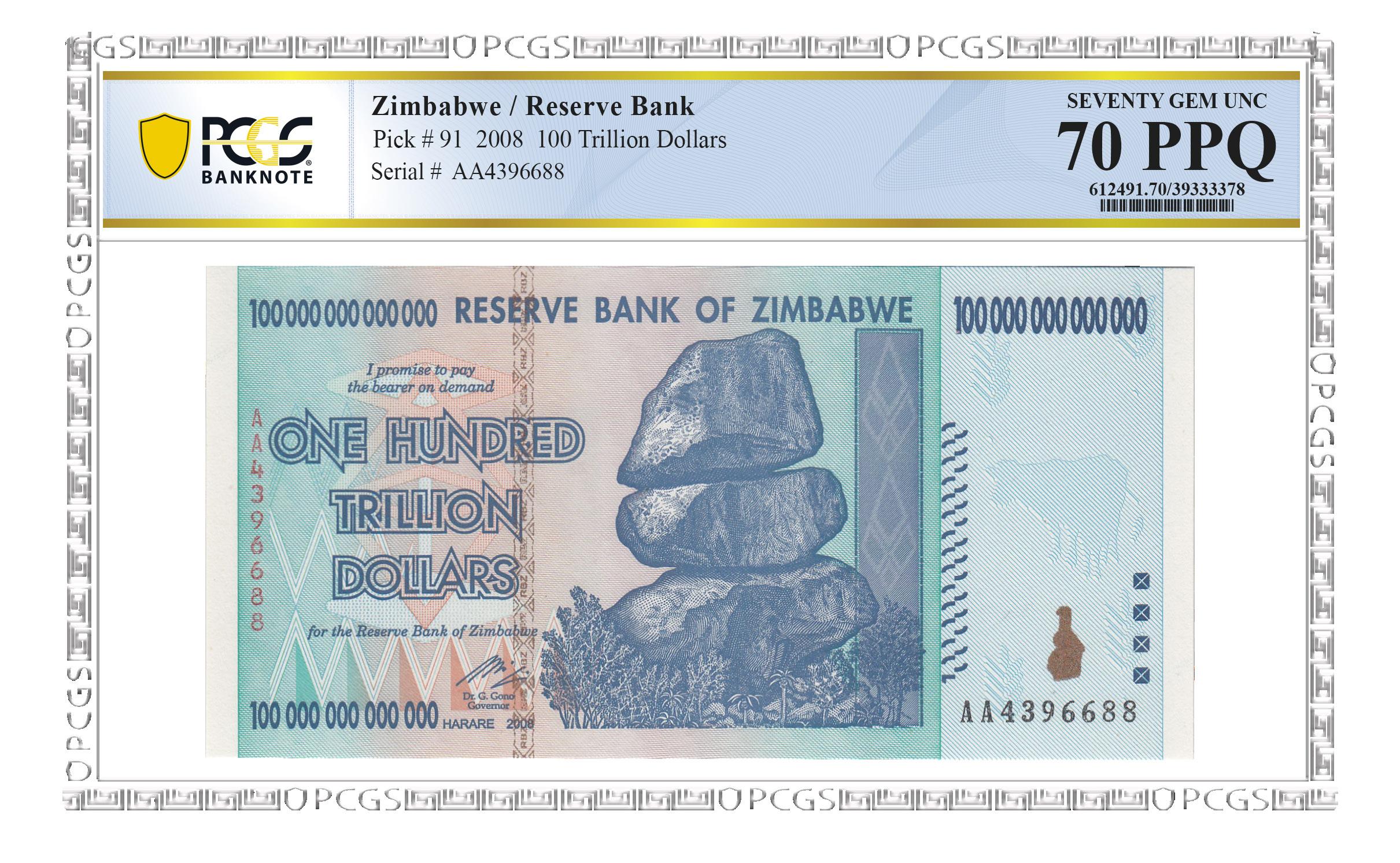

Inflation is one word we hear a lot these days. And while that word tends to elicit a harrowing gut reaction, it’s not necessarily a bad thing. Gradual, moderate, carefully monitored, and managed inflation can serve as a net benefit to an economy, helping to keep businesses profitable and employee wages on the rise, incentivizing investment and working to prevent the possibility of its dreaded inverse – deflation. However, higher rates of inflation – particularly radically elevated levels known as “hyperinflation” – can wreak economic havoc, grinding growth to a halt, making borrowing impossibly expensive, eroding the purchasing power of savings, and placing crushing financial pressure on both companies and households. The capacious arena of notaphily – or the study and collection of banknotes – contains many tangible, colorful, and crisp paper embodiments of this hyperinflation. There have been somewhere on the order of several dozen hyperinflationary episodes over the last few centuries, with the exact number dependent on how hyperinflation is specifically defined by

economists. And luckily for us notaphilists, each episode has come with corresponding banknote keepsakes that physically and visually demonstrate the abject desperation of policymakers and the resulting numeric absurdity of their late-stage banknote issues. This $100 trillion banknote issued by the Reserve Bank of Zimbabwe in 2008 represents one of the most stunning examples of hyperinflation of all time and unquestionably the single most dramatic of the 21st century.

Hyperinflation doesn’t happen by accident, nor does it occur within a vacuum. Most instances are attributable to nascent, war-torn, or otherwise unstable governments – typically under duress from forces both internal and external – literally keeping the printing presses on full speed 24/7 and adding zeros to the denominations of their fiat currencies in order to service their burgeoning debt load and keep the lights on. Such a strategy may buy a little extra time in the leadup to an inevitable day of reckoning but is obviously not a viable long-term approach in lieu of other effective structural and institutional reforms.

Zimbabwe, a former self-governing British colony once named Rhodesia, declared its independence in 1980 under the leadership of the controversial Robert Mugabe as first its prime minister and then its president. Two decades later, his same leadership led to sharp declines in external finance and agricultural export volume and the plague of a number of international sanctions and suspensions from trade organizations and commonwealths. Millions of Zimbabweans had fled the country as living standards and public health remained precarious and human rights violations were commonplace. A kind of “snowball effect” took over within the nation’s banking and financial sectors, leading to ridiculously high-denominated currency by 2008. The note featured here is the highest of all of the Zimbabwe inflationary issues, which exist in the millions, billions, and trillions of Zimbabwe dollars.

Fun fact: While this $100 trillion banknote holds the record for displaying the greatest number of zeros within its design, it is not the highest inflationary denomination ever issued. That title goes to the Hungarian National Bank’s 1946 100 Quintillion Pengo issue, which, presumably due to space constraints, features its denomination spelled out in Hungarian. Numbers can only take you so far, I suppose.

The denomination of this particular $100 trillion example is mind-numbingly lofty, and its grade is similarly high. This banknote earned every point of its Supreme Gem Uncirculated 70 PPQ grade, proudly displaying flawless, original paper, the sharpest of corners and edges, and well-balanced margins, making it a highly desirable collectable. Just be sure not to pay anywhere close to $100 trillion for it!

Because banknote lots were hung on Southern California coin shop bid boards eye-level with a first-grader, a young Philip gravitated toward collecting notes versus their circular metal numismatic cousins in the mid-1980s. He has maintained his passion for banknotes ever since and joined PCGS in his current role as banknote specialist and research manager since the launch of PCGS Banknote in early 2020.

An 1817 Capped Bust Half Dollar grading PCGS AU58+. Courtesy of PCGS TrueView.

wear or surface disturbance as would be incurred from a short period in commerce.

This 1904-O Morgan Dollar grades PCGS MS60; note the evidence of bag marks and other detractions on the obverse. Courtesy of PCGS.

Issues that were recognized as collectible and removed from circulation quickly (such as the 1909-S VDB or 1955 Doubled-Die Lincoln Cents) are plentiful in AU grades, while coins whose rarity was not discovered until many decades after their production (such as 1877 Indian Cents or 1916-D

Mercury Dimes) are scarce in such a state of preservation.

Within the About Uncirculated grade range (50 to 58 on the numeric Sheldon scale), only the most-detailed, least-worn examples warrant the AU58 grade. Such coins typically appear uncirculated at first glance but upon close examination will reveal gentle touches of friction on the highest topographical elements of the design (for example, the hair just above the ear on a Morgan Dollar).

Collecting coins in this grade thus affords the opportunity to acquire “nearly new” pieces at slightly more digestible prices than equivalent examples in the lower range of the uncirculated (60-70) Sheldon spectrum. And PCGS-graded AU58 coins have always grabbed the attention of astute collectors at auction and on the show floor. In some cases, they can be even more aesthetically pleasing than MS60-61 pieces, which, while fully uncirculated, often have surfaces significantly abraded by bag marks, as the Morgan Dollar imaged here exemplifies.

This 1857 Flying Eagle Cent grades PCGS AU58+. Courtesy of PCGS TrueView.

Within the already rarefied realm of PCGS-graded AU58 coins, a small number of exceptional pieces also receive the plus (“+”) designation. In addition to being technically wellqualified, coins must exhibit exceptional eye appeal and choice surfaces for the given grade to garner a plus from the PCGS grading team.

Pieces graded AU58+ therefore represent the ultimate

representatives of their issue within the circulated realm. They are the best-available examples that entered circulation and performed their intended duty (if only for a short spell) before being identified and preserved by some long-forgotten but prescient collector, like the stunning 1817 Capped Bust Half Dollar and 1857 Flying Eagle Cent pictured alongside this text.

An 1854 Liberty Seated Quarter grading PCGS XF45+. Courtesy of PCGS TrueView.

It is the inherent scarcity and necessary beauty of such examples that drives the strong premiums they command. They are also the highest-graded pieces eligible for the PCGS Everyman Set Registry – a competitive space in which

no uncirculated coins (and their many-zeroed price tags) are allowed.

While PCGS-certified AU58+ coins represent the crème de la crème of circulated coins, I would be remiss to mention another “magical” grade: XF45+. Much in the way the AU58+ grade denotes the finest-possible About Uncirculated example of a particular issue, XF45+ denotes the finest-possible Extremely Fine example.