Bright science, Brighter enzymes, healthy animals

Enzymes are essential for optimization of your feed and reduction of your costs, whether you want to increase digestibility of energy, protein or phosphorus.

With more than 20 years of experience, the DSM | Novozymes Alliance provides a unique comprehensive portfolio of enzyme solutions that are designed to deliver exceptional performance, along with quality that you can expect from world leaders in feed enzyme technology, so that you can succeed in your business by feeding healthy animals in a sustainable way.

Our enzymes are available in forms for every application including microgranules, thermostable granules and liquids.

If not us, who? If not now, when? WE MAKE IT POSSIBLE

www.dsm.com/anh

Follow us on:

To find out more about our products and services and to contact Lauren, visit trouwnutrition.co.uk

“Our dedicated Feed Safety Team can support all your technical and engineering needs.”

Lauren Judd

Feed Additive Product Manager Trouw Nutrition GB

On-Line Only (No Print Copy) One year: £60 Two years: £114 Three years: £153

expressed by contributors are not necessarily those of the Publisher.

Feed Compounder May/June 2023 Page 1 Opinion: Turning Negatives to Positive 2 Ryan Mounsey: Feed Production Update 4 Ruminations: 12 By Rob Daykin Colin Ley: View from Europe 14 Roger Dean: Company Reports and Accounts 18 Robert Ashton: Ten Ways to Learn to be Patient 20 Christine Pedersen: Milk Matters 22 Matthew Wedzerai: Scientifically Speaking … 24 Green Pages 26 Feed Trade Topics From the Island of Ireland Resin Acids to Improve Broiler Welfare and Performance 30 By Tiago Santos Advertising Feature: Food Grade Lubricants for Animal Feed 32 New Swine Vitamin Recommendations 34 By Gilberto Litta and José-María Hernández The Launch of dsm-firmenic 39 Delivering Sustainable Dairy Farming 40 With Dr Liz Homer Sustainability: Products or Services to Minimise the Environmental Impact of the Animal Feed Industry 43 Energy-Sparing Enzymes 46 With Sophie Malkin Feed Additives: Enzymes 48 Ruminal Support Through Turn-out and Beyond 50 With Anna Dinsdale Quality Control, Sampling & Analysis, Moisture Management 52 In Brief 54 EU Compound Feed Production Estimates for 2022 / 59 Market Outlook 2023 People 60 Buyers’ Guide 62 Comment COMPOUNDE

EED Contents may/June 2023 Vol. 43 No. 3

Print

R F

SubSCription rateS:

and On-Line One year: £80 Two years: £150 Three years: £200

0950-771X Views

©

Compounder

deputy editor: Ryan Mounsey advertiSement/SaleS manager: Fiona Mounsey editor: Andrew Mounsey publiShed by: Pentlands Publishing Ltd Plas Y Coed Velfrey Road Whitland SA34 0RA United

Web

E-mail: mail@feedcompounder.com

ISSN

Feed

2023

Kingdom Tel: +44 (0) 1994 240002

site: www.feedcompounder.com

turning negativeS to poSitive

The high inflation/cost-of-living crisis in which we are all embroiled could ultimately yield significant food and feed chain benefits. Although they don’t feel like a positive at present, the current pressures have the potential to deliver a course correction in our approach to the production, processing, distribution, and consumption of food.

A key motivation for this admittedly upbeat slant on today’s negative economic state is the growing focus on the avoidance of food waste, alongside improving returns for farmers. Both these factors could contribute to an enhanced future for feed compound use, even though manufacturing volumes may suffer some reduction in the short term.

Being exposed to retail prices which are noticeably advancing almost weekly, is clearly having an impact on consumers, in sharp contrast with the indifference many have shown towards food production and use in the past.

Surveys carried out by WRAP (Waste and Resources Action Programme) show UK food waste ranging from a high of 24.1% to a low of 13.4% over the past five years. Consumers were at their best in terms of maximum food use during the Covid-19 lockdown in 2020, having been at their most wasteful immediately before the pandemic. Since our so-called return to normal, waste levels have climbed again, edging back towards 20%.

That was before food price inflation hit 18% at the end of last year, a development which once again saw consumers cutting wastage to contain spending. WRAP has duly reported that UK citizens are making ‘widespread changes to their food habits’ to mitigate higher living costs. In November 2022, 71% of consumers reported changes to how they buy, store, manage or use food because of the rising cost of living, up from 65% in June last year.

Consumer concern about their food, and the need to make maximum use of it, is undoubtedly a positive for farmers. Many producers have complained long and hard in the past about the ‘couldn’t care less’ attitudes displayed by shoppers concerning where food comes from, domestic or imported.

Rising retail prices, while painful for consumers, are therefore a welcome development for producers and, by implication, a potential positive for feed suppliers. The recent 18% hike has helped to restore a degree of farmer/retailer balance to the marketplace. That can only be good for the long-term future of British food production, especially if it helps persuade politicians to place higher importance on securing home-sourced supplies. Free trade agreements, which to UK feed and food producers appear to be geared towards facilitating imports of cheap food, have been substantially discredited in recent months by the sight of vast areas of empty retail shelves.

There is no escape from the realities of the global marketplace.

Producers in Spain, for example, were always likely prefer to sell close to home, at minimal distribution costs, whenever supplies ran short. Surprise, surprise!

Also, we can’t control global trade or weather issues which invariably have the final word on feed and food production volumes and quality.

Take the latest global assessment of the pork market, released by Rabobank, Netherlands. The bank’s analysts say that hog production growth in North America will slow this year, alongside the widely accepted expectation that Europe’s pig supply will remain tight.

Similarly, their prediction for China is that pig production will tighten in late Q2 and Q3, with Southeast Asia set for slow growth this year. This is the challenging marketplace in which we all work, with Rabobank’s assessment of raw materials for feed production also less than upbeat.

“Global feed stocks are at historically low levels, and availability remains tight,” said the Dutch bank, adding that the Argentine harvest is set to be ‘disappointing’.

Even with the promise of a record 2023 soybean crop in Brazil, the Rabobank conclusion is that today’s ‘small global cushion’ of grain and oilseed stocks will lead to ‘additional feed cost volatility’ in 2023.

Looking for positives in the face of such reality is hugely important, hence our suggestion that a hike in food costs approaching one fifth will leave farmers with a fairer share of retail returns than for many years, and that consumers will gain more respect for domestic food products.

Rising prices, whether related to food, energy, labour, or other factors, can also have a beneficial impact on business efficiency if managed correctly. Rolling along on a wave of rising sales volumes with demand outstripping supply, although great while it lasts, can easily diminish the strength and competitiveness of individual businesses over time. FEFAC’s confirmation that EU compound feed production for farmed animals declined last year, dragged down by falling pig and poultry numbers, is a major wake-up call for us all.

Although both sectors traditionally respond rapidly once demand moves ahead of supply, the turnaround period imposes pressures on support industries, including feed. Some compounders will no doubt use this period to tighten production processes while others will change their focus.

Pet feed products are on the rise, for example, while the demand for energy by-products is arguably stronger now than ever before. There are options and opportunities to match today’s pressures, therefore, from which some businesses will emerge better equipped for the future. Even so, we’re in for a challenging next 12 months.

Page 2 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com opinion

£13,035* increase in production profitability 647-tonne* CO2e reduction 3% improvement in feed efficiency 21% saving on soybean meal use Optigen® is a superior non-protein nitrogen source that can help you overcome the protein challenge by managing fluctuating feed costs and improving the sustainability of your business. Backed by more than two decades of research, Optigen enables partial replacement of plant protein sources in ruminant rations. Ask Alltech how Optigen can help you get the most out of your protein. Boosting of your protein stocks * within a 1,000-cow dairy herd (Salami et al., 2021) the limits Call: 01780 764512 Alltech.com/uk RUMEN FUNCTION

Feed production update

By Ryan Mounsey

great

britain

march production update

Total production of compounds, blends and concentrates, including integrated poultry units, during the month of March 2023 declined by 106,400 tonnes or 7.7 per cent to its lowest level for the month in 11 years of 1,273,900 tonnes. Moreover, the total under review was a marked 86,300 tonnes or 6.6 per cent below the 10 year average for the month.

Total feed production during the month of March 2023 was made up of: 42.5 per cent poultry feed, 30.1 per cent cattle and calf feed, 13.6 per cent pig feed, 10.4 per cent sheep feed, 1.6 per cent horse feed and 1.8 per cent other feed.

For the third March in succession, total poultry feed had decreased below its year earlier level. The 541,800 tonnes of output was 40,300 tonnes or 6.9 per cent down on a year previously and, in addition, was 31,400 tonnes or 5.6 per cent lower than the decade long average for March.

All poultry feed subsectors dropped below their respective year earlier returns for the month under review. At 195,400 tonnes, broiler chicken compounds output had decreased by 9,000 tonnes or 4.4 per cent to its lowest level in six years. Production of integrated poultry units for March dropped from its year previous total by 14,400 tonnes or 7.0 per cent to 189,900 tonnes and poultry breeding and rearing compounds fell by 1,300 tonnes or 4.2 per cent to 29,600 tonnes; production from both these categories had dropped for the second year in succession. Both chick rearing feed compounds and layers compounds had declined to their lowest March output since 2015; the former fell 1,900 tonnes or 14.5 per cent to 11,200 tonnes and the latter by 12,700 tonnes or 11.6 per cent to 97,000 tonnes. Turkey feed compounds’ production decreased by a substantial 1,100 tonnes or 17.2 per cent from the March of a year previous to 5,300 tonnes, its

lowest total on record for the month.

At 383,400 tonnes, total cattle and calf feed production for March was at its lowest level for the month since 2009 and 13,000 tonnes or 3.3 per down on a year earlier. The total under review was an even more significant 24,700 tonnes or 6.2 per cent down on the decade long average for March.

Despite the overall drop, the sector’s largest component, compounds for dairy cows, surpassed its year previous output by 1,110 tonnes or 0.6 per cent and rose to 197,700 tonnes. The sector’s smallest category cattle protein concentrates also grew, by 200 tonnes or 2.2 per cent to 9,500 tonnes of output. Production of blends for dairy cows also rose sharply from the historically low return from the March of a year previous; it increased by 7,200 tonnes or 9.7 per cent to 81,300 tonnes. However, production of all other cattle compounds decreased by 9,200 tonnes or 14.9 per cent from a year earlier to its lowest total on record of 52,500 tonnes; additionally, output of all other cattle blends declined from 2022 returns by 9,600 tonnes or 26.9 per cent to its lowest level since 2005 of 26,100 tonnes. Finally, total calf feed fell for the third March in a row to 16,300 tonnes, 2,600 tonnes or 13.8 per cent down on a year previous.

Total pig feed production for March had fallen substantially from the historic high output from a year earlier, doing so by 28,400 tonnes or 14.1 per cent to 173,500 tonnes. The total under review was the smallest of the four years but was nevertheless, 400 tonnes or 0.2 per cent greater than the 10 year average for the month.

The bulk of the drop in pig feed production from a year earlier was made up by the pig finishing and pig growing feed subsectors; the former declined from its year previous return by 15,700 tonnes or 14.1 per cent, down to 96,000 tonnes and the latter did so by 7,700 tonnes or 24.1, down to 24,300 tonnes, its lowest return for March since records were kept in their current form. Pig starters and creep feed output were also at their lowest amount for March on record, production dropping by 1,000 tonnes or 20.4 per cent to 3,900 tonnes. Output of link and early grower feed was at 9,400 tonnes, 1,200 tonnes or 11.3 per cent lower than a year previous and pig breeding feed compounds production was down 2,600 tonnes or 6.2 per cent to 39,600 tonnes. Lastly, pig protein concentrates declined from year previous levels by 300 tonnes for the second year in succession, in this instance, halving down to 300 tonnes of production.

A decrease of 18,500 tonnes or 12.3 per cent from the March of a year previous brought total sheep feed to its lowest level for the timeframe under review since 1993 of 132,100 tonnes. As a result, the current total slipped a considerable 21,600 tonnes or 15.1 per cent below the 10 year average for March.

Both compounds for breeding sheep and blends for breeding sheep were at their lowest tonnages on record, dropping from a year previous by 9,700 tonnes or 12.1 per cent to 70,700 tonnes and 2,500 tonnes or 39.1 per cent to 3,900 tonnes respectively. Production of compounds for growing and finishing sheep had also declined substantially from a year previously, doing so by 6,300 tonnes or 10.9 per cent to 51,400 tonnes, which was, however, its fifth highest return

Page 4 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

for March. A reduction of 100 tonnes or 1.8 per cent in production from the corresponding month a year earlier brought blends for growing and finishing sheep down to 5,400 tonnes; in contrast, sheep protein concentrates bettered its year previous output by 100 tonnes or 16.7 per cent to 700 tonnes.

Total production of horse feed in March 2023 was 1,300 tonnes or 5.9 per cent down on a year previous at 20,800 tonnes. Due to significantly lower outputs from the first half of the decade, the total under review was a less marked 200 tonnes or 1.0 per cent below the 10 year average for the month.

Total other feed output fell significantly from a year earlier to its lowest level since 2012 of 22,300 tonnes, 4,800 tonnes or 17.7 per cent lower than the March of 2022. This decline resulted in the current total dropping a notable 8,900 tonnes or 33.3 per cent under the decade long March average.

The release of the March figures rounded off the first quarter production figures for Great Britain which are analysed below.

great britain

First Quarter overview

Total production of compounds, blends and concentrates, including integrated poultry units, during the first quarter of 2023 in Great Britain fell below 3,500,000 million tonnes for the first time since 2016. Production was 286,100 tonnes or 7.5 per cent down on a year previous at 3,340,000 tonnes. As a result of this considerable downturn, the total under review was a marked 245,000 tonnes or 7.1 per cent below the 10 year average for the period.

Total feed production during the first quarter of 2023 was made up of: 42.3 per cent poultry feed, 31.3 per cent cattle and calf feed, 13.6 per cent pig feed, 9.4 per cent sheep feed, 1.7 per cent horse feed and 1.7 per cent other feed.

At 1,411,900 tonnes, total poultry feed production during the first quarter of 2023 had decreased by 111,200 tonnes or 7.3 per cent from the corresponding period a year previously. For the first time in five years, Q1 poultry fell below the decade long average for the timeframe, doing so by 92,400 tonnes or 6.3 per cent.

After reaching record highs for the period in 2020, first quarter broiler feed production has declined year on year. The current total was 20,100 tonnes or 3.5 per cent down on a year previous at 512,600 tonnes. Production of integrated poultry units had declined 45,900

tonnes or 8.5 per cent from the corresponding period a year previous to 494,300 tonnes. Production of layer feed and chick rearing feed in the first quarter of 2023 had both dropped sharply from a year previous, the former had done so by 29,000 tonnes or 10.0 per cent to 257,700 tonnes of output and the latter by 4,400 tonnes or 11.1 per cent to 29,400 tonnes. Turkey feed output was at its lowest Q1 level since records were kept in their current form of 12,400 tonnes, 4,400 tonnes or 22.7 per cent down on a year previous. The sector was rounded off by a 3,900 tonnes or 4.4 per cent fall in output from the previous first quarter of poultry breeding and rearing feed, down to 77,500 tonnes, its lowest total for the period since 2015.

Total cattle and calf feed had decreased from the Q1 total a year earlier by 23,400 tonnes or 2.1 per cent to its lowest level for the period since 2006 of 1,046,000 tonnes. In addition, the total under review was an even more significant 76,400 tonnes or 7.1 per cent lower than the decade long average for the period.

There was a distinct split between the dairy and non-dairy feed producing subsectors in the first quarter. Both compounds for dairy cows, at 526,300 tonnes of output and blends for dairy cows, at 224,400 tonnes had both surpassed their year previous totals, doing so by 2,300 tonnes or 0.4 per cent and by 14,300 tonnes or 5.7 per cent respectively, whereas all other elements fell below their respective year previous returns. All other cattle feed dropped from a year earlier by 19,100 tonnes or 11.5 per cent to their lowest Q1 total on record of 148,300 tonnes. Production of all other cattle blends also decreased significantly from the corresponding period a year previous, doing so by 15,200 tonnes or 17.4 per cent to 75,600 tonnes. Current calf feed production was at its lowest level for the quarter since 2011 of 45,300 tonnes, 2,800 tonnes or 8.9 per cent below its 2022 output and protein concentrates for cattle and calves declined by 900 tonnes or 3.4 per cent from a year earlier to 26,100 tonnes for the quarter.

For the first time in six years, first quarter total pig feed failed to better its year previous return. The current total of 452,700 tonnes was a sizeable 95,300 tonnes or 18.8 per cent down on the output from the corresponding period a year earlier and as a result, declined 17,800 tonnes or 3.9 per below the 10 year Q1 average.

Both the pig growing feed and protein concentrates for pigs subsectors were at record lows for the timeframe under review. Pig growing feed production had fallen by 22,000 tonnes or 22.5 per cent to 64,000 tonnes whilst protein concentrates for pigs had decreased by 600 tonnes or 42.9 per cent to 700 tonnes of output. All remaining elements were also significantly down on their first quarter performances from a year earlier. Pig finishing feed, at 250,900 tonnes, was 57,200 tonnes or 22.4 per cent lower than in the corresponding period of 2022; pig breeding feed production, at 102,800 tonnes, had fallen 11,000 tonnes or 9.6 per cent; and pig starters and creep feed, at 9,900 tonnes, had dropped 2,400 tonnes or 18.3 per cent to its second lowest total on record. Finally, a 2,200 tonnes or 8.6 per cent reduction in first quarter link and early grower feed production from a year previous dropped the output under review to 22,400 tonnes.

A decrease in production from the period under review a year

Page 6 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

previous of 35,400 tonnes or 9.6 per cent brought total first quarter sheep feed production down to 315,200 tonnes, the lowest total on record. In addition, the current total was a considerable 49,500 tonnes or 14.6 per cent under the 10 year average for the timeframe.

Protein concentrates for sheep and lambs surpassed its year previous total for the period by 100 tonnes or 4.3 per cent and rose to 1,900 tonnes of output, but this was the only sheep feed category to do so. The sector’s largest element, compounds for breeding sheep, dropped 21,700 tonnes or 10.9 per cent from the corresponding quarter of 2022 to its lowest level since records were kept in their current form of 150,300 tonnes. Blends for breeding sheep output declined by over a quarter from a year earlier, the current production of 10,600 tonnes was 5,100 tonnes or 27.9 per cent lower. Compounds for growing and finishing sheep and blends for growing and finishing sheep both also failed to better their year previous returns, the former decreased by 8,100 tonnes or 6.1 per cent to 136,300 tonnes and the latter by 600 tonnes or 3.6 per cent to 16,100 tonnes.

For the third year in succession, total first quarter horse feed dropped below its year previous return, in this case by 2,100 tonnes or 3.5 per cent to 57,600 tonnes. However, the current total outpaced the decade long average for the period by 2,200 tonnes or 4.0 per cent.

Total Q1 other feed production, at 56,600 tonnes, had decreased by a considerable 18,600 tonnes or 22.8 per cent to its lowest level for the timeframe since 1995. As a result of five consecutive, year on year falls, the total under review was an even greater 29,600 tonnes or 34.3 per cent down on the 10 year average for the quarter.

Not only did every sector fall below their respective year previous returns for the quarter, they did so for every month that made up the period and Q1 production from 2022 had also declined below its year earlier counterpart. In addition, horse feed was the only sector where production bettered the decade long average for the period. All of this suggests that production will be considerably down from recent highs in 2023.

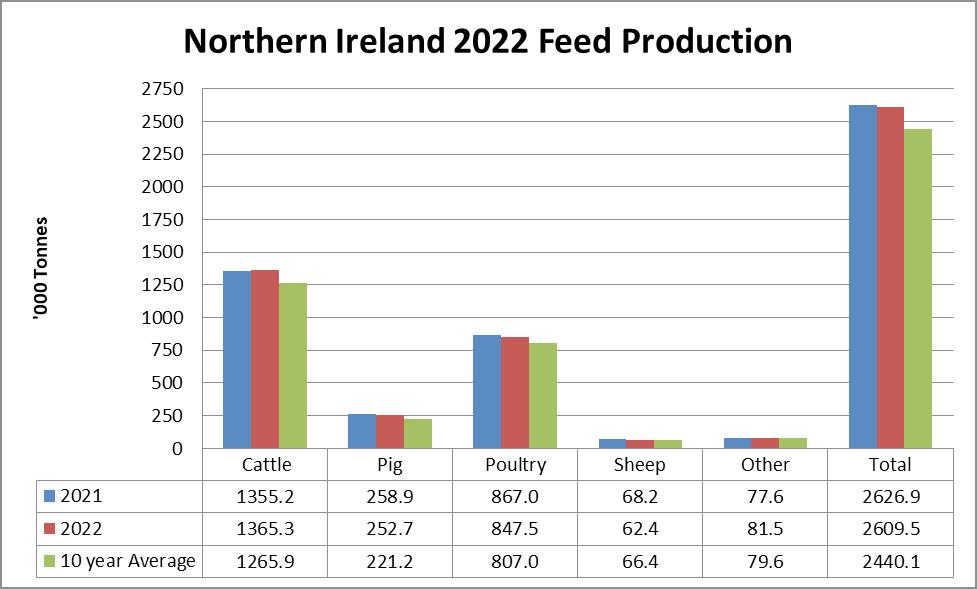

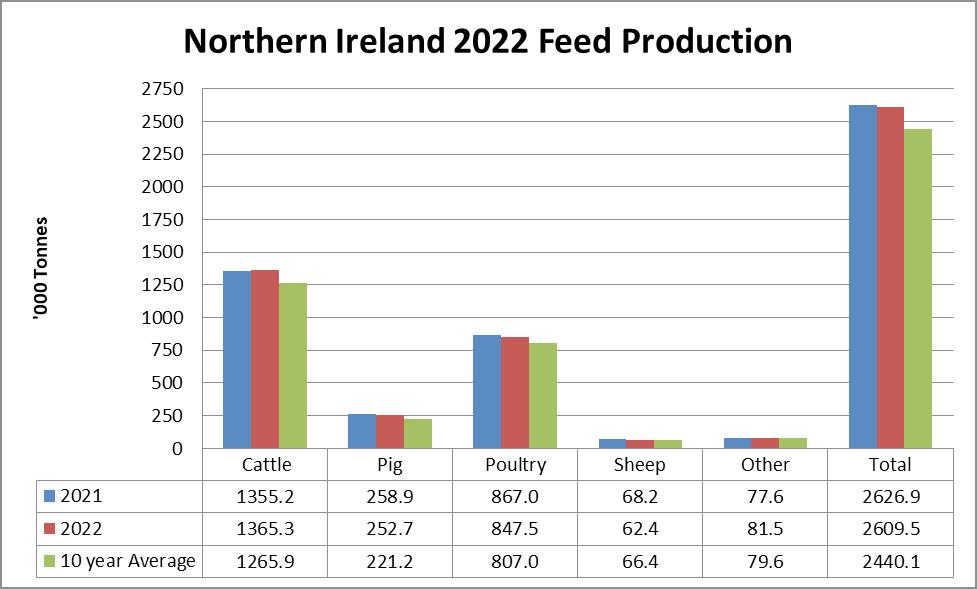

northern ireland 2022 Feed production overview

Total production of compounds, blends and concentrates, including integrated poultry units, in Northern Ireland during 2022 was at its second highest level on record of 2,609,500 tonnes. This was 17,300 tonnes or 0.7 per cent lower than a year earlier but nevertheless, was

169,500 tonnes or 6.9 per cent greater than the 10 year average for the period.

Total feed production during the year of 2022 was made up of: 52.3 per cent cattle and calf feed; 32.5 per cent poultry feed; 9.7 per cent pig feed; 2.4 per cent sheep feed; and 3.1 per cent other feed.

An increase of 10,100 tonnes or 0.7 per cent brought total cattle and calf feed production for the year up to 1,365,300 tonnes, a record high. The output under review also outpaced the decade long average for a calendar year by a considerable 99,400 tonnes or 7.9 per cent.

Despite the overall increase in production, more cattle and calf feed subsectors fell below their corresponding year earlier totals than rose above them. Output of beef cattle compounds dropped by a notable 8,300 tonnes or 5.2 per cent from its 2021 return to 150,300 tonnes; beef coarse mixes and blends also declined below its year previous return, doing so by 1,300 tonnes or 0.5 per cent to 255,400 tonnes. Both calf feed categories were down on their year previous returns: calf milk substitutes had dropped by 100 tonnes or 35.3 per cent to 200 tonnes of output for the year, and other calf compounds had done so by 1,600 tonnes or 1.9 per cent to 79,700 tonnes of production. In contrast, production from the sector’s largest category, dairy cow compounds, had risen by 5,100 tonnes or 0.8 per cent from a year earlier to a record high for the period under review of 621,900 tonnes. Dairy coarse mixes and blends had also surpassed its year previous total by 15,700 tonnes or 6.7 per cent and rose to 249,800 tonnes of output, the third highest on record for a calendar year. Protein concentrates for cattle and calves bettered its 2021 production by a considerable 500 tonnes or 18.9 per cent and finally, production of all other cattle compounds grew by 100 tonnes or 2.6 per cent from a year previous to 4,800 tonnes.

At 847,500 tonnes, total poultry feed production in 2022 was 19,400 tonnes or 2.2 per cent down on the corresponding period a year earlier. However, the total under review was 40,600 tonnes or 5.0 per cent in excess of the 10 year average for the timeframe.

Layer and breeder feed was the only poultry subsector where production increased beyond its 2021 returns, doing so by a significant 30,200 tonnes or 9.5 per cent to a record high of 348,900 tonnes. Conversely, broiler feed output decreased by a similar 35,500 tonnes or 7.4 per cent 446,500 tonnes, its lowest return in a calendar year since 2017. Additionally, turkey and other poultry feed production was at its lowest recorded level for the timeframe of 24,000 tonnes, a sizeable decrease of 13,200 tonnes or 35.5 per cent from a year previous. Lastly, chick rearing feed production fell by 1,000 tonnes or 3.3 per cent to 28,200 tonnes.

For the first time in nine years, total annual pig feed production fell below its year earlier counterpart. 2022’s return of 252,700 tonnes was 6,100 tonnes or 2.4 per cent lower than in 2021, although, the current total was still 31,500 tonnes or 14.3 per cent above the decade long average for the period.

Pig link and early grower feed was the sole pig feed category where production bettered that of a year previous, rising 2,600 tonnes or 7.3 per cent to a record high 39,100 tonnes. Pig growing feed production fell by a significant 3,700 tonnes or 7.3 per cent to 47,300 tonnes and

Page 8 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

BECAUSE IT’S ABOUT FEED COST

Fully charged, healthy growth!

GuanAMINO® is the best supplemental creatine source which ensures optimized nutrient utilization and feed costs. Furthermore, it spares metabolic energy and works towards an optimized amino acid metabolism. GuanAMINO® supplementation enables improved feed conversion, healthy muscle growth and resilience, and leads to higher income over feed costs.

Sciencing the global food challenge. | evonik.com/guanamino

the sector’s largest element, pig finishing feed, dropped by 1,000 tonnes or 1.0 per cent to 104,100 tonnes. Output of both pig starter and creep feed and pig breeding feed decreased markedly below their respective year previous returns, with the former declining by 1,700 tonnes or 5.5 per cent to 29,700 tonnes and the latter by 2,200 tonnes or 6.4 per cent to 32,400 tonnes.

Total sheep feed production for 2022 had dropped below its total from a year previously by 5,700 tonnes or 8.4 per cent. Moreover, the total under review was also 4,000 tonnes or 6.7 per cent lower than the decade long average for output from a calendar year.

Protein concentrates for sheep fell by a marked 1,700 tonnes or 98.1 per cent from the anomalous record high of a year previous to just under 50 tonnes of output, a record low for a calendar year. Production of growing and finishing sheep compounds declined below year previous levels for the second year in a row, in this instance by 900 tonnes or 3.0 per cent to 27,800 tonnes. At 22,800 tonnes, the output of breeding sheep compounds had dropped 3,100 tonnes or 12.0 per cent below its 2021 production level, whereas, the coarse mixes and blends for sheep subsector matched its year previous output of 11,800 tonnes.

A 3,900 tonnes or 5.0 per cent increase in the production of total other feed in comparison to 2021 output brought the total under review up to 81,500 tonnes. Additionally, the current total was 1,900 tonnes or 2.4 per cent in excess of the 10 year average for the period.

With production for 2022 coming in just below the record high for a calendar year posted a year previously, the Northern Irish feed industry was perhaps in a healthier position than would have been imagined considering the various challenges that arose throughout 2022. Whilst it was only the cattle and calf feed sector where production bettered its year previous return, and the entirety of this upturn came from the dairy subsectors, all sectors surpassed the long term average for output and things look encouraging as we move into 2023.

northern ireland February production overview

Total production of compounds, blends and concentrates during February 2023 in Northern Ireland amounted to 225,700 tonnes, an increase of 2,600 tonnes or 1.2 per cent from the corresponding month a year earlier and its highest total on record for the month. Furthermore, the current total was 13,800 tonnes or 6.5 per cent in excess of the

decade long average for February.

Total feed production during February 2023 was made up of: 53.8 per cent cattle and calf feed, 30.7 per cent poultry feed, 8.0 per cent pig feed, 4.3 per cent sheep feed and 3.2 per cent other feed.

At 121,500 tonnes of production, total cattle and calf feed output for February had risen by 400 tonnes or 0.3 per cent from a year previous and was at its third highest level on record. In addition, the total under review was 7,300 tonnes or 6.4 per cent in excess of the 10 year average for the month.

Despite the increase from 2022 returns, output of both beef coarse mixes and blends and beef cattle compounds fell considerably below year earlier levels. The former fell by 2,900 tonnes or 11.9 per cent to 21,500 tonnes and the latter did so by 1,800 tonnes or 12.3 per cent to 12,700 tonnes. Production of all other cattle compounds also fell sharply from a year previous to 400 tonnes, a decrease of 200 tonnes or 26.4 per cent. In contrast, output of dairy coarse mixes or blends increased by 2,800 tonnes or 12.0 per cent to its highest total since records were kept in their current form of 26,100 tonnes. Production of dairy cow compounds was also at its highest ever level for the month of 52,200 tonnes, a growth of 1,700 tonnes or 3.3 per cent from a year previous; as was all other calf compounds, where production had risen by 800 tonnes or 10.1 per cent to 8,400 tonnes.

An increase of 5,000 tonnes or 7.8 per cent from the output of 2022 brought total poultry feed production to its highest recorded level for February of 69,200 tonnes. Accordingly, the current total outstripped the decade long average for February by a notable 7,100 tonnes or 11.5 per cent.

Layer and breeder declined slightly from its record high output a year previously to 27,000 tonnes, a drop of 300 tonnes or 1.1 per cent to its second largest output. Broiler feed production was also at its second highest level for the month of 37,600 tonnes, having risen by 3,900 tonnes or 11.7 per cent from its corresponding output a year earlier. A rise of 200 tonnes or 9.1 per cent from year previous levels brought chick rearing feed to its highest February output of 2,500 tonnes, moreover, following a sharp decline in production in 2022, turkey feed output bounced back towards expected levels at 2,200 tonnes, an increase of 1,100 tonnes or 111.9 per cent.

Total pig feed was the only sector which fell below its production from a year earlier, doing so by 2,800 tonnes or 13.7 per cent to 18,000 tonnes, its lowest February production since 2017. As a result of this downturn, the current total was in line with the decade long average for the month.

All pig feed subsectors fell below their respective year earlier levels. Pig finishing feed and pig growing feed both declined by 700 tonnes from their respective 2022 returns, pig finishing feed by 8.4 per cent to 7,700 tonnes and pig growing feed by 18.6 per cent to 3,100 tonnes. Pig breeding feed was at its lowest output for February since 2010 of 2,300 tonnes, a fall of 300 tonnes or 12.2 per cent from a year previous. Additionally, pig link and early grower feed production fell by 500 tonnes or 15.0 per cent to 2,900 tonnes. Lastly, production of pig starter and creep feed, at 2,100 tonnes, had declined by 600 tonnes

Page 10 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

NAME OF THE VETERINARY MEDICINAL PRODUCT: FLUBENMIX 5%, 50 mg/g Premix for Medicated Feeding Stuff. ACTIVE INGREDIENT: Flubendazole 50mg. Legal Category: POM-VPS , Vm 43877/4013. Drug premixes for animal feed. For animal treatment only. To be supplied only on veterinary prescription. Administration by a veterinary surgeon or under their supervision. Target species: Pigs, chickens, turkeys, geese, partridges and pheasants. CONTRAINDICATIONS: Do not use in cases of hypersensitivity to the active substance or to any of the excipients. WITHDRAWAL PERIOD(S): Meat and offal: pigs: 3 days, chickens: 5 days, turkeys, geese, pheasants and partridges: 7 days. Chicken eggs: 0 days. Not for use in other poultry laying eggs for human consumption.

AUTHORISATION HOLDER:

3621 ZB Breukelen, The Netherlands. Use Medicines Responsibly. Advice should be sought from prescriber. Further information is available from the SPC or contact Kernfarm B.V. info@kernfarm.com, www.kernfarm.com. Date advert designed: feb 2023.

your local wholesaler!

5%, 50mg/g

YOUR TRUSTED

formula

PRODUCT

MARKETING

Kernfarm B.V. De Corridor 14D,

IT’S ALL IN Check

KERNFARM FLUBENMIX

THE MIX

Flubendazole

ONE

PRICED

For pigs, poultry and game birds WELL

Need a dewormer? Refresh yourself. Your flubendazole premix alternative is already here. MORE INFO? SEE KERNFARM.COM OR SCAN QR CODE

Always available

or 22.7 per cent from its corresponding 2022 total. At 9,700 tonnes of production for February, total sheep feed had matched its year previous output. 2023’s production was, however, 100 tonnes or 1.4 per cent lower than the 10 year average for February.

Mirroring the sector as a whole, growing and finishing sheep compounds equalled the output from a year previous of 2,300 tonnes. Coarse mixes or blends for sheep grew to its highest level for February

in five years of 2,600 tonnes, an increase of 700 tonnes or 34.1 per cent; conversely, production of breeding sheep compounds decreased by 700 tonnes or 12.0 per cent to 4,800 tonnes.

Following three successive year on year declines, total other feed production for February had risen by 100 tonnes or 1.2 per cent to 7,200 tonnes. However, this upturn was not sufficiently large as to bring the current total above the decade long average which it was 400 tonnes or 5.4 per cent below.

ruminationS

By Rob Daykin of Daykin Partnership

Milk prices have been falling very quickly indeed over the last few months, with data showing that some companies have dropped their prices 30% since January, and down to levels prior to the ‘big surge’ of 2021- 22. The average non-aligned price as calculated by milk price analyst Chris Walkland is now less than 37p for June. Back in January the average was 47.8p, which is a drop of nearly 11% and over 22% across all prices.

For organic milk prices it isn’t so bad. On average prices are down 7p from January and 13%, but this masks a major drop in Arla’s organic price from 53.7p down to 40.14p in May. That’s a drop of 13p and 25%!

But will the reductions stop now? That is the question. Well there is some stability on prices as some processors have held for June, most notably Muller at 40p for its ‘A’ price under its new price mechanism. This could have a significant bearing on other liquid processor’s prices as it should help to keep those firm too. Already liquid processors are starting to pay more for cheesemakers, which hasn’t always been the case and there is talk that we could be seeing the return of a liquid premium if Muller’s scheme works.

What about costs, though? Well they are falling, with wheat prices easing back as a result of the goings on in the Black Sea and with good prospects for the forthcoming harvest as crops are reported to be doing well. Protein prices are also on the wane as demand is lacklustre in some parts of the world and the crops are also looking good. However there is no doubt that feed ingredient prices are falling at a much slower rate than milk prices are doing! Currently prices for most ingredients are dropping by a few pounds a tonne, with only rapeseed and perhaps soya really coming off at a comparable pace.

What then, are the prospects for the rest of the dairying season? Well there is no doubt that the severe drop in milk prices twinned with the minor falls in feed prices has murdered the Milk Price:Feed Price Ratio, and this will be well below the threshold at which farmers feed

for milk. That, twinned with the cold and wet weather and a very shaky start to the silage season will mean that milk volumes will fall markedly in the coming months – barring a miracle! Already volumes are level with last year after being ahead by several percentage points over recent weeks and months.

The same drivers that are in play here are also in play across Europe and that is going to affect EU volumes too. Already there are some indications that German production is flat-lining and French volumes are also down. This bodes well for milk prices, at least.

All in all the view seems to be that there will be a flat Q2 and Q3 in the market, and then there will be an uplift in Q4 as volumes continue to fall off. But that theory also depends on demand for dairy and whether that starts to pick up or not. Currently it isn’t, but as prices for products start to fall in the shops we can but hope!

Who We are Daykin Partnership has over 30 years of experience in agriculture, expertise in estate management, product development and logistics. We work hard to provide up to the minute news and information as well as the latest and most innovative products from across the industry. Our extensive network covers every aspect of modern dairy farming from supply chains, market information and raw material sourcing to budgeting, staff training and ration formulation.

www.daykinpartnership.co.uk

Page 12 May/June 2023 Feed Compounder

PURIFIED MANGANESE

UNIQUE BLENDS

High

Safety standards

Stability

Bioavailability

Bioavailability

Animal performance

www.animine.eu

view From europe

By Colin Ley

Challenging times for european livestock sector

“Weak economic growth is beginning to take a toll on global pork consumption. Despite early signs that the worst of the inflationary impact may have already passed, the lagged impact on consumption is likely to be felt throughout 2023.” Rabobank.

“EU beef production is expected to decrease further in 2023 by 1.6%, mainly due to a structural adjustment in the beef and dairy sector, despite high beef prices. A smaller (pig) breeding herd as well as African Swine Fever (ASF) (is set to) push EU pigmeat production further down in 2023, by 5%.” European Commission.

The latest monthly production figures released by the Department for Environment, Food & Rural Affairs (Defra) show that the UK produced 83,000 tonnes of pig meat in March (2023), an 18% (-18,600 tonnes) decline compared to the record high production in March 2022. It is the lowest recorded production for the month of March since 2019 when both reduced slaughter numbers and lower carcase weights impacted volumes. AHDB.

“EU compound feed production (EU27) for farmed animals in 2022 is estimated at148.9 million tonnes, a decrease of 3.8 % compared to 2021. Production decreased for animal feed sectors (in 2022) but more significantly for the pig sector (-6.7%) and poultry sector (-3.2 %) mainly due to the spread of animal diseases (Avian Influenza and African Swine Fever).” FEFAC.

This is a sobering collection of soundbites, drawn from Rabobank in the Netherlands, the European Commission’s Spring 2023 short-term outlet, The Agricultural and Horticultural Development Board (AHDB) in the UK, and FEFAC, our own industry’s representative organisation. Sadly, they all tell the same story, presenting an extremely challenging picture of livestock production being locked into a significant downturn across Europe. It’s not difficult, of course, to find reasons for what we’re seeing at present.

FEFAC points to avian influenza, economic uncertainty, and ‘green and animal welfare’ pressures.

Rabobank draws attention to the impact of ‘persistently high retail prices’ which it says are limiting the consumption of all proteins. The Dutch-based global bank also points out that consumers are continuing to conserve capital by shifting everyday purchases to lower-value protein options, switching channels, and moving to smaller pack sizes.

AHDB expands on the same argument, declaring that demand is a crucial factor at present with the cost-of-living crisis impacting consumer purchases. In addition to general inflation running at around 10% in the UK in recent months, food inflation has hit 18% overall, with much higher price hikes being applied to individual food items. “In the 12 weeks to March 19 (in the UK),” states AHDB, “sales of pork (at the retail point) have fallen 3.5% year on year, while inflation driven price rises

resulted in prices paid increasing 12.5% during the period.”

Pinning the blame for what’s happening is easy enough, starting with the impact of Russia’s invasion of Ukraine on the European and Global economy, triggering production cost rises and helping to fuel high inflation rates. The fact that the war has moved into its second year with little sign of peace anytime soon, hasn’t helped.

rebound potential

Nevertheless, hope springs eternal, if only because the alternative of gloom, doom and disaster gets us nowhere in either the short or long term. Returning to our four sources of downturn reality, therefore, a few hints of optimism can still be found.

The poultry & pig feed sector may experience a rebound in Q4, states FEFAC.

Pig producer margins are recovering on historically high pig prices in Europe, states Rabobank.

With the approaching barbeque season there is opportunity for pork volumes to grow, states AHDB, commenting in its much more locally focused assessment of market trends. The UK body also says that while most pigmeat product categories have seen volumes declining, sausages, mince, burgers and grills, and pork ribs, all managed to record some growth in the most recent 12-week period.

The European Commission’s analysts were harder to please, however, when it came to looking for signs of improvement. The best I could find from them was a comment that with ‘feed prices slowly going down, the main pressure on (producer) margins is expected to cool’. Not the greatest ‘positive’ for our own industry, of course, if even the slightest hint of an on-farm boost has to be linked to cost cutting on feed production.

It is a reminder, however, that the food chain works best when all the links are in balance, or as close as possible to balance as can ever be achieved. This same point was emphasised recently by Scottish pig sector executive, Andy McGowan, Chief Executive of Scottish Pig Producers.

“European supplies of pigmeat are now running short just as they are in the UK, with prices rising quickly,” he said. “It gives us no pleasure to be proved right when we repeatedly told the rest of the supply chain that if they didn’t pay a fair price, the pigs would not be there.

“Retailers and foodservice companies need to pay a sustainable price to secure domestic supplies of high quality pigmeat. They cannot just assume that cheaper imports will always be available and hope that the consumer won’t notice the difference.”

resilience

We are a resilient industry, however, and in saying ‘we’ I’m referring to the entire food chain again.

According to British farm housing manufacturer, ARM Buildings, there are clear signs of an upturn in pig sector investments with a significant number of farmers ‘future-proofing’ their units for animal welfare reasons.

“After long periods of losses, when many producers left the industry, we are receiving an upsurge in serious enquiries for both new and refurbishment projects,” said ARM’s Paul Marland. “In particular, producers have been looking at installing freedom-style farrowing houses.

“It is encouraging that producers have sufficient confidence to invest,

Page 14 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Doing well by doing good

Sustell™ - an intelligent sustainability solution that combines the most advanced environmental footprinting calculation tool with expert sustainability, animal production and nutritional knowledge to create tailor-made, practical solutions and business development projects that enhance the environmental sustainability and profitability of animal farming.

If not us, who? If not now, when? WE MAKE IT POSSIBLE

Follow us on: www.dsm.com/anh

despite the problems they have encountered. High welfare systems are obviously going to be increasingly important in the future.”

So, there you have it. Having taken us all down the doom and gloom road of harsh economic reality, I’ve hopefully also lifted the mood with a bit of on-farm optimism.

moon shot

Picking up on FEFAC’s highlighting of ‘green and animal welfare’ pressures as one of the reasons for the current decline in feed compound volumes, I thought I would pass on the following ‘moon shot’ ideas outlined by Professor Wayne Powell, Principal and Chief Executive of Scotland’s Rural College (SRUC).

He believes we are in a uniquely strong position to use targeted innovation, backed by strong collaboration between academia, businesses, government, and communities, to shape a high value food production sector going forward. Such a sector, he adds, will be environmentally sustainable for landscapes, rewarding for farmers, beneficial for consumers and supportive of national and international commitments to reduce greenhouse gas emissions.

Prof Powell goes on to argue that the development and refinement of animal feed supplements, investment in selective breeding programmes and better use of technology to capture livestock emissions, all have a vital role to play in the future of global meat production.

“We have the means to achieve low or even zero-carbon meat at considerable scale and in ways that put us in pole position to develop a new and exceptionally valuable market in the food supply chain,” he says. “As we do, so there will inevitably be trade-offs that need careful management, including higher input costs for farmers and fewer animals overall in the food supply chain.”

Once again, the words ‘fewer animals’ won’t immediately sound good for future feed compound output.

“Yet, we need to be canny enough to appreciate that food produced to exacting environmental standards can be sold to consumers at a significant premium as compared with animals with lower welfare standards,” adds the professor. “New systems of sustainable farm monitoring accreditation will be needed. In practice, farmers should be able to achieve the same or better returns from smaller herds, freeing up land for biodiversity or other forms of food production alongside low intensity animal husbandry.

“The challenge is for the academic community to redouble its efforts to work with and support businesses, policy makers and communities to seize the opportunity in a concerted manner. Together we can adopt a ‘moon shot’ approach to rapidly developing and refining livestock production that reaps huge environmental and economic rewards in the years ahead.”

And a strong and profitable food chain should help us all, even if the volumes involved need to be adjusted.

Soybean first in Europe

I recently received an invitation to attend the 11th World Soybean Research Conference (WSRC11) which is due to take place in June (18 – 23) and is being held in Europe for the first time. Located in Vienna with Austria’s Donau Soja Association as the hosting institution, the conference programme lists contributions from leading academic and industry experts, stakeholders, and students, with the promise

of initiating discussions and debates aimed at further progressing the sector’s science and technology.

“We, the world soybean community, can only overcome the current and future challenges if we broaden our perspectives,” said Professor Johann Vollmann, Chair of the WSC11 Scientific Committee. “Therefore, we welcome all of you to participate in the conference and invite you to contribute to the programme, with sincere hopes that the conference will be a week full of new insights, intellectual excitement, and memorable moments.”

The conference agenda includes a specialist food, feed and nutrition section featuring the following presentations:

•

Feed and aquaculture developments

•

The future of soy is food

•

Chemistry and nutrition of soybeans and soy products

•

Soy protein functionality and processing

• health

Soy foods, soy bioactives, and improvement for human

•

Assessing sustainability of soybean supply chains

The impact of climate change on soybean production, an analysis of new and emerging pests and diseases affecting soybean, and a broad focus on breeding advances, are also included in the extensive programme. And there’s a session on the EU-funded ECOBREED organic development programme as it relates to advanced genotyping and phenotyping for organic soybeans.

It’s appropriate, of course, that this event is taking place in Vienna as its first European venue, given that soybeans were first introduced to the world 150 years ago by Japanese and Chinese delegations at the Vienna Expo. It was from this beginning that the industrial cultivation of soya spread to the World.

Today, according to my invitation note from the International Federation of Agricultural Journalists, Austria ranks as one of the leading producers of eco-friendly soya, with Donau Soja (Danube Soya) being the trade association that certifies regional, sustainable, and non-GMO soya across the whole of Western and Eastern Europe.

Women Farmers innovation award 2023

Finally, a plug for the role women play in the wider agricultural sector, as initiated by Copa and Cogeca, the EU-based farm and farm cooperative organisation.

With the support of Corteva Agriscience, Copa and Cogeca recently brought together eight inspiring women in agriculture who are ‘working towards a more resilient agriculture sector’. They also announced the launch of the 7th edition of the Innovation Award for Women Farmers to highlight the contributions women make towards rural development and a sustainable farming sector, presenting it as an opportunity to showcase the inspiring and innovative activities that rural women and farmers are doing across the EU.

“Our aim is twofold,” said Lotta Folkesson, Chair of Copa’s Women’s Working Party. “It’s about giving a platform to highlight how women are involved in the agricultural sector, whether that be as farmers working on a farm or as an engineer or scientist working towards a sustainable agriculture sector. It is also about creating role models and encouraging more women to choose a career in agriculture.”

There’s a 10,000 Euro cash prize on offer for the winner and a 5,000 Euro prize for the runner-up.

Page 16 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

What is HemicellTM XT and how does it differ from other enzymes?

Hemicell™ XT is a patented enzyme that can be added to pig and poultry rations to improve feed efficiency by breaking down indigestible fibres known as β-mannans. These are present in some feed ingredients and can cause a Feed-Induced Immune Response (FIIR) which increases intestinal inflammation and reduces feed utilisation.

On top of breaking down these fibres, HemicellTM XT helps to optimise gut health, reduce nutrient waste and prevent performance losses.

In what feed ingredients are β-mannans present?

β-mannans can be found in varying concentrations in soya hulls, sunflower, wheat, rapeseed, barley, and most vegetable feeds.

When should HemicellTM XT be used and at what rate should it be incorporated into rations?

HemicellTM XT should be used in all diets with a β-mannan level equivalent to, or higher than,

a 12% soybean, rapeseed, sunflower, palm kernel or guar meals (but all vegetable ingredients contribute towards the final concentration). β-mannans can cause a FIIR in concentrations as small as 0.2%, so most rations would benefit from the inclusion of the product.

HemicellTM XT can reduce feed costs, improve animal health and increase sustainability. The enzyme boosts gut health by reducing stress placed on the animal’s digestive system and the inflammation that this causes.

As a result of this, the net energy of pig rations can be reduced by up to 63 kcal NE/kg pigs2 and the metabolisable energy of poultry rations can be reduced by 90 kcal ME/kg2.

In poultry, the benefits include:

> Enhanced intestinal integrity

> Drier litter

> Fewer foot pad lesions

> Increased uniformity in broilers

For pigs, the benefits include:

> Reduced energy requirements

> Reduced inflammation in the gut

References: 1. Significance of single β-mannanase supplementation on performance and energy utilization in broiler chickens, laying hens, turkeys, sows, and nursery-finish pigs: a meta-analysis and systematic review | Translational Animal Science | Oxford Academic (https://academic.oup.com/tas/article/5/4/txab160/6373529) 2. Reducing the cost of β-Mannans (myelanco.co.uk) Elanco UK AH Limited, First Floor, Form 2, Bartley Way, Bartley Wood Business Park, Hook RG27 9XA. Telephone: 01256 353131 Email: elancouk@elanco.com Hemicell, Elanco and the diagonal bar logo are trademarks of Elanco or its affiliates. ©2023 Elanco or its affiliates. Use medicines responsibly www.noah.co.uk/responsible. Date of preparation: 02/2023 PM-UK-23-0102

TM XT? Feed stuff Mean % ß-mannans1 Soya hulls 4.83 Expelled sunflower 0.56 Wheat 0.18 Whole rapeseed 0.05 Product form Recommended inclusion per tonne of complete feed Broilers Turkeys Weaned pigs Pigs for fattening Hemicell™ XT 147g 147g 133g 133g Find out more

Company reports & accounts

By Roger Dean

Wynnstay group plc

This Group of companies published its annual Report and Accounts for the year ending 31 October 2022 on 31 January 2023.

The Group defines its activities as per the Standard Industrial Classification as the Manufacture of prepared feeds for farm animals (SIC 10910) and Agents selling agricultural raw materials, livestock, textile raw materials and semi-finished goods (SIC 46110).

For the year under review, the Group reported revenues amounting to £713.03 million. Under the heading of ‘Delivering a Sustainable Farming Future’ the report claims the Group ‘helps livestock and arable farmers to produce food in a more sustainable, environmentally friendly and profitable way’. The Group’s business model is aligned with the ‘buying needs and habits’ of the Group’s farming customer base which includes arable, livestock and mixed farms.

The Group has two main divisions. Agriculture comprises the manufacture and supply of a comprehensive range of agricultural inputs across many parts of the UK. Agriculture includes three feed mills and three blending plants. The Group also uses third party feed mills to satisfy additional seasonal and geographic demand. The division also includes Glasson, whose activities are the production of blended fertilizer, the supplier of feed raw materials and the manufacture of added value products to specialist animal feed retailers. Currently, it is the UK’s second largest fertilizer blender.

The division now encompasses Humphrey Feed and Pullets which is a leading poultry feed supplier and point of lay pullet supplier to independent poultry farmers. The business offers both traditional and organic feeds, manufactured from an adjacent mill. Humphrey Feeds and Pullets specialises ‘in offering expert knowledge on poultry nutrition and husbandry’ with what it describes as ‘a primary mission of advancing poultry performance’.

The division’s arable activities include the supply of a wide range of products to arable and grassland farmers, including seed, fertilizer and agrochemicals. The division also includes Grainlink, the Group’s in-house grain marketing company. The company provides farmers with an independent professional marketing service which is backed by the financial security of the Wynnstay Group. The company has access to major markets for specialist milling and malting grain as well as feed into mills.

The second component of the Group is its Specialist Agricultural Merchanting division which supplies specialist agricultural and associated sundry products to customers throughout Wales, the Midlands, the North West and the South West of England.

In the financial period under review, the Group generated revenues, as noted above, of £713.03 million, an increase of £212.65 million or 42.5 per cent over the corresponding figure a year earlier. As the Chairman noted, the Group performed strongly during the year and ‘trading results

set new record highs across all key financial measures. It should be noted that results benefitted substantially from some singular gains that we do not expect to be repeated in the new financial year’.

After deducting the Group’s Cost of Sales, Gross Profits during the year amounted to £90.81 million, an increase of £22.91 million or 33.7 per cent. After deducting charges for manufacturing, distribution and selling costs, administrative expenses and accounting for other operating income, adjusted operating profits amounted to £ 22.45 million, an increase of £11.36 million or 104.5 per cent. After a number of other adjustments, including interest, joint ventures and tax on the latter, the Group’s pre-tax profits for the year under review amounted to £21.12 million, an increase of £10.13 million or 92.2 per cent.

W.e. Jameson and Son ltd

This company submitted its annual report and accounts for the accounting year ending on 30 June 2022 on 15 October 2022.

The principal activity of the company during year under review continued to be the buying, processing and selling of livestock feeds and the merchanting of seeds, fertilizers and other agricultural products. The company also benefits from retail activities run through its Country Store.

The company recorded sales of £28.91 million during the accounting year ending on 30 June 2022. This compares with £23.22 million in the previous accounting year, an increase of £5.68 million or 24.5 per cent, a further reflection of the unusual trading conditions that characterized the year in question. These conditions manifested themselves in the sharp increase in the company’s cost of sales which rose from £20.68 million in the prior year to £25.84 million, an increase of £5.16 million with the result that saw the company’s Gross Profits increased from £2.54 million to £3.06 million, an uplift of approximately 20 per cent.

After accounting for administrative expenses and other operating income the company was able to report operating profits of £914,563 for the year under review. This compared with the prior year’s operating profit of £454,185, an increase in the year under review of 101.3 per cent. After accounting for a slightly reduced amount of interest payments, the company’s pre-tax profits for the year under review amounted to £923,224 compared with the previous year’s pre-tax profit of £463,467, an increase of almost 100 per cent.

The company has clearly benefitted from the minor increase in administrative expenses of just 2.7 per cent.

heygate & Sons ltd

The Group has recently reported on its activities during its financial period 28 March 2021 to 2 April 2022. The Board of Directors noted, in their annual report, that the UK’s food and agricultural sector was a highly competitive and that the economic situation remained ‘challenging’. The Board went on to note that weather and market conditions around the world had caused both global and UK grain prices to increase. The Group conceded that the ‘volatility’ of the grain price was not anticipated and, in consequence, the gross profit margin was squeezed in consequence.

During the period 28 March 2021 to 2 April 2022, the company recorded turnover amounting to £341.28 million, compared to £290.67 million in the previous accounting period of 29 March 2020 to 27 March 2021. Pre-tax profitability over the current accounting period was £15.35 million, compared to the previous year’s £6.67 million.

Page 18 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

The next generation of enzyme improving the overall feed digestibility

Reliability Sustainability

Advance improves the overall feed feed and animal production.

® Advance is based on an optimum degradation level of non-starch polysaccharides. Rovabio® Advance improves the availability of all nutrients in the feed, such as amino-acids and phosphorus, and increases its

ROVABIO® ADVANCE: THE ONLY FEEDASE

Feed Compounder May/June 2023 Page 19 www.adisseo.com

THE REVOLUTION

SODIUM BICARBONATE SODIUM CARBONATE CALCINED MAGNESITE PHOSPHATES A NEW BULK SUPPLY CHAIN FACILITY NEWPORT

+44 (0)20 8332 2519 +44 (0)20 8940 6691 sales@newport-industries.com Contact us:

FEEDS

ten Ways … to learn to be patient

By Robert Ashton

We’ve just moved from Norfolk to the Suffolk coast, and this has meant selling our home of 25 years and having a new one built. In many ways that was something of a wrench, as it was a barn we had converted and where our then teenage children had grown up and left home. But what really tested my patience was the process of conveyancing, which went on, and on and on.

We agreed a price with our buyer in October, and only exchanged contracts six months later in early April. Searches, surveys, reports, land registry discrepancies all took an absolute age. Throughout this time, there was the very real risk of our buyer dropping out, because before exchange, there is no commitment. Only when we finally exchanged contracts could I relax.

This traumatic episode prompts me to reflect on patience, which they say is a virtue, but as I’ve always found, it is difficult to be patient, when you are eager to see things moving. We got there in the end, but prompted by recent experience, here are ten ways I think we can all become a little more patient:

therapy will help you, but taking time to reflect on why you are impatient can help you become more sanguine when faced with what appears to be prevarication.

Look on the bright side 6. – I’m a great believer that behind every challenge, there is an equal and opposite opportunity. Perhaps I’m wrong to apply Newton’s third law in this human context, but as often as not, there is an opportunity lurking behind every looming disaster. Looking for the bright side can allay your impatience.

Slow down 7. ! –Take time to reflect on why are you so impatient. Will it matter if things take longer than planned? This was certainly the case with our house sale, because we were fortunate enough not to need the money from our sale, to fund the building of our new home in Suffolk. In reality, the delay we were experiencing was annoying, but not actually getting in the way of progress. The same might be true of the things that are testing your patience. Keep yourself busy 8. – There’s a good reason why we lie awake dwelling on our impatience in the middle of the night. It’s because we’ve nothing else on our mind and our brains love finding reasons to keep us awake. Having nothing to do apart from stress about something is a killer. I start each day by making a list of things I need to do. This both boosts my productivity and shifts my impatience to the back of my mind.

Wear their shoes

1. – While I found the endless hitches and delays frustrating, it helped to see things from my buyer’s perspective. He was paying more than £1m for my home, and that’s a lot of money, so he had every right to be cautious!

We’re all different

2. – I can be too quick to make decisions and often spend ages afterwards wondering if I was too hasty. Others, including my wife, take longer to make decisions, but once they’ve made up their mind, there are no later regrets. Accepting that we’re all different helps.

Listen carefully 3. – There can be a world of difference between what we want to hear and what is said. Particularly in negotiations, it’s important to pick up hints of doubt that unless addressed, will grow into delays. Better to confront concerns head on than deal with what might be stalling for time while the real decision is made.

The sun won’t shine all the time 9. – Impatience, irritation, frustration and even incandescent rage are all important aspects of the human psyche. You probably know people who appear to be happy all the time, who never have a bad thing to say about anyone or anything, and like me, you probably find them a little too good to be true. Life is meant to be hard at times, and we all have to learn to take the rough with the smooth.

Know what needles you 10. – Our tolerance to hassle varies depending on the cause, and is rarely proportional to the impact of what is causing the impatience. I had an aged uncle who would become disproportionally angry if his morning boiled egg was late, but tolerated the infirmity of old age without a thought. Knowing what winds us up, and why, can help us develop coping mechanisms.

Accept what you cannot change

4. – Solicitors and local authorities work at what feels at times to be a glacial pace, but of course they cannot afford to make mistakes, so are methodical and process led. For someone impulsive this can appear to be painfully slow, but accepting that you cannot hurry some people can reduce your level of anxiety.

Know yourself 5. – I make no secret of the fact that I’ve spend a good many years in therapy, and one of the tangible benefits of this is a greater level of self-awareness. I’m not suggesting that

Finally, let me reflect on how surprised I have been by the effect on my wellbeing of returning to live in the small town where I grew up and have been visiting regularly since moving away more than 40 years ago.

Since moving back I’ve met people I’d not seen for decades, and it’s nice to be able to drive or cycle around the area without needing a map, but what has taken my breath away has been the sense of belonging that I’ve never felt anywhere that I’ve lived since moving away. I’ve realised that until now, my work has decided the place I live and so I’ve never felt the sense of connection that I feel here.

Perhaps a future column will explore what it means to feel at home!

Page 20 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Feed Compounder May/June 2023 Page 21 www.bestmix.com • Reduce costs and prevent risks • Optimize your entire product chain • Guarantee higher-quality products BESTMIX® Feed Formulation, Quality Control, Ration Calculation and ERP solution Scan to learn more: BESTMIX® Software: The best solution in challenging times THE UK flavour manufacturer supporting British & Irish agriculture Unlock the possibilities To find out more about our unique Tastetite and other feed enhancement technologies visit our website at www.inroadsintl.com email info@inroadsintl.co.uk or call us on +44 (0)1939 236 555. 10461_Inroads_Feed Compounder Ad_Half Landscape_124x178.qxp_Layout 1 21/12/2021 14:33 Page 1

milk matters

By Christine Pedersen Senior Dairy Business Consultant The Dairy Group christine.pedersen@thedairygroup.co.uk www.thedairygroup.co.uk

dairy outlook

Unsurprisingly, the weather is a hot topic of conversation. Many producers had hoped for an early spring turnout to alleviate pressure on dwindling forage stocks and to reduce feed costs. In England and Wales, March 2023 was the wettest March since 1981. Although Scotland saw rainfall totals more in line with its average, Northern Ireland also experienced one of its wettest Marchs on record. April was predominantly unsettled but some producers took a ‘window of opportunity’ to harvest 1st cut. As I write this in early May, this month is also proving to be very wet and for many of producers who didn’t harvest in April there is little prospect of 1st cut being cut before mid to late May. The excessive rain has also delayed maize planting; hopefully by the time you read this, maize will be flourishing in warmer soils and contingency plans for clients heavily reliant on maize silage can be put aside.

Grass growth rates are in line with the average of previous years, but the wet weather has meant that utilising grazed grass has been a challenge for many producers due to difficult ground conditions and low grass dry matter. As we head towards the traditional spring peak of milk production in mid-May, the latest GB Milk Delivery report from AHDB for the week ending 29/4/23 shows milk deliveries increased by 0.4% compared to the previous week and are 0.1% below the same week last year:

spring flush but prices have now mostly dropped below 40ppl.

The cost of production is set to ease in 2023 but is unlikely to keep pace with the decline in milk price and fixed costs will still be subject to inflation in the wider economy. One of the key challenges for 2023 will be producing milk as efficiently as possible as the milk to feed price ratio reduces from 1.35 to 1.1 in a matter of months. There are a number of factors to juggle including the base milk price, ‘B’ litres or seasonal milk price adjustments, the impact of milk quality and the cost of feed, all of which require good quality data to help make the right decisions.

MCi is our web based management system which combines physical and financial data to help our clients improve herd business performance. MCi allows the user to generate a milk forecast for the year ahead and to show how this interacts with the seasonal milk price where daily limits are applied (a quota), e.g. the Arla BADP. The MCi report below is for an autumn block calving herd with surplus litres in January to May attracting penalties and the surplus litres in October to December receiving bonuses. The ‘quota’ is the BADP compared with the MCi generated forecast, with actual sales displayed. A further report shows the financial impact for each month and the total for the year.

Farm Gate Prices eased in March to 46.0ppl, down 2.3ppl (-5%) on February, but still +28% year on year. Milk quality remains high and is following the normal seasonal pattern.

Our latest milk price forecast, based on current prices and the latest market returns, suggests the Defra farm gate price will ease to 41.7ppl in April, 39.8ppl in May and June at 38.9ppl. 2023 milk prices will remain uncertain as new seasonality arrangements price marginal litres at or below AMPE which has dropped to 31.8ppl, for example Saputo’s B litre price drops to 29.8ppl in May. Much depends on what happens to liquid retail prices in the next 3 months and milk supply through the

As always, producers are encouraged to understand their milk contract and influence their milk price by implementing measures to “exploit” it. Most milk contracts now pay for butterfat and protein and as we head into the spring/summer months when average constituent levels typically dip, we will be monitoring milk quality closely and deploying feeding strategies to increase constituent yields and milk price. In recent years soya hulls have featured heavily in rations to promote butterfat but as milk contracts move towards sustainability bonuses for nil soya/soya derivatives, there is a question mark regarding their cost effectiveness if their use results in a lower milk price. From our own experiences with feed groups, we have seen compound price quotes up to £10/t higher for some nil soya/soya derivative, high fibre compounds compared to those where there are no restrictions imposed on soya use.

Purchased feeds typically represent 25% - 35% of total milk production costs and against the backdrop of rapidly falling milk prices, clients are asking where they can make savings. Any readers involved in dairy cow nutrition will know there are 3 rations for a dairy herd: the ration on paper as formulated by the nutritionist, the ration fed to the cows, and the ration the cows actually consume. Some of this discrepancy can be due to variations in forage dry matter, particularly when factoring grazed grass into ration formulation. As part of MCi development, we have created an app for TMR fed herds, MCi Manager that allows for the management of daily feeding to help to

Page 22 May/June 2023 Feed Compounder Comment section is sponsored by Compound Feed Engineering Ltd www.cfegroup.com

Daily average (million litres per day7 day rolling average) Week ending 2023 2022 Year on Year Change 15/04/2023 36.57 36.16 1.1% 22/04/2023 36.75 36.77 -0.1% 29/04/2023 36.91 36.93 -0.1% Week on Week Change 0.4% 0.4%

Policy name Brief description

Use of methane suppressing feed products (e.g. 3NOP, nitrate additives) to reduce methane emissions from livestock.

Multi-purpose breeds or multi-use of cows - (milk, calves and meat).

UK Government will continue to work with Food Standard Agency (FSA) and Food Standards Scotland (FSS), industry and the livestock sector to explore suitable policy options to encourage rapid and extensive uptake of methane suppressing feed products with proven safety and efficacy, including exploring mandating methane suppressing feed products in compound feed for cattle in England.

UK Government will monitor current market-led initiatives to increase integration of beef and dairy production chains (via dual purpose breeds or increasing use of dairy/beef cross calves) and explore policy options to support this measure should the market-led response not meet the required uptake levels or emissions savings.

Improved farm fuel and energy efficiency. UK Government will support reductions in farm non-traded carbon dioxide (CO2) emissions from motive power, pumps and drives. Actions include, amongst others, the use of minimum till and no till techniques and development of technology and equipment (for example electrified tractors and utility vehicles, the use of robots and low energy motors).

feed accurately and monitor the interactions between the current daily milk yield and feed inputs. The same data can then be automatically transferred to the monthly costings and used for emissions data.

dairy SuStainability

The focus on net zero has accelerated over the last 12 months and in early April “The Net Zero Growth Plan” and “The Carbon Budget Delivery Plan” were published. These set out how government plans to create a net-zero emission economy in UK by 2050. Whilst acknowledging that farming is one sector where some residual/unavoidable emissions are expected, Defra has developed 33 policies to help decarbonise agricultural emissions as far as possible.

1.6

0.6

0.6

The policies calculated to have the greatest potential reduction in carbon emissions by 2033 - 2037 (Carbon Budget 6 (CB6)) of particular significance to dairy farmers are shown in the table above:

The remaining 33 policies cover precision feeding and farming techniques, animal and plant genetics, animal and crop health and productivity, organic manures, soil management, hedgerows and trees.

Arla has introduced a ‘Sustainability Incentive’ to accelerate progress towards Net Zero. With the first sustainability incentive payments due in August for milk delivered in July 2023 and incentives of up to €2.4/litre, Arla suppliers are focused on maximising their points and subsequent milk price.

Avg. annual CB6 savings (MtCO2e) pa

Software for life Optimise processes Reduce labour User friendly 24/7 support Performance monitoring Flexible and configurable Stock control and traceability Tel : +44 (0) 1159813700 Email : sales@dsl-systems.com Web : dsl-systems.com Tel : +44 (0) 1260277025 Email : sales@datastorsystems.com Web : datastorsystems.com Part of the Valsoft group Advanced control, planning and information software for feed and grain plants

Scientifically Speaking …

By Matthew Wedzerai

hoW FulviC aCid reduCeS ammonia emiSSion in broilerS

In this new study, fulvic acid proved beneficial to broiler production by inhibiting urease activity and reducing the ammonia released through the faeces.

Fulvic acid is extracted from weathered coal, brown coal, and other minerals, which form a compound organic acid with high bioactive properties but low molecular weight. Fulvic acid and humic acid are the two major components of the humus, which have similar functional structures. Fulvic acid consists of numerous active functional groups including phenol, hydroxyl, carboxyl, and hydroquinone, which confer beneficial effects such as anti-inflammatory and antiviral activities. In fish, it is reported to promote the proliferation of beneficial bacteria in the intestine and improve the secretion of digestive enzymes. A recent study published in the journal of Poultry Science shows that broiler diets supplemented with 0.6 or 1 g per kg fulvic acid result in increased body weight gain and improved activities of digestive enzymes, high total polyunsaturated fatty acid content, increased superoxide dismutase and glutathione peroxidase activities, and high levels of serum IgG, IgM, and IgA but decreased levels of malondialdehyde, indicating benefits on growth performance, and antioxidant and immune system.

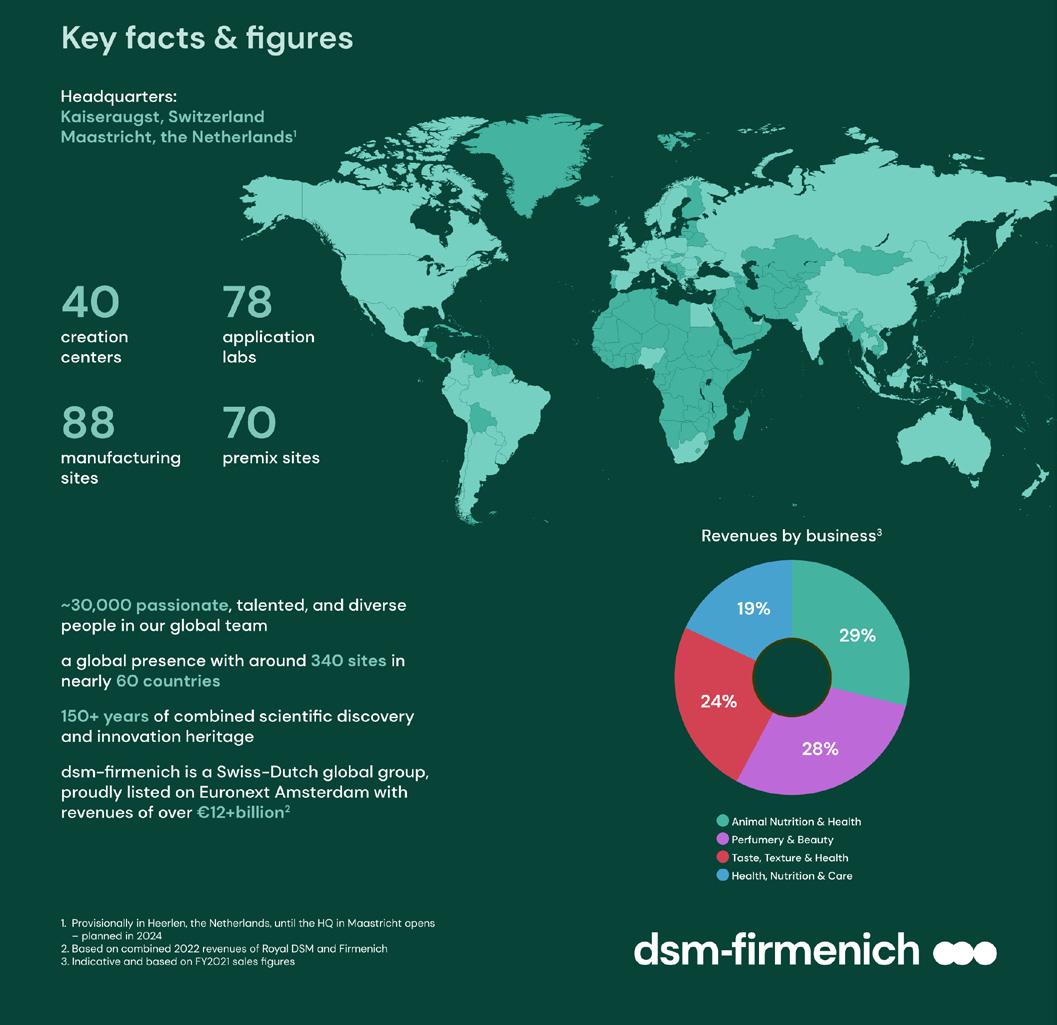

diets