Financial Aid Offer Guide

Offer is based on the student’s continued eligibility to receive those funds. Eligibility requirements for institutional scholarships can be found in the University’s Catalog at: piedmont.edu

Offer is based on full-time enrollment (12-18 semester hours each term), unless otherwise noted. Student must make Satisfactory Academic Progress as defind in the University’s Catalog and abide by all published regulations.

Book charges are estimated at $700 per semester. All charges are estimates only and should be confirmed with Student Accounts.

Gift Aid: scholarships and grants that do not have to be repaid.

Student Loans: federally offered loans that do require repayment.

Total Estimated Due: first one is only applying gift aid to charges; second is applying gift aid & student loans to charges.

Complete entrance counseling and electronic master promissory note (one-time, not annually) at: studentaid.gov

Subsidized: does not accrue interest while in school; eligibility is based on need from the FAFSA.

Unsubsidized: does accrue interest while in school.

Gross loan amounts are shown on the offer. Gross loan amounts are higher as they include an origination fee. The net amount is factored into “Total Estimated Due/Credit (if accepting student loans)” section on the offer.

Loans are offered up to maximum eligibility. Loans require six hours enrollment and contingent upon student maintaining eiligibility for funds.

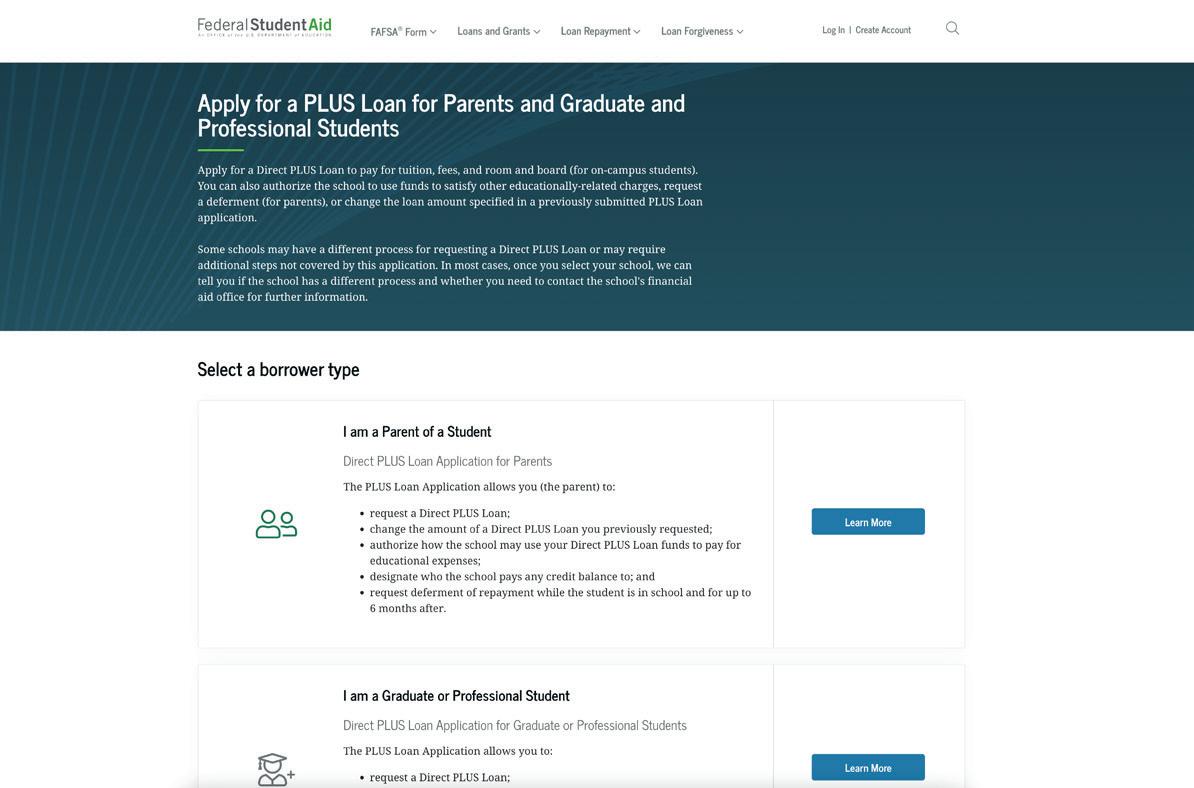

Must be a parent of an undergraduate, dependent student. Complete PLUS Loan application (annually) at: studentaid.gov

The application for fall will become available May 1st. Any additional amount needed to cover books and other expenses should be included when completing the PLUS Application. Complete the electronic master promissory note at: studentaid.gov

Parents, who have an acceptable credit history, can borrow a PLUS Loan up to the cost of attendance each year. Interest rates are variable and adjusted each year on July 1st. PLUS Loans will be ordered at the gross amount with the origination fee included.

For more information on PLUS Loans including origination fees and interest rates, visit: studentaid.gov

To apply for Georgia Tuition Equalization Grant (GTEG) and/or HOPE or Zell Miller Scholarship, a FAFSA or an Institututional Financial Aid Request Form (annually) with a GSFAPP (one-time), must be completed.

Complete a GSFAPP at: gafutures.org

Students may check HOPE or Zell eligibility throughout their college career though their GAfutures account.

For information regarding the requirements for state aid eligibility, visit: gafutures.org

Alternative, or Private, Student Loans are offered by many lenders as a source of additional funding. For a list of lenders and to apply, go to: choice.fastproducts.org

In lieu of student and/or parent loans, a monthly payment plan can be set up through the Student Accounts Office via phone at: (706) 776-0101 or email at: biz@piedmont.edu