11 minute read

Executive Summary

As one of Seattle’s oldest neighborhoods, Pioneer Square is rich in history. The area is home to a thriving arts and culture scene and offers a broad range of social services for communities in need of support. However, the area also faces public safety challenges, high commercial vacancy rates, and a large population experiencing houselessness.

The high concentration of government and office uses has shaped development patterns in Northeast Pioneer Square for years. Pre-pandemic, workers at the King County Civic Campus, the Columbia Tower, and other office buildings nearby generated much of the area’s retail demand. Following the shift toward work from home trends induced by the COVID-19 pandemic, the near single-use function of the area as an employment center has impacted the resiliency of the Northeast Pioneer Square District.

In July 2022, The Alliance for Pioneer Square contracted with ECONorthwest to develop a Retail Market Study for Northeast Pioneer Square to identify strategies to support postCOVID-19 recovery through economic development tools that bolster vibrancy across Pioneer Square.

This report is a subset of a larger, Pioneer Square-wide project to be completed in 2023 and provides background information and analysis on recent market trends and other conditions affecting Northeast Pioneer Square. This Executive Summary provides a synopsis of the report’s key findings and recommendations

Key Findings

ECONorthwest defined Primary and Secondary Market Areas for the Northeast Pioneer Square district. The Primary Market Area reflects the core area definition from the Northeast Pioneer Square Framework Plan and is the focus for understanding the current supply of retail and services for this study. The Northeast Pioneer Square Secondary Market Area is the focus for understanding demand for retail and services in the Primary Market Area.

Demographics

As of mid-2022, the Northeast Pioneer Square Primary Market Area was estimated to have a population of 987 people and 547 housing units. Nearly a third of households in the Primary Market Area are very low-income, earning less than $15,000 per year and about 9 out of 10 households rent. About 75 percent of housing units in the area are subsidized units, demonstrating the need for more diverse housing types in the area.

In 2021, the Secondary Market Area had a daytime employee population of 15,881. However, the most recent data indicate that only about 27 percent of those employees have returned to the office, which is substantially lower than the 40 percent of workers that have return to Seattle’s Downtown. About 50 percent of workers in the Secondary Market Area are employed by the government, with many working at the King County Civic Campus.

The Primary Market Area’s limited population growth and high concentration of lower-income renter households underscores the need for a more balanced mix of employees, residents, and visitors, and a broader spectrum of housing choices to support a diversified retail environment.

Real Estate Trends

Retail market trends. Between 2010 and 2022 Q2, the Primary Market Area saw the greatest rent growth of 77 percent or $9.64 per square feet, while the Secondary Market Area saw a growth of 40 percent or $6.56 per square feet.

In the second quarter of 2022, the Secondary Market Area saw the largest amount of retail space vacated in a single year approximately 26,000 square feet. About 7,500 square feet of retail space has been vacated in the Primary Market Area In the past two years.

Under current conditions, there is a surplus of retail supply in Northeast Pioneer Square. However, increasing the presence of in-person workers and attracting new residents to the area could generate demand for new retail space.

Office market trends. Between 2010 and 2022 Q2, the Primary Market Area saw its largest rent growth of 44 percent or $10.87 per square feet. Both the Primary Market Area and Seattle saw similar increases of $9.69 and $9.88 per square feet, respectively.

In 2022 Q2, the Primary Market Area had the highest vacancy rate of 25.4 percent, followed by the Secondary Market Area (18.6 percent), and Seattle (12.0 percent). Despite the Primary Market Area having the highest vacancy rate out of the two comparison market areas, rents have remained comparable to that of citywide averages in 2022 Q2, likely due to government and other institutional tenants.

Since 2010, the Primary Market Area has not experienced any new office space construction. On the other hand, the Secondary Market Area had two large office developments in 2016 and 2018 totaling almost 700,000 square feet. In comparison, the Seattle office market has been building substantial office space to accommodate its growing tech industry. Since 2010, Seattle has built approximately 26.5 million square feet of office space.

Multifamily market trends. The average per square foot rents for market rate units in the Primary Market Area have increased 29 percent ($0.53) from $1.81 in 2010 up to $2.34 in 2022 Q2. In Seattle, the average per square foot rents have increased 39 percent ($0.83) from $2.13 in 2010 up to $2.96 in 2022 Q2. Similarly, the Secondary Market Area has seen modest rent growth of 34 percent ($0.74) from $2.17 in 2010 up to $2.91 in 2022 Q2.

Housing is in great demand in Seattle and both Pioneer Square market areas. Vacancy rates in the Primary Market Area have fallen rapidly in the last decade and were at 4.9 percent in the summer of 2022, while vacancy in Seattle and Pioneer Square were 6.3 and 5.7 percent, respectively. Very low vacancy rates coupled with continued rent growth year-over-year indicates upward pressures on rents and future demand for new construction at all income levels.

Stakeholder Interviews Summary Themes

ECONorthwest staff hosted a workshop with a set of stakeholders, including property and business owners, brokers, and property managers. The following section summarizes common themes discussed by multiple stakeholders.

Encouraging King County and the City of Seattle employees to return to the office or the area for recreational purposes will help support a thriving retail environment.

The concentration of social service providers in the area provides challenges for ground floor retailers.

Large retail spaces greater than 1,500 square feet in size are challenging to lease up in Northeast Pioneer Square due to businesses requiring smaller spaces.

A substantial number of ground floor retail spaces in Northeast Pioneer Square are large, deep, and narrow with little to no opportunities for subdivision.

Stakeholders have expressed interest in changing the use of ground floor retail spaces, but the costs and required seismic upgrades to the building that are triggered with this action are cost prohibitive.

Public safety issues in the area have hindered return to the office. Some stakeholders expressed that the safety of their employees is a concern in returning to the area.

Recommendations

Based on the analysis in this report and conversations with stakeholders, ECONorthwest developed a set of strategies to help support ground floor retail in the Northeast Pioneer Square area.

Diversify the Mix of Uses in and Around Northeast Pioneer Square. The Alliance should continue to work with City agency partners and district stakeholders to support a more balanced mix of uses in the district with an emphasis on creating more workforce and market rate housing in the area.

Add Market-rate Housing to Support Neighborhood Resiliency. A more diverse mix of housing will support a more resilient neighborhood economy. The chief recommendation from a 2022 report produced for the Alliance by MIG 1 was that Pioneer Square lacked both workforce and market rate housing. Adding more housing at a range of affordability levels will attract more residents to the area and help to stabilize it in the wake of the pandemic and the remote work era. The addition of new household units will also help with replacing some of the worker demand for retail.

Leverage the Area’s Rich Arts and Culture Scene with Complimentary Uses. Capitalizing on the area’s active arts and culture scene with public art installations, gallery showings, and other outdoor art events will not only support the arts community but will also help to draw in visitors and increase their dwell time. Recognizing Pioneer Square’s arts and cultural assets and the marketing of them is an important element of economic development that can help create resiliency across the Northeast Pioneer Square District. Arts and cultural exhibits alone cannot change the retail dynamics of an area. Marketing of these assets and continued programming of complimentary uses are needed to boost visitors and attraction to the area year-round.

Support Ground Floor Activation in Large Redevelopment Projects. Our analysis indicates there are a few challenges for retail and service uses in the area, including public safety concerns and reductions in foot traffic from employees. Another major challenge is that many food service and personal services establishments have tended to be internal-facing within larger office buildings. A post-pandemic retail environment in the Northeast Pioneer Square area is likely to need more flexibility to attract patronage from more segments of demand and will need to be more externally facing to residents and visitors who come to, or pass through, the area. There is an opportunity for smaller format street facing retail to meet space needs for target business and to advance goals for a more vibrant public realm in the area.

Activate Empty Storefronts. Long term retail vacancies often require organization and active marketing efforts to advertise spaces within an area. Activating these spaces often needs creative solutions like the resources that Seattle Restored offers. Other similar programs like PopUp Denver offer financial support and a package of resources for small businesses to set up shop. This program offers financial support to small businesses and entrepreneurs to set up shop in empty storefronts in an area of the city that is struggling to recover from the pandemic and provides interior design, streamlined permitting, setup and merchandising support. Given post COVID-19 market trends, property owners may need to lower their asking rents and shorten lease terms to fill their vacant spaces. In return, active storefronts will likely lead to a reduction in crime and more pedestrian activity.

Support Employees Returning to In-Person Work. Some of the largest employers are public sector and the Alliance and stakeholders should continue to collaborate with City and County leadership to support programming and activities that can help incent and support workers returning to the area consistent with City and County policies.

Reduce Barriers to Change of Occupancy. With relatively high existing retail vacancy rates, it will be critical to support tenanting these vacant spaces by removing barriers and creating financial support programs for small businesses. Financial assistance programs could improve technical assistance resources like design and permitting services, reduced change of use fees, or direct subsidy to support tenanting vacant space and economic development opportunities for business owners.

Reduce Barriers and Support Funding to Create Smaller Retail Spaces. Many of the existing vacant retail spaces in the Northeast Pioneer Square area are larger floor-plate spaces that exceed the size demands of smaller businesses. Subdividing these larger spaces into smaller spaces that are better able to meet the needs of potential business owners and demand for those kinds of services can be extremely challenging from a design, engineering, and cost perspective.

1. Introduction

As one of Seattle’s oldest neighborhoods, Pioneer Square is rich in history. The area is home to a thriving arts and culture scene and offers a broad range of social services for communities in need of support. However, the area also faces public safety challenges, high commercial vacancy rates, and a large population experiencing houselessness.

The high concentration of government and office uses has shaped development patterns in Northeast Pioneer Square for years. Pre-pandemic, workers at the King County Civic Campus, the Columbia Tower, and other office buildings nearby generated much of the area’s retail demand. Following the shift toward work from home trends induced by the COVID-19 pandemic, the near single-use function of the area as an employment center has impacted the resiliency of the Northeast Pioneer Square District.

In July 2022, The Alliance for Pioneer Square contracted with ECONorthwest to develop a Retail Market Study for Northeast Pioneer Square to identify strategies to support post COVID-19 recovery through economic development tools that bolster vibrancy across Pioneer Square.

This report is Phase 1 of a larger project to be completed in 2023. Phase 2 will include a broader Pioneer Square market study that will be structured to provide an understanding of current market conditions and provide Alliance staff, BIA members, agency partners, and other community stakeholders with strategic actions that could support economic development and activation across the neighborhood.

This report focuses specifically on Northeast Pioneer Square, in service to the Northeast Pioneer Square Framework Plan. It provides background information and analysis on recent market trends and other conditions affecting Northeast Pioneer Square to provide a baseline understanding of market conditions for Pioneer Square stakeholders. The strategies presented in this report provide guidance on how to support existing small businesses, attract new businesses to the area, and provide tools for cross-collaboration between the Alliance for Pioneer Square, city agency partners, property owners, and businesses owners.

Organization of this Report

This report is organized into the following sections:

Section 2. Market Areas. Describes the market areas from which most retailers in Northeast Pioneer Square draw their customer base.

Section 3. Drivers of Retail Demand in Northeast Pioneer Square– Population, Employees, and Visitors. Describes the demographic and housing trends of the area including who works in Northeast Pioneer Square Residents, employees, and visitors are the prime drivers of retail demand.

Section 4. Northeast Pioneer Square Market Conditions and Trends. Presents information about the local, commercial, and residential markets. It presents real estate market trends that will be used to understand the current market conditions and help develop actionable strategies.

Section 5. Retail Leakage and Demand Analysis. Examines the retail demand and supply in Northeast Pioneer Square and evaluates the area’s potential to support new retailers.

Section 6. Recommendations Describes the retail strategies to support ground floor retail uses in Northeast Pioneer Square.

Approach

This retail study is based on an assessment of the current retail environment and trends derived from the market analysis, a district-level analysis of demographics, a retail leakage and demand analysis, and conversations with Northeast Pioneer Square stakeholders. These stakeholders include property and business owners, commercial brokers, property managers, developers, and residents.

2. Market areas

ECONorthwest defined the Northeast Pioneer Square Market Area as the geographic area in which most of the retail sales within Northeast Pioneer Square occur and where most retailers are likely to draw their frequent customer base.

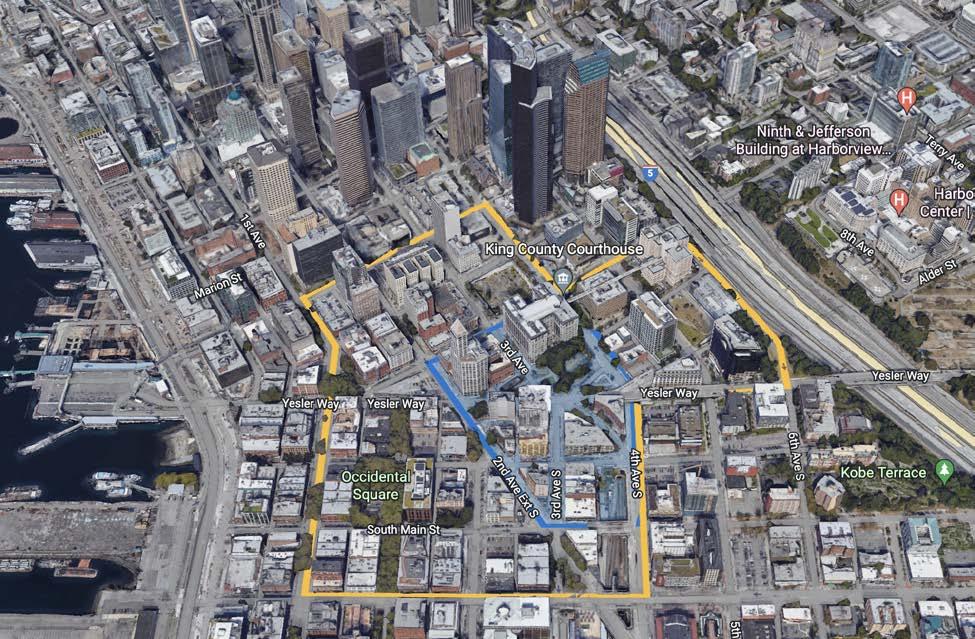

To conduct our analysis, we defined two market areas for Northeast Pioneer Square. These market areas are illustrated in the map in Exhibit 1 below. The Northeast Pioneer Square Primary Market Area reflects the core area definition from the Northeast Pioneer Square Framework Plan and is the focus for understanding the current supply of retail and services for this study.

The Northeast Pioneer Square Secondary Market Area is the focus for understanding demand for retail and services in the Primary Market Area. The Secondary Market Area can be considered the capture area for demand from employees, residents, and visitors for businesses in the Primary Market Area.

These market areas are used throughout this report to summarize and describe the demographic, housing, and employment trends for Northeast Pioneer Square, along with real estate trends and retail supply and demand.

LEGEND:

NORTHEAST PIONEER SQUARE PRIMARY MARKET AREA

NORTHEAST PIONEER SQUARE SECONDARY MARKET AREA

How market areas are defined is important to understand how segments of demand (residents, employees, and visitors) interact with current businesses and commercial real estate within the Primary Market Area. Northeast Pioneer Square is unique in that employment centers and commercial uses dominate the area, meaning the majority of demand in both the Primary and Secondary Market Areas is derived from nearby employees.

Due to the high concentration of office workers and commercial uses in Northeast Pioneer Square, the impacts of the COVID-19 pandemic have been amplified. The pandemic has led to uncertainty and foundational shifts in the demand for retail and services. Because most of the demand for retail and services in the Primary and Secondary Market Areas comes from nearby employees, remote work and hybrid work trends are significantly impacting current retail and service business. These trends will continue to have strong implications for demand for new services in the area in the near-term.

Because return to the office in downtown Seattle has not fully recovered, this report provides a few scenarios to estimate how many workers and residents would be needed to further support retail services in Northeast Pioneer Square.