Looking ahead The future of tax As part of the Kreston Reeves Looking ahead series, Andy Wallis looks to how Covid-19 might change the future of tax.

T

he cost of government support to individuals and the businesses affected by Covid-19 in the UK has already topped £100bn and will continue to rise. It is unlikely that we will ever know the exact figure, but we do know that government will, at some point, need to put in place measures to boost its coffers. So what might the future of tax look like? Tax is complex, detailed and challenging. In looking at how tax might change it would be easy to fall into the trap of examining individual taxes and how they might be tweaked to raise revenues. That is a discussion that will unfold in the coming months and possibly years as changes to the tax system are announced through the everyday course of politics. There are, I believe, some larger and more fundamental questions that government should now look to address with regards our relationship with tax. And as we begin to emerge from our Covid-19 lockdown now is the right time for government to start this national conversation.

There are three areas that should be explored: fairness, transparency and personal tax.

raise taxes on income to better and more directly fund the NHS and social care.

Personal tax

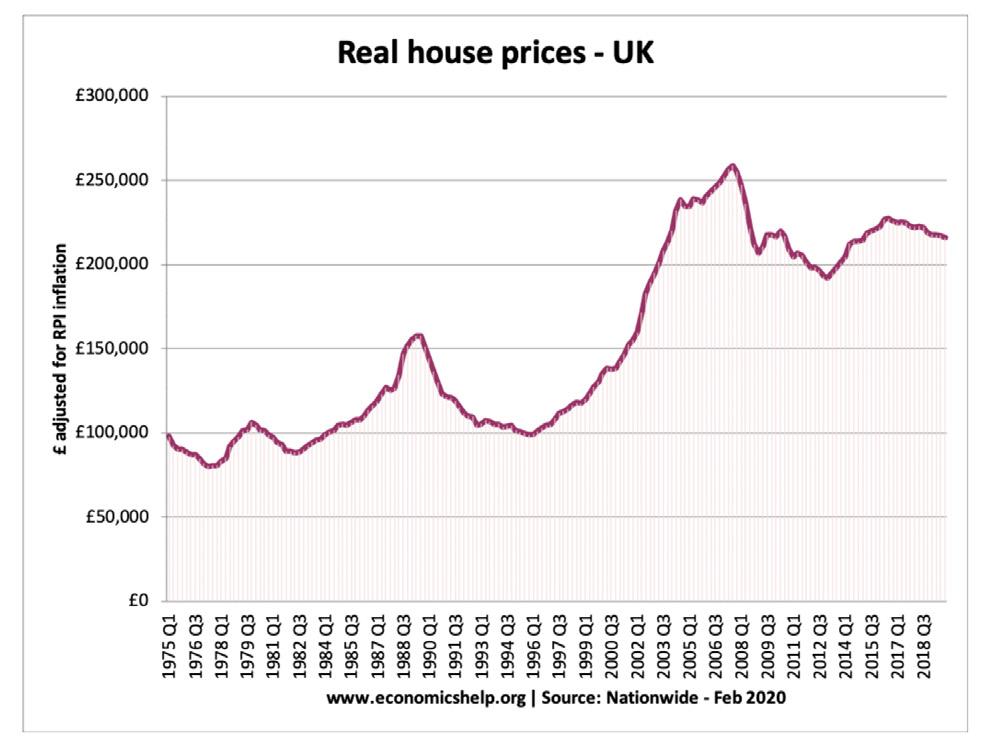

It is also important to keep in mind the austerity measures introduced by government after the 2008 crash. There

Income tax, national insurance and VAT are the three largest contributors to government coffers and affect each of us in the UK. Changes to any one of these three would generate significant additional revenues for government. A universal 1% increase in income tax rates could raise revenues of c.£6-7bn per annum. It is worth noting that the return of the 50% tax rate for additional rate payers is not likely to raise significant revenue and the resultant behavioural change could actually lead to a reduction. Covid-19 has shown society the importance and value of the NHS with overwhelming support for our carers. But it has also shown its weaknesses, particularly with regards social care. A better funded NHS and social care system is needed. Government could use Covid-19 to

“Covid-19 has led Government into radical programmes of support to businesses and individuals. It is likely to lead to further radical thinking on tax. ”

22

SURREY BUSINESS MAGAZINE