INVESTMENT

Seven Principles

of Investment in Uncertain Times by Rod Thomas FCA, Chairman, Avantis Wealth Ltd

even Principles of Investment in ncertain Times

W

hether you invest for income, savings or capital growth, the last 20 years have been dominated by uncertainty and dramatic changes to investThomas FCA,ment markets.

The impact of this incredible fall in bank base rate has been calamitous. It has effectively wiped any income from millions of investor portfolios invested in Gilts or bank and savings accounts.

man, Avantis Wealth Ltd

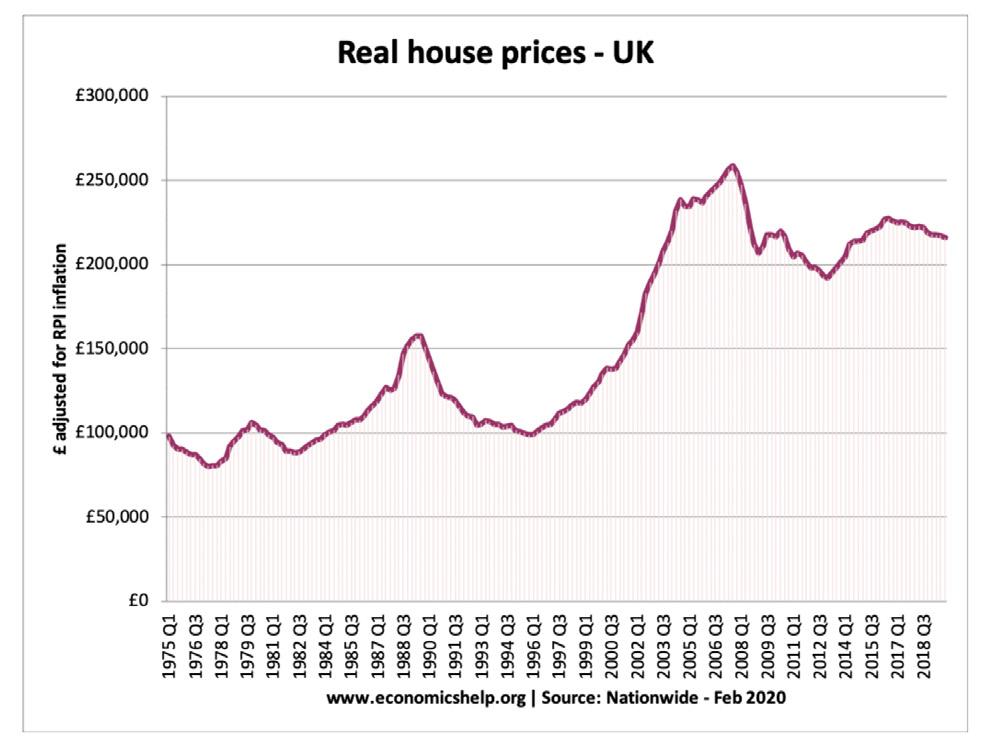

Many investors have failed to generate decent returns on Buy-To-Let (BTL) Property their money, and face even more difficulties in choosing what doincome, now. Many investors, in recent years, have chosen to invest in her you investtofor savings or capital growth, the last 20 years have been property and receive rental income. Sadly, BTL property no nated by uncertainty and dramatic changes to investment markets. Falling (and failing) investments for 20 years! longer offers the same profitability. Review the Nationwide investors have failed to generate decent returns on their money, and face even more prices across 40 years; index of house lties in choosing what to do now. Investment in shares has been the mainstay of many investportfoliosfor for20 around g (and failing)ment investments years!100 years. But consider the performance of the FTSE 100 index, which measured approx. tment in shares hasatbeen theofmainstay of many portfolios 7,000 the turn the millennium. On investment April 1st 2020, it stood for around 100 . at 5,500, a loss of 22% over 20 years.

onsider the performance of the FTSE 100 index, which measured approx. 7,000 at the This On is aApril massive underperformance by anyone’s f the millennium. 1st 2020, it stood at 5,500, a loss standards of 22% over 20 years. and a serious blow to millions of investors!

s a massive underperformance by anyone’s standards and a serious blow to millions of ors!

Government Gilts and Savings Accounts ernment Gilts and Savings Accounts

Most have also held income producing assets,forparinvestors have alsoinvestors held income producing assets, particularly retirement or to ticularly for retirement or to supplement other sources. ement other sources. Investment income primarily depends on interest rates. We

tment incomenow primarily depends on interest rates. have have the lowest bank base rate everWe (fornow more thanthe 300lowest bank base ver (for moreyears!) than 300 years!) at just 0.10% pa. at just 0.10% pa.

Over the period from 1975 to 2018, a period of 43 years, property has delivered an ave the period from 1975 to a period years, propcapital growth fromOver £100,000 to £220,000, a 2018, rate of 1.85%ofa43 year. Very disappointing. erty has delivered an average capital growth from £100,000

Not only is capital to growth questionable, the costs owning and running buy-to-let prop £220,000, a rate of 1.85% a year.ofVery disappointing. have also escalated, significantly reducing the net rental yield. Not only is capital growth questionable, the costs of owning and running buy-to-let property have also escalated, significantly reducing the net rental yield.

mpact of this incredible fall in bank base rate has been calamitous. It has effectively any income from millions of investor portfolio’s invested in Gilts or bank and savings unts.

24

To-Let (BTL) Property

SURREY have BUSINESS MAGAZINE investors, in recent years, chosen to invest in property and receive rental me.