Our new Excellence Line hammers are now equipped with the first ever monitoring system for hydraulic hammers – RD3. This system gives you detailed information about the operating hours, service intervals and GPS location of your product. You can see all the data you need by logging into the My Fleet platform. RD3 improves your fleet management, makes your processes more efficient and improves your profitability. For more information visit rammer.com/excellence or contact your local Rammer dealer. @rammerhammer @rammerhammer

Sandvik Mining and Construction Oy / Lahti, Finland / rammer@sandvik.com / www.rammer.com

The refreshing ‘can-do’ attitude of start-ups is gaining traction in the aggregates and wider construction materials world

Sandvik CEO joins ABB; HeidelbergCement and Equinor take action on CO2 emissions

UEPG says that Europe has a clear policy compass for the aggregates sector

What could a no-deal Brexit mean for aggregates businesses?

Global OEMs’ new equipment launches and

Using state-of-the-art technology to create optimum quarry haul roads improves the efficiency of aggregates processing operations 27

Fully utilising the latest machine maintenance technology can help aggregates production business owners make big annual savings

Safety and environmental requirements mean that quarry operators are turning to drill rigs and breakers as an alternative to explosives

32 WATER RECYCLING, FILTRATION & MANAGEMENT

Smarter water management and recycling solutions are increasingly in demand in modern aggregates production

10 INTERVIEW

All the key events in the quarrying & aggregates world

Raisby Quarry in the north-east of England has provided a backdrop for one of Terex Finlay’s biggest machine displays 22

A Hitachi wheeled loader is helping to drive production in Portugal, where limestone can be more profitable than marble

36 TYRES – PART 2

Premium quarrying machine tyres are an essential part of running a model, ultra-efficient loading and hauling fleet

40

Founded in 2016 by a trio of ex-LafargeHolcim senior executives including CEO Max Vermorken, SigmaRoc has grown at an impressive rate in its first three years as an AIM-listed buy-and-build construction materials company

Due to launch in Q2 next year, Metso Outotec is set to become a leading global player in process technology, equipment and services for the aggregates, mining and metals industries

44 MARKET REPORT

The EU’s TEN-T projects to extend roads, railways, airports and water infrastructure into Eastern Europe are fuelling aggregates demand in the region

50 QUARRY

A 28-tonne articulated hauler from Terex Trucks is playing a key role at a major barite mine in the stunning Perthshire region of Scotland

Everybody knows that the data you receive from machine telematics can be incredibly useful – but do you really have the time to sift through it all? Insight Reports from Volvo take all of that data and tell you everything you need to know in a few short and simple statements. Insight Reports give you clear, concise signals that you can act on immediately without having to go through mountains of data – making sense of telematics. Talk to your local Volvo dealership today.

HEAD OFFICE

EDITOR: Guy Woodford

ASSISTANT EDITOR: Liam McLoughlin

CONTRIBUTING EDITORS: Patrick Smith, Dan Gilkes

EQUIPMENT EDITOR: Mike Woof

DESIGNERS: Simon Ward, Andy Taylder, Stephen Poulton

PRODUCTION MANAGER: Nick Bond

OFFICE MANAGER: Kelly Thompson

CIRCULATION & DATABASE MANAGER: Charmaine Douglas

INTERNET, IT & DATA SERVICES DIRECTOR: James Howard

WEB ADMINISTRATORS: Sarah Biswell, Tatyana Mechkarova

MANAGING DIRECTOR: Andrew Barriball

PUBLISHER: Geoff Hadwick

CHAIRMAN: Roger Adshead

ADDRESS

Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612055 FAX: +44 (0) 1322 788063

EMAIL: [initialsurname]@ropl.com (psmith@ropl.com)

ADVERTISEMENT SALES

SALES DIRECTOR:

Philip Woodgate TEL: +44 (0) 1322 612067

EMAIL: pwoodgate@ropl.com

Dan Emmerson TEL: +44 (0) 1322 612068

EMAIL: demmerson@ropl.com

Graeme McQueen TEL: +44 (0) 1322 612069

EMAIL: gmcqueen@ropl.com

SUBSCRIPTION / READER ENQUIRY SERVICE

Aggregates Business International is available on subscription. Email subs@ropl.com for further details. Subscription records are maintained at Route One Publishing Ltd.

SUBSCRIPTION / READER ENQUIRIES TO:

Data, Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612079 FAX: +44 (0) 1322 788063

EMAIL: data@ropl.com

No part of this publication may be reproduced in any form whatsoever without the express written permission of the publisher. Contributors are encouraged to express their personal and professional opinions in this publication, and accordingly views expressed herein are not necessarily the views of Route One Publishing Ltd. From time to time statements and claims are made by the manufacturers and their representatives in respect of their products and services. Whilst reasonable steps are taken to check their accuracy at the time of going to press, the publisher cannot be held liable for their validity and accuracy.

PUBLISHED BY © Route One Publishing Ltd 2019

AGGREGATES BUSINESS INTERNATIONAL USPS: is published six times a year. Airfreight and mailing in the USA by Agent named Air Business, C/O WorldNet Shipping USA Inc., 156-15 146th Avenue, Jamaica, NY, NY11434.

PERIODICALS POSTAGE PAID AT / US POSTMASTER

ADDRESS CHANGES TO: Aggregates Business Europe, Air Business Ltd, C/O WorldNet Shipping USA Inc., 156-15 146th Avenue, Jamaica, New York, NY11434

PRINT: ISSN 2051-5766

ONLINE: ISSN 2057-3405

PRINTED BY: Warners (Midlands) PLC

refreshing ‘can-do’ attitude of

here is much talk in corporate America and the wider business world about the growing number and influence of unicorn startups. A unicorn – such as Airbnb (travel), Buzzfeed (internet software & services), Gusto (financial technology), and 4Paradigm (artificial intelligence) - is a privately held startup company valued at over US$1bn (€909.53bn). Venture capitalist Aileen Lee coined the term in 2013, choosing the mythical animal much-loved in children’s books, such as by my own two young daughters, to represent the, at that time, statistical rarity of such successful ventures.

A big downside to unicorn startups is the year-on-year losses that some seem to make. Publications such as The New York Times and The Economist have devoted many column inches to the biggest beasts in the unicorn startup stable, including Uber Technologies (Uber). Founded in 2009, the cab ride-hailing firm’s explosive growth and constant controversy has made it one of the most intriguing companies to emerge over the past decade. The company soon grew to become the highest-valued private startup company in the world, yet its operating losses keep piling up –$3bn (€2.73bn) in 2018, after a $4bn (€3.64bn) loss the previous year.

While trading on a fraction of the scale of the average unicorn startup, a buy-and-build startup business model is gaining traction in the aggregates and wider construction materials world. Summit Materials, headquartered in Denver, Colorado, U.S., is one such company. A business operating a family of decentralised and independent companies in the North America heavyweight construction materials sector, Summit Materials started in one office and now has 400 trading locations.

In Europe, SigmaRoc, a London, Englandheadquartered AIM (Alternative Investment Market) buy-and-build company founded by three former senior LafargeHolcim executives, has caught the eye with impressive growth in its first three years’ trading.

In this issue of Aggregates Business Europe, I

speak to SigmaRoc CEO Max Vermorken about the company’s initial success in creating three vibrant and ambitious business platforms in England, Wales and the Channel Islands: and, after adding to what was already a team of highly experienced and savvy building materials industry operators, SigmaRoc plans to create a Northern Europe platform, to acquire and invest in the development of small to medium-sized companies operating in countries such as France, Germany, Belgium and the Netherlands.

Looking ahead, this autumn brings many aggregates-related travel opportunities for me. I started in early September with a couple of days in Brussels, Belgium, as part of the judging panel for this year’s European Aggregates Association (UEPG) Sustainable Development Awards.

My fellow judges and I were impressed by the ambition of and attention to detail of the 50-plus award entries, which made it quite a challenge to create a shortlist for the big awards night taking place in Brussels in November.

Later in September I travelled to Spain with Metso to visit several quarry sites and interview Iñigo Ajuria, a prominent figure in the Spanish aggregates world, who runs Ofitas de San Felices (OSF) quarry, near Haro, a town in the northwest of La Rioja province in northern Spain. The quarry is one of Spain’s biggest and is known for its ophite, greenish mottled rocks with ophitic texture such as diabase. The vast site also just happens to be next to Ajuria‘s 34-hectare vineyard. More on his Tempranillo grape-based wine, along with, more importantly, his thoughts on the Spanish aggregates sector and OSF’s growth strategy in the November-December 2019 issue of ABE By the time that issue goes to press in late November, my autumn work-travel schedule, which also, at the time of writing, takes in Sweden, the Netherlands, Germany, Austria, Russia, Poland, Northern Ireland and Thailand, will have been completed, and minds will be focused on next year, including an early springtime return to Las Vegas for the CONEXPO-CON/AGG 2020 exhibition. GW gwoodford@ropl.com

UK-based carbon-negative aggregate specialist Carbon8 Aggregates has changed its name to O.C.O Technology, with immediate effect.

The move also means its awardwinning aggregate, previously known as C8Agg, has been renamed M-LS (short for Manufactured LimeStone).

M-LS is created using O.C.O Technology’s Accelerated Carbonation Technology (ACT) process. M-LS is a versatile product that has a multitude of uses in the construction industry.

It uses waste carbon dioxide gas to treat a wide range of thermal wastes and, as more carbon dioxide (CO₂) is permanently captured than is generated during manufacture, the end result continues to be the manufacture of the world’s first truly carbon-negative aggregate.

Wide-ranging applications for the aggregate include blocks, precast and ready-mixed concrete, screeds pipe bedding and various other “road” applications. The company is one of only a few in the UK to hold the Environment Agency’s “End of Waste” agreement, classifying the finished aggregate as a “product”.

The company currently produces over 350,000 tonnes of

Sandvik’s chief executive officer Björn Rosengren is to step down next year and will join Swiss-Swedish robotics and engineering group ABB Ltd as CEO, the companies said in

separate statements.

Rosengren will join ABB in February next year, ABB said. He will take over from acting ABB CEO Peter Voser in March, with Voser reverting to his position as chairman of the board at ABB, according to the company’s statement.

Voser took over temporarily as head of ABB after Ulrich Spiesshofer left suddenly in April.

Businesses which generate US$3 billion of revenue, 11% of ABB’s total annual sales, are now under review and could be sold off or closed down, Voser told Reuters in a recent interview.

Voser, the former Royal Dutch Shell CEO, who is also ABB’s chairman, has pledged a turnaround after years of

CEO Björn

will leave the Swedish company in January 2020

unsatisfactory performance. ABB shares have fallen nearly 20% in the last five years.

“Björn Rosengren has, since he joined Sandvik in November 2015, established a solid decentralised business model for the company and made the organisation more flexible and efficient,” Sandvik said in a statement.

Rosengren, 60, has also held several positions in Sandvik peer Atlas Copco and was the CEO of Finnish engineering group Wartsila between 2011–2015. In a statement following the announcement of his early 2020 departure, he said: “This has not been an easy decision. Sandvik is a great company with a lot of future potential and I will continue to lead the organisation with a strong commitment until end of January.”

Sandvik, maker of quarrying plant and associated equipment, metal-cutting tools and mining gear, is cutting around 2,000 jobs to buttress profitability in the face of early signs of slowing market demand.

Steve Greig, managing director of O.C.O Technology, pictured with a sample of the company’s aggregates

carbon-negative aggregate each year and, for every tonne of aggregate used, 1.4 tonnes of natural aggregate is saved.

Steve Greig, O.C.O Technology managing director, said: “While our old name has stood us in good stead, as our aggregates product range develops and our specialist knowledge takes us into new and exciting areas both within the UK and overseas, we needed a new identity and a brand that encompasses the full scope of our expertise.”

CRH, the Ireland-headquartered global building materials group, has posted record first half-year EBITDA (earnings before interest, tax, depreciation & amortisation) of €1.54 billion, a rise of 36% on H1 2018. The group also increased its H1 2019 sales by 11% to €13.2bn. The period under review saw CRH divest €2bn of its assets and spend €500mn on acquisitions. Meanwhile, the groupwide profit improvement programme is said to be progressing well.

Commenting on the latest trading figures, CRH chief executive Albert Manifold said: “On the back of our strategic initiatives, CRH has delivered significant profit growth in the first half of 2019, with a good performance in our heritage business and strong contributions from recent acquisitions. We are pleased to report that the board plans to continue our share buy-back programme with a further tranche of €350 million to be completed by year end. This will bring our total share repurchases in 2019 to €900 million.

“With our continued strong

cash generation and financial discipline, we expect yearend debt metrics to be below normalised levels. We anticipate further progress in the second

half of the year with benefits from positive underlying momentum in all divisions as well as good contributions from acquisitions.”

EFFECTIVE MAINTENANCE

MAXIMISE UPTIME DAILY STATISTICS

Thanks to the new ConSite Pocket app from Hitachi, you can now manage and monitor your machines using your smartphone. The app allows you to download monthly ConSite reports for each of your Hitachi machines, and connect with your local dealer if you need further support.

Available now from

Learn more at www.hitachicm.eu

INSIGHT INTO PRODUCTIVITY AND EFFICIENCY

Major infrastructure projects will contribute to growth of between 3% and 5% in France’s construction sector this year, according to Evolis.

The French construction industry group says that the sector experienced strong growth of 4.8% in 2017, followed by a slower rate of 3.1% in 2018.

Evolis says that, within an overall trend of growth, there are differences depending on the industry segment.

French non-residential construction activity will accelerate in 2019, Evolis says

The public works sector is expected to continue to rise in 2019, at a rate of 10%.

Local government spending, which accounts for 41% of overall public output, will be one of the main growth drivers. In addition, major infrastructure projects will continue to boost activity, including the Greater Paris project, the French ultrahigh-speed broadband plan and the French motorway plan.

Overall housing construction activity is expected to remain more or less stable with a possible change of 0.2%, while repair and maintenance activity is forecast to remain positive and show a 0.3% increase.

Evolis predicts that nonresidential activity growth will accelerate, with an increase of 6.4%. The impact of growing e-commerce is changing the retail sector, which saw permits fall by 22.5% in 2018, and the construction of retail stores is expected to decline by 9.5% in 2019.

CMS Cepcor, a leading manufacturer of components for crushing equipment used in the quarrying and mining industries, has opened a dedicated Global Parts Centre following the purchase of additional warehouse space with a £4mn (€4.5mn) funding package from HSBC UK.

The 6,000m² warehouse includes additional outdoor storage and is situated next to CMS Cepcor’s Technical Centre manufacturing facility on Samson Road in Coalville, Leicestershire, central England.

The new site enables further expansion of the business’s manufacturing facilities by releasing 2,500m² formerly used as storage to be utilised for increased manufacturing capacity in response to its growing portfolio of global customers. CMS Cepcor currently exports 75% of its products overseas and is targeting further export growth especially in North and South America, where a new Illinois, USA-based division of the

A dedicated Global Parts Centre for CMS Cepcor has been established through funding-package support from HSBC UK

business - CMS Cepcor Americas – has been established to directly serve these markets.

With the expanded manufacturing capabilities, CMS Cepcor plans to increase staff headcount by 20% in the next two years across all areas of its business.

Matthew Weare, the company’s managing director, said: “Following sustained growth in all business areas, we were fast reaching capacity at our manufacturing facility and headquarters. We needed a new site

expansion of our manufacturing site to keep up with rising demand from our global customers.”

Roger Pratt, area director for Corporate Banking for the East Midlands, HSBC UK said: “HSBC UK’s global reach means we’re well placed to support CMS Cepcor’s export growth with efficient multicurrency banking, local market knowledge and foreign exchange expertise.”

The organisers of Hillhead 2020 say that demand for space at next summer’s event is at a record high.

The UK quarrying, construction and recycling exhibition takes place from 23–25 June 2020 at Hillhead Quarry, near Buxton.

The organisers say that the outdoor floorplan is close to being

finalised with over 90% of space already sold. In addition to the usual Hillhead regulars, this year’s extension to the showground has allowed a plethora of new companies to attend including Yanmar, Hidromek, MB Crusher, Magni Telescopic Handlers, McLanahan Corporation, Merlo UK, Arjes (Doyle

Machinery), BHS-Sonthofen, and DAF Trucks.

The organisers say that demand for indoor space has been “unprecedented” with both the Main Pavilion and Registration Pavilion filling up quickly. Companies exhibiting for the first time include Balluff, Criptic-Arvis, Petro-Canada Lubricants, Senseye, Bonomi Group, Crush+Size Technology, Twin Disc, Lubas, Simbas, Vulkan Industries, Henkel Loctite, Sulzer Pumps, Yudin Equipment, and TCE Transmission.

Event manager Harvey Sugden said: “We know that Hillhead is an extremely popular show in the industry calendar and we always have an excellent response from exhibitors, but this year the demand has been overwhelming.”

The chairman of the managing board of HeidelbergCement, Dr. Bernd Scheifele, and the Norwegian state-owned energy group Equinor have signed a memorandum of understanding on carbon capture and storage (CCS) at an international energy conference in Oslo.

Since 2011, HeidelbergCement’s Norwegian subsidiary Norcem has been running a project dedicated to CO2 storage in the cement industry at its Brevik cement plant. The CCS project ‘Northern Lights’, which includes the project at the Brevik cement plant, has been initiated by the Norwegian government in three different industry sectors. According to the plan, the captured CO2 emissions are to be transported to empty oil and gas fields beneath the North Sea beginning in 2023 and stored there permanently. The Norwegian government shortlisted Brevik for an industrial-scale CO2 capture trial at the start of 2018.

Dr. Bernd Scheifele, chairman of HeidelbergCement’s managing board

The memorandum of understanding signed with Equinor on Thursday 5 September is a further step towards realising this CCS project. The agreement also includes the intention to examine the possibility of capturing CO2 at other HeidelbergCement plants for storage within the Norwegian continental shelf. Additionally, both companies will work on optimising

the CO2 transport chain and strive to implement CCS as a Europe-wide solution for CO2 disposal.

“At our Brevik cement plant, we have shown that we are able to capture carbon dioxide at an industrial scale,” says Dr. Bernd Scheifele. “Our CCS project is currently the most technically mature in the cement industry. We plan to capture around 400,000 tonnes of CO2 per year at Brevik, which corresponds to around 50% of the plant’s total carbon emissions.”

HeidelbergCement is set to reduce its specific net CO2 emissions per tonne of cement by 30% compared to 1990 levels by 2030. This target has been approved by the Science-Based Target initiative (SBTi) and is in line with the goals of the Paris Agreement, making HeidelbergCement the first cement company worldwide to have approved science-based CO2 reduction targets.

Aggregate Industries, a leading player in the UK construction and infrastructure industries, is rolling out its new digital platform, ‘LOOP’.

Launched this month as part of what Aggregates Industries says is its drive to “revolutionise the customer journey”, LOOP combines a number of complementary digital systems designed with Aggregate Industries’ customers at its heart, which will work together to further improve business customers’ service experience.

The first tool launched as part of LOOP is ‘LOOP – Order Tracking’ - a real-time system that allows customers and hauliers to access order and delivery information all on one convenient system.

By using LOOP - Order Tracking, customers can manage multiple orders at any one time, removing the need to log in to websites, download apps, create passwords, and remember order numbers, saving valuable time. It therefore allows for improved efficiency both

on site and within teams, enabling the customer to accurately plan when orders will arrive, managing workload and team availability accordingly. LOOP – Order Tracking will be rolled out across Aggregate Industries’ Express Asphalt, London Concrete, Ready-Mixed Concrete, Asphalt and Aggregates businesses over the coming months.

Chris Hudson, managing

director of Asphalt at Aggregate Industries, said: “As a market leader in the construction industry we’re constantly looking at ways to stay ahead of the game. LOOP has been developed as a simple, modern way to improve our customer service, streamlining efficiencies and making it as easy as possible for our customers to work with us.”

Building materials group LafargeHolcim has appointed Magali Anderson as its first chief sustainability officer. The company says the move accelerates its efforts to be an industry leader on decarbonisation, circular economy, health and safety and corporate social responsibility.

Anderson takes up the position, which is part of the executive committee, effective from October 1.

LafargeHolcim CEO Jan Jenisch commented: “This will accelerate our vision of running our operations with zero harm to people and contributing to a built environment that will be carbon neutral, fully recyclable and with a positive environmental impact.”

Anderson added: “We are uniquely positioned to be at the forefront of our industry, and we must continue challenging ourselves to create value for all our stakeholders while helping the world build as sustainably and safely as possible.”

Anderson, a French national and a mechanical engineer, has extensive international industry experience, acquired in a variety of general management, operational and functional roles in countries such as Brazil, Nigeria, Indonesia, Angola, Romania and China. She joined LafargeHolcim in 2016 as head of health & safety and the group says she has since significantly improved its safety performance.

Founded in 2016 by a trio of former LafargeHolcim senior executives and entrepreneurs, London, England-headquartered SigmaRoc has grown at an impressive rate in its first three years as an AIM (Alternative Investment Market)-listed buy-and-build construction materials company. Guy Woodford spoke to SigmaRoc CEO Max Vermorken to learn more about the ambitious business’s growth plans

SigmaRoc’s Ronez operations supply the Channel Islands with aggregates, ready-mixed concrete, asphalt and precast concrete products.

Launched just three years ago by Max Vermorken (CEO), David Barrett (chairman), and Charles Trigg (technical director), SigmaRoc has wasted no time in establishing an eye-catching building materials sector portfolio of five small to medium-sized enterprises in England, Wales and the Channel Islands.

The acquisitions and development of its companies helped SigmaRoc achieve a pre-tax profit of £5.5mn in 2018 – 113.8% up on 2017 - and annual revenues of £41.2mn (€45.34mn) – up 52% on £27.1mn (€29.83mn) in 2017.

The group’s first-half 2019 trading was also healthy, with revenues of £29.8mn and pre-tax profit of £3.5mn - up 49.7% and 25% respectively on H1 2018.

The next step, Vermorken tells Aggregates Business, is to generate significantly more revenues and continue to increase pre-tax profits through further savvy acquisitions backed up by informed local market knowledge-led management.

“David Barrett was an entrepreneur who set up a business that was eventually sold to LafargeHolcim. David, Charles and I were all working for Holcim (Northern Europe) and we constantly saw the contrast between David’s entrepreneurial business that was doing very well, and the sector major’s struggle to stay equally dynamic and therefore equally customer-focused,” explains Vermorken, a former strategic advisor to the CEO of LafargeHolcim (Northern Europe),

and a leading figure, along with Trigg, the former group head of Capex at LafargeHolcim (Northern Europe), in the 2015 merger and integration of French building materials giant Lafarge and Swiss rival Holcim.

“We wanted to do something in a decentralised way, and the achievement of SigmaRoc to date is that we’ve been successful in doing that. We run a business model on platforms; platforms consisting of connected companies in a certain region. The effective distance between the end customer and the CEO of the whole group is one person – the managing director running the regional platform. The MD constantly speaks to their customers and I constantly speak to that MD, so I’m very close to the market realities. In all industry where products do not travel far, this is a key competitive advantage.”

SigmaRoc’s three current operating platforms are Ronez in the Channel Islands; Sigma PPG (Precast Products Group) in England; and Sigma SW in Wales. A fourth, in Northern Europe, is in the process of being created after SigmaRoc conditionally agreed in September 2019 to purchase Stone, the Belgian sea defence rock quarrying group.

The Ronez operations supply the Channel Islands with aggregates, readymixed concrete, asphalt and precast concrete products. Operating out of St John’s Quarry in Jersey and Les Vardes Quarry in Guernsey, Ronez offers a full range of highquality construction materials. The firm also undertakes contracting services.

The creation of shipping division SigmaGsy by SigmaRoc has helped with transporting dry-bulk materials to Ronez sites, resulting in higher profits and operational efficiency.

The second platform, Sigma PPG (Precast Products Group), is a cluster of three companies specialising in manufacturing precast concrete products. With locations in North-West, East & Central England as well as London, the companies supply a wide and diverse range of industries, ranging from housebuilders and farmers to sea defences and car parks contractors. Sigma PPG firms are some of the most experienced and innovative in the industry: some operating for over 70 years, while others hold a record number of patents and licences.

Allen Concrete manufactures precast concrete products for the fencing and building industries. Plants in Surrey and Northamptonshire utilise modern production methods and machinery backed by careful quality control for the mass production of a large range of standard products.

The company’s expertise in the field of precast concrete production is based on more than 60 years’ experience and is available to support the manufacture of all types of special units.

The second company in the platform is Poundfield Products, a precast and prestressed concrete manufacturer based in Suffolk. Founded in 1999 to supply the concrete needs of the farming and industrial

community in East Anglia, it developed the UK’s now leading free-standing retaining wall system, the Alfabloc. It was immediately successful and today is manufactured not just in Suffolk, but also under licence in Ireland and mainland Europe.

In January this year, Poundfield Products partnered with American giant Lindsay Corporation to bring to the UK the Road Zipper, a smart-lane separation system made of concrete and with the ability to change lanes in real time.

Another company within Sigma PPG, CCP Building Products is a supplier of concrete products and aggregates in North-West England and North Wales. Its reputation for supplying high-quality, competitively priced product is well known throughout the industry and has been built on the foundations of 60 years of service to the industry.

Its portfolio of annual production includes 1.8 million precast aggregate blocks of one specification or another and over 600,000 paving flags, not including any other bespoke product that is currently manufactured.

Acquired in April this year, GD Harries (GDH) is the cornerstone of the Sigma SW platform. It is one of Wales’s largest independent suppliers of aggregates. Headquartered in West Wales, it operates out of eight granite and limestone quarries – incorporating three asphalt plants. six concrete plants, and a wharf operation, as well as a civil engineering division delivering significant infrastructure projects.

Emphasising the importance of GDH to SigmaRoc, Vermorken, a Dutch national, says: “GDH is a very significant business which offers 80 million tonnes of aggregate reserves. It has a great management team locally. Co-founder Ian Harries is still there with his partner, Janet. It’s a fully-integrated company that is the leader in their local market.

“We are building around strong companies in each of our platforms. We are starting a fourth platform in Northern Europe, again around a main business [Stone] which

allows us to integrate other assets around it. We set our operating region as within two hours’ flight of London. It means you can get there and see what’s happening on the ground and then back on the evening of the same day. It gets you to Scandinavia and to northern France, Germany and the Benelux countries. All of those countries’ markets are of a key interest to us, some more for aggregates and others more for precast concrete and other building materials, depending on the structure of the local market.”

Vermorken says SigmaRoc has brought in experienced aggregates entrepreneur Emmanuel Maes as managing director of its European arm to assist with the development of a Northern Europe platform. “Emmanuel built Group de Cloedt over 10 years from what was a family marine aggregates dredging business into a €240 million annual turnover business that is one of the largest of its kind in Northern Europe. When he left last year, the firm was operating across Scandinavia, the Baltic countries, Germany, France and Holland. He brings a lot of in-depth knowledge of those markets and will help us to target the right businesses.”

In conjunction with the recent conditional agreement to acquire Stone, which operates two quarries, a wharf and a contracting business in Belgium, focusing on armour rock for river and sea defence work, Jacques Emsens has agreed to join the board of SigmaRoc as a non-executive director.

Emsens has previously helped build SCR-Sibelco into a leading materials solutions and specialty sands company. Founded by the Emsens family, Sibelco achieved revenue of €3.5bn in 2018, with operations in 30 countries and employing over 10,000 people. Emsens serves on the board of Sibelco and on the board of Sofina (Société Financière de Transports et d’Entreprises Industrielles), one of Belgium’s largest investment companies.

He is expected to join the board in the coming months, following the completion

of the acquisition of Stone and customary director due diligence.

Further adding to SigmaRoc’s in-house executive expertise is Breedon South CEO, Tim Hall. Hall joined SigmaRoc’s board of directors as a non-executive director on 16 April this year. Hall helped build the Breedon Group into a billion-pound business and one of the UK’s major suppliers of heavy construction materials, through rapid growth and the successful execution of a buy-andbuild strategy.

“We are running SigmaRoc as a decentralised business, firmly in touch with its local customer base.”

Komatsu WA475-10 – Get ready to rumble!

With the Komatsu Hydraulic Mechanical Transmission (K-HMT) that delivers an outstanding combination of ultra-low fuel consumption and massive productivity increase, the all-new WA475-10 is an industry-leading top performer. A unique, independent control of driveline and work equipment eases operation and shortens cycle times like you never experienced before in a wheel loader.

“Tim brings decades of technical and markets’ expertise, including 10 years helping to build Breedon up from zero to a £1 billion a year revenue business,” says Vermorken. “He’s got a good business network right across England and Wales. He’s been operating in those countries for more than 40 years, so he knows everyone.

“We are going through a similar story with a different operating model. He will help steer and guide us, helping us to avoid any mistakes and go faster growthwise than we are now.”

allow you to generate cash through a business cycle even if you are not very profitable, as you are monetising your assets. Quarries are also in short supply. No one wants to live next to one, so it’s difficult to open a new one.

“There are other businesses that we like for their uniqueness. If you take Poundfield Products, for example, when Heathrow Terminal 3 was being rebuilt, all the security barriers around the airport were Poundfield precast products. That is because of the unique structure of type of their retaining wall

new markets and investing in research and development.”

Making critical business decisions and high-level business strategising has long been a feature of Vermorken’s career. Prior to his senior executive role at LafargeHolcim, he worked in private equity at the Luxembourgheadquartered Genii Group, where he reported directly to its founding senior executives. He is keen to emphasise how the SigmaRoc business model places a firm emphasis on localised customer support. “All the major building material players have a central call centre. When someone in South Wales wants a load of concrete, they might have to call, say, someone in Leicester. I’ll bet the Leicester call taker doesn’t know who the caller is and what issues they might be facing, for example traffic or weather issues locally. If you want good customer service, you need to have a call taker in South Wales who knows exactly where the product is coming from, where it’s going and who you are. From an overheads’ perspective, it’s probably slightly more expensive to have localised call takers, but it enables us to have more customers at a better margin locally, because people who buy from us understand they will get the service they need.

I ask Vermorken, who holds a PhD in Financial Economics from University College London, who he considers SigmaRoc’s rivals to be and how his company stands out from them. “There is a company in the U.S. called Summit Materials, that operates a similar business strategy to ours. They started with $500 million in assets and have now got a $3 billion-plus revenues business covering 13 or so platforms in the U.S. and Canada. Given our operating markets, I would not consider them a rival.

“In terms of rivalling us for the companies we are looking to purchase, I would say Breedon in the UK and Ireland. The group hasn’t, as yet, established itself in continental Europe. Because of the language and cultural barriers and the types of localised markets, it is less easy to build a large-scale aggregator of construction materials businesses than in the UK or U.S. Group de Cloedt was also very active in this space over the past ten years under Emmanuel Maes’ leadership.

“The businesses we are after, typically, are too small for a private equity firm to go after; largely due to their cost structure, or a lack of certain expertise. The businesses are also usually too large for family businesses to buy, as they can’t generate enough funding for an acquisition. This creates a gap for transactions worth around £10-£100 million.”

Vermorken says SigmaRoc’s acquisition strategy focuses primarily on acquiring aggregates quarrying companies. “Quarries

system, which has around 20 patents and trademarks with it.

“We buy something that’s already good and clean it up. When I say ‘clean it up’ I mean make it run more efficiently. In some cases, owners simply lacked exposure to management practices developed by larger groups, leaving us the opportunity to improve on their track record. We then start to look at what more we can do with the business that we’ve got. That includes looking at

“We said at the beginning that we could run SigmaRoc as a six- or seven-platform business, that we could run each platform at £10-£12 million EBITDA [earnings before interest, tax, depreciation & amortisation]. That gets you close enough to £100 million EBITDA. We were around £10 million EBITDA last year. It’s fun. We’re, in some ways, changing the way the industry operates, moving away from vertical integration. The opportunity is there, so why not take it?”

With big plans to establish itself in the Northern European building materials market, added to the ongoing development of its three current commercial platforms, it promises to be a very busy next 12-18 months for SigmaRoc. Given their ambitious business model, Vermorken and his management team wouldn’t want it any other way. AB

FOR QUALITY SHAPED PRODUCTS, ESPECIALLY IN HARD ROCK. MOBICONE mobile cone crushers are used in medium-hard to hard applications as well in abrasive natural stone operations. They cover a wide range of applications: from small to medium-sized batches for short-term contractor operations, all the way through to large quantities in tough quarrying operations. The MOBICONE crushers are the perfect match for mobile KLEEMANN jaw crushers and/or screening plants. MOBICONE mobile cone crusher: efficient and strong.

www.kleemann.info

Europe has a clear policy compass when it comes to the aggregates sector, says the UEPG (European Aggregates Association).

In May 2019, the citizens of the European Union (EU) expressed their political voice and elected a new European Parliament.

UEPG accompanied the election campaign with its own manifesto: ‘Sustainable Welfare in Europe needs access to primary and secondary raw materials, which is compatible with environmental management, and provides safe local jobs.’ It was distributed to more than 500 MEPs combined with an invitation to launch the ‘UEPG Policy Compass to Aggregates’.

On Thursday 12 September, UEPG welcomed in their office and garden, members of the European Parliament, policy officers from the Commission, members of NGOs [non-governmental organisations) and companies, in order to present the European aggregates industry and to link EU policies and legislation with issues for our industry. During that evening, UEPG president Thilo Juchem presented to guests the new ‘Policy Compass’ publication.

The purpose of the publication is to present an overview of the domains in which UEPG has expertise, and to link them to the directives that are being worked on by the EU institutions. This way, politicians know whom to turn to when they need support on specific legislative initiatives that are related to:

• Industrial and raw material strategy

• Environment

• Water management

• Climate change adaptation

• Safety

• Health

• Employment

• Technical Standards

• Circular economy

In the description of each topic, UEPG matches live issues with the terminology used by the European institutions. Furthermore, the graph’s form relates to the circular economy, and the use of arrows to move from one topic to the next shows how each topic is interlocked.

The document also offers the opportunity to discover the European aggregates industry’s facts and figures, as it is important to remind others that the aggregates sector is by far the largest non-energy extractive industry in its number of sites, companies, numbers employed, and tonnages produced. AB

• Get your copy of the ‘Policy Compass to Aggregates’ via the UEPG website, http://www.uepg.eu/publications/special-editions

United. Inspired.

Like you, we are constantly on the hunt for higher productivity, smarter solutions and a safer working environment. Built on our automation-ready platform, the new generation SmartROC D65 has evolved into a drill rig that is stronger and more intelligent than ever before. It is groundbreaking innovation that separates a leader from a follower.

A no-deal Brexit is still a very real possibility. Simon Trahair-Davies, partner and head of mining and minerals at Stephens Scown LLP, discusses what this could mean for aggregates businesses.

The free movement of workers in and out of the UK and EU will immediately cease, which will affect the ability of companies to move personnel to and from the UK for business reasons.

The status of UK workers in other EU states will depend on the approach taken by the country in question. Workers from other EU countries already within the UK on the date the UK leaves the EU will (in general terms) be able to apply by 31 December 2020 for either settled or pre-settled status under the UK’s EU Settlement Scheme, depending on how long they have been in the UK.

However, if the UK leaves the EU without a deal there will be no automatic right for EU workers to come into the UK and a company’s ability to transfer an EU worker into the UK will depend on the UK government’s postBrexit immigration rules which (at the time of writing) are still being developed.

Trade tariffs on imports or exports and the introduction of customs formalities at the UK/EU border

The introduction of custom checks and trade tariffs at the borders of the UK and EU could lead to both additional cost but also significant delay in delivering times. These factors may well influence the profitability of commercial agreements, or even make it impossible for businesses to perform their obligations. The risk is that the parties will be required to continue to perform their obligations in full, even if doing so has become commercially unattractive or impossible as a result of Brexitrelated events.

If there is a force majeure clause in a contract, there is the possibility that the company affected will be able to make use of it to protect itself from the consequences of a failure to supply, in accordance with the terms of a contract that has been entered into on the assumption of free movement of goods. A force majeure clause will normally suspend an obligation on a party to comply with a contract if there is an event that is outside its control that prevents it from complying with

“New steps will need to be taken by controllers of personal data where it is being transferred between an EEA country and the UK”

the contract, despite it making endeavours to mitigate the effect of that event.

However, the ability to rely on such a clause will be very fact-specific and will not provide protection where the only consequence of Brexit is that a contract becomes less economically attractive. There may, however, be clauses within the contract that allow for renegotiation of the contract in good faith if there is a material change in economic circumstances, but such a clause would have to be expressly included within a contract for this to be an option for a contracting party.

This could be a concern for companies with UK and EU subsidiaries that have to transfer data relating to employees between the UK and the European Economic Area (EEA).

Currently, personal data can be transferred between the UK and other EEA countries under the General Data Protection Regulations (GDPR). However, on leaving the EU in a no-deal scenario the UK will immediately cease to be a ‘safe’ place to transfer data without the requisite levels of protection in place in the eyes of the European Commission.

Consequently, new steps will need to be

taken by controllers of personal data where it is being transferred between an EEA country and the UK. In due course the UK may well obtain what is called an adequacy decision from the European Commission which will allow the transfer of such data, but in the interim other steps will have to be taken to ensure that transfer to and from the EEA via the UK of personal data can continue, and those may include considering using standard and ad hoc data protection clauses, binding corporate cules or codes of conduct and certification cechanisms. AB

Simon Trahair-Davies is partner and head of the mining and minerals team at Stephens Scown LLP. The firm has more than 70 years’ experience representing mining and minerals clients and its specialist team is recognised by independent guides to the law Legal 500 and Chambers.

Simon can be contacted on 01392 210700 or email solicitors@stephens-scown.co.uk. For more information visit www.stephens-scown.co.uk

A major quarry in North-East England provided the backdrop for one of Terex Finlay’s biggest-ever machine displays.

Raisby Quarry in North-East England is the biggest quarry operated by Breedon Northern, producing 1.2 million tonnes of materials/year.

Aggregates of various sizes for use in construction and asphalt along with agricultural lime are the limestone quarry’s main products, and the amount produced is growing.

Alan Mackenzie is managing director at Breedon Northern, part of the Breedon Group, and included in his responsibilities are 40 quarries; 70 concrete plants; 20 asphalt plants; block-making facilities, and a mobile concrete business. His region covers an area from the Outer Hebrides in Scotland to a line between Scarborough in the east of England to Kendal in the west.

“A lot of our quarries are small units in rural areas and Raisby Quarry is my biggest quarry. It has three benches, including one where we get agricultural lime. We export this to Europe,” he said.

“The quarry was part of Breedon Group’s 2016 acquisition of Hope Construction.

“We sell all the material we produce here, and we have put a lot of equipment into the quarry.

“To help us produce materials throughout our region we use a variety of equipment, including six Terex Finlay mobile crushing trains.

“A lot of our equipment is from Terex Finlay. We have been working with Finlay Scotland for some years, and we get a good service from them.”

And it was in Raisby Quarry at Coxhoe, County Durham, that Molson Finlay and Finlay Scotland in conjunction with Terex Finlay hosted two open days.

Visitors saw live demonstrations of 19 Terex Finlay machines working in aggregates and recycling applications and, among these, the company showcased new machines, including the I-120RS impact crusher (with grinding path option); TC-100 conveyor; TR-75 radial conveyor; the TF-75L low-level feeder and the 883+ triple shaft screener.

Fifth-generation models of the Terex Finlay 693+ and 694+ inclined screens were also previewed in advance of their global launch in Q4, 2019.

Other machines included the J-960, J-1170, J-1480 and J1170DD jaw crushers; C1540 and C1545 cone crushers; I-120RS and I-140RS impact crushers; 873, 883+ and 883+ Spaleck heavy-duty screeners, and the TC 80 conveyor.

Attendees saw working demonstrations of the new OMNI by Terex system, a realtime tablet-based system that is said to improve jobsite safety and efficiency in crushing and screening operations. It provides centralised access and enables the operator to watch, monitor and adjust working equipment from the safety of the cab.

Also on show was Terex Finlay T-Link, a remote monitoring and fleet management system that allows operators to stay connected and keep track of equipment; monitor work progress; manage logistics; access critical machine information; analyse and optimise machine performance, and perform remote operator support. The system is now available on all Terex Finlay machines.

Nigel Irvine, Terex Finlay’s sales and marketing director, said: “Many thanks to Breedon for allowing us access to this site.

and screeners at

“We were here for two weeks getting ready for this successful event, which has seen representatives from 54 companies looking at our latest offerings.

“We now have a complete line of crushing and screening equipment.”

He said that Terex Finlay products go to market through dealers, including Molson Finlay and Finlay Scotland.

In March the Molson Group acquired Finlay Scotland, a long-established equipment dealer of Terex Finlay products in Scotland and the Scottish Islands. Through the acquisition, Molson Group secured the distribution rights for the complete range of Terex Finlay mobile crushing, screening and conveying equipment across Great Britain. At its open days the new machines were introduced.

The Terex Finlay I-120RS direct-drive horizontal shaft impact crusher is a secondgeneration machine, which incorporates the new Terex CR098 impact chamber.

Terex Finlay says that a key component of the crusher is the onboard, innovative quick-detach 3.66m x 1.53m two-deck screen. For applications not requiring recirculation of materials for further processing or stockpiling, the complete screening and recirculating system can be quickly detached from the machine.

Fitted to the machine in the aggregates zone was an optional third apron (grinding path), which is used to give additional reduction for production of a qualityspecified product.

“The impactor can be used in quarrying, demolition and recycling applications and incorporates the ‘proven’ material flow which is our design ethos that is now found

handling uses in quarry, recycling, mining, port and dock, and rail applications that supply a constant feed.

The stockpiler follows the successful introduction of the TC-65 and TC-80 tracked conveyors and is said to be able to cope with a range of applications, from screening light and fines materials to primary crushing applications.

The 30m-long conveyor is hydraulically driven and has hydraulic pin-less height adjustment for both inlet and discharge end of the conveyor.

Equipped with a belt just over 1m wide and a maximum discharge height of 14.3m, the conveyor is rated up to a maximum throughput of just over 360tonnes/hour. It can be hydraulically folded to offer a compact transport envelope.

The new TR-75 radial-tracked conveyor, a stockpiling solution for mobile crushing and screening plants, is said to reduce or remove the use of wheeled loaders on site and can be utilised in a wide range of applications.

Fitted with a 1,050mm-wide belt, the conveyor has a maximum discharge height of 10.9m and with a 135° radial stockpile it gives over 10,000m³ of material with the option of an automated stockpiling mode. The conveyor moves radially and raises discharge height thus preventing material segregation on discharge,

Terex Finlay says its new TF-75L low-level feeder has been designed to maximise productivity, enhance efficiency and reduce on-site operational costs in a wide variety of applications. It estimates that the savings of running such a feeder can be up to 80%, and its new 3.5m-wide tracked TF-75L feeder with a 7m³ hopper and feed height of 1.9m offers low-level feeding from excavator, crane grabs and wheeled loaders.

speed main conveyor can handle up to 500tonnes/hour of materials, depending on the feed material and working angle of the machine. The 9.8m maximum discharge height provides a maximum conical-shaped material stockpile capacity of 1,735m³.

Also new is the Terex Finlay TF-75H high-level feeder that permits operators to directly discharge to hopper/feeder from

used for a metered or controlled feed of material when working as part of a crushing and screening train or in stand-alone

Developed for sticky, difficult and dry applications, including quarry, mining, sand and gravel, construction and demolition debris, and recycling, the 883+ tripleshaft screener features two 4.8m x 1.5m screening decks.

The triple-shaft design employs an oval-motion stroke combining linear and circular amplitude to generate an aggressive screening action, reducing plugging and binding over the screen decks.

Multiple media configurations, including bofors bars, finger screens, woven mesh and punch plates, are available for a wide range of applications from fine screening to heavy

Terex Finlay is expanding its 6 Series product range with the introduction of the 694+ WS inclined screen, which incorporates improvements made to the

The company says the key difference between the models is the new screen box, which provides three 6.1m x 1.7m inclined screens, giving a larger screening area, resulting in higher capacities.

As standard, the machine is fitted with a 650mm-wide transfer with the extended options available, and the fourth product (oversize plus) conveyor maintains the slew and tilt functions for onsite flexibility and closed-circuit applications.

Omni gives a previously inaccessible level of control to multiple mobile crushing and screening machines from a central location.

2 x remote camera views per machine greatly reduce the time the operator has to be out of the safety of the cab.

One-touch pause & ability to make multiple machine setting adjustments.

Understand operational metrics and warnings as they happen to ensure maximum uptime.

MULTI-USER Omni offers exceptional visibility by connecting to another tablet (sold separately)

A Hitachi wheeled loader is helping to drive production in a market where limestone can be more profitable than marble. Liam McLoughlin reports

APortuguese limestone supplier has added a Hitachi ZW310-6 wheeled loader to its fleet to help it maintain high productivity levels at its quarry near the town of Fátima.

The Filstone Natural quarry was established in 2002 by CEO Ricardo Jorge and produces 900,000 tonnes of material per year at the 30-hectare site.

The Hitachi loader is working on the second level of the quarry to load trucks, move limestone between different stockpiles, and feed the crushing and screening equipment. The material being handled by the ZW310-6 is a secondary commodity created by activities on the quarry floor, in which 13-14 tonne limestone blocks are cut. Reserves are currently anticipated to last for the next 100 years.

Jorge said that the Hitachi vehicle is essential to Filstone’s output, especially in a market in which limestone can sometimes be more lucrative than marble.

“We had high expectations for the wheeled loader, but were surprised by its low fuel consumption,” Jorge said. “In addition, the machine is stable and compact, and still performs as effectively as a larger machine.”

At the family-owned company, Jorge’s cousin Humberto Miguel de Jesus Santos operates the ZW310-6. He praised the loader’s “rapid, agile and smooth” performance. “Inside the cab there is near 100% visibility and it is very quiet,” he added. “In terms of maintenance, it has well-positioned access points and is easy to clean.”

At April’s bauma show in Munich, Case Construction Equipment unveiled its ProjectTETRA biomethane-powered wheeled loader concept which can run entirely on alternative and renewable fuel.

The project is intended to enable a shift away from the traditional reliance on diesel engines. The concept includes a methanepowered engine, specially designed and developed for construction applications by Fiat Power Train (FPT) which, like Case, is part of the CNH Industrial group.

Case says the technology already exists, with FPT having already produced 40,000 engines using natural gas, but this is the first time it has been used in earthmoving.

“We plan to bring it to market in a few years,” said Massimiliano Ventura, product manager for wheeled loaders, Case Europe. “It’s still in the early development stage, but there was a lot of interest from the reveal at bauma.”

Carl Gustaf Goränsson, president of construction at CNH Industrial, added: “This technology is already tried and tested in other CNH Industrial brands as there are some 28,000 methane-powered IVECO trucks and IVECO bus vehicles on the roads today.”

Case is seeking to challenge the established European players in the loading sector and build its market share. Asked about the company’s targets in the wheeled loader/excavator market in Europe, Alain de Nanteuil, product director, general construction at Case CE Europe, responded: “Becoming among the first choices for heavy equipment and being at the front of customers’ minds when they are making these decisions.”

He added that aggregates customers are looking to make their production more efficient and want to cut down their fleet costs without compromising their output. “Moreover, climate change is becoming a major concern globally and heavy-line customers need solutions/products that are not yet available on the market,” de

Nanteuil said. He added that Case will address all those needs, leveraging strongly on alternative energies, automation and digitalisation.

In July Case showcased a range of its loaders, dozers and excavators at the 500-acre Maltby Colliery site in South Yorkshire, England.

Equipment on display at the CASE Eagle Days press and customer events held on 15-1 6 July included the 721GXR, 821G and 1121G wheeled loaders; the 1650, 1850 and 2050 dozers (both fitted with Leica Geosystems); the CX300 and CX145 excavators (both with Steelwrist tiltrotators); and the SV300 skid-steer loader.

CASE Construction Equipment is upgrading the engines on its vehicles to meet the Stage V exhaust emission legislation for off-road engines. The first stage of the European Union legislation came into effect in January 2019 for engines below 56 kW as well as engines of 130 kW and above. From January 2020 it will apply for engines from 56 kW but below 130 kW.

“We will upgrade our engines to be Stage V-compliant by 2020 on all our machines in Europe, including loaders and excavators,” said Ventura.

Doosan has also been outlining its Stage V plans and says it will extend new Stage V-compliant models across the company’s entire excavator range by mid-2020.

The newly launched Doosan DX300LC-7 30 tonne model – used in the construction and demolition sectors – is the company’s first mid-sized Stage V crawler excavator. It is now being joined by the 36 tonne DX350LC-7 model – suitable for construction, demolition and small quarries – which is available to European customers from October.

Stage V ‘-7’ models of the rest of the crawler excavator range are due to be available by June 2020, according to Stephane Dieu, excavator product specialist and sales trainer for Doosan Infracore Construction Equipment EMEA.

The range covers the 40 tonne DX380LC-7 (due to be available to European customers in Q1 2020), in addition to the larger DX420LC-7, DX490LC-7 and DX530LC-7 machines which are suitable for quarrying. These models will have the same improvements as the DX300LC-7, including 360° cameras fitted as standard that provide full visibility around the excavator and allow the operator to see a top-down view of the area outside the machine. The camera array comprises a front camera, two side cameras and a rear camera - the same set-up will be used when the larger models are rolled out.

Also standard is a new 8-inch touchenabled colour LCD gauge panel to provide more information via a 30% larger screen, and a stereo system integrated in the gauge panel.

Available as options on the ‘-7’ range are LED lights to improve visibility of the excavator, side protection, an air compressor, ultrasonic detection of obstacles, and a smart keyless start system.

Speaking at the Doosan Quarry Days event held in mid-September in the Czech Republic, Stephane Dieu told Aggregates Business that the new smart power control (SPC) on the ‘-7’ range will give greater fuel economy. “Instead of having fixed RPM the excavator will adjust it to save fuel, depending on what activity you are doing,” said Dieu. “Digging needs power while less is required for lifting or emptying the bucket. SPC will improve fuel consumption by 5-7% compared with the previous models.”

The first Caterpillar 988K XE wheeled loader to operate in Europe has been proving its worth in load-and-carry

operations at the Natursteinwerke Nordschwarzwald (NSN) limestone quarry in Germany.

Fifteen years ago, NSN installed what was then the most modern fully automated gravel plant, in South Germany. “One of the areas we decided to focus on, was how fuel consumption could be further reduced without sacrificing production output,” said Stefan Pendinger, operations manager of NSN in Magstadt in the northern Black Forest region where limestone is extracted. The company purchased a Cat 988K XE with a high-efficiency electric drive system for its Magstadt plant for its load-and-carry operation.

Since then another unit has been introduced to the NSN quarry in Enzberg, north of Stuttgart. The loader features switched reluctance (SR) technology and leverages more than 15 years of Cat electric drive experience. The C18 ACERT engine, mechanical dropbox, driveline and axles from the 988K remain in the electric drive machine for consistent, trouble-

free operation. On average, around 1.5 million tonnes of limestone are extracted and processed into crushed rock, grit and sand and it is used in construction, civil engineering, and landscaping.

Construction aggregates supplier Hanson has acquired a Cat 986K wheeled loader in a deal with Caterpillar dealer Finning UK & Ireland.

The loader is the penultimate addition in a series of new Caterpillar vehicles added to Hanson’s fleet as part of a 31-machine deal struck in 2018 and will be in operation at Hingston Down Quarry in Cornwall. Hanson has worked extensively with Finning over many years, building a strong relationship that has led to a number of ongoing projects with the business.

The Cat 986K features powershift transmission, torque converter with lock-up clutch and axle shaft disc brakes. Hanson says the machine was chosen for its compact sizing and advanced technology features.

The vehicle’s VisionLink feature offers insight into the health, location and productivity of the machine, and is designed to help increase productivity, control costs, improve operator performance and ensure safety on-site.

Volvo CE says that its EcoOperator training is helping its customers around the world to slash fuel consumption, machinewear costs and environmental impact. One such company to embrace the training is Algerian limestone quarrying company SAPAM, which has a programme that focuses on improving operator behaviour to benefit fuel consumption, machine wear and uptime – ultimately boosting profitability.

The one-day course teaches operators to drive sparingly on site without affecting productivity. Although machines in drive mode are restricted to using ‘half gas’, they are able to take on the same workload and complete it at the same rate. This means fuel costs can be cut by up to 25%, improving company profits and reducing environmental impact. AB

Jordan Handel, engineering and technology manager at Proof Engineers

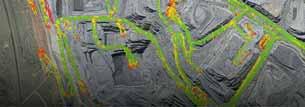

Using state-of-the-art technology to create optimum quarry haul roads is an attractive option for aggregates processing operations looking at ways of improving their production efficiency. Guy Woodford reports

Haul road specialist Proof Engineers has developed an advanced road-building program using the latest technology to design and construct haul roads that can handle high volumes of heavy quarry, mine, large civil construction and earthmoving site vehicle traffic and withstand weather erosion. Proof Engineers’ Haul Road Development Program (HRDP) focuses on innovative practices to produce durable, high-quality roads that reduce maintenance costs, while improving operating speeds and wet weather recovery.

The cutting-edge program encompasses all aspects of building haul roads, from site analysis and resource evaluation through to material selection, training and maintenance monitoring. Proof Engineers is an Australian-based company that utilises state-of-the-art technology to deliver road engineering of a superior standard on a global scale.

Specialising in haul road performance and optimisation, Proof Engineers improves sites’ operational efficiencies specifically through haul road design, construction management, maintenance programmes and monitoring solutions.

Sydney, Australia-headquartered Boral, a major international construction materials group, is among those that have been trialling HRDP to assess its impact on haul road driveability and dust levels at several of its work sites.

Proof Engineers’ engineering and technologies manager, Jordan Handel, said the HRDP’s construction methodologies were achieving high-quality roads within their clients’ budget and equipment limitations.

“Our latest design technology is used to construct roads with improved strength, functionality and drainage,” he said.

“Roads developed with HRDP have optimal rolling resistance and require significantly less maintenance, which adds up to considerable savings for our clients.

“Haul roads constructed with our HRDP require up to five times less maintenance compared to a poorly-constructed haul road.”

HRDP consists of four essential steps in order to achieve quality roads within a quarry, mine, large civil construction or earthmoving site’s operation budget and equipment limitations.

The first step is a full site evaluation, focusing on meteorological and environmental conditions that will impact design and construction, as well as the available resources to determine if the site has adequate equipment, raw materials and local skills, or if outside resources are required. Step two of HRDP evaluates and analyses all design parameters and utilises innovative technology to generate a mechanistic design that considers the selected materials and site-specific traffic conditions.

In this step, Proof Engineers considers the use of stabilisation products such as polymer additives, hydrated lime and bitumen emulsions to improve the quality of local materials in order to reduce costs.

The third step of HRDP is the construction phase: a site-tailored process involving drainage and compaction as well as the training of site personnel.

Step four involves ongoing maintenance to ensure haul roads are operating at a high level, with continuous training of site personnel to ensure roads are correctly maintained and not further damaged in the long term.

“The HRDP was developed by Proof Engineers on the premise that proper construction of quality haul roads will significantly reduce a mine site’s maintenance costs as well as decrease production cycle times,” Handel added.

“The program involves all aspects of haul road construction with a focus on material selection and construction methodologies that meet the highest standards based on optimum engineering properties such as functionality and strength.”

Proof Engineers has developed stateof-the-art road condition monitor (RCM) and dust monitor (Dustective) systems for quarry and mining operators to observe road conditions, prioritise maintenance works, improve operational efficiencies and reduce production cycle times.

The Proof Engineers’ team has a broad range of skill sets from practical, hands-on site personnel to research and design engineers, with experience in the civil and mining industries as owners, contractors and consultants.

Gallagher Aggregates has invested in two Volvo A60H articulated haulers as its prime movers for hauling Kentish Ragstone at its Hermitage Quarry near Maidstone in Kent, Southeast England.

Following an initial enquiry made at last year’s Hillhead exhibition near Buxton in Derbyshire, central England, the 55-tonne capacity A60H was trialled by Gallagher Aggregates to assess the suitability of introducing an articulated hauler of this

size to the Hermitage site. “We were impressed with the tonnage moved for a very economical fuel burn, together with fast cycle times,” said Gallagher Aggregates’ operations manager, Pat Gooney. “It certainly proved to be a success in all areas of the quarry’s production and was an immediate hit with our operators. The two new trucks are carrying out the same production as the three 50-tonne trucks they replace, and we are already seeing the immediate benefits when it comes to fuel consumption and the savings on running costs, whilst maintaining the production we require.”

Tailored to Gallagher Aggregates’ needs, the two A60Hs have had additional features fitted to them including 200mm side extensions coupled to a cantilever tailgate, increasing the hauler’s body capacity to 39m³ and maximising payload. To give extra protection to the hitch area and cab, optional front spill guards have been added to the front of the skips. This configuration allows the trucks to handle all on-site duties, which include hauling blasted material from the face to the primary crusher, along with some secondary duties around the plant. Working ten-hour shifts Monday to Friday, with half a day on Saturday, the two new A60Hs will contribute to the annual output of the quarry.

“Again, we are really impressed with the power of the trucks, especially on the gradients with the typical payloads they are carrying” said Gooney. “The new arrivals are proving very popular with their operators too. The cab is extremely comfortable and has been well thought out in its design. The two-speed reverse and fast tip and lower functions add to the overall faster cycle times, and Volvo’s unique suspension system provides excellent load retention and operator comfort.”

Terex Trucks’ northern Germany dealer, Maschinenbau Rehnen, recently exhibited an updated TA300 articulated hauler at the NordBau construction exhibition in Neumünster, a city in northern Germany. Speaking ahead of the showpiece event staged 11-15 September, Marcel Wimker, machine sales leader at Maschinenbau Rehnen, said: “Terex Trucks’ TA300 is an eye-catcher and last year we had a lot of interest in this robust and reliable articulated hauler. Visitors typically want to see the TA300 up close and sit in the cab to get a better feel for the machine. This usually plays a decisive part in the buying decision.”

Maschinenbau Rehnen became an official Terex Trucks dealer in Q4 2018. Wimker continued: “From the feedback we’ve received so far, our customers are incredibly happy with the machines because they are so reliable – that’s why customers who’ve owned or operated a Terex Trucks articulated hauler before are loyal to the brand and make repeat

Maschinenbau Rehnen recently exhibited an updated Terex Trucks TA300 articulated hauler at the NordBau construction exhibition in Neumünster, Germany

purchases. They know that the brand stands for great performance, quality and low total cost of ownership. We currently have six TA300 articulated haulers, four are rented out with customers and two are reserved and will be with customers shortly.”

Since August 2018, the TA300 has incorporated the new transmission which comes with two additional forward gears –eight in total – as well as four reverse gears. This helps to ensure smoother gear shifting and thereby superior operator comfort. In addition to this, the TA300 now delivers a

5% improvement against its predecessor in fuel efficiency, as well as enhanced performance and productivity. It also now comes with long-life transmission fluid which has helped to increase the length of time between oil maintenance intervals from 1,000 to 4,000 hours.

The hauler’s maximum speed has also increased to 55 km/h, up from 50 km/h. Ultimately, this means that customers can achieve faster cycle times, reduce the cost of operation per tonne and minimise their fuel consumption. AB

Metso’s Metso Metrics solution for aggregates customers helps monitor, maintain and manage clients’ assets

Fully utilising the latest preventive machine maintenance technology can help save aggregates production business owners big money annually. Guy Woodford reports

Crushing and screening equipment are key assets that keep aggregate producers’ businesses running smoothly and efficiently. But with mobile crushers moving frequently between sites, often in remote areas, it can be difficult to track, monitor and maintain these types of equipment to ensure their performance. Without having the right information at the right time to make important operational or maintenance decisions, extended downtime can quickly set in and production rates can suffer, challenging producers bottom lines.

Metso’s Metso Metrics technology for aggregates customers helps monitor, maintain and manage clients’ assets.

Connected equipment is ensured by many advanced sensors installed on each plant, tracking various elements around the performance of the machine.

An intuitive interface, accessible through any internet-connected device, allows the customer to know exactly what is happening with their equipment 24/7.

Metso teams, combining global and local expertise, can also use Metso Metrics to monitor customer assets, allowing them to better meet customer plant maintenance and servicing needs and helping to troubleshoot issues remotely.

Fitted as standard on Metso Lokotrack LT mobile jaw and cone crushers and Lokotrack ST mobile screens since its launch in 2016, Metso Metrics for Aggregates can also be retrofitted on older plant models.

From Metso Metrics for Aggregates, users can see key data for their whole fleet connected to Metrics. When logged in, the user can see right away combined data from their fleet in KPI (key performance indicator)

windows. This includes fleet operating hours, fuel/power consumption, next maintenance events and machine location for each machine. There are many other KPI windows and users can customise their main page view to show what they want to see when they log in.

Users can also open and see machinespecific data sheets by clicking the machine from the fleet. From here, users can see how the machine has been running each day during the time it has been connected into Metso Metrics. Data shown for the machines are operating hours, fuel/power consumption, upcoming maintenance events, maintenance log, alarm log, parameter changes and machine location. If belt scales are installed, then it’s possible to show tonnage data in Metso Metrics from the machine.

Users can run different reports from their fleet or specific machines in Metso Metrics. Also, users can order email notifications for upcoming maintenance events and active alarms about which users want to be notified.

The benefits of Metso Metrics can be summarised under three headings:

Get the most out of assets - Critical maintenance and operational data at the touch of a button, helping a company identify underperforming assets and training opportunities for continuous improvement. With access to the right data, a firm can take appropriate actions for improved utilisation rates and operational efficiency, so it gets the most out of its assets.

Improved operational efficiency - Helping to reduce routine site checks and manual reporting by providing remote visibility and reporting on the condition and performance

of a company’s productive crushing and screening assets.

Lower operational costs - Helping to lower a business’s inventory costs by mapping out which parts are required for upcoming service events. With the maintenance plans of its equipment integrated into Metso’s solution, a firm can stay on top of its equipment needs and make sure it has the right parts available at the right time, helping to control maintenance and upfront inventory costs.

The state-of-the-art Metso Metrics technology is popular among quarry customers and plant hire companies.

Anthony Ryan, sales manager for McHale Plant Sales, based in Tipperary, Ireland, says Metso Metrics is “very useful” for preventative plant maintenance and servicing.

“We can predict when a plant service is needed, allowing us to better prepare our engineers. Also, if you get a call from a customer saying that a plant alarm is on, you can see where on the plant the alarm has been activated and offer appropriate advice.