ALLU Transformer screener crusher is a hydraulic attachment for wheel loaders and excavators. Screen, crush, mix, separate and load in one step operation several different materials e.g. oil shale, rubble and limestone. The Transformer is technology which will redefine your industry. More production, more mobility and greater efficiency.

TRANSFORMING your efficiency – faster processes with ‘one step operation’.

TRANSFORMING your green credentials – less material transportation at the jobsite equals less fuel consumption.

TRANSFORMING your machines – your excavator/ wheel loader will transform into a multifunction tool that’ll screen, crush, mix and load in one step operation – with just one ALLU Transformer screener crusher.

HEAD OFFICE

EDITOR: Guy Woodford

ASSISTANT EDITOR: Liam McLoughlin

CONTRIBUTING

EDITORS: Patrick Smith, Dan Gilkes

EQUIPMENT EDITOR: Mike Woof

DESIGNERS: Simon Ward, Andy Taylder, Stephen Poulton

PRODUCTION MANAGER: Nick Bond

OFFICE MANAGER: Kelly Thompson

CIRCULATION & DATABASE MANAGER: Charmaine Douglas

INTERNET, IT & DATA SERVICES DIRECTOR: James Howard

WEB ADMINISTRATORS: Sarah Biswell, Tatyana Mechkarova

MANAGING DIRECTOR: Andrew Barriball

PUBLISHER: Geoff Hadwick

CHAIRMAN: Roger Adshead

ADDRESS

Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612055

FAX: +44 (0) 1322 788063

EMAIL: [initialsurname]@ropl.com (psmith@ropl.com)

ADVERTISEMENT SALES

SALES DIRECTOR:

Philip Woodgate TEL: +44 (0) 1322 612067

EMAIL: pwoodgate@ropl.com

Dan Emmerson TEL: +44 (0) 1322 612068

EMAIL: demmerson@ropl.com

Graeme McQueen TEL: +44 (0) 1322 612069

EMAIL: gmcqueen@ropl.com

SUBSCRIPTION / READER ENQUIRY SERVICE

Aggregates Business International is available on subscription. Email subs@ropl.com for further details. Subscription records are maintained at Route One Publishing Ltd.

SUBSCRIPTION / READER ENQUIRIES TO:

Data, Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612079 FAX: +44 (0) 1322 788063

EMAIL: data@ropl.com

No part of this publication may be reproduced in any form whatsoever without the express written permission of the publisher. Contributors are encouraged to express their personal and professional opinions in this publication, and accordingly views expressed herein are not necessarily the views of Route One Publishing Ltd. From time to time statements and claims are made by the manufacturers and their representatives in respect of their products and services. Whilst reasonable steps are taken to check their accuracy at the time of going to press, the publisher cannot be held liable for their validity and accuracy.

PUBLISHED BY © Route One Publishing Ltd 2020

AGGREGATES BUSINESS INTERNATIONAL USPS: is published six times a year. Airfreight and mailing in the USA by Agent named Air Business, C/O WorldNet Shipping USA Inc., 156-15 146th Avenue, Jamaica, NY, NY11434.

PERIODICALS POSTAGE PAID AT / US POSTMASTER

ADDRESS CHANGES TO: Aggregates Business Europe, Air Business Ltd, C/O WorldNet Shipping USA Inc., 156-15 146th Avenue, Jamaica, New York, NY11434

PRINT: ISSN 2051-5766

ONLINE: ISSN 2057-3405

PRINTED BY: Warners (Midlands) PLC

What do you get when you marry the world’s biggest-consuming nation of aggregates, by a massive margin, with a round-the-clock work ethic and huge government financial backing? The answer is the Chinese green quarrying revolution.

I was among more than 1,200 attendees, including many international guests, in the audience at the 6th China International Aggregates Conference in the city of Wuxi, eastern China, when China Aggregates Association (CAA) president Hu Youyi gave a keynote speech on how a comprehensive switch to environmentally minded production, coupled with the ecological development of quarries and their neighbouring areas was the only option to secure the long-term sustainability of the country’s aggregates industry.

Chinese aggregates demand currently accounts for 40% of the overall 50 billion tonnes of annual global aggregates demand. But while national government investment in infrastructure projects such as the Belt and Road Initiative (an up to US$8 trillion global development strategy adopted by the Chinese government in 2013 involving infrastructure development and investments in 152 countries and international organisations in Asia, Europe, Africa, the Middle East, and the Americas), and the need to house 300 million people as part of continuing national urbanisation, drive up aggregates demand, the green quarrying agenda has become president Xi Jinping’s government’s key focus for the national aggregates industry.

As a result, future Chinese quarries will have four development models: Aggregate 1.0 – green environmental protection aggregate plant; Aggregate 2.0 – extending the aggregate industrial chain; Aggregate 3.0 – green building materials industrial park; Aggregate 4.0 –eco-industrial park based on a quarry.

Expanding on his speech during an interview with me the following day, which forms part of the feature titled ‘China’s green quarrying

the

revolution’ in this issue of ABI, Hu predicted that 80% of Chinese quarries will reach the required green standard within five years. This rapid adoption of the green quarrying concept would, he said, be achieved with the help of the Chinese government and the CAA, but also, crucially, through the hard-work and efficiency of quarry operators and their employees.

In response to my gentle scepticism about the five-year prediction, Hu said: “We can dismantle a bridge and build another in one day. A 1,200-bed hospital in Beijing can be built in just one week, if demand dictates.” Having seen first-hand over several years how the Chinese quarrying sector has evolved in terms of the integration of more premium plant technology, leading to an improved final aggregate product, I can see why Hu is confident about the swift realisation of the Chinese green quarrying vision.

As well as attending the conference in Wuxi, I visited Xinkaiyuan quarry in Huzhou, northern Zhejiang province, around two-and-a-half hours drive south-west of Wuxi. In 2010, the quarry was one of the first batch of recognised green quarries in China. You can read my thoughts on what was a fascinating tour of the site in ABI March-April 2020 issue’s Quarry Profile feature. In the same issue you’ll also find a wide-ranging interview with Fang Libo, general manager of SBM Industry and Technology Group (SBM), China’s biggest manufacturer of crushing plant and associated equipment and the Chinese market distributor for McCloskey International. I spoke to Fang after a tour of SBM’s impressive museum complex at the group’s Shanghai headquarters.

A business of around 3,000 employees, SBM’s quarrying customer base stretches across China and beyond – with export customers in Africa, South America, South East Asia, India and Australia. The group has big growth plans and, given it’s a Chinese enterprise, it would be foolish to doubt that they will not only fulfil them, but fulfil them in double-quick time. GW gwoodford@ropl.com

All

Global

All

Leading quarry conveyor and associated kit manufacturers are finding their products in big demand globally

The global screening buckets and attachments market is competitive, with innovation and aftermarket support key features of many leading manufacturers’ product offer

Buyers of environmentally sound off-the-road (OTR) retreads are being given discounts and a certificate attesting to the amount of raw

A

Quarry

COVER STORY:

LiuGong’s new global Quarry & Aggregates team is part of the Chinese off-highway machine maker’s increased focus on customer segments

08 INTERVIEW

Njombo Lekula, MD of PPC RSA Cement, talks about the major threat to consumers and the integrity of the country’s cement industry at large

11 QATAR WORLD-CUP BUILD

Qatar has worked hard to overcome major construction hurdles in order to meet its FIFA World Cup 2022 hosting commitments

14 CHINA’SGREENQUARRYING REVOLUTION

The 6th China International Aggregates Conference in Wuxi heard how China is embarking on a green quarrying revolution that will transform the country’s aggregates -production industry

17 LIUGONGQUARRYING& AGGREGATESFOCUS

LiuGong, the Chinese off-highway machine maker, has created a new international team to develop its global quarry and aggregates business

36 CONEXPO-CON/AGG 2020 PREVIEW

The full lowdown on all the major equipment launches and North American product debuts at the big Las Vegas construction and quarrying machine exhibition

43 MARKET REPORT

Vietnam, Thailand and the Philippines have enjoyed recent economic growth and their construction materials markets are being fuelled by high levels of government investment in infrastructure

47 QUARRY PROFILE

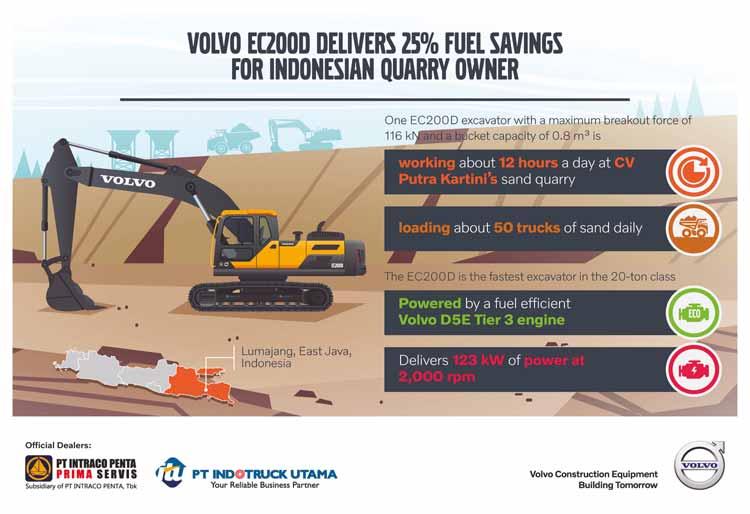

Indonesian firm CV Putra Kartini is said to be making big fuel cost savings by using a Volvo EC200D excavator at its sand quarry operations in Lumajang, East Java

Indonesian cement producer Cemindo Gemilang has become the latest international member of the World Cement Association (WCA).

The company joins as a corporate member of the WCA, whose membership spans 34 countries.

Cemindo Gemilang produces Semen Merah Putih brand cement as well as ready-mix concrete, which is available throughout Indonesia. Cemindo is also a major producer in Vietnam through its Chinfon Cement subsidiary.

Welcoming Cemindo Gemilang as a member, WCA chief executive Ian Riley said: “As we work to address the key global challenges facing the cement industry, in particular the goal of full decarbonisation, it is important that we engage dynamic emerging-market players.”

China’s involvement in infrastructure developments in emerging markets across Asia continues to expand, according to a new report. The GlobalData report estimates the total value of infrastructure projects (including building materials) in which Chinese contractors are at least partially involved at around US$235bn, while in south Asia the project values total US$191bn.

Chinese influence is expanding via the Belt and Road Initiative (BRI), which was launched in 2013 to develop the modernday versions of the land-based ‘Silk Road Economic Belt’ and the ‘Maritime Silk Road’. Under

the initiative, China is seeking to improve infrastructure in emerging markets across the world, facilitating economic development through the companies that are able to transport goods more easily and cheaply between countries along various routes.

Danny Richards, lead economist at GlobalData, commented: “Although wariness has been increasing among the governments in emerging markets over the risks of relying heavily on China for funding and construction contracts, the opportunities provided under the BRI can be attractive for governments with limited funding capacity and rising infrastructure needs.”

In Asia, reflecting political challenges and concerns over the build-up of debt, new governments in Pakistan, Malaysia, and the Maldives, in particular, have been challenging contracts that had hitherto been signed with China or have been delaying progress on existing projects.

Nevertheless, the report states that it is clear that China is heavily influencing the development of infrastructure in Asia’s emerging markets. Based on GlobalData’s analysis, if all infrastructure projects in the pipeline proceed as planned, spending on projects involving Chinese contractors could reach US$64bn in 2020, up from US$23bn in 2014.

The CDP (formerly Carbon Disclosure Project) has raised its rating of Mexican building materials giant CEMEX from B in 2018 to A- in 2019 for the company’s commitment to climate protection.

CEMEX says the rating upgrade reflects its improvement in governance, risk management, CO emissions reduction initiatives, low-carbon products, and valuechain engagement.

Vince Indigo, president commissioner of Cemindo, said that the company wants to become one of the world’s leading building materials companies by adopting innovative and eco-friendly solutions.

To date, CEMEX says it has reduced its direct CO per ton of cementitious product by more than 22% compared to its 1990 baseline, allowing the company to avoid approximately eight million tons of CO2 during 2019, equivalent to the carbon emissions of 1.6 million passenger vehicles.

The heavyweight building materials group is now taking the further steps to reduce its direct CO emissions. These include producing new types of low CO cement, and concrete products; increasing its use of alternative fuels as a substitute for fossil fuels; using waste from other industries as an alternative raw materials

substitute for clinker; expanding and protecting natural carbon sinks from its El Carmen Nature Reserve to all CEMEX quarries; and developing and testing disruptive technologies like carbon capture, technologies.

CEMEX adds that it also plans to reduce indirect CO2 emissions from electricity through the company’s use of renewable energy. Close to 30% of its power consumption

Mahendra Singhi, managing director & CEO – Dalmia Cement (Bharat), and Nilesh Narwekar, CEO – JSW Cement, have been elected as the chair and co-chair respectively of the Global Cement & Concrete Association India (GCCA India).

Serving an initial two-year term, the pair will provide strategic direction and drive ongoing sustainability across the Indian cement sector.

Based in Mumbai, GCCA India took over the work of the Cement Sustainable Initiative (CSI) India (which formerly served as the sector’s sustainability alliance) with its launch last year in July 2019. It focuses on driving forward the key sustainability work underway within the Indian cement sector, in the second-largest cement producing industry in the world.

Speaking at the GCCA India CEO meeting of the member companies in Mumbai, Benjamin Sporton, GCCA chief executive

officer, said: “I’m delighted to have overseen the first CEO meeting of the GCCA India member companies. It is important for the Indian cement sector to continue to work collaboratively on sustainability and innovation work.

“We now have eight major Indian cement companies contributing to the GCCA India work programme. India is a significant market in terms of cement-producing capacity and, with population growth, the growing demand and need for affordable houses and infrastructure, cement and concrete are going to play an important role in the future development of the country.”

Members of the Indian cement industry have been working together to achieve low-carbon growth for the Indian cement sector with GCCA India committed to taking this work forward. Sporton recognised the efforts of UltraTech Cement and Heidelberg India in helping to establish GCCA India.

China as the world’s biggest cement producer.

Research from the World Cement Association (WCA) predicts that India will increase from the 24% market share it held in 2018 to 30% by 2030.

Caterpillar reopened most of its facilities in China on Monday 10 February after getting the go-ahead from local government following the coronavirus outbreak.

The US global off-highway equipment-making heavyweight has multiple facilities in the world’s second-largest economy.

While none of its factories were in the worstaffected province, the company had delayed their reopening after the Lunar New Year by a week.

China accounts for up to 10% of Caterpillar’s sales.

A company spokesperson is quoted by Reuters news agency as saying the manufacturer is following local government direction and monitoring the epidemic’s impact on its dealer network and supply chain.

Meanwhile JCB is reducing production levels at its UK factories due to anticipated component shortages from Chinese suppliers impacted by the coronavirus outbreak.

The equipment manufacturer said the move would mean a shorter working week for around 4,000

JCB and agency shop-floor employees from February 17. This follows an immediate suspension of all overtime.

The measures have been discussed with the GMB union and will see the introduction of a 34-hour week for UK production employees until further notice. JCB employees will be paid for a 39-hour week and will bank the hours, working them back later in the year.

JCB chief operating officer Mark Turner said: “The disruption to the component supply chain in the UK comes at a time when demand for JCB products is very strong, so while this course of action is very unfortunate, it is absolutely necessary to protect the business and our skill base.

“Production in the UK has so far been unaffected by the situation in China. However, more than 25% of JCB’s suppliers in China remain closed and those that have reopened are working at reduced capacity and are struggling to make shipments.”

Turner added that it was therefore clear that the inbound supply of certain components from Chinese partners will be disrupted in the coming weeks as they seek to replenish their stocks.

In contrast China, which accounted for more than half (53%) of global production last year, will decline to 35%.

The WCA predicts that the European Union will double its market share of production from 8% in 2018 to 16% by 2030, while Japan will drop out of the top 10 to be replaced by Pakistan.

To prove deliberate flouting of standards by some third-party cement blenders in the South African cement market, PPC appointed an accredited independent laboratory in September 2017. Njombo Lekula, MD of PPC RSA Cement, reveals that the exercise has unearthed a serious breach of standards, which poses a major threat to consumers and the integrity of the country’s cement industry at large. Munesu Shoko reports

In building or civil construction, cement is the glue that binds the structure together. Yet, Njombo Lekula, MD of PPC RSA Cement, South Africa’s leading cement manufacturer, laments the influx of sub-standard products in the South African market, which are threatening the built environment and placing people’s lives at risk.

Lekula says usage of sub-standard cement has various implications that may negatively affect the sustainability of buildings and structures, thus leading to increased repair or maintenance costs, and in worst-case scenarios, resulting in injuries and fatalities due to structural failures or collapse.

Speaking to Aggregates Business International, Lekula notes that there has been an influx of third-party cement blenders in the South African cement market in the past two years. He estimates that third-party cement blenders, also known as non-integrated cement producers, now account for more than 1.8 million tonnes of cement sales per year, in a market that is selling about 13.5 million tonnes of the country’s available capacity of 18-20 million tonnes per year.

During a normal market surveillance exercise whereby it tests competitor products for benchmarking purposes, PPC found that there was huge quality gap in some of the products in the market, which warranted further investigation. In an effort to protect the wider South African cement industry and the consumer at large, PPC appointed BetonLab, a South African National Accreditation System (SANAS)-accredited independent laboratory in September 2017 to prove intentional thwarting of standards by thirdparty blenders.

“When we realised the extent of non-conformance to standards, we decided to conduct quality checks on a continuous basis. Despite the fact that we have a very capable laboratory, which I consider to be one of the best in the African cement industry, we decided to engage the services of an independent laboratory to ensure transparency and non-bias in the results. We have been monitoring this for about 18 months and the results are shocking,”

The report was recently released and the findings were shared with the National Regulator of Compulsory Specifications (NRCS) and the South African Bureau of Standards (SABS), largely showing continued non-performance of the cement tested.

Explaining the process and requirements, Lekula says the weights of the bags were checked and the EN strength-testing in accordance with SANS 50197 for two, seven and 28 days was performed. The SABS’ prescribed uncertainty of measurement allowance of 2.5% was applied when analysing the resultant data. The results showed the inability to produce a consistent quality product and thwarting of standards in most cases.

“Some of the products failed horrendously,” says Lekula “Firstly, the products failed on bag weight. In some instances, some of the bags were found to be weighing around 46kg, which is 4kg short of the required 50kg. That is unfair to the consumer. Secondly, we picked up products that did not meet the standard in terms of strength development.”

Explaining the strength-testing process, Lekula says the laboratory makes a standard cube of concrete and keeps it in a controlled condition for the prescribed two, seven and 28-day intervals. In any of those intervals, a

LEFT: Njombo Lekula, MD of PPC RSA Cement ABOVE: Integrated cement producers like PPC ensure quality is maintained throughout the process, all the way from the quarry

cube is crushed to measure strength. If a product is a 32.5, for example, it means that in 28 days it should crush at 32.5 MPa. “To give an idea of the extent of the quality shortcomings, one of the products tested crushed at 3 MPa after a 28-day period,” says Lekula, adding that non-conformity of strength and weights of some products ranged from 11% to 73% of the sample set.

The third aspect of concern was the standard deviation. “When we talk about standard deviation, we refer to inconsistency in the product, where fluctuation of quality is a major concern,” explains Lekula. “The failure to conform to local standards not only has an impact on the structural integrity of buildings, but also poses a threat to possible damage of property and even loss of life should the walls come tumbling down.”

It was also found that most of the sub-standard cement products carry the SABS

Njombo Lekula notes that there has been an influx of third-party cement blenders in the South African cement market over the past two years

mark. The SABS stamp is a mark of regulatory approval, instilling trust in the product being sold and, if used in accordance with the instructions, will result in a structure that is robust and safe.

Lekula believes one of the challenges for the relevant authorities in policing the industry is that the two organisations that are responsible – the SABS and the NRCS – are seriously underfunded, which affects their capacity. “Both the SABS and NRCS should be conducting regular surveillance visits on sites to check if producers are compliant at all times. Unfortunately, the two organisations are basically funded by the levies that they collect from the SABS mark and the NRCS trade certificate, and it is not adequate for them to properly fulfil their duties,” says Lekula.

Following PPC’s findings, the results have been presented to both the SABS and the NRCS, and action has already been taken in some instances. “We know of one blender that has been shut down completely by the NRCS due to poor quality. We are also aware that another third-party blender is in the process of being shut down because of non-adherence to quality standards. The SABS is also taking this matter very seriously and is currently looking at random testing. Previously, the SABS would advise entities of dates and time of testing, which allowed companies to adjust standards for complying purposes only,” says Lekula.

large cement producer trying to “bully” small players in the market. In fact, he is of the view that it was a matter of moral responsibility on the part of PPC.

Following these actions, Lekula says there has been an improvement in the quality of the product from some of the non-integrated cement producers in recent months. However, to ensure consistent quality going forward, PPC is lobbying the South African cement industry to self-police. One of the ways of doing that is through capacitating an independent lab like Beton-Lab to randomly conduct tests on every cement producer’s

“We believe that part of our mission as a business is to better the quality of life within the communities we operate. We have a responsibility as an industry leader, and part of leadership is to always do the right thing. Keeping quiet about this non-compliance would have been irresponsible on our part. This non-conformance doesn’t only paint a bad picture on those caught on the wrong side of the law, but the cement industry at large. So for PPC, it was about protecting the industry image and the end user,” says Lekula.

More importantly, Lekula says PPC felt it had the responsibility to protect the vulnerable markets where these low-priced, poor quality cement products are mostly sold. He reasons that these products are mostly destined for price-sensitive markets like rural areas and townships. These are areas where poor workmanship is also commonplace.

into smaller lots as a means to grow the upcoming contractor fraternity. “There is far less infrastructure development in South Africa at this point and it’s no secret that construction companies in the country are disintegrating into smaller entities. There is rapid growth of what we call ‘bakkie builders’ (medium-sized contractors) because most of the available work is in infrastructure maintenance and renovations,” reasons Lekula.

Unlike the big construction companies that had resources to check the cement products they used, the smaller companies don’t necessarily have that capacity to test their own materials, and that’s where the sub-standard cement products are infiltrating significantly. These companies also generally have an insatiable appetite for cheaper products to maximise profits, which places the country’s infrastructure builds at risk.

“The unfortunate part is that this small contractor market also accounts for a big chunk of government-subsidy housing

Qatar has worked hard to overcome major construction hurdles in order to meet its FIFA World Cup 2022 hosting commitments. V L Srinivasan reports

When the Saudi Arabia-led coalition including the UAE, Bahrain and Egypt imposed an economic and diplomatic embargo on its neighbour Qatar in June 2017, the latter was thoroughly shaken initially as the country was in the middle of constructing megainfrastructure projects worth more than US$200 billion in its run-up to holding the FIFA World Cup in 2022.

The gas-rich Gulf nation needed at least 25 million tonnes of construction material such as gabbro, cement and steel for the construction of eight World Cup stadiums, Doha Metro Rail, Lusail City, new ring roads and seaports. Most of the material was routed mainly through Ras Al Khaimah and Fujairah seaports in the UAE, and also by road from Saudi Arabia.

But there was no dearth of companies in the countries beyond the Middle East region coming forward to supply primary construction materials to Qatar. Imports from countries including Oman, Turkey, China, India, Iran, Pakistan, Kuwait and Malaysia, allowed for the timely completion ofa number of projects.

With the nearest seaports in the UAE and Saudi Arabia’s roadway closed for Qatar, the material started arriving into Qatar through its own three sea ports - Hamad, Ruwais

and Doha. Hamad port was opened a few months after the Saudi-led boycott came into force in 2017.

Soon after the Gulf crisis surfaced, the president of Qatar’s Public Works Authority (Ashghal), Dr Saad bin Ahmad Al Muhannadi, said the authority found new markets from which to import building materials at competitive prices for its ongoing infrastructure projects.

“We are coordinating with several countries for sourcing construction materials. We have sufficient stock of construction materials to implement infrastructure development projects and they will be delivered on scheduled time,” said Al Muhannadi, adding that some building materials in these new markets were available at very competitive prices compared to those coming previously from siege countries.

Qatar also started using pipes for drainage and rainwater, lamp posts and some types of steel made by local companies in place of material previously sourced from neighbouring countries. “We were able to provide alternatives

for all materials from different markets, and there is stability in supply of all type of construction materials,” added Al Muhannadi.

In December 2019, Qatar’s Ministry of Municipality and Environment and Qatar Primary Materials Company (QPMC), which is responsible for ensuring unhindered supply of building materials to the local market, decided to recycle the huge volumes of construction waste generated while demolishing hundreds of old buildings and then dumped at Rawdat Rashed landfill near Doha.

The Rawdat Rashed landfill is spread over an area of 7 million m² and has about 40 million tonnes of construction waste, which QPMC realised could be converted into usable aggregate products for many projects linked to the FIFA World Cup and for use after the tournament.

This was done following research conducted successfully by government agencies like the Ministry of Municipality and Environment, Ashghal, Qatar University and some private firms for the last four years.

“We have sufficient stock of construction materials to implement infrastructure development projects and they will be delivered on scheduled time.”

Dr Saad bin Ahmad Al Muhannadi president Qatar’s Public Works Authority (Ashghal)

One of the FIFA World Cup stadiums, Ras Abu Aboud Stadium, which has a seating capacity of 40,000, is being constructed using the shipping containers which transported materials for its development. After the tournament is over, Ras Abu Aboud stadium will become the first fully demountable stadium in FIFA World Cup history.

As many as 158 containers have been delivered to the construction site, with 30 already installed. The fabrication for the steel structure is nearing completion while the fabrication of bleachers, concourse slabs and roof steel continues. Underground utilities, including the drainage network, are more than 50% complete.

Several Qatari construction companies signed agreements with their counterparts engaged in supplying construction material in countries such as Turkey, Oman and India.

Qatar’s volume of gabbro imports from Oman stood at 37,000 tonnes in June 2017 but rose to 633,000 tonnes over the next two years. The number of Omani quarries exporting the material to Qatar also rose significantly - from two to 16.

Doha-based Dolphin Integrated Company (a subsidiary of Rafa Holding) is among the firms which have partnered with Marafi ASYAD, an integrated logistics group owned by the government of Oman, to establish Marafi Sohar, a new company for transporting, shipping and storing gabbro between Qatar and Oman in June 2018.

These firms have also developed an aggregates terminal in Oman’s Sohar Port, which is expected to increase the exports of gabbro and limestone to Qatar. The first phase of the terminal has a loading capacity of approximately eight million tonnes per year and exports a huge volume of gabbro, a coarse-grained rock used in asphalt, and other minerals.The second and soon-to-be permanent terminal phase is equipped with a state-of-the-art stacker-reclaimer system. A conveyor and semi-automated ship loaders will be commissioned later in 2020. Sohar Port terminal’s capacity will be increased to 12 million tonnes after the completion of the permanent phase.

Some two dozen Turkish companies are also presently handling projects worth over $11.6 billion in Qatar. Most of them are geared towards preparations for the 2022 FIFA World Cup. Many Turkish contractors have been bidding for Qatar’s projects as the country starts fast-tracking

In an interview with a Turkish magazine, the deputy general manager of Istanbulbased Expotim-Ladin Group, Cagatay Ersahin, said that Qatar was diversifying its oil-dependent commercial structure with different sectors including construction.

“Turkey has almost been a single largest market in Qatar creating new opportunities and our export of construction material to Qatar exceeded $260 million, as Qatar has been spending $500 million a week for its projects,” he added.

Referans Holding is another multinational company in Turkey, which signed

HBK Contracting has been awarded the main works contract for Ras Abu Aboud Stadium while the same company is part of the joint venture awarded the contract for Lusail Stadium. The scaffolding and formwork services market in Qatar is estimated to be around QR600 million ($163.2 million).

Alternatives identified

Aamal Co., one of the biggest corporate houses in Qatar, has three subsidiaries which are involved in supplying construction material to Qatari infrastructure projects.

While Aamal Readymix manufactures and supplies ready-mixed concrete, Aamal Cement Industries, is engaged in manufacturing and supplying concrete blocks, interlocking paving stone and curb stones. The other subsidiary is Gulf Rocks, which imports and supplies gabbro aggregate from Oman.

The three subsidiaries supplied around one million m³ of ready-mixed concrete, 1.5 million linear metres of concrete blocks, interlocking paving stones and curb stones and one million tonnes of gabbro aggregates between 2017 and 2019.

According to the general manager of the three subsidiaries, Parveez Aslam, they have faced some challenges since the economic and diplomatic embargo imposed in June 2017, not so much due to the closure of a road link by Saudi Arabia but by the sea and air blockade by embargo-backing countries.

“Before the blockade, all the requirement of gabbro aggregates was fulfilled by imports from Fujairah (UAE) which was shipped by sea route. After the ban, we switched to Sohar port in Oman for gabbro imports,” said Aslam.

While Sohar Port was expanding its facilities and capacity to fulfil the Qatari demand for gabbro, the Qatari construction market was affected for some months, but the situation has gradually improved since the beginning of 2018, he added.

In addition, sourcing direct channels to import spare parts and other items, which were imported from the UAE and Saudi Arabia prior to the blockade, presented some challenges, especially on prices.

Overall, Qatar has moved forward quickly by finding alternatives for sourcing materials and promoting made-in-Qatar initiatives wherever it was appropriate, Aslam said.

Pakistan also joined the nations which were helping Qatar and for the first time, one Pakistani company, Attock Cement Pakistan Ltd (ACPL), exported 55,000 tonnes of clinker, valued at around $1.5 million, to Qatar in November 2019.

While gypsum used to make drywall is being imported from Iran, gabbro used in manufacturing asphalt and concrete is now being imported from Oman instead of the UAE.

International rating agency Fitch Solutions feels that with most of the

mega-infrastructure projects in Qatar on the verge of completion, its construction industry is expected to shrink by 4.1% this year.

The development of the transportation system has been completed while most of the FIFA World Cup stadia, hotels and other tourism projects are in the final stages of construction. “These projects have driven rapid but unsustainable growth in Qatar’s construction sector over the five years prior to 2018, which averaged 22.1% annually,” Fitch noted. AB

The 6th China International Aggregates Conference held at the InterContinental hotel in Wuxi heard how China is embarking on a green quarrying revolution that will transform the aggregates production industry across the world’s most populous country.

ABI editor Guy Woodford was one of many international guests among the 9th-12th December 2019 conference’s more than 1,200 attendees

The Xinkaiyuan quarry in Huzhou, eastern China, is a leading example of a ‘green’ Chinese quarry

need to house 300 million people as part of continuing national urbanisation, is fuelling aggregates consumption, green quarrying and realising environmentallyminded commercial opportunities on land surrounding quarry sites has become president Xi Jinping’s government’s key focus for the national aggregates industry.

To help deliver a bold green quarrying revolution, the Chinese government is working closely with China Aggregates Association (CAA), the voice of the Chinese aggregates sector. This led to 10 national government departments jointly issuing on 4th November 2019 a document titled ‘Opinions on promoting the highquality development of the manufactured aggregates industry’. As well as being China’s first official government guidance on the development of its aggregates sector, it was a rare example of a multi-government department promotion of a specific Chinese industry.

Many local Chinese authorities have also adopted CAA’s recommendations in a September 2018 letter outlining how best to safeguard aggregates provision and standardise the production process. Aggregates producers now must

simultaneously complete re-habitation of their sites. Tighter controls have also been placed on the direct extraction of natural sandstone from China’s rivers and mountains.

The green quarrying revolution was the key theme of association president Hu Youyi’s keynote speech at the 6th International Aggregates Conference staged in Wuxi, a city of more than three-and-ahalf million people and a major business hub around two hours’ drive north-west of Shanghai, eastern China.

Hu stressed that China’s five major future sources of aggregates would be natural sand and gravel mining (including river and fairway dredging); construction solid waste recycling; road and other engineering construction slag recycling;

tailings and waste rock resources recycling; and primary mineral stone mine material. The manufactured aggregates processed by primary stone will be the main source of supply in the future.

Future quarries, said Hu, would have four development models: Aggregate 1.0 – green environmental protection aggregate plant; Aggregate 2.0 – extending the aggregate industrial chain; Aggregate 3.0 – green building materials industrial park; Aggregate 4.0 – eco-industrial park based on a quarry. Hu also noted that with the support of 5G technology, digital, unmanned quarries and smart mines in the aggregates industry will become a mainstream trend. The same technology will also see a rapid rise in the intelligent transportation of aggregates and the use of intelligent logistics.

“If we do not make these changes the Chinese aggregates industry will have very low efficiency,” said Hu during an interview with ABI after his keynote conference speech. “We want the industry to develop more inclusively rather than on traditional lines. This will benefit not only aggregates

More than 1,200 aggregates industry professionals, including many international delegates, attended the 6th China International Aggregates Conference

producers but also their surrounding communities. I want to help our industry reach a higher cultural level – that we share the same values as the people in the areas we work in. I also want our aggregates industry to learn from other industries; to adopt good ways of working and learn why other things did not work.”

Hu predicts that within five years more than 80% of Chinese quarries will reach the required green standard. “We will be helping quarries do this through our knowledge. We are also looking to cooperate with professional certification organisations so that quarry operators can receive official recognition for meeting a higher green standard.”

Flexibility is another key aspect of the Chinese green quarrying revolution, according to Hu. “All quarries are different. If a quarry and its surrounding area is big enough, you can look at introducing different elements, such as an eco-hotel. You also need to consider China’s varied climate. For example, in southern China where the weather is much warmer and wet, we can plant a lot of trees and plants to make the area around a quarry very beautiful.”

Hu stressed that many aggregates companies are already adhering to a higher standard of environmental protection than the government requires.

“We have visited other countries to learn about what they are doing around greener quarrying, and I have found that our values and practices in China appear to be at an advanced level. This is not just due to the size of our market.”

I asked Hu if there is a danger that increased aggregates production to meet rising Chinese infrastructure development need may harm attempts to fully implement the admirable national green quarrying plan.

Huzhou Xinkaiyuan Crushed Stone Co. Ltd, which operates the Xinkaiyuan quarry, said: “We have always paid a lot of attention to ecological protection.

Through support from the Chinese government and the China Aggregates Association, we have been able to develop our green quarry concept. In 2010, we were among the first batch of recognised green quarries in China.

“While aggregates demand linked to new infrastructure construction is very high, the speed of our quarry environmental restoration is also very high. China is renowned for its efficiency; our people are very hard-working. For example, we can dismantle a bridge and build another in one day. A 1,200-bed hospital in Beijing can be built in just one week, if demand dictates. We can balance a rise in production with the eco-quarrying plan.”

With its use of waterways to transport its aggregates products, use of production mud waste to create ceramics, electric-powered haul truck, the breeding of animals, such as chickens, to help feed employees, and the sensitive replanting of trees to allow for previously unworked areas of the site to be quarried, Xinkaiyuan quarry, in Huzhou, northern Zhejiang province, is an impressive current example of a Chinese green quarry. Speaking to ABI at the conference about the four million tonnes/ year andesite aggregates production site in eastern China, Yao Yifan, chief engineer of

“For me, there are several main aspects that make a green quarry. You need to make the best of your valuable mineral resources and not waste anything; you need to minimise the quarry’s impact on the environment and look to achieve zero emissions; and you need to know how to run the whole quarry in a good way, with a strong emphasis on product quality and added value. We can see at Xinkaiyuan quarry that after years of effort we can look around and see lots of wild animals and plants on site. We always wanted our quarry to resemble a beautiful garden.”

Song Shaomin, head of the CAA expert committee and professor of materials science at Beijing University of Civil Engineering and Architecture, also spoke to ABI during the conference. On the subject of China’s green quarrying revolution, he said: “Over the past 30 years China has developed very fast, but if we don’t change the way the aggregates industry works, it won’t be sustainable. High-quality aggregates are very important when it comes to ensuring the long life of buildings. Ensuring long life to buildings is the best way to achieve the biggest energy saving and emissions reduction. To achieve highquality aggregates, you need to invest significantly in premium technology and equipment. China wants to express to the whole world how we pay close attention to the environment.” AB

LiuGong, the Liuzhou, China-headquartered global off-highway machine maker, has created a new international team to develop its quarry and aggregates business. Guy Woodford reports

Headed by John Calder as director – Quarry and Aggregates, LiuGong’s new international quarry and aggregates team is part of the ambitious global off-highway machine market manufacturer’s increased focus on customer segments.

An Australian national, Calder has worked with LiuGong for the last two years in product support and brings extensive industry knowledge. After university, where he studied economics and business, Calder worked at International Harvester in Australia for five years. He then joined Caterpillar in Geneva, Switzerland, in 1986, where he held various senior international positions in marketing, sales and dealer development over a 30-year career.

Calder’s new and vastly experienced team will focus on ‘Back to Basics’, lowering quarry and aggregate customers’ costs and making them more productive and more profitable.

“Based on feedback from many customers, the competition seems to be doing it the other way around, so we see great potential to grow internationally. Whereas a lot of the competition are

suffering from cost creep and a focus on their shareholders, our strategy is simple and based on going back to four basic critical success factors: people, product, parts and service, and price,” said Calder.

“Our team is initially targeting a few countries that have large quarry and aggregates industries and knowledgeable dealers for this customer segment already in place. Half the team are also developing training packages for LiuGong field and product support representatives, along with the company’s dealers, focused on earthmoving, and quarrying and aggregates haulers, wheeled loaders and excavators.

“The industry is changing. Some of our competitors have got a little bit complacent. There’s an opportunity for us to relook at customer support seminars, operator training, site assessments with a focus on haul roads and loader platforms. It’s basic stuff to ensure an efficient and well-run quarry or aggregates job site.”

Calder is developing a truly international team that has over 250 years of experience in the quarry, aggregates and mining industries. Containing some of Calder’s former Caterpillar management colleagues

and longstanding dealer associates, the team members are multicultural, speak 10 different languages and are all deep subject-matter experts with sales, marketing, product development, product support, rental and used, finance and dealer development backgrounds. Their primary role will be to work side by side with global dealers to ensure their teams are well trained and focused on the specific needs of quarry and aggregates customers.

LiuGong is well covered product-wise with a well-balanced range that includes large wheeled loaders, 50, 70 and 90-tonne excavators and rigid-frame and wide-bodied trucks. More products and services are also under development.

“We have built a strong portfolio of quarry wheeled loaders and excavators. We have had a lot of positive feedback from customers about the 856H wheeled loader. It’s a good machine around stockpiles and if a customer needs to mix stockpiled material, it’s got enough power to do that. Its fuel burn is reduced due to its new Cummins-powered engine and ZF axles. It’s our flagship wheeled loader,” explained Calder.

“Our 50-tonne and 70-tonne crawler excavators are also performing very well; with quite a lot of units running at 10,000 hours and beyond. We’d like to improve our crawler excavator range even further, and, as part of that, a 90-tonne LiuGong crawler excavator will be launched in certain markets in the coming months. We are also working on new crawler excavator rock buckets and an extension to our dozer and motor grader product lines. This continuous product development means that for most quarry load and carry and stockpile applications, we will in 2020 be able to offer a pretty full range of machines.”

The third critical success factor within LiuGong’s ‘Back to Basics’ approach within the quarry and aggregates customer sector is parts and service. Machines working in quarries are in tough environments with tough materials, so speedy parts replacement and engineering service backup is essential. LiuGong has eight

regional parts distribution centres (PDCs) with local support and is committed to world-class parts availability of 95% within 48 hours.

Calder continued: “In the quarrying and aggregates industry there is always something that’s going to go wrong due to the material or the vibration, so having parts availability is the biggest concern among customers. We’ve just appointed a Global Parts Operations director, a new Global Service director, and a Global Rental & Used director.

“We are not there yet [on achieving our parts availability target]. The challenge is making sure you have the knowledge and experience to identify what are the recommended parts that should be stocked by the dealer, the fast-moving and maintenance parts; what parts should be stocked by the regional PDCs, the fast- and medium-moving parts for some major and more minor repairs, and the headquarter PDC stocking fast-, medium- and slowmoving parts, covering all kinds of repairs and maintenance needs. For example, if you have a catastrophic machine failure due to a fire, you can still get replacement parts.

It’s in the areas of slower-moving parts at the headquarter PDC and the mediummoving parts at regional PDCs that we’ve still got work to do. We are focusing a lot of attention on these areas and are making good progress.”

Calder said the continuing success of LiuGong’s joint ventures was an important part of establishing the firm as a premium global player in all its customer segments, including quarrying and aggregates.

“Our joint venture with Metso in China is going particularly well, and I believe we were on track to make a big impact in the country’s tracked mobile crusher market in 2019. We have other successful joint ventures with high-quality global brands such as Cummins (engines), producing something like 35,000 engines last year in China. Then there’s the 20-year joint venture with ZF axles. We try to have all our products fi tted with world-class components. It illustrates to quarry and aggregates customers globally how much emphasis we place on quality machine parts. We also have a wonderful engineering team that are hugely responsive.”

Calder also highlighted how LiuGong’s state-of-the-art Global R&D Centre in Liuzhou has been at the forefront of research on lowering machine emissions. “We are very keen on being good corporate citizens,” he stressed.

LiuGong sees lower costs and higher profits for customers as the fi nal keys to its success within the quarry and aggregates customer sector. Through high-performance machines using lower manufacturing costs, lower fuel and operating costs and lower parts and service costs through its dealers, LiuGong says it is committed to providing the lowest possible total cost of ownership for its customers.

“I believe our aftermarket costs for our customers are lower than our major competitors,” emphasised Calder. “We are going to be doing more local [parts and service] sourcing in regions to get the best source cost. Chinese companies in general don’t have the same short-term shareholder pressure as some of our major rivals.

“Our obligation is to ensure that this industry stays extremely viable. We need to not become a major disruptor, but at the same time offer fair value and consistent performance. This will enable our credibility to continue to grow, slowly and surely.

“Our goal is to be a world-class international player. We think we’ve got world-class products, and we think we’re getting world-class international people in to help us reach our goal. We should be regarded as an international player rather than just a Chinese one.”

Commenting on LiuGong’s new international Quarry and Aggregates team, Kevin Thieneman, vice president, LiuGong Machinery, who worked with Calder at Caterpillar China from 1996 to 1999, said: “By focusing on the unique requirements of our quarry & aggregates customers, we want to develop enduring partnerships. John and his team are a great addition to LiuGong and are well placed to help LiuGong develop and maintain long-term relationships in this industry segment.” AB

Guy Woodford visited the European headquarters of MAJOR, a leading global manufacturer of high-performance wire screening media, to learn more about the North American firm’s ambitious expansion plans for the key regional market. Meanwhile, a Keestrack plant solution is proving a big energy cost saver for a major Estonian quarrying firm

AHaver & Boecker company, MAJOR’s European operation (MAJOR Europe) is based in Battice, Belgium. The company currently sells its product range directly to customers in Germany, France, Belgium, Switzerland, Austria, Slovenia and Croatia. While working to increase its direct dealership reach in Germany and France, MAJOR is supported by dealer-led sales in the UK, Finland, Sweden, Netherlands, and Turkey.

Manufactured in Canada, Flex-Mat highvibration wire screen media – available in TENSIONED and MODULAR form and in D, S, DD (impact resistance), L (sand screening), and T (fine screening) series variants - is seen by MAJOR as a key product range for European customers.

Flex-Mat TENSIONED allows wires, bonded to lime-green polyurethane strips, to vibrate independently from hook to hook for faster material stratification. The screen media is available in a side-tensioned or end-tensioned configuration.

Flex-Mat MODULAR comprises direct switch-and-replace polyurethane modular panels said to provide substantially more open area than traditional panels, increasing the throughput of spec material.

Unlike imitation self-cleaning screens, MAJOR designs Flex-Mat to fit all decks, from scalping to finishing screening. It features up to a claimed 40% more screen capacity than traditional woven wire and a claimed up to 50% more than traditional polyurethane and rubber panels.

As of late October 2019, over 1,000 FlexMat applications had been carried out on quarrying, mining and construction job sites in Europe since 2015 – 30,000-plus globally.

A further 100-150 plant assessments have also been conducted in Europe over the past four years.

During a visit to MAJOR’s European HQ in autumn 2019, Aggregates Business learnt that plans are in place to begin producing the Flex-Mat product range in Europe within the next two years. MAJOR’s Woven Screen product range for European customers is currently made in Battice.

MAJOR’s original Battice workshop, excluding office space surface, was 1500m². The firm expanded the workshop surface up to 3700m² in 2016 by adding a new 2200m² facility. The company is in the process of extending the automation of its wire weaving machines in North America and Europe.

Globally, around 60% of MAJOR’s customers are in the aggregates sector; with 30% in mining and 10% in the recycling industry.

Speaking to Aggregates Business, Lars Bräunling, MAJOR Europe director of product technology, talked about why MAJOR, a company with a proud 130-year plus history, needed to operate differently in Europe, and not simply mirror its successful North American business set-up.

“We have a homogenous dealer-led approach to market in North America, where you can largely operate in one language and customer product needs are pretty consistent. In Europe, company type and size, produced product standards and how the products are made varies a great deal. Then there are 15-20 countries featuring many different languages that we are targeting sales-wise.”

Matej Grm, MAJOR Europe sales manager, said the diversity of the European

have a particularly strong focus on localised customer service, both in assessing and installing the best product solution and subsequent aftersales support.

“We are in the process of building a ‘tool kit’ to allow our dealers to serve our customers even better,” added Bräunling.

MAJOR’s research and development (R&D) focus is on wire screen media products delivering continuous improvement, better performance, and longer wear life. New products must also be capable of more varied applications.

The R&D focus ties in with MAJOR’s corporate philosophy, which it refers to as ‘the MAJOR way’. It includes the company’s emphasis on advanced technology, screening know-how, and business operation – helping drive materialsproducer profitability.

In November 2019, MAJOR introduced the Flex-Mat Sensor, a valuable and easyto-operate vibration data-measurement tool users can utilise to review results and finetune their screen machine without shutting down equipment. The app-controlled vibration analysis sensor enables readings of screen-box vibrations within seconds and generates a report that can be sent or reviewed.

The operator connects the single sensor to the Flex-Mat Sensor app on their phone before placing the sensor on one corner of

the machine. The user continues to move the sensor to each corner of the machine until finished. Once the measurement process is completed, the information will be delivered to the phone in the time it takes to climb down from the machine. Alternative systems may not provide the data until the following day. Machine information is stored locally for ease of use and viewing in areas with cellular limitations. Once a signal is available, the information uploads to MAJOR’s cloud service where it is viewable from a web browser. Historical equipment performance data is also viewable through the cloud.

of Keestrack’s track-mounted R6e impact crusher and three-deck C6e classifier as part of a comprehensive modernisation of its processing technology is set to save Paekivitoodete Tehas (PT) nearly €100,000 a year in energy-related operating cost at the company’s flagship quarry near Estonia’s capital city, Tallinn.

The impressive saving forecast by PT and Keestrack was made after the R6e and C6e began operating at PT’s Väo Quarry in June 2019. Connected to the grid, the new plant set-up cuts PT’s cost per final product tonne to €0.42, compared to the calculated total of €0.58 per tonne of the same machine duo’s annual diesel-electric powered operation (approx. 600,000 tonnes a year).

The reduction of pollutant emissions on site through all-electric crushing and classifying is also significant, with around 400 tonnes per year of climate-damaging CO2 avoided.

Since the installation of the R6e and C6e, the three-man working teams (excavator-wheeled loader-all-electric plants operator) have also been reaching their daily production target of 3,000 tonnes in one long or two short shifts, bringing further significant savings compared to the previous three-shift pattern, requiring 15 PT personnel.

The modernisation of the PT quarries’ set-up cost just under €1mn, with 35% of funding being provided by the Estonian Environmental Investment Centre (EIC) using EU regional funding. The significance of the project was demonstrated by the presence of numerous high-ranking representatives from politics and business

offering the full flexibility of the dieselelectric hybrid drive.

Since 1959, Paekivitoodete Tehas – ‘Limestone Factory’ in English – has supplied high-quality mineral and aggregates for the Estonian road and construction industry. Since 1989 the former state-owned enterprise has been gradually transformed into a private company and developed into one of Estonia’s leading construction materials suppliers, under the leadership of the long-standing director, today’s chairman of the board and majority shareholder, Vladimir Libman.

Today, up to 20% of the Estonian annual demand for crushed aggregates comes from PT’s Väo and Maardu quarries, with their combined extraction quantity of around 750,000 tonnes of material per year. Together with washed sand and gravel from mining residual masses with high contents of fines or clay and marl impurities and the company’s recycling activities, PT’s total production amounts to around 1.2 million tonnes per year.

On the Baltic coast, high-quality limestone is found close to the surface in 5-6-metre widths. In the past, PT has responded to the rapid growth of aggregates demand with three decentralised stationary processing units (totalling 400 tonnes per hour), whose raw materials, intermediate and end products had to be extensively hauled by rigid trucks. This low efficiency operation became problematic as the mining zone with its dust and noise emissions moved ever closer to the rapidly expanding Tallinn residential district of Lasnamäe, and its 120,000 inhabitants.

relief has been achieved through investment

•Is ideal for production volumes with large proportions of RAP

•Can use discarded consumables such as printer cartridge toner and tyres

•Features warm and cold recycling systems that can be used simultaneously

•Incorporates an integrated parallel drum system, positioned directly above the mixer, to optimise material flow and minimise wear

The Ammann ABP HRT (High Recycling Technology) plant is the industry’s recycling leader. The HRT plant:

of the production processes has focussed especially on the protection of residents and a general reduction of the environmental impact. To replace the existing installations, a mobile processing line for the production directly in the mining zone was favoured for the main Väo quarry site as well as for temporary operations in the smaller Maardu quarry (150,000 tonnes per year), 10kms away.

The entire PT processing modernisation project was supervised by Johann Prüwasser, CEO of Keestrack Engineering, the Austrian design and development branch within the Keestrack Group.

operation in the Väo quarry with all the advantages of our proven track-mounted technology,” he adds.

Two 200-metre cables from the specially installed 400V transformer station on the quarry floor now feed the Keestrack R6e and the downstream C6e classifier, directly connected to the crusher via power supply and communication cable for data exchange between the plant controls.

Powerful electric motors for the crusher drive (250kW) and the pump units of the central plant hydraulics (R6e: 90kW, C6e: 45kW), as well as electric belt drives and ancillary units, enable complete emission-

A combination of Keestrack’s R6e impact crusher and three-deck C6e classifier is set to save Paekivitoodete Tehas (PT) nearly €100,000 a year in energy-related operating cost at the company’s Väo Quarry, near Estonia’s capital city, Tallinn

Belgium, produces around 60,000 tonnes of building material products each year, with just over 50% for export customers in Europe or further afield.

In early 2019, the company identified a lack of consistent quality in every other truckload of variously sized quartz, silica, marble or limestone products processed through its Mogensen SN1544 four-deck sieving machine.

The company turned to screening wire system manufacturer MAJOR Europe, a leading manufacturer of high-performance

of Euroquartz’s other screening machines, for a solution. This led in May 2019 to MAJOR Europe installing its Flex-Mat high-vibrating wire screens on two of the Mogensen SN1544 unit’s four decks.

Eddy Depraetere, Euroquartz’s chief technology officer, said the introduction of Flex-Mat wire screens is expected to reduce the Mogensen SN1544’s production cost by 30%, with the company set to fit Flex-Mat to the machine’s two other screen decks.

When Aggregates Business visited Euroquartz in late October

of material with the Mogensen SN1544 without any problem.

“We are now able to produce a better quality product, while saving a lot of time and money through reduced maintenance. Before, we were losing one to one and a half hours of production time every time we had a problem with material throughput, such as plugging” said Depraetere.

“We initially installed the FlexMat on two decks of the Mogensen unit as we wanted to compare its performance against the screen media that came with the machine.

The successful introduction of Flex-Mat on the Mogensen SN1544 could not have been better timed as demand for Euroquartz’s product range is growing year on year. The company’s six-hectare manufacturing and storage site has been operational for more than 10 years.

“We have a wide client base. Our biggest export market is other European countries, but we also sell our products to customers in South America, China and Thailand. We also sell our sand products to the Saudi Arabians!”

crawler excavator range cabin more spacious. Each cabin also has an eight-inch hi-res display screen and reduced noise and vibrations compared to its predecessors.

The global quarry loading machine market is vibrant with many leading manufacturers due to unveil new models over the next 12-18 months. Guy Woodford spoke to experts at two leading wheeled loader and crawler excavator manufacturers to find out more about their new model plans, along with the key benefits of their current quarry-suited machine line-up

Hitachi Construction Machinery (Europe) NV (HCME) has been talking to Aggregates Business about current excavator and wheeled loader demand among European quarrying and mining customers. The major original equipment manufacturer (OEM) is launching its next-generation Zaxis-7 crawler excavators for the European market in spring 2020, and its upcoming wheeled loader models will be introduced later.

“Our large quarry and mine-suited excavators are very reliable workhorses that are thoroughly tested before coming to market. Customers using our machines recognise all these aspects,” said Wilbert Blom, HCME’s excavator product manager. “When you look at our European market share for excavators, we have close to 20% share for the 50-tonne class and up to 30% for the 85-tonne class. Customers for these models demand uptime and performance. They do not want to lose money on excessive maintenance and other issues. The machines need to deliver.”

Blom said that as HCME large crawler excavators have Hitachi-designed and engineered hydraulic systems, the manufacturer has “total control” of their quality.

He continued: “I think we can grow our market share in around 50-tonne class excavators. The market is flattening a bit. Customers are a bit more hesitant on purchasing new equipment. In the shortterm, this may help with lead times.”

Commenting on what quarrying and mining customers can expect from the next-generation large HCME Zaxis-7 crawler excavators, Blom said: “We’ve been able to make some significant improvements to the hydraulic system. This will deliver significant savings on fuel consumption, which equates to lower TCO [total cost of ownership].

“Since 2018, we’ve also had the ConSite oil sensor in our up-to-85-tonne class ZX890-6 model. It’s an oil sensor in the engine and hydraulic system, monitoring engine and hydraulic oil quality 24/7. What is unique about the oil sensor is that it’s Hitachi patented system. It detects various material contamination and the algorithms behind it measures the quality of the oil before something happens. This might, for example, detect an increase in iron particulates in the engine or hydraulic system oil and stop the main control valve from getting seriously damaged, preventing major maintenance work.”

Blom said that HCME had also listened to customers by making the new Zaxis-7

Focusing on another area of improvement, he said: “In 2018 we started supplying Hitachi-branded buckets for excavators, like we have done for some time with our wheeled loaders. Some of our excavator customers had been flagging up to their Hitachi dealer that their bucket attachments didn’t seem to work well with their machines. After exploring the root causes, we were finding that the installed bucket was too big. Now we can safeguard performance by supplying our own buckets.”

Asked about the potential for electricpowered large crawler excavators for quarrying customers, Blom said: “We already have electric-version machines for mining customers that hook up to the grid. I’ve not seen many requests from quarry customers to connect, say, an 80-tonne machine to the grid. If hydrogen fuel cell systems really become commercially viable for quarry machines, that will be interesting. Maybe some hybrid solutions can be developed which are less sophisticated. I think quarrying and other jobsite machines will become smarter, making more use of sensors to further measure productivity and safeguard their uptime. There will also be far more localised spare parts provision.”

Bill Drougkas, HCME’s wheeled loader product manager, said quarrying and mining customers are focusing on easy wheeled loader bucket filling, resulting in fast cycle times and very low total cost of ownership. “There are several sub parameters connected to this: the wheeled loader must be of high quality, come with low fuel consumption and maintenance cost, while also demonstrating an investment in operator cabin comfort, and an absolute focus on safety. With excavators, the machine is standing safely and operating in one area at a time. But for wheeled loaders, they are constantly travelling around a quarry or mine and there are on- and off-highway trucks coming in and going out of the work site. This means safety is of utmost importance.”

Drougkas said the current ZW-6 wheeled loaders have additional safety features compared to their predecessors. “One of these is for example our remote fleet monitoring system, ConSite, that could indirectly inform the operator that their operational behaviour will not result in a long lifetime for the machine. It’s important to note that doing this does not sacrifice in any way the performance of the wheeled loader. An identified problem might be, for example, an operator constantly pushing the brake pedal. Through our global e-Service platform we can detect operator behaviour that is below the average for Hitachi wheeled loaders globally. We can then pass on advice to the operator on how they can change their behaviour. By doing this, machine lifetime is significantly increased.

“We have also invested a lot of time on how to best position the engine on the frame in order to allow direct visibility to the rear two sides of the counterweight. Of course, operators use their rear-view monitor camera, but they are also always looking around as they drive the wheeled loader.”

The ZW-6 wheeled loader range also has improved traction force, said Drougkas, which has increased the filling capacity of their buckets. “Being Hitachi, we are experts in hydraulics, and can match a higher quality powertrain with high-quality components.

“In recent years Hitachi wheeled loaders have also been well received in quarries and mines due to their proven low fuel consumption. It depends on the customer work site and how they are used, but generally current generation ZW-6 wheeled loaders achieve a 10% reduction in fuel consumption than previous generation machines. Some of this is due to improved axle components and reduced friction meaning lower hydraulic losses therefore reducing fuel used to run. Overall, we have seen that the ZW-6 generation machine is very competitive.”

Drougkas said that HCME was also investing heavily in its aftermarket business. “Our Hitachi-branded buckets allow us to give a total solution to our wheeled loader

customers. There are also many initiatives for our dealers, such as how to promote Hitachi Genuine Parts. We are also providing tools like a ‘preventive maintenance cost planner’. This enables dealers and customers to really prepare servicing and maintenance needs in advance, so that when a technician visits a customer work site, they have the correct replacement parts and will not need to make one or more repeat visits. Doing more preventive maintenance also means that customers will not experience unnecessary downtime and cost due to the need to replace major wheeled loader components.”

Highlighting what quarrying and mining customers will see in the heavier upcoming models of the wheeled loaders range, Drougkas said: “They will take the machine performance and health information available to the operator to the next level. This means using a smart monitor to convey key messages via this monitor about operator behaviour and what is happening to the machine. The messages might say: ‘If you do X, you will reduce fuel consumption by Y and increase the lifetime of your machine by Z. It is moving to a kind of artificial intelligence where it comes from machine to operator communication.”

Drougkas emphasised that the design of the upcoming wheeled loaders range will follow Hitachi’s concept to preserve their strong emphasis on safety. The “highly advanced” joystick control of ZW-6 models will be enhanced further on the nextgeneration machines, he added.

Turning his attention to current European heavier wheeled loader line market demand, Drougkas said: “The demand is still there thanks to the number of major infrastructure projects taking place. We are expecting demand to remain stable in 2020.”

In the November-December issue of Aggregates Business we reported on Hyundai Construction Equipment Europe’s (HCEE) launch of its new HL900 A-series wheeled loader range with three Stage V compliant wheeled loaders: the HL940A, HL955A and

the HL960A.

For this issue, Stefan Schwill – HCEE’s wheeled loader product specialist, spoke to us about forthcoming quarrying-suited HL900-A series models. He also discussed HCEE’s plans to develop its market share for heavier, 20-tonne class plus wheeled loader models.

“We will be launching the 24.2-tonne HL970A with a 4.2m³ bucket and 31-tonne HL980A with 5.6m³ bucket models in the first half of 2020, and the 26.5-tonne HL975A with 4.8m³ bucket and CVT (continuously variable transmission) in the second half of next year,” said Schwill. “We also have the HL965 20-tonne Stage IV engine machine with 3.6m³ bucket, but there is no launch date currently for an A-series Stage V version of that model.”

Like the smaller models in the range, the 20-tonne plus A-series wheeled loaders come with an in-cabin menu allowing for three engine operation modes: Power, Power Smart and Economy, offering full engine power or reduced fuel consumption depending on the application. The new-for-Stage V models Power Smart mode in addition with EGR (exhaust gas recirculation) removal is said by Schwill to result in reduced energy losses and up to 5% fuel savings. In addition, the engine performance is optimised to deliver higher torque at lower rpm. This provides another means for improved fuel efficiency, while optimising engine power and improving engine response time.

Schwill said: “All Hyundai A-series wheeled loaders are equipped as standard with a rear-view camera developed in-house. Hyundai also offers an optional reverse-drive radar system, like a car’s, allowing the operator to quickly and reliably detect obstacles within 10 metres during day or night.”

For increased safety on the job site, Schwill highlights Hyundai’s new AAVM (advanced around view monitoring) fourcamera system which is available as an option with Hyundai Stage V A-series wheeled loaders and crawler excavators.

“The system has around view monitoring [AVM] and intelligent moving object detection [IMOD]. IMOD alerts the operator when a person or potentially dangerous object is moving too close to the machine. There are audio and visual alerts at five

in the jobsite office. The heavier A-series wheeled loaders also come with five-speeds and a lock-up function, offering further assistance with fuel saving.

Schwill continued: “A remote door opener allows you to use a small smart key

from Bosch Rexroth. Our Stage V models will only have Cummins engines, which don’t use EGR and have increased engine combustion efficiency. Having only one engine supplier allows Hyundai to connect it through ECD (engine connected diagnostics)

Liebherr’s next-generation 27-tonne TA 230 articulated dump trucks are now in production

Liebherr has launched the first of a new three-strong, next-generation articulated dump truck series, while Terex Trucks has big plans to increase its presence in Algeria’s strong construction sector. Guy Woodford reports

The first of Liebherr’s keenly awaited next-generation 27-tonne TA 230 articulated dump trucks (ADT) has gone into production. From April 2020, the initial production machines will be delivered to Liebherr rental parks and dealer rental parks in Europe, with wider sales to European customers following on in 2021. In 2021, the TA 230 will also be available from dealer rental parks in North America. The TA 230 will be followed by next-generation Liebherr 36-tonne (TA 240) and 41-tonne (TA 245) ADTs in 2023.

Last autumn, Aggregates Business watched a pre-series, next-generation TA 230 ADT being put through rigorous semi-autonomous testing at Liebherr’s cutting-edge test track and development facility in Kirchdorf an der Iller (Kirchdorf), Germany, during the manufacturer’s 2019 information event for the international construction industry press.

During the well-attended event, Werner Seifried, managing director, Research and Development, Liebherr-Hydraulikbagger, gave a presentation on how Liebherr develops and tests its earthmoving machines, citing as an example the TA 230, TA 240 and TA 245 next-generation ADTs.

During a section on the testing element of Liebherr ADT development, he said: “Articulated dump trucks are frequently used in environments where their task is to transport materials over long distances. These roads, often referred to as haul roads, are usually gravel or dirt tracks with rough services. As the usage duration of these haul roads increases, their condition deteriorates, i.e. the number of potholes and bumps rises while the quality of the road worsens.

These haul roads are now simulated on our [Kirchdorf] rough road track. This way, we can simulate realistic conditions in detail and with high-quality reproducibility in tests.”

After showing a video of four ADTs being subjected to partially autonomous, varied ground-profile testing at the Liebherr Kirchdorf facility, Seifried widened his presentation to include all earthmoving machines.

“Before we dispatch our machine, we firstly conduct an internal test for over 100 hours”