Choosing screen media for a screen box isn’t as simple as it used to be p19 as to

HEAD OFFICE

EDITOR: Guy Woodford

ASSISTANT EDITOR: Liam McLoughlin

CONTRIBUTING EDITORS: Patrick Smith, Dan Gilkes

EQUIPMENT EDITOR: Mike Woof

DESIGNERS: Simon Ward, Andy Taylder, Stephen Poulton

PRODUCTION MANAGER: Nick Bond

OFFICE MANAGER: Kelly Thompson

CIRCULATION & DATABASE MANAGER: Charmaine Douglas

INTERNET, IT & DATA SERVICES DIRECTOR: James Howard

WEB ADMINISTRATORS: Sarah Biswell, Tatyana Mechkarova

MANAGING DIRECTOR: Andrew Barriball

PUBLISHER: Geoff Hadwick

CHAIRMAN: Roger Adshead

ADDRESS

Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612055

FAX: +44 (0) 1322 788063

EMAIL: [initialsurname]@ropl.com (psmith@ropl.com)

ADVERTISEMENT SALES

SALES DIRECTOR:

Philip Woodgate TEL: +44 (0) 1322 612067

EMAIL: pwoodgate@ropl.com

Dan Emmerson TEL: +44 (0) 1322 612068

EMAIL: demmerson@ropl.com

Graeme McQueen TEL: +44 (0) 1322 612069

EMAIL: gmcqueen@ropl.com

SUBSCRIPTION / READER ENQUIRY SERVICE

Aggregates Business International is available on subscription. Email subs@ropl.com for further details. Subscription records are maintained at Route One Publishing Ltd.

SUBSCRIPTION / READER ENQUIRIES TO: Data, Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612079

FAX: +44 (0) 1322 788063

EMAIL: data@ropl.com

No part of this publication may be reproduced in any form whatsoever without the express written permission of the publisher. Contributors are encouraged to express their personal and professional opinions in this publication, and accordingly views expressed herein are not necessarily the views of Route One Publishing Ltd. From time to time statements and claims are made by the manufacturers and their representatives in respect of their products and services. Whilst reasonable steps are taken to check their accuracy at the time of going to press, the publisher cannot be held liable for their validity and accuracy.

PUBLISHED BY © Route One Publishing Ltd 2019

AGGREGATES BUSINESS INTERNATIONAL USPS: is published six times a year. Airfreight and mailing in the USA by Agent named Air Business, C/O WorldNet Shipping USA Inc., 156-15 146th Avenue, Jamaica, NY, NY11434.

PERIODICALS POSTAGE PAID AT / US POSTMASTER

ADDRESS CHANGES TO: Aggregates Business Europe, Air Business Ltd, C/O WorldNet Shipping USA Inc., 156-15 146th Avenue, Jamaica, New York, NY11434

PRINT: ISSN 2051-5766

ONLINE: ISSN 2057-3405

PRINTED BY: William Gibbons

s editor of Aggregates Business International, you can easily feel overwhelmed by the amount of new aggregates and quarrying equipment market research reports you receive, via direct company emails or Google News Alerts. As such, you need to be highly selective in which studies you choose to focus on.

One piece of research that caught my eye recently was Persistence Market Research’s (PMR) new report on African construction aggregates demand.

PMR notes that construction aggregates demand across Africa is expected to remain strong, with a compound annual growth rate (CAGR) of 5.4% over the 2019-2029 period. This, PMR states, would see African construction aggregates demand worth US$22 billion in 2029. That’s an impressive rise on what PMR tips to be demand valued at more than $12bn in 2019. On tonnage, PMR forecasts that the 2 billion tonnes of African construction aggregates demand in 2019 will rise to 3.5 billion tonnes in 2029. PMR explains how the African construction aggregates market is segmented into crushed stones, sand, gravel and other types. Crushed stones, says PMR, will be one of the most lucrative segments throughout the forecast period.

So, what’s driving this eye-catching growth in African construction aggregates demand? According to PMR, escalating urbanisation in countries such as Angola, Ethiopia, Kenya, Tanzania, Nigeria, and South Africa, is driving increased spending on new commercial and residential construction and infrastructure megaprojects, all of which require a huge volume of aggregates and other building materials. Some of the key infrastructure megaprojects are the 5,000-megawatt Upington Solar Power Park in South Africa, the Anesrif-East Mining Line in Algeria, and the KRC (Kenya Railways Corporation)-Mombasa to Malaba standard gauge railway line.

The PMR report also notes how a growing demand for leisure activities, amusement parks and other luxury sports venues in Africa is

driving the market growth of gravel throughout the continent. This, PMR says, is expected to create exciting commercial opportunities for international and local aggregates market players.

From a regional perspective, PMR says sub-Saharan Africa will account for a “prominent” share of total Africa construction aggregates market demand over the next decade, owing to its positive outlook for infrastructure and industrial applications. In 2019 sub-Saharan Africa is projected to hold an impressive 64.1% share of the Africa construction aggregates market. In east Africa, the construction aggregates markets in Ethiopia and Tanzania are anticipated to expand at relatively higher growth rates, says PMR, compared to many other African countries, owing to the substantial investment in new infrastructure in those two countries, such as energy and power plants. The north Africa construction aggregates market is also projected to be a lucrative market, with a CAGR of 5.8% in the 2019-2029 period.

At the UK Mineral Products Association’s annual conference in London, England, I listened to a fascinating presentation by Dr Matthew Free, director, Geohazard & Risk Management at Arup, an independent global firm of designers, planners, engineers, consultants and technical specialists working across every aspect of the modern built environment. He highlighted a PwC (PricewaterhouseCoopers) report forecasting that the world’s economy will double in size by 2042 compared to 2016. The report states that while the US and the EU will experience a reduction in their economic might by 2050, Africa’s economy is growing the fastest. The PwC report also tips China to have the biggest national economy by 2050, with India up from third in 2016, based on IMF (International Monetary Fund) estimates, to second, the US down from second to third, and Indonesia up from eighth to fourth.

For ABI readers, such figures from highly reputable global business market analysis sources will be very well received indeed. GW gwoodford@ropl.com

It’s

PPC

Huge

Global

Metso celebrates 30th anniversary and 10,000 sales of HP Series cone crushers at event in Macon, France

Volvo CE excavators help to meet growing demand for Indian black granitebiggest construction market

The global aggregates hauler market continues its vibrancy

New state-of-the-art conveyors offering big productivity gains

An

10 INTERVIEW

Thomas Schulz on the impressive evolution of FLSmidth’s global cement and minerals industries products and services portfolio

15 METSO AIMS BIG IN INDIA

Metso has ambitious plans to meet the expanding demand for aggregates in India

17 QUARRY PROFILE

Switching to Sandvik premium crushers and screeners in its tertiary plant production is allowing South Africa-based BluRock Quarries to nearly double its capacity

43 LSR GROUP – RUSSIA

LSR Group is in good trading health in Russia’s 700 million tonnes-a-year aggregates market

45 KAMCHATKA VOLCANIC AGGREGATES

Known for its volcanic rock-based aggregates, the Kamchatka Peninsula in Russia’s Far East could become a hotbed for national aggregates production

45 43

Fox Marble, a London, UKregistered AIM-listed company, has won a major new contract worth US$2.4m to supply its Alexandrian White marble for the two-year construction of a temple in the United Arab Emirates.

The major new order has been placed by the Swaminarayan Hindu religious order which is building a temple in Abu Dhabi on land donated by the UAE Royal family. Fox Marble will provide most of the stone for the interior of the building. Construction of the temple is to start shortly.

Fox Marble CEO Chris Gilbert commented on the order: “We are privileged to be in partnership with the Swaminarayan religious order who have built over 1000 temples around the world. This temple will be the first such place of worship in the UAE and will be a monument for many generations to come.”

South Africa’s largest cement maker PPC has appointed Dutch national Roland van Wijnen as its new chief executive officer.

With 17 years of experience at LafargeHolcim, van Wijnen was chosen following a global search, which kicked off in November 2018, to find the successor to Johan Claassen.

“Considering the specialised nature of the industry, and its challenges, as soon as Johan decided to retire, the board began a process to identify a highcalibre candidate, with extensive experience in leading cement companies in cyclical downturns and challenging markets,” said PPC chairperson Jabu Moleketi.

produced a total of 13,094 tonnes of marble at its Prilep Alpha (Macedonia) and Maleshevë (Kosovo) quarries - up 49% from 8,811 tonnes in 2017.

The company says it has made a strong start to 2019 with sales to 30 April of €515k (30 April 2018 – €76k), despite the winter shutdown of the quarries which generally results in very slow sales in the first few months of the year.

Fox Marble production in the four months to 30 April 2019 totalled 5,940 tonnes (2018 2,147 tonnes). The firm says the significant increase in production over this period is a reflection of capital investment made in its quarries.

The company has five quarries under licence (four of which are in operation) and a further five quarries under operating agreements. The quarries hold a combined volume of over 300 million m³ of premium quality marble and decorative stone.

“We are pleased to have secured Roland, a Dutch national, whose listed company experience and exposure to international global best practice will broaden the

will advance the process without any delays,” he said.

“He has been with Holcim, now LafargeHolcim, for 17 years during which time he held various senior leadership roles across the group. As CEO of the Philippine business, a public company, much the same size as PPC, he successfully dealt with similar challenges that PPC is facing. During his time Holcim Philippines successfully implemented a new retail business model and a growth strategy to best serve customers and increase profitability.”

An industrial engineering graduate from Twente University in the Netherlands, van Wijnen was CEO of some of Holcim’s Eastern European businesses between 2005 and 2010. He has also previously acted as CEO of Holcim’s global trading business before the Lafarge Holcim merger.

management practices of PPC. He is an ideal appointment as he has detailed knowledge of the cement sector. He is up to speed with our global strategic imperatives and

Having done some work for Holcim in South Africa before the company moved its operations out of the region, he is familiar with the country.

Moleketi said van Wijnen has signed a four-year contract and was expected to take over from Claassen as soon as he has received a work permit.

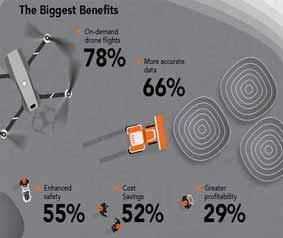

Fifteen per cent of aggregates and mining companies are saving between 600 to 2,400 hours in employee time a year by using aerial drones, according to a customer survey conducted by US drone-based aerial intelligence company Kespry.

The survey states that another 27% are saving 120-240 hours a year. Kespry surveyed the 220 aggregates and mining customers that use its platform across 3,311 worksites throughout North America. It found that 20% of companies are saving US$50,000-US$100,000+ a year by using drones, and 24% are saving US$30,000-US$49,999 a year.

Seventy-eight per cent of those surveyed said the drones enable them to more frequently survey their sites on demand, with 655 achieving greater data accuracy while reducing discrepancies and rework. Sixty-nine per cent of customers survey their sites monthly or weekly, with 36% engaged in large-scale surveys of 15 or more sites. Fifty-five per cent of customers stated they have achieved safer operations as a result of using the technology.

Eighty-two per cent of respondents said the ease of use also played a major factor in their decision to adopt the platform. Seventy-nine per cent chose the platform for speed of data capture and turnaround, and another 64% selected it for its turnkey hardware

guarantee designed to maximise uptime. Fifty per cent said they replaced contracted surveyors, measuring wheels, and GPS base and rover technology with Kespry.

Customers typically use the drones for inventory management, mine planning, materials management, contractor benchmarking, and boosting employee safety.

The 3.9 billion-tonne global cement market is being tipped to return to slight growth until 2023 after posting marginal declines from 2013 to 2018, according to a new study by the Freedonia Group (Freedonia).

A forecasted 1% compound annual growth rate (CAGR) in world cement sales during the 2018-2023 period will, Fredonia’s Global Cement report claims, be achieved despite reduced demand for the key building material in China, which accounted for over half of total global cement sales in 2018.

Global Cement predicts that China will continue to be a drag on global growth prospects for cement, as the nation’s robust economic expansion and related advances in construction slow down. Excluding China, however, Global Cement states that the pace of gains worldwide will be

much faster.

According to the new Freedonia study, cement market growth will be supported by expanding construction activity as urbanisation rates and infrastructure investment in developing regions rise; increasing modernisation and technological advancement of cement industries in low-income and developing economies; growing interest in cement products with improved energy efficiency and environmental profiles, particularly in higher-income countries; and environmental and regulatory concerns steering product innovation. As one of the world’s most energy-intensive manufacturing industries, concrete production is frequently implicated in environmental regulation –particularly in higher-income

areas such as the US and the EU. As such, the Global Cement report explains how manufacturers in these areas often focus on increasing the efficiency and quality of their operations; improving product performance; and making cement more environmentally friendly.

The new study notes how a number of environmentally conscious cement innovations have been introduced in recent years, such as TecEco’s (Australia) carbon-trapping Eco-Cement and Holcim Philippines’ (LafargeHolcim) Solido with reduced clinker content, which provide for a better environmental profile than standard cement.

More information about Freedonia’s Global Cement report can be found at: https://www.freedoniagroup. com/industry-study/globalcement-3699.htm

Saudi Arabia-based Alsafwa Cement Company has signed a contract with FLSmidth to increase its white cement production capacity.

Alsafwa aims to convert to a dual white and grey cement production line in early 2020 to target a share of the significant growth in demand for white cement in the local market.

Referencing a 2018 Mordor Intelligence report, Denmarkbased FLSmidth says that emerging economies in particular are driving global white cement demand as construction activities increase.

The Alsafwa project will

involve the modification of existing equipment to create the dual white and grey cement production facility.

FLSmidth has conducted several similar grey-to-white conversions in recent years, including for Riyadh Cement Company in Saudi Arabia and Adana Cement in Turkey.

The modified kiln at Alsafwa is expected to be commissioned in early 2020, and the production objectives are to produce a minimum of 2,000 tonnes per day (tpd) white clinker with a maximum heat consumption of 1380 kcal/kg clinker.

Ravi Saligram is to leave his roles as CEO and director of Ritchie Bros Auctioneers from 1 October this year. The Burnaby, Canadaheadquartered industrial auctioneer and used equipment seller said Saligram had taken the decision to return to his family in the United States. The company has started a search for his successor and engaged an executive search firm to assist in the process. Ritchie Bros says it will consider both external and internal candidates.

Chair of the Ritchie Bros board Bev Briscoe said: “Over the past five years, Ravi has led the transformation of the company, building on its strength as a live auction company to become a world leader in providing solutions to customers for their equipment needs. With the acquisition of IronPlanet and its successful integration, Ravi leaves us with a robust platform and strategy firmly in place for continued profitable growth.”

Saligram said that the company is on track to deliver strong earnings growth in 2019, and that the 2017 acquisition of online auction platform IronPlanet is beginning to yield tangible value.

Building materials giant CEMEX has for the fourth consecutive year been recognised by BMV –the Mexican Stock Exchange - as the company with the highest overall sustainability credentials from a total of 57 listed companies.

As part of this annual assessment, Monterrey, Mexicoheadquartered CEMEX also outperformed the average score of its industry.

For the eighth consecutive year, BMV included CEMEX in its Sustainability Index, which comprises the top performers in the three pillars of sustainability: Corporate Governance, Social Responsibility, and Environmental Care.

The award ceremony was held on 14 June in Puerto Vallarta, Mexico, at the 10th Issuer Forum of the Mexican Stock Exchange.

“This recognition encourages CEMEX to keep on enhancing our environmental, social, and governance performance and to continue pursuing our global sustainability ambitions to generate the most value for our stakeholders,” said Vicente Saiso, CEMEX corporate director of sustainability.

CEMEX says its 2018 sustainability performance highlights include zero employee fatalities for the first time, with 96% of its global operations fatality and injury free; 27.1% alternative fuels rate, the highest in the past four years; +13 million tonnes of waste from other industries seized as fuel or raw material in its production processes, representing 32 times more than the amount of waste it sent for disposal; and 21.6% reduction of specific CO₂ emissions vs. 1990, avoiding 8 million CO₂ tonnes during the year.

local and international mining and quarrying projects, bringing together both parties’ technical strengths and business insights in order to enhance product competitiveness and gain market share.

With annual revenue of US$7.5 billion in 2018, XCMG is currently the largest market player in the Chinese construction & industrial sector and ranks sixth in the world’s construction machinery industry. Rolls-Royce Power Systems has been supplying MTU S2000 and S4000 diesel engines to power XCMG’s mining trucks ranging from120 to 400 tonnage since 2012. Both parties see great potential in further exploring the market with mining equipment built in China powered by highperforming, reliable MTU diesel engines that meet Chinese and global emission standards today and in the future.

Rolls-Royce Power Systems and XCMG, a multinational heavy machinery manufacturing company based in Jiangsu, China, have formed a strategic cooperation alliance to further develop the Chinese domestic and export mining and quarrying equipment markets, providing optimised solutions to customers worldwide.

A strategic cooperation

As part of a global supply footprint development strategy in its Minerals Consumables business area, Finnish quarrying and mining equipment heavyweight Metso is initiating consultations to evaluate the potential closure or other alternatives for its foundry operation in Isithebe, South Africa.

“Our strategy is to utilise synergies of the most efficient manufacturing and sourcing opportunities globally. We are continuously developing our supply footprint to deliver the best value, availability and quality

agreement was recently signed in Xuzhou, headquarters of XCMG, by senior executives of both companies. According to the agreement, Rolls-Royce and XCMG are committed to joint efforts in exploring opportunities to integrate Rolls-Royce’s renowned MTU power and propulsion systems, including MTU Series 2000 and 4000 engines, into XCMG equipment for Chinese

Li Zong, XCMG Mining Machinery, general manager, said: “The win-win cooperation is aligned with our development strategy to continue to enhance technology and market leadership at home and abroad. The combined force of MTU and XCMG will allow us to leverage synergies and create shared value.”

The two companies also agreed to collaborate on the validation and testing of new power and propulsion technologies including gas engines and hybrid solutions, as well as applications of digital technologies, to drive low-carbon, sustainable development of the mining and quarrying industries.

for our customers,” said Sami Takaluoma, president, Minerals Consumables business area at Metso.

The Isithebe foundry produces metallic wear part castings for the mining and aggregates industries. The foundry has been part of Metso since 1998 and it has around 200 employees. In addition to Isithebe, Metso has five of its own foundries, located in Brazil, China, Czech Republic and India, and an extensive global network of external suppliers.

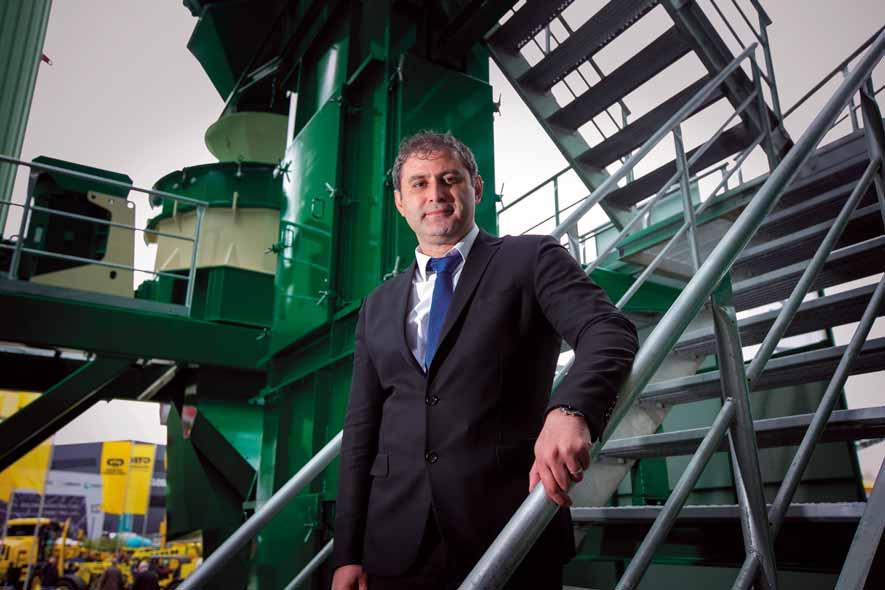

FLSmidth, a globally renowned supplier of systems, equipment, services and products to the cement and minerals industries, headed into 2019 having achieved its strongest order intake in six years in 2018, with revenue also up by 4% compared to the previous year. Aggregates Business editor Guy Woodford spoke to FLSmidth group CEO Thomas Schulz to find out what customers can expect next from the ambitious and innovative Copenhagen, Denmark-headquartered business.

Asharp mind and easy-going charm don’t always go together, but they do in Thomas Schulz’s case. Talking with him at the bauma 2019 exhibition in Munich about the current performance of FLSmidth and future group goals, it was clear that the attributes I had noted during my Aggregates Business magazine interview with Schulz fiveand-a-half years ago, soon after he’d taken over as CEO of FLSmidth, were still very much evident.

Back in August 2013, Schulz, a German national and former president of Sandvik Construction, told me that in becoming FLSmidth CEO he’d joined a “fantastic company with a very strong business model and fantastic future potential”. Keen to appraise his new firm’s offer to customers, he wasted no time in conducting a businesswide ‘Health Check’. This identified where greater working efficiencies could be achieved and led to the appointment of a new HR group executive manager.

Schulz and his FLSmidth management team have continued to push for efficiencies. Last year’s return to group revenue growth and 13% year-on-year rise in order intake were aided by a strong performance in mining, largely driven by copper demand, and improved profitability in cement, coupled with the business’s diverse and strong customer lifecycle solutions. A truly global cement and mineral industries player with over 11,000 employees in offices in more than 60 countries, FLSmidth is targeting revenues of €2.54bn-€2.81bn (DKK 19-21bn) in 2019, compared to €2.51bn (DKK 18.6bn) last year.

“We see quite a positive momentum in the mining industry. Of course, there is negative talk of an upcoming global recession, trade wars, political unrest, populism, nationalism and so on. There is a feeling that we talk ourselves into a global recession, more than it really happens,” says Schulz, who in his early career days worked in coal and other areas of mining.

“If you look at the mining industry, there was a very long period of less or no investment - a kind of recession. But since mid-2017 we have seen a clear recovery. We have seen good growth in mining capital and aftermarket business. The recovery in the mining sector will build slowly year-on-year and will be built on trust.”

Schulz says the recovery of the global mining sector is driven by mine operators looking for solutions that can drive up their

productivity and profitability.

“Mining businesses also want to have a good social and sustainability set-up: to invest in education, water recovery and other things,” he adds.

Schulz also notes that the mining environment worldwide is getting more transparent and increasingly regulated. This, he says, is partly due to tragic events such as the Brumadinho dam collapse on 25 January 2019 when Dam I, a tailings dam at the Córrego do Feijão iron ore mine, nine kilometres east of Brumadinho, in Minas Gerais, Brazil, suffered a catastrophic failure. At least 233 people died in the disaster.

“Tragedies like this are, of course, negative for the industry in terms of its ability to attract young people. It is also negative in terms of how non-mining people see the whole industry. We now have a different mining environment with more regulation demanding greater transparency. We as a services provider to the mining industry have a lot of areas where we can contribute – not only with new technology, innovation and digitalisation, but to educate and support customers in finding new ways of working with water and energy, and to lower their emissions. There is a big overlap in the cement and mining industries. They face similar problems and we can help them learn from each other.”

Speaking about how FLSmidth plans to maintain its growth trajectory over the next couple of years, Schulz says, “We have definitely strengthened our aftermarket business. We were not a player at all in wear parts – but have revealed that we will have more than 10% of our aftermarket business from it by the end of 2019. This enables us to have more contact with our clients. We have significantly more service and sales people

compared to a few years ago, despite overall staffing levels being reduced since 2012-2013.

“We are today heavier in sales and service, R&D [research and development] and technical support staff. This is good as customers request more productivity improvement and less cheap equipment. It is now more a time for premium OEM [original equipment manufacturer] solution and services suppliers to be in demand. Besides requests for performance-enhancing solutions, customers are also very keen to gain an advantage through a greater use of automation and digitalisation across their businesses. You can digitalise everything, but the key question to ask is ‘Is it a gadget, or does is really add value to my business?’ We can look at this and start tailored programmes to help customers from day one gain advantages from digital technology solutions.”

Schulz says that FLSmidth’s equal split between big mining and cement business clients and small to medium-sized mining and cement customers is a key strength of the group, “The big project business customers are our base to give us the knowledge about all the processes involved in mining different commodities. We offer most if not all core mining and cement production equipment, and all kind of aftermarket services, up to managing and maintaining complete [mining and cement production] sites.”

In his comments accompanying FLSmidth’s encouraging 2018 trading results, Schulz said the group was taking innovation

LEFT: FLSmidth group CEO Thomas Schulz at the bauma 2019 exhibition in Munich, Germany BELOW: An FLSmidth material handling equipment customer in South Africa pic: FLSmidth

is a

and digitalisation to the “next level”. I asked what he meant by that? “There is nothing that is not digitalised. It is not a product. It is a new way in how we work. You see it privately when you have kids. Five or six of them in one room and all they do is text each other. I use emails and I get the comment that I’m ‘antique’.

“Our innovation and digitalisation can be seen externally in our new products, whether it’s a new heap leaching system, crusher or working process. But equally important is the positive effect it has internally, with software programs, the use of robots and other elements speeding up processes, increasing efficiencies and improving cash return.

“Two or three years ago it was all about getting smart products out into the market. Products where we could immediately prove to customers how they would make more money by investing in them. Tomorrow it is about how digital we are and which type of interface we use to communicate with our customers.”

Schulz explains how staff in FLSmidth’s global control centre track the performance of hundreds of customer plant worldwide, with anomalies flagged up online and technical support teams dispatched to help solve production problems. He says this kind of digitally triggered, fast-reaction response to helping customers find ways of doing things better than before had to go into FLSmidth’s DNA “completely”.

“The average age in our industry is not 18, 20 or 22 - it’s around 48 years. We cannot think anymore in terms of preferring to use only a Microsoft or Apple product. The younger generation think differently. They are more results-orientated and don’t care about what tool they use to get them. You need to bring your long-term experienced staff from the analogue and internet-email world into the digital world. It’s a completely new world and one they have to adapt to and not feel scared about it – to see the opportunities it creates.”

Moving on to FLSmidth’s product range,

Schulz stresses how the group’s commitment to R&D can be seen in the fact that a new product launch is announced every trading quarter. “It has to be a new product – not an upgrade. We upgrade quite a lot of products but do not announce them as a new product.

“To achieve standardisation and value engineering we outsource a lot, so for us it’s important we work with modular components that can be sourced in higher volumes. Higher volumes mean more cost efficiency, speed, better cashflow and less quality issues.”

Schulz has a good example with which to illustrate the success of FLSmidth’s standardisation and value engineering policy. “Years back we invested some money in vertical roller mills for cement production. We had a market position but were not satisfied with it. We were in a recession and didn’t have that many orders, but we had all the experts and we said to them, ‘Come on. We have available hours. Let’s redesign these vertical roller mills so we can source them faster, make them easier to commission and improve their performance. The last two years have seen the biggest vertical roller mills sales in FLSmidth’s history – and cement is currently not a growing market.”

Schulz is excited about the potential benefits for customers from FLSmidth’s new cloud-based digital metrics & analytics on its Raptor cone crushers. The technology for the Raptor R250, R350 and R450 models was showcased at bauma 2019.

“This digital system is connected to the cloud and whatever happens at the crusher, the information about it goes immediately online and into other plant which means they can adjust their production and vice versa. It gives our customers better utilisation of their equipment and higher productivity. It’s a classical little thing that helps our customers get more profitable.”

Schulz says it is vital for FLSmidth to explore new technologies given the vastly different mining world in which the group operates in.

“Twenty to thirty years ago, 4-5% copper

content in a mined deposit was standard. Today, copper content per mined deposit is 0.2 or 0.15. We need to dig out 20 times more to get the same amount of copper. It means we have to find completely new technologies to help customers mine.”

One such new technology devised by FLSmidth and highlighted by Schulz is the Rapid Oxidative Leach (ROL) process for improving leach kinetics and recoveries of primary copper concentrates. The process is said to be capable of attaining over 97% of copper dissolution in less than six hours under atmospheric conditions.

“ROL is one key advance but the whole mining industry still uses equipment which has its IP (intellectual property) dating back to 1850 or 1870. We need to look at what we can do differently by utilising latest technologies. To best utilise such technologies, you have to invest in people – in their education, in their on-the-job training, in setting them challenges. Some people make mistakes through this, but you have to allow that. The world has got more conservative and tries to limit people. We look at it the other way and say, ‘Try it. Test it. Do it’. We think the digital world can open people’s minds again.”

Asked about his biggest achievements in his coveted role as CEO of FLSmidth and what he still has to achieve, Schulz replies, “We have fantastic people and today they understand that more. We have great collaboration among our employees and in our work with suppliers and customers. It’s a hell of an improvement on a few years ago.

“In terms of outstanding goals, we want to be the world’s number one productivity solution provider in cement as well as mining. We are in a good place in both those markets, where we have good peers and fair competition. All premium suppliers are still less than half the [mining and cement productivity solution] market, so we can really grow more. What I care most about is what our customers think about us and what we can do more for them.” AB

Cat 330 GC next-generation excavator in an Indonesian quarry

Southeast Asia’s largest economy, Indonesia, offers exciting commercial opportunities for international and regional building material suppliers and quarrying equipment manufacturers.

After his May 2019 re-election as president of Indonesia, Joko Widodo has been keen to continue delivering on his commitment to green-lighting well over US$400 billion-worth of new public works projects.

As a World Bank report in April this year notes, the diverse archipelago nation of more than 17,000 islands, 300 ethnic groups and 260 million people has charted impressive economic growth since overcoming the Asian financial crisis of the late 1990s. The country’s GDP per capita has steadily risen, from US$807 in the year 2000 to US$3,877 in 2018.

Today, Indonesia is the world’s fourth most populous nation, the world’s 10th largest economy in terms of purchasing power parity, and a member of the G-20. Described by the World Bank as an ‘emerging middle-income country’, the highly respected international financial institution has praised Indonesia for its enormous gains in poverty reduction, cutting the poverty rate by more than half since 1999, to 9.8% in 2018.

The World Bank April 2019 report adds: “Despite heightened global uncertainty, Indonesia’s economic outlook continues to be positive, with domestic demand being the main driver of growth. Supported by robust investment, stable inflation, and a strong job market, Indonesia’s economic growth is forecast to reach 5.2% in 2019.”

According to GlobalData’s May 2019 report Construction in Indonesia – Key Trends and Opportunities to 2023, the Indonesian

construction industry continues to expand at a fast pace, driven mainly by the government’s continued investment in energy and transport infrastructure. It registered an annual growth rate of 6.1% in real terms in 2018.

The industry’s output value is expected to continue to expand at a healthy rate over the forecast period (2019–2023), with investments in housing, transport and tourism infrastructure projects continuing to drive growth. In the 2019 budget, the government increased its total spending on transport infrastructure from IDR410.7 trillion (US$28.8 billion) in 2018 to IDR415 trillion (US$29.1 billion) in 2019. GlobalData says the focus on developing local energy resources is also expected to drive industry growth, thus further increasing demand for construction and quarrying equipment. The government aims to produce 114GW of power by 2024 and 430GW of power by 2050, to meet the rising electricity demand of the country.

The total construction project pipeline in Indonesia – as tracked by GlobalData and including all megaprojects with a value above US$25 million – stands at a staggering IDR9 quadrillion (US$630.9 billion). The pipeline, which includes all projects from pre-planning to execution, is well balanced, with 50.8% of the pipeline value being in projects in the pre-execution and execution stages as of May 2019.

Given the above glowing endorsements of Indonesia’s economic health and construction sector vibrancy, few are sceptical that

President Widodo will fail to make good on his huge public works spending promise. This creates greater certainty among buyers of building materials and quarrying equipment, who are increasingly looking to invest in premium plant brands.

U.S. quarrying, mining and construction equipment giant Caterpillar is among leading global market original equipment manufacturers (OEMs) looking to build on their already strong presence in the Indonesian market.

Speaking about the country’s current aggregates demand, Annas Fadly, Indonesia territory sales manager, Global Construction & Infrastructure division, Caterpillar, says: “Over the last five years demand has been increasing, driven by massive projects in construction and infrastructure from both the government and the private sector.

The impetus for construction in Indonesia can be attributed in large part to the new government’s push to accelerate the projects such as the Trans-Sumatera toll road and toll roads across Java, the Jakarta Mass Rapid Transit (MRT), the Jakarta Light Rail Transit (LRT), the new Jakarta airport, the new Priok port (also known as Kalibaru port) which will more than triple annual capacity of Tanjung Priok when fully operational in 2023, various dams and irrigation projects, and public housing.”

Fadly says that future Indonesian aggregates demand is at least likely to be comparable to current levels and may

be slightly higher, due to the number of government and privately-funded infrastructure projects, including housing and office space, still to be completed.

Turning his attention to trends among Indonesian quarrying equipment customers, Fadly continues: “The majority of them are retail customers, and most use a 20-tonne excavator with hammer for primary breaking, and 10-tonne trucks. Other customers use blasting and hammer only for secondary blasting, preferring 20 – 30-tonne excavators. Big players from the cement companies or subsidiary companies of state-owned enterprises (SOEs) operate larger equipment and take advantage of the available on- and off-board technology.”

The Indonesian government, says Fadly, has put in place new regulations and policies around the extraction of minerals including sand, lime, marble, granite and andesite. “In the past, mining licences were issued by the regional government, now all the new licences are granted by the Ministry of Energy and Mineral Resources of Indonesia.

“Unfortunately, with such high demand, illegal mining and quarrying of construction materials remains a challenge for the government and it is taking its toll on the environment. However, with more vigilant enforcement of new regulations and policies, we can expect curbing of the level of environmental degradation.”

Volvo Construction Equipment (Volvo CE) is another major global original equipment manufacturer which has a strong presence in the Indonesian quarrying, mining and construction markets. Recent projects include a Volvo EC200 excavator helping to build a road for a hydroelectric power plant, a Volvo R60D and EC950E working on a coal mine project, and a Volvo ABG5820 paver supporting efforts to improve Central Sulawesi’s transport network.

Gerrit Lambert, sales director for Volvo CE Indonesia, is another senior OEM figure with confidence in future Indonesian aggregates demand.

“Demand is forecasted to grow further. Infrastructure development is on the rise, especially highway projects, airports and ports. Therefore, to support this infrastructure development, there is a high demand for aggregates. Our 20- to 40-tonne range excavators such as the EC210D, EC350DL and EC480DL are well suited to meet Indonesian aggregates demand,” explains Lambert. “As aggregates demand increases, it means a brighter future ahead for Volvo CE.”

Citing another example of Volvo CE’s current presence in the Indonesian market, Lambert notes how contractor Mutiara Batang Toru CV is using Volvo EC200D excavators to help construct a road in a challenging rainforest landscape for a new hydroelectric plant in North Sumatra. “Both the Volvo EC200D excavators can move over 800 tonnes of aggregates every day to complete road

works within a tight schedule,” he explains.

Lambert adds: “The road construction sector has been very much underdeveloped in the past, therefore more roads are now needed to meet the population growth. Port projects in the Indonesian government are also on the rise. And all these developments require aggregates.

“To meet the future market needs, Volvo CE is ensuring that our machines are accessible to customers as we continue to improve our dealer network.

“On the product front, we offer Volvo breakers, which are designed to handle the toughest breaking jobs in mining, quarrying, demolitions and construction. Volvo breakers are our customers’ top choice when it comes to working in tough applications like stone quarries.”

Lambert highlights how a major expansion of the country’s road network is part of the Indonesian government’s plans to accelerate economic growth. He notes how several Sumatran contractors are using Volvo CE machines on one of the largest projects – the upgrade of the Trans-Sumatran Highway.

“PT Rodateknindo Purajaya and PT Baniah Rahmat Utama are using a collection of our machines to work on their respective stretches. The contract for the TransSumatran Highway is the largest of seven road projects the company is currently working on. The company has seven Volvo CE units on the job, including three compactors, two excavators, a paver and a wheeled loader.”

Lambert says Indonesian quarries are getting bigger, generating a need for bigger equipment. “As such, the demand for continuous high production and low cost per tonne is on the rise. Customers are more interested in lower fuel consumption equipment and Volvo CE machines are well known for that,” he concludes. AB

Workers on the production line of Metso’s Alwar facility

Metso has ambitious plans to meet the expanding demand for aggregates in India. Partha Pratim Basistha visited the Finnish company’s Alwar facility in the north of the country to find out more.

In the face of burgeoning aggregates demand from the Indian infrastructure sector, Metso made a massive €70m worth of capital investments in its businesses in 2018.

Some of the investment was used to expand production at Metso’s flagship Alwar minerals equipment production facility at Rajasthan in North India, to enable the introduction of new manufacturing practices and expand the product portfolio. The rest of the funding was used for the acquisition of the RMEBS valve business (which was part of the privately owned Rotex group), and to set up a new 20,000tonne capacity foundry at Vadodara, Western India.

The investments were intended to enable strong backward integration of manufacturing based on Metso’s own standards.

Speaking to Aggregates Business

International about the buoyant business demand in the Indian aggregates market, Metso president and group CEO Pekka Vauramo said: “Our strong local presence in India since 1992 has enabled us to closely address local requirements, through the right product offerings and services mix.”

Metso faces increasing local competition in the country, led by price-competitive solutions from well-established Indian crushing and screening manufacturers.

Vauramo said: “To have a competitive business positioning, our emphasis will be on curtailing the cost per tonne of operations, backed by our global expertise, and to deliver indexed rated throughput to customers, and enable them to reduce overall operating costs.”

Reductions in the cost per tonne of operations will be largely achieved by using Metso’s advanced research & development capabilities to redesign the crushing chambers, which will contribute towards

reducing waste and enabling plant owners to derive the right size of aggregates. To further lower operational costs, Metso will explore the redesign of wear parts for lesser replacements. It will also look towards higher levels of plant automation through digitisation, enabling plant owners to have better preventive and predictive maintenance, in addition to condition monitoring.

While creating a competitive edge through offering solutions to minimise cost of production, Metso will also look to meet the diverse crushing and screening application needs of the Indian market through its wide range of fixed and tracked plant of varied capacity.

One of Metso’s key strategies for consolidating and expanding its business in the country is leveraging further value from its services support. According to Vauramo this is based on the changing priorities of Indian customers, with newer plant owners

putting more emphasis on running their core business of supplying the aggregates.

“This completely unique service is based on our philosophy of Life Cycle offerings,” Vauramo said. “Here the plant owner can focus on his core business of marketing the aggregates and completely relegate the responsibility of running the plants on us to get the rated throughput. Running of the plants will be backed by both annual maintenance contracts and operational maintenance contracts.”

Metso’s new investments in its minerals equipment business in India have gone towards upgrading production standards at the Alwar facility. “We have inaugurated our new vibrating assembly shop and crusher on-line facility. These initiatives will enable us to widen our product offerings catering to wider application requirements, backed with highly superior manufacturing standards, enabling the plant owners to have higher return on investments,” said Vauramo.

To leverage quality and quantitative standards in production, a recent addition to the plant is inline assembly for the manufacturing of crushing components. This enables standardisation of the assembly process. The first phase of the

which coincided with the visit of Metso’s group CEO, is producing horizontal shaft impactors, cone and jaw crushers.

The Alwar facility is crucial to Metso’s overall business strategy as the plant meets demand in the Indian market, and also exports solutions to almost 60 other countries. The plant manufactures the Nordwheeler series of skid-mounted plant in addition to the track plant.

The Alwar facility features a complete fabrication line for producing the superstructure and associated components for crushers and screens. In addition, there are state-of-the-art plasma cutting systems for accuracy in cutting to minimise the amount of wastage. The fabrication shop houses a complete line of jigs and fixtures, made according to Metso’s own design standards to maintain evenness and repeatability in welding. The shop also has an ultrasonic testing facility for the welding joints.

The key objective of the Alwar facility is reducing production costs. This is evident from looking at the machine shop, which carries out machining of the jaw, cone and horizontal shaft impactors. Metso officials say the shop’s costs of production are low in

The key production line at the plant is for the production of rubber. This manufactures the screening media used in both aggregates and mining applications. It features an extruder and moulding press and incorporates both manual and machinery processes. In anticipation of the rising demand in the country, Metso has expanded the capacity of the shop with the recent addition of a pressing line.

Alwar also houses a pump manufacturing facility that provides solutions used in mining applications and in dewatering pumps at mineral processing sites. Backed by a complete testing line, it monitors the power flow in the pumps, in addition to temperature and vibration increases and any abnormality in sound.

Metso has invested more than €100m in its Indian operations so far. The first product it rolled out in the country was the Nordwheeler series of wheeler plant in 2012.

Metso’s orders in India totalled €293m in 2018, equivalent to 8.4 % of all orders across the Metso group for the year. In 2017 total orders were €166m. Exports account for about 20% according to senior company officials in India, having risen by around 50%

Blurock invested in new-generation Sandvik crushing and screening equipment for the upgrade of the secondary and tertiary stages of the main processing plant

A plant upgrade and several improvement measures at Blurock Quarries –anchored by a huge investment in new-generation Sandvik crushers and screens – have almost doubled the operation’s production capacity, while creating the much-needed operational efficiencies and flexibility, writes Munesu Shoko

With technology constantly advancing, industries are looking for ways to utilise the latest innovations to help their businesses run efficiently and maximise growth opportunities. A case in point is Blurock Quarries, a familyowned quarry located in the heart of Estcourt, a small town in the uThukela District of KwaZulu-Natal Province, South Africa, which has committed a huge investment in a major plant upgrade with new technology equipment, significantly boosting capacity and increasing operational efficiencies.

Blurock Quarries mines a dolorite rock with some sandstone intrusions. After the overburden layer, which is stockpiled for rehabilitation, comes a layer of weathered rock, a mixture of shale and sandstone, which is crushed to produce sub-base material (G5 and G7). Below that formation is a mixture of dolorite and a competent sandstone, which is used to manufacture G2 and general concrete products. Below that layer lies the clean dolorite, used to make road stone (20mm, 14mm and 10mm), as well as 26mm concrete stone and crusher

dust. The biggest-selling products at the moment are the 20mm concrete stone, crusher dust, G5 and road stone (20mm, 14mm and 10mm).

Since taking the reins as CEO of the family-owned enterprise back in 2015, after having served as the manager since 2010, Jeremy Hunter-Smith has focused his efforts on taking the business to the next level. He tells Aggregates Business International that following several recent interventions, the business has grown from strength to strength. Significant among some of the key initiatives in recent years was the investment in new-generation Sandvik crushing and screening equipment for the upgrade of the secondary and tertiary stages of the main processing plant. This was followed by recent investments in the modernisation of enabling infrastructure – new powerline, new substation, new switch room and a new control room, among others.

“In recent years we have focused on upgrading ourselves to be in line with the technological revolution. With the market slowdown, we have put our efforts into increasing efficiencies. A dip in the market can actually be an eye-opener for a business

– it has driven us to refocus our efforts on things that really matter, such as cutting wastages and driving efficiency in every way possible,” says Hunter-Smith.

Prior to the plant upgrade, Blurock Quarries operated an old processing plant that lacked capacity, efficiency and flexibility. The primary crusher was a Nordberg 1109 jaw crusher. It was a very old unit, one of only four brought into the country way back. From there, material was sent to a Telsmith 2536 jaw crusher, used as a secondary jaw crushing unit. “We had a primary and secondary jaw crusher. The reason was that we were able to feed into either jaw, which created a bit of flexibility in the event of a challenge with either of the two,” explains Hunter-Smith.

From there, material would go to the intermediate stockpile, from which it would be fed into a Metso HP300 cone crusher, which in turn fed the Ore Master vertical shaft impact (VSI) crusher. From the VSI, material would be fed into a Dabmar doubledeck screen. All oversize material would report back to a Telsmith 36/7” fine cone, before being fed into a 5” x 12” triple-deck screen for final segregation. This would then

feed the bins, from which the articulated dump trucks were loaded for stockpiling.

In 2016, Blurock engaged the services of a business development consultant, Deon Bosman, who suggested a growth and development plan for the operation. Based on Bosman’s previous experience with the Sandvik product, he recommended Sandvik Mining and Rock Technology South Africa to Blurock Quarries.

In 2016, Blurock started looking at areas where efficiencies could be created. The first Sandvik machine to be purchased was the CH440 cone crusher. Adam Taylor, lifecyle services manager – Crushing and Screening at Sandvik Mining and Rock Technology South Africa, says the CH440 is suitable for a high-capacity secondary application or a high-reduction tertiary or pebble-crushing application, and it can be matched to changes in production through the selection of crushing chambers and an eccentric throw. The flexibility means that it’s suitable for a wide range of applications.

In this instance, the CH440 was deployed as a tertiary crusher, replacing both the Metso HP300 and the Telsmith 36/7” fine cone. “We removed two crushers and replaced them with a single, new-generation crusher,” says Hunter-Smith. “Apart from an increase in crushing throughput, this simplified our plant layout and having one crusher in the tertiary crushing stages, instead of two, reduced our maintenance effort,” says Hunter-Smith.

The Telsmith 36/7” fine cone was an old crusher which called for regular maintenance, which in turn resulted in unwanted downtime. In addition, maintenance of the old Telsmith posed safety hazards for the maintenance crew because its older technology did not have the means to lift the top of the crusher hydraulically like the new-generation Sandvik CH440. This feature has resulted in a reduction in downtime related to clearing blockages, which have been reduced from three hours on the old crusher, to about half an hour on the new crusher.

With the new CH440, Hunter-Smith also opted for Sandvik’s Automatic Setting Regulation control system (ASRi), which enables real-time performance management, allowing the machine to consistently run at optimum levels. “When a Sandvik CH440 cone crusher is equipped with ASRi, it automatically adapts the crusher to variations in feed conditions. By continuously measuring and compensating for crusher liner wear, the automation system allows for full utilisation of crusher liners and schedules liner replacements to coincide with planned maintenance stops. It also assists in keeping the crusher choke fed. This maximises rockon-rock crushing, which helps to optimise the quality of the final product,” explains Taylor. Installing the Sandvik CH440 has altered the whole tertiary section set-up while producing the exact quality that was achieved by having a fine cone crusher in the mix, says Hunter-Smith. “Another major benefit is that we have managed to relieve the pressure

In early 2017, Blurock started looking at its whole secondary crushing application. It engaged the services of Imilingo Mineral Processing, which designed the new secondary crushing layout. The quest to improve efficiencies at the secondary crushing stage started with the purchase of a Sandvik CS430 cone crusher. This was purchased in 2016, but was only installed in 2018. “It was the exact crusher we needed to upgrade our whole secondary crushing application,” says Hunter-Smith.

As part of the new layout, a Sandvik SS1633H scalping screen was bought in November 2017. “We started installation in December 2017 and commissioned in June 2018. The reason we selected this particular scalping screen was because of its compact build and high throughput, which allowed us to sidestep the space constraints we had onsite,” says Hunter-Smith.

The Sandvik CS430 cone crusher was purchased because Blurock wanted to create flexibility by being able to take out some of the products at the scalping screen before and just after the secondary crushing stage, before the product reported to the intermediate stockpile. This has also been made possible by the CS430’s ability to produce a better aggregate shape earlier in the crushing

on our VSI. We are able to reduce the speed of the VSI due to the CH440’s attrition crushing. Reducing speed on the VSI also lowers the amount of 0.075mm material in our crusher dust. Our concrete and asphalt manufacturing customers want as little 0.075mm as possible in their crusher dust,” explains Hunter-Smith.

Along with the Sandvik CH440, Blurock purchased the SV1252 vibrating grizzly feeder (VGF). This feeds the Nordberg 1109 primary crusher and was bought to improve feeding capacity at the primary crusher. “In terms of selection, we looked at other manufacturers, but the Sandvik VGF fitted perfectly into our existing structure. Our previous VGF created a bottleneck as we could not get enough feed into the jaw, so were not running the jaw full. That resulted in poor liner wear and poor attrition crushing,” adds Hunter-Smith.

In terms of plant design, the Sandvik CS430 cone crusher has been designed to allow the crusher to run either full or empty, with a dedicated feed bin feeding into it. “We built a big feed bin before the cone crusher, which is good crushing practice because you have the necessary continuous feed into the crusher,” says Hunter-Smith. “Once everything has been set up, we will install an automated door on the feed bin – if the crusher is full, it will stay open, but if there isn’t enough material in the bin, it will close the door and wait for the bin to fill so that the crusher will never run three-quarters or halffull. It will either be full or empty – that’s the best way to run a cone crusher.”

The scalping screen allowed Blurock to take out some of the product at the secondary stage. From the new Sandvik SS1633H scalping screen, they are now able to take out a handstone, G5, general concrete stone and dump rock material. “The investment into a scalping screen and the whole secondary set-up was to facilitate the manufacture of all products that we want using our main plant, instead of having to rely on our mobile crushing and screening train for some of the products. The secondary stage upgrade is definitely money well spent,” says Hunter-Smith.

The results of the plant upgrade are apparent – with the old plant system, Blurock had the capacity to produce about 100tonnes/hour. “We were very limited because of the old equipment we had. Following the upgrade – through Sandvik product and other efficiency improvement measures – we are now able to produce between 170 and 180tonnes/hour,” concludes Hunter-Smith. AB

New plant and production hubs are making the crusher and screener market within the aggregates production business as vibrant as ever. Guy Woodford reports

Sandvik Mobile Crushers and Screens is a major player in the global quarrying equipment world, with the latest fruits of the company’s research and development work assured plenty of attention.

Recently, the Swedish quarrying equipment giant has unveiled the latest upgrade in its 2 Series plant range with the launch of the new QI442 tracked-mobile impact crusher.

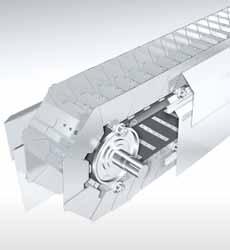

The new model includes the new CI621 Prisec impactor which comes with a host of innovations for improved efficiency and greater safety during maintenance.

Like previous Sandvik Prisec impact crushers, the new CI621 can be configured to work as either a primary or secondary crushing machine, while the plant’s two hydraulically assisted curtains can be readily adjusted to produce a wide range of highquality product sizes.

The new CI621 includes further enhancements primarily focused on increased safety during maintenance and serviceability. These include a new rotor position and locking device, new hammer locking wedges for quicker removal and fitting, and a new wedge removal tool to provide safer installation and removal. The model’s rotor bearings have also been upgraded for easier assembly and clearance setting.

An eye-catching optional feature of the QI442 is the modular hanging screen system. Recently launched on Sandvik’s mobile cone crushers, the system is interchangeable and offers the flexibility for the crusher to operate in open or closed circuit. The innovative design enables set-up in less than 30 minutes and can be fitted without the use of additional lifting equipment. The patent-pending hanging

screen option delivers multi-functionality as a one, two or three-way split screener, as well as a highly productive and efficient impact crusher.

The double-deck hanging screen enables the machine to produce two screened products and recirculate the oversize back into the feed conveyor. The oversize conveyor may be hydraulically rotated 90° for stockpiling up to three products on the floor, or 180° for removal. The tail section can be raised hydraulically to give improved ground clearance for transport when loading or unloading.

The QI442 comes with a Sandvik My Fleet remote monitoring system as standard. My Fleet has been developed to help Sandvik customers know exactly how their equipment is being utilised. Through the collection and accurate monitoring of a wide array of parameters, this is said to facilitate accurate production forecasting, ensuring that the most efficient use is obtained from equipment, thereby maximising return on investment.

The QI442 comes equipped with a range of customer-focused features designed to improve the return on investment and experience for the operator. A pre-screen is fitted to ensure maximum scalping capability and to prevent any undersize material passing through the impactor, maximising throughput and reducing wear costs. This also allows a specifically sized product to be produced from the natural fines’ conveyor. The pre-screen also has a choice of grizzly or punch plate top deck and mesh bottom, providing the flexibility to suit any application.

Rockster, the Austrian mobile crushing and screening machinery plant maker, has moved to a new base which the firm says will double

its production capacity.

The move to the 10,000m² site in Matzelsdorf, Neumarkt im Mühlkreis, Upper Austria, was made in mid-June 2019. Rockster says the step is necessary due to the company’s continuous expansion, an extended product line and shorter delivery deadlines.

Established 15 years ago in the town of Enns, Rockster has since developed two patented systems for mobile crushers and expanded its distribution network worldwide. A new head office with a 7,000m² warehouse was set up in Ennsdorf, Lower Austria, in 2008, and subsidiaries Rockster North-America, Rockster China and Rockster Germany were established between 2013 and 2016.

The new Rockster site in Matzelsdorf was acquired in January this year. The first machine to be produced at the new assembly line will be the track-mounted impact crusher R1000S.

“It is our most technologically advanced mobile crusher and we are highly motivated to deliver one of our bestsellers as the first crusher produced in Neumarkt this fall,” said Rockster chief executive officer (CEO) Wolfgang Kormann.

As part of the relocation, the company name Kormann Rockster Recycler has also been changed to Rockster Austria International. The company says the name change will accentuate and better define the international nature of its operation, needs and future goals.

As part of the move Rockster plans to hire up to 20 new employees, and Kormann says the relocation will offer improved company growth potential due to the availability of a larger space.

“Standstill means regression. Continuous development is not only essential in the

construction of our machinery, but also the infrastructure has to be adapted according to the innovations and an increased demand.”

Serge Raymond, manager-product technology at MAJOR, an innovative Québec, Canada-headquartered manufacturer of wire screens for the global aggregates, mining and recycling industries, says choosing screen media for a screen box isn’t as simple as it used to be.

“What once was just woven wire now includes a variety of alternative options, such as rubber, polyurethane, metal plates, high-vibration wire, combinations of different materials and more. With each type comes countless new options for customisations of a screen deck to provide enhanced efficiency and throughput — whether by using one type of media or blending multiple.

“Standard woven wire is often the cheapest — at first sight — option, but that’s no reason for these alternative options to be passed over without careful consideration. Depending on the application, these innovative products can improve wear life; reduce pegging and blinding; speed up the stratification process and better remove fines, increasing the overall quality of the screened product.”

Raymond offers a few reasons why one should consider high-performance screen media.

“Most types of specialised screen media offer a much longer wear life than traditional woven wire. Thick rubber and steel plate media clearly mean greater durability, but sometimes sacrifice open area. High-performance media is made up of highly engineered wires held together with polyurethane strips, which eliminate cross wires with high wear spots that are common to woven wire and a few types of self-cleaning media. This results in optimal open area and a wear life as much as five times longer than wire alone.

“High-performance screen media can offer exceptional open area — in some cases 30% more than traditional woven wire and 50% more than traditional polyurethane and rubber panels. It is often a good solution for issues such as pegging, blinding or material contamination. Some media is tapered to help solve these problems, while others use unique designs to allow wires to vibrate independently from hook to hook under material contact. The result is high frequency vibrations from

the wires, in addition to the vibration from the screen box. This virtually eliminates near-size pegging on the top decks and fine material blinding and clogging on the bottom decks. It also means less risk of material contamination and cleaner retained product through the middle decks.”

Raymond argues that because screeners are often placed at both the beginning and end of production, the right screener media can be key to the quality and volume of production. High-performance media, says Raymond, can offer the necessary efficiency boost because some kinds accelerate stratification and increase material separation.

He continues: “High-vibration wire screens operate at a high frequency to accelerate the stratification process. That frequency can be as high as 8,000 to 10,000 cycles per minute, as much as 13 times higher than the standard vibration of a screen box. The increased screening action spreads material over the entire screen’s surface area on all decks. This moves the material faster, while maximising contact to ensure optimal throughput with no carry-over. The result is a higher-quality end product.

“This type of screen media can also be extremely effective in removing fines. The result can be less water needed to wash material or, sometimes, a complete elimination of necessary water use.

“One type of screen media isn’t always the option, and the answer isn’t immediately obvious. Consult with a dealer and manufacturer to determine the best type of media to solve screening problems and improve performance. The right solution could mean turning a screen that was a bottleneck into a profit maker.” AB

3 Depending on the application, high-performance screen media can improve wear life; reduce pegging and blinding; speed up the stratification process and better remove fines 4 MAJOR says high-performance screen media can offer exceptional open area — in some cases 30% more than traditional woven wire and 50% more than traditional polyurethane and rubber panels

Metso customers from Germany, Spain, France, UK, Australia and China recently joined some of the aggregates plant manufacturing giant’s dealers, distribution partners, employees and the quarrying trade press in Mâcon, France, to celebrate the 10,000th sale and 30th anniversary of Metso’s popular Nordberg HP Series cone crushers. Guy Woodford and Liam McLoughlin were among those in attendance at the big landmark event.

Having used them for more than 25 years, it’s clear that Eurovia is a big fan of Nordberg HP (HP) cone crushers. The subsidiary of VINCI, one of the world’s main transport infrastructure construction and urban development companies, currently has around 250 HPs working at some of its 400-plus production sites worldwide –helping the firm produce 100 million tonnes/ year of aggregates and asphalt for its diverse customer base. Given that Eurovia’s headquarters is in France, it’s no surprise to learn that half of the company’s HP cone crushers are in operation at its French sites, with the latest addition – an HP300 - being the 10,000th HP model sold by Metso in the range’s 30-year history.

Representatives from Eurovia, including Didier Thèvenard, the company’s equipment director, and Vincent Follet, Eurovia’s French site operations manager, were present for the unveiling of the landmark 10,000th HP Series cone crusher during a special 10,000th sale-30th anniversary event at Metso’s key production and R&D site in Mâcon, eastcentral France, on 4th June 2019.

“Our HPs’ production quality and the final grade of product they produce corresponds exactly to market demand, especially compared to older machines,” explains Follet. “The HPs also enable us to produce the right formula of aggregates to go into our asphalt plants.” The landmark HP300 model will be used to process amphibolite rock at Eurovia company Carrières de Condat’s Pagnac quarry in the village of Verneuil-sur-Vienne, 20 kilometres south of Limoges. After its commissioning this month in July 2019, it will work alongside a fixed HP3 plant and assist in producing sand and 0-2mm, 2-6mm, 6-10mm, 10-14mm and 14-20mm aggregate product.

Aggregate Industries’ Bardon Hill Quarry in Coalville, Leicestershire, England, has been using HP cone crushers for over 27 years. The 4.5 million tonnes/year granite quarry uses two HP500, two HP400 and one HP300 cone crushers, along with five Metso screener models.

“The HPs give us a good first pass yield and capacity,” said Douglas Galbraith, Bardon Hill co-operations director, who was joined at the Metso Mâcon event by fellow operations director Steve Harle. “You turn the HPs on in

ABOVE: Metso customers, distributors, division heads and Mâcon facility employees joined in the 30th anniversary-10,000th sale celebration of the HP Series cone crushers

the morning and you rarely have an issue. They are easy to look after and are ideal for producing high-value road aggregates.”

Harle added: “We always look for flexibility in our crusher configurations and the HP cone crushers gives us that.”

Ofitas de San Felices Group (OSF) has been using HP cone crushers for more than 24 years. Iñigo Ajuria, general manager of OSF, said: “We used [Nordberg] Symons and [Nordberg] Omnicone crushers and started using HP cone crushers as it was an evolution in the technology. Metso has the best crushers on the market, the best for technology, capacity, quality, reliability and versatility.”

OSF’s fleet of HP cone crushers – one HP100, three HP200s, one HP300, four HP 400s and four HP4s – work across the company’s three ophyte rock quarries, two in northern Spain and one in Granada, Andalusia, southern Spain. They work alongside a variety of Metso CVB and TS screens. OSF has a long history of high-quality ballast production, with huge volumes used in building Spain’s impressive high-speed rail network.

The HP Series range covers nine models. The latest generation HP3, HP4, HP5 and HP6

cone crushers have proved popular among aggregates quarrying and mining customers, while the HP100, HP200, HP300, HP400 and HP500 units are still selling strongly worldwide, with the HP300 the best-selling crusher in the entire range. A truly global product, North America, Europe and Asia account for a combined 75% of HP Series sales, with South America accounting for 15% and Africa 10%.

“The HP is undoubtedly one of Metso’s most widely used innovations. It’s a technology that has been evolving throughout the years to meet customers’ changing needs, making their operations more successful through proven performance and reliable output. That’s most likely why HP has become an industry standard for a variety of aggregates and mining applications,” said Arto Halonen, vice president, aggregates crushers at Metso.

The origin of the HP Series cone crusher can be tracked back to Milwaukee, USA in the early to mid-1980s. The technological breakthroughs by the Nordberg research programme were said by Metso to redefine crushing performance and provided the basis for a new type of cone crusher introduced in 1989: the Nordberg High-Performance cone crusher series, today simply known as the HP.

Today, two thirds of HP Series models are engineered and manufactured in Metso’s cutting-edge technology centre in Mâcon,

France. The other third is produced in Metso’s technology centres in Brazil, China and India. A versatile crusher, the HP cone crusher is ideal for a wide range of fixed and mobile applications, varying from limestone to taconite and ballast production to manufactured sand.

Halonen continued: “Know-how from developing the HP and from thousands and thousands of customer applications around the world has played an integral part in Metso research and development initiatives in crushing.

“This [10,000 HP Series sales] is an important milestone for Metso and we want to thank our customers for their continued confidence in us during the first 30 years of the HP’s journey.”

Speaking at the Metso Mâcon-hosted

development of the HP Series was born out of an evolution in Metso cone crushers: from traditional, mechanical Symons’ cones, to Omnicone and then the HP Series. It was strongly driven by the need for better performance, capacity and end-product quality. When HP Series cone crushers were introduced it became possible to produce much more with the same-sized unit than before.”

Summarising the key features of HP Series cone crushers, Somero noted how they offered 35% higher production capacity than Omnicone models, greater interparticle crushing ability, higher reduction and better shape. He also highlighted how HP Series units had no separate short head and standard configurations, a high speed and long throw, a high-hold downforce, an ability to seamlessly switch between secondary, tertiary, fines and sand processing applications, a very reactive tramp release mechanism and safe, quick and easy cavity clearing.

Presenting alongside Somero at the Metso Mâcon event, Halonen said that Metso’s main direction with the HP range is to improve its serviceability and performance, rather than planning any new models. He added: “We plan to make Metso Metrics [a cloud-based, remote monitoring and data visualisation service for Metso Lokotrack mobile crushing plants] available with the HP Series. This will give operators 24-hour access to their HP

Series plant. We see an exciting long-term future for these units.” HP Series performance can already be enhanced if the cone crushers are supported by the Metso IC70C crusher automation system, allowing users to control maintenance, setting modifications, production follow-up and data extraction.

The recent event also included a tour of the Mâcon manufacturing and assembly facility. Attendees learnt how each HP Series unit takes anything between two to five days to assemble and passes through more than 150 testing points. Each model undergoes four hours of rigorous testing covering areas including mechanical reliability, vibration and operating temperature. A key facility of the €200 million sales-a-year Metso France business, around 350 of the business’s staff work at or are linked to the Mâcon site.

Emphasising the truly global appeal of the Nordberg HP cone crusher range at the anniversary event was Sinohydro Bureau 8 Co. Ltd, Metso’s first HP customer in China. The firm has been using HP cone crushers for over 23 years, most notably in the construction of the Three Gorges Dam, the world’s largest hydroelectric gravity dam that spans the Yangtze River by the town of Sandouping, in Hubei province, central China.

Minghua Xiong, chief engineer on the Three Gorges Dam project, and Handong Zhang, the project’s overall manager, were among event guests.

Zhang said: “We only used Metso

aggregates and sand processing plant in the Three Gorges Dam project. We used an HP500 as a secondary and tertiary crusher. HP Series cone crushers are first-class equipment. We also used a [Metso Superior MK III] 5065

gyratory crusher and a Barmac B9100 [vertical shaft impactor], after we were advised by Metso to upgrade from a Barmac B9000. Metso continues to contribute a lot of plant and expertise to our company.” AB

Europe’s leading aftermarket manufacturer and supplier of precision crusher spare parts and premium manganese wear parts for the Mining and Quarrying Industries.

Not many people know or have heard of Chitamba in India, but that all changed in 2008 when a fortune was discovered there — black granite. Since then, Chitamba’s black granite has become much sought-after around the world. Liam McLoughlin reports.