UNDERGROUND OPERATORS

COMMODITY SPOTLIGHT

INDUSTRY OUTLOOK

SERVICE SERVIC E VOLUME 115/02 | MARCH 2023

UNDERGROUND OPERATORS

COMMODITY SPOTLIGHT

INDUSTRY INSIGHT

TURNING WASTE INTO VALUE

RE-THINKING THE TRAJECTORY OF MINING TYRES

PRINT POST APPROVED PP100008185 OFFICIAL MEDIA PARTNERS SERVING THE MINING INDUSTRY SINCE 1908 VOLUME 115/02 | MARCH 2023

Prolong the lifespan of your asset

United. Inspired.

Midlife Services

Without proactive maintenance, as your equipment ages there is a risk of unplanned repairs, early replacement and costly downtime. Midlife services from Epiroc is a flexible service solution that will prolong the lifespan of your asset. Replacing old with new components, returning your equipment to maximum productivity and operating efficiency at a fraction of the cost of a new machine.

epiroc.com/en-au

PAUL HAYES paul.hayes@primecreative.com.au

KEEP UP WITH THE UPKEEP

Amine site is a veritable hive of human and machine activity.

From drill rigs to trucks to excavators to conveyor belts and beyond, the list of machines – and the people required to operate them – is just about endless.

And those machines need to be kept in the best possible condition. You can have the best gear in the world, but it’s not worth much if it’s not kept in tip-top shape.

That’s what makes maintenance such a fundamental aspect of a successful mining operation. Failing to undertake the necessary maintenance as and when it’s needed could result in faulty equipment.

A site with well-maintained gear can limit unexpected downtime and maximise production. Machines kept in the right condition are also safer for the people on and around them.

Maintenance can also have a major impact beyond a mine site. Keeping everything in the best possible shape helps to limit the need to purchase new equipment on a regular basis, which in turn offers mining companies a chance to generate social, environmental and reputational value.

Add it all up, and that’s why the March edition of Australian Mining has taken the opportunity to highlight the numerous approaches to maintenance, including new technologies, innovations, products and services, that are contributing to a more efficient resources industry.

Elsewhere in this issue, we have a special section appearing ahead of the AusIMM Underground Operators Conference 2023, where we look at some of the companies set to make a

CHIEF EXECUTIVE OFFICER JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY EDITOR

PAUL HAYES

Email: paul.hayes@primecreative.com.au

JOURNALISTS ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

TOM PARKER Email: tom.parker@primecreative.com.au

LEWIS CROSS Email: lewis.cross@primecreative.com.au

splash at one of Australia’s premier underground mining events.

We also sit down for an exclusive chat with industry decision-maker Gabrielle Iwanow, the new managing director and chief executive officer at Mincor Resources.

Having been appointed in July 2022, Iwanow provides some fascinating insights into the current state of the resources industry in Australia, especially the when it comes to nickel production.

And we provide some industry analysis of our own.

The end of 2022 saw some record results for Australian mining companies, as we show in a comprehensive round-up of the final quarterly reports for the year.

We also examine the answer to what has been an especially pertinent question at the start of 2023: what does the end of China’s coal ban mean for Australia?

While the move has been met with cautious optimism by local industry analysts, questions remain as to whether this seemingly major market shift will ultimately it prove more symbolic than meaningful.

FRONT COVER

Kal Tire Australia has become a trusted partner to some of the country’s leading mines. As a company that takes pride in all aspects of environmental, social and governance, Kal Tire is a responsible employer of choice that is always striving to make itself a better place to work. It also understands the need for continuous improvement and to be innovative for its customers, particularly in the area of sustainability, and that thinking helps to drive the company’s push to maximise tyre life and minimise environmental impacts.

Kal Tire is always looking for solutions for every stage of tyre life, continuing to work with customers long after a tyre has started its work on a mine site.

Cover image: Kal Tire Australia

Paul Hayes Managing Editor

ASHLEY PERRY Email: ashley.perry@primecreative.com.au

CLIENT SUCCESS MANAGER JANINE CLEMENTS Tel: (02) 9439 7227 Email: janine.clements@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

SALES ADMINISTRATOR EMMA JAMES Tel: (02) 9439 7227 Mob: 0414 217 190

Email: emma.james@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia www.primecreative.com.au

© Copyright Prime Creative Media, 2016 All rights

COMMENT AUSTRALIANMINING 5 MARCH 2023

No part of the publication may be reproduced or copied in any form or by any means without the written permission of the publisher.

BY MANARK PRINTING 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337 Published 12 issues a year

reserved.

PRINTED

REGULAR AND EFFECTIVE MAINTENANCE MIGHT JUST BE THE LIFEBLOOD OF A WELL-RUN MINING OPERATION.

IN THIS ISSUE 26 80 64 REGULARS 5 COMMENT 10 NEWS 88 PRODUCTS 90 EVENTS 44 AUSTRALIANMINING 6 MARCH 2023

Prevent the environmental & productivity impacts of premature tyre failure www.decoda.com www.linkedin.com/company/decodamining info@decoda.com Use digital technology to prevent tyre damage and combat the lost productivity cost of repairing and replacing haul truck tyres. Decoda’s industry leading AI detection system continually scans for potential obstacles and threats –proactively maximising the life of your tyres. To discover how preventing premature tyre failures can improve productivity, equipment availability, and the overall life cycle cost position of your haul trucks, get in touch.

Proactively locate, geotag, and notify cleanup crews of tyre hazards on the haul circuit

Decrease production downtime

Minimise the risk of premature tyre damage

Reduce environmental impact associated with excessive tyre disposal

Uncover mine site practices contributing to tyre damage

THE LATEST MINING AND SAFETY NEWS

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM. AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

both competitive and predictable, we are unable to make significant new investments in Queensland.”

BHP has been reassessing Queensland investments since August 2022, when the royalty hike was

That same month, BHP put plans for the Blackwater South mine in central Queensland on hold for the foreseeable future.

Queensland Resources Council (QRC) chief executive Ian Macfarlane has been vocal in his opposition to the coal royalty rates, calling on the Queensland Government to urgently review its decision.

“You can’t over-tax an industry, let alone Queensland’s most important economic driver, and expect business to continue as usual,” Macfarlane said.

AUSTRALIAN MINING GETS

THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

Alliance (BMA) sites could be “earlier than previously anticipated”.

Queensland due to the state’s coal royalty tax.

In BHP’s operational review, the company said that, while the market for coal is expected to be boosted due to increased demand from China, Queensland has become “uncompetitive” as a result of its controversial tax.

highest maximum rate in the world makes Queensland uncompetitive and puts investment and jobs at risk,” BHP stated.

“We see strong long-term demand from global steelmakers for Queensland’s high-quality metallurgical coal; however, in the absence of government policy that is

“Our mining and energy sector is the number-one contributor to the state economy, number one regional employer and number-one export industry.

“We support the jobs of 450,000plus Queenslanders and 14,000-plus businesses, who all pay taxes to help fund doctors, nurses, teachers and other government services.”

BHP said in August that the royalty hike was “quite sudden” and the end of operations at the BHP Mitsubishi

FORTESCUE EXPECTS RENEWABLES TO OUTPACE ITS IRON ORE BUSINESS

Fortescue, one of the five largest iron producers in the world, expects renewables to “play a very big part of our overall earnings in the future”.

Speaking at the World Economic Forum in Switzerland, former Fortescue chief executive officer Elizabeth Gaines said the company would continue building its iron ore business, but the scale of the world’s green energy transition would see a major increase in demand for renewable energy.

“There’s no lack of ambition for growth in our iron ore business, but when you look at the scale of

the green energy transition, it’s not unreasonable to think that ultimately renewable energy will probably outscale our iron ore business significantly,” Gaines, Fortescue’s non-executive director and global green ambassador, told the Reuters Global Markets Forum.

“I think we will see renewable energy play a very big part of our overall earnings in the future.

“There’s a view that businesses are doing this just for ESG (environmental, social and governance) reasons, but it’s also a smart thing to do, because the economics absolutely stack up.”

Fortescue is putting its money where its mouth is in terms of decarbonisation.

September 2022 saw the major miner pledge to exit fossil fuels by 2030 as part of a $9.2 billion plan to hit net-zero emissions and to not rely on carbon offsets by the end of the decade.

“We must accelerate our transition to the post-fossil-fuel era, driving global-scale industrial change as climate change continues to worsen,” Fortescue chairman Andrew Forrest said at the time.

Macfarlane said it was disappointing to hear State Treasurer Cameron Dick continue to say in the media that “coal royalties are worth fighting for”.

“Queensland’s resources sector is made up of Queenslanders, working and earning a living to support their families, so this is an odd statement for a treasurer to make,” Macfarlane said.

“Why fight the resources sector at all?

“We need the State Government to work with us, to keep Queensland strong.”

Gaines’ comments in Switzerland came after Forrest saying a string of executive resignations does not represent dysfunction at the senior levels of the company.

“As far as having high turnover, this was completely in the plan and we don’t consider it high turnover at all,” he said at the World Economic Forum.

“When we’re filling positions with different skills, the same responsibility, we need people to retire move on, or change.

“People move on, they retire, or they were bad choices. That happens everywhere.”

NEWS AUSTRALIANMINING 10 MARCH 2023

BHP HAS CALLED QUEENSLAND UNCOMPETITIVE IN RELATION TO ITS COAL TAX.

Stronger together

Schenck Process Mining has become part of Sandvik Rock Processing Solutions.

SP Mining & Sandvik share a deep passion for innovation. Our combined global footprint of R&D and

production facilities bring the expertise of our people even closer to our customers.

We are now better positioned than ever, to develop innovative solutions to the challenges of our industry.

ROCKPROCESSING.SANDVIK Watch this video to learn what this new partnership means to your business or visit our website:

Technology Metals already benefitting from the announcement.

Federal Resources Minister

Madeleine King said the grants would help to develop Australia’s critical minerals sector, support downstream processing, create jobs across regional Australia and support global efforts to achieve net-zero.

The Government has raised its loan to Hastings Technology Metals by $80 million to account for higher costs and the recent strength of magnet rare

Program will provide up to $50 million in grants of between $1 million and $30 million to support projects that will strengthen Australia’s sovereign capabilities in critical minerals, which are crucial for low-emissions technologies such as electric vehicles, batteries and solar panels, as well as aerospace and defence applications.

“The grants program will help Australia become a trusted and stable global supplier of critical minerals and rare earths which

half of eligible expenditure on projects that will strengthen global supply chains and help Australia build capacity to process critical minerals into strategically important technologies such as lithiumion batteries, rare earth element magnets, semi-conductors, and communications components.

“We expect the grants will support projects that will create jobs and investment in regional Australia, while generating further collaboration with

FORREST DISPUTES SUGGESTION FORTESCUE EXECUTIVE IS IN DISARRAY

Following a number of exits at the senior level, Fortescue boss Andrew Forrest recently rejected suggestions of executive dysfunction at the major miner.

When Fortescue’s chief financial officer (CFO) Ian Wells abruptly resigned in early January, eyebrows were raised across the resources sector.

Wells’ departure was the latest in a string of senior resignations at Fortescue –nine executives in two years – a situation the financial community reportedly described as “challenging” and “not ideal”.

“The optics of the short notice and timing of Ian’s departure are challenging, particularly given FMG has stated that Ian has resigned to pursue new opportunities,” Morgans analyst Adrian Prendergast said.

Wells’ resignation came two months after the departure of another of Fortescue’s senior financial executives, Guy Debelle.

But Forrest has said the high level of executive turnover is more like business as usual.

“As far as having high turnover, this was completely in the plan and we don’t consider it high turnover at all,” the Fortescue

executive chairman said at the World Economic Forum in Davos, Switzerland. “When we’re filling positions with different skills, the same responsibility, we need people to retire move on, or change.

“People move on, they retire, or they were bad choices. That happens everywhere.”

Forrest also said the changes represent a natural progression after the departure of former chief executive officer Elizabeth Gaines in late 2021.

“I said categorically when we were talking about the future of this company with our brilliant chief

rare earths project, located in the Gascoyne region of WA, 250km northeast of Carnarvon.

The project was the first in Australia to receive Northern Australia Infrastructure Facility (NAIF) funding.

“The road to net-zero runs through Australia’s resources sector,” King said.

“We need Australia’s critical minerals if we are to reach net-zero.”

Applications for the grant closed on February 20.

executive Elizabeth Gaines, that I would need to bring on 10 to 12 people who would be best in class,” Forrest said.

“And Elizabeth said, ‘You’re not going to be able to do that while I still hold this seat.’ And that was a very unselfish act. And I’ve simply gone ahead and done that.”

While Fortescue initially released a statement saying Wells has resigned to pursue other opportunities, the outgoing CFO shed further light on his departure a few days later by saying he was keen to “spend time with family and friends”.

NEWS AUSTRALIANMINING 12 MARCH 2023

THE AUSTRALIAN GOVERNMENT HAS RELEASED GUIDELINES FOR NEW GRANTS TO DEVELOP AUSTRALIA’S CRITICAL MINERALS SECTOR.

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

MT MORGANS GOLD MINE TO CLOSE

Dacian Gold has announced that its Mt Morgans gold mine in WA will close at the end of this month.

The mine is located 37km westsouth-west of Laverton.

Mining was first suspended at Mt Morgans in June of last year after managing director Leigh Junk stepped down.

The company is now processing historical dump leach material before the near 2.9-milliontonne-a-year mine is placed on care and maintenance.

“The decision to place Mt Morgans on care and maintenance was not taken lightly, especially given the impact on our loyal employees and contractors, and the community in which we operate,” Dacian non-executive and independent chairperson Craig McGown said.

“However, a period of care and maintenance will ultimately benefit all stakeholders by providing time to develop a robust, low-risk, sustainable plan,

NSW COAL TO STAY IN AUSTRALIA

New South Wales Treasurer Matt Kean will unveil requirements that force coal companies to reserve 10 per cent of their output exclusively for domestic use.

The requirements are being put in place to ensure the state has enough coal to fire its power stations.

Currently, some miners are forced to set aside coal for the state’s energy needs while others are not. Kean said the new requirement would help to even up this imbalance.

companies to provide 7–10 per cent of their output for domestic supply will be issued at the end of this month.

“This coal cap scheme will see NSW doing our part at the request of the Albanese Government to contribute to the national solution of this national problem,” Kean said.

“I know those currently providing coal for the local market will appreciate that companies enjoying super profits on the back of the war in Ukraine will now do their part for the domestic market. Of course they should provide Australian production for Australian

necessary to underpin the future resumption of operations.”

While Dacian announced the closure would result in some redundancies, the company plans to work to redeploy employees under a shared management services agreement with Genesis Minerals, its largest shareholder.

Genesis holds a 78.3 per cent interest in Dacian.

The cost of placing the mine on care and maintenance is estimated at $4–5 million and will

NSW coal mines run by BHP, Whitehaven and all other miners will be brought under the scheme, which originally required only 12 NSW mines to reserve a portion of their coal for domestic power generators and prevented them from charging more than $125 a tonne for intermediate grade coal.

BHP and Whitehaven have sold virtually all of their coal to exclusively foreign buyers in recent years.

Whitehaven said it was “reviewing

be funded from existing cash and gold on hand.

Comments from Genesis and St Barbara have suggested that ore from the Ulysses gold project could now be re-directed to St Barbara’s Gwalia mill, rather than Mt Morgans mill.

The news came after Dacian announced that gold production in the December quarter was 12,039 ounces, down from 21,525 in the September quarter of 2022.

A Glencore spokesperson said the NSW Government needs to better explain how the coal price cap would flow through to household power bills.

“We believe the focus should be on the shortfall of thermal coal supply required by NSW power stations,” the spokesperson said.

Sources close to the NSW Government have reportedly emphasised the policy’s intent is to bring equity for the state’s coal requirements to the industry, rather than seeing a small group of companies

NEWS

NEW REQUIREMENTS WILL SEE 10 PER CENT OF NSW COAL OUTPUT STAY IN THE COUNTRY.

Innovating for the future

Bradken’s technology transformation is supporting the evolution of the mining industry.

•Innovative mining digital technology solutions

•Asset condition and performance monitoring solutions

•Design, engineering and manufacture

bradken.com

MINRES SCORES A WIN IN RACE FOR WA GAS ASSETS

When Norwest directors recently recommended shareholders accept Mineral Resources’ (MinRes) increased takeover offer, it solidified the latest chapter in an increasingly competitive battle for gas assets in the Perth Basin.

Norwest Energy and MinRes reached an agreement in their monthslong takeover talks, with Norwest directors urging shareholders to accept the increased takeover offer of $497 million.

MinRes initially made an unsolicited $403 takeover bid for Norwest in December last year.

And while MinRes managing director Chris Ellison called the initial offer a “no-brainer”, Norwest knocked back the deal, calling it “opportunistically timed”.

“MinRes is seeking to secure control of Norwest and its Perth Basin assets without paying an appropriate premium,” Norwest said in a statement at the time.

“Accepting the offer would reduce shareholder exposure to the Lockyer

project … while increasing their exposure to the risks associated with MinRes’ other businesses and commodities.”

The Lockyer project is a major gas discovery in WA’s Perth Basin that is seen as a future source of inexpensive gas to power downstream processing in the resources-rich state.

MinRes’ sweetened offer of $497 million, which also waived the defeating condition to its offer such that the revised offer will be unconditional, won over the Norwest board.

“The Norwest board is satisfied that MinRes’ improved offer is now a good deal for shareholders and, in the absence of a superior offer, unanimously recommends shareholders should accept the revised offer before it closes,” Norwest chair Ernie Myers said.

“We have worked with MinRes in the interest of our shareholders to achieve the valuation and terms reflected in its revised offer.

“The revised offer provides Norwest shareholders with an opportunity to maintain an interest in the Lockyer project through an investment in MinRes, being a company with significantly greater balance sheet strength and underpinned by a diverse portfolio of operations.”

MinRes’ successful takeover of Norwest may mark a new chapter in mining companies’ race to get their hands on WA gas assets.

In addition to this latest deal, Gina Rinehart’s Hancock Prospecting remains in a holding pattern in its takeover efforts of efforts of Warrego Energy.

Hancock recently upped its bid to $0.36 per share, valuing Warrego at $440 million.

Warrego Energy has proven to be an especially hot commodity in WA, with Hancock Prospecting locked in a battle with Strike Energy for control of the Perth Basin company.

Kerry Stokes-backed Beach Energy had also previously been in the

takeover mix but bowed out of the race in December 2022.

And although MinRes reportedly entered the fray for Warrego by buying up 15 per cent of the energy company earlier in January, Ellison ruled out a full takeover bid.

The jewel in the Warrego takeover crown is the West Erregulla gas field 230km north of Perth.

The site is said to be a source of inexpensive gas for power generation and mineral processing, which will prove especially important as the resources sector faces a more difficult fossil-fuel market in coming years.

In the face of an ongoing energy crisis and deceasing gas supplies following Russia’s invasion of Ukraine, access to gas assets such as those in the Perth Basin has become an especially hot ticket in the resources sector.

Time will tell how far mining companies are willing to go to get their hands on these vital energy reserves.

BHP’s accelerator program, BHP Xplor, has announced its first cohort of seven companies to help with copper, nickel and other critical mineral discoveries.

BHP Xplor was introduced by the major miner in August 2022 and has since gone through hundreds of applications.

The seven companies have been selected to receive funding and support under the BHP Xplor program, designed to provide participants with the opportunity to accelerate their growth and the potential to establish a long-term partnership.

“We are amazed by the diversity and quality of the submissions we

reviewed and selected,” BHP Xplor vice president Sonia Scarselli said.

“We are confident that the BHP Xplor program will support the seven companies chosen to accelerate their concepts and ideas to help take it to the next level.”

BHP Xplor also provides BHP the opportunity to access exciting exploration prospects around the world, including new geographies and geologic concepts, helping to drive the company’s pipeline of new opportunities.

“Through this program, we hope to create disruptive results in copper and nickel exploration by identifying new concepts, leveraging new data

and testing opportunities at a much faster pace than discoveries to date,” BHP chief development officer Johan van Jaarsveld said.

Each of the seven companies will receive $US500,000 cash payment from BHP and access to a network of internal and external experts.

The seven selected companies:

• Tutume Metals – a junior exploration company searching for critical minerals in Botswana

• Impact Minerals – a junior ASX-listed explorer with a variety of battery metals projects across Australia

• Asian Battery Minerals – a junior exploration company focused on finding economic

deposits of critical minerals in the Asia-Pacific region

• Red Ox Copper – an Australian exploration group specialising in generating grassroots, greenfield conceptual plays

• Bronzite Exploration Corp – an early-stage exploration for copper in northern Canada

• Nordic Nickel – a new nickel sulphite ASX-listed explorer, focusing on two projects in northern Finland

• Kingrose Mining – a junior ASXlisted exploration company with regional projects in Norway and Finland targeting nickel, copper and platinum elements

NEWS AUSTRALIANMINING 16 MARCH 2023

BHP XPLOR ACCELERATES COPPER AND NICKEL EXPLORATION

NORWEST AND MINRES HAVE REACHED AN AGREEMENT IN THEIR MONTHS-LONG TAKEOVER TALKS.

PRIMERO LOCKS IN $62M CONTRACT

Pilbara Minerals has awarded Primero Group a $62 million contract for construction work at its Pilgangoora project.

The project, located 120km from Port Hedland in WA, is one of the largest hard-rock lithium deposits in the world.

Considered strategically important within the global lithium supply chain, the project has access to the first-class supporting infrastructure, including road and port, and

The contract is for works pertaining to the construction of the primary rejection facility and preliminary works for the new crushing and ore sorting facility.

Primero will be responsible for earth and concrete works associated with the facilities, as well as the structural, mechanical, piping, electrical and instrumentation installation.

“We are pleased to welcome the Primero team back to Pilgangoora for this important construction

MINING TOWNS PREPARE FOR THE AGE OF AUTOMATION

“Primero is a long-standing partner of Pilbara Minerals from an early stage having undertaken packages of work for Pilbara Minerals from the commencement of the project in 2017, as well playing an integral role in the successful commissioning, rampup and optimisation of the Pilgan Plant in 2019.”

The existing Pilgan Plant at the project will be integrated into the new rejection facility.

“The Primero team has an

exposure across many of the recent projects within the lithium sector,” Henderson said.

“We look forward to working closely with Primero for the safe and successful delivery of this package, which will step up our production run-rate to the next level with a total of 680 kilotons per annum of spodumene concentrate across the combined Pilgangoora operation.

“The successful completion of this project will further cement Pilbara Minerals’ position as

Just weeks after Roy Hill announced its plan to become the world’s biggest automated mine, towns across the Pilbara have been preparing for more operations to follow suit.

Automating mine sites has long been touted as a way to improve safety, productivity and efficiency, with major miners keen to adopt more of the technology.

Shire of East Pilbara president Anthony Middleton said his council understood the need for automation, but there were concerns about what it would mean for smaller towns.

said. “We always want to see a more permanent residential community. That is what contributes to the social fabric, the vibrancy and livability of regional locations.”

Towns such as Newman, located over 1000km from Perth, rely heavily on surrounding mines. Some locals are concerned that automation may impact population numbers.

“Governments have invested billions of dollars into these communities to make them habitable and now we’re moving the jobs away,” Western Mining Workers Alliance joint secretary

contacting companies and getting undertakings for the workers regarding their future employment, looking for alternate jobs and tasks within the company for these people.”

Roy Hill has already put a plan in place to re-train workers, offering reskilling programs and new roles to its truck drivers.

“Today you may be a truckie, tomorrow you might be an apprentice or ship loader operator, as we continue to build the best mining company in Australia,” Roy Hill chief executive Gerhard Veldsman said

operations over the next few years, we are going to need lots of people and different skill sets to run our operations.”

WA’s peak resources sector representative body, the Chamber of Minerals and Energy (CME), said there would always be a need for people in and around mining.

“Even where we see increasing use of automation, there are still really important jobs filled by people that support that process,” a CME spokesperson said.

NEWS AUSTRALIANMINING 18 MARCH 2023

TOWNS ACROSS THE PILBARA ARE PREPARING FOR LARGE MINES TO TURN TO AUTOMATED TRUCKS.

1300 096 618 info@nationalgroup.co nationalgroup.co

RAVENSTHORPE NICKEL MINE SWITCHES TO WIND POWER

In an effort to lower carbon emissions, the Ravensthorpe nickel mine on WA’s south coast has switched to wind power.

The proposed installation will take advantage of the strong winds coming in from the Southern Ocean and will likely generate 18–20 megawatts, reducing the mine’s reliance on diesel generators.

First Quantum Minerals’ Perthbased regional manager of projects and operations Gavin Ashley described

Ravensthorpe as a prime location for wind energy.

“We’re not connected to the grid,” he said.

“The way we produce power is from waste heat in steam turbines as we burn sulphur to generate the sulphuric acid, which we use in the nickel process.

“We also have stand-by diesel generators and recently we’ve identified that we’re short of power and we’re using our diesel generators a lot more,

FORTESCUE SETS MINING START DATE FOR BELINGA

The Belinga Iron Ore project in West Africa is set to start mining in the second half of the year.

The joint venture between Fortescue and Ivindo Iron SA is located in north-east Gabon and has worked to open growth opportunities for Fortescue throughout Africa.

Fortescue and Ivindo Iron have signed the mining convention for the project with the Gabonese Republic.

The mining convention governs all the legal, fiscal and regulatory regimes for the 4500 square kilometres that comprise the Belinga project, including early development for production of up to two million tonnes per annum.

“The Gabonese Republic chose Fortescue to develop Belinga not only due to our strong track record of delivering major projects, but due also to our company-wide commitment to use our major industrial scale and expertise to assist heavy industry combat climate change,” Fortescue founder and executive chairman Andrew Forrest said. “Geological mapping and sampling programs have confirmed our initial thoughts that this new West African iron ore hub may well one day prove to be among the largest in the world.

“The key aspect of this particular geology is its potential to dovetail

so that’s triggered this motivation to look at how we can offset that.”

First Quantum Minerals, a Canadianbased company, owns 70 per cent of the Ravensthorpe mine, with South Korean steelmaker POSCO holding 30 per cent.

Ashley said the company was part of a wider movement in the mining industry to embrace renewable energy.

“Five (turbines) is probably the most likely scenario … we’re just completing the study,” he said.

with Fortescue Pilbara ore blends. In doing so it will preserve and enhance the iron ore industry of both Australia and Gabon.”

The capital estimate for the early stage mining development is approximately $US200 million (100 per cent basis) with investment over 2023–24.

The development involves conventional open-pit mining methods to produce the ore, which will be trucked and railed over existing infrastructure and will be shipped from the Owendo Mineral Port, near Libreville.

“This emerging iron region is potentially massive. If it fulfils its

“We’re hoping to have that wrapped up in the next month, and then we’ll be looking at presenting to the board for approvals and funding.

“The ultimate timeline will depend on two real factors — the time it will take to do the various environmental and government approvals and the supply chain availability of turbines in the market.”

Ashley said the wind turbines should be operational by late 2024 or early 2025.

promise, it will complement our Australian operations through enhancing our blended products, extending our mine lives and opening new global markets,” Forrest said. “Due to its clear and unambiguous industrial leadership away from climate change, FFI (Fortescue Future Industries) has attracted respect from governments around the world.

“This support, as indicated by Fortescue’s selection to develop Belinga by the Gabonese Government, has facilitated Fortescue’s transition to a global green resources, green energy and products company.”

NEWS AUSTRALIANMINING 20 MARCH 2023

THE RAVENSTHORPE NICKEL MINE WILL SWITCH TO WIND POWER TO REDUCE CARBON EMISSIONS.

Uptime

Throughput

Energy savings

Predictive

Reduced waste

Reduced costs

Knowing

Upgrade your data systems NOW and protect what’s important before it’s too late. 1300 365 088 sales.au@ifm.com | www.ifm.com/au

you relying solely on historical data to inform decisions? Stand out from the rest with livestream analytics.

ifm moneo platform goes beyond monitoring and detection, it gives you full visibility and control over your assets.

Are

The

you?

What does it mean for

Real-time monitoring

maintenance

the

of

machinery gives you peace of

It also allows

to perform maintenance at optimal

smart way to monitor your equipment

condition

your

mind.

you

times. The

WHAT DOES AN END TO CHINA’S COAL BAN MEAN FOR AUSTRALIA?

THE RECENT PARTIAL LIFTING OF CHINA’S COAL BAN WAS MET WITH CAUTIOUS OPTIMISM IN THE AUSTRALIAN RESOURCES INDUSTRY. BUT WILL IT PROVE MORE SYMBOLIC THAN MEANINGFUL?

hen China made the decision to ban imports of Australian coal – among other items – at the end of 2020, it came as a blow on multiple levels.

Not only had Australia had been China’s second-largest coal supplier in 2019, buying up nearly $14 billion worth of coal (21 per cent of Australia’s coal exports for the year), but it marked a negative point in diplomatic relationship between the two countries; the ban came about amid escalating hostilities driven by disagreements over health matters relating to the origins of COVID-19.

WAccording to reports in the state-run Global Times, China was to prioritise imports from Mongolia, Indonesia and Russia, leaving hundreds of millions of tonnes of Australian coal anchored off the Chinese coast.

Wang Yongzhong, director of the Institute of Energy Economy at the Chinese Academy of Social Sciences, reportedly said that “as the relationship between China and Australia has been deteriorating” Australia was “gradually losing the Chinese market” to neighbours such as Mongolia.

In addition, China’s Foreign Ministry spokesperson Wang Wenbin said at the time that the country’s actions regarding imported Australian products, including

coal, were in line with Chinese laws and regulations.

And while then-Australian Prime Minister Scott Morrison said the ban would be in breach of World Trade Organisation rules, the decision stood and China was effectively no longer a customer for Australian thermal and coking coal.

Until January 2023.

News emerged on Thursday January 5 that as China was seeking more coal for its power and steel plants amid disruptions caused by the Russia–Ukraine war, it was planning to partially lift the ban and allow three governmentbacked utilities and the country’s top steelmaker to resume imports.

According to two people familiar with the matter, reports said, China’s National Development and Reform Commission held talks that week on allowing four major importers – China Baowu Steel Group Corp., China Datang Corp., China Huaneng Group Co. and China Energy Investment Corp – to make purchases in 2023.

That news was followed by January 10 reports that China Energy Investment Corp placed an order for Australian coal, and later by the arrival of 72,000 tonnes of coal in the southern city of Zhanjiang on February 9.

But assuming China is lifting its ban, what does it mean for the Australian coal industry?

MINING 22 MARCH 2023

AUSTRALIAN

COMMODITY SPOTLIGHT

CHINA IMPLEMENTED ITS BAN ON AUSTRALIAN COAL IN LATE 2020.

One could be forgiven for thinking the loss of such a key international customer would be a fundamentally damaging blow to the Australian coal industry.

But it has not been that simple.

Since China implemented its unofficial ban on Australian product, the price of coal has soared to neverbefore-seen heights. The spiking price has been largely driven by a global energy crisis and the geopolitical catastrophe that came from Russia’s February 2022 invasion of Ukraine.

The price of coal exceeded $US400 per tonne in 2022 and was hovering around $US268 at the time of publication (early February 2023).

These prices have in turn resulted in record profits for many of Australia’s major coal players.

New Hope Corporation delivered a net profit before tax of $1.401 billion for the year ended July 31 2022, which chief executive officer Rob Bishop said was due to strong demand and global supply constraints that pushed thermal coal prices to record levels.

Whitehaven Coal reported a record net profit after tax of $2 billion for the year ended June 30 2022, as well as EBITDA (earnings before interest, taxes, depreciation, and amortisation)

South32 posted record profits of $3.76 billion in the 2021–22 financial year. The windfall profits represented a massive 432 per cent jump from FY21 ($US489 million), along with a 156 per cent increase in underlying $US4.76 billion.

In addition to these types of eyeopening profits, Australian coal producers have also taken steps to diversify their customer base since China shut its doors in December 2020.

“The Australian coal industry has been successful in finding alternative markets,” a spokesperson for Australia’s Federal Resource Minister Madeleine King said in early January amid word of China easing its coal ban.

Queensland Resources Council (QRC) Ian Macfarlane echoed that sentiment, and while the QRC was clear that it would welcome the lifting of the ban, the industry’s successful efforts to broaden its customer portfolio had made it less of an imperative.

“It is worth noting that increased exports to other countries, particularly India and (elsewhere) in Asia, over the last two years have seen longterm relationships built with these countries,” Macfarlane said.

“These alternative markets to China are now seen by Queensland coal

COMMODITY SPOTLIGHT AUSTRALIAN

SUCCESSFUL IN FINDING ALTERNATIVE MARKETS (SINCE CHINA IMPLEMENTED ITS BAN).”

IMAGE CREDIT: JACKSON STOCK PHOTOGRAPHY / SHUTTERSTOCK.COM

AUSTRALIA HAD PREVIOUSLY EXPORTED BILLIONS OF DOLLARS OF COAL TO CHINA EACH YEAR.

SINCE THE BAN, COAL HAS OVERTAKEN IRON ORE AS AUSTRALIA’S TOP EXPORT EARNER.

news of the ban potentially being lifted on January 9, expectations of a major boost for exporters were more muted the following day and the overall market rose just 0.6 per cent at the time.

Australian coal doing just fine

As it happens, Australian coal has been doing quite well over the past couple of years despite not having China as a customer. In fact, coal has outpaced iron ore as Australia’s top export earner.

With prices at historical highs, Australia’s combined coal exports, which includes metallurgical coal and thermal coal, are forecast to earn $132 billion in 2022–23.

“Many Western nations are having to pay substantially more for energy, on the high chance that sanctions on Russia will see some Russian production – particularly gas and coal – become stranded from world markets,” the Australian Government’s

Resources and Energy Quarterly: December 2022 stated.

“Gas/LNG (liquid natural gas) shortages are causing some Northern Hemisphere nations to seek thermal coal to generate power for heating during winter; many Western European nations need high-quality thermal coal for their coal-fired power stations.

“Australian coal is likely to take the place of some lost Russian contracts.”

While China’s return as a customer for Australian would no doubt be welcome, industry analysts doubt a return to the previous levels of trade between the two countries.

“That doesn’t mean the move is without significance,” Reuters reported in January 2023.

“But the impact is likely to be more about improving ties between China and Australia, which became strained when Canberra called for an investigation into the origins of the coronavirus pandemic, resulting in China banning imports of several goods from Australia.”

Prior to the ban in 2020, China was importing 3.5–4.3 million tonnes of thermal coal from Australia, with the 2020 peak coming to 4.26 million in April of that year, according to data compiled by commodity analysts Kpler.

Reuters, however, reported “there are several reasons why Australian coal won’t once again become a major factor in China”.

“The first, and most important, is that Australian coal will struggle to compete on price in China, especially thermal grades used to make electricity,” the outlet stated.

China has since come to rely heavily on the availability and affordability of coal from Russia, despite ongoing sanctions, importing 2.96 million tonnes of Russian thermal coal in December 2022.

“The question is whether Australian coal miners can compete on price with Russian thermal supplies, and the answer is probably not,” Reuters stated.

Industry analysts have also speculated that while Australian producers would

COAL PRICE CAP

China looking to ease its ban on Australian coal is not the only major thing to happen in the industry in recent months.

In an attempt to curb runaway energy prices, the Australian Government announced a temporary $125-per-tonne cap on coal prices in December 2022 as part of its Energy Price Relief Plan. Australia’s electricity prices have been tipped to increase by 56 per cent by the end of 2023.

Prime Minister Anthony Albanese said at the time that the urgent action, taken in partnership with state and territory governments, would shield Australians from the worst impacts of predicted energy price spikes, and deliver responsible and targeted relief to families, small businesses and manufacturers.

The governments in major coalproducing states New South Wales and Queensland took action by effectively setting a ceiling for the price of coal used for electricity generation to $125 a tonne, with the Commonwealth to contribute to costs.

“The reality is that due to global circumstances and a decade of energy policy mismanagement, Australians will continue still see high energy prices for some time,” Albanese said.

“The average family would be $230 worse off (in 2023) if we do not take action.”

certainly find a way to reengage with China, many may be wary of casting a shadow over deals and relationships that have been established with new international customers like India and Vietnam.

Regardless, China’s hunger for coal will certainly grow as the country continues to emerge from its stringent zero-COVID policy, which brought much the country – including its construction and housing markets – to a standstill.

It is unquestionably in both countries’ interest for China and Australia to resume their coal business. But once that relationship is indeed back up and running, it seems clear, at least to industry analysts, that the volumes in question will be moderately small.

All of this would suggest that while another export avenue would be welcome, China as a customer for Australian coal may not be as important as it once was and any gains would be relatively modest. AM

COMMODITY SPOTLIGHT AUSTRALIANMINING 24 MARCH 2023

RUSSIA’S INVASION OF UKRAINE HAS IN PART SPURRED A GLOBAL ENERGY CRISIS AND DRIVEN COAL DEMAND.

Expect more sustainability

Solving the challenge of scrap tyres in a way that’s ethical and sustainable could be around the corner for Australia. After opening a thermal conversion OTR tyre recycling facility in Chile that converts scrap tyres into its base elements, Kal Tire hopes to bring this scalable solution to other regions.

Kaltiremining.com

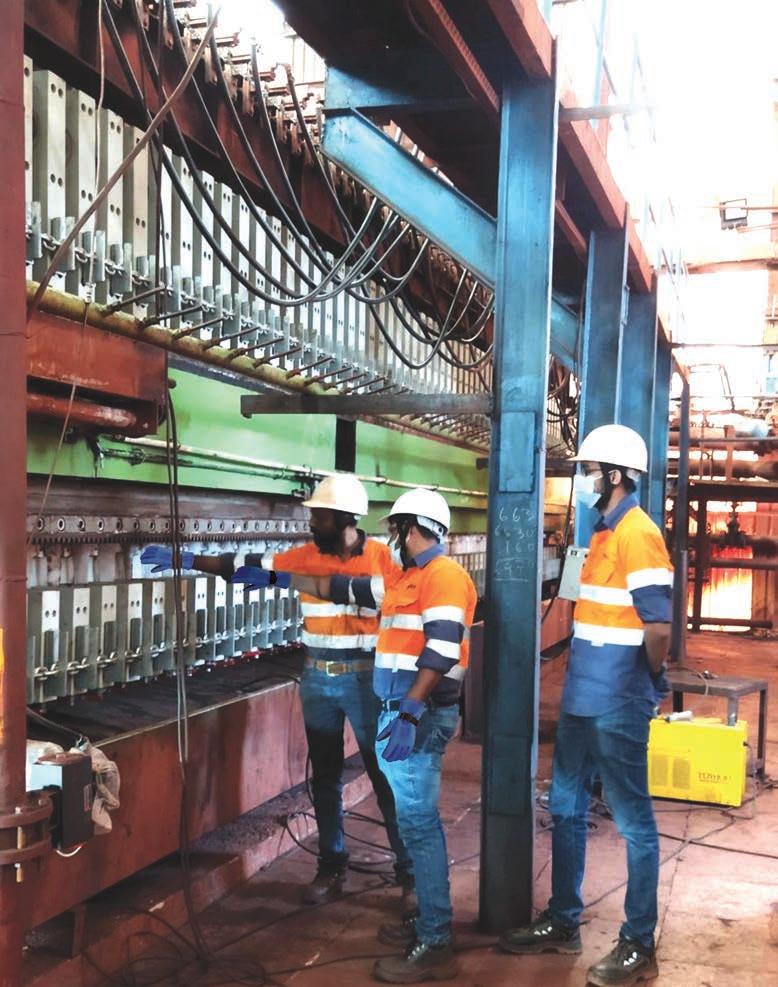

AN ESTEEMED OEM SETTLES IN NEWCASTLE

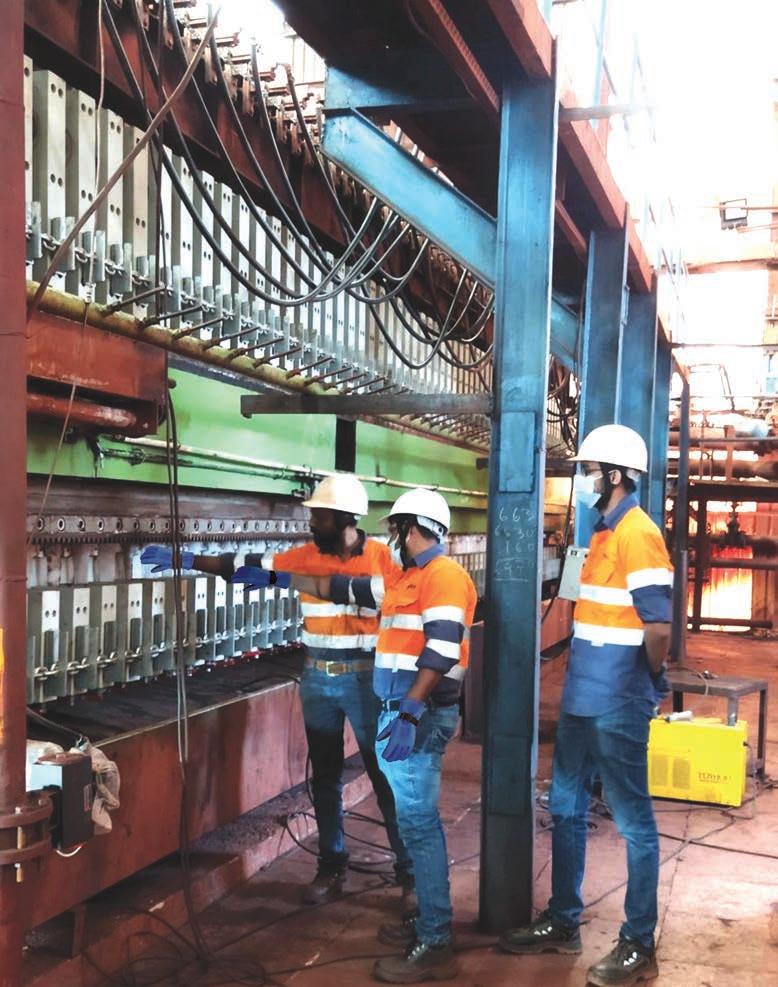

AFTER LAUNCHING A NEWCASTLE SERVICE FACILITY IN LATE 2022, ALTRA MOTION HAS ESTABLISHED A DEDICATED LOCAL ENGINEERING DIVISION TO SUPPORT ITS NSW MINING CUSTOMERS.

Already recognised as a global designer and manufacturer of motion control and power transmission solutions for the local mining sector, Altra Motion Australia is taking things up a notch in 2023.

The original equipment manufacturer (OEM) recently underwent a restructure, with a dedicated engineering division introduced to accompany its existing sales and service divisions.

Altra Motion national marketing manager Gabriel Brooks said given the OEM’s strong global engineering presence, it was a natural evolution to establish greater

engineering capability in its key markets within Australia.

“If you look at our products and you look at our customers, all of our products are engineered, so as well as having engineering support from our 26 BUs (business units) overseas, such as Svendborg, Twiflex and all of our other internal brands, we wanted to have a really strong engineering team in Australia which can be hands on for our customers,” she told Australian Mining

Altra Motion’s New South Wales clients are already seeing the benefits of this new structure, with the OEM’s recently opened Newcastle facility a strong base for all sales, service and engineering enquiries. Brooks said the new structure has enabled a “cleaner

COMPANY PROFILE MARCH 2023

ALTRA MOTION RECENTLY SET UP A TWIFLEX BRAKES CRITICAL SPARES PROGRAM FOR A NSW CUSTOMER.

ALTRA MOTION NSW SERVICE MANAGER CRAIG KELLY IS BASED OUT OF THE NEWCASTLE FACILITY.

integration” of the business, ensuring that engineering requests or enquiries can be actioned immediately.

“We found that having local engineering support and technical advisors was necessary to ensure our customers get the appropriate real-time assistance,” she said.

“In the past, the sales team would go directly to our BUs overseas, but now having a local engineering team that are educated and responsible for specific products, then they can provide real-time support.”

Altra Motion will still have continued support from its factory engineers where necessary.

“But the idea is the local engineering team can filter what goes through to them to ensure a more immediate response,” Altra Motion national technical product specialist Paul Boland told

gathering so that if an enquiry does have to go back to the appropriate manufacturing team, we’ve gathered the correct information, rather than having to go back and forth between sales personnel and a factory engineer.

for the customer. As soon as it gets technical, the engineering team is called in to represent the product, whatever the brand is.”

demonstrate his point.

pre-planned program for our ICC (International Clutch Company) shovel brakes at local mine sites in the Hunter Valley,” he said. “So now it’s not just the service program, it’s also the stocking program that goes with it and the entire pricing structure.

its entirety so that the flow from the customer’s perspective is much more seamless. They come to us with an ICC brake, we know whether we’ve got it in stock or not, or where our stock order is in relation to importing stock.”

stock orders arriving shortly, with more stock to be ordered throughout the rest of 2023.

here in Newcastle to support the ICC program, which is going to make a huge difference to turnaround times,” he said. “If we’ve got the components in stock, we can supply the part in a matter of weeks, not months.”

also recently assisted a mining company operating in the central west region of NSW establish a customised critical spares program.

The project, led by Altra Motion national technical product manager Daemon Flack, initially saw the mine site install a new set of Twiflex brakes.

“A set of brakes was removed from site and sent to our service team for a major overhaul,” Altra Motion NSW service manager Craig Kelly told Australian Mining. “Once the brakes were fully overhauled, they were sent back to site and then a new set of brakes were delivered at a later date.

“During the next shutdown, the new set of brakes will be installed into the

be overhauled at our Newcastle facility.”

As part of the critical spares program, the customer always has a spare set of brakes on hand to install whenever there is a shutdown, accelerating the maintenance process and reducing downtime. This applies not only to Twiflex brakes, but other Altra Motion products as well.

Since Altra Motion has opened its Newcastle facility, the city and surrounding mining sector are enjoying the benefits of having a globallyrecognised OEM at their doorstep.

often unspecialised and can result in reverse engineered products being manufactured and installed.

And the community is not just benefiting from Altra’s new local engineering capability, but also the established sales and services arms that have long supported NSW customers.

“As a service team, we don’t limit ourselves to just being arms and legs on-site ,” Kelly said. “We offer on-site training where we show the customer how we service products and how brakes should be set correctly.

COMPANY PROFILE

REDUCING LINE-OF-FIRE DANGER WITH SMART TOOLS

SAFEGAUGE HAS CREATED A RANGE OF INTUITIVE TOOLS THAT ARE INDISPENSABLE FOR THE SAFETY OF MAINTENANCE PERSONNEL WHEN COMPLETING THE LIVE TESTING OF HEAVY MOBILE MACHINERY.

Technicians’ reliance on wireless sensors and the need to access data when servicing mobile equipment is nothing new.

But smart, simple and safe technology for technicians working on heavy mobile machinery has been missing from that equation.

This gap in the market has been filled by SafeGauge and its awardwinning range of diagnostic tools that significantly reduces the risk of being severely injured when undertaking live testing.

“SafeGauge has squarely focused on designing and manufacturing a range of diagnostic tools that are as accessible and intuitive to use as possible,”

SafeGauge’s sales manager Josh Conroy told Australian Mining.

“When you’re a technician out in the field, you don’t want to spend half an hour trying to work out how to use the tools you’re given.”

The company has worked hard developing the core functions of a product line that includes the SafeGauge Pressure Transducer (PT) series, Dial Indicator (DI) series, Tachometer (TM) series and the Wireless Multitool (W-MultiTool).

“A significant period of field testing – adjusting, refining, simplifying –ensured the fundamental basics of the tools were right and would result in a seamless operating experience for technicians,” Conroy said.

SafeGauge is a technology company that has long been focused on providing maintenance technicians with the best equipment to do their jobs safely and efficiently.

“The risk involved with human and machinery interaction has always been significant, and although many of the maintenance tasks are routine, the dangers are ever-present,” SafeGauge founder Luke Dawson told Australian Mining

“Our technology removes technicians from those dangerous zones and, in essence, eliminates that safety risk.”

SafeGauge solutions mean multiple equipment tests can be completed simultaneously.

For example, a SafeTest PT Series kit consists of two, four, six or seven PTs, plus the W-MultiTool and charging

to plug a mechanical pressure gauge connected through a high-pressure hose into different parts of a machine or hydraulic system in order to complete a pressure test – and in doing so place themselves in unsafe, potentially dangerous positions – that requirement no longer exists,” Dawson said.

The PT connects to the W-MultiTool, which displays the live pressure readings, has a battery life of more than 20 hours, and is easily recharged using the rugged case.

The SafeGauge DI is a Bluetooth device designed to measure displacement within 0.01mm. With Bluetooth connectivity from up to 50m away, technicians retain the ability to complete maintenance safely and more efficiently.

“With the requirement to measure wear on large pins and bushes on various parts of the frame of a machine, the DI is also designed to move the technician away from crush areas while testing is underway,” Dawson said.

MAINTENANCE AUSTRALIANMINING 28 MARCH 2023

SAFEGAUGE DI IS A BLUETOOTH DEVICE DESIGNED TO MEASURE DISPLACEMENT WITHIN 0.01MM.

THE SAFETEST PT SERIES KIT IS SUITABLE FOR MEASURING GAS OR FLUID IN A VARIETY OF PRESSURES.

GROUND AND WATER CONTROL SOLUTIONS

Minova brings the full portfolio of solutions for underground mining. Every work environment has its own specific challenges.

www.minovaglobal.com/apac

BRINGING COATINGS MAINTENANCE INTO THE DIGITAL AGE

AKZONOBEL’S INTERPLAN ASSET INTEGRITY SOFTWARE HELPS MINES IDENTIFY CORROSION AND SAFETY ISSUES, PRIORITISES AREAS REQUIRING REWORK, AIDS IN DEVELOPMENT OF SCOPE OF WORK FOR TENDERING, AND OPTIMISES MAINTENANCE INTERVALS.

Interplan was launched in the 1990s to help International Paints – an AkzoNobel company – add value to paint sales and assist its customers with holistic maintenance solutions

Originally, a mine site would be inspected, with photographs taken using a film camera, that would then be developed and glued into a paper report that was written up on a typewriter.

As the technology developed and computers became more powerful, reports were digitised with paint specifications included into the report, but there was still room to improve. Working in partnership with PK Technology, USA, AkzoNobel developed the next generation of Interplan software, using direct data and mobile technologies to complete site surveys faster, more efficiently and more comprehensively.

Grant Woolnough, strategic accounts manager for maintenance and repair at AkzoNobel, has worked with Australian mine sites for the past 20 years, performing countless coatings inspections in that time.

He told Australian Mining that the industry has changed dramatically since the Interplans were introduced.

“A lot of the time when people think about maintenance, they think about replacing pumps, motors, belts, that kind of thing,” he said.

“We focus on condition assessment of the structural steel, the skeleton of the whole operation. Twenty years ago, mine(s) may have had someone dedicated to coatings assessment, but nowadays industry has changed, and this is a lot less likely.

“We have the expertise to inspect assets using NACE (National Association of Corrosion Engineers)-certified personnel, providing an accurate assessment of the facilities’ condition.”

Painting steel is up to 10 times cheaper than replacement, especially when considering operational downtime and environmental implications.

Interplan allows AkzoNobel to identify corrosion and coating issues, so the asset owner can address issues before they escalate into bigger problems. Working in conjunction with the site, AkzoNobel inspects the mine operation using a tablet to upload images and data via cloud-based software

This data is then analysed and uploaded to an interactive dashboard which the customer accesses online. This

dashboard uses a traffic-light system run in conjunction with the mine’s safety management plans, identifying exactly what needs rectification

Interplan is a live tool. When maintenance work is carried out or replacements are installed, the data is updated to reflect the changes in the assets condition so the mine can actively see what is improving and what area next requires maintenance.

AkzoNobel regional maintenance, and repair manager for south Asia, David Johnstone, said Interplan provides an accurate assessment of the facilities coating condition, which can then be used for budgetary and tendering purposes. The software also provides efficiencies by managing coating lifecycle costs, tracking repair contracts, and providing quality information for better operation, accuracy of measurement and control.

“The beauty of the Interplan is the traffic-light system on the dashboard – green means the coating is in good condition, red and purple means the coating needs immediate attention,” he said.

“Asset owners can then calculate where they need to budget capex (capital

expenditure) dollars to bring them back to spec with far greater accuracy.”

The system allows an asset manager to drill down and see what is happening at specific areas on the site.

Woolnough said AkzoNobel’s global reach and extensive expertise means customers know it can provide results.

“We’ve been around for more than 140 years internationally, and we have specialised in coatings for industry,” he said. “Customers like us because we know their systems and we talk their language. We know the industry never stops, which is why we’re always ready to send someone out to a site.

“Over the years we have created firm relationships with our customers, and we can see the results from the repeat business. If you’ve been the supplier for a business for more than 48 years, you must be doing something right.”

AkzoNobel is continuing to develop the product and is looking to incorporate new technologies and processes into the Interplan system.

Drones, automated equipment readings, and 3D analysis software will allow AkzoNobel the flexibility to assess structures at heights, underwater and underground. AM

MAINTENANCE AUSTRALIANMINING 30 MARCH 2023

INTERPLAN ALLOWS AKZONOBEL TO IDENTIFY CORROSION AND COATING ISSUES.

PAINTING STEEL IS AROUND SEVEN TO TEN TIMES CHEAPER THAN STEEL REPLACEMENT.

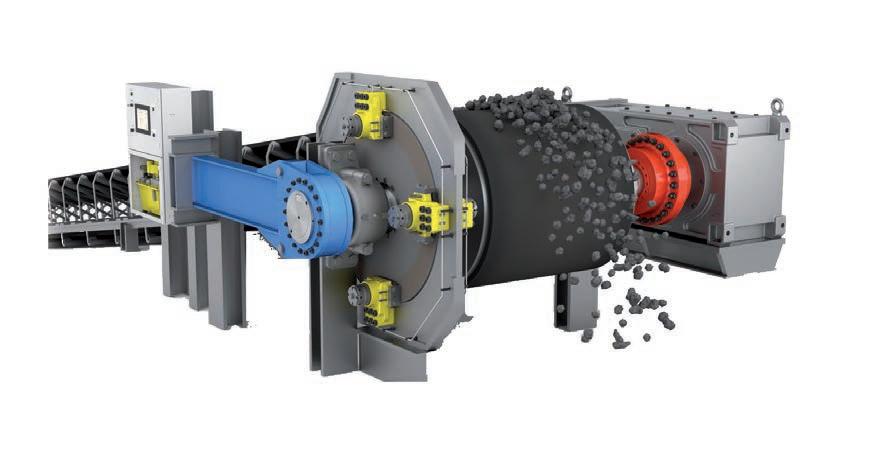

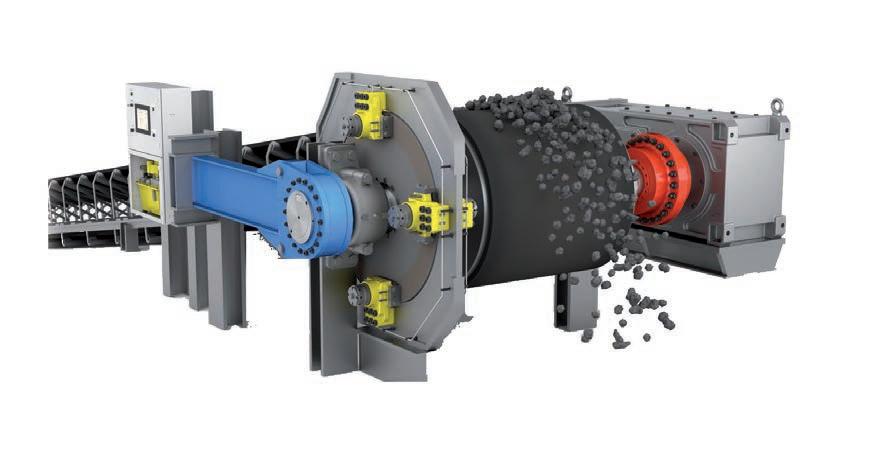

TURNING WASTE MINING TYRES INTO VALUE

The mining industry is one of world’s biggest users of offthe-road (OTR) tyres. As a consumable product, these items have traditionally had a linear make–use–dispose trajectory, with few options for refuse or reuse. However, mining companies’ increasing focus on environmental, social and governance (ESG) performance in recent years has shone a spotlight on their waste management practices and the possibility of building greater circularity into business models.

This, combined with impending regulation in various mining countries, is pushing organisations to take another look at the possibility of tyre recycling.

There is a common misconception that tyre recycling is an additional operating expense, one that companies would rather not shoulder when margins

are already squeezed by low ore grades and high energy and labour costs.

But there is a chance to generate significant social, environmental and reputational value while helping businesses towards their immediate goal of carbon neutrality and longer-term net-zero targets.

How many tyres?

According to Tyre Stewardship Australia’s 2020 Off-the-road used tyre analysis report, the Australian mining industry generated 68,100 tonnes of used tyres in 2019. Of that, 93 per cent was disposed of on-site (ie piled up or buried) three percent was sent to landfill, and just one per cent was recycled, with the remainder stockpiled or used in civil engineering.

In the five years from 2014–19, Australian mines collectively generated 315,500 tonnes of used tyres.

Mines are long-term operations, and some have commercial lives spanning more than 40 years. This means there are likely millions of tonnes of used tyres at mine sites across the globe.

“There are huge quantities of OTR tyres awaiting final deposition at mines around the world,” Kal Tire’s Mining Tire Group senior vice president Dan Allan said.

“Finding management solutions is difficult, because very few recycling facilities can handle mining tyres. Some ultra-class products weigh approximately five tonnes apiece, so they require specialist lifting equipment and transportation, in some cases, over long distances to reach the facility, and then dedicated shredders to reduce their size.”

Although in most mines used OTR tyres are buried or used to create final landforms upon closure, some companies are doing their best to repurpose them

in the interim; for example, cutting the tyres in half and using them as safety berms along haul roads or passing them to agricultural neighbours to use as cattle feed troughs.

Regardless of such measures, the problem that tyres don’t degrade remains. While their component materials are chemically inert, tyres used on-site or sent to landfill will remain in the landscape indefinitely.

“Shredding is better than burying but, ultimately, it’s just delaying their journey to landfill,” Allan said. “The world only needs so many tyres in playgrounds or lawn mulch. It really doesn’t need any more oil-based products to be burnt.

“We should be seeking out the highest and best uses for these materials. By breaking tyres down into their fundamental elements – carbon black, steel and petroleum-based products – we can reuse them to create new tyres.

MAINTENANCE AUSTRALIANMINING 32 MARCH 2023

KAL TIRE BUILDS THE BUSINESS CASE FOR OFF-THE-ROAD TYRE RECYCLING.

THE MINING INDUSTRY IS ONE OF WORLD’S BIGGEST USERS OF OFF-THE-ROAD TYRES.

“That is the optimal use because it provides a substitute for new carbon products and helps to reduce their total carbon footprint.”

Elevating awareness through ESG

While they are chemically inert, there are still many safety risks associated with storing waste tyres. But the biggest risks (and opportunities) are related to ESG.

Investors, stakeholders and landowners are becoming increasingly interested in the way in which mining companies steward the land.

In time, outdated practices such as burying tyres could pose a reputational risk for a sector whose environmental and social performance is increasingly under a microscope.

Ontario, Canada, was one of the first major mining destinations to introduce tyre recycling legislation in 2016; however, this mainly centres on shredding and repurposing the rubber.

Other Canadian provinces have voluntary initiatives; for example, Kal Tire’s Mining Tire Group has partnered with Liberty Tire LLC to offer shredding services for earthmover tyres across western Canada.

have indicated the system there has problems which have led to tyres being stockpiled.

ATLAS COPCO QAC 1450 TWIN POWER GENERATOR

FEATURES:

• Over 70% load step acceptance

• Ideal for portable and intensive use

• Robust twist lock & forklift inlets

• 110% spillage free frame

• Performs in extreme temperatures & at high altitudes

• Designed with large access doors for ease of service

• Minimal maintenance and 500 hour service intervals

cent in 2027 and 100 per cent in 2030.

To help enable this transition, Kal Tire’s Mining Tire Group opened

The QAC 1450 TwinPower™ is the ideal generator for applications requiring variable power needs that can be set to suit the time of day or specific usage requirements. Featuring 2 x 725 kVA generators inside the 20 foot containerised unit the QAC 1450 TwinPower™ allows you to run on one engine while servicing the other, providing a built-in backup as standard.

With two generators in one platform, the QAC 1450 TwinPower™ provides the flexibility you need to run at 100% power load or low power loads in the most efficient way. What’s more, every feature you need comes as standard.

LIKE TO KNOW MORE? SPEAK TO OUR TEAM TODAY

PH: 1800 733 782 www.atlascea.com.au

MAINTENANCE AUSTRALIANMINING 33 MARCH 2023

KAL TIRE’S RECYCLING FACILITY IN CHILE CAN HANDLE UP TO 20 TONNES OF TYRES PER DAY.

TYRE RECYCLING OFFERS A CHANCE TO GENERATE SOCIAL, ENVIRONMENTAL AND REPUTATIONAL VALUE.

an OTR tyre recycling facility in Antofagasta in 2021 which can handle up to 20 tonnes of tyres per day, including ultra-class products.

The company has developed a unique thermal conversion process that uses heat and friction to convert the tyres back to their base elements – 100 per cent of the material can be repurposed – with no harmful emissions.

The solution is scalable and could be replicated in other mining markets, and Australia looks set to be next.

Tyre Stewardship Australia recently received a federal grant to deliver a business case that will improve OTR resource recovery in various sectors, including mining. The final report is slated for delivery in March.

Regulations such as these are a step in the right direction; however, they are only applicable from the date of introduction. Many mines will have operated prior to this and built up a stockpile of waste tyres and/ or could find themselves exempt due to incumbent regulation at the time of permitting.

While it’s unlikely that buried tyres would ever need to be dug up, as more legislation is introduced mining companies will need to evolve their used tyre management and mine closure practices in order to be compliant.

Finding the funding

The desire for change is real, but the question of how to pay for it remains.

Regardless of the chosen method, the recycling of OTR tyres is costly and if there is no regulation mines can struggle to make the case for capital allocation.

“One way to tackle this is through accessing mine remediation budgets,” Allan said.

“Every mine has money set aside for reclamation and eventual closure. The challenge lies in accessing that budget

today, so that mines can recycle tyres progressively rather than waiting until closure when there are thousands of products awaiting disposal.”

Regulators across the globe are starting to support this thinking.

In April 2022, British Columbia introduced an interim reclamation security policy for the mining industry which requires that reclamation liability cost estimates include conventional reclamation (such as re-sloping and revegetation) and environmental liabilities (such as water treatment).

The policy also requires bonding for specific liabilities and actively

encourages progressive reclamation throughout the life-of-mine consistent with industry best practices to reduce site liabilities, closure timelines and ongoing monitoring requirements.

Carbon taxes are also on the horizon. In the places that currently have recycling legislation for OTR tyres, re-treading or extending the operating life of used tyres is an integral part of the process.

“The carbon-trading landscape is still evolving; however, it’s possible to see how re-treading and recycling could potentially be harnessed to create a carbon-positive effect,” Allan said.

“For example, Kal Tire’s Maple Program uses a third-party accredited carbon calculator to quantify and reward mining companies for the oil and carbon emissions they save by using its Ultra Tread re-treading and Ultra Repair services.”

Greater uptake of recycling can also drive social prosperity. Through committing to recycling and building partnerships with Indigenous businesses to create reliable and sustainable supply chains, mining companies have the chance to boost the local skills base and technological capabilities and leave a positive legacy for the communities in which they operate.

“Companies can create a virtuous circle,” Allan said.

“Because carbon doesn’t degrade, OTR tyres can provide a source of carbon black which can be used to reduce pressure on primary production.

“Approximately 8.1 million tonnes of carbon black are produced worldwide each year, and 90 per cent of that is used in rubber applications.

“Imagine the impact the mining industry could have on the circular economy if it worked to turn its waste tyre stream into a source of value.”

Working together to generate value

Ultimately, a diverse approach is required to boost uptake and accessibility in OTR tyre recycling.

This approach includes governmentled policy, standards (to ensure safety and quality in the collection and recycling process), proactive investments from mining companies, technological and product innovation from tyre manufacturers, and willingness from local businesses to build the skills and capacity required to turn these ‘waste’ products into a source of value.

That change necessitates openness, communication and collaboration across the complete value chain.

“To enable this transformation, mining companies should find ways to build bridges from their boardrooms to mine sites, to raise visibility of this issue and to help teams to access remediation budgets,” Allan said.

“Companies might consider ways to access those funds to meet today’s reclamation needs – they don’t need to wait until year 25 to begin turning their waste tyres into value.” AM

MAINTENANCE AUSTRALIANMINING 34 MARCH 2023

KAL TIRE’S MAPLE PROGRAM USES A PROPRIETARY CARBON CALCULATOR TO QUANTIFY AND REWARD MINING COMPANIES FOR THE OIL AND CARBON EMISSIONS THEY SAVE.

KAL TIRE OPENED AN OFF-THE-ROAD TYRE RECYCLING FACILITY IN CHILE IN 2021.

JSG A2 Smart Controller & Autolube APP

A2 controller for managing automatic lubrication systems

The JSG A2 smart controller is the next generation of lube management in progressive lubrication systems. An integrated IOT solution for managing and monitoring the lubrication of critical capital assets. Bluetooth connectivity provides localised remote management. When paired with the mobile Autolube app users have complete control of the auto lubrication system, improving the process of commissioning, testing, and troubleshooting of lubrication systems on machinery.

Our strength comes from high-quality distribution partners who manage installation, service, technical support & training nationwide. As you plan for the future, let our experience guide your success.

Lubrication Management | Flow Management | Fire Suppression

JSG Industrial Systems | jsgindustrial.com | 1300 277 454 Quality

Engineered Systems

RINGING IN 150 YEARS IN THE BUSINESS

ATLAS COPCO HAS GONE FROM STRENGTH TO STRENGTH SINCE STARTING IN 1873, AND THE COMPANY IS LOOKING TO THE FUTURE AS IT CELEBRATES ITS 150TH BIRTHDAY.

or a company to survive for 150 years while still growing and being profitable, it has to have a credible way of going forward. And that’s what Atlas Copco has.”

That is Roshan Kumbla, business development manager at Atlas Copco.

Kumbla and Atlas Copco product manager Sonik Barot agree that the 150th anniversary is a proud moment for the company, which now boasts over 40,000 colleagues and customers in more than 180 countries

Atlas Copco dates back to 1873, and the company began operations in Australia in 1950. In that time, it has been on hand for some of the country’s major historical events.

Take, for example, the rescue mission of the Granville train disaster in NSW in 1977, which was aided by Atlas Copco RH-series rock drills, a Darda rock-splitter and PRHS700 portable.

Or when palaeontologist Thomas H. Rich used assistance and equipment from Atlas Copco to help unearth a new dinosaur species in Victoria in 1984. The new species was subsequently named after the company: Atlascopcosaurus loadsi.

Having such a wide and varied history has allowed Atlas Copco to get to know its customer base and anticipate the next trends in compressors.

“F“Our continuous development and improvement processes are the keys to our growth,” Barot said.

Much of this development has been focused on sustainable solutions.

“It comes down to using less rare earth materials and using energyefficient motors,” Kumbla said. “Every product that we evolve creates real value for our customers, especially since those evolutions create less of an impact on the environment.

“We can confidently say that we’re going to be able to create more energyefficient compressors and solutions for our customers.”

For Atlas Copco, sustainability means delivering greater value to all stakeholders in a way that is economically, environmentally and socially responsible.

“Considering that the world is moving toward carbon-neutral, Atlas Copco can support this with green hydrogen production,” Barot said.

“Mines are transitioning to the minimisation of environmental harm and Atlas Copco is in a good position to be a part of this process.”

The company is already putting these future-facing plans into action by visiting mine sites and recommending environmentally friendly solutions.

“One of the gold mines we visited had multiple machines running at one time and I suggested they try our solutions which minimises their power and personal costs,” Kumbla said.

generation reduces the cost of quality compressed air and gases and significantly reduces CO2. Our patented Cerades desiccant dryer is a nice example of such a breakthrough innovation. It provides better air quality, lower energy and service costs, and health and environmental benefits.

Our ambition is to create a carbon-neutral compressor room. Thankfully, most companies have decided to become part of the solution. It’s a win-win for the environment and for the future of your business.

Scan the QR code and let’s work together for a carbon neutral future!

EQUIPMENT

“They had about eight machines running, and my suggestion was to change to one centrifugal technology which gives them the bulk load demand while turning down the power atomically based on the usage.

“This not only minimised the energy consumption, but also decreased their operational costs.”

Atlas Copco’s focus is not just on selling equipment but providing a complete solution for the customer, from selecting the correct size of compressor to the remote monitoring and diagnosis of the system.

“What makes Atlas Copco so powerful as a solutions-provider is that it is involved with every aspect of the compressed air business, supported with a broad product portfolio,” Kumbla said.

“Our 150 years of experience makes us stronger and more equipped to handle challenges, ensuring that every new product is 15–20 per cent better than its predecessor.

“So when we say a new product is being developed, it’s not just a new model. This continuous evolution makes us a leading provider.”

While Atlas Copco has a proud history, it’s these new solutions that have the company excitedly looking forward as it approaches its 150th birthday.

“One of our missions is to sell all machines with variable-speed technology by 2030, meaning that the technology will save energy from day one,” Kumbla said.

“We have a lot of confidence in our ability to do this, and in our ability to have a lesser impact on the environment.”

And Barot concurred.

“It’s not just state-of-the-art solutions that we provide, but reliable ones as well,” he said.

“Customers are looking for energyefficient, innovative and reliable solutions that work to give them peace of mind, and we are always pushing toward this.” AM

MAINTENANCE AUSTRALIANMINING 36 MARCH 2023

ATLAS COPCO HAS COME A LONG WAY SINCE ITS START IN 1873.

PALAEONTOLOGIST THOMAS H. RICH USED ASSISTANCE AND

FROM ATLAS COPCO TO HELP HIM UNEARTH THE ATLASCOPCOSAURUS LOADSI.

Integrated air quality

• Multiple smaller cartridges simplify and reduce service times and minimise oil carry over.

• The GA full feature comes with an integrated dryer for greater air quality.

• Pressure dewpoint of 3°C/37°F

• Continuously monitored dew point.

• New oil separator vessel with filter cartridges increasing compressor availability

Designed for efficiency

• SmartInjection provides exact amount of oil required to element ensuring it always works at peak efficiency.

• High efficiency IE4 (Fixed Speed) and IE5 Permanent magnet (VSD+) motors

• Optional integrated energy recovery system recovers up to 78% of energy from integrated motor and element oil circuit