PROGRESSING THE PROCESS

MINERAL PROCESSING

REMAINS AT THE HEART OF MINING OPERATIONS

REMAINS AT THE HEART OF MINING OPERATIONS

Built for demanding underground applications, the battery-electric Scooptram ST18 SG gives you the ability to work in tough conditions without exposure to diesel particulates and toxic gases. By featuring market leading battery autonomy and a complete battery safety system, you can go the extra mile when it comes to safety, sustainability and productivity in the 18-tonne loader segment.

Scooptram ST18 SG is part of the Smart and Green series and ready for automation and remote control. epiroc.com/en-au

PAUL HAYES

paul.hayes@primecreative.com.au

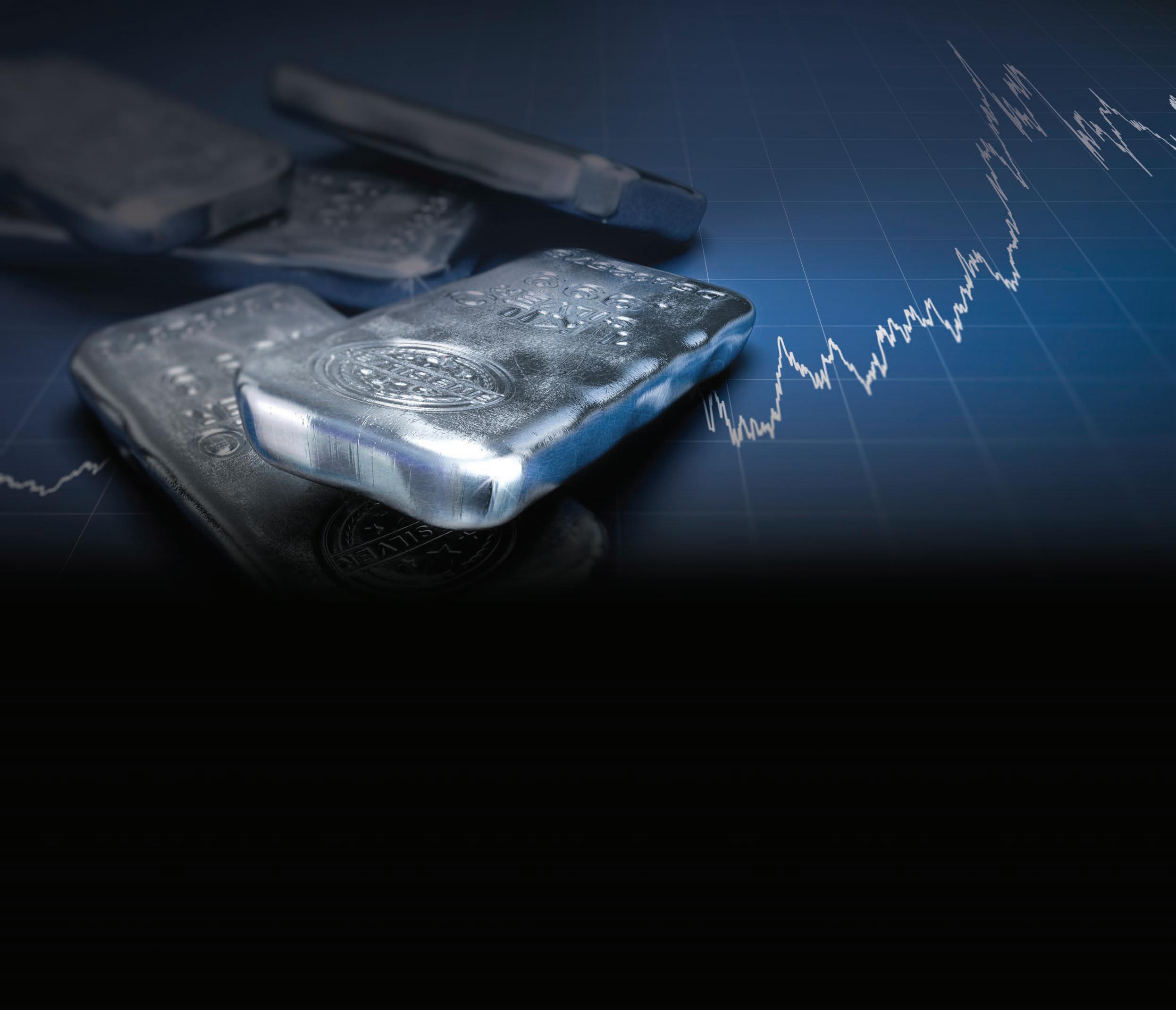

When it comes to mining, there is a fundamental truth: no matter how deep we dig, or how efficiently we move earth, there is little point to the whole thing if we can’t sort the proverbial diamonds from the rubble.

That’s why mineral processing is so essential to the industry.

The art of separating valuable minerals from the ore into a concentrated, marketable product is one mining companies are always striving to improve.

With the rising costs associated with production, coupled with the fact orebodies are getting deeper in the ground and more difficult to extract, those companies are working to shore up their operations, putting cost-efficiency at centre stage.

Fortunately, there have been a number of advances in the mineral processing space perfectly suited to capitalising on this trend. The exciting evolution of technologies will provide companies with better operational efficiency as well as a maximisation of productivity.

The April edition of Australian Mining is showcasing some of the mineral processing technologies, products, innovations and services that are helping future-proof mining companies against the challenges of tomorrow.

From powerful flotation technology to sustainable conveyor guards to filtration solutions to on-site gas-generation systems, mineral processing continues to develop and evolve.

Elsewhere, we have the first in a two-part series examining Deloitte’s Tracking the Trends report.

CHIEF EXECUTIVE OFFICER JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY EDITOR

PAUL HAYES

Email: paul.hayes@primecreative.com.au

JOURNALISTS ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

TOM PARKER

Email: tom.parker@primecreative.com.au

LEWIS CROSS

Email: lewis.cross@primecreative.com.au

TIM BOND

Email: tim.bond@primecreative.com.au

ASHLEY PERRY

Email: ashley.perry@primecreative.com.au

This annual report from the international professional services network highlights the trends that show the essential value the mining and metals sector can deliver, and we sit down with two experts to dig into some of the most important areas and how they pertain to the modern resources industry.

Sticking with industry analysis, we also provide a comprehensive breakdown on the half-yearly reports from mining companies across Australia. While these reports reveal something of a mixed bag for local miners, the future remains bright for our indispensable sector.

In this issue we also check in with some of the industry’s big decision-makers, with Australian Mining having been on hand for a recent presentation from Pilbara Minerals CEO Dale Henderson, who provided some fascinating insights from the perspective of a truly up-andcoming Australian miner.

In addition, we chatted to Roy Hill chief executive officer group operations Gerhard Veldsman about his company’s decision to become a sponsor of the 2023 Australian Mining Prospect Awards, further underlining their status as the country’s premiere awards suite for the resources sector.

DYNA Engineering is a WA-owned-and-operated conveyor specialist with more than three decades of experience in the industry. The company specialises in the design, manufacture and supply of quality conveyor equipment, components and related services. It is committed to local manufacturing, innovating the future of conveyor components, and reducing the environmental footprint of conveying operations. DYNA’s extensive range of products includes conveyor idlers, pulleys, belts, scrapers, air knives, tracking rollers and impact beds.

Cover image: DYNA Engineering

Paul Hayes Managing EditorCLIENT SUCCESS MANAGER

JANINE CLEMENTS

Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER JONATHAN DUCKETT Tel: (02) 9439 7227 Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

SALES ADMINISTRATOR EMMA JAMES Tel: (02) 9439 7227 Mob: 0414 217 190

Email: emma.james@primecreative.com.au

DESIGN PRODUCTION MANAGER

MICHELLE

A bigger machine for bigger results, Volvo’s 90-tonne excavator is built for the toughest applications with the perfect combination of power and stability.

Built with protected components, including a heavy-duty boom and arm, and strong frame structure, the machine can be relied on for durability and sustained uptime in demanding applications. Paired with the largest hauler on the market, the A60H and EC950E can be expected to deliver a high level of productivity in the mining industry.

18 INDUSTRY INSIGHT

Tracking the trends 2023: Part one

In the first of a two-part series, Australian Mining speaks with experts from Deloitte to examine the changing way mining companies are doing business in 2023.

22 INDUSTRY EVENTS

Roy Hill and Atlas Iron go Prospecting

Two of Australia’s major mining companies will sponsor awards at the 2023 Prospect Awards.

24 MINERAL PROCESSING

Shaking up flotation

Faster and more powerful flotation technology has arrived in the Australian mining industry courtesy of FLSmidth and the University of Newcastle.

28 MINERAL PROCESSING

Understanding and embracing ESG Australian Mining spoke with DYNA Engineering’s general manager about how the company is responding to changing ESG practices in the industry.

34 REGIONAL SPOTLIGHT

Boom times in the Hunter

Billions of mining dollars flow into the NSW economy, but no region has prospered quite like the Hunter.

48 INDUSTRY EVENTS

Transforming our future Austmine’s mining innovation conference and exhibition is set for Adelaide from May 9–11.

50 INDUSTRY INSIGHT

Mixed results for miners

The first half of the financial year saw some miners report positive results, while others saw a sharp drop in profits.

60 DECISION-MAKER

All things lithium with Pilbara Minerals Australian Mining was on hand for a Pilbara Minerals media briefing where boss Dale Henderson provided some keen industry insights.

longer in use. One local project is working to change that equation. REGULARS

3

6

74

78

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM. AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

same job.

The ‘same job, same pay’ reforms are leaving many, including BHP Minerals Australia president Geraldine Slattery, concerned.

further constrain a tight labour market. In December, the Australian Bureau of Statistics revealed the sector has a significant proportion of vacant positions compared to previous years.

BHP made headlines when it announced its plan to divest the Daunia and Blackwater coal mines in Queensland, and now it seems Yancoal Australia is interested in getting its hands on them.

In an interview with the AFR, Yancoal chief executive officer David Moult indicated that while the company had other potential investment opportunities, it is definitely interested in a bid for the two coking coal mines.

“For the moment our preference would be to stay focused on the BHP assets and make sure we are successful there,” Moult said.

“That is the one we are going to be focused on now and that is where we are going to be putting in our effort because it does fit very well with us.”

The potential purchase would draw from Yancoal’s immense pool of resources – a comfortable $2.7 billion cash on hand as reported in its full year financial results just last week.

An unprecedented jump in the price of coal – thanks to a global energy crisis – contributed to a record year for Yancoal, with the company reporting a revenue of $10.55 billion, up from $5.14 billion in 2021.

owners described the law as an existential threat.

“People want to have choice in how they work and how they are rewarded,” Slattery said.

AUSTRALIAN MINING GETS

THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

BHP has its own approach to dealing with labour hire with its operation services (OS) division. The division plucked thousands of casual and temporary contractors out of labour hire firms and offered them full-time positions in the company.

OS has been under scrutiny by FairWork Commission since its inception, but BHP maintains it gives its more choice over work and rewards.

BHP, on the other hand, reported a 27 per cent drop in its profit from operations, driven by a reduction in iron ore and copper prices.

In addition to BHP’s falling profits, the Queensland Government’s controversial coal royalty tax has been cited as a catalyst for the decision to sell the two mines, both of which are jointly owned by BHP and Mitsubishi as part of the BHP Mitsubishi Alliance (BMA).

The controversial three-tiered royalty system slaps producers with a 40 per cent tax on all coal prices above $300 per tonne at the highest bracket.

The middle tier enforces a 30 per cent tax above $225, while the lower end demands 20 per cent above $175.

BHP has made it clear that the company would not make any “significant new investments” in Queensland due to the coal royalty tax, saying that the state had become “uncompetitive”.

“Uncertainty caused by the unplanned increase in royalties did come into play as a contributing factor in our decision making (to divest the two mines),” BMA asset president Mauro Neves said.

A number of mines Queensland suspended production amid torrential rainfall in early March.

its wet season with approximately 370mm of rainfall over seven days, resulting in a loss of access to 29Metals’ Capricorn copper mine and New Century’s Century mine and Karumba Port Facility. Rain also closed Austral Resources Australia’s Lady Annie operations.

Electric vehicle (EV) giant Tesla has been teasing a possible agreement with a critical minerals company since mid-2022 – and it seems that it has finally come to fruition.

Under a new agreement, Australia’s Magnis Energy Technologies will supply Tesla with the critical minerals it needs to produce EVs. Tesla will purchase a minimum of 17,500 tonnes per annum (tpa) from February 2025, with a maximum 35,000tpa for a minimum three-year term.

including the Century tailings storage facility, processing plant and pipeline.” Companies worked with state authorities, including the Queensland Department of Environment and Science and the Carpentaria

team have been exemplary,” Austral said in an ASX announcement.

While not uncommon, the scale of the flooding was unprecedented, with major warnings issued for parts of Queensland.

District Disaster Management Group (DDMG) coordinator Elliott Dunn told the ABC.

Mine sites across the state heeded this warning, evacuating all non-essential personnel.

Magnis is currently in the process of selecting a final location for its commercial anode active materials (AAM) facility in the US so it can easily supply the minerals to the Americabased Tesla.

“We are really excited to bring our high-performing AAM to market that requires no chemical or thermal purification throughout the whole process, which differentiates this sustainable material in the market and provides great value to all parties,”

Magnis chairman Frank Poullas said.

The agreement is conditional on Magnis securing its US location by June 30 2023, producing AAM from a pilot plant by March 31 2024, and commencing production from the facility by February 1 2025.

This is not the first time Tesla has made a deal with a lithium miner.

In March 2022, Core Lithium secured a supply deal with Tesla but the agreement ultimately fell through in October of that year.

June 2022 saw Australia’s Liontown complete lithium purchase negotiations with Tesla.

Supply from Liontown is expected to begin in 2024, with the offtake agreement conditional on Liontown commencing commercial production at Kathleen Valley in WA by no later than December 1 2025.

Time will tell whether this third deal with Magnis will reach lithium delivery in 2025.

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

Flexibore® Layflat Hose Hamersley™ Reel System

Waterlord® Layflat Hose

The Pilbara Minerals and POSCO joint venture (JV) has secured $682 million funding for the construction of a lithium hydroxide monohydrate chemical plant in South Korea.

The loan agreement has been executed with two government-owned banks in South Korea.

The chemical plant, which is under construction in the Gwangyang region, is projected to convert approximately 315,000 tonnes of spodumene, sourced solely from Pilbara Minerals’ WA lithium operations, into lithium hydroxide.

The loan represents the remaining 60 per cent of the forecast costs required for the project’s development.

Pilbara Minerals’ managing director and chief executive officer Dale

Henderson said he was very happy with the debt funding.

“Construction of this world-class facility is already well underway, with the first train of 21,500 tonnes per annum (tpa) scheduled to start commissioning from late this year, followed by commissioning of the second 21,000tpa train in the March 2024 quarter.

“Our 18 per cent interest in the POSCO–Pilbara JV represents a key element of Pilbara Minerals’ downstream processing strategy, enabling the company to become an integrated lithium raw materials company.

“Building on our strong relationship with POSCO, we are delighted to be jointly establishing a strong

New Century Resources broke its silence following Sibanye-Stillwater’s off-market takeover bid, advising shareholders to accept the offer in early March.

In an ASX announcement, the New Century board unanimously recommended that its shareholders accept the offer of $1.10 per share.

The board said that it was unlikely a competing offer would be put forward, as Sibanye already owned a 73.41 per cent interest.

The 73.41 per cent is a significant increase from the 19.9 per cent held in February when Sibanye originally made its bid.

“As noted in the half-year accounts to 31 December 2022, a material uncertainty exists that may cast significant doubt on New Century’s ability to continue as a going concern,” the announcement stated.

foothold in South Korea’s emerging battery materials industry at the doorstep of established major battery manufacturers.”

There is an enormous demand for lithium globally, as it is one of the key components in batteries. Consequently, lithium supply goes hand-in-glove with the push for renewable energy.

Mineral Resources (MinRes) also recently reported massive profits in its half-yearly financial report driven by record lithium earnings.

The company reported earnings before interest, tax, depreciation, and amortisation (EBITDA) of $939 million, a 503 per cent jump from the same period last year.

MinRes also recently splashed close to $1 billion for an interest in lithium processing plants in China. The transaction, if approved, will see MinRes take a 50 per cent stake in Albemarle’s plants in Qinzhou and Meishan.

MinRes managing director Chris Ellison said the offshore investment would ensure the company could convert Wodgina spodumene into battery-grade chemicals in the short term.

“Doing more here in Australia is my preference over the long term,” Ellison said. “Any potential future hydroxide plant in Australia that could take our spodumene is some years off.

“We need capacity today.”

if it does not achieve compulsory acquisition.

“We will continue to advocate for change in the current strategic direction of New Century,” the company said in a statement.

“Sibanye has also recently become aware that a number of shareholders in New Century may be looking to dispose of their holdings on market.

current management, with the building of a tailings asset management service business no longer a focus.”

Sibanye called the New Century balance sheet “under strain” due to potential funding requirements for growth projects which could result in a raise in additional equity and a material dilution for existing

Schenck Process Mining has become part of Sandvik Rock Processing Solutions. Combining the expertise and reach of our teams allows us to develop even better services to ensure that your equipment operates safely and at peak performance throughout its entire lifecycle.

We are now better positioned than ever, to develop innovative solutions to the challenges of our industry.

Watch this video to learn what this new parternship means to your business or visit our website:

Key industry and community groups have met with Federal Resources Minister Madeleine King to discuss the development of Australia’s critical minerals sector.

Two roundtables were recently held in Perth, with presentations made by key resources companies, First Nations leaders and research groups as part of the consultations on the Federal Government’s Critical Minerals Strategy 2022.

The roundtables discussed how governments can attract investment and support project developments.

“Critical minerals represent the next great leap in mining, and Australia has an opportunity to add even more value to our world-

benefits of the transition to net-zero and by moving into downstream processing,” King said.

“The world will need our resources industry and our critical minerals to decarbonise, just as our domestic energy system will need lithium, vanadium, high purity alumina and platinum-group-element products for our own energy transition.

“Just like the iron ore revolution of the 1960s and growth of the LNG (liquefied natural gas) industry in recent decades, Australia’s prosperity and our jobs of the future will rely on decisions we take now to support the development of our critical minerals industry.

“Disappointed” was the word Newmont chief executive officer Tom Palmer used when discussing the rejection of his company’s bid for Australian gold miner Newcrest.

The Newcrest board unanimously rejected Newmont’s $24.45 billion takeover bid earlier in February, saying the it did not represent sufficient value for the company.

In an interview on Bloomberg Television, Newcrest interim chief executive officer Sherry Duhe said the company was “worth a lot more” than the opening bid. However,

Duhe said that Newcrest was open to “seeing how things go” regarding conversations with Newmont.

Newcrest also said in February it would give the US gold giant access to confidential information with the view to possibly receiving a higher offer.

It seemed Newmont may have taken Newcrest up on its offer, with Palmer re-commencing talks with the Australian gold miner.

“We are disappointed that the Newcrest board rejected our proposal, and we are currently

there is no net-zero.”

Demand for critical minerals continues.

The International Energy Agency projects mineral demand for use in electric vehicles (EVs) and batteries could grow at least 30 times by 2040, with lithium demand potentially growing more than 40 times by 2040, and graphite, cobalt and nickel growing between 20 and 25 times.

The Critical Minerals Strategy is designed to support:

• g rowth in Australia’s minerals processing, domestic manufacturing and other industrial sectors

our regional and First Nations communities

• Australian critical minerals playing a central role helping the country and international partners achieve their emissions reduction targets

• Australia’s ongoing commitment to environmental, social and governance (ESG) standards. Among the roundtable attendees were representatives from the Minerals Council of Australia, Indigenous Women in Mining and Resources, and resources companies including Glencore, Rio Tinto, BHP, Iluka and Lynas.

engaging with the Newcrest team in relation to their offer to provide access to more information,” Palmer said.

“If we can reach an agreement, this combination of industry-leading talent and decades of collective experience would create significant value across the global business with an ideal mix of gold and copper.”

While Newmont already owns the Boddington mine in WA and the Tanami mine in the NT, an acquisition of Newcrest would see it gain control of the Cadia mine in

NSW, Australia’s second-biggest gold producer.

“Our proposed combination would strengthen our established position in Australia, creating efficiencies and value with a shared workforce and large-scale supply chain optimisation,” Palmer said. “It would build upon the district potential in British Columbia’s highly prospective golden triangle through a combination of operating mines and development projects that would deliver value through shared technology, local capabilities, and orebody experience.”

By utilising the latest technologies we provide an advanced combination of innovative solutions which optimise our customers mining operations performance, sustainability, availability and safety, around the globe.

We supply:

• Wear parts and solutions for mineral processing, mobile and fixed plant operations

• Digital and equipment connectivity

• Asset condition and performance monitoring

• Design, engineering and manufacturing solutions

bradken.com

Albemarle is hoping to grow its lithium presence in Australia by linking supply chains to Europe vehicle manufacturers.

The lithium giant currently has stakes in two major WA lithium mines, including the Wodgina mine with Mineral Resources (MinRes).

MinRes and Albemarle also have a joint MARBL lithium venture, which will go through a restructure in the near future.

Under the restructure, Albemarle will increase its interest in the first two conversion trains of its Kemerton processing plant, while MinRes will increase its interest in Wodgina from

Australia’s longest-running coalfired power plant will shut down on April 28.

Located in the NSW Hunter Valley, Liddell is also one of the world’s oldest coal-fired power stations. The site’s operating life of almost 52 years is a historic feat considering only one per cent of power stations operate for more than five decades.

station will have produced 430,952

40 per cent to 50 per cent, operating it on behalf of the joint venture.

“Our Australian lithium assets are core to Albemarle’s strategy to build a globally diversified portfolio of best-in-class assets and resources,” Albemarle chief executive officer Kent Masters said.

“Inherent to that strategy is managing our global portfolio to maximise growth optionality and maintain a leading position in a dynamic, growing market.

“Our restructured MARBL joint venture enables each partner to deliver long-term value to our customers.”

Albemarle wants to link its WA operations to electric vehicle (EV) production in Europe.

“We see Australia’s spodumene as being a very viable resource to support (our) European expansion strategy,” Albemarle president of energy storage Eric Norris said.

“What we haven’t quite worked through is the footprint, what we’d be shipping out of Australia, whether it be six per cent spodumene or some intermediate. The sizing of that, in terms of how big a plant we’re talking about, is still under investigation.

“But assuming we’re successful, we believe a strong supply chain

would be Australia into Europe. And that, again, just speaks to the significance on a global basis of how the industry can leverage WA and how we as a leader intend to leverage Australia as critical in our supply chain.”

Norris said the company expects the joint ventures with MinRes to support the strategy while also ensuring the highest returns for shareholders.

“We have a tremendous opportunity ahead of us with the transition to clean transportation and anticipated rapid growth of lithiumion batteries,” he said.

gigawatt hours of power by the time it is shut down.

The closure of Liddell was first announced in 2015, with AGL saying it “believes that the installed capacity and energy output from Liddell is best replaced with lower emissions

According to the ABC, this shouldn’t be ruled out.

While January 2023 saw the NSW Government enact a coal reservation scheme that would see coal companies reserve 10 per cent of their output exclusively for domestic

Energy operator AEMO chief executive Daniel Westerman said there was a need for urgent and ongoing investment in renewable energy to reliably meet the needs of Australian homes and businesses.

Once Liddell is decommissioned, it

mining operations.

The fleet of light vehicles is made up of Toyota Hilux utes, converted from diesel engines to all-electric by MEVCO and its partner SEA Electric.

The switch to electric represents MinRes’ push to decarbonise its mining operations to net-zero emissions by 2050.

A demonstration model arrived in Perth this week and MinRes is expected

“MinRes has a plan to transition to a low-carbon future and cutting our reliance on diesel is central to achieving this goal,” MinRes chief executive officer (CEO) mining services Mike Grey said.

“Our MEVCO electric utes are just one of the many ways we’re driving towards net-zero and an exciting step in our decarbonisation journey.

“Battery technologies are key to a clean energy future and MinRes is

Government advisors have expressed concerns over a bauxite mine in Perth, fearing the operation threatens the nearby Serpentine dam.

US mining company Alcoa has been operating in the jarrah forest region of Western Australia since the lease was first granted in 1961. The company’s WA mines are responsible for the production close to 36 million tonnes of bauxite each year.

Roughly 75 per cent of Alcoa’s bauxite, and 71 per cent of its alumina, comes from WA jarrah

forests specifically.

But now experts fear the mine, which at its border operates just 300m from the major Perth dam, is a risk.

Chief among those concerns is the fear that spillage from the operation could seep into the dam. Government advisors have warned of the risk posed by heavy rainfall, which could wash chemical pollutants into the water supply.

Perth’s Serpentine dam holds 78 billion litres of water and forms a key part of the metropolitan areas

SEA Electric recently signed a Memorandum of Understanding with MEVCO, which saw electric Hilux and Landcruiser models made commercially available to the mining industry.

MEVCO, a systems integrator focused exclusively on electric light commercial vehicles in the mining industry, made a commitment to order 8500 units over the next five years in a deal roughly valued at $1 billion.

“This is a pivotal partnership for the

drinking water supply network.

The Sydney Morning Herald reported that Alcoa said it was actively improving its water management and monitoring and had cut reportable drainage failures to 19 in 2022. Of these failures, only one affected a dam. Spill areas were cleaned, and no hydrocarbons were detected downstream from the mining operations.

This latest development follows the company’s WA water license being slashed by a third, with authorities citing unsustainable pressure on the

According to SEA Electric, the vehicles provide all-electric range, driving performance, and environmental credentials, with zero local emissions of carbon dioxide, methane, or nitrous oxide.

“Across all industries, companies now understand they have a role to play in ensuring they are a part of the solution to the environmental problems we face,” SEA Electric founder and CEO Tony Fairweather said.

local area as the cause.

“We are working with Alcoa to reduce the impacts of their abstraction, which is contributing to declining trends not only in the Pinjarra but also the Nambeelup subarea,” a Department of Water and Environmental Regulation (DWER) spokesperson said.

“These risks and impacts can be appropriately managed through reducing groundwater abstraction.

“The department will provide assistance to Alcoa for the investigation of water use efficiency.”

The resources sector is, to put it rather simply, fundamental to modern society.

The minerals and metals produced by the mining industry contribute to almost every sector in the global market. Civil infrastructure, technology and transportation are some of the more obvious examples.

And then there’s the little things, like the alumina and cadmium in solar panels, cobalt for just about anything with a rechargeable battery, and the titanium in a prosthetic hip.

Throw a stone in any direction and you’ll very likely hit something with a component that was pried out of the dirt at some point in its life.

Giving life to such a truly mindboggling mass of products means that the industry is, rather appropriately, enormous – with the footprint to match.

Saying that the mining industry has a major role to play in driving down global carbon emissions is a statement which, generally speaking, is neither controversial nor surprising. But with the weight of responsibility bearing down on the sector also comes with the potential for world-leading change on an unparalleled scale.

In its ‘Tracking the Trends’ report for 2023, professional services network Deloitte isn’t shy about labelling green energy the key to future growth. It highlights a list of trends showing the indispensable social, environmental, and economic value on which the mining and metals sector can deliver.

The first three of these trends deals almost exclusively with the industry’s relationship with the environment.

According to the report, half of the world’s gross domestic product (GDP) is moderately or highly dependent on nature, without which the other half of GDP could not be sustained.

Natural capital is the world’s stock of natural resources, including air, soil, water and all living things. Natural capital has not only an economic worth, but a fundamental value to humankind.

Although many mining companies operate with environmental, social and governance (ESG) targets in place, the report asserts that nature-specific targets remain a rarity. Furthermore,

ESG targets are often preliminary considerations that are separate from core business functions, meaning natural capital is rarely accounted for.

“The traditional way of valuing a tenement is limited to looking at the orebody itself,” Deloitte climate and sustainability partner Michael Wood told Australian Mining

“But what we’re seeing from stakeholders and the investment community is a push for the sector to start properly valuing natural capital.”

According to Deloitte sustainability strategist Celia Hayes, valuing natural capital is something the industry has been doing indirectly for years without realising it – but it could be done better.

“Laying out an investment plan for life of mine, funding mine closures, and managing site rehabilitation are all instances of valuing or costing in natural capital,” she told Australian Mining

“But there’s much more the industry could be doing to maximise natural capital, such as ensuring they regenerate and positively impact the natural assets which they have stewardship over.”

Wood echoed this sentiment.

“If we look at the core valuation of mining assets today, it’s clear that the nature-related aspects – for example, sensitivities surrounding climate risk and biodiversity – aren’t properly valued or integrated into the financial calculations or production methodology,” he said.

Though not necessarily common, there are active examples of preserving natural capital in the industry, such as South32’s manganese operations

at Groote Eylandt on the Gulf of Carpentaria.

In order to mine the NT site, the company has to clear hectares of natural bush – that much is unavoidable with current technology. But where South32 differs is that it sends surveyors through the bush, flagging key species.

This essentially means the company has a clear understanding of ecosystem it’s working in and is able to divert its operations around habitats and other instances of natural capital where appropriate.

South32 also progressively rehabilitates the site, backfilling topsoil and seeding the ground in cooperation with traditional Indigenous owners.

In another example, steelmaker AcelorMittal maintains a carbonpositive balance at its operations in Brazil. At its largest mill, 2.6 million trees act as a green belt, helping to reduce fugitive emissions and noise pollution while buffering the operation’s thermal effects.

The company also manages the rejuvenation of 135,000 hectares of old pasture lands into forests.

“Valuing natural capital means a more holistic approach than just doing the minimum to meet regulation and avoid liability,” Hayes said.

The World Economic Forum estimates that more than half of the global GDP is exposed to a risk of loss of natural capital.

Changes to the climate, as well as the inherent finitude of resources, will affect most mining and metals companies over the next decade, making the preservation of natural capital crucial for longevity.

Miners of the future, according to Deloitte experts, will be expected to provide value of a different kind, including social and environmental. This means not just mitigating, but also creating positive impacts.

The other arm of valuing nature is what Deloitte calls harnessing Indigenous insights.

“Australia has so many unique species of flora and fauna that modern science doesn’t necessarily know how best to manage,” Hayes said. “This presents the perfect opportunity for miners to go and speak with Traditional Owners who have a much better understanding of the potential impacts of operations, such as how a particular species might react to disturbance, or what kind of vegetation mix a certain critter needs to survive,

Wood believes Indigenous insights should be a key data point in any sort of operational design decision.

“We’ve got 60,000 years of knowledge in Australia, but it isn’t being considered in the planning stages of mining

A traditional linear economy is one in which materials are sourced, converted into products and – when consumers have had their fill – tossed away.

According to the report, the intensification of climate change, environmental degradation, and widespread pollution are each a product of a linear economy.

This is an unsustainable economic model, but for the past few years it’s been undergoing something of a metamorphosis. There is an emerging emphasis on recycling, reuse, and renewables, forging an economy that is circular in nature.

But the experts say circularity isn’t just an investment trend, but rather an inevitable, systemic change – one in which mining is front and centre.

“Mining companies currently benefit massively from the linear economy

because they’re the ones turning out those finite materials,” Hayes said. “But, guess what, that gives them a lifespan.”

The three principles of circularity are designing out waste and pollution, regenerating natural systems, and keeping products and materials going for as long as possible.

By designing out value leaks or turning them into loops, companies can generate a competitive advantage through lower costs, fewer regulatory constraints, secondary income, better

ESG results, and securing social license to operate.

But the key to transitioning to a circular economy lies in determining how non-financial value is measured. Consumers care more than ever about where their products come from, and their environmental effects.

“At its heart, a circular economy is about capturing lost value that’s leaking out of the system,” Hayes said.

“Natural capital is a great example. It has much more social value now than it did 10 years ago; so by not properly valuing natural assets, a company is actually losing value.”

This principle also applies to the minerals themselves.

“Recycling aluminium generally has a much lower environmental and social footprint than extracting bauxite and alumina and making new aluminium,” Hayes said.

Regulation often follows social change, and as the world inevitably shifts towards circularity, miners are seeing ever-increasing liability.

Hayes points to the example of tailings dams.

“Tailings dams incur enormous costs and liability that follows a company for decades,” she said.

“By designing out waste and pollution, you could essentially either generate secondary income using those materials or remove the need for things like tailings dams all together.”

A circular economy isn’t just about sustainability; it’s about creating value through minimising leakage and maximising resourcefulness and social approval.

“Anglo American declared it would be shifting from a mining company to a materials solutions provider,” Hayes said. “That’s exactly the philosophy of

the circular economy. It’s about shifting away from pure rock mining to finding and utilising resources that have already been mined out of the ground.”

According to Hayes, mining companies have been engaging in circular economic practices for years.

“Regenerating natural ecosystems, reusing water, and generating money from waste are all examples,” she said. “But there’s more to it than just selling waste to somebody else.

“It’s about making the most of the natural resource and working within your ecosystem to do that.”

Driving down embodied carbon in metals: Supporting the decarbonisation of economies

“As part of the traditional linear economy, miners are often the first ones to interact with a commodity that’s going into the value chain,” Wood said.

The resource sector’s fundamental role as an extractor and processor of raw materials means its potential to lower carbon emissions across the broader economy outweighs its own footprint.

Though miners have a great deal of control over the decarbonisation of their operations, it’s much more difficult to enforce decarbonisation along the supply chain. But being positioned as integrally as they are, mining companies may have the power to see it through.

Scope 3 greenhouse gas emissions are indirect emissions that are generated upstream and downstream across the value chain. These constitute up to 98 per cent of a company’s total greenhouse gas emissions.

It’s this fact that makes them the perfect target for carbon-conscious companies. But decarbonising the value chain is no easy feat due simply to the enormity of the task. It involves

Wood said this is exactly what investors

aluminium it produces. In other words, downstream suppliers have access to ESG-related information such as carbon footprint, water use, and so on.

Rio Tinto has utilised ELYSIS and START to create value opportunities for itself along the supply chain. In February of this year, the company signed a Memorandum of Understanding (MoU) with BMW Group, supplying its responsible aluminium to a vehicle production plant in the US.

The arrangement is projected to lower BMW’s aluminium-related carbon emissions by up to 70 per cent.

Also in February, Rio signed an agreement with Japanese conglomerate Marubeni Corporation that will see its responsible ELYSIS aluminium hit supply chains throughout Japan.

“Consumers want to know more about the products they buy and be assured that they have been produced responsibly and sustainably,” Rio Tinto head of sales and marketing Tolga Egrilmezer said.

And in late 2022, Rio signed a strategic alliance with Volvo Group for the supply of responsibly sourced, low-carbon products, including ELYSIS aluminium.

Moving away from aluminium, Swedish miner LKAB formed a joint venture to create the HYBRIT initiative in 2016. The initiative aims to create fossil-free steel at an industrial scale by

iron in 2021, reducing 90 per cent of emissions in the steelmaking process.

Once implemented, the HYBRIT initiative will reduce Sweden’s national carbon emissions by 10 per cent, and Finland’s by seven per cent.

Influencing value-chain decarbonisation will allow miners to distinguish themselves in the short term while remaining competitive in the long term, but Wood believes the shift should not be underestimated.

“The costs associated with this kind of change are often underestimated by sector investors,” he said.

“That capital intensity needs to be appreciated, but there are significant upsides to getting this right.

“We’re seeing a lot of ambition to deliver, but we’re not seeing action just yet.”

The shift to a sustainable, carbonneutral future is an inevitable one, but more mining in the near term will be needed to facilitate that inevitable change.

Through preserving natural capital, adopting circular strategies at a business level, and influencing decarbonisation along the value chain, mining and metals companies can be the global leaders of this change.

How quick the sector will be to capitalise remains to be seen. AM

Roy Hill and Atlas Iron are two of the Pilbara’s iron ore miners and subsidiaries of Australia’s most successful private company Hancock Prospecting.

As part of the Hancock group, the companies mine iron ore across the Pilbara with a wealth of support from businesses around the country, along with Roy Hill’s minority partners Marubeni Corporation, POSCO and China Steel Corporation.

To further their efforts in making the group the ‘best mining company in Australia’, Roy Hill and Atlas Iron will sponsor two awards at the 2023 Australian Mining Prospecting Awards – the Lifetime Achievement award and the Discovery of the Year award, respectively.

“Now in their 20th year, the awards are an important platform to recognise and reward excellence and innovation across Australia’s mining industry,” Hancock Prospecting executive chairman Gina Rinehart AO told Australian Mining back in 2021.

“We are committed to helping our people contribute to Australia’s mining industry and think innovation and excellence should be acknowledged and rewarded.

“We are very pleased to be associated

with the Prospect Awards.”

A world-class mining operation, Roy Hill currently delivers over 60 million tonnes per annum of iron ore from its Pilbara mine to international markets.

As the only independent iron ore operation in the region with majority West Australian ownership, Roy Hill has enjoyed success in the mining industry ever since the first prospecting trip to the area in 1992.

Atlas Iron, due to its focus on smaller footprint mines, has an agile operating model and proudly collaborates with valued partners across its mining chain, located near Port Hedland, Western Australia.

The Prospect Awards provide these two companies with a premier opportunity to continue to support the Australian mining sector.

“Mining’s economic contribution to Australia is unrivalled, so it is important we not only acknowledge and provide well deserved recognition to our industry, but also celebrate our achievements,” Roy Hill chief executive officer group operations Gerhard Veldsman said.

“The Prospect Awards have become Australia’s premiere event to showcase and share the latest improvements and cutting-edge innovations across the mining industry, as well as celebrate and recognise the achievements of companies

FASTER AND MORE POWERFUL FLOTATION TECHNOLOGY HAS ARRIVED IN THE AUSTRALIAN MINING INDUSTRY COURTESY OF FLSMIDTH AND THE UNIVERSITY OF NEWCASTLE.

Galvin, who developed the Reflux Classifier and the RFC with FLSmidth, is an esteemed figure in the mineral processing industry, having invented technologies that improve grade and recovery of valuable materials.

Known for its high capacity and compact design, the Reflux Classifier has become one of FLSmidth’s most advanced fine-particle, specific gravitybased separators.

And its best attributes complement the RFC.

“In the RFC, the lamella chamber separates mineral-loaded bubbles from unwanted gangue. This allows the unit to operate at feed fluxes well above what is typically of conventional flotation machines, improving kinetics while reducing entrainment.”

system, which enables stable flotation, enhanced gangue rejection and quicker kinetics, facilitating improved performance across all quality and productivity metrics.

As Law highlighted, inclined channels enhance the segregation between bubbles and downward flowing liquid, which means the RFC can operate at elevated internal gas fractions.

With an RFC operating at full-scale for a Tier 1 mining client in NSW, Law said ESG has been a key driver of the machine’s uptake.

“If they (operators) don’t innovate, they don’t achieve their ESG targets,” Law said. “Like FLSmidth, Tier 1 miners have sustainability goals. These companies have identified that the only way they are going to achieve these goals is by becoming an innovator-slash-earlyadopter of technology rather than being a late adopter.

“This is a step change in mentality from what has historically been a conservative approach.”

Having graduated through research and development, design and concept, and full-scale on-site trials, the RFC is ready to shake up flotation in the Australian mining industry.

And with more products being developed under the Reflux banner, it looks like the sector will have more advanced flotation technologies at its disposal in the years to come. AM

RFC, YOU END UP WITH A VERY SMALL FOOTPRINT, BETTER GRADE, LESS ENERGY INPUT, LESS CAPITAL COSTS, LESS OPERATIONAL COST, AND HENCE IMPROVED ESG PERFORMANCE.”FLSMIDTH STRIVES FOR A VERY SMALL FOOTPRINT. THE REFLUX FLOTATION CELL CAN DELIVER UP TO 60 PER CENT REDUCTIONS IN ENERGY CONSUMPTION.

When asked to describe Derrick Corporation, new general manager Garth Hay was quick to answer: “welcoming,” “active,” and “robust” were some of the words that stood out.

Though he only recently joined the US-based company’s leadership, Hay is already taking the Australian office to new heights.

“The newly opened Australian office is an important milestone in our company’s strategy,” Hay told Australian Mining. “We completed development of the Australian entity recently and are excited to begin providing jobs locally.”

The third-generation family business, founded in 1951 to solve some of the industry’s most challenging mechanical separation needs, has been a present fixture in the global mining industry ever since.

“At the heart of our present-day offering resides the integrated vibratory motor,” Hay said. “It was invented by our founder and gave life to an entire line of innovated separation technology.”

The work continues, with the company’s engineers developing technologies to solve any problem.

“Derrick prides itself on being ‘best in class’ in fine separation technology,” Hay said. “Investing in research and development allows us to provide solutions and savings to our customers proactively.”

In keeping with the low-carbon trajectory of the mining industry, Derrick has introduced two new technologies: the SuperStack and the G-Vault Urethane Interstage Screen.

The SuperStack, a fine screen boasting an innovative front-to-back tensioning system, features eight decks operating in parallel and reduces the total capital and installation cost.

The G-Vault system is considered a new standard of operation and combines Derrick’s urethane, abrasion-resistant properties and non-binding technology. The result is a system with higher throughput, increased life, greater carbon retention, less maintenance, and less tank bypass. Each screen on the G-Vault can be easily removed, and the entire system is offered in greenfield and brownfield applications.

“The industry is transitioning to a low-carbon green industry. As demand for minerals in the EV (electric vehicle) battery space increases, Derrick provides the fine screen separation to increase

are investigating potential flowsheet changes for customers. This involves exploring whether a Derrick screen or screening media could replace installed equipment to improve efficiency.

“Increasing the component’s life minimises the need to manufacture a competitor’s components that require

more frequent maintenance. This reduces the overall carbon footprint and total cost of ownership,” Hay said.

With its expanded footprint in Australia, Derrick is in a prime position to assist mining operations with reducing their emissions and increasing their ambitions.

“The new office gives our team the ability to be more present in the market,” Hay said. “We look forward to attending conferences and trade shows, and holding events to grow the market’s knowledge of our offerings.

Joining Derrick Corporation has been a homecoming of sorts for Hay.

“Having only recently joined Derrick, I am really enjoying being a part of the storied Derrick family. I have never experienced a company with such a welcoming atmosphere,” he said.

“I had the opportunity to visit Derrick’s Buffalo headquarters in upstate New York and spent a week in our manufacturing facility learning about our offerings. I met with some of the more than 160 current employees who have worked with the company for more than 20 years. The team takes tremendous pride in their work, and speaking with them crystallised what a privilege it is to work for Derrick Corporation.” AM

DERRICK CORPORATION HAS BEEN A LEADER IN FINE SEPARATION FOR MORE THAN 70 YEARS. THE COMPANY IS NOW EXPANDING WITH NEW HEADQUARTERS IN AUSTRALIA.GARTH HAY, DERRICK CORPORATION AUSTRALIA’S NEW GENERAL MANAGER. DERRICK CORPORATION SOLVES SOME OF THE INDUSTRY’S MOST CHALLENGING MECHANICAL SEPARATION NEEDS.

A Customer Value Agreement (CVA) is more than just an agreement, it’s a promise that your equipment, components and your site, has the ongoing support of a team of Hastings Deering specialists.

It’s the promise of hassle-free maintenance, the promise of hassle-free ownership, and the promise of peace of mind.

Whether it’s an equipment, component or a site solution, Hastings Deering can tailor a CVA solution to suit your needs.

Scan to find out more.

hen it comes to environmental, social and governances (ESG) practices, the resources sector understands that it cannot afford to avoid the issue.

Customers, employees, communities, stakeholders, custodians and regulators are increasingly expecting companies in the industry to prove they are getting better at implementing and managing their ESG policies.

According to the ‘Responsible Mining Foundation (RMI) report 2022’, 94 per cent of mining companies scored less than 20 per cent on 15 ESG metrics, with many found to be ineffective at tracking and reporting their management.

DYNA Engineering general manager Thomas Greaves told Australian Mining one of the biggest challenges for businesses in the mining industry is the management of pollution, including greenhouse gas emissions.

“As everyone becomes more aware of mining’s impact on the planet, ESG has

Wturned the spotlight especially bright on this industry,” he said.

“Environmental policies to improve ESG include greenhouse gas emissions, energy and water usage, and climaterisk mitigation. And companies that effectively implement these policies often recognise benefits.

“As environmental factors are addressed, they may see a cost reduction in energy and water usage, operational improvements, and even develop better relationships with their customers, suppliers, employees and local community.”

When it comes to social policies, there are several that, if implemented effectively, can significantly strengthen a company’s connection with customers, employees and other stakeholders.

But implementing these policies is the tricky part. Although most companies have some level of controls in place, a weakness in any governance area can allow an incident to cause reputational damage, lawsuits, loss of social license to operate, and more.

Greaves said one of the most significant examples of DYNA’s ESG

considerations was the recognition and introduction of its high-density polyethylene (HDPE) conveyor guards.

“The guards are made from environmentally sustainable HDPE, which in itself is recycled and recyclable, instead of the traditional high-energyhungry and environmentally straining steel,” he said. “Our mining customers have supported these HDPE conveyor guards enthusiastically, in many cases supporting their own ESG initiatives.

“We have also invested heavily over the past couple of years in additional facilities and staff purely to enable us to add more sustainable HDPE products to our range.”

Greaves also pointed to DYNA’s work in certification against International Standards Organisation (ISO) in the three categories of quality, environmental, and occupational health and safety management systems.

“These certifications relate to the company’s activities in the design, manufacture, supply, inspection, and maintenance of conveyor systems and guarding, including related services,” he said.

“The respected ‘McKinsey Quarterly Report’ back in November 2019 showed ESG linked to cash flow in five important ways,” he said.

“It facilitates top-line growth, reduces costs, minimises regulatory and legal interventions, increases employee productivity and optimises investment and capital expenditures.

“Every business owner and company director is interested in improving cash flow.”

DYNA Engineering will continue to support and implement ESG practices in its own operations.

This is, in part, because METS providers could decide to which prospective customers they would consider supplying their goods and services. This choice could be based on how well a particular customer accepts and applies an adequate level of ESG considerations.

Greaves said it was actually the reverse of the conventional process, whereby the customer selects its suppliers based on the product, price, availability or aftersale service.

“The reality being if they didn’t favour ‘yours’ they could simply go another supplier,” he said. “This should not be mistaken as a veiled threat; it’s simply an acknowledgement of what could very easily happen due to the accelerating surge of ESG considerations requirements swelling and gaining momentum globally, especially for

businesses operating in the mining and mineral processing sectors.

“In a way, it’s similar to how some of the major superannuation funds are now making ethical considerations as well as financial ones when deciding where to invest members’ money. Or which brand of jogging shoes an athlete might

select based on which country they were made in and that government’s policy on underpaying workers already in poverty.

“Companies operating in the mining and mineral processing industries can no longer take a ‘wait and see’ approach with ESG. Not only will it soon become a minimum acceptable expectation of

every stakeholder, but understanding and adopting ESG practices can actually provide significant benefits for those companies.

“Fortunately, it’s not too late to get started transforming into a more sustainable and competitive business by truly embracing ESG practices.”

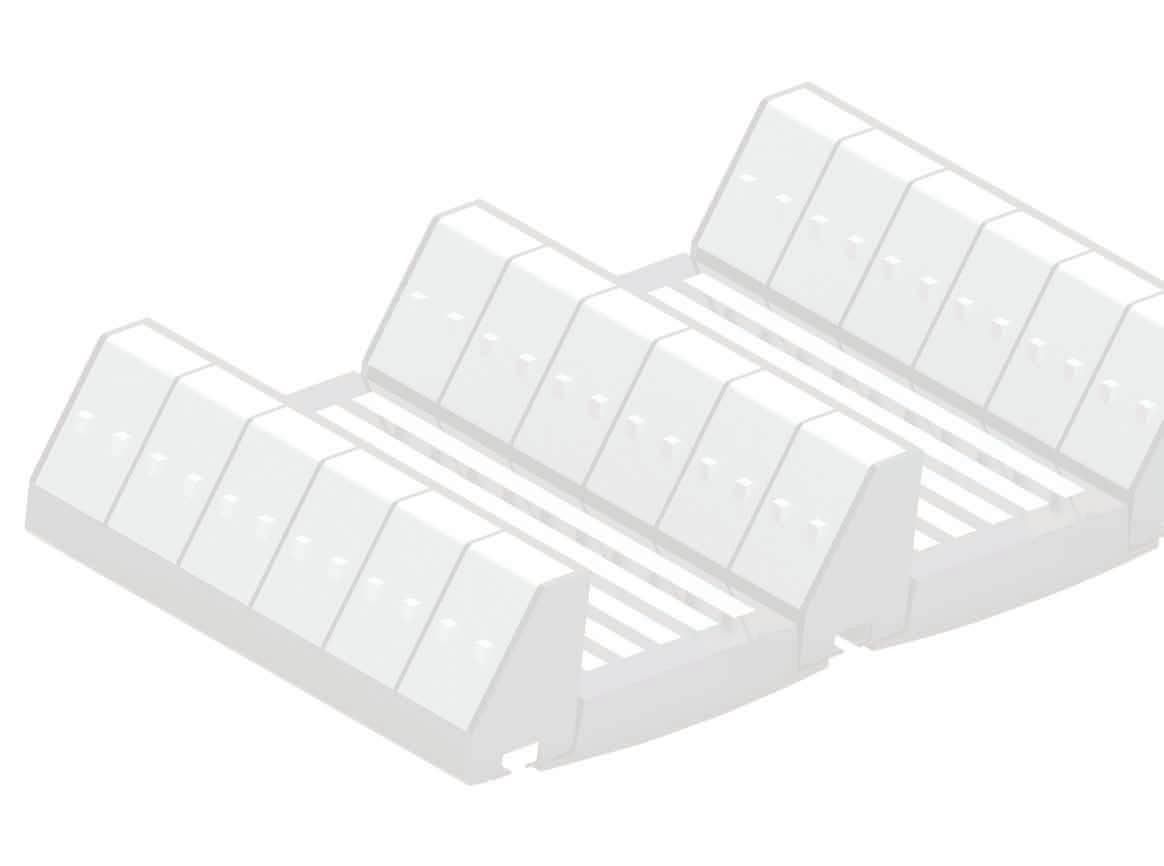

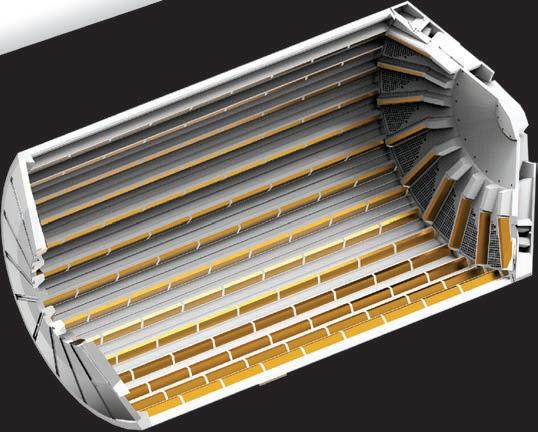

THEJO PROVIDES INSIGHTS INTO THE VERACITY OF RUBBER LINERS VERSUS COMPOSITE LINERS FOR BALL MILL GRINDING APPLICATIONS.

Roperations that are received at processing plants pass through a controlled liberation process to extract minerals through concentration.

The most used equipment for the primary-size reduction of the rock are crushers, and AG and SAG mills; however, the liberation of valuable minerals from the gangue is generally achieved by comminution process through wet grinding in ball mills.

Grinding mill operators take comfort in maintaining a minimum of 80 per cent product size of solid overflowing from the mill, generally less than 1mm and expressed in micron matching to the specification set for down-the-line processes.

The operator would therefore prefer to have an efficient and economic mill lining system that excels in efficiency of grinding without compromising the service life of wear parts.

Considering the safety of workers associated with mill operations, plus its relining and downtimes for liner changeover, it’s important to consider replaceable lining systems that offer a minimum number of wear parts per mill.

The choice of mill lining plays an essential role in the efficient operation of the mill. The lining acts as the replaceable layer protecting the inner surface of the mill from wear and tear

material, while transferring energy required to enhance the grinding efficiency of the mill. It also defines the fall trajectory of grinding media and the feed during operation of the mill. Over the years, mill liners have evolved from metal to rubber and to composites. While the metal and composite liners are mainly considered for AG and SAG mills, rubber liners are preferred in most primary, secondary, and tertiary ball mills.

many primary, secondary and tertiary ball mills, outperforming composite liners and delivering value advantage in terms of higher wear life at lesser weight of wear parts.

Lesser weight helps to avoid the usage of liner handling equipment and allows easy handling of parts by installation crews while also reducing the load acting on the drives and increasing the life of rotating parts of the mill.

Rubber liners have fewer components, allowing for safe and easy installation at minimal downtime, while also reducing the noise pollution.

The per-tonne cost of grinding in mills with rubber liners is lower than mills with composite steel liners. In addition, rubber lining systems require shorter manufacturing lead times, as customisation to clientspecific needs can be done in less time in comparison to steel lining.

It’s important to design an appropriate mill lining system for the efficient operation of a ball mill, but there remains a pervasive belief that composite mill liners (of rubber with metal) perform better than rubber in comparable situations.

The estimation of wear life can sometimes be unpredictable when it comes to composite steel liners. This could be due things like incorrect selection of steel, manufacturing defects, inadequate heat treatment, cracking, or poor bonding strength between rubber and steel resulting in unplanned shutdowns, safety hazards and major production loss.

But the trend of wear in a rubber mill lining can be easily monitored and forecast, making for much easier

Mill liner design is vital to enhance the efficiency of the mill. The mill liner profile and design should have a control over the trajectory of grinding media.

A challenge in the design of the mill liners is arriving at the ideal lifter bar and plate profile that optimises grinding efficiency of the mill without compromising wear life of the mill liners.

Thejo utilises MILTRAJ and DEM simulation software in customising mill lining solutions.

The TEL800/TEL700 rubber formulation used in Thejo’s THOR liners is predominantly based on highquality natural rubber blends.

“The TEL800 series of rubber compounds gives an edge over other rubber formulae available in the market,” Thejo said. “Our range of formulation demonstrates superior physical properties in tensile strength, abrasion loss, tear strength, and elongation at break.”

A high-quality rubber mill lining system with good wear life is a boon for wet grinding applications. If designed properly, it also contributes primarily to determining the efficiency and availability of mills and the entire process plant. AM

OUR RANGE OF FORMULATION DEMONSTRATES SUPERIOR PHYSICAL PROPERTIES IN TENSILE STRENGTH, ABRASION LOSS, TEAR STRENGTH, AND ELONGATION AT BREAK.”IT’S IMPORTANT TO CONSIDER REPLACEABLE LINING SYSTEMS THAT OFFER A MINIMUM NUMBER OF WEAR PARTS PER MILL WITH OPTIMISED WEAR LIFE.

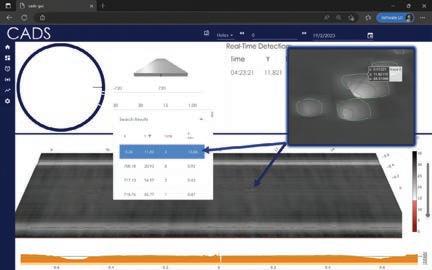

Are

Uptime

Throughput

Real-time monitoring

Energy savings

Predictive maintenance

Reduced waste

Reduced costs

AIR LIQUIDE HAS BEEN PROVIDING ITS N2 FLOXAL AMSA SOLUTION TO UNDERGROUND COAL OPERATIONS FOR DECADES, AND CONTINUES TO REFINE IT FOR THE MODERN MINE.

Aand goaf sealing. These two solutions were used in tandem until a 2002 study by the CSIRO found that nitrogen was just as effective as boiler gases, and the industry moved toward a solely nitrogenbased operation.

In keeping with the trend, Air Liquide developed its Floxal Onsite Nitrogen AMSA units, which have since been adopted by Australian and international longwall coal operations.

“Air Liquide’s N2 Floxal AMSA solution is synonymous with reliability, cost-effectiveness and environmental friendliness,” Air Liquide national and key accounts manager Sajimon Joseph said.

“The fact that Floxal units can produce nitrogen at nine bargs (a unit of gauge pressure) or more helps the goaf sealing with positive pressure in the balance chamber.”

This is a sentiment echoed by Air Liquide national key accounts manager for mining and extraction Rick Edwards.

“It was a first-of-its-kind solution when it was first implemented and we have been refining it ever since,” Edwards told

“The use of Floxal N2 plants for underground coal mines was only pioneered 15 years ago. The first units were built to supply 500m3 per hour and it became clear that while the solution showed significant promise, higher flow rates were needed.”

Using Air Liquide’s medal polymer hollow fibre gas separation technology, the fact the units produce nitrogen at a pressure of about nine bargs enables the inert gas in the area to be recirculated through the mine.

The medal polymer hollow fibre also allows the air to be circulated over large distances while the unit can stay close to the power source.

“These units are already giving groundbreaking results due to this unique ability to provide previously unavailable large quantities of nitrogen at much higher pressures than has been available from alternative methods and suppliers,” the company said in a statement announcing the range back in 2007.

“In a nutshell, Air Liquide’s innovative mobile systems provide some unique benefits to the mines in terms of safety, reliability and cost-effectiveness.”

The first AMSA unit was delivered to Anglo Coal’s Dartbrook mine in New South Wales in 2007, closely followed by the second unit being delivered to the Austar mine near Cessnock, NSW.

Xstrata Coal took ownership of the third unit that same year and installed it at the Oaky Creek mine in central Queensland.

“We support our customers in their development by offering innovative custom-made solutions, which helps them strengthen their efficiency and

safety,” executive vice-president and member of Air Liquide’s executive committee Jean-Pierre Duprieu said at the time.

“Mining has been identified as a growth market in Australia and these important successes in the mining industry with this unique solution illustrate the group’s capacity to grow into new markets and territories.”

Air Liquide has continued to develop its coal mine AMSA solution since 2005, delivering them to coal mines throughout the country.

In 2009, the company signed a contract with Peabody Energy for the delivery of an AMSA 3000 series Floxal at its North Wambo mine in NSW after a six-month trial at the Peabody Bowen Basin mine. A contract with Fitzroy Reources for its Carborough Downs mine in Queensland followed and, in 2010, Whitehaven Coal commissioned Air Liquide to deliver a generator to its Narrabri operation in NSW.

In addition, the Kestrel mine near Emerald in Queensland also made use of a Floxal generator.

Despite the success, Air Liquide has committed itself to continuously redefining the units as the mining sector changes, including customising the units if needed.

Each Floxal unit is built to a standard design, but the company works with the customer to tailor them if needed, working to the specifications of each onsite supply system.

Guaranteeing a convenient, worryfree on-site solution is something that Air Liquide is proud to provide – and its Floxal solutions help it do just that.

“The main benefit of a Floxal is the reliability,” Edwards said.

“This is not only because of the built in redundancy of the equipment, but the fact it is a complete supply solution, backed by trained technicians and experienced local experts.” AM

AIR LIQUIDE’S N2 FLOXAL AMSA SOLUTION IS SYNONYMOUS WITH RELIABILITY, COSTEFFECTIVENESS AND ENVIRONMENTAL FRIENDLINESS.”AIR LIQUIDE’S FLOXAL ONSITE NITROGEN AMSA UNITS HAVE BEEN ADOPTED BY AUSTRALIAN AND INTERNATIONAL COAL OPERATIONS.

– Cutting-edge technologies with Liebherr Assistance Systems

– First step towards automation with Bucket Filling Assistant

– Up to 20% fuel consumption reduction with smart energy management

– Weight-optimized attachments for maximizing bucket payload

– Latest cabin design with enhanced ergonomics providing a comfortable working environment

– Perfect match with Liebherr Mining large and ultra-class trucks

liebherr.com/ nextgeneration

Mining Excavator R 9600The NSW Hunter region has a centuries-old relationship with mining, with the first ever coal plucked out of the earth by settlers at the Hunter River mouth in Newcastle during the 1790s.

Coal soon became Australia’s first ever commodity export, with a shipment leaving Newcastle for India in 1801.

Some two centuries on, some things have changed. We’re no longer using convicts as miners, for one, and somewhere along the line, we also swapped the pickaxes for complex industrial machinery, which is a bit more efficient than breaking rocks by hand.

But other things have stayed the same. Like the fact the Hunter is still yielding

coal on a global scale, while it continues to attract prospectors from around the world in droves.

There’s a reason the Hunter boasts the largest regional economy in Australia, accommodating around 427,000 jobs, with a staggering gross regional product (GRP) of $43 billion a year.

Situated at the northern end of the Sydney Basin bioregion, this fertile and prospective land boasts port access and proximity to Sydney, making it a top choice for winemakers and miners alike.

This popularity was confirmed by a recent annual membership expenditure survey conducted by the NSW Minerals Council (NSWMC), which reported

record mining spending and jobs between 2021 and 2022.

The survey engaged 27 participating mining companies active in the region, including major players like BHP, Newcrest Mining, Whitehaven Coal, Yancoal Australia and Idemitsu, to name a few.

The survey was aimed at quantifying mining expenditure across the entire state of NSW, but it was the Hunter region that stood out as receiving the highest overall impact –by a significant margin.

Last year saw mining companies directly inject a total of $6.3 billion into the Hunter region’s economy, the largest share of direct expenditure by region in NSW. This figure was an increase

of $200 million from the previous year and counted for 30 per cent of the Hunter’s GRP. Furthermore, this marked the third consecutive year that the mining industry’s direct spending in the Hunter has exceeded $6 billion.

OF MINING DOLLARS FLOW INTO THE NSW ECONOMY AND THE EFFECTS HAVE BEEN FELT ACROSS THE STATE, BUT NO REGION HAS PROSPERED QUITE LIKE THE HUNTER.COAL REMAINS KING IN THE HUNTER, PRODUCING AROUND 160 MILLION TONNES A YEAR.

MINING CLEARLY CONTINUES TO PROVIDE ECONOMIC STRENGTH AND STABILITY TO THE HUNTER, SUPPORTING THOUSANDS OF HUNTER FAMILIES AND BUSINESSES.”

Of the $6.3 billion spent in the region, $1.6 billion went to wages, while $4.7 billion went to goods and services that were purchased from more than 3000 local businesses.

The Hunter was also home to more mining jobs than anywhere else in the state.

Participating companies reported directly supporting 13,589 full-time equivalent jobs across the Hunter. The second highest area was the state’s central west with 5601 jobs – less than half that of the Hunter.

The average salary for workers directly employed by participating companies

across the state was approximately $144,550 in 2021–22.

Being so active in the region, mining companies have supplied millions to local government bodies and community organisations.

According to the NSWMC report, participating miners contributed $4.8 million to 398 community organisations across the Hunter, again the highest in all of NSW. These organisations cover a wide range of areas, including health, education, environment, and the arts.

Mining companies supported local government bodies in the Hunter with roughly $32.5 million.

“These very strong results highlight the importance of mining for the Hunter’s economy, and for mining communities across the region,” NSWMC chief executive officer Stephen Galilee said. “Mining clearly continues to provide economic strength and stability to the Hunter, supporting thousands of families and businesses.”

Nothing has influenced the Hunter’s economy quite like coal. The region’s coal industry is one of the most important in the country, producing around 160 million tonnes annually.

Coal recently dethroned iron ore as Australia’s most valuable export, thanks in part to rising demand and soaring prices driven by a global energy crisis.

With coal prices reaching “historically high” levels, it’s forecast that Australia’s national coal exports will gross $132 billion in 2022–23.

Key to the Hunter’s participation in this booming global industry is the Port of Newcastle, where miners ship their minerals and metals to import partners all over the world, including in Japan, South Korea and Taiwan, to name a few.

In order to keep up with immense traffic, the Port of Newcastle is similarly enormous. In fact, it’s the largest coal export port in the world.

In 2021, it shipped 166.1 million tonnes of cargo, including over 90,000 metric tonnes of aluminium to South Korea and Japan.

In January 2023 alone, it moved 10.4 million tonnes of exports, 10 million of which was exclusively coal. Other mineral concentrates made up roughly 18,200 tonnes of the figure.

There are many major mining operations on the go in the Hunter, most of which are coal projects.

For example, Glencore and Yancoal co-own the Hunter Valley operations, which in 2021 moved 10 million tonnes of coal and contributed $862 million to the regional economy.

The New Hope-owned Bengalla mine produces 12.8 million tonnes of coal a year, with operations planned through to 2039.

Then there’s the famous Mt Arthur – the largest coal mine in the state,

capable of producing 20 million tonnes a year. It’s worth noting, however, that BHP recently announced the 2030 closure of the site, citing the NSW Government’s coal retention scheme as a contributing factor.

The scheme, unveiled by NSW Treasurer Matt Kean at the start of 2023, introduces requirements that force the state’s coal companies to reserve 10 per cent of their output exclusively for domestic use.

The move is designed to ensure the state has enough coal to fire its power stations amid the energy crisis.

In addition, the Federal Government recently a domestic price cap on coal, effectively setting ceilings for the price of coal used for electricity generation to $125 a tonne.

It’s a decision that’s left many miners frustrated.

Yancoal Australia voiced its concern in an ASX statement, saying that the policy will have a direct impact on the company’s revenue, while also presenting a significant logistical challenge.

But others, like Whitehaven Coal, seemed to take the news in stride, with the company saying it was finalising plans to ensure it meets its new obligations, while also minimising value leakage for its shareholders.

But even with the reservation scheme and the shift towards renewable energy, it’s unlikely that king coal is going away anytime soon.

In a joint research report by Shell and Deloitte, it was revealed that global demand for steel is set to rise by 10–35 per cent by 2050 compared to 2019.

The steel sector is still highly reliant on coal to meet 75 per cent of its energy demands. Metallurgical coal is also a fundamental reducing agent in the steelmaking process, making its substitution complex.

With a year-on-year increase in spending and jobs from the mining industry, seemingly bottomless coal reserves, and a global water gateway, the Hunter region evidently remains an extremely enticing place for miners to do business. AM

COAL RECENTLY DETHRONED IRON ORE AS AUSTRALIA’S MOST VALUABLE EXPORT, THANKS IN PART TO RISING DEMAND AND SOARING PRICES DRIVEN BY A GLOBAL ENERGY CRISIS.”

DYNA Engineering has developed a “chamfered mesh pattern”, designed to reduce washdown splash back and increase visibility through the guard panels.

This design feature is a major “point of difference” compared to standard HDPE mesh and will improve inspection and cleaning operations.

Washdown Mesh

• Up to 50% additional spray-through for washdown.

Increased Visibility

• Up to 25% additional viewing angle and see-through viability.

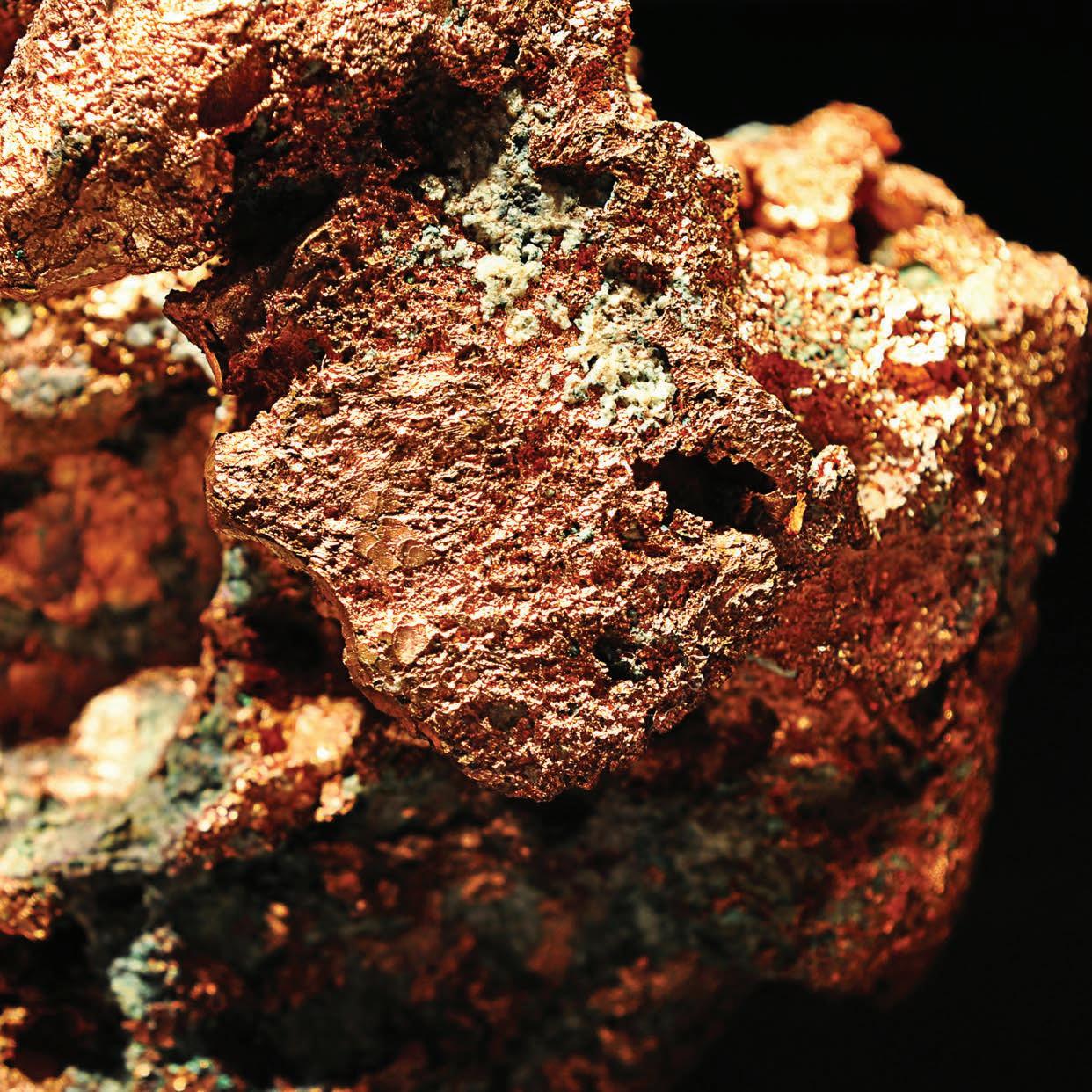

ROBUST ✓ LIGHTWEIGHT ✓ ECONOMICAL ✓AUSTRALIAN MINING SAT DOWN WITH BELARAROX MANAGING DIRECTOR ARVIND MISRA TO DISCUSS THE VALUE OF CLEAN ENERGY METALS.

Belararox is an advanced mineral explorer focused on high-value clean energy metals.

With a phase two drill campaign having just commenced at its NSW-based Belara and Native Bee prospects, targeting additional mineralisation that builds on already defined resources, managing director Arvind Misra sat down with Australian Mining to discuss the business.

Tell us about the journey that led you to Belararox?

I studied at the Indian Institute of Technology in India in a town called Varanasi. It’s a premier institute in India, but it was smaller back then – only around 2000 seats with about a million people applying for a spot. So I went through rigorous testing and got in.

In my last semester, Rio Tinto came to the campus. The company was there because they were attending a conference – it was a bit of a fluke.

They spoke to the head of the mining department at the university about a fiveyear graduate position in Australia. So I applied and I got it, and then I came to Australia as a graduate engineer in 1988.

Since then, I’ve worked with a number of small and large mining companies in Australia, Africa and Asia, including almost 11 years as managing director of India Resources. In that time, I’ve worked on all sorts of high-profile projects. I joined Belararox May 2021, and under my advice the business made its initial public offering and became an ASX-listed public company.

How has Belararox evolved over time?

We’re growing. We’ve got more projects on a larger scale.

I suppose you could say that the company has evolved from having one

arm in NSW – which is a 643km2 area that we’re still expanding and working on today – to a second major arm of operations in the San Juan province of Argentina.

San Juan is very mining-friendly – it’s actually ranked number one by the Fraser Institute of Australia in terms of mining friendliness in South

America. There are a lot of big players active there.

So to answer the question, we’ve evolved from having one smaller operation to a second project on a much bigger and exciting scale. But having said that, we’ve still got a lot of work to do in moving ahead.

What does the NSW expansion mean for Belararox?

We’ve expanded our exploration tenement to 643km2 around our Native Bee and Belara prospects, which sit along the Lachlan Fold belt.

As part of phase two drilling, we now have an inferred resource of five million tonnes.

At the Belara prospect, we have drilled about 700m so far, yielding very highgrade results – 7m at 2.22 per cent zinc and 2.54 per cent copper, so that’s very good.

What this shows us is that there’s exploration potential at Belara with mineralisation open to the north and down-dip.

So that’s Belara, but we also have Native Bee.

What’s important about Native Bee is that there are old mine shafts to the south where the area was mined pre-World War

for very high-grade copper and gold. But there isn’t a single hole drilled there – not one. This is the extension we’re talking about, we’re drilling there right now.

I’m excited about these sites because they’re highly prospective. They can be drilled for some time – a few more campaigns.

Can you tell us about Belararox’s focus on clean energy metals?

The world is working towards decarbonisation, and we are working towards a similar goal as a company.

In the future there’s going to be a lot of solar and wind energy. For that you need a lot of copper and zinc, and lithium for batteries in electric vehicles. That’s where we are going in the future.

That’s our vision, to help the world

become a better place by contributing to global decarbonisation.

What other projects does Belararox have in the pipeline?

As I said, the company acquired a project in San Juan that we’re very excited about. There are a lot of big players there, it’s a highly prospective area.

Lundin Mining spent $4 billion setting up their Josemaria copper mine there, and Barrick own another two mines in the nearby area.