5 minute read

INDUSTRY OUTLOOK

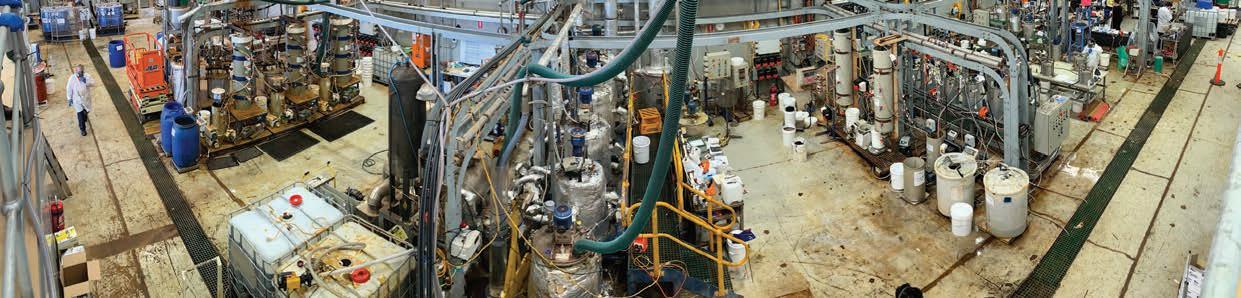

QUEENSLAND PACIFIC METALS CONDUCTED STUDIES FOR ITS TECH PROJECT IN WESTERN AUSTRALIA.

SOUTH KOREA PRESENTS AS PERFECT PARTNER

AUSTRALIA’S CRITICAL MINERALS SECTOR IS WELL-POSITIONED TO BENEFIT FROM GROWING INTEREST FROM KOREAN INVESTORS. THEIR RELATIONSHIP IS BUILT ON RESOURCES, REPUTATION AND MUTUAL TRUST.

Business has been booming on both ends of this handshake of late, as the Republic of Korea’s (South Korea’s) gross domestic product (GDP) teeters inside the world’s top 10 and remains a valuable export destination for Australia.

Considering South Korea is home to three of the largest battery manufacturers in the world – which combine for a market share of 34.7 per cent – it would make sense to diversify its source of raw battery materials.

However, critical minerals hubs such as China and the Democratic Republic of Congo have shown instability of late – the former seeing anti-Chinese sentiment grow in Korea and the latter with environmental, social and governance risks.

South Korea, therefore, now views the reliability of Australia’s critical minerals more favourably.

Trade and Investment Queensland (TIQ) commissioner for Korea, Ryan Freer, explains what makes Australia so attractive.

“Australia is viewed by Korean investors as a trusted partner and as one of the safest places around the globe to do business,” Freer says.

“When it comes to mineral resources investments, Korean investors have strong trust in Australia’s regulatory standards and Australian businesses’ environmental, social and corporate governance structures are highly regarded.”

South Korea consumed 48,000 tonnes of lithium and 67,000 tonnes of nickel in 2020, both of which are expected to smash past 100,000 tonnes per year by 2030. At the same time, Australia mined 47 per cent of the world’s lithium resource in 2017 and holds the world’s largest nickel resource (24 per cent).

Freer was appointed commissioner in July to boost Queensland’s presence in export supply chains.

He understands what it takes to create strong trading partnerships and has stepped in at a promising time.

“I feel fostering the right relationships around shared interests is critical. Only then can miners and processors build awareness, create confidence and deliver mutual benefit,” Freer says.

“Queensland’s well established resource sector has led to the development of world-class infrastructure to support export markets. Our strategic location has also led to the formation of strong, longterm strategic relationships between companies from Asia and Queenslandbased resource companies.”

TIQ has helped to facilitate a significant agreement between Queensland Pacific Metals (QPM) and Korean manufacturers LG Energy Solutions (LGES) and POSCO.

The seven-year, $19.35 million deal will see QPM ship 10,000 tonnes of nickel and 1000 tonnes of cobalt to the manufacturers every year once its Townsville Energy Chemicals Hub (TECH) project is up and running.

“QPM’s project was identified by TIQ’s mining, resources and energy team in Queensland as an attractive project for the Korean market from the early stages of the project,” Freer says.

“Representatives from our Korean office visited QPM’s proposed site in Townsville and met with the QPM leadership team in 2020 to improve our understanding of the project to support pitching to Korean corporates.”

From there it was a matter of pitching the project to the right South Korean businesses and a multi-milliondollar deal was signed.

Freer says it is a terrific effort by QPM to secure the deal, but the commissioner suggests it won’t be the last of its kind.

“Given Korean investors are relatively conservative by nature, it is a significant achievement by QPM to secure an investment from LGES and POSCO in the early stages of the project, in the midst of a global pandemic no less,” Freer says.

“Agreements of this nature, where offtake is secured along with an investment, are becoming more common as the battery market in Korea evolves at a high growth rate.

“Businesses now recognise the increasing importance of securing a stable supply of raw materials for battery manufacturers, which has resulted in increased investment activity from companies like LGES and POSCO.”

QPM chief executive officer Stephen Grocott says the agreement will allow for significant developments to occur at the TECH project.

“In March 2021, QPM raised $20 million. The investment from LGES and POSCO delivers a similar amount. Now with $40 million of funding, QPM is fully funded to advance the TECH project through feasibility, approvals and critical path detailed engineering,” Grocott says.

The TECH project is undergoing a definitive feasibility study to confirm if it can process 1.5 million wet metric tonnes per year of high-grade nickel laterite ore.

QPM has discussed the deal with a number of offtake partners from around the world. Grocott says, however, QPM never set out to partner specifically with Korean businesses.

“With project funding being a key hurdle for QPM, our biggest focus was counterparty risk and having an offtake partner that was bankable in the eyes of financiers,” Grocott says.

“With LGES and POSCO, we don’t mind where our product ultimately goes to as their operations are global. The key is that they are highly reputable counterparties.”

It shows in the attitudes of both South Korean investors and Queensland’s resources sector that trust and reliability are the biggest players in this growing partnership. And the friendship won’t simply vanish once a deal is secured.

“We will continue to support QPM, including Stephen Grocott, when he travels to Korea to meet with the investors in the coming months,” Freer concludes. AM

TRADE AND INVESTMENT QUEENSLAND COMMISSIONER FOR KOREA RYAN FREER.

YOUR WR810 DELIVERY IS HERE

WR810 Delivery with crane for added support.

Choosing the right support vehicle for an underground mining operation can significantly increase the productivity of the production fleet and reduce operational costs. The Elphinstone range of WR810 underground support vehicles is designed to thrive in Australia’s harshest mining environments. The WR810 Delivery with crane ensures parts, components, equipment, and maintenance personnel are transported safely and securely throughout the mine. Integrated into the WR810 operator station is a ROPS/FOPS (Roll-Over Protective Structure), ISO 3471:2008, (Falling Object Protective Structure) ISO 3449:2005 that o ers protection to the operator.

Elphinstone Pty Ltd

Visit our website or contact us on the following. sales@elphinstone.com | +61 3 6442 7777 elphinstone.com

HIAB X-HIDUO 092 loader crane and deck.

The fully integrated HIAB X-HIDUO 092 ‘optimal performance’ loader crane features a lifting capacity of 2900 Kg, and a 7.7m outreach providing a reliable partner for day to day heavy lifting. Operated by manual lever control or via the HiDuo wireless joystick remote, the operator can manoeuvre loads from a distance with built-in intelligence and Automatic Speed Control (ASC) for safe and e ective load handling. Hydraulically controlled stabiliser legs with levelling sensors provide a safe foundation with easy pack up for safe transit. The checker plate deck features two emergency stops, tie-down points, and 3-point access with high visibility green handrails and ladders on both sides.