Australian Resources & Investment

The next step in the evolution of underground mechanical rock excavation is here. The Mobile Miner family consists of powerful mechanical rock excavation machines that are fully customisable to your specific needs. The continuous mining technology makes your project more productive, more predictable and easier to schedule compared to the drill and blast method. It also creates a safer and cleaner work environment due to no explosions, less need for ventilation and a much lower risk for falling rocks - a safer work environment for everyone.

When IMARC takes place in Sydney in November, the resources industry will be able to reflect on 2022’s achievements while establishing the building blocks for 2023 and beyond.

2022 has whizzed by and by the time the International Mining and Resources Conference (IMARC) arrives in Sydney in November, industry professionals will have a solid reference book of the year’s achievements and lessons learned.

These insights will form the basis of discussion and collaboration between fellow mining leaders and resource experts, facilitating the sector’s continued transformation into 2023 and beyond.

And sustained growth it will need.

PricewaterhouseCoopers’ (PwC) ‘Mine 2022’ report shines a light on what it believes is the resources industry’s most pressing concern: critical minerals.

“(Critical minerals is a pressing issue) on the back of that transition to a low-carbon world, and the massive amount of investment that’s needed to support that,” PwC Australia partner Marc Upcroft said.

“And it’s becoming clear to us that if you’re trying to achieve the energy transition on the current target and timetable, this only happens if there’s a substantial increase in exploration, discovery, development and mining of critical minerals.”

The resources industry has its work cut out for it, and it’s events such as IMARC that can accelerate the dialogue needed to foster the sector’s critical minerals future.

Hawsons Iron graces the front cover of our October issue, and we chat to managing director Bryan Granzien about the company’s incredible growth in the 14 months since the company changed its name from Carpentaria Resources.

Harnessing the strengthening ‘green steel’ narrative, while continually de-risking its namesake project at the same time, Hawsons Iron’s share price was up by more than 450 per cent year-onyear when this issue went to print.

We shine a light on the happenings of Diggers & Dealers 2022, where gold and battery metals took centre stage.

Here, the likes of BHP, Newcrest Mining, Agnico Eagle, IGO, Lynas Rare Earths, Genesis Minerals and St Barbara gave fascinating insights into their projects and the resources sector more broadly.

We chat to Diatreme Resources’ chief executive officer Neil McIntyre about the complexity of the silica sand market and how the company is progressing en route to becoming a producer.

Tony Featherstone explores the soaring coal market, and how its current performance contradicts overarching sentiments regarding the maligned sector.

The sustained uncertainty surrounding the global iron ore market is also discussed, with China set to have greater control on pricing and negotiations through a new state-owned iron ore purchaser. So how will this affect Australia’s iron ore producers?

Elsewhere, there’s chats with ASX-listed mining services companies RPMGlobal, Duratec and Mitchell Services, while we also explore IMARC in greater detail.

Happy reading.

Tom Parker EditorEDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

MANAGING EDITOR PAUL HAYES

Tel: (03) 9690 8766

Email: paul.hayes@primecreative.com.au

CLIENT SUCCESS MANAGER JUSTINE NARDONE Tel: (03) 9690 8766

Email: justine.nardone@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGER TONY NGUYEN Mob: 0411 059 305

Email: tony.nguyen@primecreative.com.au

SALES ADMINISTRATOR

EMMA JAMES

Tel: (02) 9439 7227 Mob: 0414 217 190

Email: emma.james@primecreative.com.au

DESIGN PRODUCTION MANAGER MICHELLE WESTON michelle.weston@primecreative.com.au

ART DIRECTOR BLAKE STOREY blake.storey@primecreative.com.au

KERRY PERT, LOUIS ROMERO

FRONT COVER IMAGE CREDIT: Hawsons Iron

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00

For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA 11-15 Buckhurst St, South Melbourne, VIC 3205, Australia www.primecreative.com.au

© Copyright Prime Creative Media, 2021

All rights reserved. No part of the publication may be reproduced or copied in any form or by any means without the written permission of the publisher.

PRINTED BY MANARK PRINTING 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337

Published 12 issues a year

Big producers have seen record earnings as the energy crisis intensifies, but the sector is fully valued for now.

If Australia’s coal sector is in trouble, someone forgot to tell ASX-listed coal stocks.

Many have soared this year, continuing a remarkable rally that has frustrated investors who gave up on the sector.

In the recently concluded 2021–22 financial year (FY22) earnings season, leading coal producers reported record profits, buoyed by strong prices. Several coal companies increased their dividend and some announced share buybacks to return excess cash to shareholders.

But can the rally continue?

After such strong gains, coal stocks are due for a period of consolidation. The question is whether the rally can find its next leg.

Australian Resources & Investment analysis of 10 of the largest coal-related stocks highlights the rally. The median total return of these stocks (assuming dividend reinvestment) is 150 per cent over one year to early September 2022.

Over three years, the average annualised return is 41 per cent. For context, the S&P/

ASX 200 Accumulation Index (including dividends) returned one per cent annually in this period.

At a company level, the rally in coal stocks this year has been breathtaking. Sector star Whitehaven Coal has surged almost fourfold to $8.63* from its 52-week low of $2.30.

Chinese-owned Yancoal Australia has leapt almost threefold to $6.15* from its 52week low of $2.23.

New Hope Corporation, Stanmore Resources, Coronado Global Resources and Bowen Coking Coal have also starred.

TerraCom (formerly Guildford Coal) has gone from a 52-week low of $0.15 to almost $1.02*.

But percentage gains can deceive.

Coal stocks mostly plunged between 2018 and early 2020 as fossil-fuel producers lost favour with investors. Some funds that use environmental, social and governance (ESG) filters avoided the sector.

At the time, technology stocks were in vogue thanks to record-low interest rates (which benefit companies with long-duration earnings) and a seemingly insatiable appetite for growth companies. Fewer investors wanted to buy coal stocks.

Contrarians who bought coal stocks when the sector was on its knees deserve their gains. Of course, not every coal stock has starred. Coal-related companies such as Aurizon Holdings, a rail operator, and Dalrymple Bay Infrastructure, a port operator, have underperformed. Some coal-services stocks have struggled.

Also true is that coal companies, like other minerals producers, benefited as commodity prices soared during the early stages of Russia’s invasion of Ukraine amid a growing global energy shortfall. Record-high coal prices were a huge tailwind.

Nevertheless, the sector’s share-price rally this year has strong foundations.

What ultimately matters most is company earnings. On this score, leading Australian

coal companies have superbly capitalised on the conditions to deliver booming profits.

Whitehaven reported revenue of $4.9 billion for FY22, up from $1.57 billion a year earlier. Underlying earnings (EBITDA) were $3.06 billion in FY22, up from $204 million in FY21. Whitehaven declared a fully franked dividend of $0.40 a share (on top of an interim dividend of $0.08) and continued its share buyback.

In August, Yancoal Australia reported record revenue and earnings. Sales leapt to $4.76 billion in the first half of FY22 from $1.75 billion in the same period a year earlier. Underlying earnings were $3.15 billion in the first half, up from $406 million.

Stanmore Resources reported underlying earnings of US$726 million for the first half of FY22, up from a $10.1 million loss in the same period a year earlier. Stanmore’s acquisition of BHP Minerals’ 80 per cent interest in BHP Mitsui Coal in May 2022 was well timed. Stanmore is also acquiring the remaining 20 per cent from Mitsui.

These and other earnings results from coal producers had a common theme: strong coal demand and tight supply underpinning record thermal coal prices.

“Events over the past two years have caused a shift in global trade flows and tightened the supply of all coal products, leading to strong demand and record high prices,” Whitehaven noted in its FY22 results.

“Global supply/demand imbalances are expected to continue to support high coal prices.”

As prices for thermal coal (used in electricity-generation) rise due to Indonesia’s export ban last year and the Russia–Ukraine war this year, process for metallurgical coal (used in steel production) fell in the fourth quarter of FY22. Fears of a global economic recession and lower steel demand weighed on metallurgical coal.

Analyst valuations of leading coal stocks suggest the sector is fully valued for now, although not excessively so given the extent of recent gains. A consensus share-price target among analysts of $8.50 suggests Whitehaven is at fair value.

Morningstar, however, values Whitehaven at $9 a share. As analysts continue to upgrade earnings forecasts for top coal producers, it’s likely that company valuations will also rise, suggesting some value remains in the sector.

Fast-growing coal producers, such as Stanmore Resources and Coronado Global Resources, still trade below consensus analyst forecasts (compiled by FN Arena). New Hope Corporation trades slightly above the consensus price target.

Care is needed with consensus price targets. Some coal stocks have limited analyst coverage, meaning the consensus target is based on a small sample of

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs.

Before acting on information in this article, consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article.

research. In addition, many ASX-listed coal stocks are too small to attract significant broking research.

Caveats aside, consensus estimates suggest two main views towards coal stocks: first, that the sector is now fully valued after soaring gains this year; second, that value still exists within the sector over the medium term (3–5 years), largely on supply constraints.

Both arguments have merit.

Coal producers such as Whitehaven have justified their price gains with soaring earnings. But several tailwinds for the sector are turning into short-term headwinds, best reflected in falling metallurgical coal prices.

The biggest headwind is the prospect of global recession and potential demand destruction for some commodities. China’s economic slowdown is particularly concerning for steel production and metallurgical coal demand. After rising in the first half of 2022, Chinese steel production fell sharply in June and July.

Against that, there have been ongoing rumours of China lifting its ban on Australian coal. This speculation boosted coal stocks in July, though it seems premature given

lingering trade tensions between China and Australia.

On balance, a period of consolidation for coal stocks seems likely in the short term as leading producers maintain (or give back) some of their recent gains. Investors should watch and wait for better value in the sector over the next 12 months.

However, medium-term (3–5 years) prospects for coal production remain encouraging. Wood Mackenzie, a commodity forecaster, predicts global demand for coal will stay largely flat to 2030. Advanced economies will face a structural decline in demand to 2050, while developing economies will see continued demand growth for coal.

Geopolitics are another factor. The Russia–Ukraine war has reinforced the risks of relying on autocratic nations for energy supply or moving too quickly towards renewables when there is not sufficient baseload power supply. European and North Asian countries now face a challenge in replacing Russian coal – a positive trend for Australian coal.

Unlike previous commodity supercycles that were largely driven by demand factors,

this one is being driven more by supply. The boom in ESG investing and the move away from capital investment in fossilfuel production in coal and oil limits future supply.

Oil supermajors, for example, are investing far less in new production compared to previous cycles. This long-term supply–demand dynamic could underpin high coal prices for longer than the market currently realises.

Few people doubt the world needs to move towards clean energy and away from fossil fuels like coal over the coming decades, or that more investors will avoid coal stocks on ESG grounds when building portfolios. That’s their right.

But as the recent profit-reporting season has shown, the market underestimated the earnings and growth potential of Australia’s coal sector. That might continue to be the case in the next few years if the market does not fully appreciate future supply constraints in coal and oil.

The key is buying into the sector during periods of market volatility.

*Share prices are determined as of September 20.

WE ARE ALL part of the race to become more environmentally friendly. A significant part of that race is global electrification, which involves world powers scrambling to gather the necessary minerals required for the process – and our progress.

It seems graphite is currently viewed as the ‘dark horse’, but we suggest aluminum may tie this race.

Leaving aside clichés, there has been a massive global surge in research and development for energy storage solutions. The University of Queensland is a key part of that research.

Still an essential part of the humble pencil, graphite is the second largest component by weight in lithium batteries and plays an integral role in electrification.

A hybrid-gasoline electric vehicle (HEV) can carry up to 10kg of graphite, and a plug-in electric vehicle (EV) has around 70kg. This would equate to more than 70,000 tonnes of natural graphite for the production of every million EVs.

Coupled with this is the growth of other electronics that rely heavily on lithium-ion batteries, as well as forthcoming developments in portable tools and energy-storage applications.

Producing around 60 per cent of the world’s flake graphite, China is the world’s largest supplier of the mineral, followed by Mozambique and Brazil. Graphite is also produced in Canada, India and Russia. Interestingly, the US – one of the main global forces in the EV industry – has been late to the party on mining graphite.

In Australia, Quantum Graphite’s (ASX: QGL) Uley graphite project is within the wholly owned Mikkira graphite deposit located on the Eyre Peninsula in South Australia.

The company’s proprietary process is environmentally sustainable and entirely based on renewable energy, and its joint venture with Sunlands Co. sees them use their technology to manufacture the flake graphite-based storage media to be installed within long duration energy storage cells.

The jagged and gapping actions of the share price history for Quantum Graphite restricts our analysis to a starting point in December 2021. The price rose strongly into 2022 to halt in momentum divergence at $0.38 in February, pulling back to test support at $0.24 before regaining its momentum.

Breaking away through $0.38 in early May, the price reached another momentum hurdle at $0.52 on May 23. The price has since paused and pulled back to bounce from support at $0.325.

It’s likely that more price churning may occur between $0.32 and $0.43 as momentum rebalances. Beyond this, we would look for a return to the upward path through the $0.45–0.52 area for a potential into the $0.70–0.80 range. A fall through $0.275 may produce a deeper pullback.

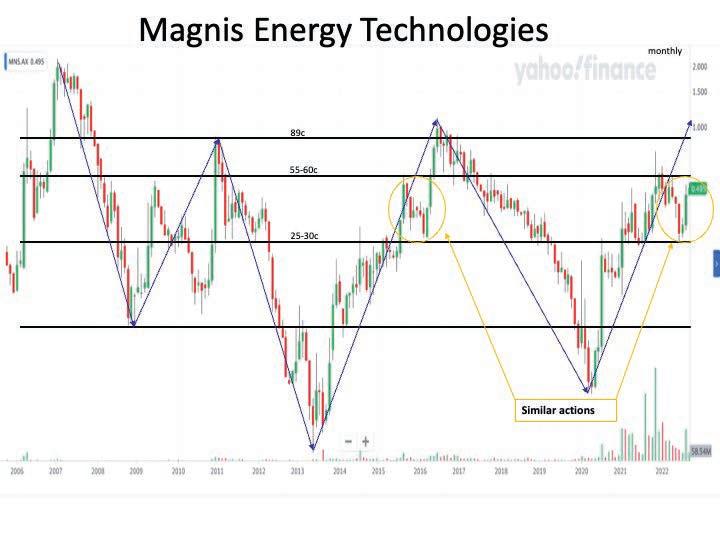

Magnis Energy Technologies (ASX: MNS) is also listed on the New York over-the-counter and Frankfurt markets. The company has vertically integrated its lithium-ion battery technology and materials by holding strategic assets, investments and partnerships in the electrification supply chain.

Along with its US partners, the company operates a gigawatt-scale lithium-ion battery manufacturing project

in Endicott, New York. It has plans to commercialise and patent technology to develop green-credentialed lithium-ion battery cells, with the aim to produce high-performance anode materials utilising ultra-high-purity natural flake graphite from the its Nachu graphite project in Tanzania.

The share price for Magnis Energy has been on a rollercoaster ride from the early 2000s. Following a peak at $2.17 in January 2007, the price fell sharply to a low and turning point around $0.10 in October–December 2008. This spurred a significant recovery to $0.89 in early 2011.

The pattern of strong upthrusts followed by sharp declines continued with a spike low at $0.24 in mid-2013 and then an interim high at $1.12 in June 2016. The most recent low was $0.47 in April 2020. At this time, a strong reversal developed and expanded to support the 2021 upthrust, which reached $0.755 in November last year.

The price has pulled back in line with a momentum peak, finding support drawn back to 2008 in the $0.25–0.30 range. The action appears similar to that experienced in early 2016, when the price tackled resistance in the $0.55–0.60 area before breaking through and surging higher.

A similar outcome would see the price head towards $0.89 through $1.00 and possibly into the $1.50–2.00 range. A drop below $0.40 may delay the upward path.

Now for the next step.

The University of Queensland’s Australian Institute for Bioengineering and Nanotechnology has been using breakthrough technology for the creation of graphene aluminium-ion cells. The innovative discovery with the Graphene Manufacturing Group (listed on the Toronto Stock Exchange) claims to charge 60 times faster than the best lithium-ion cells, and can hold three times the energy of the best aluminiumbased cells.

The aluminium-ion battery composition consists of an aluminium foil anode, a graphene cathode, and an aluminium-chloride electrolyte. The batteries contain no lithium, copper, manganese, or cobalt. They are safer, with no upper ampere limit to cause spontaneous overheating. Due to their stable base materials, the batteries are easily recyclable, charge much faster and provide a longer range, resulting in a more sustainable outcome.

The technology has been referred to as “game-changing”, offering a real alternative to the existing lithium-ion batteries in almost every application.

With its Toronto Stock Exchange listing, Graphene Manufacturing Group’s share price is quoted in Canadian dollars. The price has been moving in a broad upward channel from the middle of last year, and from July this year has encountered resistance from its mid-way channel in the $C4.00–4.20 zone.

More churning may occur in the price action beneath this barrier with support in the $C3.00–3.50 area with an upward breakaway through $C4.20, signalling the next stage higher towards $C5.00 and potentially $C6.00 and possibly much higher. A drop below $C3.00 may produce heightened price volatility.

As the great battery race enthrals the world and energy research strives for new and better options, lithium and graphite remain the key elements for the time being, but aluminium is likely to provide a paradigm shift.

Magnis Energy’s share price has been on a rollercoaster ride since the early 2000s. Graphene’s share price trajectory on the Toronto Stock Exchange.Since changing its name from Carpentaria Resources, Hawsons Iron has experienced incredible growth as it advances its namesake magnetite project.

When Hawsons Iron Limited was established in August 2021, it kickstarted an exciting new chapter for the burgeoning iron ore miner.

Each milestone in the past 14 months has progressively de-risked the Hawsons Iron project and further highlighted the potential of its Hawsons Supergrade product (70 per cent iron).

And investors are buying in. The company’s share price was trading at $0.45 at the time of writing (September 19), which was up more than 450 per cent year-on-year.

In March 2022, Hawsons Iron purchased the full stake in its namesake project after acquiring the remaining 6.04 per cent interest owned by Starlight Investment Company.

Hawsons managing director Bryan Granzien said acquiring the remaining stake enabled the company to manage the

bankable feasibility study (BFS) and project build “more efficiently and effectively”.

“No doubt, removing this potential complication at the joint venture level, opens all avenues for the company to move forward, including the consideration of strategic joint venture partners later if, or when, we wish to,” Granzien said when the announcement was made.

“We see this as a strategically important transaction, as it really paves the pathway for the future.”

In June 2022, Hawsons Iron made a significant announcement by opting to develop a 20-million-tonne-per-annum (Mtpa) project rather than the 10Mtpa option outlined in the 2017 pre-feasibility study (PFS).

Granzien said the 20Mtpa option improves the environmental, social and governance (ESG) profile of the project,

as the transport method utilises an underground slurry pipeline instead of rail.

Granzien said 20Mtpa also facilitates greater opportunity to attract capital investment.

“You could argue that was a brave decision by the board, changing from a PFS model of 10Mtpa using existing infrastructure into one of the largest undeveloped iron ore mines and, when operational, a large-scale mine crucial to filling the significant supply shortfall expected for high-grade magnetite for green steel,” Granzien told Australian Resources & Investment.

“(Opting for 20Mtpa) has really made the market look very differently at the project and its potential.”

Granzien said Hawsons Iron’s July 2022 resource upgrade was another key milestone.

This saw Hawsons upgrade the project’s mineral resource to 3.95 billion tonnes at a 12.2 per cent DTR (magnetite recovery rate) for 484 million tonnes (Mt) of concentrate, including a maiden 54Mt in the measured category (193Mt indicated and 239Mt inferred).

“The combined measured and indicated resource of 247Mt sets up the BFS for the ore reserve estimation to satisfy project lenders that there is sufficient high-grade material to confidently meet targeted minimum concentrate production of 20Mtpa,” Granzien said.

“This upgrade is significant because having these mineral resources in the higher confidence measured and indicated categories is necessary for the BFS,

converting our resource to reserves and finalising our project financing package.”

Underpinning the decision to go ahead with the 20Mtpa option was the execution of a non-binding memorandum of understanding (MoU) with Flinders Ports.

As part of this agreement, Flinders Ports will finance, construct, own and operate the Myponie Point port in South Australia, reducing Hawsons Iron’s capital requirements in the process.

The next step will be for Hawsons Iron to upgrade its Flinders Ports partnership to a binding agreement, which will effectively unlock Myponie Point and Hawsons’ export pathway to the world.

Granzien said the Federal Government renewing Hawsons Iron as a major project

in April 2022 was another significant milestone, along with the South Australian Government’s recent declaration that it will assess its potential as a major project.

Hawsons Iron also has the recognition of the New South Wales Government, which has declared the project a State Significant Development.

“Now you’ve got the Federal Government, the New South Wales Government and the South Australian Government recognising the potential and importance of this project not just from an economic point of view, but as a significant player in helping to decarbonise the steel industry,” Granzien said.

Granzien said South Australia’s “major project” declaration had the potential to help streamline approval processes.

“This is very much recognition that this is large scale with significant economic potential to South Australia. It fits well with South Australian plans around hydrogen, green steel and opening up the Braemar minerals province.

“And it’s a good ESG story, so it’s consistent with how they’d like to see sustainable development of mining in the future.”

In September 2022, Hawsons Iron engaged Citigroup Global Markets Australia (Citi) as a strategic advisor to assist in assessing strategic partnering opportunities for its namesake project.

Granzien said this was the formalisation of an established relationship with Citi.

“This was something we’ve been working on with Citi for some time, so it didn’t come out of left field,” Granzien said.

“We’ve been talking to them on several fronts and we’ll continue to do, so this is part of a larger relationship.

“Citi is one of world’s biggest banks in terms of investment in the resources industry. They’ve got a large amount of funding available to ESG projects and they’ve probably got the biggest global network or reach to steel mills and other investors.”

Paul Cassano, who Hawsons Iron has appointed as its new project director, will take responsibility for leading the preparation of the BFS.

With more than 30 years’ experience in the resources sector, Cassano has held divisional chief executive officer and executive general manager roles at Downer, along with an executive general manager role at Thiess. He also held several management roles with BHP Billiton in the past.

Hawsons Iron’s next priority is producing a compelling BFS, which Granzien said would enable the company to raise the capital needed to build the Hawsons Iron mine and its associated infrastructure.

The BFS will demonstrate Hawsons Iron’s capacity as an operating mine, authenticating the project’s many components.

Preparing a BFS is a complex exercise, so Hawsons has engaged several external companies to support its completion.

This includes Worley Group, which is undertaking the metallurgical and process engineering for the process plant test work program and mine engineering design.

Slurry pipeline specialist Fortin Pipelines is examining water and the direct-toport underground pipelines, the latter of which connects the project with Myponie Point. Port infrastructure expert Royal HaskoningDHV is examining port design.

Global environmental advisory firm SLR Consulting, as environmental impact statement (EIS) consultant, is leading environmental approvals in New South Wales and managing the project’s environmental approvals in South Australia.

Then there’s engineering group Australian Mine Design and Development (AMDAD), which is preparing a complete Hawsons Iron mine plan, including final pit design, mining sequence, implementation schedules, fleet composition, costings, pathways to net-zero emissions, and more.

Hawsons has also received a comprehensive report from Advisian, detailing the ideal energy balance to optimise the project’s ESG and sustainability outcomes.

This report sets out three decarbonisation pathways for Scope 1 and 2 emissions

abatement, the most comprehensive of which would enable Hawsons Iron to achieve net-zero emission status required for green steel production by 2035.

An advisory committee of specialists is ensuring the BFS is fit-for-purpose to secure funds to develop the world-class mine.

Committee members Nick Jukes, Genevieve Gregor and Richard Robinson bring decades of expertise in engineering, development and financing to enhance the success of the BFS.

Granzien said a compelling BFS would instil confidence in stakeholders such as banks, investors and potential offtake partners that the Hawsons Iron project can “achieve all the things we know it can”.

With every new announcement and milestone, Hawsons Iron adds to its narrative – the story of an inspired new approach to an age-old commodity that is just as pertinent as it is important.

Considered the world’s most important engineering and construction material, steel demand is set for further growth as the world decarbonises.

And in order to meet their net-zero targets, steelmakers will become more selective about the iron ore products they purchase.

To put it simply, the higher the grade the better, and with one of the highestgrade iron products on the seaborne market Hawsons Iron has an important role to play.

In the second of a two-part series, we explore the remaining two themes discussed in PwC’s ‘Mine 2022’ report: critical minerals and ESG.

Critical minerals are increasingly permeating the global mining and economic dialogue as the world’s pursuit of decarbonisation heats up.

Geoscience Australia defines a critical mineral as a metallic or non-metallic element that is essential to the functioning of our modern technologies, economies and national security, which is also at risk of experiencing supply chain disruption.

While the European Union (EU) published its first critical minerals list in 2011 –featuring 14 minerals on the bill – Australia didn’t debut its own list until 2019.

Today, the list features 26 minerals and Geoscience Australia provides data around each commodity’s geological potential in Australia, its demonstrated resources, and the local and global production levels.

Some of the most recognisable names on the list include lithium, cobalt, rare earth elements and vanadium, but one could be forgiven for never having heard of beryllium, bismuth, niobium and rhenium.

PricewaterhouseCoopers (PwC) believes critical minerals represent the most significant issue facing the global mining sector today.

This was highlighted in the firm’s recent ‘Mine 2022’ report, which examines the performance of the world’s top 40 mining companies in 2021, while unpacking the most urgent trends facing the global mining industry.

In the August issue of Australian Resources & Investment, we explored two of the four themes discussed in the report,

shining a light on the record-breaking financial performance of the world’s top miners in 2021 and examining the increased volume of mergers and acquisitions (M&As) in recent times.

In the second of a two-part series, we unpack the pressing concern that is critical minerals and investigate environmental, social and governance (ESG) – a concept that is growing in stature and will increasingly influence investor sentiment into the future.

Every year, PwC ranks the world’s top 40 mining companies through the aggregation of public information such as annual reports and financial reports available to shareholders.

The rankings also express PwC’s point of view on topics affecting the industry,

developed through interactions with its clients and other industry leaders.

Majors BHP, Rio Tinto and Vale maintained their grip at the top of the list –at one, two and three, respectively, in 2022 – while Glencore rose from eighth spot to fourth, overtaking Fortescue Metals Group in the process. Fortescue slumped from fourth to 10th, joining Newmont Corporation (seventh to eighth) and Russia’s MMC Norilsk Nickel (sixth to ninth) as sliders in the top 10.

Chinese coal miner China Shenhua Energy Company (fifth), US copper juggernaut Freeport-McRoRan (sixth) and Anglo American (seventh) made up the rest of the top 10.

The list demonstrates the global nature of the mining sector, with representation from 12 countries, including Switzerland, Mexico and Saudi Arabia. Newcrest Mining (25th)

Smelting is an important process in creating copper.Australia’s critical minerals list features 26 minerals, including lithium, cobalt and vanadium.

and South32 (26th) were the other Australian companies featured on the bill.

Critical minerals can be concisely construed by a brief definition but their influence is far greater than that. The global net-zero race is dependent on these minerals. Without lithium, cobalt and vanadium, electric vehicles (EVs) cannot be manufactured, while silicon and rare earths elements are vital for renewable power generation.

EVs, wind and solar energy underpin net-zero targets and if manufacturers don’t have sustainable access to critical minerals when the 2030s and 2050s come around, limiting the effects of climate change will be nigh on impossible.

“(Critical minerals is a pressing issue) on the back of that transition to a lowcarbon world, and the massive amount of investment that’s needed to support that,” PwC Australia partner Marc Upcroft told Australian Resources & Investment.

“When you look at the mineral content that’s needed to support that (transition), we’re talking about more, not less, minerals.

“And it’s becoming clear to us that if you’re trying to achieve the energy transition on the current target and timetable, this only happens if there’s a substantial increase in exploration, discovery, development and mining of critical minerals.”

Mine 2022 demonstrates that not only are critical minerals inherent resources to the manufacturing of batteries and

renewable energy infrastructure, but these green technologies are also more materialintensive.

“The production of a solar farm requires three times more mineral resources than a similar-sized coal plant and constructing a wind farm needs 13 times as much as a comparable gas-fired plant,” the report stated.

Mine 2022 estimated offshore wind power generation to require 15,409kg of critical minerals per megawatt of power, with onshore wind power generation necessitating 10,167kg of critical minerals per megawatt. In comparison, a natural gas plant requires 1166kg of critical minerals per megawatt.

Solar photovoltaic cells – the devices that convert sunlight into electricity – require 6834kg of critical minerals per megawatt, while a coal-fired plant needs 2485kg of critical minerals per megawatt.

There are expectations that lithium demand will rise from approximately 500,000 tonnes of lithium carbonate equivalent (LCE) in 2021 to between three and four million tonnes (Mt) in 2030.

According to S&P Global, demand for copper will nearly double to 50Mt by 2035, while demand will reach more than 53Mt by 2050 – estimated to be more than all the copper consumed globally between 1900 and 2021.

Furthermore, S&P Global forecasts a 10Mt copper shortfall in 2035.

“The energy transition is going to be dependent much more on copper than our

current energy system,” S&P Global vice chair Daniel Yergin said.

“There’s just been the assumption that copper and other minerals will be there ... copper is the metal of electrification, and electrification is much of what the energy transition is all about.”

According to a recent report from the Cobalt Institute, the cobalt market experienced 22 per cent growth in 2021 and this trend will continue to rise by about 13 per cent per year for the next five years.

The institute expects annual cobalt demand to approach 320,000 tonnes in the next five years, up from 175,000 tonnes in 2021, with 70 per cent of the growth to come from the EV sector.

EV-related cobalt demand overtook other battery applications in 2021 to become the largest end user of cobalt at 34 per cent of demand, totalling 59,000 tonnes.

And lithium, copper and cobalt make up only three of the critical minerals central to the renewable energy transition.

As miners and end users attempt to marry up their order books and timelines, commodity prices have been volatile – to say the least – in recent times. The supply–demand equation has been far from stable, a situation Upcroft expects to continue going forward.

“We want to have a stable environment for what is, in history, one of the most significant transitions we’ve ever seen in terms of the scale of change and the pace of change,” Upcroft said.

“When you look at the broader net-zero ambition that we have as a planet, and you consider specifically the energy transition, it’s impossible to see that scale of change when you look at the mineral component.

“(There’s) such large shifts in supply and demand of very large scale but (also) a bit of uncertain timing in amongst all of that as well.

“It’s impossible to see all that play out without that associated higher volatility in price.”

Upcroft believes that while people are aware of the climate ultimatum and what is required as a result, there is less clarity regarding the specific timing of renewable energy penetration and what this means for mineral demand.

“It’s about forecasting what’s going to happen and when,” Upcroft said.

“And “when” is probably the most critical piece because we all know what the end game looks like. If we fast forward to 2050, we know what that looks like in terms of EV penetration, renewable energy penetration, etcetera.

“It’s the timing around all of that and what that means for the increases in demand for minerals that have to somewhat marry up with what the supply for minerals can deliver.”

Linked to the pursuit for decarbonisation is the mining industry’s ESG responsibility, which also concerns the sector’s social

licence to operate and societal reputation.

PwC put it best.

“In all industries, the ESG revolution is upon us,” it said in Mine 2022. “Miners will see tangible business benefits by reorientating operations around a value proposition that puts people and planet alongside profit.

“As miners work to provide the minerals to achieve a net-zero future, the societal impact on communities and the broader ecosystem of stakeholders must be front of mind.”

PwC said ESG presents risks and opportunities for the top 40 mining companies.

Governments and regulators are sending clear signals that companies will be held accountable if they don’t operate in more sustainable and ethical ways.

Upcroft said the Australian mining industry has gone through a major ESG transition in recent years and that most Tier 1 miners were now well advanced in their ESG strategy.

“Go back two or three years and ESG was more of an add-on to the mining company strategy rather than being an integral part of it,” he said.

“There’s still more to come from these larger miners and a lot of that’s focused on making the whole group strategy inclusive of ESG, so that ESG can become an equally important pillar for value creation.”

Upcroft said that while much of mining’s next tier was beginning to embrace ESG, there were still “laggards” in that space.

“The key feature (among that next tier) is that, corporately, ESG is still … an add-on to their existing strategies and operations

rather than an integral part,” he said.

“We expect to see the leaders in the ESG space – and the leaders in the mid-tier space – to be the ones who properly integrate ESG into their strategy rather than ignore it or bolt it on to what they’ve been doing previously.”

The mining industry can implement sustainable practices by providing materials

and mineral processing capacity for the renewable energy transition; however, this is not a “free kick” to being an ESGprogressive enterprise.

“Mining (companies) can’t really see their role in energy transition as a free kick on ESG, corporate trust and that social licence to operate,” Upcroft said. “To properly do well on that front, trust needs to be genuinely

earned and maintained.

“We’re all alert to the potential of greenwashing … these days, so I don’t think it’s going to be as easy a run as perhaps people thought it might be.

“And the importance of that is (the fact) solid ESG credentials are quickly becoming an entry point to raising debt and equity.

“You don’t have the time anymore to raise the equity, build the project and then over the next five to 10 years build your credentials and everything else. If it’s not there upfront, then you might not get your debt or equity. Or if you do, it’ll come at a higher cost.”

ESG could be the difference between closing a crucial loan or debt arrangement with a bank or winning over a major shareholder.

It may not be an attractive concept on paper, but it will underpin the future viability and prosperity of the mining industry, whether companies like it or not.

Silica is beholden to a complex global marketplace and precise-albeit-relativelysimple mining process. Australian Resources & Investment shines a light on emerging silica sand company Diatreme Resources.

In far north Queensland ¬– about 220km north of Cairns – lies the world’s largest silica sand mine.

Cape Flattery is owned by Mitsubishi Corporation, which ships roughly three million tonnes (Mt) of silica sand from the operation each year, bound for Japan and other parts of Asia.

Silica has traditionally been used in glass, foundry and chemical industries, but it has a growing profile in the renewable energy sector, where the commodity is important in the manufacture of photovoltaic cells in solar panels.

There are several emerging Australian companies looking to bring silica sand projects online in the coming years. Chief among these is Diatreme Resources, with its Galalar and Northern Resource projects located adjacent to Cape Flattery.

Galalar and Northern Resource are situated at the south and north of a single tenement, covering an extent of a large dune field which has been accumulating sand for millions of years.

A 2021 pre-feasibility study (PFS) indicates Galalar has a post-tax net-present value (NPV) of $358 million, an internal rate of return (IRR) of 66 per cent, and capital payback within 1.4 years.

Diatreme said Galalar had the potential to support the manufacture of 3.2 billion solar panels, the equivalent of taking 132 million cars off the road.

Diatreme inked a landmark agreement with global industrial minerals company Sibelco in late June.

Sibelco became a major Diatreme shareholder through a $13.97 million share placement, while Diatreme’s existing major shareholder Ilwella raised a further $3.3 million for the emerging miner.

Sibelco and Diatreme have also agreed to a joint venture to develop Galalar and Northern Resource, supported by a $35 million investment from Sibelco split across two tranches of $11 million and $24 million.

Diatreme chief executive officer Neil McIntyre said the Sibelco partnership was “transformational” for the company.

“Sibelco is one of the world’s largest industrial minerals companies,” McIntyre told Australian Resources & Investment

“The company is European headquartered but has worldwide operations and, particularly in the silica space and high-end silica, Sibelco is a world leader.

“There’s no company that understands the silica market better.”

McIntyre said the agreement with Sibelco is made more significant by the fact silica projects aren’t straightforward for emerging miners.

“The struggle for a junior in transitioning from exploration into pre-development and development,

particularly in industrial minerals, is (the fact) getting genuine offtake in place with major manufacturers is very difficult,” he said. “Particularly in high-purity silica because you’re mining and selling a product almost at a chemical grade.

“The specifications for this product are so fine – down to parts per million – and as a start-up the end users look at you somewhat sceptically regarding your ability to deliver the quality of product they need.”

For glass manufacturers producing on continuous batching processes, incorrect silica specifications (impurities) can lead to glass bubbling and other issues, which can ruin the product altogether. The ramifications can be more severe than an errant piece of glass, with a company’s industry standing on the line.

“Manufacturers are hypersensitive about their reputation and their ability to be able to deliver the products they need,” McIntyre said.

McIntyre said while the silica market has a long history, it lacks the transparency of other commodity markets and has traditionally been difficult to understand.

But that’s changing.

“Traditionally, a lot of the silica market in Australia has been dominated by trading houses – Japanese trading houses, in particular,” McIntyre said. “Mitsubishi is one of them and there are two or three others out of Western Australia that dominate that market.

“This creates a market that’s incredibly opaque and you can’t easily see the substance behind it in terms of pricing and in terms of the products they’re producing.

“So what we’re seeing is a level of maturity coming into the silica market now, with a number of listed companies like us. There’s about three or four in Western Australia.

“We’re a public company, we publish and talk about everything to do with our business, and that’s new.”

As part of the Sibelco partnership, McIntyre said Diatreme will continue to manage the day-today on-ground matters, including exploration, permitting approvals, engagement with Traditional Owners and government.

Sibelco will enable Diatreme access to its network of specialist processing technology, expertise, and 150 years’ worth of experience in silica sand.

McIntyre said this would be critical in establishing future offtake agreements, as Sibelco understands how to develop a supply chain and what buyers want.

“In many ways, it’s a great marriage of the offshore, technical and market understanding married up with the domestic, deep understanding of the resource,” he said.

Diatreme aims to complete its Galalar bankable feasibility study (BFS) and lodge its environmental studies by early 2023.

The company aims to complete permitting and approvals by late 2023, before Galalar production begins in 2024.

Diatreme established an MoU with Far North Queensland Ports Corporation in August to support its Northern Resource project. The MoU outlines key terms of cooperation in advancing exports from Northern Resource via the Cape Flattery port.

The company also lodged two mining lease applications (MLAs), as well as four infrastructure MLAs for Northern Resource, which McIntyre said was the first step in opening this project to potential export development activity.

Diatreme will continue resource drilling at Northern Resource to upgrade resource categories and further understand the tenure.

With a PFS and BFS still to be completed for Northern Resource, McIntyre said it was about 18 months behind Galalar.

But that doesn’t mean it isn’t impressive.

“While they are separate and distinct projects, the advantage of the northern project (Northern Resource) is we believe it’s probably of a larger scale than the southern project (Galalar),” McIntyre said.

“If we’re looking at potentially about 1.3 million tonnes of exported product from the south, we’ve probably got two to three million tonnes from the northern project subject to, of course, further proof through resource drilling and higher categories in the resource.

“We think the north has much larger potential, so it would be an important addition moving forward as we aspirationally aim for three to five million tonnes of production within five years, subject to advancement through permitting and approvals processes.”

The Diggers & Dealers Mining Forum took place in Kalgoorlie in August. Australian Resources & Investment explores the key themes to emerge from the revered conference.

The 2022 Diggers & Dealers program was jam-packed with big names, with the likes of BHP, Fortescue Metals Group, Newcrest Mining, Agnico Eagle, and many more presenting at the three-day event.

Some presentations were more circumspect than others, with a few companies content to stay in their lane, but there were enough scoops for the attentive journalists who were looking for them.

Given Diggers & Dealers takes place in Kalgoorlie, in the heart of the WA Goldfields, the precious metal’s future was a key theme of the conference.

Battery metals was another prevailing subject across the three days, while many junior miners also had the opportunity to strut their stuff before an interested investor audience.

Australian Resources & Investment unpacks the key ideas to emerge from this year’s Diggers & Dealers.

Diggers & Dealers’ gold mining contingent was represented by Newcrest Mining, Agnico Eagle, Northern Star Resources, Genesis Minerals, Capricorn Metals, Bellevue Gold, Calidus Resources and more.

In fact, at least 19 gold mining companies presented at the conference, with organisations brandishing projects of varying maturation and sizes.

Newcrest used its presentation at Diggers & Dealers to voice its desire for new gold exploration opportunities.

“Exploration is a team sport, it’s not just something that one company can do on its own,” Newcrest general manager for exploration Fraser MacCorquodale said on the first day of the conference.

On the lookout for potential gold partners at Diggers & Dealers, MacCorquodale said Newcrest could bring more than 40 years of exploration experience and transactional flexibility to a joint venture (JV).

He said the company was agile, able to quickly complete a transaction, and had “experience in quickly transforming opportunities into long-term mines”.

MacCorquodale said the Havieron project in WA, which Newcrest shares in a 70:30 JV with Greatland Gold, was an example of the company’s exploration credentials.

Havieron has been an undoubted success story since the two companies inked a fourstage farm-in agreement to explore the project in March 2019.

This materialised into a fully-termed JV agreement in November 2020, and Newcrest and Greatland Gold have since achieved milestone after milestone.

Greatland Gold recently reported a $US1 billion increase in Havieron’s net-present value (NPV).

The project is valued at $US1.2 billion as at December 2021. When stage one of the Havieron pre-feasibility study (PFS) was released two months prior, Havieron was worth $US228 million.

Such is Havieron’s appeal, Andrew Forrest’s Wyloo Metals recently bought into Greatland Gold via a two-tranche, $120 million investment. The investment comprises an initial $60 million equity subscription, which is subject to shareholder approval, with a potential $60 million to follow.

Wyloo will become Greatland Gold’s largest shareholder following the investment, owning approximately 8.6 per cent of the gold company.

One of the most anticipated presentations of Diggers & Dealers 2022 was Genesis Minerals, with attendees waiting with bated breath for an update on its deal talks with St Barbara.

Genesis managing director Raleigh Finlayson obliged, to some extent, highlighting that the two companies, which both have significant footprints in the Leonora gold region of WA, married up nicely.

“Having done extensive DD (due diligence) on each other’s assets, we can see operational synergies that can pair the right rocks with the right mills, the right skills with the right minds and provide operational levers to de-risk assets to the benefit of shareholders,” he said.

Finlayson said the companies were exploring ways of “differing but ultimately eliminating material capex (capital expenditure)” in an inflationary cost environment not seen since the 1980s.

Finlayson’s message was that the company had the resources to progress discussions at its own pace.

“We have time and capital, we’ve got over $100 million in our bank accounts and if we take into consideration the money options, that’s $150 million of money on our balance sheet,” Finlayson said. “We have optionality as I’ve articulated, but ... we’ll remain patient and disciplined on our overarching five-year strategy which we’re only four months into.”

St Barbara was also represented at Diggers & Dealers, with the company’s chief financial officer Lucas Welsh making a presentation.

Welsh didn’t mention anything specifically about St Barbara’s ongoing discussions with Genesis, but he did highlight the company’s significant landholding and presence in the Leonora region, suggesting it would be central to any consolidation in this gold mining district.

Both Genesis and St Barbara have shown their proclivity for mergers and acquisitions (M&A) in recent times, having acquired Dacian Gold and Bardoc Gold, respectively, in 2022.

When this feature was written (September 20) there had been no update on deal talks between Genesis and St Barbara.

Another keen M&A player at Diggers & Dealers was Gold Road Resources, which recently acquired DGO Gold and its 14.4 per cent stake in De Grey Mining along with it. Gold Road managing director Duncan Gibbs said the company, which owns half of the Gruyere gold

mine in WA with South Africa’s Gold Fields, is open to further bolstering its portfolio.

“We’re happy to play in kind of any space, so we’re certainly able to look at projects in that advanced exploration, development (phase),” he said. “You know, first prize is probably an operating asset, but everybody else is looking for those and, you know, it’s generally hard to see value.”

Gold Road’s shareholding in De Grey just got a lot sweeter after the latter company added an extra 2.1 million ounces (Moz) of potential gold production to its fancied Mallina project in WA.

A Mallina pre-feasibility study released in September demonstrated the potential for 6.4Moz of gold to be produced across a 13.6year mine life. A 2021 Mallina scoping study indicated a 4.3Moz production profile across the life of mine.

Diggers & Dealers attendees received an update on Agnico Eagle’s recently acquired Fosterville gold operation in Victoria (through its purchase of Kirkland Lake Gold), with vice president of corporate affairs (Australia) John Landmark demonstrating the company’s exploration efforts at the mine.

Landmark said the Canadian-based gold miner was investing $US60 million ($89.2 million) in exploring Fosterville in 2022, with the hope of achieving 200,000m of diamond drilling.

“(In July), we completed the twin decline drives across to Robbins Hill,” Landmark said. “In putting this drive across – it’s a twin drive which is nearly 5km long – we did that 10km of driving in just over two-and-a-half years.

“We’re now in a position to put seven drill rigs underground to define Robbins Hill. So we’ll be doing that over the next couple of years.”

Located 4km north of the existing Fosterville mine, the Robbins Hill deposit has the potential to become the project’s second mining operation. Landmark said Robbins Hill had 3km of down-plunge mineralisation.

It’s not all gold in the Goldfields, with the WA region playing an important role in supplying the renewable energy transition.

BHP used its presentation at Diggers & Dealers to reinforce its commitment to its Nickel West operations in the northern Goldfields.

Nickel West president Jessica Farrell said the major miner planned to spend more on exploration at the operations in 2022 than it has in any other year.

“To underscore this point, this year will be the highest annual spend for exploration in Nickel West since BHP acquired the WMC (Resources) assets in 2005, a testament to the focus and commitment BHP has to its nickel business right now,” she said.

With 75,000 hectares of exploration potential within the Agnew–Wiluna greenstone belt, BHP plans to spend more than $140 million on brownfield exploration in the next two years to further understand the tenure.

“We have a large nickel sulphide resource with in excess of 7.4 million tonnes of nickel in the Agnew–Wiluna belt that still remains largely unexplored,” Farrell said.

“This is a highly prospective strip, approximately 150km long … and has a number of deposits that we are looking to understand further and potentially mine.”

BHP expects three out of five passenger car sales to be electric by 2030, before rising to nine out of 10 by 2040.

And with nickel proving to be an important component of the batteries that power electric vehicles (EV), BHP’s lowest plausible case foresees a doubling of nickel demand in the next 30 years.

Lynas Rare Earths Australia’s sole rare earths producer, Lynas Rare Earths, also presented at Diggers & Dealers, with managing director and chief executive officer Amanda Lacaze delivering an entertaining insight into the company.

The presentation coincided with Lynas announcing a $500 million project to expand capacity at its Mt Weld mine and concentration plant in the Goldfields.

Lynas’ expansion plans start with increasing Mt Weld’s feedstock capacity from 7000 tonnes per annum (tpa) to 12,000tpa of neodymiumpraseodymium (NdPr) equivalent in 2024.

The company’s 2025 growth plans, which were announced in May 2019, targeted 10,500tpa by 2025.

Lacaze said there was potential for a greater production boost, too.

“Two additional stages still in development will target an additional 4800tpa,” she said at Diggers & Dealers. “As we move further into the orebody and down the grade curve and into new mineralogies, we will begin increasing throughput from 0.3 million tonnes per annum to 1.3 million tonnes per annum, and that gives us sufficient headroom to continue to grow.”

Lacaze said the expansion would enable Lynas to improve Mt Weld’s sustainability profile, with a high recovery water recycling circuit planned for the operation.

Lynas will also transition Mt Weld’s power from diesel generation to a gas hybrid renewable solution. The $500 million project is fully scoped and funded from Lynas cash flow.

Lacaze said a rare earths deficit was looming, and that China had gained control of the market.

“Demand for magnetic materials is forecast to double by 2030,” she said. “But this demand is within a market which is structurally illequipped to meet the increased demand.

“Over the past 30 years, China has become dominant in many minerals processing and manufacturing sectors and there is nowhere where this is more evident than rare earths.

“In a nutshell, China has leveraged its resource and processing knowhow to develop a dominant position in the supply of essential materials for green future-facing industries.”

IGO’s nickel assets include the Nova, Forrestania and Cosmos operations in WA.Lynas managing director and chief executive officer Amanda Lacaze at Diggers & Dealers 2022.

Nova has been a star player for IGO in recent years and delivered another strong performance in the 2021–22 financial year (FY22), producing 26,675 tonnes of nickel (FY22 guidance: 25,000–27,000 tonnes).

IGO achieved cash costs of $1.95 per payable pound (lb) of nickel in FY22, which fell below targeted costs of $2.00–2.40/lb despite the inflationary pressures currently affecting the Australian mining industry.

IGO managing director and chief executive officer Peter Bradford said the company was

attempting to transfer its Nova expertise to its other recently acquired assets.

“We’re … looking at ways we can take some of those learnings at Nova and transfer those into the new assets at Cosmos and Forrestania, as well as looking for ways we can get operating synergies across the three mines,” he said at Diggers & Dealers.

Bradford said IGO was also carrying out a “systematic review” of Forrestania’s tenements. This includes exploring the potential of the operation’s Flying Fox and Spotted Quoll mines.

This could include additional nickel, lithium and gold resources.

IGO is targeting first production at Cosmos in mid-2023, which is later than what was advertised by previous owner Western Areas.

“We’ve adopted a different plan, a different strategy for how we (will) bring the operation through development,” he said.

“We’ve reset everything around when the shaft will be completed and that’s going to be completed about the middle of next year.

“So that buys us more time to invest more money in the processing infrastructure –expand that beyond the 750,000 tonnes per annum envisaged by Western Areas to lock in 1.1 million tonnes per annum.

“And it buys us more time to open up multiple areas underground so that when we do start production, we can … substantially fill the mill at that time.”

Whether it was gold, nickel, rare earths, lithium or copper, or anything else, many compelling insights came from Diggers & Dealers 2022.

But while battery metals will be increasingly sought-after amid a strengthening renewable energy transition, it’s clear gold isn’t going anywhere just yet.

Rich with nickel and lithium resources, the Goldfields region of Western Australia will become increasingly important in the green energy transition. And Duratec will support the region every step of the way.

The Australian resources sector has been an integral part of Duratec’s success since its inception in 2010, and the ASX-listed company has established a particularly strong presence in the Goldfields region of Western Australia.

The often-harsh environments of the mining industry mean infrastructure is subject to corrosion, and Duratec’s team of engineers specialises in the protection and remediation of steel and concrete.

Duratec supports a range of commodities in the Goldfields, including gold, nickel and lithium, with much of its remediation work stemming from existing mines rather than capital expenditure (capex) projects.

“More than 95 per cent of what we do is maintenance, where the operation takes things offline or there is a shutdown, and there is time pressure,” Duratec general manager Chris Oates told Australian Resources & Investment

Duratec project manager Carl Klem said its mining clients were often reactive to infrastructure concerns and, given miners have strict KPIs, downtime needs to be limited.

This means Duratec must respond quickly and efficiently.

“When a plant is offline, mining companies or contractors can lose significant money,” Klem said. “They don’t have redundancies to take tanks out of a circuit and still operate at an optimal rate.

“So our work is time-critical and often involves a lot of on-the-spot problem solving. Half the time we walk into situations where we’re not aware of the full scope of work.”

Klem said Duratec may be engaged to fix one issue, but there will often be other concerns that must be rectified as well.

“We might have been tasked to paint inside a tank, but once we arrive we find that the floor needs to be cut out and repaired, and other issues could be present.

And we have to do this quickly so the client can get the tank back online.

“There’s a regular set of challenges for us in the Goldfields. We go into these jobs prepared to see the worst, and most of the time we’ll see what we expect to see.”

Duratec was engaged by a third party to complete internal and external coating works on a tank at St Barbara’s Leonora gold operations in the Goldfields.

Having successfully restored the tank through blasting and painting its internal walls, Duratec was awarded a truck stop remediation project and various structural blast and paint works around site.

Duratec has also worked with BHP at its Nickel West operations in the Goldfields, where the contractor was tasked with restoring a deteriorated acid bund.

The company installed 1200 square metres of acid-proof coatings and 400 square metres of acid bricks, equating to 17,000 acid bricks and 30,000kg of products installed.

Duratec received positive feedback from BHP, along with high safety achievement recognition.

Oates sees a bright future for the Goldfields and for Duratec’s work in the region, with the demand for battery metals, such as nickel, set to exponentially grow.

This will result in more battery metals projects and a greater need for remediation works.

Oates said Duratec grew 30–40 per cent more in the 2021–22 financial year (FY22) compared to FY21 and expects the company to be active in the Goldfields “as long as gold’s being made and nickel’s being made”.

“The future for Kalgoorlie and all mining is pretty strong,” he said. “If you look at it from a macro level, where’s the world heading?

“We know EVs (electric vehicles), battery and energy storage are going to become more and more prominent, and if you look at that more closely, commodities such as cobalt, nickel and lithium are going to become more important – these are abundant in WA.

“Considering the Russia–Ukraine conflict, manufacturers are realising we need more homegrown materials. That plays right into the favour of Kalgoorlie and Duratec.”

Duratec generated $310 million of revenue in FY22 – a sizeable jump from the $235.7 million earned in FY21.

The company also enjoyed increases in its EBITDA (earnings

before interest, taxes, depreciation, and amortisation) and NPAT (net profit after tax) year-on-year and expects its revenue and NPAT to increase again in FY23 with more than $700 million worth of active tenders.

While Duratec’s investors are in favour of mining, they are also cautious of the sector given commodity prices can experience volatile highs and lows.

Oates said that as the company further bolsters its investor base, accurate messaging is more important than ever.

“Mining is generally a capex environment,” Oates said.

“But we’re not linked to capex, we’re linked to maintenance. And this is what we tell our investors.

“As Duratec consistently grows its presence in the mining industry, we’re not suffering the highs and lows associated with capex.”

Oates said even if a commodity increases or decreases in price, a mining company must always maintain its assets.

“When that tank drops, you’re going to give us a call and we’re going to fix it no matter what the price of gold is,” he said.

“So what do our investors look for? We’ve got exposure to mining and we’ve got exposure to defence, which has been consistent over 10 years and has a massive pipeline.

“We’ve also got exposure to building and facades, as well as all other existing infrastructure such as wharfs, ports and holding tanks, etcetera.”

Duratec also supports other industries such as oil and gas, transport, marine, industrial and property services, meaning the company can draw on many different economic avenues.

And given the Goldfields will become increasingly important in the green energy transition, Duratec has a bright future in the region and the broader Australian mining industry.

A range of factors are set to dampen Australia’s iron ore export earnings, including reduced prices.

Central purchasing and a slowing Chinese housing market could have major effects on Australian iron ore producers – and beyond.

China has been Australia’s top consumer of iron ore for decades, accounting for 80 per cent of our exports of the mineral in 2021.

Export revenue has delivered longstanding profits to Australian miners and boosted the country’s tax revenue. However, Australia’s iron ore profits are threatened with the recent development of the China Mineral Resources Group (CMRG), set to act as China’s central iron ore purchaser.

This central purchasing power is designed to control demand and enhance Chinese steel producers’ negotiating power over prices. As the expected principal Chinese channel for buying imported iron ore from international third parties, the CMRG also assumes responsibility for raw material supplies to China’s steel industry, which absorbs approximately 70 per cent of global production, largely from Australia.

The formation of the CMRG, in combination with the recent weakness in China’s residential property sector, is set to place downward pressure on prices and dampen Australia’s iron ore export earnings, projected to fall from $133 billion in 2021–22 to $116 billion in 2022–23, and by a further $85 billion by 2023–24.

The establishment of CMRG stems from the retaliation of China’s Iron and Steel Association (CISA) against a perceived iron ore producers’ cartel. The push for centralised buying is in response to a period of high iron ore prices, which hit a record $US240 per tonne (t) in May 2021, delivering significant profits to a set of concentrated iron ore majors, whose production costs at the time were less than $US15/t.

The threat to Australia’s iron ore demand is further exacerbated by China’s objective to reduce steel production in line with its goal of cutting carbon emissions.

This central purchasing program is part of China’s wider strategy to achieve 45 per cent iron ore ‘self-sufficiency’ by 2025, demonstrating a determination to wean itself off Australia’s iron ore. China’s senior government officials set a goal to boost domestic iron ore production by 30 per cent, increase investments in overseas mines, and strengthen scrap steel recycling.

But domestic production of Chinese iron ore isn’t the real problem for Australia. China’s ore grades are far lower than Australia’s and expanding its output will also increase carbon emissions, which will be counterproductive to emission targets.

While China’s steel industry will likely always need Australian iron ore, the country’s attempt to shake up the global iron ore market will have obvious ramifications for Australian exporters.

The world’s four biggest suppliers of seaborne iron ore – Rio Tinto, BHP, Fortescue Metals and Brazil’s Vale – account for approximately 70 per cent of global trade and 80 per cent of China’s imports.

But Australia’s big iron ore players, for their part, are not demonstrating any signs of public panic, arguing that supply and demand are more prominent drivers of commodity prices.

Is Australia being too complacent?

At worst, China’s newly formed central agency could decide to favour nonAustralian suppliers.

In fact, iron ore isn’t the only commodity at threat. China has already established informal central purchasing groups like large state-owned oil refiners who collectively buy crude oil or copper. As such, it seems very likely China will apply this type of structure to additional critical resources in the future, particularly if the CMRG proves successful.

The other critical factor threatening Australia’s iron ore profits is China’s sluggish gross domestic product (GDP), which grew just 0.4 per cent in the second quarter of 2022, largely as a result of extensive lockdowns as part of its COVIDzero response to the pandemic.

In September, the south-western Chinese metropolis of Chengdu announced a lockdown of its 21.2 million residents for citywide COVID testing. Other major cities are simultaneously tightening restrictions, ranging from work-from-home requirements to the closure of entertainment businesses in some districts.

While there has been a small rebound in activity as lockdowns ease over time, the economy will need to grow by 8.5 per cent in the second half of the calendar year to reach the nation’s 2022 GDP target of 5.5 per cent –a highly unlikely outcome.

According to the World Economic Forum, every percentage point decline in China’s GDP results in a 0.3 per cent reduction in global GDP.

In contrast to other major economies, China has been reducing interest rates to counter the economic impacts of its

COVID-zero policy, high debt challenges, weak income growth and, importantly, the property crisis.

While China enjoyed growth in the property sector since the early 2000s before reaching a peak in 2018, hundreds of thousands of home-buyers are now refusing to pay mortgages for pre-sold properties as developers struggle to complete housing projects on time. In fact, Chinese developers have only delivered 60 per cent of homes they presold between 2013 and 2020, and Chinese mortgage debt grew by $US4 trillion over the same period.

There are three key reasons buyers are striking on mortgage repayments. First, there are concerns property developers such as Evergrande will head into administration before projects are completed. Second, there is a possibility of financial destabilisation of the banking sector that is at risk of mass loan defaults. Lastly, the recent plummet in housing value suggests properties are likely to be worth less than what consumers originally purchased them for.

These factors strike parallels with the financial unrest in the lead up to the global

The CMRG is part of China’s strategy to achieve 45 per cent iron ore ‘selfsufficiency’ by 2025.

financial crisis and should therefore be a cause for concern.

The liquidity crisis stemming from the property sector, which accounts for approximately 30 per cent of China’s steel demand, is squeezing profits from Australia’s large miners, sending iron ore stocks into a bear market amid falling demand and rising costs.

More broadly, the impact of this property crisis is likely to impact Australia’s terms of trade.

Since 2005, Australia’s terms of trade (the ratio between the index of export to import prices) has been on the incline, largely catalysed by China’s accelerating demand for resources, while the cost of Australia’s manufactured imports has been simultaneously falling. As a result, every tonne of Australian exports was buying a greater value of imports.

However, with China’s GDP growth well off their target, a return to the longrun average for the terms of trade could affect $250 billion of Australia’s national annual income, with implications for government budgets and Australian living standards.

Adapting old mine sites to generate clean energy has long-term benefits for companies, communities and the environment.

Mine-closure planning traditionally focuses on reducing a site’s environmental liability, with the goal of restoring the landscape as close as possible to its pre-mining status.

But what is less considered is the potential for mine-closure planning to create long-term benefits by constructing renewable energy assets on old sites.

“Renewable energy is an exciting opportunity to explore in mine-closure planning,” SRK Consulting principal consultant – mine closure Danielle Kyan said. “It’s early days, but there are

more conversations underway about the potential for construction of renewable assets on old mine sites.”

Kyan emphasised, however, that renewable assets may not be feasible on all mine sites.

“The key is to be open-minded and ask questions about renewables early in the mine-closure planning process,” she said. “The projects are emerging.”

A key example is the former Kidston gold mine, about 275km north-west of Townsville in Queensland. Once home to Australia’s largest open-cut gold mine, the project closed in 2001 after 90 years of operation.

Genex, a power company, is now transforming the site into a cleanenergy hub by combining solar, wind and pumped-storage hydro power. This landmark conversion of a disused gold mine will generate enough electricity to power 143,000 homes for eight hours –and is expected to create at least 500 jobs during construction.

The Kidston Pumped Storage Project essentially turns the mine’s massive opencut pits into a giant battery by pumping water into an upper energy-storage reservoir when energy prices are low. It then releases the water through reversible turbines into

the lower reservoir to generate power when energy demand is high.

The facility will store energy from an operational 50 megawatt (MW) solar farm, as well as a planned 150MW wind farm due for completion in 2024.

At the Muswellbrook coal mine in the upper region of the Hunter Valley, New South Wales, planning is underway to transform Australia’s oldest open-cut coal mine into a major renewables precinct.

In addition to a pumped hydro project, there is potential to add solar, battery storage and green hydrogen facilities to the mix.

Kyan expects more mine closures in Australia this decade to involve the construction of renewable infrastructure.

“Some mines suit wind, solar, hydroelectric, geothermal or other renewable assets,” she said.

“The mines are typically on large, cleared areas of land, have been used for industrial purposes, and have existing infrastructure and a potential workforce.”

Many mining companies already use renewable technologies.

“We see a number of mines in remote areas installing renewable energy grids to power their sites,” Kyan said. “They’re using renewables in an operational capacity to reduce the project’s carbon footprint.

“The next step is exploring renewables in mine-closure planning strategy to create new opportunities.”

Kyan says building renewable energy assets on old mine sites potentially has longterm benefits for companies, communities and the environment.

“Mine closure has always been thought of as a cost,” Kyan said. “Renewables can provide an opportunity to develop new income from disused sites.

“That could change how we think about and fund mine-closure.”

There are also opportunities for mining companies to collaborate with energy companies on developing renewable

clean-energy projects. The Muswellbrook Pumped Hydro project, for example, is a joint venture between AGL and Idemitsu Australia Resources.