in energy storage

THE ROLE OF GAS IN THE ENERGY TRANSITION

Where are the opportunities in WASTE-TO-ENERGY?

Hydro: the backbone for RENEWABLES IN AUSTRALIA

INNOVATION

ISSUE 6 · June 2019 · www.energymagazine.com.au

COUNT ON THE TRACK TRENCHER AND TEAM THAT DELIVERS.

Vermeer’s range of Commander® Track Trenchers have been helping deliver major infrastructure projects throughout Australia and the Oceania Region for over 30 years. Our nation-wide dealer network is there to support you on-site and in the project office, backed by a global network over 6,000 people in 60 nations. Contact us to learn how we can support your project. /

VermeerAustralia

1300 VERMEER Vermeer and the Vermeer logo are trademarks of Vermeer Manufacturing Company in the United States and /or other countries. © 2019 Vermeer Equipment Holdings Pty Ltd. All Rights Reserved. Overseas model shown.

VERMEER.COM.AU |

JOB DONE.

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

energymagazine.com.au

Hydro is having a big moment in the energy industry, so it’s been a pleasure to speak to some of the biggest players from the sector for this issue of Energy

I’ve often been puzzled as to why hydro didn’t seem to have more buzz or excitement around it in recent years, as we started to realise that renewables need to be coupled with storage if they are to truly develop and dominate the energy mix in this country. The excitement seemed to be reserved for lithium battery storage developments – but as many before me have rightly pointed out, a major pumped hydro development can have the storage capacity of hundreds or thousands of lithium batteries combined.

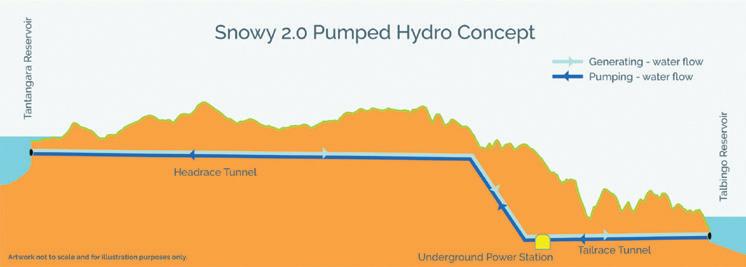

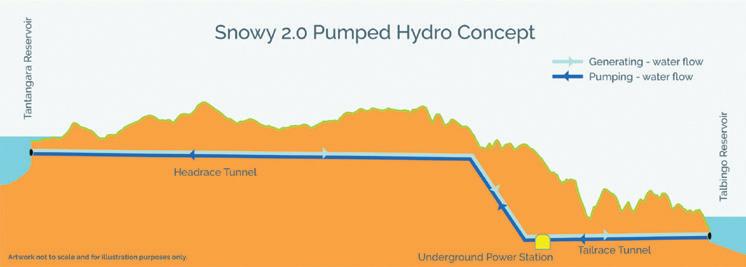

But in recent months, the tide seems to be shifting. There has been bipartisan political support for major hydro projects, such as Snowy 2.0 and Tasmania’s Battery of the Nation. Other commercial developments, such as Genex Power’s Kidston Pumped Hydro project, have achieved financial close with industry backing, showing that the market believes in the future role pumped hydro will be playing in our energy mix.

Pleasingly, we were able to speak to all three of the proponents of these projects for this issue of Energy, and I hope you enjoy the insights they provide into the work that has gone into getting their developments to the point they’re at now; and the next steps ahead for these projects.

Another hot topic in the industry at the moment is power purchase agreements (PPAs). It seems that at least weekly we’re hearing news of another major PPA being signed, with some of the most significant ones having the power to underwrite major projects and propel the renewable industry forward.

In this issue, we’ve taken a closer look at some of the more recently signed PPAs around the country, and we also ask the question – what can traditional developers and retailers do to become more involved in this emerging sector of the market?

We’ve also taken a closer look at the latest news from the networks side of the industry, recent developments in the world of oil and gas, and the latest thinking around the opportunities the waste-to-energy sector represents. As always, I hope you enjoy reading our latest issue.

1

Laura Harvey Editor June 2019 ISSUE 6 ISSUE 6—JUNE 2019 WELCOME

WELCOME Editor Laura Harvey Journalist India Murphy Senior Designer Alejandro Molano Designer Jacqueline Buckmaster Danielle Harris Business Development Manager Rima Munafo Publisher Chris Bland Operations Manager Kirsty Hutton Digital Marketing Manager Sam Penny Cover highlights our feature on the current wave of interest in hydro power. Where are the opportunities in WASTE-TO-ENERGY? INNOVATION in energy storage THE ROLE OF GAS IN THE ENERGY TRANSITION Hydro: the backbone for RENEWABLES IN AUSTRALIA ISSUE June 2019 www.energymagazine.com.au Monkey Media Enterprises ABN: 36 426 734

St

EDITOR’S

954 204/23–25 Gipps

Collingwood VIC 3066 P: (03) 9988 4950

Published by We’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950. 5,096 This publication has been independently audited under the AMAA’s CAB Total Distribution Audit. Audit Period: 1 April 2018 – 30 September 2018

info@energymagazine.com.au ISSN: 2209-0541

2 June 2019 ISSUE 6 www.energymagazine.com.au OIL & GAS 25 The critical role of gas in the energy transition 26 Perception the key to oil and gas success ENERGY NETWORKS 10 The grid of the future: we need more interconnection 14 Surviving a crisis: getting through when the worst case scenario hits 18 Distributed energy in Western Australia: what are the customer implications? 22 The solar surge – networks are here to help 25 14 INDUSTRIAL ENERGY 28 Power purchase agreements: revolutionising energy retail 28 NEWS 6 Share economy to assist transition to clean energy 6 ElectraNet to upgrade Eyre Peninsula transmission network 7 Victorian wind farms benefit local communities 7 $10 million for WA microscale LNG plant 7 Energy efficiency increasing in Australian homes 8 EUAA: it’s not too late to fix gas 8 Safety first for QLD’s renewable industry 9 AGL to build pumped hydro energy storage in SA EACH ISSUE 1 EDITOR'S WELCOME 4 CONTRIBUTORS 76 FEATURES SCHEDULE 76 ADVERTISERS’ INDEX CONTENTS

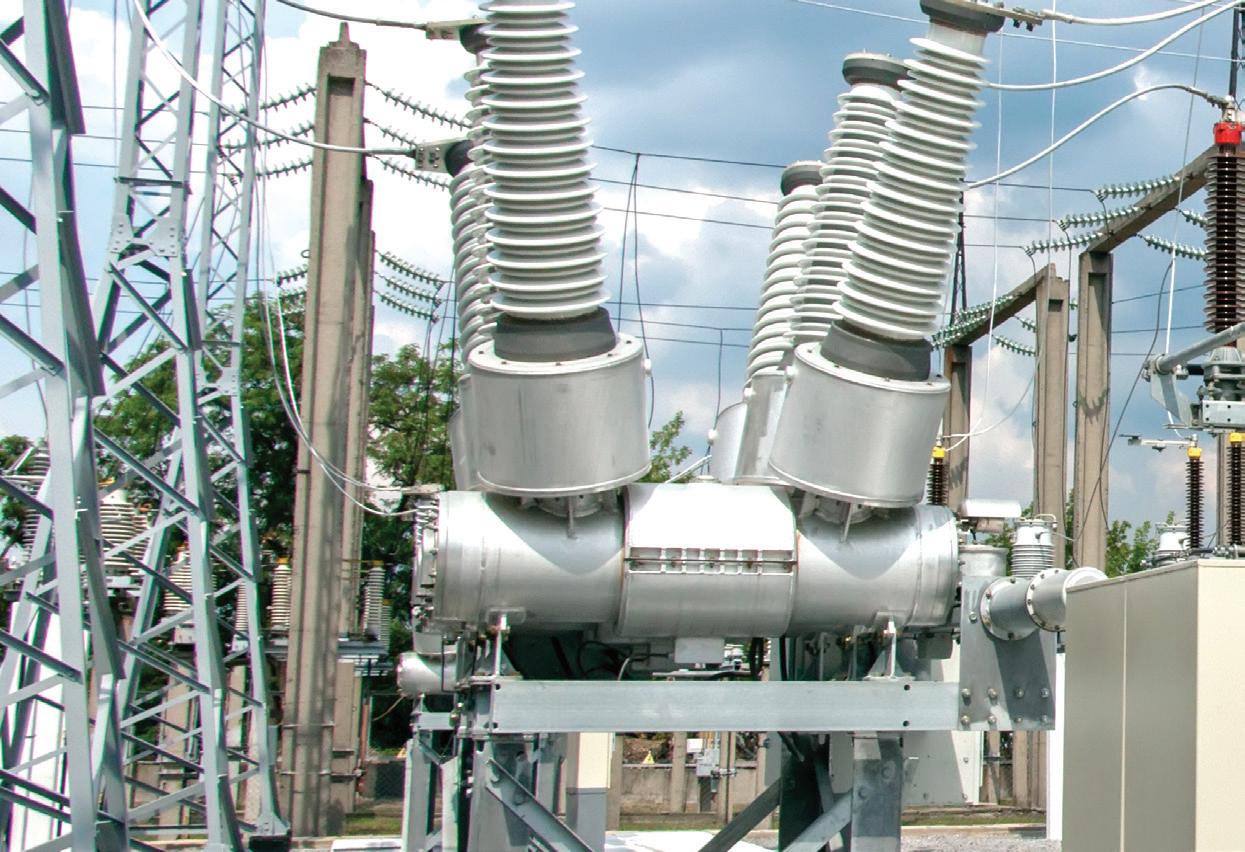

CONTENTS 3 www.energymagazine.com.au June 2019 ISSUE 6 TRANSFORMERS AND SUBSTATIONS 54 Enhancing electrical supply in the ACT 56 Redefining the benchmark for optimised substation asset testing VEGETATION MANAGEMENT 58 Working to improve vegetation clearance outcomes near powerlines 61 Managing the environment around our networks WOMEN IN ENERGY 62 The changing face of construction: Angela Klepac 54 SECURITY 72 Why wait for a cyber catastrophe to prepare for a cyber attack? 72 SOLAR 68 Aerial imagery: the best kept secret in solar AUTOMATION 70 Automation – the key to unlocking the future of the energy industry 70 HYDRO 40 Underpinning Australia’s renewable energy future – powering ahead with Snowy 2.0 44 Hydro power: the backbone for renewables in Australia 40 WASTE-TO-ENERGY 48 Where are the opportunities in waste-to-energy? 50 Making a move in the new energy frontier 52 ResourceCo steps up its delivery of alternative energy solutions 48 STORAGE 32 The lynchpin that makes future energy markets reliable 36 Looking beyond lithium batteries: innovation in energy storage FUTURE ENERGY 38 Balancing a changing energy mix 32

Phaedra Deckart

General Manager, Energy Supply and Origination, AGL

Phaedra Deckart is a senior executive with over 20 years of experience in the global energy sector. She began her career in law before segueing seamlessly to the oil and gas industry upon joining Santos Limited, where she held a variety of commercial, corporate, gas and LNG marketing positions. Phaedra’s career at AGL has traversed leading AGL’s wholesale gas supply portfolio as Head of Wholesale Gas and now as General Manager, Energy Supply and Origination. Phaedra leads the transformation of AGL’s energy supply portfolio through this dynamic time in the energy market.

Chief Executive Officer, ElectraNet

Steve is a resources industry executive with more than 20 years’ experience, including a solid background in Australian energy markets, primarily associated with large oil and gas joint ventures, corporate strategy, and business and corporate development opportunities. Appointed as Chief Executive of ElectraNet in December 2014, Steve previously held a number of senior and executive roles with key Australian energy companies, leading commercial, marketing and corporate development functions. Steve’s formal qualifications include a Bachelor of Science (with Honours) and a Graduate Diploma in Applied Finance And Investment. He has attended University of Chicago Business School’s Executive Program in Corporate Strategy, and Oxford University’s Advanced Management and Leadership Program.

Chief Executive Officer, Snowy Hydro

Paul Broad was appointed Managing Director and Chief Executive Officer of Snowy Hydro Limited in July 2013. Before being appointed as a Director, Paul was Chief Executive Officer of Infrastructure NSW, AAPT, PowerTel, Energy Australia Sydney Water and Hunter Water.

Chief Executive Officer, Hydro Tasmania

Steve Davy was appointed Chief Executive Officer in September 2013 and has been with Hydro Tasmania since 2005. Steve is Chairman of Hydro Tasmania’s mainland retail business, Momentum Energy, selling electricity on mainland Australia and on the Bass Strait islands. He has previously served as Chair of the Australian Financial Markets Association Environmental Products Committee, and is a Director of the Australian Energy Council.

4 CONTRIBUTORS

Steve Masters

Steve Davy

June 2019 ISSUE 6 www.energymagazine.com.au

Paul Broad

General Manager Gas Markets, Jemena Gabrielle Sycamore

Gabrielle is the General Manager leading Jemena’s gas business, and she is responsible for making sure Jemena understands the different and changing needs of all its gas customers. Gabrielle is passionate about putting Jemena’s customers first, and enjoys working with customers to change the way Jemena does things to better meet their needs.

As Zinfra’s National Manager – Power, Angela has particular expertise in leading and managing diverse and specialised teams in the area of engineering and procurement; undertaking strategic operational reviews and providing direction for process improvement; identifying and developing cost saving opportunities; establishing high performance teams who deliver superior results in challenging environments; stakeholder relationship management; change management and identifying associated risks and creating effective controls; and strategic experience in influencing and developing new technology in supplier markets.

Utilities Lead, Australia and New Zealand, Accenture

Simon Vardy is the managing director of Accenture’s Utilities Strategy practice across Australia and New Zealand. In addition, he serves as the Accenture Sustainability lead. During his career, Simon has gained extensive experience in strategic business transformation, growth strategy, performance improvement, strategic cost reduction, investment analysis and regulatory issues analysis. Simon works with some of Australia's leading energy and utility companies (electricity, gas and water), government departments and industry associations and has a specialisation in energy and water market reform, and strategic business model development. Prior to working in consulting, Simon held line management positions in mining, manufacturing and IT services. Simon holds an MBA from the Melbourne Business School, a Bachelor of Information Systems from Monash University and has published a number of public reports, research papers and thought leadership.

Policy Adviser WA, Australian Energy Council

As the Australian Energy Council’s Western Australian policy expert, Scott has a strong background in the state’s energy and mining industries. He has significant experience in product development, marketing and price reform roles in the electricity sector. He had a pivotal role in developing, advocating and delivering demand based tariffs for Horizon Power customers. Scott has a particular depth of expertise in energy systems modelling, electricity pricing, energy storage and integration of renewable energy into isolated power systems.

5 CONTRIBUTORS

Simon Vardy

Scott Davis

National Manager – Power, Zinfra

www.energymagazine.com.au June 2019 ISSUE 6

Angela Klepac

SHARE ECONOMY TO ASSIST TRANSITION TO CLEAN ENERGY

Arecent study from RMIT University and Monash University researchers has found energy sharing platforms may effectively assist the transition to new energy technologies, cleaner energy, and better consumer outcomes.

The findings state that Australian households are adopting new energy technologies, and are excited by the idea of platforms similar to Airbnb and Uber, which would enable them to trade and share their excess power. This would enable Australians to reduce their electricity bills, reduce their environmental impact, and help stabilise the grid, without the complicated processes which can discourage pursuing opportunities to participate in the energy market.

“People were widely enthusiastic about generating and storing their own energy, but complexity and distrust in the energy sector limited their potential as participants in an efficient electricity grid,” lead author, Dr Larissa Nicholls from the RMIT Centre for Urban Research, said.

“In the age of the sharing economy, consumers’ relationships with the electricity system are changing,” she said.

“The concept of sharing or donating energy is appealing as a response to this widespread concern for vulnerable people, who may struggle with the cost of energy or be unable to access renewable power.”

The research also found that households are already considering feeding their electricity into the grid for collective use as a form of sharing energy with other households – but they want to be confident their clean electricity benefits people who need it, rather than boosting energy company profits.

Report co-author, Associate Professor Yolande Strengers from Monash University, says householders’ relationships with the electricity grid and market are changing.

“The energy sector expects households to become active participants in the energy system – shifting and shaving their energy use and navigating a complex energy market or agreeing to more automation of their home appliances,” she said.

The research team warns that energy sharing will need to be carefully introduced.

“As has been reported in cities with high uptake of Airbnb and other sharing platforms, there is potential for some people to miss out or be disadvantaged in the sharing economy,” Dr Nicholls said.

“Programs and platforms need to ensure that consumers are the primary beneficiaries, and rules and regulations need to address equity concerns.”

The RMIT and Monash University researchers will be releasing an engagement strategy for the sector later in 2019.

ELECTRANET TO UPGRADE EYRE PENINSULA TRANSMISSION NETWORK

The Australian Energy Regulator (AER) has approved a proposal from ElectraNet to build a new transmission line on the Eyre Peninsula.

The project involves constructing a new double-circuit 132kV transmission line from Cultana to Port Lincoln, via Yadnarie, with the ability to upgrade the Cultana to Yadnarie section to 275kV at a later date.

ElectraNet Chief Executive, Steve Masters, said news of the project’s approval was great for the region with the new transmission line to provide Eyre Peninsula with a more reliable and secure electricity supply into the future.

“In close consultation with key stakeholders across the Eyre Peninsula, ElectraNet has been working diligently to

secure regulatory approval to construct a new transmission line which delivers benefits to homeowners, businesses and the region,” Mr Masters said.

“This new line will meet the immediate supply needs of the Eyre Peninsula and will future proof the network to cater for increased capacity if and when new mining developments and renewable energy projects proceed.

“Once operational it will remove current network constraints, allowing the market to benefit from more low cost energy from existing wind farms on the Eyre Peninsula. It will also provide greater opportunities for new demand and renewable energy developments on the Eyre Peninsula.

“Throughout the project’s development we have been mindful of the need to keep costs as low as possible for customers.

“The cost of the new transmission line is fully offset by avoiding the cost of replacement works on the existing transmission line and annual generator network support payments, resulting in almost no price impact for a typical residential customer.

“The regulator’s approval of the new power line is great news for all involved and I thank everyone for their input during the project’s development and regulatory approval process.”

Following approval by the regulator, the project is still subject to receiving other relevant approvals. The new transmission line is estimated to cost approximately $240 million and works are planned to begin during 2020.

NEWS 6 June 2019 ISSUE 6 www.energymagazine.com.au

VICTORIAN WIND FARMS BENEFIT LOCAL COMMUNITIES

Benefit sharing programs by two new Victorian wind farms show that community expectations when it comes to new developments are being met, according to the Australian Wind Alliance.

The 300MW Delburn Wind Farm and the 700MW Hexham Wind Farm will create structured cash payments, community funds and investments opportunities as part of a benefit sharing program.

The Delburn Wind Farm plans to distribute over $3 million per annum into the local area, and the Hexham Wind Farm plans to pay neighbours $1000 per year (indexed with CPI) for each turbine constructed within three kilometres of their dwelling and $100 for each additional turbine constructed between three and six kilometres of the dwelling.

“Sharing financial benefits equitably is crucial for community acceptance,” Australian Wind Alliance National Coordinator, Andrew Bray said.

“The new wind farms appearing throughout Victoria actively fight climate change and move us away from polluting sources of power but they need to deliver for host communities as well.”

$10 MILLION

FOR WA MICROSCALE LNG PLANT

The WA Government has teamed up with The University of Western Australia (UWA) and the LNG industry to develop the world-first microscale LNG plant.

The State Government will provide $10 million over ten years and grant suitable land in the Kwinana industrial precinct to support the development of the LNG Futures Facility in Kwinana.

The facility is expected to create up to 1,400 jobs for Western Australians, and will position the state as a global leader in developing and testing new LNG technology.

The industry-led initiative has been backed by UWA, Chevron, Shell, Hyundai Heavy Industries and National Energy Resources Australia. It is a priority of the LNG Jobs Taskforce. LNG companies, contractors, service providers and small to medium businesses would be able to test and refine new processes in a live plant environment. It is expected the plant would have the capacity to produce ten tonnes of LNG per day.

"This is a major investment to further position Western Australia as a global LNG hub,” Western Australia’s Premier, Mark McGowan, said.

"Western Australia has the local talent and expertise to help shape the LNG jobs and operations of the future, and this facility will only strengthen the state's unique advantages.”

ENERGY EFFICIENCY INCREASING IN AUSTRALIAN HOMES

The CSIRO has found that Australian residential homes are becoming larger in size and more energy efficient, thanks to new data from its Australian Housing Data (AHD) portal.

Around 11.4 per cent of Australia’s emissions can be attributed to households, and with construction continuing at a steady pace, the AHD Portal can pinpoint where energy efficiency efforts are on track, and where they may need increased focus.

Key findings drawn from the data (based on apartments and houses) includes:

» 195,000 new homes were built in Australia in the past year

» There is steady progress in building of high-performance homes, especially in Tasmania and the ACT

» Overall, Australian homes are increasing in size, with an average floor area of 132m2 (this includes houses and apartments)

» Average dwellings were most likely to have a metal roof, brick veneer walls, and a concrete floor

» The average newly-constructed home had an energy rating of 6.2 stars. This is an improvement since the introduction of star ratings in 2001, when the average home was estimated at 1.8. This translates to an annual saving of approximately

» $560 in energy bills and 2.3 tonnes of CO2 equivalent (tCO2-e) in greenhouse emissions per house.

CSIRO Grids and Energy Efficiency Research Director, Dr Stephen White, said the data shows steady progress in residential sustainability efforts.

“In order to meet national challenges of sustainable energy and resilient cities, it’s vital that we track progress. As an independent research agency driving innovation in energy, particularly residential energy rating, CSIRO is well placed to do this,” Dr White said.

“Tracking these changes is an important step to ensure emissions goals are met, while seeing where more attention is needed across the industry.”

The portal contains data across states and climate zones and can be further broken down by design (e.g. dwelling class and floor area), construction (e.g. type of walls and roofing) and fixtures and appliances (e.g. solar PV and heating/cooling systems).

The construction of homes varies somewhat from state to state, reflecting the flexibility of the NatHERS software to meet both the variations in climate and product availability in each jurisdiction.

CSIRO will update dashboards within the AHD Portal monthly, ensuring it is a relevant and accessible tool for the benefit of residential energy efficiency stakeholders, nationally.

7 www.energymagazine.com.au June 2019 ISSUE 6 NEWS

EUAA: IT’S NOT TOO LATE TO FIX GAS

lingering issues with pipeline pricing are all issues that need to be addressed.

“We need to recognise that mistakes have been made in the past and that we have failed to strike the right balance between maximising LNG exports and maintaining a reasonable price for Australian gas users.”

Many industrial gas users are reporting that if costs do not come down to more sustainable levels we are highly likely to see significant demand destruction, job losses and higher prices of many day to day items used by every Australian.

“The EUAA acknowledges the Federal Government has taken some actions to address this situation but unfortunately it has not been enough and clearly more needs to be done.”

The EUAA discussion paper seeks to kick start the gas market reform conversation that seems to have fallen off the political radar over the past twelve months. It puts forward options ranging from a COAG Energy Council-led market reform process through to direct government assistance and market intervention.

The Energy Users’ Association of Australia (EUAA), which represents many of Australia’s largest gas users, has released a National Gas Strategy Discussion Paper, posing a range of potential solutions to the gas crisis gripping Australia’s east coast.

“Solving the gas crisis must become a priority before we run out of time and options,” said EUAA Chief Executive Officer Andrew Richards. “It’s not too late to fix this, if we act quickly and decisively.”

Since Australia has commenced exporting gas via the east coast LNG terminals, the cost of gas for Australian users has gone up by as much as 300 per cent. While the market has softened in the last twelve months, gas costs are still 200 per cent higher today than they were four years ago.

Supply constraints including state-based moratoria, a lack of genuine competition, low liquidity levels, poor transparency and

Many of the policy and regulatory options put forward in the discussion paper borrow heavily from initiatives either already in place or being seriously contemplated in electricity markets, such as asset underwriting and funding assistance. Many of the issues facing gas markets are similar to those in electricity markets so using these existing initiatives makes perfect sense.

“While people may baulk at some of the options put forward in this discussion paper, the EUAA suggest that some different thinking is required. Given the gravity of the situation, we need a step change in policy, not more incremental changes.

“Big solutions are required to solve big problems, including the potential of governments stepping in for a period of time to ensure the viability of many of our gas intensive industries such as food processing and building products manufacturing.

“We are confident that the gas crisis can be resolved if governments, industry and gas users act quickly and decisively. We think our discussion paper is a good starting point.”

SAFETY FIRST FOR QLD’S RENEWABLE INDUSTRY

Anew code of practice and electrical safety regulations will be implemented in May 2019 to enhance safety in Queensland’s commercial solar farm industry.

The new regulations mean only licensed electricians can mount, locate, fix or remove solar panels on solar farms with a total rated capacity of at least 100kW.

Industrial Relations Minister, Grace Grace, said the Construction and operation of solar farms Code of Practice 2019 and the Electrical Safety (Solar Farms) Amendment Regulation 2019 would become law on 13 May and cover all Queensland solar farms.

“These new regulations are all about ensuring we keep pace with new and

emerging technologies and keep workers safe,” Ms Grace said.

Minister for Natural Resources, Mines and Energy, Dr Anthony Lynham, said Queensland remained firmly on track to achieve its target of 50 per cent renewable energy by 2030.

“Based on strong growth of renewable energy in the state it is estimated Queensland will reach 20 per cent by 2020.

“The new code and regulations can only enhance the industry – ensuring the safety of workers and the highest safety standards.’’

Electrical Safety Commissioner, Greg Skyring, said health and safety was the key priority for the electrical industry.

“The new code of practice and regulations will provide guidance and clarity for solar farm developers, owner and contractors when it comes to their electrical safety duties,” Mr Skyring said.

NEWS 8 June 2019 ISSUE 6 www.energymagazine.com.au

AGL TO BUILD PUMPED HYDRO ENERGY STORAGE IN SA

AGL has successfully secured the right to develop, own and operate a 250MW pumped hydro energy storage project at Hillgrove Resources Limited’s Kanmantoo copper mine in South Australia’s Adelaide Hills region.

AGL’s Executive General Manager of Wholesale Markets, Richard Wrightson, said, “This is an exciting project, which is consistent with our plans to continue to invest in our core energy markets business as customer needs and technologies evolve.

“If we proceed and the project is approved, it would be an important addition to our technology mix in South Australia, where we have significant wind and thermal generation.

“It would help us to meet the changing needs of the South Australian energy market, in which energy storage assets are likely to be needed to provide dispatchable capacity as renewables generation increases over coming years.”

Mr Wrightson said the signing of binding agreements was the start of a multiple stage process to progress the project, including the lodgement of a development application in 2020.

AGL would buy the land required for the project from Hillgrove shortly after a final investment decision, which is expected to be made after the completion of processing at Kanmantoo.

“If all approvals are received, we expect the project to be complete and operating by 2024,” Mr Wrightson said.

From savings in capital expenditure costs during the initial design and build stage to reducing operations and maintenance (O&M) expenditures, the AVEVA portfolio for the power industry adds value at every stage of the plant lifecycle, helping to extend the total lifetime value of power assets

9 www.energymagazine.com.au June 2019 ISSUE 6 NEWS

linkedin.com/company/aveva @avevagroup aveva.com in

THE GRID OF THE FUTURE: INTERCONNECTION WE NEED MORE

by Steve Masters, ElectraNet Chief Executive

by Steve Masters, ElectraNet Chief Executive

It’s been touted as providing the missing link for Australia’s electricity network as we transition to a decentralised, renewables-focused grid, and here, ElectraNet Chief Executive Steve Masters explains why an interconnector between South Australia and New South Wales is the project we can’t afford not to build.

10 ENERGY NETWORKS June 2019 www.energymagazine.com.au

On current lists of the world’s most rapidly changing industries, renewable energy sits alongside, if not above, cybersecurity, biotechnology, virtual reality and artificial intelligence. While the global automotive industry might like to claim that there will be more technological advancements in its sector in the next five years than in the past 50, it doesn’t even rate a place in a countdown of the fastest growing industries.

The global energy transformation is currently gripping the world’s power systems, as we move toward low emission and decentralised supply sources – and nowhere is this being felt more strongly than in South Australia. In Australia and in particular, South Australia, our energy market supply chain – encompassing generation, transmission, distribution, retailers and consumers – is undergoing transformational change as the sector transitions to lower carbon emissions and emerging technologies.

More decentralisation requires more interconnection

The importance of the electricity industry to the Australian economy cannot be overstated.

Safety, reliability, affordability and the impact of emissions reduction policies are front and centre in our minds at ElectraNet, reflecting the priorities of the wider community. Affordability issues are widely reported and impact all of us, and it is a little known fact that transmission costs in South Australia represent only around six per cent of a typical residential bill. And when the lights go out, for whatever reason, the expectations of our community are amplified and the finger pointing begins.

What is clear from the transitioning Australian energy market is that we can’t afford to be “just in time” with transmission. As the Australian Energy Market Operator (AEMO) recognised a few years ago, a more decentralised grid must be a more interconnected grid. Critical transmission infrastructure needs to be in place and ready earlier; and we need to be there before new replacement generation is turned on, not playing catch-up after. The same goes for new generation. This required shift in thinking and planning is obvious on face value, but at times difficult to implement against recent examples of some large-scale generation retirements, and a regulatory framework made for a different paradigm.

Australian Energy Market Operator’s (AEMO) 2018 Integrated System Plan (ISP) acknowledges the fundamental transformation of eastern Australia’s power generation and electricity grids, representing the National Energy Market (NEM). Large amounts of coal generation are expected to close over the next 20 years to be replaced with wind, hydro and small- and large-scale solar generation. The ISP identifies significant investment in transmission, energy storage, flexible thermal capacity and distributed energy resources, will be required to support this transformation, and in particular to fully harness the diversity and intermittency of the future generation mix.

What role can SA play?

Approaching the past three years, ElectraNet has been investigating options to deliver greater energy connection between South Australia and the eastern states. This work, backed by extensive modelling, independent analysis and significant stakeholder engagement, has been described as the most

11 ENERGY NETWORKS www.energymagazine.com.au June 2019 ISSUE 6

comprehensive regulatory investment test for a transmission (RIT-T) project ever undertaken in the NEM and to go before the Australian Energy Regulator. Our cost benefit analysis is consistent with AEMO’s conclusion that a new interconnector between South Australia and New South Wales is an important element of a NEM’s roadmap, and one of its immediate priorities that would deliver positive net market benefits as soon as it can be built.

Project EnergyConnect – the preferred option identified in the Project Assessment Conclusions Report (PACR) published in February 2019, is a 900km interconnector between Robertstown, in South Australia, and Wagga Wagga, in New South Wales, via Buronga, jointly delivered by ElectraNet and TransGrid. An additional 24km connection from Buronga to Red Cliffs would also enable access to renewable generation in north-western Victoria.

The key findings in the PACR and accompanying reports and modelling, demonstrate a new, double-circuit 330kV interconnector between South Australia and New South Wales is expected to:

» Deliver net benefits of approximately $1 billion over 21 years, including wholesale market fuel cost savings in excess of $100 million/year as soon as it is commissioned (primarily from avoided expensive gas-fired generation in South Australia)

» Reduce annual residential bills by about $66 in South Australia and $30 in New South Wales, and annual small business customer bills by $132 in South Australia and $71 in New South Wales

» Provide diverse, low-cost renewable generation sources to help service New South Wales demand going forward, particularly as existing coal-fired generators retire

» Avoid substantial capital costs associated with enabling greater integration of renewables in the NEM

» Generate sufficient benefits to recover the project capital costs within 14 years

» Generate over 200 regional jobs in South Australia and over 800 regional jobs in New South Wales during construction, and create around 250 and 700 ongoing jobs in South Australia and New South Wales respectively

» Improve the ability of parties to obtain hedging contracts in South Australia and help relieve the tight liquidity in hedging markets currently

ElectraNet has engaged widely with key stakeholders during this RIT-T process, and it is vitally important this project is thoroughly examined by the Australian Energy Regulator in order for the community to have confidence in this investment.

As the electricity sector transitions, coal generators are expected to continue to retire from the market over the medium to longer term. The retirement of coal generation is expected to be most rapid in NSW, and all eyes are currently focusing on the upcoming coal-fired Liddell power station retirement in 2022. Project EnergyConnect is scheduled to be in place around the time of this closure, providing timely additional transfer capacity to allow for the sharing of reserves between states.

Going forward, the progressive retirement of around half of the New South Wales coal fleet by 2035 (or sooner) means that alternative low emission supply sources will be required to fill this gap whilst meeting Australia’s policy commitments.

Our assessment shows that a new interconnector between South Australia and New South Wales allows greater exports

from existing and new high-quality renewable generation sources in South Australia and western New South Wales, that enables supply requirements in New South Wales to be met at a lower cost than if New South Wales was required to draw on other generation sources, including new gas generation, to fill the gap.

Any earlier retirement of coal generation in New South Wales would accelerate delivery of these benefits.

The preferred option provides a benefit through being able to avoid the transmission investment that would otherwise be required to unlock additional renewable generation resources in the Murray River and Riverland renewable energy zones (REZs), which have been identified by AEMO in the ISP as being priority areas to assist NEM transition. Since late 2018 for example, over 600MW of solar generation has reached committed status west of Wagga Wagga.

Where to from here?

A different generation map is emerging across Australia. It is obvious that a large amount of new generation will be built in areas that have not previously hosted such assets.

As we move to a lower carbon economy with renewable generation taking a greater share of the market, the reality is that current transmission highways do not align with where the best generation sources are to supply Australia’s future needs.

Interconnectors that coincide with REZs support ease of connection to the grid; it is cheaper for these generation proponents to be more proximal to transmission highways. Not surprisingly, Project EnergyConnect is attracting interest from potential new proponents.

The European Commission recognises the widespread benefits from well-interconnected energy networks: increased security of supply, affordable prices via market integration and decarbonisation through increasing levels of renewable generation. The Commission views interconnection as an essential precondition for realising an integrated, competitive and sustainable European electricity market, and has a target of achieving an interconnection capacity of at least ten per cent installed electricity production capacity across its members by 2020 – with a view to eventually achieving a single, European energy market.

The South Australian and New South Wales Governments are both strong supporters of Project EnergyConnect, with a Memorandum of Understanding signed by both parties in December 2018 and financial underwriting of early works by the South Australian Government to accelerate some activities in advance of awaiting regulatory outcomes.

Total renewable energy resources in South Australia exceed its combined minimum demand and current export capability, putting it at the forefront of renewable penetration levels in power systems across the world.

South Australia also has among the most abundant and highquality renewable energy resources in Australia and has seen an unprecedented, and highly publicised, uptake of renewable generation over the last decade.

Harnessing this competitive advantage in a transformational market setting for the long-term benefit of customers and communities across eastern Australia is a national imperative.

12 ENERGY NETWORKS June 2019 ISSUE 6

1 Based on independent modelling by ACIL Allen. 2 Based on independent modelling of broader economic benefits by ACIL Allen.

SURVIVING A CRISIS:

14 ENERGY NETWORKS

GETTING THROUGH WHEN THE WORST CASE SCENARIO HITS

All energy utilities have a plan in place for when any range of natural disasters hit, but what do you do when you’re facing a one-in-500 year event of unprecedented magnitude? This was the challenge facing Energy Queensland after the devastating Townsville floods in February, and they share their insights into surviving and thriving after this event here.

15 ENERGY NETWORKS

The community of Townsville is still picking up the pieces after one of its worst natural disasters in living memory.

In February, North Queensland’s largest city was suffering from the effects of drought when an unprecedented monsoon event dumped a year’s worth of rain in just over a week.

While floods are part and parcel of a normal wet season in North Queensland, the relentless deluge took the community by surprise and tested the mettle of Energy Queensland’s Ergon Energy and Energex emergency response teams.

The Ross River snakes through the city and many denselypopulated suburbs were in the firing line when it broke its banks, peaking at 42.99 metres, while the dam reached 244.8 per cent and the flow of water was 2000m3/second.

More than 3300 homes and businesses were inundated during the record flood, along with critical infrastructure, including the power network operated by Ergon Energy.

At the peak of the 1 in 500-year event, more than 17,000 customers were without power, many of them de-energised for public safety reasons.

Safety comes first

Energy Queensland’s Executive General Manager for Distribution, Paul Jordon, said community safety was at the heart of the response.

“Once we knew the city was facing the worst case scenario, we did everything in our power to protect the community, reduce the risk of damage to the electricity network that supports them and keep customers informed of impending outages.

“This involved invoking/enacting our flood plans, including preemptive de-energisation, dismantling and removing vital equipment such as switchgear and SCADA systems from substations in the firing line, and sandbagging equipment that couldn’t be readily shifted to higher ground.

“In a rapidly-evolving disaster, keeping an eye on the weather, working closely with emergency services and communicating with customers was critical.

“Through direct contact, traditional media and social media, we urged people in the flood zone to be prepared for protracted power interruptions and enact their household emergency plans, especially our life support customers.

“The frequent delivery of electrical safety messages to the community was also vital,” Mr Jordon said.

A unique event needs a unique approach

While the Ergon team is well-versed in disaster response, this highly unpredictable and protracted flood event required a different approach.

“When a storm or cyclone hits a region, our crews have a clear understanding of what type of damage to expect, and once the weather front moves on you can generally move troops in immediately to commence restoration,” Mr Jordon said.

“Floods are incredibly frustrating compared to a cyclone or

super-cell storm, because the damage occurs slowly and you know that every litre of water entering each padmount, pillar box, substation and meter box is bringing with it debris, soil and silt.

“With around 50 per cent of Townsville’s flood-affected areas being supplied by an underground network, you know every piece of equipment will have to be methodically opened, cleaned, tested and repaired and dried before we can safely re-energise. You know the task ahead will be painstaking, and massive.”

Bring in the troops

With that in mind, Ergon mobilised troops from across the state, including reinforcements from South East Queenslandbased sister company Energex, to support local crews in what would be an around-the-clock restoration effort.

Mr Jordon said bringing in additional crews to a disaster area is not about throwing as many people at the problem as possible. Given the nature of the event, it was important to consider the best skillsets required and actually getting resources into the area as soon as possible before access was completely cut.

“From a social perspective you have to be aware that every person responding to a natural disaster, while undoubtedly carrying out an important task, must also have as minimal impact as possible on the limited resources, such as accommodation and food, Mr Jordon explained.

“From an operational perspective, you have to have an extremely good understanding of what damage crews are likely to find, and only deploy staff with the specialised skills required to get the power back on. For example, knowing we were facing significant damage to the underground network, we needed to move additional staff with these skills into the region.

“At the same time, we were providing support to local team members who had been personally affected by the disaster, which obviously had a devastating impact on the community.”

While restoration crews were keen to get out and help get the community back on its feet, they were faced with a frustrating wait for floodwaters to recede.

“The problem with flooding on this scale is it takes time to subside and much of the damage is hidden under the water’s surface.

“It’s frustrating for crews who are ready to respond, but cannot begin inspecting the network until floodwaters recede and in this case it was days before the true extent of the damage was revealed,” Mr Jordon said.

The view from above

In the meantime, aerial inspections gave crews some insight into the challenges ahead. The Australian Army provided Ergon chopper flights, enabling crews to scope damage in areas that remained cut off because of floodwaters, debris and structural damage to a bridge.

Drones, which have become a vital weapon in Ergon Energy’s arsenal, were widely used to find faults amongst the devastation.

Mostly, fault-finding meant a hard slog on foot for crews in hot, humid and muddy conditions.

Mr Jordon said once Ergon had a clearer picture of damage to the

16 ENERGY NETWORKS June 2019 ISSUE 6 www.energymagazine.com.au

network, it was time to devise a meticulous restoration plan for the community.

“Planning is everything when it comes to natural disasters and there’s only so much you can do until you know the full extent of the damage.

“We had a good idea what to expect, but we needed the waters to fully subside to know exactly what would be required in terms of staffing, spares and equipment to enable us to devise an accurate restoration plan timeline,” he said.

Working towards a goal

Ergon set an ambitious restoration target: to have every property that was safe to re-energise back on the grid ten days after the peak of the flooding.

“The plan also included a street-by-street restoration timeline, which we released to the public via our website, social media and traditional media, and delivered to the Local Disaster Management Group.

“This detailed public plan gave everyone an idea of when power would be restored to their properties and allowed them to plan their lives around it. Ultimately, it gave the community a form of certainty in a very difficult time,” Mr Jordon said.

The restoration plan also gave crews a goal and it wasn’t long before they were aiming to exceed the community’s expectations.

“Within hours of us going public with the document our crews said they wanted to achieve the goal a day earlier.

“Although we’d said we’d have power available to everyone by the Tuesday evening, crews had it restored on Monday afternoon.

“Their drive was nothing short of incredible and we could not have been any prouder of their efforts.

Above all else, the meticulous planning, resourcing and restoration planning, combined with outstanding commitment from staff, saw this result achieved without a single recordable injury.

“They were inspired by the support of members of the

community, who often greeted our crews with cold drinks and snacks as they worked in temperatures tipping 40 degrees with stifling humidity and often ankle-deep in mud,” Mr Jordon said.

In challenging conditions, Ergon and Energex crews ticked off an impressive to-do list:

» Restored power to 17,000 customers

» Assessed, cleaned and repaired all the city’s inundated substations

» Assessed, cleaned and/or repaired nearly 1700 pillar boxes

» Assessed, cleaned and repaired around 180 padmount transformers and high voltage switchgear

» Replaced two damaged padmount transformers

» Pumped, cleaned and dried dozens of pits

» Replaced two switching stations

» Replaced four poles

It was a massive undertaking by crews, which went a long way to helping restore a sense of normality to a community in crisis.

From every disaster response, there are valuable lessons, and Paul Jordon observed a few keys at the heart of the success of the Townsville flood response. He said it was imperative to empower crews with ownership of the disaster response by ensuring they were safe, well-resourced, had clear work plans each morning and were kept informed of the holistic restoration process.

“Keeping the community and key stakeholders informed throughout the event also went a long way to quelling any angst about the power situation.

“Getting the restoration plan out early also gave customers the information they needed to get on with life, while at the same time rallying our crews with a goal.

“At the end of the day, we all want the same thing – the safe and timely restoration of power.”

17 ENERGY NETWORKS www.energymagazine.com.au June 2019 ISSUE 6

DISTRIBUTED ENERGY IN WESTERN AUSTRALIA:

by Scott Davis, Policy Adviser WA, Australian Energy Council

The proliferation of distributed energy resources, such as rooftop solar, is continuing around Australia at a rapid case, and this is particularly the case in WA. Here, Scott Davis from the Australian Energy Council considers the implications of increased distributed resources, particularly in the context of Western Australia’s “islanded” electricity market.

Distributed Energy Resources (DER), such as rooftop solar and batteries, have the potential to offer customers lower cost, reliable, efficient energy, and the possibility of energy independence. However, while there has been a growing focus on DER1 benefits, they also come with some challenges.

What are the customer implications? And what are customers looking for from the energy supply changes that are currently underway? Here we take a look and consider it from the perspective of changes underway in Western Australia’s wholesale electricity market.

The energy transformation

The Wholesale Electricity Market (WEM) operates in the 261,000 square km South West Interconnected System (SWIS) and provides around 18 million MWh of electricity to 1.1 million households and businesses annually. The SWIS has an ‘islanded nature’ – it stands alone from the National Electricity Market (NEM) and therefore needs to be more secure and reliable than a power system with interconnections2

Collectively, rooftop DER is the largest energy source in the SWIS, according to the Australian Energy Market Operator’s

(AEMO) most recent Integrating Utility-Scale Renewables and DER in the SWIS report. There is now over 1000MW of rooftop photovoltaic (PV) DER installed behind the meter in the distribution networks. AEMO estimates that installed rooftop DER will more than double by mid-2028 to 2400 MW3

The take up of solar in WA has been accelerating and it now has three of the top ten postcodes nationally for the level of solar installations. Mandurah to Perth’s south is the postcode with the second highest number of solar installations nationally. And the size of the solar systems being installed on rooftops has progressively been getting bigger.

As noted by WA electricity retailer Synergy, in this evolving electricity system (figure 1), an affordable, reliable, and sustainable energy supply remains what customers want4. Customers want to keep it simple but they also expect increasingly greater choice and technology enablement.

However, there is uncertainty as to how simple DER will remain for customers – and it is concerning when proposed future DER models have a range of new players involved in the mix, with multiple parties developing and offering customers a new suite of products and services. These scenarios must not only consider added complexity for the customer, but also need to maintain customer protections.

June 2019 ISSUE 6 www.energymagazine.com.au 18 ENERGY NETWORKS

Definition of DER: By ‘distributed’ we mean connected to consumers on the distribution network, and we imply small scale and a diversity of locations and technologies. ‘Energy’ refers to both the release and absorption of energy. ‘Resources’ means being put to a useful purpose. Some examples therefore could include inverter-based generation, batteries, controlled small loads and electric vehicles. 2 AEMO, Integrating Utility-Scale Renewables and DER in the SWIS, March 2019 3 AEMO, Integrating Utility-Scale Renewables and DER in the SWIS, March 2019 4 Synergy presentation, WA Electricity Reform: Have we got DER Covered? panel, 7 March 2019 Pricing & the flow of benefits Customer experience and the utility value proposition Appropriate customer protections

models and enabling technologies

Figure 1. The evolving electricity system. Source: AEMO. 1

Business

WHAT ARE THE CUSTOMER IMPLICATIONS?

ENERGY NETWORKS

www.energymagazine.com.au June 2019 ISSUE 6 19

Scott Davis.

The Australian Energy Market Operator (AEMO) says that the many different forms of DER, with new and varying business models, “can provide a range of grid, essential, emergency reserves, and network support services. Unlocking these new value streams in addition to the consumers’ services must be supported by markets and competition to support the investment choices delivering the best value.”5

To provide equitable access to the benefits of DER, a strong holistic market design, backed by a strong regulatory framework, is imperative. A substantive framework is already in place with existing retailers that covers various consumer laws, privacy protections, and regulated contracts. And while tweaking this framework will no doubt be required, retailers are seemingly in a strong position to continue to provide customer protections when offering future DER services.

High DER future

The impact of a high DER future is already being felt in Horizon Power’s service area. The utility is “bringing the future forward” by accelerating the uptake of DER in the town of Onslow . The pilot program aims to generate 50 per cent of the town’s electricity from renewable energy sources, by providing residents and businesses with access to low-cost solar and battery storage systems6

Horizon Power has developed a framework where controllable DER is linked to centralised control and dispatch via a DER management system (DERMS), as outlined in Figure 2.

However the Onslow trial is looking beyond getting the technology architecture right. It is aiming to understand how customer engagement, incentive design (including the transaction framework for the services that customers are providing), as well as how contractual and regulatory frameworks support a new supply model.

From a technology perspective, all the pieces are there, but it is complex to get end-to-end commands from the control room to a customer device. There's as many as nine different vendors involved in Horizon Power getting a command from end-to-end. So it will be important to consider open standards and protocols to ensure the necessary interoperability exists for reliable communications.

Potential challenges are becoming apparent to Horizon Power in relation to applying DERMS in markets such as the National Electricity Market (NEM) or WEM. For example, a command dispatched to a DER might be intended to achieve a certain outcome for the distribution operator, but that may run contrary to the objectives of the retailer. It raises the question of how the

Technology view only one part of the whole:

» Underpinned by standards and common protocols (IEEE, AS4777, AS4755 etc)

» Installer base skill development required

Other parts include:

» customer engagement

» incentive design including transaction framework

» contractual and regulatory framework

customer’s individual investment is factored into an analysis of optimal customer outcomes. It is likely to take a lot of time and effort to get all of the fundamentals of DER orchestration in place for it to bring system wide and society wide benefits.

Understanding customer needs

While decisions about where and when to install DER and how to operate it are increasingly consequential, many electricity customers lack the information, time and control to efficiently direct investment in, and operation of DER.

As part of its annual retail competition review, the Australian Energy Market Commission (AEMC) polled 2000 respondents about a range of energy technologies such as solar, batteries, smart devices, and energy services. Initially the participants had trouble understanding energy services and their benefits. The participants were shown an advertisement of a typical day of an average family, and how the family interacted with energy services. Afterwards, they showed increased interest in energy services, particularly in relation to what energy technology to purchase next, and services become the most valued offer.

EnergyOS is also focused on the theme of energy services. To really engage with the full suite of DER opportunities, the tech start-up believes that consumers must first become familiar with the new generation of services available. They say that this requires a different way of thinking: services are fundamentally different from products, and therefore, require a different mindset.

Western Power is looking to further understand customers' future energy needs through utilising energy scenarios – like the uptake of different technology, macroeconomic and demographic factors – and how these determine future energy requirements of customers. They are modelling 50 scenarios and 50 future grids to determine what would be the most efficient grid to serve the most likely future energy need. From that, they pose the question of how to transition to that new grid. A lot of the modelling uses automated tools and systems, and it is currently a proof of concept that Western Power is looking to develop further.

It is clear that the benefits of DER need to flow across the value chain for retailers to sustainably offer a compelling value proposition to customers. To support this, reform is needed in relation to network tariffs and other pricing signals. Such reform may even encourage further product development, with the possibility of energy products coming to mirror Telco products. So while the customer challenges of a high DER future are evident, there is also confidence that solutions can be developed.

June 2019 ISSUE 6 www.energymagazine.com.au 20 ENERGY NETWORKS

5 AEMO, INTEGRATING UTILITY-SCALE RENEWABLES AND DER IN THE SWIS, MARCH 2019 6 https://horizonpower.com.au/our-community/projects/onslow-distributed-energy-resource-der-project/

Figure 2. The Onslow Microgrid – technology view. Source: Horizon Power, from the WA Electricity Reform: Have we got DER covered? forum.

11-14 June 2019

Melbourne Convention and Exhibition Centre | Australia

Headline speakers include:

Exhibition 700+ Attendees 200+ Organisations 95+ Industry speakers 6x Conference streams 96 Hours of content over 4 days 14 Scheduled networking hours

1500m2

Audrey Zibelman Chief Executive Officer AEMO

Sara Bell Founder and Chief Executive Officer Tempus Energy (UK)

Michelle Shepherd Commissioner AEM

Merryn York Chief Executive Officer Powerlink Queensland

Paula Conboy Chair AER

Paul Italiano Chief Executive Officer Transgrid

Aidan O’Sullivan Head of Energy and Artificial Intelligence Research University College London (UK)

Brett Redman Chief Executive Officer AGL Energy

Jeff Dimery Managing Director and Chief Executive Officer Alinta Energy

THE BIG ISSUES

THE KEY PLAYERS

ONE

REGISTER TODAY! Book before 3 May and save up to $400! www.energyweek.com.au +61 (0)2 9977 0565 info@questevents.com.au Introducing the Supported by: Organised by: Barista Sponsor: ENERGY readers receive 10% off the registration fee, quote ‘ENR10’ at registration

Mark Twidell Managing Director APAC Tesla

ALL

ALL

ALL UNDER

ROOF

THE SOLAR SURGE — NETWORKS ARE HERE TO HELP

by Andrew Dillon, Chief Executive Officer, Energy Networks Australia

With the expansion of solar energy already impacting our electricity grid – and with the volume only increasing in the years to come – the impact on our networks is going to be significant. How we continue to manage the transition to bidirectional energy flows will have a critical impact on our networks, and networks are working to deliver the best path forward.

Solar saturation

The expansion of solar and other distributed energy resources (DER) has changed our grid, a distribution system originally designed for unidirectional power flow but now required to accommodate two-way flows that can fluctuate significantly within relatively short time periods.

The risk of reverse demand/power flows associated with high rooftop solar adoption has been a growing national issue, identified as a clear priority in the 2017 Energy Networks Australia and CSIRO Electricity Network Transformation Roadmap (ENTR).

With the rapid uptake of DER such as household solar and, increasingly, storage devices, a substantial proportion of Australia’s zone substations will reach reverse demand/power flows significantly earlier than previously thought. This is a problem for the grid because, if unmanaged, it can cause voltage fluctuations resulting in localised power outages, damage to appliances and potentially even compromise electricity system security. The indicative threshold for when reverse flows occur is when penetration of rooftop solar adoption reaches about 40 per cent – although this can vary, depending on the hosting capacity and topology of the electricity network.

The Open Energy Networks project, being delivered by Energy Networks Australia and the Australian Energy Market Operator (AEMO), has used updated data to map how soon zone substations will reach this threshold. It shows almost a quarter of zone substations will likely hit 40 per cent solar penetration by 2025. This is slightly more pronounced in the populated areas of the coast, but not exclusively so.

How do we manage it?

In managing traditional distribution networks with unidirectional flow, there was limited need for control of the feeder as it was typically set up so that the range of anticipated voltage excursions did not exceed the allowable voltage limits. However, with increased DER penetration, this is no longer possible in many

cases without dramatic excursions outside the allowed voltage limits (with subsequent rooftop solar inverter tripping), unless dynamic control is implemented.

Given the relatively low level of monitoring and control that was implemented to cope with what was a relatively predictable operating regime, significant enhancement of monitoring and control functionality is required to provide for the robust connection of DER within the safe technical range of the network’s capacity, and to allow for the optimisation of the performance of the integrated network with its connected devices.

With the updated outlook, the enhancement of monitoring and control functionality required to manage the system when it goes into reverse demand will be required earlier for some sections of the network than previously thought.

Through the Open Energy Networks project, Energy Networks Australia is taking a lead role in this adaption by redesigning the management of DER in partnership with AEMO.

The best way to manage voltage issues and integrate increasing levels of solar and storage into the system is to develop a smarter and more flexible grid. Electricity networks are working towards being coordinated and optimised both locally and across the wider energy system – Open Energy Networks is examining how best to do this.

Demand shift

The rapid growth of household solar means far more electricity is now generated in the middle of the day and supply often exceeds demand. This is called a solar trough, or the back of the ‘duck curve’. It can cause grid instability and reliability issues. In the evening, when the sun goes down but everyone gets home from work, demand spikes – again putting pressure on the grid – and wholesale prices rise so all customers are impacted by higher bills. Managing these shifting sands by simply investing more in infrastructure is one way of dealing with this, but that also results in all customers paying more.

June 2019 ISSUE 6 www.energymagazine.com.au 22 ENERGY NETWORKS

Slow DER scenario

Updated projected decade in which the zone substations within each Australian postcode within the NEM and WEM will reach a threshold penetration of rooftop solar adoption (40 per cent) indicative of reverse demand/power under the ESOO Slow DER uptake scenario

(Source: Open Energy Networks 2019).

Moderate DER scenario

Updated projected decade in which the zone substations within each Australian postcode within the NEM and WEM will reach a threshold penetration of rooftop solar adoption (40 per cent) indicative of reverse demand/power under the ESOO Neutral DER uptake scenario

(Source: Open Energy Networks 2019).

ENERGY NETWORKS www.energymagazine.com.au June 2019 ISSUE 6 23

Fast DER scenario

Updated projected decade in which the zone substations within each Australian postcode within the NEM and WEM will reach a threshold penetration of rooftop solar adoption (40 per cent) indicative of reverse demand/power under the ESOO Fast DER uptake scenario

(Source: Open Energy Networks 2019).

Time of use tariffs

Everyone’s heard of time-of-use tariffs. They’re intended to price services (typically utility-type or publicly funded/subsidised) to manage demand and congestion – and are therefore more expensive during high-use periods and cheaper in lower-use periods. This incentivises more efficient consumption patterns from customers.

For energy customers, this type of pricing offers significant potential benefits.

It makes far more sense to implement pricing signals to smooth out the ever-growing trough and peak periods, encouraging less electricity use at peak demand times and more at lower demand times. If enough customers use less energy at peak periods by shifting their consumption to other times of the day or by simply using less, network augmentation can be delayed or prevented. This means cheaper prices for customers.

If customers can easily shift their consumption away from peak periods, then they can take advantage of a retailer’s time-of-use offer and save on their electricity bills. The South Australian Power Network estimates a customer with an electric vehicle on a time-of-use tariff and charging the electric vehicle in the middle of the day could save as much as $500 per annum compared with a flat retail price.

The reality of an increasingly distributed energy landscape presents challenges that must be managed not only with engineering solutions, but by influencing and managing consumption behaviour. Time of use pricing structures are as essential as engineering innovations to not only avoid the network infrastructure investment that would otherwise be needed, but to improve pricing equity and maximise the benefits of the DER evolution for all end-use customers.

June 2019 ISSUE 6 www.energymagazine.com.au 24 ENERGY NETWORKS

THE CRITICAL ROLE OF GAS IN THE ENERGY TRANSITION

by Phaedra Deckart, General Manager, Energy Supply and Origination, AGL

In a rapidly evolving energy market, AGL’s Phaedra Deckart argues that gas has a critical role to play as we transition to future fuel sources that are clean, reliable and affordable.

Energy is an industry in great transition, moving towards reliable power for customers that’s lower cost and lower carbon.

At AGL, we believe that gas will play a critical role in this transition.

Right now, we have $1.9 billion worth of energy supply projects under development, with a further $1.5 billion subject to feasibility.

These projects range from upgrades to our existing sites to new renewables projects. Three are gas projects worth $945 million, which we see as playing an important role in this transition period to ensure clean, reliable and affordable electricity.

There are several reasons why we believe gas is critical in the transition. Firstly, it’s the most cost-effective way to ‘firm-up’ renewable sources like solar and wind power.

Renewable energy is now the cheapest form of new-build generation in Australia, so firming it up cost-effectively is critical for energy affordability.

It’s also accessible – whether that’s from domestic resources or through LNG imports – and it’s flexible, and is the cleanest burning fossil fuel.

There’s the availability of the existing large gas storage and pipeline networks, particularly in our southern states, which can manage the variability in demand. These assets, along with potential future storage associated with LNG import projects, can provide the necessary capacity to meet the growing peak summer gas demand requirements.

Gas-fired power generation has proved to be a relatively lower cost, low emissions source of synchronous generation, and has provided critical network stability, along with other technologies.

We understand that gas is only a medium-term fuel, and while some would like us to jump straight to battery storage and large renewables, we need a reliable supply of lower emission fuel to generate the firming capacity needed while battery costs continue to decline.

Most pressing is access to gas, which was backed up by the Australian Energy Market Operator’s report recently released at the end of March, which is forecasting a gas shortage from 2024 without a new source of supply coming to market, and which shows that the east coast will see tight supply from 2021.

AGL supports initiatives that bring more supply and a diversity of suppliers to the market, including domestic gas resource development and potential imports of gas and LNG.

To facilitate this, we support State and Federal Governments in making informed policy decisions based on scientific

evidence to ensure that necessary development and investment can occur while also protecting our environment.

A stable regulatory environment is also important to facilitate investment in energy and ensure Australians have access to reliable, clean and affordable energy in the years ahead.

We also believe another significant factor is increasing the depth and liquidity in gas markets, and growth in gas forward markets, as a way of managing risk, offsetting potential price volatility with increasing linkage between electricity and gas markets.

Clearly, there are challenges to address, but we believe the benefits for customers and Australia’s productivity are clear and gas provides an important way of transitioning to a clean, cost-effective and reliable power.

Phaedra Deckart is a senior executive with over 20 years of experience in the global energy sector. She began her career in law before she transitioned seamlessly to the oil and gas industry upon joining Santos Limited, where she held a variety of commercial, corporate, gas and LNG marketing positions. Phaedra’s career at AGL has traversed leading AGL’s wholesale gas supply portfolio as Head of Wholesale Gas and now as General Manager, Energy Supply and Origination. Phaedra leads the transformation of AGL’s energy supply portfolio through this dynamic time in the energy market.

www.energymagazine.com.au June 2019 ISSUE 6 OIL & GAS

25

PERCEPTION THE KEY TO OIL AND GAS SUCCESS

International experts and Australian industry leaders will provide up-to-date analysis, case studies and technical know-how on the big issues facing our industry, as they converge in Brisbane this May for the annual APPEA Conference and Exhibition. Ahead of the event, Russell Curtin, Partner & Oceania Oil & Gas Leader, EY, discusses industry highlights from the past twelve months and the major issues ahead we all need to consider.

In your view, what have been the key highlights/successes for the industry in the past 12 months?

The past twelve months have seen a number of exciting developments in the oil and gas industry that all underscore the importance of gas in the regional energy mix, and create great opportunity for Australia in general.

We have seen great progress in brownfield LNG developments including Scarborough, Browse and Barossa Caldita driven by the regional demand opportunity. And at home, assuming high rates of penetration and advances in technology of renewables, we still see strong demand for gas.

The domestic gas landscape has seen Beach integrate Lattice, Mitsui acquire AWE and Santos acquire Quadrant.

And while we have seen some progress on advancing the badly needed and politically stranded resources in NSW and the Northern Territory, there has been much activity to firm the east coast domestic gas supply with LNG import terminals progressing their investment cases.

Finally, in the midst of a low exploration spend this country, what little exploration drilling there has been has seen success in the Dorado discovery – the largest oil discovery in Australia for decades.

What do you predict will be the major issues that the oil and gas industry will be dealing with in the coming 12–24 months?

Critical to the success of industry in Australia is that old intangible “perception”. Intangible in nature, it’s hard to define the cost of the current issue and is better considered an opportunity to harness in shaping the nature and extent of future success.

The findings of the Hayne Royal Commission into the financial services industry are a stark reminder of this. The findings set out principles for guiding financial services companies on their obligations to customers and the broader community. These principles have broader applicability and it’s worth considering how the findings might apply to all industry including the oil and gas industry.

Hayne questioned the fundamental pillars upon which organisations are built. He has called into question what is valued, how organisations are governed, what is produced, how products

are sold, and how individuals can be held to account. This thinking on culture and values has also been reflected in the recently released ASX Corporate Governance Council revised guidelines which set out thinking on best practice corporate governance.

To be successful in addressing this challenge we must consider alignment of the levers of culture including the complex interplay between them. This might include the following key questions.

» Do you have a structured, organisation-wide view of current culture?

» Is your current culture supporting you to meet your purpose and strategy?

» Are you clear on your desired culture, and has the Board endorsed this target?

» To what degree are you measuring and reporting culture to your leaders?

» To what degree do you perceive cultural tension in your organisation?

As a key contributor to the event, the APPEA Conference is clearly a major strategic conference in EY’s calendar. What do you anticipate APPEA 2019 will deliver to delegates at such a crucial time for the industry?

APPEA 2019 is a chance to celebrate the industry’s crucial position in supplying secure, affordable and sustainable energy to Australia and the region. We can all reflect on the commercial and technological successes and breakthroughs which have made Australia’s oil and gas industry among the most innovative and competitive in the world.

It has long been forecast that commodity price volatility was likely to be sharper and more frequent than in the past couple of decades, and that forecast is holding true. And with a Federal Election looming, there will be volatility and uncertainty in the media too.

Resilience remains a key characteristic of future success. Oil and gas makes a significant contribution to the Australian economy and will continue to do so for the foreseeable future. The APPEA conference provides a connection to robust parts of our economy and offers delegates the opportunity to remain informed, insightful and relevant. Not only can we help the industry remain strong, we can also play a leadership role in the energy future for Australia.

26 OIL & GAS

27 OIL & GAS

Russell Curtin will be at the EY Collaboration Centre in the APPEA 2019 Exhibition to discuss the hot topic of Reimagining the energy future at 1pm Tuesday 28 May. For further information on APPEA 2019, visit www.appeaconference.com.au

Russell Curtin.

As prices across the National Electricity Market become increasingly volatile, and as business and community expectations move users towards renewable sources of energy, industrial users around Australia are increasingly turning to Power Purchase Agreements (PPAs) to meet their energy needs. We take a closer look at some of the PPAs recently signed in the Australian energy market, and consider the role traditional energy industry suppliers can continue to play in this new paradigm.

POWER PURCHASE AGREEMENTS:

REVOLUTIONISING ENERGY RETAIL

By India Murphy, Journalist, Energy Magazine

28

INDUSTRIAL ENERGY

PPAs provide consumers with an alternative to purchasing from traditional retailers and instead enable consumers to negotiate a longer term contract with a stable price for the supply of renewable energy. Purchasing power at a consistent rate is obviously an advantage in the current fluctuating market, and provides a much needed sense of security for buyers.

Against a background of sharply rising electricity prices, particularly since the closure of the Hazelwood coal-fired power plant in Victoria in 2017, corporate Australia’s desire for more certainty and lower energy prices has contributed to a sudden spurt in the corporate PPA market.

Since taking off in 2016, almost 30 PPAs have been signed, supporting solar and wind projects with a combined capacity of nearly 3600MW1. These have contributed to the recent boost in renewables investment, a positive outcome as Australia pushes towards a more sustainable future.

At the time of print, 48 per cent of current Australian corporate PPAs are solar, eight per cent are a mix of wind and solar, and the remainder of the PPAs are wind2

Let’s take a closer look at some of the most recently signed PPAs in the Australian energy market.

Viva Energy and Acciona Australia

Victorian projects currently dominate the share of PPA projects, accounting for 47 per cent of the renewable project capacity3

This statistic includes Viva Energy, who entered into a PPA with Acciona Australia to secure stable pricing on approximately 100GWh per annum of electricity from Acciona’s Mt Gellibrand Wind Farm in February 2019.

The Mt Gellibrand Wind Farm in Victoria produces 30 per cent of all wind farm generation in Australia, and was completed late in 2018. Viva Energy supplies around a quarter of Australia’s liquid fuel requirements, and their Geelong refinery is one of the state’s largest electricity users. The PPA will enable the refinery to begin the transition to renewable energy, with the wind farm currently powering one third of its electricity load.