SIGNS OF HOPE for the post-COVID world

Hydrogen’s role in decarbonisation

Providing the deep storage Australia needs

POWERING REMOTE COMMUNITIES:

WA’s distributed plan

ISSUE 10 · June 2020 · www.energymagazine.com.au

Solis-110K-5G

Solis Commercial & Industrial PV Inverter

Efficiency

High power tracking density

90MPPT/MW

Maximum efficiency up to 98.7%

Power generation revenue increased by 3.5% year-on-year

Smart

Optional AC SPD level-I function

Economy Safe

String-level monitoring to improve O&M efficiency

I-V curve diagnostic technology could diagnosis the MW-power

plant within 5 minutes

Support night reactive power compensation

Optional AFCI function can identify faults in the arc current to avoid 99% of the fire risk

Support up to 150% DC/AC ratio, reduce system LCOE

Support PV “Y” connecter

Support 185mm2 aluminum AC cable

Optional PLC communication, save cable cost

w: ginlong.com | Stock Code: 300763.SZ t: +61 3 8555 9516 | e: sales@ginlongaust.com.au Made by Ginlong Technologies

As I sat down to write the Editor’s Welcome for this issue of Energy, I felt compelled to reflect on my welcome from the last issue, released in March.

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

energymagazine.com.au

info@energymagazine.com.au

ISSN: 2209-0541

It was almost bizarre to read that welcome; written just three months ago, with no mention of coronavirus or the seismic change that would hit our professional and personal lives in a matter of days.

In the weeks and months since COVID-19 began to make its mark in Australia, taking us into lockdown and a completely changed way of life, we’ve been through many stages of the crisis.

There was the initial stage of rapid response, where we shifted ways of running our organisations to allow social distancing, and in particular, the isolation of critical energy industry personnel (the people that literally keep the lights on around the country).

Then, as we moved to lockdown, we had to quickly set up the industry for working from home wherever possible, while also carrying on with the provision of our essential services without interruption – almost as if we weren’t dealing with the extensive level of change that we were.

Now, at the time of going to print, lockdown restrictions are easing, and we’re taking our first tentative steps into the new, post-COVID world.

We know there will be challenges –there will be steps forward, followed by steps back. We won’t be returning to business as usual any time soon – if ever.

But despite the gravity of the situation, throughout the crisis period, there have been signs of hope. Neoen is moving forward with the construction of Australia’s biggest solar farm in Queensland; the Federal Government has implemented the $300 million Advancing Hydrogen Fund; the Queensland-NSW Interconnector has been given the greenlight; and the $10 billion Surat Gas Project in southern Queensland has been sanctioned.

These are all critical projects for our industry; and now, in the current environment, they will also be critically important for the national economy.

The energy industry will have an important role to play in Australia’s recovery from the impacts of coronavirus.

Beyond the projects outlined above, many are also calling for the transition of Australia’s energy market to be a cornerstone of the country’s path to recovery.

We’re in the fortunate position of being part of an essential services industry, and one where there are opportunities amidst the challenges. And hopefully, when I write my next Editor’s Welcome in another three months, there will be more positive news to report for our industry.

1

Editor ISSUE 10—JUNE 2020 WELCOME EDITOR’S WELCOME universal partial discharge (PD) measurement represents the next generation of our innovative testing technology. New time-saving added to make it the most rugged, flexible available for detecting PD activity and assessing failure in a wide variety of electrical equipment. user-configurable software is also fully MPD 600 devices. www.omicronenergy.com/mpd800 info.australia@omicronenergy.com hands on MPD 800 –easy partial discharge testing ISSUE 10 June 2020 www.energymagazine.com.au SIGNS OF HOPE for the post-COVID world Providing the deep storage Australia needs Hydrogen’s role in decarbonisation POWERING REMOTE COMMUNITIES: WA’s distributed plan

Media Enterprises

St

Laura Harvey

Monkey

ABN: 36 426 734 954 204/23–25 Gipps

Collingwood VIC 3066

Published by We’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950. 6,229 This publication has been independently audited under the AMAA’s CAB Total Distribution Audit. Audit Period: 1 April 2019 – 30 September 2019 June 2020 ISSUE 10 Editor

Harvey

Editor

Journalists

Butler

Ho Design Manager

Molano Designer

Development Managers

Publisher

Bland

Australia grapples with the ongoing COVID-19 crisis, the energy industry is continuing to provide maintenance and other services so we can continue to deliver this essential service.

Laura

Assistant

Imogen Hartmann

Lauren

Eliza Booth Kim

Alejandro

Jacqueline Buckmaster Business

Rima Munafo Brett Thompson

Chris

As

2 FUTURE ENERGY 24 Hydrogen’s role in decarbonisation: ensuring a responsible transition 28 How to build an electrolyser 32 Renewables: breaking records and leading the way for economic recovery 34 Supporting the transition to high levels of renewables in the NEM 38 Finding and developing the next big thing INDUSTRY INSIGHT 08 Signs of hope for the post-COVID world RETAIL 12 Compassionate and positive leadership during COVID-19 16 Inclusive energy: supporting customers with disabilities STORAGE 20 Tasmania: providing the deep storage Australia needs 24 08 ENERGY-FROM-WASTE 40 Rising waste levies provide opportunities for highenergy users 40 NEWS 4 New CEO appointed at Western Power 4 Renewables could jumpstart economy, create 50,000 jobs 5 Landmark PPA signed for Australia’s largest solar farm 5 Energex’s Greenslopes depot to kick off 6 Federal Government implements Advancing Hydrogen Fund 7 Powercor’s bushfire safety device granted final approval EACH ISSUE 1 EDITOR'S WELCOME 64 FEATURES SCHEDULE 64 ADVERTISERS’ INDEX CONTENTS June 2020 ISSUE 10 www.energymagazine.com.au

POWERING REMOTE COMMUNITIES

42 Western Australia launches roadmap for DER integration

46

TRANSFORMERS AND SUBSTATIONS

46 Fast and easy partial discharge testing with the Omicron MPD 800

47

ENERGY TRANSITION

47 Australia has the capacity to lead the coal phase-out – but it won't happen any time soon

50

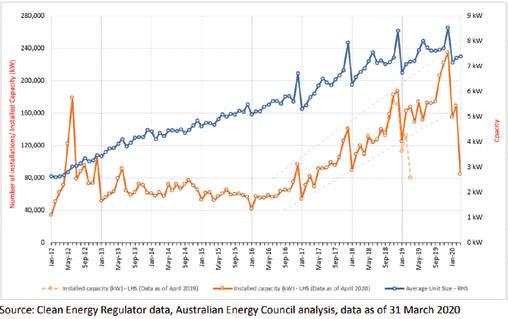

SOLAR

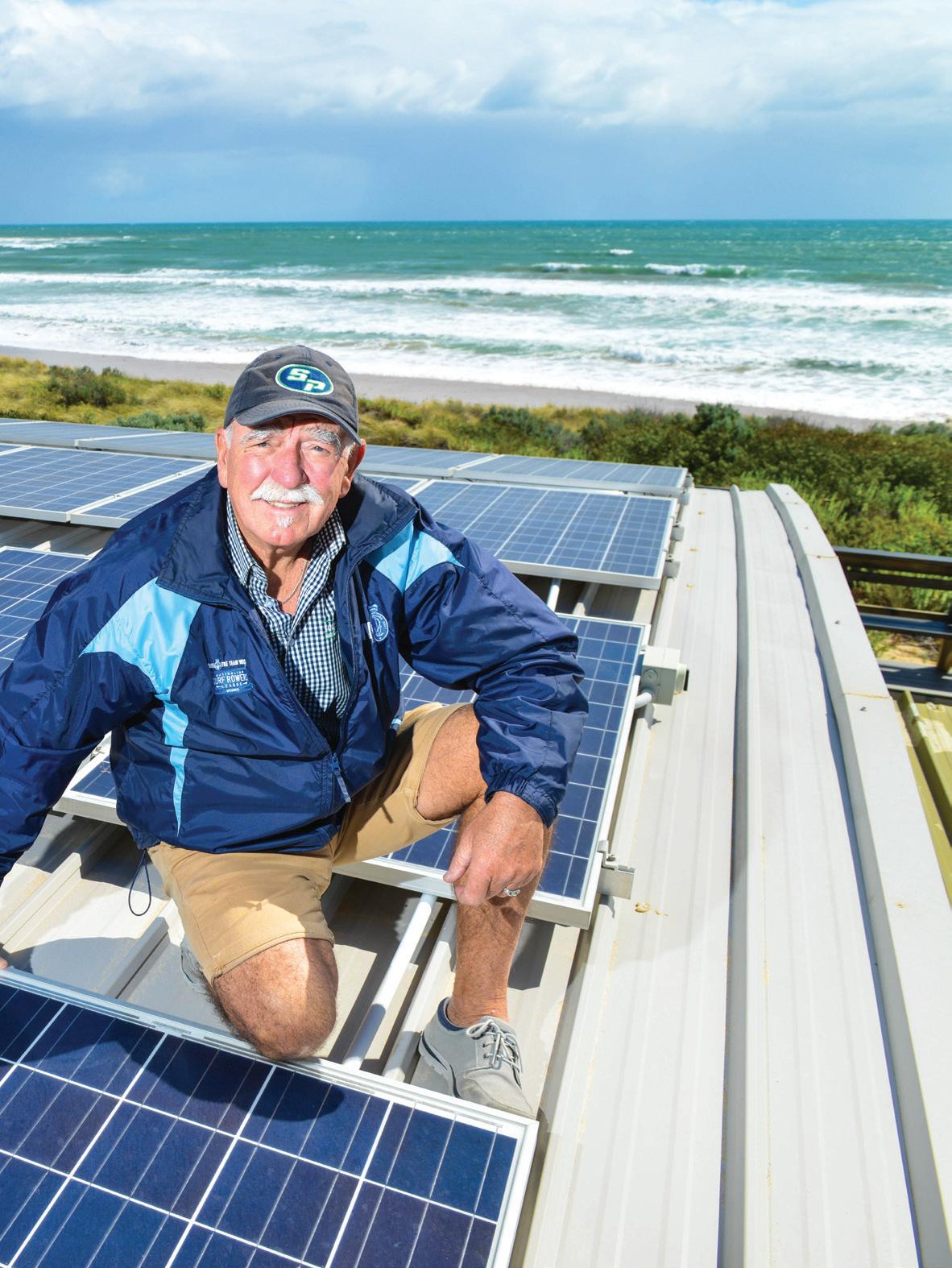

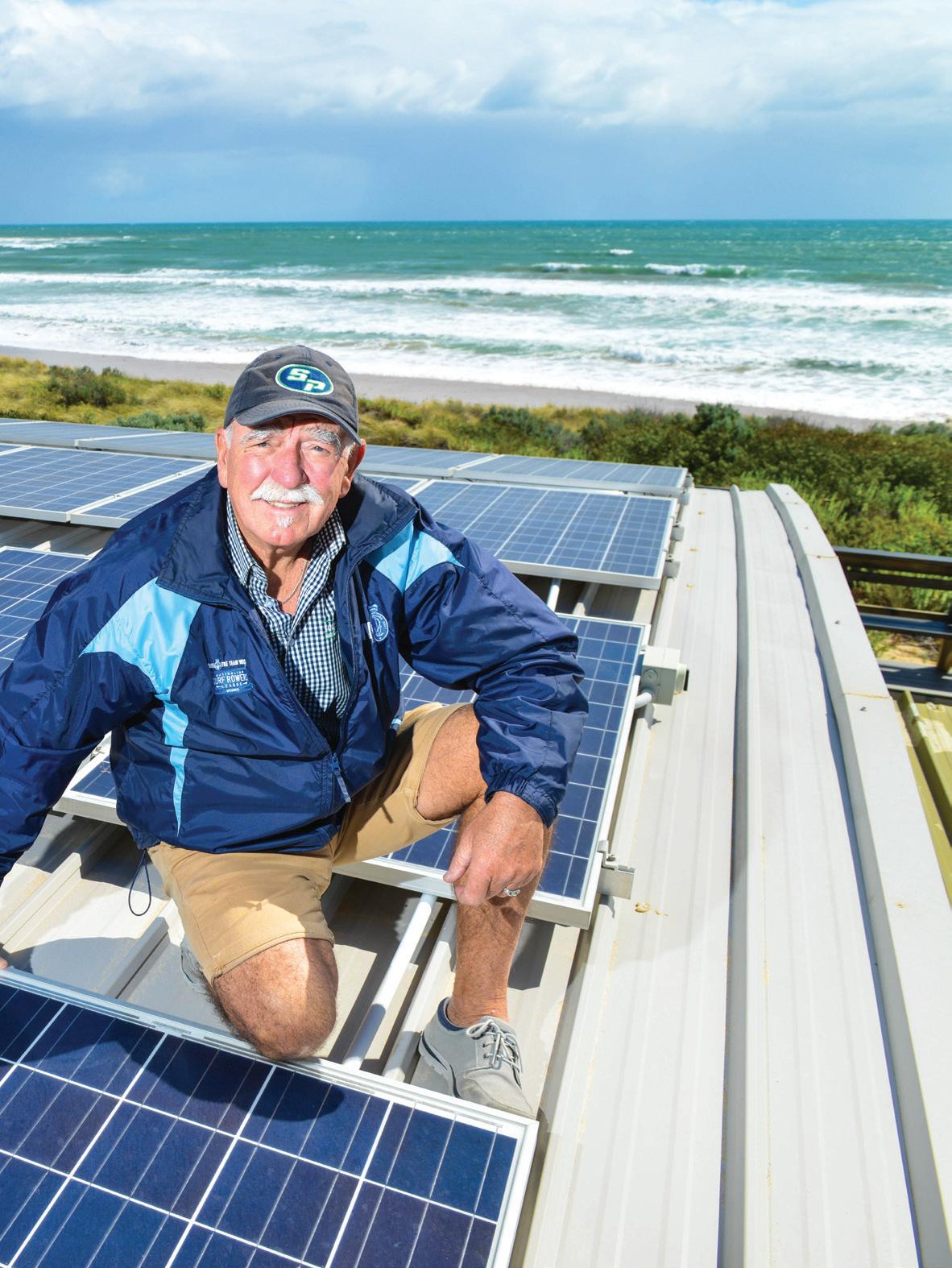

50 Slashing emissions and setting examples

ENERGY NETWORKS

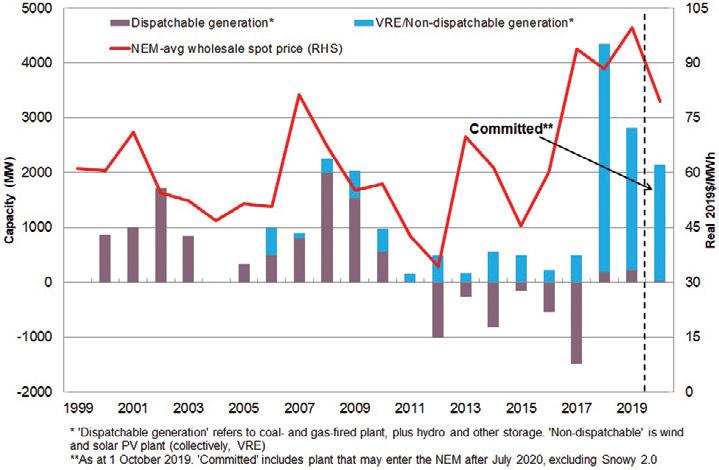

54 Barriers to entry into the electricity generation sector: insights from an investor survey

OIL & GAS

58 Negative oil prices = lower electricity prices?

60 Signs of hope as Arrow sanctions Surat Gas Project

62 Global oil market crash: the implications for energy around the world

CONTENTS 3

58 www.energymagazine.com.au June 2020 ISSUE 10

42 54

NEW CEO APPOINTED AT WESTERN POWER

Western Power has appointed a new CEO following an extensive recruitment process.

Western Power announced that Ed Kalajzic had been awarded the role.

Board Chair, Colin Beckett, said Mr Kalajzic stood out as the most qualified candidate to lead Western Power.

“Mr Kalajzic’s strong record of leadership and experience, his drive, and detailed knowledge of the Western Australian business landscape clearly demonstrated to us he is the right person to lead the company,” Mr Beckett said.

“I take this opportunity to thank our Acting CEO Dave Fyfe for his fine

leadership during the COVID-19 crisis. Western Power under Dave’s stewardship has earned high marks around the country for a steady approach to business during very uncertain times.”

As required by the Electricity Corporations Act 2005, the Western Australian Minister for Energy, Bill Johnston, confirmed his agreement with the Board’s decision.

Mr Kalajzic, who has been Western Power’s Chief Financial Officer since October 2019, said it was a great honour to lead one of Western Australia’s major companies during a period of significant change.

“I don’t think you could imagine a more disruptive time to take the helm of a business,” Mr Kalajzic said.

“But I’ve been so impressed by the way our 2800-odd staff members have risen to the challenge of the times and adopted new and innovative ways to keep the lights on for our 2.3 million customers.

“I’ve seen this innovation in many areas during my time so far at Western Power, and that gives me confidence we can continue to be the trusted energy source for Western Australians for decades to come.”

Mr Kalajzic commenced at Western Power in October 2019 as Chief Financial Officer and is experienced in financial and strategic management skills, as well as capital management, strategic planning, finance, accounting and business transformation.

RENEWABLES COULD JUMPSTART ECONOMY, CREATE 50,000 JOBS

The Clean Energy Council has laid out a plan to leverage Australia’s renewable energy and energy storage potential to jumpstart the nation’s economic resurgence from the COVID-19 pandemic.

A Clean Recovery outlines a plan to leverage accelerated investment in renewables to drive Australia’s economic recovery.

The Clean Energy Council said that the current pipeline of investment could create over 50,000 new jobs, lower power prices, and inject over $50 billion worth of investment to revitalise economic activity in regional and rural communities.

Clean Energy Council Chief Executive, Kane Thornton, said that A Clean Recovery is an opportunity to transform Australia forever, cementing the nation’s position as a clean energy superpower.

“There are currently hundreds of large-scale wind and solar projects that have been identified with planning approval and are well placed to proceed quickly,” Mr Thornton said.

“Bringing forward these projects could deliver over $50 billion of investment, more than 30,000 MW of capacity and more than

50,000 new jobs in constructing these projects, along with many more indirect jobs.”

A Clean Recovery could also empower energy customers and drive down power prices by supporting even more Australian homes and businesses going solar and installing household batteries and driving down their power bills.

“This isn’t about a handout for industry, when government is directing scarce taxpayer funding to other essential services and areas,” Mr Thornton said.

“There is an enormous appetite for private investment in clean energy that can be unlocked through smart regulatory reform, sensible energy policy, investment in the grid and energy storage.”

Adopting the measures laid out in A Clean Recovery would boost Australia’s economy with over $50 billion of new investment, tripling the amount of large-scale renewable energy installed in Australia, with the vast majority of projects located in rural and regional areas.

Crucially, it could also cement Australia’s position as a global energy superpower and leading exporter of renewable hydrogen, securing export revenue and jobs for the 21st century.

“A Clean Recovery could build on the recent success of clean energy. Over the past three years, there has been over $20 billion worth of new large-scale wind and solar projects committed, equating to 11,149MW of capacity and creating over 14,000 new jobs,” Mr Thornton said.

Accelerating the clean energy transition remains a major challenge worldwide. For the Clean Energy Council, the massive disruption brought about by COVID-19 also creates an opportunity for Australia to accelerate this shift to clean energy and prepare the country for the future.

A Clean Recovery argues that renewable energy remains one of the few investments that can both deliver economic growth and carbon abatement.

NEWS 4 June 2020 ISSUE 10 www.energymagazine.com.au

LANDMARK PPA SIGNED FOR AUSTRALIA’S LARGEST SOLAR FARM

Renewable energy producer

Neoen has signed a 352MWp power purchase agreement (PPA) for Australia’s biggest solar farm.

The contract will enable Neoen to build the 460 to 480MWp Western Downs Green Power Hub near Chinchilla in South East Queensland, delivering clean energy into Powerlink Queensland’s transmission network.

This is CleanCo Queensland’s second renewable energy offtake agreement since its establishment in December 2018, and it will contribute over 30 per cent of the energy required for CleanCo Queensland to meet its target of 1GW of new renewable generation by 2025.

Neoen Australia’s Managing Director, Louis de Sambucy, said, “We are excited to work in partnership with CleanCo, with whom we share the same long-term vision.

“The electricity produced by the Western Downs solar farm will complement CleanCo’s hydro energy production and it will be our first project in Queensland.

“We are fully committed to delivering this landmark deal by making the most of the region’s excellent solar resources, the use of the latest technology and our experience in delivering solar farms on time and on budget.

“We look forward to Western Downs becoming a lighthouse project in achieving excellent regional economic and local community outcomes that will be needed in the aftermath of COVID-19’s impact on the economy.

“This will also help the Queensland Government work towards its ambitious target of 50 per cent renewable energy by 2030.”

As Queensland’s publicly-owned clean energy company, CleanCo Queensland is focused on activities that help to improve electricity affordability, contribute to achieving the state’s 50 per cent renewable energy target by 2030 and create new investment and jobs in regional Queensland.

The Western Downs Green Power Hub will be a major contributor to those objectives. It will generate energy to power 235,000 Queensland homes, or enough to power every home on the Sunshine Coast.

CleanCo Queensland’s inaugural CEO, Maia Schweizer, said, “This is an exciting initiative which is delivering a better future for Queensland.

“We’re delivering affordable, secure and clean energy, which is powering new jobs right across our state.”

Powerlink Queensland Interim Chief Executive, Kevin Kehl, said the Western Downs Green Power Hub is extremely well positioned to connect to the national grid via Powerlink’s transmission network.

“This project will bring Queensland to 2000MW of large-scale renewable generation connected to the transmission network in the state,” Mr Kehl said.

The $570 million investment by Neoen is expected to create up to 400 jobs for the local and South West Queensland area when construction begins in July 2020.

Connection will be via the Western Downs substations via a new overhead line, with energy generation scheduled to start in the first quarter of 2022.

As per its strategy, Neoen will also be the long-term owner and operator of the project, sharing the ongoing benefits of this development with the local community.

The establishment of a Community Benefit Fund will provide opportunities for local community-building initiatives totalling $100,000 every year for the lifetime of the project.

Neoen is also working closely with the Traditional Owners, the Barunggam, to go well beyond current best practice for Indigenous participation, targeting ten per cent of the project’s economic benefits, including employment, training and supply chain outcomes.

Neoen’s Chairman and Chief Executive Officer, Xavier Barbaro, said, “We would like to thank CleanCo Queensland for putting its trust in us.

“The signing of this first power purchase agreement for a Queensland project fully illustrates our willingness to extend our leadership in Australia, our first country in terms of capacity installed.

“As one of the world’s leading and fastest-growing independent renewable energy producers, we are committed to delivering affordable, reliable and clean energy to communities through our wind, solar and storage projects, in Australia and in all our geographies.”

ENERGEX’S GREENSLOPES DEPOT TO KICK OFF

Work has started on the $32.5 million redevelopment of Energex's Greenslopes depot, creating a boost for construction jobs.

Queensland Energy Minister, Dr Anthony Lynham, said Queensland-based builder Alder Constructions was on site in May 2020 to build a new workplace for more than 200 Energex field, design and project staff.

“The building will house existing staff from the Greenslopes depot, as well as additional Energex staff from other Brisbane locations.

“This includes 100 field and rapid response crews to deploy around the clock, whether it’s for power issues after storms or to assist at emergency scenes.”

Member for Greenslopes, Joe Kelly, said construction would

provide dozens of tradespeople jobs throughout the life of the project.

“With more construction in the area and additional Energex staff based in Greenslopes, there’s no doubt local businesses will also benefit from additional people working nearby,” Mr Kelly said.

The 5000 square metre office building on Barnsdale Place at Greenslopes replaces the existing building built in the 1970s.

Construction work on the new project is expected to be complete by mid-2021.

Once completed, the new site will increase light vehicle parking to 130, cater for nearly 80 response vehicles and work seamlessly with the existing 3000 square metre warehouse.

Queensland’s publicly-owned electricity companies – Powerlink, Ergon, Energex, CS Energy, Stanwell Corp and CleanCo – will invest more than $2.2 billion on capital works in 2019-20, supporting up to 4900 jobs.

5 NEWS www.energymagazine.com.au June 2020 ISSUE 10

FEDERAL GOVERNMENT IMPLEMENTS ADVANCING HYDROGEN FUND

The Federal Government has established a $300 million Advancing Hydrogen Fund to position Australia as a world leader in hydrogen production and exports.

The new fund will finance projects focused on growing a clean, innovative and competitive hydrogen industry in Australia. It is the Government’s first financing fund that is dedicated to hydrogen projects.

The fund will back projects that align with priorities under the National Hydrogen Strategy. This includes areas such as advancing hydrogen production, developing export and domestic supply chains, establishing hydrogen hubs and backing projects that build domestic demand for hydrogen.

The Advancing Hydrogen Fund will be administered by the Clean Energy Finance Corporation (CEFC) and will provide concessional finance for projects that will support a national hydrogen industry.

Finance Minister, Mathias Cormann, said the Government is drawing on the energy and financial markets expertise of the CEFC, which has invested more than $7.7 billion in clean energy so far, to help drive investment in hydrogen.

“This new fund will be a catalyst for the future growth of Australia’s hydrogen industry, which has the potential to boost Australia’s energy security, while creating more new jobs across the country and becoming a major new export industry,” Mr Cormann said.

“There are many innovative Australian organisations working to advance the hydrogen industry and this fund will support that work. Our Government is very committed to backing technological advances in the hydrogen industry.”

Energy and Emissions Reduction Minister, Angus Taylor, said the Advancing Hydrogen Fund met a commitment in the National Hydrogen Strategy, launched at the COAG Energy Council meeting in November 2019 to build Australia’s hydrogen industry into a global export industry by 2030.

“The Australian Government has a strong commitment to building a hydrogen industry which will create jobs, many in regional areas, and billions of dollars in economic growth between now and 2050,” Mr Taylor said.

“Importantly, if we can get hydrogen produced at under $2 a kilogram, it will be able to play a role in our domestic energy mix to bring down energy prices and keep the lights on.

“Our hydrogen industry has the ability to make a tremendous positive impact both at home and overseas.

“From cheaper energy bills and job creation in regional Australia, to playing a role in reducing global emissions both at home and in countries that buy Australian produced hydrogen, the industry’s potential cannot be ignored.”

Mr Taylor also noted that, according to Bloomberg New Energy Finance, this $300 million fund, along with the recently opened $70 million Renewable Hydrogen Deployment Funding Round administered by the Australian Renewable Energy Agency (ARENA), is one of largest commitments to the hydrogen sector made by any government in the world.

Australian Hydrogen Council CEO, Dr Fiona Simon, said, “The government clearly recognises that we can’t take the foot off the accelerator – this pandemic is temporary, but our need for energy is permanent and growing.

“We must improve community and industry energy efficiency by harnessing the power of hydrogen.

“Researchers and innovative businesses across the country are working flat out to deliver hydrogen applications and large-scale supply. Australia needs to have the most efficient and cost-effective energy mix to fuel industry and community requirements, and hydrogen has a crucial role.

“The National Hydrogen Strategy set out that a hydrogen industry would be pursued, and these funds show that the strategy has real commitment. The strategy is a solid plan to build our domestic markets and exports back to the highest possible levels after an economic downturn or any change in global energy preferences.

“Hydrogen can help us to solve our energy dilemma through providing high volumes of energy to industry, cities and homes across Australia and address energy security.

“The Federal Government has taken a step which will give confidence to many business and research institutions that hydrogen is a national priority and will be supported in the future.”

The Government has set an economic goal for hydrogen of ‘H2 under 2’ – that is hydrogen at or under $2 per kilogram – the first technology goal in the Technology Investment Roadmap. That’s the point where hydrogen becomes competitive with alternative energy sources in large-scale deployment across our energy systems. This goal is essential to drive down the cost of new technologies, and the Advancing Hydrogen Fund will help to achieve this price point.

The Government has issued the CEFC with a revised investment mandate, to make up to $300 million available for the Advancing Hydrogen Fund.

APPEA Chief Executive, Andrew McConville, said the natural gas industry was well-placed to assist in the development of a largescale and innovative commercial hydrogen industry, both in using natural gas to produce hydrogen and using gas infrastructure to process and transport hydrogen.

“Australia’s LNG export success story means our industry has the technology, expertise, and commercial and trade relationships to make hydrogen exports a reality,” Mr McConville said.

“There is tremendous interest globally in hydrogen as a new, cleaner fuel. Australia is well-placed to capitalise on our already abundant natural advantage.”

The Australian Government, through the CEFC, has delivered significant projects in the energy efficiency, renewable energy, transport, agriculture and energy-from-waste sectors, facilitating almost $28 billion of clean energy projects Australia-wide since its inception.

In total, the Government has now made available over $500 million in support for hydrogen projects since 2015. These industry partnerships will help develop tangible solutions allowing hydrogen to have a future role in providing affordable and reliable energy for all Australians.

NEWS 6 June 2020 ISSUE 10 www.energymagazine.com.au

POWERCOR’S BUSHFIRE SAFETY DEVICE GRANTED FINAL APPROVAL

Energy Safety Victoria has officially approved a safety device installed in Ararat by electricity distributor Powercor.

Victoria’s energy safety regulator confirmed that Powercor’s Rapid Earth Fault Current Limiter (REFCL) device at the Ararat Zone Substation is fully compliant.

Powercor’s REFCL program is being rolled out in three phases, with the first completed last year.

The Ararat REFCL is the first device to be formally completed as part of phase two.

While the device was first switched on in December 2019 and has been operating in its most sensitive setting on Total Fire Ban Days since, the ESV compliance approval marks the final stage of the Ararat installation.

Powercor REFCL Technical Director, Andrew Bailey, said Ararat was one of ten zone substations supplying numerous communities across the Powercor network to now have the device installed.

“The REFCL device is part of our broader bushfire mitigation program and is already keeping communities safer,” Mr Bailey said.

“While the Ararat safety device is in operation all year round, on days of Total Fire Ban it operates at heightened fault sensitivity, in line with regulatory requirements.”

When the device operates, crews patrol the line to determine the cause of the fault and ensure it is safe for the community before switching power back on.

While this can mean it can take longer to restore a fault on a Total Fire Ban day, it provides added protection to communities and reduces the risk of fires starting from powerlines.

The Ararat Zone Substation supports 6699 customers within the region, supplied by four feeders and 793km of power lines.

REFCL devices are being installed in some of the state’s highest bushfirerisk areas as directed by the Victorian Government’s program in response to recommendations from the Victorian Bushfires Royal Commission.

On 21 November 2019, which was Victoria’s first code-red declared Total Fire Ban day since Black Saturday, REFCLs

detected and activated for six permanent faults and 32 temporary faults. Between October 2019 and the end of March 2020, there were 18 Total Fire Ban days in western Victoria.

On these days, REFCLs activated 13 times for permanent faults and 75

temporary faults. Other communities that will receive REFCLs under phase two are Ballarat North and South, Bendigo, Charlton and Terang.

These are required to be compliant by ESV by 1 April 2021.

7 NEWS www.energymagazine.com.au June 2020 ISSUE 10 PROTECTION IS IN OUR NATURE EVERY CONNECTION COUNTS Animals and vegetation cause up to 30% of outages globally. You can improve your reliability metrics, while reducing your total cost of ownership with TE Connectivity’s Raychem Wildlife & Asset Protection solutions. Our insulating covers and protection products are designed for easy installation and allow visible inspection. They are made of a unique UV-resistant, non-tracking material, field-proven to help protect your assets throughout their service lifetime. Learn more about our Raychem WAP customizable portfolio for medium and high voltage insulation applications at TE.com/wap. ©2020 TE Connectivity. All Rights Reserved. EVERY CONNECTION COUNTS, Raychem, TE, TE Connectivity and TE connectivity (logo) are trademarks of TE Connectivity. WAP ad 122-185.indd 1 06.05.2020 19:21:42

SIGNS OF HOPE FOR THE POST-COVID WORLD

As we’ve moved through the stages of responding to COVID-19, there’s plenty to remain positive about in the energy industry.

8 INDUSTRY INSIGHT

It’s now been more than three months since we started to seriously feel the effects of the coronavirus here in Australia. We’ve moved through the various stages of lockdown, and are now slowly starting to chart the course to recovery. The economic impacts of the crisis have been immense, and the energy industry has not been immune. Here, we take a look at how the crisis has unfolded and impacted the energy sector, and look ahead to some of the opportunities this unprecedented event will provide us with moving forward.

In the first weeks of the unfolding COVID-19 crisis, federal and state governments moved quickly to establish a coordinated national approach to managing the impacts of the pandemic, fully supported by industry associations and energy utilities.

Federal Government initiatives were announced, a number of the state governments announced payment freezes or subsidies for household and business energy bills, and energy retailers moved quickly to provide support to customers experiencing hardship.

The Federal Government, through the Australian Energy Regulator (AER), also quickly set reasonable expectations of energy companies to protect households and small business customers during the COVID-19 pandemic.

The Australian Energy Council (AEC) confirmed that energy retailers were ready to provide scalable, accessible and tailored assistance to all affected customers. AEC Chief Executive, Sarah McNamara, also welcomed the AER’s recognition that the viability of energy businesses must be protected.

“For that reason, over the coming months, a whole-of-sector response is vital to achieve the best outcomes for

customers. We look forward to working with the AER and other market bodies, governments and stakeholders on the best ways to share the risks and costs across the sector and work through these expectations,” Ms McNamara said.

Energy Networks Australia CEO, Andrew Dillon, backed up these comments and said networks were working to assist customers.

“Networks continue to discuss with governments, regulators and retailers about the best ways to support customers through this difficult period,” Mr Dillon said.

“Energy networks understand many households are also facing challenging circumstances. With many customers now working from home, networks are doing what they can to minimise the impact of planned outages for critical work and to keep them as short as possible.

“Safely keeping the lights on and the gas flowing for the months to come is critically important, and networks are continuing to undertake critical works to keep energy supplies safe and reliable.”

Together with ENA, the AEC devoted significant effort in the immediate aftermath of the pandemic on maintaining the safety of energy industry people, ensuring the security of the energy system, and supporting customers who were experiencing difficult circumstances.

“Safety is always our top priority. Energy companies have undertaken a range of measures in response to this pandemic to ensure its workforce, assets and energy supply are protected,” Ms McNamara said.

“There continues to be industry-wide consultation on pandemic preparations and necessary responses with AEMO in regular discussions with generators, network and transmission companies and gas companies.”

Pandemic response measures underway include:

» Ensuring essential supplies, including the stockpiling of fuel supplies

» Reviewing any scheduled plant or network outages for maintenance and assessing the need and potential for rescheduling

» Further restricting access to control rooms and limiting access to areas required by critical staff

» Splitting of teams and establishment of multiple, separate teams

» Rostering changes

» Non-contact and social distancing for shift changes

» Implementing new working arrangements, including having staff work remotely when feasible

» Monitoring of essential service providers

» Maintenance of personal protective equipment stocks

9 INDUSTRY INSIGHT

The ENA also moved to remind customers that part of keeping the lights on and gas flowing during these uncertain times is continuing to carry out scheduled maintenance works across our networks. Many utilities have reported frustration from customers having their services shut down during this challenging period; however Mr Dillon reminded customers that “there is a need to continue critical maintenance to protect lives, prevent damage to properties and keep the power on for the future”.

Ensuring a steady stream of supply

In the upstream energy sector, the Australian Petroleum Production & Exploration Association (APPEA) and Australian Pipelines and Gas Association (APGA) are both working with members, governments and energy users to ensure the delivery of essential gas supply to local customers.

APPEA Chief Executive, Andrew McConville, and APGA Chief Executive Officer, Steve Davies, confirmed members were taking all steps necessary to ensure the production and delivery of gas supplies continued.

Mr Davies said the upstream and pipeline industries had robust operational integrity measures in place at all times, but were vigilant to the additional challenges posed by COVID-19.

“We are ensuring good information flows and open channels of communication as they are absolutely essential elements of the response in this rapidly changing situation,” Mr Davies said.

“We are continuously monitoring the situation and are taking appropriate precautions to ensure the energy we need in our homes, commerce and industry is delivered.”

A word from the frontline

The country’s energy utilities have been quick to reassure customers that they have the necessary precautions in place to maintain supply while protecting the safety of employees and the community.

Common themes in the response from energy utilities have been strict isolation protocols; limits on face-to-face interactions where possible; additional cleaning of sites and workplaces; additional personal protective equipment for staff; telephone contact with customers before crews arrive; and phone notification of future outages, rather than face to face.

Other measures include increased infection control measures, ceased business-related international travel, and teleconferences rather than face-to-face meetings where possible.

Most companies have also established separate locations, backups and staffing in critical service areas like control rooms; and have limited access to, and contact between, those teams to sustain customer operations in the event a case is confirmed.

Changing demand

Another element of the changing pandemic operating environment is the shifts in demand that have occurred as a result of the pandemic.

The Australian Energy Market Operator (AEMO) has advised that they expect that reductions in demand may continue to increase incrementally over time at current levels of restrictions, with some states likely to exhibit changes in demand.

Some potential COVID-19 demand impacts have now been recognised in Victoria, where average demand reduction during morning peaks reached eight per cent (approximately 400MW) for the first time over a working week in the state.

The midday trough fell five per cent (approximately 200MW) from pre-COVID-19 levels on weekdays, and three per cent on weekends (approximately 100MW), and rooftop solar variability makes it uncertain if the demand reductions are from COVID-19.

Elsewhere across Australia, COVID-19 demand reductions continue to be observed in Queensland and New South Wales, which have seen further falls in demand over the weekday morning and night-time, while reductions continue to be lower on weekends.

As restrictions are progressively lifted, demand is expected to increase, as has been demonstrated in overseas cases, including, most prominently, Italy.

In addition, AEMO expects that as cooler weather prevails, Australians might see an increase in load volatility, reflective of a greater proportion of residential (weather sensitive) load on the grid. All regions except Queensland are expected to see a lift in maximum and minimum demands during the cold weather.

It’s important to note that Australia, overall, has seen only moderate reductions in demand as a result of the pandemic.

An evolving industry

Despite the challenges the industry has been facing, many industry bodies and commentators are also viewing the pandemic, and the changes it has brought with it, as a chance to implement the changes we have been needing as an industry for a while now.

According to Matt Rennie, EY’s Power & Utilities Leader, the energy transition will not stop because of COVID-19; it will stall, and then accelerate.

“There is no doubt that one of the big winners from the current COVID-19 crisis will be battery/solar companies and virtual power plants,” said Mr Rennie.

“Our research shows that batteries and solar energy on households will reach cost parity with the grid next year.

“As the economy re-opens, we expect to see a boom in home electrification. This will place more pressure on AEMO, and network companies, to get the necessary frameworks and regulation in place to deal with bi-directional flows on the network.”

The Clean Energy Council meanwhile is arguing that the clean energy industry should be a key part of the economic recovery from the crisis.

It has released a report, A Clean Recovery, which highlights the fact that an enormous pipeline of wind and solar projects across Australia should be brought forward to:

» Create over 50,000 new direct jobs –and many more indirect jobs – in the construction of these projects, and an additional 4000 ongoing jobs in operations and maintenance.

» Triple the amount of large-scale renewable energy installed in Australia. Over 30,000MW of new capacity would be built, on top of the existing 16,000MW of renewable energy generation in the National Electricity Market, accelerating Australia’s shift to a grid dominated by clean energy.

» Drive down power prices and empower energy consumers with rooftop solar and household batteries.

» Inject $50 billion worth of investment into the Australian economy, particularly in rural and regional areas where these projects are located. This investment would be delivered by investors and allow government to direct scarce taxpayer funding to other essential services and areas.

For its part, the Australian Energy Market Commission (AEMC) has stated that the COVID-19 crisis should serve as a reminder of the importance of reform – including striving for a more secure, reliable and cheaper energy system.

According to AEMC Chair John Pierce AO, right now, the Commission is doing its bit by helping to ensure the power system is resilient enough to deal with what the crisis brings.

Along with energy market body colleagues Clare Savage and Audrey Zibelman, Mr Pierce has been consulting exhaustively on plans to both protect consumers and to ease the regulatory pressure on industry during the pandemic.

June 2020 ISSUE 10 www.energymagazine.com.au 10 INDUSTRY INSIGHT

“At the same time, we are deeply committed to ensuring that important energy market reforms are progressed in a way that accommodates and responds to the conditions that we all now find ourselves in,” said Mr Pierce.

“As well as keeping the lights on during the crisis, it is crucial that we continue working on reforms that will help position Australia for a successful recovery when the crisis recedes.

“The three market bodies, with our distinct roles and shared objectives, are working together to ease the path of transition.”

According to Mr Pierce, it’s important that all three bodies remain focused on what we want our energy systems to look like post-crisis. He also noted that work to

unlock innovation made possible by new technologies and digitalisation is going ahead, albeit with considerable flexibility.

In particular, Mr Pierce signalled a continued commitment to the implementation of five-minute settlements, as well as the ongoing reform of the frequency control frameworks.

Key focus areas for the AEMC in the weeks and months to come include the security of the grid system, as we move away from baseload power to intermittent resources; and security of supply, particularly on peak demand days.

The path forward

As the industry, and indeed the world, moves past the initial phases of the crisis, which involved deep shock, significant

challenges and considerable change, the next step will be adjusting and adapting to the new normal we find ourselves in.

The most important priorities of keeping the lights on, and protecting our most vulnerable customers, have been achieved remarkably well, given the circumstances we have been dealing with.

Pleasingly, and as outlined in this article, the industry’s governing bodies seem intent on focusing on the opportunities that present themselves as a result of the enormous change we’re going through.

Like any industry, and like any individual, the path ahead won’t be easy. But there are signs of hope, and exciting new projects and objectives to focus on and work towards as we begin the path of recovery from COVID-19.

www.energymagazine.com.au June 2020 ISSUE 10 11 INDUSTRY INSIGHT

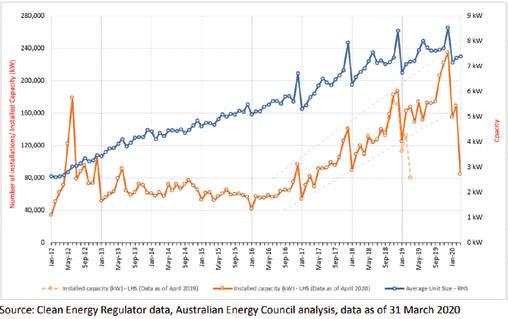

As many industries have moved to having employees working from home, demand profiles across the National Electricity Market have been shifting.

COMPASSIONATE AND POSITIVE LEADERSHIP DURING COVID-19

Mere months after his appointment as the new CEO of Powershop and Meridian Energy Australia, Jason Stein was faced with a baptism of fire: a devastating global pandemic. Energy magazine spoke to Jason about Powershop’s strategies to support customers through COVID-19, his visions for the company, and how to find opportunities amidst disaster to create a sustainable future for Australia.

Since it was founded in 1998, Meridian Energy, along with its retail arm, Powershop, has grown to break ground in the Asia-Pacific region’s renewables space: Powershop is now Australasia’s largest 100 per cent renewable energy generator, Meridian Energy achieved the largest IPO in New Zealand, and the company is also the largest electricity generator in New Zealand.

Expanding its operations to Australia in 2003 and founding Meridian Energy Australia in 2007, the company has continued to drive the development and operation of an integrated energy business underpinned by renewable energy generation.

In November 2019, Jason Stein, a long-time employee of the company, was appointed as Chief Executive for Meridian Energy Australia and its subsidiary, Powershop Australia.

Taking over the role from Ed McManus, Jason has assumed leadership of both Powershop and Meridian’s Australian renewable generation business.

After working for Meridian for almost 12 years, Jason has developed a wealth of knowledge and experience across all aspects of the company. He previously held the position of General Manager of the Office of the Chief Executive, where he was General Counsel and Company Secretary, accountable for the Sustainability, Legal, Regulatory, Government Relations and Communications functions.

But when he relocated from Wellington to Melbourne to begin his new role as CEO of Meridian Energy Australia and Powershop Australia, Jason hardly expected he would soon be steering the company through a global pandemic.

With empathy, positivity and determination, Jason has swiftly adapted to changing conditions to enable Powershop to continue supporting its customers through unprecedented challenges.

Stepping up to lead the way on climate change

Jason is obviously extremely passionate about the prospect of delivering affordable renewable energy to customers.

When asked why he wanted to take on

the Chief Executive role, Jason cited the importance of renewable energy uptake amidst the global climate crisis.

“The opportunity to lead this organisation at this particular stage of the climate change conversation was a huge reason for me to take the job,” Jason said.

In May, the Australian Energy Market Operator released its Renewable Integration Study, suggesting that wind and solar resources could, at certain times, provide as much as 75 per cent of Australia’s energy by 2025.

The study shows that while there are technical challenges to maintaining system security as Australia increases its reliance on renewables, it already has the capabilities to meet those challenges.

For Jason, Powershop’s role is to provide a clean option for the increasing number of energy customers who value long-term ecological sustainability.

“We are really focused on helping Australia move to renewable generation, and giving customers a choice to choose an energy provider that puts the environment at the heart of what it does and is doing good things,” he said.

June 2020 ISSUE 10 www.energymagazine.com.au

12 RETAIL

www.energymagazine.com.au June 2020 ISSUE 10 13 RETAIL

“Fundamentally, I actually do believe that Australia needs more renewables in our generation, and we are committed to continuing to invest in that. And the continued investment over time will help decrease energy costs for Australian households.”

Jason said he wanted Powershop to lead by example, making positive change both internally and externally.

“We do strive to do the right thing for our customers and for our employees, and for our stakeholders as well, regardless of what the industry as a whole is doing.”

What Australians are looking for in a power provider

At such a unique time in history, the energy sector is not only highly competitive, but also rapidly evolving. Power providers must recognise that customers’ needs and preferences are changing with the times.

For Jason, Powershop’s strategy shows that when a provider articulates a

compelling reason for customers to join up, it becomes a self-fulfilling prophecy.

“Australians are looking for energy providers that support the values that they support, so Powershop is focused on giving Australians the choice of an energy provider that aligns with them,” he said.

“We’re focused on ensuring that customers know we're doing the right thing for them and the environment, and ultimately, the more customers we get, the more we can invest in renewables. And that's what we'll continue to do.”

For Jason, it is inevitable that more people will start choosing their power providers with sustainability in mind, and that customers will start to lead the way towards greater renewable uptake in Australia.

Seeing the impacts that carbon emissions are starting to have, and the response we’ve had after the summer bushfires – it will cause more people to think about where their energy comes from.

Compassionate, customer-centred support during COVID-19

Tragically, Australia’s devastating bushfires have not been the only disaster to severely impact the energy sector this year. The COVID-19 pandemic has presented unprecedented challenges with global ramifications.

Right now, however, the immediate priority for Jason is for the sector to band together to mitigate the impacts of the pandemic, built around an empathetic, customer-centred approach.

To achieve this, Powershop is supporting its customers and continuing to work on its customer support programs and initiatives. The company is regularly reviewing these initiatives to ensure that they are appropriate and actually meaningful for the people who need them.

“I've been pretty impressed by the really positive way that all in the industry have been dealing with COVID – and in particular the customer focus at this time,” Jason said.

June 2020 ISSUE 10 www.energymagazine.com.au

14 RETAIL

“Many of our customers are facing great pressure and anxiety at this time. From my perspective, it's wonderful to see the industry being human with customers and showing compassion.

“We're trying to help those people with things like payment plans; but over and above that, when I think about the people in our team assisting these customers, it’s about showing them empathy and kindness above all else.”

Energy sector collaboration crucial for customers

Beyond the tragic deaths of over 200,000 people worldwide, the COVID-19 pandemic has also wrought havoc on the global economy. It’s been estimated that approximately eight per cent of Australians – or 1.6 million people – lost their incomes in the first week of lockdown.

For their part, energy retailers are working on numerous measures to assist customers experiencing financial hardship as a result of lockdown.

This has been assisted by new interim authorisation from the ACCC for the sector to cooperate on developing relief measures to residential and business customers.

“There has been distinct collaboration, and plenty of industry initiatives that are working well – and collaboration across all parts of the industry isn't always easy,” Jason said.

Nevertheless, the challenges presented by COVID-19 are unprecedented.

“The reality is, our customers are going through a once in a lifetime problem. Our customers are very loyal to us, and we want to repay that loyalty by helping them in a meaningful way.”

In such extraordinary circumstances, Jason said energy retailers have a responsibility to support Australians through uncertainty.

“It’s also really important that we recognise our role, as a power provider, in helping the economy when we get through this, to allow smaller businesses in particular to get through to the other side of this crisis. Making sure that we have adaptable and flexible plans for those customers is really critical.”

Adapting fast, staying nimble: leadership during a crisis

The nation-wide lockdowns mandated by state and federal governments to combat the pandemic have, of course, required major changes for Powershop’s staff. The

company’s customer support team, based in a small provincial town in New Zealand, have all transitioned from a call centre environment to working from home.

This transition was made easier by the fact that, well before the pandemic hit, Powershop had already been testing the possibility for its staff to work from home. Staff only need a work laptop, which allows the platform to seamlessly transition to any location.

“It was actually a part of our regular thinking about how we deal with crisis,” Jason explained.

“We have a good sized call centre, but we aren't super large, which allows us to be agile and nimble. We still kind of have that startup mentality, and we actually managed to get everyone working seamlessly from home over a day or two.”

Jason gave a shout out to Powershop's frontline staff, whose work he described as “brilliant”.

“It isn’t easy working from home when you’ve got children there, but these guys have been the unsung heroes, quietly and calmly getting on with keeping the business running smoothly.”

Leading the more than 90 staff of Powershop and Meridian Energy Australia through an unexpected global crisis is an extremely daunting prospect. But Jason said his familiarity with the business from almost 12 years’ service has made leadership during this time much easier.

“I know the business well, I've been around the Australian market for a number of years. And I’ve known the executive team for a number of years. So it's been very seamless.”

Jason said the organisation’s emphasis on fostering a highly collaborative and connected culture also assisted in managing COVID.

“We've accelerated the use of our existing technology to keep the team connected and informed and engaged. We've actually maintained all of our regular team routines and rituals, such as our usual, twice weekly all staff meeting.”

And that means the entire business – including workers at the top of wind turbines.

“We also do things like continuing our regular kitchen table trivia, it’s just all happening online now. In fact, this week, I had my first ever experience of a virtual lunch to farewell a really long-standing employee.”

Jason said he and his team are tuned in to those possible impacts of the pandemic

on culture and wellbeing, particularly as a result of working remotely. Management regularly checks in on staff and is providing strategies and initiatives to support the team as well as the business.

“For me personally, I want to keep in touch with most people, either directly or indirectly. So I've seen or heard from almost everyone in our business since lockdown,” Jason said.

“I guess in a personal way, it's my real firm view that as an organisation, in the long run we'll actually be judged by how we demonstrated empathy, positivity and put our staff and customers first.

“As a leader, I still really believe that call to action is right. It's important to demonstrate kindness and respect, but with a real focus on the positive opportunities that arise.”

Positive thinking: creating opportunities amidst disaster

The devastating impacts of Coronavirus have disrupted 2020 plans and sparked widespread debate about the ‘new normal’ – and what the sector will look like in a post-COVID world. Jason believes part of this process of readjustment and recovery will necessarily involve deeper thinking about the environment and people's impact upon it.

For Jason, the key to making the most of any crisis situation is focusing on the positives.

“We do believe that as a result of this unexpected event, opportunities will arise,” he said.

In order to take advantage of these opportunities, Powershop is continuing to develop its pipeline of renewable energy projects in Australia, so it can increase the size of its generation – either through its own development opportunities or through acquisition.

“We announced a few months back that we would purchase a development opportunity in New South Wales, and we continue to look at others that are at various stages. We have a very active development team who are looking to shift the dial there – we’re not sitting back and waiting for things to happen,” Jason said.

“What hasn't changed is our commitment to build a sustainable energy future for Australia. So we're still focused on growth, and ultimately, our focus remains on making a real difference for Australia by investing in renewable generation, and giving customers the choice to buy from a company they can be proud of.”

www.energymagazine.com.au June 2020 ISSUE 10 15 RETAIL

INCLUSIVE ENERGY: SUPPORTING CUSTOMERS WITH DISABILITIES

June 2020 ISSUE 10 www.energymagazine.com.au 16 RETAIL

www.energymagazine.com.au June 2020 ISSUE 10 17 RETAIL

With one in five Australians estimated to be living with a disability, it’s important for companies to be inclusive and understanding to the needs of their diverse customer base. Energy bills can be confusing at the best of times, but for some Australians, understanding the difficult language that comes with their bills can be a daunting task. With a new set of guides developed by AGL and disability support organisation Scope, customers now have access to important information about their energy usage and bills.

For customers it’s important that they have access to important information concerning their bills, so that they can make informed choices about their usage and payments. Unfortunately, there can be a lot of information that is difficult for people to understand, with walls of text and unfamiliar words causing stress for customers.

In an effort to be more inclusive and sensitive to the needs of consumers, energy company AGL has developed a set of guides which aim to assist customers in understanding their energy bills. In collaboration with disability support organisation Scope, the easy English guides were developed with the aim of providing accessible information using simple language, clear fonts and images.

The easy English guides were designed using evidence-based best practices, including employing and liaising with people with low English literacy, to create a simplified source of information without unnecessary jargon.

The guides were developed for a range of audiences, including the estimated 44 per cent of Australians who have difficulty reading and writing, including people with intellectual disability and people from culturally and linguistically diverse backgrounds. With large, clear fonts and images, the guides are also a useful tool for the elderly and people with low vision.

By providing customers with information written in easy English and accompanied

How to save energy and save money

Energy Efficiency Guide

Easy English

by helpful images, people are able to do everyday tasks like banking, paying bills, and using online services.

AGL Customer Advocate, David Bland, said that the guides help empower people to make informed decisions when it comes to their energy usage and bills.

“Energy is complicated, and bills are at times difficult to understand, so it’s so important we meet the needs of all of our customers,” Mr Bland said.

“We conducted research with the University of Melbourne and the Thriving Communities Partnership into improving access and support for consumers with cognitive disabilities.

“We have developed eight guides, covering reading bills, energy efficiency and payment support options, in a style that provides understandable and concise information for people with low literacy.”

With people currently spending more time at home, understanding how to be energy efficient and save money is a big priority. With the assistance of the easy English guides, customers will be able to engage with their usage and make informed decisions for themselves and their families.

To further assist customers who speak little English or who have a different first language, AGL has also translated some of its easy guides into commonly spoken

languages including Chinese, Vietnamese, Italian, Korean and Arabic.

The guides themselves break down different topics, highlighting common difficult words in blue and providing helpful explanations. They also highlight important information with images and provide information on who to contact in an emergency. There is also a section at the end of each guide where customers can write further notes to assist them in the future.

AGL has also made the guides on energy efficiency available to other energy companies to help them assist their own customers and to maximise the benefits of the guides across the community.

“We are sharing our energy efficiency guide with other energy retailers, generators and network operators so they can also help their customers understand how they can manage their energy use,” Mr Bland said.

By providing consumers with tailored information, customers are able to experience a better quality of customer service and feel more empowered when it comes to their energy usage and bills.

Adapting to the needs of customers is an important step to become a more inclusive world.

June 2020 ISSUE 10 www.energymagazine.com.au 18 RETAIL

Low emission natural gas

Powering Australia to a clean energy future.

Natural gasNaturally part of every day.

bright-r.com.au

Brighter is an initiative of the Australian Petroleum Production & Exploration Association. Authorised by S Browne, Melbourne.

TASMANIA:

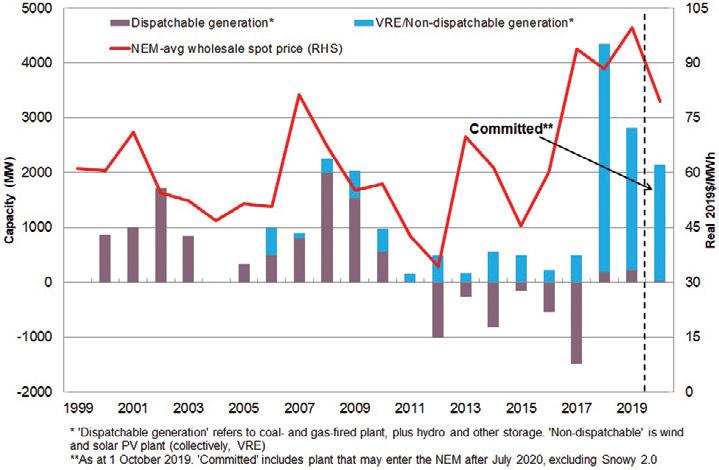

Australia’s National Electricity Market (NEM) is undergoing a major transition, from dependence on fossil fuel, to predominantly using renewable energy. Accurately predicting what the future power system will look like is incredibly difficult, particularly in a time of rapid change. Yet it is clear that the variable generation renewables provide will need to be backed by sufficient flexible supply options (such as storage) to ensure the reliable electricity Australian customers expect.

This is where Hydro Tasmania’s Battery of the Nation project, and the deep storage opportunities it offers, comes in. The project is not a new one – it was first flagged in 2017, and has regularly formed a part of the national discussion regarding the changing energy market since then.

Battery of the Nation is about investigating and developing a pathway of future development opportunities in hydropower system expansion, including pumped hydro.

Tasmania has significant potential in the future development of wind and hydropower, coupled with more transmission and interconnection. Through Battery of the Nation, Tasmania could make a much greater contribution to the NEM, delivering more clean, reliable and affordable energy.

Tasmania is well placed to support the transition of the NEM, and has set a renewable energy target of producing 200 per cent of its current needs by 2040.

Tasmania’s naturally favourable topography and existing hydropower system provide an ideal opportunity to develop cost-effective deep storage pumped hydro that Australia needs to manage uncertainties and achieve a reliable future NEM.

What is deep storage – and why do we need it?

Deep storage is energy storage with the ability to operate over many hours as an optimal, least-cost choice, able to manage realistic uncertainty in the power system. It will play a critical role in efficiently supporting Australia’s energy transformation.

The Australian Energy Market Operator (AEMO) first started using the term “deep storage” in 2019, in discussions about the different sorts of storage requirements the market of the future would need.

“Up until recently storage was just storage, but the market planner last year started to point to big differences between what you might call shallow and deep storage,” said Christopher Gwynne, Battery of the Nation Project Director for Hydro Tasmania.

“Shallow storage essentially is storage that is less than four to six hours worth of storage in terms of its duration. Deep storage has a longer duration, greater than twelve hours.”

As the market transitions to having more input from renewable sources, these forms of short, or shallow storage, are the ones we need in place first – and they’re the ones we’re already starting to see on the market, in the form of projects like the Hornsdale battery in South Australia, and smaller, distributed batteries.

But according to Mr Gwynne, most of the analysis that’s going on around the world is showing that as markets move further into their transformations, longer, deeper storage options are required in order to maintain a stable and reliable power system.

June 2020 ISSUE 10 www.energymagazine.com.au

20 STORAGE

PROVIDING THE DEEP STORAGE AUSTRALIA NEEDS

www.energymagazine.com.au June 2020 ISSUE 10 21 STORAGE

“What this means is that by the mid to late ‘20s, we’re going to need some of these longer duration, deep storage assets to start to come into the market,” said Mr Gwynne.

“The value of this type of storage is in the fact that it’s better placed to manage longer term variations in supply, like what we might see during a wind drought, or a successive number of days of low solar output in the system.

“When dealing with these conditions, you’re going to need deep storage to help manage the reliability of the system.”

Potential sites and timelines

When it comes to the sites Hydro Tasmania is considering for hydro storage development as part of the Battery of the Nation initiative, Mr Gwynne is very clear on the fact that all sites under consideration need to have a clear linkage to the mainland.

In the case of Battery of the Nation, this is in the form of the concurrent Marinus Link project, a proposed 1500MW capacity undersea electricity connection to link Tasmania and Victoria.

This project, proposed by TasNetworks, would be delivered in two stages – in the first stage, 750MW would come online around 2027, with another 750MW a year or two after that. Hydro Tasmania is looking to have a Battery of the Nation pumped hydro site online to coincide with the launch of the second cable.

“The reason for this is because you have to remember that the whole existing hydropower system in Tasmania is like one big deep storage asset already – and it’s a deep storage asset that has excess capacity in it at the moment,” said Mr Gwynne.

What that means is that when the first Marinus Link cable is connected to the mainland, it will essentially be able to utilise the existing Tasmanian scheme to bring additional storage capacity to the Victorian market in particular.

June 2020 ISSUE 10 www.energymagazine.com.au 22 STORAGE

Hydro Tasmania’s infrastructure at Lake Plimsoll.

“The reason why we can do that is because when that first cable is built, a lot of wind and solar development will be stimulated, not just in Tasmania, but most likely in Victoria as well,” said Mr Gwynne.

“So all of a sudden, Tasmania isn’t relying on our hydro systems to keep the lights on all of the time anymore – we’ll have new sources of supply to assist in doing that. That then allows us to better use the storage attributes of the hydro system, which is a much better use of that asset, rather than providing baseload energy all of the time.”

Hydro Tasmania is then looking at commissioning a pumped hydro site to come online when the second Marinus cable is connected.

“We’re currently looking at three sites, and each of these is in quite intensive feasibility assessment at the moment,” said Mr Gwynne. “We’ve got two in the north-west, one at Lake Cethana and one at Lake Rowallan. They’re both lakes that are in our existing hydropower scheme, we would augment them to be able to manage a new pumped hydro station. The third site we’re looking at is on the west coast, in our existing system again, parallel to the current Tribute Power Station. That site would effectively be connecting up two existing reservoirs we have in our scheme, and we’d be building a new pumped hydro station there.”

The next step for Mr Gwynne and his team is to narrow the three sites under feasibility down to one, which will happen over the next 12 to 18 months. Conveniently, this timing lines up with the Final Investment Decision on Marinus Link – so when the market makes its decision on this project, Hydro Tasmania will be ready to pull the trigger on its preferred site and commence construction.

Who still needs convincing?

Given the benefits Battery of the Nation has to offer, and the clear need we will have for deep storage as we transition to cleaner sources of energy, it does raise the question: who still needs to be convinced that this project will be a necessary part of our future energy system?

“One of the challenges that we’ve had with this project right from when I started, which was back in 2017, was that there was a really low level of awareness in the broader national market on how the Tasmanian power system worked, in particular the hydro system,” said Mr Gwynne.

“That’s not a criticism; it’s just the fact that no one really needed to know how it worked, because it was a physically separate system in the NEM.

“So when we started talking about the potential of pumped hydro development in Tasmania, many people assumed that the hydropower system in Tasmania worked exactly like the existing Snowy scheme, and looked at it through that lens. However, they’re very different systems.”

According to Mr Gwynne, Snowy has never been used like baseload generation. Its role in the market has never really been to keep the lights on 24/7, it’s been there to fill the gaps when other forms of generation weren’t able to do the job.

For Hydro Tasmania however, its role has always been quite different. It has had to keep the lights on, and because of this, it is a very different system to Snowy.

“Because these differences aren’t widely known, our focus has been on building an understanding of what the potential looks like in Tasmania, and why this should be a project that figures in the market of the future,” said Mr Gwynne.

“We’re also building an understanding of the benefits that will come with building another interconnector between Tasmania and Victoria.

“It’s only when you understand the power of the hydro system that sits at the other end of the cable, and the potential for what it could do when we start to reach higher levels of renewable energy penetration in the system, that’s when you start to fully appreciate the benefits that come from building another interconnector.”

According to Mr Gwynne, the conversations that are happening in the industry and the market about these two intertwined projects are critically important right now, as we start to take the first steps towards the renewable energy future we’ve long been talking about.

The future is uncertain and we need sound supply options

Key strategic decisions in coming years will shape the NEM for decades to come; and yet, the same factors that are prompting the critical infrastructure decisions are also the source of substantial uncertainty.

Increasing levels of low-cost wind and solar will result in increased need for flexible supply, such as storage, to maintain reliability.

Deep storage provides a robust plan for the future NEM. As the supply options in the power system become more variable, storage will need to play an increasingly important role.

Importantly, for over 100 years, Hydro Tasmania has managed the challenges of ensuring reliability in a power system dependent on weather-driven renewable energy. This provides a strong understanding of how longer storage duration supports more flexible operating choices.

Hydro Tasmania is quick to point out that there is a role for all storage types in the energy market of the future. The role for deep, longer duration storages will be in maintaining system reliability. For the market we wish to have in the future, Battery of the Nation is of vital importance.

www.energymagazine.com.au June 2020 ISSUE 10 23 STORAGE

HYDROGEN’S ROLE IN DECARBONISATION: ENSURING A RESPONSIBLE TRANSITION

by Dr Daniel Roberts, Leader, Hydrogen Energy Systems Future Science Platform, and Dr Justine Lacey, Research Director, Responsible Innovation Future Science Platform, CSIRO

Australia is blessed with vast energy resources, many of them renewable. Some of the nations to which we export our coal and gas are not so fortunate and are grappling with how to transition from a reliance on these imports to lower-emissions alternatives. As a result, people are now exploring how hydrogen could play a role as Australia navigates its own transition to cleaner energy.

Hydrogen may seem new to some, but it has been used for almost a century as an industrial feedstock. For decades, scientists have been espousing its virtues more broadly as a carbon-free energy carrier, suitable for use in transport, domestic and industrial energy applications. The challenges with transitioning this concept from the lab to industry have largely been in the areas of economics and infrastructure, which meant that for a long time, hydrogen energy applications have remained in the realm of research and development.

But much has changed.

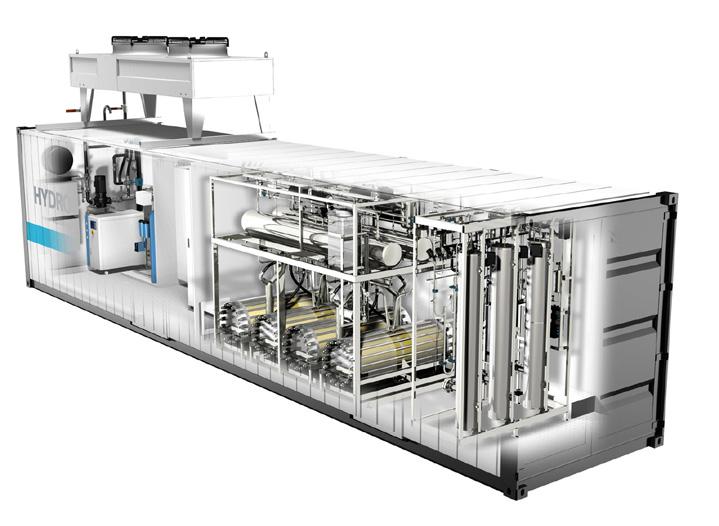

The cost of wind and solar PV have decreased significantly. Electrolysers (which use electricity to produce hydrogen from water) are now larger and more affordable. And fuel cells and storage for hydrogenpowered cars are lighter and more efficient. In the context of renewable energy export, there are new technologies supporting the storage and distribution of hydrogen at scale. Hydrogen now has the very real potential for use in transport, power generation, smoothing out grid fluctuations, storing energy in off-grid applications and export. In addition, hydrogen demonstration projects are already taking place at scale across the value chain in Australia and around the world.

24 FUTURE ENERGY

June 2020 ISSUE 10 www.energymagazine.com.au

25 FUTURE ENERGY June 2020 ISSUE 10

To decarbonise our energy systems, CSIRO is looking at the responsible innovation of hydrogen technologies as well as the technical challenges. For successful adoption, there needs to be social awareness and acceptance. (Image credit: CSIRO.)

26 FUTURE ENERGY

June 2020 ISSUE 10 www.energymagazine.com.au

It seems at first glance that hydrogen may well be the decarbonisation silver bullet whose time has now come. Many involved in the rapidly-growing hydrogen sector would support this notion, and from a technical perspective, hydrogen systems have the potential to have significant positive impacts. Of course, there are challenges to realising these: those related to cost and technological readiness are welldocumented, and most roadmaps and action plans are clear on the pathways to address them. There remain, however, some non-technical challenges that need to be managed. Where and how we source the hydrogen and the motivations behind it, for instance, are already complex issues. Issues like these, along with the range of perceptions that exist regarding safety, impact the acceptance of these new technologies by the public – and we know that community and public acceptance is required if large-scale activities are to be supported.

The colour of hydrogen

A spectrum of colours of hydrogen has emerged. Black and grey are often used to describe hydrogen made in the ‘traditional’ way from coal and natural gas, respectively (with brown sometimes thrown in if the coal is a lignite). If the carbon dioxide from these processes is captured and stored, then the hydrogen is blue. Green hydrogen is made from renewable energy. The discussion around the colour of hydrogen is relevant in the context of a responsible transition towards net zero emissions and is already emerging as a divisive theme. Hydrogen’s benefits are technically achievable. But using green hydrogen, at the scale and costs needed by short-to-medium term global demand projections, is assessed by many as being difficult.

One response to this has been the use of grey and blue hydrogen as a means of supporting cost-effective, large-scale projects, increasing the green content as costs fall and availability increases. Central to the success of these projects is the matter of trust: what will be the driver to move away from cheaper, lessgreen hydrogen in the future?

Who is allowed to play?

The discussion around the colour of the hydrogen we use represents just one of the challenges faced as hydrogen moves from an ideologue’s dream to an emerging industrial reality. It follows from the arguments above for using a grey-blue-green transition pathway that for the transition to be successful at scale it is likely that we will need large companies to be part of it, and in many cases, to be leading it. This is certainly the view of the IEA as discussed in its report on the oil and gas sector and the energy transition1. Such organisations would bring momentum,

1 https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions

scale, and influence; however, some also bring a fossil fuel history that is deemed by many as unwelcome in the new age of renewable hydrogen.

As carbon-intensive companies transition to include (often green) hydrogen into their business plans, a related aspect that needs to be considered is a social license to operate. We know how important social license is from our experience with onshore gas and other contentious energy activities. If societal expectations are encouraging these companies to make the transition to renewable energy supply, how might that translate into consumer demand for new hydrogen opportunities as they emerge?

These discussions show how even though hydrogen is usually communicated as a good news story, there are many aspects that can be perceived as negative. This is important for recognising why different stakeholders might initially respond in different ways to new and sometimes unfamiliar hydrogen technologies. Understanding how different stakeholders make sense of the roles, benefits and impacts of hydrogen energy systems is important for understanding their long-term uptake and acceptance.

Bringing the people along: the importance of public acceptance

For successful adoption, hydrogen energy needs to be accepted and supported by government, industry and communities, and we have seen how this might not be as simple as initially thought. Understanding the societal and community impacts of new hydrogen energy systems, including concerns about safety and the environment, alongside the economic opportunities that are emerging, are important in this regard. And while we can point to plenty of benefits, it does not necessarily follow that Australian communities are ready to make the shift.

Research tells us that while the public has a generally positive attitude towards hydrogen energy, their current awareness of hydrogen and its potential uses is low2. There are certainly positive perceptions of the environmental benefits of hydrogen energy systems, especially those based on renewable energy; however, there is also a range of negative views about safety, cost and efficiency, as well as where the hydrogen comes from.

Building awareness about safety measures, standards and regulation is required to create a sense of acceptable risk (like that with other fuels) to support more positive attitudes towards hydrogen as an energy source. This presents an opportunity for effective communication and collaboration about the potential for hydrogen in Australia, but also to integrate the safety case into planned activities and outcomes of demonstration projects – such as that done by the H21 suite of projects in the UK3. Such an approach will allow researchers, industry, government and communities to work together to determine whether these new hydrogen energy systems are safe, sustainable and acceptable.

At CSIRO, we are conducting research to understand how community values, aspirations and needs can inform fit-for-purpose communication strategies about the industry and specific projects, especially for remote and regional Australian communities. We are also supporting co-design of engagement strategies in partnership with hydrogen demonstration projects.