How to get to 100% renewable gas by 2050

The projectmega sending power from the NT to Singapore

Electricity distributor lessons from the NSW floods

Exclusive:

ISSUE 18 · June 2022 · www.energymagazine.com.au

CHRISTINE CORBETT TALKS AGL’S FUTURE

Introducing hyCLEANER solarROBOT now available in Australia Self propelled user friendly Robot that can be used on large solar

with its modular

and

driving functions

roisystems.com.au 1800 088 990 | Email | Website | Free Call Contact us today for more information

systems

design

automated

info@roisystems.com.au

Undoubtedly, one of the biggest topics amongst the industry at the moment is the proposed demerger of AGL Energy, which will be determined by the impending shareholder vote on 15 June. At the time of writing, billionaire Mike Cannon-Brookes has launched a campaign to topple the demerger and bring forward the closure of AGL’s coalfired assets. I had the opportunity to speak with AGL’s Chief Customer Officer, Christine Corbett (featured on our cover), who, if the demerger is successful, will step into the role of Chief Executive Officer of the retail arm of the two businesses. In this feature, we unpack what recent events mean for the future of AGL, and we explore what a demerged business would look like through Christine’s uniquely customer-centric lens. Much like the rest of the industry I’m sure, the Energy team is eager to see what happens, and we’ll be covering the events as they unfold.

we speak to New South Wales’ Essential Energy about what it was like being front-and-centre during the disaster as they share some invaluable lessons from the event.

Lauren DeLorenzo

Stephanie Nestor

Mikayla Bridge

Holly Tancredi Design Manager

Alejandro Molano Designers

Luke Martin

Danielle Harris

Jacqueline Buckmaster

Rima Munafo

Brett Thompson

Radhika Sud Marketing Associate

James Holgate

Jackson Barnes

As well as this unfolding story, this issue covers a number of projects that are happening around the country, with transmission playing a big role in the energy transition. We look at Project EnergyConnect in South Australia and New South Wales, and the Western Victoria Transmission Network Project. Plus, we explore the Australia-Asia PowerLink, which is designed to combine the world’s largest solar array and battery with 5,000km of transmission, sending electricity from the Northern Territory to Singapore.

One thing that continues to impress me about our industry is the dedication and fortitude shown during moments of crisis, especially with ever-changing climate conditions that wreak havoc on our environment, our communities, and particularly, our utilities. We saw this play out earlier in the year as Queensland and New South Wales grappled with extreme flood conditions that saw National Disasters Zones declared, with residents left stranded and powerless. In this issue,

I’m pleased to see the calendar now stacked with a number of in-person events where we can get out and about, connect, collaborate and challenge each other. That said, I’ve found the virtual format that sustained events throughout the COVID-19 pandemic to still be an excellent way to stay up-to-date on industry dialogue, innovation and solutions in a more flexible way. Energy’s sister publication Utility will be hosting the landmark virtual event for the Australian utility sector, Digital Utilities 2022, from the 21–23 June. The event will focus on three major topics: future grids, engaging customers and cyber security. If you haven’t already, I highly recommend that you register at: https:// www.digitalutilities.com.au.

As always, I love to hear from you about what’s happening in the industry, whether it’s projects, research, challenges or opportunities. If you have a story that you’d like to share, please get in touch.

Imogen Hartmann

1 www.energymagazine.com.au June 2022 ISSUE 18 ISSUE 18—JUNE 2022 WELCOME

Editor EDITOR’S WELCOME Leading the way new energy future. electric and we are ready for renewable energy. global manufacturer of solar inverters and charging infrastructure for all size applications. services are based on decades of experience dedication and expertise of our specialist teams in the solar and e-mobility sectors is the we build a better world to leave to future fimer.com/anz www.energymagazine.com.au Electricity distributor lessons from the NSW floods Exclusive: CHRISTINE CORBETT TALKS AGL’S FUTURE The projectmega sending power from the NT to Singapore How to get to 100% renewable gas by 2050 Monkey Media Enterprises ABN: 36 426 734 954 C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066 P: (03) 9988 4950

(03) 8456 6720

ISSN: 2209-0541 Published by We’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950. Editor

Hartmann

F:

monkeymedia.com.au info@monkeymedia.com.au energymagazine.com.au info@energymagazine.com.au

Imogen

Journalists

Christopher Allan

National Media and Events Executives

Jacob Trad Marketing Manager

Andie James Digital Marketing Assistants

Publisher

Editor

Cover image depicts AGL Energy’s Christine Corbett for our exclusive feature on the company’s future ahead of the proposed demerger.

Chris Bland Managing

Laura Harvey

2 FUTURE ENERGY 18 Mitigating the impacts of coal asset retirement in regional Australia 20 Creating waves: using market demand to promote ocean energy 24 David O’Hara: being a trusted partner means people are the priority 26 Unpacking Australia’s hydrogen forecast: policies, costs and exports 30 The 4 biggest challenges of wind turbine maintenance STORAGE AND SOLAR 32 From the Northern Territory to Singapore: the Australia-Asia PowerLink 34 Furthering second life batteries: the communication solution 36 The distribution revolution INDUSTRY INSIGHT 10 What’s next for AGL? Christine Corbett talks demerger 16 How to get to 100 per cent renewable gas by 2050 18 10 NEWS 4 Three states to participate in 12-month EV Grid Trial 5 $70 million funding for TAS Green Hydrogen Hub 6 $11 million for WA clean energy initiatives 7 AEMO announces roadmap for NEM reforms 8 New grid-scale battery to be installed in QLD 9 ESOO update: maintaining reliability post-Eraring closure EACH ISSUE 1 EDITOR'S WELCOME 64 FEATURES SCHEDULE 64 ADVERTISERS’ INDEX CONTENTS June 2022 ISSUE 18 www.energymagazine.com.au 32

CONTENTS 3 SAFETY AND RISK MANAGEMENT 42 When disaster struck: electricity distributor lessons from the NSW floods 45 Remote management key to power line safety 42 ENERGY NETWORKS 38 Transitioning SA’s power system with Project EnergyConnect 40 Q&A: Western Victoria Transmission Network Project 38 www.energymagazine.com.au June 2022 ISSUE 18 ASSET MANAGEMENT 58 Grid transformation engine: translating concepts into reality 60 Energy sector asleep as CDR deadline looms WASTE TO ENERGY 62 7 tasks for Australia’s bioenergy future 58 VEGETATION MANAGEMENT 54 Vegetation management that’s ahead of the pack AUTOMATION 56 Automated systems mark the future of electricity networks 54 INDUSTRIAL ENERGY 46 Meeting hydrogen refuelling infrastructure requirements 48 The industrial challenges of hurtling towards net zero 50 How energy workers can protect their kids’ health for longer 46 TRANSFORMERS AND SUBSTATIONS 52 A trusted partner for a major Australian infrastructure electricity project 52

THREE STATES TO PARTICIPATE IN 12-MONTH EV GRID TRIAL

Electric Vehicle (EV) drivers in Victoria, Tasmania and the ACT are participating in a 12-month EV Grid Trial looking at how home fast-charging technology can potentially reduce energy costs and electricity grid demands.

Five electricity network businesses – Jemena, AusNet, United Energy, TasNetworks and EVOEnergy – together with charging infrastructure company, JET Charge, are partnering in the trial, co-funded by the Australian Renewable Energy Agency (ARENA).

As part of the 12-month trial, ‘smart chargers’ have been installed at the homes of more than 160 EV owners in Victoria, Tasmania and the ACT. These smart chargers not only charge EVs up to three times faster than the chargers that usually come with the vehicle, but also allow electricity network operators to dynamically adjust when the vehicle charges.

This means participants’ EVs can be plugged in when it’s convenient, but charged at times when the electricity grid has more capacity, whether that’s after midnight, or during the day when excess solar energy is being fed back into the grid – ideally leading to lower electricity bills for all consumers.

Information about EV charging habits so far shows most owners plug in their vehicles to charge at around 6pm, already a time of high demand on the electricity grid.

Electricity networks are also considering what they need to do to get ready for increased demand on the grid, with a $3.4 million ‘smart charger’ trial that kicked off 1 April 2022.

Through the trial, participants will have more visibility of their EV charging data, and electricity network operators will gain a better understanding of how to work with EV owners to manage the increasing demand on the grid.

‘Solar soak’ events on forecast sunny days during the trial will allow participants to be notified ahead of time to have their cars plugged in during a day when there is an abundance of solar energy being exported into the grid. This will aid in better understanding the impact of EV charging in absorbing surplus electricity and helping manage grid voltage.

Federal Government projections indicate EVs will be up to 30 per cent of all new cars sold by 2030, which would mean about 1.7 million electric cars on Australia's roads.

The EV Grid trial is being led by Jemena, who has partnered with Victorian electricity distribution network businesses AusNet Services and United Energy, TasNetworks in Tasmania and EVOEnergy in the ACT.

The trial has been co-funded by ARENA under the Advancing Renewables Program.

4 June 2022 ISSUE 18 www.energymagazine.com.au

NEWS

$70 MILLION FUNDING FOR TAS GREEN HYDROGEN HUB

The Federal Government has announced $70 million in funding to turn Tasmania’s Bell Bay into a green hydrogen hub and unlock the potential for large-scale green hydrogen exports in the state.

The green hydrogen hub will be part of the Federal Government’s expanded $464 million regional program and will maximise the opportunities for Bell Bay, and Tasmania, to be a leader in this energy source.

The Tasmanian Government said it believes Bell Bay presents a perfect location for a nation-leading green hydrogen hub with its advanced manufacturing zone, renewable energy availability, advanced infrastructure, water availability and port access.

The newly formed Renewables, Climate and Future Industries Tasmania, Government businesses, hydrogen proponents and hydrogen support partners, worked together on the Tasmanian Green Hydrogen Hub Project submission which was presented to the Federal Government in late 2021.

The investment will have matching support from the Tasmanian Government working with Tasmanian GBEs and departments, with proponents paying their share of infrastructure costs.

The renewable hydrogen hub is in line with the Tasmanian Renewable Hydrogen Action Plan which sets the goal of Tasmania as a globally significant exporter of green hydrogen from 2030.

The hub is expected to establish the right environment and infrastructure necessary for operations to start unlocking the potential for large-scale green hydrogen exports and supporting domestic market activation in Tasmania and on the mainland.

There is significant interest in Bell Bay from some of Australia’s largest potential hydrogen producers, including Fortescue Future Industries, Woodside Energy, Origin Energy and ABEL Energy.

5 www.energymagazine.com.au June 2022 ISSUE 18

NEWS

$11 MILLION FOR WA CLEAN ENERGY INITIATIVES

The Western Australian Government has dedicated $11 million for seven innovative clean energy projects through the second round of its Clean Energy Future Fund (CEFF).

The CEFF will support regional projects that have the potential to support reductions in greenhouse gas emissions and create hundreds of jobs.

The projects include solar, wind, biogas and biodiesel generation, battery and pumped hydroelectric storage, geothermal energy, and the replacement of gas with electricity to decarbonise the alumina refining process.

The seven projects are expected to:

» Invest $197 million, much of it in Western Australia

» Create up to 255 jobs during construction and provide 63 jobs operational jobs

» Generate 81,000MWh each year, enough to power 16,000 Western Australian homes

» Avoid around 132,000 tonnes of carbon emissions each year, or 2.4 million tonnes over their design lives

If the pilot projects are successful and technologies prove commercially viable, the seven projects could reduce emissions by 32 million tonnes of carbon dioxide equivalent in Western Australia.

Project funding is conditional on successful completion of a formal funding agreement.

The successful Clean Energy Future Fund Round 2 projects include:

» Frontier Impact Group’s Narrogin Renewable Diesel Project

» Power Research and Development’s Pumped-up Walpole Project

» Advanced Energy Resources’ Castelli Moora Microgrid

» Strike Energy’s Mid West Geothermal Project

» Alcoa’s Electric Calcination Project

» Metro Power Company’s AmbriSolar Battery Energy Storage System Project

» Alinta Energy’s Port Hedland Big Battery Project

The $19 million CEFF is administered by the Department of Water and Environmental Regulation, with support from Energy Policy Western Australia.

6 June 2022 ISSUE 18 www.energymagazine.com.au

NEWS

AEMO ANNOUNCES ROADMAP FOR NEM REFORMS

The Australian Energy Market Operator (AEMO) has announced the development of a roadmap to facilitate the approved post-2025 National Energy Market (NEM) reforms.

As part of the Energy Security Board’s (ESB) integrated engagement to progress on the Post2025 market design, AEMO is leading the development of a ‘NEM Regulatory and IT Implementation Roadmap’.

Towards the end of 2021, National Cabinet approved the ESB’s Post-2025 market reforms.

The reforms seek to change the NEM design to enable the continuing provision of the full range of services to customers necessary to deliver a secure, reliable and lower emissions electricity system at least-cost.

As part of the roadmap, AEMO will navigate the breadth of ESB reforms over the coming few years, de-risking delivery and informing implementation timing.

AEMO Executive General Manager – Reform Delivery, Violette Mouchaileh, said, “The ‘roadmap’ will help avoid unnecessary or duplicative costs, and identify where strategic investments, such as IT systems and business processes, can be made to deliver efficient outcomes for AEMO, market participants and consumers.”

AEMO will develop the roadmap with stakeholders through the Reform Delivery Committee (RDC).

Demonstrating a commitment to working transparently and collaboratively with industry, the RDC consists of nominees from the market bodies, NEM participants, consumers and representatives of the renewable energy, demand management and energy efficiency industries.

Complementing its role with the roadmap, AEMO is also working with the ESB and its members, the Australian Energy Regulator and Australian Energy Market Commission, progressing reform workstreams and associated initiatives, including:

» Resource Adequacy Mechanism and a Capacity mechanism

» Transmission reform and congestion management mechanism

» DER Integration and the Essential System Services

Another workstream, data strategy, has been added, recognising the importance and value that digitalisation and data will provide to consumers, industry, operators and regulators during the transition of the energy system.

AEMO is providing input into reform initiatives including data services, network visibility, bill transparency and data associated with electric vehicles.

7 www.energymagazine.com.au June 2022 ISSUE 18 NEWS

NEW GRID-SCALE BATTERY TO BE INSTALLED IN QLD

Publicly-owned generator CS Energy will install a 100MW/200MWh grid-scale battery in Queensland, aiming to provide clean and reliable energy to the state.

The battery will be installed in Chinchilla, marking a step forward for the Western Downs Region as it plays a key role in Queensland’s renewable energy revolution.

The 100MW/200MWh battery will be made up of Tesla Megapacks and form part of CS Energy’s energy hub at Kogan Creek.

Treasurer and Minister for Trade and Investment, Cameron Dick, said the $150 million project was expected to create up to 80 jobs during construction and up to ten jobs when operational.

“Queensland has the natural resources of wind, sun and water to be a renewable energy superpower,” Mr Dick said.

“As we work towards our target of 50 per cent renewable energy by 2030, we can also support more jobs in new industries right across regional Queensland.

CS Energy CEO, Andrew Bills, said the battery would be built next to Kogan Creek Power Station, providing its employees with exposure to new assets, training and skills as Australia’s energy sector transforms.

“This project is about utilising the Kogan Creek site’s existing attributes of grid connection, water, land and workforce to create new opportunities,” Mr Bills said.

“Large-scale batteries are an important next step in creating a more flexible and diversified energy portfolio for CS Energy and our owners, the people of Queensland.

“Adding firm, fast start generation assets to CS Energy’s portfolio will enable us to more effectively respond to the changing demand and shape of the National Electricity Market.”

The Chinchilla Battery will have a relatively small footprint (100m x 150m) and be connected to the grid via Powerlink’s 275kV Western Downs substation.

Construction is expected to begin in late 2022 after all relevant development approvals have been finalised. The battery is expected to be operational in late 2023.

8 June 2022 ISSUE 18 www.energymagazine.com.au

NEWS

ESOO UPDATE:

MAINTAINING RELIABILITY POST-ERARING CLOSURE

AEMO’s update to the 2021 Electricity Statement of Opportunities (ESOO) report has found that the potential Eraring Power Station closure in 2025–26 will not hinder New South Wales' energy reliability if investments and projects remain consistent.

AEMO’s Executive General Manager System Design, Merryn York, said the expanded assessments consider private and government-supported projects critical to improving reliability forecasts in the coming decade.

Considering only existing and committed developments, AEMO forecasts an initial period of unserved energy (USE) above the reliability standard (0.002 per cent USE) in New South Wales, leaving reliability gaps of 590MW from 2025–26, 330MW in Victoria from 2028–29 and 770MW in Queensland from 2029–30.

To increase transparency and inform stakeholders, AEMO extended its reliability assessments based on various combinations of generation, storage and transmission investments not yet deemed committed under AEMO’s ESOO methodology. These forecasts are based on the ‘step change’ scenario developed with stakeholders for the Draft 2022 Integrated System Plan (ISP).

This includes anticipated projects in AEMO’s Generation Information file and anticipated and actionable transmission investments, largely in the Draft 2022 ISP. A third case includes generation and storage targets considered in the New South Wales Government’s Electricity Infrastructure Investment Roadmap.

Anticipated projects improve forecast USE in New South Wales to within the reliability standard in 2025–26.

“New South Wales’ reliability will further improve following the completion of the

Sydney Ring (July 2027) and HumeLink (2026) transmission projects, which allows more southern New South Wales generation capacity, such as Snowy 2.0, to reach Sydney, Newcastle and Wollongong during times of supply scarcity,” Ms York said.

Ms York said that the generation and transmission projects including the New South Wales Government Electricity Infrastructure Roadmap, are crucial to meeting reliability standards in the state by 2025–26.

A further 138,000MW of proposed developments have not been included in any of the reliability forecasts, including numerous shorter-duration storage projects that may further improve reliability.

AEMO will take updated commitments into account for 2025–26 in making its next reliability assessment in August 2022.

www.energymagazine.com.au June 2022 ISSUE 18 9

NEWS

WHAT’S NEXT FOR AGL? CHRISTINE CORBETT TALKS DEMERGER

10

INDUSTRY INSIGHT

It’s the topic that has dominated talk in energy circles this year – the AGL demerger. Energy sat down with Christine Corbett – the incoming Managing Director and CEO of a demerged AGL Australia – to discuss the demerger, her vision for AGL’s future, and her perspective on critical challenges in the broader energy industry.

AGL’s demerger is designed to create two industryleading companies, each with strategies tailored to their individual purposes.

Accel Energy will be Australia’s largest electricity generator, providing low-cost energy and driving the energy transition by repurposing its sites into low emissions energy hubs.

AGL Australia meanwhile will be a leading multi-service energy retailer in Australia, supported by a sophisticated market trading function with access to firming, storage and renewable assets to help manage its energy portfolio risk.

The proposed demerger would see Graeme Hunt, the current Managing Director and CEO of AGL Energy, step into the role as Managing Director and CEO of Accel Energy, while Christine Corbett, AGL Energy’s Chief Customer Officer, would move into the role of Managing Director and CEO of AGL Australia.

Earlier this year, the demerger plans were thrown into the spotlight when AGL Energy received two unsolicited takeover bids from Brookfield consortium and billionaire Mike

Cannon-Brookes, which would see the pair acquire 100 per cent of AGL’s shares and close its coal-fired power stations early.

The AGL Energy Board stated that both proposals materially undervalued the company on a change of control basis and were not in the best interests of AGL Energy shareholders.

“Obviously, the consortium saw value in the business that we have and they saw value in the energy transition,” Ms Corbett said.

“But we want to be able to unlock that value and share it with our shareholders, and the unsolicited bids and offers didn't create value for our shareholders.

“The Board saw that it was in the best interests of shareholders to reject those bids and we've kept on with our number one strategy, which is the demerger.”

Mr Cannon-Brookes then changed tack and came for AGL again in May, this time acquiring an 11.28 per cent stake in AGL shares through his family’s private investment group, Grok Ventures, making him the company’s largest shareholder. But concerns have been raised by a number of proxy advisers because his holding was gained through a series of swaps and derivatives, meaning partially borrowed stock can be recalled with three days' notice – the implication being that he does not have the same exposure to share price changes as other shareholders.

Mr Cannon-Brookes made it clear in a letter sent to AGL’s board of directors that he intends to block the 15 June vote on the company’s demerger, which requires 75 per cent approval to go ahead.

Mr Cannon-Brookes claims the demerger would lead to two weaker entities, which he claims will be more costly to run and delay the transition to net-zero. Instead, Mr Cannon-Brookes believes that by remaining one entity, AGL could begin shutting down its coal power generators and take itself out of coal power by 2030, in order to speed up the transition to renewables.

AGL Energy said it has invited Mr Cannon-Brookes to share his plan for how this could be achieved without negatively

impacting shareholder value, customer prices and reliability but said Mr CannonBrookes has provided no such a plan.

AGL Energy said, in contrast, it has spent more than 12 months working on its plan for the demerger and how both AGL Australia and Accel Energy will support Australia’s energy transition.

AGL Energy stated, “It is a real plan, backed by real investment and a pipeline of real projects to lead Australia’s energy transition. Both companies will have investment grade credit ratings and will create a direct opportunity to invest in leading aspects of Australia’s energy transition.”

AGL: demerger is still best

“The unanimous view of the Board is that the demerger is the best way to create shareholder value by allowing flexibility and a more focused strategic direction for each company moving forward, and providing clear pathways to low-carbon futures and tailored financial structures aligned to the profiles of each business,” Ms Corbett said.

“We have a clear plan that will deliver the best outcome for our company, our shareholders and for Australia’s responsible transition.

“This plan is backed by real investment and a pipeline of real projects to lead the transition, including a commitment to underwrite 3GW of renewables and flexible energy generation capacity by 2030, and a defined pipeline of 2.7GW of wind, battery, pumped hydro and low-carbon firming projects.

“The Demerger Scheme Booklet gives our shareholders a clear and detailed plan for how we will accelerate Australia’s decarbonisation in a way that wouldn’t otherwise be possible.

“The key part about the Demerger Scheme Booklet is that the Independent Expert has recommended that it is in the best interest of shareholders for the demerger to go ahead.”

June 2022 ISSUE 18

11 INDUSTRY INSIGHT

In the Demerger Scheme Booklet, the AGL Energy Board summarises that the demerger will provide four key advantages to its shareholders: unlocking value through the two separate entities and dividend policies; creating two industry-leading companies, within which shareholders can invest based on their value preferences; providing tailored purpose in individual strategies and initiatives; and enabling the future of energy through the responsible acceleration of decarbonisation.

On the flip side, the disadvantages associated with the demerger include the one-off implementation costs of approximately $260 million, the additional ongoing operating expenses of running two separate entities, and the loss of scale and diversification.

The AGL Energy Board maintains that the advantages of the demerger outweigh the disadvantages.

“The Board considers that the potential for these additional costs can be offset by operating cost savings that AGL Australia and Accel Energy will have the potential to realise following the demerger, including technology cost reductions and reduced overheads driven by a more focused organisational structure,” Ms Corbett said.

The Demerger Scheme Booklet also outlines the alternatives that were considered by the AGL Energy Board, which included maintaining the current business structure; accelerating coal-fired asset closure whilst maintaining the current business structure; an internal separation within AGL Energy; a partial or whole strategic sale to another buyer; or an Initial Public Offering (IPO).

12 INDUSTRY INSIGHT

AGL’s proposed demerger would see Christine Corbett, AGL Energy’s Chief Customer Officer, move into the role of Managing Director and CEO of AGL Australia.

The AGL Energy Board said that, after considering these alternatives, it found that the demerger is “more likely to enhance value for AGL Energy Shareholders over the long term”, which was supported by the Independent Expert Grant Samuel.

AGL Energy said that the transformation of its business will enable decisive action to better address its climate-related risks whilst taking the lead in supporting Australia’s energy transition, creating long-term value and sustainable investment opportunities at the same time.

According to Ms Corbett, as the broader energy industry undergoes a transformation, it paves the way for businesses to do the same.

“It absolutely is the right time to transform, to create a stronger future for two leading energy companies,” Ms Corbett said.

“We've got two leading energy companies, two new strategies, two new purposes, and it allows us to unlock value and allows for our investors to participate in different ends and different sides of the energy transition story.”

AGL Australia: what would it look like?

Ms Corbett explained that the proposed strategy for AGL Australia’s future is built on four pillars:

1. Customer obsession

2. Accelerating decarbonisation

3. Scaling up renewable energy investment

4. Engaging stakeholders (customers, community and employees)

Ms Corbett said that the combination of these four pillars makes for an exciting challenge – one that she’s eager to get stuck into.

“We have a clear plan that will deliver the best outcome for our company, our shareholders and for Australia’s responsible transition.”

“I'm really excited about our purpose, which is connecting every Australian to a sustainable future. We've got the brand, we've got the scale and those two things really give us a really exciting opportunity to accelerate decarbonisation – and we can do that with customers at the heart,” Ms Corbett said.

Ms Corbett spent a large part of her career in executive roles at Australia Post, culminating in the position of Chief Customer Officer – the same title she currently holds at AGL Energy. This customer-centric skillset is one that Ms Corbett intends to employ front and centre if she moves into the role of CEO.

Energy customers are unique, according to Ms Corbett, chiefly because of the historically low engagement and trust levels. This is something she expects to grow in importance, particularly with the electrification of the economy, wherein customers start to see energy in all aspects of their lives.

Part of the challenge will be demystifying energy and sharing value with customers. Another foundational element of engagement lies in customer service and using digitisation as the vehicle for that.

“Customers expect to be able to get in touch with you any time of the day or night,” Ms Corbett said. “So how you digitise and use technology to make it simple and easy for customers is going to be important.”

The new prosumer profile

The energy customer profile is changing as more and more consumers transition to prosumers. As the retailer-customer dynamic changes, AGL Australia will have to accommodate for the shift and ensure that it is still adding value.

For Ms Corbett, the solution again lies in engagement – a strategy that she has seen play out in a similar way at Australia Post. Ms Corbett explained that previously, Australia Post was primarily a “letters business” with relatively low engagement from its customers until it transformed into a parcels eCommerce company – where much of the power was placed back in the customers’ hands.

“As the customers were ordering, they wanted to follow and see where that parcel went. So we had to change technology systems, we had to change infrastructure. We had to change processes and we had to get customers engaged. It was a whole new strategy,” Ms Corbett said.

13 INDUSTRY INSIGHT

“I look at energy and it's really similar. You've gone from sort of a traditional utility, which is fairly ubiquitous, to all of a sudden understanding now you're a customercentric organisation.”

With this engagement comes the opportunity for energy customers to really “lean in” and understand their own energy behaviour and usage. This in turn offers opportunities for businesses like the potential AGL Australia to identify the ideal products and services, like demand response programs and virtual power plants, that can service those growing needs.

Accel Energy: what would it look like?

The big question around Accel Energy is how it would manage the closure of its existing coal-fired asset base, and achieve a balance of maintaining energy system security, while also keeping in step with shareholder and community expectations regarding coal exit.

“Accel Energy has two key aims. One is to really understand and ensure the continuity and security of supply. That's really important given they're the largest generator in the National Electricity Market (NEM). So, it is absolutely about making sure that they can keep the lights on for Australia,” Ms Corbett said.

“At the same time, renewable energy is going to be part of their future, so it's also really about making sure that there's a responsible, orderly transition from thermal hubs to low carbon industrial hubs. That's really the second part of their key strategy – it's looking at attracting different industries.

“They've got a renewable energy pipeline of opportunities. That's part of their strategy as well, you can't be the largest generator in the NEM without making sure that you've got reliability, security and consistency, but you also need to transform – and that's what Accel will be doing.”

To this end, early in May, AGL announced Global Infrastructure Partners as its 49 per cent equity partner in the Energy Transition Investment Partnership (ETIP), a $2 billion investment vehicle designed by AGL for Accel Energy to develop, own and manage an initial approximately 2.7GW of quality renewables and low carbon firming assets. These Foundation Projects will support Accel in maintaining its position as one of the largest operators and off-takers of renewable energy in Australia, and

“We have said before that the transition needs to be managed in a responsible way – any other approach would have serious implications for electricity prices, grid stability and jobs.”

to drive Australia’s energy transition by developing new renewable and low-carbon firming assets.

Flexible timelines for a responsible transition

In terms of timelines for how quickly Accel Energy would exit coal, Ms Corbett said Accel has released closure “windows” to give the business the opportunity to bring forward the closure of coal-fired power stations if the system was ready and the market conditions were right.

These windows also allow for policy changes, such as the Federal Government’s recent request to extend the generator closure notice period that energy companies should be required to give from 3.5 years to a minimum of five years.

Ms Corbett said the windows that Accel has put in place would accommodate either notice period, therefore creating flexibility in the planning process for those assets.

“We have already brought forward our coal closure dates, and we’ll be reviewing this every year should the system demonstrate it is ready even earlier for coal generation to close,” Ms Corbett said.

“If we can move faster in a responsible way, then we will. We have already closed the first unit at our Liddell Power Station, and we are on track for its full closure in less than a year’s time. Our work to transform the site into the Hunter Energy Hub is well advanced.

“We have said before that the transition needs to be managed in a responsible way – any other approach would have serious implications for electricity prices, grid stability and jobs.”

What’s next for AGL?

AGL’s Board of Directors remain confident that the demerger will proceed as planned; and Ms Corbett is particularly excited about the climate targets that the company would achieve if the demerger is successful.

AGL Australia is set to be immediately carbon-neutral (scope one and two) on listing, and has a commitment to have 50 per cent overall reductions by 2030 based on FY19 levels, and being net zero by 2040.

As for what she’d like to leave as her legacy as the CEO of a demerged AGL Australia, Ms Corbett is focused on the goal of seeing every Australian connected to a sustainable future.

This circles back to the four pillars of the business – customer obsession, accelerating decarbonisation, scaling renewable investment and engaging stakeholders – as well as engaging employees and bringing them on the journey to achieving the mission.

“People looking for work have more agency in that choice than ever before, and we’re in the fortunate position of having employees coming to us and saying ‘I want to work for a company where I can make an impact’ – and at AGL Australia you can make an impact.

“Having a purpose that really resonates, with people being able to wrap their hands around it and say, ‘I can understand my role in bringing that to life’, that's amazing... it's a humbling, wonderful opportunity to lead an organisation that has that at its core.”

As for AGL Energy’s future if the demerger isn’t voted through, neither party has confirmed what that will look like yet. Energy magazine will be covering the story as it unfolds on 15 June and beyond, so make sure to keep an eye out for updates at: www.energymagazine.com.au

June 2022 ISSUE 18 www.energymagazine.com.au 14 INDUSTRY INSIGHT

15 INDUSTRY INSIGHT

www.energymagazine.com.au June 2022 ISSUE 18

Christine Corbett plans to bring her uniquely customer-centric skillset into her incoming role as CEO of AGL Australia.

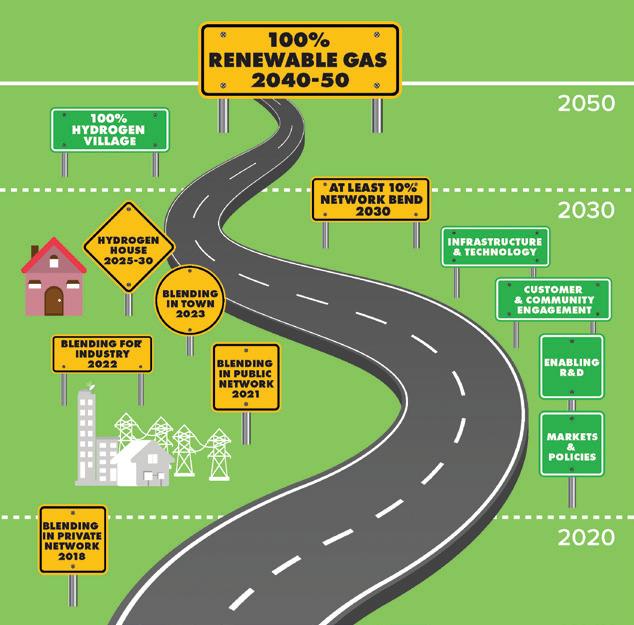

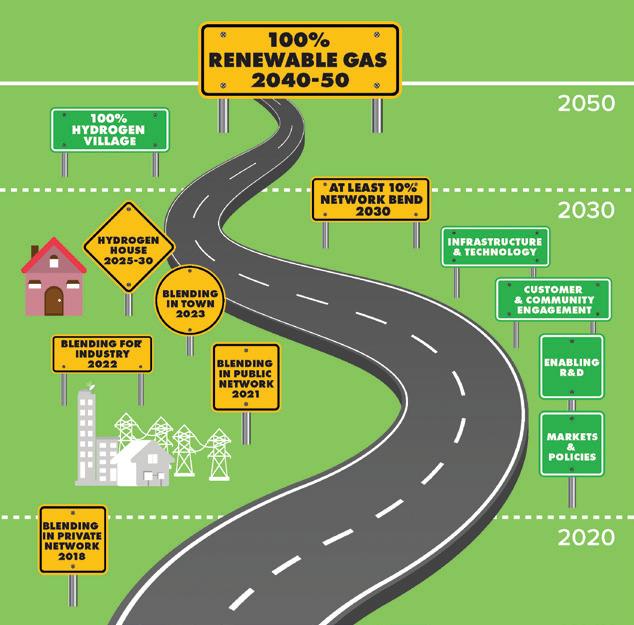

HOW TO GET TO 100 PER CENT RENEWABLE GAS BY 2050

by Dennis Van Puyvelde, Head of Gas, Energy Networks Australia

GAustralia’s gas networks have developed a high-level plan to reach net zero emissions and are aligned on the need to decarbonise. All have made commitments to achieve net zero by 2050 or earlier. Meeting these targets will need coordinated action across many sectors of the economy. Energy Networks Australia and the Australian Pipelines and Gas Association have released a plan that details what is needed to reach these decarbonisation objectives.

as Vision 2050: Delivering the pathway to net zero for Australia – 2022 Outlook details what actions must be completed in the near term to achieve at least ten per cent renewable gas in networks by 2030 and what needs to be done for the transition to 100 per cent renewable gas by between 2040 and 2050. Blending hydrogen is already being undertaken in Adelaide and Western Sydney with more projects coming online on the west and east coasts in the next couple of years.

High level roadmap to reach 100 per cent renewable gas by 2040 to 2050

Australia’s gas networks worked with DNV GL to develop a detailed action plan to achieve these decarbonisation goals. Both hydrogen and biomethane pathways were considered. Five tenets were agreed:

» Customer Focus: Consumers today benefit immensely from cost-effective and convenient gas supplies, and rely on gas for a range of services, including cooking, hot water, space heating, power generation, and industrial heat and feedstock. The transition must support consumers in the residential and commercial, industrial, power generation, and transport sectors to decarbonise in a cost-effective and convenient way, keeping disruption to a minimum.

» Safety: The high safety standards that exist for the current gas grid need to be maintained, through the development of the best technology and procedures for renewable and decarbonised gases across the Australian system, including the high-pressure transmission pipelines, the low-pressure distribution network, and end-user appliances.

» Security of Supply: A renewable and decarbonised gas network needs to maintain the existing high security of supply standards, with very rare unplanned interruptions, including by ensuring sufficient physical network capacity, efficient and safe system operation, and access to sufficient renewable and decarbonised gas production and storage capacity.

» Market Development: To achieve net zero, the gases in the network need to be certified as genuinely renewable and low carbon, enabling producers to produce renewable and decarbonised gases at a competitive price, with customer contracts forming the basis for the project and long-term operational financing, together with appropriate market incentives.

» Supply Chain: The supply chain and skilled workforce need to be available at the right scale and with sufficient agility to deliver the renewable and decarbonised gas transition on time, including the provision of enough appliances and other equipment, and to carry out the installations, connections, and asset upgrades safely and smoothly.

Cross-cutting actions

The review of cross-cutting actions showed that good progress is being made with customer engagement and developing the business case for renewable gases. Work is underway to address the technical, environmental, and economic regulation requirements with the release of the papers on the reviews of the National Gas Law being noted as good progress in this regard. Market development is an area that requires further attention, especially in developing certification schemes, suitable incentives, or a renewable gas target.

June 2022 ISSUE 18 www.energymagazine.com.au

16 INDUSTRY INSIGHT

Biomethane actions

Biomethane is the renewably produced equivalent of natural gas. Blending biomethane into the gas network is already widely practiced in Europe, and rapidly progressing in Australia. The main advantage of this pathway is that no changes are required to pipelines, networks or appliances.

Developing the biomethane pathway relies on supplying enough organic feedstock to replace the current volumes of natural gas.

Hydrogen actions

Reaching 100 per cent hydrogen in networks will be achieved in two stages. The first is to blend at least ten per cent into the network, followed by a second stage of conversion of the network to 100 per cent hydrogen.

The main objective of the blending stage is about engaging with customers, building scale, and preparing for conversion to 100 per cent including assessments of infrastructure suitability, scaling up hydrogen production and developing a local manufacturing capability for hydrogen appliances.

The second stage would involve making modifications to infrastructure to ensure safe operation, replacing natural gas appliances with hydrogen ones, and replacing the fuel in pipelines and networks with hydrogen. Introducing the right policy options at the right time will be important to facilitate that conversion, for example, enabling the introduction of hydrogen-ready appliances before the conversion is planned to take place.

There are several hydrogen blending projects operational in Australia with more coming online. Many tests and studies have been completed to provide confidence that blending ten or 20 per cent hydrogen in gas networks can be done safely without adverse effects on customers.

Reaching 100 per cent hydrogen will require additional focus on the supply of hydrogen appliances. There is an active and successful program to develop hydrogen appliances in the UK via the Hy4Heat program. Similar work needs to be accelerated in Australia to develop, certify and provide suitable appliances for the Australian market to enable conversion to 100 per cent hydrogen.

Next steps

Transitioning to fully renewable energy is a multi-decade process. The electricity sector started this journey in the early 2000s with the introduction of the Mandatory Renewable Energy Target. Renewable generation across the National Energy Market is currently at around 25 per cent with the intention of reaching 100 per cent by the 2040s – a total of more than four decades.

Decarbonising the gas sector shouldn’t take that long. Early progress in renewable gas is creating a pathway to reach net zero emissions. But more support is needed to develop a renewable gas market. The introduction of a renewable gas target may just be the signal needed.

Gas Vision 2050 can be viewed at www.energynetworks.com.au/projects/gas-vision-2050/

Gas Vision 2050: Delivering the pathway to net zero for Australia – 2022 Outlook outlines the path to 100 per cent renewable gas by between 2040 and 2050.

www.energymagazine.com.au June 2022 ISSUE 18

17 INDUSTRY INSIGHT

MITIGATING THE IMPACTS OF COAL ASSET RETIREMENT IN REGIONAL AUSTRALIA

by Christopher Allan, Journalist, Energy magazine

How might coal-reliant Australian regions find economic stability in a clean energy future? A new research report has analysed the challenges and opportunities that face South-West Queensland as it faces coal asset retirement. Here, we explore key insights from the research and look at the broader implications for energy transitions around the country.

Published by Australian policy think-tank Blueprint Institute, the report, Breaking new ground: Challenges and opportunities of a changing energy landscape in regional Australia: South-West Queensland, suggests that with the right support, regions that have long housed Australia’s coal assets could absorb the challenges of a shifting energy landscape, and even capitalise on emerging sectors for regional job creation.

With a focus on challenges facing South-West Queensland, the report models energy transitions around Australia, particularly in other regions facing coal asset closures and related issues of loss of local economic activity, a shortage in job opportunities, and even exiting migration from the region.

The challenges of closing coal Stretching from the Simpson Desert to Toowoomba Range and encompassing communities like Chinchilla, Roma and Longreach, South-West Queensland has long served as a home to coal industries.

But with the Australian Energy Market Operator (AEMO) predicting that coal-fired generators will retire two to three times faster than previously anticipated, completely disappearing from the grid by 2043, South-West Queensland will need a campaign economic renewal to mitigate this changing energy landscape.

The report states, “For many decades, South-West Queensland has quietly prospered as a cornerstone of Australia’s agriculture and resource industries.

June 2022 ISSUE 18 www.energymagazine.com.au

18

FUTURE ENERGY

“Collectively, local coal assets currently employ over 1,500 workers directly and create opportunities for many more through indirect economic activity.

“South-West Queensland is currently unprepared to deal with the rapid coal phasedown which is underway.”

For example, in the community of Tarong, a township of 180 people, coal-related industries currently employ more than 15 per cent of the local workforce, and high wages from coal jobs have supported a variety of local businesses to prosper.

“The projected closure of the Tarong coal-fired generator in 2036–37 – though closure may come earlier as cheaper renewable energy alternatives enter the grid – will necessitate a proactive and efficient workforce shift to minimise the impact on the community,” the report said.

In addition to loss of jobs and local economic stimulation, the necessary closure of coal assets can also result in crippling migration from small towns, with South-West Queensland already experiencing limited population growth.

“Without action, this trend could accelerate into the kind of mass exodus seen in Spain’s former coal towns, as unemployed coal workers are forced to move to urban centres for low-paying, insecure jobs in service industries,” the report said.

Opportunities in renewable energy

The renewable energy sector will undoubtedly help South-West Queensland adapt its economy to a changing energy landscape, with renewable projects offering both ongoing operation and maintenance jobs as well as short-term jobs in construction and installation.

In fact, the report projects (conservatively) that incoming renewable installations will create 6,200 new jobs in South-West Queensland.

A major Battery Energy Storage System (BESS) project in Tarong and the Kogan Creek renewable hydrogen demonstration plant will join existing renewable energy assets in the region, like Coopers Gap Wind Farm – Queensland’s largest operational wind project.

The model finds that initial job figures from renewable projects match the employment base of the local coal industry.

However, the report concedes that renewable energy job creation will skew towards shorter term positions created in the construction of major infrastructure.

“It is unrealistic to expect the renewable energy industry alone to mitigate the inevitable loss of well-paying and stable coal jobs,” the report said.

“South-West Queensland requires considered policy that seizes the opportunity contained in the initial surge of investment in renewables, and channels it into lasting opportunities that produce jobs in diverse industries in the long term.”

Emerging industries

Some of the emerging industries with the power to support South-West Queensland’s economic revitalisation, alongside renewable generation investment, include clean industries and critical minerals mining.

Clean industries

Clean industries have already begun trials in South-West Queensland, with federal funding delivered for a methane demonstration project near Roma, and construction commenced on a hydrogen demonstration plant at Kogan Creek.

“Though the initial employment figures for these clean hydrogen feasibility projects are modest, the success of these early studies could lead to enormous benefits in Kogan Creek over the coming decades if the plants are scaled up,” the report said.

A hydrogen production facility at the Kumbarilla Renewable Energy Park, scheduled to commence in 2024, could create 144 short-term positions during construction as well as 480 ongoing positions to operate and maintain hydrogen production.

Critical minerals mining

Importantly, Australia’s clean energy future could offer a growth opportunity for our traditional mining industries.

As the world’s largest lithium exporter and a major exporter of rare earth elements, Australia is entangled in global supply chains for construction of important clean energy assets like batteries, wind turbines and electric vehicles.

“By 2040, between 5,400 and 9,450 (depending on policy action) new jobs in critical minerals mining are projected in Queensland, with the greatest concentration of known sites clustered around Mount Isa,” the report said.

“While this would require South-West Queenslanders to relocate north, the close industry match could be a big advantage for those currently working in thermal coal mining.”

A path forward

The report concludes with recommendations for supporting the economic renewal of South-West Queensland in a changing energy landscape, including a suggestion for Federal Government to provide $20 million in funding to establish coal adaptation authorities in Groom and Maranoa.

A coal adaptation authority would analyse the region’s shift to clean energy, investigate implications for regional residents, and engage with communities to develop strategies that respond to local concerns.

It is also recommended that the Federal Government offer financial and administrative support to coal asset operators to develop proactive renewal strategies for exiting coal infrastructure. This could involve federal funding that matches private investment from operators, up to $100 million per asset.

Another report recommendation is for the Queensland Government is to ensure that five per cent of collected coal royalties are directed to coal adaptation authorities – which would have amounted to $175 million in 2019–20.

A further recommendation is that Queensland and local governments together maintain strong support for renewable energy zones and other new manufacturing and industrial precincts that will encourage investment into the South-West Queensland region.

“The shift to a clean energy economy may not seem easy for those local communities in the region that currently rely on coal, but it can succeed,” the report said.

“South-West Queensland possesses all the necessary ingredients to benefit from the future that is already knocking at our door.”

www.energymagazine.com.au June 2022 ISSUE 18

19 FUTURE ENERGY

Although renewable energy presents economic opportunities, it will take considered policy to mitigate the loss of jobs exiting coal assets.

June 2022 ISSUE 18 www.energymagazine.com.au 20 FUTURE ENERGY

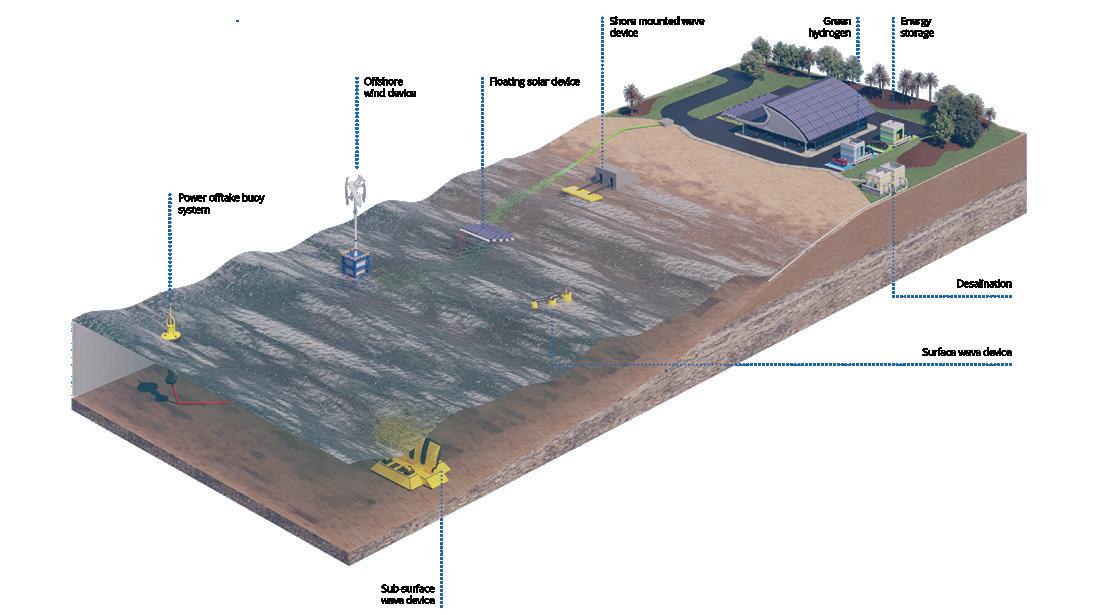

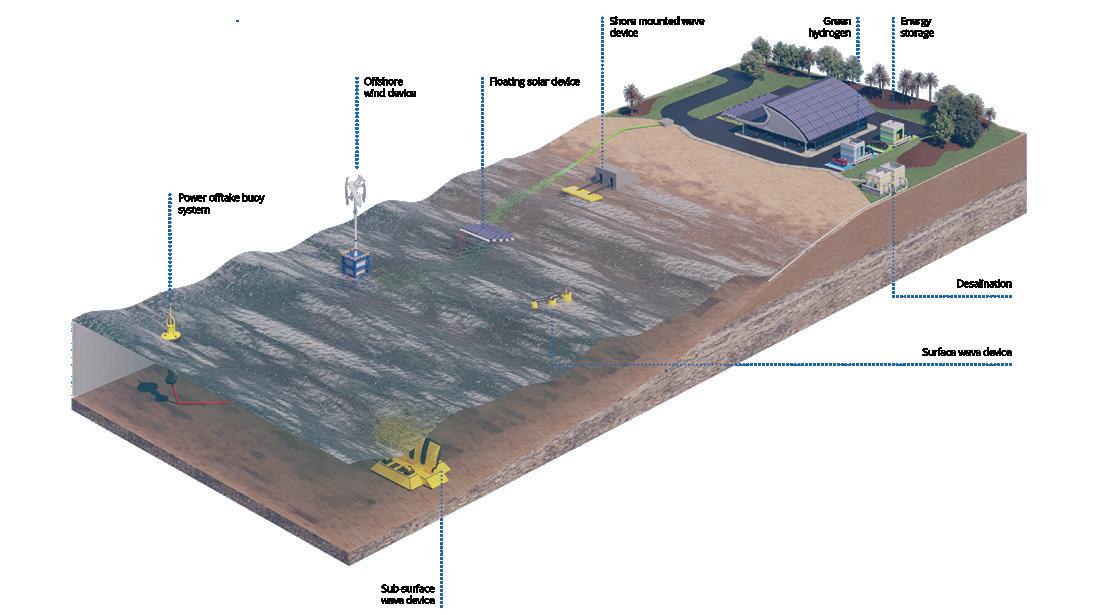

CREATING WAVES: USING MARKET DEMAND TO PROMOTE OCEAN ENERGY

by Stephanie Nestor, Journalist, Energy magazine

In Australia’s transition to renewable energy, there has been a heavy focus on pushing markets to take up new technology. A newly announced project from National Energy Resources Australia (NERA) and the Australian Ocean Energy Group (AOEG) endeavours to instead promote the adoption of ocean energy through market demand.

www.energymagazine.com.au June 2022 ISSUE 18

21 FUTURE ENERGY

NERA is supporting the AOEG to establish a world-first Integrated Ocean Energy Marketplace (IOEM) in Western Australia. The project aims to educate users about ocean energy technology and encourage its integration alongside other renewables.

The IOEM was announced in May 2022 at the AOEG’s Market Summit in Hobart and a feasibility study has been launched to look into developing the project.

The AOEG cluster, which was established with NERA’s support in 2018, is driving the IOEM, aiming to promote awareness, accessibility and affordability about ocean energy technology.

Bringing ocean energy to the market

AOEG Cluster Manager, Stephanie Thornton, said currently Australia’s energy markets are largely unaware of the benefits of integrating ocean energy with other renewables, including offshore wind.

“We need to address this and raise the market’s awareness of the benefits of multi-purpose offshore energy parks that can optimise energy planning solutions as well as delivering low carbon solutions to marine based industries and communities,” Ms Thornton said.

“Through the IOEM we hope to demonstrate our vision. We believe seeing leads to understanding and understanding underpins adoption.

“This philosophy is at the heart of AOEG’s vision for the marketplace.”

The project will have two stages – the first will be an online platform to help match end-users to energy solutions, and the second will be a pilot-scale offshore integrated grid system near Albany, Western Australia, to showcase these ocean energy solutions.

The first stage

The IOEM project’s first stage is a virtual marketplace and learning centre, which is intended to provide a forum for mutual understanding of the energy needs of endusers and potential ocean energy solutions.

This digital marketplace will draw data from existing wave and tidal energy projects through simulation to mix and match end-users to proposed ocean energy system integrations and potential providers.

NERA’s Ocean Energy Program Manager, Alex Ogg, said the first stage is an interim stepping stone to start the engagement between developing technology and market sectors for ocean energy.

“Our vision for the IOEM is a demand creation mechanism to bridge the gap and enable decision-making from end users by providing confidence in the products,” Mr Ogg said.

The second stage

The second stage will be the construction of a physical marketplace in Albany, which will use an integrated microgrid to showcase ocean energy alongside other renewables and demonstrate the economic and social value of integrated offshore energy solutions.

“While there are centres for testing a product development of ocean energy devices in Europe, the UK, Canada and the US, this will be a world-first ‘public’ market facing resource for ocean energy,” Mr Ogg said.

“Technology agnostic, the IOEM will showcase how a microgrid based system can provide power to a typical blue economy end-user through an interactive platform.”

The microgrid will include a combination of wind and wave energy converters, onshore and offshore solar, storage and application technologies such as green hydrogen production, desalination capability and electric vehicle (EV) charging.

Alongside the microgrid, a database of ocean energy device capabilities will also allow potential end-users to understand the strengths of such a system, model their particular energy requirements, and find options which suit their needs.

End-users will work with an associated project development partner to design, cost, procure and develop stand alone or integrated energy solutions for commercial applications.

Why ocean energy?

With ocean energy being largely overlooked in Australia, market-users are unaware of the capabilities of tidal and wave energy.

Ocean energy technology captures clean and reliable energy from the wind passing over the surface of waves or the currents caused by tides.

When integrated with other renewables, ocean energy brings stability to the system by providing continuous power and reducing the need for storage or diesel back up. It can also help balance grids when other renewables, such as solar and wind, are not producing enough.

Solar and wind can be intermittent due to weather conditions, whereas wave and tidal energy are more predictable and are able to fill in the gaps in supply, which is what the IOEM will showcase through its working integrated microgrid.

Mr Ogg said AOEG is looking to the northern hemisphere for inspiration in this field.

“We love the concept of energy islands which are being developed, particularly in France, Denmark and the Netherlands. They are simply amazing and will play a major role in future decarbonisation,” Mr Ogg said.

“They’re literally an island, with a fully integrated energy system – ocean energy, solar and wind all connected to supply gigawatts of electricity. It’s something really exciting that’s emerging, and of course ocean energy is part of that.

“In Australia, the resources are as good or arguably better. We could combine renewable offshore energy precincts with food production – supporting aquaculture, kelp production and blue carbon sequestration farms as an example.”

June 2022 ISSUE 18 www.energymagazine.com.au

22 FUTURE ENERGY

NERA’s Ocean Energy Program Manager, Alex Ogg, said Australia has excellent potential for ‘energy islands’.

From market awareness to market shift

AOEG has identified four main focus areas to promote the adoption of ocean energy:

1. Building awareness

2. Increasing accessibility

3. Supporting affordability

4. Establishing a project delivery system

The IOEM seeks to encourage the blue market sector in particular to adopt ocean energy through market-pull rather than technology-push.

By making markets aware of ocean energy technology, the IOEM can encourage users to incorporate wave and tidal energy, while also promoting government funding in the area.

In Australia, there are currently some wave farm projects in development on a pilot-scale, but the technology is not being pushed as much as other renewables.

“There is low visibility and low confidence, with few or no commercial devices in operation in Australia and hence, no place to see ocean energy being produced,” Mr Ogg said.

“There are also negative perceptions on the back of some early failures and a general perception that ocean energy is an expensive option.

“Because of low demand and the above dynamics, governments and policy makers have yet to prioritise the support of technical development, subsidies and blended finance options which would facilitate commercialisation and scale.”

The IOEM will give visibility to early pilots and commercial projects, using this to leverage acceptance from the market and end users. Then, via visitation at the physical marketplace or online engagement, it will hopefully prompt government support and adoption.

Where to from here?

To help turn its vision into reality, AOEG is currently seeking partners who can assist in making ocean energy a leader in the transition to sustainable and reliable energy.

NERA CEO, Miranda Taylor, said the work done by the AOEG cluster to drive this technology-led and integrated energy project demonstrates the strengths of the cluster model in accelerating the commercialisation of technology and renewable energy solutions.

“NERA helped establish the AOEG in 2018 because the evidence from around the world clearly demonstrates that clusters provide the business model to achieve market visibility, connect technology innovators with end-users and

drive more rapid innovation and business development,” Ms Taylor said.

“The AOEG Cluster is facilitating the vital collaboration and innovation that is needed to ensure Australia achieves a net zero future and grows a strong offshore renewable sector, blue economy and diverse businesses.”

Mr Ogg said the real challenge in the sector is identifying the customer, as most are not aware of ocean energy technology or how they can incorporate it into their systems.

“We can see the opportunity, but as a tiny speck in the climate change discussion, acquiring the resources we need to do the job at the scale we need is currently elusive. When you don’t have leadership in government, business and communities sharing a similar vision, it feels like pushing a boulder up a hill,” Mr Ogg said.

By using market demand to encourage adoption, the IOEM will focus on building awareness around the capabilities and benefits of ocean energy, giving users a chance to incorporate the technology on their own terms.

www.energymagazine.com.au June 2022 ISSUE 18

23 FUTURE ENERGY

Concept of physical marketplace at Albany showcasing integrated ocean energy and renewable technologies. Image source: NERA.

DAVID O’HARA: BEING A TRUSTED PARTNER MEANS PEOPLE ARE THE PRIORITY

The energy sector will rely on trusted partners to adapt to dramatic change during the next 25 years, and particularly valuable are those partners that won’t compromise on core objectives like the safety of people. As General Manager of Projects and Infrastructure at Zinfra, David O’Hara knows that the best way for leaders to navigate a period of change is to truly embody a clear strategy – one that speaks to long-term values like the safety of people and securing the right people for the job.

Since joining the Zinfra Leadership Team in 2020, David O’Hara has worked to promote a peoplefocused growth strategy that lays a healthy foundation for profitability across the entire organisation.

Drawing on 15 years’ experience across management and engineering roles in industrial construction, Mr O'Hara has led cross-business initiatives at Zinfra that optimise project execution and delivery methodology – initiatives that have established Zinfra as a trusted partner for the future of the energy infrastructure sector.

When it comes to fulfilling Zinfra’s role as a trusted partner to its customers in the energy industry, Mr O'Hara has found that a clear strategy, shared by all, can do wonders.

“My view is that good strategies ought to be very simple, otherwise they’re not executable,” Mr O'Hara said.

“If you try to tell a team of several hundred people a very complicated strategy, with lots of different components, you’re going to lose them after two or three minutes.”

Mr O'Hara explained that while the Zinfra mission is to act as a trusted partner for the energy sector, the Zinfra strategy is very much focused on people and their safety, sharing a mantra of “Safety, then Profitability”.

“Ultimately, to my mind, strategy is about achieving your objectives,” Mr O'Hara said.

To demonstrate this, Mr O'Hara offered three key objectives that truly guide the Zinfra strategy: the objective of safety – to hurt

no person; the objective of profitability – making a reasonable, sustainable, repeatable margin; and the objective of using the best people in the industry.

For Mr O'Hara, being a trusted partner to industry flows naturally from the achievement of clearly defined objectives.

“If your objectives are clear - if you keep it really simple like that and communicate it like that to everybody – then everybody knows what you’re about and can jump on the bus,” Mr O'Hara said.

“In order to be trusted, we need to be able to deliver on the commitments that we’ve made.

“Being a contractor makes this very simple, as your commitments are all listed down – it’s just about delivering all the time.”

The safety of people is our number one priority

When expanding on the idea that a trusted partner needs to always put the safety of people first, Mr O'Hara revealed the far-reaching effects of this core value at Zinfra.

“Safety is our number one priority, full stop,” Mr O'Hara said.

“I have a firm view that it’s people who make a business safe, not systems.

“You can override a system, but if your people have a safety mindset in them, you’re going to have a culture of safety, and a culture of thinking safety first every time.”

In this sense, the strength of all systems actually flows on from a culture of safety first embodied by people and their decisionmaking.

June 2022 ISSUE 18 www.energymagazine.com.au

24 FUTURE ENERGY SPONSORED EDITORIAL

Indeed, Mr O'Hara stressed that while safety is often at the forefront of contractors at projects in the field, Zinfra’s advantage is how safety first is recognised at an executive level.

“We are fortunate enough to have a business at Zinfra where at every executive level – from managing director to myself, but also at the operations manager level and beyond that – everybody has a safety first mindset,” Mr O'Hara explained.

“It’s printed on our shirts – every single Zinfra shirt has safety first written on it, and that is a value that we live and breathe every day.”

Mr O'Hara knows first-hand the value offered by a culture of safety, drawing on 15 years’ work history that has taken him to major energy facility projects around the country in an Engineering, Procurement and Construction (EPC) capacity – from utility scale power stations, to wind farms and natural gas transmission facilities.

“We have an executive and senior management team that is genuinely focused on safety and, by and large, has actually come from the field or has spent significant time in the field – and I’m included in that.”

“I’ve seen what can happen if it goes wrong, but I’ve also lived and breathed and acted in high-risk activities as distinct from just looking down on it from the tower.”

Building an adaptable and connected workforce

By delivering a growth strategy that focuses heavily on the best outcomes for people, Mr O'Hara understands how to truly build an adaptable workforce, from onboarding to career development.

“Our onboarding process has matured enormously over the past couple of years, to the point that we now have a formal structured process with two days of training for all of our new starters,” Mr O'Hara said.

“Some of this process is being implemented retrospectively, to make sure that everybody gets caught in the net.

“It’s evolved into a multifunctional, multidisciplinary, interactive session that happens within Zinfra projects and infrastructure, to ensure that everybody has the same onboarding and training, and nobody has any gaps in their knowledge as they’re brought into the business from somewhere else.”

For Mr O'Hara, a socially connected workforce can be vital for improving work processes, staff mental health, and even empower staff to find the right role within the organisation.

“What we find is that by hook or by crook, people tend to interact in person,” Mr O'Hara said, explaining that he encourages people to ensure they interact with others on a regular basis.

“What I’ve found as restrictions have eased is it’s easy to forget how useful those incidental conversations can be and how much value can be generated from those.

“I know it sounds nebulous or ill defined what that value means, but in terms of providing a solution in ten minutes instead of ten days of email exchange and misinterpretation – it makes an enormous difference.”

For Mr O'Hara, encouraging conversations is also critical for staff mental health.

“I’m focused on the mental health of some people who might be more vulnerable, ensuring that they have the opportunity to interact with people that could be avoidable by virtue of working from home – we get to a point where we ensure that everybody has interactions and we can keep an eye on one another as teammates.”

Finally, Mr O'Hara has also found that a people-first growth strategy and a socially connected workforce can be vital for ensuring individual adaptability.

“I often try to model how a career can develop and change,” Mr O'Hara said.

“We do move people from place to place within the business, and also from function to function within the business.

“And I consistently push the message to my team that if they want to seek an opportunity elsewhere in the business, then that’s something that I will quite happily facilitate, in particular if it’s going to make them a better leader, a better manager, a better functionary.”

Mr O'Hara’s people-based growth strategy for Zinfra – grounded by values like safety first and the importance of communication – has set Zinfra up as a trusted partner for the energy sector, with clear successes including Zinfra’s well-established culture of safety and its socially connected, adaptable team.

www.energymagazine.com.au June 2022 ISSUE 18 25 SPONSORED EDITORIAL FUTURE ENERGY

U NPACKING AUSTRALIA’S HYDROGEN FORECAST: POLICIES, COSTS AND E XPORTS

by Lauren DeLorenzo, Journalist, Energy magazine

Due to emerging technologies, market factors and Australia’s federal priorities, there has been a huge surge of interest in positioning hydrogen as the fuel of the future. But what will the future of hydrogen actually look like?

June 2022 ISSUE 18

26

FUTURE ENERGY

27 FUTURE ENERGY

According to a PwC analysis, there are over 90 hydrogen projects in the works in Australia, with a collective, conservative estimate of over $250 billion in investment. There’s no doubt that the sector is widely seen as an opportunity to build economic growth, to establish export supply chains and to reduce emissions.

The Federal Government has outlined the steps to make Australia’s hydrogen industry a major global player by 2030, with Australia’s National Hydrogen Strategy setting up the sector as a priority for investment and growth.

But establishing the industry as a major global force is dependent on a number of constantly changing factors, such as production costs, transport costs, partnerships and regulations.

Here, we look at how these factors are expected to change in the future, and what it will mean for the trajectory of hydrogen in both domestic and international markets.

How much will it cost?

Green hydrogen, which is created by splitting water into hydrogen and oxygen through electrolysis, produces significantly less emissions than fossil fuel-based hydrogen production.

The good news is that with Australia’s abundant land and resources, we are well-positioned to produce globally competitive green hydrogen.

The bad news is that currently, the cost of large-scale electrolysers is standing in the way of widespread production. But that is expected to change.

A PwC Australia report, Getting H2 right: Success factors for Australia’s hydrogen export industry, anticipates a steep drop in Australia’s green hydrogen production costs by 2040 (see figure 1). In fact, green hydrogen is expected to become the joint-lowest cost fuel globally, becoming cost-competitive with grey hydrogen between 2030 and 2040.

“To drive down the cost of hydrogen production, the industry must focus on overcoming the cost of large-scale electrolysers while continuing to drive down the price of our internationally competitive renewable energy,” Mr Haynes said.

“Over the longer term, there is great potential for Australia to play a leading role in a globally traded hydrogen market.

“Australia must put this opportunity at the forefront to demonstrate its intent and conviction in a green hydrogen future, or risk innovation and investment being deployed elsewhere.”

The factors driving cost changes

As green hydrogen projects grow in scale around the world, confidence is expected to grow in financing improved manufacturing facilities for electrolysers. Increased investment in research and development of electrolysers, in addition to better access to equipment, is also expected to bring down costs of electrolysers, and of green hydrogen by extension.

The Clean Energy Finance Corporation’s 2020-21 Annual Report shows that current electrolyser costs of $1.1 million per megawatt are expected to drop to around $500,000 per megawatt by 2050.1

Meanwhile, new technological developments are also expected to drive down electrolyser costs, with innovations in electrocatalysts and fuel cells increasing the capacity and efficiency of these systems.

On top of these changes, a decrease in costs of other forms of renewable energy, such as low-cost solar and wind, will also drive down the cost of green hydrogen production. This is because electricity supply represents over half of green hydrogen production costs.

Developers can look at reducing production costs by considering how to best size the electrolyser, the choice of technology and the best location for the project, where there is easy access to resources such as water supply and export infrastructure.

Investing in export infrastructure

As Australia’s hydrogen sector looks to prove its value in the global supply chain, investing in transport infrastructure will become increasingly vital.

“For nations such as Japan and South Korea, who want to reduce their emissions but don’t have the renewable energy capacity domestically to meet those needs, importing green hydrogen is an increasingly attractive opportunity,” Mr Haynes said.

“Other energy-rich nations are racing to capture this opportunity, so there’s no time to waste. We need a timely and robust regulatory framework that will give industry the confidence to develop the infrastructure, reputation, people and export pathways that will ensure we are globally competitive.”

PwC Australia Integrated Infrastructure partner, Lachy Haynes, highlighted a number of factors which would help reduce the price of green hydrogen.

The location of the hydrogen project will greatly factor into transport costs, and project developers should consider whether transport costs outweigh the advantages of the selected location.

The PwC report found that although the Federal Government’s seven priority regional hydrogen hubs all have access to port

28 FUTURE ENERGY

Year AUD Cost per kilogram 2025 $5.70–$6.10 2030 $4.10–$4.50 2040 $2.00–$2.45 2050 $1.65–$2.05

Table 1: Australia’s forecast green hydrogen production cost (AUD/kg).

1

Getting

Source: PwC Australia, Getting H2 right: Success factors for Australia’s hydrogen export industry

PwC report,

H2 right: Success factors for Australia’s hydrogen export industry

infrastructure, further coordination is needed to reach the full cost-effective potential of hydrogen export infrastructure.

Adapting to new forms of hydrogen transport

This coordination must cater for the major forms hydrogen exports can take, each with its own challenges and advantages.

Liquified hydrogen, which is cooled to -253oC and transported in specially designed ships, is effective in that it does not have to be converted back to a hydrogen molecule once it reaches its destination. However, this form of hydrogen export requires costly infrastructure and technology to transport, and hydrogen boil-off can occur during shipping.

Another common method is combining hydrogen and nitrogen to form ammonia, which can then be transported. Although transporting hydrogen in this form is much simpler in terms of the technology and infrastructure needed, it requires significant processing to extract the hydrogen from the ammonia once it arrives.

When hydrogen is added to toluene, it becomes a liquid organic hydrogen carrier called methylcyclohexane, which can be transported at ambient temperature and pressure. This also requires significant processing to extract hydrogen once it reaches the destination, however toluene can also be captured for reuse in this process.

Each form has different infrastructure requirements and associated costs. Emerging technologies, such as compressed hydrogen tankers, may also increase efficiency and reduce costs in the future.

“For investors, the complex supply chain considerations for hydrogen projects present more challenges than core infrastructure assets,” Mr Haynes said.

“Many hydrogen export projects currently under development have formed consortia bringing together the requisite industry knowledge, skillsets and delivery capability.”

According to the PwC report, forming project consortia reduces construction, technology, market and offtake risks, and teaming up with credible export partners can bolster investor confidence.

Policy challenges for hydrogen’s future infrastructure

As Australia plans for a growing hydrogen sector, changes in its regulatory framework will be required to make the most of existing infrastructure and assets.

“Beyond the physical infrastructure required across the renewable hydrogen value chain, it is the ‘soft’ infrastructure – in other words, the regulatory and social infrastructure – that is the binding ingredient to accelerate the uptake and growth of green hydrogen in Australia,” Mr Haynes said.