EnergyAustralia’s Catherine Tanna on

HOW TO FIX ENERGY

LIGHTS ON, PRICES DOWN

The industry outlook for 2018

THE STATE OF SOLAR

MICROGRIDS

COMMUNITY FOCUSED RENEWABLE ENERGY SERVICES

• Solar Installations/Construction

• Project Management

• Recruitment/Search

• Labour Hire

• Consulting

With Australia currently at the forefront of the global Renewables boom, this has inevitably attracted a significant number of local and offshore investment. As a result, the number of projects under various stages of development is higher than ever before and continues to increase. By all accounts, 2018 will be an excellent year for the Australian Renewable Energy industry.

One of the challenges this creates for both new market entrants as well as established players, is the aggressive competition for the best talent in the market place.

Cranfield Projects boast 15+ years renewable energy industry experience, with the most comprehensive network in the industry. So by partnering with us, you are as good as guaranteeing your success in your renewable energy project execution.

Whether it’s a national Solar PV installation campaign; a utility scale wind / solar farm project recruitment program; or any other recruitment service requirement, contact us today and we will help you pave the path to success.

We currently offer 20% discount for new clients. Contact us today.

operations@cranfieldgroup.com.au

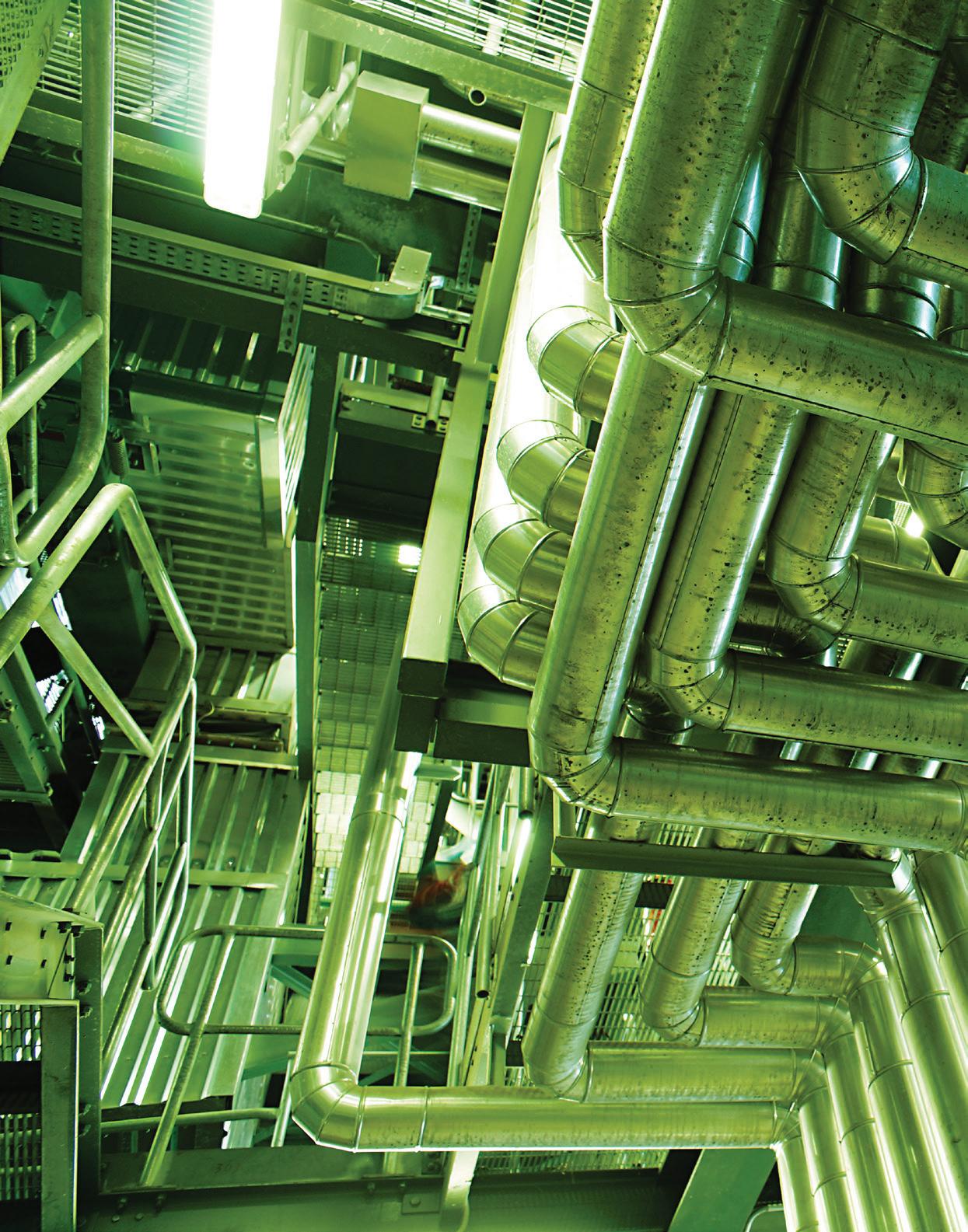

Cover image highlights our feature on Australia's solar industry.

FROM THE PUBLISHER

Welcome to the first edition of Energy magazine. If you’re reading this copy of Issue One you are likely to be working within Australia’s vast energy industry. You’re sure to know the current challenges and issues in the sector surrounding the energy ‘trilemma”- establishing new forms of energy that are reliable, affordable and clean.

You only have to pick up a newspaper or tune into the news to hear stories about how the country is dealing with power supply and prices, while trying to transition to low-carbon energy. With so much discussion already, the question becomes: why create a dedicated magazine to this industry now?

and substations, battery storage, gas, future fuels, electric vehicles, and all that’s in between.

Monkey Media Enterprises

ABN: 36 426 734 954

PO Box 1763

Preston South VIC 3072

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

energymagazine.com.au

info@energymagazine.com.au

ISSN: 2209-0541

The answer is simple, Energy is made for the industry. We’ll be looking at the policies and politics affecting the sector; but we will always place the emphasis on outcomes rather than political point-scoring. We are committed to helping the industry move forward and looking at how to take advantage of new opportunities and best position yourself in energy’s brave new world.

Energy will help to answer the questions the industry is currently grappling with, including:

» What are the energy sources of the future?

» How do we provide energy that is clean, affordable and reliable?

Jessica Dickers Managing Editor

Laura Harvey Associate Editors

Lauren Cella

Charlotte Pordage Journalists

Elisa Iannunzio

Nicole Valicek

Kirsty Hutton

Marketing Director

Amanda Kennedy

Marketing Associate

Sam Penny

Marketing Assistants

Rima Munafo

Katie Chancellor

Production and Customer Service

Titian Bartlau

Senior Designer

Alejandro Molano

Designer

Jacqui Abela

» How do we give customers what they want?

» How do we contend with disruption in the energy sector?

» How do we digitise our networks safely, securely and efficiently?

We’ll do this by talking to major industry associations representing the sector, as well as energy companies and independent experts. For this first issue, you will read contributions from the Australian Energy Council, Energy Networks Australia, National Energy Resources Australia, Clean Energy Council, CSIRO, the Australian Gas Infrastructure Group, the Energy Pipelines Cooperative Research Centre, Horizon Power, and the Energy Users Association of Australia.

We will also be working with a number of other associations which you can read more about in our upcoming issues. We know how varied the energy industry is, so our aim is to cover everything from solar, wind, hydro power, waste-to-energy, energy networks, microgrids, transformers

In this issue, we take a look at the current state of electricity networks and the solar sector, and delve deeper into how microgrids and demand response is easing pressure on the network and giving power back to the consumer, especially during the hot summer months. We also look at specific solar technologies that are helping to convert the most power from the sun, as well as some of the future fuels that will soon start flowing through Australia’s pipelines.

Our goal is for Energy to not only become the industry’s guide to what is happening in the sector, but the place to go for in-depth analysis of the issues and a look at how you can take advantage of new opportunities.

Energy is published by Monkey Media, the team behind highly-regarded industry publications including Utility, Infrastructure and Pump Industry, and will be a fully integrated platform. In addition to the quarterly print magazine, we also have an established website and weekly newsletter that covers breaking industry news. Head over to www.energymagazine.com.au to explore the online home of the magazine and subscribe to the magazine and enewsletter.

Australia’s energy sector, while often politicised, has a critical impact on the day to day lives of everyone in this country. We want to highlight the work that everyone in the sector does to ensure the lights stay on while also helping to provide some solutions to make sure this continues.

Through our other publication Utility, we’ve seen energy production and reliability continue to become a bigger issue over the last few years and realised there was a strong need for a dedicated platform on which to have these important conversations. While the future of the energy industry looks very different than it has over the last century, we believe it has never looked brighter and are excited for what the industry has in store for 2018 and beyond.

48 Australian solar eclipses previous record

50 Sunny days ahead: emerging solar technologies

54 Speed, power and mobility key to solar success

56 World’s first integrated solar pumped hydro project

62 Future fuels for Australia’s energy supply mix

70 The pathways forward for the energy sector

Managing Director, Horizon Power

Frank has held various executive management roles over the last 27 years in the European, Asian and Australian oil, gas and power industries. Contributing significantly to the energy sector in Australia and overseas, Frank is a board and committee member of the Electricity Networks Association, and a member of the Chamber of Commerce and Industry WA General Council, and Australian Electricity Market Operator Expert Panel.

Chief Executive, National Energy Resources Australia (NERA)

As NERA Chief Executive, Miranda is a strategic leader at the forefront of innovation and collaboration within the Australian energy resources sector. It is a role she is passionate about, bringing together the country’s best minds from technology, research and enterprise, all with the aim of building a more sustainable and efficient energy resources sector. With more than 20 years’ experience in strategic policy, risk management and stakeholder engagement, Miranda has a great understanding of the challenges being faced by the sector - one of the country’s biggest economic contributors and employers. Her interest in transformative and disruptive thinking, coupled with her significant industry experience, ensures NERA plays a vital role in leading the future of the energy resources sector.

Miranda has overseen NERA since its inception in 2016 and prior to appointment as CEO, Miranda was the Director Environment, Safety & Operational Performance for APPEA, Australia’s peak oil and gas representative.

Energy Program Director, Grattan Institute

Tony has been Director of the Energy Program since 2011 after 14 years working at Origin Energy in senior executive roles. From 2009 to 2014 he was also Program Director of Clean Energy Projects at the Clinton Foundation, advising governments in the AsiaPacific region on effective deployment of large-scale, low-emission energy technologies. In 2008, he was seconded to provide an industry perspective to the first Garnaut climate change review.

General Manager Corporate Affairs, Australian Energy Council

Sarah was appointed as the Energy Council’s General Manager of Corporate Affairs in January 2016. Sarah is a corporate and government relations professional with more than 10 years’ experience working with policy and regulatory frameworks across the resources and energy sectors.

Most recently she was Chief of Staff to the then Minister for Industry, the Hon Ian Macfarlane, and prior to that worked as a senior policy adviser to the Prime Minister (energy, resources, environment, agriculture and communications).

Sarah has also worked for the industry - between 2008 and 2013 she worked in AGL’s Corporate Affairs team as Head of Government Affairs (and for some of that time also headed up its Community Engagement team). Sarah began her career as a corporate lawyer, and has a Bachelor of Arts/Law from the University of Melbourne. She also worked as a policy adviser in the Howard Government.

Over the last 28 years Andrew has held a variety of public relations, sales and marketing, and senior management roles in the energy utilities sector. In August 2016, Andrew joined the Energy Users Association of Australia as its Chief Executive Officer. Immediately prior to his current role, Andrew had been with Pacific Hydro for 16 years in the role of Executive Manager, External Affairs where he led a team of professionals who managed media and public relations, corporate marketing, community engagement, reputation enhancement, government affairs and policy development.

In addition to this, Andrew was company spokesperson for over 12 years and had represented the company at numerous state and federal parliamentary inquiries into energy and climate change policy along with significant engagement with industry, government and media stakeholders both in Australia and internationally.

Andrew has been active with various industry associations having been a director and president of the Australian Wind Energy Association, director and deputy chair of the Business Council for Sustainable Energy, and was a founding director of the Clean Energy Council having also played a central role in its formation.

Managing Director, EnergyAustralia

Catherine Tanna is Managing Director of EnergyAustralia, one of the country’s leading energy retailers, providing gas and electricity to more than 2.6 million customer accounts throughout the east coast of Australia.

Catherine is a member of the Board of the Reserve Bank of Australia and a member of the Business Council of Australia. She joined international oil and gas company BG Group in 2009 as Managing Director of its Australian business, QGC Pty Limited, and Executive Vice President for Australia and China. Catherine led the development of Queensland’s first LNG project, one of Australia’s largest capital infrastructure projects at the time. In 2012, she was elevated to the position of Chairman, BG Australia.

Prior to joining BG Group, Catherine had a long career with Shell and BHP Billiton. At Shell, she was Executive Vice President of Shell Gas & Power with responsibility for Shell's LNG, gas transmission and power generation interests across Africa. She held similar roles covering North Asia, Russia, North America and Latin America.

Matt is the Oceania Leader of EY’s Power and Utilities business, and leader of the Global Power and Utilities Transactions business, responsible for the coordination of business strategy to clients in the energy, water, gas and infrastructure industries. This role covers not only the markets of Oceania, but also EY’s TAS Power and Utilities functions in the Americas, Europe, Africa, Asia, Russia and the Middle East.

Andrew Dillon is an experienced energy sector executive, most recently as the General Manager Corporate Affairs at AusNet Services, owners of electricity transmission and both gas and electricity distribution networks in Victoria. Prior to AusNet, Andrew was General Manager Corporate Affairs at Energy Supply Association of Australia, worked in Corporate and Government Affairs at TRUenergy (now Energy Australia) and was a Senior Ministerial Adviser. He is also a Director at Goulburn Valley Water. Over two decades Andrew has worked in many parts of the energy industry as well as in government and consulting. He was appointed the Chief Executive Officer of Energy Networks Australia on 20 November 2017.

NORTHAM SOLAR FARM REACHES NEW MILESTONE

Progress continues on the largest solar project under construction in Western Australia following the completion and execution of the detailed transaction documentation for the Partnership Agreement with co-equity investors Indigenous Business Australia (IBA) and Perth Noongar Foundation (PNF).

The design and construct contract of Carnegie Clean Energy’s 10MW Northam Solar Farm with the Energy Made Clean and Lendlease Joint Venture has also now been executed.

The Northam Solar project has a capital cost of approximately $17 million, which includes Carnegie’s development fee.

Significant progress has already been made with initial engineering works and long lead items ordered. The project is on track to be complete in the second half of 2018 when it will begin selling power into the Western Australian grid.

It is the largest solar project currently under construction in Western Australia and the first ever to be developed on

a “merchant” basis where the power is not contracted under a long-term offtake agreement. Carnegie retains a 50 per cent interest in the solar farm.

The Northam Solar Farm has been developed as a template for future projects where Carnegie receives value from multiple revenue streams, including:

» Electricity sales

» Renewable energy certificate sales

» Reserve capacity credit payments

» Project construction and operating and maintenance

» A project development fee

Carnegie’s Managing Director, Dr Michael Ottaviano, said, “This is an important step forward to formally move the project into

the construction and delivery phase. We look forward to working with IBA, PNF and Lendlease on the delivery of this innovative project.”

Indigenous Business Australia’s Chief Executive Officer, Rajiv Viswanathan, said, “IBA is excited to see this partnership come to life, demonstrating how we can work alongside Indigenous organisations and the private sector to generate positive financial and social returns from new areas of the economy.”

Perth Noongar Foundation’s Chairman, Cedric Jacobs, said, “We are excited about the journey we are on together with Carnegie and IBA. We recognise the tremendous effort and engagement by all parties to date”.

EASTERN POWER BILLS PREDICTED TO DECREASE IN MID-2018

Power bills should start to ease in the eastern states from the second half of 2018 as new generation capacity enters the market.

This is one of the predictions from the Australian Energy Market Commission's (AEMC) annual residential Electricity Price Trends Report. The report forecasts electricity prices across the east coast should fall by between five to seven per cent in the 2018-19 financial year and fall even further in the following year. The report predicts electricity prices will increase in 2018-19 in WA, the ACT and the Northern Territory.

AEMC Chairman, John Pierce, said the report shows wholesale electricity costs are now the single biggest driver of change in residential electricity bills – unlike earlier price trends reports which found network costs were the main driver.

Mr Pierce said prices rose sharply in 2017 by almost 11 on a national basis as

consumers felt the impact of Hazelwood and Northern coal-fired plants retiring, and the lack of replacement investment, combined with high gas prices.

“But we expect these price rises will be reversed over the next two years as around 4,000MW of RET-funded wind and solar generation enters the system," Mr Pierce said.

However, the report also found that over time, low wholesale prices contribute to the closure of coal-fired plants. Without new investment to replace these older generators, wholesale costs will start to increase again as supply falls.

“Without investment in replacement dispatchable capacity, wholesale prices will go up again and remain volatile. And the rollercoaster will be repeated,” Mr Pierce said.

To this end, the AEMC is working with other market bodies on the Energy Security Board on the national energy guarantee design.

CONSTRUCTION BEGINS ON GRANVILLE HARBOUR WIND FARM

Construction on Tasmania’s $280 million Granville Harbour Wind Farm has begun.

Once completed, the wind farm will have 31 turbines providing 112MW of capacity, enough to power more than 46,000 homes.

Construction comes after Hydro Tasmania announced in 2017 that it reached an in-principle agreement with Westcoast Wind in relation to a power purchase agreement.

In addition to Granville Harbour, construction on Cattle Hill Wind

Farm in the Central Highlands is progressing, and Hydro Tasmania is continuing with its $1 billion ten year upgrade to facilities to increase generation by 250GWh, which is enough additional generation to power over 30,000 Tasmanian homes.

The Granville Harbour Wind Farm will contribute towards plans to double Tasmania’s renewable energy capacity, have 31 turbines and connect to the network at Reece Power Station.

Hydro Tasmania welcomed the official start of construction on the 112MW wind farm on Tasmania’s west coast.

Director of Wholesale Energy Services at Hydro Tasmania, Gerard Flack, said the business will buy about 360GWh of energy and renewable energy certificates per year from the new wind farm.

“The birth of Granville is another sign that Tasmania’s national energy revolution is really taking off,” Mr Flack said.

“We’re delighted to be supporting the Granville Harbour Wind Farm, and helping to make it happen.”

Tasmania currently has about 300MW of on-island wind power capacity, providing almost 10 per cent of Tasmania’s electricity.

The Battery of the Nation initiative, including plans for more interconnection, will open the door for up to 3000MW of Tasmanian wind power.

“Tasmania has huge natural advantages – including an existing hydropower system, exceptional wind resources, elite expertise, and the head-start we’re already taking,” Mr Flack said.

“Pumped hydro energy storage supports and complements wind development. Our work to identify Tasmania’s best possible pumped hydro sites under Battery of the Nation is progressing well."

RECORD INVESTMENT TO HELP MEET AUSTRALIA’S EMISSIONS TARGETS

There will be enough renewable energy projects built over the next three years to meet Australia’s Renewable Energy Target in 2020, according to the Clean Energy Regulator (CER).

The CER has previously said that to meet the Renewable Energy Target approximately 6000MW of capacity would need to be announced and built between 2016 and 2019.

This milestone has been surpassed ahead of schedule following a record level of investment in renewable energy in 2017.

Already, 4924MW of the 6532MW of capacity that has been firmly announced is under construction or already operating, with the balance expected to be fully financed and under construction in early 2018.

More than 1600MW of projects have a power purchase agreement in place which are expected to reach financial close.

According to the CER, the construction of this level of firmly announced renewable projects will lead to an investment of more than $12 billion which will support growth in the Australian economy.

Queensland has the largest share of this new build with more

than 2000MW of capacity, followed by Victoria with around 1600MW and New South Wales with 1400MW.

One of the major shifts in the market, is the huge increase in share of large-scale solar.

In the first 6000MW committed under the scheme, solar contributed only four per cent of the total. In the firmly announced projects since 2016, solar now makes up 46 per cent.

This will ensure significant additional electricity supply is available in the market well ahead of 2020.

As outlined in the Australian Energy Market Commission’s 2017 Residential Electricity Price Trends Report released in December 2017, this extra supply is expected to apply downward pressure on wholesale electricity prices over the next three years.

2018 should see around 2600MW of new renewables projects commence operating which will further strengthen reliability and reduce emissions in addition to reducing electricity prices.

This additional supply is expected to lead to a reduction in large-scale generation certificate spot prices.

These certificates are purchased by liable entities, mostly electricity retailers, to meet their renewable energy target obligations.

SMART INNOVATION, BUILT FOR THE FUTURE

WILSON TRANSFORMER COMPANY has a successful history of providing transformer solutions for the renewable sector, including wind farms, solar applications and hydro power stations.

We have designed and manufactured transformers to suit both Medium Voltage (MV) and High Voltage (HV) substation applications. Our transformer designs are optimised according to parameters such as generation profile, feed in tariff, distribution voltage, corrosive environment, wind profile, project design life, expected revenue per kWh and cost of capital.

Power Transformers

Distribution Transformers

Compact MV Substations

Open Skid Solar Substations

Special Transformers

Fault Current Limiters

Special Applications

Monitoring & Control Solutions

WA GAS PIPELINE RECEIVES FINAL APPROVAL

APA Group has received final approval from the Western Australian Department of Mines, Industry Regulation and Safety for the construction of the 198km Yamarna Gas Pipeline (YGP).

Civil and construction work, and installation of the generators and gas engines has also begun at the 45MW Gruyere Power Station, which will be connected to the YGP.

APA will design, build, own and operate the pipeline and the 45MW gas-fired power station, at a total construction cost of around $180 million.

APA has subsequently appointed Nacap Australia as the construction contractor for the pipeline.

Nacap has begun establishing a temporary 200-person construction camp along the pipeline route and will mobilise its workforce to site to begin works in February 2018.

The Gruyere Gold Project is a 50:50 Joint Venture between Gold Road Resources and Gold Fields (Gruyere JV), and is located in the Yamarna greenstone belt of Western Australia, 200km northeast of Laverton and to the north of APA’s Eastern Goldfields Pipeline.

A 15-year transportation agreement has been entered into with the Gruyere JV to deliver the necessary energy for the project.

Gas will be transported almost 1,500km to the site using four of APA’s interconnected gas pipelines: Goldfields Gas Pipeline, Murrin Murrin Lateral, Eastern Goldfields Pipeline and the Yamarna Gas Pipeline.

Commissioning of both pipeline and power station is expected to be in late 2018, to align with the Gruyere JV’s expectation of first gold scheduled for early 2019.

Construction is expected to be complete by the June 2018 quarter.

»

Power Systems Australia (EPSA), Australia’s only authorised Cat® engine dealer with seamless support provided by Cat®service

FUTURE ENERGY POLICY IS BEING SET IN 2018

BE INSPIRED BY THE OPPORTUNITIES THAT A TRANSFORMATION ACROSS THE NEM CAN BRING AND COLLABORATE WITH LIKE-MINDED BUSINESSES

JOIN US FOR 2 DAYS OF INFORMATIVE & INSIGHTFUL DISCUSSIONS INCLUDING A ROUNDTABLE WITH THE REGULATORS, FEATURING AUDREY ZIBELMAN, AEMO; JOHN PIERCE, AEMC; JIM COX, AER; AND DR KERRY SCHOTT, ENERGY SECURITY BOARD.

REGISTER NOW AT EUAA.COM.AU

A SUSTAINABLE APPROACH TO TEMPORARY SITE POWER

TIn a move toward sustainability, Federal and State Governments are adopting the Infrastructure Sustainability Council of Australia’s (ISCA) sustainability rating system for all major construction projects. Now the need for sustainable power generation on project sites is high, with innovative green products not only helping to achieve sustainable practices, but are now also important in securing tenders.

he IS rating scheme provides a consistent approach to infrastructure sustainability, enabling smarter solutions that reduce risks and costs, and promote resource efficiency. ISCA plans to launch IS rating v2.0 in 2018, introducing new categories that will consider sustainability through the lens of economics, workforce, resilience and green infrastructure.

One of the high value components in the rating scheme is temporary site power and lighting during a projects construction. Typically, traditional diesel generators can create 2.65kg of CO2 for every litre of fuel consumed.

Generator hire company Green Power Solutions (GPS) offers various solutions that can help the construction industry achieve sustainability by balancing power efficiency and environmental impact against risk and cost reduction.

Sustainable and renewable temporary power generation

One solution is GPS’ biodiesel powered mobile generator. Burning biodiesel emits no sulphur dioxide and CO2 is absorbed

in the growing cycle of the organic matter that produces biofuels, giving biodiesel a zero carbon footprint. This is in line with the Federal Government's long-term target of net-zero emissions by 2050. GPS’ biodiesel biofuels meet Australian and international standards using 100 per cent ethical feedstocks.

GPS has also incorporated a hybrid generator solution for temporary power supply covering various sized sources. The hybrid generator combines diesel generation with two or more renewable energy sources to increase system efficiency and further reduce costly diesel consumption.

Managing Director at GPS, Danny Williams, said, “We can help boost the IS rating with the unique advantages of our products, including that it costs you less in the long term.

“With over 30 years experience in diesel powered generators, generator rental and biofuels, our products are tailored for optimised efficiency and increased reliability.”

For more information, visit www.greenpowersolutions.com.au.

NEW WASTE-TO-ENERGY FACILITY IN THE WORKS

Phoenix Energy will start preliminary groundwork on Australia’s first waste-to-energy facility in Kwinana, WA, in early 2018.

Phoenix Energy and project co-sponsor Macquarie Capital have entered into exclusive negotiations with a consortium to design, construct and operate the facility — which will start commissioning in the fourth quarter of 2020 and is expected to be fully operational in the second quarter of 2021.

The consortium includes Spanish infrastructure and renewable energy company Acciona, and waste management and energy services company Veolia.

The facility is the only waste-to-energy source to be appointed to the Preferred Supplier Panel for Sustainable Energy Generation, that is operated by the WA Local Government Association (WALGA).

Councils are now able to purchase the baseload renewable energy that is generated from their own specific municipal waste, ensuring that their power is being sourced renewably from waste created in their community.

Eight Local Government Authorities have long-term contracts in place to utilise the residential (post-recycling) rubbish from their area to generate baseload renewable energy.

The appointment of Kwinana Waste-toEnergy as a preferred supplier means that

other councils can also supply their waste under the WALGA process and purchase the power back.

Set to be the first of its kind in Australia, the facility will be able to process 400,000 tonnes of waste a year and will generate about 40MW of energy.

STORING ENERGY FOR A SUSTAINABLE FUTURE

Australia’s peak industry event for energy storage, the fifth annual Australian Energy Storage Conference and Exhibition (AES 2018), is coming to Adelaide from 23-24 May 2018.

As Australia transitions to a low carbon future, energy storage has been brought to the forefront of industry conversation. While the implementation of battery storage is increasing, the energy storage umbrella covers many applications and technologies, from pumped hydro to thermal.

These technologies are important, but the focus should be on overall sustainability - environmental and business - and finding the right solution for each situation.

With South Australia arguably the country’s leaders in clean-energy and sustainability, it’s a fitting location for AES 2018, which will see presentations from industry experts, and exhibits from leading companies that are implementing energy storage solutions at the residential, commercial and grid levels.

With a theme of ‘Storing Energy for a Sustainable Future’, the event will explore the huge potential of emerging energy storage, focus on the technologies that will support this transition, and give delegates the chance to lean more about South Australia’s leadership in this fast growing sector.

Renewable energy leaders

The exhibition will be host to industry leading companies, including Tesla, Redflow, Toshiba, Kokam, ANT Solutions and many more, giving attendees

an opportunity to hear about new products and technologies in the energy storage space.

The conference will also feature a keynote presentation from Chairman of GFG Alliance and majority shareholder of SIMEC Zen Energy, Sanjeev Gupta, who has become a major player in South Australia’s energy market. Recently the SA Government contracted SIMEC Zen Energy to help move the state towards a 100 per cent renewable energy target.

Get up close and personal on a site tour

AES 2018 will showcase energy storage integration in energy networks across Australia through a series of comprehensive workshops, an “Ask the Expert” industry session, a comprehensive social program, as well as a new look exhibition floor.

This year will also feature site tours from selected commercial and utility energy storage companies around Adelaide, allowing conference delegates an in depth look at innovative technology and installation, and how to overcome barriers in their deployment. Attendees can talk directly with site owners and technology providers, with the tours running on Tuesday 22 May and open only to conference delegates. Site tours will include Hornsdale Wind Farm, Adelaide HS and Tonsley, and Redflow.

Don’t miss the chance to meet and connect with key decision-makers and be at the heart of the energy storage revolution.

The Australian Energy Storage Conference and Exhibition 2018 will run from 23-24 May at the Adelaide Convention Centre. To register, visit www.australianenergystorage.com.au.

In 1957, CBI Electric invented the highly sensitive residual current device (RCD), which eventually resulted in South Africa being the first country in the world to make the use of RCD’s mandatory.

The development of circuit breakers, from miniature to molded case circuit breakers, utilises Hydraulic Magnetic technology. All of the circuit breakers CBI Electric manufactures employ the Hydraulic Magnetic principle of operation. This technology boasts two distinct properties; one is the accurate tripping characteristics, and the other is that it is independent of ambient temperature variations.

CBI Electric, perhaps better known in Australia as Heinemann Electric, has a long history that dates back to the 1950’s and early 1960’s, and is known for its SF range of products that have been entrenched in Australian mining, rail, industrial and commercial applications.

POSSIBLY THE COOLEST CIRCUIT BREAKER ON THE MARKET

CBI circuit breakers utilise Hydraulic Magnetic technology which always carry 100% of rated current with the trip point unaffected by changes in ambient temperatures.

CBI Electric has products to suit mining, commercial, rail, industrial, solar, telecommunications, and automation, as well as the unique CBE range for OEM equipment.

The CBE range

The CBE range boasts a wide selection of circuit breakers for equipment in the B, C and DD FRAME, and also includes the 13mm narrow profile QY and QDC ranges available for AC and DC applications. These products can be customised to a customer's needs and individual specifications, assuming the specification is covered by the relevant standard. The full range and technical data sheets are available at www.cbi-electric.com.au.

Lack of space?

Try Q Range 13mm circuit breakers

Due to the fact that the modular width is 13mm instead of the traditional 18mm, you will realise a space saving of more than 30 per cent in the same cabinet size. This is ideal if you are going to upgrade existing equipment, equally so if you would like to fully optimise and reduce the dimensions on a new design.

More compact dimensions are often associated with higher temperatures, but as the Q-Range is hydraulic magnetic and thus unaffected by ambient temperature, it allows for the 13mm profile and will always hold rated current. Specially adapted busbars with 13mm modular width, are available in various configurations.

The new 300V, 400V and 600V DC Y frame breakers

CBE has recently released the Y frame, which is also available in the 13mm profile for telecommunication DC applications. This utilises the Hydraulic Magnetic technology and takes advantage of the 30 per cent space saving as per the Q Range.

Solar battery storage for off grid, residential and commercial applications

Utilising its Hydraulic Magnetic technology, CBI Electric has released a range of circuit breakers for the battery storage market which include the standalone breakers from 80A -250A 80V DC, as well as the complete enclosure which houses two breakers to safely protect and isolate battery strings from 80A to 250A.

With the use of Hydraulic Magnetic you are guaranteed to have no effect on the breakers from ambient temperatures, and when fitted into a MCB shell up to 250Amps the customer can save space and enjoy the ease of switching against fuses and MCCBs.

The 250A MCBs are a four-pole unit which come fitted with busbars to achieve the 250A rating and allow for up to three cables to be fitted to the bars. 80A and 100AMP are two-pole units, the 125A and 150A are three-pole units, and the 200A is a four-pole unit. The 250A unit uses a unique 19mm design per pole with the 80A -200A utilising the unique 13mm design per pole.

The Remote Actuation Unit (RAU) is a factory fitted module that enables the automated switching of DD-frame circuit breakers. The unit can actuate the circuit breakers both ON and OFF.

The actuation of the circuit breaker pole occurs completely internally. The RAU unit is mounted on the left hand side of the circuit breakers and can be connected to up to a three-pole unit.

The RAU connects to circuit breakers with a standard toggle. The circuit breakers can be manually operated when in the REMOTE mode. Two indicators are present on the front face of the RAU unit. The first is an LED that provides an indication of the mode of operation as well as showing the unit’s operational status.

The second is a colour flag indication which highlights the position of the latching mechanism of the connected circuit breakers. The unit has a select switch, providing the ability to specify the operation mode - remote or manual. A signal output provides feedback to the user that there is power on the load side of the circuit breakers.

The unit comes with a universally standard connection terminal. For DC circuits up to 300A, and AC circuits up to 100A, the RAU has a operating voltage range of 15Vdc to 80Vdc. Applications include battery storage, telecommunications, railways, solar and system automation.

CBI can design this product to your needs, whether it be three individual circuits at different current ratings or up to the full capacity using three bridged breakers. These are available in one, two and three-pole configurations.

POLYBOX Polyethylene Enclosures

These are enclosures that can withstand the harshest conditions, and come in a range of sizes and designs, including wall mount, pole mount and floor standing pillars. The range features IP54 enclosures that are heat resistant; have a 15 per cent reduction in heat than conventional enclosures to protect sensitive equipment; are acid resistant; fire retardant; won’t attract lightning strikes; are approximately 30 per cent lighter than standard metal enclosures; and can be recycled up to five times.

CBI’s in-house design and assembly has, to date, completed projects using Polybox enclosures for utilities, solar installations, and commercial and industrial projects including temp boards specifically designed and manufactured for Sydney tunnel projects.

Pole top boxes for utilities allow visible indication of phase fault - this can be

seen from ground level and can be easily switched back to the on position once the fault is cleared.

Pole mounted power quality application for utilities.

Distribution pillars feature a unique anti gravity three point slam lock for added security and are approximately 50 per cent lighter than conventional pillars.

POLICY

by Sarah McNamara, General Manager Corporate Affairs, Australian Energy Council

by Sarah McNamara, General Manager Corporate Affairs, Australian Energy Council

CERTAINTY

CRITICAL ISSUE

The beginning of 2018 has focused on whether the National Electricity Market can withstand the demands of summer. This would have been unheard of not that long ago, but the state wide blackout that occurred in South Australia in September 2016 and subsequent supply issues elsewhere last summer have made reliability of supply a “front and centre” issue.

For this summer, the Australian Energy Market Operator (AEMO) committed funding to arrange additional reserve supply under its Reliability and Emergency Reserve Trader (RERT) powers. In a late January heatwave, AEMO prepared some of this reserve plant to operate, but while conditions were tight, it didn’t need to be called on.

This did not prevent finger pointing about the lack of wind generation when required in hot conditions, or questions being raised about the reliability of coal and gas-fired plants in the heatwaves.

So the year started as 2017 finished, in an ideological debate about the best way forward and the merits of different forms of generation, the nature of policy risk, climate change and how much life is left in old power stations.

Recent plant closures

All forms of generation have their challenges at times of high temperatures and peak demand. The biggest difference at the moment is the lower dispatchable reserve margin available in the market, due to the closure of plants like Hazelwood in Victoria and Northern in South Australia. They were the most recent of 10 coalfired generators that have left the National Electricity Market since 2012, taking more than 5,000MW of firm, dispatchable capacity with them. The retirement of another 15,0000MW is likely to occur over the next 15-20 years. Retiring power plants at this rate without replacement creates supply-demand imbalances.

The plants that have closed have not been replaced with likefor-like generators. Since 2012 we have seen more than 3500MW of large-scale renewables and another 3400MW of rooftop solar introduced with support from the Renewable Energy Target, as well as various state-based support schemes. But this new variable renewable energy generation is not the same as new dispatchable capacity.

At a practical level it means the level of back-up generation is thinner and so trips on individual units during high demand are now likely to be more significant and noticeable.

The increase of reliability risks is the reason why the recently formed Energy Security Board has recommended a reliability guarantee obligation as part of the proposed National Energy Guarantee (NEG), which is currently before the Council of Australian Governments’ (COAG) Energy Council.

Policy certainty needed

The solution to energy policy in Australia hasn’t changed in a decade. At a strategic level, and from the industry’s perspective, it isn’t overly complicated. Australia needs policy certainty to foster adequate investment and thereby provide access to energy resources. Once that is in place, the market will make the necessary investments in response to market incentives which will restore confidence in electricity reliability.

The design of the future grid will be shaped by things such as the cost of technologies like renewables and storage, the price of gas, the ability of technologies like lower emissions coal to

get cheaper and cleaner, the evolution of distributed energy like solar, and the way consumers are encouraged and incentivised to handle their demand.

It is the reason why bipartisan agreement on national energy and climate policy is critical and is being urged by the energy industry and business more broadly.

Resolution of energy policy will remain challenging in 2018, particularly when you take a look at the political calendar for the year. There will be three state elections – South Australia and Tasmania in March and Victoria in November. A conventional (ie not a double dissolution) federal election is possible from 4 August 2018. In all three states, energy policy and developments will be an important focus and part of the political debate. The Labor governments in SA and Victoria are committed to continuing to develop renewable generation and battery storage.

The stakes are high

Further south, energy has not been far away from the headlines in Tasmania because of the “energy crisis” it went through in 2016 with the loss of the Basslink interconnector and low dam levels, and debate over the retention of the Tamar Valley gas-fired plant. More recently, discussion of the state becoming the “battery of the nation” as well as a jointly funded Federal and State Government feasibility study into a second Basslink interconnector are underway.

So the energy stakes continue to be high. The NEG is a considered and welcome proposal which

addresses all three elements of the so-called energy policy trilemma - reliability, cost and emission reductions.

The two arms of the NEG are a reliability guarantee to ensure energy is always available, and an emissions guarantee to enable the energy industry to meet its share of Australia’s commitments on greenhouse gas emission reductions. The reliability guarantee is planned to become effective by the end of 2019 with the emissions guarantee to come into effect in 2020. Compliance with the guarantees will be the responsibility of electricity retailers.

A detailed design consultation will begin shortly to assess how best to implement the NEG with as little impact to market participants as possible, and avoiding unintended or unforeseen consequences.

The Energy Security Board is well placed to run this consultation and stakeholders are cautiously optimistic that a workable NEG can be the outcome. It is critical that this consultation does involve all of the industry, including large and small players, in order to develop the right set of market mechanisms to bring the NEG to life. Support for, and participation in, this consultation with the Energy Security Board will be the key task of 2018 for the Australian Energy Council, and the industry as a whole.

The success of the NEG will be measured by whether it can achieve the necessary bipartisanship and COAG endorsement to enable it to become a durable policy on which industry can rely, and investment can occur. Without that support, policy instability will continue and the industry will struggle with the kind of investment uncertainty that has occurred over the past decade.

HAVE CONFIDENCE – WE CAN FIX ENERGY

by Catherine Tanna, Managing Director, EnergyAustralia

There’s a well-known joke about a tourist in the Australian outback who asks a local for directions to Sydney. The local, a farmer leaning on a fence post, thinks for a while, then replies: “Well, if I were you I wouldn’t start from here…” That’s energy. If we wanted to build a modern, efficient energy system in Australia, we wouldn’t start from where we are right now, either.

It seems like the situation has come on us with little warning. It’s more shocking because for the past two decades energy supply has been reliable and prices have been steady –even falling.

But energy is vital to the health and wellbeing of all Australians. So, we have to fix it.

And, I believe we will fix it.

First, we need to agree what success looks like.

To a normal person, with far better things to do with their lives, energy must be desperately difficult to make sense of. In their eyes it must seem politicians, electricity and gas retailers, generators, green groups and consumer organisations are pulling in different directions.

In 2017, we had more than a dozen examples of governments directly intervening in energy markets.

On the surface, action on international gas contracts, compulsory arbitration in pipeline disputes and the removal of rights of appeal for poles and wires networks all seem good for retailers and for customers.

Perversely though, these polices add risk, which discourages investment. You can make the case that, in hindsight, many of these interventions were less about providing policy certainty, and more about finding an immediate solution to a political problem.

It hasn’t been all bad, though. We welcomed moves by the Federal Government to make power bills and offers more transparent. We will always support measures which make energy easier to understand, so customers can get a deal that’s right for them.

But what’s next? Snowy 2.0, more coal-fired power stations backed by government, using taxpayers’ money to fix a problem the private sector is willing to solve? These assets aren’t cheap and tie up capital for decades.

In a competitive market, government and industry share responsibility for energy. Right now, the politics are making it very hard for good politicians to do the right thing.

So, we are where we are. What do we do about it?

I think success means delivering affordable, reliable and cleaner supplies of energy for everyone in Australia, no matter what they earn or where they live.

When we prioritise one of those things over another, we get the situation we have now: high power prices and, in some states, the lights going out.

The answer is simpler than you might think. It’s this: confidence, in fact, restoring the confidence of the private sector to make the long-term investments needed.

Don’t mistake simple for easy, though.

Yes, the National Energy Market needs tweaking, but not an overhaul.

Attracting investment in new generation is critical to restoring the vitality of the NEM. If we’re to do that, there is no substitute for stable, bipartisan energy policy, one that provides transparency in generation markets and sets a long-term trajectory for carbon emissions.

That kind of policy is integral to giving business the confidence to invest, whether that’s backing new, cleaner generation to replace coal or entering long-term energy contracts.

Confidence fixes most things.

Yes, a mechanism for pricing carbon will impose cost for industry. So why would the three largest energy retailers advocate for such a thing?

Because of the certainty it provides. The knowledge that the rules won’t change as governments change is far more valuable. We’re already working hard to ease the pressure on families and businesses from power prices:

» We’re continuing to invest in the reliability and efficiency of our big power stations at Yallourn and Mt Piper, so they’re there when needed. These plants are giving us time to make an orderly transition to cleaner sources of generation.

» We’ve committed an additional $1.5 billion to supporting the development of new wind and solar projects in eastern Australia, representing 500MW of additional capacity.

» We’ve brought to market the next generation Redback Smart Hybrid System; this new technology combines a solar inverter, battery enclosure and intelligent energy management software into one package. The Redback system was specifically created to put families and businesses in control of their energy consumption.

» We’ve established partnerships with the Sydney Opera House and Melbourne Cricket Ground to help these remarkable icons use energy more sustainably, in ways which one day may be applied in homes around the country.

» We’re investigating $1 billion of potential new gas-fired generation, a $480 million pumped hydro project in South Australia and a $160 million energy recovery project in New South Wales, all of which could provide new supplies and stability to the grid.

» We’ve started an exciting trial with the Australian Renewable Energy Agency and the Australian Energy Market Operator aimed at securing 50MW of demand response reserve capacity in New South Wales, Victoria and South Australia.

» We’re investing an additional $10 million in our national hardship program which provides financial and other support to people in need.

» We’ve launched a new rate-fix product, Secure Saver, that allows households to avoid rises in energy tariffs for the next two years, while we work to ease the pressure on power prices.

That’s just a fraction of the things we’ve done and what we’re doing. Of course, there is much more to do.

But imagine what we could achieve with the confidence that comes from stable policy, with knowing that a major investment today won’t be rendered obsolete tomorrow.

EnergyAustralia doesn’t have all the answers – we can only deliver reliable, affordable and cleaner energy for all as part of a much broader response, one that involves all parts of industry and governments working together.

The National Energy Guarantee is a serious proposal to address reliability and emissions reductions. We hope it can lead to agreement between State and Federal Governments on a national approach that reduces duplication and unnecessary cost for customers.

It’s an opportunity for our politicians to do the right thing for families and small business across the country.

Rarely, if ever, has there been so much attention on energy. And rightly so, because of the good it does for our community.

It’s precisely the right time for this brand-new publication Energy to harness the focus on the sector and lead the way forward. I wish you all the best and look forward to future editions, when we can say energy has been fixed.

People are looking to us to get it right.

WHAT THE ENERGY RESOURCES SECTOR CAN LEARN FROM A

famous fairy tale

In the fast changing technological and digital world we live in today, exploration and creativity are going to be skills as essential to society as STEM (science, technology, engineering and maths).

My holiday reading this Australian summer included a brilliant Chinese science fiction novel. Death’s End (part three of The Three-Body Problem by Liu Cixin), is a novel on a grand scale. Liu brilliantly deploys hard science and the law of physics to ground the novel and convey a sense of measured reality, whilst simultaneously taking us on a huge leap of imagination to explore the scale of the universe and the consequences of our human choices. As one commentator observed, “At its core, science fiction capitalises on uncertainty about the future to push the boundaries of the reader’s imagination.”

Death’s End got me thinking about two things. The first is the potential power of stories to convey important messages - if done well and wisely - and the second is the complex interaction of consequences from developing, finding, choosing and applying science and technology solutions.

by Miranda Taylor, Chief Executive, National Energy Resources Australia (NERA)With digitalisation, new technologies and new energy sources all disrupting the industry, energy resource companies are looking to create new growth areas and innovate current business models. But how does this relate to fairy tales?

Miranda Taylor from NERA explores how the choices and collective actions of industry could take advice from the creative world.

Solutions causing more problems

This was given a somewhat humorous twist for me by a social media post by The Economist that I spotted on Twitter; “plastic-eating caterpillars could save the planet”. In turn, I was quickly reminded of the famous children’s rhyme, ‘There was an old lady who swallowed a fly'.

The old woman eats increasingly large animals to deal with the problems introduced by eating the previous animal i.e. a spider to eat the fly, a bird to eat the spider and so on. The rhyming tale is silly and fun, and children love this, but like many fairy tales it has a dark side - the old lady ultimately dies.

A clear message would be that solutions can beget different and far worse problems. I won’t comment here on the plastic-eating caterpillars, except to say that the introduction of plastics technology dealt with some serious previous problems and introduced new ones.

In a recent article in The Australian, Bjorn Lomborg, Director of the Copenhagen Consensus Centre stated in regards to climate change:

“…goodwill isn’t enough to stop climate change, and history is littered with well-meaning policies that turned out to be unhelpful or even worse than the problems they were meant to address.”

He cited a historical example, Mao Tse-Tung’s ‘Four Pests’ campaign – an attempt to improve crop yields and tackle serious health issues in China through the

eradication of pests, one being sparrows. Infectious diseases such as tuberculosis, plague, cholera, polio, malaria, smallpox and hookworm were endemic in late 1940s China, and at a time of huge political and social transition urgent solutions were needed.

The campaign was a success – the whole population was rallied to enact it - but that very success was also an unmitigated disaster for the Chinese people. With no sparrows to eat them, the population of other pests such as locusts ballooned, crops failed and contributed to a famine, and it is estimated that around 30 million lives were lost. Novel agricultural techniques implemented through the Great Leap Forward further contributed to the disastrous effects of the campaign.

Creating connections for growth

So, what does this all mean for the energy resources sector and Australia broadly?

One thing we can be 100 per cent sure about as 2018 speeds up, is that the convergence of technologies and innovative business models, and the rapid development of new energy sources and electrification, will disrupt industries, economies and society.

But - and it is a huge but - we must make informed, strategic choices, understand the consequences (intended and unintended) of those choices when combined, and take action collectively. Without doing this, we

create the potential to create our own sector’s version of China’s 'Four Pests' campaign.

Over the next five years, energy resource companies will be working to drive productivity improvements and optimise existing assets, develop and access talent and knowledge to adapt digital and automation technologies, and create new value and growth areas and innovative business models. At the same time, those companies need to look forward to a decarbonised economy, anticipate technology disruptions and diversify.

Working together we can tackle big challenges and successfully transition Australia into a fair, smart, high value, digital, export-focused economy, and the energy resources will be well placed to provide Australia with reliable, secure, cost-effective and decarbonised energy for decades to come, while simultaneously growing a strong domestic industry of technology and service providers, and generating future focused jobs.

NERA will continue to work with industry to create connections for growth and help unlock new commercial opportunities through collaboration between industry, SMEs, supply chains, entrepreneurs, investors, and the scientific and research community.

Digitising the sector

Our focus this year will be to support the increasing digitalisation and automation of the energy resources sector, informed by the growing role of sensors, data, machine learning and AI to provide insights and inform action.

We will also be working to deepen the connections between the research sector, particularly PhD students, with innovative SMEs to develop and commercialise digital technology in partnership with larger supply chain companies and contractors, and miners/ operators.

A key action will be to support the researchers and end users to come together with innovative SMEs to co-create and commercialise solutions – with the start-up and SME sector most able to be agile and innovative.

NERA welcomes you all to 2018, and may we not eat a spider if we should swallow a fly without rigorously framing the problem first.

AUSTRALIA’S FUTURE ELECTRICITY SYSTEM

For most of Australia’s history, electricity has come from big power sources. Up until around a decade ago, a power station was typically a huge coal-fired steam turbine plant that took many hours to turn on or off. And until very recently, we had almost no way to store most of this power. All around the world, this is now changing.

We are moving into a world of distributed electricity, flowing from multiple sources rather than a few giant structures. US research firm Navigant, borrowing a term from online technology, has talked of an ‘energy cloud’ made up of millions of small suppliers. It’s a world in which most consumers will have much wider energy choices.

New technology falls in price

Thanks to a fall in prices over the past decade, solar photovoltaic cells have become a viable way to generate electricity, says Stuart Allott, AEMO’s group manager of communications and corporate affairs.

While companies have been creating large solar farms to produce electricity, households have been creating another major source of solar power; solar arrays on the roofs of their homes. Wind power too has come down in price, as companies learn how to make more efficient wind generators.

Electricity storage becomes affordable

Electricity experts of three decades ago noted that electricity could not be effectively stored. But new battery technology originally developed for laptops and phones has changed that. Efficient, affordable battery storage makes solar and wind power far more useful, allowing power from these sources to be stored and fed back into the grid when needed. They effectively become an additional power source for the whole national system. Tesla, known more as an electric car manufacturer, made headlines last year regarding its 100-megawatt battery array near Jamestown, South Australia. Further north, at Port Augusta, the SA Government has also commissioned a 150-megawatt solar thermal plant whose molten salt system can store the sun’s

heat for several hours. The salt storage technology lets the plant produce energy during the evening, when electricity demand is highest.

Such plants produce far less power than a plant like NSW’s coal-fired Eraring Power Station. But there will soon be far more of them. Experts like Jo Witters, head of AEMO’s Centre for Innovation, and Tony Wood, director of the Grattan Institute Energy Program, expect dozens of these cleaner-power, small generation plants to join the system in the coming years.

All this power is flowing through a national transmission system that can now send substantial amounts of power from sunny parts of eastern Australia to other areas that may be overcast and windless. In a highly interconnected system, the ability to move power is as important as storing it.

Putting the puzzle together

As Mr Allott notes, another way to meet demand is to have some electricity users agree to stop taking energy or provide power from sources like backup generators at peak times – what is sometimes called a ‘virtual power plant’. AEMO has already struck a deal of this sort for the 2017-18 summer.

In the years ahead, Allott says more consumers will likely be able to make similar deals, getting paid for minimising their use when demand for electricity is highest.

Mr Wood points out an additional source of change in the system. In recent years, many power plants have moved from government to private ownership. When governments build power assets, Mr Wood notes, they tend to build more than what is needed. Private owners often find ways to do things more cheaply, because their owners share in any savings. But as Mr Wood points out, private owners are less willing to build generating capacity that may not be used.

The result of all these changes is now emerging. It’s a substantially different power system where many sources of

power enter and leave the grid at different times of day and night – Navigant’s ‘energy cloud’. No longer does the bulk of Australia’s power come from sources that stay on 24 hours a day – as of 2017, AEMO has calculated that coal has fallen to under 50 per cent of the Australian electricity and gas system’s total supply.

And a rising proportion of the electricity fed into the system now comes from electricity users – businesses and households that don’t think of themselves as ‘electricity businesses’. As the system evolves, more and more consumers will have greater control over how they use and pay for power.

As the system evolves, CSIRO modelling raises the possibility that by 2050, up to 45 per cent of Australia’s electricity supply could be provided by millions of such sources around the country.

The body in charge of turning all these pieces into a reliable, affordable electricity supply is AEMO. It works within government policies while advising the government on how to ensure Australia has electricity ready as the generation mix changes.

Keeping the lights on

AEMO’s job is to look ahead and make sure the national electricity system always has electricity ready to be dispatched, while keeping downward pressure on prices. Mr Allott describes it as a careful balance.

“Our role is to keep the lights on,” he says. AEMO’s target for availability of supply, at 99.998 per cent, is one of the world’s most stringent, Allott notes.

AEMO’s task will continue to evolve over the years as the electricity industry evolves, with Wood expecting the evolution to take “the next couple of decades”. It’s an explosion of innovation and consumer choice that will change Australia.

For more information or to read other industry insights from AEMO, visit energylive.aemo.com.au

ARE AUSTRALIA’S ELECTRICITY NETWORKS READY TO INNOVATE?

by Michael Rath and Kumar Padisetti, DeloitteWe hear a lot about innovation, but what actually is it? It is hard to find a consistent definition and what it is meant to achieve. Innovation can be described as the creation of a new, viable business offering 1. It differs from invention in that it goes beyond products and extends to platforms, business processes and the overall enhancement of a consumer’s experience. Most importantly, innovation brings added value across all of these areas.

Australia’s electricity network businesses find themselves in the middle of an energy transition brought about by rapidly changing technology, and dynamic and evolving consumer preferences, including escalating energy prices and a regulatory environment that is grappling to respond to a changing market. They recognise the need to innovate right now and know they need to invest more in transformational innovation, new products and markets.

The challenge however is to expand their innovation into areas they find less easy in order to overcome the difficult structural changes needed. Innovation through the process of energy transition represents the greatest opportunity for network

businesses to invest and deliver value for the consumer.

Deloitte’s Innovation in Electricity Network study2, assessed the state of innovation within Australian electricity networks and found an urgent need for them to innovate in order to meet (and exceed) customer needs into the future. The study also identified a need for greater investment in transformational innovation, including distributed energy resources, battery storage, multi-flow networks, demand and energy management, and advanced data analytics and automation.

Network businesses recognise the risks and opportunities presented by disruption and, in response are becoming more innovative. Innovation for network businesses is viewed as a developing capability.

They accept the need to take advantage of changes in technology, however over half of those who contributed to the study acknowledged they lack the current capability to act upon their innovation ambitions. They feel limited by their ability to access innovation opportunities in these areas due to regulatory frameworks and organisational risk appetite.

Five other key takeaways from the study include:

1. Electricity networks have big ambitions for innovation in their businesses.

They see the need to direct a greater proportion of investment to transformational innovation in new products and markets. Today, 17 per cent of networks’ innovation investment is directed toward gamechanging, transformational innovations. In five years, networks want 24 per cent of innovation investments to have a transformational ambition.

2. Network businesses need to create the right environment for innovation to deliver on their big ambitions. 61 per cent say they do not effectively measure innovation progress or outcomes to identify when they’ve done it successfully or poorly. Only 11 per cent of businesses think they are effectively recognising and rewarding staff contribution to innovation.

3. Networks’ ability to innovate is constrained by their appetite for risk and the regulatory environment in which they operate. Australia’s regulatory framework defines areas in which regulated network activity can occur, including the types of activities that can be undertaken. In addition to regulatory requirements, businesses acknowledge a lack of appetite for risky investments. Many of the more innovative network businesses are more motivated to pursue higher risk opportunities where and when needed.

4. Network businesses are highly specialised and focus their innovation investment on core assets and business processes.

63 per cent of networks’ innovation investment is in core business. The challenge is to expand innovation effort into areas they find less comfortable in order to overcome the difficult structural changes needed and access opportunities to create value for consumers.

5. Some network businesses have welldefined and understood innovation strategies, but many also identify issues within their strategy or their ability to execute.

Strategies may articulate the networks’ ambition, but many are not clearly laying out the specific actions, roles

ABOUT THE AUTHORS

and responsibilities needed to deliver. Our analysis found no correlation between businesses’ innovation ambitions and their ability to execute. The barriers to innovate may be significant enough to prevent the delivery of new ideas and value creation.

What is clear is businesses need to have a bold, clear innovation strategy with tangible targets and expected outcomes, freeing people up to innovate in a disciplined way that embraces risk, and accepting potential failure in the pursuit of positive and sustainable results.

Where to from here?

Ultimately, network businesses will be able to say they have a high degree of innovation maturity and capability when innovation becomes an organisational core capability and is a highly systematised effort with adaptive capabilities. Processes, governance and resourcing will be refined, additional reinforcing mechanisms implemented to accelerate outcomes, and novel, specialised capabilities created to adapt to new opportunities.

The way we produce and use electricity is rapidly changing. It is essential that network businesses navigate this change and deliver the benefits of innovation to customers. Their ability to lead effectively will influence Australia’s ability to address the energy trilemma – cleaner, affordable and reliable electricity.

Michael Rath is a power sector specialist and National Leader for Energy and Resources.

Kumar Padisetti is a partner and leads Deloitte Access Economics’ Energy and Resources team.

TECHNIQUES TO MITIGATE BUSHFIRE RISK WHEN DEPLOYING RECLOSERS

Throughout Australia, NOJA Power’s OSM Recloser has become the trusted name in bushfire mitigation technology. Collaboration between the Brisbane-based manufacturer and Australian utilities has culminated in a suite of protection and automation functionality deployed to resolve the challenges of Australia’s catastrophic bushfire season.

After the 2009 Victorian bushfire disaster, thousands of NOJA Power Reclosers were deployed to solve and mitigate bushfire risk. Nine years later, the system is still achieving its goal.

The key to bushfire mitigation strategy in reclosers relies on:

» Secure communications and control of the auto-reclosing sequence

» Advanced sensors and protection functionality designed to monitor and act on high-impedance earth faults

» Enclosing the insulation system completely in an IP66 rated enclosure

Any form of reclosing is not the solution to wildfire or bushfire mitigation, reclosers must be used in single shot mode on fire risk days.

Reclosing is an important but small part of an overall bushfire mitigation strategy. Utilities need to consider fault detection techniques to detect high impedance faults in the first place. Some of these protection capabilities available in NOJA Power’s OSM Recloser are listed in the table below.

NOJA Power OSM Recloser System

Bushfire Mitigation Strategies

Mechanical Protection and Automation

Arc Fault Venting

200mA SEF Minimum Pickup

Fully Enclosed Design High Resolution SEF

No Exposed Solid Dielectric ANSI46 Broken Conductor

Admittance Protection

Harmonics Protection

Negative Phase Sequence Protection

Smart Grid Automation

Whilst the deployment of NOJA Power Reclosers throughout Australia has been successful in mitigating fire risks across the country, it is imperative that the entire system be considered. For all the protection functionality in the device, an absolute necessity is arc fault control and venting.

The OSM Recloser is a fully encapsulated product, where the entire device is contained within a Stainless Steel IP66 Rated enclosure. This enclosure ensures arc fault containment and venting in accordance with the requirements of IEC62171-200 and confirmed by type test certification of the recloser at Test & Certification Australia.

For a full test video, go to www.nojapower.com.au/typetest/ recloser-arc-fault-containment-solid-dielectric.html

Not only does this rugged enclosure provide containment and controlled venting for arc faults, it protects the solid dielectric insulation from the harsh Australian sun. Solid dielectric insulation reliability is achieved by shielding the insulators from solar radiation.

“Bushfire risk is one of the greatest challenges that Australian electricity utilities face,” said NOJA Power Group Managing Director, Neil O’Sullivan.

“At NOJA Power, we have focused significant R&D resources to equip our OSM Recloser products with functionality and safety features to provide the tools to our electricity utility customers to correctly manage their bushfire mitigation programs.”

MICROGRIDS – NAVIGATING

NAVIGATING THE CHANGE

by Frank Tudor, Managing Director, Horizon Power

by Frank Tudor, Managing Director, Horizon Power

As Australia’s energy industry undergoes unprecedented change driven by consumers’ desire for more choice and control, Horizon Power’s unrelenting focus is on the future – and that future is microgrids.

Western Australia is helping to shape the energy transformation journey, with our regional and remote communities at the forefront of the energy production frontier.

Why? Because the technological changes currently underway are focused on integrating customers and their devices at the low voltage distribution side of networks.

This poses challenges at a technical level, to both integrate and then optimise the interaction of these devices at a very high level of penetration (more than 50 per cent) for the benefit of the individual owner and collectively for the interconnecting network system.

This also poses challenges around regulation and pricing. The ability to trial different concepts in partnership with communities, without the undue impediments of differential ownership of the existing supply system and heavy

regulation, make our portfolio of microgrids ideal development platforms (sandboxes if you will) to prove concepts, and develop capable and valuable intellectual property.

Microgrids are an ideal solution for our communities – Horizon Power services the biggest area with the least amount of customers in the world; for every 53.5km² of terrain, we have one customer. We have nearly 40 microgrids spread across a vast area of 2.5 million km².

Microgrids unlock the potential for technological advances, cost-saving measures, and more renewable and environmentally-friendly energy options to be implemented into a network.

Microgrids are self-sufficient electricity networks that can be embedded in, or be remote from, a larger network. These grids enable distributed energy resources like solar panels and batteries that are located away from a central power station to feed into the network.

As an intelligent network, a microgrid will also allow the integration of smart devices and appliances. Distributed energy resources can be combined to complement the main power supply and help meet demand, and can offer greater potential for consumer participation, catering to a future world where prosumers are the norm.

So the challenge we face is managing the integration of the distributed renewable energy sources into our existing networks.

Putting it into practice

At present, some microgrids in our service area, such as in Carnarvon and Broome, have reached capacity for how much solar energy they can host, but that will soon be a thing of the past as developments and upgrades are made.

The Pilbara town of Onslow is the first of our microgrids to be tested, with up to 50 per cent of the town’s energy needs to be delivered by a combination of solar and battery storage.

The project includes essential electricity network infrastructure upgrades, a new transmission line and substation, as well as a 5.25 megawatt gas-fired modular power station, designed to efficiently contract in size as the renewable energy contribution expands to meet energy needs.

Our Onslow microgrid project is one of the largest undertaken in the Asia Pacific region. Distributed energy resources will be integrated, in collaboration with

the community, at levels not previously achieved in remote microgrids. This work will see the replacement of the entire traditional power system in Onslow.

Our business strategy – something we invested significant time in to revolutionise – outlines the shift we want to see from traditional energy infrastructure to a future of more rooftop solar, batteries and stand-alone power systems in each of our electricity networks.

This approach is receiving widespread acclaim from industry experts. In 2017, Deloitte named Horizon Power as one of the three most innovative electricity companies in the nation.

Running

with the research

Our strategy is based on forecasts that by 2050, around 62 per cent of our systems will be best served by distributed energy resources, 12 per cent will be offgrid (such as standalone power systems), and the remaining 26 per cent will remain centralised, but incorporate a high level of renewable sources.

As a result, carbon emissions are forecast to reduce by 51 per cent over the same timeframe, while reliability will improve and overall system security will be maintained.

Bloomberg notes that more has been spent globally in recent years on renewables than thermal generation, and Navigant Research anticipates that more will be spent on distributed rather than centralised renewable energy by the end of this decade.

Studies by CSIRO and Energy Networks Australia foreshadow a similar trend towards distribution enabled by advances in technology. This will inevitably challenge regulation, business models and the very essence of the status quo in the electricity industry which has developed without much change over the last century.

I would argue that microgrids in their various guises will form the DNA of the electricity industry in the 21st century.

The technology we are developing here in regional Western Australia will steer the nation’s energy industry into the future and help us achieve our core business objective – to become the world’s leading microgrid company.

Ours is a rare and unique portfolio, and one that is ideal for developing and refining the products and services for this new world of energy.