SOLAR FORECASTING by predicting cloud behaviour

The clusters powering Australia’s hydrogen future

FIVE WAYS ENERGY TECHNOLOGY will change in the next decade

ISSUE 13 · March 2021 · www.energymagazine.com.au

“Run with us – Your partner in Plastics”

All Australian Supplied Electrical Cable Cover is manufactured in accordance with AS4702-2000 and is independently tested, by TUV Rheinland Australia

Unique rounded edging of the Cable Cover ensures maximum installer safety and reduces the risk of injury

100% Recycled Plastic

Notched Pallet allows web hoist to be safely fed through the coil and ensure safe offloading of larger coils

Gas Protection Covers available in a range of sizes

The Corrugated Cable Cover, is a patented product, manufactured under License

Thicknesses range from 3mm to 10mm, Widths available from 100mm up to 600mm

Standard Slab Length available in 1.2, and 2.1 Metre

Standard Coil Lengths are 10 Metre, 15 Metre, 20 Metre, 25 Metre and 150 Metre

Both Plastics Extrusions Thailand, and AGC Plastics, are 100% Australian owned and ISO accredited Companies

The product is continuously checked during the production cycle to ensure the surface finish, size, weight and impact strength are to the required specification

In-Line Printing allows for product batch and manufacture date for identification and tracing

Maintain strict control over all our procedures so as to maintain the highest quality of both product, and service to our customers

+61 432006775 rory@agcplastics.com.au

for further information.

Contact Rory Livingston AGC Plastics Pty Ltd 38 Sarton Road, Clayton Victoria, 3168 Australia www.agcplastics.com.au AGC Plastics has a number of quality distributors in Australia, as well as internationally. Please contact us

CABLE COVER

AS4702-2000 ELECTRICAL

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

energymagazine.com.au

info@energymagazine.com.au

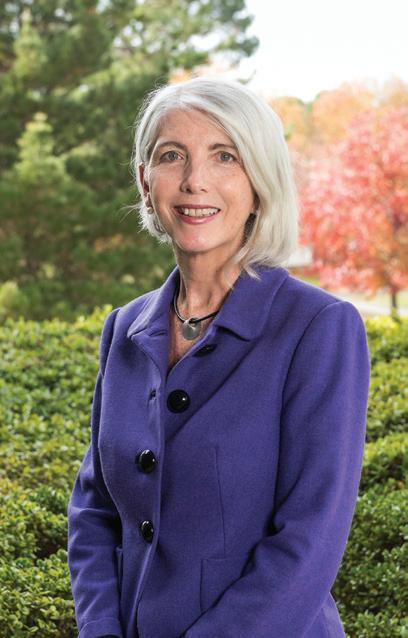

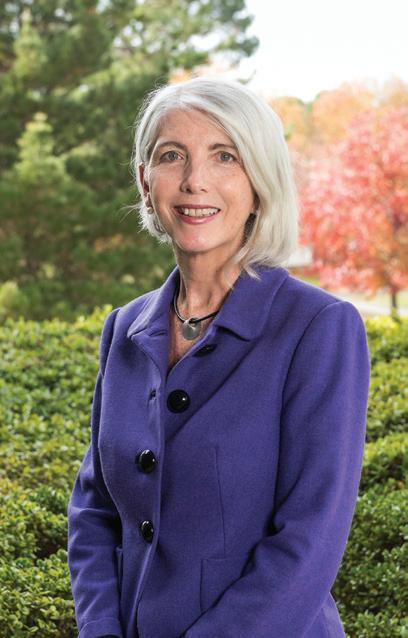

Anew year brings the chance to start afresh and look at exciting new possibilities, and from where I sit, the energy industry has embraced this opportunity enthusiastically.

After the challenges that were thrown our way in 2020, both professionally and personally, it’s great to see that the industry has started 2021 by focusing on the things that we can do to make energy supply and delivery better for customers.

The role hydrogen will play in the years ahead remains the topic of most interest to our readers, and there have been a number of significant milestones in this space. Most notable perhaps is the role National Energy Resources Australia will play by establishing a $1.85 million network of hydrogen technology clusters to foster the connection and collaboration that will be required for this sector to take off. Like many of you, I can’t wait to see the developments that unfold from this national network.

And while hydrogen is a hot topic in the industry, the role natural gas will play

in our energy future is also being hotly debated. On the one hand, we have Prime Minister Scott Morrison spruiking the benefits of a gas-fired recovery from the economic impact from COVID-19; and on the other, Tony Wood from the Grattan Institute argues that not only is this position incompatible with our emissions targets, it also just doesn’t make financial sense. And then we have Western Australia, where the gas is plentiful and set to supply the state and international export partners with gas for many years to come.

We’ve explored all of these perspectives in this issue of Energy, and while I don’t have a crystal ball, I suspect we’ll ultimately see a gradual approach to the gas transition, with gas still playing a role for a while to come; and with hydrogen making steady advances and inroads into our consumption.

As always, I’m keen to hear your thoughts on this topic – drop me a line at the address below to share your thoughts on this, and any of the other issues we’ve covered in this issue of Energy

1

Laura Harvey Editor ISSUE 13—MARCH 2021 WELCOME

www.energymagazine.com.au NOUS CB5834 (REQUESTED EARLY RIGHT HAND SIDE) SOLAR FORECASTING by predicting cloud behaviour FIVE WAYS ENERGY TECHNOLOGY will change in the next decade The clusters powering Australia’s hydrogen future

The

1, 36–38

EDITOR’S WELCOME

Monkey Media Enterprises ABN: 36 426 734 954 C/-

Commons, Office

Gipps St, Collingwood VIC 3066

P: (03) 9988 4950

by We’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950. March 2021 ISSUE 13 Editor

Editors

Editor

Manager

ISSN: 2209-0541 Published

Laura Harvey Assistant

Eliza Booth Imogen Hartmann Contributing

Michelle Goldsmith Design

Alejandro Molano Designers

Jacqueline Buckmaster Danielle Harris National Media and Events Executives

Publisher

Rima Munafo Brett Thompson Marketing Associate Radhika Sud Marketing Assistant Stephanie Di Paola

Chris Bland Cover image highlights the work currently being done by Solcast and AEMO to improve our ability to forecast the impact of cloud cover on solar supply to the grid.

2 SOLAR AND STORAGE 22 Five ways Australia’s energy technology will change in the next decade 24 The first step before you build solar or wind 26 Boost your solar output by 30 per cent 28 The future of solar battery technology SOLAR AND STORAGE 10 Economics prove renewables are the future of energy generation 14 WA trials broaden horizon for microgrids 16 Cloud computing: renewable forecasting by predicting cloud behaviour 20 Where is bioenergy in the renewable energy conversation? 22 10 HYDROGEN AND FUTURE FUELS 30 Powering Australia’s hydrogen future 34 Why hydrogen is the better battery 30 NEWS 4 AGL reveals big battery project suppliers 5 WA awards stand-alone power system contracts 5 $10 million Victorian hydrogen hub 6 New leadership at AEMO 7 Electricity prices to drop, report says 8 World’s biggest battery bound for NSW 9 Mega energy class action against QLD generators EACH ISSUE 1 EDITOR'S WELCOME 64 FEATURES SCHEDULE 64 ADVERTISERS’ INDEX CONTENTS March 2021 ISSUE 13 www.energymagazine.com.au

CONTENTS 3 INDUSTRY INSIGHT

Gone with the wind: how wind power has affected electricity prices and volatility 56 CONSUMER AND INDUSTRIAL RETAIL

Virtual PPAs: the future for energy trading DOMESTIC GAS OUTLOOK

Dousing the flame: why natural gas isn’t the economy-saving solution Australia needs

Connecting the dots: bringing gas to market

Highs and lows: Western Australia’s ten-year gas outlook 40

ENERGY

Sowing the seeds to reap smart meter rewards

Time is running out to salvage Australia’s EV future 52 PROJECT SOLUTIONS

Managing communications on a remote site

Mobile contact voltage solution quickly identifies hazardous condition in schoolyard 36 60 www.energymagazine.com.au March 2021 ISSUE 13

56

60

40

44

48

SMART

52

54

36

38

AGL REVEALS BIG BATTERY PROJECT SUPPLIERS

Two energy storage technology companies have been chosen by AGL to supply approximately 1,000MW of grid-scale battery storage under nonexclusive framework agreements.

AGL Chief Operating Officer, Markus Brokhof, said Wärtsilä and Fluence were chosen through a competitive tender process for their capability, experience and pricing as well as their alignment with AGL’s values and strategic objectives.

“This framework agreement is another example of AGL getting on with the business of energy transition and will enable delivery against our commitment to build 850MW of grid-scale battery storage by FY2024,” Mr Brokhof said.

“Wärtsilä and Fluence are both global leaders in energy storage technologies, ensuring we are investing in the highest standards for performance, reliability and safety.

“We are already well advanced with our planning process and these framework agreements will reduce tender timeframes for individual projects, enabling faster project schedules and commercial operation.

“We’re excited to see our grid-scale battery plans begin to come to life; we know energy storage technology is critical in creating cleaner and smarter distributed energy infrastructure.

“Our grid-scale battery plans provide critical firming capacity to the market and will play a leading role in the energy industry’s transition over the coming decades.”

In 2020, AGL announced plans to build batteries at Loy Yang A Power Station in Victoria (200MW), Liddell Power Station (150MW) and Broken Hill (50MW) in NSW, and Torrens Island (250MW) in South Australia.

Mr Brokhof said AGL has been Australia’s largest private investor in renewables and is now leading in the development of storage technology such as batteries, ranging in size from grid scale to residential.

“Grid-scale batteries allow AGL to leverage excess solar and wind generation to provide capacity when renewable sources are not generating,” Mr Brokhof said.

“These plans are part of the commitments made in our Climate Statement which targets net zero emissions by 2050.”

Wärtsilä Energy Sales Director, Suraj Narayan, said he was delighted that AGL had selected Wärtsilä as one of the suppliers for the projects under its grid-scale battery plans.

“AGL is a valued customer for Wärtsilä and we look forward to providing our smart technology solutions to support AGL’s plans for critical firming capacity that will play a leading role in the energy transition from coal to renewables,” Mr Narayan said.

Fluence Vice President of Global Markets, Jan Teichmann, said AGL is leading the way, taking battery-based energy storage in Australia to the next level to deliver large-scale flexibility that is critical to support the National Electricity Market.

“Australia’s grid is evolving quickly, and batteries can fill critical gaps left by coal and gas retirements, both as the super-fast services needed to strengthen the grid and as a source of peak power,” Mr Teichmann said.

“As a pioneer of the technology, Fluence’s team has seen the demand for energy storage grow to where we are now regularly contracting and deploying both 100+ MW storage solutions and portfolios of storage assets on grids around the world.”

NEWS 4 March 2021 ISSUE 13 www.energymagazine.com.au

WA AWARDS STAND ALONE POWER SYSTEM CONTRACTS

The Western Australian Government has awarded $17 million worth of contracts under a program to roll out 98 stand alone power systems (SPS) across WA’s network – the largest single rollout of its kind in Australia.

The units will provide a more reliable, greener power supply to residents across the South West Interconnected System at locations including Kalbarri, Three Springs, Merredin, Jerramungup and Rocky Gully.

The successful WA contractors are: Hybrid Systems, BayWa r.e. Solar Systems, Balance Utility Solutions and AGL Energy Services, who are working with Bunbury subcontractor Positive Off-Grid Solutions.

An SPS is a more efficient option than traditional poles and wires in supplying electricity to regional households and businesses. The units typically include solar panels, a battery and, where required, a back up generator.

The 98 units will replace around 330km of overhead powerlines, which would have needed to be replaced at a significant cost. They will also improve land amenity for farmers and reduce bushfire risk.

WA Energy Minister, Bill Johnston, said, “Through the McGowan Government’s Energy Transformation Strategy, we’re revolutionising the way we deliver and provide energy to Western Australian homes.

“Stand alone power systems are an excellent alternative for regional customers and while they’re part of Western Power’s service area, they operate independently to the main grid.

“The increased rollout of SPS is creating new jobs and training opportunities for Western Australians.

“These new contracts will create jobs for Western Australians and support small businesses during the manufacture, installation and commissioning phases.”

$10 MILLION VICTORIAN HYDROGEN HUB

The Victorian Government has announced a new $10 million hydrogen hub in Melbourne’s south east, set to create hundreds of jobs and help develop new clean energy technologies.

The Swinburne University of Technology Victorian Hydrogen Hub (VH2) will be a major national precinct to explore new hydrogen technologies, including clean energy vehicles and hydrogen storage containers.

The hub will provide opportunities to students, researchers and industry, and be a place where the community can learn about hydrogen as a sustainable energy source.

Victorian Minister for Higher Education, Gayle Tierney, and Minister for Energy, Environment and Climate Change, Lily D’Ambrosio, said the facility would stimulate Australia’s hydrogen sector and establish Victoria as a leader in developing clean, more efficient and reliable energy sources.

“We are proud to be investing in this innovative project that will drive the state’s COVID-19 recovery – by giving Victorians more opportunities to learn and find pathways into meaningful careers,” Ms Tierney said.

VH2 will create about 300 new full-time jobs, with half its PhD and Masters scholarships to be awarded to women to boost female participation in the sector.

“This hub will help give Victorians the skills and experience we need to unlock the hydrogen industry – driving down emissions while creating green jobs in a growing industry,” Ms D’Ambrosio said.

Construction will begin in early 2022 and take about 18 months, with a twin facility slated for Stuttgart in Germany, fostering an Australian-first international hydrogen development partnership.

VH2 is a key component of the Victorian Government’s Renewable Hydrogen Industry Development Plan, which was released in February and sets the framework for building a thriving hydrogen economy over the next decade.

Swinburne University Vice-Chancellor, Professor Pascale Quester, said, “We’re grateful to the Victorian Government and our partners for their support as we work for advancements in hydrogen technology and focus on wider technological advancements for Victoria, Australia and the world.”

Fuelling hydrogen partnerships

This project was funded through the $350 million Victorian Higher Education State Investment Fund which is supporting universities with capital works, research infrastructure projects and applied research focused on boosting Victoria’s productivity and economy as the state recovers from the pandemic.

The funding enables CSIRO to partner with Swinburne University of Technology to support the VH2. Under the partnership, CSIRO will receive more than $1 million towards the development of a refuelling station to fuel and test hydrogen vehicles.

The refuelling station, to be located at CSIRO’s Clayton campus in Victoria, is a key milestone in the development of CSIRO’s national Hydrogen Industry Mission, which aims to support Australia’s clean hydrogen industry – estimated to create more than 8,000 jobs, generate $11 billion a year in GDP and support a low emissions future.

CSIRO Executive Director, Growth, Nigel Warren, said, “As Australia considers energy alternatives, we know hydrogen is clean and will be cost-competitive – but a major barrier to it becoming a fuel source for cars and trucks is how to refuel, and the lack of refuelling infrastructure.

“The refueller is a significant step towards removing that barrier.”

The refueller project will demonstrate a fleet trial for CSIRO hydrogen vehicles with the potential for expansion, providing refuelling opportunities to other zero emission Fuel Cell Electric Vehicles (FCEVs) in the local area.

CSIRO is engaging with vehicle companies such as Toyota Australia to support the future adoption and supply of FCEVs in Australia.

Toyota Australia’s Manager of Future Technologies, Matt MacLeod, said, “Toyota Australia is delighted to support the development of this new hydrogen refuelling station in Victoria with next-generation Mirai FCEVs.

“This is a significant step towards having the necessary refuelling infrastructure to help grow hydrogen opportunities in Australia.

“We look forward to working closely with CSIRO and their partners on this exciting project.”

5 NEWS www.energymagazine.com.au March 2021 ISSUE 13

NEW LEADERSHIP AT AEMO

Anew CEO and Managing Director has been appointed to Australian Energy Market Operator’s (AEMO) Board.

Daniel Westerman has been appointed to the position, commencing 17 May 2021.

Mr Westerman joins AEMO from National Grid, a leading London-listed international electricity and gas utility, where he has held a variety of senior executive roles since 2014, and currently serves as Chief Transformation Officer and President of Renewable Energy.

Mr Westerman is a chartered engineer and an experienced business leader with significant breadth in the energy sector.

At National Grid, Mr Westerman has been responsible for engineering, planning and operational control of the electricity transmission network across Great Britain, as well as the development of distributed energy systems such as rooftop solar, storage and energy metering.

Most recently, Mr Westerman has grown a large-scale renewable energy business and led transformation and change programs across multiple business units and geographies.

Mr Westerman also brings significant commercial and regulatory experience in both the UK and several US electricity markets.

AEMO Chairman, Drew Clarke, said the board was pleased the CEO search process attracted strong interest from high-calibre energy leaders both within Australia and globally.

“Daniel was selected from a strong field of leaders in the energy sector, and the board is confident his experience positions him well to lead AEMO through the next phase of transition in the energy sector,” Mr Clarke said.

“Experience in a commercial setting was highly valued in AEMO’s search, and the board was pleased to secure a candidate with experience leading major infrastructure projects through the investment cycle.”

Mr Westerman said he was delighted to return to Australia and lead AEMO at a time when electricity and gas systems nationally and globally are undergoing rapid transition.

“I’m looking forward to collaborating with market participants, policymakers and stakeholders across the energy industry to help inform and shape the best outcomes for consumers as the technology mix undergoes a dramatic transformation,” Mr Westerman said.

“Australia is leading the world in the adoption of renewable energy systems, and AEMO plays a critical role in maintaining a stable supply of power to the millions of homes and businesses that benefit from the energy these systems provide.

“As our economy recovers from the impacts of the pandemic, the gas markets operated by AEMO will continue to play an important role in both the export and domestic energy sectors.

“AEMO must continue to operate our energy systems today while planning for the challenges of tomorrow, and that will be my focus.”

Mr Clarke also thanked AEMO’s acting CEO, Nino Ficca, for his stewardship of the organisation since the departure of former CEO, Audrey Zibelman, in December 2020.

“Under Nino’s guidance, the important work of AEMO will continue smoothly across the summer and autumn, and the board looks forward to Nino returning to his role of non-executive director upon Daniel’s commencement,” Mr Clarke said.

NEWS 6 March 2021 ISSUE 13 www.energymagazine.com.au

ELECTRICITY PRICES TO DROP, REPORT SAYS

The Australian Energy Market Commission (AEMC) has released its 2020 Residential Electricity Price Trends Report, forecasting a continuous decline in electricity prices in the coming years.

The AEMC’s report forecasts that, on average, residential electricity prices will fall by 8.7 per cent to 2022-23, saving households more than $100 annually.

Reductions are forecast across the entire National Electricity Market (NEM), with a drop of more than $200 expected for households in South Australia

Falling wholesale costs are the primary driver of the price and bill reductions, with the AEMC predicting that wholesale costs will drop by more than $150 (27.4 per cent) during the period.

With wholesale prices making up around a third of retail energy bills, the Federal Government said it expects that those lower prices will be passed on to Australian families and small businesses.

The forecasted lower prices come on the heels of ongoing policy action from the Federal Government to lower energy costs and improve outcomes for families and small businesses, which has seen wholesale prices falling for each of the last 15 months, and seven consecutive quarters of year-on-year retail price reductions.

Minister for Energy and Emissions Reduction, Angus Taylor, said lower costs were good for the economy and consumers as Australia emerges from the COVID-19 pandemic.

“Cheaper electricity puts more money in the pockets of hardworking Australians,” Mr Taylor said.

“After what has been a tough year for everyone, news that electricity prices are expected to continue falling in 2021 is a welcome relief.

“The Government is constantly working to help Australians pay less for their energy bills and this report confirms that our actions are having an impact.

“Electricity prices should not hold households and small businesses back, which is why our Government will continue to work hard to keep prices down and the lights on.”

Even though prices are forecast to fall over the next three years, the AEMC predicts a slight increase in prices and bills in 2022-23, which it attributes to the closure of the Liddell Power Station.

The Federal Government said it was protecting families and businesses against the risk of price rises with its outlined expectations of the electricity sector to deliver 1,000MW of new dispatchable energy before Liddell closes in 2023.

“The Government is on the side of consumers,” Mr Taylor said.

“We are taking strong action to ensure Australians are paying less to keep lights on.”

7 NEWS www.energymagazine.com.au March 2021 ISSUE 13

WORLD’S BIGGEST BATTERY BOUND FOR NSW

CEP.Energy is set to build the largest proposed gridscale battery in the world, under a new 30-year lease agreement with the Hunter Investment Corporation.

The proposed battery will have up to 1,200MW total capacity and will be based within the Hunter Economic Zone (HEZ) precinct at Kurri Kurri.

The NSW battery would be the largest asset in CEP’s planned network of four grid-scale batteries across the country, with total capacity up to 2000MW.

Peter Wright, CEO of CEP, said the business is on track to become the largest battery storage asset owner in the Australian energy market.

“CEP’s grid-scale battery network is part of our dual-track strategy to generate and store clean, reliable and cost-effective electricity for Australian businesses, and make excess power available to the national grid to firm up the increase in renewable generation,” Mr Wright said.

“To achieve this, we have secured strategic locations with excellent access to existing network connection infrastructure.

“We have also assembled a senior management team with outstanding credentials in national energy system design and management.

“The HEZ site is zoned for heavy industrial use, pre-approved for power generation and located adjacent to existing substations.

“It is among the best handful of sites in Australia for reliable and efficient grid connection.”

Mr Wright said the Hunter battery is proposed to be developed in stages. An expression of interest process to select a battery provider will soon be issued.

Commencement of construction of CEP’s NSW big battery is planned for the first quarter of 2022, while the target timeframe for commencement of operations is 2023.

Morris Iemma, Chairman of CEP, said integrated grid-scale battery networks are accelerating Australia’s transition to a clean energy future.

“Big batteries, including the one planned by CEP for the Hunter, will play a major role in filling the gaps left by the gradual retirement of coal and gas-fired generation assets, including the nearby Liddell Power Station,” Mr Iemma said.

“The clean energy roadmap laid out by the NSW Government has provided the market with the confidence to invest in renewable generation supported by large battery storage.

“This project will help ensure the Hunter region of NSW remains true to its heritage as one of the nation’s energy powerhouses as we work towards a cleaner, decarbonised future.”

The Energy Security Board Post 2025 Market Design Directions Paper, released in January 2021, states:

Over the next two decades 26-50GW of new, large-scale variable renewable energy – in addition to existing, committed and anticipated projects – is forecast to come online

This will be supported by between 6GW and 19GW of new flexible and dispatchable resources as approximately 16GW of thermal generation retires

Mark Stedwell, CEP’s Chief Strategy Advisor and previously GM Real Time Operations and Systems Capability at the Australian Energy Market Operator, said, “Reliable battery storage will provide contingency supply to enable greater levels of variable renewable generation to penetrate the Australian energy market moving forward.

“There is clearly scope for more big battery projects that stack up in terms of location and a sustainable business model.”

CEP’s grid-scale battery network will be progressed concurrently with its development of an aggregated Virtual Power Plant (VPP) comprising 1,500MW of industrial rooftop solar generation supported by up to 400MW of battery storage over the next five years.

The rooftop VPP strategy is aimed at stimulating new jobs and economic activity in major manufacturing and commercial hubs in Australia by reducing operating costs for energy-intensive businesses.

NEWS 8 March 2021 ISSUE 13 www.energymagazine.com.au

MEGA ENERGY CLASS ACTION AGAINST QLD GENERATORS

Law firm Piper Alderman has filed the nation’s largest energy class action suit, on behalf of over 50,730 electricity customers, in the Federal Court of Australia against two Queensland state-owned electricity generators.

The QLD Energy Class Action is a legal claim being brought against electricity generators Stanwell and CS Energy for allegedly manipulating the electricity pricing system and artificially inflating consumers’ electricity bills.

The class action was initiated on 18 June 2020 by Piper Alderman and is funded by LCM (an Australian litigation funder). The action is brought on behalf of anyone who paid for electricity in Queensland at any point from 20 January 2015 to 20 January 2021 and who has registered to participate.

The majority of registrants are residential energy customers. However, there are also over 1,600 businesses registered. These comprise ASX-listed companies, industrial users of electricity and SMEs.

The claim filed is seeking damages on behalf of registered participants only, however, Piper Alderman has indicated that it will apply to join new registrants to the action providing a final opportunity for electricity consumers to join the action if they wish.

As a litigation funder is covering the legal costs, it does not cost anything to join the action. The QLD Energy Class Action is based on a no win, no fee basis.

Greg Whyte, head of Piper Alderman’s Dispute Resolution and Litigation team in Brisbane, said, “There is a lot of complexity in electricity generation and power prices.

“Our team has spent over two years investigating Stanwell and CS Energy’s unlawful conduct.

“The unlawful conduct occurred at the generation stage, and your retailer simply passed that cost through to consumers.

“This is why this action is available to all Queensland businesses and residents.

“The facts indicate, and we will seek to prove, that the defendants manipulated the wholesale cost of electricity for their own profit. It amounts to a hidden tax paid by Queenslanders.

“We brought this action on behalf of Queensland-based businesses and households who have all been affected. The conduct of Stanwell and CS Energy has had a devastating effect on the Queensland economy.

“Queenslanders who paid for electricity between January 2015 and January 2021 are invited to visit www.QLDEnergyClassAction.com.au to register for the action. I encourage them all to join.”

In a media release, Stanwell said, “The proposed class action is opportunistic and entrepreneurial, funded by an international litigation funder that treats class actions as a means of generating profits.

“Stanwell strongly rejects Piper Alderman’s allegations and will vigorously defend the allegations in the courts.

“At no stage has the Australian Energy Regulator found Stanwell misused its market power or breached market rules.

“Many of the allegations being made by Piper Alderman quote a 2016 report by the Grattan Institute.

“The Australian Energy Market Commission – which makes the rules for the National Electricity Market – has reviewed the Grattan Institute’s 2016 report and dismissed many of the claims contained in it, including key allegations which Piper Alderman is levelling against Stanwell.

“Queensland taxpayers would bear the costs of defending this class action because it will reduce the dividends which Stanwell can deliver to help fund vital health, education and police services.”

9 NEWS www.energymagazine.com.au March 2021 ISSUE 13

ECONOMICS PROVE RENEWABLES ARE THE

FUTURE OF ENERGY GENERATION

by Eliza Booth, Assistant Editor, Energy Magazine

SOLAR AND STORAGE 10 March 2021 ISSUE 13 www.energymagazine.com.au

There’s no doubt that renewable energy is the way of the future, but often the cost of transitioning to clean energy sources presents a major roadblock for uptake of renewables. Now, a new report from CSIRO and AEMO has found unequivocally that renewables, like wind and solar, are the cheapest new sources of electricity generation in Australia – a third cheaper than previously estimated – and will remain the cheapest option for the foreseeable future.

To learn more about the report’s findings, Energy Magazine talked with Paul Graham, Chief Economist at CSIRO's Energy business unit, and co-author of the GenCost 2020-21: Consultation draft, about the new report’s most critical findings and what it means for the future of energy generation and renewables in Australia.

The rise of variable renewables

In December 2020, CSIRO released the GenCost 2020-21: Consultation draft, the third such report since beginning in 2018, undertaken in collaboration with the Australian Energy Market Operator (AEMO). The aim of the report is to provide current and updated capital cost estimates of different types of electricity generation technologies and storage options in Australia. GenCost also plays a major role in the future of the energy industry as the modelling provides a roadmap for industry, councils and government to reference.

This year’s GenCost report was particularly interesting, with new and updated modelling showing that renewables like wind and solar currently are, and will remain for the foreseeable future, the cheapest form of electricity generation.

Mr Graham said that the new GenCost report focused on factoring in the additional costs that often come with the integration of variable renewables like storage and transmission, with the results showing that variable renewables will remain the most cost-effective form of electricity generation, even with the added cost of storage and transmission factored in.

“We’ve reported in the past that renewables were looking very low cost, but this is the first time we’ve more accurately calculated the cost of all the additional integration costs that come with variable renewables,” Mr Graham told Energy magazine.

“As we know, variable renewables only provide power when the sun’s shining or the wind’s blowing. So it’s always been a concern for everyone in the electricity sector, how would we proceed with using that as our main source of supply, because you have to back them up.”

In order for variable renewable energy to work seamlessly, storage and transmission of the generated electricity is a major

consideration. Mr Graham said that current transmission methods are designed primarily to take energy from coal fields to city centres and are not optimised for variable renewables to be integrated. In addition, storage is another major consideration when it comes to renewable uptake. There needs to be adequate storage facilities to ensure that there is enough energy supply to keep the grid running smoothly during peaks and troughs.

“What you generally find is that the more variable renewables you add, the more storage you have to add. It actually increases non-linearly. So that’s another big cost. So initially transmission is the main cost, but as you get towards 70, 80, 90 per cent variable renewable, storage is overwhelmingly the largest cost associated with renewables,” Mr Graham said.

In earlier reports, Mr Graham said that they tried to include these kinds of costings, however the calculations were much more simplified at the time. Originally they added one piece of storage equipment for every solar and wind farm that was deployed, however, this year’s report found that this was causing drastic over-estimates as that much storage is not needed.

“It turns out, that was overkill. You don’t need that much storage,” Mr Graham said.

“That was adding upwards of nearly $100 a megawatt hour to the cost of a solar or wind farm. Now that we’ve got the more accurate estimate, it’s only adding up to about $30 a megawatt hour. So it was nearly triple the cost that we previously expected.”

Mr Graham said that this time the GenCost report also included transmission cost estimates, which helped to give more accurate results.

“Previously, we were just looking at storage, and this time we included transmission. The thing about transmission is we’ll always need to add that, no matter what scale of variable renewables we’re going for. So it is an important factor, and that’s all based on inputs that AEMO has developed for their integrated system planning. We’re using all their transmission costs, so that we’re consistent with common views about what transmission will cost in the future.”

This comes as incredibly exciting news for the energy industry and for the uptake of variable renewables. The fact that current and accurate estimates

SOLAR AND STORAGE 11 www.energymagazine.com.au March 2021 ISSUE 13

from the GenCost report find that the cost of variable renewables are a third less expensive as previously estimated, even with the inclusion of storage and transmission costs, means that more companies, councils and governments will be incentivised to invest in, and transfer to, variable renewable generation.

Modular technology and hydrogen potential

While variable renewables are projected to be the most cost-effective form of energy generation for the future, there’s also good news for modular technologies becoming more affordable and accessible. The new GenCost report found that modular technologies such as solar PV and batteries will continue to experience the fastest rates of reduction of costs thanks to the faster turnover rate of producing these technologies compared to other technologies such as carbon capture and storage (CSS), which have much longer turnover rates

Mr Graham said that technologies that are repeatable, like solar cells that are used on roofs, at large scale and in electronics, as well as batteries, which are used in services like personal electronics, large-scale projects and electric vehicles, are best placed to take advantage of technological advances and improvements.

“There’s something about these technologies that you can produce modularly, because you’d get the turnover rate of producing them much faster,” Mr Graham said.

“Compare that to a coal CCS plant, you do it once, and it costs three to five billion. Then you don’t do another one for a while. You can still carry the learnings over but it takes a lot longer, and you just can’t get the rate of turnover to actually build improvements over time. But solar PV and batteries have got that option, and that possibility that manufacturers are able to exploit.

In particularly exciting news, Mr Graham and his team think that this repeatability could probably be seen with hydrogen electrolysers too.

Mr Graham said that electrolysers, which are used to make hydrogen from electricity, are experiencing growth and innovation

similar to solar and batteries have in the past. These cost reductions in modular technologies are also helping to scale up Australia’s hydrogen energy generation potential, which is great news for the Australian Federal Government who is investing in this form of energy as part of its National Hydrogen Strategy¹.

“[Electrolysers] are going through a process where there’s lots of demonstration projects going on around the world, much like there was for solar ten years ago, and like there was for batteries five or seven years ago. So it looks like we’ve got a potentially modular technology that’s starting to scale up. There’s an expectation that we might also be able to get these cost reductions falling for hydrogen electrolysers,” Mr Graham said.

“We’ve noticed in the last two years a huge step up in the interest around hydrogen for clients and partners, including government, university and industry. Everybody wants to look at hydrogen from some sort of angle, whether it’s research or just trying to understand the future possibilities.”

The way forward

Although the findings of the GenCost report are fantastic news for the renewable energy generation sector, it also found that there are still many roadblocks impeding cost reductions for other clean energy technologies like CCS, nuclear, small modular reactors, thermal and ocean energy, and Mr Graham said it all comes down to investment.

“There’s nothing magical about the passage of time that makes those technologies cheaper, the only way they get cheaper is if people invest,” Mr Graham explained.

“From our observation, when you’ve got a technology that’s sitting higher up its learning curve, there hasn’t been too many built, the only way to bring it down is by building them, as demonstration plants or commercial plants. If that doesn’t happen, then they stay stuck.”

Mr Graham said that the best hope for real change and advancement in these technologies is through global cooperation and investment, as has happened with batteries and electric vehicles.

“With a coordinated global approach, the technologies that are lagging behind will be able to catch up, giving more options and opportunities for renewable, clean energy to enter the grid.

Feedback from the industry

Before the GenCost report was released to the public, it was initially shared with key stakeholders to gauge reactions. Mr Graham said that with reports like GenCost, there is generally interest in the updated current costs reported and how these costs are determined.

“The feedback has generally been just wanting to question and understand that we’re getting those costs from the right sources. The sorts of things that people might raise is, ‘Oh, I see you’ve got that price for batteries. I’m seeing a different price. What were your specs?’.”

For the 2020-21 GenCost report, AEMO commissioned engineering consulting and advisory company, Aurecon, to assist with calculating the current costs and utilise its own data to project where these costs might move in the future. This, combined with industry feedback is invaluable to produce the most accurate data possible.

“A lot of the discussion with stakeholders is just trying to find common ground about what we’re actually talking about. One of the difficulties we have, for example, with coal-fired plants and updating their costs is we haven’t built any for quite a while, for more than a decade. So what is the current cost for coal in a country that hasn’t built any? Do we look to China? Do we look to somewhere nearby that’s built something? How do you adjust for engineering costs and exchange rates?,” Mr Graham explained.

Now that the GenCost 2020-21 report has been released to the public for industry and commentator feedback, CSIRO and AEMO are considering the input.

“The feedback is always very useful and we’ll be sure to incorporate any immediate improvements where we can, and where not, build in opportunities in future releases.”

The GenCost 2020-21: Consultation draft is available from the CSIRO website. https://publications.csiro.au/publications/ publication/PIcsiro:EP208181

SOLAR AND STORAGE 12 March 2021 ISSUE 13 www.energymagazine.com.au

https://www.industry.gov.au/policies-and-initiatives/growing-australias-hydrogen-industry

1

WA TRIALS BROADEN HORIZON

FOR MICROGRIDS

Typically, Horizon Power’s portfolio of systems are relatively small and geographically isolated microgrids.

Renewable energy generation is growing to become one of the largest generators on many of these microgrids, which presents increasing risk in the form of renewable energy variability.

The Carnarvon microgrid trials, which started in 2018, work to address these challenges by exploring options to better integrate DERs in regional and remote community microgrids. The intent is to provide data-driven understanding of the impact of weather, particularly cloud events, on the power system and how to leverage visibility and control of DERs to manage the potential of high DER penetration.

Weather impact on solar generation

82 participants with PV systems in Carnarvon in Western Australia took part in the trials. The PV power output on these 82 premises were metered separately to gather data about the true loads that have been masked by PV for over a decade. The use of monitoring devices provided customers with insights, giving them better understanding of energy efficiency and opportunities to manage their power use.

by Monaaf Al-Falahi, Technical Program Coordinator, Energy Networks Australia

Horizon Power is in the final stage of a three-year microgrid trial in Carnarvon, Western Australia. This ground-breaking work aims at better understanding the effects of renewable energy generation and network connected battery systems and explores options for visibility and control of distributed energy resources (DERs). The results are fascinating.

Data collected from these customers’ PV systems was also used to understand the impact of weather on the solar PV generation.

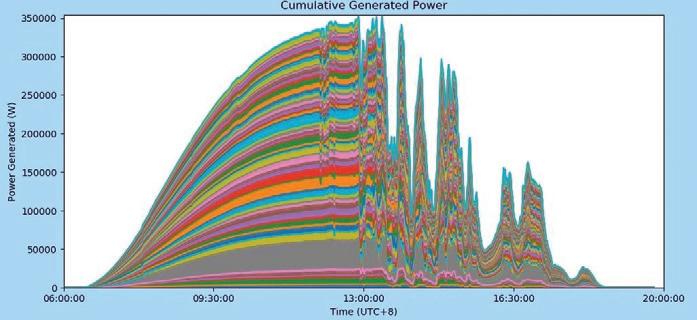

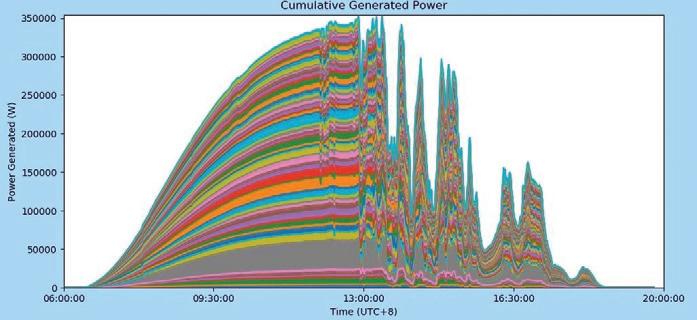

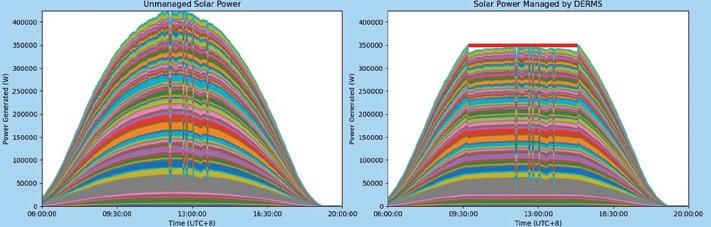

Figure 1 shows the data from the PV systems of the trial participants, which represent about 3MW of PV currently connected to the Carnarvon network. Each colour represents the PV solar system output of one system.

As can be seen, the data shows how the PV generation is impacted significantly by cloud events on a typical cloudy day. These sudden changes in the solar generation negatively impact the network voltage and

hence stability of the grid. To mitigate these impacts, the PV systems’ outputs need to be managed in a way that preserves the stability of the network.

DER control and visibility

The trials installed ten new PV/battery systems and upgraded six existing customer PV systems to include a battery and a Reposit Box. A commercial solar farm also received a partial upgrade so the trials could control a portion of its capacity.

The trials used the Reposit Virtual Power Plant (VPP) platform on these 17 DER systems to learn how to manage the

SOLAR AND STORAGE 14 March 2021 ISSUE 13 www.energymagazine.com.au

Figure 1. The power generated by the trial participants’ PV system in one day

(Source: Horizon Power’s DER Trials and Carnarvon DER Trial).

amount of renewable energy flowing into the network at key times of the day. The aim was to limit the amount of energy exported from managed systems onto the network but not limit the ability of customers to meet their own energy requirements.

The trials have been testing visibility and control of PV and energy storage to explore VPP features that can use DER to assist power quality as well as developing feed-in management techniques that preserve value for customers. They are also testing battery optimisation and innovative tariff models, with methods to exchange value with customers for DER activity that does not pass through the tariff meter. This can include discharging a battery during the peak demand period, which is entirely consumed behind the meter, and therefore remains invisible to the retailer.

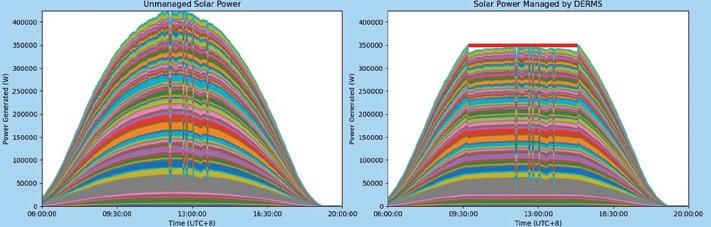

Figure 2 demonstrates the hypothetical role of feed-in management in limiting the power exported into the network from PV systems during peak PV generation period. A temporary percentage limit is applied to all feed-in manageable systems to limit the power exported back into the network, therefore preventing reverse power or power quality issues. This can provide network operators with the flexibility to

control the network voltage during peak solar generation periods and provide customers with benefits as they can either charge their batteries (if they have one) or increase their load during feed-in management time.

The Reposit Box was allowed to control the battery charge and discharge and pre-charge the battery before 7:00am if it estimated the solar PV would not provide enough energy to charge for the peak period usage. Once the battery has sufficient charge for the estimated peak period usage, the Reposit Box then discharges it to match demand during the peak period.

Using this approach, the customer’s peak time network load was reduced by 64 per cent, the network average peak load was

reduced by 67 per cent and delivered a customer bill saving of 36 per cent.

It is the combination of smart DER technology and the right pricing signals that Horizon Power hopes can create value for the customer and the network assets.

To date, the trials have enabled Horizon to develop a framework for complex power system analysis as well as working with Murdoch University to develop feed-in management strategies.

The outcomes of the trials will assist in building core competencies in the management of DER via VPPs within a microgrid setting and creating a customercentric approach to DER orchestration.

The final report outlining the results of the trials is expected to be published in the first quarter of 2021.

SOLAR AND STORAGE 15 www.energymagazine.com.au March 2021 ISSUE 13

Figure 2. Power generated from unmanaged PV systems (left) and managed PV systems (right) (Source: Horizon Power DER Trials and Carnarvon DER Trial).

CLOUD COMPUTING : RENEWABLE FORECASTING BY PREDICTING CLOUD BEHAVIOUR

by Michelle Goldsmith, Contributing Editor, Energy Magazine

As the amount of solar and wind generation in electricity networks increases, so does the need for accurate forecasting of the energy provided to the grid. Inaccurate estimates can have severe consequences for renewable energy companies, consumers and power supply. However, advanced weather modelling, which can predict the near-future behaviour of clouds, provides a solution. Energy spoke to Solcast CTO and co-founder, Dr Nick Engerer, about how high-tech cloud watching leads to renewable energy innovation.

When intermittent renewable energy sources, such as solar and wind farms, are integrated into electricity networks, energy operators require accurate forecasts of the energy they will provide to ensure the smooth operation of the grid. Otherwise, weather events like a sudden storm blocking out the sun’s rays may cause an unexpected drop in electricity supply, requiring the deficit to be made up by other power sources. Previously, the models used for these estimates had limited accuracy, sometimes causing large discrepancies between expected and actual supply.

“Large-scale solar and wind farms are subject to penalties from the Frequency Control Ancillary Services (FCAS) market for forecasting error,” said Dr Engerer.

“Historically, they could only use the internal Australian Energy Market Operator (AEMO) models for estimates, respectively ASEFS and AWEFS, which is Australian Solar or Wind Energy Forecasting System. It was identified that site operators were better placed to understand local conditions and forecast output at the site.”

In light of this issue, the renewable energy providers and the AEMO began a process of consultation to develop a solution that would be beneficial to the industry.

SOLAR AND STORAGE 16 March 2021 ISSUE 13 www.energymagazine.com.au

“What that ended up culminating in was some rule changes allowing wind or solar farms to provide their own forecasts for the dispatch interval. So every five minutes they’d provide their own dispatch target, and they could leverage more accurate technologies for solar or wind forecasting. That change was really important for the market.”

Forecasting future weather now

Solcast has been at the helm of a number of key projects to develop and deploy technologies to enable more accurate forecasting. These include the $2.63 million Real-Time Operational PV Simulations project, which received $1.19 million from ARENA and spanned from 2016 to 2019. This project involved deploying advanced modelling to provide low voltage network operators (DNSPs) with high resolution solar energy forecasting data mapped to their electricity networks.

Solar forecasting technology developed by Solcast was used to detect, track and predict the future positions of cloud cover through the use of weather satellites and numerical weather models. The resulting solar radiation forecasts could then be converted to power output predictions.

In 2020, Solcast was awarded $994,000 by ARENA for a $2.91 million Gridded Renewables Nowcasting Demonstration project in South Australia. This project will demonstrate improved ‘nowcasting’

(i.e. five minutes to six hours ahead) using an advanced gridded, rapidly-updating, spatially aware forecast model, providing much more accurate estimates than could be gleaned via existing numerical models that only update a few times a day.

These improved forecasts are shared with the AEMO, the local distribution network operator (SA Power Networks), energy retailers (Snowy Hydro and Energy Australia) and generator asset operators, via project partners, Weatherzone and TESLA Asia Pacific.

“Situational awareness and operational forecasting are critical functions for AEMO as the generation fleet becomes increasingly weather dependent and we continue to observe evolving market trends with the rapid uptake of renewable energy,” said AEMO Chief Operations Officer, Michael Gatt.

“It might be useful to think of it as version one and version two,” said Dr Engerer. “We have deployed version one globally, including across all of Australia. We've done that since 2016 really. But what we're doing in South Australia with the funding from ARENA is working on improving the solar forecasting with version two, where we're modelling how clouds are likely to change over the near term.

“You can think of version one as mapping where clouds are now, identifying their features, and then moving them forward in space and time, but not knowing whether or not they're going to grow or shrink, or change shape in the near future. Clouds do that a lot, particularly during thunderstorms or other weather events.

“Version two is working with other meteorological information to determine whether clouds are likely to get bigger, or to shrink, or to change their shape, and including that in the near-term forecasting.

“There are a few other components, we're also engaging with the short-term wind energy forecasting challenges. We're also trying to engage temperature forecasting, for example. But in this South Australian project, it's strictly limited to the wind and solar components for now.

“Having an additional source of rapidly updating forecasts is helping AEMO identify risks and uncertainty to assist management of the power system in South Australia,” said Mr Gatt.

“One of the biggest challenges this project is helping to develop capability of, is the forecasting of the timing and magnitude of ramping events, such as movement of large cloud banks over South Australia which can quickly impact rooftop solar generation.”

By predicting renewable energy generation in the near-future horizon, including ramping events and periods of suppressed generation, the technology enables operators to proactively manage voltage fluctuations, overcoming one of the key challenges that may otherwise limit renewable energy penetration in electricity networks. The results coming in from the SA nowcasting project demonstrate the advanced forecasting model’s ability to predict previously unforeseeable weather events.

SOLAR AND STORAGE 17 www.energymagazine.com.au March 2021 ISSUE 13

“The South Australian grid has one of the highest penetrations of renewables in the world,” said Dr Engerer. “This has raised the stakes for getting forecasts wrong. It's required an advancement in the capabilities of updating forecasts quickly, providing them accurately, capturing the latest cloud cover conditions, delivering them in real time, and continually updating them every time we get new information from the weather satellites.

“Really, what we're trying to do is improve the accuracy of predicting fastmoving, fast-changing cloud cover events, particularly. The emphasis is on those because they are the ones that change the availability of solar the most quickly and by the largest amount.

“For instance, we recently had a cloud front go through South Australia that the existing forecasting systems missed. That meant they couldn’t predict the 450 megawatt drop in power from rooftop solar. That’s like a whole coal power plant turned off without warning.

“If you don’t predict that ramp down, it can mean the market is unexpectedly short on energy. This means that other facilities have to be drawn upon through the spot market. It makes electricity more expensive. It also reduces the security of the system, because that kind of drop can also lead to other bigger problems in the network such as grid instability.

“Our model was able to predict the cloud front. It’s those events we want to get right. And that event showed that we can do that.”

Predicting the unpredictable

The enhanced forecasting abilities of Solcast’s model are particularly advantageous in situations of a high uptake of renewable energy in localities

with extremely changeable weather. Such conditions are not restricted to Australia, and innovative real-time forecasting technology has applications around the globe.

“Solar is growing around the world nearly everywhere,” said Dr Engerer. “As the installation of solar picks up, local energy markets begin to require some level of forecasting. They might need a forecast for an hour ahead, two hours ahead, a day ahead, or like in Australia, five minutes ahead. How you engage with that problem actually changes a bit, depending on how far ahead you're trying to forecast. We're very well suited to doing all of those horizons, but particularly very good at what’s going to happen in the next few minutes to the next few hours.

“The second ingredient relates to the actual climate. We know that there are situations that are harder to forecast than others. If you have a lot of complex terrain around – hills, valleys – this makes the meteorology much more difficult, because you get clouds forming in the mountains, you get fog forming in the valleys and the local meteorology is much more chaotic. A great example is the interactions with warm ocean currents like in Florida, United States, where there are thunderstorms nearly everyday in spring and summer. Anywhere that has convective storms also becomes quite challenging to forecast.

“For example, one of the places that we operate our services is in Taiwan. In summer thunderstorms happen daily. It's impossible to have a perfect forecast in those conditions. So you have to work with the network operators you're providing the forecast for to help them understand the limitations. It's more than just providing a forecast, it's helping users understand how to interpret the data.”

Looking to the future, Dr Engerer envisages demand for advanced forecasting technology to continue to increase, both within Australia and around the world, as solar penetration continues to grow.

“South East Queensland and Western Australia are not far behind South Australia in their need for improved technologies in this space. So an eventual nationwide rollout is absolutely the plan.

“In some regions the right causes and conditions have come together to drive growth in solar really quickly. We provide services in Taiwan, we've also done so in Vietnam, those are two really good examples of the government putting out some incentives, and investment coming in from mature, knowledgeable markets to build those facilities and get them up and going. It happens really fast. Ukraine is another great example. And as soon as that comes in, the people responsible for the power system need access to this technology.”

Dr Engerer sees the development of the technology as a continuous process of improvement and refinement, as knowledge cumulates from projects like that underway in South Australia. The capabilities of the near-future forecast modelling provide an exciting example of Australian projects and expertise reaping benefits significant to energy markets worldwide, and demonstrate how, through stakeholders coming together in such projects, the technological limitations of existing systems can be overcome.

SOLAR AND STORAGE 18 March 2021 ISSUE 13 www.energymagazine.com.au

INVISIBLE GIANT VISIBLE FUTURE

Established in 2006, Antai is a global leader in hard and core technology for solar mounting and tracking systems.

Based on the vision of being the Backbone of the Solar World, Antai has been continuously optimising its global offering, with offices in Japan, Australia, Singapore, the Philippines, Vietnam, Malaysia and Brazil.

Antai offers a range of solar mounting systems including:

• Solar tracking

• Ground mounting

• Carport mounting

• Pitched roof mounting

• Flat roof mounting

Antai has been ranked No.1 among Chinese suppliers to Japan for 7 years and been the Top 1 solar racking supplier in Australian distribution market since 2019, thanks to our one-stop service , on-time technical support and professional after sales service.

Antai leads the solar mounting and tracking sector with cost-effective designs and reliable supply chains.

Fujian Antai New Energy Tech. Corp

029

www.antaisolar.com 1300

832 info@antaisolar.com

) *

CEO Jasmine Huang

WHERE IS BIOENERGY IN THE RENEWABLE ENERGY CONVERSATION?

With the circular economy providing a real focus in Australia in 2021, it is critical that renewable energy takes its rightful place as a significant driver of the sustainable outcomes needed to drive that transition. It’s also important that bioenergy starts to become a serious part of the conversation around the renewable energy transition.

The role of bioenergy in supporting the move to a renewables dominated electricity grid remains a core focus of leading Australasian resource recovery company ResourceCo.

CEO of ResourceCo Energy Systems, Henry Anning, who recently moderated a panel for Bioenergy Australia on the subject, said it is critical these issues are explored through the Energy Security Board’s Post-2025 Electricity Market Design project.

“The electricity sector is rapidly transitioning from fossil fuels to renewables, from baseload to intermittent, and from large scale to distributed, but we are not seeing enough attention on what’s required to achieve those sustainable outcomes,” said Mr Anning.

Mr Anning said while it was encouraging to see the Federal Government putting a focus on environmental stewardship, including work on climate resilience, implementing export waste bans, and investing in new and upgraded waste management infrastructure, bioenergy was yet to attract the same recognition.

“Solar and wind renewables have previously held the focus of policymakers, but hopefully this year we will see an elevation in the role of energy-from-waste, supported by strong waste management policy.

“It’s pleasing to hear the increased public debate around targets and timelines for Australia to reach net zero emissions and an acknowledgement from the Prime Minister that technology will be a significant driver of change.

“We’re also keenly awaiting release of the Australian Renewable Energy Agency’s Bioenergy Roadmap, which will help inform investment and policy decisions in the sector.”

As a company, ResourceCo is a leader in the development of world-class energy-from-waste plants, which divert waste from landfill and lower carbon emissions through production of a commercially-viable sustainable energy product.

ResourceCo Energy manufactures processed engineered fuel primarily from waste timber materials but also previously nonrecyclable plastics, cardboard, paper and textiles.

“Energy recovery from residual waste is a proven and successful energy solution widely adopted across Europe and the UK. There are a lot of upsides for Australian businesses who recognise the opportunity to reduce their long-term energy costs, risk and emissions.”

As well as investing in its own plants in Adelaide and Sydney, ResourceCo has also invested in the development of tailored solutions for businesses.

“The material ResourceCo produces can be used in boilers to make steam that can be then used for process heat, but it can also provide for power generation. High energy users with existing boilers using between 100,000 gigajoules and a petajoule of natural gas can convert to renewable energy by installing between a five and 40 megawatt recovered fuel boiler.

“Essentially, we’re providing a unique alternative heat solution to gas, coal or electricity in the form of a 90 per cent renewable heat source, at the same time diverting resources that would otherwise be destined for landfill.”

SOLAR AND STORAGE ENERGY PARTNER CONTENT 20 March 2021 ISSUE 13 www.energymagazine.com.au

For more information on ResourceCo and its energy-from-waste initiatives, head to www.resourceco.com.au

TOMORROW’S SOLUTIONS. TODAY

FIVE WAYS

AUSTRALIA’S ENERGY TECHNOLOGY WILL CHANGE IN THE NEXT DECADE

by Domenic Capomolla, Chief Executive Officer, Tango Energy

What can we expect from the energy industry as we move further into the 2020s, and adjust to a COVID-normal world? Here, Domenic Capomolla dusts off the crystal ball and shares his predictions.

SOLAR AND STORAGE 22 March 2021 ISSUE 13 www.energymagazine.com.au

Amajor impediment to the rollout of green technology, like solar panels and battery storage, has been cost. But it’s the same with every new technology.

There’s a period in which a new technology is prohibitively expensive. That’s due to high front end research and development costs, smaller production runs until the market becomes convinced of a new technology’s benefits, and low demand.

But once demand grows, it becomes a major driver to delivering affordable technology. As economies of scale kick-in, the technology improves, supply chains open up, the price drops and the technology becomes not only affordable, but a must have.

That was the case with VCRs, mobile phones, CD players and DVD players. When they first entered the market, they cost thousands of dollars, but confident of latent demand in the market, manufacturers began rolling them out at scale, bringing the price significantly down.

When it comes to renewable energy, we’re at such a point now. The drive to better and cheaper green technology is well underway and will only gather momentum.

Here are five ways energy technology will evolve and change over the next decade.

Solar panel affordability will drop a further 15-35 per cent by 2030

Once the market recognises there is demand in the market for a good, it’s not long before new entrants arrive. That has certainly been the case with solar panels.

In Australia, there are over 2.53 million homes with solar panels, but of course solar panels are part of a global industry, with many suppliers in the market, driving down price at the same time as improving efficiency.

In the decade since 2010, global solar panel installations grew six-fold and prices have dropped from $2 per watt to $0.20. Add to that a 90 per cent drop in the price of polysilicon in that period – $80 to $8.40 – and the trend is clearly down.

The cost of solar panels has dropped significantly over the last 20 years, and we expect to see a further drop in the sphere of 15-35 per cent by 2030 as the technology improves, becomes cheaper, and we cross a cost-benefit tipping point.

Already we’re at the stage where you can have a solar panel installed and pay it off over several years. The cost savings from the panel cover the additional costs of the panel, so effectively you’re getting it for free. And after you’ve paid it off, you end up with essentially free, or very cheap power for that property. That is an attractive proposition and becoming very hard for consumers to resist.

By 2030 over 30 per cent of Australian roofs will be covered by solar

As of 31 August 2020, more than 21 per cent, or 2.53 million, Australian homes had solar panels. It’s a trend that is expected to continue.

In 2018, solar accounted for 5.2 per cent of Australia’s total electricity production, producing 11,324MW of power. The figure has since jumped to 17,616MW in 2020.

By the close of 2018, 1.96 million houses had solar panels, with a further 78,000 covering commercial and industrial roofs. As of June 2020, Australia had over 2.53 million solar panel installations, but that is set to continue apace.

As technology becomes cheaper, more installers enter the market, and more affordable market innovations like battery storage and aggregator technology come on board, it will just continue to climb.

We expect that by 2030, one third of all Australian roofs will be covered in solar.

Virtual power plants

Right now, energy wholesalers and retailers dominate the energy market. They provide either old energy like coal and gas, or like Tango Energy and its wholesale partner, Pacific Hydro, invest in wind, hydro and solar farms.

But there is currently technology that is allowing residential houses with their own solar panels to hook into virtual power plants.

Virtual power plants use sophisticated aggregator digital technology to hook houses up together into a network that can sell power back into the grid.

Not only does this mean that as a household you can supply your own energy and sell your own energy, for the broader public it’s a much more efficient and responsive form of power compared to baseload power.

By 2030, we think that virtual power plants will supply a large portion of the Australian energy market.

The expansion of battery storage

Battery storage is the next frontier of energy technology and one that’s the natural successor and compliment to solar panels.

The idea is simple enough. Rather than drawing on the electricity network to power your house or business in the evening, or when the sun’s not shining, you draw on your own power source –a battery.

The inability to store renewable power has always been the knock on the technology from doubters, but players like Tesla are showing that battery storage is here to stay and only set to get cheaper.

As with solar panels, so too with battery storage, demand and competition in the market is driving prices down.

Very soon we’ll be at a point where the economic outlay for domestic, industrial or commercial is so small that it will be a no brainer. Already it makes economic sense, it’s just a question of whether people have that capacity or willingness to invest.

We predict that over the next decade, a quarter of all homes with solar panels will also have battery storage.

Upgrade of the grid to take more renewable energy

The national electricity grid was established differently in different states a long time ago.

In Victoria, it was built to fan out from the LaTrobe Valley to transmit electricity from big coal-fired power stations. The grid is designed to accommodate this baseload power, rather than to incorporate the intermittent energy that comes from renewable sources.

Once the national grid is upgraded with new poles and wires, it will be more flexible and capable of integrating the increasing loads being generated from renewables.

To illustrate the problems the grid represents to transmitting power, it’s a bit like trying to suck a pea through a straw.

There is enough renewable energy to feed into the grid to ensure supply during periods of peak demand, that’s not the problem. The problem is that the grid is not designed to accommodate the quick supply of energy that renewables can supply.

Once the grid is upgraded, that will go a long way to not only securing energy supply, but we expect that by 2025 the energy mix running through the grid should regularly be 50 per cent renewable/50 per cent old energy.

SOLAR AND STORAGE

23 www.energymagazine.com.au March 2021 ISSUE 13

Domenic Capomolla.

THE FIRST STEP BEFORE YOU BUILD

SOLAR OR WIND

Australia’s love of renewable energy is showing no signs of slowing, with the nationwide adoption of renewable energy growing on average 44 per cent annually over the last ten years. One of the most critical aspects to ensuring a renewable development is financially viable is the monitoring that needs to be undertaken on-site before construction commences. Here we take a look at fundamentals of ensuring a monitoring campaign that produces high-quality data.

As Australia continues to invest in renewables, emerging as a global leader in the field, there is a growing desire amongst the industry to understand the crucial elements that are essential for bringing a successful renewable development project to life.

But before a single panel or turbine can be constructed, there is one foundational aspect that is essential to the success of any solar or wind development – a successful monitoring campaign. Although some differentiation exists between the processes of solar and wind monitoring, one key principle rings true across the board: attaining the highest quality data from your initial resource monitoring campaign is crucial.

“Being able to deliver a gold-standard monitoring campaign is undeniably one of the most important aspects of a successful renewable development,” said renewables specialist, Dr Matthew Bechly. “Without high quality campaigns, you can’t ensure the bankability of your project.”

Data collected from these monitoring campaigns is used to measure expected energy output, and is carried across all financial modelling to predict future income with a high level of certainty. This data is

incredibly important, as it supports and validates a project's investment prospects as well as giving a lens into the long-term profitability of a potential site. So what makes for a great monitoring campaign, and how can we ensure that a resource campaign runs successfully?

There are two core elements that contribute to a successful monitoring campaign. First, high-quality instruments and equipment to ensure accurate data collection; and second, comprehensive data collection across varying locations on the proposed site.

Australian Radio Towers, an engineering, fabrication and construction company, is one company that has continued to see the benefits of investing in high-quality monitoring campaigns and the equipment necessary to make that happen. Having worked in the industry since 2008 and having supplied monitoring equipment since 2011, the Australian Radio Towers team has continued to see monitoring investments pay off.

“Having been involved in weather monitoring systems and their long-term implications for some time now, there is no denying the benefits of working with the highest quality equipment when striving to deliver a successful monitoring campaign,” said Dr Bechly.

“We’ve even seen some of our monitoring stations weather a cyclone, intact. If that site had been using a cheaper, less durable set of equipment that wasn’t able to withstand the severe weather event, the whole campaign would have been compromised, making it very hard for developers to seek investment to move the project forward.”

Having installed monitoring stations across all states of Australia, Australian Radio Towers has supplied equipment to withstand the rugged Australian terrain, and have consistently been a testament to the notion that investing in high-quality campaigns will always be money well spent.

24 March 2021 ISSUE 13 www.energymagazine.com.au

Rugged monitoring equipment is essential to gathering high-quality data.

SOLAR AND STORAGE ENERGY PARTNER CONTENT

Weather monitoring is essential to the success of a renewable energy project.

Looking for a complete solution for online events?

Combining our experience in publishing, live events, digital marketing and video production, Monkey Media has the capability to deliver a range of online events for your organisation.

Specialising in the energy, infrastructure and utility sectors, we combine our expert knowledge in these fields with our behind-the-scenes knowhow to help you deliver your events in a range of online formats.

We work closely with our partners to understand why and how you want to connect with your audience online, and can recommend the right solution to help you cut through and achieve the high levels of audience engagement and participation you’re looking for.

Some of the online events we can help you deliver include:

Webinars

Virtual conferences

Awards nights

Round tables

Online learning for a complete online event solution

9988 4950

03

www.monkeymedia.com.au/services/custom-virtual-events/

BOOST YOUR SOLAR OUTPUT BY 30 PER CENT

Solar panel tracking isn’t a new technology, but today, some project developers will still question the value of adding trackers to their solar farm. Here, we take a closer look at solar tracking technology, and the efficiency gains developments can see when trackers are used – which can be up to 30 per cent in some cases.

Solar trackers have been in use in the energy industry since the early 2000s, allowing owners of solar panels –from smaller residential arrays to large-scale utility developments – to enhance the amount of sun that directly hits their solar panels each day.

Taking a step back, solar trackers work by increasing the amount of light solar panels are exposed to. The more light they are exposed to, the better they work. Further, the angle at which sunlight hits a solar panel – the angle of incidence – also has an impact on how effective a solar installation will be. The narrower the angle, the more energy a solar panel will produce. Anything that you can do to reduce the angle of incidence, such as installing a solar panel tracker, will optimise the amount of energy a particular solar panel can produce.

Bringing things back to the 2020s, in the two decades since solar trackers started to become widely used, there have been significant developments in their efficiency and operation. We now have the option of single-axis and dual-axis solar trackers, and trackers on frames, which can increase the level of sunlight directly hitting a solar panel. There has also been considerable reduction in the number of moving components in trackers, providing the significant benefit of reduced maintenance.

Significant research has been conducted around Australia to understand the bottom line benefits adding solar trackers to a large development can provide. While the exact figure varies, depending on the location (adding trackers will provide increased benefit the further south the location) and size of the installation,

developers can expect to see a gain in efficiency of up to 30 per cent with the addition of solar trackers.

The essentials of solar tracking

While in many cases the addition of trackers will be a no-brainer, like many things in life, the devil is in the detail. There are a range of tracking technologies on the market, so it’s important to be discerning and ensure you select a product that will deliver for you for many years to come.

One of the biggest challenges when it comes to solar tracking is ensuring accurate, trouble-free positioning of the panels. To ensure this, a tracking system needs to be highly rugged and able to withstand wind and weather. It must also function reliably and maintenance-free for many years. Altra Motion brand Thomson offer affordable linear actuators and screw jacks, custom-fitted solutions to these challenges.

Solar tracking requires actuation solutions that are stiff and will not backdrive in high wind conditions. All Thomson actuators and screw jacks can be equipped with a holding brake that eliminates back-driving.

Accurate tracking often requires some form of feedback. Most Thomson actuators and screw jack models can be equipped with encoders, resolvers or potentiometers to meet either analog or digital feedback requirements.

All Thomson actuators and screw jacks are available with adjustable end of stroke limit switches to protect the panel from damage due to overtravel in either direction; and multiple mounting options are available.

Actuators and screw jacks require little to no maintenance, making them ideal

for solar panel applications. Thomson actuators and screw jacks are offered with both analog and digital feedback to allow precise tracking of the sun.