POWER TO THE PEOPLE:

how consumers are changing the energy landscape

The grid of the future could have wheels

THE TOP 5 ENERGY TRENDS OF 2022

how consumers are changing the energy landscape

The grid of the future could have wheels

4-5 MAY 2022

2 DAY, FREE TO ATTEND

• 120+ local & international exhibitors

• Newest trends & products

• 6 conference streams

• 200+ expert speakers

• Latest smart solutions

• CPD points & training

• Dedicated networking sessions

• Electric vehicle test drive

• 60th anniversary celebration

• And more...

smartenergyexpo.org.au

HMonkey Media Enterprises

ABN: 36 426 734 954

C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

energymagazine.com.au

info@energymagazine.com.au

ere we are at the beginning of our third year amidst a global pandemic, although it feels like we’re in a very different place than this time last year. It’s been a big adjustment as we’ve begun ‘living with the virus’, and many essential industries have been feeling the impacts of the surge in cases at the start of 2022. On the other hand, at the time of writing, I’m preparing to attend a large in-person industry event interstate, the first that I’ll have attended in years – so it’s great to see these getting underway, and I look forward to meeting some of you as these continue.

Michelle Goldsmith Journalists

Christopher Allan

Lauren DeLorenzo

Alejandro Molano Designers

Jacqueline Buckmaster

Danielle Harris

Luke Martin

Rima Munafo

Brett Thompson

To kick things off for the year, in this issue, we’ll be looking at the top 5 energy trends that we can expect to see in 2022, as well as some exciting developments to keep an eye on. Storage has emerged as a key topic in this issue, as we look at the potential of electric vehicles as ‘batteries on wheels’, and in the second installment of our two-part series, we list the emerging big battery projects around the country.

One challenge from the COVID-19 pandemic that the industry continues to grapple with is the rise of household energy debt, prompting the need for new, consumer-centric approaches to energy affordability and alleviating financial hardship. We explore some of these initiatives in this edition, as well the effectiveness of retailer hardship programs on offer.

On that note, perhaps the most important theme that I’ve seen in this issue, and in the industry more broadly, is the impact that the consumer is having on the energy landscape. Consumer habits, needs, and investments are shaping the industry, and as more virtual power plants come online, we’re starting to see households become increasingly empowered in the energy transition to lower emissions. I think that we’ll begin to see energy dialogue

becoming more reciprocal between consumers, utilities and retailers – and I think that’s an excellent step in the right direction when it comes to forming our collective energy future.

In preparation for this issue, I was able to speak with Secretary General and CEO of the World Energy Council, Dr Angela Wilkinson, about the idea of ‘humanising energy’. I found our conversation insightful, to say the least, and I encourage you to read this article. One thing Dr Wilkinson said that struck me was that the energy transition is “a process, not a destination”. I think Dr Wilkinson’s words are a great reminder that we’re not looking for a fix-all technology, nor are we likely to reach a full consensus on one strategy, fuel source or generation method. Instead, the transition will be an ongoing, constantlyevolving process, and a challenging one at that – but one that I look forward to exploring with you in this and future issues of Energy magazine.

Imogen Hartmann

The Kurri Kurri-based 660MW gas plant, the Hunter Power Project, has been granted environmental approval, allowing for construction to begin.

The Federal Government is providing up to $600 million in equity to support the gas-fired power station, after setting a target for an extra 1,000MW of dispatchable energy in New South Wales following the Liddell Power Station closure.

Federal Minister for the Environment, Sussan Ley, said the project had been approved after a rigorous assessment and on the condition that the project proponents, Snowy Hydro Limited, meet the conditions set by the New South Wales Government when it approved the project.

“This thorough bilateral assessment with New South Wales has paved the way for the development and operation of this new critical infrastructure in a way

Afinal report from an expert panel has set out guidelines to ban embedded networks in new residential buildings in Victoria.

The Embedded Networks Review was established as part of the Victorian Government’s election commitment to improve consumer outcomes in the energy market.

The panel leading the review − comprised of energy market and consumer advocacy experts − released its final report after hearing from hundreds of frustrated Victorians feeling ‘trapped’ in embedded networks.

Embedded networks are private electricity networks that serve multiple customer premises in a building or selfcontained site.

They are commonly used to supply power to consumers in developments such

that sensitively manages, protects and rehabilitates the environment,” Ms Ley said.

Federal Minister for Industry, Energy and Emissions Reduction, Angus Taylor, said the Hunter Power Project was critical to keep the lights on and power prices low after the closure of the Liddell Power Station in 2023.

“The project is good for jobs, it’s good for business and importantly it’s good for securing affordable, reliable power,” Mr Taylor said.

“It will support up to 600 direct jobs at peak construction and 1,200 indirect jobs across New South Wales.”

The Federal Government announced its plans to proceed with the build of the gas power plant in May 2021, following a gas ultimatum that was issued the previous year.

Since then, the project has been met with considerable backlash from experts, industry bodies and consumers.

“A utility-scale battery for this site was the smarter choice both economically and environmentally,” Clean Energy Council Chief Executive, Kane Thornton, said.

“The Kurri Kurri plant is only expected to run for about one week of every year. When battery storage can deliver a cost saving of 30 per cent while delivering greater flexibility and significantly reducing emissions intensity, it makes no sense to be spending taxpayer dollars on this fossil fuel project.

“It sends the wrong message to clean energy investors and to communities, at a time when the International Energy Agency says that there is no space for new fossil fuel developments if the world is to reach net-zero emissions by 2050.”

as apartment blocks, retirement villages, social housing, and caravan parks.

Victorian Minister for Energy, Environment and Climate Change, Lily D’Ambrosio, said, “We want to ensure that Victorians living in new and existing residential embedded networks can get access to the same competitive retail offers and consumer protections that other people have.

“That’s why we promised to act to ban these networks in new apartment blocks, which too often lock in high costs.

“I want to thank the panel for their work and their report, which we will respond to later this year.”

The panel recommended reforms for new and existing embedded network customers in apartment buildings, supporting the Victorian Government’s proposal to ban new networks from 1 January 2023, with exemptions if operators can show that 50 per cent or more of a

site’s electricity consumption is met by on-site, low-cost renewable energy.

The reforms will also mean the more than 140,000 Victorians living in residential embedded networks will have access to the same competitive retail offers and consumer protections as other Victorian consumers.

The promise to ban embedded networks is the latest in a series of energy market reforms already delivered by the Victorian Government, including the Victorian Default Offer, a ban on door-to-door sales and cold calling, and increased penalties for retailers who engage in dodgy behaviour.

These measures aim to increase fairness, reduce market complexity and contribute to a fall in power bills.

The Victorian Government will consider the panel’s final report and respond to its recommendations by mid-2022.

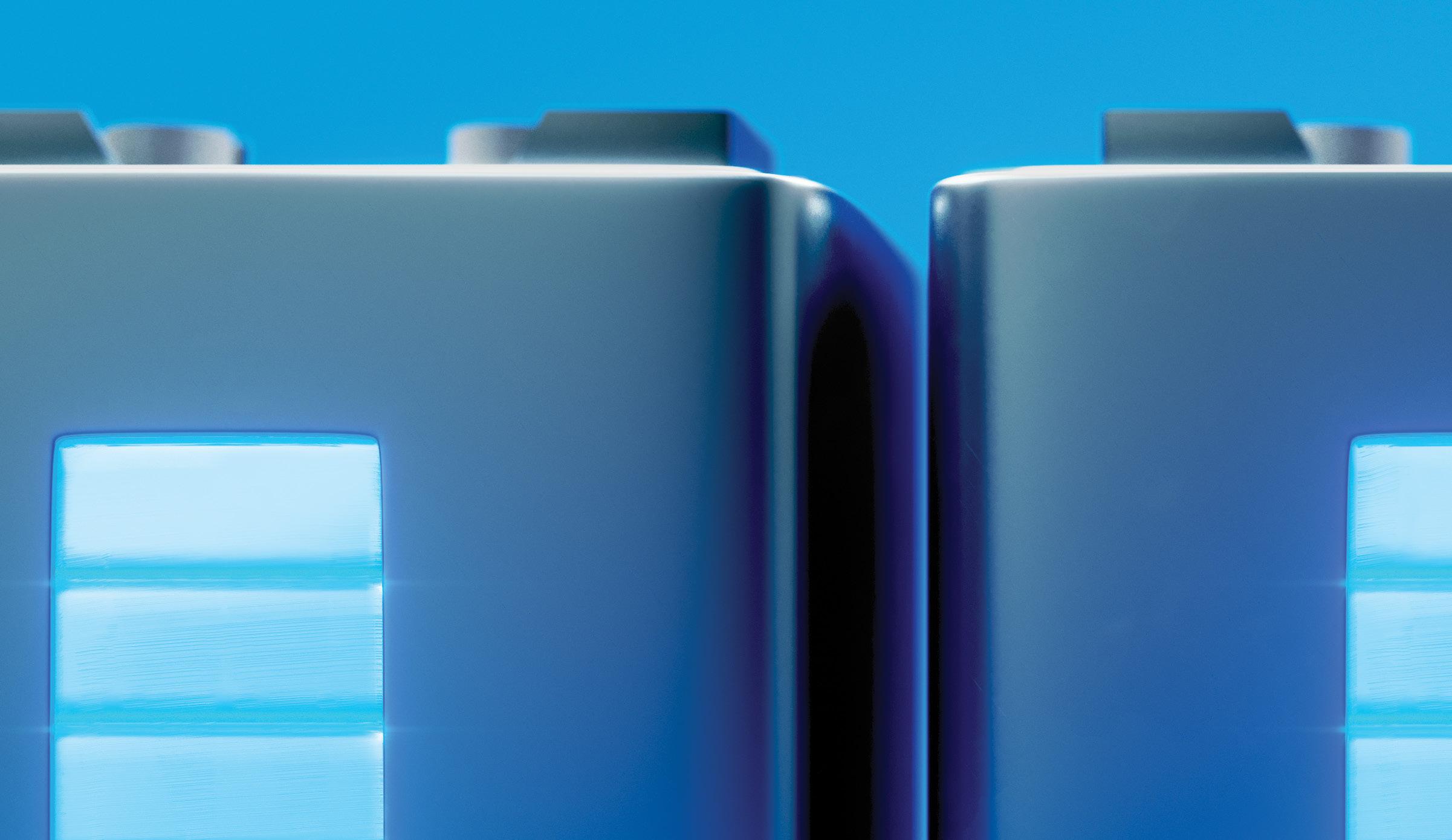

The Australian Renewable Energy Agency (ARENA) has launched a $100 million funding round for new battery energy storage projects of 70MW or larger.

ARENA’s Large Scale Battery Storage Funding Round will provide up to $100 million in funding to new grid scale batteries equipped with advanced inverters and which operate in the National Electricity Market or Western Australia’s Wholesale Electricity Market.

In addition to supporting new build projects, funding will also be available to existing grid scale batteries seeking to retrofit advanced inverter capability.

The funding round aims to incentivise and de-risk private sector investment and overcome barriers to the deployment of advanced inverter technology.

By funding advanced inverter technology at scale, ARENA hopes to provide valuable insights into the operations and emerging

capabilities of advanced inverters.

It is expected that the funding round will support at least three projects, with a maximum grant available of $35 million per project.

Applications will be open to all battery energy storage technologies, provided that they are equipped with advanced inverters.

Advanced inverters enable grid scale batteries to provide system stability services traditionally provided by synchronous generation, such as coal or gas.

Finding new ways of providing stability to the electricity system will enable the grid to operate with higher shares of variable renewable energy.

In July 2021, the Australian Energy Market Operator (AEMO) published its white paper on advanced inverters, highlighting the importance of grid scale batteries equipped with advanced inverter technology in supporting the energy transition.

ARENA CEO, Darren Miller, said the funding round will support grid scale batteries that can provide system stability during periods of very high renewable generation.

“Grid-scale batteries and other types of energy storage technology will be vital to support our future electricity system powered by renewables,” Mr Miller said.

“This funding round will demonstrate the role of advanced inverters in grid scale batteries to provide system stability, facilitating a more efficient transition and accelerating the uptake of renewable generation.”

“We’ve seen promising signs that advanced inverters can support system stability, but it’s clear public sector investment is still needed to prove the technology at scale.

“We’re confident that ARENA funding will help drive the uptake of this technology and provide valuable lessons that will benefit the industry as a whole.”

Hydro Tasmania’s mainland energy retailer, Momentum Energy, has appointed a new Managing Director.

Lisa Chiba has taken over the role, following a long career in retail utilities and financial service sectors.

Hydro Tasmania Acting CEO, Ian Brooksbank, said Ms Chiba was perfectly placed to lead Momentum Energy into its next phase of growth, having spent the past 20 years in a variety of utility and financial leadership roles in Australia and the UK.

In the UK, Ms Chiba led customer services at iSupplyEnergy, and worked with a range of well-known brands as a director in customer and digital practice at management consultancy, Baringa Partners.

Since her return to Australia, Ms Chiba has been working with Origin Energy as Group Manager, Retail Growth and Governance.

Ms Chiba’s appointment follows the resignation of Amy Childs in August 2021.

Momentum Energy is a leading mid-tier energy retailer, headquartered in Melbourne and with a call centre and service team in Tasmania.

Single-phase 4-quadrant Class 1 energy meter

HV ConductorDown safety alert Three-phase 4-quadrant energy meter Management means measurement plus control

PowerPilot provides the platform to enable the full use of smart technologies with:

• Bushfire mitigation with ConductorDown technology

• RCD remote monitoring

• Power quality measurement in a Class 1 metre

• Safety features including loop impedance, open phase and other fault monitoring

• Prepare for disruptive technologies such as EV and PV

• All delivered via secure communications infrastructure

• Multiple other safety and network management features

• Designed and built by a power utility, for power utilities

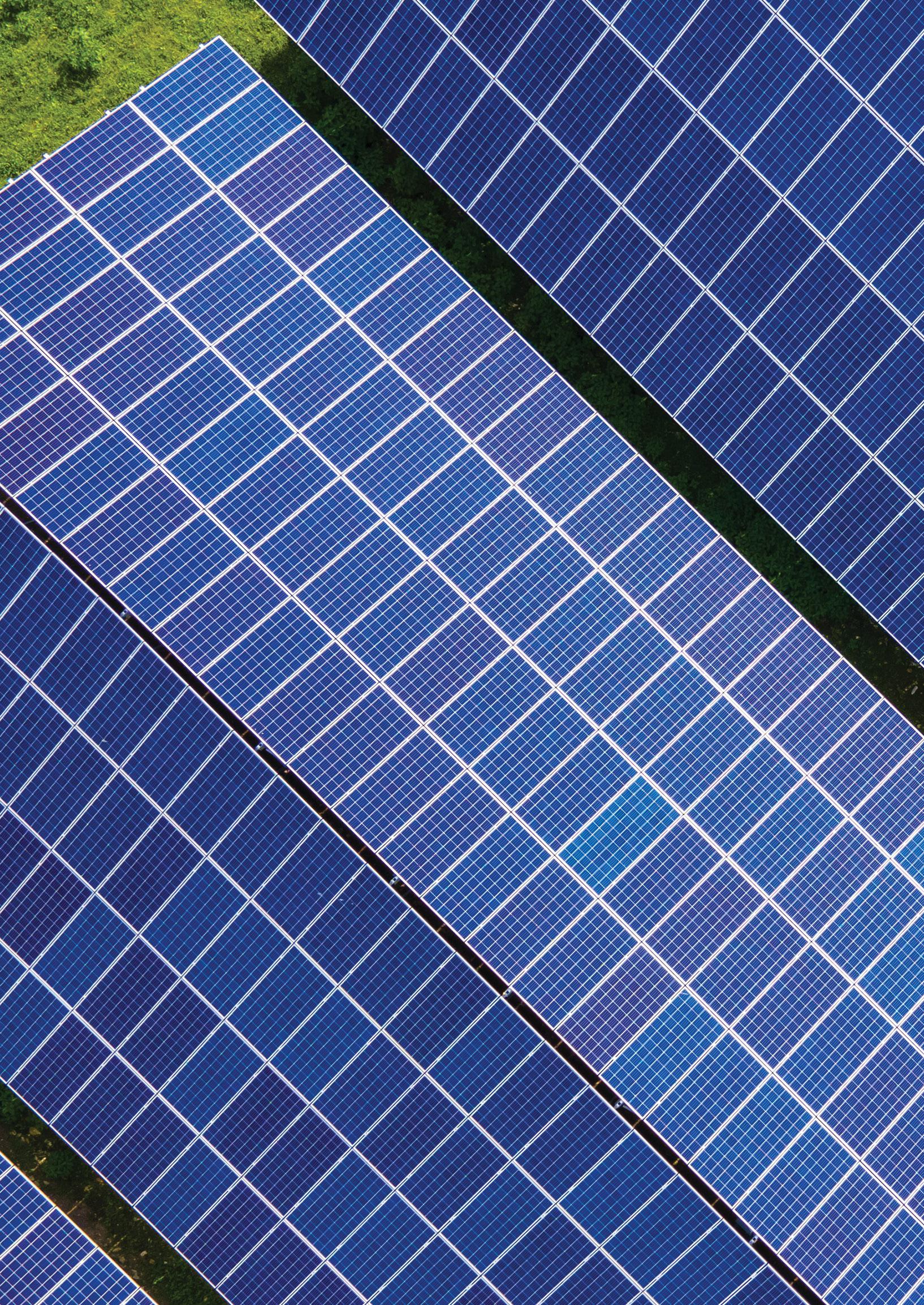

Western Australia has announced a new solution to increase network reliability and enable the future growth of rooftop solar panels.

The energy collectively generated by residential solar panels in the South West Interconnected System (SWIS) is more than the amount generated by Western Australia’s largest power station.

This unmanaged energy puts residential power supply at risk on mild sunny days when rooftop solar generation is high and demand from the system is low.

As of February 14 2022, new or upgraded solar panels will be installed with the capability to be remotely turned off, for short periods, when demand for electricity reaches a critically low level.

Remotely switching off solar panels will be used as a last resort to prevent

widespread power interruptions and is expected to occur a few times a year for a few hours. This won’t affect the resident’s power supply.

Power stations will be turned down first, with rooftop residential solar the last to be impacted.

The measure, which will not affect homes with existing solar panels, will allow the continued uptake of solar panels without increasing costs.

The Australian Energy Market Operator (AEMO) welcomed the announcement, which supports its priority recommendation in the Renewables Integration Paper –SWIS Update, to help manage power system security and reliability during emergency operational conditions to be used as a measure of last resort to prevent widespread power interruptions.

Total renewable generation is meeting up to 70 per cent of total energy demand

The Victorian Government has announced more than $7 million in funding for renewable hydrogen trials and studies, aiming to grow the sector and reduce emissions.

Victorian Minister for Energy, Environment and Climate Change, Lily D’Ambrosio, announced recipients of grants whose projects will support the development of Victoria’s renewable hydrogen sector.

“Renewable hydrogen is a key part of our clean energy transition, ensuring we can meet our target of halving emissions by 2030 and hit net zero by 2050,” Ms D’Ambrosio said.

“These exciting projects will help businesses push the frontiers of renewable hydrogen and embrace this clean energy solution.”

$6.6 million is being provided through the Renewable Hydrogen Commercialisation Pathways Fund to support six projects that will see Victoria

in the SWIS, 64 per cent by rooftop solar, in particular time intervals.

AEMO expects this to continue growing with installed rooftop solar capacity to virtually double in the next decade.

During daylight hours, with clear sky conditions, rooftop solar is the largest single generator in the SWIS.

AEMO Executive General Manager in Western Australia, Cameron Parrotte, said, “It is important to note that this measure is to be used as a backstop capability only.

“AEMO has access to a range of tools to help us forecast future system conditions and manage challenging operational conditions, such as low load events.

“These include reducing large-scale generation, procuring additional essential system services to ensure the system can be operated at a lower load level and coordinating with Western Power to manage voltages on the network.”

produce and use renewable hydrogen in real-world applications.

Volgren Australia will develop two commercial-grade hydrogen fuel cell electric buses for trials in Dandenong, while Viva Energy will develop a hydrogen refuelling station to co-locate with EV charging in a public New Energies service station.

Air Liquide and Energys Australia will develop renewable hydrogen production facilities for transport, while Boundary Power will develop an Australian-first, solar-renewable hydrogen standalone power system.

The Boundary Power system will convert solar power into hydrogen, and use that hydrogen to generate electricity during power outages or in remote areas that are not served by the grid.

Telstra received funding to deploy a renewable hydrogen fuel cell generator at regional mobile communication sites, to strengthen the grid and remove reliance on fossil fuels generators.

More than $800,000 will be shared by eight recipients through the Renewable Hydrogen Business Ready Fund to develop business cases or feasibility studies to support their transition to renewable hydrogen.

The grants are being delivered as part of the Victorian Renewable Hydrogen Industry Development Plan – which was launched in February 2021 to foster a thriving renewable hydrogen economy in Victoria.

Victoria’s renewable hydrogen sector aims to create long-term jobs through skills development and new career pathways, driving innovation and reducing greenhouse gas emissions across industrial, energy and transport sectors.

As leading multinational designers and manufacturers of innovative power transmission products, the brands of Altra Motion offer many critical drivetrain solutions for a wide range of renewable energy applications.

Service Support by Trained Technicians

Specialist Tooling for Maintenance

Genuine OEM Spare Parts

Local Spares Stocking Program

Australia’s energy industry, like much of the world, is on a journey to cleaner, more reliable and more sustainable power – colloquially dubbed as ‘the transition’. The ongoing challenge dominates the conversation in the industry, and in state and federal politics. But, it’s not simply an industry or a political issue, nor is it solely an environmental or economical issue. As Secretary General and CEO of the World Energy Council, Dr Angela Wilkinson, would put it – it’s a human issue.

The World Energy Council, formed in 1923, is a network of the world’s principal independent and impartial energy leaders. The council acts as the leading global energy body, with over 3,000 member organisations spanning 90 countries.

The purpose of the council is to inform energy strategies across the world through high-level events, including the World Energy Congress, and publishing authoritative reports to inform energy policy dialogue.

One such report is the 2022 World Issues Monitor: Energy in uproar – achieving commitments through community action, which outlines the critical uncertainties and priorities of actions as identified by 2,200 surveyed energy policymakers, CEOs, and leading experts.

For Dr Wilkinson, the World Energy Council represents an ‘energy ecosystem’, comprising all forms of fuel sources, politics and technologies – embodying independence and neutrality.

Dr Wilkinson explained that the energy leadership landscape is becoming increasingly crowded, competitive and conflictual – and that with this comes the risk of extreme polarisation, an unhelpful outcome for any modern energy society.

A big component of this potential polarisation is the language that’s used in the energy dialogue, and how technocratic vernacular can be a barrier to including consumers in the conversation.

“I think the energy industry does itself a disfavour – it's never been very good at communicating,” Dr Wilkinson said.

“Fundamentally, our society's relationship with energy is changing, and as that relationship changes, so does our relationship with each other. And we're talking about achieving a global energy transition in a faster time than ever before in human history, and in a way which is successfully managed,” Dr Wilkinson said.

“Often, when you get into conversations around energy, most people don't know where they use energy, how they use energy, how much it costs them to use it, how much this transition costs, or what their role is in it.

Secretary General and CEO of the World Energy Council, Dr Angela Wilkinson

In the World Energy Council’s World Energy Trilemma Index 2021, Dr Wilkinson stated that energy agendas were in need of a serious priority check, “Some advocates wrangle over the colour of new fuel types, whilst billions of people have no connection to electricity, or lack access to quality energy for clean cooking, better health, and new livelihoods. Some voices are powerful, yet many remain literally power-less.”

“Fundamentally, our society's relationship with energy is changing, and as that relationship changes, so does our relationship with each other.”

“Our mission is to secure the benefits of sustainable energy for everybody,” Dr Wilkinson said. “So, more sustainable energy, climate neutrality and social justice.”

It’s an extensive scope of works, but within it is a particular and rather personal focus.

“Our current vision is humanising energy, because we need to involve more people and communities in delivering a successful global energy transition.”

Part of the ‘humanising energy’ strategy is ensuring ‘energy literacy’ is as ubiquitous as possible. Like digital or financial literacy, Dr Wilkinson believes that energy literacy is essential to flourishing societies. Language makes up a big part of that, but it’s not solely a communications issue – especially when it comes to the global energy transition, the impacts of which are felt everywhere, not just within the industry.

“There are large parts of society that are totally unprepared for the real choices and the depth of change that's involved. We're never going to achieve success unless we involve them, unless we equip them, unless we help them articulate their role and their story in the energy transition.”

Dr Wilkinson asserts that, in addition to energy affordability, sustainability and climate neutrality, it’s imperative that we factor in social justice to the overall transition equation. A stark reminder of this was the energy transition from coal to gas in the UK in the 1980s, which left a lot of community members stranded.

“It left a lot of people out of jobs, and we carry those political scars today,” Dr Wilkinson said.

The abrupt closure of coal mines in the UK was followed by rioting and mass unemployment levels and, subsequently, severe political disenfranchisement in mining communities. Dr Wilkinson said there are lots of similarities between those UK mining communities, and those in the US and Australia, and therefore the learnings can be carried over in terms of creating smoother energy transitions – ones that don’t leave communities in the cold.

Aberdeen, a city in north-east Scotland, is, like much of the world, embarking on a journey to cleaner energy, but it’s not easy – especially with its roots firmly planted in oil and gas.

“If you think about Aberdeen, you think about the gateway to the north sea in oil and gas production terms,” Dr Wilkinson said.

“Their identity as a city is wedded to oil and gas. So, how can we help them involve citizens in thinking about the choices they face and in rebuilding Aberdeen’s identity as a world energy city that is successfully managing its energy transition?”

There’s no magic recipe, according to Dr Wilkinson, but the important part is to include the humanisation element into conversations and decision-making. For each community, the ways in which they find their way through this transition and how they facilitate workforce transition and skills diversification will be unique. That’s why the community needs to be “at the table” when it comes to solutions dialogue, to be a part of that process.

A vision and prospectus report published by the Aberdeen City Council, A climatepositive city at the heart of the global energy transition, outlines the importance of community in redefining the city’s progressive role in the energy world.

The report states, “Moving to a future of net zero carbon emissions and beyond, whilst ensuring that everyone can prosper, regardless of status or income, is often

termed a ‘just transition’ and should be a key guiding principle for Aberdeen. So, at the same time as helping to catalyse the global energy transition, we need to realise shared opportunity and prosperity for all of our local people and communities by embedding just transition principles at the heart of every climate action we bring forward.”

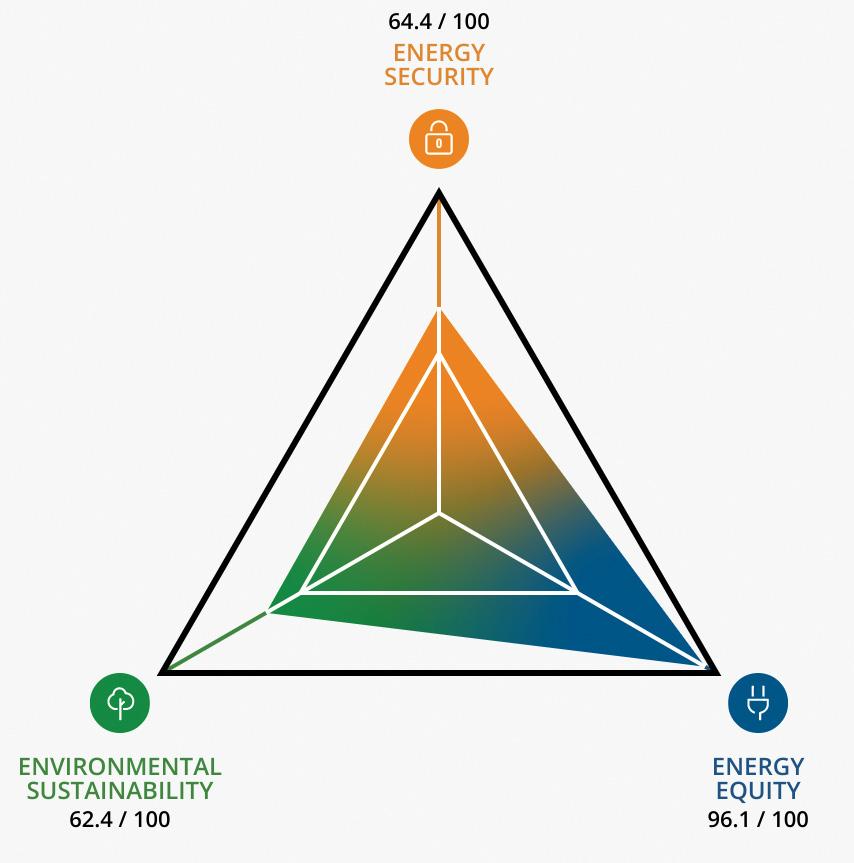

How does Australia’s energy stack up against the rest of the world?

The World Energy Trilemma Index was designed as the first energy policy decision-support tool, creating a critical integrated policy framework which could aid in the development of sustainable energy systems. The World Energy Trilemma Index enables the design of new energy realities and policy design challenges through retrospective analysis via three lenses: energy security, energy equity and affordability, and environmental sustainability.

In 2021, Australia ranked 18th in the World Energy Trilemma Index, with the top three spots going to Sweden, Switzerland and Denmark, respectively. Australia received an overall trilemma score of 74.61 Australia’s score breakdown goes as follows:

Australia’s ranking on the World Energy Trilemma Index, based on security, equity and sustainability. Source: World Energy Council

Energy Security score: 64.4 / 100 (‘A’ rating)

The report states, “While Energy Security is rated A relative to the rest of the world, the score itself of 64 is low in absolute terms”. This can be attributed to a lack of diversity in generation and storage, however, the generation mix is changing with battery, pumped hydro and gas storage set as focus areas for federal and state governments.

Energy Equity score: 96.1 / 100 (‘A’ rating)

Australia achieved one of the strongest Energy Equity scores, driven largely by a focus on reliability, access and affordability.

“Affordability in particular is a key focus for the government, given the changing energy mix, uncertainty over fossil fuel prices and enormous geographic scale of the energy system,” the report states.

Environmental Sustainability score: 62.4 / 100 (‘C’ rating)

Australia demonstrated poor performance in terms of Environmental Sustainability, specifically with a substandard penetration of renewables and CO2 emissions per capita.

“The Federal Government has been seen to be relatively skeptical of climate change historically, and strong support still remains for the fossil fuel industry,” the report states.

Overall findings

The 2021 trilemma scores recorded for Australia showed little change in the three dimensions from the past year, indicating that Australia was relatively unaffected by the COVID-19 pandemic, and has almost no reliance on energy imports.

However, Australia’s ranking does not reflect its potential, according to the report, “Given Australia’s strong macro-economic and development fundamentals, wide-scale solar and wind resources, plus insulation from COVID-19, one might expect a global ranking of higher than 18.

Sweden – a consistently high-ranking country on the World Energy Trilemma Index – demonstrates a strong emphasis on equality and social security. The report states, “Swedish energy policy is governed by the triangle of sustainability, affordability and energy security. The Trilemma score reflects the importance of equity well.”

As well as performance, the World Energy Trilemma Index also measures improvement – illustrating the significance of improving access and diversifying energy systems. The overall top three improving countries since 2000 were Cambodia, Myanmar and the Dominican Republic, which may have low overall ranks but have demonstrated noteworthy efforts to improve their energy systems.

The World Energy Council recently published its 13th iteration of the World Energy Issues Monitor, representing the largest survey of its kind of senior energy professionals, governments and civil society. The World Issues Monitor Survey was undertaken promptly after the COP26 held in November 2021.

The World Issues Monitor Survey questionnaire considered 25 core energy transition issues, with the following emerging as the top concerns:

» Economic growth

» Commodity price volatility

» Geopolitical uncertainty

“This year's edition of our World Energy Issues Monitor reflects increasing global uncertainty about the collective ability to manage a steady global energy transition, as rising energy costs and fragile geopolitics shift leaders’ focus away from meeting demand for more sustainable energy and addressing climate change,” Dr Wilkinson said.

“Leadership uncertainty reflects the complex challenges of coordinating actions on net zero energy uses, without triggering new threats to regional and global stability.”

The World Issues Monitor indicates that, despite a certain level of optimism coming out of COP26, climate change was eclipsed by the concern from rising energy costs, and didn’t make it to the top of leaders’ list of critical uncertainties.

Renewable energies were defined as action priority, while hydrogen remains to be viewed with a high degree of uncertainty across most regions as leaders explore how to build a functioning hydrogen economy.

Amidst all the mounting uncertainty, the World Issues Monitor also reported a significant focus on issues affecting equity, with quality energy access featuring as an action priority for the first time, across all regions.

“This suggests that global leaders recognise the need to humanise the energy transition by building equity and resilience,

and ensuring reliable, affordable and safe energy supply for all,” the report states.

In Australia, there’s a plethora of opportunities to humanise our energy system, according to Dr Wilkinson.

“There's a lot going on in Australia around innovation, around hydrogen, around batteries, around different choices and options. And now it's about really activating this community-led system change at every level of society.”

As for the rest of the global energy industry and the ongoing transition to net zero? The answer remains much the same.

“Humanising energy is our imperative,” Dr Wilkinson said.

“The world cannot wait for full consensus, nor for intelligent machines to deliver the answer. The next big thing in energy is not a moon-shot technology but thousands of smaller steps that mobilise sufficient critical mass and accelerate human-centric know-how in securing quality energy access for all.”

With a new year comes new trends, and with the energy transition continuing to accelerate, there are some key developments to keep an eye on. Whether you’re an investor or a consumer, get ready to see the energy market and the technologies that drive it become smarter and more affordable. AGL Chief Customer Officer, Christine Corbett shares her views on some of the big trends the energy market can expect to see in 2022.

It seems every week a new electric vehicle (EV) model is being released by car manufacturers as the demand for electric vehicles intensifies. Billboards and TV advertisements are no longer targeting the 2X2 Ute, but rather the ease and power a driver could have with an EV.

While adoption in Australia has been slower than in other countries, the momentum and demand is increasing, and I expect this trend will continue to grow in 2022.

Charging infrastructure is also becoming more accessible and, importantly, more affordable, as are the EVs themselves – making it a more achievable option for many consumers.

While pricing isn’t matching that of petrol-fueled cars yet, I believe the next five years will see a real transformation in what vehicles we drive, and how we drive them.

Benefits can be even greater too when coupled with solar and battery technologies in the home or business, further driving emissions reductions and supporting Australia in meeting its long-term commitments.

At AGL, we want to be the power behind what is driving Australians, connecting them to a sustainable future and supporting their transition. Our EV subscription trial has continued to expand across the country, providing consumers with the opportunity to experience life behind the wheel of an electric vehicle, without the commitment of ownership.

As more EVs hit the open road, the big test for industry and governments will be focusing on initiatives that facilitate consumer access and develop technical insights to inform regulatory design.

By doing so, EVs will play an important role in achieving the energy transition, providing new job opportunities and seeing more Australians driving their way to a more sustainable future.

The last couple of years have, quite literally, kept us grounded at home, and we’ve soon come to realise that as much as they are places of rest and relaxation, they are also places where we tend to consume the most energy. They require heating and cooling, they pump out the hot water, and they are filled with seemingly endless electrical appliances like microwaves, refrigerators, and kettles.

In the midst of the energy transition, households are becoming increasingly empowered to be part of our journey to a lower emissions future, resulting in more options to make changes to household energy consumption right from the palm of our hands –our smartphones.

Indeed, there are the smart devices that we have grown accustomed to – robotic vacuums, voice-controlled smart speakers and universal remote controls – but in 2022 I think we’ll see a lot more of these technologies applied to our larger white goods like air-conditioners, refrigerators and dishwashers.

Smart meters and monitors offer a promising strategy for reducing consumption, particularly when demand is at its peak. More and more energy retailers are offering programs for customers which notify them when demand for electricity is high, giving customers the choice to opt in or out of these ‘peak events’.

AGL’s Peak Energy Rewards program is one such system, and customers can be rewarded with credits if energy reduction targets are met. We believe that affordable, sustainable energy should be the reality for every customer.

Product and technology offerings need to evolve in line with our changing wants and needs and, importantly, offer solutions that are more efficient and affordable.

Storage is one thing we can never seem to have enough of, and that applies to the energy industry, too. As renewable energy sources continue to enter the market, batteries – both household and grid-scale – will play a critical role in stabilising the grid.

As demand for household solar continues to grow, so too does the demand for solar batteries. These batteries, when partnered with existing solar panels, store unused energy generated during the day to use at night, making the most of solar energy and now only leaving behind reduced energy costs.

When we view this technology at a much larger scope, grid-scale batteries are well-positioned to respond quickly and flexibly to the market and energy system’s needs. If we then add a combination of other renewable and firming technologies to the mix like gas, hydrogen, and pumped hydro, we have a strong ecosystem that I believe will eventually power all of Australia’s future energy needs.

With this concept in mind, AGL has developed an integrated, low carbon industrial energy hub strategy for our existing thermal generation sites, one that we have seen executed successfully overseas. As the first unit closure of Liddell fast approaches and its 250MW grid-scale battery receives development approval, we are very much looking forward to this milestone to pave the way for our future transition and rehabilitation projects.

Businesses know they can’t offset their way to carbon neutrality without additional compensation measures. Every business, big or small, must reduce its emissions and improve its business practices first and foremost, but once that has been addressed offsets can be used to fill the gaps and assist businesses to reach carbon neutrality.

Internationally and here in Australia, we are seeing offset markets becoming more sophisticated and a number of accepted and refined methodologies are being developed. This, combined with the increasing demand for offsets, has resulted in the offset market becoming one of the fastest-growing sectors in the world.

Australian carbon credits regulated by the Clean Energy Regulator are seen as a high-quality offset that is appreciating in value. Over the course

of 2021, the market saw an increase of over 200 per cent in ACCU spot price, and many analysts are predicting this will rise further in the coming years.

Landholders have enormous potential to capitalise on this market, particularly indigenous organisations who can generate credits through practices like savanna burning on cultural lands. Looking after country now has the added opportunity of providing economic development for their communities while also meeting Australia’s environmental commitments.

We know that creating a low carbon future is important to the businesses that we work with, and through innovation and agility, we are able to develop integrated energy solutions to meet their decarbonisation goals, as well as ours at AGL.

5. Discussions on market design

I always encourage healthy discussion, whether it be with my family at the dinner table, in meetings at the workplace, or over lunch with friends. Discussion brings about fresh ideas and opinions that we may otherwise not have thought of, generally leading to a more efficient, all-encompassing solution.

The transition sees the energy industry evolving at a rapid pace and I anticipate that in the coming months there will be increased discussion and collaboration between government and key stakeholders on the structure of the National Electricity Market (NEM). As renewable technologies and developments continue to enter the market, the NEM needs to evolve into a modern energy system that remains fit to meet the needs of consumers. This may mean a change in reforms that will help to maintain grid security and reliability, and provide certainty for future investment. As we see this progress, it’s critical that the government and key stakeholders, such as large energy companies like AGL, work together to ensure a reliable and affordable energy transition. We know energy, and AGL has been actively involved in the NEM 2025 consultations and we look forward to further discussion this year.

Treating electric vehicles as ‘batteries on wheels’, an innovative new technology has the potential to play a key role in Australia's renewable energy and net zero emissions strategies, while letting electric vehicle (EV) owners make the most of their investment.

With Australia leading the world in the number of rooftop solar panels per capita, many households are already evaluating the benefits of an in-home battery for storing excess solar power. As EVs become more common, owners and grid operators will also be able to take full advantage of the battery sitting in the driveway.

Through iMOVE Cooperative Research Centre (iMOVE), The University of Queensland (UQ) has launched an international trial to determine whether the spare battery capacity in EVs could be used to drive the uptake of renewable energy, power homes and support the grid.

The 'Electric vehicles: Supporting uptake, investigating smart charging' project focuses on studying how EV owners currently use and charge their vehicles. It aims to understand how EV adoption could be accelerated, by examining consumer willingness to purchase EVs and participate in smart charging programs.

As with in-home batteries, in-vehicle batteries can be bi-directional – used to store excess solar power and then provide it back to the home when needed – known as Vehicle-to-Home (V2H).

Using EV batteries to power homes in the evenings, rather than drawing expensive peak electricity from the grid, allows households to both reduce power bills and the peak load on the energy network. If required, vehicles can recharge from the grid late at night, when off-peak

electricity is cheaper, to ensure they have enough charge for the next day's driving.

Just like in-home batteries, the excess power stored in EVs can also be offered back to the energy provider, a fledgling concept known as Vehicle-to-Grid (V2G).

Treating networks of EVs as virtual power plants adds capacity to the grid, manages EV charging, and allows for better utilisation of distributed energy and assets. This can lower infrastructure costs and better manage peak demand, to help providers bring down energy costs.

EVs can also be utilised to store excess grid power during the day to combat voltage fluctuations and other power quality issues, which can force home solar systems to reduce their output on sunny days when too much energy is being fed back into the grid.

While there is a range of technical and infrastructure challenges to overcome, V2G has the potential to make a significant contribution to Australia's energy needs. It can also play a key role in assisting the transport sector in reaching net zero carbon emissions by 2050.

One of the key challenges with implementing a national V2G strategy is understanding whether EV owners are ready and willing to surrender control over how and when their vehicle charges.

In this project, UQ has partnered with EV analytics platform Teslascope to address these questions. The study is recruiting Tesla owners internationally to better understand driving and charging behaviour across the globe.

iMOVE Managing Director, Ian Christensen, said for electricity to be a good candidate for replacing fossil fuels, there needs to be increasing engagement between the transport and energy sectors.

"iMOVE stands ready to assist industry participants to engage with this question of what technology they are going to utilise in order to become more sustainable into the future," Mr Christensen said.

"We're not advocates of any particular solution, except we would observe that the transport sector will need a range of solutions to curb its carbon emissions because there's no one solution that will satisfy all the transport requirements."

While many new EVs coming to market offer a driving range of more than 400km, most private vehicles are driven less than 50km a day. E-Mobility Research Fellow at UQ and Head of Policy, Electric Vehicle Council, Dr Jake Whitehead said, in theory, if all of Australia's 16 million cars were EVs with a modest driving range, they could store enough energy to power the entire country for 24 hours.

"I'm not suggesting the entire country will be solely powered by electric vehicles, but the potential storage capacity offered by an orchestrated V2G program illustrates that it could have an important role to play in soaking up excess renewable energy and providing it back to the grid during peak demand," Dr Whitehead said.

"The excess energy capacity in EVs presents an incredibly valuable resource, but only if EV owners are willing and able to share it, and are properly compensated for doing so."

The study offers a unique opportunity to better understand EV driving and charging behaviour in different markets, Dr Whitehead said, as well as the opportunities for EVs to provide energy services and generate extra income for owners.

It will initially involve up to 500 Tesla owners, and use Teslascope’s analytics platform to collect vehicle usage data. In exchange for secure and confidential access to their usage data, participants are provided with a free 12-month premium Teslascope subscription.

The study is initially limited to Tesla owners in Australia, North America and Europe. As more manufacturers open up access to vehicle data, future studies will be able to consider expanding to include other EV brands.

"With the support and trust of users, we will be able to leverage these learnings to influence government policy – including the rollout of public charging infrastructure," Dr Whitehead said.

"We also aim to use the findings of this research to address some of the common misconceptions around how EV owners use their vehicles and highlight how this technology provides far greater benefits than risks to the energy sector."

UQ PhD student Thara Philip said for initiatives like V2G to succeed, it is important to understand the current behaviour and attitudes of EV owners, to see whether they are well-aligned with the requirements of V2G or present additional barriers.

"Range anxiety" is a recurring theme in Australia's EV debate, with a concern that vehicles could run out of charge during a long journey. This can make EV owners apprehensive about participating in V2G

networks and handing control of their vehicle's charging to the grid operator.

"We need to address the question of what's required to ease range anxiety," Ms Philip said.

"EV owners might be prepared to let their electricity provider choose when to charge and discharge their vehicle, if the owner could be assured that in the morning they'd always have a minimum range of 150km, for example."

"There is also the potential impact of price signals on consumer behaviour, such as a larger economic return for participating in V2G, or paying a premium for overriding the smart charging controls and choosing to charge your vehicle from the grid during peak time."

Apart from consumer willingness, a wide range of challenges must be addressed throughout the EV ecosystem before widespread V2G adoption can become a reality. Support for V2G bi-directional charging plugs and standards from EV manufacturers, as well as in-home charging infrastructure, still varies widely. Grid connection agreements with energy providers also present further challenges.

Of the various EV charger plugs across the globe, only Japan's CHAdeMO standard currently supports V2G. While V2G support is on the roadmap for some of the other charging standards, Dr Whitehead said it could be five to ten years before it becomes commonplace in EVs, and the functionality will likely come at an additional cost.

A technical concern is the impact of the extra charge cycles on the lifespan of the battery. While smart algorithms can optimise charging to minimise the impact of extra usage, participating in V2G is not covered under current battery warranties from many EV manufacturers, including Tesla.

In theory, V2G should take a toll on battery life compared to an EV which was only used for transport, with perfectly optimised charge cycles, Dr Whitehead said.

"Yet, the reality is that most electric vehicles aren't charged perfectly in an optimised way," Dr Whitehead said.

"Studies have found that, compared to how the average person is actually charging an electric vehicle right now, participating in V2G and smart charging results in a pretty similar battery life.

"Behind the scenes, those smart charging algorithms make decisions which make good financial sense for EV owners."

While the benefits of V2G could help make EVs more affordable and drive takeup, the return on investment for EV owners is not yet clear, particularly when allowing for the cost of in-home bidirectional EV charging infrastructure.

Kristian Handberg, Head of Electric Mobility at Viva Energy and former Electric Vehicle Lead at AGL Energy, said, "Vehicleto-Grid is an evocative concept which has been around for a while.

"There are many reasons to embrace it but, from an economic standpoint, many homes may not justify the expense of both an in-home battery and the extra costs of supporting V2G with their electric vehicle.”

V2G is also hampered by the fact that related charging infrastructure is yet to be standardised, meaning EV owners can't be sure that their current charging equipment will be compatible with V2G in the future. Finalising grid connection agreements with energy providers, to export energy from EVs into the grid, also has a long way to go.

Mr Handberg said the payback time for V2G needs to be less than the average time people keep a new car, which is only three to five years. For now, the technology is still in its early stages and highly proprietary, meaning technology obsolescence remains a challenge to ROI.

"This means V2G will remain an early adopter solution for some time yet – at face value, people think it's an amazing idea, that stationary cars can be used to solve other problems – but the devil is in the detail," Mr Handberg said.

"As it becomes clearer where V2G makes sense, I can imagine bus depots and multistorey car parks becoming building blocks for our energy system."

“There’s no one way to solve our energy, transport and environment challenges,” Mr Christensen said.

“There are many, many pieces to the puzzle, and we need to keep pushing forward with our understanding – such as with this project.”

by Michelle Goldsmith, Contributing Editor, Energy magazine

by Michelle Goldsmith, Contributing Editor, Energy magazine

It’s official: Australia likes big batteries. The last few years have seen numerous new battery projects announced, existing projects completed, and new projects began. And there’s more to come. Independent energy consultancy Rystad predicts that Australia’s total utility-scale battery capacity will double over 2022, passing 1.1GW. The first part of this article provided an overview of battery energy storage systems (BESS) currently operating or under construction around the country. In this second installment, we look at some of the biggest batteries in the pipeline.

In the November 2021 edition of Energy, we looked at the big batteries already operating around Australia and those in various stages of construction. In the time since, the 300MW/450MWh Victorian Big Battery has come online, and commissioning has begun at the 50MW/75MWh Wallgrove Grid Battery in New South Wales. Additionally, ground has been broken on several new big battery projects.

Neoen has begun construction of the 100MW/200MWh Capital Battery project, located just north of Transgrid’s Queanbeyan substation. Due to the emerging market for battery services, the company decided to double the battery’s initially planned 50MW capacity. Of this larger capacity, 50MW was committed as part of the ACT Government’s 2020 renewable energy auction, with a further 50MW yet to be contracted. The battery will be linked to the ACT grid through the neighbouring substation. Neoen awarded Doosan the engineering, procurement and construction services contract for the project. The battery is expected to start operating in the first half of 2023.

In South Australia, work on the 250MW/250MWh Torrens Island grid-scale battery is underway. The battery, located at AGL’s Torrens Island gas facility, is the first of AGL’s planned 850MW of battery projects to break ground. AGL appointed Wärtsilä to construct the $180 million project. The storage duration of the big battery will initially be for one hour (250MWh), with space for future expansion of up to four hours (1,000MWh). The battery is expected to be fully operational by early 2023.

Kwinana Big Battery (100MW/200MWh), Western Australia

Synergy’s $155 million Kwinana Big Battery is under construction at the decommissioned Kwinana Power Station. NHOA Australia received the contract to deliver the 100MW/200MWh lithiumion battery system, and awarded a $50 million contract to

GenusPlus Group for engineering, procurement, construction and commissioning. The Western Australian Government provided $140 million for the project, with the Federal Government contributing $15 million. The battery is expected to come online by the end of 2022.

A 150MW/150MWh battery is under construction at the site of the former Hazelwood coal-fired power station in Victoria’s La Trobe Valley. The Hazelwood battery will utilise existing infrastructure at the site to connect to the Victorian grid. When complete, the $150 million installation will be Australia’s largest privately funded BESS. Engie has a 70 per cent ownership stake in the battery, and the remaining 30 per cent belongs to Macquarie’s Green Investment Group. The owners appointed Fluence to build, operate and maintain the BESS, under a 20-year contract. The battery is due for completion in November 2022.

In addition to those already under construction, a multitude of big battery projects are soon to begin or have been confirmed. With the market for grid-scale battery services expanding rapidly, an ever-increasing number of projects are being announced or progressing through various stages of planning. According to Rystad data, as of December 2021, around 28GW of utility-scale batteries were in the pipeline across Australia. Here we look at a selection of the largest confirmed battery projects so far.

Kurri Kurri Battery (1.2GW), New South Wales

In 2021, CEP Energy unveiled plans for a 1.2GW (1,200MW)

battery energy system at Kurri Kurri. CEP Energy has secured a lease on the site of the proposed project, which is approved for power generation. Construction is expected to begin this year, so the BESS can start operating in 2023.

Goyder Renewables Hub BESS (up to 900MW/1.8GWh), South Australia

Neoen has secured approval to build a battery of up to 900MW/1800MWh in Goyder South, as part of the $3 billion

Goyder South Renewables Zone project. The zone will also feature up to 1.2GW of wind energy, and 600MW of solar power generation. Work has already begun on the first stage of the project, which involves constructing a 412MW wind farm at the site.

Loy Yang Battery (200MW/800MWh), Victoria

AGL has received planning approval for a 200MW/800MWh battery at the Loy Yang Power Station in Victoria’s Latrobe Valley. This BESS is part of the company’s planned national rollout of 850MW of grid-scale batteries.

Eraring Battery (700MW/2.8GWh), New South Wales

Origin is progressing plans for a 700MW/2800MWh grid-scale battery at Eraring Power Station in New South Wales. The company has lodged a connection inquiry with TransGrid to connect the battery to the national grid via the Eraring substation. The full capacity of the BESS will be deployed over three stages, with the first expected to be reached by the end of 2022.

Gould Creek Battery (225MW/450MWh), South Australia

Maoneng has received development approval and is undertaking procurement for a 225MW/450MWh BESS adjacent to the Para transmission substation in Playford, South Australia. Construction is planned to begin in late 2022, with completion expected before the end of 2023.

Sunraysia Emporium BESS (100MW/200MWh), New South Wales

Maoneng has announced a 100MW/200MWh battery system, called Sunraysia Emporium, near Balranald in New South Wales. The battery is expected to be completed in 2022/2023.

Bouldercombe Battery (50MW/100MWh), Queensland

Genex is progressing plans to build a 50MW/100MWh battery on land adjacent to Powerlink's Bouldercombe substation in Queensland. The battery will comprise forty Tesla Megapacks and is expected to be operational by the end of 2023.

Big Canberra Battery Project (250MW), Australian Capital Territory

The ACT Government has announced plans to build 250MW of battery storage capacity and is in the process of shortlisting proposals. The total storage capacity will be made up of one or more batteries spread across the territory.

Massive proposals

In recent times, dozens of new battery storage projects have been proposed. These include multiple battery systems with massive storage capacities of over a gigawatt. Those that follow are just a few of the biggest proposed big batteries to date.

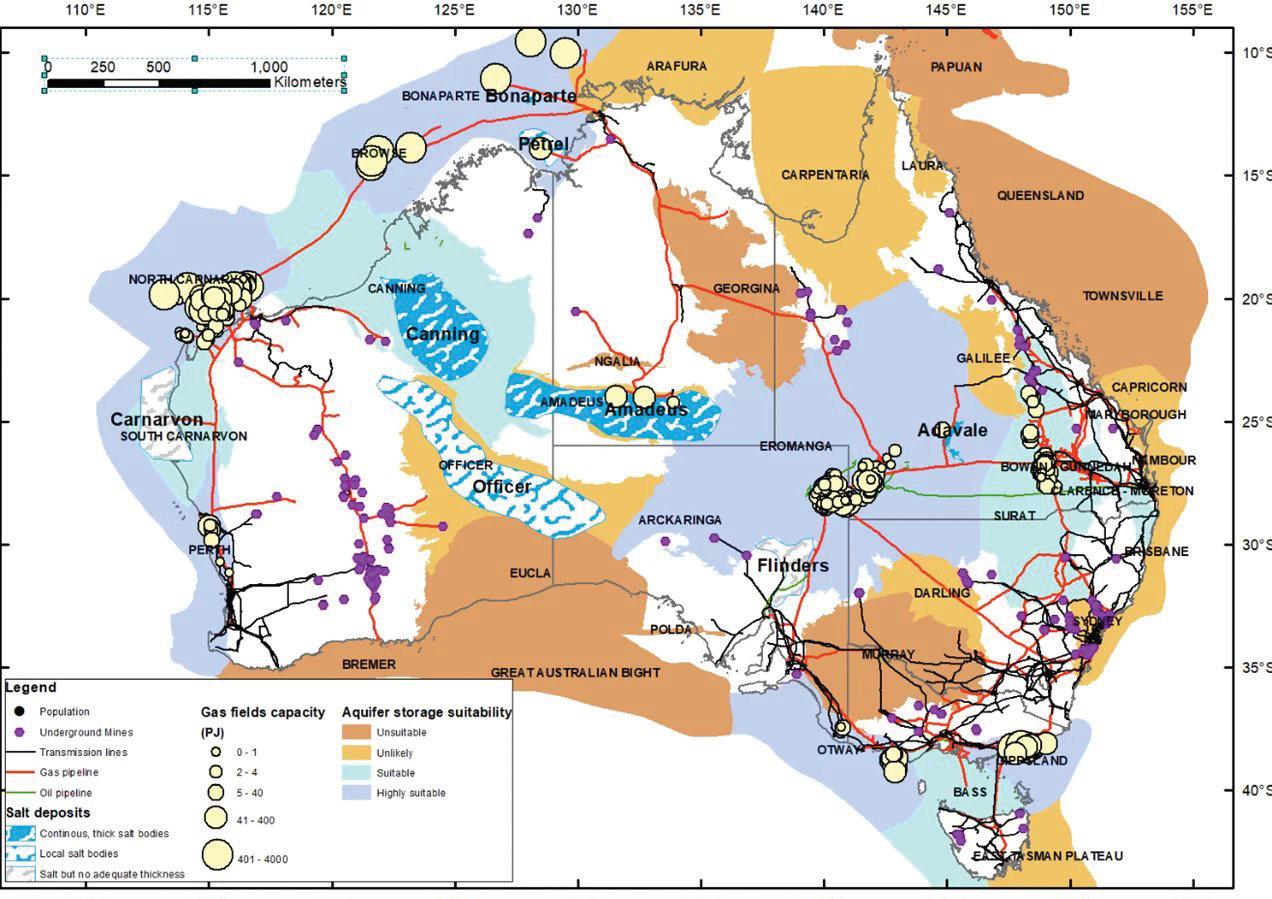

Australia-Asia PowerLink Battery (36–42 GWh), Northern Territory

In the Northern Territory, Sun Cable intends to build a 36–42GWh battery. The Australia-Asia PowerLink would be the world’s largest battery storage facility and solar farm. It is intended to supply Darwin, Singapore and Asian Markets. The project is expected to cost around $30 billion to construct, and to provide around $2 billion of energy exports per year. The first supply of electricity to Darwin is forecast for 2026, the first supply to Singapore in 2027, and full capacity by the end of 2028.

Photon Solar and Storage Battery (3.6GWh), South Australia

Dutch-based solar developer Photon Energy proposes to construct a 300MW solar generation facility, along with 3.6GWh of battery storage, in South Australia. Photon has secured land for the project and is progressing plans.

Melton Renewable Energy Hub BESS (600MW/2.4GWh), Victoria

Syncline Energy has released plans to build a 600MW/2400MWh BESS in Victoria. According to the proposal, the Melton Renewable Energy Hub will connect to the grid via AusNet’s Sydenham terminal station.

Among the many other large grid-scale battery projects proposed across Australia are the 500MW/1GWh Great Western and Wallerawang 9 batteries, and the 700MW/1.4GWh Waratah Super Battery, all in New South Wales; the 203MW/812MWh La Trobe Valley BESS in Victoria; and the Robertstown Solar Battery (250MW/1GWh) in South Australia. The rapid expansion of the energy storage arena, and a continued drive to decarbonise the economy and reach net-zero emissions, means one thing is for sure about Australia’s big battery future: more is yet to come.

Spanning the borders of north-east South Australia and south-west Queensland, it’s mostly red desert as far as the eye can see, but you will also find the Cooper and Eromanga Basins which house Australia’s largest onshore oil and gas field development operated by Santos. As businesses seek more sustainable ways to operate and decarbonise, Santos partnered with AGL to find a renewable way to power 12 remote oil well pump motors.

From working in an isolated location, to experiencing extreme weather events and managing an evolving pandemic, the project had unprecedented challenges, but AGL found the perfect solution through the development of a hybrid microgrid.

When AGL’s sustainable business energy solutions team began work on the project, one of the biggest challenges was creating a system that would perform in such a remote location. Deep in the South Australian desert, the Charo oil field is a three-hour drive from the company town of Moomba, which operates a small regional airport with limited incoming flights. For personnel travelling by road, Moomba is a minimum two-day drive from Adelaide. Once on-site, the vast and desolate environment of the Cooper Basin sinks in, with the area experiencing extreme heat with temperatures up to and in excess of 400C. But, AGL’s team was up for the unique challenge.

AGL’s Chief Customer Officer, Christine Corbett, has been with the organisation since 2019 and during this time has expanded AGL’s commitment to finding smarter sustainable solutions for customers. Stepping into her role with a customer-centric mindset, Ms Corbett has been an advocate for improving the experience of all AGL customers, big and small. Ms Corbett said in the early stages of the project, the team had to think outside the box to assess how they would be able to construct this micro-grid in such a remote location of Australia.

“For this project, our team was comprised of project managers and

engineers who were experienced in working remotely and in harsh weather conditions,” Ms Corbett said.

“With a site only accessible by a challenging dirt road and in an area that can see extensive flooding, it was crucial we had the right people working together.”

Each worker on site was specialised in remote-area work for extended periods of time and working in demanding conditions that require psychological management, high safety precautions and preparedness for summer heat stress.

“Within an environment like the Cooper Basin, team members become teammates – looking out for each other and prioritising safety.” Ms Corbett said

The AGL team started the project with limited information on the current operations or historical power usage of the oil pump motors. This data is a crucial

piece to the puzzle in these projects, in order to understand how the motors were operating. To overcome this gap the AGL engineers model how the microgrid would operate once commissioned, using data loggers which allow the current operations to be examined.

“The sheer remoteness of the site, combined with obtaining granular data on its current power usage, was a challenging task,” Ms Corbett said.

As this data was gathered, reviews of the oil pump energy demands revealed the highly dynamic nature of the electrical loads that could fall to low levels and increase to high levels in the space of a few seconds. This potential rapid change provided AGL with the insight it needed to design and construct the optimal microgrid.

“From here the team was able to develop a sophisticated engineering solution by undertaking a series of studies to inform the system design and ensure

that the microgrid would be fit for purpose,” Ms Corbett said.

“We know that no two businesses or projects are the same, with varying needs and requirements from solar and energyefficient lighting to power factor corrections and operating solutions, and this project was one of the most unique the team has done to date.”

For this project, constructing a hybrid microgrid solution was the key to supplying power to a remote area that is largely unsupervised. With nearby well sites, it was advantageous to supply the sites from a single point via high voltage transmission. By using multiple power sources in the microgrid, the AGL team has prepared Santos for inclement weather events that have the potential to disrupt one power source, like cloud cover disrupting solar. Further, the supervisory control and data acquisition (SCADA) system was installed as part of the microgrid to assist in remote monitoring and control, reducing the potential need for site visits.

“The hybrid microgrid was an excellent solution for Santos and supported their goal to lower emissions and operating costs while continuing to support the powering of the oil well pump motors,” Ms Corbett said.

The microgrid consisted of a centralised solar PV system, a Battery Energy Storage System (BESS), and generators connected to motors via high-voltage power lines. The new system would improve efficiency, reduce maintenance time and fuel, while decarbonising by introducing renewable energy into the power generation.

Each facet of the microgrid complemented the other; gensets to provide baseload energy, the battery to manage load dynamics to help generators

maintain fuel efficiency, the PV charges the battery during the day to reduce the load on the generators, a control system, and SCADA to ensure the effective management of site loads by dictating how and when the equipment operates.

The microgrid was also designed with a modern automatic control system that is capable of managing the dynamics of electrical loads, diagnosing faults, and optimising the system’s operations.

“More than 12,000 work hours later, the team had in place a distributed energy resource that will create an efficient and sustainable solution for Santos and a great example of what can be done for other energy-intensive businesses,” Ms Corbett said.

While there are other microgrids operating in Australia, this project is innovative, acting as a prototype microgrid

that is specialised for the dynamic welllease load requirements. As a unique and specialised solution, microgrids are not a one-size-fits-all concept, but rely on a design that manages elements and environmental factors specific to that project.

In this case, the remoteness of the Cooper Basin meant that AGL’s microgrid needed to have the capacity to manage loads throughout the day in extreme conditions. By ensuring the microgrid was capable of this, AGL has enabled Santos to maintain the production of its oil wells. Over time, the microgrid will be fine-tuned to meet potential climatic changes of the site and to sub-surface well-lease reservoir conditions. This process will allow AGL and Santos to collaboratively tweak the microgrid, potentially improving the system's performance.

“We are committed to using the latest technologies and innovations to create distributed energy resources which support big and small businesses,” Ms Corbett said.

“Our work with Santos has extended over four years with 55 completed projects in the Cooper Basin, providing them with energy solutions to further their business and improving both the commercial performance and environmental impact of its operations.

“This work has helped Santos shift to sustainable energy sources, utilising battery energy storage systems and ground-mount solar PV systems integrated with Santos' existing gensets.

“As the largest ASX investor in renewables we are committed to helping all businesses reach their decarbonisation goals while ensuring their operations remain viable and affordable well into the future.”

your leading source of news for the local government sector

Council has been developed to keep you up-to-date with all of the latest news, discussions, innovation and projects in the local government sector.

Council is fully integrated across print and online, featuring a website updated daily with the latest industry news, a weekly e-newsletter delivered direct to your inbox, and a quarterly magazine that can be read in print and online.

Published by industry publishing experts Monkey Media, Council will arm community decision-makers with the critical information they need to deliver a better future for cities, towns and suburbs all over Australia.

HEAD TO THE WEBSITE TODAY to sign up for the FREE WEEKLY NEWSLETTER!

www.councilmagazine.com.au

info@councilmagazine.com.au

by Dawson Johns, Managing Director, Zenaji

by Dawson Johns, Managing Director, Zenaji

There are many claims in the industry about lower-cost batteries in the future. However, the laws of supply and demand continue to prevail, with demand continuing to outstrip supply. Battery prices ultimately reflect this.

very major manufacturer of cars worldwide is moving to an electric vehicle range in the belief that this will reduce carbon footprints but also put increasing pressure on prices. Rare earth metals are in great demand in the manufacturing of many batteries. The base costs of metal are rising and with increasing demand comes the inevitable price increases.

India is likely to produce 30 per cent of the world’s lithium batteries in the next decade. One report (PRAXIS 2021) predicts battery prices are likely to drop 6 per cent per annum till 2030 to below $100 US per kWh. However, given the cost of batteries today is close to material cost, exactly why this is a likely scenario appears to be based on a series of assumptions rather than anything else.

Below is an overview of two of the potential technologies emerging in the battery world which show promise.

Operating through a chemical process known as 'reversible rusting', these batteries take in oxygen when discharging, which then causes a reaction with iron to produce rust. An electrical current then converts that rust back into iron during the charging process, releasing oxygen from the battery releases.

This appears to be a low-cost solution but less commercially viable. This process is inefficient and losses of energy will be high, meaning that for each kW of energy earned only a fraction of that energy will become available to the user. Safety issues are a major concern as these batteries can overheat, cause fire, or explode if damaged.

These batteries are currently being developed in laboratories and are a new development that could allow for much greater energy storage capacity than a typical Lithium battery. These batteries would literally 'breathe' air by using free oxygen to oxidise the anode. The technology has been described as “promising” but like practically all new technologies there are a number of technological issues yet to be resolved. One of these is the quick build-up of performance, including a quick build-up of performancedecreasing by-products and the resulting problem of 'sudden death', where the battery ceases to work without warning.

Zenaji continues to assess the latest in battery technology from around the world and is yet to find a better technology to replace Lithium Titanate (LTO) as the best solution available for long-term stationary storage. This is because of LTOs many benefits including energy density, safety, longevity, cycle life, temperature tolerance, efficiency, and lifetime cost.

Zenaji manufactures the world’s safest, infinitely scalable batteries with its Aeon (2kWh) and Eternity (32kWh) LTOs. Zenaji offers the world’s longest warranty at 22,000 cycles per battery.

Find Zenaji batteries at R&J Batteries Australia-wide. Visit zenaji.com or rjbatt.com.au for more information.

Zenaji Aeon Lithium Titanate (LTO) Batteries provide safe, costeffective power. Making them your lifetime energy storage solution.

• Infinitely Scalable

• Economic Lifetime Cost

• 20 Year or 22,000 Cycle Warranty

• Superior Performance

• Smart, Easily Mountable Design

• Domestic, Commercial & Off-Grid Installations

Available from R&J Batteries branches and distributors across Australia. Ask our battery experts for more information on Zenaji Batteries

Melbourne’s iconic CBD bathed in sunlight is quite a spectacular view — but now the city’s sun-soaked skyline can offer more than just a killer Instagram photo. New research from Monash University has unveiled the massive potential of solar photovoltaics (PV) integration in transforming Melbourne into a near-self-sustaining city.

Cities suck up huge amounts of energy, but produce very little themselves.

New research from Monash University has revealed a massive opportunity for Melbourne, and cities like it, to shift this balance.

The study, first published in the journal Solar Energy, found that integrating solar technology in roofs, walls and windows could account for up to 74 per cent of Melbourne’s electricity supply.

The bulk of that solar energy supply (88 per cent) could be produced through rooftop solar alone.

Wall-integrated and window-integrated solar technologies, which could be used to capture solar radiation bouncing off of city skyscrapers, could produce 8 per cent and 4 per cent of that supply, respectively.

Researchers from the ARC Centre of Excellence in Exciton Science based at Monash University worked with collaborators at the University of Lisbon to chart the amount of sunlight that reaches the city annually, taking into account shadows from taller buildings.

By mapping the solar radiation, researchers were able to create an adaptable model which can estimate the maximum solar power generation potential of Melbourne.

Co-author and Lecturer for Environmental and Civil Engineering at Monash University, Dr

Jenny Zhou, said the workflow of the study was made deliberately transparent to encourage more types of this research in other cities.

“The simulation models we used in our study are open source tools with little or no cost,” Dr Zhou said.

“So any other cities can borrow the model from our study and produce their own estimates.”

The research focused on the 37.4km section of central Melbourne – an area that consumes around 7.5 per cent of the state’s entire energy supply.

First author of the study and private sustainability expert, Dr Maria Panagiotidou, said there are clear benefits to implementing solar PV.

“Solar is widely available and technology has made incredible steps in the last 20 years,” Dr Panagiotidou said.

“So it’s quite important to be able to capture this energy, which is an opportunity that would otherwise be wasted. We wanted to, through this research, demonstrate the absolute maximum potential of this.”

Melbourne’s energy demand is highest during the day, when people are using energy inside city buildings — during the times when solar is

most able to provide additional supply.

Localised energy production during these hours of sunlight could have significant cost and resource-saving implications for Melbourne. With electricity generation typically sourced from the LaTrobe Valley, electricity losses can occur during transmission to the city.

Corresponding author and Professor of Engineering at Monash University, Jacek Jasieniak, said that local energy production avoids “quite sizeable” losses of electricity.

Electricity transmission from LaTrobe Valley to Melbourne began in the 1920s; before that, Melbourne ran on local generators.

Now, localised energy production in Melbourne could be a key energy solution.

“It almost seems like there’s an opportunity to go back a hundred years, but actually reinvent and rethink the sustainability and the cost benefits of doing that,” Professor Jasieniak said.

So what steps are needed to make the most of solar PV in Melbourne?

Dr Zhou explained that although rooftop solar has proven to be the most viable solar technology for broad energy production, the challenge is incentivising its implementation in existing sites.

“Our study implies a policy gap in building refurbishment, because transforming the city services to solar energy collectors requires retrofit of the existing building,” Dr Zhou said.

“But the relevant policies that support this kind of change aren’t there.”

For new sites, the planning process needs to consider the viability of solar PV within the building’s urban environment, and how that might change in the future.

“It goes beyond a building to a more systemic approach in how we view energy at a collective scale,” Professor Jasieniak said.

Another complication comes from competing interests in building development. Building developers and renewable energy experts must find a solution which maximises solar surfaces while optimising building space.

“There’s no reason why Melbourne, if it was properly developed as a CBD, couldn’t be a renewable energy zone, right?” Professor Jasieniak said.

“It can produce so much renewable energy. But for that to happen, you need to bring the right people together in a collaborative way. And I suspect at this stage, that piece hasn’t really come through because of competing priorities.”

When it comes to window and wall solar installations, the process is even more logistically challenging.

“In those instances, at least for windows, you’d have to physically replace all the window structures, and then you’d need to connect the electrical connections from the windows into the main electrical connection of the building. Now that is not as straightforward as rooftop,” Professor Jasieniak said.

Another challenge to solar integration lies in managing the utility side — how would Melbourne’s solar upgrade engage with the existing energy grid?

“The only way to really maximise the utility of those types of installations is by coupling to the actual electrical networks and really understanding, how does a building individually, and as a collection of buildings in a region like the CBD, participate in a market?” Professor Jasieniak said.

“And what role does energy storage have in actually shifting the electricity?

“We should be co-developing what that future would look like with distribution companies, with our wholesale market operator and with other parts of the energy system to understand how to best evolve.”

Dr Zhou said that the challenge of addressing these issues is establishing a common vision for how Melbourne could become an energy generator.

“When we are talking about how we implement PV technologies, there are so many decision makers in this process, and they are usually separated,” Dr Zhou said.

“So I think it’s important to establish a common vision.”

How far can new solar tech take us?

With new technological developments, solar PV is becoming increasingly efficient.

Upcoming solar technologies have projected efficiencies that are 20 per cent higher than current devices, allowing for greater solar power generation capacity.

Window and wall solar technologies are still developing, with the next generation of materials evolving to deliver much higher efficiencies.

“There’s a lot of materials development, and solar cell device engineering needed to actually develop stable, nontoxic solar window technologies, that can be integrated into buildings at the scale that we need them to be integrated,” Professor Jasieniak said.

Dr Zhou said, “There’s always a trade off for solar window technologies… how can we increase the generation efficiency and then at the same time satisfy occupants’ need for natural light?”

While developments in solar technologies can unlock new emissionsreduction opportunities, Dr Panagiatidou said that even wide-scale adoption of solar PV might not be enough with current solar efficiencies.

“Even if we do cover whole cities with solar PV… we still cannot reach net zero,” Dr Panagiatidou said.

“We still cannot cover the energy consumption of the present, let alone of the future. So in my mind, this highlights the need to actually reduce our energy consumption.

“If we consider current consumption and production, I still believe that there is a big gap. If we say that solar can solve all of our problems, I think we are, at the moment, not right.”

Though a completely self-sustaining city might be beyond reach, developing solar technologies could bring Melbourne closer to this goal.

The Australian Renewable Energy Agency (ARENA) is investing in ultra low cost solar, which supports PV with 30 per cent module efficiency, bringing Melbourne’s net zero goal in sight.