Why aren’t more Australians driving EVs?

Structured plan to help flatten aviation’s CO2 curve

Batteries in the burbs: exploring the potential

Co-locating RENEWABLES AND BATTERIES: assessing the benefits

ISSUE 12 · November 2020 · www.energymagazine.com.au

Enterprise-Grade Internet & Phone for Remote Sites

Activ8me Business Services offers remote communications solutions for energy providers in remote Australia.

Solutions Available:

Unlimited data plans

Low contention rates

Fixed or portable hardware

Solar, self-sufficient options

Optional P2P, Extended Wi-Fi and Public Wi-Fi

Installation & Field Support Australia-wide

Our solutions overcome the limitations of integrating data-hungry applications, remote monitoring and M2M platforms into isolated operations.

No matter how harsh, remote or isolated the site, we’ve got a solution for you.

For enquiries contact our Corporate Sales team or visit: business.activ8me.net.au

Supporting 13 22 88 Contact Us Business Services

The Federal Government’s Budget for the 2020-21 financial year was handed down on October 6, and the energy industry gained an insight into how our future –at least in the short-term – will look.

The Government doubled down on its commitments to the gas industry, flagging that our recovery from the economic fallout from COVID-19 will be powered, largely, by gas.

This will perhaps be most keenly felt in the role gas will play in the $1.3 billion Modern Manufacturing Strategy, with it identified as the key energy source, and in some cases feedstock, to power our manufacturing goals.

Interestingly, the government also announced the creation of an inaugural National Gas Infrastructure Plan, which will identify priority infrastructure projects. It will also look at options to boost the Wallumbilla Hub into a more transparent Australian Gas Hub, like the Henry Hub in the United States.

In excellent news for the ongoing growth and development of our renewable energy sector, the Australian Renewable Energy Agency has been allocated $1.4 billion over the next ten years, ensuring its future for this period. The Clean Energy Finance Corporation was also handed new funding; and the government will expand the focus of both organisations so that they can invest in technologies to lower emissions outside of wind and solar.

Significant investments in transmission will also be made, with up to $250 million to accelerate major transmission projects such as Marinus Link, Project EnergyConnect and VNI West to the next stage.

In response, the Federal Opposition has argued that what the energy industry actually needs is a $20 billion plan to rewire the electricity grid, which it says is “desperately outdated”. Updating the transmission network would allow Australia to properly integrate the full capacity of the growing renewables sector and unlock its potential.

Given that there’s at least 18 months until the next federal election, the path that has been set for industry by the government is clear. What’s also now clear is a position from both of the major parties on where they believe the energy industry should be moving.

On the one hand we have investment in transmission, gas and renewables; and on the other, a play to “rewire the nation” to fully capitalise on the benefits of renewables. It’s a case of the slow and steady transition to renewables, versus rapid investment to bring the inevitable forward more quickly.

As an industry, we now know where the goalposts are. Our job, as we move forward into the COVID-safe, COVIDnormal world, will be to deliver the best outcomes within the framework that has been established for us. I know this industry is up to the task. Laura

1

Editor ISSUE 12—NOVEMBER 2020 WELCOME

www.energymagazine.com.au VERMEER CB6342 Co-locating RENEWABLES AND BATTERIES: assessing the benefits Why aren’t more Australians driving EVs? Batteries in the burbs: exploring the potential Structured plan to help flatten aviation’s CO2 curve Monkey Media Enterprises ABN: 36 426 734 954 204/23–25 Gipps St Collingwood VIC 3066 P: (03) 9988 4950

(03) 8456 6720

ISSN: 2209-0541 Published by We’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950. November 2020 ISSUE 12 Editor Laura Harvey Assistant Editor Imogen Hartmann Journalists Lauren Butler Eliza Booth Design Manager Alejandro Molano Designer Jacqueline Buckmaster National Media and Events Executives Rima Munafo Brett Thompson Marketing Associate Radhika Sud Marketing Assistant Stephanie Di Paola Publisher Chris Bland Cover image is of the Gannawarra Energy Storage System. In this issue of Energy, the operators of this system have shared some of their learnings from the first operational period for the GESS.

Harvey

EDITOR’S WELCOME

F:

monkeymedia.com.au info@monkeymedia.com.au energymagazine.com.au info@energymagazine.com.au

2 EMBEDDED NETWORKS 18 What the Victorian Default Offer means for the future of embedded networks 20 Energy disruption is here –but not as we expected GRID INTEGRATION AND STABILISATION 10 Maximising solar by rethinking PV panel orientation 14 Co-locating renewables and batteries: assessing the operational implications 18 10 RENEWABLES 22 Australia’s renewables journey: moving from fossil fuels to clean energy powerhouse 26 Federal Budget misses a trick, but states pick up the slack 28 Dealer reach means less downtime for Sequentia Services 30 Structured plan to help flatten aviation's CO2 curve 22 NEWS 4 What the budget means for energy 5 Funding changes for ARENA and CEFC 6 Australia-Germany hydrogen supply chain in the works 6 Former AGL exec to head up Tas Gas 7 Snowy 2.0 gets construction go-ahead 8 Australia’s first lithium-ion battery manufacturing facility EACH ISSUE 1 EDITOR'S WELCOME 64 FEATURES SCHEDULE 64 ADVERTISERS’ INDEX CONTENTS November 2020 ISSUE 12 www.energymagazine.com.au

CONTENTS 3 BIOFUELS 56 Harnessing the power of biosolids to make hydrogen 56 DEMAND MANAGEMENT 60 A proactive approach to managing large energy demands INDUSTRY NEWS 62 SA Power Networks wins 2020 Industry Innovation Award ELECTRIC VEHICLES 42 Queensland's Electric Super Highway takes shape 45 Why aren’t more Australians driving EVs? 48 Australia’s first electricpowered cherry-picker hits the streets 50 Electric vehicle subscriptions: the model for the future? 42 DEVELOPMENTS 52 The development approvals process: positioning your project for success 52 DISRUPTION 34 Batteries in the burbs: exploring the potential SWITCHGEAR 38 Safely grounded: timing measurements on gasinsulated switchgear EQUIPMENT 40 The products at the heart of critical infrastructure 34 62 60 www.energymagazine.com.au November 2020 ISSUE 12

WHAT THE BUDGET MEANS FOR ENERGY

The Federal Government has allocated almost $2.5 billion to the energy industry in the 2020-21 budget; with the gas sector flagged to play a pivotal role in Australia’s economic recovery from the COVID-19 pandemic.

Specific initiatives announced for the energy industry for the 2020-21 period include:

» Up to $250 million to accelerate major transmission projects such as Marinus Link, Project EnergyConnect and VNI West to the next stage. Together with existing support for HumeLink and the QNI Interconnector, this means all priority transmission projects are being accelerated, creating thousands of new jobs, putting downward pressure on prices and shoring up the reliability of the grid.

» A $53.6 million microgrid program to support the development of pilot projects in regional Australia, building on the success of the current Regional and Remote Communities Reliability Fund. This will help deliver more affordable reliable power in regional communities across Australia.

» Helping connect the North West Minerals Province (NWMP) near Mount Isa to the NEM through further support for the CopperString high voltage transmission line. This will allow major users in the NWMP to access reliable and more affordable energy supply, and encourage further investment in mining and processing in the region.

» $28.5 million to deliver cheap and reliable energy to Western Australians through the South West Interconnected System Big Battery project and a WA-based microgrids program for remote and indigenous communities.

» $52.2 million to improve energy efficiency, lower bills and deliver abatement, including $24 million to fund building upgrades and reduce energy costs for community groups and for small and medium hotels.

» $4.9 million over two years to improve cyber security in the energy sector and prepare government and industry for future threats.

The government is also strengthening Australia’s long-term fuel security through a $250.7 million investment in new diesel fuel

storage facilities and progressing reforms to boost the resilience of fuel supply and support local refineries.

Gas is set to play a huge role in the Federal Government’s economic recovery plans, with the announcement of an inaugural National Gas Infrastructure Plan (NGIP) to identify priority infrastructure projects, and options to boost the Wallumbilla Hub into a more transparent Australian Gas Hub, like the Henry Hub in the United States.

On top of the $42 million of investments to unlock supply, $10.9 million will be invested to strengthen gas infrastructure planning and deliver market reform to lower the price of gas for households and manufacturers.

The Federal Opposition responded to the Budget’s energy initiatives by outlining its own plan to invest $20 billion in rewiring the electricity grid, to allow Australia to adapt to changing energy markets and become a renewable superpower.

If elected, Labor would rewire the nation to drive down power prices, giving the economy a boost of up to $40 billion and creating thousands of new jobs – particularly in regional areas.

Australia should be a renewable energy superpower, according to the Labor Party, but the country’s electricity transmission system is “desperately outdated”. They argued that Australia’s transmission system doesn’t properly integrate the full capacity of the growing renewables sector, let alone unlock its potential.

Federal Labor Leader, Anthony Albanese, said, “Australia’s electricity network was designed for a different century, and transmission systems themselves are operated by monopoly providers who keep taking households and businesses for a ride.”

By establishing the Rewiring the Nation Corporation (RNC) and keeping it in public hands as a government-owned entity, Labor said it will ensure the grid is rebuilt at the best price possible.

The RNC would partner with industry and provide low cost finance to build the Integrated System Plan. The end result is expected to be cheaper electricity prices for homes and businesses.

Labor said it would ensure Australia’s modern energy grid would be built by Australian workers using Australian suppliers by mandating local supply and local labour.

NEWS 4 November 2020 ISSUE 12 www.energymagazine.com.au

FUNDING CHANGES FOR ARENA AND CEFC

The Australian Renewable Energy Agency (ARENA) and the Clean Energy Finance Corporation (CEFC) have received a funding boost of $1.9 billion from the Federal Government, ensuring their operation for the next decade.

Prime Minister Scott Morrison has also unveiled plans to introduce new legislation which would allow ARENA and the CEFC to invest in technologies to lower emissions outside of wind and solar, including carbon capture and storage, hydrogen, soil carbon, and green steel.

ARENA will be allowed to invest in renewable energy projects that are in the early stages of research and development while the CEFC is restricted to funding clean energy technologies that are in the commercial phase.

Mr Morrison said the $1.9 billion investment package in future technologies to lower emissions would back jobs, cut costs for households and improve the reliability of energy supply, however there is some concern from the industry that the new changes could potentially extend the life of coal-fired power plants.

“Australia is in the midst of a world-leading boom in renewable energy with over $30 billion invested since 2017. Solar panels and wind farms are now clearly commercially viable and have graduated from the need for government subsidies and the market has stepped up to invest,” the Prime Minister said.

“The government will now focus its efforts on the next challenge: unlocking new technologies across the economy to help drive down costs, create jobs, improve reliability and reduce emissions. This will support our traditional industries – manufacturing, agriculture, transport – while positioning our economy for the future.

“This will not only cut emissions, but deliver the reliable energy Australia needs while driving down prices for homes and businesses.”

The new package also invests in a range of low-emissions, reliable new technology advancements including:

» Supporting businesses in the agriculture, manufacturing, industrial and transport sectors to adopt technologies that increase productivity and reduce emissions through a new $95.4 million Technology Co-Investment Fund that was recommended by the King Review

» Piloting carbon capture projects with a $50 million investment in the Carbon Capture Use and Storage Development Fund

» Helping businesses and regional communities take advantage of opportunities offered by hydrogen, electric, and bio-fuelled vehicles with a new $74.5 million Future Fuels Fund

» Setting up a hydrogen export hub worth $70.2 million to scale-up demand

» Backing new microgrids in regional and remote communities to deliver affordable, reliable power with $67 million

» Contributing $52.2 million to increase the energy productivity of homes and businesses, including a sector specific grant program for hotels supporting equipment and facilities upgrades

» Slashing the time taken to develop new Emissions Reduction Fund (ERF) methods from 24 months or more to less than 12 months, involving industry in a co-design process and implementing other recommendations from the King Review into the ERF, worth $24.6 million

» Boosting energy and emissions data and cyber-security reporting and supporting the delivery of future Low Emissions Technology Statements under the Technology Investment Roadmap process, as well as developing an offshore clean energy project development framework, together worth $40.2 million

Minister for Energy and Emissions Reduction, Angus Taylor, said getting the next generation of energy technologies right would not only help to keep prices low and the lights on, but would grow jobs, strengthen the economy and reduce emissions.

“We will reduce the cost of new and emerging technologies, not raise the cost of existing technologies or layer in new costs to consumers and businesses through mandated targets or subsidies,” Mr Taylor said.

“The government recognises the strong growth in emerging energy technologies that will play a role in Australia’s energy mix into the future. We need to get the balance right and our investment to re-energise ARENA will deliver that.

The Federal Government said it will provide ARENA with guaranteed baseline funding of $1.43 billion over ten years.

ARENA CEO Darren Miller welcomed the new funding and an ongoing role for the agency.

“We are delighted to see ARENA’s important role acknowledged with new funding, and we welcome a new era for ARENA,” Mr Miller said.

“There is still much work to be done but with an experienced team, industry knowledge and strong networks across a range of technologies and sectors, ARENA is well positioned to support Australia’s energy transformation and emissions reduction goals.”

Over its lifetime, ARENA has helped to improve the competitiveness of renewable energy technologies such as large-scale solar, grid-scale batteries, pumped hydro, bioenergy, distributed energy technologies and hydrogen. Since 2012, ARENA has supported 543 projects with $1.58 billion of funding that has leveraged nearly $5 billion in additional private and public sector investment.

5 NEWS www.energymagazine.com.au November 2020 ISSUE 12

AUSTRALIA-GERMANY HYDROGEN SUPPLY CHAIN IN THE WORKS

Australia has signed an agreement with Germany initiating a joint feasibility study into the potential for hydrogen collaboration, including the future development of a hydrogen supply chain between the two countries.

Minister for Trade, Tourism and Investment, Simon Birmingham, said partnerships with countries such as Germany would be key to the development of a strong and worldleading hydrogen industry in Australia.

“These kinds of partnerships will be critical to further developing our emerging hydrogen industry and Australia’s future as a powerhouse in clean energy exports,” Mr Birmingham said.

“Exploring opportunities for future collaboration on commercial-scale operations, and investments in hydrogen production is vital if Australia is to realise the significant economic benefits and job creation opportunities hydrogen brings.

“This study gets the ball rolling on the development of a future hydrogen supply chain with Germany, which could lead to billions of dollars in export earnings for Australia and help them meet their future clean energy ambitions.

“With Australia well positioned to be a major supplier of low emissions hydrogen, and global demand for hydrogen continuing to grow, we need to continue to develop links with future importers around the world.”

Minister for Resources, Keith Pitt, said the study will look to underpin the future of hydrogen supply and help to inform two-way trade and investment between Australia and Germany.

“This kind of cooperation is another step in helping to secure Australia’s clean energy trading future which is backed by our abundant natural resources and strong history of being a reliable supplier,” Mr Pitt said.

“This agreement will open up another new market for our resources and potentially create thousands of new job opportunities for Australians well into the future.

“Clean hydrogen is a transformational fuel that can be used to power vehicles, generate heat and electricity, and as a chemical feedstock in major industrial applications.

“Australia has what it takes to be a world leader in hydrogen production and exports that will help our trading partners lower their emissions.”

FORMER AGL EXEC TO HEAD UP TAS GAS

Tas Gas has a new Chief Executive Officer, with former AGL executive Phaedra Deckart stepping into the role in October.

Ms Deckart had been a senior executive with AGL since 2015 and was part of the transformation of the company’s energy supply portfolio across gas, power, fuel and logistics, while navigating the transition to renewables across solar, wind and battery technology.

Ms Deckart has experience in the gas and energy sector having held various commercial positions at Santos across the domestic gas and global LNG market.

Ms Deckart said, “I am delighted to be joining Tas Gas, a business that has Tasmania at its heart, and provides gas distribution and gas supply to Tasmanians to heat their homes and provide energy to their businesses.

“It is a privilege to take up this role and ensure we continue to provide this essential service to customers and grow the business from its solid foundation.

“As we look to the future and to getting the Australian economy moving again, I believe the energy sector can play a key part in the recovery.”

Tas Gas Chair, Paul Adams, said the board was pleased to have appointed someone with Ms Deckart’s reputation and experience to lead Tas Gas through the next phase of its growth.

“We’re excited to have someone who has built such a strong reputation for advocating for the continuing role of gas as the natural partner in Australia’s energy transition and for providing a voice for the customers and communities that she’s served,” Mr Adams said.

Minister for Energy and Emissions Reduction, Angus Taylor, said collaborating with key partners such as Germany will help to drive down the cost of new hydrogen technologies.

“Australia has the natural competitive advantage to be a world leader in exporting hydrogen. The expertise and infrastructure from our gas industry will assist us to use hydrogen as an energy source at home,” Mr Taylor said.

“Australia’s future hydrogen industry has the potential to generate 7,600 new jobs by 2050, many in regional Australia, with exports estimated to be worth around $11 billion a year in additional GDP.

“This is why the Australian Government has committed more than $500 million to back this industry’s development.”

This partnership with Germany comes in addition to existing commitments Australia has already sought with other like-minded economies including Japan, South Korea and Singapore.

Information about the study and Australia’s hydrogen strategy is available on the Hydrogen Strategy website.

Australian research and industry partners can submit an Expression of Interest to the study at GrantConnect.

“We look forward to working with Phaedra and we are confident she will help to achieve the company’s full potential over the coming years.”

Mr Adams acknowledged departing CEO, Cameron Evans’, leadership through the sale of Tas Gas to Infrastructure Capital Group and through the challenging conditions during the pandemic in 2020.

Mr Evans has overseen a period of growth for the Tas Gas business, including the establishment of the business in Victoria through the Energy for the Regions Program, the integration of Gas Pipelines Victoria and the recent sale of Enwave.

Ms Deckart will continue to serve on the Australian Gas Industry Trust Board.

NEWS 6 November 2020 ISSUE 12 www.energymagazine.com.au

SNOWY 2.0 GETS CONSTRUCTION GO-AHEAD

The Federal Government has granted approval for Snowy Hydro to begin main works on its Snowy 2.0 project.

As the shareholder of Snowy Hydro Limited, the Federal Government’s approval for Snowy to commence main works follows final environmental regulatory approvals for the project in June 2020.

Future Generation Joint Venture, the main contractor building the project, will now begin construction of an underground power station, waterways and access tunnels, and other supporting infrastructure.

This builds on the exploratory works for Snowy 2.0, which commenced in 2019 and included constructing site access roads, excavating an exploratory tunnel and establishing a construction compound.

Former Finance Minister, Mathias Cormann, said that infrastructure projects like Snowy 2.0 will play a key role in Australia’s economic recovery from COVID-19 by creating jobs and boosting economic activity.

“More than 500 people and 100 local businesses have already been engaged on this project and we expect 5,000 direct and indirect jobs to be created over the life of the project, with the potential for many more jobs to be created locally and in the broader region through supply chains and support services,” Mr Cormann said.

“The economic benefits of Snowy 2.0 will have an enduring impact on the Snowy Mountains region, with the project providing opportunities for local businesses, improvements in local infrastructure and increased economic activity well into the future.”

Energy and Emissions Reduction Minister, Angus Taylor, said in addition to creating jobs and increasing economic activity in the region, Snowy 2.0 will drive down electricity prices across the National Electricity Market and deliver more reliable power.

“Snowy 2.0 is a defining project in our country’s history and forms a key part of the government’s agenda to deliver affordable and reliable power,” Mr Taylor said.

“The commencement of main works moves us a step closer to realising the benefits of Australia’s largest renewable energy project, the impact of which will be felt by millions of Australians.

“Those benefits are clear – affordable and reliable power across the National Electricity Market to ease pressure on Australian households and businesses.”

The Federal Government has committed up to $1.38 billion in equity for Snowy 2.0, with the remainder of the project to be financed by Snowy Hydro Limited.

Snowy 2.0 will provide an additional 2,000MW of fast-start, dispatchable energy and provide 350,000MW hours of large-scale storage, enough to power the equivalent of 500,000 homes for over a week during peak demand.

The project aims to reduce volatility in the market, support reliability and bring down power prices for Australian families and businesses.

Snowy Hydro Limited expects first power from Snowy 2.0 in 2025.

7 NEWS www.energymagazine.com.au November 2020 ISSUE 12

AUSTRALIA’S FIRST LITHIUM-ION BATTERY MANUFACTURING FACILITY

Lithium-ion battery manufacturer, Energy Renaissance, has announced the build of Renaissance One, a new $28 million battery manufacturing facility in Tomago, in the Hunter Region.

Mark Chilcote, Managing Director of Energy Renaissance, said, “We have settled on Tomago as the site of our first plant, construction will commence and the plant is scheduled for completion in 2021.”

Mr Chilcote said that the 4,000 sqm purpose-built facility will be constructed by local property developer ATB Morton and have an initial battery production capacity of 66MWh per annum, with plans to scale its Australian operation to 5.3GWh of energy storage per annum with an additional investment of more than $200 million.

“Over 1,700 direct jobs will be created during the construction and operational phase, and another 6,500 indirect jobs will be generated for the benefit of the Hunter,” Mr Chilcote said.

“The Hunter Region has all the right skills, natural resources, expertise and an abundance in solar energy for us to develop a successful battery manufacturing business in Australia.”

It’s expected that more than half of the batteries produced at Renaissance One will be exported through the Port of Newcastle.

The Federal Government provided a co-funded grant of $246,625 through the Advanced Manufacturing Growth Centre to Energy Renaissance. This has been used to accelerate research and development as it starts to manufacture batteries locally.

Patron Senator for the Hunter Region, Hollie Hughes, said, “Energy Renaissance will make clean and affordable energy more accessible and create greater energy security for Australia and our neighbouring countries.

“Once Renaissance One is operating at capacity, it will be able to provide – in the space of a year – enough batteries to power every public school, hospital, fire station, SES unit and new home built in Australia.

“That’s reassuring because Australia will be able to rely on its own source of renewable energy in the very near future.”

Ms Hughes said that the company’s investment in the local economy will support the Hunter region and help lead Australia’s economic recovery.

“I would like to encourage other manufacturers to move to the area to create a renewable energy manufacturing hub.

“With its deepwater port and proximity to the Newcastle University there is no better location for renewable energy manufacturers.”

Mr Chilcote said that building Renaissance One at Tomago will provide significant competitive advantages to Energy Renaissance.

“Access to the Port of Newcastle will allow us to ship our batteries to Southeast Asia while working with highly-skilled talent from CSIRO’s Energy Centre and graduates from the University of Newcastle,” Mr Chilcote said.

Dr Jens Goennemann, Managing Director of AMGC, said, “With its new site, Energy Renaissance will leverage Australia’s abundance of natural resources by adding value to raw materials, building onshore capability, and exporting into global markets.

“This in-turn will generate significant local manufacturing jobs and boost prosperity for the nation while giving Australia a significant foothold in the growing energy storage sector.”

The battery project aligns with the Federal Government’s Technology Investment Roadmap, which identified Australia as a potential world leader in the investment for renewable energy.

NEWS 8 November 2020 ISSUE 12 www.energymagazine.com.au

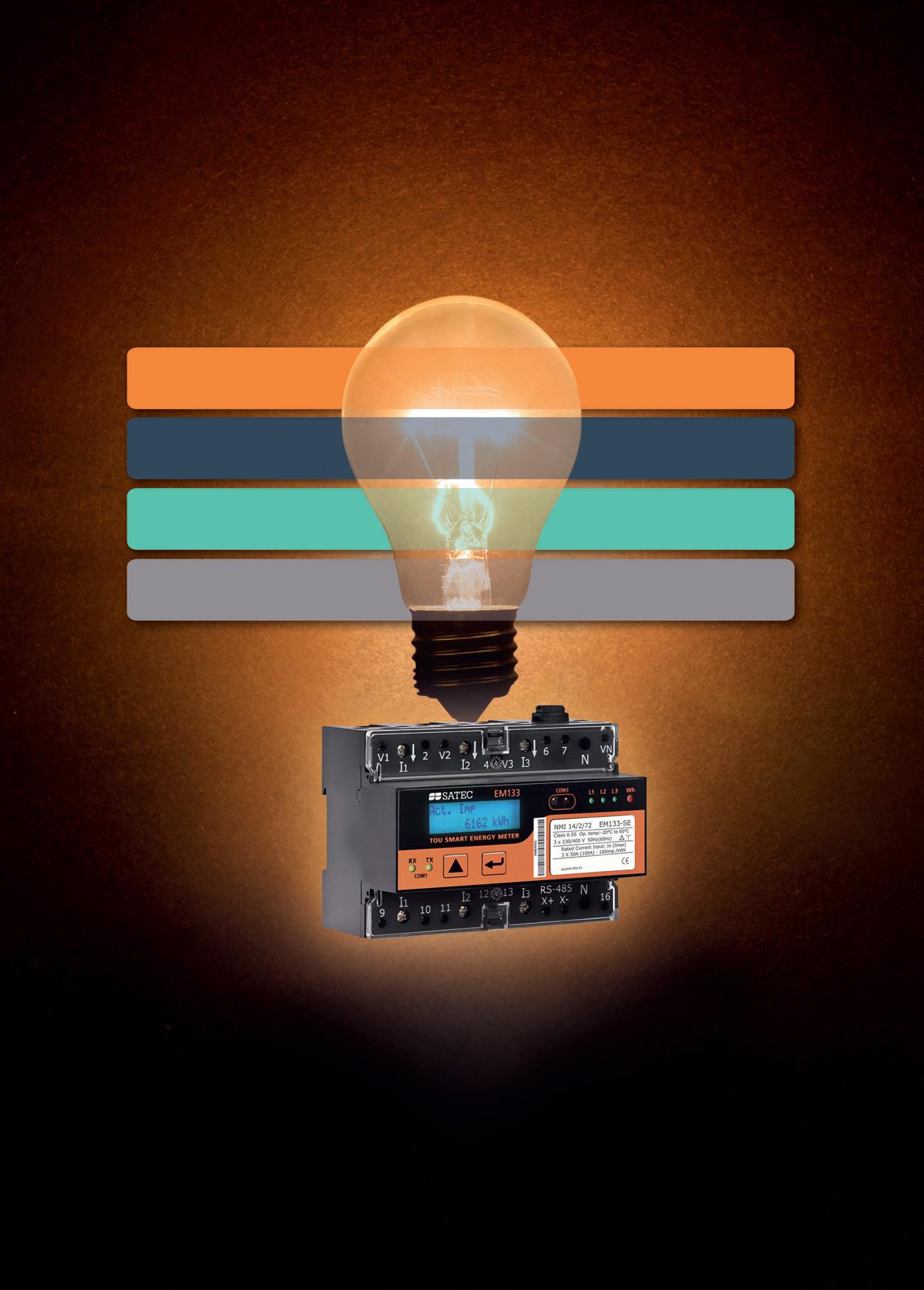

NER Chapter 7 compliant

3x Load Survey Files

Remote Disconnect

Demand Side Participation

AEMO Metrology Policy ready

Power of Choice (PoC) Energy Metering POWER OF CHOICE Flexible Metering Installations

Market Settlement Data (5-min, 15-min, 30-min)

Protocols: MV90, Modbus, JSON, IEC 60870

Dual Communications Options RS-485, 4G, Ethernet, WiFi, JSON

Another 1st by

RS00150AB

MAXIMISING SOLAR BY RETHINKING PV PANEL ORIENTATION

Traditionally, solar PV panels have been orientated in a northerly direction, towards the equator. But new research from the University of South Australia questions whether this is the most effective approach, particularly in a residential setting, where north-facing panels will produce the most energy in the middle of the day – outside the usual residential usage peaks.

Over two million Australian households – more than 20 per cent – now have rooftop PV solar panels, and while this is a generally positive scenario, the increased uptake of PV systems around the nation is creating a few challenges for our electricity industry.

UniSA solar researcher, Kirrilie Rowe, said one key problem currently facing home PV stems from the discrepancy between the times of peak use and peak production.

“Solar panels on residential dwellings are typically installed facing the equator

10 www.energymagazine.com.au GRID INTEGRATION AND STABILISATION

to maximise the energy collected, but the power generated by an equator-facing panel peaks at around midday, whereas residential loads typically have peaks in the morning and afternoon,” said Ms Rowe.

At the moment, households are paid a feed-in tariff for excess electricity they send to the grid, but, as the number of homes producing electricity increases, the viability of exporting to the grid is reduced.

“In some markets at certain times we’re already seeing over-supply during peak production times, which can cause grid instability and is leading to reduction in feed-in tariffs,” said Ms Rowe.

“The real challenge now facing the solar industry is finding ways to balance production and consumption by maximising self-consumption for the solar panel owner.”

Offering one elegantly simple solution to this challenge, Ms Rowe’s research explores how rethinking the orientation of rooftop solar panels might better match times of production to patterns of consumption, even if that means a slight reduction in overall energy generation.

“Traditionally, PV panels are mounted facing the equator as this creates more energy per square metre of PV panels, but this orientation does not necessarily

maximise the community self-use of the energy prior to the excess being exported to the wider grid,” said Ms Rowe.

“By orienting panels in different directions rather than just facing the equator, it’s possible to minimise the shortfall between load and generation for a community precinct.

“This benefits the end-user by decreasing the amount of electricity required to be imported, and the stability of the grid by decreasing the amount of variability between peak and low loads.”

A recent study by Ms Rowe and Associate Professor Peter Pudney

11 www.energymagazine.com.au November 2020 ISSUE 12 GRID INTEGRATION AND STABILISATION

calculated the optimal panel orientation for self-consumption for a community of 29 individual dwellings and a residential building with 42 apartments in Australia.

The individual dwellings form a residential development at Lochiel Park, South Australia, designed by the South Australian Government to be a ‘model green village’, with every house having a minimum 7.5-star NatHERS rating. The electricity use of each property is recorded every minute, and this data was aggregated to provide 30-minute samples for Ms Rowe and Associate Professor Pudney’s research, with data from two separate years (2015 and 2017) compared.

The apartment data for the research came from an inner northern suburb of Adelaide, the location of the state's first higher density urban infill project. All buildings meet 5-star Green Star As Built standards, a sustainability rating system launched in 2003. Hourly energy use data from a block of 42 apartments was used, from years 2016 and 2017.

Neither the individual nor apartment dwellings are organised as embedded networks, but the load data was aggregated as if they were.

“Our analysis uses detailed load data and detailed irradiance data, and shows that optimal panel placement for self-consumption is only towards the equator when the area of PV panels is small,” said Ms Rowe.

“In all cases, if the panel area is small enough so that the household will not export, then facing the panel north is best. But as panel area increases, it becomes better to face the panels north-west to meet the afternoon loads, and if even more panel area is available, then panels should be faced north-east and west.”

By placing panels more north-east and north-west, the load in the middle of the day was still met, but a greater proportion of the morning and afternoon load was also addressed.

For precincts made up of either the individual dwellings or the apartments, panels oriented north gave the greatest initial reduction in the shortfall between generation and load when PV area was below around seven square metres per dwelling, which currently equates to around a 1.4kW array.

For total panel areas beyond this size, panels were never oriented north.

Over the next few years, as solar uptake increases, feed-in tariffs fall and the cost of solar batteries remains prohibitive, the real value of solar self-consumption will continue to rise. Initially, government subsidies such as generous feed-in tariffs were required to encourage the uptake of rooftop solar, but these subsidies are now decreasing or disappearing altogether.

However, Ms Rowe believes that, as feed-in tariffs diminish, rooftop solar can remain cost effective as long as the local generation is self-consumed.

“Future electricity tariffs are likely to be structured to try to limit electricity use during periods of high demand and encourage use during periods of low demand, by imposing high import costs during periods of high demand and low import costs during periods of low demand,” said Ms Rowe.

“Where feed-in prices are still available, export prices are usually significantly lower than import costs. Orienting photovoltaic panels to best match the load results in less energy imported from the grid during the morning and afternoon peak demand periods, which generally will result in a more cost-effective renewable energy system than if panels were placed north.”

Long-term growth in energy demand from the grid, or increases in peak power demand from the grid, may also increase the price of grid electricity due to the necessity for grid augmentation. Structuring residential communities such that they slow the rate of increase in peak power demand will also tend to lower the cost of electricity over the longer term.

The strategy developed by Ms Rowe and Associate Professor Pudney offers a simple approach to improving self-consumption in precincts without increasing set-up costs on new PV systems, and the method could also be easily adopted for remodelling existing systems.

“The information on how to orient solar panels to minimise power shortfall is useful to groups developing housing precincts, and has been used to design a renewable energy system for a retirement village with 24 dwellings,” said Ms Rowe.

“Future work will incorporate energy storage into the model,” she added.

12 November 2020 ISSUE 12 www.energymagazine.com.au

INTEGRATION AND STABILISATION

GRID

“Run with us – Your partner in Plastics”

All Australian Supplied Electrical Cable Cover is manufactured in accordance with AS4702-2000 and is independently tested, by TUV Rheinland Australia

Unique rounded edging of the Cable Cover ensures maximum installer safety and reduces the risk of injury

100% Recycled Plastic

Notched Pallet allows web hoist to be safely fed through the coil and ensure safe offloading of larger coils

Gas Protection Covers available in a range of sizes

The Corrugated Cable Cover, is a patented product, manufactured under License

Thicknesses range from 3mm to 10mm, Widths available from 100mm up to 600mm

Standard Slab Length available in 1.2, and 2.1 Metre

Standard Coil Lengths are 10 Metre, 15 Metre, 20 Metre, 25 Metre and 150 Metre

Both Plastics Extrusions Thailand, and AGC Plastics, are 100% Australian owned and ISO accredited Companies

The product is continuously checked during the production cycle to ensure the surface finish, size, weight and impact strength are to the required specification

In-Line Printing allows for product batch and manufacture date for identification and tracing

Maintain strict control over all our procedures so as to maintain the highest quality of both product, and service to our customers

+61 432006775 rory@agcplastics.com.au

for

Contact Rory Livingston AGC Plastics Pty Ltd 38 Sarton Road, Clayton Victoria, 3168 Australia www.agcplastics.com.au AGC Plastics has a number of quality distributors in Australia, as well as internationally. Please contact us

further information.

ELECTRICAL CABLE COVER

AS4702-2000

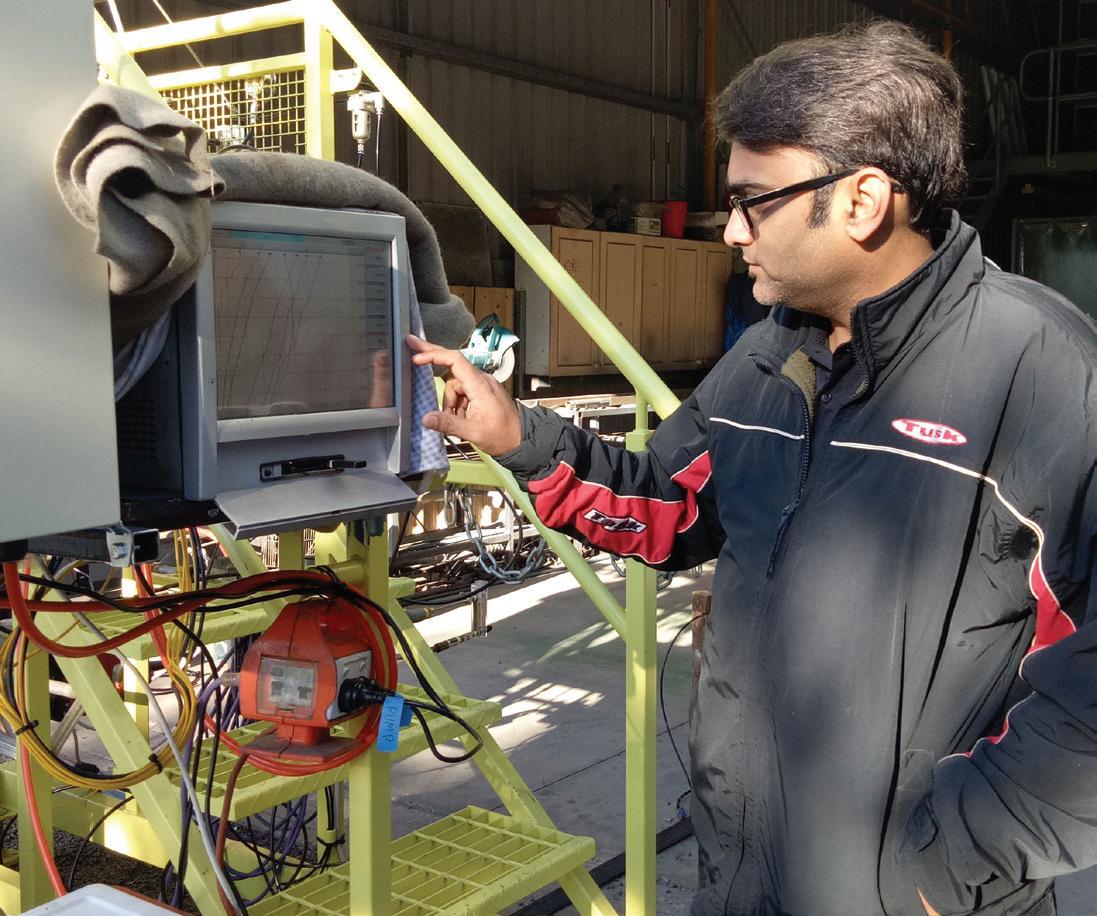

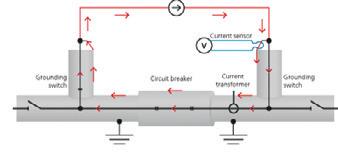

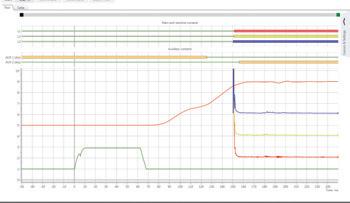

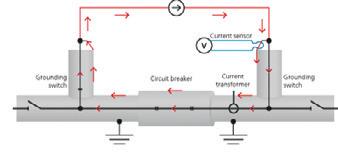

CO-LOCATING RENEWABLES AND BATTERIES: ASSESSING THE OPERATIONAL IMPLICATIONS

by Andrew Stiel, Energy Markets and Offtake, Edify Energy

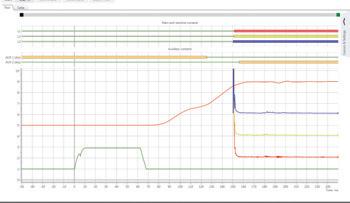

Edify Energy, with support from EnergyAustralia, recently published a knowledge sharing report covering the first 12 months of operations for the Gannawarra Energy Storage System –a 25MW/50MWh lithium-ion battery that shares connection infrastructure with the 50MW Gannawarra Solar Farm. Here, we explore some of the learnings from this first operational period and provide insights into how this may drive development decisions for future battery systems seeking to support renewables and advance the transition to a sustainable energy sector.

14 GRID INTEGRATION AND STABILISATION

15 GRID INTEGRATION AND STABILISATION

If investment in the National Electricity Market (NEM) in the last few years has taught us anything, it is that there needs to be a renewed focus on energy projects premised on the potential to both create value and mitigate risk (technical, market and operational), rather than being solely driven toward the lowest levelised cost of energy. The coordinated investment of batteries and renewables is a potential pathway to realise value creation and risk mitigation, and one that is consistent with the findings of the most recent Integrated System Plan from the Australian Energy Market Operator (AEMO).

The inclusion of batteries in the business case for renewable projects has a number of advantages, such as diversification of revenue streams (for example, energy markets and frequency control ancillary services) and mitigating market risks such as increasingly shallow prices during daylight hours for solar. What is not clear however, is the deployment model to access these advantages. In particular, the question on whether to co-locate the renewable and battery facility behind common network infrastructure or to establish each facility on a stand-alone basis does not always have an obvious answer.

The principal feature that distinguishes the Gannawarra Energy Storage System (GESS) from other operational batteries in the NEM is the fact that it shares network connection infrastructure with the Gannawarra Solar Farm (GSF). The obvious benefit of such an arrangement is that it allows for greater utilisation of

costly network infrastructure. The drawback is that, depending on the relative size of the network infrastructure, this sharing could introduce an export constraint for the combined facility. In the case of the 25MW GESS and 50MW GSF, a combined 50MW export limit exists. However, this export limit only serves as a constraint to the extent it prevents access to commercial opportunities for either project; something that can be assessed by viewing the first 12 months of GESS’s operations.

Does shared network infrastructure constrain co-located battery operations?

The role that batteries have been playing in energy and frequency control ancillary services (FCAS) markets in the NEM is already widely reported on. Consistent with other batteries, the predominant source of revenues in the first 12 months of GESS’s operation was from FCAS, not the time shifting of energy. For the most part, the 50MW export constraint did not place a significant commercial limitation on the operation of GESS and its access to energy and FCAS market opportunities. The observed dispatch profile of GESS closely tracks that of prices (that is, dispatching in mornings and evening peaks); a trend that is anticipated to continue as increased solar uptake continues to depress prices during daylight hours. This brief period of operation of GESS therefore highlights the complementary nature of solar (if not wind) and batteries, with batteries serving to mitigate the downside

16 November 2020 ISSUE 12 www.energymagazine.com.au GRID INTEGRATION AND STABILISATION

Edify Energy has published a knowledge sharing report which covers the first 12 months of operation of the Gannawarra Energy Storage System.

market price risks of correlated solar in a way that is not overly burdened by the physical constraints introduced by common network infrastructure.

That said, there were inevitably occasions (including some high price periods) where the 50MW export constraint of the combined facility did introduce a commercial limitation on GESS’s operation. During these periods, it was demonstrated that having access to an accurate solar forecasting system and a high degree of coordination between this telemetry and the trading floor is important to limit lost value that could otherwise be captured with greater confidence in the solar output. This effect can be most pronounced in the morning and evening ramp up and down periods, during which solar output is harder to forecast and which also coincide with the end and beginning of price peaks.

Another distinguishing feature of GESS is that network tariffs are incurred when drawing a load through Powercor’s 66kV distribution network; a position that is inconsistent with Transmission Network Service Provider approaches (and is currently subject to standardisation via rule change processes). The management of GESS’s state of charge therefore needs to account for these

tariffs. The presence of GSF however creates an opportunity to avoid these network tariffs, where charging during solar hours would not place a load on Powercor’s 66kV network. This option is not available to a stand-alone battery solution connected to a distribution network, which in all instances would face network tariffs when performing a charge.

Could reform expand the value creation and risk mitigation options?

In addition to making greater utilisation of network infrastructure, the co-location of batteries and renewables should also be capable of accessing further integration benefits, which are not accessible today, but could be proposed as part of current market design reform efforts.

These include, but are not limited to:

» Using the battery to make real-time adjustments in output (i.e. depart from its scheduled position) in response to the renewable generator’s fluctuating generation to permit selfperformance of regulation services and bring causer pays FCAS relief to the renewable generator; a material operational cost and risk that cannot be directly hedged today. This is in contrast to classifying the combined facility as a scheduled generator (recognising the potential capacity and energy limitations of the battery in managing a scheduled position) or providing concurrent regulation FCAS from the battery, which is not a perfect hedge to this exposure.

» Constraint relief, whereby a load created by the co-located battery permits greater output from the renewable generator during periods of network constraints. The objective here should be to permit coordination in dispatch so that it is only the co-located renewable generator that is the beneficiary of this load, and no free-rider situation is created to the benefit of other generators behind the constraint. This would serve to address a material operational risk facing many renewable generators and improve the commercial case and utility of batteries. It has application to both existing generators looking for options to mitigate new constraints, and projects in development looking to mitigate expected constraints.

» Improved compliance against aspects of Generator Performance Standards, such as using the technical properties of the battery system to meet Continuous Uninterrupted Operation (CUO) requirements or provide a degree of system strength remediation. Generators today carry significant technical compliance obligations but are not always empowered to manage them. Expanding the technical options available for generators to meet compliance obligations with co-located battery systems should benefit developers and the stability of the system alike.

With recent statements from Canberra in support of gas as a transition fuel at odds with findings in AEMO’s ISP, which view of the future ultimately proves correct will largely be determined by investors in the energy sector.

Observing and learning from early battery projects is important to inform developers and investors to ensure the optimal and correct decisions are taken.

We at Edify see the growing coordination between renewables and batteries as an inevitable eventuality as the sector strives for a sustainable, low-cost and stable system. We’ll continue to play a leading role in driving toward optimal outcomes for investors, consumers and the energy system. The future is now. There is no time to waste.

17 www.energymagazine.com.au November 2020 ISSUE 12 GRID INTEGRATION AND STABILISATION

The Gannawarra Energy Storage System knowledge sharing report for the first 12 months of operation can be found at www.edifyenergy.com

WHAT THE VICTORIAN DEFAULT OFFER MEANS FOR THE FUTURE OF EMBEDDED NETWORKS

With many Victorians doing it tough this year, cheaper prices for utilities is always welcome news. In July 2020, the Victorian Government announced new pricing reforms that would place pricing caps on electricity for Victorians living in embedded networks. We take a closer look at the Victorian Default Offer, what it means for customers and what it means for electricity businesses.

What is the Victorian Default Offer?

The reforms announced in July were part of a series of reforms to improve energy prices and transparency across the Victorian energy market. These reforms resulted in the Victorian Default Offer (VDO) being implemented, which imposed pricing caps on standing offers, meaning that retailers cannot charge over these set prices.

The VDO is part of the Victorian Government’s Energy Fairness Plan which is making the electricity market fairer, simpler and more affordable for all customers. It was introduced after an independent review found that Victorians were paying too much for their energy needs.

In September, the VDO was extended to include customers in embedded networks, which are electricity networks that are privately owned and managed, and supply electricity to a specific building or area, such as apartment buildings, caravan parks, retirement villages and small businesses.

According to the Essential Service Commission (ESC), the extended VDO reforms will benefit over 104,000 Victorian customers in embedded networks.

It’s estimated that with the new pricing caps in place, residents of apartment buildings, caravan parks and retirement villages could save between $180 and $370 a year on energy bills, while small

businesses in shopping centres could save between $900 and $2,200, helping both individuals and businesses during one of the toughest times in Australia.

Phil Baxter, Chief Executive Officer of embedded network provider WINconnect, said that there were multiple reasons for price increases for Victorian customers over the past few years, including the closure of key infrastructure, as well as a lack of retail competitiveness.

“There are many reasons why power prices have escalated over the past five years. The major driver has been on the supply-side, where generation disruption such as the closure of the Hazelwood Power Station – previously one of Victoria’s largest generators –alongside significant investment in poles and wires infrastructure, have contributed to bill increases,” said Mr Baxter.

“But there have also been issues relating to retail failures whereby non-engaged customers receive unfair prices when their conditional discount agreement ends, as well as issues relating to a lack of a competitive retail environment in some states.

“The VDO has been designed as a ‘safeguard’ tariff for customers who may have let their energy agreement expire. It sets a default or ‘ceiling’ tariff that cannot be exceeded.”

18 November 2020 ISSUE 12 www.energymagazine.com.au EMBEDDED NETWORKS

New reforms from the Victorian Government will ensure customers of embedded networks, such as those seen in shopping centres, are always getting a fair deal on energy.

What the VDO means for embedded networks customers

With the introduction of the price caps, customers across Victoria can look forward to cheaper electricity bills and the peace of mind that they are getting the best deal possible.

Mr Baxter said that the extended VDO for embedded networks has great benefits for customers and also has implications for retail competition.

“The VDO is a standard tariff that all retailers must offer. This tariff is set by the regulator and is one that is important to get right. If the VDO is set too low, then this might be good for consumers in the short-term. However, this outcome can also have significant implications for retail competition, innovation and investment that the industry desperately needs to modernise the supply chain in the longer term,” said Mr Baxter.

There has also been some customer hesitation surrounding embedded networks in the past when the VDO was not yet implemented. However, with price caps now in place for embedded networks, customers will begin to see the benefits of belonging to these microgrids.

“Embedded networks offer significant benefits to consumers. Through the collective power of an embedded network, consumers can gain the power to drive down their energy costs, influence the source of their energy supply mix and also support investment in distributed renewable generation within their own network,” said Mr Baxter.

“Embedded networks are the microgrids of the future. So too, any property designed as a community energy network future-proofs that community for the proliferation of smart, clean distributed generation and storage that are sure to arrive in time. This trend, as well as the trend towards more sustainable, urban, community living, is undeniable and the benefits need to be harnessed.

“WINconnect’s solutions are pioneering sustainable communities of the future, and our hope is that one day all the communities we serve – whether that be an apartment building or a shopping centre – will become carbon neutral.

“That’s why we need to get the policy right. We believe a well-regulated, competitive framework for the future development of community energy networks is the key to ensure consumers can not only get as good as the retail market, but do better.”

Facilitating and encouraging industry compliance

One of the ultimate aims of extending the newly implemented VDO to embedded networks is to put customer’s faith back into embedded networks. The reforms help to reign in operators who may have not been supplying customers with the best price, or who were perhaps not passing on possible savings to consumers.

However, Mr Baxter said that we shouldn’t rely solely on pricing caps to ensure that operators comply with best practices.

“The application of the VDO to embedded networks brings pricing policy in line with all other energy consumers in Victoria. That is an important step and is well overdue. But we shouldn’t consider broad, strict price regulations to be a panacea for the issue of industry non-compliance and proliferation, whether perceived or real, of bad actors.”

Dealing with industry non-compliance requires careful and diligent work on the part of the regulator to ensure they get to the root cause of the problem.

“Sledgehammer approaches such as strict price regulation and bans on certain commercial activity do not get to the root cause of what drives these behaviours and runs the risk of destroying the embedded network benefits as providers are driven out,” said Mr Baxter.

“The reality is that there are many significant reforms that are required in this area that go beyond price regulation – including those raised by the AEMC.”

The regulations raised by the Australian Energy Market Commission (AEMC) in 2017 outlined regulatory framework to provide embedded network customers with better protections and access to more competitive offers. These proposed laws and regulations included the registration of embedded network service providers, as well as the authorisation of off-market retailers. It also included a plan to transition some legacy embedded networks to the new arrangements.

However, more needs to be done to ensure consumers are protected and given choice in embedded networks.

“The exemption scheme, allowing non-licensed organisations to service embedded networks, is no longer fit for purpose and should be abolished,” said Mr Baxter. “Licensed embedded network retailers are directly accountable to the regulator, the ombudsman and their customers, just like conventional retail energy providers.

“In addition to this, there are serious technical reforms that are required – first proposed by the AEMC and supported by WINconnect – to make it easier for consumers to use their power of choice within embedded networks. This can only be tackled at a national level, with the full commitment of the AEMO and other industry members.”

It is clear that although there is some real work being done to transform Australia’s energy market into a fair, simple and regulated industry, more still needs to be done to ensure industry compliance, and that consumers are protected and supported through one of the toughest times in recent history for the country.

19 www.energymagazine.com.au November 2020 ISSUE 12 EMBEDDED NETWORKS

BUT NOT AS WE EXPECTED ENERGY DISRUPTION IS HERE –

The rapid uptake and deployment of residential solar and home batteries is having a significant impact on Australia’s energy system. Governments and regulators need to be acting now to ensure we see the full benefits renewables can provide, particularly in the embedded network and prosumer spaces.

For some time, we’ve known that increased uptake of new energy technology would revolutionise the energy sector. While this transition has been rapid, it hasn’t been driven by traditional vertically integrated energy players.

Instead we’ve seen increased private investment in new energy technologies, which is ushering in the rise of a more distributed generation model. For example, Australia has the highest uptake of solar globally, with more than 21 per cent of homes having rooftop solar PV1 generating their own renewable energy.

While this increases the cheap renewable energy being generated, there’s a catch. Solar production doesn’t offset the demand on the network during morning and evening peaks.

Instead solar production is at its peak during the middle of the day when there’s lower demand from households. This leads to surplus generation, which then flows back into the grid. Australia’s energy infrastructure was designed to manage only one-way electricity flow – so, if left unmanaged, surplus solar generated electricity can overwhelm the network and trigger widespread power outages.

This leaves traditional large generators with two options: they can ramp down generation during the middle of the day then ramp up generation in the evening when solar production curtails, or they can continue to generate during the middle of the day but for a much lower sell price.

The former isn’t viable as it takes too long to ramp up and down, leading to operational inefficiencies. The latter has created an untenable situation where some generators are even paying customers to use their electricity. Both of these create pricing volatility – the grid was never set up to operate this way.

Consumers and businesses should be looking to reduce reliance on the grid, to limit exposure to network insecurity and market volatility. While investing in rooftop solar is one way to do this, we now need to see investment in battery technology.

A household that invests in battery technology can store surplus solar generated during off-peak hours to then be used during peak hours. This prevents surplus solar flowing back into the grid during off-peak, and reduces demand on the grid in peak, stabilising the network and reducing costs.

Simple changes in regulation can encourage more private investment in battery technology.

Consumers currently pay a flat price for electricity, so return on investment in battery technology is low. If cost-reflective pricing was introduced, where electricity price is higher during peak and lower during off-peak, then batteries help to avoid peak period pricing and return on investment improves. Then we would see cheaper energy, and create a new generation of ‘prosumers’ who can generate, store and distribute their own power, and buy and sell from the grid as needed.

In addition, embedded networks help take solar and battery storage ‘behind-the-meter’. The benefits from the technology can then be shared within residential or commercial developments. Again, this protects consumers from grid volatility.

Disruption to the energy sector is here, but not as we expected it. Doing the right things now will reap the benefits of cheaper, cleaner and more reliable energy later.

For more information on how you can benefit from embedded networks and behind-the-meter technologies, head to www.winconnect.com.au

1https://www.energy.gov.au/households/solar-pv-and-batteries#:~:text=Australia%20has%20the%20highest%20uptake,have%20been%20installed%20across%20Australia

20 November 2020 ISSUE 12 www.energymagazine.com.au

EMBEDDED NETWORKS ENERGY PARTNER CONTENT

Community Energy Networks

The backbone of energy innovation for multi-tenanted properties.

We connect communities to sustainable and equitable energy services, now and for the future.

By working with communities to make it easier for them to access and share the benefit of the latest innovations in sustainable technologies.

Solar PV Systems

EV Charging Stations

P: 1300 791 970 E: Enquiries@WINconnect.com.au www.WINconnect.com.au

Battery Storage

AUSTRALIA’S RENEWABLES JOURNEY: MOVING FROM FOSSIL FUELS TO CLEAN ENERGY POWERHOUSE

by Imogen Hartmann, Assistant Editor, Energy Magazine

Renewables are a hot topic in the Australian energy industry as the sector evolves and transforms.

Australia’s abundant natural resources means a slew of potential for renewable energy, but moving from potential to delivery can be challenging. Here, we take a look back at Australia’s energy past, consider our potential, and look at some of the clean energy projects delivering big results around the country.

With Australia being a member of the 2016 Paris Agreement, energy makes up a big component of the federal interest in meeting carbon emissions commitments. However, renewable energy still only accounts for a small percentage of Australia’s total energy production and consumption.

In 2019, total electricity generation in Australia was estimated to be 265,117 gigawatt hours (GWh), and fossil fuel sources contributed 209,636 GWh (79 per cent) to this total. Coal accounted for the majority of electricity generation, at 56 per cent of total generation in 2019.

Renewable sources contributed 55,481 GWh (21 per cent) of total electricity generation in 2019, an increase of 12 per cent compared with 2018.

Historically, much of Australia’s energy needs have been met by fossil fuels because of the abundance of these low-cost coal resources, which have underpinned some of the cheapest electricity in the world. But times are changing. Recently, in a study providing estimates of the cost to generate electricity from new power plants, AEMO and the CSIRO concluded that wind and solar are clearly the cheapest new form of electricity generation.

These findings held true even while acknowledging the need to factor storage

22 November 2020 ISSUE 12 www.energymagazine.com.au RENEWABLES

into new wind and solar projects. Even when variable renewables are backed up with two or six hours of battery or pumped hydro storage, the renewable generators were able to undercut their competitors.

Our fossil fuel history

Black and brown coal can be found throughout the country, with the most significant black coal resources located in the Bowen-Surat (Queensland) and Sydney (New South Wales) basins.

Australia’s annual thermal and metallurgical coal exports are worth more than $40 billion, mainly to Japan, India, European Union, Republic of Korea and Taiwan, making it one of Australia’s largest commodities.

The Gippsland Basin in Victoria holds most of Australia’s very large brown coal resources, where it is primarily used for electricity production. Current rates of production indicate that there are nearly 500 years of brown coal resources remaining.

Meanwhile, the Carnarvon, Browse and Bonaparte basins off the north-west coast house a significant amount of Australia’s large conventional gas resources. There are also smaller resources in the Gippsland Basin offshore Victoria and the onshore Cooper-Eromanga Basin in South Australia. EDR of conventional gas is adequate at current levels of production for around 60 years.

Coal seam gas (CSG) resources are growing due to increased exploration, with the Bowen, Surat and Sydney basins being identified for their significant economic demonstration of resources, in addition to the major coal basins of Eastern Australia.

Though small by world standards, Australia’s crude oil resources, found largely in the Carnarvon and Gippsland basins, are bolstered by significant condensate and LPG resources associated with the major largely undeveloped gas fields in the Carnarvon, Browse and Bonaparte basins off the north-west coast of Western Australia. There are still a number of sedimentary basins yet to be assessed.

23 www.energymagazine.com.au November 2020 ISSUE 12 RENEWABLES

The driving force of renewables

Currently, renewable energy sources make up small proportions of Australia’s electricity generation. Of the 21 per cent of Australia’s total electricity generation that comes from renewable energy sources, seven per cent comes from wind, seven per cent also comes from solar, and hydropower contributes five per cent.

The share of renewables in total electricity generation in 2019 was the highest since levels were first recorded in the early 1970s.

In addition to the major contributors, Australia is also home to a variety of other renewable energy sources including geothermal, bioenergy, ocean/wave power and hydrogen, which is expected to both play a major role in Australia’s future energy mix, as well as becoming a significant export for the country.

With wind, solar and hydropower being Australia’s most common forms of renewable energy, wind is the most widespread, solar is the most well-known, and hydropower is the oldest form of renewable generation.

Wind power

Wind power is electricity generated by wind turning the propeller-like blades of a turbine around a rotor, which spins a generator, which creates electricity.

Commonly, wind turbines are located on hilltops or near the ocean – with some wind turbines being built in the ocean, either floating on the surface or using large pylons extending to the seafloor.

The windmill shape is the most common, although this can vary and is often being tested and adjusted across the world.

Thanks to several new projects commissioned in 2019, wind energy overtook hydro power as the leading source of renewable energy for the first time ever. The cumulative installed capacity of wind energy in Australia has been steadily growing, and has more than tripled since 2010.

Wind is one of the lowest-cost sources of new electricity supply in Australia, and with the cost of utility-scale wind energy expected to continue to fall, new wind farms are expected to continuously deliver cheaper electricity.

Solar power

Solar energy is produced from the heat and light of the sun, which is then converted into electricity or used to heat air, water or other substances. Solar energy can also be used to create solar fuels such as hydrogen.

The process of harnessing solar power can be divided into two types: solar photovoltaic (PV) and solar thermal.

Solar PV uses a technology called a semiconductor cell or a solar PV cell to convert sunlight directly into electricity.

A common form of solar PV is solar panels, where the PV is typically encased in glass and an aluminium frame. One or more panels can be installed to power a single light, cover the roof of a house for residential use, or be assembled into a large-scale solar farm generating hundreds of megawatts of electricity.

Solar thermal energy is when sunlight is converted into heat (thermal energy), which can be used for a variety of purposes, including creating steam to drive an electricity generator. A refrigeration cycle can also be derived from heat energy to produce solar-based cooling.

The two main types of solar thermal technologies include:

1. Small-scale thermal technology used for space heating or to heat water (such as in a solar hot water system)

2. Large-scale power generation using a field of mirrors to reflect sunlight onto a receiver, which shifts the heat to a thermal energy storage system, where the energy can then be released from storage as required.

Hydropower

Moving water (usually from a dam or reservoir) being converted into energy is called hydropower.

The electricity is produced as the water is passed through an electricity generator known as a turbine, which drives the generator to convert the motion into electrical energy.

Hydropower is one of the oldest and most mature energy technologies, having been used in various forms for thousands of years, and provides some level of electricity generation in more than 160 countries.

Pumped hydro energy storage (PHES) is an emerging form of hydropower which differs in that it uses two dams, with one higher than the other. Water can then be pumped from the lower dam into the higher one when demand for energy is low, so that excess energy from the grid, or wind or solar farms, can be stored until the energy is required.

This process can be reversed by returning the water to the lower dam using a hydroelectric turbine, aided by gravity, releasing the stored energy. The generation of hydroelectricity in this manner is almost immediate, and is available to be fed into the grid quickly when demand for electricity spikes.

Renewables around the nation

Because of Australia’s diverse landscape and ecosystem, the spread of generation

from different renewable types differs from state-to-state, depending on what’s most available and accessible.

Western Australia

A recent 20-year forecast of Western Australia’s power system indicated a huge increase in renewable generation. The modelling anticipated there would be a strong uptake in wind power and that rooftop solar would continue to displace traditional forms of generation.

Current renewable projects and achievements include:

» The 132MW Merredin Solar Farm in the Wheatbelt region – the state’s largest operating PV project.

» The 180MW Warradarge Wind Farm, near Eneabba, with 51 turbines – among the largest in Western Australia with a tip height of 152m, sporting some of the longest blades onshore at 66.6m.

» The $39.87 million Perth Wave Energy Project – the world’s first commercialscale wave energy array that is connected to the grid and has the ability to produce desalinated water.

» The $495 million East Rockingham Waste-to-Energy project, recovering energy from 330,000 tonnes of residual waste per annum to produce 28.9MW of power.

» The Asian Renewable Energy Hub, a large-scale wind and solar hybrid renewable energy project near Port Hedland.

South Australia

South Australia leads the nation in terms of renewable energy commercialisation and potential. It is home to some of the windiest and sunniest places in Australia, and current Energy Minister Dan van Holst Pellekaan has set himself a goal of getting the state to its ambitious target of net 100 per cent renewable electricity before 2030.

Current renewable projects and achievements include:

» The Lincoln Gap Wind Farm, which will ultimately consist of 464MW of wind turbines.

» South Australia’s Virtual Power Plant (SA VPP) – the largest virtual power plant in the country.

» Hydrogen Park South Australia (HyP SA) – Australia’s largest renewable hydrogen project.

» A hybrid wind and solar plant on the cards at Port Augusta Renewable Energy Park.

» A record supply of 100 per cent of the state’s energy needs by solar power for one hour on 11 October 2020, using the state’s 288,000 PV rooftop systems to provide 992MW and largescale solar 313MW.

24 November 2020 ISSUE 12 www.energymagazine.com.au RENEWABLES

Tasmania

Tasmania has a plan to become a global renewable energy powerhouse with a renewable energy target which would see the state double its renewable energy generation by 2040.

Tasmania has also long been seen as the home of hydropower, with an extensive network of hydroelectric dams across the state.

Current renewable projects and achievements include:

» Project Marinus, a 1,500MW second undersea interconnector that would help deliver renewable energy from Tasmania to Victoria to help stabilise the national grid.

» Battery of the Nation, a nation-leading pumped hydro storage facility.

» The 5MW George Town Solar Farm, which will be Tasmania's first largescale solar farm.

» The 12.5MW Wesley Solar Farm, which will be Tasmania’s largest solar farm.

Northern Territory

With so many of the Northern Territory’s communities living remotely, reliable offgrid energy sources are critical for the state to bring power to the residents. This is why local and remote solar systems are one of the more commonly utilised renewable energy sources in the Territory.

Current renewable projects and achievements include:

» The $59 million NT Solar Energy Transformation Program (SETuP), which deployed medium and high penetration renewable energy systems to 26 remote communities.

» Northern Territory Government solar and battery stimulus packages for the purchase and installation of solar PV systems with batteries and for adding batteries to existing systems.

Victoria

The Victorian Government is focused on increasing the penetration of renewables in the state, and recently increased the Victorian Renewable Energy Target (VRET) to 50 per cent by 2030.

Current renewable projects and achievements include:

» In September, the Victorian Government announced the second round of the VRET Auction, testing the capacity of industry to deliver at least a further 600MW of renewable energy.

» The expansion of Victoria’s Solar Homes program, allowing eligible landlords to apply for an interest-free loan in addition to the existing rebate available.

» A $15.3 million package of renewable energy investments to help reduce the state’s emissions, including $10.3 million for energy efficiency and affordability improvements, including solar installations on public buildings on crown land; $4 million to fund energy efficiency upgrades for hot water systems and lighting in public housing high-rise properties across Victoria; and $1 million in grants to help regional communities deliver renewable energy projects.

New South Wales

NSW is a leader in the development of large-scale solar projects. These solar farms support jobs and investment in regional NSW, help to diversify the state’s energy mix and drive down costs for future large-scale solar developments.

There are already 16 major operating large-scale solar farms in NSW, and current renewable projects and achievements include:

» The development of three Renewable Energy Zones, including an 8,000MW zone in New England and a 3,000MW zone in Central-West Orana.

» A state-government set target of up to ten per cent hydrogen in gas networks by 2030.

Queensland

Home to abundant sunshine, it’s little wonder that Queensland has invested heavily in solar energy infrastructure for the state.

Current renewable projects and achievements include:

» The development of three Queensland Renewable Energy Zones located in southern, central and northern Queensland, for which the government has allocated $145 million.

» The Western Downs Green Power Hub near Chinchilla, 250km north-west of Brisbane. At a size of 460MW of installed solar panels once built, it will be Australia’s largest operating solar farm. The site also holds up to 150MW battery energy storage potential.

» The construction of a new wind farm in Warwick, the state’s first publiclyowned new renewable energy generation in 20 years.

Australian Capital Territory

With one of Australia’s most progressive governments, the ACT is making waves when it comes to the development of its renewables scene. Since January 2020, the territory has been powered by 100 per cent renewable energy, which is achieved through a combination of sourcing renewable energy from other states, as well as generating its own clean energy within the territory.

Current renewable projects and achievements include:

» Evoenergy’s Ginninderry Residential Battery Trial, which will provide subsidised residential batteries for up to 75 homes in Ginninderry in Stage 1A. The project has been designed to explore how small-scale solar and batteries interact with local electrical infrastructure in areas of 100 per cent solar uptake.

» The ACT Labor Government has committed to building a 250MW battery system if re-elected, which would be one of the biggest battery storage systems in Australia.

25 RENEWABLES

FEDERAL BUDGET MISSES A TRICK, BUT STATES PICK UP THE SLACK

by Kane Thornton, Chief Executive, Clean Energy Council

With the COVID-19 pandemic plunging Australia into its first recession in almost 30 years, the October Federal Budget was touted by the Federal Government as one of the most important since the Second World War. As such, it represented an enormous opportunity to modernise the energy system and create the building blocks for a renewable energy export industry, all while significantly reducing Australia’s emissions profile.

Unfortunately, the Budget failed to grasp this opportunity fully, all but ignoring the considerable potential of renewable energy to create jobs, drive investment and reduce emissions. However, the Budget did provide some positive signs – both from the government and the opposition – that the ideological heat may finally be coming out of the energy policy debate and that some degree of bipartisanship on energy could be possible.

Missed opportunity, but some progress made

In the leadup to the Budget, the Clean Energy Council outlined its vision for the economic recovery in A Clean Recovery, a comprehensive package of reforms to use renewable energy to inject more than $50 billion into the economy and create over 50,000 jobs in regional Australia while building the infrastructure necessary to develop a 21st-Century electricity system.

Despite receiving enormous support from right across the spectrum – including big business, community groups, energy experts and economists – the government ignored most of the measures outlined in A Clean Recovery, passing up the opportunity to create thousands of clean energy jobs and drive unparalleled investment in rural Australia.

26 November 2020 ISSUE 12 RENEWABLES

However, there were some positives for the industry, with the Budget locking in previous commitments to extend the Australian Renewable Energy Agency and support important transmission investments. Other new initiatives such as the instant asset write-off available for businesses will also likely boost the uptake of commercial-scale solar, while a range of programs to develop skills and workforce capability will likely help develop the clean energy workers of the future. There were also some encouraging signs for women wanting to work in the renewable energy industry, with the allocation towards women in science, technology, engineering and maths likely to result in a more inclusive and diverse workforce.

Hope for truce as Opposition replies