Want to reach energy industry decision makers?

In B2B, the sales cycle is long. You’ll always have people at different stages of the buying cycle, so your marketing needs to be always on.

Decision makers in the energy industry gain information from a wide range of sources. The team at Energy are able to provide a complete range of marketing solutions:

● Brand building

● Educating the market

● Generating leads

● Creating engaging content

● Managing your social media and SEO

● Setting up marketing funnels

We also have a team of editors, designers and marketing experts who specialise in the energy sector and can help make the most of your campaign.

Scan this code to learn how we can help you ensure your marketing is always on.

www.energymagazine.com.au

As we come to the close of another year, it’s natural to reflect on how the past 12 months have played out for the energy sector. I think it’s fair to say, it’s been a bit of a bumpy ride!

For me, one of the biggest stories of the year has been the rise of energy activism, which probably had its greatest impact on the industry through the rise of “teal independents” at the Federal Election; and Mike Cannon-Brooks’ influence in the canned AGL demerger.

What are the lessons we can learn from these major events?

I think the first one is, ignore the will of the people to decarbonise and mitigate the impacts of climate change at your peril. AGL is the cautionary tale that the other major gentailers, and the industry at large, won’t forget in a hurry. And as Australia continues to face the impact of climate disasters – most recently, more major floods in Victoria and New South Wales – sustainability and impact on climate will continue to be front of mind for energy customers.

Secondly, the transition towards renewable energy has already picked up pace, and now, this will only continue to escalate in the years to come. In 2022, we saw a number of coal plant closures brought forward, including AGL’s announcement that it would exit coal completely by 2035 (brought forward from 2045); and Origin Energy’s announcement that it would close the Eraring coal-fired power station seven years earlier than scheduled, now in 2025.

Last year, EnergyAustralia also announced that it would exit coal by 2040. With AGL’s 2035 promise, it wouldn’t be

surprising if they too brought their plans even further forward in the year ahead.

All of this points to the industry currently being closely aligned with AEMO’s “Step Change” transition scenario, as outlined in the Integrated System Plan (ISP). In the ISP, four scenarios are outlined: Slow Change, Progressive Change, Step Change and Hydrogen Superpower. Step Change has long been considered the more likely transition scenario – and events of 2022 are thus far indicating that this assumption has been correct.

So where does that leave the industry for 2023? At the reading of the Federal Budget in October, it was forecast that power prices will rise 20 per cent in the second half of 2022 and a further 30 per cent in 2023-24. This leaves the industry to grapple with the dual challenges of transitioning to clean energy, while trying to manage skyrocketing costs.

Certainly no easy feat – but it’s a challenge that I know the industry is ready to tackle head on.

Laura Harvey EditorWe’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950.

AEMC RECOMMENDS 100 PER CENT UPTAKE OF SMART METERS BY 2030

The Australian Energy Market Commission (AEMC) has recommended a 100 per cent uptake of smart meters by 2030 in a draft report, detailing the acceleration of smart meter deployment.

The draft report for the Review of the Regulatory Framework for Metering Services outlines 20 key recommendations for accelerating the rollout of smart meters and shows a 100 per cent uptake would deliver net benefits to the tune of $507 million dollars for all National Energy Market (NEM) regions, including New South Wales, Australian Capital Territory, Queensland and South Australia.

The AEMC is working with stakeholders to accelerate a smart meter rollout in the NEM, to support the energy transition and build a smarter grid for the future.

The draft recommendations and options in the Review of the Regulatory Framework for Metering Services report reflect the many stakeholder ideas and suggestions put forward to the Commission in submissions and at the Review’s forums and reference groups.

Key recommendations include potential changes to the energy rules to support a more coordinated program of meter replacements in addition to ensuring appropriate safeguards for privacy.

AEMC Chair, Anna Collyer, said smart meters offer customers more ways to engage with the energy market now and in the future, as we continue up the tech curve.

“Smart meters turn power into knowledge and knowledge is power. Consumers can make informed choices which in turn open the way to greater retail options that suit their family or business usage patterns,” Ms Collyer said.

“The electricity market needs a critical mass of smart meters across households and businesses before we can introduce other significant advances necessary to reach net zero.”

Other potential benefits consumers can unlock with smart meters include:

» Remote meter readings means no more manual meter readings or estimated bills, providing accurate real-time information about electricity usage

» Customers can see their usage more frequently and accurately, meaning they have more control over their daily energy use and can potentially change their usage patterns by identifying cheaper times to use energy and as a result, cut the costs of their bill

» Access to different flexible pricing options, meaning customers can choose different rates for electricity that suit them – those without solar or batteries can especially benefit from new tariffs that reward usage during times of excess solar generation, helping to cut costs of their bill and reduce solar wastage

» Faster detection of faults and outages to alert distribution businesses quickly identify if the power is out, speeding up power reconnection for consumers.

Ms Collyer said that as well as providing benefits to consumers, smart meters are vitally important for the evolution of the electricity network.

“You can’t run a smart system on the old, ‘dumb’ technology like traditional accumulation meters,” Ms Collyer said.

“Smart meters are foundational to a more connected, modern and efficient energy system that allows all consumers to get data about their household energy use.

“They also allow providers, in a secure way, to get the information they need to provide better service to consumers.

“Smart meters really are the gateway to a more dynamic and flexible market where energy is traded both ways.

“The sharing of power quality data with distributors would also help manage supply and reduce future spending on expensive poles and wires.”

Energy Networks Australia has welcomed the recommendations, which it said will allow electricity retailers, energy networks and customers to securely access energy use data quickly and accurately to provide better energy services.

Energy Networks Australia CEO, Andrew Dillon, said the current smart meter rules had not delivered for customers and a new approach was needed.

“Smart meters are a key enabler of a smart grid. We can’t run a 21st century grid with 19th century meter technology,” Mr Dillon said.

“Customers with smart meters can take advantage of flexible pricing to tailor their use to when power is cheaper and save on their power bills.

“They also help networks identify, locate and fix faults and outages faster and make connection processes far simpler, which delivers better customer service.”

Mr Dillon said the entire economy was adopting better technologies to aid in the transition to net zero, and energy networks were an essential platform to deliver a decarbonised future.

The draft report, Review of the Regulatory Framework for Metering Services, is available on the AEMC website.

Stakeholder and industry feedback will be accepted until 2 February 2023 and the final report is expected to be released in mid-2023.

$62B CLEAN ENERGY PLAN TO MAKE QLD RENEWABLE ENERGY CAPITAL

Abold new $62 billion clean energy future has been announced for Queensland – including the largest pumped hydro scheme in the world, which will supply clean, reliable and affordable renewable energy for half of Queensland’s entire energy needs.

Queensland Premier, Annastacia Palaszczuk, said the plan will make Queensland the renewable energy capital of the world.

The Queensland Energy and Jobs Plan includes:

» 70 per cent of Queensland’s energy supply from renewables by 2032, 80 per cent by 2035

» Two new pumped hydros at Pioneer/Burdekin and Borumba Dam by 2035

» A new Queensland SuperGrid connecting solar, wind, battery and hydrogen generators across the state

» Unlocking 22GW of new renewable capacity – giving Queensland eight times the current level

» Publicly owned coal fired-power stations to convert to clean energy hubs to transition to, for example, hydrogen power, with jobs guarantees for workers

» Queensland’s publicly-owned coal-fired power stations to stop reliance on burning coal by 2035

» 100,000 new jobs by 2040, most in regional Queensland

» 11.5GW of rooftop solar and 6GW of embedded batteries

» 95 per cent of investment in regional Queensland

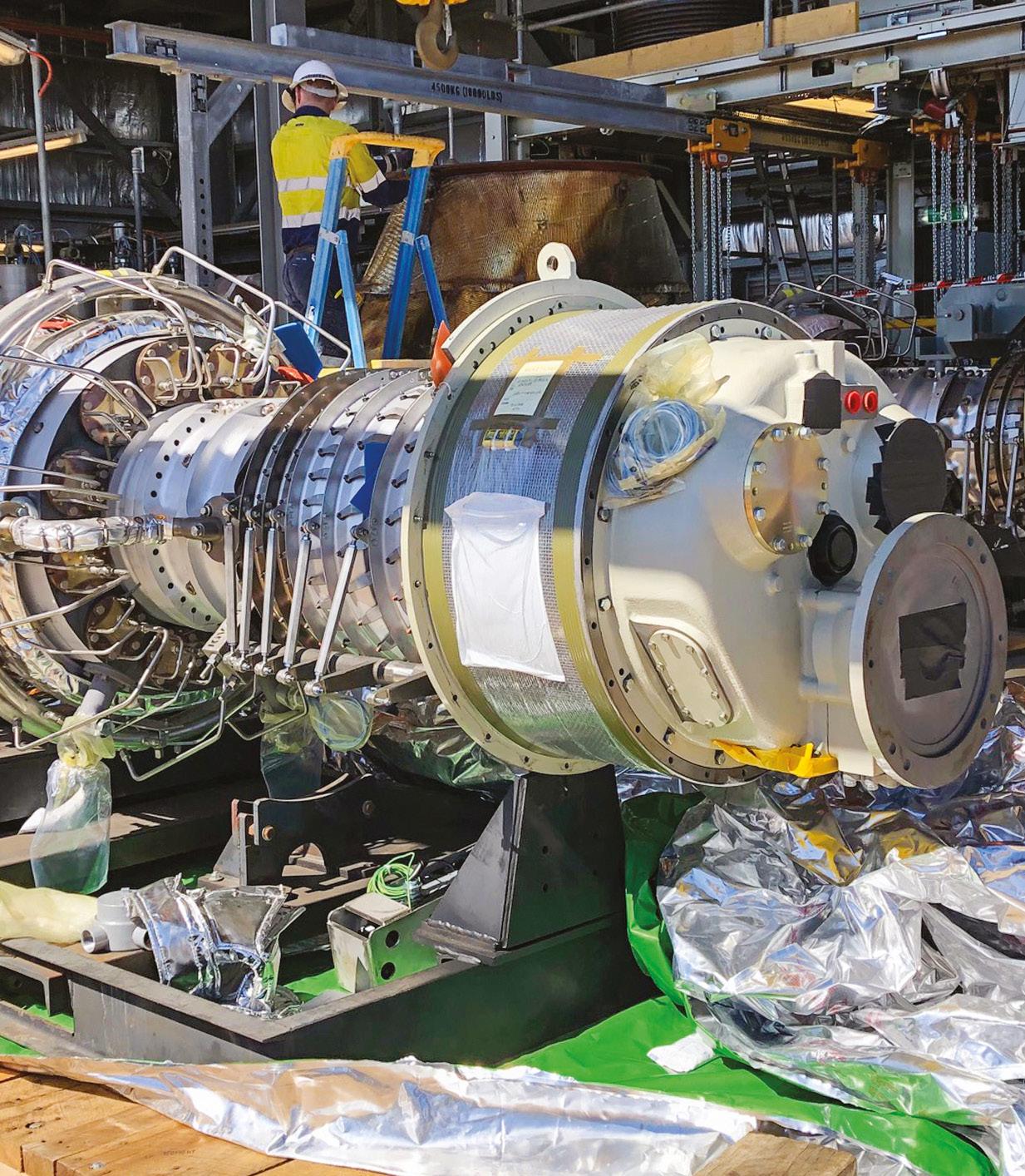

» Building Queensland’s first hydrogen ready gas turbine

» Projects subject to environmental approvals

Ms Palaszczuk said the visionary plan will set Queensland up for the next century, with the focus on cheaper, cleaner and secure energy for Queenslanders.

Ms Palaszczuk also discussed a new publicly owned entity – Queensland Hydro –to progress the project.

“The Pioneer-Burdekin mega project, west of Mackay could be the largest pumped hydro project in the world, with potential generation capacity 2.5 times that of Snowy 2.0,” Ms Palaszczuk said.

“It has the potential to deliver up to 5GW for 24 hours or 120GWh, given the favourable topography of the area.

“That’s 617 times larger than South Australia’s Hornsdale battery and 20 times larger than Wivenhoe.

“The high-quality wind and solar resources across North Queensland means it could also unlock large volumes of renewable energy capacity for local industry.

“This makes the region even more attractive for global investment in emerging industries like green hydrogen, green metals and manufacturing.”

Queensland Treasurer, Cameron Dick, said publicly owned entity – Queensland Hydro – would ensure Queenslanders continue to reap rewards from their publicly owned energy assets.

“Since 2018, the Palaszczuk Government has delivered up to $575 of dividends to Queensland electricity customers via asset ownership dividends and cost of living rebates,” Mr Dick said.

“All that money – $1.19 billion – has gone back into the pockets of Queenslanders instead of corporate shareholders.

“That’s only possible because Queenslanders own their electricity assets and weren’t sold off like the former LNP government wanted to do.”

Queensland Hydro will conduct further studies and deliver a detailed assessment for the Pioneer-Burdekin project to Government in 2024, including consultation with traditional owners and the community, hydrological modelling and assessment of environmental and social impacts, as well as commercial and financial modelling.

Queensland Hydro will also continue to investigate other largescale, long-duration pumped hydro sites in the event the project is unable to proceed.

Climate Council CEO, Amanda McKenzie, said the Queensland Government’s plan shows significant progress for the state.

“Queensland has substantially raised its renewable energy target to 70 per cent by 2032, with a $62 billion investment in regional communities, good jobs and clean power for all Queenslanders,” Ms McKenzie said.

“This now puts Queensland ahead of the big states for their 2030 renewable energy targets.

“Queensland is now aiming for 60 per cent by 2030 – compared to Victoria which has pledged 50 per cent by 2030 and no specific target for New South Wales.

“The great work Queensland has started must be accelerated with a rapid replacement of coal and gas-fired power by clean, cheap renewables over this decade. There will also be no need for any new fossil fuel projects.”

Australian Energy Council General Manager for Corporate Affairs, Ben Barnes, said the encouragement of private

investment, alongside state commitments, would be critical to its overall success.

“We support the ultimate aims of cleaner, cheaper power and stand ready to work positively with the Queensland Government towards the plan’s success. We note very major investments will be made by publicly-owned businesses which will unavoidably have some impact on investor confidence.”

Queensland Resources Council (QRC) Chief Executive, Ian Macfarlane, issued cautionary support for the plan, warning also that work was needed in attracting large-scale private investment.

“The energy plan’s ambitious centrepiece, a transition to 70 per cent renewable energy by 2032, will require detailed planning and

extensive industry and community consultation over many years,” Mr Macfarlane said.

“This underlines the opportunities to diversify Queensland’s energy mix, but also the immense size of the challenge.

“Queensland will need large-scale investment to meet this target, but at the moment Queensland is cementing a reputation as a higher risk jurisdiction where the rules of engagement can change suddenly without warning.”

QRC said recent increases to coal royalties, to which it is opposed, had eroded industry confidence in its leadership.

“The biggest signal the Palaszczuk Government has sent to resources and energy investors in 2022 is to hike coal royalty taxes to the highest in the world, without consultation.

“A recent report from Commodity Insights warned of the significant risk of a contagion effect to investment in other commodities, including gas and hydrogen. International investors are sounding a note of caution that Queensland is no longer the trusted place for project partnerships that it once was.”

NSW TRANSMISSION HOSTS RECEIVE $200K BONUS

New South Wales farmers hosting transmission infrastructure will receive an additional $200,000 per kilometre paid over 20 years, following alleged disparity in remuneration payments. Landholders hosting transmission infrastructure have historically been paid less than those hosting electricity generating technologies such as solar and wind.

Now, the New South Wales Government has announced it will pay an additional $200,000 to said landholders from its newlyintroduced Strategic Benefits and Payments scheme, in addition to existing statutory compensation payments made under the Just Terms Act.

The decision has received broad support from advocacy groups and transmission businesses, including the Renewable Energy Alliance (RE-Alliance), Farmers for Climate Action, Energy Networks Australia and Transgrid.

Transgrid CEO, Brett Redman, welcomed the new rules which he said would support the national transition to renewable energy and further enable the supply of renewable energy to consumers.

“Transgrid has been working closely with the New South Wales Government on the details of the proposal and we are pleased to see the Strategic Benefit Payments provided for landowners who host transmission assets,” Mr Redman said.

“The payment will apply to private landowners hosting our major transmission projects EnergyConnect and HumeLink, as well as those landowners affected by any future projects such as VNI West, which are part of Transgrid’s energy superhighway,the Australian Energy Market Operator’s Integrated System Plan and Renewable Energy Zones.

“Transgrid’s overriding considerations have been to ensure that the payment is equitable for new transmission project landowners, addresses the social licence issues raised by them and balances these factors with the need to represent value for energy consumers.”

Energy Networks Australia CEO, Andrew Dillon, said the payments would help get transmission infrastructure built on time to enable the transition to net zero energy.

“The New South Wales Government is taking major strides in solving the challenges of building transmission infrastructure including how networks engage with communities and landowners and implementing social licence best practice. This may form a blueprint for other jurisdictions,” Mr Dillon said.

“Australia is working towards a net zero energy grid but is impeded by a lack of transmission infrastructure.

“Our existing network regulations focus on keeping payments to landowners as low as possible. The current regulatory approach is

a handbrake on getting projects built and challenging and divisive for affected communities.

“Strategic benefit payments are a major step to addressing this problem.”

Farmers for Climate Action CEO, Dr Fiona Davis, said the new policy had the potential to help win social licence for the transmission required for renewable energy developments, speed up bringing projects online and provide stable alternative income for farmers.

“Farmers for Climate Action has called for exactly this kind of arrangement and we’re so thrilled to see it become reality in New South Wales,” Dr Davis said.

“Community support is essential to deliver the thousands of regional jobs these renewable energy projects bring, and a policy like this brings benefits to the local community. Farmers who have alternative income during drought keep employing locals and spending money in local pubs, cafés and retail stores.

“We know this won’t solve every community concern and that some farmers oppose transmission on their land under any circumstances, and we continue to suggest renewables companies in Renewable Energy Zones contribute to a local community fund.”

RE-Alliance National Director, Andrew Bray, said it was important that state governments treated landholders hosting transmission lines as equal stakeholders in energy projects.

“NSW has a number of renewable energy transmission projects in the pipeline that will carry high volumes of clean power across NSW and to neighbouring states,” Mr Bray said.

“By hosting transmission lines, landholders are creating value for energy consumers, and it’s important they are treated as core stakeholders and benefit materially for the role they play in our future energy system.

“Farmers hosting transmission lines on their property will now receive payments more comparable to those hosting a solar farm or wind farm.”

Mr Bray said RE-Alliance would call on other state and territory governments to adopt similar measures ahead of the national energy transition.

“Energy Ministers are set to meet at the end of the week. Following today’s announcement, harmonising payments across state jurisdictions is likely to be on the agenda,” Mr Bray said.

“Some transmission lines cross state borders, and it’s simply untenable to have landholders receiving different amounts on either side.”

APA PURCHASES BASSLINK FOR $733M, ENDING LEGAL WOES

Ayears-long dispute between the Tasmanian Government and operators of the underwater Basslink interconnector, Basslink Pty Ltd (BPL), has been resolved with the company successfully purchased by APA Group for $773 million.

In 2015 both the Tasmanian Government and Hydro Tasmania sued BPL for damages following a lengthy outage of its Basslink interconnector due to thermal overstressing caused by the company’s operational practices.

After five years of legal arbitration, High Court Chief Justice, Robert French, found in favour of the Government, awarding $70 million in damages and ordering BPL to take measures against further outages. In 2021 Hydro Tasmania terminated its Basslink Services Agreement with BPL, forcing the company into receivership.

Now, natural-gas producer APA Group has committed to purchasing BPL in a $773 million deal that will resolve much of BPL’s ongoing legal disputes, which includes payment to Hydro Tasmania of an agreed financial settlement in relation to

disputed amounts owed to Hydro Tasmania in connection with the Basslink Services Agreement (which was terminated earlier this year).

APA will also progress technical improvements to Basslink, including implementation of the mitigating actions required by the 2020 Arbitration process.

Hydro Tasmania looks forward to working with APA as they move Basslink to a sustainable footing where it will continue to play an important role in energy security as well as providing trading opportunities for the business.

NEOEN, BHP SIGN 70MW RENEWABLE ENERGY BASELOAD CONTRACT

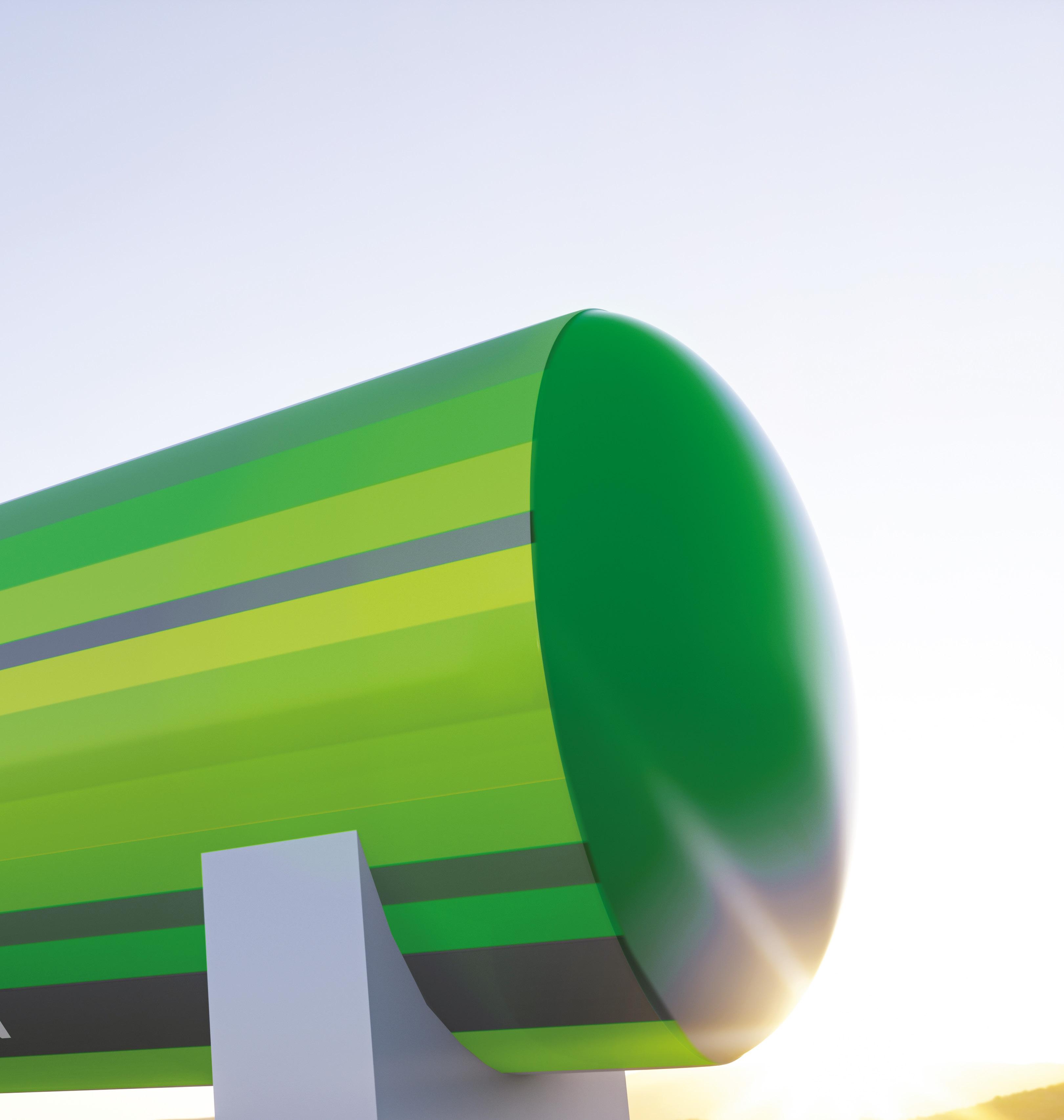

Operations at BHP’s Olympic Dam in South Australia will be powered by the Goyder South wind farm and Blyth Battery project from 2025 under a new Neoen and BHP 70MW renewable energy baseload contract.

Olympic Dam has one of the world’s most significant deposits of copper, gold and uranium. This baseload contract is the first of its kind for Neoen and is expected to meet half of the project’s electricity needs from July 2025.

Under the contract, Neoen will deliver a green energy solution 24/7 to the mine, along with the associated large-scale certificates (LGC). To provide energy 24/7, Neoen will integrate output from its Goyder South Stage 1 wind farm and storage from its Blyth Battery, supported by its energy management expertise.

Neoen Australia’s Managing Director, Louis de Sambucy, said Neoen are delighted to provide BHP with this highly innovative solution. “We are convinced that our ability to combine our assets and

our energy management capabilities to create bespoke commercial offers will be a key element of success for our future developments,” Mr de Sambucy said. Neoen will dedicate half of the output of Goyder South Stage 1 wind farm to this contract. Neoen will firm the intermittent wind energy, combining the storage capacity of Blyth Battery and its energy management expertise.

Goyder South Stage 1 is a 412MW wind farm currently under construction.

It is the first phase of Neoen’s flagship project known as the Goyder Renewables Zone, a hybrid wind, solar and storage project, located near Burra in South Australia’s Mid North region.

The exceptional wind resources of the area are making this project world-class in terms of both size and competitiveness.

Goyder South Stage 1, consisting of Goyder South 1a and 1b, is the first stage of Neoen’s flagship project known as Goyder Renewables Zone – a hybrid wind, solar and storage project located in mid-north South Australia. The Goyder Renewables Zone leverages the exceptional wind and

solar renewable resources of the area and will deliver a significant economic boost to the region.

Goyder South has development approval for a total of 1,200MW of wind generation, 600MW of solar generation and 900MW of battery storage capacity – making it South Australia’s largest renewable project.

The two parts of Stage 1 include:

» 209MW underpinned by two long term power purchase agreements with the Australian Capital Territory (ACT) Government and Flow Power

» 203MW underpinned by this new 70MW baseload contract with BHP

Neoen’s Chairman and Chief Executive Officer, Xavier Barbaro, said thanks to Neoen’s storage assets and deep expertise, it is now able to offer 24/7 energy to its customers.

“This first baseload PPA is a significant step forward for Neoen and will serve as a template for future contracts, opening up great market opportunities in Australia and in the rest of the world,” Mr Barbaro said.

MARINUS, KERANG LINKS FAST-TRACKED FROM $20B FUND

The Federal Government has committed to conditional funding for major renewable and transmission projects –including the Marinus and Kerang links – from its $20 billion Rewiring the Nation plan.

The new commitments include a $75 million investment to fast-track the Marinus Link project, a $1.5 billion loan for Victorian Renewable Energy Zones (REZ), and a $750 million concessional loan for the Victoria-New South Wales Interconnector (VNI West) KerangLink.

Prime Minister, Anthony Albanese, said the conditional funding would strengthen investment and growth in Australia’s future energy grid.

“Rewiring the Nation has always been about jobs in new energy industries, delivering cleaner, cheaper and more secure energy, and bringing down emissions – today it begins doing just that,” Prime Minister Albanese said.

“An electricity grid built for the 21st century is absolutely critical, but until the election in May there was no plan to deliver, let alone to do so at lowest cost for consumers.”

The significant investment in transmission infrastructure has been celebrated by Energy Networks Australia CEO, Andrew Dillon, who said the project would deliver more secure and reliable access to renewable energy sources.

“Australia is working towards a net zero energy grid but is hampered by a lack of transmission infrastructure. These new links are key steps towards a 21st Century renewable energy grid,’’ Mr Dillon said.

“Network investment is critical to enable the most affordable transition to a net zero energy system.

Kerang Link and Victorian REZs

The Federal Government has agreed to fast-track Victorian REZs and offshore wind development with $1.5 billion of

concessional funding for REZs and offshore wind projects.

In addition, a concessional loan of $750 million will be allocated toward the VNI West KerangLink.

Promising 4,000MW of new power generation VNI-West KerangLink will support more than 2,000 direct jobs during construction and generate $1.8 billion in net market benefits.

Victorian Premier, Daniel Andrews, said the investment acknowledged Victoria’s nation-leading emissions reduction efforts.

“Victoria has cut emissions by more than any other state, tripled the amount of renewable energy and created thousands of jobs. We’re not just talking about climate action – we’re getting on with it.”

“All of this means more jobs, cleaner energy and cheaper power bills for Victorians.”

Marinus Link

The Federal Government has committed $75 million from its Rewiring the Nation plan, and signed a partnership with the Tasmanian Government to jointly fund the ambitious Marinus Link project.

Construction will see more than 255km of undersea transmission cable delivering renewable energy generation and storage for the mainland through Tasmania’s Battery of the Nation projects.

The project comprises two under-sea transmission cables connecting Tasmania and Victoria, promising 1,400 jobs in Tasmania during peak construction, 1,400 jobs in Victoria, and up to $4.5 billion in positive net market benefits, including to electricity users.

The partnership will supercharge investment in Battery of the Nation, which is expected to deliver up to 670 direct jobs across Tasmania in a letter of intent that includes:

» Access to a concessional loan from Rewiring the Nation, through the Clean Energy Finance Corporation

for approximately 80 per cent of the project costs of Marinus Link, with the additional 20 per cent to be an equity investment shared equally between the Commonwealth, Victoria and Tasmania to the critical project off the ground

» Up to $1 billion of low-cost debt from Rewiring the Nation for Tasmania’s Battery of the Nation projects, including Tarraleah Power Station redevelopment and Lake Cethana Pumped Hydro

» Low-cost debt to link Cressy, Burnie, Sheffield, Staverton and Hampshire in Tasmania, known as the North West Transmission Developments (NWTD), which will increase the capacity of the network in Tasmania

The joint-commitment has been welcomed by Marinus Link’s major stakeholders, including Hydro Tasmania and the Marinus Link organisation.

Marinus Link CEO, Bess Clark, said at 1500MW, Marinus Link has about three times the capacity of the existing Basslink interconnector, and equivalent capacity to the former Hazelwood power station in Victoria, able to supply over 1.5 million Australian homes with electricity.

“The project has been identified by the market operator as urgently required and this announcement provides the commercial framework to see the project progress through to operation,” Ms Clark said.

“Marinus Link will ensure long-term energy security and provide Tasmanians with a stronger, more resilient grid. Marinus Link will allow Tasmania’s capacity-rich hydro generation to be better utilised, alongside new wind and solar energy.”

Hydro Tasmania CEO, Ian Brooksbank, said his organisation welcomed the new commitment, which will harness Tasmania’s abundant natural resources.

“Hydro Tasmania welcomes the

announcement of a new partnership between the Tasmanian and Federal Government to back progressing Tasmania’s renewable energy ambitions through Marinus Link and Battery of the Nation,” a Hydro Tasmania spokesperson said.

Marinus Link involves approximately 255km of undersea High Voltage Direct Current (HVDC) cable and approximately 90km of underground HVDC cable.

It will also include converter stations in Tasmania and Victoria, and approximately 240km of supporting High Voltage Alternating Current (HVAC) transmission in North West Tasmania, known as the North West Transmission Developments.

“A game-changer”

The Clean Energy Council (CEC) said the announcement that the Federal Government has reached agreements with the Victorian and Tasmanian Governments to proceed with a range of critical transmission projects will unlock massive investment in renewable energy and is a game-changer for Australia’s clean energy transition.

CEC CEO, Kane Thornton, said a smart, modern and strong transmission system is a “crucial piece of the jigsaw puzzle to deliver a lower cost, more reliable and clean energy power system and transition Australia to become a clean energy superpower”.

“Australia is rapidly transitioning to a more flexible, low-cost, clean energy system and transmission projects – such as Marinus and KerangLink – and energy storage play a crucial role in Australia’s energy future,” Mr Thornton said.

“Marinus Link will allow Tasmania to export its considerable pumped hydro and wind energy resources to the National Electricity Market and open up further investment opportunities in renewables.

Support for renewable energy zones and offshore wind projects is also a smart investment in the energy infrastructure necessary for the 21st century.”

Mr Thornton said CEC knows that clean, low-cost renewable energy and storage is the answer to Australia’s energy supply concerns.

“Speeding up investment is critical to lowering energy prices, ensuring a reliable grid and unlocking an enormous amount of renewable energy investment,” Mr Thornton said.

“This is the sort of political leadership and tangible action investors have been calling for to ensure we have a smart, modern and 21st-century electricity grid.

“[The] announcement shows how quickly we can make progress on the energy transition when governments across the country are working together.”

The CEC will continue to advocate for reform to the energy market and regulatory tests for new network investment, as well as a renewable energy storage target. Combining wind and solar with storage like batteries, hydro and pumped hydro, and the transmission needed to move clean energy around the country, will ensure every Australian has access to clean, affordable and reliable energy.

Confidence and certainty for Hydro Tasmania

Hydro Tasmania CEO, Ian Brooksbank, welcomed the strong government support for the partnership between the Tasmanian and Federal Government.

Mr Brooksbank said that the announcement of low-cost financing through the Rewiring the Nation plan provided confidence and certainty to Hydro Tasmania for its Battery of the Nation vision to maximise Tasmania’s existing hydropower capacity and add pumped hydro.

“Marinus Link will open up even greater two-way market access, stimulating renewable energy investment in Tasmania including our hydropower projects,” Mr Brooksbank said.

“Battery of the Nation will bring an additional 1500 MW of on-demand capacity into the national market – that means it’s available at the ‘flick of the switch’.

“The first 750MW Marinus Link cable will unlock flexibility in our existing hydropower system to provide the on-demand backup needed. It also opens up potential for capacity upgrades in our assets including the Tarraleah scheme and the West Coast stations.

“The second 750MW cable creates the opportunity to develop pumped hydro – a 750MW, 20-hour, cost-competitive, long-duration storage opportunity at Lake Cethana.”

With more interconnection, new wind projects and increased hydropower capacity, Tasmania will produce more than enough renewable energy to power Tasmanian homes, businesses, and industries plus it can export the extra power to support a clean energy future for Australia.

“Benefits will flow back to Tasmania through access to affordable power, economic investment, creation of much needed jobs, attraction of new business, and increased profitability for Hydro Tasmania which brings revenue to the State Government to support vital infrastructure and services,” Mr Brooksbank said.

“Tasmanians can be proud that we are doing our bit to address climate change, while also reaping the benefits of lower power prices, greater economic returns to the state, and the jobs and investment that will help grow our economy for the future.”

Transgrid recently published its Transmission Annual Planning Report 2022 which supports calls for major transmission projects to be delivered faster and cheaper for consumers.

This key report aligns with the Australian Energy Market Operator’s 2022 Integrated System Plan which states investment in new transmission needs to begin “as urgently as possible”.

A June 2022 report by Endgame Economics found prompt investment in transmission upgrades reduce the average wholesale price of electricity, however prices become higher and more volatile with extended delays to transmission upgrades.

It also found that the increase in average wholesale cost added to consumer bills with a delay greatly outweighs the small reduction in transmission cost due to deferred transmission capital expenditure.

For example in NSW, the predicted residential consumer bill increase due to

transmission delays are $283 (1.4 per cent) for a one-year delay to the ISP base case, $575 (2.8 per cent) for a two-year delay, and up to $1,428 for a four-year delay (6.9 per cent) (calculated over the FY26-2040 period, in real 2022 dollars).

It means consumers will likely have larger electricity bills with greater transmission delay.

Equally important is the reality that the National Electricity Market (NEM) is facing serious risk of energy shortages as we transition from coal to renewables at a rapid rate – even faster than expected. This is the critical decade for energy. The expansion of our grid is essential to underwrite energy security and mitigate the risk of significant black outs. We are building the infrastructure to enable the integration of existing and future wind, solar and hydro power. Our transmission projects EnergyConnect, HumeLink and VNI West will get this energy to market, filling the gap left as coal-fired generators become unreliable and retire.

The recent energy market crisis demonstrated the current system’s lack of resilience and the high consumer cost of disruption. These risks will continue until we have a strong, flexible electricity network capable of safely delivering high volumes of renewable energy.

Transgrid is responding to this reality.

It is imperative Transgrid builds new transmission now, to avoid paying much more for this critical infrastructure later.

We recently delivered the $236 million upgrade of the Queensland-NSW Interconnector enabling more energy to flow between the states. Transgrid has also delivered its $45 million Victoria-NSW Interconnector (VNI) upgrade, allowing more renewable energy to flow between Victoria, NSW and the ACT.

Construction is well underway on Australia’s largest electricity grid project, the $1.8 billion EnergyConnect interconnector, which will enable the sharing of energy between NSW, South Australia and Victoria for the first time.

This critical project will allow integration of renewables in the state’s south-west and provide the best chance of meeting the nation’s clean energy targets while helping to drive down the cost of wholesale electricity. These tangible benefits represent valuable outcomes for everyone in the NEM.

Transgrid is also planning the VNI West project which will enable more energy sharing between NSW and Victoria. This will converge in Wagga Wagga with EnergyConnect and another actionable ISP project HumeLink.

HumeLink is a key component in a robust, future grid. It will enable a successful and rapid integration of new, clean energy from renewable energy zones and unlock the full capacity of Snowy 2.0. This energy, from wind, hydro and solar farms, will be shared across NSW, the ACT and the NEM.

The Australian Energy Regulator recently provided a vote of confidence in Transgrid’s HumeLink project by approving a $322 million funding agreement for Stage 1 early works. The delivery of HumeLink, alongside

EnergyConnect and VNI West will reshape the NEM – providing a strong and stable platform for Australia’s economic growth.

These priority transmission projects will form the country’s energy superhighway. They must be progressed as urgently as possible. We will achieve this by bundling the projects together to ensure we are able to attract and retain the people and materials to deliver them.

Transgrid is investigating the integration of these projects into a single simultaneous program to deliver them earlier and cheaper, which will help put further downward pressure on customer bills.

Any delays to these projects will likely have a significant ripple effect on all dependent on our network.

For example, any delays to HumeLink would threaten the timely connection of new renewable generation and new interstate connections to the grid.

We must get ready faster for the retirement of the ageing coal generation fleet. Building now to facilitate the connection of new renewable generation

and storage is the only acceptable path forward for Australia’s energy consumers, who will reap the rewards of a rapid acceleration for generations to come.

AUSTRALIA’S ENERGY FUTURE IS RENEWABLE AND IT’S HERE. ARE YOU READY?

Year on year, the percentage of renewable energy entering the Australian electricity market is growing, and these figures are only set to increase as states and territories embrace increasingly optimistic net-zero goals. With these enhanced net zero goals will come a flurry of project activity to deliver on targets, and it is increasingly important that developers work with partners equipped to deal with the challenge of rapid renewable energy project deployment.

In the Australian Energy Market Operator’s (AEMO) most recent Quarterly Energy Dynamics report, it advised that coal-fired generation decreased by an average 117MW (12 per cent) compared to Q2 2021; and gas, solar and wind generation increased at all times of day, with distributed PV continuing to grow, increasing by 46MW (28 per cent) on average compared to Q2 2021.

By 2050, it is estimated renewable energy will supply the majority of the National Energy Market’s (NEM) electricity needs, with significant reductions continuing for coal and fossil fuel plants. Several coal plants are planned to shut down early, including the recently announced Loy Yang A Power Station – with the new closure date almost ten years earlier than previously announced.

The Federal Government’s Australian Energy Statistics (AES) report into 2020-2021 energy generation and use showed that in 2021, renewables represented a record high of 29 per cent of the total energy generation in the country, while fossil fuel generation continued to decline.

Diversifying energy streams creates a more interconnected grid, which means the grid needs to flex with the changing contributions of different energy sources – as well as the changing demands of Australian consumers.

The Australian Clean Energy Regulator (CER) also knows the importance of getting more renewable energy into the grid.

“As the rapid pace of renewable investment continues, planning for the integration of a much higher penetration of renewables into the national electricity grid is the next key phase in Australia’s transition to a clean energy future,” the CER said.

It’s important then, with multiple new renewable energy projects underway and being connected to the National Electricity Market, that developers look to trusted experience and stability in their

renewable partners, to ensure that projects are constructed with the best equipment on the market.

Since 1916, MM Electrical Merchandising has been supporting the energy industry as Australia’s largest distributor of electrical, communications, solar and electrical component products. Greentech sits within the MM Electrical Merchandising Group and is Australia’s largest wholesaler network of solar and renewable energy specialists.

Since its inception, Greentech has been focused on supporting the stabilisation of the energy transition in Australia, and with over 3,000 staff across Australia, Greentech has the maturity and experience to support their customers as they begin or expand their transition to renewables.

Greentech supplies the world’s leading brands across products including photovoltaic panels, mounting systems, inverters, batteries and electric vehicle chargers. With national coverage, credit facilities, and the best brands, Greentech offers a complete solution. Greentech has the necessary equipment and instalment options, with a huge Australian inventory across its warehouses to support the growing renewable demand.

Adaptive, and understanding of the changing needs of the energy industry, Greentech haven’t lost their personal touch, and are proud to bring the same traditional service values they began the company with.

Greentech’s experience has consistently supported Australia’s businesses and contractors in the renewable energy sector. A leading supplier, Greentech’s online system allows for 24/7 web access and click and collect, so you can shop the needs of your business, in your preferred way.

We know Australia’s renewable energy future is here. Greentech is ready. Are you?

For more information on the products and services Greentech can provide for your business, head to https://greentech.mmem.com.au

SUPERSIZED STORAGE: THE AUSSIE BATTERIES GETTING BIGGER AND BETTER

By Holly Tancredi, Assistant Editor, Energy MagazineAnnouncements regarding new large, grid-scale batteries are becoming a constant in Australia. So what big batteries have been produced, what’s been completed thus far in 2022 and what is being developed for Australia’s future and the AEMO’s ISP goal of 15GW of total storage capacity?

The consistent increase in renewable energy in Australia’s energy market is creating a regular need for demand management and battery storage solutions. Across the country, a number of big, utility-scale batteries are already in operation, helping to ensure the reliability of our energy network. A number of new storage developments have been announced this year, which will continue to backup the network as renewable energy penetration increases.

Supersized energy

To ensure New South Wales continues to have reliable energy supply following the anticipated closure of the Eraring Power Station, the New South Wales Government is delivering the Waratah Super Battery project. The project includes the largest standby network battery in the southern hemisphere, providing a service of up to 700 megawatts of capacity dedicated to supporting the transmission grid.

The Waratah Super Battery will operate as part of a System Integrity Protection Scheme (SIPS) designed to monitor transmission lines and enable the battery to act as a 'shock absorber' in the event of any sudden power surges, including from bush fires or lightning strikes.

By supplying additional on demand capacity, the Waratah Super Battery provides a virtual transmission solution that will increase the transmission capacity of the existing network, allowing electricity consumers in the Sydney, Newcastle, Wollongong demand centres to access more energy from existing generators.

The Waratah Super Battery project is being delivered as a Priority Transmission Infrastructure Project, or PTIP, under the Electricity Infrastructure Investment Act 2020 (the Act), and is the first PTIP to be delivered under the Act.

The super battery is set to provide additional energy generation for Sydney, Newcastle and Wollongong while renewable energy zones (REZs) and further transmission projects are completed. It will further serve as the backup energy supply during outages which will be necessary as the Eraring Power Station closes in 2025.

In October 2022, the New South Wales Government issued a formal direction to Transgrid, as Network Operator, to carry out the Waratah Super Battery, including designing a $30 million control system to trigger the battery into operation when additional energy is required.

Transgrid CEO, Brett Redman, said Transgrid was fully committed to ensuring a more reliable, affordable and sustainable energy supply for Australians as they work

with the government to accelerate the transition to a clean energy future.

“The co-location of the super battery and our substation will bring new life and jobs to the retired Munmorah coal-fired power station site as well as ensuring additional energy is located near high growth areas including the burgeoning Lake Macquarie and Central Coast regions,” Mr Redman said.

“The Waratah Super Battery is part of the NSW Government’s Electricity Infrastructure Roadmap which is bringing together transmission, generation, storage and firming infrastructure to ensure we can pivot away from old world coal towards new, clean energy sources.”

Would you like a SuperGrid with your Big Battery?

Queensland’s Energy and Jobs Plan, announced in September 2022, outlined significant changes to how the state is planning to “remove regular reliance on coal-fired generation by 2035” with a 70 per cent renewable target by 2032 and 80 per cent target by 2035. The plan outlined the steps to convert the state’s electricity grid into a “SuperGrid”.

More detailed Battery Industry and Energy Storage strategies will be released in 2023 and 2024 respectively. The State also announced major funding – $500 million – for public and locally owned energy businesses to invest in battery storage, while the funding for subsequent REZ developments and upgrades will be around $4.5 billion.

Queensland also continued its aptlynamed “battery blitz” in 2022, with the addition of many large grid-scale batteries and finished projects reaching capacity.

The Wandoan South Battery Energy Storage System (BESS) recently reached its full capacity and is currently supplying 100MW of grid capacity and storing up to 150MWh of renewable energy to its Queensland consumers.

The project, which was acquired by AGL in August 2022, offers 100MW of grid capacity energy – equivalent to powering 57,000 homes.

“Storage projects like the Wandoan South BESS will enable AGL to leverage excess solar generation in Queensland and provide capacity when AGL’s Cooper’s Gap Wind Farm in Queensland is not generating or when the energy market needs it,” said Markus Brokhof, AGL’s Chief Operating Officer.

The battery, originally owned by Vena Energy Australia, is now under the ownership of AGL for a 15 year contract, following an 18 month testing and commissioning process.

The State Government has also completed an $8 million battery in Tanby, with Deputy Premier and Minister for State Development, Infrastructure, Local Government and Planning, Stephen Miles, calling the battery an important and innovative addition to energy supply for Central Queensland.

“We know there’s been a huge uptake in rooftop solar energy in Yeppoon and Rockhampton and this investment will drive even more,” Mr Miles said.

“It means renewable energy made during Central Queensland’s many sunny days can be stored to use during peak demand periods in the evening.”

Western storage at scale

In Western Australia, Synergy’s Big Battery is the major storage development set to help power the state.

Battery storage is fast becoming a critical part of Western Australia’s energy landscape and Synergy’s Big Battery, once constructed, will be the biggest in the state. As a key element of the Western Australian Government’s Energy Transformation Strategy, it will help support the state’s electricity system and enable the uptake of more renewables in the community.

Planned to be the size of 14 tennis courts with the generating capacity of 100MW/200MWh, the Synergy Big Battery will be capable of powering 160,000 homes for two hours.

The Big Battery project was announced by WA Premier Mark McGowan and Minister for Energy Bill Johnston in October 2020. Currently under construction at Synergy’s Kwinana Power Station, it is set to be operational at the end of 2022.

The Big Battery will have an easy, millisecond transition from charging and discharging to ensure reliable, stable power is provided whenever needed.

Victorian Big Battery number…?

In December 2021, Neoen celebrated the operational opening of the biggest system battery in the Southern Hemisphere, its 300MW Victorian Big Battery located in Geelong, Victoria. Its production is supporting the Victorian Renewable Energy Target (RET) of 50 per cent by 2040 and was delivered alongside collaborators Tesla and AusNet Services.

Neoen’s plan for a second big battery for Victoria is currently in its early planning stages. If approved and completed as outlined, the project would have a huge 600MW capacity and be connected to the Moorabool Terminal Station and would be operated independently as a separate entity.

Neoen Chief Executive Officer, Xavier Barbaro, said the Victorian Big Battery was a major milestone.

“We are convinced that large-scale battery storage is a vital element of the energy transition, and we are proud of our leadership in this sector. We will continue to build on our experience to deliver world leading solutions that help to shape and transform the grid of the future, for the benefit of industry and consumers across Australia and around the globe,” Mr Barbaro said.

The Victorian Hazelwood Battery Project, announced in December 2021, is set to be online in November 2022, providing 150MW/150MWh. In July 2022, the installation of accessories, cooling systems and a header tank was undertaken; and its main transformer, which converts 33,000 volts into 220,000 volts and weighs over 100 tonnes, was also delivered and installed.

The Koorangie Energy Storage System (KESS) contract was awarded to Edify Energy in September 2022 and is currently in its development phase in Gannawarra Shire Victoria. Its unique lithium-ion battery is designed to provide 125MW of services, and connect to the 220kV Murray River REZ. The KESS was designed to boost the REZ’s renewable hosting capacity and further stabilise the network when it commences operations in 2025.

Renewable energy company, Maoneng, also has 1,800MWh of BESS projects in development across the country. Most recently, its 240MW/480MWh Mornington Peninsula Battery achieved development approval in the middle of 2022. With four other utility-scale batteries in New South Wales and Adelaide set for a 2023 operational timeline, the batteries will provide pivotal energy storage for the clean energy transition.

Powering people and their future

Big batteries, with their major construction work and maintenance, create thousands of jobs for the Australian workforce, the majority from the construction industry. All the big batteries discussed supported around or over 100 construction jobs and created numerous permanent positions across their projects.

Large-scale battery storage is an invaluable part of Australia’s transition to net zero and a clean energy future. The increase of renewable energy will be supported by batteries' ability to meet consumer demand at times when renewable energy isn’t being generated, providing the crucial missing link to ensuring ongoing energy supply.

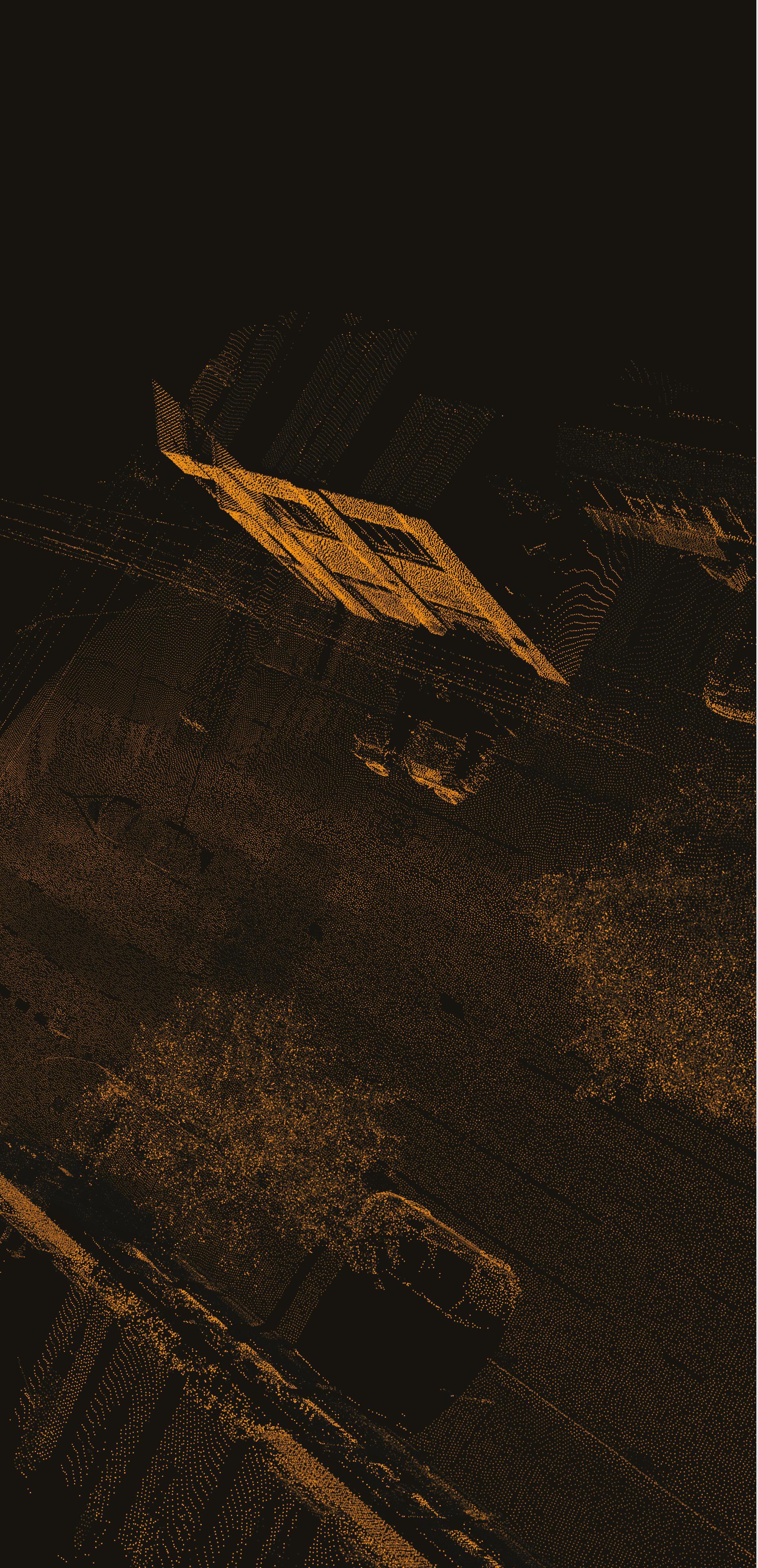

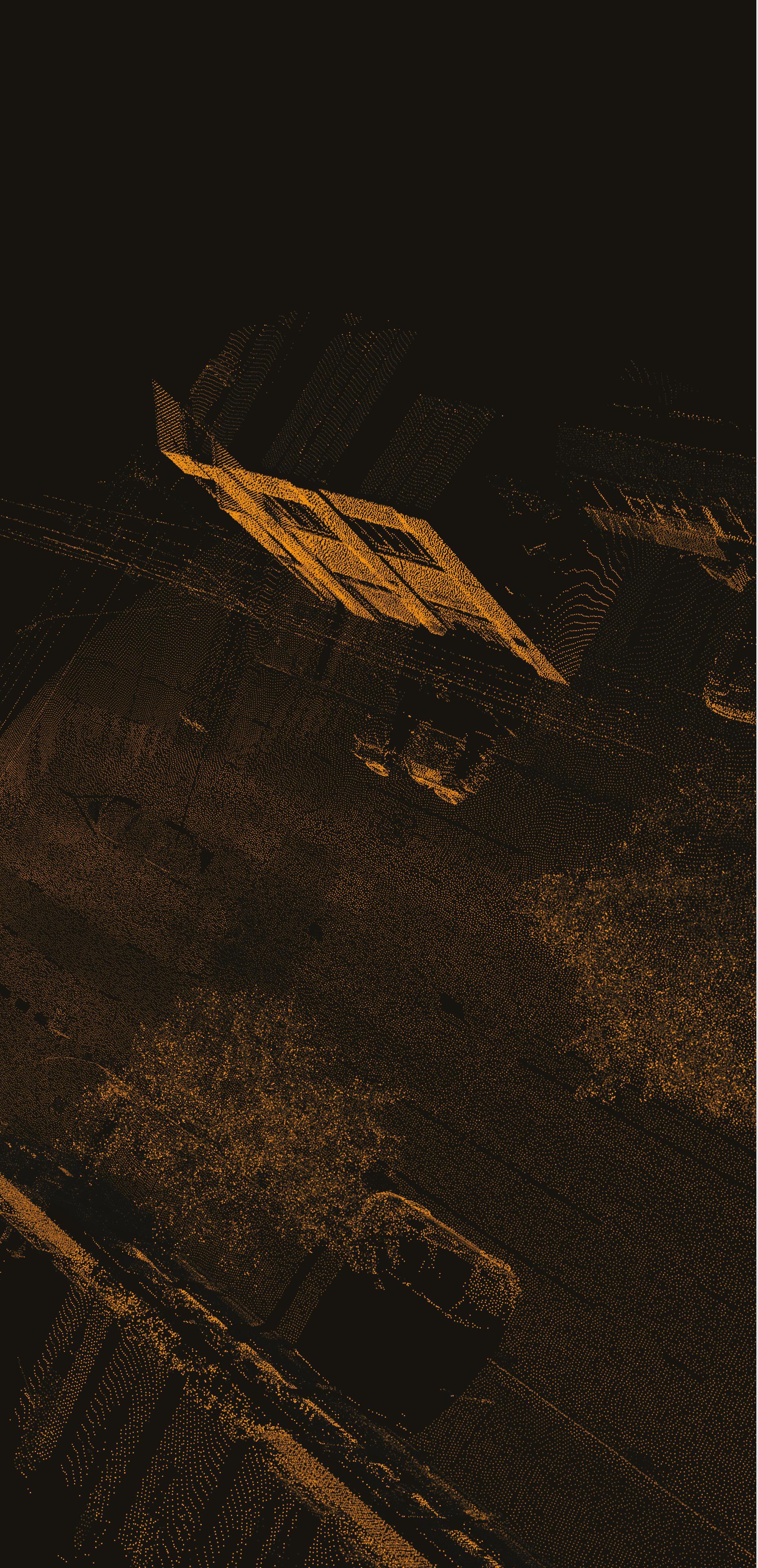

DELIVERING GEOSPATIAL INTELLIGENCE FOR HORIZON POWER

In Western Australia, Horizon Power is leading the energy transition with a clear strategy to deliver cleaner and sustainable renewable energy solutions for regional and remote areas of the state. Its transformational Geospatial Intelligence Program will create a common operational view of the network and assets that stakeholders can easily explore, analyse, and visualise to make informed decisions.

Horizon Power has selected geospatial specialist Altavec to deliver the Geospatial Intelligence Program. With a network spread across thousands of kilometres, the program will optimise asset performance, and keep the network safe and reliable.

Leveraging remote sensing, imagery, and advanced analytic technologies, the program aims to deliver a geospatial intelligence solution that transforms Horizon Power’s ability to quickly understand the state of the network.

When imagery and operational data is available in one system and integrated with analytics, it will become much easier for stakeholders to understand the state of the network – HV and LV distributions assets, clearances, and vegetation. This solution will enhance Horizon Power's ability to resolve core data issues with network alignment and implement predictive maintenance strategies aimed at reducing network failures and damages. The centralisation of knowledge, more accurate data, and enhanced management visibility will significantly reduce risks and improve network reliability while lowering costs.

The innovative use of imagery and other remote sensing technologies will lead Horizon Power away from the run-to-failure model and towards a predictive data-driven model.

Altavec delivers a world-class, cloud based geospatial intelligence platform. The Altavec AIMS 3D platform is designed to process LiDAR (for network realignment, vegetation analysis and network clearance analysis) and images (for asset condition monitoring) in a highly automated fashion. The result being the full network rendered in 2D and 3D, matched to Horizon Power’s assets, and tagged with defects or vegetation encroachments. With the addition of artificial intelligence (AI) and machine learning (ML) techniques, Altavec scans thousands of images collected across the network in minutes, and guides Horizon Power to areas of concern. Streamlined analytics enable the delivery of actionable insights to decision makers who can get the right team to the right

place at the right time. Altavec is investing heavily to continually improve the accuracy and breadth of the automation.

Business benefits delivered to Horizon Power include:

» Virtual inspections will provide the ability to plan beyond the near run to failure model and gain visibility into the health of assets and equipment that cannot be seen from the ground

» Accurate identification and quantification of non-compliant asset conditions, prioritisation of asset maintenance/repairs and targeted preventive maintenance that increases the life of assets and reliability across the network

» Situational awareness of the network will improve preparedness during emergency events and natural disasters

» Access to geospatial information will assist in planning and prioritising before crews begin field work, reduce site assessment visits and field travel time. The information will also improve permitting workflows, resulting in better data and time savings for both office and field crews

» Reactive maintenance costs will be reduced, with improved system reliability and fault response efficiency

Altavec (previously known as Geomatic.ai) is a Tech Mahindra company, specialising in geospatial and network intelligence services to deliver digital asset insights. Designed to empower infrastructure businesses to make truly informed decisions about their assets, the team at Altavec convert LiDAR and imagery into digital network models for compliance, analysis, planning and design purposes.

Having completed over 300,000km of network survey and analysis work across Australia, Altavec has been trusted partners to Australian utilities for more than 20 years. Ongoing advancements in automated analytics along with developing machine learning and artificial intelligence algorithms ensure Altavec delivers the future of network intelligence, now.

To learn more about Altavec’s solutions, head to http://altavec.com

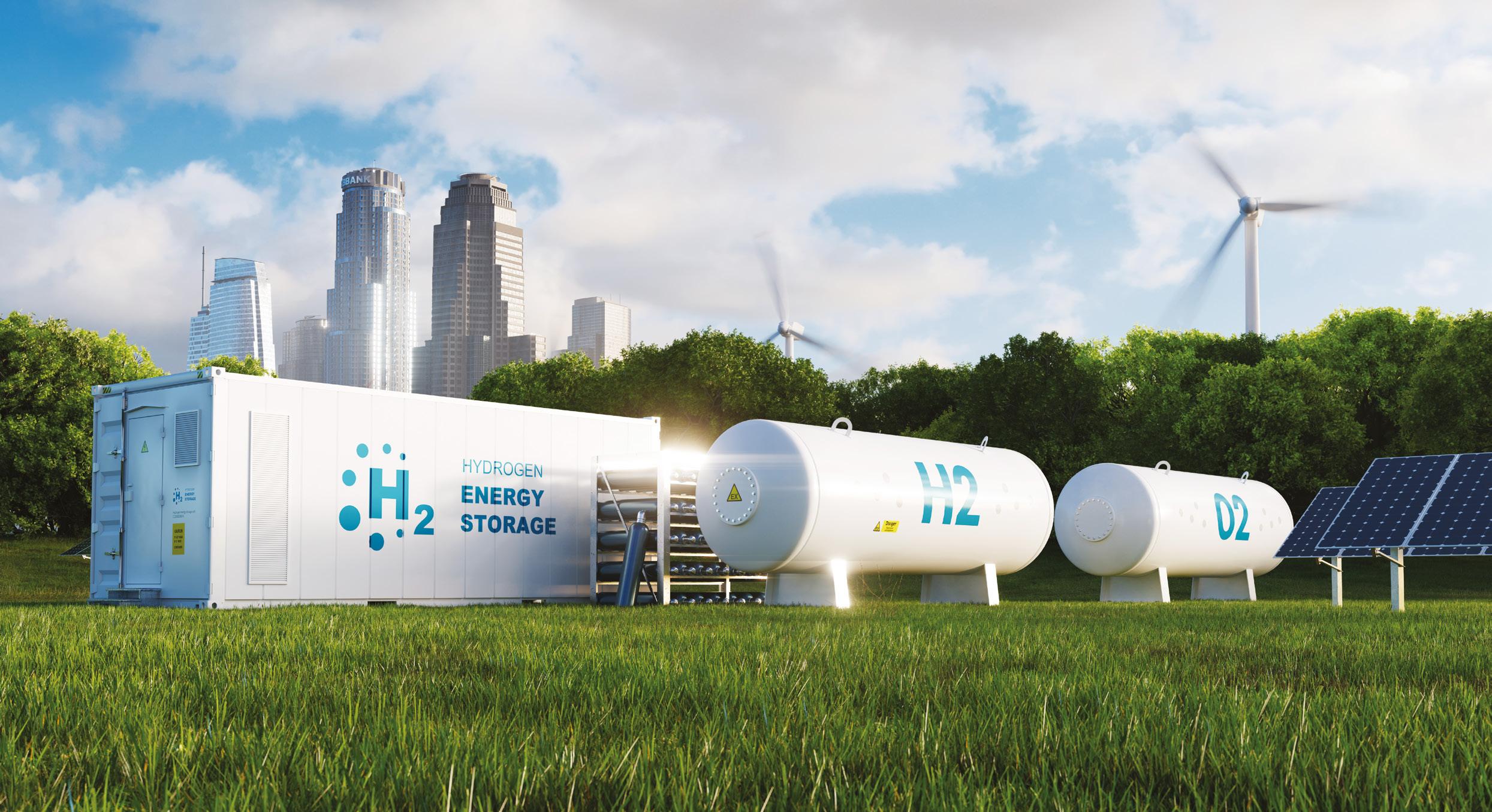

TO COMMERCIALISATION THE AUSTRALIAN HYDROGEN INDUSTRY’S PATH

ByDrFionaSimon,CEO,AustralianHydrogenCouncilWiththemanyannouncementsbeingmadeabouthydrogeninthemedia,itmaybeasurprisetohearthatthe cleanhydrogenindustryinAustraliaisfarfromcommercial.

Global announcements from around the world demonstrate that this situation is not unique. In its 2022 Hydrogen Insights publication, the global Hydrogen Council reports that only around ten per cent of the proposed $240 billion worth of large-scale project announcements have reached final investment decision, and the International Renewable Energy Agency has commented on the high uncertainty about which specific announcements will materialise.

Considerable investment is needed to close the economic gap between where we are now and hydrogen as a commercial proposition. For Australia to meet its hydrogen ambitions, this investment will likely be tens of billions of dollars.

Of course, the economic dividend for being among the first countries to do so successfully will be worth many times more.

The issue is that today’s markets still regard carbon emissions as externalities, and clean and green alternatives to fossil fuels as needing to cost a ‘green premium’.

We can see circumstances changing, but we are not yet in a place where the benefits of the energy transition are valued sufficiently to bring in low to zero emissions alternatives like hydrogen – at least not at scale.

Government policy is the only way to level the playing field and accelerate market developments in the public benefit. We need to see government policy manifested in mechanisms like carbon pricing, taxation costs and benefits, targets and rebates.

The overarching policy mechanism for valuing carbon in Australia is the Safeguard Mechanism. It requires Australia's largest greenhouse gas emitters to keep their net emissions below a baseline.

The Australian Government intends to gradually reduce baselines to help Australia reach net zero emissions by 2050. It proposes introducing credits for facilities that emit less than their baseline and providing tailored treatment to emissionsintensive, trade-exposed facilities so local businesses are not disadvantaged compared to international competitors. The Government is currently consulting on the details of this proposal.

The proposed changes to the Safeguard Mechanism will mean that industry effectively assigns a value to being able to maintain productivity while reducing emissions.

Done properly, this is exactly what’s needed. But it is unlikely that this will be enough. In the absence of an economy-wide carbon price, we need a suite of policy mechanisms.

The United States has taken steps to draw investment in hydrogen through measures included in its Inflation Reduction Act. These measures include the provision of tax credits for the production of clean hydrogen, with the size of the credit based on the carbon intensity of the hydrogen product. Projects can attract a multiplier if they meet eligibility criteria relating to job and apprenticeship creation and the use of locally produced steel in project construction.

This policy has the potential to bring forward investment in hydrogen production and the ability to produce green hydrogen at cost parity with carbon intensive grey hydrogen.

Funding and concessional loans are also vital, and this is recognised in Australia.

We have our Australian Renewable Energy Agency (ARENA), which provides direct funding to select projects, and the Australian Government’s ‘green bank’, the Clean Energy Finance Corporation (CEFC). Both play an important role in hydrogen, particularly ARENA’s support of pilot and demonstration projects. The CEFC has a $300 million Advancing Hydrogen Fund, and will be vital to the industry, however the CEFC can only finance commercial projects in order to provide a return to taxpayers.

ENGIE and Yara Pilbara Fertiliser reached final investment decision for the Yuri Renewable Hydrogen to Ammonia Project in Western Australia, which is supported with $47.5 million investment from ARENA.

A 10MW electrolyser, powered by 18MW of solar PV and supported by an 8MW battery energy storage system, is expected to generate renewable hydrogen to produce renewable ammonia at a neighbouring liquid ammonia plant.

The green hydrogen produced will ultimately displace existing grey hydrogen and kickstart the Australian market for clean hydrogen as a feedstock. Once commissioned, it will be among the largest renewable powered electrolysers in the world. ARENA is supporting three 10MW electrolyser projects scheduled to come on-line in 2023 and this is a promising start.

But the scale of the electrolysers required to reach scale will be closer to 1GW – and we will need several of these.

The Yuri Project is a great start – it is exactly the kind of ‘no regrets’ project for hydrogen that we need to see get up, where we know hydrogen has a role and where decarbonisation benefits are immediately obvious.

These types of projects are critical to ensuring that Australia receives the greatest return on its public investment in hydrogen and driving the additional private investment required to bring the industry to scale. Imagine what could happen when this kind of industrial change is further driven by policy like the Safeguard Mechanism.

DELIVERING SUCCESSFUL ENERGY PROJECTS IN THE RENEWABLE REVOLUTION

By Fiona McIntyre, Partner, PwC Australia’s Energy Transition teamTo achieve net zero by 2050, Australia’s energy landscape needs a massive, rapid step-change. The task is enormous – but so are the opportunities. Here, we take a look at the mammoth program of work required to build the renewable energy infrastructure Australia needs, and the key considerations developers undertaking these projects need to consider.

With coal power stations expected to retire two to three times faster than scheduled, the Australian Energy Market Operator (AEMO)’s 2022 Integrated System Plan estimates that by 2050 Australia will need nine times the current level of renewable generation, five times the distributed solar PV generation and three times the firming capacity and storage solutions. This is just to replace retiring coal generation and doesn’t even begin to factor in a new domestic and export green hydrogen industry.

The scale of this generation and firming deployment will require more than 10,000km of new transmission lines to get the electricity to consumers – an enormous investment in new transmission infrastructure.

The most efficient and cost-effective way to manage these challenges is expected to be through the development of Renewable Energy Zones (REZs), where new renewable energy and storage developments can be concentrated. REZs can provide efficiencies in the amount of transmission lines needed to connect to the grid and population centres, reducing the cost to consumers, and can minimise risks for investors by potentially sharing some infrastructure and costs across multiple parties.

The National Electricity Market (NEM) is already intricate, and overlaying statebased REZs adds further complexity. Investors and project developers will need to understand how the state-based REZ schemes interface with the NEM and AEMO rules. Of course, in such a dynamic and evolving sector, there are also many layers of uncertainty – including future

regulatory and policy changes, such as the Energy Security Board’s transmission access reforms, which have the potential to impact operations and returns for investors and consumers.

These are exciting times for infrastructure investors and renewable energy developers, but it will be critical to come to grips with complexity in some key areas in order to maximise the likelihood of success and avoid preventable pitfalls. The following four areas are essential considerations right now.

1. Getting connected

Improving the grid connection process and making it quicker and easier to connect is key to accelerating the energy transition.

The time it takes to develop a project and reach financial close has progressively increased and often takes more than

three years – yet it only takes a few weeks to connect solar PV to a rooftop. As a consequence, the amount of distributed renewable energy added to system capacity has exceeded 3 GW for each of the past two years.

The proposed concept and design of REZs, with their significant upgrades in transmission infrastructure, is likely to shorten the process of grid connection and reduce the likelihood of curtailment. Batching power system and connection studies, as proposed for the Central West Orana REZ, will speed up connection compared with undertaking these sequentially.

Investments in transmission in the REZs will be essential for fast-tracking new renewable generation so it is ready to meet the accelerating timeframe of coal retirement.

2. Supply issues across the energy value chain

The pipeline of infrastructure projects in Australia is already significant. Adding REZs to this picture raises a burning question: will there be enough appropriately qualified personnel available to build the REZs to the expected quality and schedule? One aspect of the solution is likely to be upskilling and retraining workers displaced from industries such as coal mining. While this will be positive for affected communities, it is unlikely to be sufficient in itself to achieve the build out, so early preparation and resource planning will be essential. Beyond personnel, will there be enough of the necessary technologies, materials and equipment for forthcoming renewables, storage and transmission investments? It is likely that pressures will emerge right across the value chain. Giga projects such as Sun Cable’s Australia-Asia Power Link will require a huge amount of transmission lines and HVDC cables, with the quantum

required potentially too great for a single supplier or even a single region. New renewables projects will need to consider alternatives early.

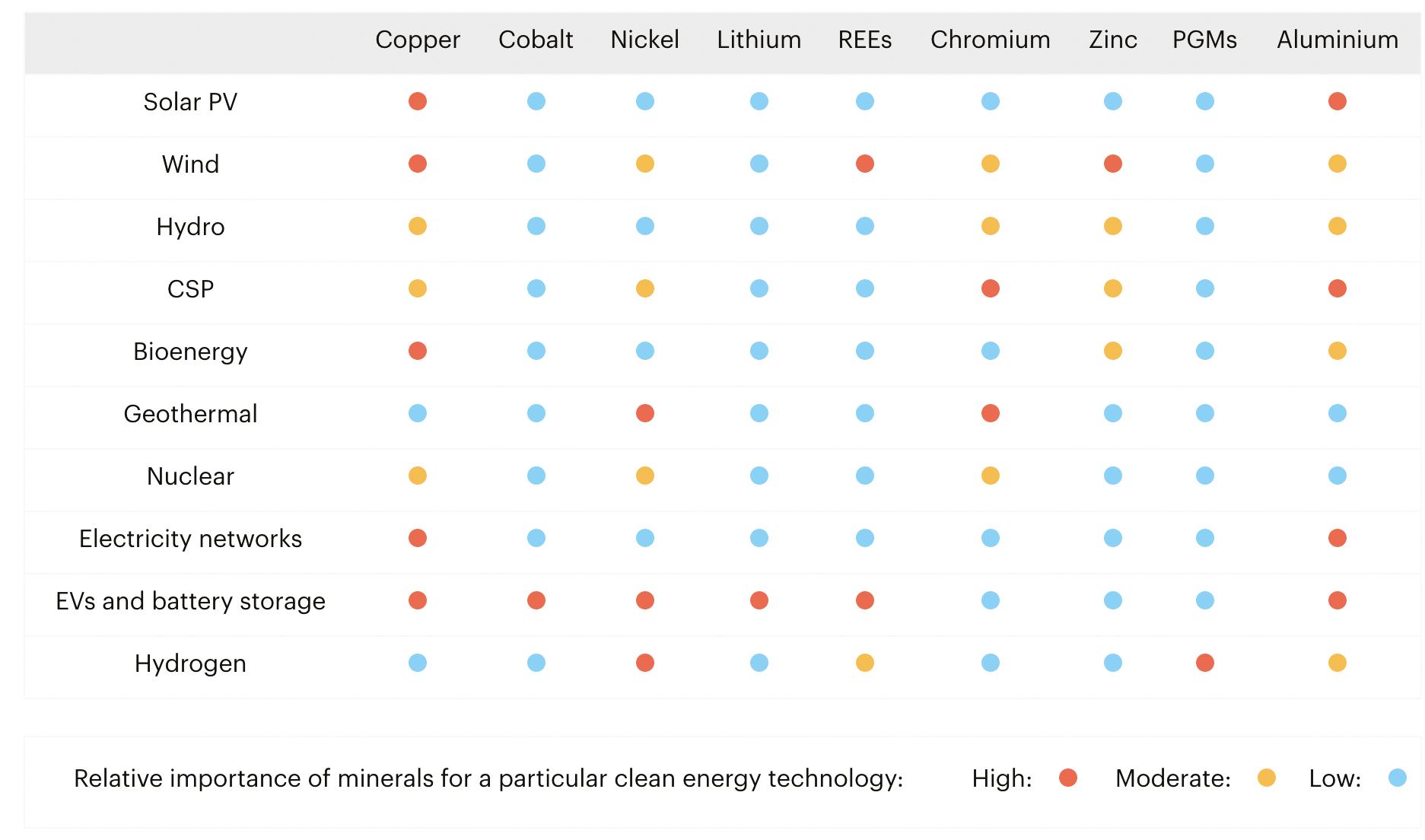

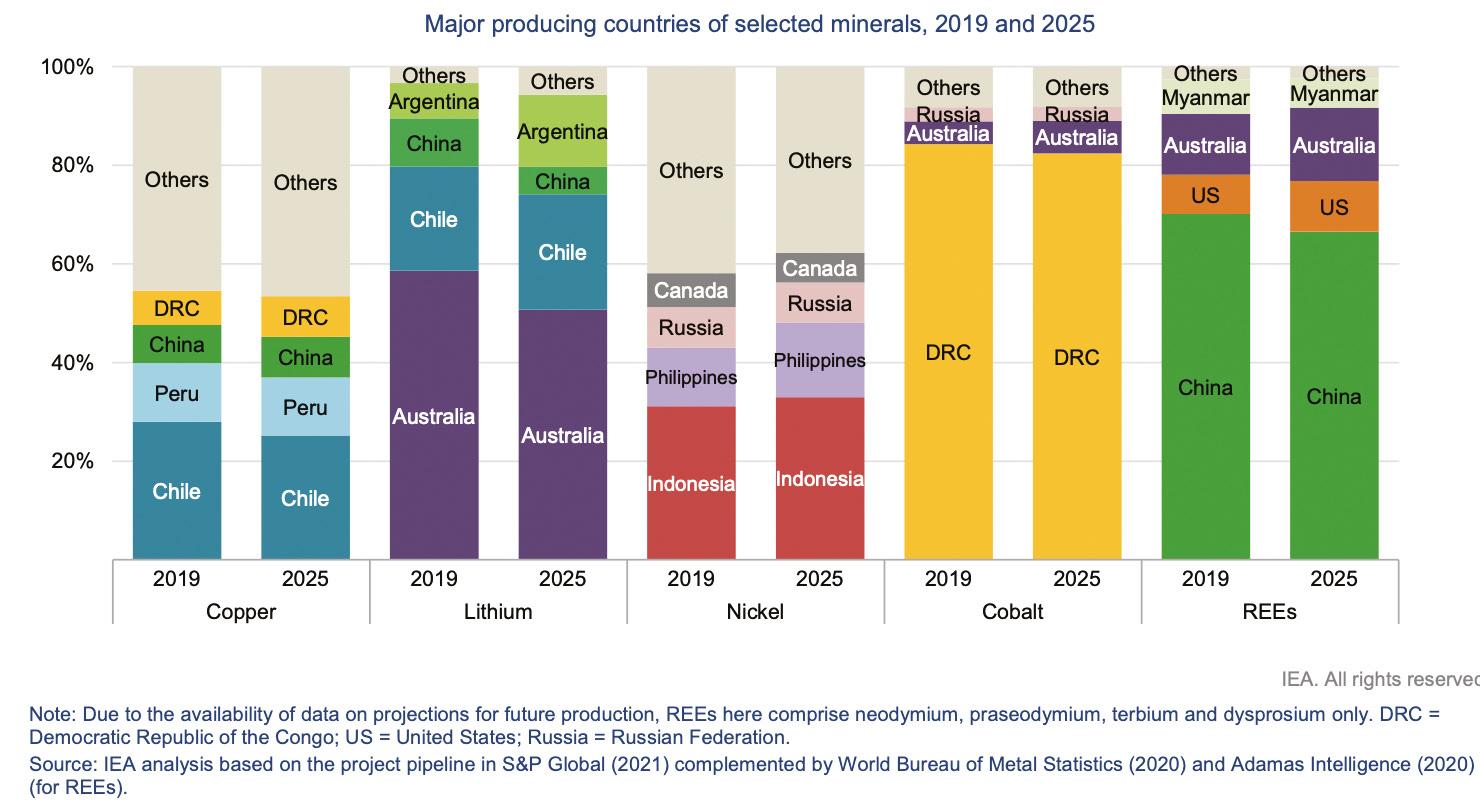

Another significant challenge is availability and cost of key critical energy minerals required in renewable energy technologies. The cost of minerals such as silicon, lithium and cobalt has skyrocketed and is likely to escalate further under the pressure of the energy transition and global geopolitical dynamics.

For projects that have already locked in their power purchase agreements (PPAs) and expected internal rates of return, rising equipment costs and changing cost assumptions will have implications. Some solar projects have already encountered much higher than expected costs for solar panels. Who will bear the impact of these escalating costs? Will the project still be viable? This dynamic needs to be factored into a project’s expected returns and considered by potential offtakers.

3. Environmental, social, and governance issues

Environmental and social licence can make or break a project, so it’s vital that environmental, social and governance issues remain at the front of the agenda. Mere compliance with the basic requirements of legislation is unlikely to win over a community or build a positive reputation.

Social licence will be a key issue when developing REZs. Many of these areas currently have limited transmission infrastructure, so routes, land access and easements for new infrastructure will need to be negotiated carefully with landholders and local communities, and with a particular focus on First Nations peoples. Early engagement will be very important so that everyone can understand the scope and intended outcome of the project, potential

visual or environmental impacts, alternative routes or construction methods, and possible community benefits.

Although some examples of best practice in community engagement are beginning to emerge in Australia, there is still much to be done to build greater trust with communities across the country to support the energy transition.

Consideration should also be given to ethical and human rights issues throughout the value chain, such as the risk that materials or components may have been extracted or manufactured under conditions of modern slavery, or other socially and environmentally harmful practices.

4. Obtaining an offtake

Ultimately, most projects will not secure financing or progress to construction without an offtake arrangement to underpin the revenue stream. The demand for offtake is changing. The days of the ‘Big 3’ retailers being the predominant offtakers has passed, and the corporate PPA market continues to grow as companies seek to reduce emissions and control their exposure to volatile power prices.

In NSW, it will be interesting to see the interplay of offtakes and the long-term energy service agreements, which will offer an option to access price guarantees for eligible generation, long-duration storage and firming projects.

A new energy paradigm is unfolding around us in real time. In this rapidly evolving energy market, there will continue to be complexities, unknowns and risks for investors and developers. However, none of the challenges we’ve discussed in this article are insurmountable, and they shouldn’t overshadow the excitement of the sector’s opportunities. Early awareness of these considerations will go a long way towards more positive project outcomes.

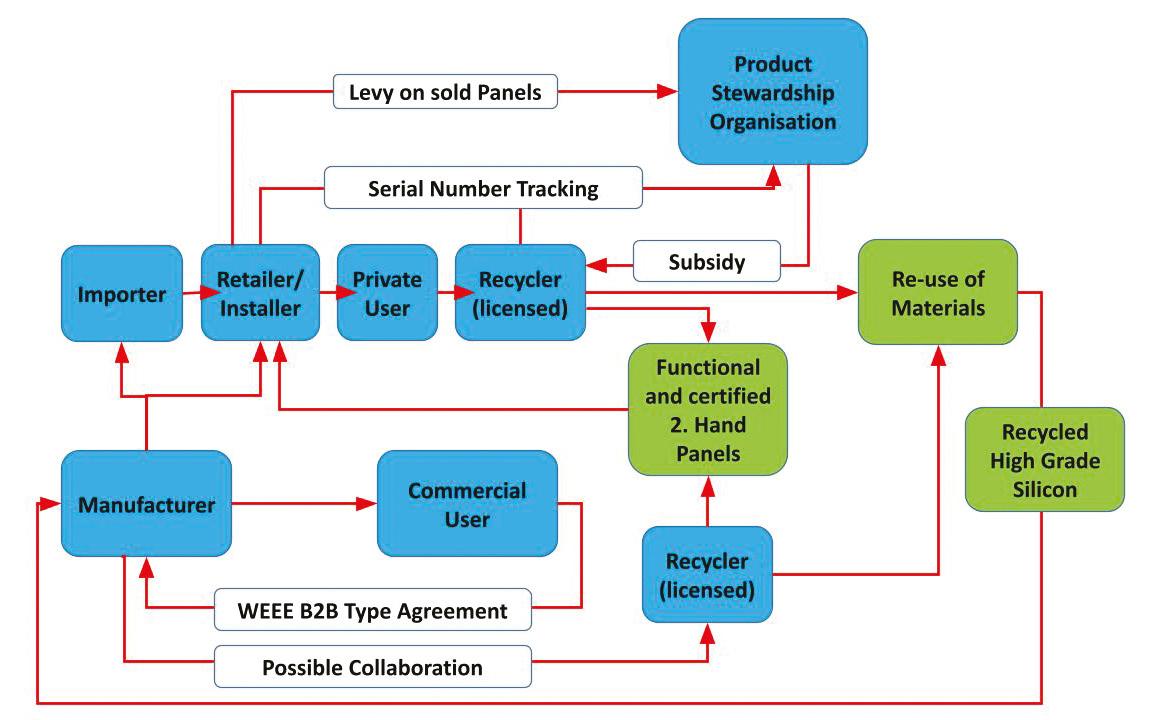

MANAGING SOLAR WASTE: GETTING AHEAD OF THE CHALLENGE

By Peter Majewski, Professor Advanced Materials, UniSA Future Industries InstituteCurrently, about 80 million solar PV panels are installed in Australia, 90 per cent of which are silicon solar panels. By 2030, solar panels are expected to create a cumulative waste volume of more than 500,000 tonnes and more than 1.1 million tonnes in 2040. To avoid an unwanted waste legacy, a robust legislation could regulate the end-of-life management of solar PV panels.

Possible regulatory environment

Landfill bans for solar panels, like in Victoria, can be a powerful tool to achieve desired outcomes. However, such regulatory measures should be accompanied with legislations that supports recycling of old panels. Tracking of panel’s serial numbers to provide information about the whole life cycle of a panel can also be a useful tool.

The ownership of the panels also needs regulatory clarification. Once the panels are installed on a rooftop of private dwellings, their operator is obviously the owner of the dwelling. However, once the panels are dismantled and on their way to a recycler, ownership and responsibilities for the proper handling of the panels needs to be clarified. In case of commercially used solar PV panels of solar farms, it can be expected that business agreements between panel manufacturers and solar farm operators clarify the ownership and end-of-life arrangement for the panels before the solar farm gets planning approval.

Potential product stewardship scheme

A products stewardship scheme for solar panels can legislate that panels must be recycled through certified recyclers. Existing

products stewardship schemes can be used as models for such schemes, like the National Television and Computer Recycling Scheme, the Battery Stewardship Scheme in Australia, or the Tyre Stewardship Australia.

A scheme can distinguish between panels from private users and commercial users. In case of commercially used panels the business-to-business (B2B) model of the European Union’s Waste from Electrical and Electronic Equipment (WEEE) Directive could be applied. Here, a producer must declare that the producer has the adequate resources available to finance environmentally sound end-of-life management processes for the product. The coverage of the related costs, take back options, or other related end-of-life management actions can be negotiated between the producer and business end user. This B2B model would ensure that legislators have a clear understanding of the end-of-life management of panels and the ability to monitor declared actions at the end of the panel’s life.

Legislation can also encourage manufacturers to engage in enterprise agreements with local solar panel recyclers to manage the collection and recycling of panels if the manufacturer does not offer a take back scheme. This may be especially of interest

for overseas manufacturers who are expected to ensure that panels undergo end-of-life management processes which are in line with the legislation of the jurisdiction where the panels reside.

A common issue with new end-of-life legislation is how to deal with existing products which are subject of the new end-of-life legislation. One solution can be to exclude all previously sold products from the new endof-life legislation. This, however, would cut off recyclers from a valuable stream of material to be recycled waste until newly sold products reach their end-of-life. This would delay the development of proper recycling processes and, therefore, would be a barrier for establishing a circular economy for solar panels. Therefore, it is recommended to include existing panels in an end-of-life legislation and design the scheme in a way that it can also deal with existing panels considering both avenues, recycling and re-use.

Re-use of functional panels

Many panels, which are replaced, are still fully functional. Solar panel re-use offers a variety of social and environmental benefits and is an approach that could easily fit into existing collection and recycling networks and processes. A bare minimum would be a certification like the electric compliance certificate or equivalent provided by a certified electrician or equivalent to ensure safe operation of the second hand panels.

Consumers of second hand solar PV panels need to be certain that the second hand panels are still working at a certain defined capacity. Therefore, a certificate would be necessary that provides information about the capacity and age of the second hand panel. Again, this certificate would need to be provided by a certified individual or organisation to ensure legal compliance before the panel enters the second hand economy.

Levy to support a scheme

Long term experience in waste management, domestic and international, indicates that convenience for consumers through collection of unwanted products without paying a levy at disposal of the product appears to be important to increase collection rate and decrease illegal disposal.

It can, therefore, be recommended that an upfront levy for supporting a product stewardship scheme for solar panels and their recycling is requested, like for car tyres, to avoid a disposal fee for consumers. Especially in the case of upgrading existing solar systems through new panels, a disposal fee for the old panels could be detrimental for the solar industry as consumers may delay or cancel the upgrade if the levy is too high.

Experience also shows that high collection rates are achieved where a fully funded not for profit product stewardship organisation is overseeing the product stewardship scheme. This would require that the levy is set at a level which not only allows to support collection and recycling of the panels, but also provides funds to support the operations of an effective product stewardship organisation.

At the current stage, the level of the levy is difficult to define. Whatever levy is applied, previous studies clearly show that it is essential to continuously monitor and, if necessary, adjust the levy to ensure high collection and recycling rates with time.

Ensuring compliance

One issue with end-of-life legislation is the control of compliance avoidance or free riders. Free riders are organisations that may benefit from an end-of-life legislation without contributing to the cost of the scheme. One obvious measure would be a legislation that says that only panels from participating manufacturers can be sold in Australia. Because such restriction may be in conflict with national competition and consumer rules or international general trade agreements, legal accreditations of such measures from related government bodies and regulators may be necessary.

Market forces can also be exploited to control free riders by involving retailers. As all products are designed with a consumer choice in mind, the product must attract consumers. Products that can only be legally disposed of at the cost of the consumer, as their manufacturers do not participate in a product stewardship scheme, may not attract much consumer attention. Thus, consumer engagement in end-oflife legislation schemes is essential to close the loop. Legislation needs to require that retailers of panels must provide consumers with information about manufacturer’s participation in end-of-life schemes and potential costs for the consumer in case the consumer chooses panels from not participating manufacturers.