Quality air is CRITICAL TO COMPRESSION

CEO: John Murphy

COO: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Adam McCleery

Ph: (03) 9690 8766

adam.mccleery@primecreative.com.au

Art Director: Michelle Weston

michelle.weston@primecreative.com.au

Sales/Advertising: Joanne Davies

Ph: 0434 785 611

joanne.davies@primecreative.com.au

Production Coordinator:

Salma Kennedy

Ph: (03) 9690 8766

salma.kennedy@primecreative.com.au

Subscriptions AUS NZ O/S

1 year subscription 99 109 119

2 year subscription 189 199 209

For subscriptions enquiries please email subscriptions@primecreative.com.au

The backbone of F&B manufacturing

TCopyright

Food & Beverage Industry News is owned by Prime Creative Media and published by John Murphy. All material in Food & Beverage Industry News is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in Food & Beverage Industry News are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

© Copyright Prime Creative Media, 2023

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Cover

Image: CAPS

Head Office

379 Docklands Drive

Docklands VIC 3008

Ph: +61 3 9690 8766

enquiries@primecreative.com.au

http://www.primecreative.com.au

Sydney Office

Suite 11.01, 201 Miller St, North Sydney, NSW 2060

Printed by: Manark Printing

28 Dingley Ave Dandenong VIC 3175

Ph: (03) 9794 8337

Editor: Adam McCleery

he journey for any food or beverage manufacturer begins with the right facility design and layout.

By successfully achieving this, a manufacturer can optimise flow and dramatically improve productivity by strategically arranging production lines, storage areas, and packaging stations.

Equally important are machinery solutions that facilitate improved food processing. From mixers and fryers to automated filling and packaging lines, the right equipment ensures food products are prepared and packaged correctly, minimising human error and upholding product integrity.

Labelling machines also play a vital role, ensuring accurate representation of ingredients and compliance with nutritional guidelines, which has become increasingly important as consumer demands around these points continues to evolve.

Meanwhile, automation is transforming production processes several industries, including food and beverage.

By integrating automated systems, manufacturers can achieve improved consistency and output while quality control systems equipped with sensors can detect deviations in real-time, allowing for timely adjustments and minimising waste, an essential feature in today’s efficiency and sustainability focused world.

With all of this in mind, it is easy to recognise that the reliability of machinery and facility solutions cannot be overstated.

But it’s not just about production output. Implementing preventive maintenance schedules is another crucial aspect when it comes to reducing downtime and extending the lifespan of equipment.

Meanwhile, in an industry increasingly reliant on technology, predictive analytics powered by IoT and machine learning have demonstrated the ability to forecast equipment failures, allowing manufacturers to address issues before they impact production.

Then there’s solutions centred on improved sustainability.

Modern machinery often includes energyefficient features that lower operational costs while

simultaneously reducing environmental impact. Furthermore, equipment designed for effective waste management is essential for complying with increasingly stringent environmental regulations.

Safety and compliance with regulatory standards are paramount in food manufacturing. Facilities and machinery must align with guidelines set by organisations like the FDA and USDA, ensuring rigorous sanitation and hygiene protocols.

Additionally, worker safety remains a priority; features like emergency stops and safety guards on machinery protect employees in a demanding manufacturing environment.

Technology continues to revolutionise the sector with Enterprise Resource Planning (ERP) systems becoming increasingly popular, from inventory management to production scheduling, all designed to enhance overall operational efficiency.

Traceability solutions, such as 2D Barcodes, are another innovation that has helped strengthen the supply chain, which has proven crucial for quality assurance and effective recall procedures moving forward.

Finally, the human element cannot be overlooked. Ongoing training and skill development for operators ensure that the workforce is equipped to handle the latest machinery and maintain high quality standards.

This investment in people is what ultimately drives innovation and competitiveness.

This interplay between facility design and machinery solutions is vital for the food and beverage manufacturing sector.

As technology evolves and regulatory landscapes shift, manufacturers must adapt to maintain their edge. The commitment to efficiency, quality, safety, and sustainability will determine who thrives in this competitive industry.

And as we delve into those themes in this issue, we invite you to explore the innovations and strategies that are helping shape the future of food and beverage manufacturing.

Until next month, happy reading.

16 MEET THE MANUFACTURER

Frenchies Brewery has adapted to the Australian market, creating a unique blend of two esteemed brewing cultures.

20 AIR COMPRESSION

Optimised air compression systems, like those from CAPS, play a vital role in the success of food and beverage manufacturers.

22 PACKAGING

Krones and PureCycle Technologies are working together to transform polypropylene recycling.

24 AUTOMATION

Automation in manufacturing offers many benefits, as demonstrated by Lumix’s solutions.

26 DIGITAL SOLUTIONS

Neogen Analytics is helping transform how food and beverage manufacturers manage and interpret data.

28 TRACEABILITY

GS1 helps manufacturers adopt 2D barcode technology to improve transparency and enhance consumer engagement.

30 COLD CHAIN

WestCool Transport offers reliable, high-quality refrigerated transport services with the support of Scully RSV.

32 INGREDIENTS

Biospringer by Lesaffre was the first company to manufacture yeast extract for commercial purposes back in 1958.

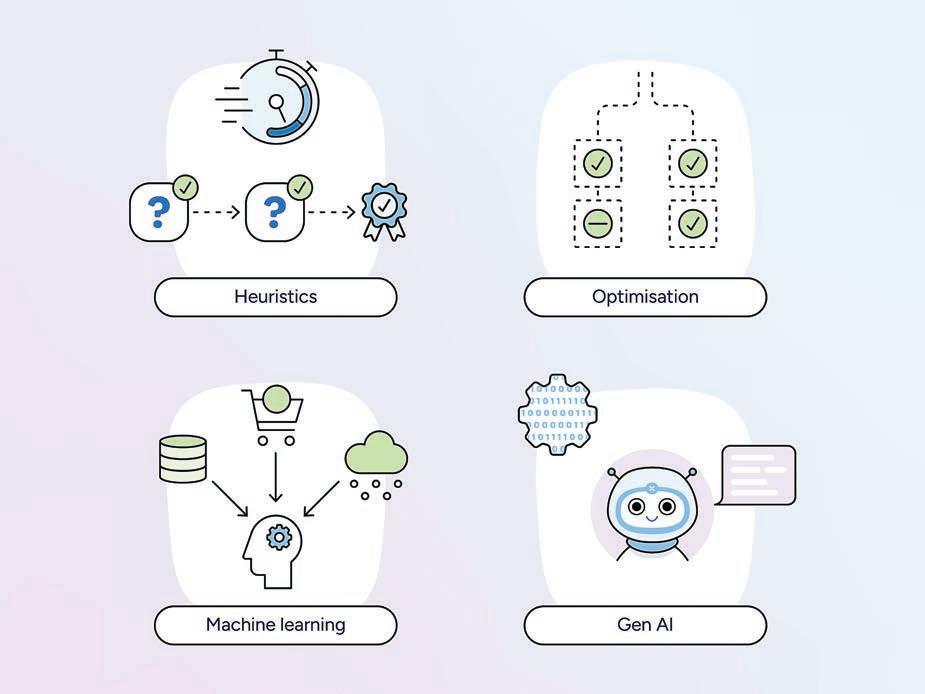

34 DIGITALISATION

RELEX Solutions is helping the industry capitalise on the rise of Artificial Intelligence and Machine Learning technology.

38 MEGATRANS

A wrap up and review of this year’s MEGATRANS expo from the heart of Melbourne.

40 GOVERNMENT INVESTMENT

Government investment continues to help enhance the Australian food manufacturing sector’s global competitiveness.

42 CIRCULAR ECONOMY

Chemists at the University of New South Wales have developed a new battery component that utilises food-based acids.

44 SOFT PLASTICS SCHEME

The Queensland Government has committed to launching a new pilot program for soft plastics recycling inside the state.

46 FOOD SCIENCE

The University of Queensland has created new tissue-culture technology specifically for the improved production of avocados.

48 CROP OUTLOOK

The Australian agriculture sector’s gross value of agricultural production is expected to rise over the coming year.

50 PRODUCTS

Celebrating four decades of OrgraN

As OrgraN celebrates its 40th anniversary, the business reflects on a journey marked by innovation, resilience, and a steadfast commitment to health and wellness.

As one of the first companies to innovate and produce gluten free products, the OrgraN brand has continued to be recognised by consumers across the world.

Since its inception, OrgraN has grown from a small retail store in Victoria, into a globally recognised allergen-free food producer, with its products now reaching over 70 countries.

This milestone is not just a celebration of years but a testament to OrgraN’s enduring impact on families and individuals around the world who rely on safe, nutritious, and delicious food options.

OrgraN was founded with a clear mission: to create food products that cater to the growing need for allergenfree options. In the early years, from

1985 to 1990, OrgraN’s rapid growth saw the company relocate five times in just five years as they revolutionised the market with their allergen free products.

Each move represented a step closer to fulfilling its mission, driven by a passion to ensure that those with dietary restrictions could still enjoy delicious and wholesome meals.

Today, OrgraN’s product range includes over 100 products, from breakfast cereals to crispbreads, pasta, and flour. Max Buontempo, the managing director of the business, adds that OrgraN offers safe and healthy solutions for every meal.

“This mission is more than just a statement, it’s a guiding principle that influences every aspect of the company’s operations. Roma’s values-led approach is evident in its commitment to its people, the health and wellness of the community, and a deep pride in its heritage, which spans more than seven decades,” said Buontempo. innovate, introducing new product lines its consumers,” F

Nissin Foods acquires Australian frozen food manufacturer

Nissin Foods has signed a Share Sale and Purchase Agreement to acquire the Australian frozen food manufacturer.

The company, ABC Pastry, is based in Sydney and manufacturers frozen dumplings, offering both its own and third-party branded products.

The acquisition is valued at AU$33.7 million, and upon completion ABC Pastry will become a wholly owned subsidiary of Nissin Foods, focusing on the frozen food market and serving retailers across Australia.

Nissin Foods anticipates that its expertise as a publicly listed company will enhance ABC Pastry’s operational and financial management, supporting its long-term growth and diversifying Nissin Foods’ business portfolio.

This acquisition is seen as a strategic move for Nissin Foods to enter the expanding Australian frozen food market.

Demand for frozen dumplings is increasing, driven by rising Asian migration to Australia and a growing

Food Group

OrgraN has grown from a small retail store in Victoria into a globally recognised allergen-free food producer.

The Nissin

expects opportunities for growth in the premium frozen food sector in Australia.

Reduce salt while improving taste of your formulations thanks to Biospringer’s fermentation-based ingredients

Your main challenges:

Reducing salt

Improving taste naturally

Selecting clean label ingredients

Our ingredients benefits:

Springer® Umami is a range of fermentation-based ingredients labeled as “yeast extract” in Australia. Yeast extract is a versatile ingredient that enables food formulators to reduce salt and sodium levels by up to 30%, while improving the taste of the final product, thanks to its naturally occurring umami.

Biospringer by Lesaffre’s guarantees

Multipe sourcing

We have 10 manufacturing sites worldwide*

Sustainable ingredient

Our ingredient is coming from fermentation, a natural process used for centuries Visit our website to learn more www.apac.biospringer.com

Lead time

Be delivered quickly and on time, thanks to our multiple factories

Product quality

French product quality and consistency

Global brewer continues to invest in Australian market

The name and design for the $1.8 million upgrade of the James Boag’s Brewery visitor centre has been revealed, with the iconic visitor attraction to be relaunched as the Boags Brewhouse.

The Boags Brewhouse will serve as the new home for Tasmania’s beloved James Boag’s Brewery brand and its products, becoming a key tourism destination for both locals and visitors.

The development will honour the heritage of the existing building while introducing a new brewhouse hall, tasting area, and a redesigned beer garden. A relocated Boag’s museum will also be featured, highlighting the iconic brand’s 143-year history.

Inside, the Boags Brewhouse will incorporate Tasmanian timber throughout, from the bar to the ceiling. The walls will display approximately 1,000 limited-edition beer cans and bottles, alongside memorabilia spanning

Local distiller takes home highest honour at IWSC awards

Naught Gin has made history by winning the IWSC Classic Gin Trophy at the renowned International Wine & Spirit Competition (IWSC), the oldest spirits competition worldwide.

Earlier this year, Naught’s Overproof Gin earned a gold medal at the IWSC and since progressed to trump other classic gins from around the globe to secure the IWSC Classic Gin Trophy.

This achievement follows a series of gold medals for Naught in 2024 at major international spirits competitions, spanning the San Francisco Spirits Competition, Global Gin Masters, Singapore World Spirits Competition, and the Australian Distilled Spirits Awards.

With this latest win, Naught Gin has cemented its reputation as one of Australia’s, and the world’s,

Your Confidence in the Future

Mixer grinder

Coca-Cola Europacific Partners (CCEP) Australia has announced its founding membership of the Empowered Women in Trades (EWIT) Alliance.

EWIT is a not-for-profit organisation focused on increasing women’s participation in the Australian manufacturing, construction, and renewable energy sectors.

Its goal is to raise the percentage of women in skilled trades from 3 per cent to 30 per cent by 2030. The alliance was created to enable organisations of all sizes to support EWIT’s objectives.

Alliance members will participate in initiatives aimed at promoting skilled trades to women and girls, including tool skills days, talent attraction programs, school outreach, and participation in expos, conferences, and advocacy efforts.

CCEP Quality Assurance team

CCEP becomes founding member of women in industry alliance SPC and The Original Juice Company merge

Two iconic Australian businesses are merging, together with the powdered milk business of a third Australian founded business, Nature One Dairy.

The Original Juice Company will acquire SPC Global, and the powdered milk business owned by Nature One Dairy via a binding Merger Implementation Deed and Share Sale Agreements subject to several conditions including approval by the Original Juice Co. shareholders in November 2024.

The Original Juice Company intends to issue 133 million shares to the shareholders of SPC as consideration for the Transaction. Concurrently with the acquisition of SPC, OJC intends to issue up to 29 million shares and pay cash of up to $6 million to the shareholders of Nature One Dairy.

On completion of the Transaction, OJC, SPC and NOD shareholders are expected to hold 15.5 per cent, 69.2 per cent and 15.3 per cent of the Combined Business respectively. The Combined Business is expected to deliver more than

member, Bolor Erdenekhuu, is an example of the successful work being undertaken by EWIT to promote the benefits of a skilled trade to women.

“I am a tangible example of how programs like EWIT can effectively support women entering skilled trades,” she said.

“EWIT not only provide technical skills but also build confidence and open pathways for women in industries where they are traditionally underrepresented.

“Programs like EWIT not only benefit individual participants but help businesses address skills shortages and improve workforce diversity.”

A key pillar of CCEP’s ‘This is Forward’ global sustainability action plan is to champion inclusion, challenge inequality and support economic mobility.

Focus areas include enhancing the company’s gender diversity and fostering the growth of emerging female talent.

Focus areas include enhancing the

company’s gender diversity and fostering the growth of emerging female talent as it strives to meet its 2030 goals of having

one-third of its workforce be women and 45 per cent of management positions held by women. F

$400 million of revenues and more than

$29 million of EBITDA in FY25.

Former Asahi Beverages Group CEO and current SPC director, Robert Iervasi has been appointed the managing

director of the merged business, which will own and operate three business divisions, namely SPC, The Original Juice Co. and Nature One Dairy. Together the businesses create a

substantial Australian based and owned global food and beverage companies that will continue to support Australian producers and execute on a global growth strategy. F

Concrete consisting of coffee grounds makes its debut

Major Road Projects Victoria (MRPV) and BildGroup are using concrete mixed with biochar from spent coffee grounds as a partial substitute for river sand in the Pakenham Roads Upgrade.

Organic waste like spent coffee grounds contributes 3 per cent of greenhouse gas emissions and can’t be directly added to concrete due to decomposition risks.

Instead, the grounds are converted into biochar.

Australia generates 75 million kilograms of coffee waste annually, which could replace 655 million kilograms of sand, while globally, 10 billion kilograms could replace 90 billion kilograms.

For this project, five tonnes of coffee grounds (about 140,000 coffees) were converted into two ton of biochar, laid in a 30-cubic-metre footpath.

This initiative is part of broader

circular economy efforts, including reusing soil and using foam bitumen and rubber tyre road barriers. MRPV’s Brendan Pauwels highlighted the ecological benefits and cost-cutting potential of coffee concrete.

RMIT’s Dr. Rajeev Roychand emphasised the importance of diverting organic waste from landfills.

BildGroup’s CEO, Stephen Hill, noted that this project diverted 140,000 coffees from landfill and saved over three ton of sand. RMIT previously conducted a trial in Gisborne, Victoria, showing coffee concrete’s potential to be 30 per cent stronger by using low-energy biochar production.

RMIT is now seeking commercialisation partners in construction and agriculture to further develop biochar products, with support from various organisations and local Indigenous coffee suppliers. F

RMIT’s Dr. Rajeev Roychand emphasised the importance of diverting organic waste from landfills.

Image:

Carelle

Mulawa-Richards, RMIT University

ACCC receives boost in funding

The ACCC has welcomed the announcement of $30 million in additional funding over three and a half years for investigations and enforcement relating to the supermarket and retail sector.

ACCC Chair Cass-Gottlieb said the added resources would greatly strengthen the ACCC’s enforcement and compliance efforts in a crucial sector that millions of Australian consumers depend on.

“Active, evidence-based enforcement of the Competition and Consumer Act is core to the ACCC’s work, and is essential for deterring conduct that harms consumers, competition and fair trading, and by extension productivity and the wider economy,” said Cass-Gottlieb.

“The ACCC’s work has always reflected the current issues impacting the Australian economy, consumers and businesses – informed by evidence, information and intelligence from a range of sources.

“This includes reports to our Infocentre and social media, engagement with consumer stakeholders and other government departments and regulators, as well as pro-active surveillance.

“This funding will enable us to escalate a range of investigations in this sector, including in relation to potential

misleading pricing claims or practices, claims about delivery timeframes and costs including for regional and remote Australians, and businesses misrepresenting consumers’ rights under the Australian Consumer Law.”

Each year in February and March,

the ACCC outlines its compliance and enforcement priorities.

This year, those priorities include addressing competition, consumer issues, fair trading, and pricing concerns in the supermarket sector, particularly focusing on food and groceries. While

New appointments to Coopers Foundation Board

Aformer South Australian Premier and a sixth-generation family member have been appointed to the Board of the Coopers Foundation.

Steven Marshall and Bec Cooper have joined the Board of Governors of the charitable foundation established in 2006 by Coopers Brewery and the Cooper family.

Marshall served as the 46th Premier of South Australia from 2018 to 2022.

After 14 years of dedicated service, he left Parliament in February 2024. A recipient of the Centenary of Federation Medal in 2001 for his services to the disability sector, Marshall is also Chair

of the Australian Advisory Council for MITRE.

Bec Cooper has worked in the advertising and fashion industries, and currently operates a veterinary practice for racehorses which she co-founded.

The daughter of Coopers Foundation chair Mel Cooper, Cooper has worked at the Brewery in various casual roles and supported the Foundation over the past 10 years.

“Steven and Bec both have a strong commitment to community service in line with the Foundation’s aim to improve the quality of lives of Australians in need,” said Mel.

“Throughout his whole career, and

The ACCC has welcomed the Federal Government’s additional funding which is designed to support investigations and enforcement in the supermarket sector.

the ACCC is already actively pursuing these issues, the additional funding will enable it to identify, advance, and expedite further matters.

The funding will add approximately $8.5m each year for the next 3 and a half years from January 1, 2025. F

most notably during his time as Premier and a member of Parliament, Steven has given tireless service to the community. Steven also comes from a family business background and shares the high value our family places on philanthropy.

“Bec is the first of the sixth generation of the Cooper family to join the Foundation Board. Bec has been actively involved with the Foundation’s fundraising work for over a decade and I’m delighted to see the next generation continuing the family’s charitable work.”

The total amount of funds it has donated is now more than $7.8 million, with 260 charities having received financial support since its inception. F

Image: Coopers Foundation

Bec Cooper is the first of the sixth generation of the Cooper family to join the Foundation Board.

Fonterra release revised strategy to grow value

Fonterra Co-operative Group Ltd has released its revised strategy, which will see the Co-op deepen its focus on its high-performing Ingredients and Foodservice businesses to grow value for farmer shareholders and unit holders.

This follows a strategic review that confirmed the Co-op’s strengths as a B2B dairy nutrition provider, resulting in Fonterra’s decision to explore divestment options for its global Consumer businesses.

Chairman Peter McBride says the revised strategy creates a pathway to greater value creation, allowing the Co-op to announce enhanced financial targets and policy settings.

“Through implementation of our strategy, we can grow returns to our owners while continuing to invest in the Co-op, maintaining the financial discipline and strong balance sheet we’ve worked hard to build over recent years,” said McBride.

“We have increased our target average return on capital to 10-12 per cent, up from 9-10 per cent, and announced a new dividend policy of 60-80 per cent of earnings, up from 40-60 per cent. At all times, we remain committed to maintaining the maximum sustainable Farmgate Milk Price.”

Looking out to the next decade and beyond, Fonterra has made six strategic choices.

The first is to deliver the strongest farmer offering by working alongside farmers to enable on-farm profitability and productivity and support the strongest payout.

Fonterra are also aiming to deepen Fonterra’s position as a world-leading provider of sophisticated dairy ingredients and build trading capability to grow both the Farmgate Milk Price and earnings.

The company wishes to keen up its momentum in Foodservice by expanding its successful Foodservice business in China and other key markets to grow earnings.

Investing in operations for the future is also massive for Fonterra.

The co-op will invest in an efficient manufacturing and supply chain network that allows flexibility to allocate milk to the highest returning product and sales channel.

Fonterra is also prioritising sustainability by further improving the Co-op’s sustainability credentials and strengthen partnerships with customers who value this position.

The co-op will also prioritise using science and technology to solve the Co-op’s challenges and build on competitive advantages. F

Fonterra has made six strategic choices including working alongside farmers to enable on-farm profitability.

& Beverage Industry News, 150 x 195 mm, Packaging,

Perfectly integrated packaging solutions

Reliability, efficiency and optimised resource consumption: Krones’ innovative filling and packaging concepts are perfectly tailored to your particular needs – for glass bottles, PET containers or cans.

The Federal Government has appointed five new directors to help Wine Australia in research, development, and extension, covering issues of national importance for the local wine industry.

These new director appointments work to ensure compliance with Wine Australia’s regulatory functions by investing in research and development, building markets, and disseminating market information and knowledge.

Minister for Agriculture, Fisheries and Forestry, Julie Collins, announced the directors who she said were qualified and possess a wealth of skills, expertise, and board experience.

“They will help foster and encourage profitable, resilient and sustainable Australian winegrape and wine businesses,” said Collins.

“Wine Australia is well positioned

New directors appointed to Wine Australia board Report reveals how AUS red meat stacks up globally

MLA has released the 2024 State of the Industry Report on the economic importance of the Australian red meat sector and how it stacks up against our global counterparts.

Entering 2023, the red meat sector was on the tail end of three years of rebuilding.

The sector shifted during the year, driven by worsening conditions and poor seasonal outlooks, which impacted confidence.

Peak production and slaughter numbers started moving through the supply chain, driving prices down to long-term lows. Despite the ease in prices, industry remained resilient in the face of this instability due to strong demand across a diversifying export market and strength in the processing sector. Industry turnover remained above levels from five years ago, totalling $81.7 billion, though it was 2 per cent below the previous year.

to continue supporting a competitive wine sector, growing domestic and international markets and protecting the reputation of Australian wine, thanks in great measure to the contributions of the outgoing board members.”

All newly appointed, the following directors will serve a three-year term from 1 October 2024.

• A ngeline Achariya, Victoria

• Roslyn Baker, Queensland

• A ndrew Kay, South Australia

• E lizabeth Riley, New South Wales

• Peta Slack-Smith, Victoria.

The appointments join Wine Australia’s incumbent chair, Dr Michele Allan AO.

They replace the outgoing board of Catherine Oates, Catherine Cooper, Frances-Anne Keeler, Mitchell Taylor, Justine Brown and John Lloyd.

The Government’s $3.5 million Grape and Wine Sector LongTerm Viability Package includes an independent impact analysis led by Dr Craig Emerson.

This package concerns fair trading, competitive relationships, contracting practices and risk allocation in the sector. Public consultation for the analysis is now open. F

Most of this turnover came from three states: NSW (28 per cent), Victoria (24 per cent) and Queensland (22 per cent), with WA (14 per cent), SA (8 per cent), Tasmania (3 per cent), and the NT (1 per cent) rounding out the remaining.

Over 400,000 people were employed through the sector, lifting last year alongside 76,999 red meat businesses, also up 3.2 per cent on the previous year, indicating strength in the industry.

The value of red meat and livestock exports rose 3 per cent to $18.2 billion in 2022–23.

In 2023, Australia was the secondlargest beef exporter and the world’s largest sheep meat and goat meat exporter.

Volumes of Australian beef and veal exports lifted 27 per cent on 2022 totals.

Sheep meat exports were up 15 per cent, creating the highest export figure on record, while goat meat exports lifted an impressive 55 per cent.

The United States and China were

Industry turnover remained above levels from five years ago, totalling $81.7 billion.

markets that supported exports during this period of high supply.

Goat meat exports totalled 33,904 tonnes shipped weight in 2023, up

55 per cent on the year prior. The US remains the largest destination for goat meat, accounting for 42 per cent of exports or 14,477 tonnes in 2023. F

The new appointments join Wine Australia’s incumbent chair, Dr Michele Allan AO.

Ken Whittingham and Mark Robinson of Fort Restructuring have secured the sale of pioneering plant-based food producer Fenn Foods’ major assets, days after the Sunshine Coast company entered liquidation.

Gold Coast-based Smart Foods have entered an agreement to purchase plant and equipment, stock, vEEF and LOVE BUDS brand names, registered IPs, and other intellectual property related to the producer of meat-free alternatives.

“As one of the largest suppliers of plant-based and meat free products to major supermarkets in Australia, there was a very real risk that consumers could have faced product shortages,” said Whittingham.

“This combined with the fact we are dealing with stocks of perishable goods

Queensland food producer’s assets saved from liquidation Coles opens second automated customer fulfilment centre

Coles has opened its second Customer Fulfilment Centre (CFC) in New South Wales.

It’s the second of two CFCs to launch this year as part of a $400 million partnership with global leader in online grocery transformation, Ocado, with the first CFC opening in Truganina, Victoria last month.

The CFC will house a range of specialty brands and local foods from smaller suppliers like the Byron Bay Peanut Butter Company, who first started selling their product at local Byron Bay markets.

The extended product ranges also span the health and dietary, vitamin and baby categories.

meant that we needed to move quickly to ensure the best possible outcome –with this transaction being completed within seven days of our appointment as liquidators, after discussions with several potential buyers.”

The asset sale, for an undisclosed amount, is also expected to see up to half of Fenn’s 32 employees offered new roles with Smart Foods and continued production at a state-of-the-art Sunshine Coast facility.

Liquidators are also working towards secured creditors and employee entitlements being paid out of remaining company assets with Fenn Foods Pty Ltd, ceasing to operate as an entity.

Fenn Foods was founded in 2015 and merged with a competitor in 2023, with its vEEF and LOVE BUDS brands stocked by Woolworths and Coles.

The asset sale will see up to half of Fenn’s employees offers new roles within Smart Foods.

The new Coles automated fulfilment centre will also employ more than 1,000 team members.

Customers will also have the choice of extended delivery windows from 5am to 10pm, with later cut-offs for both next day deliveries in the morning and evening. The Ocado technology utilises artificial intelligence (AI), robotics and automation to transform the way Coles Online orders are picked, packed and delivered.

The Wetherill Park site has a footprint of more than 87,000 square metres – four times the size of the Sydney Cricket Ground – and can hold three million units of stock while having

the ability to process more than 10,000 customer orders per day when running at full capacity.

The site features a centralised hub, known as ‘The Hive’, where a fleet of more than 700 bots will fulfil a

customer order containing 50 items in just five minutes, while an AI ‘air traffic’ control system will oversee the bots as they move around 3D grids, transporting containers of grocery items to be packed and delivered. F

Founded by Michelin star chef Alejandro Cancino, the company had invested

heavily in research, product development and manufacturing facilities. F

Where Australian beer meets European craftsmanship

In its seventh year, Frenchies Brewery has adapted to the Australian market to thrive as an establishment that unites the best of two renowned brewing cultures. Jack Lloyd Writes.

Frenchies Brewery co-founders, Vincent De Soyres and Thomas Cauquil, were destined to take French flavours abroad from the moment they met at catering school in 2005.

“I was honing my skills as a brewer and Thomas was training to be a chef. We quickly became good friends,” said De Soyres.

When they two weren’t studying, they were soaking in culture, inspiration and knowledge from travels around Europe.

One of their more outlandish expeditions took them to the volcanoes of far east Siberia, where the duo’s mission to launch an authentically French brewery first began.

“It’s this very spot where we came up with the concept of launching our own brewery, where I would oversee the beers, and Thomas the food,” said De Soyres.

A s plans progressed and ideas turned into possibilities, the pair moved to Australia where they would search for an ideal gap in Sydney’s brewing market.

After much deliberation, De Soyres and Cauquil noticed that most breweries were heavily reliant on food trucks for food options. This would motivate the pair to focus on providing the finest French beer and food styles in one venue.

“ We wanted to differentiate ourselves by being the brewery who offers the best food in Australia.

Thomas comes from a Michelin star background, so it is extremely good quality food,” said De Soyres.

After struggling to find a space that

could accommodate their ambitious ideas, they eventually found The Cannery.

De Soyres said the Rosebery industrial complex turned shopping centre was too perfect to turn down. It had the correct zoning, great foot traffic and a sizeable loading dock.

“I remember saying, it’s got everything, let’s give it a crack,” said De Soyres.

T he Cannery has been home to Frenchies Brewery since it launched in 2017. Now in its seventh year, the brewery experienced growth to the point where Frenchies now has its own bakery.

Ushering in a new generation of brewing

After more than half a decade entrenched in brewing production and processes, De Soyres now finds himself with different responsibilities.

“A lot of my days consist of managing brewing contracts and maintaining relationships with hop and malt partners and canning companies,” he said.

While still involved with the recipes, ingredients, and delivery timelines, De Soyres has handed the reins to now Head Brewer, Sam McDonough.

“He’s got heaps of experience and different techniques. He looks after the day-to-day process in the brewery,” said De Soyres.

Having avoided any transitional pains, Frenchies Brewery’s production system is operating at full capacity.

McDonough and his team stand to benefit from numerous systems that help the brewery excel in quantity and quality.

Frenchies Brewery was founded to provide the finest French beer and food styles all in one venue.

Images: Frenchies Brewery

Among the systems is a massive three vessel brewhouse, which ensures that product supply meets demand.

“It allows us to make 6000 litres of beer a day. It’s a super vessel,” said De Soyres.

A longside capacity, Frenchies’ European flair shines through. Instead of jacketed steam-based systems typical of Australian breweries, Frenchies use tanks that are heated using direct fire.

“The direct flame heats up the bottom and the sides of the tank. That creates a bit of caramelisation. It’s very typical of French brew houses,” said De Soyres.

“ We don’t need as much caramel to get a sweet note in the beer.”

Frenchies’ European heritage is further represented in its Horizontal Bright Beer Tanks that offer gentle and efficient clarification.

“Horizontal Tanks are typically European. In France, Belgium, and Germany, maturation tanks are quite shallow but very long,” said De Soyres.

“They allow us to clarify the beer a bit faster, without having to go through the centrifuge.

“For typical tanks, it takes days for a little particle of protein or yeast to go from the top of the tank to the bottom. Whereas our particles have to just fall from one metre.”

Frenchies utilises lenticular filters for the safety and efficiency benefits they offer.

“ These are very specific to us, because it’s not a centrifuge, it’s not a platen frame filter,” said De Soyres.

“It’s completely enclosed under pressure. You have a gentle filtration so you can be very precise on what you want to remove and what you want to keep in the beer.

“That is how we managed to get our lagers crystal clear.”

Unlike other breweries who outsource yeast, Frenchies owns a yeast propagator that allows it to grow yeast, which helps cut costs.

“They’re small tanks where we can grow our own yeast and use specific yeast strains that you can’t find easily on the market. They are very high quality and very expensive,” said De Soyres.

“Belgium and France are quite yeast driven. When transforming the sugar into alcohol, the yeast produces those very particular flavours.”

Adapting to market dynamics and overcoming financial pressures

De Soyres said equally important to these processes is identifying and staying ahead of market trends and financial dynamics. Since Frenchies’ inception in 2017, the industry has been unstable due to factors such as the pandemic and the cost-of-living going up.

Despite Frenchies’ evident European influence, this uncertainty meant the brewery had no choice but to experiment and adapt to a market that is looking to avoid expense.

“With the cost of living, what people and pubs are after is cheaper beer,” said De Soyres.

To cut these expenses, Frenchies

To hit market successfully, Frenchies began to develop affordable Australian lagers with Frenchies Mid and Frenchies Dry.

All vessels have automated temperature control

• 3000L x 3 vessel Brewhouse

• Direct Fire Kettle

• 5 x 2600L CCV fermenters

• 3 x 2800L CCV fermenters

• 3 x 6000L CCV fermenters

• 3 x 2800L Horizontal BBT (Bright Beer Tanks)

• 2 x 750L Horizontal BBT / serving tank

• 2 x 6000L Horizontal BBT

• 2 x 200L automated yeast propagators

• Pilot batch system: 200L

• Triple Lenticular Filtration Plant

• ECC Codi counter pressure canning line

• 3 Head Keg Cleaner

• 2 x 4 head keg racking bench

• 2 x CIP cart

• 1.5 inch and 2-inch hoses

Co-founder Vincent De Soyres is now focused on managing brewing contracts and maintaining relationships with clients and customers.

Frenchies Equipment Snapshot

began to develop affordable Australian lagers.

“We have done two new beers. Frenchies Dry, and Frenchies Mid. These taste like the typical Australian beer,” said De Soyres.

“You’re getting all that Australian lager flavour, yet it’s much cheaper to produce and sell. Pubs buy their kegs from big brewers for $300 to $400. We can sell all kegs for way cheaper than this to them.

“There’s not much that goes into these beers, and that’s what the market wants.”

Despite its growth beyond an exclusively European offering, Frenchies still maintains a distinctive French touch.

“Being a French restaurant that makes French food with French beers, we were trying to be unique to ourselves. It took us a while to realise that people want cheaper beers,” said De Soyres.

“However, we still have our products still have the French touch from our equipment and brewing processes.”

After beginning to experiment with other styles of beer, De Soyres was led down an entirely different path of revenue. This is where Frenchies would introduce contract brewing.

Upon researching the concept, De Soyres realised contract brewing was a major source of income for most large breweries.

“All the established breweries do contract brewing. If you go to Heineken, they have many different brands, and they also brew for other brands,” said De Soyres.

“Obviously you can’t have breweries everywhere. That’s why there’s an actual demand for this. We have the expertise in brewing, so we thought, this can pay the bills.”

Flash forward to 2024, and Frenchies finds itself producing kegs and cans of beers, cocktails, sparkling waters, seltzers and functional drinks for startups, brands and large companies.

“We can help people go from the very start of the idea all the way to commercialisation. This helps us with the daunting economy,” said De Soyres.

Utilising software to streamline operations

Behind the production process is the reliance on various softwares that ensure consistency. De Soyres said that a huge help in maintaining process structure is a brewery management software.

“You can follow who’s doing what in the brewery. You can see who added

what hops at what time, at what year, at what temperature, at what gravity,” he said.

To ensure recipes remain correct, De Soyres utilises another software system that is aimed at the brewing sector specifically.

“That’s where we do all our recipes and measure our efficiencies. There are heaps more relevant metrics that we manage and follow,” said De Soyres.

Pioneering a circular economy

As well as ensuring equipment, processes and quality control systems are in check, Frenchies has started doing its part in an industry-wide sustainability shift.

De Soyres said that every week Frenchies donates a few tonnes of spent excess grain to a local farmer to feed cattle and pigs.

“Every time we do a batch, you’ve got about half a ton of spent grain. We take all the sugar out of the grain, and we give them the grains with all the proteins,” he said.

Beyond this, the brewery ensures that leftover bread from Frenchies Bakery does not go to waste. The team extracts all complex sugar from the bread to incorporate into their brewing process.

“ We use the leftover bread that hasn’t been sold at the bakery and cut it, dry it, and then put it into a mash to extract all the complex sugars out of it,” said De Soyres.

“Bread is pretty much solid beer. It’s made from the same ingredients, so it’s easy for us to reuse those.”

Frenchies has a three vessel brewhouse, which ensures that product supply meets demand.

‘The Cannery’ has been home to Frenchies Brewery since it launched in 2017.

Building community and fostering feedback

Another fundamental process to the core of Frenchies’ identity is its free bi-monthly tasting nights. De Soyres said these are run to provide insights for both the brewers and customers.

“From these sessions we get feedback on what people like, don’t like, and what they’re looking for in beer. It keeps us really in touch with the core market,” he said.

“We present all the new beers that we’ve released and talk through how we made them, what makes them special and what sort of flavour to look for.”

De Soyres said the nights are also a chance to give back to the community.

“The free tasting is our way of giving back to our customers and to thank them for following us,” he said.

Celebrating Seven Years

A recent tasting night celebrated the

seventh birthday of Frenchies. De Soyres recalled becoming emotional when he reflected on how much the brewery has grown.

“ We’ve grown steadily and continuously, through lots of hard work, stress and reward. Last year, we doubled in capacity,” he said.

“Celebrating this with our friendship family of around 60 people was great. It was emotional.”

De Soyres admitted that the anniversary is even more special when you consider for a long time, the brewery wasn’t on stable footing because of the pandemic.

“We almost didn’t make it the first year, or in the third year, and now it’s the seventh year and we’re still here. We’ve managed to keep our head above the water and to be there celebrating us was great,” he said.

“We are now striving as much as we can in this economy, compared to other

heartbreaking scenarios of some who went into administration or liquidation.”

In classic brewing fashion, Frenchies marked the milestone with a new Belgian Golden Ale. ‘The Devil’ pays homage to a classic ale, which is often cracked open in celebration.

“It is our seventh anniversary beer. We really want to pay tribute to historically, one of the best beers in the world,” said De Soyres.

“When you open a bottle of Duvel, it’s an occasion, especially in Australia. We thought for a seventh birthday that it was quite fitting.”

Expanding Operations / Future of Frenchies

Moving forward, De Soyres said Frenchies is targeting more restaurants and small bars as outlets for Frenchies’ products.

“We haven’t found any space but we’re looking at it. We have a few

customers of ours who run bars, restaurants or pubs, who also were looking at growing with us hand in hand,” he said.

With a keen eye on the market, De Soyres is focused on tapping into the carbonated drink market and further enticing Sydney bottle shops.

“From an innovation perspective I think we’re trying to keep an eye on soft drinks and carbonated drinks in general,” he said.

“We also want to keep increasing our presence in Sydney… We really want to refocus on our local customers.”

Not only is Frenchies targeting the expansion of its brewing operations, but more bakery outlets are also in the works.

“ We’re thinking perhaps opening more bakery outlets or shop fronts, because we can produce a bit more than we do at the moment,” said De Soyres. F

Delivering solutions to maintain air quality

The need for optimised air compression systems to prevent contamination on the production line is crucial for the success of food and beverage manufacturers.

Air purity is critical in food and beverage manufacturing. Optimising the operation of your air compression while maintaining protections against contamination from particles, water, and oil, across multiple facets of production is vital to quality and output.

Choosing the right solution is not only about delivering the required performance outcomes but ensuring you have the service and support available, especially when any downtime has a costly impact.

As an industry leader, CAPS Australia offers multiple ways to successfully achieve your performance outcomes. Providing compressed air and power generation solutions across Australia, CAPS has an extensive range of products and brands to provide complete air and power solutions that are suitable for local operating requirements.

Oil-free compressors

The food and beverage industry requires clean, dry compressed air to comply with safety and hygiene standards. The ideal approach to achieving and maintaining this critical air purity is to minimise the risk of contamination in the first place by using oil-free compressors.

Though they can come with a higher initial capital cost, oil-free compressors offer long-term benefits associated with less ancillary equipment and servicing, as well as a significant reduction of risk, often making them a more valuable investment.

CAPS Australia meets this requirement with its range of ISO Class 0 oil-free compressors, guaranteeing 100 per cent oil free air for industrial applications.

For larger scale applications, CAPS has a full range of oil-free centrifugal compressors as well as rotary screw compressors from 37kW to 355kW in either fixed or variable speed.

These machines are versatile

and tailor-made, so there are many factors to weigh up when choosing the right compressor. Elements such as size, speed control, continuous or intermittent usage, portability, and site operating conditions including altitude and ambient temperature, can all impact which system will suit your needs.

T he experts at CAPS can help you assess your requirements to find you the perfect match.

On a smaller scale, CAPS can offer scroll compressors in an all-in-one solution with a dryer, storage tank and compressor in a single unit, keeping the real estate of the system as compact as possible.

T his smaller footprint translates to higher efficiency, a key component when choosing the right compressed air system, particularly as energy prices continue to climb across the country.

Offered as single phase from 1.5kW – 2.2 kW or three phase from 3.7kW to 7.5kW, CAPS suggests this integrated solution as ideal for small food and beverage applications requiring oil-free air. Setups can be configured to support the industry’s vast array of end process needs.

Cost-effective solutions

Due to their lower initial costs, many manufacturers opt instead to use oil-lubricated compressors with air treatment processes downstream.

From 5kW through to a 315kW, there are many technologies and brands to choose from, meaning it can be quite challenging to evaluate different compressors and select the best technology for your system.

CAPS offers a full suite of compressed air solutions and have the expertise to help you choose the right

equipment to suit your needs.

CAPS understands that every application is unique, which is why it offers customised solutions and provides ongoing support to ensure optimal performance.

Air treatment

Air dryers are an essential to meeting the quality of air critical to food and beverage manufacturing.

Air dryers help to remove moisture from compressed air systems, decreasing the humidity and preventing bacteria from growing, as well as warding off rust and extending the life of the machine.

Desiccant air dryers are popular for industrial applications and processes that require extremely dry air, where a desiccant material such as silica gel, molecular sieve or activated alumina is housed in a container through which

Images:

CAPS Australia

CAPS Australia offers multiple ways to successfully achieve your desired air compression outcomes.

cleaned before it can be compliant with relevant standards. Filters use a variety of technologies, including coalescing and adsorption, to remove dust, oil, and other contaminants from compressed air systems. Reliable and customisable, they are available in various sizes and configurations to meet your specific needs.

T he at-scale generation of nitrogen to support operational needs is a challenge that CAPS Australia has efficient solutions for with engineered nitrogen (N2) generation systems to support on-site demands. Producing dependable and economical supplies of nitrogen, the systems allow you to generate the quantity and purity of nitrogen necessary for any application on site.

Systems designed to suit the application

CAPS delivers complete solutions, designed, developed by its in-house engineering team, and supported through its Australian ISO9001 accredited manufacturing facility. The custom-built systems are perfectly matched to clients’ requirements.

This expertise also enables CAPS,

performance and life of equipment and infrastructure.

Local knowledge and support

Founded in Western Australia in 1980, CAPS joined the Ingersoll Rand family earlier this year expanding its access to the Ingersoll Rand’s global offering of innovative and mission-critical air, fluid, energy, and medical technologies that enhance industrial productivity and efficiency.

With 10 branches nationwide, the dedicated CAPS team delivers exceptional service, expert advice, support and spare parts.

Their 24/7 maintenance and breakdown service ensures customers’ operations run smoothly.

The national footprint means CAPS has skilled teams working in the same time zones as its clients, enhancing their support to customers through the entire process - from understanding their requirements, offering suggestions, and providing advice, to ultimately delivering the solutions they need.

The support continues throughout the equipment’s operational life, with CAPS providing Ingersoll Rand

Ingersoll Rand.

Scheduled air compressor maintenance, as well as using predictive analytics, helps prevent unexpected interruptions in your production.

With more flexibility than an extended warranty, PackageCARE maximises your equipment uptime.

Rental equipment to keep you operating

CAPS can also get clients operational without big capital costs by delivering its competitively priced, turnkey rental solutions.

Keeping your operations running smoothly all year round, CAPS offers short and long-term rental of compressors and generators across Australia.

Ideal for special projects, seasonal peak demand requirements and covering any operational breakdowns, renting provides the flexibility to suit your needs.

With vast experience in renting equipment, CAPS has a large fleet of units ready for immediate dispatch from our local hubs satisfying a wide range of applications, including mining, agriculture, and industry, all while

Global technology, suited to local conditions

Utilising quality products with proven reliability, CAPS’ range of industrial equipment features worldrenowned partner brands such as Ingersoll Rand, AIRMAN, Mitsubishi Generator Series, Sauer, Next Turbo Technologies, Bollfilter and more.

This enables CAPS to provide customers with access to the best technologies in:

• rotary screw and centrifugal air compressors

• portable diesel air compressors

• power generators

• i ndustrial filtration

• a ir blowers

• g as generators (oxygen and nitrogen)

• a ir treatment equipment including custom built heavily engineered vessels

• engineered packages to suit customer’s needs and location

• parts and accessories

CAPS delivers global technology, suited to Australian conditions, backed by local service. F

To learn more, get in touch with the CAPS team on 1800 800 878 or visit www. caps.com.au.

The team at CAPS Australia understand that every application is unique, which is why the company offers customised air compression solutions.

Closing the loop on polypropylene

Krones and PureCycle Technologies aim to overhaul polypropylene recycling through advanced technologies to enhance production efficiency and sustainability.

Originally a mechanical engineering firm, Krones has expanded its solution offerings to include bottling lines, packaging machines, and digital solutions. However, the company’s diversification doesn’t stop there.

K rones also offers a range of innovative technologies that are designed to enhance production efficiency and sustainability, especially for food and beverage manufacturers.

As the industry evolves, Krones continues to focus on meeting the changing demands of consumers and manufacturers alike, positioning itself at the forefront of modern beverage production.

That’s why Krones partnered with PureCycle Technologies, known for its patented process of purifying polypropylene waste into high-quality recycled resin, to advance the recycling of polypropylene and ‘close the loop’.

PureCycle Technologies’ innovative approach utilises a unique solvent-based method that separates and purifies polypropylene from contaminants and other plastics.

This process not only enhances the quality of the recycled material but also ensures that it meets the rigorous standards required for various applications, from automotive components to consumer goods.

Polypropylene is a plastic that poses environmental challenges due to its low recycling rates.

These challenges include:

• non-biodegradability;

• m icroplastics;

• resource-intensive production;

• chemical pollution;

• end-of-life challenges; and

• ecosystem disruption.

Addressing these challenges requires improved recycling infrastructure, development of biodegradable alternatives, and greater public awareness of responsible plastic use.

This collaboration aims to develop innovative solutions for the recycling and repurposing of polypropylene waste.

Using the proprietary process to create ‘ultra-pure’ recycled resin from used polypropylene plastics, PureCycle is

Automation in the face of labour shortages

The benefits of automation in food and beverage manufacturing are numerous, including the ability to mitigate risks associated with labour shortages.

Post COVID, industries have had to face and deal with the issue of staff shortages, none greater than the meat and food manufacturing industry

This had led to industry looking to automation solutions to combine the lack of skilled labour and staff shortages to keep up with domestic consumer demand.

A key player in this field, LUMIX Procut, specialises in providing automation systems designed to meet the needs of food and beverage manufacturers, and to en-sure products move smoothly down the line without delays.

The company offers a range of solutions through its various distribution partnerships, which enhance production process, including automatic skewering and filleting machines, and process automation in cutting, mixing and packaging steps.

This focus on automation not only provides solutions in staff shortages but also boosts efficiency and product quality improvement in the process.

The industry is grappling with labour shortages – with some manufacturers finding it difficult to acquire enough skilled and qualified workers – which has promoted many companies to seek out automation solutions.

And as the need for efficiency grows, so does the demand for smarter technology to streamline operations.

The team at LUMIX Procut are actively provide feedback to their manufacturing partners, such as EBAKI, MHS, EMSENS, and LAKIDIS, on these pressing issues.

As a result, the team at LUMIX Procut are well placed to provide the right solutions for the issue at hand.

One standout example of the solutions offered by LUMIX is EBAKI’s horizontal filleting machine, which has already been successfully

implemented for several medium-sized food manufacturing customers across the country.

This machine, which cuts boneless meat horizontally, has transformed the workflow of these customers, being able to put out a week’s worth of cuts in a matter of hours.

Previously, one customer relied on two skilled butchers who worked 38 hours a week to fillet chicken breasts for skin sales.

Now, with the EBAKI solution, the process has been revolutionised. The compact machine, capable of producing up to 400 kilograms of product per hour, allowed the customer overhaul and streamline its production tasks.

“Our solutions allow qualified butchers to spend more time honing their craft,” said Anton Novopashin, partner, and director at LUMIX Procut.

“They can focus on making sausages or preparing special cuts of steak, as that’s their expertise.”

By doing so, the customer could also expect a quick return on investment through efficiency and output than prior to the solution’s application.

The implementing of automation also means businesses can shift their skilled workforce from manual jobs to more specialised tasks, ultimately enhancing product quality.

Another meat producer invested millions in a new chicken schnitzel line, but it struggled with the portion sizes required.

In response, and in collaboration with LAKIDIS, LUMIX Procut provided the meat producer with an ideal solution.

However, the transition to automation isn’t without its challenges.

Many companies find that using unskilled labour in a highly automated environment is not effective.

“EBAKI’s machines can produce up to 6000 kilograms of product per hour, so it’s crucial to ensure that we can handle that output effectively. We need to make sure that products move smoothly down the line without delays.”

The need for complete solutions that ensure proper input and output when using machines is critical. While automation can speed up production, integrating it thoughtfully into existing workflows is also essential for success.

“EBAKI’s machines can produce up to 6000 kilograms of product per hour, so it’s crucial to ensure that we can handle that output effectively,” said Novopashin.

“We need to make sure that products move smoothly down the line without delays.”

Currently, collaborations with key

brands in the poultry sector highlight this ongoing effort.

“For example, EMSENS produces the skewers found in supermarkets, and every poultry manufacturer is now utilising these machines,” said Novopashin.

“While automation can significantly streamline the production process, logistical hurdles remain, such as the time it takes to load and unload boxes.”

The importance of collaboration is evident in these solutions, with manufacturers eager to receive feedback to improve their processes.

Lumix offers a range of automation solutions to help improve production efficiency, such as those sourced through its EBAKI partnership.

Meanwhile, in terms of safety, MHS machines offer portion-cutting solutions that address some of the industry’s biggest concerns.

“Many medium-sized businesses currently use bone saw machines, which can be unsafe because operators have their hands close to the blade,” said Novopashin.

In contrast, MHS machines come equipped with a computer-based screen, allowing users to set desired thickness and weight for cuts while maintaining a safe distance from the blade.

This automation not only enhances safety, by keeping hands further away from blades, but also allows companies to reallocate labour effectively.

“Staff shortages are a common issue across all industries, so if someone

doesn’t show up, having automation in place means you have the flexibility to adapt,” said Novopashin.

The positive impact of automation can also be seen in the bakery sector, where a customer supplying the food service industry has experienced the benefits firsthand.

Manual cutting often leads to inconsistencies in thickness, which can affect cooking and product quality.

“When butchers cut by hand, the blade can flex, leading to uneven thickness,” said Novopashin.

“In contrast, with automation, the blade remains rigid throughout the process, ensuring uniformity and improved cooking results.”

The feedback from customers who have embraced these automated

solutions has been positive. Many were initially hesitant about making such an investment, but the results speak for themselves.

“What used to take a week now only takes a few hours,” said Novopashin, highlighting how automation has freed staff to focus on other essential tasks.

To ensure a smooth transition for new users, the company has established a test kitchen where customers can experience the machinery firsthand.

“We conduct all the trials here to give them the confidence to use the machines on their own,” said Novopashin.

After installation, training is provided to help customers troubleshoot any issues that may arise.

All of LUMIX Procut’s equipment solutions are also manufactured in

Europe, ensuring high quality and compliance with stringent safety regulations that meet, and in most cases, exceed those in Australia.

“Everything is certified to meet European and Australian safety standards,” said Novopashin.

The need for reliable and effective solutions is underscored by specific customer experiences.

Ultimately, the journey toward automation is not just about enhancing production efficiency; it’s about revolutionising the way food is processed.

With a focus on optimising production lines and addressing the labour shortage, businesses are embracing technology that not only streamlines operations but also elevates the quality of the end product.

The implementing of automation also means businesses can shift their skilled workforce from manual jobs to more specialised tasks.

All of LUMIX Procut’s equipment solutions are manufactured in Europe, ensuring high quality and compliance with safety regulations.

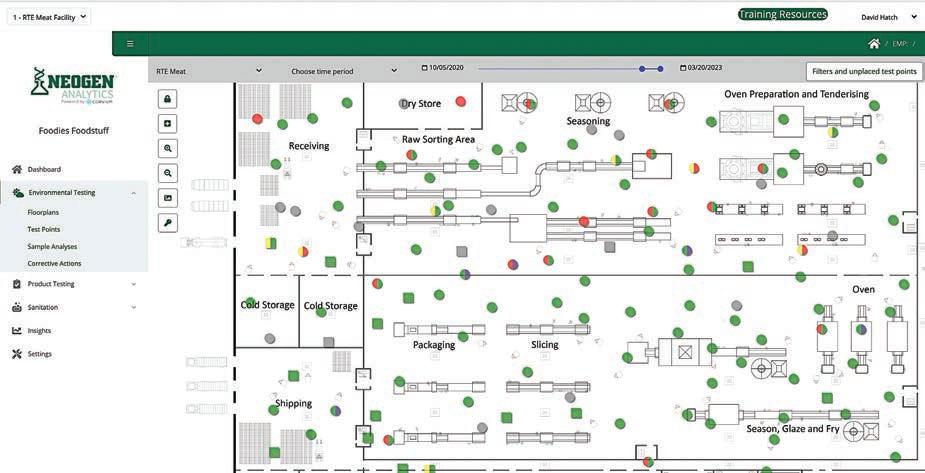

Transforming food safety with technology

Neogen Analytics is transforming how food and beverage manufacturers manage and interpret testing data to create strong food safety processes and outcomes.

Under the leadership of an industry veteran with a wealth of experience in data technology, Neogen Analytics is helping food and beverage manufacturers leverage the best results it can out of food safety management platforms.

“I’ve spent three decades working in various data technology environments, with the last six and a half years specifically in the food and beverage industry,” said David Hatch, vice president, Digital Solutions Marketing, Neogen Corporation. This expertise played a key role in the development of Neogen Analytics.

The journey began in January 2018, when Hatch and his colleague’s joined forces with a pair of microbiology

doctoral candidates who had come out of MIT with ideas for rapid diagnostics of pathogens like Listeria and Salmonella. The result was the launch of Corvium, a software firm dedicated to automating food safety testing workflows and analytics.

Their partnership laid the groundwork for what would become a component of Neogen’s operations after its acquisition of the startup company in February 2023.

“Through my work with the team in those early days, I received a rapid education on how data and technology could impact food safety. It’s been an amazing discipline to learn,” said Hatch.

“And since becoming part of Neogen and gaining access to the global

resources that come along with that, I am genuinely excited by how much we’ve been able to develop the platform and what we have already been able to achieve for the companies using it.”

“In this industry, it quickly becomes clear that the people involved understand that lives are at stake every day. It’s motivating to know that, in some small way, we contribute to making the world a safer place to eat. Not every job offers that kind of fulfilment.”

This sense of purpose drives Hatch and the team at Neogen to continuously innovate and refine its platform.

“I’ve always been drawn to how data and information can impact organisations, businesses, communities, and populations,” said Hatch.

“The speed of communication and how well it’s understood are crucial factors in driving positive outcomes.”

Drawing from his background in healthcare analytics, he sees parallels between the two fields.

“The diagnostics from Neogen’s testing devices and laboratories assess the health of a facility, similar to how we evaluate patient health in healthcare,” said Hatch.

“Corrective actions in food safety are akin to treatment plans. By addressing these issues, we help customers lower their risks and avoid unexpected production line shutdowns, which can be very costly.”

At its core, Neogen Analytics offers a cloud-based digital platform designed to

Images: Neogen

Neogen Analytics provides a suite of data, tools, and solutions that help manufacturers improve food safety processes.

streamline food safety testing workflows and time-to-information.

“We’ve built software that enables a variety of food safety applications to operate within it,” said Hatch.

“For instance, our environmental monitoring application digitises and automates environmental monitoring programs, while our product testing program enables our customers to better manage risk and quality objectives. The system connects Neogen’s testing devices to the platform, enabling data to be unified and delivered to any internetconnected browser device.”

This modular approach allows customers to transition from outdated methods, such as spreadsheets and paper, to an automated digital system.

“Many organisations have ineffective methods for collecting and analysing data, which prevents them from taking necessary actions,” said Hatch.

Empowering food safety professionals

“We want to reduce the time it takes to access information, enabling food suppliers to quickly see diagnostic results and take action before issues escalate into costly problems,” said Hatch.

One of the standout features of the platform is its ability to visualise data.

“When users log into the software, one of the first things they see is a dynamic map of their facility,” said Hatch.

This map, which uses the customers’ engineering drawings or digital photos, provides a clear and intuitive representation of test points and their statuses.

“This feature has become one of the most beloved components of our program because it conveys information in a way that’s accessible to food safety professionals, who may not be as techsavvy as financial analysts,” said Hatch.

The demand for such solutions has surged over the past six years, indicating a shift in industry expectations.

Audits play a crucial role in maintaining food safety standards.

“When a third-party auditor sees that a company has command and control over its food safety data, it makes a strong impression,” said Hatch.

“One customer shared that they turned their laptop to face the auditor to show a map of the entire floor plan, which demonstrated the level of organisation and control over their food safety processes.”

This ability to present data in an organised manner not only facilitates

food manufacturers.

“Instead of sifting through pages of documentation, they can access everything they need right there,” said Hatch.

“ This display of data transforms relationships and word spreads, our customers recognise that we’re doing something different.”

As Neogen Analytics continues to evolve, the integration of artificial intelligence (AI) and machine learning into its platform is on the horizon.

“We’re moving in the right direction, but there’s still work to be done,” said Hatch.

T he platform is already designed to track trends and patterns in food safety data, allowing users to recognise potential issues before they escalate.

“We ingest at least six months’

implementation, so from day one, customers have trending graphs ready,” added Hatch.

This proactive approach helps to detect potential issues before they amount to non-conformances that could lead to production disruptions.

The platform is built to be open and integrative, allowing customers to connect data from their existing testing devices, third-party laboratories, and other data sources.

“All of our customers use some form of laboratory for diagnostics, and we’ve built an integration engine to handle data in any format it comes to us,” said Hatch.

T his flexibility ensures that Neogen Analytics can meet the diverse needs of its clientele.

The growing emphasis on

sustainability is another emerging focus for the company. As companies face increasing pressure to reduce their carbon footprints, Neogen’s platform helps them analyse data and discover new efficiencies within their production processes.

“One large meat producer began looking at how they could minimise waste and energy consumption,” said Hatch.

“ They were able to determine the root causes of scrapped production runs and reduce the occurrence of this scenario.

“ This led to improved production yield while reducing the energy and landfill consumed by waste.”

By addressing these issues, companies can not only comply with regulations but also enhance their operational efficiency.

“One of our board members has emphasised the importance of sustainability, prompting us to think about how our solutions align with these initiatives,” said Hatch.

Neogen Analytics has a robust platform that empowers customers to take control of their food safety processes. The company is making strides in ensuring that the food supply remains safe and reliable.

As the industry evolves, Neogen Analytics remains committed to leveraging technology and data to drive positive outcomes in food safety, ultimately contributing to a healthier and safer world.

“This is what excites me, Neogen shares this vision and has allowed me to take part in leading the messaging and launch of these initiatives globally.” said Hatch. F

David Hatch (left) was key to the advancement of Neogen Analytics, bringing decades of experience in data tech.

Neogen Analytics provides a host of benefits including a live floor plan for real-time monitoring.

Global food brands continue to adopt 2D barcode technology to streamline operations and improve transparency across the the food and beverage industry.

Global retailers and brands unite

The adoption of 2D Barcode technology by global food and beverage brands continues to help enhance transparency, operational efficiency, and consumer engagement.

Several international brands have come together to support the adoption of next-generation barcodes in retail. The new technology promises streamlined operations, improved transparency and enhanced consumer engagement for the food and beverage industry.

the door for dynamic updates to content, enabling brands to adjust product details without having to reprint labels, leading to flexibility, sustainability, and reduced cost.

to unlock new valuable capabilities, delivering more benefits to their customers, shoppers and consumers,” said Mark Batenic, former CEO of the Independent Grocers Alliance (IGA).

supply chains,” said Maria Palazzolo, CEO at GS1 Australia.

“This technology is a cornerstone in maintaining transparency, which is increasingly important to consumers.

With a collective commitment from companies such as Procter & Gamble, Mondelez and Nestle, the next-gen barcode is poised to become the new standard.

In retail, the most common of the next-generation barcode is a QR Code that follows GS1 standards. GS1 is the not-for-profit organisation that is rolling out next-generation barcodes across the continent.

These act like traditional QRs, with one major difference; they will be able to be scanned at retail pointof-sale, just like a traditional barcode; paving the way for a global migration to GS1-powered QR Codes in the retail industry.

Unlike traditional barcodes, the advanced codes not only store more information, but also connect consumers to real-time data, through a simple scan via a smart phone.

They Provide instant access to a wealth of product information – such as ingredients, allergen warnings, verified sustainability certifications and even viewing the product’s journey through the supply chain.

For producers and retailers in the food industry, the barcodes also open

The exciting part of this movement is the collaboration between international retailers and brands that have aligned as signatories on a global industry endorsement statement to drive the adoption of the next-gen technology, recognising its value across the entire supply chain.

“We expect that the transition to next-generation barcodes will happen gradually across the world, but one thing is certain: those retailers and brands that accelerate through this transformation the fastest will be best positioned

Subhead: What does it mean for food and beverages in Australia?

The introduction of next-generation barcodes in Australia presents an opportunity for retailers and brands to innovate in an increasingly complex trading environment.

The technology not only enhances operational efficiency but also helps brands meet the evolving food safety, traceability and environmental standards that are shaping the future.

“The next generation of barcodes will mean greater visibility and control across

“We see this next evolution in barcoding capabilities as the future for food safety and product traceability in Australia.

“Beyond safety, sustainability is also a key focus. Next generation barcodes will enable brands to share sustainability efforts with shoppers and consumers directly, offering unparalleled transparency across everything from carbon footprint to water usage, sustainable sourcing practices and so much more.”

Reshaping the shopping experience

While the global and local push for next-generation barcodes is gaining momentum, the transition will take time. GS1 is working with Australian retailers, brands, and regulatory bodies to ensure a smooth rollout.

Australian consumers can expect to see more of the new barcodes on their favourite products soon.

Industry leaders are confident that this shift will redefine how Australian consumers interact with their products.