Expertise - Passion - Automation 88 ANZ Sales People Let the facts speak for themselves 5 Countries R&D Centres 1,450 Engineers 18 Engineers in ANZ 81% Countries 7,900 Sales People 700,000 Variations 10 ANZ Branches 28 Production Locations 5 Local Production Facilities 12,000 Products DECEMBER 2022

Choose the world leader in pneumatic automation for your next project.

SMC Corporation offers a commitment to Japanese quality, customer centric design, local manufacturing and unmatched commercial support.

It’s no wonder SMC was voted as one of the Forbes Top 100 Most Innovative Companies. Let the facts speak for themselves.

SMC - more than pneumatics

- Passion

www.smcanz.com

Expertise

- Automation

SMC Corporation Australia | New Zealand Group

When it comes to your food and beverage facility... Why would you settle for second best?

Renewed focus on Australian manufacturing

DECEMBER 2022 PLUS: Cold Chain | Machinery | Alternative Packaging

CEO: John Murphy

COO: Christine Clancy

Group Managing Editor (Northern): Syed Shah

Editor: Adam McCleery

Ph: (02) 9439 7227

adam.mccleery@primecreative.com.au

Design Production Manager: Michelle Weston

michelle.weston@primecreative.com.au

Art Director: Blake Storey

Designers: Kerry Pert, Tom Anderson

Sales/Advertising: Stephanie Suzuki

Ph: +61 422 046 711

stephanie.suzuki@primecreative.com.au

Production Coordinator: Janine Clements

Ph: (02) 9439 7227

janine.clements@primecreative.com.au

Subscriptions AUS NZ O/S

1 year subscription 99 109 119 2 year subscription 189 199 209

For subscriptions enquiries please email subscriptions@primecreative.com.au

Local manufacturing continues to see growth

Copyright

Food & Beverage Industry News is owned by Prime Creative Media and published by John Murphy. All material in Food & Beverage Industry News is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in Food & Beverage Industry News are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

© Copyright Prime Creative Media, 2019

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Head Office 379 Docklands Drive Melbourne VIC 3008

Ph: +61 3 9690 8766

enquiries@primecreative.com.au http://www.primecreative.com.au

Sydney Office Suite 303, 1-9 Chandos Street Saint Leonards NSW 2065, Australia Ph: (02) 9439 7227

Editor:

Adam McCleery

Welcome to the December edition of Food & Beverage Industry News. The special feature for the last issue of 2022 is centred around the theme of Australian made, the importance of which has grown in recent years.

In the wake of the COVID-19 pandemic many processes within the food and beverage manufacturing sector are undergoing changes to mitigate the same risks in the future, namely those around access to materials and goods.

The impact on the supply chain, especially the international, has been widely covered during and since the end of the pandemic but the ramifications are still being felt as producers and manufacturers continue to make changes.

As I’ve discovered while speaking with a number of stakeholders in the industry, finding local sources for materials and product is becoming more critical than it had pre-COVID.

There are several factors for the renewed focus on Australian made but a common thread I am always finding is the confidence that sourcing local gives to the supply chain, because there is less risk of major disruptions like those still being felt.

On top of the pandemic factor, is the growth in innovation, connectivity, and automation. As producers and manufacturers continue to adopt newer and more efficient solutions their capabilities grow. The trickle-down effect sees local companies expanding, leading to more investment in the local industry and market.

Stakeholders have also said that several their

clients are now eager for locally made products and pieces of machinery, with the parts also being available locally, in order to mitigate the risk of a backlog.

In a highly competitive environment like the Australian food and beverage market, any lost time is very costly, meaning being able to source what you need quickly is of paramount importance.

Then there is the issue of supply chain cost. As inflation continues to climb and the cost of moving material and product from country-to-country increases, companies are looking at better and more affordable solutions. This is likely another driver in a renewed focus on finding locally made products.

International supply chains will no doubt experience some rebound in the coming year, however the impact of the last handful of years and the flaws that have been discovered as a result have also likely set into motion a new perception of how to balance both local and international supply chains to mitigate the risks associated with both.

The first half of 2023 will be an interesting one, from an economic standpoint, and if the industry continues to react with agility to the changes, then I foresee another bumper year of expansion and innovation.

Covering the industry throughout 2022 has been a great experience which has taught me a lot.

I look forward to what 2023 will bring for the Australian food and beverage industry.

Until next year. Happy Reading!

Printed by: Manark Printing 28 Dingley Ave Dandenong VIC 3175 Ph: (03) 9794 8337

WELCOME

4 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

1300 007 224 | info@pbbg.com.au | paulbrady.com.au

We build food facilities from end-to-end and deal with everything in between.

18

MEET THE MANUFACTURER

The Bondi Brewing Co is finding great success in the competitive brewing space and continues to partner with other companies.

22

MACHINERY

Industrial innovator Schaeffler is helping combat labour shortages and increasing cost of production.

PACKAGING

COPAR continues to see the popularity of wheat straw as a viable packaging option grow in Australia, and abroad.

SUSTAINABILITY

SMC Corporation Australia New Zealand has built a strong reputation for helping companies reach sustainability targets.

FLOWMETERS

AMS Instrumentation and Calibration brings Katronic’s flowmeters to the Australian market.

WAREHOUSING

CBRE Australia is working with the industry on the challenges around the supply and demand of industrial space.

CRYOGENIC FREEZING

Air Liquide has extensive knowledge and expertise in in designing cost-efficient cryogenic solutions.

ENGINEERING

Niras continues to provide the Australian industry with specialist and multi-disciplinary engineering solutions.

COLD CHAIN

Paul Brady Build Group’s solutions for cold storage have proven popular with the food and beverage industry.

38 CONSTRUCTION

Total Construction’s insight into the challenges of cold chain facilities and how best to utilise the space moving forward.

6 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

08 NEWS

42

18 24 34 30

40 AIP 41 DAIRY

NEW PRODUCTS

NIRAS is a leading independent advisor within the Food & Beverage industry when it comes to investments, projects execution, production optimization, sustainable solutions, and green energy transition of your manufacturing facility. We can draw on our specialists across the world, but our local experts know the exact conditions and challenges of your local context. • Excellence in project delivery • Local support with a global mindset • Leading in sustainable solutions • Strategic masterplanning • Smart upgrades • Optimization and automation • Robust manufacturing • Electrification of industrial production • Green energy transition www.niras.com/sectors/food-and-beverage/

Managing Director Melbourne, Australia +61 488 786 484 EDLY@niras.com

Market Director

Melbourne, Australia +61 451 125 223 GLJA@niras.com

Glenn Jacobsen

Edward Lynch

Glenn Jacobsen

Edward Lynch

Arnott’s Group and CleanPeak Energy to deliver behind the meter solar and battery installations

The Arnott’s Group and CleanPeak Energy have signed an agreement to transition the worldclass Huntingwood manufacturing facility to 100 per cent renewable electricity by 2029.

The 44,000sqm manufacturing facility operates 24-hours, seven days a week, running five different automated manufacturing lines, producing around 53 per cent of The Group’s total biscuit volume. The site employs over 400 people and bakes around 56 million kilograms of biscuits annually, including some of Australia’s favourites like Tim Tam, Shapes and Jatz.

CleanPeak will install a 4.1 MW rooftop solar system which will operate alongside a 15 MWh battery energy storage system, generating more than 5.25 GWh of renewable electricity. CleanPeak will then source an additional 17.3 GWh of mixed renewable and

non-renewable electricity required for the site, progressively moving to renewable electricity from 2023, and reaching 100 per cent by 2029.

The rooftop of the multi-building facility will house around 10,000 panels and be connected to inverters and a battery energy storage system. The integrated solar and battery assets will operate to smooth the solar output each day in-order-to match the energy usage of the site.

The Arnott’s Group, supported by energy consultant World Kinect Energy Services, embarked on the journey to transition to renewable electricity across their operations over 12 months ago.

CleanPeak was selected as The Group’s partner to deliver an onsite solution and compliment this with a multiyear in-front-of-meter energy offer that will allow the site to transition to 100 per cent renewable electricity

operations in a cost-effective manner.

CleanPeak’s capital investment will give the Arnott’s Group certainty over the site’s electricity costs for the next

seven years.

Building works will begin in the coming months, with the installation due to be fully operational by the end of 2023. F

Pact’s billion bottle recycling project wins award

The Pact Group has won a major sustainable project award for bringing Australia’s biggest and most advanced PET plastic recycling facility to life in just 370 days.

Pact was awarded the Australian Institute of Project Management’s Sustainable Project Management Achievement Award for NSW for the $50 million Circular Plastics Australia (CPA) PET plastic recycling facility in Albury.

The CPA facility is a joint venture between Pact, Cleanaway Waste Management, Asahi Beverages and CocaCola Europacific Partners (CCEP).

A team from Pact project managed the build, which was delivered safely, on time and under budget on a greenfield

site during a period of major global challenges, including the COVID-19 pandemic, supply chain pressures, and the blockage of the Suez Canal.

Despite these challenges, it took one year and five days to establish the site, construct the facility, install the equipment and services, commission the machinery, and train a new team.

The facility, which commenced operations in February 2022, has the capacity to recycle the equivalent of around 1 billion 600ml PET plastic beverage bottles each year into highquality food-grade resin.

Cleanaway collects, sorts and delivers PET plastic waste from kerbside collection bins and container deposit

schemes to the Pact-operated facility for recycling. The recycled resin is then used by Asahi and Coca-Cola to manufacture

make new beverage bottles and food packaging. F

NEWS 8 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

Construction on the project is expected to begin in the coming months.

The Pact facility can recycle the equivalent of 1 billion 600ml PET bottles each year.

Beneficial Beer Co partners with fintech company BetaCarbon

Beneficial Beer Co has struck a deal with BetaCarbon, an Australian fintech company enabling retail investors to take part in the Australian carbon market.

Beneficial Beer Co is the first FMCG brand to partner with BetaCarbon in a deal that will see BetaCarbon QR codes on all its Stone Cold Lager cans, encouraging customers to redeem 100 free Australian Carbon Tokens (BCAU).

BetaCarbon offers the world’s first digital token based on regulated carbon credit.

It converts Australian carbon credits into Australian Carbon Tokens, with each token representing 1 kg of CO2 that has been avoided or removed from the atmosphere. 1000 BCAUs are

equivalent to one Australian Carbon Credit Unit.

Founded last year by ex-HSBC managing director Guy Dickinson, BetaCarbon was born to give the public exposure to an asset class that previously was only available to wholesale investors.

From the outset, Beneficial Beer Co’s founder and serial entrepreneur David Jackson knew he wanted his business to be a driving force for good.

Driven by the value of ‘Brewed for Humankind’, Beneficial Beer Co works with solar-powered brewing partners and actively recycles spent production grain to feed local livestock, with the latest BetaCarbon partnership another string to the company’s sustainability bow.

The funding will be used to produce

Nestlé to plant 10 million trees in Australia by 2025

Nestlé announced at COP27 Biodiversity Day that it aims to plant 10 million trees in Australia by 2025 in partnership with Greening Australia, Canopy and One Tree Planted.

The ambitious project is part of Nestlé’s Global Reforestation Program, which aims to plant and grow 200 million trees globally by 2030 as part of the company’s efforts to achieve net zero emissions.

Establishing the 10 million trees, a biodiverse mix of native species will sequester an estimated 2.1 million tonnes of CO2 over a 25-year carbon crediting period. Averaged over the project lifetime, this is equivalent to fuel emissions from over 25,000 cars each year.

The partnership between Nestlé, Greening Australia, Canopy and One Tree Planted will ensure that the trees are monitored across 28 years as they mature, delivering long-term environmental and economic benefits.

Working in collaboration with local landholders and communities, the 10 million trees will restore local biodiversity,

improve water quality and enhance degraded soils.

Trees will be planted in locations linked to regional areas where Nestlé sources its raw materials and will be registered by Greening Australia’s environmental markets business, Canopy, for carbon credits with Australia’s Clean Energy Regulator.

Nestlé’s Reforestation Project in Australia has commenced, with plantings underway with private landholders in the Strzelecki Ranges and in East Gippsland, Victoria.

Nestle’s reforestation initiative plays a significant part in the company’s global goal to meet net zero emissions by 2050, outlined in Nestle’s Net Zero Roadmap.

As part of Nestlé Australia’s progress towards 2050, in 2021 it switched to sourcing 100 per cent renewable electricity – avoiding around 73,0002 tonnes of carbon emissions each year.

Nestlé Australia is also transitioning 100 per cent of its packaging to be recyclable or reusable and more than 90 per cent of its packaging is now designed for recycling. F

NEWS www.foodmag.com.au | December 2022 | Food &Beverage Industry News 9

a pale ale and pilsner in 2023, increase national distribution and grow the Beneficial Beer Co team nationally.

Beneficial Beer Co is available across

57 stockists in Sydney, Queensland, Victoria, Tasmania and Western Australia as well as New Zealand, their website and a range of online stockists. F

The funding will be used to produce a pale ale and pilsner in 2023, and to increase national distribution.

Nestlé Australia is also transitioning 100 per cent of its packaging to be recyclable or reusable.

Coles scoops up top wins at Product of the Year awards

Thousands of Australians have voted 11 Coles exclusive and Own Brand products from across the supermarket aisles as winners at the 2023 Product of the Year Awards.

The most awarded retailer for the third year running; Coles collected awards across 11 different categories, including fresh meat, pantry, convenience and skincare.

Product of the Year is the world’s largest consumer-voted awards program which recognises product innovation and serves as a shortcut for shoppers helping them to save time and money.

The complete list of 11 awardwinning products exclusive to Coles are:

• Coles Salted Caramel Sticks Vienna Sticks 5 pack

• Coles 90 Calorie Fibre Bakes Choc Brownie 5 Pack 120g

• Coles Flavour Creations Homestyle

8 Veg & Chicken Soup 430g

• Coles PerForm Chicken, Kale & Quinoa Soup

• Coles Rolled Oats Value Pack 1.8kg

• Coles Australian Extra Virgin Olive Oil 1L

• Coles Sweet Potato Chips 750g

• Coles Finest Certified Carbon

Neutral Beef Scotch Fillet Steak

• Coles Free Range Pan Sized Middle Bacon 200g

• CUB Biodegradable Fragrance Free Baby Wipes 80pk

• KOi for Men Hydrating Aloe & Patchouli Face Moisturiser 100mL

Coles general manager own brand Charlotte Rhodes said, “Coles works closely with some of Australia’s best producers to create great value, new and innovative products to inspire customers and help us fulfil our strategy to make Coles an Own Brand Powerhouse.

“Our customers are at the heart of what we do at Coles, and we are proud to be recognised by them in this year’s Product of the Year Awards –particularly across so many categories which means our customers can pick up an award-winning product in nearly every aisle from delicious ice cream,

healthy convenience meals to 100 per cent Aussie meat.

To close out the 11 awards, Coles came out on top when it comes to household essentials, with Coles Rolled Oats Value Pack 1.8kg and Coles Australian Extra Virgin Olive Oil 1L both deemed musthave, great value Australian staples. F

Norco wins regional Excellence in Large Business award

Norco Co-operative, Australia’s largest and oldest dairy co-op has won the Excellence in Large Business Award at the 2022 Northern Rivers Business Awards.

This is the second consecutive year in which Norco has received the accolade and is testament to its ongoing commitment to its farmers, employees and the local community in an unprecedented and challenging year.

One of Northern Rivers largest private employers, independent judges praised Norco for continuing to safeguard its community of 292 Australian dairy farming producers while also cementing a strong, vertically integrated business with exceptional expertise in food and rural retailing.

Receiving the prestigious award was Norco general manager of Manufacturing, Adrian Kings who was elated and said it recognises the hard

work and commitment of every single individual within the co-operative.

Program, which assists farmers in rebuilding their herds following the unprecedented February flooding.”

The 2022 Northern Rivers Business Awards recognises and celebrates business excellence across its diverse regional economy with strong industries such as manufacturing, tourism, health and education.

Norco will now represent the region at the State Business Awards to be held on November 18, in Sydney.

In other award news, four Norco farmers in NSW and Queensland were represented in the Top 100 Australian dairy farmers, an award recognised by industry body, Dairy Australia.

The award brings national recognition to the highest quality milk producers and the important role they play. F

NEWS 10 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

The 2022 Northern Rivers Business Awards recognises and celebrates business excellence across its diverse regional economy.

Coles took home 11 awards at the 2023 Product of the Year Awards.

The GrowHub Innovations Company partners with ManukaLife

Singapore’s one-stop farm-to-table solution for food traceability and data analytics, The GrowHub Innovations Company announced its strategic partnership with ManukaLife, Western Australia’s high-grade manuka plantation developer and producer of premium-grade manuka products.

The GrowHub will be ManukaLife’s appointed distributor for some of its premium-grade manuka honey, royal jelly, and oil products in Southeast Asia and China. Shoppers will now be able to purchase ManukaLife’s famed Manuka honey, Royal Jelly and Propolis sachets, and Medicated Throat Spray.

Other products will be available on The GrowHub partner retail channels in Singapore, Indonesia, Malaysia, and China as well as from its own eCommerce shop. To support the distribution of its

products, The GrowHub will provide ManukaLife with its Web-3 technology framework that enables traceability and authentication of its products using machine learning and artificial intelligence which automatically detects imitations and suspicious behaviour.

Stakeholders from origin to destination can easily trace the history of the product along the supply chain and validate its authenticity.

In addition to this, The GrowHub will also provide ManukaLife customer analytics to understand the reception of its products in the markets.

Through data available via The GrowHub, ManukaLife will be able to gain a better understanding of the perception of the product by consumers, identify optimal product pricing, and generate other key insights that will help

them better market their products to customers in the region.

“We have always placed our focus in the Southeast Asia and North Asia region,” said Lester Chan, CEO of the GrowHub Innovations Company.

“This partnership with ManukaLife has given us the opportunity to look beyond traceability, minimising chances of product counterfeiting to protect brands and build trust and confidence among our consumers.” F

NEWS www.foodmag.com.au | December 2022 | Food &Beverage Industry News 11

INSTRUMENTATION & CALIBRATION PTY LTD SPECIALISTS AMS have been suppliers of instrumentation and calibration equipment to all industries since 1973 representing some of the world’s leading manufacturers of the equipment in their field. www.ams-ic.com.au The Liquid Measurement Experts Dew-Point, Humidity and Oxygen Specialists Analytical Process Division www.ams-ic.com.au sales@ams-ic.com.au Leaders of Inline Process Control Solutions Gas Analysis Combustion Gas Analysis

The GrowHub will also provide ManukaLife customer analytics to understand the reception of its products

Chobani generates half a million meals for Australians

Victoria-based food brand Chobani’s Fruit for Good yogurt collaboration with Foodbank has recently come to an end, generating half a million meals for Australians facing food insecurity.

In February Chobani collaborated with Foodbank to create a categoryfirst yogurt with 100 per cent of profits donated to the charity.

Available in Coles, Woolworths and independent retailers, the 170g pot Fruit for Good was a fruit salad flavoured yogurt with a blend of pineapple, strawberry, watermelon and apple.

Across its entire supply chain, Chobani’s suppliers and retail partners supported Fruit for Good, donating either partial or 100 per cent of their profits to increase the initiative’s impact on Foodbank.

Chobani Australia general manager ESG and general counsel Tim Browne said he was thrilled with the initiative’s impact.

“Our long-standing partnership with Foodbank is one we’re extremely proud of. Having already donated the equivalent of more than one million meals through dedicated regular yogurt donations over the last ten years, Fruit for Good was a way of challenging our own norms.

“We created a product we knew our Chobani consumers would love, whilst allowing them to do good simply by doing the weekly grocery shop. The combined impact with our retail and

supplier partner contributions was significant, and we’re proud to say together we’re donating the equivalent of 552,000 meals to Foodbank.”

Foodbank’s tenth annual Hunger

Champion Flour Milling announces new leader

New Zealand-based flour miller Champion has announced that Chris Anderson will be its new director and country manager for New Zealand.

The appointment was suggested by sibling company Allied Pinnacle Chief Executive David Pitt and Managing Director Takao Ouchi to leverage the legacy and combined strength of the two leading Australian and New Zealand flour milling businesses.

Both companies are owned by parent company Japan’s Nisshin Seifun Group Inc., which approved the new director’s appointment as Champion’s shareholder.

Anderson has over 20 years of FMCG experience across a broad range of sectors and categories, having held senior commercial roles with Coca Cola Amatil, Streets Ice Cream, SC Johnson and Goodman Fielder.

Most recently Anderson held the role of merchandise manager for Foodstuffs

North Island, with multiple category responsibilities including Bakery, Chilled, Alcohol, Deli, Eggs, and Beverages.

In July 2020, Anderson led FoodStuffs to partner with Fonterra to produce Simply Milk, New Zealand’s first carbon-neutral milk. The milk, created in response to consumer demand allows conscious Kiwis to reduce their carbon footprint through purchase.

Allied Pinnacle CEO David Pitt, said he is thrilled to have the highly

Report revealed that natural disasters can be what kicks off the cycle of food insecurity, with 19 per cent saying natural disasters were a reason they couldn’t meet their household’s food needs. F

accomplished FMCG professional join the executive team.

“Chris has a proven track record of finding customer-centric solutions and as we continue to shift gear from strategy to execution, he will lead the team to drive value and win in our chosen categories. Across both markets, we have a clear vision – to be the Flour, Bakery Ingredients and Frozen Baked Goods business partner of choice in both Australia and New Zealand.” F

NEWS 12 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

Foodbank’s tenth annual Hunger Report revealed that natural disasters can be what kicks off the cycle of food insecurity.

Coles Group to launch SECOS MyEcoBag

Coles Group will be launching MyEcoBag compostable bag products by SECOS in 770 retail stores across Australia.

The selection by Coles follows a recent range review involving SECOS’ compostable products and is on the back of significant sales growth year on year for MyEcoBag in Woolworths stores.

SECOS Group develops and manufactures sustainable packaging materials, supplying its proprietary biodegradable and compostable resins, packaging products and high-quality cast films to a blue-chip global customer base.

For Coles, SECOS will launch a new shelf-ready presentation pack of the well-received 36L pack and a new 27L pack. Both packs are ideal for kitchen food and garden waste diversion to green bins FOGO programs, providing a fully compostable solution.

In Australia, the wider availability of SECOS’ compostable bags via Coles stores will give more households participating in approved council food organic waste programs the option to dispose of the bags and food waste in their green waste bin.

The use of SECOS’ compostable bags offers households a clean and convenient way to assist with the separation of their

food waste which is critical to ensure food does not end up in landfills.

Coles has added the two MyEcoBag SKUs on a non-trial basis, which will be distributed nationally. The ongoing supply of the two MyEcoBag SKUs will be subject to meeting sales projections as part of the annual range review.

The significant growth in MyEcoBag sales in Woolworths and now Coles will take the MyEco branded products to over 2,000 retail stores in Australia. This store footprint plus SECOS’ Australian-wide distribution network, which supplies a select range of independent stores gives the company a significant retail reach.

SECOS has said it continues to develop further opportunities for growth in new markets for its branded MyEcoBag and MyEcoPet line of products and is working to garner market share in grocery and convenience stores in Australia, the USA, Latin America, and elsewhere.

The increased sales of the MyEco range in Australia is supported by SECOS’ recent manufacturing capacity expansion in the group’s new Malaysian biopolymer plant which commenced production in the March 2022 quarter with capacity to support annual sales of $25 million. F

www.foodmag.com.au | December 2022 | Food &Beverage Industry News 13 Place a sustainable future in the hands of consumers AUSTRALIAN-MADE COMPOSTABLE PACKAGING TO GAIN EXCLUSIVE ACCESS AND TO BE NOTIFIED OF OUR SAMPLE AVAILABILITY, SIMPLY SCAN THE QR CODE AND REGISTER RIGHT AWAY. FOOD | FRESH PRODUCE | MEAT PACKAGING sales@copar.eco WWW.COPAR.ECO+61255656770 NEWS

Coles Group will be launching MyEcoBag compostable bag products by SECOS in 770 retail stores.

FSAA announces board ahead of 2023

With another successful year for the Foodservice Suppliers Association Australia (FSAA) rapidly drawing to a close, the organisation’s Annual General Meeting has again taken place in Sydney last week.

Not only a time to reflect on progress, and to plan for the year ahead, the AGM facilitates the important process of electing and establishing the organisation’s Board.

Board members play an integral role in ensuring the continuation of a focus on providing opportunities for FSAA members through networking, education and professional development.

New Board members include Kristina Czepl of Nestle Professional

who is taking over the reign from Scott Stuckman.

The FSAA said it is delighted to welcome back Jeff Dhu of Anchor Food Professionals, as director, re-joining the Board after a hiatus. The FSAA added that it is privileged to be able to tap into his 37 plus years of experience within foodservice, his leadership and the respect he garners from the industry as an innovator and forward thinker.

Collectively the Board has more than 339 years in the foodservice industry, creating a solid foundation of insight and experience to ensure the FSAA continues to add value, continues to take the organisation forward and continues to focus on what is most pressing and important for its members.

The full list of Board Members of the FSAA for 2023 is as follows:

Office Bearers

Chairperson – Ken Hartley, Priestley’s Gourmet Delights

Vice Chairperson – Andrew Low, Ordermentum

Treasurer – Lindsay Yeomans, The Armory

Secretary & CEO – Minnie Constan

Directors

Jeff Dhu, Anchor Food Professionals

Yezdi Daruwalla, Unilever Food Solutions

Kristina Czepl, Nestle Professional

Barton Beverley-Smith, Primo Foods

Donna Cox, noumi

Wayne Viles, Unox Australia

Eugene Visione, Birch & Waite

David White, DKSH

Tony Nay, Incremental Marketing. F

Closing the loop on soft plastic packaging with new recycling trials

Australia’s food and grocery manufacturers are backing a new scheme aimed at keeping soft plastic packaging out of the landfill and helping to build a new recycling industry producing sought-after food-grade, recycled soft plastic packaging.

Coinciding with National Recycling Week, the first in a series of trials of kerbside collection of soft plastic

recycling of plastics such as bread bags, cereal box liners and ice cream wrappers easy for participating households.

The trials are part of the National Plastics Recycling Scheme project (NPRS), which is led by the Australian Food and Grocery Council (AFGC) and will help design a model for large-scale “bag-in-bin” kerbside collection and sorting of soft plastic packaging for advanced recycling.

About 487,000 tonnes of soft plastic

packaging was used by businesses and homes in Australia in 2019-20 with just four percent of that material recycled.

Diverting soft plastics from landfill will provide a clean stream of material for Australia’s emerging advanced recycling industry.

Plastics from the Macedon Ranges Shire Council trial will be taken for advanced recycling to APR Plastics in Dandenong, Victoria.

In advanced recycling, the material

is converted into oil that can be used to make new plastics.

Seventeen major food and grocery manufacturing companies have signed on as Foundation Supporters of the NPRS project, committing funds to the trials and pilots.

Food and grocery manufacturing is a $133.6 billion industry in Australia that employs more than 272,000 people, and sustainable packaging is a key focus for ensuring a sustainable future . F

About 487,000 tonnes of soft plastic packaging was used by businesses and homes in Australia in 2019-20.

NEWS

Foodbank Australia calls for urgent food donation tax reform

Despite clear environmental, social and economic benefits of donating food to food relief, Australia’s current tax framework does not motivate food producers to donate excess stock.

In fact, in tax terms, donating is no different to recycling or sending to landfill even though it may cost the company more.

Australia currently wastes over 7.6 million tonnes of food each year costing the economy over $36.6 billion. Of this, 70 percent is perfectly edible and redirecting it to food relief would potentially deliver a social return of $2 billion at a time when the demand for food relief has never been higher.

Foodbank is recommending that Australia’s tax settings be recalibrated to incentivise donations to food relief.

Experience in other countries, including the USA, France, Canada and the Netherlands, shows that tax incentives are the most effective way to increase the redirection of food donations to food relief.

The tax incentive proposal, developed by KPMG Australia with the support of the Fight Food Waste Cooperative Research Centre and Australia’s food relief sector recommends a two- tiered tax incentive based on the ability to offset a percentage of costs related to food donations from taxable income.

Its aim is to encourage food producers to donate surplus product to food relief rather than sending it to landfill.

KPMG has now completed a follow-up project where it consulted widely with the food industry to determine the feasibility and potential effectiveness of the proposed tax incentive.

Interviews were conducted with 33 companies representing both national

and local businesses along the whole food supply chain. The overwhelming message is that there is whole-of-sector support for the scheme. In fact, companies are highly passionate about the potential of the incentive to really shift the dial on redirecting surplus to food relief.

Fonterra appoints new chief financial officer

The Fonterra Co-operative Group announced the appointment of Neil Beaumont to the role of chief financial officer, effective early February 2023.

Beaumont is an accomplished Group CFO, experienced in operating at the most senior levels of global and in complex business environments.

Most recently he was senior managing director, chief financial and risk officer at Canada Pension Plan Investment Board (CPPIB), with responsibility for leading the operations, finance and risk functions for the CAD $500 bn investment fund.

“We’re delighted to welcome Neil to the team. He’s an experienced global

finance leader whose expertise in strategic implementation will be a real asset to our management team,” said Fonterra CEO Miles Hurrell.

Beaumont has held senior roles at BHP Billiton in Chile and Australia and at KPMG. He is a Chartered Accountant with the Canadian Institute of Chartered Accountants and holds

The Foodbank Hunger Report 2022 highlighted that over 2 million Australian households were severely food insecure in the last 12 months and on any given day 306,000 households are receiving assistance from food relief organisations. F

University of Saskatchewan.

Hurrell thanked the acting CFO Chris Rowe for his contribution covering the position following the resignation of previous CFO Marc Rivers. Chris will continue in the acting role until Neil joins the Co-op early next year. F

NEWS www.foodmag.com.au | December 2022 | Food &Beverage Industry News 15

Over 2 million Australian households are severely food insecure.

ALDI statement on NSW singleuse plastic ban expansion

In a statement, ALDI Australia has said it understands the environmental impact of single-use plastics and has taken multiple steps over the years to take responsibility for any potential impact.

The statement followed New South Wales’ ban on single-use plastic items, which has been expanded from 1st November to include single-use plastic straws, stirrers, cutlery, plates, unlidded bowls, cotton buds, as well as foodware and cups made from expanded polystyrene foam (EPS).

Reaffirming ALDI commitment to plastic waste reduction and the steps that they have taken to reduce their impact, Daniel Baker, corporate responsibility director for ALDI Australia said, “Finding sustainable alternatives for packaging has always been important to us at ALDI. With our strong focus on tackling plastics, we are supportive of

the Meeting of Environment Ministers to work with the private sector to reduce waste.

“We agree the business plays a critical role in developing a circular economy and in turn, reducing plastic waste, ALDI has a commitment to a 25 per cent reduction of plastic packaging by 2025, and we are well on our way to achieving this.”

“ALDI recognises the negative environmental impact of single-use plastics, which is precisely why we’ve never provided free-of-charge plastic carrier bags and made the decision to remove all single-use plastic tableware from our shelves in 2020,” explained Baker.

“We were the first major Australian supermarket to replace plastic straws with paper straws on juice boxes. The roadmap also identifies the negative impact of microbeads, which ALDI

stamped out across our cosmetics, personal care, detergents, and cleaning ranges in 2018.

“Preventing plastics waste from entering the Australian environment is

ALDI was the first major supermarket in Australia to replace plastic straws.

essential, and ALDI is excited to continue stepping up and take responsibility for our impact. We welcome and encourage others in the industry to join the fight alongside us.” F

Victorian Government highlights food manufacturing priorities

The Victorian Government recently announced its vision for the future of the state’s manufacturing industry, for the first time highlighting alternative proteins as a priority sector within food manufacturing.

Victorian minister for Industry Support and Recovery Ben Carroll launched the Made in Victoria 2030: Manufacturing Statement, which outlines the Government’s ongoing plans for the state’s $31 billion manufacturing industry.

It was noted that the agrifood sector still has room for significant innovation and growth.

Victoria’s $36.9 billion food manufacturing sector accounts for a third of the state’s manufacturing output. It exports over $9 billion in manufactured food and beverage products annually and employs more than 74,000 people.

Within the food manufacturing sector, the statement included the following strategic priorities:

• Advanced food manufacturing capability and food innovation

• Growing Victoria’s sustainable food manufacturing capability

• New high-growth sectors and valueadd opportunities

• Developing Melbourne’s north as a centre for Victoria’s world-class food innovation and value-adding ecosystem

The statement also highlighted Victoria’s achievements in the food manufacturing sector:

• S VG Thrive agrifood accelerator located in Melbourne

• $133 million investment by George Weston Foods in facilities across regional Victoria

• $12 million investment in alternative protein innovation at the Grains Innovation Park in Horsham

• $10 million investment in Morwell Food Manufacturing Precinct

• Food Frontier inaugural alternative protein conference in Melbourne

• Delivery of the Australian Food Innovation Centre business case

Within the new policy statement, the Victorian Government noted that the already strong agrifood sector still has room for significant innovation and growth, pointing to the work of existing R&D centres such as AgriBio research centre at La Trobe University and the National Food Innovation Centre at CSIRO in Werribee. F

NEWS 16 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

internationalcoffeeexpo@primecreative.com.au Melbourne Convention and Exhibition Centre www.internationalcoffeeexpo.com Melbourne International Coffee Expo 2023 PACKAGING TECHNOLOGY CELEBRATING 10 YEARS OF EVERYTHING COFFEE Celebrating 10 years of MICE and everything coffee Equipment Roasters Production Packaging 17—19 August 2023 Book your stand to take part in the Southern Hemisphere’s largest dedicated coffee trade show.

How small brewer found success and growth in competitive market

Bondi Brewing Co got its humble beginnings in a Bondi Beach garage but today the manufacturer is on major retail shelves and across the hospitality industry. Adam McCleery writes.

MEET THE MANUFACTURER 18 Food&Beverage Industry News | December 2022 | www.foodmag.com.au

Bondi Brewing Co. was founded in the Eastern Suburbs of Sydney and continues to grow in popularity.

When Bondi Brewing Co founder Paul Parks started brewing beer as a hobby, he never expected that within a handful of years the company would be upscaling to meet consumer demand, let alone be selling his beer.

“We started in a garage, but we first approached local bars and restaurants and we really got that support behind us and without that I think it would have been impossible because we are up against 400 other brands out there which makes it hard to get the volume up quickly and get those commercials in the right space to keep you going,” said Parks.

Parks had already made beer brewing a long-time hobby before the idea to go commercial every struck him.

“I’ve been brewing beer for quite some time for friends and family, it started as a hobby, but I teamed up with Brendan McKenna and he has a good business head on him,” he said.

“He encouraged me to make something more out of the hobby and he helped me structure it right, set up the company and get the license. From there we went out to market and started brewing beer commercially.”

Bondi Brewing Co beer can now be

found in hospitality establishments and retail outlets but Parks said the growth happened organically and off the back of listening to his customers.

“I started with the kits from the supermarket when I started. I worked on one particular beer more than the others and that was just a pale ale which I kept tweaking based on feedback,” he said.

This philosophy remains at the heart of how Bondi Brewing Co decide what products to push, and which ones might not be doing so well, which in time has borne fruit for the company.

“We were messing around with ingredients and quantities until we came across a recipe that everyone said would be a success. It was called Beach Beer Bondi and that was our first product,” said Parks.

“It was a more hoppy beer but if you describe it to a non-beer drinker you would call it fruity flavoured. We released that beer in 2018.”

Recognising the growth of the craft beer market, and at the right time, was another pillar in Bondi Brewing Co’s early success.

“If we follow trends from over in the USA, over the last 15 to 20 years the consumer market has moved dramatically over to craft beer,” said Parks.

“Now you can feel fancy when talking about the latest craft beer that’s out there.”

Local support was also a critical part of keeping Bondi Brewing Co alive in the early days, and for its growth.

“We were also lucky to get in the Bondi BWS, and through investigation we found the right person to talk to and put our pitch together before speaking to the team leaders for the local beer department in Woolworths,” said Parks.

“They were great, they helped coach us along and helped us grow.

“All our products are approachable and easy to drink, our mantra is ‘the beer for drinking’ so we make beers we want to drink. With that in mind we developed a dryer and less sweet product.

“That was our angle and our point of difference and again that was well received.”

And it was this strong local support which also helped Parks maintain good cash flow while slowly expanding the business into what it’s becoming today.

“We are a local brand from the area so when we first started the business, we had a different name more synonymous with a specific area of Bondi, the first beer we brought out we designed the labelling ourselves and we gave them a simple design to look like a coffee cup,” he added.

“Then we stuck Bondi on the side and people started to refer to us as the ‘Bondi beer’, so we ran with that and decided to own it.”

“Listening to the consumer definitely plays a part with our growth and how

www.foodmag.com.au | December 2022 | Food &Beverage Industry News 19

MEET THE MANUFACTURER

The Bondi Brewing Co. has partnered with Jim’s Mowing as part of its strategy to collaborate with interesting brands.

Strong community support for Bondi Brewing Co. helped the brand gain traction in the market.

"We had the idea while chatting and we wanted something to be truly Australian and a Jim’s mowing van came along and we just knew that was the one."

successful it was around the Bondi area because people want to support local and

else and being our main market, we investigated the idea.”

That same 2018 summer was when Parks was first confident that they were onto a winning brand, especially after brokering deals with national companies.

“The summer of 2018, with the volume we sold and seeing our merchandise spreading, gave us confidence that we have a brand that

Co. has been following consumer trends and giving people what they want.

A key to the success of

MEET THE MANUFACTURER

Jim’s Lager is the brain child of the Bondi Brewing Co. and Jim’s Group.

Bondi Brewing

LIQUIDE premium gases keeping your produce as fresh as the day you harvested

AIR

ESSENTIAL SMALL MOLECULES FOR MATTER

Discover How. Air Liquide’s +50 years expertise and experience in the food industry could elevate your produce.

It’s vital that decision makers look towards supporting efficiency centric automation.

A rock-solid gateway to eliminating machine failures

In a market contending with labour shortages and increasing cost of production, it’s vital that key decision makers look towards supporting efficiency-centric automation frameworks.

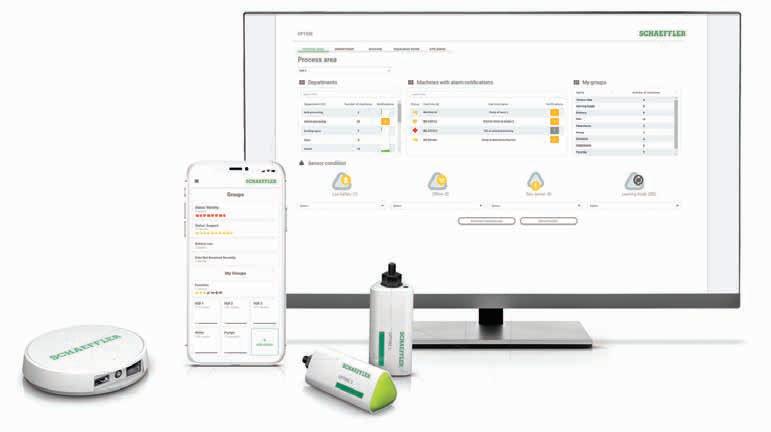

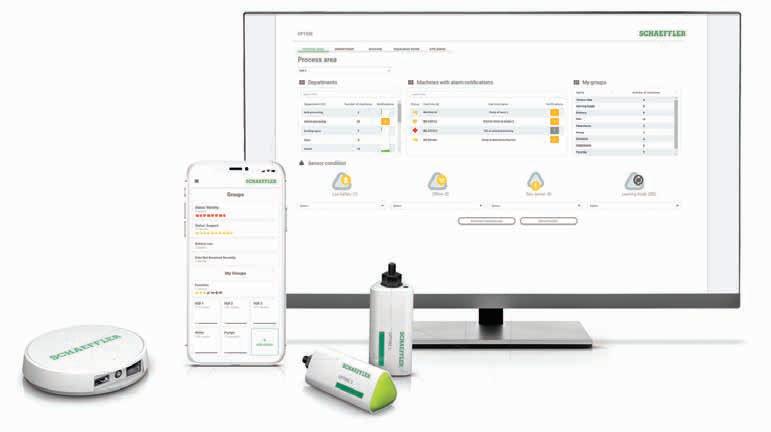

Industrial innovator Schaeffler is combating these challenges head-on with their Lifetime Solutions portfolio. Ben Kang, manager for this suite at Schaeffler Australia, explains that the offering can be categorised into three parts – predicative maintenance, smart maintenance tools, and lubrication.

The first of these encompasses the brand’s plug-and-play condition monitoring tool, OPTIME, which facilitates anomaly detection and AI diagnostics in the cloud.

The OPTIME software environment can be integrated into commonly used systems such as PI Historian, SCATA, and SAP via REST API, and is accessible through a user-friendly web or smartphone interface.

Compatible with most machines,

it works to detect bearing damage, lubrication related issues, imbalance, and misalignment before breakdown calls for costly unplanned downtime and consequential damage to the asset.

The second category – smart maintenance tools – covers a selection of modern equipment that helps to look after componentry, such as alignment tools, induction heating devices, and hydraulic equipment.

“These are widely used by large food and beverage manufacturers around the world, often in tandem with the available product training and localised support,” said Kang.

“The key drawcard is its universal standardisation – if a company has one plant in France, and another in Australia, they can rest assured that the technology will work the same and the support is available everywhere.”

The third category in the Lifetime Solutions suite is smart lubrication portfolio. From high performance greases designed to ensure high

bearing performance, to remote connected, lubricating devices such as OPTIME-C1, this range can be implemented to provide extended operating life, combat labour costs, or provide visibility on points that are difficult to monitor manually.

“These singular units are connected through the OPTIME mesh network,” said Kang.

“Users can – from the dashboard application – visibly track things like lubricant fill quality, days remaining on each grease cartridge, and battery life.

“For an industry like food and beverage, where you’ve got a lot of smaller machines spread out in a plant, keeping on top of each and every lubricator can be quite challenging. So having all this information on display is a game changer.”

The OPTIME mesh network allows a single site to deploy many points within a robust digital infrastructure. Each point, whether it is a smart lubricator or vibration sensor, will ‘talk’

to each other, allowing one gateway to service a wider area via a robust mesh network. It is also self-repairing, to accommodate for when one unit exits the mesh during equipment service or relocation.

“This is an important point to consider when choosing a remote monitoring solution,” Kang explained.

“The first thing people ask is whether the communications are reliable between each node in the network, and what we’ve seen with OPTIME as it’s been deployed in the field is its connectivity is rock-solid. Features like the battery life and data collection capabilities are world-leading for this type of technology.”

When it comes to food and beverage operations, compliance is king.

Depending on the type of site, each piece of equipment will need to meet specific and stringent standards – and these will likely require constant monitoring.

In answer to this, Schaeffler has honed solutions such as an OPTIME

22 Food &Beverage Industry News | December 2022 | www.foodmag.com.au MACHINERY

The food and beverage industry consists of countless moving parts, and closely monitoring each point of potential failure is both costly and time-consuming, Food & Beverage Industry News reports.

sensor designed for explosive environments, and monitoring tools for applications like oil pumps, grain handling equipment, and open conveyor systems.

“Because of industry-specific requirements and food safety laws, it’s important that operators can keep a close eye on whatever’s being processed on site,” Kang continued.

“If one of our sensors can flag an issue on a small section of a conveyor line, that could potentially prevent contamination and total batch recall which would cost the user significantly – financially and reputation-wise.”

The move towards automation and digital environment processing is happening at a rapid pace, and according to Kang, those who fail to uptake new technologies such as remote condition monitoring will likely

www.foodmag.com.au | December 2022 | Food &Beverage Industry News 23 MACHINERY

State of the art food production and storage facility Temperature controlled throughout Total size 8,200sqm* Fully drive around Accessed from on-grade and recessed docks *approx. Michael O’Neill 0431 500 939 michael.oneill@cbre.com.au Shaun Timbrell 0433 302 979 shaun.timbrell@cbre.com.au Rajal Chaudhary 0413 485 456 rajal.chaudhary@cbre.com.au Contact the exclusive leasing agents for more information or to arrange a tour: 7-9 George Young Street, Auburn, NSW 2144 For Lease Schaeffler Lifetime Solutions can eliminate up to 100 per cent of machine failures.

Wheat straw gains in popularity

COPAR is experiencing first-hand the growing popularity of wheat straw as a viable option for an alternative packaging source, both locally and abroad. Food & Beverage Industry News reports.

With the announcement that Australia would be phasing out single use plastics permanently, the search for viable alternatives has kicked up a gear for the food and beverage industry.

Recently, REDCycle’s soft plastic recycling program, whereby consumers dropped off their soft plastics at Coles and Woolworths, temporarily suspended its collection. Although REDCycle planned to scale their recycling, they could not keep up with the rapidly growing soft items collected and resorted to stockpiling it in warehouses. This practice is both an environmental and safety risk and lead to the suspension of the program in November 2022. This highlights the inherent difficulties into relying strongly on recycling plastic as a solution for the plastic pollution crisis. Further, this erodes consumer confidence in recycling, particularly current packaging that still contains the REDCycle disposal instructions. Other alternatives that focus on compostable products for packaging materials are viable options. Other packaging options that consist of compostable materials should also be utilised to achieve extended producer responsibility and a circular economy

With the time given for businesses

to transition away from plastics many have started to inquire with developers, manufacturers, and suppliers of alternative packaging such as paper and hemp.

However, a new option is quickly gaining traction overseas and here in Australia for its long list of advantages which include easy turnaround, local supply, being compostable, and being capable of creating a circular economy around it, and that is wheat straw.

COPAR, specialists in sustainable packaging solutions, have been researching and developing wheat straw pulp, in partnership with the University of Newcastle and other interested stakeholders, as a viable fibre-based packaging option.

“The interest in wheat straw has really grown, particularly overseas,” said COPAR business development manager, Colin Farrell.

“We attended the London Packaging Week Trade Show in September 2022, after meeting with major packaging distributors and other technology partners in Manchester. They showed strong interest in the wheat straw option.

“We got over 200 leads at that trade show. The demand for pulp-based packaging over there is probably more advanced than here in Australia. This is because they have more penalties

in relation to using virgin plastic in packaging.”

Farrell said he observed that the United Kingdom has taken a more concerted approach with consumer waste management, particularly composting as high value recycled organic material, and appeared to be a key driver behind the interest in wheat straw fibre-based packaging.

“For example, in England they have multiple recycling and waste bins, with general waste only needed to be collected once a month, if the consumer divides up the waste and recycling items correctly,” added Farrell.

“I was told that when this was introduced, many people thought was it wasn’t going to work, but it has proven to be a success.

“Most of Australia still adopts a recycling bin and waste bin only. It goes to show we have some catching up to do from a consumer perspective and I think compostable products are a great option for that.

“Ideally, we would love to see this fibre-based product go into some type of organics or compost bin, because it’s made from wheat straw, and it can break down there. Of course, we need to see an expansion of composting bins for that to become a reality.”

And with the government ban

on plastics being made official, compostable/recyclable packaging is more important than ever.

Paper-based packaging has also started to see a return to popularity, although more innovative than those offered in the past. But Farrell said the industry can’t afford to run the risk of relying heavily on one form of alternative packaging again, as with plastic.

“We are keen to collaborate with local councils to conduct case studies in terms of waste management.”

“We may see in the near future why plastics ended up being the option most businesses stuck with for so long,” said Farrell.

“We can’t put all our eggs in one basket in terms of alternative packaging, and in this case that would be paper packaging and using recycled plastics.”

The environmental impact of increasing the use of paper-based packaging was another area of concern for Farrell.

“We have to cut down trees to make paper, you can reuse paper, some paper can be composted, but recycling has the added process to break it down to prepare for recycling,” he said.

“Whilst with composting we can use wheat straw as an alternative. And you can keep that circular economy with wheat straw.

PACKAGING 24 Food&Beverage Industry News | December 2022 | www.foodmag.com.au

Wheat straw as an alternative packaging solution was a hit at a London trade show.

This is because until recently, the wheat straw off cuts we use has been treated as a waste by-product of the agricultural industry, however the wheat pulp has proven to be a great foundation for packaging.

On top of this, it is cheap, in abundance in Australia, has a rapid turnaround time and perhaps most importantly, it creates a new revenue stream for Australian farmers.

“It’s also quicker to grow and easier

plastic in the first place will become more apparent as we move away from it. Plastic is a very flexible and cheap product that suits many packaging requirements – it is now, however, increasingly harmful to the environment upon disposal”

Being able to source all the required materials for wheat straw packaging in Australia also cuts down on supply chain times and mitigates the risk of major disruptions.

“When you get your materials locally you have full control of the supply chain, and it also gives farmers extra revenue because wheat straw we use was always discarded as waste. We are using that waste to provide our farmers with an additional source of income.,” said COPAR marketing specialist, Fathima Sameer.

“Suppliers who want to buy from us will want to know where their products come from, who has manufactured and supplied it.

“In our case we have everything happening in Australia and that’s something that is evident in the trade show, even though we are form Australia they were interested in Australian made products because they have the ability to track the supply chain.”

COPAR also boasts the ability to tailor make products for the market.

“Being a manufacturer ourselves we can cater to multiple industries which means we have the ability to customise the product to what the business and consumers want,” said Sameer.

For Farrell, the provenance of their product is also of extreme importance.

“Overseas they also want to know the quality of the wheat straw, where it’s sourced,” he said.

“Those issues are becoming more apparent, consumer demand is one driving force behind that, wanting to know where the packaging is coming from and how it’s made.

“Wheat straw is a new product, and we should be proud in Australia to be jumping onto it. For Australia it is a great solution in terms of wheat straw being the right product.”

A critical step to seeing wheat straw

packaging take off is being able to accredit Australian sourced and made wheat straw for global consumption.

COPAR has partnered with the University of Newcastle to achieve this very goal.

“We have a research arrangement with the university of Newcastle which we started in 2021,” said Farrell.

“Australia, to its credit, has a higher standard than the rest of the world for testing bio-packaging products, as it must pass an earthworm toxicity test, to ensure a consistently high quality, high value compost that is good for the environment.

“Australia doesn’t have any internationally recognised certification service, so the University of Newcastle is working to develop one.

“They are undergoing that process to get the certification to be able to do that on Australian products. We aren’t sure on the time frame, but it should be soon.”

And in terms of interest in Australia already, Farrell said the company has over 300 current leads regarding the development of wheat straw packaging.

“When the certification centre is opened, testing can be done more cheaply and at our back door which speeds up the supply chain,” added Farrell.

“And our products will have that testing and certification with the University of Newcastle to international standards which will open up wider markets.”

It’s an exciting time in the alternative packaging space and the message from COPAR is to diversify the market options. F Wheat straw is gaining popularity as a packaging alternative.

PACKAGING www.foodmag.com.au | December 2022 | Food&Beverage Industry News 25

Food and beverage trends: Sights set on sustainability

As sustainability targets get ever closer, SMC Corporation Australia New Zealand continues to guide companies towards reaching and exceeding them. Food & Beverage Industry News reports.

With a firm focus on sustainable development goals, SMC Corporation Australia New Zealand works with customers who set bold energy efficiency targets, and achieving these is paramount.

“We deal with customers with similar targets and objectives to our own,” explains Paul Grantham, global accounts manager – End User Lead ANZ for SMC.

“We understand that there is the need to obtain these targets and then there is the realisation of ‘but how do we make this happen?

“Customers are looking at their sustainability targets and trying to figure out how this translates into operational efficiency.

“Many of our customers are multisite, multi-state companies, and rolling this out across the various sites and operations can prove challenging.”

Take a dairy company for example, said Grantham. One site may be

“It is rarely simple as the different sites will have different challenges and also possibly different targets based on what they manufacture,” he said.

This is where SMC comes in.

“We engage with the team at a group level to understand the business target but also at site level to better understand the business’s goals and to develop a tailored solution. Thanks to our national footprint, this is backed by local, on-the-ground support,” Grantham added.

Food and Beverage Trends

More customers are in search of energy saving components.

“The recent national budget highlighted the rising cost of energy (by 30 – 50 per cent) which places major pressure on businesses in terms of cost and competitiveness,” said Grantham.

Data is also an important factor as Grantham explains.

“Products that can log the data are in demand. Customers want to be in the

by giving them detailed insights into air consumption and what they can do it to improve it.”

Grantham adds that washdown technology is a must-have in food factories.

“IP69K valves offer a high flow rate and can also be washed down,” he said.

“They don’t need to be in a cabinet, and you can install them close to the application which is very handy from an installation and cost point-of-view.”

SMC offers FDA and EHEDG compliant fittings such as the KFG and KQG series.

“They don’t harbour any dirt or food particles and there are no areas where they can gather so they’re safe for use,” added Grantham.

The SMC Edge

“We are continuously innovating to help make factories more efficient,” said Grantham.

“A common query that we receive is cantered around running plants’ compressed air at 7 bars. Customers will

pressure across the whole plant.

“Recently, we helped a customer to identify a piece of equipment that required a higher pressure to run, we were able to recommend a solution from our standard range of products and once implemented and monitored to ensure the change was sustainable it assisted the plant on the journey to their goal of running their plant at 6 bar. It’s a simple solution with big benefits.”

This is a perfect example of how SMC tackles an energy saving project.

“Now that we have reduced the pressure from 7 to 6 bar, we can move onto the next pain point,” said Grantham.

Grantham’s advice to customers wishing to achieve further energy savings is as follows:

1. Break it down into methodical steps: “Every step in the right direction brings you closer to your goal. After dropping from 7 to 6 bar, you will find that you are using your equipment more efficiently and will continue to see improved outcomes in your plant.”

2. S avings lead to savings: “Efficiencies lead you to places where you can achieve more savings. Companies have listed targets that they want to meet, but they are sometimes unsure of how to get there, and when it comes to compressed air that’s where we come in.”

3. Apply a long-term view: “We take a long-term approach to identify what’s in the pipeline so that we can help our customers plan. We ask ourselves questions like ‘does the customer have new equipment coming in and can the compressor handle it?’” We constantly review the goals and strategy in place to ensure continuous improvement.”

Looking ahead, Grantham said that SMC is bringing some new technology on-board.

“We have a new AMS (Air Monitoring System) coming in in 2023,” he said. F

SUSTAINABILITY 26 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

Paul Grantham said it was an advantage that SMC has similar sustainability objectives to its clients.

Tying together future-proofed predictive maintenance, smart tools, and lubrication systems, this portfolio helps plants to bolster compliance and reduce downtime. Harnessing AI diagnostics and a comprehensive analysis suite, OPTIME forms a mesh network to detect bearing damage, lubrication issues, imbalance and misalignment before it’s too late.

User-friendly interfacing technology with lubricators offers live visualization on lubricant fill, days remaining on grease cartridges, and battery life. Get notified of machine condition, and stay ahead of your equipment to avoid unplanned shutdowns.

www.schaeffler.com.au

Eliminate machine failure and food waste with Lifetime Solutions

Reduce waste Extend equipment life Minimise energy consumption

We pioneer motion Plug and

play.

Advanced monitoring.

Accurate monitoring requires the right instrumentation

AMS and Katronic supply the Australian food and beverage industry with some of the highest rated and popular flowmeters, which already have a proven track record.

When Molson Coors Brewing Company was in the market for a reliable, robust, and accurate method for monitoring performance of its brewing, cleaning, and processes, they contacted Katronic for assistance.

Katronic specialises in clamp-on, ultra-sonic flow metres and non-invasive process measurement instrumentation and modern electronics and sensor technology.

The company was established in the United Kingdom in 1996 as a distributor of process measurement instrumentation with a focus on ultrasonic technologies.

Since then, the company has evolved into being a highly regarded manufacturer of its own brand of clamp-on flowmeters and works tirelessly to maintain an excellent reputation for quality products and market-leading customer service.

AMS Instrumentation are the distributor of Katronic machinery and technology within Australia and the success of Katronic’s work with the Molson Coors Brewing Company is a great example of how the partnership between the two companies is benefiting the industry.

One of the problems faced by the Molson Coors Brewing Company’s engineering team was the lack of

verification methods for its existing in-line flow meters, or for measuring pipelines where flow metering was absent to begin with.

This was of particular importance when it came to the clean in place entries and on the water supply pipes where the system had been in operation for a significant period of time.

That also applies to the plant’s effluent overflows where strict environmental standards must be met.

Solution

The solution given to the Molson Coors Brewing Company came in the form of a Katronic portable clamp-onflowmeter. By having the KATFlow 230, the engineers at the brewing company were then able to carry out a complete survey of all critical pipelines within the production process.

As all measurements were taken non-invasively, it ensured that there was no need to interrupt the production lines, and by extension removed, any risk of contaminating the flowing liquid.

Furthermore, as the flowmeter can be programmed and the sensors installed very easily and in short time, several pipelines could be measured in a short period of time.

The implementation of the Katronic flowmeter was successful and has proven popular with the engineering team at the Molson Coors Brewing Company.

As a result, the engineering team commented that they were ‘highly satisfied’ with the high specifications of the unit, the ease with which it can be used, and the excellent build quality of both the sensor and the electronic transmitter.

Some of the listed advantages of the KATFlow 230 also includes the simple, quick and cost-effective installations and measurement capabilities, no interruptions to ongoing production processes, and the option to integrate temperature inputs for greater process control.

On top of these advantages, the KATFlow 230 is also capable of measuring different pipe materials and diameters, is easily portable throughout the whole plant and a robust, reliable, and accurate instrument.

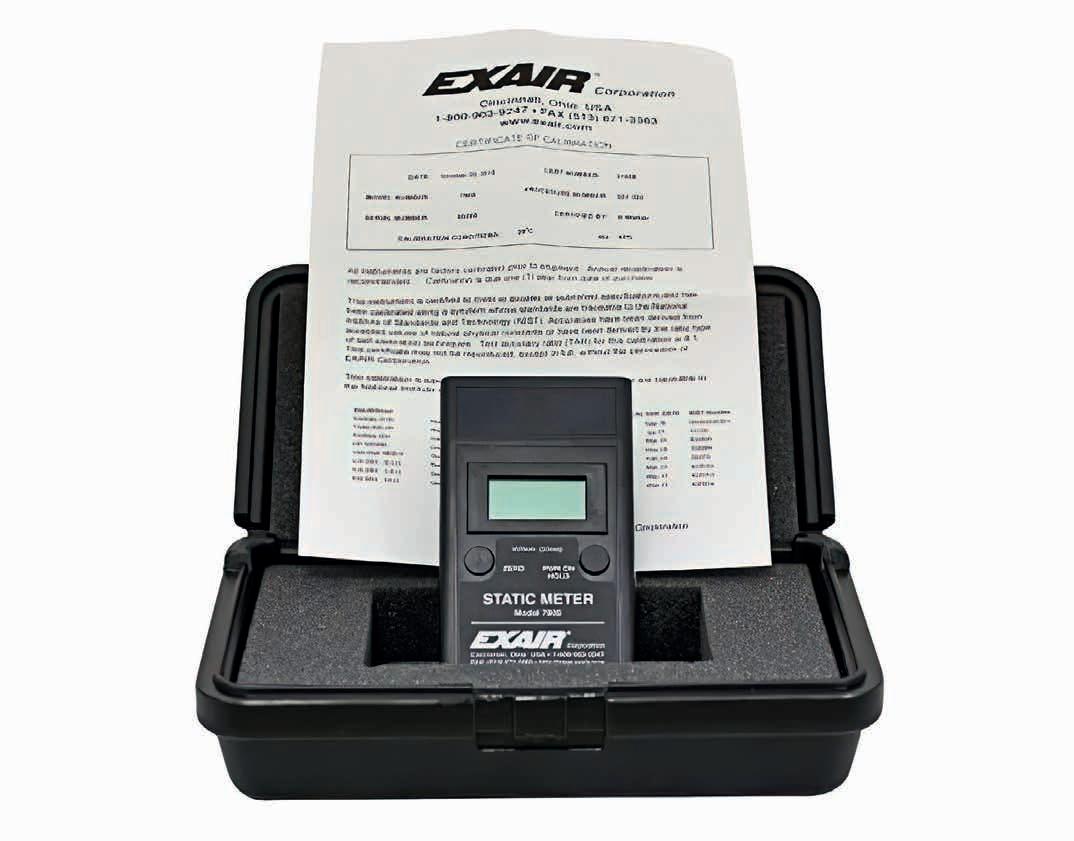

AMS can help Australian food and beverage manufacturers get hold of any of the Katronic clamp-on ultrasonic flowmeters.

AMS has been supplying instrumentation to most, if not all, of the industries in Australia for almost half a century, from government departments to public utilities and food and beverage manufacturers.

Having Katronic as part of the company’s suite of offerings means Australian manufacturing has access to proven, and popular, technology.

28 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

FLOWMETERS

F

AMS Instrumentation are the distributor of Katronic technology in Australia.

Katronic’s flowmeter offerings have already proven popular in Europe.

Demand for F&B industrial space is the highest it has ever been

As the food and beverage industry continues to recover from the impact of the COVID-19 global pandemic, several of the disruptions caused by the event have also resulted in supply and industrial space concerns in Australia.

CBRE Australia, a commercial real estate group, has seen firsthand how disruptions to the supply chain, and changes in consumer demand off the back of extended lockdowns, has impacted the industry.

“There has been a huge take up over the last couple of years, occupiers have been taking additional space because

supply chains have been unreliable and consumer demand increased dramatically,” said Michael O’Neill, CBRE NSW director and managing director of CBRE Western Sydney.

“Many occupiers have moved to a ‘just in case’ model rather than the traditional ‘just in time’ model.

“That has created demand for extra space and contrary to that is the supply of new stock has not kept pace with that demand. Whether it be delays due to COVID, delays due to wet weather, and delays with planning.

“These factors mean users have wanted more space but there has been

less supply.”

As an example, 2021 saw the highest take up of industrial space ever in Australia, and by a significant amount, O’Neill added.

Traditionally the gross take-up around the Sydney area has been dominated by postal, transport, and warehousing over the last decade, but in the last two years that has seen an increase in a range of industries particularly food related groups.

“This is largely due to an increasing e-commerce penetration rate,” said O’Neill.

“A lot of people have gone to 3PL’s for

overflow, however the manufacturing sector, which includes food production, has represented a significant part of that, 21 per cent in fact.

“The penetration rate will continue to increase, and I think population growth will keep that momentum going moving forward.”

The growth seen over the last two years is trickling across all sectors of the food and beverage manufacturing industry, including at the retail level, which is helping drive the demand for more stock and industrial space.

“With respect to non- discretionary retail spend, this has been growing at an

30 Food &Beverage Industry News | December 2022 | www.foodmag.com.au

WAREHOUSING

The food and beverage industrial sector experienced a record uptick in the demand for more industrial space off the back of several external factors including the pandemic and supply chain disruptions.

Adam McCleery writes.

10 billion in 2021, and expected to double to AUD 20 billion by 2026.”

These changes have also resulted in new approaches to the types of industrial buildings companies are now looking to construct.

“We are seeing that many developers recognise the strong demand by specialised food users, especially in in-fill locations like Auburn but also in outer west locations like Eastern Creek and Glendenning,” said O’Neill.

“I would estimate that for somewhere between 30 and 40 per cent of occupiers on new development stock on inner locations is being driven

challenges is that supply is so tight that developers do not necessarily need to build specialised buildings to attract occupiers because demand for ambient space far outstrips supply.

Figures from CBRE Research also show that Australia’s food and beverage exports totalled $47 Billion in 2021, which made up 10 per cent of the nation’s total merchandise exports and is expected to increase to $66 Billion in 2026 off the back of Australia’s comparative advantage in food production.

“The growth in the food and beverage industry, associated

comparative advantage in food production, coupled with strong export ties with countries exhibiting a growing middle-class population, we expect further expansion of Australia’s food and beverage sector.”

These industries which fall under non-discretionary retail trade sector underpin the long stability of the industrial and logistics sector and by extension the cold storage sector.

All of these factors mean the demand for space and the industrial space available, is imbalanced significantly, O’Neill said.

“At the moment, the vacancy in

The demand for industrial food facilities is far outsripping the current supply.

O’Neill added that occupiers in all industries were well advised to consider their requirements no less than 18 months in advance to ensure they can consider green field solutions.

“The prevailing market conditions mean that occupiers will need to compromise if they are not in the market 18 months from their desired commencement date.

“ There are definitely some ideal pre-lease and speculative solutions provided occupiers engage earlier than in the past. There is always the chance of finding a good solution with 6 months lead time, but it’s unlikely.” F

www.foodmag.com.au | December 2022 | Food &Beverage Industry News 31

WAREHOUSING

"The growth in the food and beverage industry, associated manufacturing, and distribution operations, is led by both domestic and global demand factors."

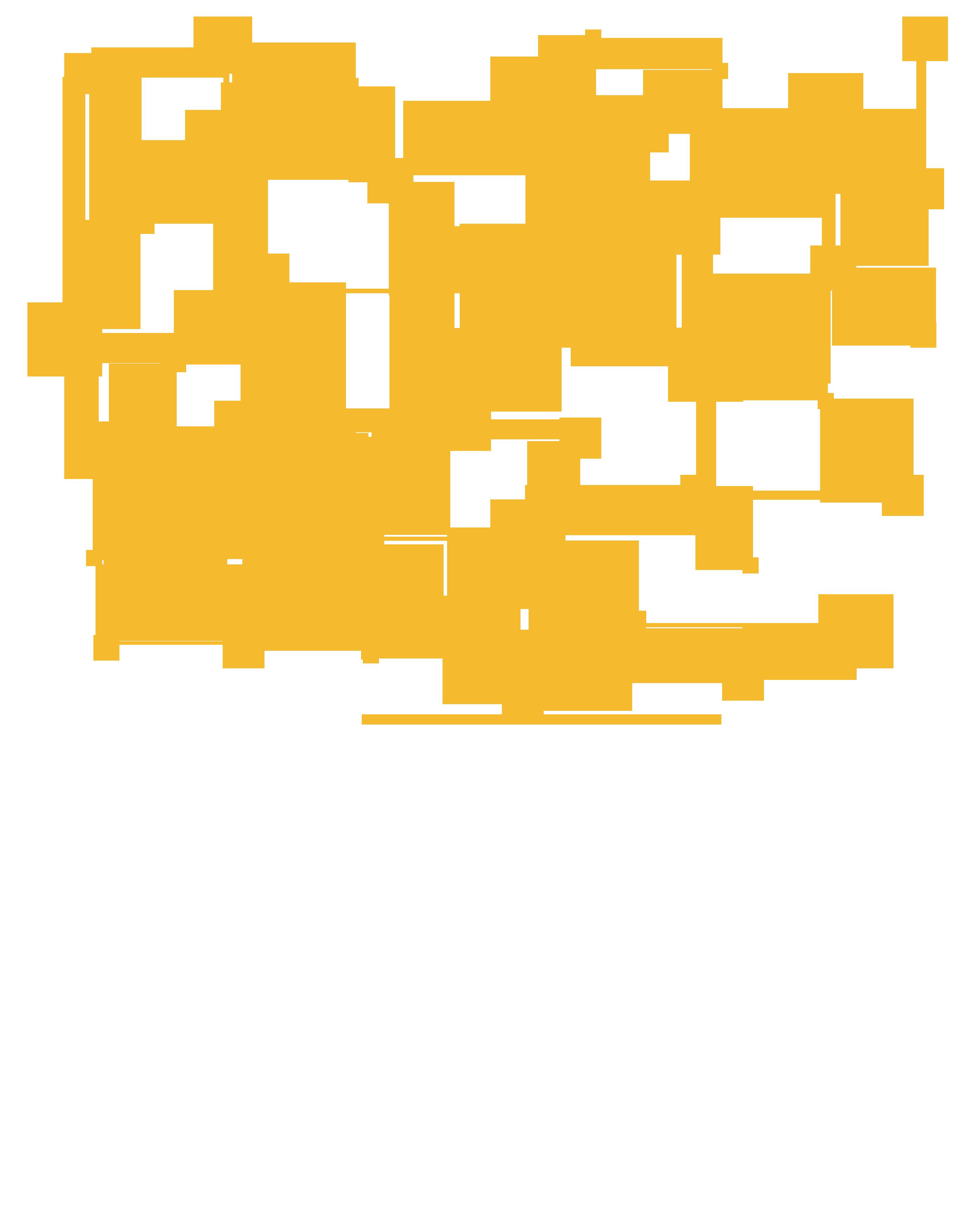

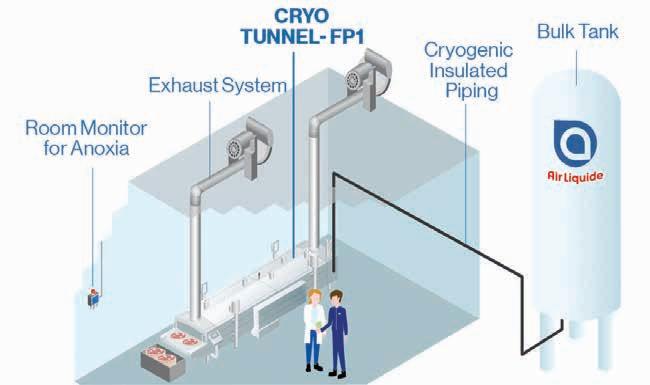

In-line Cryogenic Freezing: a tailored solution

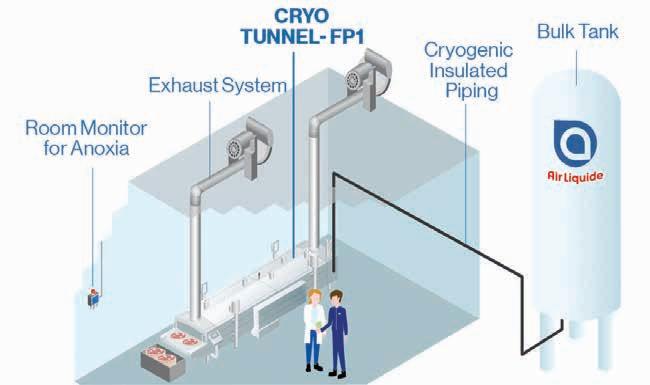

Air Liquide provides expert knowledge and experience for the best cryogenic freezing solutions. Food & Beverage Industry News reports.

Time is of the essence when it comes to freezing. Cryogenic freezing is a niche application in the food refrigeration market and refers mainly to the use of liquid nitrogen and liquid carbon dioxide as the refrigeration mediums.

The colder temperatures of these cryogens enhance the quality of the food product by freezing it much faster than with traditional freezing methods.

Faster freezing results in the formation of smaller ice crystals which causes less damage to the cellular structure and helps to retain the food product’s initial texture, colour, and flavour attributes.

In addition, cryogenic freezing contributes to higher yields by rapidly locking in the product’s moisture content so that there is very little weight loss from dehydration during the freezing process.

Integrating a cryogenic freezing solution into a new or existing production line involves a good understanding of the composition and properties of the food product that needs to be frozen, along

knowledge and expertise, through its worldwide network of food cryogenic specialists and research laboratories, to be able to design the most cost-efficient cryogenic solution that is customized to meet the specific needs of each manufacturer.

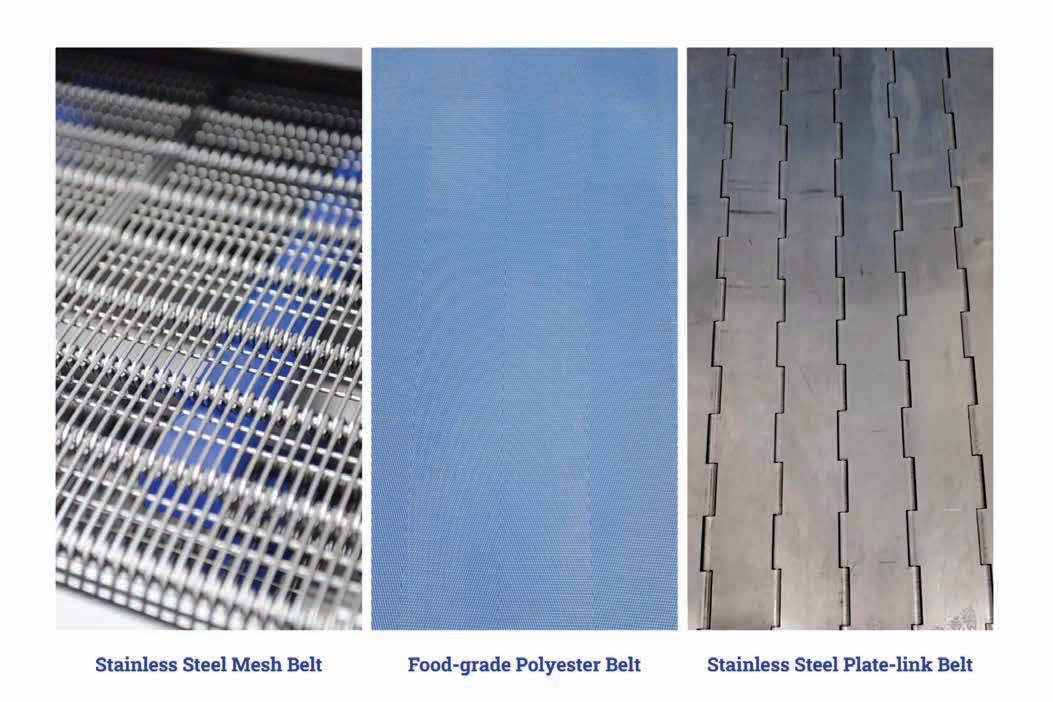

Air Liquide also offers an extensive range of cryogenic food processing equipment, in various models, widths and lengths, that can be perfectly matched with the food product, production volumes and amount of available floor space.