UNIQUE CONTENT AND INSIGHT FOCUSED ON KEY TRENDS IN THE GLOBAL CONSTRUCTION EQUIPMENT AND TECHNOLOGY MARKET FROM THE INDUSTRY’S BEST-INFORMED AND MOST INFLUENTIAL SOURCES

GLOBAL REPORT

CONSTRUCTION EQUIPMENT AND TECHNOLOGY 2022

UNCERTAINTY AFTER RECORD-BREAKING YEAR

DIGITAL CONSTRUCTION WORKS CHANGE DRIVES HEAVY LIFTING INNOVATION FUELLING THE FUTURE IS A GAS, SAYS CUMMINS

EXOSKELETONS THAT FIT LIKE A GLOVE METSO SWITCHES ON SUSTAINABLE CRUSHING FOCUS: WEST AFRICA, PHILIPPINES, INDONESIA APPLICATION EXPERTISE FROM FAYAT BUILD BACK BETTER MAKES A REAL DIFFERENCE

www.worldhighways.com | www.aggbusiness.com

GLOBAL REPORT

Editor: Geoff Hadwick

Contributing Editors: David Arminas, Guy Woodford

Designers: Simon Ward, Andy Taylder

Production Manager: Nick Bond

Office Manager: Kelly Thompson

Circulation & Database Manager: Charmaine Douglas

Internet, IT and Data Services Director: James Howard

Managing Director: Andrew Barriball

Chairman: Roger Adshead

Editorial contributors: Liam McLoughlin, Pete Kennedy, Graham Anderson, Munesu Shoko, V L Srinivasan

COVER IMAGE: © Scaliger | Dreamstime.com

ADDRESS:

Route One Publishing Ltd, Second Floor, West Hill House, West Hill, Dartford, Kent, DA1 2EU, UK

Tel: +44 (0) 1322 612055

Fax: +44 (0) 1322 788063

Email: [initialsurname]@ropl.com (e.g. radshead@ropl.com)

ADVERTISEMENT SALES

Head of Construction Sales: Graeme McQueen

Tel: +44 1322 612069

Email: gmcqueen@ropl.com

Sales Director: Philip Woodgate Tel: +44 1322 612067

Email: pwoodgate@ropl.com

Sales Director & Classified: Dan Emmerson

Tel: +44 1322 612068

Email: demmerson@ropl.com

Italy: Fulvio Bonfiglietti

Tel: +39 339 1010833

Email: bonfiglietti@tiscali.it

Asia / Australasia: Roger Adshead

Tel: +44 7768 178163

Email: radshead@ropl.com

Global Report Construction Equipment & Technology

ISSN 2634-3223 (Print)

ISSN 2752-8375 (Online)

05. GLOBAL MARKETS REVIEW

Global construction equipment sales rose 10% in 2021 to a new record of 1.196 million units, according to data from Off-Highway Research (OHR). However, a -5% fall in demand is expected this year … But not all is lost. Will that still be enough to give 2022 the second-highest sales volumes on record?

20. DIGITAL CONSTRUCTION WORKS

Conquer technology interoperability gaps with DCW. Digital Construction Works is all about the “transformative power of digital”. It is designed to be a leading integrator of construction technology services, a power that will help to deliver projects smoothly, on time, and on budget. Use the platform to increase productivity, reduce risk, and deliver reliable, efficient project results. Are you connected?

26. THE POWER DEBATE: HYDROGEN

Cummins has been at the cutting edge of developing power solutions for more than 100 years and is continuing to lead the market by developing a range of sustainable drivetrains powered by new fuel sources. Why is the industry’s number one power player concentrating so strongly on hydrogen?

29.

HEAVY LIFTING AND CRANE TECHNOLOGY

Construction heavy lift and abnormal load transport companies have been undervalued in the past … hugely important but often overlooked. Today, things like giant pre-fabricated bridge sections are helping contractors to increase their productivity levels, but how is it all being lifted into place?

36. THE WORLD IN NUMBERS

We live in interesting times. Here are a few key facts and figures to help make sense of it all.

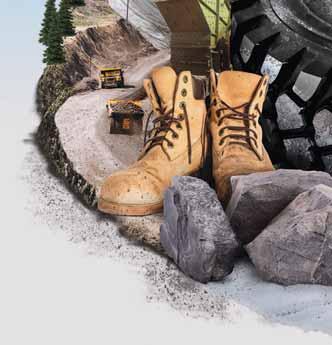

42. METSO: PLANET POSITIVE

Switch on to sustainable crushing and screening. Everywhere you look you can see the impact of climate change, depleted natural resources, and increasing urbanisation. The demand for sustainable solutions is increasing every day as digitalisation paves the way forward. How can you make your equipment fleet as sustainable as possible?

45. SUPPLY CHAIN MANAGEMENT:

AMERICA

The haves and the have-nots: not all will survive. Supply chain complications are more than just an inconvenience to the construction equipment manufacturing industry. Successfully navigating the supply chain has never been more essential, and the difficulties involved are creating a world of “haves and have-nots”. Will your business survive?

50. SUPPLY CHAIN MANAGEMENT: EUROPE

While Covid-19 restrictions have been rolled back in many countries, global construction equipment supply chain issues persist. In Europe, the situation has been exacerbated by the Russian invasion of Ukraine, plus renewed pandemic lockdowns in China. How tense is it really getting out there?

56. EXOSKELETONS & ROBOTICS

Exoskeletons and digitally-connected clothing, once just a pipe dream, are now helping managers on big construction sites to improve a variety of metrics such as connectivity and productivity. Often called wearables or exosuits, they can be as large as a space suit or as small as a glove. How do they work?

60. REGIONAL FOCUS: WEST AFRICA

As policymakers in West Africa seek tools to stimulate economic growth, there is a distinct focus on infrastructure development as a cornerstone of the region’s economic recovery plans. Investments in road corridors and transport projects at large are expected to continue apace as West Africa scales up regional integration.

65. REGIONAL FOCUS: EUROPE’S NEW SILK ROAD

A heavyweight fight: EU’s Global Gateway v China’s Belt and Road Initiative. Global Gateway is the European Union’s fight-back programme to counter China’s Belt and Road Initiative, a megaproject that Brussels believes the Chinese will use to increase their political and economic influence around the world. It’s going to be a big fight … But how viable is this ambitious EU alternative?

68. INNOVATION FROM FAYAT

The construction equipment sector needs to work towards decarbonisation and digitalisation, says Fayat. From safe and alternative drive systems to new technologies for reduced energy consumption, improved carbon footprints, autonomous operations, and digital integration, Fayat is making these ideas reality today.

74.

REGIONAL FOCUS: PHILIPPINES AND INDONESIA

As quarantine restrictions ease and Covid takes a back seat, government spending is starting to speed up a host of major infrastructure projects in The Philippines and Indonesia. New capital cities, new roads, and new high-speed rail lines are all underway. Is it fast-forwards to a brighter future?

79. BUILD BACK BETTER

Construction industry experts are pleased with the U.S. government’s plan to invest heavily in the country’s infrastructure. But more details are needed to stave off growing uncertainty. How, exactly, will the money go from the government’s funding pot to repairing the potholes? That’s the $1.2 trillion question.

Build your next highway project on a secure platform

We help accelerate highway construction projects through the adoption and use of digital workflows, BIM for infrastructure assets, digital twins, and best practices. We integrate the right combination of third-party applications and technology to improve transportation planning, design, construction, and operational outcomes.

We integrate the myriad of disconnected planning and design-build applications with your job site, machinery, and sensor technology, allowing for enhanced communication and seamless project management from the office to the job site.

*Ask us about our Integrated Highways Solution of third-party applications and technology for the planning, design, and construction of your next project. We’ve integrated the best of what vendors offer into a fully integrated highway solution.

Contact DCW to learn more.

UNCERTAINTY FOLLOWS A RECORD-BREAKING YEAR

Global construction equipment sales rose 10% in 2021 to a new record of 1.196 million units, according to data from Off-Highway Research (OHR). However, a -5% fall in demand is expected this year but that would still give 2022 the second-highest sales volume on record, says the same source. Guy Woodford reports.

Acombination of low interest rates, stimulus spending on infrastructure and high commodity prices last year was, states OHR, a “heady combination” for the construction equipment market.

China was the only major regional market that failed to grow in 2021. OHR notes that some of the strongest growth was seen in North America (up 25%) and Western Europe (up 22%), while emerging markets, excluding India and China, were up 24%. The OHR figures exclude compaction equipment and cranes.

OHR highlights some significant downside risks in 2022. Inflation and the prospect of rising interest rates have been factors for several months and may be a growth brake. Russia’s invasion of Ukraine and the resulting international sanctions have, says OHR, heightened this situation.

Looking further ahead, industry research company Freedonia tips global demand for construction machinery to grow 4.1% per year to US$250 billion in 2025.

Rising construction activity due to factors ranging from: population growth. to increasing industrial output; increased infrastructure spending; and advances in worldwide mining, forestry activity and energy production, are said by Freedonia to be key factors fuelling unit sales.

Freedonia says: an increase in replacement sales of global construction equipment, after many operators delayed machinery purchases in 2020; the embrace of newly developed, state-of-the-art construction

equipment, costing considerably more than predecessors; and rising sales of replacement parts and attachments as the amount of equipment in use worldwide increases, will also boost sector demand.

Global sales of construction equipment 2002-2021 (Units)

Source: Off-Highway Research

EUROPE

BUILDING ON A “REMARKABLE OUTCOME”

Demand for construction equipment in Europe continued its eye-catching growth in 2021, after the industry had already seen a return to growth in the second half of 2020 when the impact of the pandemic was receding.

Off-Highway Research reports that the bounce back in 2021 was much stronger than expected at +22% in Western Europe alone (196,396 units, compared to 160,946 in 2020) – the second-highest total on record.

European construction equipment association CECE says demand benefitted from a combination of stable performances by different end-user segments and pandemic stimulus measures, whose potential fully unfolded in 2021.

It adds, however, that the industry also experienced the most severe supply chain disruptions in recent history, in particular shortages of raw materials and components, as well as scarce and expensive freight transport.

“Against this backdrop, the 24% [CECE figures] increase in sales in 2021 on the European market is a remarkable outcome,” said CECE president Alexandre Marchetta.

“The European construction equipment industry is indeed resilient as shown over the last two years. The continued increase in demand in our largest markets, the

European recovery programme and the global construction boom are boosting our business. We are doing everything we can to maintain the positive direction in the coming years. This includes the urgent topics of decarbonisation, digitalisation and the EU regulatory agenda.”

The figures surely include a statistical ‘base effect’ of yearly comparison, with the enormous drop caused by the first pandemic lockdown in 2020. However, after weathering the Covid crisis, CECE notes that underlying demand within the industry has remained strong and is on track to close the gap to the record sales levels of 2007.

2021 saw consistent trends across the equipment sub-sectors with all product segments recording growth in sales of between 22% and 30%. Concrete machinery saw the strongest growth, slightly above the levels seen in the other sectors.

From a regional perspective, the markets that were hit hardest in 2020 –particularly the UK and Spain – saw the best performances in 2021. Southern Europe and CEE markets saw above-average growth in sales, and even the mature markets in Northern Europe saw similar levels of recovery. None of the markets saw a fall in sales in 2021, and the only market that experienced single-digit growth was the high-volume German market. The fact that

Gross growth 2020-2023 (Domestic product & Investment in equipment)

Sources: European Commission - Feb.2022, (GDP)ONS for UK (GDP, European Commission - Nov.2021)

it has still not reached saturation levels can be considered a positive outcome. Turkey continued its recovery from the catastrophic levels of decline seen in 2018/19 and saw the highest levels of growth across the market regions.

Providing an outlook for European construction equipment market in 2022, CECE says the business climate index for the industry recorded its highest ever value in the July 2021 survey and maintained extremely high levels throughout the rest of the year. In the first two months of 2022, there was another small improvement both for the current business situation and future sales expectations.

European manufacturers hope that supply-side bottlenecks will create fewer concerns for the rest of the year. CECE says the demand-side clearly remains strong, as all equipment sub-sectors were expecting business to improve in the months leading up to the summer of 2022.

In February this year, the CECE Business Barometer, highlighted that more than 50% of manufacturers surveyed were experiencing order backlogs of six months or more. All statistics and surveys presented in the current Annual Economic Report have so far indicated that the European construction machinery industry is very well positioned. CECE warns, however, that these expectations are likely to be negatively affected by the current tensions and the effects of the war in Ukraine.

Off-Highway Research says the Russian and Ukrainian construction equipment markets are likely to collapse in 2022 due to the invasion of Ukraine and sanctions against Russia. The markets’ combined sales of 25,000 units in 2021 equate to roughly 2.5% of global demand, says OHR. However, Russia is a significant market for mining equipment sales. OHR says the impact for the European market and wider-world construction equipment sector from a deterioration in the Russian and Ukrainian construction equipment markets is likely to come from an indirect economic effect.

Komatsu WA475-10

The WA475-10 is an industry-leading top performer. Its Komatsu Hydraulic Mechanical Transmission (K-HMT) and the 217 kW / 291 HP engine deliver an outstanding combination of productivity increase and ultra-low fuel consumption. An independent control of the driveline and work equipment makes your work easier and shortens cycle times, to provide you with a unique operating experience in a wheel loader.

NORTH AMERICA

THE RECORD-BREAKING YEARS

There was a strong 23% rise to 196,070 units in North America construction equipment sales in 2021 thanks to a residential boom, new statistics from OffHighway Research shows.

OHR notes there is also a bullish forecast for the market in 2022, largely thanks to President Joe Biden’s US$1.2 trillion residential and infrastructure bill.

A significant structural swing towards compact equipment to 66% of volume demand in 2021 vs 33% in early 1990s has also been noted by OHR. This is said to be due to impressive growth in the residential construction market. OHR says a rise in larger equipment types should follow in 2022.

OHR expects North American construction equipment sales to rise over the next two years, taking the market to new record levels. However, as in Europe, serious issues remain with construction materials and labour shortages.

According to the February 2022-published business intelligence data from the Association of Equipment Manufacturers (AEM), the global economy expanded by a robust 5.1% in 2021. And while projected growth of about 3.9% is expected for 2022, slower growth seems like a foregone conclusion. Short-term factors like the lingering Covid-19 pandemic, ongoing supply chain issues and persistent labour

shortages, as well as long-term factors like deglobalisation and inflation, have emerged to dampen enthusiasm a bit on the heels of what has been a strong economic resurgence worldwide.

“The last recession we experienced ended the longest period of economic expansion in the United States, and that recession lasted from February 2020 to April 2020,” said AEM director of Market Intelligence Benjamin Duyck. “Two months, in traditional economic terms, can’t even be accurately described as a recession. However, this economic disruption has impacted us all greatly, and we are still dealing with the after-effects today – labour shortages, supply chain problems and higher interest rates.”

AEM has surveyed its members quarterly for nearly two years regarding how quickly they expect to recover to pre-Covid-19 levels. For some time, the responses had been generally quite positive, according to Duyck.

“But the data for this last quarter is moving again in the other direction, largely due to the headwinds we’re facing with inflation, workforce issues and supply chain disruptions,” he said.

Construction industry value is expected to grow 4.5% this year, largely driven by residential.

AEM member perceptions show strong demand (83% see year-over-year growth

ahead), and it’s reasonable to expect growth of 6-10% over the next 12 months on the heels of 6-10% stronger growth than was expected in 2021.

Infrastructure spending is set to gain significant momentum in the coming years. Uncertainty related to the Covid-19 pandemic, high material costs and monetary policy all remain concerns.

Dublin, Ireland-based ResearchandMarkets.com’s December 2021-published U.S. Construction Equipment Market - Strategic Assessment & Forecast 2021-2027 report states that the U.S. construction equipment market size will be valued at US$32.68 billion and reach a volume of 191,836 units by 2027, growing at a compound annual growth rate (CAGR) of 6.23% by volume during the 2021-2027 period.

The reopening of manufacturing plants after Covid-19 and building more manufacturing plants to reduce the growth of unemployment are, says ResearchandMarkets.com, a leading business market intelligence firm, going to be driving factors for the demand of construction equipment.

The same source tips the construction sector at various levels under private, state, and federal governments to boom with double-digit growth at least through 2022 and 2023 due to the increase in arms exports from the United States to boost the construction equipment market.

CENTRAL & SOUTH AMERICA

BRAZIL LEADS THE CONSTRUCTION EQUIPMENT DEMAND RACE

Arizton, a major business market intelligence company, forecasts that construction equipment demand in Brazil will pick up pace in the years to 2028.

In 2021, the Brazilian government planned to invest round US$30 billion for the development of national transport infrastructure, says Arizton. A further investment of around US$16 billion is likely to be made for the development of 14 highways in 2022. Airport development projects are under progress in Sao Paulo, Santos Dumont, and in Rio de Janeiro. For port redevelopment, Arizton notes that a further US$19.2 billion has been allocated. The works cover five terminals in Sao Luis, Maranhao, and Rio Grande do Sul ports.

Arizton says the Brazilian government aims to achieve carbon neutrality by 2050, prompting big investment in solar, wind and hydroelectric generation plants across the country. Subsidies for the installation of renewable energy plants and easy financing facilities by financial institutes are supporting the growth of renewable energy projects in the country.

segment in Brazil is estimated to reach 23,519 units by 2028,” a March 2022-published Arizton market report states.

Arizton expects Brazil’s earthmoving equipment market to grow strongly by 2028, owing to the increased government investment in highway, metro, and airport construction projects and the expansion in the construction, transport, and renewable energy sectors.

A Latin America construction equipment market study by Arizton published in January 2022 predicts the market to be valued at US$5.06 billion by 2027, growing at a CAGR of 4.75% in the 2021-2027 period.

“Enhanced demand for natural resources in recent years will positively impact demand for construction equipment used in the mining industry, such as excavators, loaders, and cranes,” states the study.

It continues: “There is robust demand for construction equipment in the region.

GlobalData reports that construction market output in Mexico was valued at US$115.6 billion in 2020 and was forecast to record growth of more than 10% in 2021

Caterpillar, Komatsu, Volvo Construction Equipment Brasil, Sany and XCMG Brazil are said by Arizton to be the leading construction equipment manufacturers in Brazil, which saw 30,800 units sold in 2020, up 14% compared to the previous year, according to a study by the Brazilian Association of Technology for Construction & Mining (Sobratema).

After India, Arizton reports that Brazil is the second-largest market for backhoe loaders in the world. “The government’s ambitious plan for water sanitation, which aims to provide clean water to 99% population by 2023 and other sewage treatment projects, is expected to drive the demand for backhoe loaders, as they are extensively used for handling water pipes in these types of projects. The backhoe loaders

Contractors, mining, and construction companies are the major consumers in the Latin American

companies such as Carlyle Group, Grupo Orguel, and BigRentz have a reasonable share in the market.

“With the increase in construction activities, the demand for road rollers also increases. Various road and highway redevelopment projects such as developing Interserrana highways, connecting Matehuala- Saltillo roadways with Cuidad Victoria- Monterrey roadways are planned in Mexico. All this will propel the demand in the Latin America construction equipment industry.”

GlobalData reports that construction market output in Mexico was valued at US$115.6 billion in 2020 and was forecast to record growth of more than 10% in 2021. The same source says the Mexican construction market is projected to register an annual average growth of more than 2% between 2022-2025.

In September 2021, GlobalData notes that the government submitted its 2022 budget proposal to Congress, of MXN7.3 trillion (US$350 billion) to promote economic growth, regional development projects, social equality, financial stability and maintain fiscal discipline. Global Data states that the proposal outlined how government policies will continue to focus on healthcare, social programmes and investment, and that it will prioritise ongoing investment projects, such

CHINA

CHINA MARKET PASSES PEAK

Off-Highway Research notes that as soon as China emerged from its national lockdown in March and April 2020, it embarked on a massive stimulus programme. “The main instrument of this was allowing provincial governments to issue special bonds. This saw construction equipment sales rise 30% in 2020 to more than 412,000 units, or more than 480,000 units if compaction equipment and mobile cranes are included. Such high sales have only been seen once before in China, during the boom of 2010 and 2011. That was also a result of stimulus spending, on that occasion in response to the global financial crisis,” OHR observes in its March 2022-published Global Briefing report.

However, as OHR states, that stimulus boom essentially only lasted 12 months. The first quarter of 2021 saw extremely high sales, but in the next three quarters, the number of machines sold was significantly lower than the volumes seen in a year previously. The net result was that construction equipment sales in China fell 6% overall last year (to

389,062 units). OHR reports that it was the only major market to see a decline in sales in 2021, highlighting that the cycle in China is somewhat out of step with the rest of the world.

OHR predicts that the Chinese construction equipment market will fall back over the course of 2022 and 2023 to more normal levels of around 300,000 units per year. Although this represents a steep fall from 2020’s high of 412,000-unit sales, OHR argues that this represents a return to normal, rather than a worrying collapse.

Inevitably, OHR believes parallels will be drawn between the current outlook and the aftermath of the 2010-2011 stimulus boom, which was followed by a deep, painful five-year recession. However, the downturn forecast in China for the early 2020s is expected to be relatively short-lived and shallow.

OHR states: “The structure of demand has changed in China over the last decade. Construction equipment sales are much less dependent on new build infrastructure

projects, as activity shifts more towards maintaining and repairing the infrastructure which was built in the boom years of the 1990s and 2000s. In addition, activities such as agriculture and industry have become more mechanised and are driving demand for equipment.”

Interestingly, OHR highlights that construction equipment production in China hit a new record high in 2021 at more than 548,000 units, or more than 630,000 if mobile cranes and compaction equipment are included. The 7% growth was achieved despite a 6% decline in sales of equipment in China, which, says OHR, illustrates the country’s strengthening position as a major exporter of construction equipment.

The off-highway business market intelligence consultancy adds: “The difference between sales and production of equipment was just over 159,000 units, or 29% of production. This was the largest the gap has ever been in both absolute and percentage terms. Although it is not necessarily safe to assume that all these machines were exported, the figures illustrate China’s importance as an equipment producer. Only Japan exports more machines.”

GlobalData says construction output in Northeast Asia, including China, is forecast to record a 4.2% growth and reach US$4.71 trillion in 2022 compared to $4.52 trillion in 2021. It will account for 39% of the projected $12.19 trillion of global output this year, says the leading data analytics company. However, the growth of construction output in Northeast Asia in 2022 has been revised downwards by 0.8% this quarter due to the slowing construction activities across the region.

According to a recent Arizton report, the China construction equipment market is projected to reach a value of US$79 billion by 2028. The global business market intelligence consultancy says increased demand for construction equipment is due to a rise in transport infrastructure projects and government-led affordable-home schemes.

Arizton states that the Chinese government’s intention to invest US$573 billion in infrastructure projects will fuel the growth of long-term industrial development.

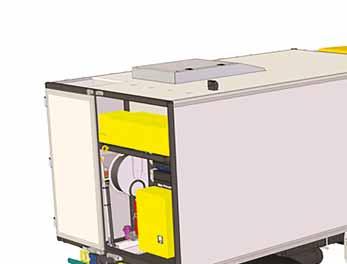

Guaranteed compliance with the German TA Luft Regulation VOC < 50 mg / Nm³

Future-proof.

BENNINGHOVEN HOT-GAS GENERATOR

BENNINGHOVEN recycling drums using counterflow action with a hot-gas generator offer an environmentally friendly, future-proof solution that is always a reliable investment. Depending on the quality of the recycled material, quantities as high as 100 % can be added. In addition, emissions are brought significantly below the level required by standards and the total energy consumption of the plant is reduced.

JAPAN

STABLE JAPANESE DEMAND

Japan’s construction equipment sales rose slightly in 2021 to 68,379 units compared to 67,645 units in 2020, according to new Off-Highway Research) data. The same source reports that Japanese sales are likely to drop by more than 2,500 to 65,670, before a further slight drop to 63,065 units in 2023. Looking further ahead, OHR forecasts 2026 sales of 64,250 units.

Arizton reports that demand for earthmoving equipment and cranes will drive construction equipment market growth. The same source notes that Hitachi Construction Machinery Japan has signed 54 disaster agreements with local governments in Japan to supply construction equipment to disasterprone areas.

Arizton says building works linked to the recent Tokyo 2020 Olympics, held in 2021 due to the coronavirus pandemic, have been a boon to the Japanese construction equipment industry.

“There are high expectations from remote control of ICT construction machinery as the country’s population is decreasing due to the low birth rate. To solve this, the Ministry of Land, Infrastructure, Transport, and Tourism supports the ‘i-Construction’ initiative. This aims to boost productivity and make construction sites appealing by using contemporary technology such as IoT and

AI,” states Arizton.

Arizton highlights that for major construction projects, building companies and contractors are replacing old equipment with TIER-4 emission norms-compliant equipment. “This is because global warming and excess greenhouse gases are deteriorating the environment. The new engines with compliance with the emission norms are more fuel-efficient. This adds specific cost savings for the operators and helps reduce emissions,” notes Arizton.

“Urban engineering projects and building renovations require compact and multifunctional construction equipment that is suitable for small-scale construction projects. Thus, the increasing urban engineering projects will be fuelling the demand for backhoe loaders in Japan

“Large construction projects such as the redevelopment of Shibuya and Toranomon–Azabudai district leads to the increasing demand for bulldozers in Japan.”

Arizton notes that the Japanese government is involved in the field investigation of 15,000 sites for landslide disaster prevention. This, the business market intelligence consultancy states, will drive the demand for rough terrain cranes as they can operate on uneven surfaces.

Japan is the third-largest producer of

Japan economic outlook growth projections 2021-2023 (Real GDP, annual percent change)

Source: IMF, World Economic Outlook, April 2022

steel and the second-largest producer of iodine in the world. Arizton predicts that the demand for these metals is expected to rise due to their use in the construction and manufacturing industries.

Analysing major Japanese construction equipment manufacturers 2021 launch highlights, Arizton points to Kobelco’s introduction of ICT-enabled construction machinery with a navigation system to cater to the needs of high construction and mining projects. The ICT-enabled solution incorporates monitor displays and alerts in the driver’s cab and a machine control system that lets the operator undertake complex work operations with easy lever manipulation.

Arizton notes Sany’s launch of a new crawler crane in July 2021 – the SCC9800TM – featuring a 4,500-ton lifting capacity, one of the world’s highest.

GlobalData says the Japanese infrastructure construction sector will grow, supported by government investment on public works to improve regional connectivity. The sub-sectors in this sector include rail infrastructure, road infrastructure, and other infrastructure projects. The pipeline, which includes all projects from pre-planning to execution, is skewed towards early-stage projects. GlobalData states that the majority of the pipeline value is in projects in the planning stages as of January 2022.

INDIA

GROWTH RETURNS TO INDIAN MARKET

Before the Covid pandemic, Off-Highway Research notes that 2020 was expected to be a year of robust growth for the Indian construction equipment market, following the disruption of the 2019 general election.

“In the event, the pandemic precipitated a 10% decline in sales (61,960 units in 2020), which took demand back to where it was in 2017, leaving it some 25% lower than the peak year of 2018. As disappointing as this was for a market, which was showing clear signs of returning to robust growth at the end of 2019, a 10% downturn as a result of the pandemic and lockdowns is not as bad an outcome as might have been expected,” OHR reports in its March 2022-released Global Briefing.

OHR highlights that the 10% rebound in 2021 (to 68,326 units) took sales back to their 2019 levels. The market in India continues to be driven by infrastructure investment, which continues to broaden out from the traditional focus on road building.

“Equipment production in India totalled 78,675 units last year, or 94,844 machines when mobile cranes and compaction equipment are included. This Indian

consumption of equipment in 2021 represented an excess of some 12,000 machines, or 15% of production” the OHR Global Briefing continues.

OHR observes that India has virtually no imports of construction equipment, with the vast majority of demand met by domestic production. The consultancy states that the major suppliers in India are the international OEMs and their joint ventures, although there are a number of indigenous producers too.

OHR adds: “The last decade or so has seen these international OEMs start to use their factories in India as export hubs, to serve the surrounding region, as far afield as the Middle East and Africa.

“By far the highest volume machine produced in India is the backhoe loader –India represented 55% of global backhoe loader production last year. Although the vast majority of these are sold domestically, production exceeded sales in India by more than 6,000 backhoe loaders last year, which gives some indication of the size of the export market for these machines.”

Arizton predicts that India’s crawler excavator sales will grow at a CAGR

(compound annual growth rate) of 5.41% in the 2021-2027 period to 34,366 units by 2027.

The Indian crawler excavator market is witnessing rapid growth in demand for medium crawler excavators, says Arizton, a U.S.-headquartered global business market intelligence consultancy.

“The government is focusing on green building projects to promote demand for fuel-efficient, lesser-emission crawler excavators. Increasing government initiatives such as increasing the steel production capacity to 300 million tons by 2030 indicates future demand for large excavators used in mining,” Arizton reports.

GlobalData expects India’s construction industry to grow by 5.8% in 2022, supported by a series of investments in transport, health, and housing infrastructure developments. GlobalData notes that the government unveiled its Pradhan Mantri Gati Shakti Master Plan in October 2021, a INR 100-trillon (US$1.3 trillion) project to develop holistic infrastructure, aiming to boost economic growth through infrastructure investment and propel India’s development over the next 25 years.

In June 2021, GlobalData reports that the government approved the INR500-billion (US$6.5 billion) loan guarantee scheme for Covid-affected sectors (LGSCAS), to provide financial guarantees for building new healthcare projects, as well as upgrading existing infrastructure. A project can receive a maximum loan of up to INR1 billion (US$13 million), with the interest rate capped at 7.95%. GlobalData states that the Indian construction industry’s growth will also be supported by the government’s plan to significantly increase the stock of affordable housing units for low and middleincome cohorts, under the Housing for All programme to 2022 end.

Over the remainder of the forecast period, between 2023 and 2025, the Indian construction industry is expected to register an average annual growth of 6.2%, supported by investments under the INR111-trillion (US$1.5 trillion) national infrastructure pipeline (NIP), between the 2020 and 2025 fiscal years (April 2019 to March 2025).

REST OF ASIA

BACK TO WORK

The resumption of construction projects and new investments is set to improve prospects for construction equipment sales in the Southeast Asian countries of Vietnam, Thailand and the Philippines in 2022.

GlobalData predicts the Thai construction industry will register an average annual growth of 4% between 2022 and 2025

Vietnam saw 20% less construction in 2020 and the first half of 2021, while there was a 13% reduction in the demand for cement in the Philippines, according to Alexander Baart, regional director Southeast Asia for wet processing equipment manufacturer CDE. He says the good news is that public and larger projects are now resuming across the Southeast Asia region.

“From today’s perspective there are reasons to believe that after Lunar New Year [February 1] in Thailand and Vietnam the volumes will grow back to pre-Covid levels,” says Baart. “In the Philippines we already foresee a 6% higher demand of cement compared to 2019.”

Baart adds that a growth of 6% is expected this year in Thailand’s construction business, while in Vietnam it is expected to be between 3 and 5%. In both countries the driving force is the resumption of new projects.

Market analyst GlobalData says that the South Asia region (including Vietnam, Thailand and the Philippines) should generate construction output values in 2021 that will surpass the 2019 pre-Covid levels in real (constant prices) terms.

ASEAN Analytics highlights three of the biggest public infrastructure initiatives in the region that could contribute to aggregates demand as being the Northeastern HighSpeed Rail project in Thailand, Long Thanh International Airport in Vietnam, and the new Manila International Airport in the Philippines.

Covid has put a dampener on the Philippines’ economy and is still affecting logistics flow in the country, according to Peh Jing Peng, Volvo CE’s head of market for Philippines, Taiwan and Brunei.

“Philippines is currently suffering from the Omicron wave of infection which

is still growing,” says Peng. “Nevertheless, the government has put an emphasis on the construction industry to boost the economy.”

GlobalData estimates that the Philippines construction industry recorded an annual growth of 21.9% in 2021, with output predicted to surpass pre-pandemic levels in 2023. The analyst adds that the sector’s output in the second half of 2021 was supported by improving investor confidence and investment in transport, renewable energy, residential and commercial infrastructure projects.

The Philippines construction industry is projected by GlobalData to expand by an annual average rate of 9.6% from 2022 to 2025. The AmBisyon Natin 2040 programme, which promotes the development of affordable housing, transport and renewable energy infrastructure, is expected to drive the industry’s long-term growth.

An increase in foreign direct investment (FDI) will also contribute to the construction industry’s growth momentum in the next few years.

Raven Chua, head of market Thailand, Laos & East Timor at Volvo CE, says that Covid-19 has heavily impacted the tourism sector in Thailand, which accounts for around 20% of the country’s overall gross domestic product (GDP).

“The Thai government has diverted much of the country’s budget to support countermeasures against Covid, especially for SMEs, which has caused delay to megaproject investments,” says Chua. “Vaccinated travel lanes opened in October 2021 but were closed again in December due to the Omicron outbreak.”

Travel in the country was re-opened from February 1, 2022, and Chua says that, as the tourism sector recovers, it will push demand for infrastructure and therefore construction

equipment.

GlobalData predicts the Thai construction industry will register an average annual growth of 4% between 2022 and 2025, supported by improving investor and consumer confidence and government investments on road, rail, renewable energy and housing projects. Further supporting growth will be investment in both the Southern (SEC) and Eastern Economic Corridor (EEC) programmes. The value of approved developments in the EEC totals THB669bn (US$20.7bn), with four of the corridor’s six flagship projects currently in execution.

GlobalData predicts the Vietnamese construction industry will register a CAGR of more than 8% between 2022 and 2025, supported by ongoing construction works on the considerable pipelines of public infrastructure projects. As part of its transport infrastructure spending plan of between VND973.8 to 1,472 trillion (US$4365bn), the government plans to construct and renovate existing road, rail, inland water, sea and air transport infrastructure in the period through to 2030.

The election of Yoon Suk-yeol, a conservative former prosecutor, as South Korea’s new president in March 2022 is unlikely to impact the firm infrastructure spending commitments made by former president Moon Jae-in. This is highly encouraging for construction equipment demand prospects.

Moon Jae-in’s administration committed to building 1.27 million homes in the metropolitan Seoul area through its New Town Development Plan. Further building plans include the erection of 300,000 more houses in Seoul’s satellite cities to stabilise real estate prices. The price of real estate has doubled in many parts of the country during the last couple of years, and it has become impossible for young people to purchase homes.

SUB-SAHARAN AFRICA

POPULATION GROWTH FUELS EQUIPMENT DEMAND

Sub-Saharan Africa received an overall score of -0.24 on GlobalData’s February 2022 Construction Project Momentum Index, which provides an assessment of the health of the construction project pipeline at all stages of development from announcement through to completion.

Every construction project in GlobalData’s database is assigned a score of between 5 and -5 based on its current progress, a score which is continually updated. These are then weighted by the value of each project to come to reach overall scores for countries, regions and sectors.

That score puts sub-Saharan Africa in last place out of 11 regions and is a decrease on its score from January 2022 (0.25) when it ranked in 10th place.

GlobalData comments: “One reason for sub-Saharan Africa’s relatively poor performance in the index is its residential sector, which scores just -0.76, the worst worldwide. Sub-Saharan Africa’s commercial and leisure sector, by contrast, has performed somewhat better, with a score of 0.55 (putting it in 5th place globally).

“Within sub-Saharan Africa, the problems

Africa: Value of projects planned by sector ($m) Sources: MEED Projects, December 2021

in the construction sector are most significant in Nigeria, which scores just -0.91 in the index. The situation in Ethiopia, however, is somewhat better with a score of 1.01.”

A December 2021-published GlobalData report states that South African construction industry output in the long-term will be supported by investments related to the 10-year US$133-billion infrastructure plan unveiled by the government in 2020. The plan comprises 276 projects in various sectors including transport, energy, housing and water. Of the total, GlobalData notes that US$62 billion will be spent over the next four years alone.

equipment sales in South Africa totalled nearly 6,000 units in 2018, according to OffHighway Research data. OHR says this was an increase from the low point of 4,613 machines in 2016.

Population growth is the primary driver of infrastructure investment in Africa

The South African construction industry is said by GlobalData to be supporting the government’s aim to produce 26% of the total electricity from renewable energy sources by 2030. To achieve this goal, the state-owned electricity public utility company, Eskom, invested US$6.6 billion on the construction of wind farms and solar plants until 2030.

The government’s intentions to increase the number of Special Economic Zones (SEZ) across the country will further support construction industry growth, says GlobalData. In October 2021, South Africa’s president, Cyril Ramaphosa, announced plans to designate the Sedibeng area into a SEZ, with the SEZ expected to attract 99 investment opportunities worth US$3 billion. Construction and surface mining

In MEED’s Africa Projects 2022 study published in December 2021, editorial director Richard Thompson cites a World Bank estimate that Africa’s economy contracted by -3.4% to US$2.36 trillion in pandemic-hit 2020. However, Thompson notes that the continent, including its huge sub-Saharan region, is set for recovery in 2022, with the IMF forecasting real GDP growth of 4%.

He continues: “Population growth is the primary driver of infrastructure investment in Africa. The continent’s population is expected to rise to about 1.35 billion in 2022, up from around 605 million in 1990. In 2021, Africa’s population expanded by 2.4% cent, according to the IMF. This is expected to continue.”

Thompson explains that Africa’s infrastructure projects are not evenly distributed across the continent. “The continents five biggest projects marketsEgypt, Nigeria, South Africa, Tanzania and Algeria - account for more than half of all projects in Africa. Several of the ‘big five’ economies are major oil and gas exporters, however, and project activity often follows the trends in global oil prices. On a regional basis, North Africa accounts for over 30% of the value of all projects in Africa, with about $711.9bn of projects planned or underway.”

MIDDLE EAST & NORTH AFRICA

VAST POTENTIAL

MEED’s March 2022-published GCC Construction 2022 report includes commentary from Richard Thompson, its editorial director, who states that “after six challenging years for the GCC (Gulf Cooperation Council) construction industry, contractors, consultants and suppliers can at last look forward to a return to growth and the prospect of rising project opportunities in 2022.”

With what MEED, a leading business intelligence company focused on the Middle East and North Africa, notes as some $1.4-trillion worth on construction and transport projects planned in the GCC that have yet to see their main contracts awarded, the pipeline of future project opportunities is said by Thompson to be “vast”, with Saudi Arabia and the UAE accounting for “nearly 85% of the GCC’s planned future projects”.

His analysis continues: “The outlook for the GCC construction industry has been transformed in 2022 by the sustained recovery in oil prices that started in the second half of 2020, and which continued through 2021 and into 2022. The increased revenues from oil exports have eased the pressure on national finances and is enabling governments to stimulate the recovery through investment in strategic infrastructure projects. At the same time, increasing consumer confidence, the return of international travel, and rising property prices are enabling renewed private investment in commercial real estate projects.”

A recent GlobalData report valued the Egyptian construction market at US$64.5 billion in 2021

MEED’s Thompson notes that GCC contractors say they are now more wary of signing new contracts after being financially hurt by the pandemic in 2020 and 2021 and reports that some clients have not compensated them for delays. “When it comes to new awards, taking future risks on pandemics and viruses may be an issue for some contractors as clients do not usually accept taking such risks,” states MEED. Another concern flagged by Thompson is supply chain bottlenecks and rising costs.

“Ships and ports are all facing setbacks and this trend will continue and will inevitably affect projects that are dependent on foreign materials. Some projects will have to be delayed.”

For future growth, MEED believes much will depend on Saudi Arabia, which, says Thompson, “plans to deliver some US$1 trillion of projects as part of its Vision 2030 strategy that aims to transform the kingdom’s economy.”

Thompson says that while an uptick in construction contract awards is widely expected, the surge in tender activity and the race for delivery is creating pressure. “Many projects are coming up at the same time and this will put a strain on the supply chain and the capacity of subcontractors.”

A January 2022-published MEED report on the outlook for major projects in the Middle East and North Africa (MENA) in H1 2022 is very upbeat. As Richard Thompson notes: “The need for infrastructure and economic diversification is more vital than ever, and much of the region is wealthy and committed to ambitious development plans. This will drive investments into capital projects over the next decade, led by the

region’s biggest market, Saudi Arabia.” Thompson states that about US$800 billion of projects are underway across the MENA region, with another US$3.3 trillion at some stage of planning. Thompson notes that the GCC accounts for about two thirds of the current market, while Egypt and Iraq have big potential.

He continues: “But with finances stretched, and the battle against Covid-19 still far from over, the recovery will be slower than most would wish, and companies will face increasing pressure from clients and competitors to offer low delivery prices. There is no longer any room for waste and inefficiency.”

A recent GlobalData report valued the Egyptian construction market at US$64.5 billion in 2021. The same source said it is forecast to grow at an average annual growth rate (AAGR) of more than 10% during the 2023-2026 period. Egyptian construction last year was supported by a recovery in the country’s economic conditions and the ongoing construction of large infrastructure projects, improvement in restaurants and hotels activities, and export-oriented business. National construction output over the forecast period will be supported by investment in the development of fourth-generation cities.

CONQUER

TECHNOLOGY INTEROPERABILITY

GAPS

AND MAXIMIZE YOUR WORKFLOW GAINS withDCW’s productivity-focused and digitally-connected platform

Digital Construction Works is all about the “transformative power of digital”. It is a leading integrator of construction technology services … no one else is doing what we do or how we do it … an expertise that will help to deliver your projects smoothly, on time, and on budget. DCW’s mission is to “create innovative solutions to complex challenges by understanding the pressure firms are under to increase productivity, reduce risk … and deliver reliable, efficient project results”. Are you connected?

Norway Riksvei 3/25 Highway Project connecting the town of Oslo to Trondheim. Read full story: https://www.digitalconstructionworks.com/ solutions/case-studies/norways-biggest-road/

Jason Hallett is currently Chief Executive Officer of Digital Construction Works (DCW), a joint venture formed in October 2019 between Bentley Systems and Topcon Positioning Group. DCW is focused on digital integration and automation services for construction. Jason assumed the role of CEO in January 2022 after holding the position of Chief Operating Officer since the company’s inception. Prior to DCW, Jason served as Vice President of Global Software Business Development and Digital Construction at Topcon Positioning Systems, where Topcon had employed him since 2007. His career has been working in the surveying and construction industries for 34 years.

JASON HALLETT

Mr. Hallett’s primary responsibilities at Topcon included leading the MAGNET Systems business of Topcon and the Digital Construction initiatives related to the strategic digital co-venture partnership with Bentley Systems. While at Topcon, Mr. Hallett also held the position of Vice President of Global Product Management. He is a licensed California Professional Land Surveyor (since 1999), has been awarded multiple patents, holds a Certificate of Business Excellence from the Haas School of Business at U.C. Berkeley, holds a B.S. degree in Management, and holds an A.A. degree in Business.

QHow would you sum up the immediate benefits of the tighter integration of construction operations that users will gain when using DCW services and technology? Tell us the key advantages that DCW brings…… and are there any early adopters you could mention that are finding success with DCW and the DCW Integrations Platform?

Jason: The primary value that we see is DCW greatly reduces the technical debt related to disconnected tools that result in manual handovers today. Our platform closes these technology gaps and automates the handovers through integrations that are tied to a digital workflow engine, which ultimately saves our clients’ time. It improves data fidelity and ensures that schedule deviations can be managed in near real-time.

As far as early adopters go, one case that we have just published online is a project we did with Mortenson Construction, where we integrated the 4D Model, and also integrated a material-tracking system called Jovix for use on their construction project to build the largest soccer stadium in the U.S. We were able to help them seamlessly integrate their applications to help manage their supply chain.

During the stadium construction, the Mortenson/Messer project team needed help solving a specific business problem around realtime visibility into critical path material fabrication, delivery, and installation. The Mortenson Sports and Entertainment Group field manager approached the Mortenson Innovator Group with a big problem, stating he had no visibility into critical path methods, particularly with steel in the supply chain. They wanted absolute

They also wanted to understand the entire supply, from fabrication, to mill order, all the way to erecting on-site. The steel structure for the construction was roughly a $30 million steel package with 6500 tons of steel and roughly 5000 pieces of steel, so it was critical to get it right. It also had to streamline the difficult task of status visualizations of building information and 4D models.

The team also found that bridging the connections with the multiple product sets in use and the corresponding integrations work that was needed was challenging. Furthermore, once established, the ongoing maintenance of those connections, was another challenge.

&

Norway Riksvei 3/25 Highway Project: one of 28 separate civil engineering structures built while connecting the town of Oslo to Trondheim. Read full story: https://www.digitalconstructionworks.com/solutions/ case-studies/norways-biggest-road/

➔ We also integrated a Tekla-formatted file and it allowed us to overlay the material status information on the 4D Model. Then, with our integration with Microsoft Power BI, we can present in near real-time the status of all the materials so that they can react faster with more transparency on the project.

Construction completed early and under budget during a volatile construction market experiencing supply chain and labor issues.

QI always like to say that the construction industry’s been going digital for about 30 years. I’ve been in the industry for about 35 years, and I was largely responsible for taking people off of field books and into digital data collection

One of the issues facing a lot of construction firms is with legacy technology. How will DCW be able to integrate with the legacy technology being used by contractors? And what level of data will clients be able to recover from these legacy technologies for the project model?

Jason: I always like to say that the construction industry’s been going digital for about 30 years. I’ve been in the industry for about 35 years, and I was largely responsible for taking people off of field books and into digital data collection. So, going digital is a never-ending process. It’s something that you have to be constantly striving for to see those efficiency gains.

What we try to do with legacy systems is to integrate with the flat files, with the data formats that are open and available out there. One thing we try to do is we actually normalise the data and tuck it into our data warehouse so that it can be accessed and aggregated with other systems that are coming onto the market all the time.

A lot of the industry is moving towards API interfaces that are open and can be connected to, but then with the legacy systems, you still don’t want to lose that information. You want to bring that information forward, so we also integrate with a lot of formats there, too.

QWhat would you say are the biggest barriers to further integration of data using this technology?

Jason: Ultimately, I think we should call the barriers just opportunities. There’s an opportunity for most of the platforms and solutions that are out there to create a more open environment. The maturity of the APIs, the ability to deliver more information and to exchange more information in real time is a huge opportunity for organizations.

In my opinion, it is what is needed in the industry to make construction take that step function forward and go more digital. I think API maturity is going to be a big, constant topic, as is, certainly, moving those legacy systems you mentioned earlier into a more modern approach, a more cloud-connected solution.

QHow will DCW facilitate progress towards a more sustainable future for construction?

Jason: This is actually something we’re tackling for clients in the Netherlands. Currently, they have instituted a regulation that addresses CO2 emissions, and they require the bidders to estimate what their carbon footprint will be on the project. If they don’t perform against this estimation and they don’t achieve it, then they will actually receive a penalty. That’s a big motivator for people to become more sustainable.

QHow straightforward is it to set up a new project? Can the DCW Integrations Platform import external data needs? And how does it reduce workloads and save time? Is there an easy security process?

Jason: The platform is really straightforward. It’s really intended to be easy to use and easy to access. We can integrate with various login credentials, for example with OIDC, or we can integrate a company’s active directory, So from the security perspective, it’s quite flexible. What we do is, log in to the DCW platform, set up the projects and then set up the integrations for the clients. We do a lot of that hands-on work. Once it’s configured and tailored to your organization, it’s very easy to add a project. Workflows can then be copied from project to project. It only takes minutes to add a project.

QDoes the DCW Platform create a consistent structure across the company? Is it an easy-to-use access platform where data from all departments will allow everyone on the project team and in the wider company to work with the same data?

If you think about the current tool that you are using today –maybe it delivers volume estimations or something like that – but then if you can tackle that or tie that together with, say, the schedule on what you estimated, and then see what happens in the field with regard to the performance of the machines that are doing the work, then you can actually get insights out of the data and across the department from the grading manager to the estimator.

Once you’ve connected the people in the field, you can actually return the results in near real-time

Jason: The platform is essentially a data pipeline network and a data warehouse. So, what we try to encourage people to do is keep using the tools they are currently using. Then, we integrate those tools so that the data is accessible and connected to the platform so that it can be aggregated in a single dashboard and presented in new and more innovative ways for generating project insights, including project status and potential issues. Project-to-project comparison allows for gradually improving your company’s project performance and sending out better bids.

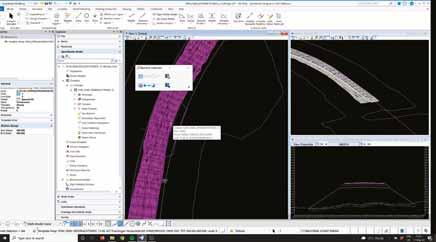

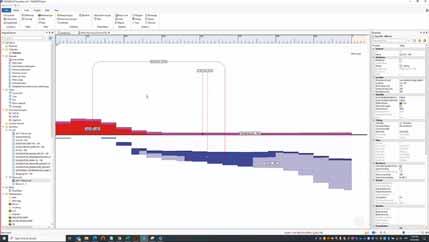

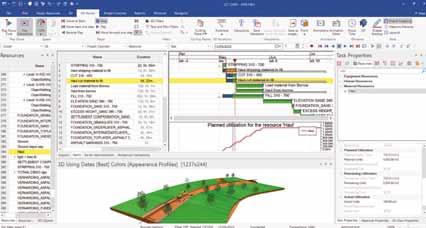

How DCW’s new Integrated Highway Workflow integrates OpenRoads Designer, SYNCHRO 4D, MAGNET, and Sitelink3D to connect the site to the office in one seamless cycle

So … it connects those sources and that information.

QDoes the DCW Platform enhance and encourage collaboration? Is information generated shared in real time with the project team? Is the team instantly updated on changes in the project and schedules, etc.? And does DCW help reduce errors or conflicts?

Jason: The platform is all about collaboration. That’s really what it’s geared towards. If you can connect the schedule or the plan, which ultimately results in tasks, you can move that data out to the field and have it delivered automatically for construction execution. Once you’ve connected the people in the field, you can actually return the results in near real-time.

I just say “near real-time” because you don’t want to have data points coming in constantly; it’s just going to be a whole bunch of noise. But if you get the data coming in that you really want to

A fully Integrated Highway Workflow – connecting the job site heavy equipment and technology to the office planning, design and engineering applications and syncing the data using a DCW Insights and a Construction Power BI Connector – all within the Digital Construction Works (DCW) Integrations Platform.

DCW not only connects different tools but automates workflows with alerts and creates centralized dashboards full of rich insights, powered by data across construction sites, to inform better decision-making.

DCW connects the job site machinery and tech with the office planning and design applications.

deliver, or that you are contractually required to deliver, then you deliver in near real-time, and you get results, say, in a matter of hours, versus weeks.

We had some clients tell us that sometimes the data they receive is weeks old so they can’t even address the relevant issue which they would have been able to if they had the information a lot sooner.

QHow will the DCW Integrations Platform be supported and made scalable for the future? Will there be consistent maintenance and support of DCW? Is there a roadmap for future development and how well is it designed to adapt to future technologies?

Jason: Yes, there is a roadmap. At this point, we have a pretty large backlog of things that we want to integrate with and that we’re working on for clients. We try to do our integrations based on realworld client engagements. Then, we make it sustainable and scalable. We package every integration up, almost like a product.

Most of my life has been spent around product management so I look at every integration as a little trainee product. And then I look at every workflow that we tie to the integration as another type of product. Then, when we move from, say, one project to the next, or from one client to the next, the integrations can be reused and reconfigured, if you will, to suit their unique needs.

Every construction business is unique. Even though they might use the same tools, they might use them in different ways. So, what we try to do is make the integrations stable and normalized, and then we try to tailor the deliverables, or the KPIs – the results of connecting the data – so that they suit the client that we are actually working for.

QWhat can you tell us about some of the new developments with DCW? We understand there are some new launches in the pipeline.

Jason: There’s lots of stuff in the pipeline, for sure. It’s amazing the demand we get from the industry right now. There’s a lot of new technologies cropping up all the time. One of the new technologies that came from one of our shareholders, Bentley, is the integration of OpenRoads Designer for design, SYNCHRO 4D, which is their planning tool, with Topcon’s MAGNET mass haul and Sitelink3D product. Topcon is also one of our shareholders. The combination of these applications offers a fully integrated highway design and construction workflow where all of the project data is combined within the platform where it can be analyzed and visualized into valuable project insights.

It’s interesting if you think about integrating, say, the schedule and the tasks with the machines as I described earlier. If you could do that automatically, you don’t have to do double entry. You’re not wasting a whole bunch of time. You can communicate even with subcontractors doing that work in a more efficient and automated way. So that’s one thing we’re really focused on.

And, of course, we’re focused on round-tripping the data back from that system, as well. We want to do it in a way that, for example, allows the subcontractor working for the GC to review and then approve the information they want to push back. And to do it digitally.

QIs there anything else in the pipeline?

Jason: Yes. Something else that we’ve taken on recently is we are working with Topcon’s monitoring business and with the Bentley Sensemetrics business. We’re working on integrating those solutions

so that we can start tying IOT sensors and monitoring systems to the construction ecosystem just to be able to deliver more information related to the project in near real-time, as I described before.

QYou have two primary shareholders in DCW. How easy is it for you to integrate technology from competing companies into the DCW work file?

Jason: That’s a really good question. One of the things that our shareholders decided when they started DCW was that DCW needed to go out and be an agnostic integrator in the industry. The only way we can move the industry forward is through that kind of thought leadership and around the idea that market expansion is good for everyone.

So, if we can get the market to expand and adopt more technologies, it’ll benefit everyone, including the shareholders. Honestly … we’ll integrate with anything that can be integrated.

QWhat effect do you think the pandemic has had towards driving the construction sector towards digitalization?

Jason: From what we experienced in the beginning, it was interesting because I think everything just came to a grinding halt which was pretty eye-opening, I think, for the world. Then, all of a sudden, everybody started to realise that they could do a lot more by being remotely connected if they had the right tools to engage in those tasks or those meetings, or whatever they are.

You saw a lot of new technology come on very quickly in that time. And I really do believe that there is a lot more done today digitally than even, say two years ago, as a result of the pandemic. I think people being remote is just something we’ve all accepted now. And I think it’s going to continue.

I also think that DCW is in a good spot because that’s exactly what we’re focused on – being able to do more digitally and remotely. You should be able to work with systems that are out in the field and get the information back to office without having to drive out to the site or meet face to face. It’s absolutely a trend we’ve seen … and one we believe will continue.

FUELLING THE FUTURE IS A GAS SAYS CUMMINS

Cummins has been at the cutting edge of developing power solutions for more than a hundred years and is continuing to lead the market by developing a new range of sustainable drivetrains powered by sources such as clean diesel, natural gas, batteries, and hydrogen fuel cell electric engines. Why is the industry’s number one power player concentrating so strongly on hydrogen? Jeremy Harsin reports.

Cummins has decided that hydrogen will play a key role in the decarbonisation of the global construction equipment business and the group is focusing its attention on three key areas: the production of green hydrogen; the management and transportation of hydrogen; and the application of hydrogen in engines and fuel cells.

So, first things first. What is green hydrogen? Hydrogen as a fuel source is lightweight, easy to store, and capable of providing high energy per unit mass, with no CO2 emissions at the point of use. For hydrogen to be truly emission-free, the production of the fuel needs to be “green” … in other words, made without the direct emission of air pollutants or greenhouse gases. Without hydrogen being green, it cannot be a meaningful part of the solution as we move toward carbon neutrality.

Most hydrogen today is grey rather than green. It is produced by a process called

“steam methane reforming”, a system which uses large amounts of power (usually provided by natural gas) and creates millions of tons of carbon dioxide each year. This is clearly not very eco-friendly.

So … how is green hydrogen produced? Green hydrogen is produced using electrolysis to turn sustainable power (wind, solar, hydro) into hydrogen with zero carbon dioxide emissions. At the moment, the cost of producing green hydrogen is expensive, which limits its adoption. This cost is projected to remain above that of current solutions for at least 5-10 years.

However, it is inevitable that green initiatives instigated by corporations or governments around the world will force the move to hydrogen faster. Fleet customers operating municipal machinery or equipment at airports, distribution centres, and ports could also put pressure on manufacturers to offer hydrogen solutions as they look to reduce emissions in line with their own local

sustainability plans.

Companies like Cummins are investing in research to advance electrolyzer technology so green hydrogen can be made in a more cost-effective manner and reduce the environmental impact of hydrogen technology. An example of this is a partnership with Air Liquide and the construction of the world’s largest proton exchange membrane electrolyzer which is producing up to 8.2 tons per day of lowcarbon hydrogen in Québec, Canada.

HYDROGEN STORAGE AND SUPPLY

Hydrogen is more energy-dense compared to diesel or natural gas. One kilogram of hydrogen has the general energy equivalence of roughly 3 kg, or 1 gallon of diesel fuel. So, compared to diesel or natural gas, hydrogen will be able to power a vehicle the same distance using less fuel.

On-board storage is a critical component of hydrogen power. Hydrogen needs to be

compressed into a tight space to store enough to meet duty cycle requirements. Cummins has entered into a joint venture with NPROXX, a world leader in high-pressure hydrogen storage for both stationary and mobile applications.

Supply and infrastructure will remain a challenge. Even with the many projects currently in place to increase hydrogen refuelling, that will take time and resources to develop. Adoption of hydrogen will probably begin in markets where fuelling can be done centrally such as at home-base operations or close to large hydrogen hubs.

As the scaling up of hydrogen production, distribution, equipment, and component manufacturing continues, the costs involved are projected to decrease over the next decade for a wide range of applications, making hydrogen competitive with its internal combustion engine (ICE) counterparts.

The integration of and interaction between hydrogen fuel cells or engines, batteries, powertrain, and fuel storage will be critical to their success. Understanding and adapting the overall powertrain system will be crucial to achieve it.

HYDROGEN ENGINES

Cummins is developing hydrogen-powered combustion engines. This is following an award from the UK Government, and the group is working on 15-litre and 6.7-litre engine platforms which will provide a sustainable solution that is more aligned with current machine designs, reducing complexity for OEMs.

A hydrogen ICE fits in today’s machines, works with today’s transmissions and hydraulic systems, and integrates seamlessly into the industry’s existing service networks and practices.

End users are expected to respond positively to the potential for a hydrogen engine because of the zero-carbon fuel combined with familiar technology.

Cummins’ programme has seen testing conducted of medium-duty 6.7-litre and heavy-duty 15-litre engines. These engines will aim to achieve zero-carbon emissions, enhanced power density, and improved thermal efficiency for equipment manufacturers within common engine designs.

The next step is to match the performance capability of the powertrain to applications with high load factors and high equipment utilization, those that have the biggest challenge to find viable zero-carbon solutions in the near term.

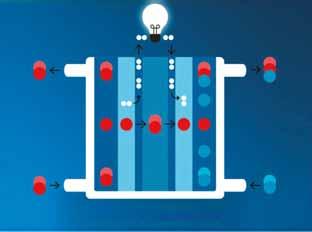

A fuel cell is a clean energy source with the only byproducts being electricity (power), heat and water

Launching hydrogen engines will also benefit other paths to reach a zero-carbon future, such as hydrogen fuel cells. By creating a viable use case and demand for hydrogen in the near term, we can accelerate

hydrogen infrastructure build-out and increase scale production of vehicle storage tanks.

Both advances are necessary for the widespread adoption of fuel cell powertrains.

HYDROGEN FUEL CELLS

A fuel cell is an energy converter, using an electrochemical reaction to take the chemical energy stored in a fuel source and convert it to electricity. It is comprised of two electrodes and an electrolyte membrane. The electrodes are called a cathode and an anode, and they sandwich the electrolyte membrane between them.

Within this power system, a series of chemical reactions occur to separate the electrons from the fuel molecules to create energy.

Hydrogen is fed into the anode on one side while oxygen is fed into the cathode on the other. At the anode, the hydrogen fuel molecules are separated into protons and electrons that will travel different paths toward the cathode.

The electrons that are generated then go through the electrical circuit, creating the flow of electricity. The protons travel through the electrolyte to the cathode. Once at the cathode, oxygen molecules react with the

The reuse of appropriate components will drive economies of scale while also providing reliability and durability equal to diesel. Experience in spark-ignited natural gas will also be harnessed as this technology is brought to the forefront. In fact, Cummins’ next generation of agnostic engine platforms will be able to run on clean diesel, natural gas, and hydrogen.

Hydrogen combustion engines will provide a low-cost, zero-carbon solution for high load factor and high utilisation applications where battery-electric solutions cannot meet the operational requirements and fuel cells are not yet economically viable.

The key benefit of using hydrogen engines is that they minimise the impact on the machine design. The hydrogen engine slots in where the diesel would, with the main change being in fuel storage and supply.

➔ electrons and with the protons to create water molecules.

A fuel cell is a clean energy source with the only byproducts being electricity (power), heat and water. A single fuel cell alone only produces a few watts of power; therefore, several fuel cells can be stacked together to create a fuel cell stack.

When combined in stacks, the fuel cells’ output can vary greatly, from just a few kilowatts of power to multi-megawatt installations.

The two main types are proton exchange membrane fuel cells and solid oxide fuel.

Proton exchange membrane (PEM) fuel cells: Also referred to as polymer electrolyte membrane fuel cells, this type of fuel cell uses a polymer electrolyte and operates at lower temperatures of around 80 degrees Celsius. PEM fuel cells are more suitable for mobile and back-up power applications due to their high-power density and quick start-stop capabilities.

needed within construction efficiently whilst meeting zero-emission demands.

Solid oxide fuel cells (SOFCs): SOFCs use a hard, non-porous ceramic compound as their electrolyte and operate at high temperatures, as high as 1,000 degrees Celsius. This type of fuel cell is most suitable for stationary applications because it is highly efficient and fuel-flexible. In addition, waste heat may be harnessed and reused to increase the overall system efficiency.

FUEL CELLS IN OPERATION

Hydrogen fuel cell technology can offer a power solution that does the heavy work

Fuel cells work by sucking in oxygen from the air to create a reaction, turning the hydrogen into electricity. The time delay for this to happen is managed by the battery. Both the battery and fuel cell feed power to the machine’s electric motor in parallel.

A fuel cell can be considered as a battery that generates its own electricity. It works alongside battery technology; ultracapacitors, lithium-ion, or lead-acid in a hybrid set-up. The battery is there for instantaneous response, providing high power for a short period until the fuel cell works.

The fuel cell sucks in oxygen from the air to create a reaction, turning the hydrogen into electricity. The time delay for this to happen is managed by the battery. Both the battery and fuel cell feed power to the machine’s electric motor in parallel.

The battery size and fuel cell depend on the duty cycle of the machine. The package needs to be matched specifically to this, as it impacts cost and weight. Engines are more flexible to duty cycle and power changes, so you can have a wide range of power from one displacement.

Installation engineers will define how these are integrated; the configuration, and refining of the interaction between fuel cells, batteries, powertrain, and fuel storage.

Understanding and adapting the overall powertrain system will be crucial going forward. This encompasses every component that converts the engine’s power into movement, any interacting systems, and how they work in the varied duty cycle requirements across different sectors.

SUITABILITY FOR OFF-HIGHWAY MACHINES

Adoption of fuel cells will be gradual over the next 10-20 years as it becomes not just environmentally but also operationally and economically viable for OEMs and operators. Cummins believes that hydrogen engines will be adopted more quickly and will help build the fuel-supply infrastructure.

Stationary power will be limited by the infrastructure of fuel. Data centres need high MW of power, so using natural gas with solid oxide fuel cells is more suitable. This is known as blue hydrogen, because it emits carbon that needs to be captured and put back into the ground.

Hydrogen makes sense for larger equipment with high utilization and energy demands due to charging infrastructure limitations and the size of batteries needed—as well as their higher cost. The long recharging times required by larger equipment can also be a deterrent.