UNIQUE CONTENT AND INSIGHTFUL OPINIONS ON THE SHIFTING MOVEMENTS WITHIN THE MARKET BY THE INDUSTRY’S MOST INFORMED AND INFLUENTIAL SOURCES

GLOBAL REPORT

CONSTRUCTION EQUIPMENT 2020

LEASING AND RENTAL TRENDS | SUSTAINABILITY | DOWNSIZING | THE DIGITAL AGE

CHINA: THE FUTURE | GLOBAL MARKETS REVIEW | ASPHALT PLANT TECHNOLOGY

Metso Nordtrack™

Nordtrack™ mobile crushers, screens and conveyors make it easy for you to get your operations up and running on time and on budget. With pre-configured products and a limited, well-defined choice of options that are backed up by a worldwide sales and support network, Nordtrack is ideal for contractors who need to meet project timelines and capacity quickly.

metso.com/nordtrack

Editor:

Geoff Hadwick

Contributing Editors:

Mike Woof, David Arminas, Guy Woodford, Enrique Saez

Designers:

Simon Ward, Andy Taylder, Stephen Poulton

Production Manager:

Nick Bond

Office Manager:

Kelly Thompson

Circulation & Database Manager:

Charmaine Douglas

Internet, IT and Data Services Director: James Howard

Managing Director: Andrew Barriball

Chairman: Roger Adshead

Publishing Director: Geoff Hadwick

Editorial contributors: Liam McLoughlin, Kristina Smith, Graham Anderson, Munesu Shoko, Alan Dron

COVER IMAGE: ©Bluebay2014 | Dreamstime.com

ADDRESS:

Route One Publishing Limited, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

Tel: +44 (0) 1322 612055

Fax: +44 (0) 1322 788063

Email: [initialsurname]@ropl.com (e.g. radshead@ropl.com)

ADVERTISEMENT SALES

Head of Construction Sales: Graeme McQueen

Tel: +44 1322 612069

Email: gmcqueen@ropl.com

Sales Director: Philip Woodgate Tel: +44 1322 612067

Email: pwoodgate@ropl.com

Sales Director: Dan Emmerson Tel: +44 1322 612068

Email: demmerson@ropl.com

UK / Classified, North America: Yvonne Tindall Tel: +44 1622 844027

Email: ytindall@ropl.com

Italy: Fulvio Bonfiglietti Tel: +39 339 1010833

Email: bonfiglietti@tiscali.it

Japan: Ted Asoshina Tel: +81 3 3263 5065

Email: aso@echo-japan.co.jp

Asia / Australasia: Roger Adshead Tel: +44 7768 178163

Email: radshead@ropl.com

Global Report Construction Equipment

Print ISSN 2057-3510

Digital ISSN 2057-3529

CONTENTS

05. Global markets review:

Long-term gain, short-term pain Global construction equipment demand will remain healthy in the decade ahead, with many national governments and ambitious private enterprises committing to significant new infrastructure projects. The future looks bright.

22. The world in numbers: Infographics to make you think We live in interesting times. The global economic and political landscape is in a state of flux like never before as populism, pandemics and protectionism disrupt the status quo. We have selected a mix of key facts and figures to help you make sense of it all.

25. Leasing and rental trends: Servitisation, technology and sharing Market upheavals are driving rapid strategic change in the way construction equipment is owned, sold, rented, leased and used. Do you know what servitisation and the shared economy mean? And where is the technology taking us next?

31. Downsizing: The power game: Less is more as engines get stronger Two decades of diesel engine developments have not only helped to reduce emissions, they have also increased power-to-weight ratios. Is your business making sure it can get the same performance levels from smaller machines?

35. View from the top interview: Is e-equipment the new normal?

At the recent BICES exhibition in Beijing, Global Report sat down with two of LiuGong’s most senior directors. On show was the company’s first range of all-electric construction equipment. Is this the future … or is it the new normal?

40. Sustainabilty:

Construction has a crucial role Construction accounts for more globalresource use than any other industry. It will have a crucial role in the circular economy. How can your business help contractors get the licences they will need to run the site of the future?

47. Logistics: Who can you really trust out there?

Global supply chains involve lots of organisations doing lots of transactions every day, all around the world. Everything is based on trust. How do you make sure that every link in the chain is doing what it is supposed to do? Who can you really trust?

52. Special report: Brazil

Brazil flags up order and progress

The Brazilian construction equipment sector is showing signs of recovery after the country’s economic and political crisis of 2014-2017. Now, at last, there are signs of better times ahead. Can order and progress start to reign again?

56. Fleet cost management:

Wealth and efficiency mean control

A wide range of machinery and technology is needed to run one of today’s large, modern construction sites, and it comes at a huge cost. So, why are the best ways to acquire and operate these expensive equipment fleets often overlooked?

61. Special report: Africa:

Closing the infrastructure gap

Africa’s infrastructure investment gap stands at somewhere between US$68 and US$108 billion per year. The need to spend is obvious and the continent’s backers clearly agree. At long last, it looks like things are moving in the right direction.

67. China: The future:

The dragon emerges from Covid-19

As China’s construction equipment manufacturers ramp up production following the global virus pandemic, what shape will they and their markets be in? Are they thinking local or global? How are their strategies changing in these volatile times?

72. The digital age: Building a brave new world

This is the year that the European Union will push ahead with its new DigiPLACE project, an initiative designed to develop a construction industry “fit for the digital age”. But what does that mean on the ground, in the real world?

76. Asphalt plant technology: Powered by globalisation and data

New asphalt plant technologies are spreading around the world, thanks to globalisation and the availability of information. How do the sector’s leading players think that things will change as these transformative global trends take hold?

PERERFORMANCE

As Global Report 2020 was going to press, the Covid-19 pandemic was continuing to disrupt the global economy. Our expert writers have taken the long view wherever possible and tried to identify the key long-term trends that will affect us all. However, there are clearly going to be some unexpected bumps in the road ahead. Here, in our traditional opening feature, we have collected together independent analysis on markets around the world from the best sources in the business. It is, as always, a snapshot based on their thinking at the time. But, in these unusual times, the sources that we have used here, and throughout the rest of the Global Report 2020, have all said the same thing: This is what we think right now. The long-term outlook is good, they all agree. But things in the short-term are looking far more tricky.

LONG-TERM GAINS AFTER SHORT-TERM PAINS

Global construction equipment demand will remain healthy in this new decade, with many national governments and ambitious private enterprises committing significant financial sums to new transport and utilities infrastructure works. There are lots of large-scale residential and commercial building projects in the pipeline too. The future looks bright. Guy Woodford reports.

The global market for construction equipment reached a historical peak in 2018, with 1.1 million units sold, according to Off-Highway Research (OHR), a leading off-highway business market intelligence consultancy. In the same year, the global value of construction equipment sales was $110 billion. Having begun last year, OHR forecasts the decline in worldwide sales, which began last year, will continue until 2021, after which the next phase of growth will occur.

U.S.-headquartered business market research analysts Freedonia tip global demand for construction equipment to expand 4.4% a year between 2018 and 2023. This is a notable recovery from “weak” performance between 2013 and 2018. Freedonia notes that crucial trends driving market gains include advances in worldwide building and nonbuilding construction activity; and the expansion of the global mining, forestry, energy, and

agricultural sectors, which will generate demand for a variety of construction equipment. Further positive trends include a recovery in commodity prices which will improve the financial position of mine operators, who are significant purchasers of construction equipment; and rising construction and mining sector mechanisation rates in numerous developing nations. Furthermore, Freedonia believes that the development of technologically advanced and more versatile construction equipment will spur replacement sales price increases, boosting value demand even if unit demand stays flat.

On a less positive note, Freedonia also states that hampering market gains is the sizeable amount of construction equipment already in use in industrialised countries and the continuing popularity of used machines in developing nations.

Freedonia predicts that the Asia/Pacific

region will account for 53% of all new construction equipment demand, with China alone comprising 27% of all further product sales gains in the 2018-2023 period.

MarketsandMarkets, a leading global B2B (business-to-business) market research company, whose broad industrial expertise portfolio includes building and construction, notes that the concept of self-driving or autonomous construction equipment will continue to gain traction in the next few years. The firm also forecasts a vibrant equipment rental and leasing sector fuelled by infrastructure building project contractors keen to access premium equipment without paying its entire cost. Meanwhile, MarketsandMarkets has also highlighted how a lack of standardisation for engine technology, including emission standards, is hampering the export of machines. High production costs also represent a significant challenge for construction equipment manufacturers.

EUROPE

A PERIOD OF GROWTH ENDED BY CHALLENGING TIMES

With annual revenues of €40 billion generated by its 1,200 companies and their combined 300,000 employees, the European construction equipment industry is a big player globally.

Off-Highway Research (OHR) notes that European equipment demand has generally been improving since the postfinancial crisis low point in 2009, although the sovereign debt crisis of the early 2010s derailed growth in 2012 and 2013.

The acceleration in 2016-2018 was particularly sharp, and 2019 sales totalled some 178,000 machines. While not up to the high of more than 200,000 units seen at the peak in the mid-2000s, OHR states this represents very healthy demand for Europe.

OHR says: “The last three years have seen equipment sales in almost all European countries grow. The underlying reason has been improving economic growth in the region. There has also been strong residential construction activity, particularly in Germany, reform in France in the form of 2015’s ‘Macron Law’, recovery in the Southern economies hit hardest by

the global crisis, a climate of low interest rates and a good number of significant infrastructure initiatives.”

So far, OHR continues, the uncertainty of Brexit has had little effect on the UK market or broader equipment demand in Europe. With more than 38,000 machines sold last year, demand in Britain and Northern Ireland was almost as high as it was in the boom of the mid-2000s. House building has been strong over the last few

years, particularly in London and the South East, and there is now a good pipeline of infrastructure work.

“There is little doubt that when – and if –Brexit happens that there will be disruption for the industry. Tariffs and bureaucratic barriers could disrupt the flow of machines and parts, and in the longer term, the negative impact on the UK economy is likely to feed through to reduced demand for equipment,” says OHR.

AMMANN ARS SOIL COMPACTORS

PRODUCTIVE. SUSTAINABLE. COST-EFFECTIVE.

• Multiple vibration frequencies and centrifugal forces enable productivity on a wide range of materials and compaction thicknesses.

Ammann ARS Soil Compactors utilise advanced technology that meets the latest emissions standards, reduces fuel usage and gives operators valuable data that eliminates unnecessary passes.

That’s just the beginning of the advantages these machines offer.

• The new ECOdrop initiative and new technologies improve efficiency and reduce fuel consumption and the amount of required fluids.

• The compactors are extremely manoeuvrable and stable thanks to the no-rear-axle structure.

In terms of equipment, OHR highlights that the mini excavator is hugely popular in Europe, partly because of the ever-maturing rental industry, and now accounts for some 40% of equipment sales in unit terms.

Europe’s construction machinery manufacturers association, CECE, reports that 2019 was a positive year for the sector. However, the forecast for 2020 is that market conditions will be challenging.

Speaking during an online CECE press conference in March 2020 to launch the association’s Annual Economic Report and highlight the CECE’s response to the Covid-19 pandemic, Sebastian Popp, secretary of the CECE Statistical Commission, said the European construction equipment industry was now at the “edge of a cyclical downturn”. However, an initially predicted 5% reduction in equipment demand in 2020 has now been made irrelevant by the Covid-19 pandemic. Looking at the market more closely reveals some crucial pointers and Popp said: “More than half of the equipment sold comes from the three main markets, Germany, France and the UK.” He explained that these account for 25%, 14% and 12% of sales of construction machines in Europe respectively.

Popp said that for many equipment sectors, there was a ‘bauma effect’, with sales

NORTH AMERICA

proving strongest in the first two quarters of 2019. However, the earthmoving equipment sector bucked this trend. “Sales grew 6%, and the growth continued through 2019.”

He continued, “The sector bounced back in early 2020. Until February 2020, we had seen a good recovery.”

How the EU will respond economically to the current pandemic remains to be seen. But Popp added: “When we will see stimulus packages, the infrastructure sector will be one to benefit.” And he explained that this would help boost future construction activity.

Meanwhile, Riccardo Viaggi, secretary

HEALTHY DOMESTIC DEMAND BUT CHINESE TRADE WAR GOES ON

As in Europe, North American construction equipment demand is now the highest it has been since the preglobal financial crisis peak of the mid-2000s, states Off-Highway Research (OHR).

Indeed, the North America market is forecast by OHR to continue its growth until 2022, when sales are expected to reach a peak level of 240,000 machines. Following this, a modest decline is anticipated in 2023 to around 225,000 machines.

OHR notes that lighter equipment types have benefitted most from a residential boom, with strong growth in mini excavators, telescopic handlers and smaller classes of crawler excavators. As in Europe, OHR

notes that the backhoe loader is falling out of favour a little in North America, but sales remain around 10,000 units per year.

OHR says that skid-steer loaders still sell in huge numbers to construction and agriculture in North America, but at 34,000 unit sales last year, the market is far from its peak of 73,000 units in 2000. The fundamental change has been the emergence of compact tracked loaders from the early 2000s onwards. Their lower bearing pressure – and therefore better abilities on poor ground conditions – have, says OHR, moved them ahead of skid-steer loaders in many applications and sales last year were more than 50,000 machines. The similarities in

general of CECE, explained that the group has been lobbying for the deadlines for the Stage V emissions requirements to be extended. He said that incomplete and unsold engines meeting the needs of the transition period had been stockpiled due to a shortage of components to complete them and reduced engine demand. Viaggi explained that sticking to the original Stage V deadlines would result in the scrapping of many components, which is not desirable from an environmental perspective. Europe’s road-building sector continues to offer excellent sales opportunities to construction OEMs (original equipment manufacturers). In Q1 2019, GlobalData reported that its Construction Intelligence Center (CIC) was tracking road-related construction projects in Europe with a total value of US$485.8bn. Of this, $198.2bn was, at the time, in the execution stage and US$165.3bn in the planning stage. Russia accounted for the highest value at $66.2bn, followed by the UK with projects valuing $64.8bn. Norway and Romania follow with road construction projects with a cost of $52.2bn and $31.9bn respectively. The highest value project in Europe as of Q1 2019 was the $25bn floating underwater tunnels project in Norway followed by the US$15.3 billion Central Ring Road development in Moscow, Russia.

ABOVE: North American construction equipment demand is now the highest it has been since the pre-global financial crisis peak of the mid-2000s

design and capacity of skid-steer and compact track loaders mean this shift is perhaps best thought of as a change in undercarriage preference, rather than a migration to a new type of machine.

GlobalData’s

Trends and Opportunities to 2023 that the U.S. infrastructure construction market is due to record a CAGR (compound annual growth rate) of 6.83% in nominal terms in the 2019-2023 period. Increasing demand for new infrastructure and maintenance works, along with urbanisation growth and the rise in e-commerce, is creating significant investment opportunities, especially for the transport sector, notes Global Data. In July 2019, under the Infrastructure for Rebuilding America (INFRA) discretionary grant programme, the U.S. Department of Transportation (USDOT) granted US$856mn to develop railway and related infrastructure. Out of the total investment, the government agreed to spend $135.5mn towards the rebuilding of two railway corridors in the country.

BELOW: Construction workers assess plans for a building project in St Louis, Missouri

The whole construction project pipeline in the U.S. – as tracked by GlobalData and including all megaprojects with a value above $25mn – stands at $852.2bn. The pipeline, which consists of all projects from preplanning to execution, is relatively skewed towards late-stage projects, with 58.7% of the pipeline value being in projects in the preexecution and execution stages as of October 2019.

GlobalData highlights that the continuing U.S-China trade stand-off continues to have a destabilising effect on the American construction industry.

On 1 August 2019, president Donald Trump announced that he would impose a new 10% tariff on a further US$300bn of imported Chinese goods, ranging from clothes to smartphones, marking a sharp escalation of the ongoing trade war between the two countries. This new round of tariffs is in addition to the current tariffs of 25% on $250bn of Chinese imports. Already, highlights GlobalData, U.S. construction companies are shifting supply chains and delaying capital expenditure as a result of the previous U.S. tariff increases on Chinese products and overseas metals. “This latest

CENTRAL & SOUTH AMERICA

announcement of tariffs on Chinese imports, together with the effects of previous tariffs, will further undermine business confidence, and likely lead to weaker construction growth,” concludes GlobalData.

The previous Trump-government-imposed tariffs on $250bn worth of Chinese goods entering the U.S., resulted in retaliatory tariffs on $110bn-worth of U.S. goods imported to China. The AEM (Association of Equipment Manufacturers), the North American-based international trade group representing off-road equipment makers and suppliers, has long voiced its concern about the U.S. government’s imposition of tariffs on imported Chinese goods.

Remaining with GlobalData, the global business market intelligence consultancy’s Construction in Canada – Key Trends and Opportunities to 2023 notes that in the 2019-2023 period, Canadian construction activity will benefit from the government’s planned investments in infrastructure. Under the Investing in Canada Plan, the government plans to invest a total of CAD 180bn (US$139bn) in crucial infrastructure sectors until 2028 – generating significant commercial opportunities for construction equipment makers, both domestic and international. The Canadian construction industry’s output is likely to be supported by improvements in business confidence over the forecast period, which will drive investment in overall infrastructure, notes GlobalData. Also, the government’s aim to improve local energy resources will support investment in energy-infrastructure projects, which will, in turn, fuel growth in the industry.

POLITICAL UNCERTAINTY REMAINS A MAJOR PROBLEM DESPITE SEVERAL LARGE INFRASTRUCURE GAINS

Deloitte’s Global M&A (Mergers & Acquisitions) Construction Monitor 2018-2019 reports that there were nine mergers and acquisitions valued at US$5mn or more involving construction companies in 2018, the same level as in 2015.

Between 2018 and 2022, GDP (gross domestic product) in Latin America is expected to grow to an annual average

of 2.6%, notes the Deloitte report. Total infrastructure spending was tipped to reach US$142.5bn in 2019 and $175.8bn in 2020, creating new commercial prospects for construction equipment makers.

New governments in Latin America brought perspective for a region struggling economically. Deloitte says that political stability is vital for the future growth of the

Latin American construction markets. Total infrastructure investment in Latin America is estimated at 2.8% of GDP, significantly trailing the 5.2% investment requirement as defined by the United Nations, states the Deloitte report. Estimates of the infrastructure financing gap in the region vary. For this to close, investment levels must increase in the six countries

that account for over 90% of infrastructure investment in the region (Brazil, Peru, Mexico, Argentina, Chile and Colombia).

More positively, a combination of favourable demographic trends and the implementation of legislative reforms throughout Latin America is generating a wide range of infrastructure investment opportunities investors, says Deloitte. Total regional infrastructure spending is projected to reach $142.5bn in 2019 and $175.8bn in 2020.

GlobalData’s Construction in Brazil – Key Trends and Opportunities to 2023 report says that the Brazilian construction industry is expected to remain sluggish in 2019, before recovering to an annual average rate of 2.3% in real terms during the latter part of the 2020-2023 period. GlobalData says the recovery will be driven by the government’s efforts to improve the country’s infrastructure and increasing investment in energy and manufacturing plants.

The total construction project pipeline in Brazil – as tracked by GlobalData and including all megaprojects with a value above US$25mn – stands at BRL2.2tn ($597.8bn). The pipeline, which consists of all projects from pre-planning to execution, is skewed towards early-stage projects, with 57.4% of the pipeline value being in projects in the pre-planning and planning stages as of November 2019.

Global Data’s Construction in Mexico – Key Trends and Opportunities to 2023 report notes that Mexico’s recently launched infrastructure

plan could restore investors’ confidence and add to national construction industry growth. However, the same source believes public spending will remain subdued and private investment restrained if security issues and uncertainties around the policies of president López Obrador continue. A highprofile example of policy uncertainty was López Obrador’s decision to cancel the partbuilt US$13 billion airport for Mexico City five weeks before taking office in the summer of 2018.

Ongoing civil protests in Colombia are expected to have a negative impact on the country’s economy

raise investment in sectors such as transport, energy and communications were affected by the country’s worsening financial conditions, including the transmission line between Río Diamante to Charlone, the Vaca Muerta gas pipeline and the Norpatagónico (North Patagonia) railway line project.

The report also comments that a weak external environment, which could lead to a lower-than-expected decline in the price of oil, could also make it harder for the Mexican government to achieve its fiscal target, and further constrain much-needed spending on public works. According to the Mexican Chamber of Construction Industry, the 2020 budget for 12 government ministries and state-run companies that have traditionally dominated public sector construction is 8.6% lower than that approved in 2019.

GlobalData notes that the Argentinian construction industry was expected to contract by 6% in 2019 and 2.4% in 2020, due to the continued deteriorating macroeconomic conditions and the challenging business environment. Many of the construction projects included in the plan that was launched by president Mauricio Macri’s outgoing administration in 2019 to

GlobalData says the Argentinian construction industry is expected to recover during the 2021-2023 period, supported by new president Alberto Fernández’s efforts to revitalise the economy and subsequent improvements in investor and consumer confidence. Investments in road infrastructure projects include the Safe Highways and Roads Network program and the Corredor C Toll Road development.

Ongoing civil protests in Colombia are expected to have a negative impact on the country’s economy, notes GlobalData.

The global business market research consultancy says this could harm construction spending – and construction equipment demand. In November 2019, protests began in response to the government’s plans to reduce benefits for workers and retirees and in support of the country’s peace agreements. These escalated into a broader outcry over dissatisfaction with president Iván Duque’s policies on economic reforms, corruption, violence and environmental protection.

STILL DRIVING UP DEMAND AND R&D INVESTMENT

China’s 25 leading excavator makers sold a total of 235,693 excavators in 2019, up 15.9% year-on-year, according to data from the China Construction Machinery Association (CCMA).

CCMA figures show that 209,077 excavators were sold in the domestic market, rising 13.4% year-on-year, while export of the equipment surged 39.4% to 26,616.

Off-Highway Research (OHR) says the Chinese market experienced a severe downturn in 2015, when sales fell to less than 140,000 machines, a fall of 40% compared to the previous year. Even more dramatic is the comparison with the peak level of sales reached in 2011 at 475,000 machines.

However, since 2016 China has been on a steady recovery path which has led to the latest peak in 2018 – when, OHR notes, nearly 340,000 machines were sold, one-third of global sales that year.

Exports of construction equipment from China remain significant, primarily to emerging markets. In 2018, 85,000 machines were exported, which represented 20% of total machine production.

Production of crawler, mini and wheeled excavators totalled 248,600 units in 2018, according to a detailed analysis in the February 2020 Market Report from OHR’s Chinese Service. It was the second year in a row that the country’s excavator production had set a new record, and output was 18% more than was seen at the height of the stimulus spending boom in 2011.

The OHR Chinese Service study looks on a factory-by-factory basis at the manufacturing of the three types of excavator for all significant OEMs (original equipment manufacturers) – both domestic and international – active in China. It compares actual production in 2019 with the design capacity of each factory.

One alarming conclusion is that although there have never been more excavators produced in China, factory utilisation last

year stood at only 51% of theoretical capacity. However, it is a moot point as to whether full capacity is achievable. Demand in the previous two years has seen waiting times lengthen due to component supply shortages – particularly hydraulic components.

The downturn in China from 20112016 followed an extraordinary boom in equipment sales in 2010 and 2011, which OHR’s Chinese Service notes was the result of the national government’s approximate US$600bn stimulus package. The remarkable high this created was followed by a long and painful recession for the industry. New equipment sales were hampered by the perfect storm of lower construction activity and a large population of young machines in the field.

OHR’s Chinese Service says that the remedy for Chinese construction industry woes came in late 2016 in the shape of new infrastructure investment under president Xi Jinping’s Belt and Road Initiative (BRI). The BRI is developing modern-day versions of the land-based ‘Silk Road Economic Belt’ and the ‘Maritime Silk Road’ of the 21st Century. It is seeing massive investment in China’s land and sea transport infrastructure and has also seen Chinese banks fund projects in neighbouring countries. Both measures have been extremely positive for the Chinese construction equipment industry. One of the crucial points about the overseas aspects of BRI is that projects are often carried out by Chinese contractors (or their joint ventures), and there is a tendency for them to source equipment from producers in China.

Although the peak in equipment sales associated with these projects now looks to have passed, only a moderate decline was forecast in the Chinese market in 2019. A more pronounced downturn may come in

2020, but at this stage OHR says it does not expect the market to fall off a cliff in the same way that it did in 2012.

In the past wheeled loaders have been the workhorse machines of Chinese construction, but in 2017 they were outsold by crawler excavators for the first time. OHR’s Chinese Service says this is partly due to the greater availability and acceptance of crawler excavators, as indigenous companies have developed good machines over the last ten years to compete with products from international original equipment manufacturers (OEMs) manufacturing in China.

Also, smaller classes of wheeled loaders have come under considerable pressure from cheaper alternatives – mostly locally made low-technology farm equipment.

China’s involvement in infrastructure developments in emerging markets across Asia continues to expand, according to GlobalData, a leading global business market intelligence consultancy.

GlobalData estimates the total value of

infrastructure projects (including building materials) in which Chinese contractors are at least partially involved at around $235bn, while in South Asia the project values total $191bn. Chinese influence continues to expand via the BRI. Under the initiative, China is seeking to improve infrastructure in emerging markets across the world, facilitating economic development through the companies that can transport goods more quickly and cheaply between countries along various routes.

Danny Richards, lead economist at GlobalData, said: “Although wariness has been increasing among the governments in emerging markets over the risks of relying heavily on China for funding and construction contracts, the opportunities provided under the BRI can be attractive for governments with limited funding capacity and rising infrastructure needs.”

In Asia, reflecting political challenges and concerns over the build-up of debt, new governments in Pakistan, Malaysia, and the Maldives, in particular, have been challenging contracts that had hitherto been signed with China or have been delaying progress on existing projects.

Nevertheless, GlobalData says China is heavily influencing the development of infrastructure in Asia’s emerging markets. Based on the global business market intelligence consultancy’s analysis, if all infrastructure projects in the pipeline proceed as planned, spending on projects involving Chinese contractors could reach $64bn in 2020, up from $23bn in 2014.

JAPAN

JAPANESE MARKET DIFFERENTIALS

The Japanese construction equipment market moved to a different rhythm compared to many other markets over the 2010s, according to Off-Highway Research (OHR). It had a peak in 2013 as a result of prime minister Shinzo Abe’s reform and stimulus policies – known as ‘Abenomics’ – along with reconstruction work following the March 2011 Tohoku earthquake and tsunami, OHR notes.

There was something of an improvement in 2017, continues OHR, but it is debatable whether this was due to improving fundamentals in Japan or other factors. A planned increase in consumption tax in 2015 had been pushed back to 2017, and there is some evidence to suggest a lot of equipment buying took place ahead of this to avoid the price increase. In the event, the tax hike was pushed back again to October this year and could be delayed further.

Another factor, notes OHR, was the rise in equipment demand throughout Southeast Asia in 2017 and 2018. These are the traditional disposal routes for used equipment from Japan, and the need for machines in these countries at reasonable prices encouraged Japanese rental companies and contractors to renew their fleets.

Following the resultant blip in new equipment sales in Japan in 2017, OHR

REST OF ASIA

reports that the market fell back 5% in 2018.

Sales in Japan are dominated by indigenous OEMs (original equipment manufacturers) such as Komatsu and Hitachi Construction Machinery. OHR states that the only foreign supplier of any significance is Caterpillar, which owes its presence to a long-standing joint venture with Mitsubishi, established in 1963. Caterpillar began to buy out its partner in 2008, notes OHR, and the presence in Japan is now wholly owned by the US-based company.

OHR adds: “A consequence of the dominance of Japanese suppliers is that demand is centred around the products those companies have historically offered. Mini and crawler excavators sell in high numbers alongside wheeled loaders, and there is also some demand for dozers, graders and dump trucks.

“There have never been significant sales of backhoe loaders, skid-steer loaders or telescopic handlers in Japan. The common types of lifting equipment are stiff-boom loader cranes and rough terrain cranes, which are permitted to drive on public roads.”

To repair the country’s old infrastructure, GlobalData’s Construction in Japan – Key Trends and Opportunities to 2023 report notes that the Japanese government is investing JPY3tn (US$27bn) under the new public

spending programme on infrastructure redevelopment to March 2021. Under this programme, the government is funding 132 repair or refurbishment projects involving the country’s airports, roads, bridges and power plants. The government’s focus on the development of renewable energy infrastructure will also drive construction industry growth. Additionally, the country’s hosting of world sporting events such as the Rugby World Cup in 2019 and the Olympic Games in 2020, has dramatically boosted the construction industry’s output.

GlobalData also highlights that in the first half of 2019, the government announced plans to develop three rail lines to enhance transport and reduce travelling time by connecting Haneda Airport to stations in the capital city Tokyo. The government aims to link the airport to Tokyo, Shinjuku and Shin-Kiba railway stations with an estimated investment of JPY300bn ($2.7bn) by 2029.

The total construction project pipeline in Japan – as tracked by GlobalData and including all megaprojects with a value above $25mn – stands at JPY33.5tn ($300.7bn). The pipeline, which consists of all projects from pre-planning to execution, is skewed towards late-stage projects, with 58.1% of the pipeline value being in projects in the pre-execution and execution stages as of July 2019.

MOSTLY ATTRACTIVE EQUIPMENT MARKETS

While China is the Asia-Pacific region’s, indeed the world’s, biggest construction equipment buyer, many other regional nations have vibrant national construction markets, creating exciting commercial opportunities for global and regional OEMs (original equipment manufacturers).

The Indonesian construction industry registered an annual growth rate of 5.8% in real terms in 2019, according to GlobalData’s Construction in Indonesia – Key Trends and Opportunities to 2024 report. The report notes that Indonesia’s construction industry will continue to grow at a fast pace during the 2020-2024 period, notwithstanding short-

term disruption and potential risks owing to the coronavirus outbreak, particularly across Asia.

GlobalData states that Indonesia’s president, Joko Widodo, is expected to drive forward further large-scale developments, while the country is also attracting financial support from China for major infrastructure

works under the Belt and Road Initiative (BRI). The industry’s output value in real terms will achieve a compound annual growth rate (CAGR) of 5.59% over the forecast period.

The government plans to spend IDR571 trillion ($40bn) on the development of transport infrastructure in Jakarta by 2029. Under these plans, announced in March 2019, the government intends to build a 120km light transit railway corridor in the capital city. Additionally, in May 2019, the government announced plans to invest IDR6 quadrillion ($412bn) in developing the country’s overall infrastructure from 2020 to 2024. It will see the construction of 25 new airports, highways, affordable houses and power plants. Furthermore, the government plans to add 430GW of new power-plant capacity by 2050.

on infrastructure in the first half of the year.

In March 2019, the government launched the Philippine Construction Industry Roadmap 2020-2030. It aims to increase the construction industry’s contribution to the Philippine economy from PHP2.3tn ($44.1bn) in 2018 to PHP130tn ($2.5tn) by 2030. Furthermore, GlobalData states that the roadmap will also increase the job opportunities for construction from four million jobs in 2018 to seven million by 2030.

Ongoing civil protests in Colombia are expected to have a negative impact on the country’s economy

Deloitte’s Global M&A (Mergers & Acquisitions) Construction Monitor 2019 notes that South Korea’s construction market volume was worth US$112.31bn in 2019, 6.8% lower than in 2018. Due to new regulations on the residential market, the overall margin of the domestic construction sector has declined.

research and development (R&D) will support national construction industry growth between 2019 and 2023. In January 2019, the government approved KRW24.1tn ($21.5bn) to develop 23 projects linked to highways, rail, manufacturing plant and hospitals.

Vietnam’s construction industry registered an annual growth of 9.1% in real terms in 2019, following average annual growth of 9.7% during 2015-2018. It was due to positive developments in economic conditions and investments in transport, residential and energy-infrastructure construction projects. Additionally, government efforts to attract foreign investment supported the industry’s growth.

The Philippine construction industry expanded by 9.4% in real terms in 2019, according to GlobalData’s Construction in the Philippines – Key Trends and Opportunities to 2024 report. The report states that the growth was preceded by an average annual growth of 10.9% during the preceding four years. Growth during the GlobalData report’s 2015-2019 forecast period was driven by continuous spending on large-scale transportation and energy projects under the “Build, Build, Build” (BBB) programme.

Although the overall spending on infrastructure remained healthy in 2019, GlobalData notes that a delay in the approval of the 2019 budget and the 45-day ban on public works – due to the prohibition of

The Deloitte report states that the profitability of the South Korean construction sector has declined continuously due to a lack of infrastructure and housing projects. Medium- and small-sized construction companies are struggling to survive and are experiencing difficulties in their cash flow management.

Larger construction companies will be able to overcome this period, says Deloitte, as they are part of conglomerates. In 2018, most big deals exceeding $105bn involved transactions between group companies, such as Hyundai, Hyosung and Lotte.

On a more positive note, GlobalData’s Construction in South Korea – Key Trends and Opportunities to 2023 report states that the South Korean government’s investment

Vietnam’s construction industry output value will continue to expand during the 2020-2024 period, with investments in transport infrastructure, energy and manufacturing, according to GlobalData’s February 2020 published report Construction in Vietnam – Key Trends and Opportunities to 2024. The report highlights how in January 2020, for example, the World Bank signed an agreement with the Vietnamese government to provide a loan worth VND229.1bn (US$10.3mn) to build a new bus rapid transport corridor in Ho Chi Minh city.

In September 2019, the government announced plans to spend VND30 trillion ($1.3bn) to create a new expressway in Mekong by 2023. The focus on the development of local energy resources will drive industry growth. The government plans to install 55.3GW of a new coal-fired power plant in the country during the 2020-2030 period. GlobalData states that the government also plans to add 7.2GW

www.liebherr.com info.lex@liebherr.com www.facebook.com/LiebherrConstruction

AFRICA

MORE POSITIVES THAN NEGATIVES

South Africa remains Africa’s biggest national construction and other offhighway equipment sales market. A surge in demand from the mining segment, particularly coal mining, has been responsible for significant equipment sales in the country in recent years, says Off-Highway Research (OHR). However, the construction industry has been weak and increased investment is badly needed to stimulate machine sales.

According to OHR’s new Special Report on South Africa, the country’s equipment sales totalled nearly 6,000 units in 2018. This was higher than the low point of 4,613 machines in 2016, but demand remains below a natural and healthy industry level. However, even in its depressed state, the South African market for new equipment was worth just over US$1 billion in 2018, OHR reports.

shortage has been the key positive in the equipment industry over the last 2-3 years. Mining has driven significant volumes in the dump truck, excavator and wheeled loader segments, and the industry’s need for large equipment is also a plus for the industry.

“Although the need for electricity and therefore coal is still acute in South Africa, Off-Highway Research believes the equipment-buying cycle associated with this has peaked. Volumes are at historically high levels, and the scope for further growth is therefore limited.”

Deloitte’s Global M&A (Mergers & Acquisitions) Construction Monitor 20182019 report says margins are under pressure in South Africa as construction firms are competing for work. “This limits their ability to price their offerings fairly. Another major problem has been the pricing model used in SA, which puts all risks in the hands of the construction companies. This is unlike the typical construction contracts in Europe and the US, which use a ‘cost-plus’ system,” says the report.

On a more positive note, Deloitte’s

report adds that in sub-Saharan Africa, the construction industry was due to grow by 3.5% in 2019, up from 3% in 2018.

China is the most significant foreign player in infrastructure financing and construction in Africa

China is the most significant foreign player in infrastructure financing and construction in Africa, mainly through its more than US$1 trillion Belt and Road Initiative (BRI). Indeed, according to Deloitte’s Africa Construction Trends (ACT) 2019 report, China funds 92 projects – one in every five projects – across the continent (20.4%, and up from 18.9% in 2018), now making it the secondlargest funding source after African governments. Private domestic firms follow this with 49 projects (10.8%), and international DFIs (development finance institutions) with 46 projects (10.2%).

The Deloitte report states that China continues to dominate as the most prolific (and single country) builder of projects across Africa, constructing 140 projects (31%). This is down from 160 projects last year. Private domestic firms follow with 104 projects (23%) under construction. Other

“Mining has driven significant volumes in the dump truck, excavator and wheeled loader segments”

Source: Africa Construction Trends Report 2019, Deloitte

notable single-country builders include South African firms constructing projects outside of South Africa, albeit some way behind with 17 (3.8%) projects, and Italian firms with the same number of projects. Projects built by China fall primarily within the transport sector.

Deloitte’s ACT 2019 report says North Africa – made up of Algeria, Egypt, Libya, Morocco, South Sudan, Sudan, Tunisia, and Western Sahara – has 87 building infrastructure projects valued at $50mn or more that had broken ground as of 1 June 2019 with a combined value of $144.8bn.

North Africa accounts for 19.2% of the 452 $50mn-plus building infrastructure projects on the continent and 29.1% in terms of their US dollar value – making it a desirable regional market for construction equipment manufacturers. The number of projects in North Africa decreased by 25.3% from the previous year, while the value of projects dropped by 2.4%. Within the region, Egypt has the most projects with 49, followed by Algeria with 17 projects, and then Morocco with 16 projects.

Deloitte’s ACT 2019 report states that the East Africa region – comprising Burundi, Comoros, Djibouti, Eritrea, Ethiopia, Kenya, Rwanda, Seychelles, Somalia, Tanzania

and Uganda – had seen a steady rise in the number of infrastructure projects tracked by the report in the past few years. This is said to be due to increased regional investments in infrastructure development.

The total number of $50mn-plus projects in East Africa rose by 30.9% between 2018 and 2019, with the region currently recording 182 projects under construction. The East Africa region accounts for 40.3% of projects across the continent and 29.5% of the value – making it an even more attractive market than North Africa for construction OEMs (original equipment manufacturers).

Turning to West Africa – which includes Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, the Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone, and Togo – Deloitte’s ACT report highlights that the region has 75 projects valued at $50mnplus currently underway, with a total US dollar value of $80.9bn. The region accounts for 16.6% of all projects in Africa and 16.3% of the continent’s total project dollar value.

Last year, the number of projects in West Africa decreased by 28.6% from 2018, while the value decreased by 2.4%. The report notes that some small-scale transport projects were completed in the region, while at the same

time large-scale projects such as Nigeria’s $18bn Centenary City were added.

Nigeria holds the highest number of projects in West Africa with 21 projects (28%), valued at $54.2bn (67.1% in US dollar value terms). Ghana follows Nigeria with 16 projects, valued at close to $14bn. These two countries combined account for 49.3% of all projects in West Africa and 84.4% of the region’s total project value.

Looking at the Central Africa region –comprising Cameroon, Central African Republic (CAR), Chad, the Democratic Republic of the Congo (DRC), Equatorial Guinea, Gabon, Congo-Brazzaville, and São Tomé and Príncipe – Central Africa represents 3.5% of all projects in Africa worth $50mn-plus and 1.3% in terms of US dollar value. The region is home to 16 $50mn-plus value projects – which are worth a combined $6.5bn. The number of projects, as well as the corresponding US dollar value, represent a decrease of 38.5% and 75.8% respectively from the previous year. Deloitte notes this is the result of a delay to various projects until further notice across the region.

Cameroon accounts for the largest share of $50mn-plus value projects in the region with 50% of all works, and the DRC accounting for 59.6% of projects by value. Regional

MIDDLE EAST

ENCOURAGING MIDDLE EASTERN MARKETS

According to Deloitte’s Global M&A (Mergers & Acquisitions) Construction Monitor 2019, the growth of the construction industry in MENA (Middle East, North Africa) was estimated to be the fastest worldwide in 2019, with a rate of 7.5%. This growth, the report states, is expected to continue until 2022, averaging 6.8% yearon-year. The Deloitte study says the Middle East construction sector has become highly competitive and price-conscious, which has resulted in a ‘lowest-bid-wins’ model.

The Deloitte report says Middle East spending levels have fallen but regional governments are continuing to invest in infrastructure projects. It continues: “The construction sector is driven by the fundamental role it has as a driver for economic growth and job creation. Moreover, a growing population, tourism and mega-events such as the Expo 2020 and FIFA World Cup in 2022 lift the need for infrastructure.”

Projects in the pipeline of the countries in the Gulf Cooperation Council (GCC) amount to over US$2.5trn, according to the Deloitte report. The Kingdom of Saudi Arabia is leading the way, taking up almost half (46%) of the volume, followed by the United Arab Emirates with $750bn in the pipeline.

Deloitte’s Global M&A Construction Monitor 2019 adds: “Although oil prices have risen, it appears that more cautious capital infrastructure spending is now the norm. Future market performance will be determined largely by the oil price, regardless of market reforms achieved.

“Private sector capital is expected to play a bigger role in the industry, either through Public-Private Partnerships or fully private projects. The private sector will demand a more mature contracting environment with fairer contracting practices and a more balanced approach to risk allocation.

“Given where the Middle East is in the economic cycle, investors are unlikely to seek acquisitions for the foreseeable future – other

“An increase in crude oil production and government efforts to diversify the economy is likely to drive investment”

than ‘fire sales’. However, some construction companies may merge for strategic purposes or to improve their purchasing power.”

In its Q1 2019 report Project Insight: Road Construction Projects – Middle East and Africa, GlobalData forecasts that road investment will gather pace in the Middle East up to 2025, with car ownership increasing sharply. Therefore, road investment is predicted to rise by 116%, to reach $31 billion per year in the 2015 to 2025 period.

GlobalData notes that the Saudi Arabian government announced plans to attract SAR1.6 trillion ($429bn) of private investment under the National Industrial Development and Logistics Program (NIDLP) during the next decade. Under this, the government aims to develop the industrial and transport infrastructure of the country to diversify the country’s economy and reduce its reliance on the oil sector.

Following two years of contraction, the United Arab Emirates (UAE) construction industry rebounded in 2018, and registered growth of 4.2% in real terms, notes GlobalData’s Construction in the UAE – Key Trends and Opportunities to 2023 report.

Recovery in the country’s construction industry is expected to continue during the GlobalData report’s 2019-2023 forecast period, driven by a declining budget deficit and improving investor confidence, which will support new investments in residential, energy and utilities, infrastructure and commercial construction projects. Furthermore, an increase in crude oil production and government efforts to diversify the economy is likely to drive investment in the UAE construction industry during the forecast period.

GlobalData’s report highlights UAE investment in transport, energy and social

infrastructure development projects under various programmes. The programmes include the Ministry of Education Strategic Plan 2017-2021, the National Strategy for Higher Education 2030 and Education 2020 Strategy, the Energy Strategy 2050, the Sheikh Zayed Housing Program, and the Dubai Tourism Strategy. These, GlobalData believes, will support UAE construction industry expansion during the forecast period. In October 2018, the government approved the new Dubai Tourism Strategy intending to attract 21-23 million visitors by 2022 and 2325 million tourists by 2025.

After a recovery in 2017, GlobalData says the Iranian construction industry suffered a downturn in 2018, where it contracted by 4.2% in real terms. The dip followed annual growth of 4.3% in 2017 and a yearly decline of 12.7% in 2016. This decline can be attributed, according to GlobalData, to an economic slowdown due to the U.S. sanctions and low oil prices. In May 2018, the U.S. announced its withdrawal from the Joint Comprehensive Plan of Action (JCPOA) and imposed a fresh round of sanctions on Iran, which affected both Iranian oil exports and the country’s revenue.

With the sanctions back in place, GlobalData expects the country’s construction industry to contract by 5% in real terms in 2019, before recovering in the latter part of the forecast period (2019–2023). GlobalData says the industry’s output value will grow at an annual average growth rate of 4.4% during the 2020–2023 period, as the government focuses on developing the country’s infrastructure projects and building new manufacturing plants. Growth will also be supported by investments in renewableenergy projects and the implementation of solar- and wind-energy projects, notes GlobalData.

HIGH PERFORMANCE RUNS IN THIS FAMILY.

Get more from every earthmoving machine and operator on site.

The Trimble® Earthworks Grade Control Platform is a next generation machine control system that optimizes your mixed fleet for an integrated site solution. This simple, intuitive platform enables your operators to stop the guesswork and start using the friendly Android™ UI and 10-inch touch screen to drive efficiency, deliver on schedule, and do more with dirt than ever before.

Ask for the full family of next-gen machine control. From the company that invented machine control. trimble.com/earthworks

For excavators, dozers, and motor graders.

THE WORLD IN NUMBERS

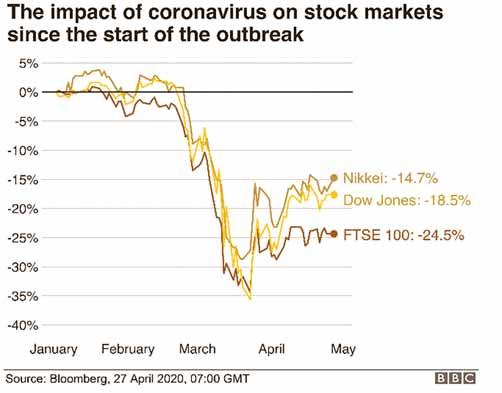

At the start of 2020 the world economy was expected to show a modest annual increase, although the United Nations had already predicted overall global growth to experience a ten-year low. Emerging economies were set to make significant inroads in economic rankings, challenging long-held Western dominance. Climate change was a growing concern, exacerbated by unprecedented events. Fifteen extreme weather disasters in 2019 were estimated to havecaused at least one billion dollars-

worth of damage each, with seven of the 15 causing over $10bn each. No continent is now considered immune. And then, just as the new year began, along came the COVID-19 pandemic, forcing communities into lockdown and decimating economies. As of April, the International Monetary Fund (IMF) predicts the global economy will contract sharply by at least 3% in 2020 and suggests that the pandemic’s economic damage will rival that of the 1930s Great Depression. If the virus can be contained,

the IMF predicts growth of 5.8% in 2021 but it warns of even more severe outcomes if containment fails. On a more positive note, the world’s CO2 emissions are predicted to fall by 8% in 2020, according to the International Energy Agency. Let’s take a look at some key indicators. We have split the infographics into different sections: Global Outlook Pre-Covid-19 … Global Outlook Post-Covid-19 … Emerging Markets … Resources … Digitalisation … Artificial Intelligence … Infrastructure.

GLOBAL OUTLOOK (PRE-COVID-19)

World economic outlook update: 2020 (growth projections)

Source: International Monetary Fund, January 2020

GLOBAL GROWTH HAS BEEN DECLINING BUT THERE WERE TENTATIVE SIGNS OF STABILISATION

Source: International Monetary Fund, January 2020

THE 173 COUNTRIES OUTSIDE OF THE

GLOBAL OUTLOOK (POST-COVID-19)

World economic outlook April 2020 (growth projections)

Source: International Monetary Fund, April 2020

EMERGING MARKETS

Emerging markets will dominate the world’s top 10 economies in 2050 GDP at PPP (purchasing power parity)

Source: International Monetary Fund for 2016 estimates, PwC analysis for projections to 2050 The World In 2050, PwC, 2017

UK99Germany

France1010UK

E7 economies G7 economies

VIETNAM, THE PHILIPPINES AND NIGERIA COULD MAKE THE GREATEST MOVES UP THE RANKINGS

VIETNAM 32-20 (12 PLACES) PHILIPPINES 28-19 (9 PLACES) NIGERIA 22-14 (8 PLACES)

Share of urban consumption growth

Source: McKinsey Global Institute, April 2019

ASIA COULD DRIVE 50% OF FUTURE CONSUMPTION GROWTH

For construction

RESOURCES

Actual and projected material use by year (billions of tonnes)

Source: OECD, FT calculations, 30 December 2019

GLOBAL USE OF SAND IS SET TO SOAR

DIGITALISATION

Growth, McKinsey Global Institute, April 2019

ACROSS OUR FOCUS COUNTRIES, DIGITAL ID COULD UNLOCK ECONOMIC VALUE EQUIVALENT OF BETWEEN 3-13% OF GDP IN 2030

$15.7 TRILLION THE AMOUNT GLOBAL GDP WILL GROW BY 2030 THANKS TO AI 40% AI CAN INCREASE PRODUCTIVITY BY 14x THE AMOUNT AI STARTUPS GREW OVER THE LAST TWO DECADES 6x THE AMOUNT INVESTMENT IN AI STARTUPS GREW SINCE 2000 77% OF THE DEVICES WE USE FEATURE ONE FORM OF AI OR ANOTHER

of potential value could accrue to individuals on average in emerging economies in our focus group, making it a powerful tool for inclusive growth

The ground rules are shifting, and quickly ... major structural changes in global equipment supply chains are beginning to play out

SERVITISATION, TECHNOLOGY AND THE SHARING ECONOMY

Market upheavals are driving rapid, strategic change in the way construction equipment is owned, sold, rented, leased and used. Do you know what servitisation and the shared economy means? And where is all that new technology taking us next?

Join Graham Anderson to find out more.

For years, construction equipment manufacturers have spoken about moving directly into rental markets. Their concerns and desires have been well documented – equipment is becoming more complex and expensive; and rental companies do not have the necessary skills, or financial strength, to fully exploit its potential.

What is more, they argue, the rental sector is fragmented, and dominated by small, technologically backward companies. As such, the sector is driven by price and is acting as a block to innovation.

But while there have been individual, episodic examples of direct OEM (original equipment manufacturer) involvement in rental markets, the longed-for supply chain restructuring has not taken place.

Critics of the OEMs have long dismissed their arguments as little more than public relations exercises or thinly disguised and short-term attempts to gain market share.

companies – that is to say, their own biggest customers. Tricky.

But today, the ground rules are shifting, and quickly. Despite the caveats, it is increasingly apparent that major structural changes in global equipment supply chains are beginning to play out, whether in Asia, Europe or the USA.

Driven by technology, the growth of the sharing economy and the rise of a global and expanding Chinese equipment sector, the industry is engaged in an accelerating rethink of its relationships, strategies and structures.

And that was before the impact of the Covid-19 virus which – for better or worse –could give the whole reform process a crisis-driven injection of energy.

Cassinelli believes that LiuGong will be able to treble rental revenues within five years

These same critics also point out that the OEMs have a fundamental problem – if they move into rental themselves, they could end up competing with the established rental

In January this year, LiuGong, the fast-growing and ambitious company headquartered in Liuzhou in southern China, revealed its plans to move into the rental business in a big way.

The company is already the world’s 10th-largest construction equipment manufacturer by market share and the world’s largest manufacturer of wheeled loaders.

A few days later, it also announced that

Graziano Cassinelli has joined the company to lead its newly formed Global Rental and Used Equipment unit.

Cassinelli brings to the Chinese company a wealth of knowledge from years of experience in the rental and used-equipment business.

In his most recent position, he spent almost five years with Caterpillar, including time as rental services territory manager for South-east Asia and India where he worked on developing a new Rental Services Network along existing dealer organizations.

Within weeks of those announcements, LiuGong underlined the depth of its commitment to rental with the news that it was in the process of acquiring Herc Holding’s Chinese business Herc Rentals China – previously known as Hertz China.

LIUGONG ACQUIRES HERC RENTALS

Based in Shanghai, Herc Rentals China has two main branches and eight depots, plus a very high-profile brand. Cassinelli believes that LiuGong will be able to treble rental revenues within five years, on the back of a still strong Chinese market buoyed by growing interest in rental.

But while LiuGong is initially focusing on its home market in China, its ambitions do not stop there – or with the Herc acquisition.

Cassinelli explains: “The Herc acquisition

is specifically for the Chinese market. Herc will allow us to accelerate the rental process. Outside China, we will be supporting our dealers moving into rental. We will succeed if we can engage and support our dealers worldwide in the rental business.”

We believe that the future is in sharing and rental

Further acquisitions might be considered at some point in the future, but while there is nothing planned at present, Cassinelli says that developing a rental business in Europe is on the cards.

LiuGong Machinery vice president Kevin Thieneman, underlined LiuGong’s long-term strategic ambition and its plans for the rental market.

“Rental is the largest segment for the construction equipment industry in Europe and North America and is projected to become a leading segment in China. This new endeavour will champion LiuGong’s efforts to become a leader in rental and used equipment.”

Chris Sleight, managing director of independent consultancy Off-Highway Research, said that LiuGong’s move made sound sense from their perspective.

“In China, the market for organized professional rental is relatively new and only really in the big cities. Also, what is rented out is an eclectic mix of equipment – aerial platforms, gensets and so on.

“For LiuGong, they are not really active in the market for the types of equipment that are most commonly rented out in China. So, they are creating a channel that is currently not renting out their equipment, but hopefully will in future.”

He adds: “As for the European market, it is very difficult for LiuGong and the other Chinese manufacturers to get through the door with the current European rental companies, who tend to buy established brands, with brand recognition and known residual values.

“So, from LiuGong’s point of view, what have they got to lose by moving into the rental space themselves? I think other Chinese manufacturers will look at what LiuGong is doing with interest – and if it is successful might well consider a similar move.”

HITACHI PREMIUM RENTAL

Another equipment manufacturer carving out a new strategy in response to rapidly changing markets is Hitachi Construction Machinery (Europe) which launched Hitachi Premium Rental in Europe in 2018.

Many commentators see the Hitachi Premium Rental programme as similar to the types of “servitisation” business models being developed in many other industries – that is to say the application of services to products in order to create additional value or a new offering to customers. Such ongoing services can deepen and extend the relationships manufacturers have with their customers, adding value in such a way that price is no longer the key purchasing factor.

Rene Koops, HCME’s general manager for Business Development and Marketing, says that the development of the Hitachi Premium Rental programme fits perfectly within the company’s worldwide strategy of putting emphasis on the value chain.

“We want to focus more on the downstream revenues that come out of the entire life cycle of the Hitachi products. This can be rental, but also used equipment, parts and service, and maintenance contracts, for example.

Earlier this year, Graziano Cassinelli joined Chinese equipment manufacturer LiuGong to lead its newly formed Global Rental and Used Equipment unit. With a wealth of top-level experience in the rental and used equipment sectors, and the Herc Rentals China deal concluded, Cassinelli explained that LiuGong’s rental ambitions reach well beyond its home market in China.

“The main reason for LiuGong’s move is that rental is growing everywhere, and it is becoming a big portion of the market in China. Four or five years ago rental had less than 10% penetration of the Chinese market, now that is 20% and it will be 25% by 2025 – with further growth after that,” Cassinelli said.

And he added that “in terms of rental-market penetration, Europe and the USA are 15 years ahead of China”, which means there is plenty

“For each region we have stipulated a specific strategy how to roll this out. In Europe, where we work with an independent dealer in each country, we opted for the rentto-rent model.”

In this context, rent-to-rent means that HCME rents the machines to the dealers and the dealers rent them to their customers as part of a package of services. The machines remain assets of HCME.

Koops says: “Actually, the whole idea behind it is the shift towards the sharing economy. We believe that the future is in sharing and rental. Even though the construction industry may be more conservative, we think that the tendency will shift from owning equipment to using (renting) equipment.

“The Hitachi Premium Rental programme, which is in essence a rent-to-rent concept, was established to support our dealer network to make that transition. We wanted to give them the opportunity to build up a rental fleet, or in some cases, like in Italy, to extend their rental fleet by keeping the investments off balance.”

of scope for growth. He said that Herc Rentals China will be concentrating on larger equipment beside AWP (aerial work platforms) business and will especially focus on infrastructure, road and rail projects.

“Our plan is quite simple – Herc will be a hub that will manage rental for LiuGong, support our dealers as needed and support our key accounts especially in the road and rail sectors.

“Rental for us has two main focal points – to occupy the rental space which is strong globally and growing fast in China, and to give customers the chance to experience LiuGong equipment without making a commitment to buy at the outset.”

But while LiuGong is initially focusing on its home market in China, its ambitions do not stop there – or with the Herc acquisition.

“Professional rental is

growing in China because of its reliability, flexibility and financial advantages. In addition, rental gives clients the capacity to carry out bigger projects than they can with their own current fleets. He added: “We are planning to move into Europe and to occupy a space in the market, especially in central and eastern Europe. That is really important for our strategy – but first we will need to take care of the market in China which accounts for 80% of our sales.”

RIGHT: Will contractors invest in machinery after this crisis or spread the economic risk by renting, asks Hitachi?

BELOW: HCME is focusing on compact and mid-size excavators and wheeled loaders because dealers want to sell long-term rental contracts

Hitachi’s plan was to invest 100 million euros within three years. The programme is now in its third year of operation and is on track. At the time of writing there were around 500 active units in the European rental fleet. More important still is the fact that Hitachi Premium Rental seems to have been well received by the market.

Koops adds: “Almost all of our dealers throughout Europe have been making use of the Hitachi Premium Rental programme, simply because there is no reason not to. They can hold on to their cash and/or use it for other investments.”

He described it as “a magnificent way for dealers to do some economic risk-spreading with regards to their rental fleet” – something that is especially pertinent in the current Covid-19 crisis.

And despite current circumstances, Koops remains optimistic about the future.

“Our rental team aims to fulfil a more consulting role towards our dealers, and we are proud to see some dealers expanding their rental operations. The Covid-19 crisis will maybe first slow us down a bit, but we have high expectations of the post-Covid impact with regards to rental. Do you really want to invest in machinery after this crisis? Or would you prefer to spread the economic risk by renting?”

Some commentators have asked whether Hitachi’s move is ultimately less about strategy than driving market share, especially in the competitive mini-excavator market, but Koops says that is emphatically not the case.

“HCME is mainly focusing on the compact and midsize excavators and wheeled loaders. Why? Because our dealers focus more on long-term rental contracts, not the day-byday rental that would require a completely different organisation.

“The contracts are most of the time 3-6 months or longer. It is all about offering this flexible service to their customers. At the same time, because of the high competition in the mini-segment we have chosen to first focus on mid-size and large machinery.

“Once we have developed this together with our dealers, we can make the next steps – that might include the daily service operations that are needed for miniexcavators.”

What is clear is that Hitachi’s strategy is raising eyebrows. Koops claims that “there is no OEM that works on this scale to support their dealer network in this way – to help them become sustainable for the future, when

it is not about the machine anymore, but about service, parts, and offering flexible and reliable solutions to their customers.”

Like Koops, Rob Oliver, chief executive of the UK’s Construction Equipment Association, feels that business models are changing fast, driven by a myriad of factors coming together at the same time.

“We feel that some contractors are more attracted to buying their own equipment and the old model of plant hire is looking a bit outdated. I think we are moving towards a “power by the hour” model where equipment might be rented for a specific job, rather than by the day or time period.”

Of course, for the UK there are additional pressures. “What is more, within the UK market, there is a feeling that shortages of labour and skills – exacerbated as a result of Brexit – might drive change and innovation through the demand for increased efficiency and automation.

“It will be interesting to see whether the major changes in equipment and how projects are managed will simply put too much strain on the existing supply chains and business models.”

THE EUROPEAN RENTAL ASSOCIATION

In contrast and unsurprisingly, Michel Petitjean, secretary general of the European Rental Association (ERA), does not see the structural changes discussed – and in some cases acted upon – by the OEMs as a threat to the rental market. Nor does he see the rental sector as a brake on innovation. Rather the opposite, in fact.

“I do not believe that the fragmented nature of the rental market is a source of weakness; it is a source of strength. The rental industry comprises many very small local companies and some very large companies – and you might argue that ones at most risk are those in the middle, the medium-sized ones.”

He continues: “I have to say that I do not believe it is the small companies that are a brake on innovation. In my experience, many of the smaller – and newer –companies are often driven by young, clever and tech-savvy people.”

He is also dismissive of any concerted move by the equipment manufacturers into the rental sector, apart from for companyspecific, strategic reasons. He has seen it before.

“The subject of OEMs moving into rental has been discussed for very many years,” Petitjean says. “Of course, OEMs change their strategies the whole time trying to gain a competitive advantage and take account of changing market circumstances – perhaps in an attempt to boost market share.

“But in my experience, most of the dealers, with few exceptions, have never been convinced and in many cases are concerned that they will be seen as

competitors to their biggest customers.”

He welcomes Construction 4.0 and similar industry-wide digitisation initiatives but argues they are only really for major projects and are a small part of the whole market.

“The future of the rental industry as a whole will not be defined by such big projects. The bulk of the industry will still be working in a traditional way.

“So, I feel that technological change will happen more slowly than many people think. The bulk of the industry will remain traditional, with some of the larger companies experimenting with new business models and ways of working.”

Yet despite this apparent scepticism, Petitjean and the ERA are fully engaged in the debates about the future of the industry.

The ERA has its own Future Group considering what the rental branch of the future might look like, and the ERA is working closely with the European

equipment manufacturers and the European Commission.

Riccardo Viaggi, secretary general of the Committee for European Construction Equipment (CECE), is careful not to describe OEMs and rental companies as adversaries, but rather as two groups looking for the best solutions for the industry at large.

“From my point of view the rental industry will not really be an obstacle to change. We work very well with the ERA and the firms I have dealt with are well aware of the issues and the changes that we must all make.

“I am quite optimistic that the rental sector is able to respond to these developments. They are taking steps to address the changes required. We are already seeing substantial consolidation and rationalization – for example Cramo being acquired by Boels Rental and Loxam’s acquisition of Ramirent.”

A recent CECE report (detailed elsewhere in this edition of Global Report)

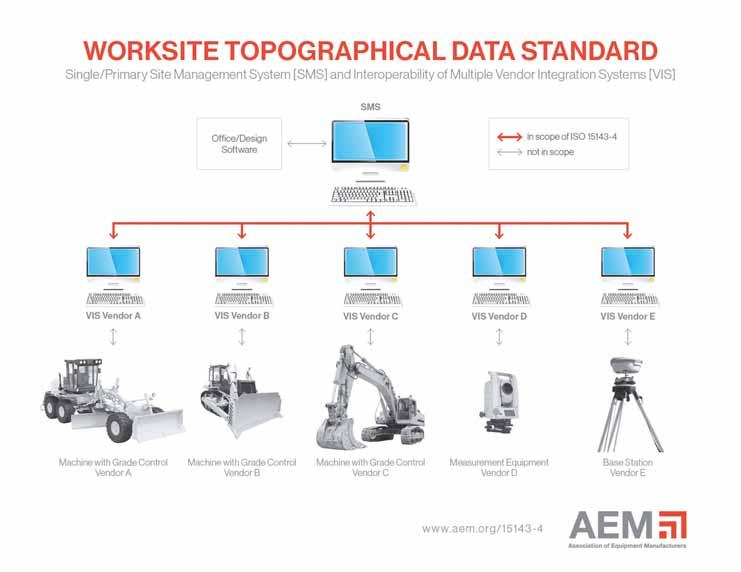

ABOVE: A simple visual representation of the standard. Each vendor server (VIS) (i.e. Trimble, Topcon, Leica, etc) will continue to talk to the machine(s) on site with its control system. Each of those servers will also communicate to a single-site server (SMS). The standard addresses that server-to-server communication – which are the red bold arrows.

– Digitalising the Construction Sector – foreshadows current developments: “Because of digitalisation, the boundaries between different players are gradually blurring, opening the way for new forms of business management – for instance, rental companies may be interested in gradually moving into logistics, while some OEMs are already providing rental services to their customers.”

Nonetheless, Viaggi does not predict a wholesale OEM move into rental. “I do not see anything more than isolated developments for specific market or strategic reasons. Any moves of OEMs into rental at the moment is episodic and there is no reason to think that will change at present.”

SERVITISATION

Servitisation, however, is a different matter. “Servitisation is much more than the OEMs moving into rental – at root it is about improving the management of fleets and delivering more value to machinery users through better and long-term services around the machine.

“What we are also seeing is a big push towards platformisation – a platform of data that is interoperable because it uses common standards.”

That push is being funded by an EUfunded project called DigiPLACE. In effect, DigiPLACE is a sort of feasibility study, gathering together inputs from all those in the construction industry value chain, from clients to contractors to manufacturers and suppliers.

Viaggi explains: “The idea is to identify what a digital platform might look like – not to create the platform itself but to define it and find common denominators across the different elements in the industry.

“We have completed the initial steps and are now at the stage of describing how the platform should be structured.”

CECE’s 2019 report, Digitalising the Construction Sector, was a stock-taking exercise, helping the organization prepare for the EU’s work in this area when it started.

It also underlined the fact that developing technologies have the potential to dramatically alter relationships and business models in the construction market.

“Many industries have been disrupted by technology, of course – and not always in a good way,” Viaggi says. “We wanted to ensure that our voice was heard and that we, as an industry, were in control of changes that are coming.

“The equipment manufacturing sector in