UNIQUE CONTENT AND INSIGHT FOCUSED ON KEY TRENDS IN THE GLOBAL CONSTRUCTION EQUIPMENT AND TECHNOLOGY MARKET FROM THE INDUSTRY’S BEST INFORMED AND MOST INFLUENTIAL SOURCES

GLOBAL REPORT

CONSTRUCTION EQUIPMENT AND TECHNOLOGY 2021

A TALE OF TWO DIFFERENT GLOBAL MARKETS

TOPCON SEES REVOLUTION IN THE AIR

ALTERNATIVE AND CLEANER POWER SOURCES

SURVIVING SUPPLY CHAIN DISRUPTION

INTELLIGENT TYRES MEAN LONGER LIVES

KEEPING TRACK OF ASPHALT TECHNOLOGY

HOW DO END-USERS SEE FUTURE NEEDS?

TRIMBLE’S VISION FOR FASTER PROJECTS

CUTTING AGGREGATES PRODUCTION COSTS

www.worldhighways.com | www.aggbusiness.com

Editor: Geoff Hadwick

Contributing Editors:

Mike Woof, David Arminas, Guy Woodford

Designers: Simon Ward, Andy Taylder

Production Manager: Nick Bond

Office Manager: Kelly Thompson

Circulation & Database Manager: Charmaine Douglas

Internet, IT and Data Services Director: James Howard

Managing Director: Andrew Barriball

Chairman: Roger Adshead

Publishing Director: Geoff Hadwick

Editorial contributors: Liam McLoughlin, Kristina Smith, Graham Anderson, Munesu Shoko, Alan Dron

COVER IMAGE:

©Binu Omanakkuttan | Dreamstime.com

ADDRESS:

Route One Publishing Limited, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

Tel: +44 (0) 1322 612055

Fax: +44 (0) 1322 788063

Email: [initialsurname]@ropl.com (e.g. radshead@ropl.com)

ADVERTISEMENT SALES

Head of Construction Sales: Graeme McQueen

Tel: +44 1322 612069

Email: gmcqueen@ropl.com

Sales Director: Philip Woodgate

Tel: +44 1322 612067

Email: pwoodgate@ropl.com

Sales Director: Dan Emmerson

Tel: +44 1322 612068

Email: demmerson@ropl.com

Classified: Dan Emmerson

Tel: +44 1322 612068

Email: demmerson@ropl.com

Italy: Fulvio Bonfiglietti

Tel: +39 339 1010833

Email: bonfiglietti@tiscali.it

Japan: Ted Asoshina

Tel: +81 3 3263 5065

Email: aso@echo-japan.co.jp

Asia / Australasia: Roger Adshead

Tel: +44 7768 178163

Email: radshead@ropl.com

Global Report Construction Equipment & Technology

Print ISSN 2057-3510

Digital ISSN 2057-3529

CONTENTS

A tale of two markets

“One country, two systems” is how the Chinese have described the governance of Hong Kong and Macau in recent years. “One global construction equipment industry, two markets” is equally apt when comparing Chinese sales with the rest of the world. Who’s up and who’s down? And why?

20. View from the top. Interview. Topcon: A revolution’s coming

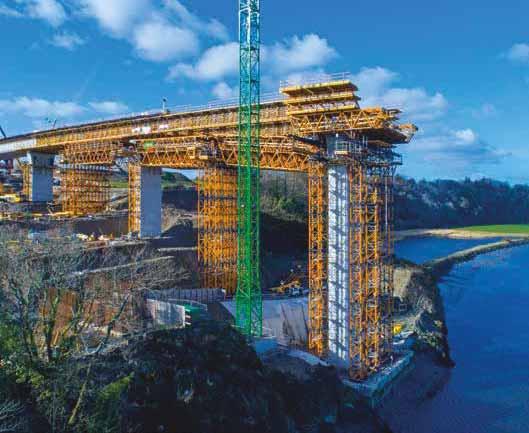

58. Global Infrastructure.

Special report. The leading economies: From pandemic to phoenix

How are the world’s leading economies going to rise from the ashes of the COVID-19 pandemic? We take a look at the G7 and the G20 countries as they push for more infrastructure investment at a faster pace. And what is happening in the United States? Is it the “new deal” all over again, or is it papering over the cracks?

The construction equipment industry is at a turning point. Topcon’s senior leaders believe that we are about to see the adoption of new construction technologies. The time is ripe as a new, younger and more tech-savvy generation comes to the fore. Governments could save billions, but where does the smartphone fit in?

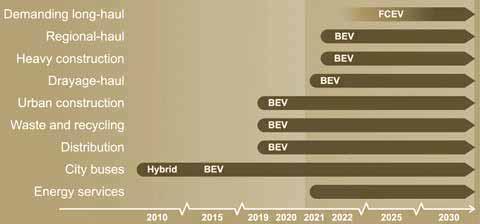

24. Alternative power: Governments and customers drive alternative fuel ideas

The move to electric power is gathering speed with government policies seeking a reduction in the use of combustion engines to address climate change and air pollution. Can construction equipment operators plan to win more tenders if their on-site machines use electric or other zero-emission power sources?

32. Logistics: Survival of the fittest

The global pandemic has shaken up the world’s supply chains. If being flexible, resilient, creative and digitally aware of shipping delays and delivery status were important before COVID-19, they are now business-critical. Has your logistics strategy got what you need to survive? Is your supply chain fit for purpose?

42. Special report. North Africa:

North Africa needs infrastructure investment to recover. Bad news first: the North African construction sector has been hit hard by COVID-19 and the triple whammy of lower oil production, low oil prices and contracting non-oil sectors. The good news is that the region’s governments have identified infrastructure development as the best way forward. What’s being planned?

48. Thinking tyres: Get more out of your tyres

Intelligent tyre technology is playing an ever-more important role in building sustainable construction equipment fleets. François Didion, vice president for construction and defence mobility at Michelin, takes a look at what this means on site. What are the key trends and what comes next?

51. Asphalt technology: Keeping track

Next-generation technology and the ‘pandemic effect’ is encouraging contractors to use digital asphalt-tracking systems. From mixing the asphalt to laying the road surface itself, everything is being far more closely monitored and managed. How well is your business keeping track of what is being laid down?

68. View from the top. Interview. Trimble: Trimble’s vision of a far more efficient future

Trimble is offering a future vision of more efficient, optimised construction operations for faster project delivery. Managing and analysing site equipment data is a growing trend, as is remote diagnostics. Work patterns are changing fast. What does this all mean on the ground, in the real world?

71. End-user perspective. What are contractors thinking? The big rethink If there is one clear business lesson to be learned from the pandemic, it is this: The big contractors are rethinking their construction equipment needs. The global construction sector is about to feel the winds of change more rapidly and more dramatically than most. The reasons are many and complex. Are you ready to meet their needs?

76. The world in numbers: Infographics to make you think. These are interesting times. The global economic and political landscape is in a state of flux like never before as populism, pandemics and protectionism disrupt everything. Grab a few key facts and figures to help make sense of it all. For instance, what are infrastructure megatrends and whose competitiveness is in decline?

80. Aggregates production: Connectivity and communication are key. Technologies such as telematics, data analysis and fleet management solutions are augmenting more traditional methods in helping quarry operators to improve overall productivity and keep their cost per tonne down. What does the future hold?

85. Compaction: Be more efficient and use clever thinking. A semi-automatic compactor allows the operator to first use the machine to map the boundaries of the area to be compacted, and then to key in the necessary compaction parameters. The machine then takes over control of the drive, steering and vibration parameters. Is this the template for a more efficient way forward?

Economic Recovery

Technology For Moving Forward

As things start to move again, now is the time to make an immediate impact.

Our solutions integrate easily and drive productivity across your entire workflow. You’ll have all the tools needed to land new work, get back on track, and make up for lost time.

And you can proceed safely, with technology that lets you put less people on a job site, for a shorter amount of time, with plenty of space.

topconpositioning.com/recovery

As Global Report 2021 was going to press, the COVID-19 pandemic was continuing to disrupt the global economy. Our expert writers have taken the long view wherever possible and tried to identify the key long-term trends that will affect us all. However, there are clearly going to be some unexpected bumps in the road ahead. Here, in our traditional opening feature, we have collected together independent analysis on markets around the world from the best sources in the business. It is, as always, a snapshot based on their thinking at the time. But, in these unusual times, the sources that we have used here, and throughout the rest of the Global Report 2021, have all said the same thing: This is what we think right now. The long-term outlook is good, they all agree. But things in the short-term are looking far more tricky.

‘One country, two systems’ is a Chinese constitutional principle describing the governance of Hong Kong and Macau since they became Special Administrative Regions (SARs) of China in 1997 and 1999, respectively. Adapting the phrase to ‘One global construction equipment industry, two markets’ is apt when considering the strength of Chinese sales in 2020 compared to everywhere else. Guy Woodford reports.

Anew report by Off-Highway Research (OHR), a management consultancy specialising in the research and analysis of international construction and agricultural equipment markets, notes that thanks to huge stimulus spending, Chinese construction equipment sales rocketed by 30% to 412,440 units in 2020, from an already impressive 316,093 units in 2019.

Contrast that to the key sales markets of North America and Europe, which both saw, according to OHR figures, sales falls of 16% (194,821 to 164,540 units, and 187,108 to 157,268 units, respectively). Excluding China, rest-of-the-world construction equipment sales were down 12% (754,984 to 661,409 units) year on year in 2020.

However, as OHR states, the 2020 COVID-19-induced sales downturn was not as bad as initially feared, with sales of heavy equipment, excluding

those of China, harder hit than compact equipment trading. Furthermore, the global sales outlook for 2021 is much brighter, with many nations pledging hefty infrastructure spending to get their countries back on their feet after over a year of business as unusual.

With the vaccine rollout continuing worldwide and COVID-19 disruption

Global: Selected economic indicators, 2015-2020*

significantly reducing, GlobalData, a leading business market intelligence consultancy, expects global construction output to expand by 4.5% this year, following an estimated contraction of 2.9% in 2020.

The global construction equipment market is, once again, gearing up for better times.

Source: International Monetary Fund, World Bank

EUROPE

SLOW BUT POSITIVE STEPS

After an unprecedented COVID19-disrupted year in 2020, CECE (Committee for European Construction Equipment) predicts a positive environment for business in 2021.

“This overall positive assessment can be somewhat mitigated by the uncertainties around COVID vaccinations and the timing of government stimulus packages in Europe and US. What seems evident is that 2021 will not be synonymous of a quick return to precrisis levels of sales,” summarises Riccardo Viaggi, CECE’s secretary general.

Sales on the European construction equipment market went down by 6.4% in 2020, according to CECE figures. This seemingly modest drop is due to the performance of high-volume light and compact equipment, whose sales were almost unaffected at -3%. In contrast, heavy construction machinery suffered a 19% fall in sales.

Viaggi notes that a Q4 2020 recovery in sales was clearly visible in most product segments. This has boosted overall business confidence, which CECE tracks monthly with its own Business Barometer.

He continues: “At the moment of drafting this [March 2021], CECE can confirm that after months of improvement, the CECE business climate index was significantly higher than before the pandemic a year earlier. A significant majority of manufacturers expect business to grow in the first half of the year, and the level of satisfaction with current business has also improved significantly. In addition, the order intake for European manufacturers has been growing year-on-year since December 2020, and sales on the European market are also on a clear growth path.”

Viaggi says that the latest surveys are also highlighting how European manufacturers are optimistic about their home markets and are also expecting improved business in most regions globally.

“This includes high hopes for the US market with the expectation that the new administration will address the need for infrastructure investments and begin to move towards policies that encourage free trade. Latin American markets show the potential to recover from the weak market experienced in 2020. The Middle Eastern

Source:

market appears to be on track for further growth which began in the second half of last year and will be supported by improving oil and gas prices.”

Returning to the European market, Viaggi says regional disparities remain a significant feature.

“The notorious North-South gap which has existed since the global economic crisis in 2009, has been getting gradually smaller. However, this development came to a halt in 2020. The most notable example was the Spanish market, which suffered significant falls during the COVID crisis. In contrast, the Italian market proved to be much more resilient last year and will profit from enormous amounts of resources from the Recovery Plan. It seems that the major markets in Europe, and those that were not affected significantly by COVID will be relatively stable in 2021. This includes the Nordic markets as well as Germany, France, Benelux, Austria, and Switzerland.”

When looking at the main end-using segments for equipment, Viaggi says it seems likely that the rental sector may see a better year in 2021 after experiencing difficulties last year.

“Greater usage of rental machines is a pattern often seen during periods of economic uncertainty. In other segments, construction, landscaping, and quarrying are all currently operating at quite high-capacity levels in most parts of Europe.

“A forecast of 5% growth in the European equipment market is a realistic assessment of prospects for 2021. However, against a background of on-going uncertainty due to COVID, and the fact that the market is still at comparably high absolute levels of sales means that even a flat market in 2021 would not be a disappointment.”

In its April 2021-published Global Markets Review, Off-Highway Research said that while a steep fall in construction equipment unit sales was anticipated in Europe when lockdowns were put in place, a rebound “clearly took root from the summer onwards”. This, says OHR, meant the downturn in the full-year 2020 was not as bad as first feared.

NORTH AMERICA

TURNING THE CORNER

As the North American construction and agriculture equipment industry emerges from a full year under the COVID-19 cloud, a clear majority (88%) of equipment manufacturers report a positive outlook for 2021, according to a March 2021 survey by U.S.-based AEM (Association of Equipment Manufacturers). More than half (55%) of the respondents from leading equipment manufacturers expect sales to increase or remain stable despite the ongoing impact of the global pandemic. The online survey was targeted at employees of AEM-member companies and includes results from more than 130 respondents, including CEOs, vice presidents, and sales and operations leaders, among others.

“The equipment manufacturing industry has continued to operate throughout the COVID-19 pandemic and has successfully adjusted to challenges to make the equipment that builds, feeds, and powers our country,” said AEM president Dennis Slater. “Equipment manufacturers have begun to turn the corner. We now need [U.S.] Congress and the President to pass long-overdue legislation that will invest in and modernise our nation’s infrastructure.”

U.S. President Joe Biden has said his proposed US$2tn plan to rebuild America’s

Source: Off-Highway Research

“crumbling” roads, bridges, railways, and other infrastructure would rival the space race in its ambition and deliver economic and social change on a scale as grand as Franklin D. Roosevelt’s New Deal in the 1930s.

Looking at the biggest challenges facing company executives and the equipment manufacturing industry as a whole in 2021, AEM-survey respondents indicated that the lingering COVID-19 pandemic and keeping employees safe and on the job remain the top concerns, followed by finding skilled workers for new jobs being created.

Turning to how the COVID-19 pandemic is changing the workplace, one in eight respondents said that it will have a lasting impact on how they work. Face-to-face meetings with colleagues and work travel are the top two activities they look forward to in 2021.

Additional top survey findings include a clear majority (88%) taking a positive outlook for 2021 while only one in ten has a negative outlook. One in five (19%) said that sales are up while one in three (36%) indicated that sales are stable, citing a strong pipeline of orders; increased customer demand; a robust economic rebound; the essential status of customers (including construction workers and farmers); and a level playing field due to no travel.

Almost half of AEM-survey respondents (45%) said that sales are down as a result of the COVID-19 pandemic, citing supply chain disruptions; reduced demand for new products; limited international sales (due to travel restrictions); inability to meet with dealers and customers; delayed or cancelled projects at the state and local levels.

The construction and agriculture equipment manufacturing industry in the U.S. supports 2.8 million jobs and contributes roughly US$288 billion to the economy every year.

OHR, a leading construction equipment market research consultancy, has reported that North America [U.S. & Canada] construction equipment sales dropped 16% in COVID-19-hit 2020 (194,821 to 164,540 units).

expected to reach $52,477.6 million by 2027 from $38,382.5 million in 2019. It is estimated to grow at a CAGR of 6.2% from 2020 to 2027. With rising demand from contractors and industrial end users, the adoption of excavators in mining, construction (road and building), and demolitions is increasing, R&M. com notes in its Q1 2021-published report, United States Heavy Construction Equipment Market Forecast to 2027: Breakdown by Construction, Oil and Gas, Mining, Manufacturing, and Other Industries. Crawler excavators, dragline excavators, wheeled excavators, suction excavators, and long-reach excavators are said in the report to be the most popular machines used by mentioned industries.

R&M.com states that regular OEM (original equipment manufacturer) product launches are contributing towards recent market growth. For instance, in December 2020, Doosan presented its largest and most powerful excavators for the construction and mining industry. The company has expanded its excavator product line by introducing the new Doosan DX800LC-7 excavator for heavy construction, mining, and infrastructure work. CASE Construction Equipment, John Deere, Caterpillar, Volvo Construction Equipment, and Doosan are, says the R&M.com report, among the leading companies operating in the U.S. heavy construction equipment market. The companies are all said to be adopting organic growth strategies, including product launches, to sustain their position in what is described as a “dynamic” market. Global

ResearchAndMarkets.com states that the U.S. heavy construction equipment market is

CENTRAL & SOUTH AMERICA

FOLLOWING A BRAZILIAN GROWTH LEAD

The Brazilian construction sector is said by industry insiders to have a positive outlook for 2021, with growth expected not only from the real estate sector, but also from infrastructure. Brazil, insiders say, can take advantage of the resources of international investors, who have already started to return to the country.

The above analysis was one of the main evaluations of debaters attending the fifteenth staging of M&T magazine’s Trends in the Construction Market event.

The strategic event held on Thursday, 26 November 2020, which brought together, virtually, an audience of more than 1,500 people, included a debate involving, among others, Afonso Mamede, president of the Brazilian Association of Technology for Construction and Mining (Sobratema), Carlos Silveira, president of the Superior Council of the Industry Union of Heavy Construction of the State of São Paulo (Sinicesp), Eurimilson Daniel, vice president of Sobratema and director of the Brazilian Association of Unions and Associations Representing the Lessors of Machines, Equipment and Tools (Analoc) and economist Luis Artur Walnut.

“The private sector is currently investing in the [construction] sector. But new infrastructure also depends on public investment, which is going through a series of difficulties in the current politicaleconomic scenario. So, one way out is

foreign investment, but there is an important conditional, the guarantee of legal security,” said Mamede.

The latest Sobratema study of the Brazilian construction equipment market presented at the event by Mario Miranda stated that national construction equipment sales were expected to grow 14% in 2020 compared to 2019, reaching 30,800 units sold.

For 2021, the study expects an increase in sales of around 20% in the segment of yellow line machines and 25% for the entire construction equipment sector. According to Miranda, regarding expectations for 2021, 67% of construction companies and rental companies are optimistic about the Brazilian economy, 70% are optimistic about the construction sector and 86% are optimistic about their company.

GlobalData has lowered its 2020 construction output forecast for Latin America to -11.4% from -6.8% previously, mostly due to the slower than expected rebound in construction activity in the second half of the year as the coronavirus continued to spread across the region and construction companies were still struggling to revive their operations.

Dariana Tani, a GlobalData economist, said: “The revised forecast makes Latin America the world’s worst-performing region in terms of construction output and reflects the deepening economic damages of the COVID-19 pandemic and strict lockdowns

imposed by authorities to limit its spread.”

Among the largest countries in the region, Peru’s construction output was expected by GlobalData to contract the most in 2020 at -24%, followed by Argentina (-23.5%), Mexico (-15.2%), Colombia (-13.2%) and Chile (-8.2%).

Tani continues: “The progress in the reactivation of projects and start of new ones in some countries has been affected by the continued increase in the number of COVID-19 cases and the heightened uncertainty surrounding the economy. In 2021, GlobalData expects the industry to remain weak, increasing by just 0.2% before recovering to 3.1% over the remaining forecast period (2022–2024).”

Peru, Chile, and Colombia are expected to be the best performers in 2021 with output expected to rebound to 16.8%, 6.8% and 4.8%, respectively.

Tani adds: “While activity is expected to gradually recover in the coming months as more COVID-19-related restrictions are eased throughout the region, output levels recorded before the pandemic are not expected to be restored in the next four years – given the region’s structural weaknesses and longstanding issues that have been aggravated with the pandemic, including fiscal constraints, social tensions, rising inequality, low productivity and general discontent with democratic institutions.”

67% of construction companies and rental companies are optimistic about the Brazilian economy

An operator changing a filter on a PowerROC D55 DTH surface drill rig in Baota Hill Mine in Nanjing (image: Epiroc)

STAGGERING GROWTH IN CHINESE SALES

China’s 26 leading excavator makers sold a total of 126,941 excavators in the first quarter, surging 85% year on year, data from the China Construction Machinery Association (CCMA) has revealed.

Taking a closer look at the CCMA data, 113,565 excavators were sold in the domestic market, rocketing up 85.3% year on year, while exports of the equipment rose by 81.9% to 13,376.

In March alone, excavator sales came in at 79,035 units, up 60% from the same period last year.

CCMA notes that sales of digging machines are an important indicator of the vitality of an economy as demand is usually backed by growth in mining and infrastructure development.

Meanwhile, the CCMA has also highlighted that sales by China’s 23 top loader manufacturers hit 22,772 in March 2021, a 52% year-on-year increase. Some 4,151 loaders were exported, a 40.5% upsurge from the same period in 2020. In the first quarter, total loader sales reached 39,333 units, increasing 60.7% year on year.

Chinese construction equipment industry insiders state that the vigorous pace of sales shows sturdy demands for building machinery and macroeconomic energy in the quarter.

Huge stimulus spending in China saw the national construction equipment market rise from the already buoyant levels of 2019 by a further 30% (316,093 to 412,440 units), according to April 2021-released figures from Off-Highway Research (OHR).

OHR notes that as soon as China emerged from its national lockdown in March and April last year, it embarked on a massive stimulus programme. The main instrument of this was allowing provincial governments to issue special bonds. OHR says this saw construction equipment sales rise to more than 412,000 units, or more than 480,000 units if compaction equipment and mobile cranes are included. Such high sales have only been seen once before in China, highlights

OHR, during the boom of 2010 and 2011. That was also a result of stimulus spending, on that occasion in response to the global financial crisis.

OHR continues: “The last ten years has seen the structure of demand shift in China, with excavators and mini excavators becoming the dominant products. The traditional high-volume equipment type, the wheeled loader, still sells in very large numbers – at more than 102,000 units sold

Global sales of construction equipmentChina, 2016-2020 (units)

last year, China accounted for well over half the global demand for this type of machine. However, in the boom of 2010 and 2011, sales of wheeled loaders came to more than 200,000 units in each of those years.”

That is also the view of Eric Neal, executive director of Cummins off-highway business, who adds the proviso that this is dependent on “as long as we can get the material to build engines. We’ve got a lot of demand right now that can certainly support that

79,035 EXCAVATORS SOLD IN MARCH ALONE 60%

22,772 LOADERS SOLD IN MARCH ALONE 52%

YEAR ON YEAR ONE AR

Source: CCMA

Source: Off-Highway Research

growth, and maybe more actually,” he says.

In a COVID-hit year of general market contraction, Eric Neal, executive director of U.S. engine giant Cummins’ off-highway business, said China in particular, and also India, had been the countries providing the biggest boost to the company’s revenue streams during 2020, both for on-highway and off-highway engines. Neal made the observation while speaking to world construction equipment trade media at a Cummins’ virtual press event in March 2021.

In its November 2020-published report Construction in China – Key Trends and Opportunities to 2024, GlobalData states that to mitigate the economic impact of the pandemic, China’s president Xi Jinping fast-tracked the implementation of major infrastructure projects (except in the hardhit Hubei region), resuming nearly 90% of all major infrastructure projects as soon as mid-March 2020. This, notes GlobalData, was at a time when major markets across the world had only just started to implement COVID-19 containment measures.

The report continues: “In another positive development, real estate and fixedasset investments have regained growth momentum, following the temporary disruption in the first quarter of the year. Moreover, in September 2020, the National Development and Reform Commission (NDRC) approved 14 fixed-asset investment projects worth CNY177.8 billion (US$25.15 billion), following approvals of CNY68.9 billion (US$10.1 billion) in August 2020.”

GlobalData expects China’s construction industry to grow by 1.9% in 2020 and record an average annual growth of 4.7% between 2021-2024. The industry’s growth over the forecast period is expected to be driven by investments in new infrastructure projects, which in addition to transport projects, also includes investments in the areas of 5G networks, artificial intelligence and the internet of things and data centres. According to the government-backed think tank, the Center for Information and Industry Development (CCID), the country is expected to spend CNY10 trillion (US$1.4 trillion) on new infrastructure projects between 2020-2025. Real estate and fixed-asset investments have regained growth momentum

NEW STABI/H

REVOLUTIONIZING SOIL STABILIZATION

JAPANESE FOCUS ON RENEWABLE ENERGY, TRANSPORT, TELECOMMUNICATIONS & MANUFACTURING

OHR figures show that Japan’s equipment sales rose 3% to 67,645 units, compared to 65,645 units in 2019, indicating that Japan, along with China, managed to buck the downward global trend. Despite the pandemic causing a significant slowdown in the first half of the year, OHR explains that increased public spending on infrastructure was a trigger for the recovery in the second half of the year. This was particularly apparent in medium-sized equipment such as crawler excavators and wheeled loaders.

Additionally, OHR says there was a certain amount of pent-up demand in Japan. The consultancy says that the introduction of higher consumption tax in 2019 distorted the normal seasonal pattern to some extent and demand fell once the new 10% rate was introduced in October. However, OHR notes that fleet renewal cannot be put off indefinitely, and sales in 2020 were lifted somewhat as a result of the unnaturally low sales in the latter part of 2019.

“Having said that, the Japanese market is a relatively consistent one, with sales for the last four years coming in between 63,000 and

68,000 units per annum. So, while a 3% fall in demand is forecast for this year, it is arguably more accurate to view it as a continuation of a stable sales pattern,” OHR states.

Prior to the COVID-19 crisis, GlobalData highlights that the Japanese construction industry registered minimal growth in 2019, with output expanding by 0.5% in real terms – up from a decline of 1.1% in the previous year. This low growth is attributed to an economic slowdown, coupled with subdued consumer and business confidence amid the consumption tax hike, a major typhoon and weak global demand.

Although residential construction investments remained minimal, GlobalData states that the construction industry’s output was supported by investments in civil engineering and non-residential buildings. In December 2019, the government launched an economic stimulus package, which includes an allocation of about JPY6 trillion (US$55 billion) on public investments, following a series of natural disasters which caused huge damages to the country’s infrastructure.

“Although the country has not enforced

Source: Off-Highway Research

a strict nationwide lockdown in response to the pandemic, the construction industry was adversely hit by the temporary halt in construction work by major contractors such as the Obayashi Corporation, Taisei Corporation, Kajima Corporation and Shimizu Corporation, among others,” reports GlobalData, who tipped Japanese construction industry output to fall 4% in real terms in 2020.

On a brighter note, GlobalData expects the Japanese construction industry to stabilise and register an annual average growth of 1.2% between 2021-2024, supported by investments in the transport, renewable energy, telecommunication and manufacturing sectors. GlobalData says Japanese Prime Minister Yoshihide Suga and his government plan to develop 10GW of offshore wind capacity by fiscal year (FY) 2030/2031, in line with its target to increase the share of renewable energy in its total power mix to 22-24% by 2030; this will attract public and private sector investments in renewable energy projects.

IT’S TIME TO MAKE THE SWITCH

THE NEW HCS COUPLERS

INTRODUCING THE NEW BENCHMARK FOR HIGH FLOW PERFORMANCE ON ANY JOBSITE: FROM CAT. More uptime and lower back pressure, so reduced fuel burn. Improved quick disconnects, so 10x longer lifespan. And industry-leading safety measures like smart sensor technology to see when a tool is properly attached – and keep it there even if a line breaks. Keep your operators safely in their (comfortable) seats switching tools easily, and watch your productivity go up. Make the switch and connect with Cat to find out more.

INDIA

BIG INDIAN INFRASTRUCTURE SPENDING

Prior to the COVID-19 pandemic, OHR reports that 2020 was expected to be a year of robust growth for the Indian construction equipment market, following the disruption of the 2019 general election.

In the event, OHR notes that the pandemic precipitated a 10% decline in sales, to 67,635 units, or 73,275 if mobile cranes and compaction equipment are included. This, says OHR, took demand back to where it was in 2017 and was some 25% lower than the peak year of 2018. “As disappointing as this was for a market which was showing clear signs of returning to robust growth at the end of 2019, a 10% downturn as a result of the pandemic and lockdowns is not as bad an outcome as might have been expected,” OHR summarises.

OHR highlights that there were almost no mini excavator sales in India prior to 2010. However, this is now a product offered by several suppliers, some of which manufacture in-country. This has seen demand rise to just above 1,000 units per year, and OHR expects this to rise to well over 2,000 sales per year over the medium term.

During a 13 April 2021 press conference at JCB’s global HQ in Rocester, Staffordshire, central England, the company’s CEO, Graeme Macdonald, stressed how India deserved a “special mention” when welcoming increased global construction equipment demand in the first quarter of 2021.

“The market there collapsed by 94% in April, May, and June last year. By comparison, in Q1 the Indian market has grown by 29% compared to the same period of 2020. So, the market in India is far larger than it was before the pandemic, which is great news given our presence in that market.”

Macdonald added that construction of JCB’s new £65 million (US$90mn) factory in Gujarat, Western India, was also progressing well and, on completion, will give the construction equipment giant “much-needed manufacturing capacity”.

In its March 2021-published report Construction in India – Key Trends and Opportunities to 2025, GlobalData expects Indian construction output to register growth of 13% in real terms in 2021 –

following a decline of 12.4% in 2020. The outbreak of the COVID-19 pandemic and subsequent lockdown restrictions weighed on the industry’s production last year, notes GlobalData. On a positive note, Prime Minister Narendra Modi’s government investment in infrastructure development aided the industry’s recovery in the final quarter of the year. Quoting figures from the Ministry of Statistics and Programme Implementation (MOSPI), GlobalData says the Indian construction industry grew by 6.2% year on year (YoY) in Q4 2020 – up from YoY declines of 7.2% in Q3 and 49.4% in Q2 2020.

GlobalData expects the industry to register double-digit growth this year, before recording an annual average growth of 6.2% between 2022-2025.

The new GlobalData report continues: “The industry’s growth over the forecast period will be supported by investment in transport, energy, residential and industrial infrastructure projects. In the 2021/2022 fiscal year budget, the government allocated INR5.5 trillion (US$78.2 billion) towards capital expenditure. Also announced was an increase in the number of projects in the National Infrastructure Pipeline, rising from 6,835 projects to 7,400. To fund the new projects, the government plans to increase the share of capital expenditure in central

establish a new INR200 billion (US$2.8bn) development finance institution, with a lending target of INR5 trillion (US$70.5bn) over the next three years.”

Volvo India is reportedly bullish about its truck sales in the Indian market and expects a 30% to 40% growth in this category of the construction equipment market during the next financial year, 2021-22. Speaking to The New Indian Express, an Indian Englishlanguage broadsheet daily newspaper, Kamal Bali, MD, Volvo Group India, said that the manufacturer’s medium, light, and heavy trucks were doing well and that they have achieved pre-COVID sales levels. Bali added that the increase in industrial and mining activity will act as growth drivers and boost sales.

Front entrance of BKT’s state-of-the-art

GlobalData expects Indian construction output to register growth of 13% in real terms in 2021

V-SHAPED RECOVERY

Global construction equipment makers will be heartened to hear that the COVID-19 pandemic-ravaged construction industry in South and Southeast Asia is set to post a V-shaped recovery in 2021, according to GlobalData.

The stringent lockdowns and social distancing rules due to COVID-19 have severely disrupted the construction industry across the region.

Consequently, its construction industry was expected by GlobalData to contract by 8.5% in 2020. However, assuming that a widespread second wave of infections is avoided, GlobalData says output will rise sharply in 2021 because of the low-base effect, as well as the underlying potential for growth in the region given the rising middle-class population, and investment in housing and infrastructure.

The slump in construction output is reflected in the unprecedented sharp contraction in the second quarter in countries such as Singapore (-59.3%), India (-50.3%), Malaysia (-44.5%) and the Philippines (-33.5%).

However, GlobalData says industrial construction could benefit indirectly from the COVID-19 crisis in the medium- to longterm period, as the industrialised countries seek to diversify their supply chain away from China. South and Southeast Asia are said by the major business market research firm to provide an attractive alternative with low labour costs as well as a large captive market

in the form of an expanding middle-class population.

Dhananjay Sharma, construction analyst at GlobalData, comments: “Infrastructure is expected to be a key growth driver in 2021 and beyond as governments across the region look at investments in infrastructure to stimulate the economy and create jobs. This would be aided by in Chinese investments in Belt and Road Initiative (BRI) projects in the South and South-East Asia region, which will support infrastructure growth in Pakistan, Bangladesh as well as ASEAN (Association of Southeast Asian Nations) members including Myanmar, Vietnam, Malaysia, and Indonesia. Increasing investments in renewable energy projects and in 5G infrastructure would also support growth over the medium to longterm.”

The residential market was weak in several countries in the region even prior to the COVID-19 outbreak, but the pandemic and the subsequent lockdowns have worsened the situation. The sector will continue to struggle as economic activity weakens, remittances decline and unemployment rises. Unsold inventories will further apply pressure as developers could hold off or cancel projects in the short term.

Nevertheless, over the medium- to longterm period, the rising middle class will generate housing demand which will, in turn, drive the market for government-supported, affordable housing.

The commercial sector is expected to

be severely affected by the virus outbreak. Investments in the commercial market are expected to be cancelled or pushed back reflecting the collapse in the travel and tourism industry.

Sharma concludes: “The industrial sector is expected to suffer in the short-term, affected by the temporary shutdown of the production units of various companies across the region. This will affect the investments as companies could cut back on their expansion plans. However, in the long-term, the industrial construction segment is likely to benefit from the US-China trade war as well as the move to diversify supply chain from China following the disruption in early 2020.”

South Korea has been praised worldwide for its impressive technology-led handling of the COVID-19 pandemic. As a result, the country’s construction sector remained vibrant in 2020. The Korea Herald newspaper reported in January this year that South Korea’s biggest construction equipment maker, Doosan Infracore, saw its domestic sales rise 18% last year.

Doosan Infracore said it sold more than 4,000 units of construction equipment, including excavators and wheeled loaders, in the local market in 2020, the highest annual sales in 10 years since 2011.

The Korea Herald reports that in South Korea, three manufacturers – Doosan Infracore, Hyundai Construction Equipment, and Volvo Construction Equipment – are vying to expand their presence.

Infrastructure is expected to be a key growth driver in 2021

HeidelbergCement, Cimburkina cement grinding plant, Burkina Faso

SUB-SAHARAN AFRICA

SUB-SAHARAN AFRICA SET FOR BETTER 2021

While sub-Saharan Africa’s huge infrastructure development continues to offer attractive commercial opportunities to construction equipment manufacturers, progress in 2020 was significantly hindered by several key factors.

A 5.2% fall last year in sub-Saharan Africa (SSA) construction output was forecast by GlobalData. The prediction is said by the major business market intelligence consultancy to reflect the deep impact on the region’s economic activity and investment growth, stemming from the wider global slowdown, the outbreak of COVID-19 in the region and possibly a lack of available external financial support.

Yasmine Ghozzi, an economist at GlobalData, comments: “There are key downside risks for this outlook, particularly regarding the ongoing COVID-19 pandemic, the resilience of the region’s healthcare systems and the accessibility to an effective and affordable vaccine, political instability and possibly climate-related shocks such as floods or droughts.

“Key drivers for growth in 2021 include improvement in exports and commodity prices as the global economy recovers on the

Sub-Saharan Africa construction output is expected to grow by 3.7% in 2021

back of rolling out the vaccine, along with pick-up in both private consumption as ease of restrictions slowly materialize and in investment supported by a return to foreign direct investment (FDI).”

Sub-Saharan Africa construction output is expected to grow by 3.7% in 2021, says GlobalData, as once the industry is permitted to operate at normal or near-normal levels, there could be a sharp recovery in output levels compared to periods when works were not permitted or were severely restricted.

“This will particularly be the case when comparing Q2 2021 output levels with those in Q2 2020 in South Africa and Nigeria,

where activities were completely halted due to strict lockdown measures. However, despite the expected growth in 2021, output will still be below 2019 levels.” GlobalData concludes.

In a Q4 2020-published regional overview report, The World Bank said that despite subSaharan Africa being the world’s largest freetrade area and a 1.2 billion-person market, a substantial downturn in economic activity will cost the region at least US$115 billion in output losses.

The World Bank tips sub-Saharan Africa to rebound in 2021, however it stresses that growth will vary across countries. The report

“Once again, East Africa, with a 30.6% share, recorded the highest number of projects (118 projects)”

A LONG WAY TOGETHER

EARTHMAX SR 41

No matter how challenging your needs, EARTHMAX SR 41 is your best ally when it comes to operations that require extraordinary traction. Thanks to its All Steel radial structure and the special block pattern, EARTHMAX SR 41 provides excellent resistance against punctures and an extended service life. In addition to long working hours without downtime, the tyre ensures extraordinary comfort.

EARTHMAX SR 41 is BKT’s response to withstand the toughest operating conditions in haulage, loading and dozing applications.

europe@bkt-tires.com

continued: “While South Africa is expected to experience a weak recovery, overall growth in the Eastern and Southern Africa region is expected to average 2.7%. While Nigeria’s economic recovery will be weak, the Western and Central Africa region is expected to experience an average growth of 1.4%. Many countries have seized the opportunity within the crisis to move faster on necessary reforms and investments that will be crucial for longterm development. However, concerns of a second wave are fuelling further uncertainty.”

Deloitte’s Africa Construction Trends Report 2020 includes 385 projects with a total value of $399bn. “On a year-on-year basis, the total number of projects in the report declined by 14.8%, while the total value of projects dropped by 19.8%. Once again, East Africa, with a 30.6% share, recorded the highest number of projects (118 projects), followed by Southern Africa, with 26.5% (102 projects) and West Africa, with 19.7% (76 projects),” the report stated.

In the East African region, Uganda, with 27 projects, and Kenya, with 26 projects,

recorded the highest number of projects in the region. This keeps them among the top five countries in the continent in terms of number of projects.

Egypt and South Africa both registered 40 projects, making them the countries with the highest number of projects on the continent. Egypt recorded a project value of $93.7bn (23.5% of the continental value). Meanwhile, Nigeria recorded the second-largest project value of $52.4bn, followed by South Africa, with a project value of $50.4bn, and Tanzania with $33.5bn.

The Deloitte report continued: “In 2020, almost three in four projects (73.2%) were in the low value range of $50m-$500m (compared to 64.8% in 2019). An overall total of 46 projects were valued between $501m and $1bn. Seven projects were valued at above $10bn.

Of these, the top three include Egypt’s New Capital City worth $58bn, Mozambique’s Offshore Area 1 Liquefied Natural Gas (LNG) project worth $23bn, followed by Nigeria’s Centenary City worth $18bn.

MIDDLE EAST & NORTH AFRICA

REAWAKENING MENA MARKET

Construction output in the Middle East and North Africa (MENA) region was forecast by GlobalData to contract by 4.5% in 2020 but recover and post growth of 1.9% in 2021 and 4.1% in 2022. GlobalData says the 2020 contraction reflects the severe impact of the COVID-19 lockdowns and other restrictions on construction activity.

“The [MENA] construction sector will face headwinds in 2021 with a slow recovery, but the pace of recovery will be uneven across countries in the region. Throughout 2020, and running to 2021, spending on real estate megaprojects, especially in the GCC [Gulf Cooperation Council], is likely to take a backseat due to budget revisions,” says Yasmine Ghozzi, a GlobalData economist.

On a positive note, Ghozzi adds that large-scale projects in the oil, gas, power and water sectors have gained traction despite the downturn in market conditions this year, and this is likely to continue. “As a result, some local contractors are pursuing development in these sectors to replace the loss of real estate work. There is also a push towards decoupling power and water production across the region to reduce energy consumption, providing the impetus for Independent Water Projects (IWP) implementation. In the future, there will be a lot of contract awards in that respect as the region pushes its renewable energy programme, particularly solar photovoltaic and wind.”

GlobalData has slightly revised its forecast for Saudi Arabia’s 2020 construction output to -1.9% from -2.8% and expects a recovery for the sector of 3.3% in 2021. This revision reflects an improvement in economic performance, the Kingdom ending a nationwide curfew at the end of September, lifting restrictions on businesses after three months of stringent curbs and a notable decrease in infection rates.

Recovery is also underlined by the crown prince’s announcement in mid-November that the Public Investment Fund (PIF) is to invest SAR150bn (US$40bn, 5% of GDP per annum) in the economy in 2021-22.

GlobalData still maintains its forecast for a UAE construction output dip of 4.8%, with a rebound in 2021 of 3.1% and a promising

medium-term outlook.

Ghozzi adds: “The recent approval of a new Dubai Building Code is a positive development for the UAE. The new code outlines a revised set of construction rules and standards and seeks to reduce construction costs by streamlining building rules.”

The UAE is proceeding with plans to expand its production capacity, with Abu Dhabi National Oil Company (ADNOC) announcing its five-year investment plan worth US$122bn.

GlobalData estimated 2020 construction output in Qatar and Kuwait to be down -4.5% and -9.5%, respectively. However, neighbouring Oman was tipped by the same source for a 10.3% drop in construction output. This was said to be due to the industry’s struggles with challenges presented by the outbreak of COVID-19, low oil prices and the impact of sovereign credit rating downgrades.

Ghozzi states: “The new fiscal plan launched by the Omani Government to wean itself off its dependence on crude revenues through a series of projects and tax reforms is a good step which will aid the construction sector recovery in the medium term”.

An

The UAE is proceeding with plans to expand its production capacity

GlobalData tipped construction in Egypt to grow at 7.7% in 2020, slowing from 9.5% in 2019 – given a short-term slowdown due to the pandemic – and 8.9% in 2021. The industry is also expected to continue to maintain a positive trend throughout the forecast period.

Ghozzi continues: “Egypt has become the first sovereign nation in the MENA region to issue green bonds with a US$750m issuance. Bonds’ earnings will be used to fund projects that meet Egypt’s commitment to the UN goals for sustainable development.”

GlobalData expected Israel’s construction industry to contract by 8.9% in 2020, reflecting the significant fallout from the pandemic, with growth expected to resume at a modest pace in 2021.

“Containing a second wave of the virus, while trying to revive the economy and approve budgets for 2020 and 2021, are the government’s top priorities. However, difficult decisions will be postponed, with the deadline to pass the 2020 budget being pushed to the end of 2020,” summarised Ghozzi.

In the Arab Maghreb, GlobalData maintained its forecasts for construction volume decline in 2020 for Morocco and Algeria at -5.5 and -3.4%, respectively.

A REVOLUTION’S COMING

The construction equipment industry is at a turning point. Topcon’s senior leaders believe that we are about to see a huge surge in the adoption of new construction technologies. The time is ripe as a new, younger and more tech-savvy generation comes to the fore. Governments could save billions, and where does the smartphone fit in? Pete Kennedy reports

Jamie Williamson has seen the construction industry undergo a transformation before, and he believes he’s about to see one again.

Two-person surveying teams, “where one individual is looking through the instrument and the other is walking,” were on every jobsite in the 1980s.

Back then, Williamson, now an executive vice president at Topcon Positioning Group in Livermore, California, watched the duos work with interest. The irony was that he was keenly aware that a system that could be operated by just one person was already on the market … a system that was also more accurate and required half the labour.

And yet, two-person crews continued to traipse through construction projects. Williamson remembers thinking that it wouldn’t be long before the one-person system took over. “In a couple years, everyone is going to have one of those things,” he predicted.

He was right. Some 40 years later, about 40,000 of these one-man systems are sold annually. “That’s on top of the systems that are already out there,” he said.

Yes, it’s true, everyone now has “one of those things”.

Williamson believes the industry is about to experience another transformation: the widespread adoption of machine control systems and the advanced project management tools that go with them. “Eventually every jobsite in the world will be using that technology,” he said.

Two other Topcon leaders, Murray Lodge, senior vice president, and Ulrich Hermanski, executive vice president, agree with their colleague. Combined, the three have nearly a century of experience with construction technology.

Now, years of laying the groundwork are about to pay off with dramatic increases in utilisation of machine control and management, the three believe. In addition,

new applications are being found for geopositioning technology, which uses satellites and ground stations to monitor construction progress – and to provide essential quality control efforts, among many other benefits.

A revolution is underway, and here are the reasons why Topcon’s top three think the industry is on the brink of a mass adoption of these new technologies.

MACHINE CONTROL ADOPTION IS NEAR

The rumblings of a significant uptick in acceptance of machine control – automated systems that precisely position construction equipment and help operators accurately control machine movement – began two or three years ago. “The smartphone was the main driver,” Williamson said. “It started the demystification process.”

There are other forces at work. OEMs now deliver machines from the factory with integrated machine control systems, making

access easier. After-market solutions have improved as well.

And then there is cost. Prices for the technology are falling, primarily because hardware components are mass produced and available off the shelf. Creative financing and attractive lease and subscription plans have also lowered costs.

In addition, there is a growing realisation among businesses that the technology is needed to compete.

“We are now at the cusp of where people ‘get it,’” Lodge said. “Now, you’re getting where people realise, ‘If I don’t have it, I can’t compete.’”

All three agree the opportunities are incredible. “If you look at the industry, we have 500,000 to a million machines out in the marketplace that have no type of grade control,” Williamson said.

As an industry, sales of grade control systems are in the low tens of thousands per year. “If you look at that, and compare the adoption to the one-person levelling system, that same evolution is going to happen,” he said.

The planets are aligning.

SMALL CONTRACTORS ARE READY TO MAKE A BIG SPLASH

Scan as you build says Ulrich Hermanski: “Whatever needs to be corrected can be done in that moment, before you go to the next step.”

the smaller machine, Lodge said. But that has changed.

“As the price continues to come down, that part of the pyramid with all the smaller machines, the smaller contractors, will explode over the next five years,” Williamson said. “It’s a huge opportunity and likely to be one of our biggest growth areas.”

Owners of smaller machines are starting to understand the return-on-investment opportunities. “If you can put something on a dozer that doubles its capacity, it has a much bigger impact on the capabilities of that small company,” Williamson said.

ON-SITE VERIFICATION HAS ARRIVED

On-site verification, which monitors progress and quality in real time, is becoming increasingly important for roadbuilding and vertical construction. It is a very new process, and one with considerable promise. It uses geopositioning technology to connect the office and the field instantaneously.

“From a knowledge standpoint, people are looking for answers right away,” Lodge said. Such data will have a significant impact on quality and the avoidance of costly rework. It is also likely to be another adoption catalyst.

Smaller contractors – and smaller machines –offer an even greater opportunity.

Hundreds of thousands of compact track loaders and mini-excavators are produced in Europe and North America every year. “If you compare that to the number of larger dozers and excavators, it dwarfs it,” Williamson said.

To this point, cost has primarily limited the number of smaller contractors who leverage the machine control technology. Until recently, it could cost almost as much as

People are now on the cusp of “getting it” says Murray Lodge: “Now, you’re getting where people realise … if I don’t have it, I can’t compete.”

A more technologically savvy younger generation will also ease the transition.

“They’re not afraid of technology,” whether they are the machines’ owners or the operators, Williamson said. “The older generation was. Even if the owners were progressive, they feared their operators wouldn’t use it if they bought it.

“The younger generation, they can’t live without it. It’s not, ‘Should I get it?’ It’s … ‘I have to get it.’”

“Imagine you are constructing a large building with a steel structure and after two weeks, you find out something was wrong during the earlier production,” Hermanski said. “It takes enormous cost – and enormous effort – to correct that.”

Previous verification consisted of bringing a team in once every week – or two weeks, or month – to scan all the progress. The team members returned to the office, processed the data and compared it against the plans.

Finding a discrepancy was a big problem. “Then you needed to go back and correct the problems and measure the changes,” Hermanksi said. In extreme situations, that could mean breaking up concrete or bringing down steel.

On-site verification prevents such problems. Geopositioning devices utilise satellites and ground stations to provide measurements, while a scanner offers instant comparisons.

“You are scanning as you build,” Hermanski said. “You can compare it with the plans immediately – on the site. Whatever needs to be corrected can be done in that moment, before you go to the next step.”

A timely response can be a big cost-saver. For example, corrections can be made to concrete before it hardens.

While Hermanski’s discussion focuses on

➔ building construction, the same process – and benefits – apply to roads and grading. In the past, a contractor might evaluate a job every few weeks. The problems uncovered could be devastating and lead to costly rework and overtime.

“Oops – a month in we made this mistake,” Williamson said.

The verification helps with scheduling, too. “With the data that’s available today, I can know this afternoon how much dirt I moved this morning,” Williamson said. “I can know if this project is ahead of schedule, or behind.”

Today’s tighter deadlines make the verification all the more critical, Lodge said. “Back in the day, a contractor might say, ‘OK, this is going to take us five months’ – and halfway through he might look around and realise he’s not on schedule,” he said.

“You can’t do that anymore. You have timelines you have to meet. You have all these subs that have to fit within it.”

Documentation is another benefit. Contractors have records of the quality and timeliness of the work.

THE AUTONOMOUS MOVEMENT IS GAINING STEAM

jobsite – not as a test, but as a functioning part of a jobsite,” Hermanski said.

He expects the asphalt compactor to be the machine that breaks the barrier.

“A roller works in a limited area,” Hermanski said. “It’s not driving around somewhere. It’s simple to control and to protect.” A compactor essentially moves backward and forward, and automatic shutoffs can help ensure safety.

“In the next one to two years, an autonomous roller will be available and working on a

Machine control and positioning is being transformed says Jamie Williamson: “The smartphone is the main driver. It started the demystification process.”

Dozers and graders are more difficult to control autonomously because they work in less confined areas. Excavators have more variables and moving parts. “On an open construction site, it’s not as easy as people think,” Hermanski said.

Does the market really want to eliminate the use of an operator in favour of autonomous machines? Hermanski said yes – at least in some cases. “With rollers and trucks, those are the lowest skill levels you have,” he said. “These are hard jobs to fill.”

Paving would be another candidate for autonomous operation, with one big caveat. “On a paver, you need to make a decision now that has an influence in 20 to 30 metres, so that makes it harder,” he said.

The first working autonomous roller will be retrofitted with controls, Hermanski said. As the concept becomes more well-received, look for machines to be specifically built for autonomous operation.

“We have to change our way of thinking,” he said. “We are making what we already have autonomous. We need to develop different types of machines – not to simply make the machines we already have run automatically.”

GOVERNMENTS CAN SAVE STAGGERING SUMS

Governments are slowly but surely – make that very slowly – starting to adopt the technology and include it in the roadbuilding process, in one form or another.

The biggest opportunities lie with use of 3D milling and paving, Lodge said. Key is the implementation of variable depth milling and paving methods and real-time quality control systems. In the long run, projects are completed sooner, quality is improved and road life extended. All these benefits add up to considerable cost savings.

“For their money, if we’re getting 10 projects, can we improve and get 11?” Lodge asked. “Can we get 14 – for the same amount

That’s considerable value. Lodge also said it’s realistic if 3D planning is used. There are transportation agencies that have taken such steps – “and a whole lot who haven’t,” Lodge

noted, as agencies are sometimes slow to adopt new approaches.

Still, the benefits could be substantial enough to drive acceptance.

“It’s not just that the contractor was able to save $300,000 on one project,” Lodge said. When you look at a wider scope, “that $300,000 turns into $300 million … which then turns into $3 billion.”

The level of detail is critical to the 3D concept. Previously, a survey crew walked the pavement with a stick and every seven metres took an elevation – on the centreline, the midpoint of the lane and the right shoulder.

“With 3D, you can do the survey in a matter of hours, versus days or weeks, and it’s much more accurate,” Williamson said. The data is gathered by crew members simply driving down the targeted road. “Then they create a 3D model of what the current surface looks like – ruts included – down to a couple of millimetres of precision ,” Williamson said. They have information for every millimetre of the road, compared with every seven metres the old way.

The detailed 3D design and variable milling to precise heights removes more material in the bumps and less in the dips to leave a smooth surface and consistent depth for the paver. The 3D approach makes the machines smarter and more aware of the surface they’re working on.

The smarter machines improve smoothness to such a degree that years can be tacked onto road life. Big dollars are saved on the jobsite, too, as material usage is much more efficient.

“It’s a game changer,” Williamson said.

And it will take a game changer to move government agencies. Lodge said that the paving industry uses 2D technology on about 80% of roadbuilding projects. “If you’re talking about 3D adoption, it goes down to about a half of a percent,” he said.

That usage rate makes it seem that adoption is a long way down the road. But the Topcon experts expect it to grow quickly because of the staggering improvements that can be made with the 3D process. The technology adds efficiencies, quality and cost savings during dozing, grading, soil compaction, paving and asphalt compaction. It also ties into the plant and material transport.

GREEN BENEFITS

The technology makes operations greener, too … in seemingly countless ways.

An efficient paver burns less fuel, as do efficient mills and compactors. Minimising

It also means less mix has to be produced, reducing fuel burn and emissions at the plant. Less material has to be hauled to the jobsite, preventing the emissions that go with it.

Smooth roads last longer because they don’t have bumps that get pounded by heavy vehicles. That longer life adds up to incredible savings when road systems of the world – or even a local jurisdiction – are considered. The smooth roads also prevent vehicle damage, which has green benefits of its own, such as extended life of auto parts.

And yes, the technology can contribute a great deal to the other kind of green – money. It’s not unusual for customers to double their production, depending on the machine type and application.

“You’re burning less fuel and controlling materials to low single-digit percentages for overruns,” Williamson said. The technology provides efficiencies at every stage of the building process. That means enormous savings in fuel, emissions and natural resource utilisation.

“It’s a societal benefit that we haven’t pushed enough as an industry, and we need to,” Williamson said. “It saves taxpayers money. It saves our planet.”

Here is how Topcon Positioning Group explains its technologies:

Machine control: Machine control hardware and software solutions were developed to determine a machine’s current position on the earth and compare it with the desired design surface. Using data from satellites or total stations and 3D models, the technology ensures that machine operators can accurately position machinery, check grade, automate equipment functions and collect data. Through the use of various positioning sensors and a display, machine control gives operators a clear reference between the position of the machine bucket or blade and the design surface.

Geopositioning: Identification of geographic location by means of technology.

2D machine control: Also known as “indicate” systems, provides positioning guidance with lasers, slope sensors, and/or sonic trackers, etc.

3D machine control: Positioning control using Global Navigation Satellite System (GNSS) or local positioning systems (LPS) to calculate 3D positioning of the blade, bucket, etc.

GOVERNMENT POLICIES AND CUSTOMER ROADMAPS DRIVE ALTERNATIVE POWER IDEAS OS

The move to electric power is gathering speed with government policies seeking a reduction in the use of combustion engines to address climate change and air pollution. Proponents of the technology say that construction equipment operators can gain an advantage in tenders by demonstrating their sustainability credentials with zero-emission machines. Liam McLoughlin reports

The use of alternative power solutions in construction equipment is being driven by a number of factors, specifically the desire to minimise both vehicle emissions and operational costs.

A range of alternatives to traditional diesel power is being developed by equipment manufacturers including electric-battery power, and fuel cells that produce electric power from sources such as methane, lithium, propane and – increasingly commonly - hydrogen.

The global electric off-highway vehicle market size in a pre-COVID-19 situation was projected by a MarketsandMarkets report to reach a value of US$6.3bn in 2020 and increase to US$17.5bn by 2025.

The research company says that the global financial slowdown following the COVID-19 pandemic has led to original equipment manufacturers (OEMs) delaying new vehicle

developments and launches in the offhighway electric vehicle sector.

However MarketsandMarkets says this is likely to be only a temporary slowdown: “The upcoming emission norms for offhighway vehicles, development of new and advanced products, and recovery of end-use sectors post-2020 are expected to support the growth of the electric off-highway vehicle market in the coming years.”

Market analyst Grand View Research says that increasing requirements in emissions standards for off-highway vehicles have been implemented by government authorities, such as the standards for greenhouse gas (GHG) emissions by the US Environmental Protection Agency (EPA), BS-VI in India and China VI. This greater stringency in global emissions requirements, which also includes the EU’s Stage V standards, has shifted the focus of OEMs towards

TOP: Hydrogen fuel cells have the potential to power heavy construction equipment

alternative powertrain sources such as hybrid electric and full electric off-highway vehicles leveraging the demand globally.

VOLVO

CE WILL BE NET-ZERO BY 2050

Sweden-based OEM Volvo Construction Equipment (Volvo CE) has fully committed to the global Science-Based Targets initiative, aiming towards being a net-zero emissions company by 2050 at the latest. A first goal is that 35% of all machine sales should be electric by 2030. In 2019 Volvo CE stopped developing any new diesel-powered compact construction machines.

The company has developed a range of battery-electric construction equipment in recent years. In 2017 it unveiled the EX02

RIGHT: JCB says its 220X hydrogen-powered excavator is a potential game-changer in the move to zero-carbon off-road machines

fully-electric concept excavator and followed this in October 2020 with the 14-tonne EX03, its first prototype in the mid-size excavator segment.

Ahcène Nedjimi, lead engineer and specialist in electromobility at Volvo CE, says: “The move to electric power is a transition that is gathering speed. Government policies and market trends are seeking to reduce the use of combustion engines in both on-road and off-road applications to address climate change and mitigate air pollution.

“Both Volvo Group, our parent company, and Volvo CE have a really strong commitment to meeting the requirements of the Paris Agreement on climate change and reducing carbon emissions. We also see a strong ambition in our customers’ roadmaps towards the reduction of their emissions.

“Every new project with compact wheeled loaders and excavators is now electric. We have started with two machines - the ECR25 Electric 2.5 tonne compact excavator and the L25 Electric compact wheeled loader. We began with compact machines as that is where the greatest demand is, particularly for use in urban areas.”

Nedjimi says that the near silence of such machines can play a vital role in reducing the issue of noise in urban environments. According to research by the European Environment Agency this is a major problem affecting the health and wellbeing of millions of people in Europe. According to Volvo CE, electric machines provide operators with a more peaceful work environment with lower vibrations and

noise so they can talk more easily with coworkers.

Electric machines also open up practicable working hours in urban locations, enabling digging to take place outside a bedroom window, school zone or hospital room, and even through the night.

Nedjimi says that Volvo CE is focused on developing electric battery solutions for small to mid-size construction machines, but continues to explore the most appropriate technologies to electrify all segments of construction machinery. Volvo Group has recently launched a joint venture with Daimler Truck to produce fuel-cell solutions for use in long-haul trucks and beyond, and will be exploring the use of this technology in other applications.

Attractive opportunitites in the electric off-highway vehicle market

AGGRESSIVE STEP TOWARD MINIMISING EMISSIONS AND VENTILATION COSTS IN UNDERGROUND MINING

THE HYDROGEN FUEL CELL

The use of hydrogen fuel cells as an alternative source of electrical power in the construction equipment sector has seen major recent announcements from companies including JCB and Hyundai Construction Equipment.

In July 2020 JCB unveiled the working prototype of a new 20-tonne excavator, powered by a hydrogen cell. The UK manufacturer claims its 220X hydrogenpowered excavator is a potential gamechanger in the move to zero-carbon off-road machines.

JCB’s product innovation director Bob Womersley said the development of the 220X has progressed well and provided useful knowledge.

Source: Secondary Research, Expert Interviews, Company Presentations, and MarketsandMarkets Analysis NEW PRODUCT DEVELOPMENT, EXPANSION & INVESTMENTS WOULD OFFER LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS IN THE NEXT 5 YEARS HIGHER INITIAL COST THAN CONVENTIONAL ICE VEHICLES (INTERNAL COMBUSTION ENGINE)

➔ The development came a year after JCB said it had made manufacturing history in 2019 by going into full production with a fully electric mini excavator, the 19C-1E. JCB has also extended electric technology to its Teletruk telescopic forklift range with the launch of an electric model, the JCB 30-19E. “We’ve learnt so much about hydrogen and how to manage it and get the best out of the performance of the machine,” added Womersley. “We continue to make great progress with the technology.”

Mini excavators have considerable potential for making sizeable steps forward

will do its very best to meet the challenges that lie ahead as countries around the world attempt to establish global standards in terms of certifying the performance of equipment and legislating relevant laws for the commercialisation of hydrogen-powered construction equipment, and play a leading role in the market moving forward.”

OTHER ALTERNATIVES

Womersley says that JCB is anticipating a rapid rise in the uptake of electrified machines, especially in the area of compact and lighter mid-range equipment, where the company already has several electrified construction models on the market including an electric mini excavator, electric 1-tonne capacity site dumper, two electric forklifts and an all-electric telehandler. Womersley says deploying electric machines can make economic sense for operators: “The critical thing about capital plant investment is that it has to pay back for the customer –unlike a passenger car, say – and we can see that the business proposition is working well for our customers such that the increased penetration of electrified machines is well underway, just by virtue of the fact that the machines pay back.”

Hyundai Construction Equipment (HCE) has joined forces with the Hyundai Motor Group to develop hydrogen fuel-cell-powered construction machines. Hyundai Motors and Hyundai Mobis will design and manufacture hydrogen fuel-cell systems, including power packs, while HCE will design, manufacture, and evaluate the performance of excavators and forklifts. The partners have set a date of 2023 to begin mass production and distribution.

HCE says that, given the rapidly rising demand for eco-friendly equipment around the world, hydrogen-based construction equipment will help it to compete in the global construction market moving forward. It adds that, compared to lithium batteries which have been marred by structural issues limiting various attempts to increase battery capacity, hydrogen fuel cells are much easier to expand, making them a much more logical choice for large forklifts or excavators.

Hwang Jong-hyun, head of the R&D division for material handling at HCE, said: “Hyundai Construction Equipment

In terms of other new potential power sources apart from fuel cells and battery power, JCB’s Womersley says there is also the possibility for alternative fuels for internal combustion engines (ICEs) to become available which have a very low or even zero CO2 impact.

Mini excavators have considerable potential for making sizeable steps forward in zero-emission battery-powered equipment, according to Burkhard Janssen, Hitachi Construction Machinery Europe (HCME) department head, special applications & new technologies.

“Mini excavators are leading the field in this development, due to the small size of batteries required,” Janssen says. “Rapid charging times and sufficient operation capacities are vital for their successful adoption in the market.”

Janssen adds that drives for efficiency and environmental concerns are increasing the

demand for electric in Europe, particularly for compact equipment that is often used in heavily populated urban environments.

“Contractors are looking to gain an advantage in tenders by demonstrating their sustainability credentials,” he says.

Due to the high costs of the battery package, Janssen says that electric machines are currently too expensive for most customers when just replacing dieselpowered machinery.

In some European countries there are subsidies available to stimulate electrification or other alternative powertrain solutions.

“However, if none are available, rental could be an interesting starting point,” Janssen adds. “Manufacturers will need to provide the whole package - cables, transformers, battery packs and job site support.”

CUMMINS IS INVESTING HEAVILY

US engine manufacturer Cummins is a major proponent of hydrogen fuel-cell technology, which it says could be the fuel of the future. The firm is best known for its diesels but is investing heavily in developing new power sources for mobile machines, including both electric and hydrogen technologies.

Cummins says it is combining its powertrain expertise and its fuel -cell and hydrogen technologies in a variety of applications, including semi-trucks, delivery trucks, transit buses, refuse trucks and passenger trains.

Amy Davis, president of Cummins new

COULD A ‘TESLA’ BE ABOUT TO EAT THE OEMS’

ELECTRIC LUNCH

Tesla has gone from a niche manufacturer of 147 electric cars in 2009 to now producing over 500,000 vehicles a year

With electrification (along with digitalisation and autonomy) all set to change the construction equipment sector, could the industry’s established original equipment manufacturers (OEMs) be wrongfooted by a new market entrant?