Australian Power Equipment is a leading provider of low, medium and high-voltage power equipment across the Power Generation, Infrastructure, Renewable Energy and Resources sectors.

As the agents for Üntel cables, B&D transformers, Leistung Energie switchgear, CAB cable systems and WE Walter substations, they can supply new equipment to specification.

With a strong commitment to sustainability, the company also provides repurposed and refurbished equipment including substations, transformers and switchrooms.

They can provide immediate solutions to unplanned outages with their in-stock equipment or their critical sourcing solutions.

Australian Power Equipment is dedicated to delivering exceptional customer service and electrical engineering support, ensuring businesses can make best-practice decisions for their operations.

P: (03) 9690 8766 www.primecreativemedia.com.au enquiries@primecreative.com.au

Editor

Rebecca Todesco

Journalists Kody Cook

Sarah MacNamara

Tess Macallan

Art Director

Alejandro Molano

Designer

Jacqueline Buckmaster

Business Development Manager

Terry Braithwaite

Marketing Manager

Radhika Sud

Marketing Associate

Bella Predika

Digital Marketing Assistants

Emily Gray Amy Boreham

Publisher

Sarah Baker

Managing Editor

Laura Pearsall

I SSN: 2653-634X Published by

As the dust starts to settle following the last few eventpacked months, the end of the year is finally in sight. But you’d be mistaken for thinking that this means the mining industry is slowing down in any way.

Exploration continues to charge ahead, with funding and government support backing the projects and companies that are driving the growth of Australia’s critical minerals sector. The industry is also seeing an uptick in the adoption of renewables and electrification across operations, demonstrating the sector’s commitment to doing business better.

Once again, Mining is stacked with expert insight into the biggest trends affecting the sector, including the thousands of new workers Western Australia’s resources and energy sector will need before 2029; and a new, innovative way that mine waste can be repurposed ahead of the Brisbane Olympics.

In this issue, EY explores the top ten business risks and opportunities for mining and metals in 2025, delving into the results from its latest report and the potential impacts on the sector.

conferences, and share details on the major mining event that will call South Australia home from 2025.

With additional features on sustainability, asset management and mine rehabilitation, Mining keeps its finger on the pulse of the industry to bring you the biggest topics that are impacting the sector.

This issue also takes a deep dive into the container deposit scheme that is spreading across Western Australian mine sites in a bid to tackle the 50 million ten-cent containers lost to landfill on mine sites annually.

As always, if there’s a topic, project, technology or challenge you’d like to read about in future editions, please feel free to flick me an email – I’d love to hear from you.

Rebecca Todesco Editor

Drop Rebecca a line at rebecca.todesco@primecreative.com.au or feel free to call her on 03 9690 8766 to let her know what you think. Don't forget to follow Mining on social media – find us on LinkedIn, X and YouTube.

Make certain your service body is functional, compliant and great value.

BUILT FOR FUNCTIONALITY

MODULAR & FLEXIBLE

Mobile workspaces that adapt your unique needs

STRONG & SEALED

Protect your gear from dust, rain and theft

MAXIMISE PAYLOAD

Alloy body so you can carry more

BUILT FOR COMPLIANCE

USER FOCUSED DESIGN

Maximise usability, ergonomics and safety

CERTIFIED

ADR approved and triple ISO certified

FLEET CONSISTENCY

Dependable fleet-wide solutions, nationally

BUILT FOR VALUE

DURABLE & LONG LASTING

Transferable to your next 2 utes!

DEALER & FMO SUPPORT

Easy end-to-end customer care support and back-up

TURNKEY SOLUTIONS

Proven designs with all required accessories

Pilbara Minerals has locked in a new $1 billion debt facility as a revolving credit facility (RCF) to help increase the company’s financial flexibility, with competitive pricing and an enhanced covenant framework and terms.

The RCF can be utilised for refinancing and general corporate and working capital purposes, subject to drawdown conditions.

Pilbara Minerals intends to repay all outstanding amounts under its existing ten-year $250 million debt facility with Export Finance Australia and the Northern Australia Infrastructure Facility

and its five-year US$113 million syndicated debt facility.

Pilbara Minerals’ Chief Financial Officer, Luke Bortoli, said establishing the RCF is an important step in maturing the company’s capital structure.

“The new corporate facility replaces Pilbara Minerals’ existing loan facilities,

Mr Bortoli said the company is pleased by the strong appetite from existing and new lenders to participate in this facility, which has strengthened the company’s institutional banking relationships as it continues to play a leading role in the global lithium value chain.

“Export Finance Australia and the

Anglo American’s divestiture of its 33.3 per cent minority interest in Jellinbah Group, a JV that owns a 70 per cent interest in the Jellinbah East and Lake Vermont steelmaking coal mines in Australia, will result in $1.6 billion in cash proceeds.

The buyer, Zashvin, already owns 33.3 per cent of the shares in Jellinbah, along with Anglo American and Marubeni.

Anglo American does not operate the Jellinbah mines or market any of their production volumes. The sale is subject to customary regulatory approvals and is expected to be completed in the second quarter of 2025.

Duncan Wanblad, Chief Executive of Anglo American, said the company is delighted to have agreed terms with its JV partner, Zashvin, to sell its minority interest in Jellinbah.

“The cash proceeds of $1.6 billion reflect the exceptional quality of the Jellinbah business. Our process to sell the rest of our steelmaking coal business – being the portfolio of steelmaking coal mines that we operate in Australia – is now at an advanced stage, and we are on track to agree terms in the coming months.”

Zashvin’s James Xu said, “Jellinbah’s success has been driven by robust partnerships.

“We appreciate Anglo American’s significant role in this journey and value its dedication to making this transaction smooth and efficient.

“As a family that’s been with Jellinbah since its inception, our increased investment not only reflects our confidence in Queensland’s coal industry but also our commitment to supporting the central Queensland community.”

The International Mining and Resources Conference and Expo (IMARC) once again descended on the Sydney Convention and Exhibition Centre from 29–31 October, with a record 9,000 delegates from 115 countries crossing the threshold.

When not exploring the over 20,000m2 of exhibition floor, attendees were able to attend the more than 370 technical talks, panel discussions and keynotes taking place across the nine concurrent conferences.

Federal Minister for Resources and Northern Territory, Madeleine King, spoke at the conference for her third consecutive year as Australia’s resources minister.

During her address, Ms King highlighted the importance of the resources sector in delivering growth opportunities and benefits to the nation.

“Royalties from mining projects across our country help to build roads and hospitals, just as Australian iron ore and metallurgical coal have produced the steel that built the great cities of Asia.

“Growing our resources sector is key to achieving the net zero transition and securing a Future Made in Australia,” Ms King said.

International representation “IMARC brings together an enormous number of companies, exhibitors and

senior representatives of countries from around the world here to beautiful Sydney to discuss mining and resources,” Ms King said.

Canada, Chile, Peru, Germany, TimorLeste and France were just some of the companies with representation on the exhibition floor.

General Manager at Terrain Tamer, Brent Hutchinson, commended the event on its international presence and said Australia exports its mining expertise and knowledge well.

“[IMARC works for us because we’re growing globally and this is an international show,” he said.

“It’s Australia’s true international mining show.”

Over the three-day event, hundreds of meetings between miners and investors also took place at IMARC Connect. The networking opportunities on offer at IMARC 2024 was a key standout for MASPRO Regional Business Development Manager, Roxanne Bekker.

“The networking is very valuable. I always tend to catch up with the same clients coming to IMARC, touching base and really finding out what the new problems in the industry are.”

Ms Bekker stressed the importance of learning from these conversations and

workshopping with the team about what could be done to solve these issues.

“Every year, as things change, as we solve certain problems, new ones arise. You have to keep moving forward,” she said.

MASPRO National Sales Manager, Peter Lowenhoff, echoed Ms Bekker’s enthusiasm.

“I’ve had some good conversations with a couple of different companies, getting a great understanding of their whole fleet in areas and the even different mines that they actually operate on.

“I got a greater understanding of what’s happening in South America and had some good conversations with people from Peru,” he said. “I’m very interested in working with companies that we can help in those areas.”

Sydney is already locked in as the host of the 2025 event, with around 70 per cent of exhibition space already sold.

IMARC COO, Anita Richards, thanked the efforts of IMARC’s Founding Partners, Austmine, AusIMM and Mines and Money, and the support of the New South Wales Government as Host Partner.

“A special thank you must also go to our sponsors and exhibitors, whose invaluable contributions are propelling us into the future,” Ms Richards said.

Western Australia’s resources sector continues to deliver record levels of employment with 134,871 full-time equivalent (FTE) positions in the 2023-24 financial year.

This marks the seventh consecutive calendar year of jobs growth, with the past five years setting record highs.

FTE positions in mining operations were up year-on-year for most minerals with the major movers being lithium, gold and iron ore.

Western Australia remained the leading destination for exploration investment in Australia with the $2.58 billion spent in 2023-24 accounting for 62 per cent of the national spend. Key exploration targets included critical minerals such as lithium, rare earths (which achieved record spending levels), nickel/cobalt and copper.

Iron ore continues to be the bedrock of Western Australia’s resource output, with sales of $142 billion supported by higher prices and record production of 866 million tonnes.

Gold continued to shine with all-time high sales of $21 billion driven by the highest prices ever recorded.

Despite the market headwinds for battery minerals, lithium ($8.4 billion), nickel ($3.8 billion) and copper ($1.1 billion) achieved strong sales, as did alumina ($6.6 billion), mineral sands ($1.2 billion) and salt ($814 million – the highest on record).

The petroleum sector continued to be an important contributor to the state economy with sales of $51 billion. Liquefied Natural Gas (LNG) was the main driver with sales of $36 billion, followed by condensate at $8.4 billion, domestic gas at $2.9 billion and crude oil at $2.5 billion.

Western Australia’s reputation as a well-regulated and reliable business partner saw more than $32 billion invested in the resources sector in 202324. This result continues the upwards trend in investment since mid-2019.

The investment pipeline also had projects valued at about $50 billion committed or under construction.

Western Australian Premier, Roger Cook, said that these remarkable results support jobs across the state and deliver tremendous economic benefits to Western Australia and its regional communities.

“Our economic management of the resources sector is second to none, and that is why Western Australia will drive the national economy for decades to come,” Mr Cook said.

“We are a global investment destination of choice as we remain a reliable business partner, we maintain a robust regulatory framework and we have a long history of major mining and mineral processing successes.

“I am very pleased to see the interest in critical minerals extend from exploration to production as we are working hard to ensure Western Australia plays a key role in decarbonising the global economy.”

Western Australian Minister for Mines and Petroleum, David Michael, said that Western Australia’s resources sector has delivered yet another exceptional performance and it’s great to see there are more employment opportunities than ever before.

“It’s especially pleasing to see exploration spending continue its impressive run with the global demand for commodities –especially critical minerals – showing no signs of slowing down,” Mr Michael said.

“The future looks particularly positive with billions of dollars’ worth of projects under construction or committed as we seek more downstream and midstream production activity.”

Just as there is no one-size-fits-all project, equipment that can be tailored to meet specific needs is a must-have for successful projects.

With a legacy of over 45 years servicing Australian heavy industries, Toshiba’s low voltage electric motors are known for their reliability and robust nature. However, it’s the customisation capabilities of its products that the team can hang its hat on.

As Australia’s mining and resources industries continue to grow, the need for reliable motors and machinery is critical on busy project sites. Complex needs, coupled with strict regulations and rigorous safety requirements, drive industry demand for product customisation.

Toshiba’s low-voltage electric motors are renowned for their quality – delivering reliable power and performance to busy sites. With two large motor modification workshops strategically located in Sydney and Perth, Toshiba is perfectly placed to support the success of its clients’ projects. However, in customisation capabilities is where Toshiba’s name stands tall.

Toshiba Product Manager – Low Voltage Motors, Mark Grabe, said, “Having an experienced team in both our Sydney and Perth workshops means that Toshiba low voltage motors can be customised to the highest degree.

“It’s a service we’re really proud of, and one that we offer as a standard.”

Workshops in these vital locations means that Toshiba low voltage motors can be customised and delivered to site within days, already tailored to meet project needs.

When it comes to customising, it’s not just the odd motor here or there; 80 per cent of Toshiba motors supplied in Australia are customised to client specifications.

From a change in the paint colour used to enlarging the size of terminal boxes on motors; or from fitting additional thermistors/RTDs to installing special flanges or rain hats, this level of customisation means getting under the hood and delivering a completely unique product, designed for sitespecific requirements.

However, customisation never means compromise.

Toshiba motors are equipped to meet stringent safety and compliance standards for use in hazardous areas, complete with certifications and audits from international safety bodies, such as non-sparking (Ex nA), increased safety (Ex e), explosion-proof (Ex d), dust-ignition proof (Dip), and more.

Each customised Toshiba motor undergoes rigorous strength and efficiency verification testing at Toshiba’s Sydney performance testing centre.

The motors are tested on load under different parameters, based on customer needs. These tests are designed to mimic on-site conditions, demonstrating true performance to ensure the assets are ready for real-world operation.

“Our testing facility means that our customers know their motors will arrive ready to work and can face up to the pressures of site. It’s peace of

mind that you don’t get anywhere else,” Mr Grabe said.

The quality of operation is backed up by a hands-on support team. After all, motors don’t only work during business hours – they’re operational 24 hours a day, 365 days a year. This means that Toshiba’s engineering service team is too, providing a critical emergency breakdown service. With an extensive local inventory, a new asset can be customised and supplied to site as quickly as possible, limiting costly downtime.

Australia’s heavy industries rely on assets meeting the complex requirements of unique projects as they evolve, and depth of customisation is critical.

Toshiba provides unmatched customisation capabilities for its low voltage motors, providing assurance to customers that its assets will power their projects – now and into the future.

Keeping up with the latest insights and best practices for effective supply chain, logistics and procurement management is vital for maintaining a competitive edge in the modern resources sector.

As logistics networks and supply chains grow increasingly complex and vulnerable, inefficient management can, for example, lead to greater operating costs, delays in meeting deadlines and deliveries and decreased productivity. CQUniversity recognises the skills shortage and growing demand for industry professionals with supply chain, logistics and procurement expertise needed to respond to today’s fast-paced, competitive business environment.

In response, CQU has developed the Graduate Certificate in Strategic Supply Chain Operations. This specialised postgraduate course provides industry professionals and managers with contemporary knowledge and competencies to address the skills shortage in Australia’s diverse industries.

A pathway to expertise

With a choice of full-time (six months) or part-time (12 months) study, this course will provide industry professionals and managers with the latest expertise in supply chain, logistics and procurement management to help them stay ahead of the curve.

The course delves into emerging business trends, new innovative technologies, contemporary industryspecific supply chain and procurement challenges and emerging solutions. It is crafted to ensure that students are equipped with cutting-edge knowledge and competencies relevant to current industry trends and technologies. For example, it includes modules that keep students up to date on the latest emerging technologies, such as blockchain. This comprehensive approach will empower graduates to make informed decisions and drive tangible results within their organisations.

Graduates of this course can expect to have an enhanced ability to:

♦ Analyse the value chain within a supply chain by integrating advanced frameworks, finding inefficiencies and opportunities for process improvement

♦ Devise strategies for re-engineering supply chain processes to boost performance

♦ Analyse the importance of probity and integrity in procurement processes and decision-making

♦ Use insights from industry challenges and leading research to design optimised supply chain networks

♦ Employ leading procurement strategies in sourcing, tendering, and contract management

♦ A ssess the accountability and transparency of procurement practices in both public and private sectors

♦ E xplore strategies and innovative technologies to foster beneficial buyer-supplier relationships

♦ Design a procurement excellence framework incorporating ethical governance, innovation, technology and sustainability

Industry professionals and managers eager to take advantage of the valuable learnings offered in this postgraduate course must have completed an Australian Qualifications Framework (AQF)-equivalent Bachelor’s degree or higher equivalent qualification; or completed an AQF-equivalent Diploma qualification with a minimum of two years relevant business experience; or have a minimum of five years relevant professional business experience.

The course will launch online in March 2025. For more information, visit cqu.edu.au and search ‘strategic supply chain operations’.

Round 30 of the Exploration Incentive Scheme (EIS) Co-funded Drilling Program will award 50 applicants, including six prospectors, grants worth $7.28 million for projects to be drilled between December 2024 and November 2025.

Western Australian Mines and Petroleum Minister, David Michael, announced the successful applicants, with 17 of the successful companies targeting battery minerals, including lithium and rare earth elements (REE).

confirming a belt-scale mineral system at its nickel sulphide Mulga Tank project.

WA1 Resources is achieving promising results having drilled a discovery hole into its P2 Target in 2022 with the assistance of an EIS co-funding grant.

The company believes the site may host a large, mineralised carbonatite system located approximately 35km from the Luni discovery in the West Arunta, south of Halls Creek.

Australia as a dynamic global supplier of future battery minerals and materials.

“It is pleasing to see exploration expenditure continue to rise in Western Australia, hitting a record $2.6 billion in 2023, with demand for critical minerals soaring on the back of global decarbonisation initiatives.

Recent success stories from co-funded drilling projects include Kingfisher Mining, which reported a new lode of REE mineralisation at its Mick Well project.

Western Mines Group also reported success this month with the company’s EIS co-funded drilling in early 2024,

Applications for Round 31 of the Co-funded Drilling Program, Series 8 of the Energy Analysis Program (EAP) and Venture 2 of the Co-funded Geophysics Program (CGP) will open in February 2025.

Mr Michael said, “The race to find critical minerals underlines the State Government’s aim to position Western

Equip yourself with in-demand skills and knowledge in supply chain, logistics, and procurement management to drive performance within your organisation and maintain a competitive edge.

Start online in March

“The EIS continues to support major mineral discoveries, with each project increasing the odds of opening new mines and creating jobs in regional communities.

“Our mining sector has once again demonstrated the significance of mineral exploration to Western Australia’s prosperity, with mineral sales reaching $192 billion in 2023.”

Mining spoke to Agrimin CEO and MD, Debbie Morrow, about her switch from project to corporate positions, keeping miners safe and potash contributing to global food security.

In September 2023, Debbie Morrow joined Agrimin as CEO and Managing Director. Ms Morrow’s journey to Agrimin involved 24 years at Woodside, with 16 years spent on projects before moving to corporate roles, followed by a stint with OZ Minerals as global Projects Executive. In April 2024, Debbie also joined the Board of GR Engineering Services as a NonExecutive Director.

Agrimin is a Western Australia-based minerals company and owns the Mackay Potash Project. The Mackay project is predicted to be the world’s lowest cost producer of sulphate of potash (SOP).

SOP is a speciality fertiliser, with demand forecast to grow in order to feed the growing global population against the challenge of shrinking arable land.

Lake Mackay is currently the largest undeveloped SOP brine deposit in the world, boasting a considerable drainable mineral resource of 123 million tonnes.

When the opportunity to work at Agrimin presented itself, Ms Morrow said the decision to move was daunting, not just because she was moving to her first CEO and MD role, but because the commodity in Western Australia had struggled in the past.

“There was a lot of negative sentiment about the commodity in Western Australia as the two early movers had not been commercially successful.

“Going from a big company where your financial sustainability or security is not something you ever really worry about as an employee, to the junior environment was also very different,” she said.

“But the more I learnt about potash, and the more I understood about global food security challenges, the more I wanted to be involved.”

Ms Morrow made the decision to join Agrimin after learning more about

the commodity and its role in global food security.

“I love the commodity, I love the project that we’re going to be developing and I love the land and communities we will be operating on and with for many years ahead. That's how I got here.”

The transition from project delivery to corporate roles did not come easily.

“When I transitioned from major projects in Woodside to the corporate roles in Woodside, I really struggled, to be honest.

“I had historically excelled at bringing teams together to deliver a highly visible goal with tangible interim milestones, and corporate roles are not the same as that. You don’t have the same fast-paced, ever-present goals that you must achieve. My leadership style has certainly had to change over time, and this role again has been another significant shift.”

Ms Morrow’s exposure to the resources industry started from a young age, with her father in the offshore drilling industry. Her own entry to the industry was something of an accident after accepting a summer vacation slot at Worley resulted in her falling in love with the resources industry.

The mining and resources industry has experienced significant momentum

years, and Ms Morrow has seen the shift occurring firsthand.

“I look back to when I started over 25 years ago, when bullying and sexual harassment was rife and known about and tolerated. It was clear in those days that women didn’t progress as fast or as far, or even at all, in some cases.”

Ms Morrow has a key piece of advice for other women embarking on their own journeys in the industry, no matter their role or ambition.

“The thing that helped me the most was having true sponsors; not mentors, not ones that are assigned to you, but having sponsors that will speak for you in rooms when you're not there. They don't necessarily need to be significantly more senior. They just need to be in different and the right rooms.”

Another key lesson she learned early in her career was the importance of being true to herself.

“I think I tried to fit in a bit too much, to emulate my successful male colleagues in terms of style and approach rather than being more myself,” Ms Morrow said.

“A now laughable example is when I got a promotion and a female colleague sat me down and suggested that I should start dressing more like a man, because if I wanted to keep progressing, the more they thought I fitted in, the more chance I'd have of being promoted.

“It is easier to be what you can see. We all need to see female leaders being themselves.”

Ms Morrow strives to use her platform to speak at as many conferences and events as possible in an effort to help everyone that is following her through the ranks.

Although significant progress is being made industry-wide to change the nature of the workforce and ways of working, Ms Morrow said that women still have to make certain sacrifices if they want to follow in her footsteps.

“If you want to choose an executive pathway, and if you want to aim for the C-suite and beyond, you need to make a conscious decision as a female that that’s what you’re going to do,” she said.

“I say that because particularly if you have a family, there are times in your career where getting the balance right for both work and at home can be very tough. I would describe it, no matter your circumstance, as a period of compromise, having a family and progressing your career.”

Compromise aside, Ms Morrow said that one of the best pieces of advice she can give to other women in the industry is to be themselves.

“Get your circle around you, to support you, take every opportunity offered, have fun and be yourself. Staying true to your own personal values can sometimes feel challenging in our industry, but it’s so

important that you don’t lose your own compass along the way.”

A keen interest of Ms Morrow is helping the industry understand the potential of SOP in contributing to global food security.

At present, the Mackay Potash Project is at the stage of finalising approvals and gathering investment. Ms Morrow said that although global investor interest is quite strong for SOP, the challenge from a domestic perspective is to prove that the company and project have a technical solution that will be commercially viable in Western Australia.

“The world needs our commodity, and currently Australia relies on importing this critical fertiliser. Our Lake Mackay Potash Project is going to be six per cent of global supply from just one asset in

Western Australia, and we have much more potash opportunity than that as a state, and as a country.

“On the global stage, the investment opportunities are much more significant because the demand for potash is outstripping supply.

“Globally, potash is emerging as a critical mineral and supply chains are realising that not only do we not have enough of this commodity, a significant amount of the global market relies on China and China also has high domestic use.”

Alongside her passion for SOP and supporting other women in the industry, increasing worker safety is a topic she is vocal about. In the last 24 months, there have been 15 fatalities in mining and resources in Australia, a figure which Ms Morrow called “heartbreaking”.

When it comes to worker safety the best approach is to eliminate the risk altogether and technological innovations can go a long way in facilitating this. Although technology is certainly assisting in this endeavour, Ms Morrow said that there will always be workers in the industry and that keeping them safe should be the foremost priority.

“I still maintain a huge focus on people,” she said. “It’s people that get injured; it’s people that are on the front line – the ones making those final decisions when, unfortunately, sometimes things go wrong.

“The innovation that is happening is fantastic, and I think it is going to significantly reduce risk in the industry, but we still need to keep focusing on people.

“Even though some roles might be removed or become less risky it’s still all about people for me – making sure that people go home.”

Ms Morrow said one focus area is the concept that there should only ever be one workforce on a site: one cohesive health, safety and well-being culture.

“If you look at most of the fatalities, they’re contractors, not employees. There should only ever be one workforce on a construction and operational site: not an owner and contractor workforce.”

With a large portion of the sector’s workforce consisting of contractors, the cycling workforce can lead to challenges of competence, experience and capability.

“Sometimes with management systems you've got owners’ systems, then contractors, and even subcontractors with subcontractors. It starts becoming

quite difficult to ascertain for your own governance and assurance that everything, all the checks and balances are not only there, but they’re being diligently applied.

“Anything that makes people’s roles on site more ambiguous or complex leaves room for error,” she said.

Ms Morrow said that having one genuine and cohesive culture of care for every person that comes on-site is the best way to set up for success.

“I know sometimes financially that’s difficult; I know sometimes the sites are so large it’s difficult; sometimes there’s so many contractors, it’s difficult; the workforce rotates, it’s difficult. But if we keep saying it’s all difficult, and we don’t try to simplify and form cohesion then I think we’re not using every single tool in our toolkit to make sure that health, safety and well-being is the core of everything we do.”

Further underscoring her commitment to safety is Ms Morrow’s Non-Executive Board role with Miners Promise, a charity that “is doing a job that none of us want to have to do”.

Miners Promise steps in and supports the families of individuals who have died on-site, filling the gap in what the employer and EAP can do. Miners Promise helps with practicalities like paying for funeral costs, liaising with police and coroners, offering mortgage or rental support, providing food, managing donations for the families

and establishing trusts for the affected children’s education. Most importantly of all, Miners Promise provides a dedicated Family Support Adviser who offers traumainformed grief support and counselling, a trusted companion on a journey of tragedy that no one should have to experience –losing a loved one at work.

Ms Morrow said that one key difference in what Miners Promise does compared to the EAP or other mental health plans is that it doesn’t stop.

“We are there for as long as the families need us, and sometimes that can go on for years post-event and we're still there supporting them with counselling, our family support groups and any other needs they have.”

Ms Morrow said the organisation has sadly been very busy in the last two years, with most of the 15 families affected by workplace tragedies under the care of Miners Promise. To further support the families under its care, Miners Promise is working on a strategy to be more accessible to industry and establish a sustainable financial structure.

“We need a sustainable funding model, because we need to be here when the industry and families need us.”

Ms Morrow said that with many company vision statements and health and safety policies saying that all injuries and incidents are preventable, it can be hard to get mining companies onboard.

"Trying to get companies to invest in Miners Promise in advance of a tragic event is quite tricky, because no one wants to plan for, or have, a fatality.

“It’s an amazing organisation but it's one that all of us would love not to need to exist.”

The feedback coming from the industry uncovered a reluctance from some mining companies to have their logos on the Miners Promise website, as it could be seen as the company accepting the likelihood of fatalities occurring.

To combat this, Miners Promise has come up with a new strategy where companies can sign up through a ‘Partnership of Care’.

“This means we’re there if you need us and your sign-up contribution and modest annual retainer makes sure we’re there for other families that need us across the whole Australian industry.

“The game-changer with the new ‘Partnership of Care’ model is that with sign-up we would integrate with emergency response plans, or whatever the different companies call them so that in the event of a tragic fatality, Miners Promise will be an integral and immediate part of the response activation.

“At the moment, when tragedy strikes we are often searching through our networks to find a contact into the mine site, which means that the families miss out because they’re not getting the absolute best of care as quickly as possible.

“We’d love to not be needed, but conversely, we want to be there to care for families in the terrible event that they do need us.”

In an industry where maximising ore recovery is critical, mining organisations turn to companies that differentiate themselves through the provision of top-tier solutions.

Hayward Gordon, a leading brand in industrial mixing technology, distinguishes itself by offering its 3AM45 impellers with a unique mid-solidity axial flow design. This design is unparalleled in the industry and provides exceptional benefits for carbonin-leach (CIL) and gold leach applications.

The mid-solidity impellers are engineered to improve the efficiency of oxygen dispersion compared to the low-solidity hydrofoil. Their unique design ensures oxygen is effectively broken into smaller bubbles, enhancing mass transfer rates and ensuring uniform oxygen distribution throughout slurry. This is crucial for maximising gold recovery rates and improving overall process efficiency.

In gold leach and CIL applications, midsolidity impellers provide superior mixing performance by maintaining a balance between shear and flow. The impeller’s unique blade surface area allows it to handle apparent viscosities exhibited by the slurry that can occur when the solids concentrate reaches approximately 50 per cent by weight.

This flow and shear balance is essential for preventing sedimentation of the solids and ensuring a homogeneous mixture. The improved mixing performance leads

to better contact between the gold ore and the leaching agents, resulting in higher gold extraction rates.

An advantage of mid-solidity impellers in CIL applications is reducing carbon breakage. With more mixing at a lower tip speed, the design minimises the mechanical stress on activated carbon particles, preserving integrity and enhancing absorption capacity. This boosts efficient gold recovery and reduces the need for frequent carbon replacement.

Through impeller design optimisation, these mixers require less power to achieve desired mixing results, leading to significant energy consumption savings. When comparing the impeller power number (Np) to the impeller flow number (Nq) of other types of impellers, the AM mid-solidity hydrofoil provides maximum flow while reducing the mixers’ operating costs. This efficiency contributes to a lower cost of ownership and a more sustainable and environmentally friendly gold leaching process.

Mid-solidity impellers are versatile and can be effectively used in various stages of the gold leach and CIL processes. Their robust design ensures reliable performance and longevity, making them suitable for challenging environments. Whether in the initial leaching tanks or the final CIL stages, these impellers consistently deliver high-quality mixing results, thereby enhancing the overall effectiveness of the gold extraction process.

Maintaining the optimal performance of equipment is crucial. Agitators essential for mixing and maintaining homogeneity in gold leach or other applications can benefit from a review of the installed mixer.

HG’s approach to upgrading agitators involves thoroughly assessing the existing equipment and process requirements. EBARA HG can recommend and implement upgrades that enhance performance using the latest impeller technology and extensive process knowledge.

Industries evolve, and so do their processes. Changes in production methods, raw materials, or regulatory requirements can necessitate modifying existing agitators.

EBARA HG’s flexibility and adaptability makes it an ideal partner for retrofitting agitators to meet new process demands. EBARA HG provides customised solutions, ensuring upgraded equipment aligns perfectly with the updated process parameters.

EBARA HG’s portfolio includes a variety of Hayward Gordon mixers and agitators, each designed to handle specific applications and built to deliver reliable and efficient performance. This versatility allows the company to cater to various industries, from mining to chemical processing.

EBARA HG’s commitment to innovation and quality makes it a leader in agitator upgrades and retrofits. EBARA HG’s ability to diagnose performance issues and adapt to changing process requirements ensures its clients can maintain optimal operations. In choosing the Hayward Gordon brand, industries can benefit from enhanced efficiency, reduced operational costs and improved product quality.

For more information, visit ebarahg.com

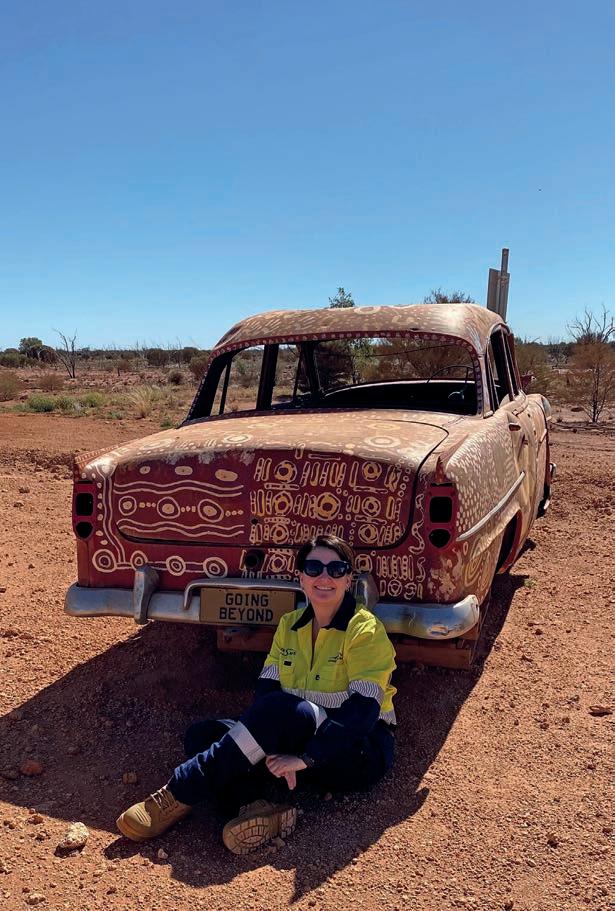

The dust has officially settled on the 2024 WA Mining Conference and Exhibition, and Mining is here with your comprehensive event wrap-up.

For the fifth year in a row, the WA Mining Conference and Exhibition took over the Perth Conference and Exhibition Centre. This year’s event experienced the highest attendance in its history, with more than 3,000 visitors attending the twoday event.

From 9–10 October, the PCEC was transformed into a hub of technological innovation, with state-of-the-art solutions on display for attendees, across the expansive exhibition floor.

The 2024 exhibition floor featured an expanded range of exhibitors, with big names including Epiroc, ifm, Motion, RaptorTech and Blackwoods all showcasing their latest innovations and cutting-edge technology.

(L-R) Mining Editor,

Upton, Research Portfolio Manager at Minerals Research Institute Western Australia, Geoff Batt, and United Nations Association of Australia (WA

Environment Committee Convenor, Dr Silvia Lozeva, discuss developing a circular economy for critical minerals.

The extensive speaker conference attracted a stream of delegates encompassing the breadth of the resources sector, examining areas such as decarbonisation, tech-driven mining operations and developing a circular economy for critical minerals, to name a few.

Experts from industry, academia and government shared their insight, case studies and thought leadership, including a panel discussion with Rio Tinto and asset- and material-tracking specialists Track’em on empowering operational excellence.

Western Australian Mines and Petroleum Minister, David Michael, kicked off the conference on day one,

telling attendees that the Western Australian mining sector has plenty to be excited about.

“It is clear from the breadth of topics on the conference agenda that the sector remains strong and there are opportunities on the horizon.

“Tech in the Western Australian mining sector has been applied to a range of industries and regions worldwide. The continued innovation we see is crucial as companies and governments seek solutions and adapt to climate change,” Minister Michael said.

“Western Australia is already well established as a global resources leader, and this will continue to grow into the future.”

Other presentations from key industry personnel included Minerals Council of Australia, Executive Director – Western Australia, David Parker, Alcoa Principal Research Scientist, Talitha Satini and Head of Economics at the Chamber of Minerals and Energy Western Australia, Aaron Walker.

Throughout the two-day event, Mining took to the floor to hear from some of the event’s exhibitors.

Rick Hurlbatt from Viper Metrics said that the 2024 event was the company’s second year at the show and it was much more successful than last year.

“We had a lot more people coming through and lots of good conversations

that are 100 per cent conversations that we probably wouldn’t get access to

Mr Hurlbatt said that crowd attending the 2024 event had a lot of diversity, which was “fantastic” for the company.

“We don’t do a lot of advertising outside of this event, and this really brings in some new leads who wouldn’t have heard about the products before,” he said.

It’s a sentiment that was echoed by National Account Manager for

“It’s been a good flow of people with lots of new networking opportunities and people to talk to – both suppliers that are exhibiting and just wandering through, and also end-users and customers as well, which is great.”

Mr Bodel said that Blackwoods has such a vast range industries and verticals it works in, so exhibiting at WA Mining gave it a chance to demonstrate its capability and understanding, build its network and find the right people to talk to.

“You very rarely get an opportunity to get everyone in the same room,” he said. “Mining in Western Australia and across Australia is very region-based. It’s very hard and costly to go see all of those and many of those.

“These events give you an opportunity to try and draw those people into one room and one space, to try and capture as much as you can, and is an easy and streamlined way to then follow up later.”

Local Perth business RaptorTech exhibited at the event for its second time in a row. Aaron Locke, one of the founders of RaptorTech, said that exhibiting at WA Mining was incredibly important for brand recognition.

“We kicked off about six years ago as a business, and when you come out, no one knows who you are.”

Mr Locke said that even if RaptorTech doesn’t directly sell anything at the show, it’s important that people know it’s there.

“We’ve got people who saw us last year and they’ve come back this year and seen how much our stuff’s evolved. They’re really interested in working with us,” he said.

“For us, its about getting that exposure that's in a crowded marketplace and is difficult to get.”

For the first time in the event’s history, the Australian Mining Prospect Awards were held on the first night of the WA Mining event.

Adorned in their finest formal wear, attendees were treated to floor-toceiling views of Perth’s skyline as they celebrated those who are excelling and going above and beyond in the industry.

The esteemed awards have been celebrating and rewarding innovation across the country’s resources sector for more than a decade.

This year’s Prospect Awards recognised industry excellence in eleven categories, with awards sponsored by some of the biggest names in the Australian sector.

A big congratulations again to the following winners:

♦ Indigenous and Community Engagement Award – Buru Rehab

♦ E xcellence in IIoT Application Award –Orica Digital Solutions

♦ E xcellence in Environmental Management & Sustainability Award –BHP’s West Musgrave project

♦ E xcellence in Mine Safety, OH&S Award

– Roy Hill’s ‘Safer Summer’ program

♦ Project Lead of the Year –Claude Mocellin

♦ Innovative Mining Solution –IPI Australia

♦ Outstanding Mine Performance –Mineral Resources

♦ Mine Project Success of the Year –Robson Civil Projects

♦ S afety Advocate of the Year –Lani Hilder

♦ Discovery of the Year – IGO

♦ Australian Mine of the Year – Roy Hill

This year was Prime Creative Media’s first time holding the event and General Manager of Events, Siobhan Rocks, is eager to build on the event’s exceptional reputation.

“Western Australia is an important market for the mining industry, and we’re focused on connecting buyers in that market, so they don’t have to come all the way over to the eastern seaboard to talk to people within mining communities,” she said.

“At the end of the day, we’re here to connect mining businesses, and our packed exhibition floor showcased technical and digital innovations across the entire resources value chain.”

Ms Rocks said she is delighted that so many people from Western Australia’s mining industry turned up to celebrate the industry.

“It’s clear from discussions at the event that the industry is undergoing a tremendous amount of change and we’re excited to continue to champion the sector’s growth and success.”

The WA Mining Conference and Exhibition will return in October 2025, and Ms Rocks said the team is taking on the feedback they received from this year’s attendees to make next year’s event bigger and better.

“The team have hit the ground running and are already looking towards the next event,” Ms Rocks said. “We’re excited to be involved in championing Western Australia’s dynamic and world-leading resources sector.”

Off-site machine repairs delay projects and hurt profitability, which is why delivering on-site maintenance for heavy mining equipment is crucial to maximise uptime and minimise costs.

Field Machine Tools (FMT) – an Australian-owned company that has grown to become one of Australasia’s leading suppliers for specialist on-site maintenance machines – was recently announced as the Australian distributor for Specialised Fabrication Equipment (SFE) Group.

The partnership is set to drastically increase FMT’s product range with specialised tools and equipment that will help it better service the mining industry.

SFE Group was formed with the vision of merging various fabrication tool businesses and brands together to offer the world’s most comprehensive range of orbital welding, fabrication, precision engineered applications and cutting solutions for a wide variety of industries.

It was founded in 2019 after the merger of three world-leading original equipment manufacturers in the field of fabrication equipment, tooling and machinery: B&B Pipe and Industrial Tools LLC, Mathey Dearman Inc and TAG Pipe Equipment Specialists. SFE Group has also acquired the AXXAIR Group, Magnatech LLC and, most recently, Climax Portable Machining & Welding Systems LLC.

Climax offers on-site repair and maintenance machines, reducing downtime and keeping equipment like excavators, tractors, loaders and cranes operational. Thousands of companies worldwide rely on Climax to maintain their fleets and maximise machine uptime.

Mining operations are remote and challenging, with fierce competition and thin profit margins. Downtime is costly, making portable machine tools essential. Climax has long been trusted by the mining industry for its reliable and efficient tools.

Underground repairs require versatile, adjustable equipment to perform

efficiently in cramped conditions. The Climax BB5000 line boring machine meets these needs with its compact design and 30-minute installation. It integrates with automated welders, enabling simultaneous boring and welding to improve productivity.

By combining forces with Climax, SFE Group now offers the world’s most extensive range of highly engineered industrial tools for portable machining, cutting, orbital welding and specialised fabrication. Climax offers one of the most comprehensive product ranges on the market with over 53 years’ experience in the industry.

As the Australian distributor for SFE Group and an existing supplier of Climax tools and products, FMT has cemented itself as Australia’s leading supplier for specialist on-site machining equipment and portable maintenance machines.

FMT Group provides a very broad range of products and accessories for the industries it serves. By developing relationships with job shops and manufacturers in the US, Europe and other overseas sources, FMT delivers quality products to Australia. This strategy enables FMT to furnish customers with the best products available and the most affordable pricing in the industry.

For more information, visit fmt.com.au

By Guy Boggs, CEO of the Cooperative Research Centre for Transformations in Mining Economies (CRC TiME)

Decades ago, the concept of mine closure – the process of planned decommissioning and rehabilitation of a disturbed site – expanded the mining life-cycle.

This expansion was in response to environmental legacies left by sites previously considered to be effectively remediated and others that had been abandoned by poor operators.

Much time, investment and expertise has deepened understanding of the environmental, technical and other challenges of mine closure since then.

Driving much of this work was the mindset that returning land to its prior state should be the goal. Yet, while there is a growing catalogue of instances of land restored to native vegetation or for pastoral or other agriculture use, there are still too few examples of sites being relinquished.

Recognition of the social, economic, environmental and cultural complexity of mine closure and post-mine transitions is increasing alongside costs associated with delivering commitments. Many companies have had to revise upwards publicly disclosed closure liabilities.

This is occurring at the same time as regions across Australia – and globally –are preparing for or undergoing structural transformations as mines end production. It’s also important to remember the fundamental truth that all mines will eventually close.

With almost 240 mines in Australia expected to close by 2040 – about ten per cent of all current mines – the time is now to change the industry’s approach.

Importantly, there is increasing recognition of the need to do so. And, at the core of this, is recognition to shift focus from what is being transitioned out of – mining – to what is being transitioned into.

Changing the frame can help put the collective focus on how value is optimised and can be delivered through closure phases of mining and positions all stakeholders for their post-mine future.

Changing the frame can also help see the opportunities within mine closure and transitions, despite the challenges.

In 2023, CRC TiME partnered with CSIRO on the Enabling mine closure and transitions: Opportunities for Australian industry report – the first exploration of the market in mine closure technology, services and equipment for local, Indigenous and Australian enterprises.

Landmark analysis found expenditure on mine rehabilitation and closure activities could exceed $4 billion each year to 2040.

This alone sets out a compelling case for coordinated action to turn the domestic challenge into local and global opportunities.

As the report notes, this $4 billion expenditure represents a demand for equipment, technology and service solutions that optimise mine closure and transitions to both reduce closure costs and create better environmental and social outcomes.

Recovery of resources in mine and tailings is gaining increasing attention. CRC TiME’s mine closures industry report noted the business opportunity in solutions that enable efficient and precise mineral extraction and processing to reduce the volume of waste generated during mining

waste management liabilities at closure.

This is being seen in development and deployment of novel low-impact and precision mining technologies. For example, EnviroCopper is undertaking pilot-scale projects to extract copper from legacy copper mines in South Australia. Solutions are also needed to re-use mined waste rock piles for use on mine sites or in other industries, reducing waste volume managed during mine closure processes. For instance, waste rock and tailings are commonly co-disposed to backfill mining voids with physically stable mixtures, where economically feasible. Or construction materials for local infrastructure can be produced via circular economy principles.

Developing technologies to characterise and recover critical and strategic minerals resources from mining waste, potentially offsetting the costs of mine rehabilitation activities, is another growing field. Australia’s Mine Waste Atlas, hosted by Geoscience Australia, presents a world first pre-competitive data set to support project development.

Repurposing and transitioning for post-mine use

The mining estate covers disturbed and non-disturbed land and has direct and indirect relationships with many regional communities across Australia. The mined landscape is now being viewed through a lens of value and how the investment being made can position assets for future use.

CRC TiME’s foundational study on post-mining land uses across Australia and global case studies, featured in the recently released book 102 things to do

with a hole in the ground, highlighted the breadth of novel uses being found for mining features, ranging from tourism opportunities to hosting renewable energy projects or even internationally significant dark matter research facilities.

A values-based shift to nature, driven by nature positive and decarbonisation commitments being made by different sectors and investment community is also leading to a relook at land under mining stewardship. This raises questions on how and where investment is best directed to optimise natural capital value.

Partnerships and governance structures that bring post-mine stakeholders into decision-making processes as early as possible often lead to novel solutions being progressed and are critical to a valued and accepted post-mine transition. Developing new solutions can enable effective engagement, co-design, and mutually beneficial partnerships to improve social performance, reduce social and governance risks and optimise outcomes. These include tools for inclusive communication, facilitation of complex stakeholder engagements and data management solutions.

The creation and continuation of business and employment opportunities for First Nations and regional communities delivers long-term benefits. Traditional knowledge, stewardship practices and deep connection to Country are invaluable cultural assets to protect, nurture and actively support.

Aboriginal and Torres Strait Islander Peoples and businesses can economically benefit in the emerging industry of sustainable seed collection services for revegetation and rehabilitation. Training a new workforce in seed supply

services is already on its way, with examples like the Gelganyem Seed Project, the collaboration within the Midwest Employment and Economic Development Aboriginal Corporation, Kakadu Native Plants rehabilitating the Ranger project, and Rio Tinto’s Weipa bauxite mine being supplied seeds by Aurukun, Paranum and Mapoon collection groups.

Traditional Owners are vital in improving closure and post-closure outcomes. Kia Dowell, Chair of Gelganyem, explains Traditional Owner Business involvement in the closure and rehabilitation of the Argyle diamond mine:

“Traditional Owner Businesses (TOBs) play a crucial role in the mine closure process by providing a broad range of services including earthworks and civil packages, plumbing, electrical, maintenance, environmental monitoring, land management, cultural awareness training and cultural heritage protection. There are 21 TOBs on site, seven off site (not working on ADM closure) and four new businesses (still getting established).”

The consistent message heard at CRC TiME is the need for better and new resources to guide potential post-mining land use activities and recognise the transition capacity of regions. Put simply, it is a need for tools that support the transition to what’s next.

Together with partners across different regions, CRC TiME is developing tools to support:

♦ Regional cumulative effects assessment and management, including guidance, a roadmap, toolkit and principles for integrating Indigenous and Western knowledges

♦ Collaborative planning for people

navigating mine land transition through a deliberative, consensusbuilding process that provides lessons for other regions in transition Regional workforce planning, including a new regional employment forecasting tool to understand the effects of diversification currently being piloted in the Bowen Basin, Queensland and Bell Bay, Tasmania Legacy and post-mine atlas concepts, including developing atlases on water, sites to potentially host renewable energy resources and mineral byproducts that can support regional planning, including attraction of new post-mine investment

Together, these tools will better equip regional communities, miners, postmine investors, Traditional Owners and businesses and governments to create and deliver solutions that best align with regional economic futures.

If the goal is to transform the mining lifecycle for the better, people involved in mine closure and transitions need the right skills at the right time to understand what is possible.

Given the current mine closure education and training options across the country were unclear and scattered, CRC TiME engaged the Mining and Automotive Skills Alliance (AUSMASA) and Business Skill Victoria (BSV) to undertake a strategic review of the available offerings.

Interestingly, in Australia, only 36 professional development courses cover mine closure in some form; of those, only two do so specifically. Fifteen higher education units exist with mine closure as a learning outcome, and there is no VET qualification in mine closure currently available.

CRC TiME is working to fill this gap, with cross-cutting education and training projects. CRC TiME is partnering with Curtin University (CU) on an Indigenousled project to develop VET products relating to mine closure and post-mine transitions. CU and the University of Queensland delivered the world-first Mass Open Online Course ‘Foundations of Mine Closure and Sustainable Transitions’ in 2023-24 as part of this program.

Re-framing the transition of mines post-closure as an opportunity raises questions, challenges and innovation. What is clear is there are significant benefits to all stakeholders that can be realised through this new approach.

The fluids in mining applications are among the most volatile that a pump can move.

The mining industry puts pumps through more extreme conditions than any other sector, which is why choosing the right equipment is vital.

Pumps on mine sites face a variety of harsh conditions and operational challenges that can lead to equipment failure, and therefore costly downtime and repairs.

The most prevalent cause of mine dewatering pump failure is clogging from gritty, suspended solids and slurry. Water that makes direct contact with the operation is often dirty, containing foreign materials such as drill cuttings or solids generated by site traffic.

To overcome this issue, site managers can use a pump with solids handling features, such as abrasion-resistant coatings and lip seals to prevent solids from contacting the mechanical seal.

The fluids in mining applications are among the most volatile that a pump can move. From superheated water laden with pyrite, iron or sand, to emulsified brine phase drilling fluid, there is no shortage of liquids that will punish a pump over time.

Even the hardiest equipment can succumb to corrosion, so it is important to choose pumps that are designed to be resistant to harsh materials, and to perform regular inspections to catch corrosion issues before they turn into costly failures.

A supplier that knows the score

Established in 1968, ROTO Pumps is a pioneering manufacturer of progressive cavity pumps in India, with more than 50 years’ experience providing high-quality, efficient and reliable pumping solutions to a wide variety of industries.

ROTO Pumps has exported its pumping solutions to more than 50 countries around the world, demonstrating its dependability as a manufacturer and supplier of high-quality equipment.

It has been a supplier of pumps directly to Australia since 2001 – its first warehouse outside of India. With its head office in Dandenong and satellite sales managers in Sydney, Brisbane and Perth, ROTO Pumps’ reach is steadily growing as end-users recognise its high-quality products and expertise.

Purpose built and industry tested

The earliest of ROTO Pumps’ products were used in a variety of mining operations, thus ROTO Pumps’ niche in the sector is strongly rooted in its more than half a century of experience providing dependable pumping solutions for critical applications.

ROTO Pumps understands that pumping equipment must be especially robust to withstand the harsh conditions of the resources sector. Responding to the needs of the industry, ROTO Pumps offers a range of solutions proven to be effective in a variety of mining applications, including mineral processing, slurry transfer, dewatering, emulsion matrix, cement and slurry transfer, water spray for dust suppression and other general applications.

ROTO Pumps offers technical consultation services to assist customers in selecting the optimal pumping solution for their specific application. ROTO Pumps’ experts analyse site conditions and fluid properties and recommend the most efficient pumping solution.

ROTO Pumps also offers a preventive maintenance service to ensure troublefree operation of pumps in the long run, including services for equipment from other manufacturers.

For more information, visit rotopumps.com.au

E mpowering your mine operations with Roto’s high pressure flexible shaft series pumps. Unleash the solution that challenges excess wate r, ensuring safe and efficient operations ; the Underground Maintena n ce Engineers’ Choice for ground water control.

Features:

•Robust construction for prolonged life and reliable performance

• Adaptable for challenging underground environments, available in fixed station configurations for single lift or staging along with portable packaged solutions

• Forge a direct connection with the manufacturer, ensuring personalised support,

By Michael Rundus, EY Regional Mining and Metals Leader, Oceania

A new report from EY explores how the energy transition is disrupting the sector and permeating 2025’s risks and opportunities radar.

1. Capital

2. Environmental stewardship

3. G eopolitics

4. Resource/reserve depletion

5. License to operate

6. Rising costs and productivity

7. Climate change

8. New projects

9. Changing business models

10. Innovation

Capital takes top spot

Mining companies are under increasing pressure to manage capital effectively while making strategic investments in future growth. The huge demand from the energy transition means miners must increase output and grow.

Environmental stewardship ranks second in the report this year, with miners elevating it above a broader focus on environmental, social and governance (ESG). This is largely driven by growing investor expectations and new environmental standards.

According to the survey, nearly half of the industry’s leaders (46 per cent) are confident in their ability to fulfil their nature-positive obligations – underscoring a broader commitment to address environmental concerns proactively.

Waste management is another area of scrutiny from investors. This year, the focus on waste extends beyond

biodiversity, water management and other critical ESG issues across the sector.

Concerns amid rising demand

Resource depletion, ranked fourth, and new projects, ranked eighth, are new risks identified in the study this year, driven by soaring demand for minerals and rising exploration and construction costs.

Achieving global decarbonisation targets by 2050 will require a significant increase in the number of mines and volumes produced. However, capital raised for exploration has declined by four per cent year-on-year, with budgets favouring gold over future-facing minerals like copper. Lack of new discoveries and long permitting times add further complexity to the situation and put the energy transition at real risk.

With few major copper discoveries in the last decade and a global average of 15.7 years to bring a new mine online, the industry is facing a critical supply gap.

Geopolitics ranked higher in the latest survey than it did previously, with more companies realising the necessity of building resilient supply chains and initiating alternative strategic options, including partnerships and joint ventures.

Four risks fell out of the top ten in EY’s latest report – governance, cyber, digital and workforce. The omission of cyber and digital could be due to an increase in awareness and the widespread use and integration of digital solutions into everyday business. Although there is still a focus on cybersecurity, exclusion from the list could mean that companies are at the post-implementation stage whereby they are managing and maintaining solutions.

Ongoing skills and labour shortages continue to plague the industry, making the omission of workforce from the list surprising. Workforce risks have a significant ripple-on effect on other risks, yet as many as 55 per cent of survey respondents did not include it in their top ten ranking.

Forging a sustainable path forward EY’s findings show a mining sector tasked with a monumental challenge: to significantly increase the production of minerals for the energy transition, while navigating capital discipline and strategic growth amidst a backdrop of economic uncertainty, resource depletion, heightened ESG expectations and the complexities of launching new projects.

It is no easy feat. Yet, the future of the energy transition – and indeed, the planet – depends on the sector’s ability to respond effectively to these pressing demands.

Mining operations are now being asked to deliver more, while under pressure to use less (energy). To address this challenge, the industry is increasingly adopting variable frequency drive (VFD) technology to control the speed of energy-intensive rotating equipment.

This adoption is driven both by the need for flexible production rates and the significant energy savings achievable through effective VFD implementation. The energy-saving potential of VFDs varies depending on each application.

Although most VFDs can now achieve around 98 per cent efficiency levels, when looking at higher power applications, or multiple lower powers, the combined efficiency loss can result in significant heat generation which must be considered during design stage for sizing of external cooling systems.

For active front end/low harmonic technologies these losses can be more than doubled. To dissipate heat, traditionally external air-conditioning systems are introduced to supply sufficient cooled air to the VFD systems,

which is then recycled into the room to be cooled once again. These cooling systems also add substantially to the total energy consumed, and level of investment required.

Many years ago, to combat this, Danfoss developed an innovative ‘back channel cooling’ concept for its VLT Drive series which removes up to the 90 per cent of the generated heat without the need for large external air-conditioning systems.

Now, with the introduction of iC7-Automation, the next generation of intelligent VFDs, the good news for the mining industry is that Danfoss will continue with this cooling design as part of this new series, resulting in large savings on both CAPEX and OPEX of mining processes.

Reliability of plant will be critical to meeting the production demands of the mining industry. A loss of production through a system breakdown can cost companies enormous losses both in revenue and reputation.

With the latest VFD innovation, Condition Based Monitoring (CBM) now offers the possibility to monitor and

report on the performance of external critical mine processes. Although remote monitoring via cloud connectivity is now commonly available, not all customers wish to adopt this for reasons including expense to implement, and the increasing concern of cyber-attacks.

To offer customer confidence and flexibility, Danfoss has introduced the world’s first cyber-secure VFDs with crypto chip technology and drives with EDGE computing technology.

This now gives customers freedom of choice as to whether data is gathered securely from the cloud or on a local level (EDGE) within the mine. Through continuous monitoring of critical mining processes, the VFD can now detect performance deviations and predict potential failures, before they occur, enabling proactive maintenance, minimising disruptions to mine production.

Craig Rapson

Global business development director industry – mining, minerals, cement Danfoss Power Electronics and Drives

For more information, visit danfoss.com

The iC7 series brings unique secure-by-design drives, increasing your security against cyber-attacks

By Tara Diamond, Deputy Chief Executive, Australian Resources and Energy Employer Association (AREEA)

Recent modelling reveals Western Australia’s resources and energy sector will need a minimum of 11,000 new workers by 2030.

Right now, it can sometimes feel like the industry is trying to catch a break.

Rapid technological shifts, global supply, demand and price volatility and broad and impactful IR changes are among the challenges. But the echo of the past is a reminder that the sector is never static.

There’s always been a barrier to face and overcome and there’s always been the promise of a reward for overcoming it.

AREEA’s Resources and Energy Workforce Forecast 2024-2029 report, released in September 2024, reflects both sides of this story.

In the 12 months to May 2024, the national resources and energy workforce shed some 35,000 jobs. More than 20,000 of these losses happened in Western Australia – the powerhouse state of mining and energy investment.

Notably, capricious international prices for critical minerals and rare earths suspended work at key Western Australian nickel and lithium operations –which only a year earlier were riding high.

On the east coast, regulatory red tape, activism and lawfare have blocked major ventures such as the Regis Resources McPhillamys gold mine.

Notwithstanding these challenges, the pipeline of major projects remains strong.

The Resources and Energy Workforce Forecast 2024-2029 breaks down the estimated labour required to operate new, expansion and restarted mining, oil and gas projects.

The report shows there are 107 major resources and energy projects in Australia’s investment pipeline – either already committed or considered advanced – expected to enter production between the second half of 2024 and end of 2029.

These projects are worth about $131 billion and are forecast to drive demand for around 26,810 new production-related jobs.

While estimates are slightly down on last year’s report covering 2023-2028 (103

projects worth $142 billion and 28,000 jobs), the consistency reported across AREEA’s past five editions demonstrates the ongoing attractiveness of Australia as a place for major resources project investment.

Mining commodities retaining their traditional strengths include coal (13 projects for 4,836 workers), iron ore (eight projects for 4,495 workers), gold (13 projects for 2,830 workers) and critical minerals (14 projects for 3,078 workers).

Meanwhile, the energy industry continues its mini-investment boom, with 19 prospective projects that could drive demand for 3,410 new operating phase employees by the end of 2029.

The world’s energy security will depend on gas continuing to play a crucial role in the global energy mix. That’s even as resources and energy businesses adapt and innovate, using advanced technology and upgrading skills to ensure productivity and job security across the industry are enhanced and strengthened. This is on top of developing those low-cost, lower carbon strategies and technologies that will keep the sector robust and profitable.

Western Australia remains the epicentre of the resources and energy industry, with 48 projects in its investment pipeline forecast to create demand for 11,065 new workers.

That equates to 40 per cent of the national forecast workforce growth over the next five years.

Western Australia remains diverse and prosperous: of 37 mining projects, iron ore will spur demand for 2,095 workers, led by Southdown, Western Range and Lake Giles – all by the end of 2026. Seven gold projects, including Hemi gold and the KCGM mill expansion, should see nearly 1,700 new workers needed by the end of 2027.

While lithium potential (seven projects, 970 workers) has eased, it will, together with other critical minerals and rare earths (seven projects, 1,000 workers), continue to support a buoyant labour market.

Four copper projects – with West Musgrave the jewel in the crown – will require around 1,200 workers by the end of 2026.

A range of other minerals, including nickel, cobalt and alumina, make up eight projects requiring about 1,500 workers across the forecast period.

While these projections are a wonderful sign for the industry after recent job losses it’s a matter of filling the positions – and the industry has struggled over the past few years with skills shortages in crucial occupations and roles.

Engineering and geology are two of the highest skills in demand, but geoscience graduates are in major decline and reports have projected an engineering skills crisis by 2040.

That said, the on-the-ground challenge of finding people seems to have tapered off slightly from two years ago.

A big part of the battle is the notion that mining is not going to be around forever. Nobody could dispute that the industry has changed from 20, or even five, years ago. However, strong growth clearly continues, with thousands of job opportunities. It’s just that many of the jobs are different and will be different –requiring high tech and other new skills.

A lot of effort needs to be dedicated towards attracting people into the sector, ensuring awareness of the great prospects of a long-term career. There's no magic solution. It’s about pulling all the levers in a multifaceted approach.

That means a well-funded, coordinated and navigable education system so the VET sector and universities produce courses and learning outcomes aligned to what the industry needs.

Industry must also appeal to the next generation’s curiosity and forwardthinking by accentuating rapidly increasing automation, robotics and high-tech skills and roles.

The industry is changing, and the workforce conundrum is an evolving challenge, but one the industry is certainly up for.

AREEA has vocally opposed the Federal Government’s sweeping IR ‘reform’ agenda.

New union workplace rights, the ‘right to disconnect’, multi-employer bargaining, regulated labour hire arrangement orders and revised

conditions around casual employment are already impacting the mining industry.

While AREEA shares the government’s vision for a “dynamic and inclusive labour market”, this can’t be delivered without a flexible workplace relations system that supports productivity growth and competitive businesses.

Budget windfalls in Western Australia, Queensland and the first two consecutive federal budget surpluses in 16 years were delivered on the back of record commodity export volumes and $74 billion in annual tax and royalties.

Excessive regulation, red tape and unnecessarily complex industrial relations transaction costs will only blunt this achievement and cost jobs.

A carefully balanced approach to regulation is imperative to fostering the investment and innovation the mining sector needs.