GLOBAL STANDARD FOR SUSTAINABILITY AND CLIMATE REPORTING

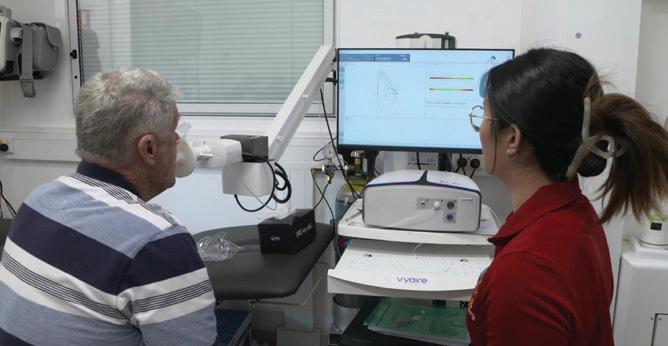

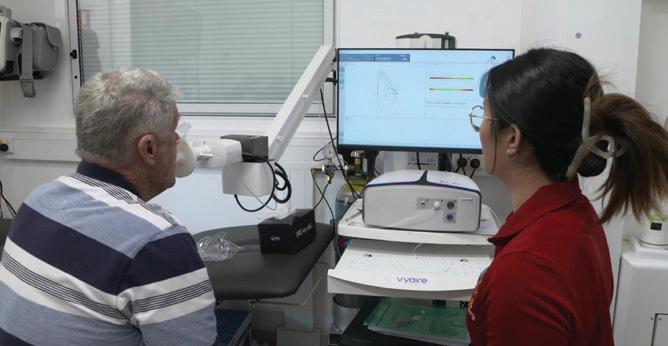

NSW MINING INDUST � Y SHAKEUP HEALTH CHECKS SAVING MINERS’ LIVES

Issue 5 \\ Summer 2023 \\ www.miningmagazine.com.au SMART | CRITICAL | CIRCULAR | DIGITAL

Established in 1995, Field Machine Tools has thrived as a privately owned Australian company supplying portable maintenance machines and engineering solutions to clients across Australia. The business aims to flatten production downtime by providing operators with the most complete scope of products and accessories for industries across Australia and beyond. 1300

BRISBANE A: 2, 5 Percy Drive, Brendale, QLD, 4500 P: (07) 3889 7622 E: sales@fmt.com.au PERTH A: 3, 48 Hardey Road, Belmont, WA, 6104 P: (08) 9470 6088 E: sales@fmt.com.au MELBOURNE A: 1, 53-57 Rimfire Drive, Hallam, VIC, 3803 P: (03) 9703 2250 E: sales@fmt.com.au Keep your plant, pipe and valve infrastructure strong with Field Machine Tools

368 368 www.fmt.com.au www.fmt.com.au 1300 368 368

Tess Macallan

Kody Cook

Yasmin Isaacs

Alejandro Molano

Senior Designer

Luke Martin Designers

Danielle Harris

Jacqueline Buckmaster

National Media Executives

Rima Munafo

Brett Thompson

Ryan Sheehan

Radhika Sud

Marketing Associates

James Holgate Rhys Dawes

Isabella Predika

EDITOR’S WELCOME

As the weather starts to warm up, and 2023 begins to wind down, it is a pleasure to bring you the final edition of Mining Magazine for the year. And what better way to charge into summer and the new year than with a copy of Mining Summer tucked under your arm?

The close of another year brings us one step closer to achieving the net zero emissions goals set by the industry. To tackle these challenges, countries around the world are working harder than ever to build reliable critical minerals supply chains. As such, Australia’s critical minerals industry was never far from the spotlight in 2023, with overseas tours to secure international partnerships, and the Federal Government pledging a $2 billion expansion in critical minerals financing.

In the final magazine of the year, we take a deep dive into tungsten and unpack the revival of tungsten projects in Australia and the mineral’s significance in the green transition.

Mine rehabilitation continues to be a priority for the industry, and in this edition of Mining we hear from Ravi Naidu from Contamination Assessment and Remediation of the Environment (crcCARE) about how a unified national approach to rehabilitation and remediation of mine sites across Australia is needed going forward.

This edition also includes articles from health experts examining the dangers of silica dust, the increase in silicosis diagnoses in former miners and the mobile health units offering free lung screening in Queensland.

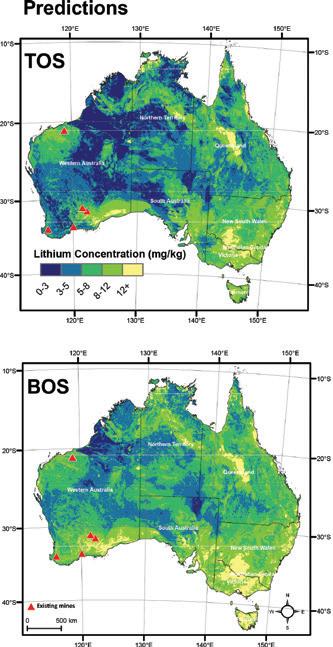

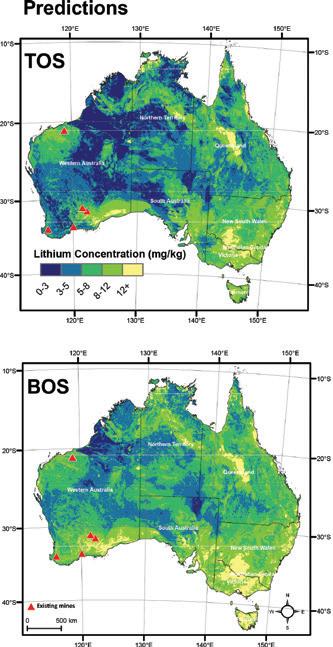

Innovations in mineral exploration are continuing to drive the industry, including Sydney University’s creation of the first digital map of lithium content in Australian soil and drone-based magnetometry facilitating exploration in remote and inaccessible locations.

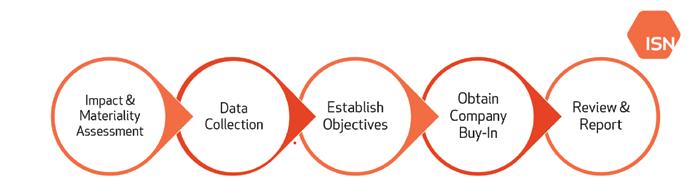

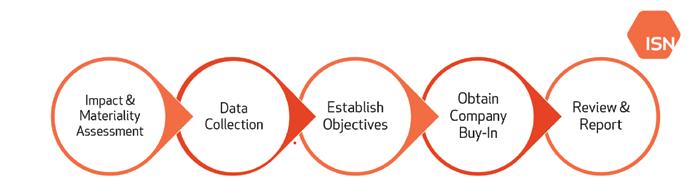

With additional features on creating ESG roadmaps and engaging with artisanal miners, Mining Summer is full to the brim with the latest topics that are rocking the mining industry.

2023 has seen a great deal of progress and innovation across the industry and all the signs are pointing to 2024 being another big year for the industry. I wish all Mining readers happy holidays and a safe new year.

As always, if there’s a topic, project, technology or challenge you’d like to read in future editions, please feel free to flick me an email – I’d love to hear from you.

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 1 ISSUE 5 - SUMMER 2023 | MINING

Rebecca Todesco Editor Drop Rebecca a line at rebecca.todesco@monkeymedia.net.au or feel free to call her on 03 9988 4950 to let her know what you think. Don't forget to follow Mining Magazine on social media – find us on LinkedIn, Twitter and YouTube. Scan to subscribe to Mining Magazine’s weekly newsletter – delivered to your inbox every Wednesday afternoon. Monkey Media Enterprises

36 426 734 954 C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066

(03)

4950

Editor

ABN:

P:

9988

monkeymedia.com.au info@monkeymedia.com.au miningmagazine.com.au info@miningmagazine.com.au

Rebecca Todesco Journalists

Design Manager

Marketing Manager

Digital Marketing Assistant

Emily Gray Publisher

Editor

ISSN: 2653-634X Published by This document has been produced to international environmental management standard ISO14001 by a certified green printing company.

Chris Bland Managing

Laura Harvey

Mining Magazine acknowledges Aboriginal Traditional Owners of Country throughout Australia and pays respect to their cultures and Elders past and present.

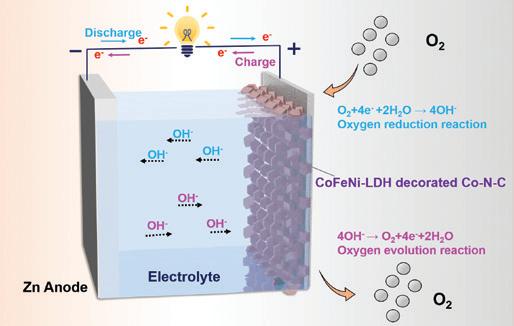

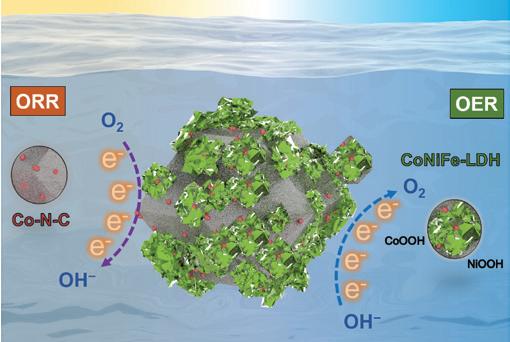

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 2 10 46 32 36 MEETING THE CHALLENGE OF POWERING EXTREME APPLICATIONS 36 MOVE OVER LITHIUM, THERE’S A NEW BATTERY IN TOWN 38 ENGAGING WITH ARTISANAL MINERS: AN OPPORTUNITY FOR VALUE 46 Artisanal scale mining (ASM) often shares land concessions with large-scale mining projects. As extensions of neighbouring communities, these miners are a unique stakeholder group that are integral for the community relationship focus of larger mining companies. TAILINGS MANAGEMENT TRAINING FOR PROFESSIONALS IN THE FIELD 32 Although there have been a number of high-profile failures of tailings storage facilities (TSFs) in recent years, including one in Australia in 2018, the failure of the Feijão (sometimes referred to as Brumadinho) TSF in Brazil in January 2019 has changed the industry irreversibly. TREATING RESOURCE - RICH WATER 40 A UNIFIED APPROACH TO MINE REHABILITATION AND REMEDIATION 42 THE CHANGING FACE OF INDUSTRY IN NEW SOUTH WALES 26 SKILLS SHORTAGES THREATEN INVESTMENT AND JOBS GROWTH 28 STAINLESS STEEL SOLUTIONS FOR PILBARA IRON PROJECT 10 SIX REASONS MINERS SHOULD CARE ABOUT SILICOSIS 12 When people think of the dangers of mine sites, they often conjure up images of heavy equipment, large haul trucks and explosive blasts. Less thought of are the subtler, long-term hazards that can affect the health and wellbeing of miners, including those that do not reveal their consequences until years later. FOUR FIFO GREEN FLAGS 14 THE MULTI - TALENT FOR THE MINING INDUSTRY IN AUSTRALIA 16 THE TUNGSTEN REVIVAL 18 INCREASING MINERAL INVESTMENTS IS FUTURE CRITICAL 22 SAVING ENERGY AND MONEY IS IN THE AIR 24 INDUSTRY INSIGHTS COMMODITIES IN FOCUS STAKEHOLDER ENGAGEMENT ASSET MANAGEMENT MINE REHABILITATION ENERGY EFFICIENCY CRITICAL MINERALS IN FOCUS 40 18 26

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 3 48 56 52 WORKWEAR THAT WOMEN WANT TO WEAR 52 EMPOWERING WOMEN IN RESOURCES: THE SISTERS IN MAINTENANCE PROGRAM 54 An inclusive and diverse workforce means a stronger, more productive mining industry. With the recent launch of its Sisters in Maintenance program, Thiess is providing new pathways for Aboriginal and Torres Strait Islander women to enter the industry. EDITOR’S WELCOME 1 ADVERTISERS’ INDEX 64 FEATURES SCHEDULE 64 THE ROLE OF DRONE - BASED MAGNETOMETRY IN ADVANCING MINERAL EXPLORATION 48 The use of drones in the mining industry has been taking off over the last few years, with an array of drone-based technologies being utilised to streamline mining operations, as well as for asset management and monitoring. Drone-based magnetometry is one of the technologies that is gaining traction in the mineral exploration sphere overseas and is under rapid development in Australia. MAPPING AUSTRALIA’S LITHIUM FRONTIER 50 GLOBAL FOCUS ON ESG IN THE SUPPLY CHAIN 56 A NEW ERA OF CLIMATE RELATED FINANCIAL REPORTING: WHAT MINERS NEED TO KNOW 58 ROUTINE CHECKUP GIVES SECOND CHANCE AT LIFE 62 JOBS AT RISK AFTER MOUNT ISA MINES CLOSURE ANNOUNCEMENT 4 LAWSUIT WARNING ISSUED TO CORE LITHIUM 5 NEWMONT OFFICIALLY CLEARED FOR NEWCREST ACQUISITION 5 UPDATED FEASIBILITY REPORT FOR MAJOR KAOLIN PROJECT 6 RESOURCE ESTIMATE UNCOVERS SECOND LARGEST GRAPHITE DEPOSIT IN AUSTRALIA 7 CHINOVA LOOKS TO SELL AUSTRALIAN COPPER - GOLD OPERATIONS 7 RIO TINTO TO RAMP UP GUDAI - DARRI IRON MINE PRODUCTIVITY 8 MOVEMENT IN THE INDUSTRY 9 INSTRUMENTATION, CONTROL AND MONITORING HEALTH, SAFETY AND ENVIRONMENT REGULARS

NEWS

WOMEN IN MINING

JOBS AT RISK AFTER MOUNT ISA MINES CLOSURE ANNOUNCEMENT

Glencore has announced that the Mount Isa Mines underground copper operations and copper concentrator will be closing in 2025, after operating for 60 years.

Mount Isa Mines’s other metals assets –including the copper smelter, George Fisher Mine, zinc-lead concentrator, and lead smelter in Mount Isa, as well as the copper refinery in Townsville – will all continue operating.

Glencore has conducted a range of studies and reviews seeking to further extend the life of the underground copper mines, but it has not been possible and the mines have reached the end of mine life.

The studies revealed that the remaining mineral resources are not economically viable due to low ore grades and areas where, due to geological conditions, safe extraction can’t be achieved using current technology. All of this is coupled with ageing infrastructure.

Glencore’s Lady Loretta zinc mine, located 140km north-west of Mount Isa, which was a finite orebody with a seven-year mine life, is also set for closure in 2025.

Glencore’s Chief Operating Officer of Zinc Assets in Australia, Sam Strohmayr, said that Glencore knows that the decision will be disappointing for its people, its suppliers, and the Mount Isa community.

“The reality of mining is that mines have a beginning, middle and end. And unfortunately, after 60 years of operation, Mount Isa’s underground copper operations have now reached that end,” Mr Strohmayr said.

“We want to give our people as much time as possible to consider the best options for them and their families, which is why we are notifying our workers and the community almost two years before these mines close.

“Our focus over the coming months will be to work closely with our people and contractors, our suppliers, and the Mount Isa community to provide support as we move towards closure of these assets.

“Our Mount Isa underground copper mines, copper concentrator and supporting services currently employ around 1,200 people.”

Mr Strohmayr said that it’s too early to put a figure on how many people may receive redundancies until Glencore works through a process of speaking to each worker and discussing options around retention, redeployment, and retraining.

Mr Strohmayr said redundancies are the last resort and will be offered only when other options have been exhausted.

“Glencore will continue to invest in the long-term future of Mount Isa Mines, including the George Fisher Mine with a current life of mine to 2036, and our zinc-lead concentrator and lead smelter.

“We also expect the copper smelter and refinery to continue operating to 2030, subject to approval of additional capital investment.

“These are important strategic assets, not just for Glencore but for the North West Minerals Province and the future of Queensland’s critical minerals industry.”

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 4 NEWS

LAWSUIT WARNING ISSUED TO CO � E LITHIUM

Tesla has issued Core Lithium a notice, warning about potential legal action after the Australian lithium producer failed to materialise a 2022 supply agreement by the set deadline.

The two companies failed to reach a deal by 26 October 2022, as decided earlier, and now Tesla is looking to take “all available legal remedies” unless the parties mutually resolve the matter, Core Lithium said in a presentation in August.

The notice of a potential legal claim is related to a binding term sheet the companies signed in March last year to negotiate the terms of a supply agreement under which Tesla would have received spodumene, a lithiumrich mineral.

The lithium producer was negotiating with Tesla to supply 110,000t of spodumene from its Finniss project in Australia’s Northern Territory.

NEWMONT OFFICIALLY CLEARED FOR NEWCREST AC Q UISITION

Newmont Corporation has announced that all of the government regulatory approvals necessary for the acquisition of Newcrest Mining have now been secured, after the Securities Commission of Papua New Guinea (SCPNG) granted it the necessary exemptions.

The Philippine Competition Commission (PCC) has also indicated its approval of the proposed transaction.

Newmont’s President and CEO, Tom Palmer, thanked Papua New Guinea’s (PNG) Government and said that Newmont is looking forward to building strong and mutually beneficial partnerships with the government and people of PNG to generate lasting shared value and meaningful economic development through the Lihir gold mine and the Wafi-Golpu gold and copper project.

“As the world’s leading gold company, we recognize PNG’s significant, untapped economic potential and support providing its citizens the opportunity to invest in and benefit from our operations, projects and social contributions,” Mr Palmer said.

Newmont also announced that it has taken steps to establish a dedicated Business Unit in PNG with the appointment of Alwyn Pretorius, who will assume the role of Managing Director and be based in Port Moresby. Newmont also plans to establish a secondary listing of Newmont stock depositary interests on the PNGX from closing of the transaction.

On 14 May 2023, Newmont announced its definitive agreement to acquire Newcrest.

The combination is expected to create a world-class portfolio of assets with the highest concentration of Tier One operations, primarily in favourable, low-risk mining jurisdictions.

Newmont and Newcrest anticipate the transaction closing in the fourth quarter of 2023, subject to the satisfaction of customary closing conditions.

Newmont stockholders voted on the proposed transaction on 11 October 2023, and MDT and Newcrest’s shareholder vote took place on 13 October 2023.

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 5 NEWS

UPDATED FEASIBILITY REPORT FOR MAJOR KAOLIN PROJECT

Andromeda Metals has released the results of an updated Definitive Feasibility Study (2023 DFS) for its Great White Deposit, following the conclusion of a commercial strategy review. According to the company, the Great White Project is construction ready, with the required permits in place.

The study found that the project’s Net Present Value (NPV) increased by 65 per cent to $1,010 million, and average annual earnings before interest tax depreciation and amortisation increased by 59 per cent to $130 million.

The increased NPV compared to the 2022 DFS, primarily results from:

♦ Strengthened global prices driven by geopolitical risk and global and regional supply shortages

♦ Enhanced product mix and partner portfolio

♦ Established high value in use of Andromeda products in key market segments

♦ An updated mine development plan (based on the Mine to Market response) that supports an accelerated sales profile and reduced costs across the life of mine

♦ Improved weighted average product margin by 34 per cent to $450/t of product

The commercial strategy review confirmed The Great White Project’s kaolin core product portfolio and identified a value in use that is above market in established and growing segments for high quality ceramic tiles and porcelain tableware.

Andromeda’s complementary product portfolio was defined as Great White HRM™ and industrial sand co-products.

In addition to the current established use of this product as a rheology modifier, the global market for low-carbon concrete production has been identified as a further opportunity to be commercialised.

Industrial sand co-products (not commercialised in the 2022 DFS) will be sold to meet the regional shortfall in the construction and infrastructure markets.

Subject to additional funding, the commercial strategy review identified an opportunity for High Purity Alumina (HPA) to become part of Andromeda’s complementary product portfolio. Technical and market validation is proposed to restart, after the project’s commissioning.

It is estimated $8-10 million will be required to complete a prefeasibility study on HPA, the commercialisation of which is not included in the 2023 DFS.

Andromeda said it is focused on the sustainable development of its future operations, through a low-impact approach to mining and processing over the life of the Great White Project, and effective, ongoing, and transparent consultation across all stakeholders, including First Nations people and the local community.

Andromeda Metals’s CEO and Managing Director, Bob Katsiouleris, said that the 2023 DFS represents the outcome of a rigorous commercial and business strategy review for commercialising our construction ready project, to meet rising market demand.

“As we move to finalising debt funding, the 2023 DFS will underpin our funding strategy for the remaining capital required to move towards anticipated construction and into production.”

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 6 NEWS

RESOU � CE ESTIMATE UNCOVERS SECOND LARGEST GRAPHITE DEPOSIT IN AUST � ALIA

Anew mineral resource estimate for International Graphite’s Springdale Graphite Project in Western Australia has exposed the site as the second largest known graphite deposit in the country.

The estimate was prepared by independent consultancies, OMNI GeoX and Trepanier, and is 3.4 times the previous estimate.

International Graphite Chairman, Phil Hearse, said that the results from an extensive drilling campaign in 2022-23 had surpassed all expectations.

“Not only have we significantly increased the size of the mineral resource, 27 per cent of it (by contained graphite) is now at an ‘indicated’ category which provides a strong foundation for future technical and economic studies,” Mr Hearse said.

“This is a huge achievement for the business and an important milestone as we drive to establish ourselves as one of the first vertically integrated producers of battery anode graphite. These results show that Springdale has the mineral resource base to underpin our mine to market vision for decades to come.”

International Graphite Managing Director and CEO, Andrew Worland, said that the company set out to upgrade the existing mineral resource and expand it.

“To expand it by almost three-and-a-half times, improve the overall grade, and have over a quarter now classified as ‘indicated’, is testament to a well planned and executed program by our technical team,” Mr Worland said.

“We have only scratched the surface at Springdale.

“So far, exploration has been limited to approximately ten per cent of the Springdale tenement areas. More than 80 per cent of the aeromagnetic anomalies on a portion of our tenure has yet to be tested.

“It is notable that ten per cent of the new mineral resource estimate stems from an exciting new graphite discovery at Mason Bay, 2km east of Springdale. Further drilling will seek to expand this resource.”

Mr Worland said that across Graphite International’s tenements, there is significant potential for further mineral resource growth to be defined if it follows the same exploration model.

“Graphite mineralisation at Springdale is fine flake and ideally suited to a streamlined flowsheet producing a single concentrate feedstock for downstream processing and the lithium-ion battery market.

“Our team is now working to optimise the mine development pathway, planning further infill and exploration drilling and integrating Springdale with the company’s planned Graphite Battery Anode Facilities in Collie, Western Australia.”

CHINOVA LOOKS TO SELL AUSTRALIAN COPPER - GOLD OPE R ATIONS

Chinova Resources, owned by Chinese organisation Shanxi Donghui Energy Group, has announced that its Australian copper-gold operations are up for sale, with the intent to have a deal finalised by the end of 2023.

The operations in Queensland state include the Osborne copper gold processing plant, Mount Elliot mine, infrastructure including an airport, roads and a power plant, and a number of development sites. The mine is near the town of Cloncurry, 660km west of the port of Townsville.

Chinova Resources Executive Director, Theo Tsihlis, said that the Chinova package has had good interest from large, established, international miners, as well as ASXlisted junior to mid-cap mining companies looking for a relatively large acquisition to propel them onto the radar of institutional investors.

“Some multinational private equity groups have also shown interest,” Mr Tsihilis said.

“We would be expecting that an offer would be north of $300 million, and we would like to conclude it this year.”

Shanxi Donghui Energy Group bought the mine from Ivanhoe Australia in 2013.

Forecast production for 2024 is 7,900t of copper and 39,400oz of gold. A sales agreement for supply from Osborne is in place with commodity trader Hartree Partners.

Development projects include the Mt Dore copper heap leach project, which has an eleven year mine life and the Merlin molybdenum rhenium copper project. Its mineral resources estimates include 3.9 million tonnes of contained copper, 6.8 million ounces of contained gold, 96,000t of molybdenum and 12,000t of cobalt.

7 NEWS

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5

RIO TINTO TO RAMP UP GUDAI - DARRI IRON MINE PRODUCTIVITY

Rio Tinto has announced that it is looking to incrementally increase production capacity at its latest iron ore mine, Gudai-Darri, a process which is expected to cost approximately $130 million.

The $3.1 billion Gudai-Darri mine is located in the Pilbara, Western Australia, and began production in 2022, reaching its planned annual capacity of 43 million tonnes less than 12 months from first ore.

The planned capacity increase will be achieved through upgrades within the plant including chutes and conveyor belts, as well as utilising an existing incremental crushing and screening facility already onsite.

The larger operation will require an additional mining fleet, including haul trucks and diggers, as well as a small expansion

of the product stockyards. The capacity increase is subject to environmental, heritage and other relevant approvals.

Rio Tinto Iron Ore Managing Director of Pilbara Mines, Matthew Holcz, said that what Rio Tinto has learnt during the rapid ramp-up of Gudai-Darri has given it the confidence to find better ways to increase capacity at its newest and most technologically advanced mine.

“Rather than taking a capital-intensive approach to replicate existing infrastructure, we have now identified a low-capital pathway to creep capacity to 50 million tonnes a year,” Mr Holcz said.

The capital intensity of any increase in capacity of Gudai-Darri is expected to be around $10 per tonne.

You’ve just found them.

We know the importance of choosing the right equipment. With our extensive range of pumps, first class customer service and ongoing comprehensive support, Kelair Pumps Australia are second to none when it comes to your pumping requirements.

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 8 NEWS WHEN PUMP KNOWLEDGE MATTERS Rely on Kelair Find out more today 1300 789 466 www.kelairpumps.com.au

for the pump experts?

are

Dewatering.

Looking

We

Kelair Pumps. Fluids transfer including fuels, oils and lubricants. Refining, smelting and milling process. Water treatment.

10/23

MOVEMENT IN THE INDUSTRY

Your industry personnel roundup – here we cover who’s moved where, which boardrooms have been shaken-up and the new leaders making big decisions in organisations across the industry.

Fortescue Metals Group underwent arguably the biggest shakeup in the industry’s recent months, losing its Chief Executive Officer, Chief Financial Officer and the Director of Fortescue Future Industries all in the space of a week.

Mere days after attending the company’s 20-year anniversary celebrations, then-CEO Fiona Hicks was the first one to jump ship, leaving the company on 28 August – less than six months into the job. Hot on the heels of Ms Hicks’s announcement was CFO Christine Morris's departure on 31 August – a mere three months into the role. Fortescue Future Industries Director, Guy Debelle, quickly followed suit, with his exit from the company announced on 1 September.

Venture Minerals announced its new strategy aiming to recruit new talent and skill sets to the company’s Non-Executive team. Part of this strategy was the appointment of a new NonExecutive Director to its Board, with Philippa Leggat stepping into the role. A further progression in the strategy will involve the current Non-Executive Chair, Mel Ashton, retiring from his position following the company’s mid-November Annual General Meeting. The company has commenced a recruitment process to secure a new Non-Executive Chair.

Another company that made changes to its leadership team is Newmont Corporation, announcing a number of leadership appointments in efforts to strengthen the company’s operating model and boost safe and productive operations of the company’s expanding portfolio of assets with the proposed acquisition of Newcrest.

Natascha Viljoen joined Newmont as Chief Operating Officer on 2 October. It was announced that Suzy Retallack would take

on the responsibility of Executive Australia, in addition to her role as Chief Safety and Sustainability Officer (CSSO) and will be based in Perth, Australia. This appointment is due to the Australia region being expected to have a significantly increased operational and strategic importance to Newmont’s global portfolio upon completion of the Newcrest transaction in the fourth quarter 2023.

Summit Minerals welcomed a new CEO, with Jiahe “Gower” He stepping into the role and bringing extensive experience in the lithium and battery metals industry to the team.

Lithium Australia announced the appointment of a new Managing Director, with the promotion of the current CEO of Lithium Australia, Simon Linge, to the company’s Board, in addition to his ongoing role. Mr Linge has been Lithium Australia’s CEO since January 2023 and is a highly credentialed executive, bringing more than 25 years of global manufacturing, recycling and engineering services experience to the company.

Rio Tinto appointed a new Chief Executive of Aluminium to lead its alumina business, succeeding Ivan Vella who operated in the role for almost three years. Jérôme Pécresse stepped into the role on 23 October.

Rio Tinto also appointed a new Non-Executive Director to its Board, with James “Joc” O’Rourke commencing in the role on 25 October.

Liontown Resources appointed a new General Manager of Operations to its Kathleen Valley Lithium Project. Aaron Nankivell stepped into the role with his appointment coming well ahead of project start-up, which is on schedule for first production mid-2024.

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 9 NEWS

STAINLESS STEEL SOLUTIONS FOR PILBA R A I R ON P R OJECT

With its vastness and resource potential, Australia is an attractive destination for international companies looking to broaden their portfolios.

One such example of an international enterprise operating in Australia is CITIC. CITIC is the largest conglomerate in China and the largest producer of steel in the world.

CITIC Pacific Mining (CPM) – which is a wholly-owned subsidiary of CITIC –developed the Sino Iron Project, which is the largest magnetite mining and processing operation in Australia.

Magnetite is a mineral and a valuable source of iron ore, and is mainly used in steelmaking. The six processing lines in the Sino Iron Project concentrator are designed to process 24 million tonnes of high-grade magnetite concentrate annually.

Ensuring efficient and productive operations is an enormous undertaking, and in order to keep the project running smoothly and guarantee continuous operations, a 500kL fuel farm needed to be completed.

The fuel farm also needed to be well-made and ready to provide fuel to ships coming in to load the magnetite for export.

Background

In order to facilitate the building of this fuel farm, CPM investigated the feasibility of traditional piping methods but quickly realised that doing so would be expensive and time- consuming.

In addition to this, there was also the potential for quality issues, which would mean that pipes would need to be sent back for re-work.

Sourcing solutions to help CPM avoid these problems became a top priority and in order to do so, CPM needed to find and use a solution that was capable of adapting to problems as they arose.

Finding a solution

When dealing with a project involving 330m of piping and located at a remote fuel farm, the margin for error is close to nil.

This was the scenario that was facing CPM Sino Iron plant at Cape Preston in the Pilbara region of Western Australia.

For this undertaking, five different sizes of piping, ranging from 28mm to 168mm, were required, and any errors or discrepancies in traditional welding would result in a large loss of time and productivity.

The search for a trusted partner led CPM to Ibex Australia, with CPM electing to use Ibex’s Impress® stainless steel piping system to achieve the desired result on time and well below budget.

An advanced, weld-free pipe system, the Impress® system is used for transporting fluids and gases used in mining, oil and gas, wastewater management, and many more.

The results

Utilising Impress® press fit technology meant that the installation was able to be completed in a fraction of the time it would have taken using traditional methods. As well as this, no quality issues were found with the pipes, meaning they could be installed and put to immediate use.

The decision to use Ibex’s Impress® system saved CPM a great deal of time and money and ensured that the project was completed on schedule.

Key features like no welding, low labour costs, easy installation and reliable results make the product a ‘no brainer’.

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 10 INDUSTRY INSIGHTS | SPONSORED EDITORIAL

www.ibexaustralia.com.au

Ibex Australia is a family-owned and operated business with more than 30 years of experience delivering smarter, safer industrial stainless steel piping solutions to industry. To learn more about Ibex Australia and their range of high-quality press fit products and fittings, and their commitment to excellence, head to

EXPERIENCE QUICK , CLEAN , AND SAFE INSTALLATIONS WITH IBEX’S INDUSTRIAL PIPING SYSTEMS

At Ibex Australia, we know that efficiency is crucial in the mining industry. That's why we offer fast, clean, and safe industrial piping systems that eliminate hot works and passivation.

With our commitment to quality, timely delivery, and responsive customer service, Ibex is your trusted partner in delivering exceptional results and boosting your bottom line.

Experience the difference with Ibex Australia.

SMARTER, SAFER INDUSTRIAL PIPING SOLUTIONS 1300 85 45 20 ibexaustralia.com.au

SIX � E A SONS MINERS SHOULD CA � E ABOUT SILICOSIS

When people think of the dangers of mine sites, they often conjure up images of heavy equipment, large haul trucks and explosive blasts. Less thought of are the subtler, long-term hazards that can affect the health and wellbeing of miners, including those that do not reveal their consequences until years later.

Silicosis is the oldest occupational lung disease on record, but despite its age and history, there has been an alarming increase in cases emerging in Australia recently, including a worker at the Boddington gold mine being diagnosed in October 2023.

Silicosis is an irreversible, debilitating and potentially fatal lung disease caused by inhaling crystalline silica particles, commonly found in dust-generating activities such as mining, construction, fabrication, and installation of materials like engineered stone. These silica dust particles are invisible and 100 times smaller than a grain of sand, meaning they can travel deep inside the lungs and wreak havoc.

Alongside this rise in silicosis diagnoses comes an increase in knowledge and awareness of the disease and its causes, and a determination to stop it at the source.

In June 2023 the Federal Government established The National Occupational Respiratory Disease Registry Bill 2023 in the hopes of identifying and eliminating the causes of deadly occupational respiratory diseases like silicosis. The Bill puts in place a national registry for reporting all occupational respiratory diseases and makes the reporting of silicosis

mandatory. The Bill is intended to support the identification of industries, occupations, job tasks and workplaces where there is a risk of exposure to respiratory disease-causing agents.

The Thoracic Society of Australia and New Zealand (TSANZ) has some concerns with the parameters and practical elements of the Bill, but has said it firmly supports the government’s introduction of a respiratory disease registry.

The silicosis epidemic

Curtin University estimates that more than 275,000 Australians are now at risk of diseases caused by breathing in silica dust – more than the entire population of Hobart and Launceston combined – and this number is expected to increase.

TSANZ CEO, Vincent So, said that regardless of whether coal, gold, or something else is being mined, it is always embedded in rock and layers of rock need to be cut through to get to the mineral.

“Stone contains silica and the cutting process will liberate this in dust form,” he said.

According to Mr So, there are six reasons miners should care about silicosis:

12

INDUSTRY INSIGHTS

It is progressive and irreversible

Silicosis is a chronic lung disease that progresses over time. Once silica particles enter the lungs, they cause inflammation and scarring, leading to the formation of scar tissue which causes the lungs to harden and contract. This scarring restricts a person’s ability to breathe properly and often causes breathlessness. There is no cure for silicosis, and the damage it causes to the lungs is irreversible.

It has significant health impacts

Silicosis can have severe health consequences for affected individuals. One of the biggest challenges with the disease is that symptoms often occur late in life, with many sufferers not noticing their onset until much later.

Symptoms typically include a persistent cough, shortness of breath, chest pain and fatigue.

As the disease progresses, however, it can lead to more serious complications like lung infections and failure, and an increased risk of developing other conditions, including tuberculosis, lung cancer, emphysema and some chronic skin and joint problems.

It is an occupational hazard

Silicosis is primarily an occupational disease, affecting workers who are exposed to high levels of silica dust. Industries whose workers are at a high risk of silica dust inhalation include mining, construction and sandblasting.

It significantly impacts sufferers’ quality of life

The breathing difficulties and reduced breathing capacity caused by silicosis can make it challenging to perform everyday tasks, affecting a sufferer’s physical capabilities and overall wellbeing. As such, the disease can limit a person’s ability to work, participate in activities and enjoy an overall fulfilling life.

It has economic and social implications

Silicosis has far-reaching consequences beyond just an individual level; families are greatly impacted, both emotionally and economically, as they support their loved ones through the difficulties associated with the disease. This economical support may be necessary if silicosis-affected individuals face financial hardship due to having to change work, a reduced ability to continue working, and for medical care.

It is preventable with proper measures in place

One of the characteristics contributing to the

tragic

reputation of silicosis is the fact that it is largely preventable. Through proper workplace controls, such as effective dust control, wet cutting, adequate ventilation, and the use of personal protective equipment, exposure to silica dust can be minimised.

Mr So said that minimising dust generation is important in mining, and one way this can be achieved is by adding water to the cutting process – so called wet-cutting.

“Mechanising the process without workers being in close vicinity would help as well. If possible, extractor fans would reduce dust exposure and finally, exposed workers need to wear adequate personal protective equipment – minimum P2 masks.

“In addition to the dust minimisation, removal, and wearing personal protective equipment, it is good practice to check the functioning of the equipment regularly and conduct workplace air monitoring to ensure that the safety measures in place are delivering the desired result,” Mr So said.

SafeWork Australia, as the national source of information on current regulation, can provide guidance on what more can be done to protect workers.

Preventing silicosis at the source

Mr So said that if these preventive actions are not used, which is frequently the case in Australia, then unnecessary suffering and loss of life may occur.

“We recommend industry liaise with SafeWork Australia, Lung Foundation Australia, and the Thoracic Society of Australia and New Zealand to source appropriate information material for workers and employers to increase their awareness of the potential risks associated with working in mining.

“For the safety of the miners’ families, workers should be advised not to leave the workplace wearing clothing contaminated with dust.”

Mr So said that current cases of silicosis are likely based on past exposures, before the dangers of the disease were fully appreciated.

“Silicosis is preventable and using elimination, removal, and protection measures plus education and awareness should help prevent an increase in new silicosis cases. We are now aware of the problem but need to stop exposures to prevent further disease.”

Mr So recommends miners that are exposed to respirable crystalline silica to contact the SafeWork office in their state and to contact their GP if they display symptoms.

“Silicosis requires long term specialist management. While currently there is no specific treatment for silicosis, there is a lot of ongoing research, and some treatments may come online in the near future.

“The best way forward now is for industry, workers, and health professionals to work together to provide the safest workplace for all.”

Vincent So is CEO of The Thoracic Society of Australia and New Zealand (TSANZ).

TSANZ is the only health peak body representing a range of professions (medical specialists, scientists, researchers, academics, nurses, physiotherapists, students, and others) across various disciplines within the respiratory/sleep medicine field in Australia and New Zealand.

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 13

INDUSTRY INSIGHTS

FOUR FIFO G � EEN FLAGS

Fly-in, fly-out (FIFO) is an often inevitable aspect of working in the mining industry, and the long hours and shift work can take a toll on physical health and wellbeing. However, there are key amenities that mining operations can offer FIFO workforces to showcase a commitment to alleviating the burden of FIFO lifestyles and securing the physical and mental health and wellbeing of their workforce.

Healthier meal options

When it comes to maximising output in a FIFO workforce, a fundamental step is ensuring the food they’re consuming is healthy and nutritious. Working longer hours and being away from family can make it easy for workers to default to unhealthier comfort foods when onsite.

Results from a study conducted in 20221 which surveyed FIFO workers in Australia’s mining industry found that although workers had good physical health status (91.2 per cent), 71.4 per cent were overweight/obese (BMIs were calculated using participants’ self-reported height and weight).

Ensuring that workers have access to a large range of fresh fruit and vegetables, as well as wholemeal options can help workers maintain a healthy lifestyle onsite.

Some newly-developed FIFO accommodation facilities offer workers expanded menus and a wider range of dining options, as well as smoothie and juice bars.

Holistic wellbeing facilities

Hand-in-hand with offering more nutritious meal options comes the need to provide a more comprehensive approach to health and wellbeing. Having a dedicated team onsite committed to supporting the wellbeing of workers is also an important step in a holistic health approach.

Incorporating this holistic approach is a focus for mining companies that are creating new FIFO facilities or revitalising existing locations. Plans for future FIFO accommodation incorporate a range of fitness options for workers to utilise, such as gyms, swimming pools, indoor fitness centres, multipurpose sports courts and running tracks.

Complementing these facilities are onsite health and wellbeing teams offering workout classes, nutrition consultations, health coaching and personal training.

Advanced accommodation

Traditionally, the FIFO lifestyle involves workers spending extended amounts of time away from their family and friends, which can often lead to feelings of isolation and loneliness.

A critical factor in bolstering FIFO workers’ mental health is facilitating their continued connection to their loved ones offsite. This means providing reliable, fast internet connections, as is being rolled out at FIFO sites across the country.

Emerging FIFO accommodation facilities are also offering larger, more inclusive lodging options for workers. These pod-like rooms are suitable for singles or couples, and offer larger beds, adjoining ensuites and kitchenettes in the hopes of encouraging a more diverse workforce.

This new kind of accommodation prioritises worker comfort, boasting air conditioning, increased privacy and security and a personal laundry with washer dryer – negating the need for workers to use communal laundries.

Engaging entertainment

FIFO workers work hard so providing outlets where they can unwind is important for mental wellbeing. Giving workers enjoyable, fun ways to spend their free time can go a long way in building their happiness and improving their mental health.

Mining companies acknowledge this, and emerging FIFO facilities are expanding to include broader recreation options, including cinemas, mini golf courses and golf simulators. Other FIFO recreation facilities offered across Australia include beach volleyball, walking and cycling paths.

FIFO work can be unavoidable, but mining companies are increasingly working hard to ensure that their workforce is taken care of and able to perform at their best, and this endeavour starts with FIFO.

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 14

INDUSTRY INSIGHTS 1. Asare BY, Robinson S, Powell D, Kwasnicka D. Health and related behaviours of fly-in fly-out workers in the mining industry in Australia: a cross-sectional study Int Arch Occup Environ Health. 2023 Jan;96(1):105-120. doi: 10.1007/s00420-022-01908-x. Epub 2022 Jul 25. PMID: 35879565; PMCID: PMC9312312.

THE MULTI - TALENT FOR THE MINING INDUSTRY IN AUST � ALIA

The mining and metal industry's products support and enable many sectors around the world, including but not limited to consumer electronics, agriculture, critical infrastructure and transportation. The demand for metals and minerals is expected to increase as the global energy transition continues to accelerate.

An increasing number of miners are enhancing their efficiency by implementing low-carbon technologies and methods, by collaborating with processors to produce metals that meet consumer demand for eco-friendly products and by accessing financing linked to sustainability. A wide range of modern technologies are creating value and contributing to the achievement of economic growth and a future with lower carbon emissions.

Due to the vast scope of the mining industry, this article will focus on mining pump applications and their potential to decrease carbon emissions, promote a safer work environment and generate consistently low operating costs.

Expectations in the mining industry

The expectations for mining equipment can be categorised as cost, performance and HSE (Health, Safety and Environment).

Performance is the primary factor, denoting satisfactory outputs and desired metal qualities. Operators can increase profitability by using mining pumps with lower running costs; nonetheless, not at the expense of reliability or safety. Pumps with high dependability require less maintenance. The fewer times maintenance personnel need to inspect or repair the

pump, the better. More preferably, personnel could dismantle the entire pump simply and safely without relocating it to a work stand.

Moreover, the industry prefers a full-proof pump that can withstand the harsh conditions of mining. In certain instances, it is important to consider factors such as pH levels and salinity when selecting building materials. In specific regions of Western and Southern Australia, the water contains salinity levels up to 33 times greater than seawater, attributable to an inland sea that existed several hundred thousand years ago.

An omnipresent factor: mine dewatering

Water can enter mines through two different means: artificially added to remove overburden, waste or rock debris along with facilitating the washing of crushed ores, or naturally as underground water. Mine dewatering serves multiple purposes, including active dewatering of both ore and waste rock, which is essential to ensure continuous operation. Additionally, maintaining dry pit floors and underground workings is necessary to minimise the risk of sudden flooding or mudslides. Releasing pore pressures in open-pit slopes and underground workings is critical to avoid pit bench failures or collapse in underground operations.

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 16

INDUSTRY INSIGHTS | SPONSORED EDITORIAL

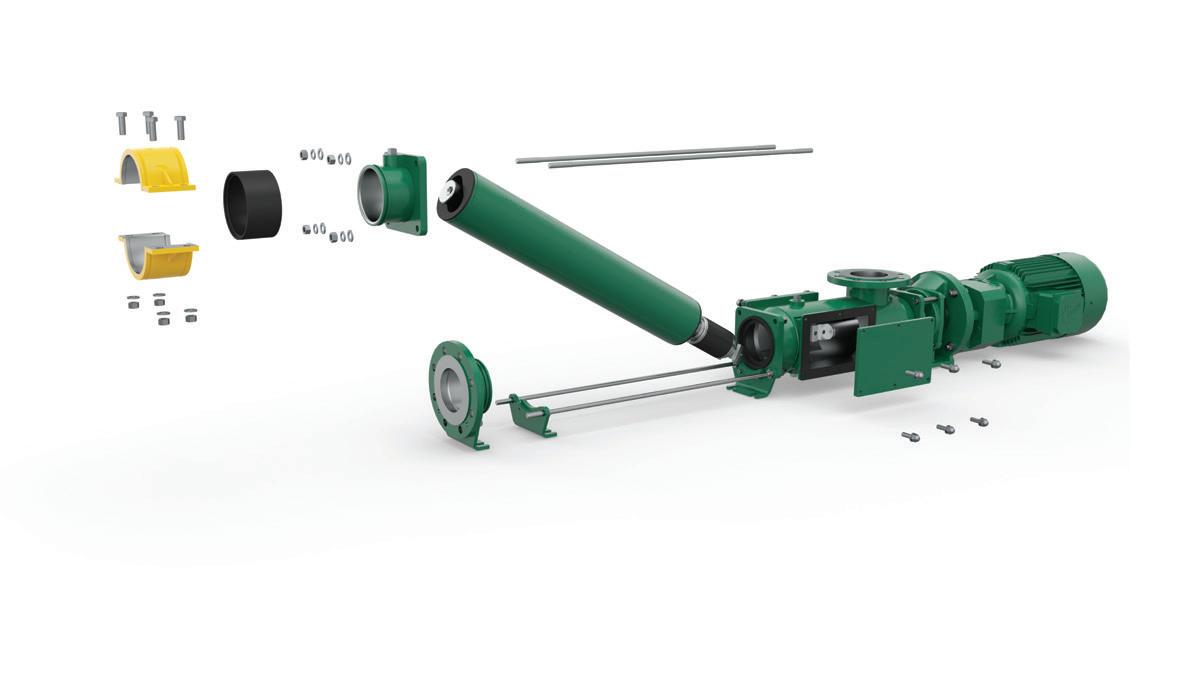

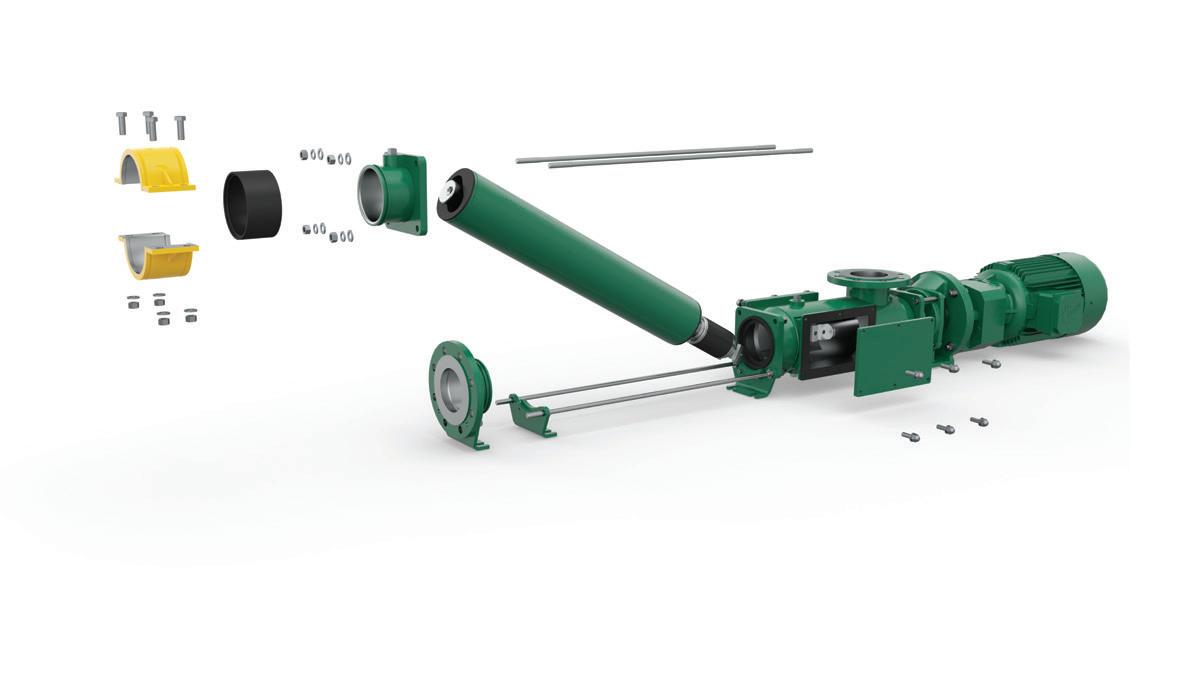

Main applications for progressive cavity pumps in mining

SEEPEX progressive cavity (PC) pumps are versatile and are used in many environments, whether above or below ground. Many are operating in flocculants plants, as their functioning principle preserves the shear-sensitive flocculants used in thickening processes. SEEPEX PC pumps also offer dependable and cost-efficient solutions to recover thickener underflows and transfer abrasive mineral pulps or tailings. Reagents used in flotation circuits (PAX, GUAR, MIBC) are easily measured and added with pinpoint accuracy. With high pressure outputs available, many mines rely on SEEPEX pumps for their underground mine dewatering pumps or for filter press feeding applications. Other applications where SEEPEX pumps are acknowledged include the preparation and loading of viscous explosives emulsions from mobile manufacturing units for rock blasting.

Energy savings with SEEPEX PC pumps from SEEPEX are well suited for transferring abrasive, corrosive and even shear-sensitive media with minimal wear, particularly those with high solids content. The pumps operate at low speeds and possess a clear flow passage, resulting in low shear and smooth flow. Compared to other pump types, the low installed power of SEEPEX pumps allows customers to achieve significant energy savings.

A noteworthy feature of SEEPEX pumps is the lack of gland seal water, which eliminates additional costs such as water pumps, sumps or similar expenses. Moreover, SEEPEX's PC pumps foster flow stability by ensuring constant flow irrespective of backpressure or solids content variations. Additionally, unlike other pumps, PC pumps from SEEPEX can operate effectively at any point on their curve, rendering them even more valuable in changing conditions, as they have no BEP (Best Efficiency Point). Hammering is unnecessary as the pumps offer minimal pulsation flow and are reversible for back flushing.

Mining is an energy-intensive industry, and pumps can help to reduce a mine’s energy consumption and overall carbon footprint. SEEPEX pumps offer reduced life cycle costs because energy and water consumption are much lower compared to alternative pumping methods. Moreover, SEEPEX covers maintenance needs with inclusive, easy maintenance features that facilitate quicker, safer and more cost-efficient maintenance. Pumps can be mounted on simple baseplates with a variety of gearbox and drive combinations, or on engineered skids that can optionally include solid control hoppers, discharge piping and non-return valves for safe operation.

Why choose SEEPEX?

SEEPEX pumps are capable of handling abrasive, corrosive, and shear-sensitive media with ease. They provide a dependable and cost-effective solution for conveying mineral pulp with the appropriate solid content to ensure operational efficiency. With a wide range of materials available, SEEPEX ensures optimal compatibility with corrosive substances, while the PC pump principle preserves the integrity of viscous and shear-sensitive flocculants. SEEPEX pumps ensure high efficiency, allowing you to reap all the benefits of positive displacement pumps, even when handling media with high solids content.

With SEEPEX, clients receive top-tier engineering services utilising an engineering, procurement and construction management (EPCM) approach, backed by a global presence and local spare parts and maintenance support.

CONTACT SEEPEX

SEEPEX is one of the world's leading specialists in the field of pump technology. The product portfolio includes progressive cavity pumps, pump systems and digital solutions. SEEPEX also offers innovative solutions for conveying aggressive or abrasive media with low to high viscosities. Since 2021, SEEPEX has been part of the Ingersoll Rand Group, a global supplier of mission-critical flow creation and industrial solutions, consisting of more than 40 renowned brands. Ingersoll Rand Inc. (NYSE:IR), driven by an entrepreneurial spirit and ownership mindset, is dedicated to helping make life better for our employees, customers and communities. For more information, visit www.IRCO.com

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 17

SPONSORED EDITORIAL | INDUSTRY INSIGHTS

SEEPEX Australia Pty. Ltd. Unit 1, 47 Lake Road Tuggerah NSW 2259 Australia

+61

4355 4500

Tel:

2

info.au@seepex www.seepex.com

Mines will face water issues at some point during their operation and it is a frequent problem

PC pumps can aid in wastewater management for remote mining camps that house the mining crews, too.

TTHE TUNGSTEN � EVIVAL

By Rebecca Todesco, Editor, Mining Magazine

Australia’s Critical Minerals List contains more than 25 minerals, all of which have been flagged by the Federal Government as essential to modern technologies, economies and national security. As Australia ramps up mineral exploration in its race to net zero, there has been one critical mineral whose name has been bounced around more than usual.

he minerals involved in electric vehicle (EV) production, like lithium and cobalt, as well as some rare earth elements, have featured heavily in recent news stories, in part thanks to the increasing prevalence of EVs.

Tungsten, like many other critical minerals, flies below the radar in terms of public consciousness, despite being crucial to many everyday technologies such as electrodes, heating elements and even light globes.

Tungsten – also known as wolfram due to its primary ore mineral being wolframite – has found itself in the spotlight in recent months due to its unique qualities and potential applications in emerging technologies.

Assistant Director of Mineral Resource Assessment at Geoscience Australia, Alanah Hughes, said that tungsten alloys are some of the hardest metals and that tungsten is in possession of the highest melting point of all metals.

“Demand for these so-called ‘hard metals’ is currently being driven by electronics, construction, aerospace and military applications,” Ms Hughes said.

“Many of us use tungsten in everyday items such as light globes, and it is becoming more popular in modern jewellery. It is also used for computers and other electronics because it is such a good conductor of electricity and won’t overheat.”

Tungsten alloys are also used in cutting and drilling tools as some compounds are almost as hard as diamond. In addition to this, the mineral is also valuable in aviation, space and defence uses and even in darts and high-performance race cars.

Recent months have seen the revival of tungsten mining projects and operations around the world, and Australia is no exception. Following the suspension of operations at Wolfram Camp in 2016, the Kara mine in Tasmania became the only operating tungsten mine in Australia.

Now, however, another two mines have joined Kara – Mount Carbine in Queensland and the redeveloped Dolphin mine on King Island, Tasmania – bringing the total of operating tungsten mines across the country to three.

According to Ms Hughes, there has also been a recent discovery of a smaller, high-quality tungsten deposit 2km north of the Dolphin mine. Venture Minerals – owner of the Mount Lindsay deposit in Tasmania – is actively working towards tungsten production at this location by 2025.

In addition to this, EQ Resources was awarded the tender for resource exploration operations across a 480km² area, which includes the abandoned tungsten mine Wolfram Camp in July 2023. The tender could provide an opportunity to turn former mines into assets. Situated 90km west of Cairns, miners have been extracting wolframite from the site since the 19th century.

Impacts on supply chain instability

Director of Mineral Resources Advice and Promotion at Geoscience Australia, Allison Britt, predicts that the revival of Australia’s tungsten mines will have a significant impact considering the supply chain instability currently facing the industry.

“Recent military conflicts have changed access to tungsten. Russia, who used to supply three per cent of global supply, now have less readily available stock. This has created increased dependency on products from China – which has limited export licences for its products – and while they hold the largest resources of tungsten in the world at 47 per cent, and are by far the largest producer at 84 per cent, they are also the world’s largest consumer of tungsten.”

Ms Britt said the development of alternative supply chains of tungsten for Australia is now strategically important due to it being recognised as a critical mineral by not only Australia, but also the EU, the UK, Japan, Korea, India and the US.

“This is because of its importance to modern technologies for its hardness, stability and high melting point, which are particularly valued for military technologies, such as armourpiercing shells and armoured tanks.”

This revival of tungsten mines and mining not just in Australia but around the world can be attributed to increased demand and restricted supply chains.

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 18

CRITICAL MINERALS IN FOCUS

Wolframite ore from Wolfram Camp mine, Queensland. Photograph by Yanbo Cheng, Geoscience Australia.

“The easing of COVID restrictions saw a rebound in manufacturing activity and tungsten demand, with a subsequent increase in price,” Ms Hughes said.

The price per tonne of tungsten has doubled over the past three years from a low in January 2021 of AU$269.77, to highs of AU$537.84 in October 2022 and AU$537.55 in September 2023.

Australia’s tungsten potential

On Australia’s Critical Minerals List, Australia’s geological potential for tungsten is listed as high, with prospective tungsten projects across the country.

According to Senior Mineral Systems Geoscientist, Yanbo Cheng, most tungsten mineral deposits around the globe are genetically related to granitic rocks, with tungsten mineralisation having been found in a number of different of mineral systems, such as granite-related sheeted-quartz veins, pegmatite, greisen, breccias, carbonate replacement/skarn, porphyry and orogenic gold-type deposits.

Mr Cheng said that Australia’s granitic rocks and geology demonstrate diverse features, including some good endowment for tungsten mineralisation.

“Although the currently active tungsten mines are on the eastern side of Australia, the largest reported tungsten resources in Australia are in Western Australia.”

Mr Cheng said that the O'Callaghans deposit – which is the largest tungsten resource in Australia – is a skarn type mineralisation associated with the O'Callaghans Granite and contains 0.23 million tonnes (Mt) tungsten trioxide (Newcrest Mining Limited, 2023).

After O'Callaghans, Australia’s second-largest reported tungsten resource is located at Mount Mulgine, which is an Archean porphyry tungsten-molybdenum system. According to the owner of Mount Mulgine, there is a combined Mineral Resource estimate of 219 Mt at 0.11 per cent tungsten trioxide (Tungsten Mining, 2023).

In addition, there are several other prospective tungsten projects in the Northern Territory and South Australia.

“Overall, there is a full spectrum of granitoids and the right geology for the formation of tungsten deposits in Australia, which is comparable to the tungsten fertilised terranes in other parts of the world, for example in south China and northwest Canada. Geologically the mineral potential for tungsten resources in Australia is high, but to realise this potential, more data and exploration is needed in the future,” Mr Cheng said.

Capitalising on Australia’s geological potential

“Although tungsten resources are found throughout the world, China generates more than 80 per cent of mine production and dominates global consumption. In response to the recent growth in global tungsten demand, customers have been seeking alternative sources of supply and have been looking to Australia with our high-quality tungsten deposits. However, we are still considered a minor producer on the world stage.”

According to Ms Hughes, “Tungsten is used in a number of critical technologies that are expected to grow in the next decade and Australia is well-placed, in terms of mining and minerals extraction expertise, to develop our tungsten resources and improve connections with emerging markets.”

Ms Hughes said Australia has an opportunity to develop strategically important projects to attract international investment, enhance domestic capability, and, importantly,

19

CRITICAL MINERALS IN FOCUS

Mount Carbine mine, Queensland, in 2015. Photograph by Yanbo Cheng, Geoscience Australia.

www.miningmagazine.com.au Summer 2023 \\ ISSUE 5

Tungsten price chart over the past three years between October 2020 and October 2023. Tungsten price is in Australia dollars. Information from S&P Global.

demonstrate the sector’s ability to create economic opportunities for Australian communities.

“Australia has robust regulatory frameworks and highly regarded ESG credentials, helping to ensure that we are a premier destination for investment.

“Geoscience Australia is supporting decision-making throughout the value chain as demand for critical minerals is predicted to grow, whilst ESG considerations from production and processing are increasingly scrutinised.”

Despite Australia’s high geological potential for tungsten, and second-place ranking for tungsten resources after China, Ms Hughes said that on a world scale, Australia’s production is minor.

“Australia has a real opportunity to grow this sector of the economy by providing responsibly sourced tungsten to our global partners, and building stronger and more diverse supply chains.

“Australia’s mineral endowment makes us an attractive destination for mineral exploration, and our mining sector is underpinned by robust ESG credentials and legislative frameworks that will support investment in downstream processing and value creation.”

According to Ms Hughes, Geoscience Australia publishes an annual review of exploration expenditure, commodity trends and significant results in the Australian Mineral Exploration Review and during the 2022 calendar year, Australian exploration expenditure for minor metals, a category which includes tungsten, increased by 66 per cent from the preceding year. Tungsten intercepts were reported in Tasmania, Queensland and Western Australia whilst in the Northern Territory tungsten was encountered in association with molybdenum and copper.

“The owners of the Dolphin tungsten mine on King Island are looking into the feasibility of downstream processing of tungsten concentrate,” Ms Hughes said.

Anticipating tungsten demand

Mr Cheng said that tungsten consumption is likely to be influenced as the transition to renewables accelerates and new technologies, such as using tungsten in lithium-ion batteries, emerge.

“Australia is well-placed to become a leading supplier of critical minerals like tungsten as the world moves towards net zero emissions targets.

“Geoscience Australia has a proven record of expanding and delivering innovative knowledge in mineral resources and multiple successes developing novel resource exploration concepts and tools. These include the mineral systems concept and the Eureka prize-winning Economic Fairways Mapper developed in collaboration with Monash University, as part of the ongoing Exploring for the Future program.

“Extracting critical mineral resources from different mineral systems is an emerging field, and there is enormous scope for both academics and mineral explorers. Like many other critical minerals, tungsten resources can be discovered in a variety of mineral systems associated with diverse types of granitic rocks,” Mr Cheng said.

“Australia’s pre-competitive geoscience from government and academia, combined with world-leading mineral exploration, and development and production experience within the Australian mining industry will accelerate new discoveries and projects in brownfield and greenfield areas in the upcoming years.”

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 20

CRITICAL MINERALS IN FOCUS

Wolframite ore from Mount Carbine mine, Queensland. Photograph by Yanbo Cheng, Geoscience Australia.

Because Every Second Matters Specially Designed for Fast-Track Maintenance

Clamp

Specially designed clamp enables quick removal of rotor and stator without dismantling discharge line.

Split Coupling Rod

Enables quick dismantling of pumping elements from the coupling rod.

Dual Inspection Windows

Provides access to split coupling rod and also allows removal of any blockage.

YEARS IN AUSTRALIA

RO TO P UM P S L TD . (AUSTRALIA) Gl o b al Pr es en ce : Au s tral i a | Germany | India | Malaysia | South Africa | UK | USA | UAE s al es @ r o to p u m p s . co m . au | w w w . r o to p u m p s . co m . au

Roto KWIK Pumps

INCREASING MINERAL INVESTMENTS IS FUTU � E C � ITICAL

By Tania Constable, Chief Executive Officer of the Minerals Council of Australia

Australia is at risk of ceding its advantage to global competitors as the world’s economies jockey for prime position in the emerging clean energy mining boom.

The Mineral Council of Australia’s (MCA) recently released report Future Critical: Meeting the minerals investment challenge highlights that Australia is at risk of dealing itself out of trilliondollar critical minerals markets unless it gets serious about addressing rising costs, declining productivity and increased policy risks.

Deepening investment uncertainty, exhaustive delays in environmental approvals and the proposed introduction of rigid and costly industrial relations laws are combining to blunt Australia’s ability to fully capitalise on this once-in-multiplegenerations mining boom.

All-industry productivity has halved since the Hawke-Keating reforms of the 1990s and mining capital stock has plateaued at $933 billion over the last five years. In addition to this, Australia has the third highest company income tax rate among Organisation for Economic Co-operation and Development (OECD) countries.

The MCA report highlights the crucial role minerals and resources play in Australia’s economy and communities, as well as their inherent connection

to Australia’s long-run prosperity and the funding of government services, and the risks of missing an impending golden opportunity to secure the nation’s prosperity for decades to come.

Over the last 20 years, mining has been either the first or second largest contributor to Australia’s economic growth.

From 2012-13 to 2021-22, mining companies have paid $252 billion in wages to hard working Australians, on top of $295 billion in taxes and royalties that help fund hospitals, schools, aged care, childcare and infrastructure.

The mining industry’s strong links across the entire economy has resulted in benefits from its activities being widely distributed – spending on domestic goods and services by mining companies accounts for five per cent of the total intermediate use by all industries across the Australian economy.

The MCA report shows that for every new job created in mining, 6.14 new jobs are created across all industries.

22

CRITICAL MINERALS IN FOCUS

If a major expansion of mining were to occur – similar to the previous mining boom earlier this century – households would be $11,700 better off, real wages would be 9.4 per cent higher and the economy $290 billion larger by 2030.

However, time is running out for Australia to catch the wave of mining investment needed to achieve the collective global pursuit of net zero emissions.

Catching the mining investment wave

As global demand for minerals and metals intensifies, Australia’s global competitors are responding rapidly. Governments in other mineral-rich nations are clearing the path, enticing investment with targeted policies, streamlining approvals, breaking down barriers and embracing this opportunity.

The pathway to delivering global net zero emissions is uncertain, but current policy settings are minerals-intensive.

Astronomical volumes of minerals and metals will be required to achieve net zero emissions by 2050. The International Energy Agency estimates that by 2030 alone, 50 new lithium mines, 60 new nickel mines and 17 new cobalt mines will be needed to supply the materials required to meet demand for battery storage.

Business management consultant McKinsey estimates that up to US$4 trillion in investment in mining, refining and smelting will be required by 2030 to hit net zero targets. For mining alone, that represents an increase of US$160 billion a year to 2050 –more than double current levels of investment.

The challenge is immense.

Although the sustainability of the Federal Government’s fiscal position depends on the mining industry’s profitability and mining has been consistently at the forefront and is a critical driver of Australia’s productivity growth, Australia’s labour productivity and investment growth are in severe decline.

Capital investment has traditionally played a central role in Australia’s productivity growth, including the flow of foreign

capital, but remains under siege due to increased competition from global competitors.

Of great concern, the report shows that the mining industry’s net capital stock is plateauing at a time when it should be accelerating to take advantage of the boom in critical mineral production, a further dent to the nation’s lagging productivity.

While Australia has the attributes, the workforce, the expertise, and the array of deposits required to be a leading global supplier of the critical minerals, governments have a critical role to play.

Stepping stones for governments

The push to unlock this opportunity must be supported with enabling government policy that improves Australia’s competitiveness in attracting investment, clears regulatory impediments, and boosts productivity.

Government must aim to eliminate existing policy impediments to mining activity in Australia that include:

♦ Regulations that seek to address environmental, heritage, culture or safety issues but create excess regulatory burden without benefits

♦ Policies that affect decisions about whether to explore for new reserves, change production plans, and expand or develop new mines

♦ Under-provision of public goods such as transport infrastructure, national security and cyber security that impair the mining industry’s ability to operate

♦ Political factors that present difficulties in gaining community support for projects, as well as the political process delaying or preventing investment

As the report clearly argues, maintaining Australia’s competitive edge in mining will require immediate and coordinated action by governments to ensure a prosperous future for all Australians.

The report provides a key message to federal, state and territory governments; the opportunity is there for the taking.

Future Critical: Meeting the minerals investment challenge can be viewed in full on the MCA website: https://minerals.org.au/resources/future-critical

23 www.miningmagazine.com.au Summer 2023 \\ ISSUE 5 CRITICAL MINERALS IN FOCUS

SAVING ENERGY AND MONEY IS IN THE AI R

With compressed air being responsible for ten to 15 per cent of industrial electricity use Australia-wide, an air audit can reveal surprising opportunities to reduce energy consumption and overall business costs.

Compressed air systems using outdated technologies, poorly sized equipment or inadequate control systems which are operating with unknown air leaks can lead to inefficiency and overspending. Energy efficiency air audits can identify opportunities to reduce energy consumption and operating costs, while increasing system reliability, productivity and even equipment life.

Why is an air audit necessary?

Compressed air is an inefficient form of energy, with 90 per cent of the input energy normally discharged to the atmosphere as waste heat. Additionally, compressed air systems are often poorly set up, maintained and controlled which creates further inefficiencies. It is not unusual to find a system using only 50 per cent of compressed air productively. This is not only costly from a sustainability standpoint; wasting energy means wasting money. This is why both government and industry bodies recommend that businesses take measures to improve the efficiency of their compressed air systems.

CAPS Australia delivers a complete range of auditing solutions that are at the forefront of the compressed air industry. With a ‘whole system’ approach that provides long-term, sustainable and financially rewarding solutions, CAPS has consulted for some of Australia’s largest and most well-known companies, helping them obtain government grants, achieve environmental goals, reduce lifetime costs associated with compressor equipment and improve efficiencies.

What does an air audit involve?

Not all audits are the same, but the most effective are designed from the ground up to be a comprehensive system analysis tool that considers a broad range of variables beyond the compressor itself.

A comprehensive audit should include analysis of:

♦ Air demand – an analysis of system operations such as air flow, pressure, power consumption, air usage and quality

♦ Pressure drops – regulation of air pressure used by end devices

♦ Leak reduction – detect and eliminate artificial demand

♦ Control methods – identifying what is the most efficient system (start/stop, load/unload, throttling or variable speed), based on operating needs

♦ Compressor selection – whether you are best suited to reciprocating, rotary screw or centrifugal compressor technologies

♦ Alternative technologies selection – whether you would benefit from electronic controllers that would match demand across multiple compressors, waste heat recovery that recycles ‘electrical compressor waste’ for secondary uses in your facility, and other ancillary equipment that will minimise the impact on your efficiency

♦ General – analysing whether the location and arrangement of your compressed air equipment is ideal, along with a review of current system maintenance

The audits CAPS provides are typically non-invasive, low-cost and simple to undertake, yet provide highly valuable insights into the operation and efficiency of your system. Designed around you, with easy-to-understand, meaningful and implementable reports, CAPS makes recommendations for smarter alternatives which can reduce energy use and enhance your bottom line.

Big picture thinking for smarter, greener outcomes that ultimately improve overall site profitability are key to longterm sustainability journeys. CAPS identifies cost-effective energy efficiency opportunities to reduce greenhouse gases, meet long-term objectives like productivity targets and social responsibilities, and manage upfront, maintenance and lifetime costs.

If your system hasn’t been measured, how will you know how much you can save?

Learn more at www.caps.com.au

Summer 2023 \\ ISSUE 5 www.miningmagazine.com.au 24

CRITICAL MINERALS IN FOCUS | SPONSORED EDITORIAL

CUSTOM SKID PACKAGES

CAPS offers mine-spec skid packages as standard to better accommodate safety and performance in extreme conditions.

INGERSOLL RAND AIR & POWER TOOLS

Time-proven, quality tools specially designed for assembly, industrial and vehicle service.

01 02 03 04

FIXED AIR INSTALLATIONS

Ingersoll Rand, CAPS, and Hertz brand electric compressors available as oilflooded or oil-free.

RENTAL SOLUTIONS

Mine-spec AIRMAN portable diesel air compressors and power generators, air treatment, and specialist equipment.

SERVICING & SPARE PARTS

24/7 service nationwide for maintenance and emergency breakdowns.

CALL 1800 800 878 OR VISIT CAPS.COM.AU

COMPLETE AIR & POWER SOLUTIONS FOR MINING

05

THE CHANGING FACE OF INDUSTRY IN NEW SOUTH WALES

By Rebecca Todesco, Editor, Mining Magazine

The decisions and legislations of state governments can have a significant impact on the mining and resources industry. New South Wales is no exception, with coal royalty hikes and the 2023–24 State Budget announcement shaking up the state’s mining industry over recent months.

With the current coal cap due to expire on 1 July 2024, and in the lead-up to the 2023–24 State Budget, the New South Wales Government opened consultation on the coal cap in place and called on mining industry leaders to have their say on coal’s future in the state.

As part of the consultation process, the State Government wrote to relevant parties and invited them to give their feedback on the future of the cap.

The government sought input from these industry parties to help it:

♦ Review the impacts of the Coal Market Price Emergency directions on the coal industry and electricity market

♦ Understand the likely impact on domestic coal and electricity prices from when the directions are due to expire on 1 July 2024

♦ Consider whether potential alternative policy options are necessary to minimise the impacts on electricity bills once the directions expire

♦ Understand the effects of a possible new coal royalty rate system, or adjusting existing royalty rates, to respond to market conditions

At the conclusion of the consultation period, the New South Wales Government announced in early September the updates that would come into effect following the coal cap expiration.

It was announced that under the new scheme, coal royalties would increase by 2.6 per cent from 1 July 2024,

replacing the emergency domestic coal cap and reservation measures the previous government had introduced in December 2022.

When the updates were announced, the State Government said it intended to use the funds raised from the new measures to rebuild the state’s essential services, as well as providing families with cost-of-living relief.

Coal royalty raise rebuttal

The updates to the coal royalties scheme were not welcomed within the industry, however, with the New South Wales Minerals Council’s CEO, Stephen Galilee, saying that the increase in coal royalty rates would “impose a significant additional impost on coal producers at a challenging time of lower coal prices and increased operating costs”.

26

COMMODITIES IN FOCUS

“It puts an uneven and unfair burden of budget repair on our coal producers and coal mining communities,” Mr Galilee said.

“The coal industry directly employs nearly 30,000 people in New South Wales and supports 180,000 indirect jobs. Nearly 7,000 New South Wales businesses are part of the mining supply chain.

“Coal remains New South Wales’s most valuable export commodity by far and continues to deliver over 70 per cent of electricity used in homes and businesses across New South Wales.”

Mr Galilee said the announced royalty increase will mean the state’s coal producers will pay at least 30 per cent or more in royalties than they do under the existing royalty arrangements, continuously throughout the commodity price cycle, including when coal prices are low.

“A 30 per cent increase in taxes is not insignificant and has the potential to impact future investment decisions and jobs in the New South Wales coal mining industry.

“When coupled with the cyclical nature of coal prices, it’s difficult to see how this increase in royalties will not impact future jobs and investment,” Mr Galilee said.

Throughout the State Government’s consultation process, the New South Minerals Council remained a firm advocate for wanting to retain the preexisting royalty structure and rates. According to Mr Galilee, one of the reasons for this stance is the fact that New South Wales’s coal royalty rates are already higher than the rates for other minerals.