GREEN CORRIDORS: forging a net zero path

Charting the course for QLD's RESOURCES INDUSTRY

MATERIALS

Issue 1 \\ Spring 2022 \\ www.miningmagazine.com.au SMART | CRITICAL | CIRCULAR | DIGITAL

DEMAND FOR RENEWABLE ENE � GY SYSTEMS

Programmed. Connecting customers and communities.

At Programmed, we are a part of your community. We deliver awardwinning integrated services across facility management, maintenance, and recruitment, engaging in meaningful ways to build strong customers and great communities with training and local inclusion.

That is how, every day, we seek to redefine what it means to get a job done right.

To find out more, visit programmed.com.au

Programmed artwork by Rohin Kickett

Welcome to the first edition of Mining Magazine, a new publication that explores the latest news, discussions, innovations and projects in Australia’s mining sector.

Monkey Media Enterprises ABN: 36 426 734 954

C/- The Commons, 36–38 Gipps St, Collingwood VIC 3066 P: (03) 9988 4950 monkeymedia.com.au info@monkeymedia.com.au miningmagazine.com.au info@miningmagazine.com.au ISSN: Pending

It is an exciting time to be involved in the mining sector; the world is changing, with a push towards having a reduced reliance on coal for energy production, and increasing pressure on traditionally strong export markets for minerals like iron ore.

But on the flip side, the global thirst for technology like smartphones, computers, solar panels, batteries and electric vehicles is growing at an exponential rate; and Australia has significant deposits of the critical mineral resources required to build these products.

Australia is already a world leader in the export of resources, with a welldeveloped industry that is able to supply countries with high-quality, ethically sourced minerals using environmentally sustainable practices.

However, the industry also faces a number of challenges including skills shortages, mental health and well-being, and the need to digitalise and reach ESG and sustainability goals.

For Mining’s inaugural edition, we take a closer look at some of these challenges as well as other major topics the mining sector is grappling with, such as demand for critical minerals, automation, and exports and trade. We also explore the trends impacting the sector, what our future mines could look like and what governments and mine owners/ operators are doing to drive the sector into the future.

In this issue, the Queensland Department of Resources discusses the Queensland Resources Industry Development Plan, which charts a course for everyone to work together to transform the industry so it continues to create jobs and prosperity – responsibly and sustainably. It examines the six key focus areas identified in the plan, and

what it imagines the industry will look like in 30 years’ time.

We have an article from Peter Majewski from UniSA’s Future Industries Institute that looks at materials demand for renewable energy systems until 2025, and the CSIRO shares a brief history of critical minerals. We also explore what the future of the industry could look like through key industry trends, and take a deep dive into green corridors.

For this launch edition, we’ve partnered with IMARC and WA Mining Conference and Exhibition to distribute the magazine. We’ll be partnering with other major mining events over 2023 for distribution, so be on the lookout for us.

Mining is published by Monkey Media, the team behind highly regarded industry titles including Pump Industry, Utility, Infrastructure, Energy and Council. As well as the quarterly print magazine, Mining is supported by a website which is updated with breaking news daily, and a weekly enewsletter which delivers all of the news for the week directly to your inbox. Head to miningmagazine.com.au to explore the online home of the magazine, and subscribe to the enewsletter or magazine if you haven’t done so already.

Australia’s mining industry is on the cusp of significant change; but with great change comes great opportunity. It is our aim to provide the industry with the knowledge that will propel it forward to continue to be a leader on the global critical resources stage.

If you have any innovations, projects, research or thought-leading ideas you’d love to share with Mining Magazine, you can email me at lauren.cella@monkeymedia.com.au.

I hope you enjoy Issue 1.

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 1 ISSUE 1 - SPRING 2022 | MINING

Lauren Cella Editor I’m keen to hear your thoughts and feedback on our first issue. Drop me a line at lauren.cella@monkeymedia.com.au or feel free to call me on 03 9988 4950 to let me know what you think. Cover image highlights our article from the Queensland Department of Resources which looks at its 30-year plan to drive the state's resources industry to a strong future. MATERIALS DEMAND FOR RENEWABLE ENE � GY SYSTEMS Issue \\ Spring 2022 \\ www.miningmagazine.com.au SMART CRITICAL CIRCULAR DIGITAL GREEN CORRIDORS: forging a net zero path Charting the course for QLD's RESOURCES INDUSTRY

Managing Editor Lauren Cella Assistant Editor

Editor

Goldsmith Journalists

Allan Design Manager

Martin

Media and Events Executives

Manager

Associate

Marketing Assistants

Ta Publisher

Bland

Growth and Strategy

Harvey

by This document has been produced to international environmental management standard ISO14001 by a certified green printing company.

WELCOME

Lauren DeLorenzo Contributing

Michelle

Christopher

Alejandro Molano Designers Luke

Danielle Harris Ozlem Munur National

Rima Munafo Brett Thompson Marketing

Radhika Sud Marketing

Andie James Digital

James Holgate Jackson Barnes Natalie

Chris

GM

Laura

Published

EDITOR’S

CRITICAL MINERALS IN FOCUS

SUSTAINABILITY

A heightened focus on ESG is gaining momentum within the mining industry, as non-financial factors play an increasing role in investor and consumer decision-making worldwide. This new reality calls for mining businesses to consider the unique ESG risks to which their operations are exposed, and measure, report and improve performance on various ESG criteria. Understanding ESG principles and adopting an appropriate framework enables companies to provide the transparency and accountability that investors now require, overcoming challenges while offering opportunities for innovation and value creation.

INDUSTRIAL AUTOMATION

FUTURE MINES

Although

environmental and

landscape have caused swift shifts in miners’ priorities. Here, we look ahead to the biggest areas of opportunity in mining and the challenges the industry is looking to tackle in the coming years.

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au 2

36

ESG: BEYOND THE BOTTOM LINE 28

14

44 28

THE IMPORTANCE OF MINE REHABILITATION 32 LONG - RANGE PLAN DRIVES THE QUEENSLAND RESOURCES INDUSTRY TO A STRONG FUTURE 44 For decades to come, high school principal-turned-Resources Minister, Scott Stewart, wants to see young Queenslanders excitedly planning a career in a resources industry that offers high wages, secure, safe jobs, and opportunities to make the world a better place. TOP TRENDS FOR DIGITAL IN MINING 48 INDUSTRY FORECAST: REVENUES RISE, BUT FOR HOW LONG? 52

commodity prices

global political,

UNEARTHING THE FULL POTENTIAL OF BIG DATA IN MINING 36 For an industry that boasts incredibly advanced machinery and sophisticated remote operating systems, there is

of room to improve the way that information is stored, accessed and implemented across mining operations. Here, we look at challenges of managing big data and how miners can use these systems to drive down costs and spur forward-thinking solutions. THE TRANSFORMATIONAL TECHNOLOGY BEHIND RIO TINTO’S MOST ADVANCED MINE 40 MATERIALS DEMAND OF RENEWABLE ENERGY SYSTEMS UNTIL 2025 14 During the past ten years, the uptake of renewable energy systems, especially solar photovoltaic (PV) panels and wind turbines, has significantly increased, and represents a significant change in the way we are generating power on-grid and off-grid. Both technologies have become important means to transition to an electric power generation which is renewable, scalable and free of greenhouse gas emission. A SHORT HISTORY OF CRITICAL MINERALS 20 They are the very definition of a modern hot commodity. Jane Nicholls reports on how governments decide what minerals are added to the critical minerals list, and why it’s a brilliant opportunity for the Australian resources industry. HOW CRITICAL MINERALS WILL TRANSFORM THE MINING INDUSTRY 24

remained high in 2021, changes in our

social

a lot

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 3 56 60 TAPPING MINERAL WEALTH IN MINING WASTE COULD OFFSET DAMAGE F�OM NEW GREEN ECONOMY MINES 60 To go green, the world will need vast quantities of critical minerals such as manganese, lithium, cobalt and rare earth elements. But to some environmentalists, mining to save the planet is a hard pill to swallow if it leads to damage to pristine areas. EDITOR’S WELCOME 1 ADVERTISERS’ INDEX 64 FEATURES SCHEDULE 64 FORGING A NET ZERO PATH WITH GREEN CORRIDORS 56 Governments and industry bodies are reaching for increasingly ambitious environmental targets, challenging miners to make drastic cuts in emissions in the coming years. But the key to achieving this could lie in creating a new green pathway in one of the most notoriously difficult areas to decarbonise – shipping. GOVERNMENT COMMITS TO IMMEDIATE ACTION ON SKILLS SHORTAGE 4 MINE EXTENSION PROVIDES STABILITY FOR CQ MINING WORKFORCE 5 WA ACCELERATES EFFORTS TO ACHIEVE NET ZERO IN MINING 6 NEW CEO COMMENCES AT WA CHAMBER OF MINERALS AND ENERGY 6 NEW ACLAND SECURES MINING LEASES ENDING 15 - YEAR FIGHT 7 NEW QRC REPORT PREDICTS MAJOR CHANGES FOR QLD RESOURCES SECTOR 8 INDUSTRY MAKES $3.9B INVESTMENT IN MINERALS EXPLORATION 9 BHP’S NEW PROGRAM TO ASSIST MINERAL EXPLORATION STARTUPS 9 COMBINING LOCATION, TRACKING AND AI FOR ENHANCED MINE SAFETY AND PRODUCTIVITY 10 A PORTABLE VALVE ACTUATOR FOR THE MINING SECTOR 12 EXPORTS AND TRADE MINERALS PROCESSING REGULARS NEWS

GOVERNMENT COMMITS TO IMMEDIATE ACTION ON SKILLS SHORTAGE

The Federal Government has committed to several policies addressing ongoing skills shortages following the conclusion of its Jobs and Skills Summit.

The event engaged representatives from industry, unions and other stakeholders. Following the consultation, the Federal Government committed to the immediate implementation of 36 initiatives.

Two of these policies seek to improve upon current skills shortages, and include:

♦ An additional $1 billion in joint federal-state funding for fee-free TAFE in 2023 and accelerated delivery of 465,000 fee-free TAFE places

♦ An increase in the permanent Migration Program ceiling to 195,000 in 2022-23 to help ease widespread, critical workforce shortages

The Minerals Council of Australia (MCA) celebrated the Federal Government’s commitment, which it says will improve the strength and composition of the domestic resources workforce.

MCA Chief Executive Officer, Tania Constable, said the policies would

drive greater participation in the mining industry.

“The MCA welcomes the positive announcements on childcare support, training and skilled migration at the Jobs and Skills Summit and will continue to engage constructively on proposals to increase real wages through productivity growth,” Ms Constable said.

“The Federal Government’s commitment to increase permanent skilled migration by 195,000 nationally will benefit regional communities, with an extra 9,000 places providing the mining industry an increased talent pool.

“Bringing forward child support and more fee-free TAFE places are important measures to increase choice and pathways for Australians, including women, people with disability, First Nations people and families.”

However, Ms Constable cautioned against proposed changes to industrial relations reform, suggesting any change must be ‘carefully considered’.

“The strong contribution of mining –and the opportunities for further minerals development and value-adding – must not be compromised by a return to industrial disruption and wage-price

inflation, which characterised industrywide bargaining prior to the Keating Government’s workplace relations reforms,” Ms Constable said.

“A number of new workplace relations priorities nominated by the Minister for Employment and Workplace Relations, Tony Burke, will require careful consideration and extensive consultation to avoid unintended and counterproductive outcomes for jobs, productivity, wages and investment in the technology and equipment that will position workers to thrive in the industries of the future.

“No case has been made to extend multi-employer bargaining to high-paying industries like mining.

“As the Minister indicated, any change must preserve the ability of employers to make enterprise agreements under the current regime.

“Mining has successfully used enterprise bargaining and a suite of employment options to treble employment over the past 20 years from 88,000 to 278,000 people, with 88 per cent of those jobs being permanent and average wages across the industry of $144,000 a year.”

NEWS 4

MINE EXTENSION PROVIDES STABILITY FOR CQ MINING WORKFORCE

ACentral Queensland steel-making metallurgical coal mine extension has been approved, ensuring the continued support of more than 700 mining jobs.

Queensland Resources Minister, Scott Stewart, said the extension of the Carborough Downs mine near Moranbah would increase the mine’s lifespan by another eleven years and support its large workforce.

“The Carborough Downs mine is a significant employer and economic contributor for the Isaac region and this extension ensures the future stability of those jobs,” Mr Stewart said.

Carborough Downs is an underground metallurgical coal mine which is owned and operated by Fitzroy Australia.

The mine currently supports about 700 employees, with nearly 70 per cent of its workforce being local or drive in, drive out workers.

Mr Stewart said the investment is a strong vote of confidence in the Queensland resources sector, including its large deposits of high-quality steelmaking coal.

“This extension will create flow-on economic benefits for the entire Isaac region, from tools, safety and workwear suppliers right through to our pubs, cafés and accommodation providers.

“Queensland offers a great lifestyle and having good jobs available in the regions is an important way to sustain this.”

Coal production from the mine’s extension is expected to begin within the next 12 months.

Mr Stewart said the Queensland Government will continue to support the resources sector for the royalties and jobs it generates, particularly in regional Queensland.

“The resources industry directly supports about 77,000 jobs across the state, particularly in the regions, which account for around two thirds of all mining jobs,” Mr Stewart said.

“Queensland is naturally blessed with the world’s highest quality metallurgical coal, which the world needs to make steel.

“Even as the world transitions to renewables, metallurgical coal for steel will remain an essential, and valuable, international export commodity for Queensland.”

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 5

NEWS HIGH QUALITY STAINLESS STEEL PLUGS, RECEPTACLES AND COUPLERS Full phase to earth segregation Arc extinguishing phase insulators Easier shape to handle ISO9001 Certified Low Voltage Range 660 - 3300 Volts 60 - 90 Amp High Voltage Range 11,000 Volts 800 Amp w w w a u s p r o o f c o m a u ( 0 7 ) 4 9 7 8 4 0 0 0 s a l e s @ a u s p r o o f c o m a u

WA ACCELERATES EFFORTS TO ACHIEVE NET ZERO IN MINING

The Western Australian Government will expand the research scope for the Minerals Research Institute of Western Australia (MRIWA) in a bid to support research into clean energy and emission reduction technologies.

Western Australia Mines and Petroleum Minister, Bill Johnston, made the announcement at the MRIWA Net Zero Emission Mining WA Conference, along with announcing the launch of the Hybrid Power Purchase Agreement guide and template.

The template will help facilitate contract negotiations between miners and independent power producers for the installation of on-site renewable generation.

“Expanding MRIWA’s research scope will position our state to benefit from research and development focused on emissions reduction and the broader clean energy value chain,” Mr Johnston said.

With decarbonisation activities and downstream processing opportunities accelerating, momentum continues to grow for

industry to reduce emissions and reach the Western Australian Government’s goal of net zero emissions by 2050.

The Government is supporting industry by:

♦ Allocating $6 million in funding for research and development in critical minerals, precision and low-impact mining, and the uptake of clean energy technologies

♦ Developing its Sectoral Emissions Reduction Strategies with industry

♦ Drafting the Greenhouse Gas Storage and Transport Bill

♦ Providing a series of resources through its Energy Industry Development (EID) team

While many clean energy technologies are well-established, significant technological barriers remain that are preventing broad adoption. Specific applications of clean energy solutions at scale, particularly in heavy and extractive industries, remains a challenge.

MRIWA will commence consultations to identify and prioritise the high-impact research areas in parallel to legislative changes being made.

NEW CEO COMMENCES AT WA CHAMBER OF MINERALS AND ENERGY

The new Chief Executive Officer (CEO) of Western Australia’s Chamber of Minerals and Energy (CME), has officially commenced their new role.

Rebecca Tomkinson comes to CME from the Royal Flying Doctor Service (RFDS), where she served as CEO for more than four years.

Ms Tomkinson has taken the reins from Paul Everingham, who stepped down from the role at the end of his contract earlier in the year.

Ms Tomkinson said she was excited about the opportunity to serve as CME’s CEO.

“It is a real honour to join CME and I am looking forward to working in partnership with our member companies in the mining and resources sector in Western Australia,” Ms Tomkinson said.

“Our sector is the engine room of the Australian economy and plays a critical role in our communities, our economy and our everyday lives.”

During Ms Tomkinson’s tenure at RFDS, the service achieved significant growth and new capabilities through diversification and technological advances, including the introduction of two new aircraft types at the RFDS in Western Australia – Pilatus PC24 jets and EC145 helicopters – both national firsts for the organisation.

The Rio Tinto LifeFlight PC24 jets have halved flight times and increased patient capacity on long-haul routes across Western

Australia since their introduction in 2018. The integration of the jets led to the RFDS being named the state’s Tech Company of the Year in 2019.

Ms Tomkinson thanked acting CEO, Rob Carruthers, for managing the organisation since late May.

“Rob has expertly guided CME during the past several months, including establishing important links with the new Albanese Federal Government and leading the response to the WA Parliamentary Inquiry Into Sexual Harassment Of Women In the FIFO Mining Industry,” Ms Tomkinson said.

“I will work closely with Rob and the executive team over the next month as I make the transition out of RFDS into CME.”

After more than three and a half years with CME, Mr Carruthers will depart the organisation to take up a new corporate affairs role at Liontown Resources.

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au

NEWS 6

NEW ACLAND SECURES MINING LEASES ENDING 15 - YEAR FIGHT

After a 15-year-long battle, New Hope Group has secured mining leases for Stage 3 of its New Acland Mine, following an independent assessment by Queensland’s resources ministry. The company has sought an expansion to the New Acland mine for over a decade, a project that will increase total capacity to 7.5 million tonnes and extend operations by at least 12 years.

The only remaining primary approval required for New Acland Stage 3 to proceed is the granting of the Associated Water Licence by the Department of Regional Development, Manufacturing and Water.

New Hope Group Chairperson, Robert Millner, said the issue of the New Acland Mine Stage 3 Mining Leases is very welcome and long awaited news.

“New Hope and the local communities around Acland and Oakey are now only one step away from restarting the New Acland mine where there has been mining activity for over 100 years,” Mr Millner said.

“New Acland Stage 3 stacks up environmentally, socially and financially, and is consistent with and delivers on the recently released and extensive Queensland Government Resources Industry Development Plan.

“Unfortunately after 15 years of seeking approvals, New Hope remains at risk of ongoing delays caused by objectors utilising the court system to engage in ‘lawfare’ to slow down the approval process, regardless of the merits.

“We are hopeful that the Queensland Government can see a way to finally approve New Acland Stage 3 with certainty to secure jobs in the region and significant economic benefits for Queensland.”

7 NEWS

NEW QR C REPORT PREDICTS MAJOR CHANGES FOR QLD RESOURCES SECTOR

The Queensland Resources Council (QRC) has released its latest State of the Sector report for the June 2022 quarter, with the new data showing the fallout of the Queensland Government’s royalty hike as well as predicting major changes to the sector’s workforce over the next three years as companies accelerate efforts to achieve 30 per cent female participation by 2026.

The report confirms the Queensland Government’s decision to impose the world’s highest royalty taxes on coal producers has hit the resources sector hard, with more than one quarter (27 per cent) of resources leaders expecting to employ less people at existing operations over the next five years as a direct result of the State Government’s royalty hike.

The same survey conducted six months ago found that at that time, no Queensland CEOs expected to cut jobs over the next twelve months and 35 per cent were feeling confident about increasing employment at their operations.

QRC Chief Executive, Ian Macfarlane, said the report confirms the industry’s worst fears about the impact of the government’s higher royalty taxes on future investment plans.

“This latest data shows the State Government’s extra royalty tiers have dramatically impacted business confidence and investment plans across all commodities, not just coal projects,” Mr Macfarlane said.

“The report is a major red flag because it shows how much the royalty hike has hurt Queensland coal projects as well as gas, base metals and critical minerals projects.”

Mr Macfarlane said while it’s not possible for resources companies with

established operations in Queensland to relocate mines, new projects or planned expansions of existing sites will be hit hard as companies consider investing in less highly taxed destinations.

The report found that 54 per cent of CEOs believe the likelihood of expanding or upgrading their existing operations has decreased because of the royalty hike.

Additionally, 62 per cent of CEOs said the likelihood of new projects had also fallen, with 38 per cent saying the chance of undertaking new projects had dropped by more than 25 per cent.

Despite coming against the backdrop of a national jobs and skills summit and major skilled worker shortage across the industry, the report did contain some good news, showing that 78 per cent of the state’s CEOs plan to implement new diversity and inclusion programs over the next 12 months.

According to the report, 85 per cent of Queensland CEOs believe a more diverse and inclusive workforce improves staff attraction and retention rates, and 62 per cent believe it boosts business performance, productivity and employee wellbeing.

Mr Macfarlane said the intense competition for skilled workers has helped to accelerate company efforts to recruit more women and people from Indigenous and culturally diverse backgrounds.

“Along with other industries, resources companies have been struggling for some time to fill positions because of border restrictions relating to the pandemic and Australia’s historically low unemployment rate right now,” Mr Macfarlane said.

“The positive out of this for Queenslanders is that

new doors are opening for a wider and more diverse section of our community to get a well-paid job in our minerals and energy sector, where they can contribute to our industry’s transition to a lower emissions future.”

According to the QRC’s most recent diversity and inclusion report, the proportion of women in project management roles has more than doubled over the past ten years and now sits at 23 per cent.

Over the past five years, the number of women in trade and operational roles has increased by 37 per cent, representing nearly 14 per cent of these positions.

The report also included a CEO sentiment survey, which found the top three concerns keeping Queensland resources leaders awake at night right now are:

The global macroeconomy, with some CEOs pointing to a looming recession and the impacts of the Ukraine war as a major concern

High input costs which has jumped from sixth place to number two since the December 2021 quarter

The problem of attracting and retaining skilled employees, which has fallen from the number one position for the first time since the June 2021 quarter

NEWS 8

INDUSTRY MAKES $3.9B INVESTMENT IN MINERALS EXPLORATION

The Minerals Council of Australia (MCA) has released a report calling for greater business investment in new technologies and projects.

MCA Chief Executive Officer, Tania Constable, said the MCA’s Economic Series Report demonstrated the need for investment growth.

“The last decade has seen Australia going from one of the best performing OECD countries for private sector capital investment to one of the poorest performing and labour productivity growth falling 2.5 percentage points,” Ms Constable said.

“Since the end of the last mining investment boom, growth in the economy’s real net capital stock

substantially slowed and it is now growing at its lowest rate in 60 years.

“Unless this is turned around, Australia is at risk of experiencing continued weakness in business investment, which in turn will further weaken the contribution from our stock of capital to productivity growth.”

To attract capital investment, the report highlights the need for economic reforms that deliver internationally competitive tax settings; expanded trade and investment opportunities; efficient and effective regulatory settings; practical and beneficial workplace relations rules; an efficient transformation to net-zero emissions; and, industry-focused skills and training programs.

“The minerals industry has demonstrated its ability to be a major contributor to Australia’s private sector capital investment and productivity growth owing to the expansion of mining that began in the 2000s,” Ms Constable said.

“The industry can again make a substantial contribution to lifting productivity if policy settings make Australia a competitive destination for large-scale investment in mining and minerals processing projects.

“A one per cent lift in productivity by 2030 would deliver a $200 billion boost to the Australian economy, 9.4 per cent increase in real wages and Australian families $11,700 better.”

BHP’S NEW PROGRAM TO ASSIST MINERAL EXPLORATION STARTUPS

BHP’s new cohort-based accelerator program – Xplor – will offer early-stage startups in-kind services, mentorship, networking opportunities with industry, and investors and connections to hasten critical minerals exploration.

The program is set to assist early-stage mineral exploration startups find critical resources, such as copper and nickel, to drive the energy transition.

BHP Xplor merges concepts from both venture-capital and early-stage accelerators, to establish a fit-for-purpose exploration portfolio of innovative earlystage mineral exploration companies and help drive their exploration campaigns.

BHP’s Chief Development Officer, Johan van Jaarsveld, said that through this program BHP hopes to create disruptive results in copper and nickel exploration by identifying new concepts, leveraging new data and testing opportunities at a much faster pace than discoveries to date.

“The demand for future-facing commodities, such as copper and nickel, needed to support the global energy transition, is forecast to increase in the coming decades – the launch of BHP Xplor will help us accelerate in finding these critical commodities now and into the future,” Mr van Jaarsveld said.

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 9 NEWS

COMBINING LOCATION, TRACKING AND AI FOR ENHANCED MINE SAFETY AND PRODUCTIVITY

MAs the resources industry rapidly digitalises, implementing technology that allows for digitally-enabled decision-making represents a major opportunity for the sector to improve operations. If a mining company has access to a digital map of a mine site, showing the location and quantities of equipment and materials, the whereabouts of personnel, and has access to enhanced communication, it can not only increase productivity but also improve health and safety outcomes on-site.

erging location and tracking with the intelligence of AI, new technology from Australian-owned company, Contact Harald, provides mining companies with better methods to bring significant operational and process improvements, allowing workers to find equipment and locations with an interactive map of assets tagged with tracking technology.

This powerful combination also helps create a safer work environment as personnel can be located and tracked quickly by first responders if someone is injured, or in times of emergency.

Such technology paves the way for companies to unlock the value of technology through integrated operations, enabling them to be more agile in their response to changes and to make informed operational decisions.

Ask Harry

Ask Harry is an intelligent digital assistant designed to streamline mining safety procedures and provide the industry with operational productivity gains. Using multilingual voice control as the main input, Ask Harry makes finding and reporting information simple. It can also be used by personnel to call for help, either by phone or two-way radio.

Find Harry

Find Harry is an integrated location and tracking system, designed for both real-time tracking and last-seen location solutions. It helps improve safety and efficiency by providing a clear picture of workers' whereabouts and the precise location of tools, equipment, inventory and assets, at all times. Combining multiple technologies such as GPS, Bluetooth and Wifi, Contact Harald tailors cost-effective solutions to meet the unique scenarios and needs of its customers.

Merging technologies to transform the mining industry

Combining Ask Harry’s ease, speed and multilingual offerings with Find Harry’s location capabilities, provides mining companies with the tools needed to unlock value across the mine site by:

♦ Enhancing communication

♦ Providing faster access to information

♦ Enabling quicker, more accurate safety reporting

♦ Optimising inventory, equipment, asset and fleet management

With Harry's network of beacons and tags, users can view a digital map of the mining site, showing the location of equipment, materials and the whereabouts of personnel.

Mining personnel can also access job information, directions and safety updates with a call to Harry, and upload reports onsite through their mobile phones or two-way radios. In the case of an incident, those nearby can call Harry to alert emergency personnel, and the location services provided by Harry can help early responders rapidly locate those injured.

Having produced innovative solutions over the past decade, and being the first to squeeze battery-powered Bluetooth tracking technology inside a credit card, Matt Denton, Contact Harald’s CPO, said Ask Harry and Find Harry build on the evolution of the company’s work to find new ways to provide effective answers for the challenges faced by businesses globally.

“Find Harry is the natural evolution of our work in location technologies over the past decade. We are expanding our products to include indoor, outdoor and proximity-based solutions,” Mr Denton said.

“When you add Ask Harry in the mix you get location with intelligence, creating smarter ways to use your location data. Ask and Find Harry form a powerful duo to help create a safer work environment, plus increase productivity.

“I'm certain that the sector is about to make great strides in productivity and worker safety.”

The Ask Harry and Find Harry solutions will launch toward the end of Q3 2022 in Australia, with offerings in the US to be made available around late Q4 2022. For more information, visit bit.ly/askharry-mm

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au 10

NEWS | SPONSORED EDITORIAL

change scan QR code

for the Australian Resources Industry RiMine Discover more: www.rittal.com.au

Designed

A PORTABLE VALVE ACTUATOR FOR THE MINING SECTOR

By definition, open pit mines are often located in remote areas, and can be large or even gigantic (some mines are much larger than large cities).

The process of operating a mine is complex and involves many industries. The infrastructure (electricity, clean water, wastewater, roads, etc.) is comparable to that of a large city, not to mention the industrial infrastructure itself.

Water is a resource that is used extensively in all areas and its supply is critical. It often comes from far away and is transported by large pipelines.

Whether in the water pumping stations at the ocean's edge, on the route of the pipelines or – above all – in the mine itself, the water networks are complex, with enormous flows and consequently large valves. Often, these valves are manual and, given their size and the torque required, require several thousand turns of the hand wheel to open or close them, which represents a very long operating time.

Modec portable valve actuators are used for preventive maintenance

♦ Drastic reduction in operating time

♦ Reduced fatigue, risk of accidents and occupational illness

♦ Protection of the valve itself with our power, speed and torque control systems

♦ Increased valve service life due to shorter, easier and therefore more regular maintenance operations

♦ The valves are of course located in remote and sometimes very isolated locations

This is where the Modec range is of particular interest due to the possibility of using portable battery-powered actuators (with a continuous autonomy of up to 90 minutes), or actuators with combustion engine (in this case the autonomy is limited only by the size of the petrol canister taken by the operator).

For the numerous valves located in pumping stations or water treatment complexes (most often equipped with a compressed air network), a particularly powerful and light pneumatic compressed portable actuator can also be used. It is also possible to use one of the battery-powered actuators directly connected to the mains for total autonomy.

♦ Simple installation : The portable actuator and flying adapter can be installed in seconds

♦ Ease of use : The device is intuitive, safe, lightweight and can be used safely by anyone

1300 FMT FMT (368 368)

Melbourne

1/53-57 Rimfire Drive

Hallam VIC 3803

Brisbane

2/5 Percy Drive

Brendale QLD 4500

Perth

3/48 Hardey Road

Belmont WA 6104

sales@fmt.com.au fmt.com.au

♦ Robustness : Portable actuators do not require any special maintenance and are particularly suitable for demanding environments

♦ Versatility : With only five models (two pneumatic, two battery, and one gas) and a few adapters, any valve can be handled in any environment. Whether the need is to save time by going faster or to gain strength for difficult valves, our devices are there for you

♦ Associated gains : It is not necessary to look far to see the gains brought by these portable actuators – saving time (and therefore money), reduction of accidents, sick leave and occupational illness which cost the company a lot of money, reduction of drudgery (operator satisfaction and improved productivity), drastic improvement of equipment maintenance and consequently its lifespan

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au

NEWS | SPONSORED EDITORIAL 12

Established in 1995, Field Machine Tools has thrived as a privately owned Australian company supplying portable maintenance machines and engineering solutions to clients across Australia. The business aims to flatten production downtime by providing operators with the most complete scope of products and accessories for industries across Australia and beyond.

BRISBANE A: 2, 5 Percy Drive, Brendale, QLD, 4500 P: (07) 3889 7622 E: sales@fmt.com.au PERTH A: 3, 48 Hardey Road, Belmont, WA, 6104 P: (08) 9470 6088 E: sales@fmt.com.au MELBOURNE A: 1, 53-57 Rimfire Drive, Hallam, VIC, 3803 P: (03) 9703 2250 E: sales@fmt.com.au Keep your plant, pipe and valve infrastructure strong with Field Machine Tools

Modec Easy Duty Electric Portable Actuator Modec Portable Actuator Pumping Station

1300 368 368 www.fmt.com.au

MATERIALS DEMAND OF RENEWABLE ENERGY SYSTEMS

UNTIL 2025

By Peter Majewski, Future Industries Institute, University of South Australia

By Peter Majewski, Future Industries Institute, University of South Australia

14 CRITICAL MINERALS IN FOCUS

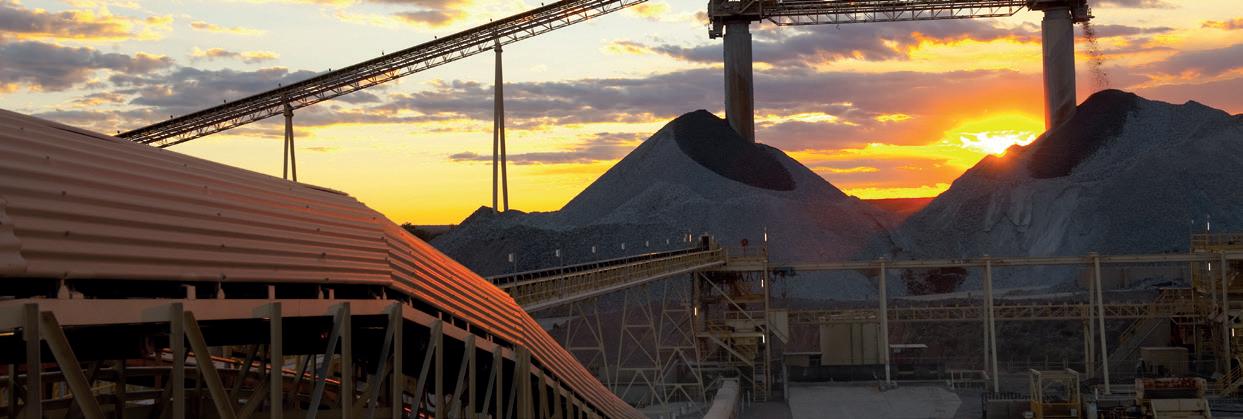

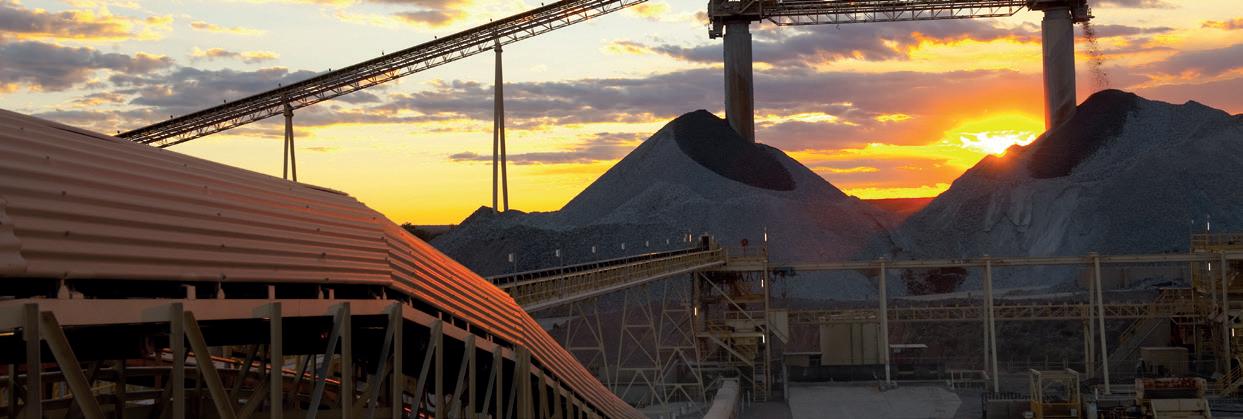

During the past ten years, the uptake of renewable energy systems, especially solar photovoltaic (PV) panels and wind turbines, has significantly increased, and represents a significant change in the way we are generating power on-grid and off-grid. Both technologies have become important means to transition to an electric power generation which is renewable, scalable and free of greenhouse gas emission.

15 CRITICAL MINERALS IN FOCUS

Recent reports of The World Bank¹ clearly highlight the future demand in mineral and metal resources to manufacture renewable energy systems, and estimates that over three billion tonnes of minerals and metals are needed to manufacture renewable energy systems. This is especially the case for energy storage, which requires an up to 500 per cent increase in production of graphite, lithium and cobalt; and solar PV and wind power systems require significant resources of aluminium, silicon and rare earth elements.

In 2050, the entire 2018 production volume of nickel will be consumed to manufacture renewable energy systems, and the production of vanadium and indium needs to be doubled to satisfy the demand. In addition, it is estimated that up to 29 million tonnes of copper have to be mined by 2050 to provide sufficient amounts for renewable energy systems.

All this is required to avoid a global temperature increase of 2°C. However, if more ambitious climate targets are requested – and this is not unthinkable – the required amount of minerals and metals for the manufacturing of renewable energy systems will be even higher. While this demand in minerals and metals represents a significant challenge in future, it also represents a significant economic opportunity for mineral-rich nations and related industries, and the prognosis provides the necessary data for long-term planning in this industry sector.

While these reports are providing an important outlook of what will be necessary in 2050 from today’s point

of view, it still needs to be considered that technology change may affect this prognosis within the next 30 years. For example, the report of the Club of Rome in the early 1970s² gave the prognosis that the world will run out of essential minerals and metals within a few decades. However, this prognosis was quickly rendered obsolete by the rise of plastics and polymers – which by now have replaced minerals and metals in numerous applications – by the rise of computers and ICT which transformed manufacturing, and the discovery of more and more minerals and metals resources worldwide.

More challenging may be the aspect of technology change, which may significantly reduce the expected demand in minerals and metals in some areas, but may increase the demand of other minerals and metals in other sectors of renewable energy systems. New concepts for wind power systems, called vortex wind power, may provide wind energy with less demand in materials, especially materials for the wind turbine blades and generators³. However, more significant development may have to be made in order to make such wind power systems compatible with conventional wind power systems.

Currently, 85 per cent of all solar photovoltaic panels are based on silicon. However, new solar PV systems are emerging, which are based on copperindium-gallium-selenide instead of silicon⁴. While such PV systems may play a more significant role in future, it is not very likely that they will replace siliconbased solar PV systems in the near future, as significant investments were made to build manufacturing capacities for silicon

solar PV systems, so they will most likely stay for some time.

It is, therefore, essential to assess the demand in minerals and metals for renewable energy systems over a much shorter time frame in order to identify potential bottlenecks in supply which may affect the spread of renewable energy systems.

Increase of renewable energy capacity until 2025

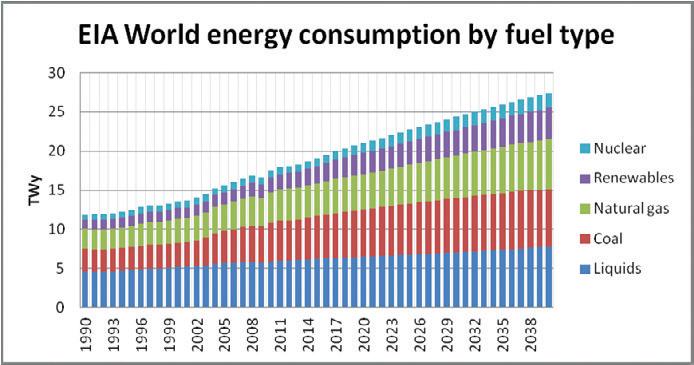

Together, solar PV and wind power technologies generated 1.44TW of electric power in 20205. Considering the increase of solar PV power and wind power since 2011, it can be expected that by 2025 solar PV power will generate electric power in excess of 1.5TW and wind power in excess of 1.1TW (Figure 1)6

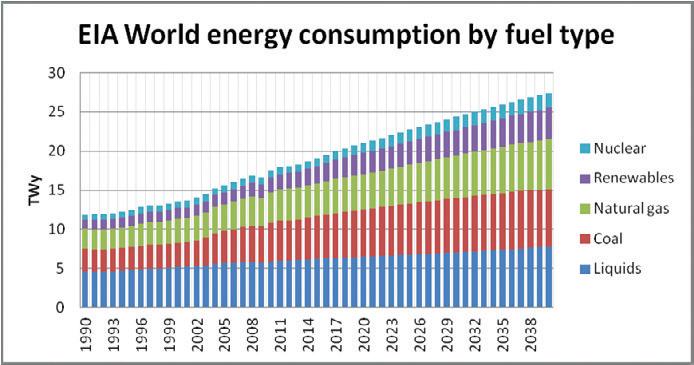

These combined 2.6TW of electric power generated by a conventional black coal plant would produce about 16.4 billion tonnes of CO2. However, as shown in Figure 2 the demand in electric energy increases by almost the same amount between 2020 and 2025, and therefore, the increased solar PV and wind power uptake will most likely only address the increased global energy demand and not reduce greenhouse gas emissions.

16

CRITICAL MINERALS IN FOCUS

Figure 1: Increase in the uptake of solar and wind power⁵ and expected further increase until 2025. Grey: wind power; black: solar PV power.

Compared to conventional electric energy generating technologies, the energy density in kilograms of weight per watt generated by solar PV or wind power systems is very low. Compared to coal and gas, solar PV requires about five to ten times more essential materials and wind energy requires nine to 18 times more8. This only considers the essential materials for the actual power generation like copper, silicon and other metals. If additional necessary materials used in the systems are included– like glass and aluminium for solar PV panels, fibreglass composites in wind power, and steel for the mounting the solar PV systems or building the wind turbine towers – the ratios are much larger.

Materials demand for solar photovoltaic power until 2025

Solar PV power generation has significantly increased worldwide between 2015 and 2020 by 490GW5. This means that – considering a state-ofthe-art solar PV panel during this time

period produced 300W to 350W – a staggering 1.4 billion to 1.63 billion solar PV panels were installed during this time period worldwide.

At a usual weight of a solar PV panel of about 18.5kg9, to achieve this, 17.6Mt to 20.5Mt of tempered glass, 3.9Mt to 4.5Mt of aluminium for the frame of the panel, 0.78Mt to 0.9Mt of silicon for solar cells, and 0.26Mt to 0.3Mt of copper for the junction box, and 3.4Mt to 3.9Mt of polymers for waterproofing were consumed. In total, 25.9Mt to 30.1Mt of materials.

However, in regards to copper, the numbers are even higher for solar panel systems due to the interconnection of the panels and connections to the storage battery and grid. It is estimated that about 4.6 tonnes of copper per megawatt generated is needed for complete systems8. Considering this number, the amount of copper consumed is about 2.25Mt. In addition, about 15Mt of steel for the mounts of the panels in complete systems were consumed.

By 2025, as outlined above, the expected installed capacity of solar PV power generation will have increased by about 800GW to about 1,500GW worldwide. Considering that the newest panels are capable of producing an output of 350-400W, it can be expected that in addition to the recently installed 1.4 billion to 1.63 billion panels another two billion to 2.3 billion panels need to be manufactured and installed during the time period between now and 2025. This would see a demand of 25.2Mt to 28.9Mt of tempered glass, 5.5Mt to 6.4Mt of aluminium, 1.1Mt to 1.3Mt of silicon, 0.37Mt to 0.42Mt of copper, and 4.8Mt to 5.5Mt of polymers. The demand for copper will reach between about 4Mt to 4.4Mt, and for steel about 24Mt when complete solar systems are considered, as outlined above.

While silver is used in older solar PV panels, it has gradually been replaced in manufactured panels. Therefore, silver demand for solar panel manufacturing over the coming years is not considered in this discussion.

Materials demand for wind power until 2025

Wind energy has been the second biggest renewable energy producer after hydro energy over the past 20 years. However, it can be expected that it will be overtaken by solar PV power in the near future. Due to better and more predictable wind resources offshore, wind power is being increasingly generated by offshore wind farms with foundations embedded in the ocean floor, or using new floating wind turbine technology. However, due to higher costs for

17

CRITICAL MINERALS IN FOCUS

Figure 2: World energy consumption. Source: US Energy Information Agency⁷.

offshore wind farms, onshore turbines remain the dominant technology.

During the past 35 years, wind turbines have become significantly taller and more powerful. The world's largest wind turbine currently is the 260m-tall Haliade-X offshore turbine. It features either a 14MW, 13MW or 12MW capacity, a rotor with a total diameter of 220m and three 107m-long blades.

In 2020, 733GW of wind power was generated worldwide5. During the time period between 2015 and 2020, the wind power capacity increased by about 317GW. In the near future, the expected increase in wind power capacity is about 400GW resulting in a total capacity of above 1,100GW to 1,200GW by 2025 (Figure 1)10

As for solar PV power, this increase of 400GW in capacity will result in significant demand in materials. Considering the current state-of-the-art wind towers, the expected increase would require the manufacture and installation of an additional 30,000 wind towers of Haliade-X size or 130,000 of the state-ofthe-art smaller 3MW onshore wind towers by 2025.

The demand in materials varies between the various types of wind towers.

Older wind turbines apply a gearbox between the rotor and the generator. Newer wind turbines are mainly manufactured using a direct drive, i.e. gearbox free, power transmission to the generator. While removing the gearbox provides a significant weight reduction by reducing the amount of steel for the turbine, direct drive turbines require higher amounts of copper of 3000t to 5000t per gigawatt generated as well as higher amounts of rare earth elements for the permanent magnets (100 to 240t per gigawatt generated) (Table 2).

Based on the data given by the International Energy Association7 and the European Commission11, at the expected increase of about 400GW of wind power capacity, the expected demand in rare earth elements can be calculated to be between 40,000 tonnes and 96,000 tonnes between now and 2025. For copper, the demand would be between 1.2 and 2Mt. About 2.2Mt of zinc and between 48Mt and 52Mt of steel would be required. Demand in minor components of the wind turbines would be 0.2Mt to 0.4Mt of aluminium, 0.12Mt of nickel, 0.04Mt of molybdenum, 0.32Mt of manganese, and 0.2Mt of chromium.

At the current state of wind power technology, it is estimated that eight to 13.4 tonnes of wind turbine blade materials is required to generate one megawatt of electric power12. Therefore, about 3.2 to 5.4Mt of glass fibre and carbon fibre composite material for wind turbine blades would be demanded until 2025.

Discussion

While the benefit of using solar PV and wind power to reduce greenhouse gas emission during electric power generation is widely acknowledged,

1. K. Hund, D. La Porta, T.P. Fabregas, T. Laing, J. Drexhage (2020), ‘Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition’, The World Bank, Washington, DC, USA

2. Donella H Meadows, Dennis L Meadows, Jorgen Randers, William W Behrens (1972), ‘The Limits to Growth’, Universe Books, New York, USA

3. P. McKenna (2015), ‘Bladeless Wind Turbines May Offer More Form Than Function’, MIT Technology Review <https://www.technologyreview.com/2015/05/27/167972/bladeless-wind-turbines-may-offermore-form-than-function/>

4. J. Ramanujam and U.P. Singh (2017), ‘Copper indium gallium selenide based solar cells – a review’, Energy Environ. Sci. 10, pp. 1306-1319 <https://doi.org/10.1039/C7EE00826K>

5. International Renewable Energy Agency (IRENA) (2021), ‘Renewable Capacity Statistics 2021’, Abu Dhabi, UAE

6. R. Andrews (2021), ‘Emission reduction and world energy demand’, last accessed 25 May 2021, <http://euanmearns.com/emissions-reductions-and-world-energy-demand-growth/>

7. T-Y. Kim and M. Karpinski (2020), ‘Clean energy progress after the Covid-19 crisis will need reliable supplies of critical minerals’, last accessed 21 May 20211, <https://www.iea.org/articles/clean-energyprogress-after-the-covid-19-crisis-will-need-reliable-supplies-of-critical-minerals>

8. M. Hall (2020), ‘World could add more than 900 GW of solar by 2025 if politicians grasp the nettle, IEA, last accessed 25 May 2021, <https://www.pv-magazine.com/2020/11/10/world-could-add-more-than900-gw-of-solar-by-2025-if-politicians-grasp-the-nettle-iea/>

9. P. Majewsk, W. Al-shammari, M. Dudley, J. Jit, S-H. Lee, K. Myoung-Kug and K. Sung-Jim (2021), ‘Recycling of Solar PV Panels - Product Stewardship and Regulatory Approach’, Energy Policy 149, 112062, <https://doi.org/10.1016/j.enpol.2020.112062>

10. J. Lee and F. Zhao (2021), ‘Global Wind Report 202’1, Global Wind Energy Council, last accessed 25 May 2021, <https://gwec.net/global-wind-report-2021/>

11. S. Carrara, P. Alves Dias, B. Plazzotta, C. Pavel (2020), ‘Raw materials demand for wind and solar PV technologies in the transition towards a decarbonised energy system’, European Commission, Luxembourg: Publications Office of the European Union, 2020

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au 18

CRITICAL MINERALS IN FOCUS

Material Amount [tonnes/GW] Aluminium 500-700 Copper 3000-5000 Glass/carbon fibre composite 8100 Rare earth elements 44-239 Steel 119500-132000 Zinc 5500

Table 2: Materials in direct drive wind turbines11 Numbers in tons/GW capacity.

the required demand in materials to satisfy the expected increase in power generation by these technologies is of concern (Table 1).

To put these amounts of materials in some context, it can be calculated that the required amount of aluminium would be sufficient to build 100,000 airliners of the newest type of Boeing 73713. The amount of steel would be enough to build almost 1,200 Golden Gate Bridges, and with the amount of copper required it would easily be possible to connect planet earth with the sun with a 1.5mm solid copper wire.

However, compared with the production numbers of these materials in 2020, shown in Table 3, the situation appears less critical. Nevertheless, the expected future demand in these materials represents a significant additional demand which can be considered a reasonable challenge, especially in regards to rare earth elements, as the demand competes with the increasing demand of other essential technologies such as information and communication technologies. Nevertheless, the prognosis also presents a short-term business opportunity for the producers of these materials and mineralrich nations.

Given the significant demand in these materials within a rather short timeline, it is essential that markets, supply lines, and manufacturers of these materials

and renewable energy systems are prepared to achieve this. In addition, governments need to create and ensure undisrupted supply lines and trade agreements for these goods to guarantee the expected increase in renewable energy capacity. The consequence would be an undesirable significant increase in greenhouse gas emission due to increased conventional power generation.

It also has to be considered that at one stage, in about 15 to 25 years, the renewable energy systems that are currently installed, and those which are to be installed within the next few years, will reach the end of their operational life and will eventually go to waste. Most of the applied metals will go through recycling, but some of the materials are either very difficult to recycle or it is not economical to recycle them. One example is glass fibre composite material. The amount of this material consumed in wind turbine blades which were installed since 2015 and are expected to be installed until 2025 is about 5.7Mt to 9.6Mt, and causes a significant challenge for end-of-life management and recycling21

Silicon from existing solar PV panels is currently only recycled in very small amounts. The combined amount of

silicon consumed for manufacturing solar PV panels since 2015 and required for the solar PV panels until 2025 is expected to be about 1.88Mt to 2.2Mt.

In this context, economic recycling processes for silicon from solar PV panels is, therefore, important to ensure that this valuable material is incorporated into the circularity of the economy and reused for the manufacturing of solar PV panels or other silicon-based products such as silicon carbide ceramics.

Some materials are used across both technologies, such as copper, and some materials are crucial for generating electric power by the technologies, such as silicon and rare earth elements. These materials can be considered as absolutely essential, while others are only used for structural components, like aluminium and steel. Materials, like aluminium, which are not essential for directly generating electric power, can therefore be replaced by other materials, or made redundant by changing the design of a solar panel. Developments in this direction are already ongoing, such as the emerging organic solar cells22, floating solar panels and solar farms, which may require more light weight designs23, and build-integrated solar panels24

in Mt.

12. P. Liu and C.Y. Barlow (2017), ‘Wind turbine blade waste in 2050’, Waste Management 62, pp. 229–240

13. Modern Airliners (2022), ‘Boeing 737 Specifications’, last accessed 22 June 2021, < https://modernairliners.com/boeing-737/boeing-737-specifications/>

14. M. Garside, ‘Major countries in silicon production 2010-2020’ (2021), last 18 May 2021, <https://www.statista.com/statistics/268108/world-silicon-production-by-country/>

15. Global Data (2021), ‘Global copper production to recover by 5.6 % in 2021’, last accessed 18 May 2021, <https://www.globaldata.com/global-copper-production-recover-5-6-2021-covid-19-hit-output-2020says-globaldata/ >

16. International Aluminium (2022), ‘Primary Aluminium Production’, last accessed 18 May 2021, <https://www.world-aluminium.org/statistics/>

17. Statista (2021), ‘Global Production of Zinc Metal from 2004 to 2020’, last accessed 18 May 2021, <https://www.statista.com/statistics/264878/world-production-of-zinc-metal/#:~:text=In%202020%2C%20 approximately%2013.7%20million,world's%20largest%20producer%20of%20zinc>

18. M. Garside (2021), ‘Major countries in rare earth mine production worldwide 2020’, last accessed 18 May 2021, <https://www.statista.com/statistics/268011/top-countries-in-rare-earth-mine-production/>

19. S. Mazumdar (2020), ‘The Glass Fiber Market’, last accessed 18 May 2021, <http://compositesmanufacturingmagazine.com/2020/01/2020-state-of-the-industry-report/>

20. World Steel Association (2021), ‘Global Crude Steel Output deceases by 0.9% in 2020’, last accessed 18 May 2021, <https://www.worldsteel.org/media-centre/press-releases/2021/Global-crude-steeloutput-decreases-by-0.9--in-2020.html>

21. P. Majewski, N. Florin N, J. Jit and R.A. Stewart (2021), ‘Product Stewardship Policy Consideration for Wind Turbine Blades’, Energy Policy, submitted April 2021

22. L. Duan and A. Uddin (2020),’ Progress in Stability of Organic Solar Cells’, Adv Sci 22, 1903259, doi: 10.1002/advs.201903259.

23. P. Ranjbaran, H. Yousefi, G.B. Gharehpetian and F.R. Astaraei (2019), ‘A review on floating photovoltaic (FPV) power generation units’, Renewable and Sustainable Energy Reviews 110, pp. 332-347

24. B. Joseph, T. Pogrebnaya and B. Kichonge (2019), ‘Semitransparent Building-Integrated Photovoltaic: Review on Energy Performance, Challenges, and Future Potential’, Internat J Photoenergy, 5214150, <https://doi.org/10.1155/2019/5214150>

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 19

Material Weight % Glass 68 % Aluminium 15 % Silicon 3 % Tedlar and EVA 13 % Copper 1 % Steel About 30 tons per MW capacity

CRITICAL MINERALS IN FOCUS Material Solar PV Panels Wind Turbine Towers Total Production 2020 Silicon 1.1-1.3 - 1.1-1.3 7.514 Copper 0.37-0.42 1.2-2 1.57-2.42 2015 Aluminium 5.5-6.4 0.2-0.4 5.7-6.8 6516 Zinc - 2.2 2.2 13.717 Rare Earth Elements 0.04-0.096 0.04-0.096 0.2618 Glass 25.2-28.9 - 25.2-28.9 unknown Glass/carbon fiber - 3.2-5.4 3.2-5.4 719 Steel 24 48-52 72-76 186420 Polymers 4.8-5.5 Not available

Table 1: Materials in solar PV panels. Average weight of an about 400W panel is about 18.5kg⁹.

Table 3: Material demand between now and 2025 at an expected increase in power generation of about 800GW for solar PV power and 400GW of wind power. Numbers

A SHO R T

HISTO � Y OF

CRITICAL MINERALS

By Jane Nicholls

By Jane Nicholls

They are the very definition of a modern hot commodity. Jane Nicholls reports on how governments decide what minerals are added to the critical minerals list, and why it’s a brilliant opportunity for the Australian resources industry.

20

CRITICAL MINERALS IN FOCUS

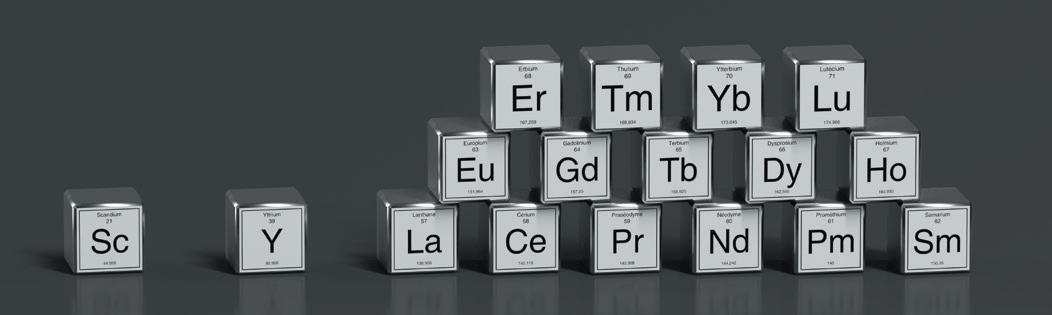

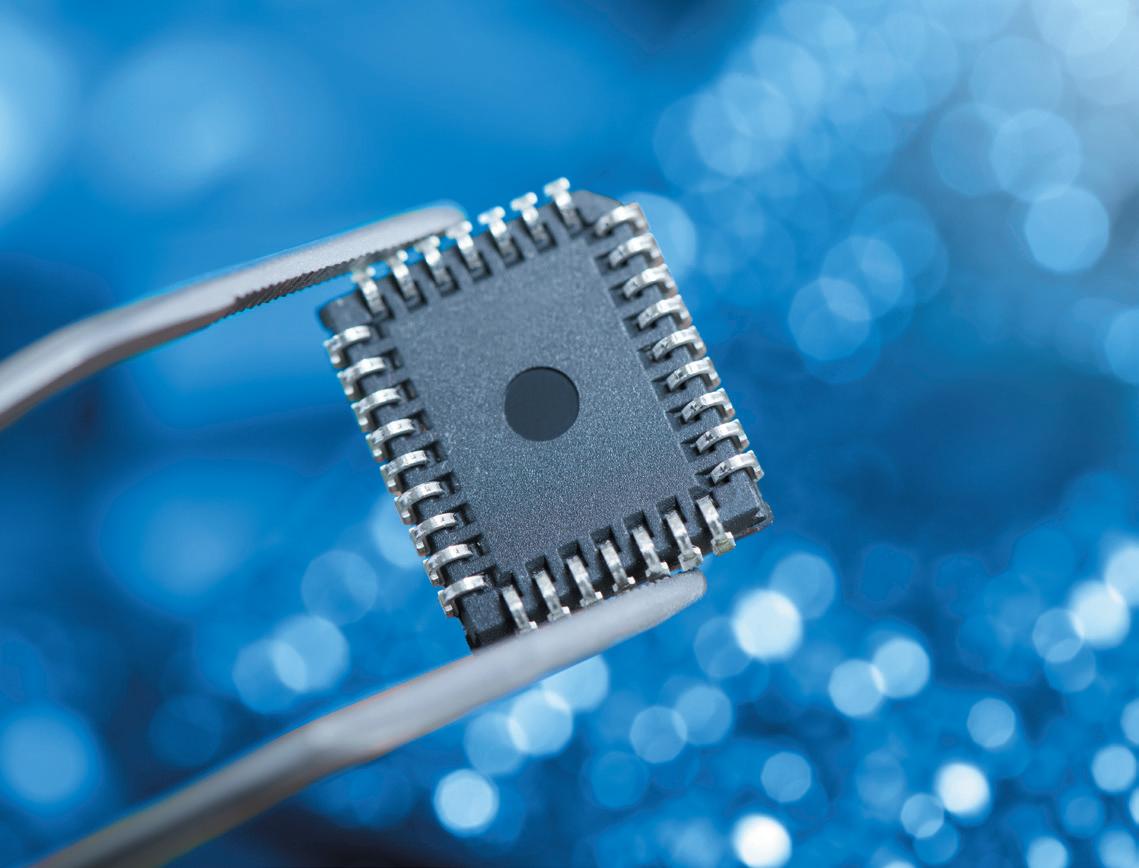

Innovation is the simple reason that attention to critical minerals is in such sharp focus. Numerous technologies – from EV batteries to PV cells, from fibre-optic cables to semiconductor chips – rely on these minerals, which means we’re using more of them and in greater volumes.

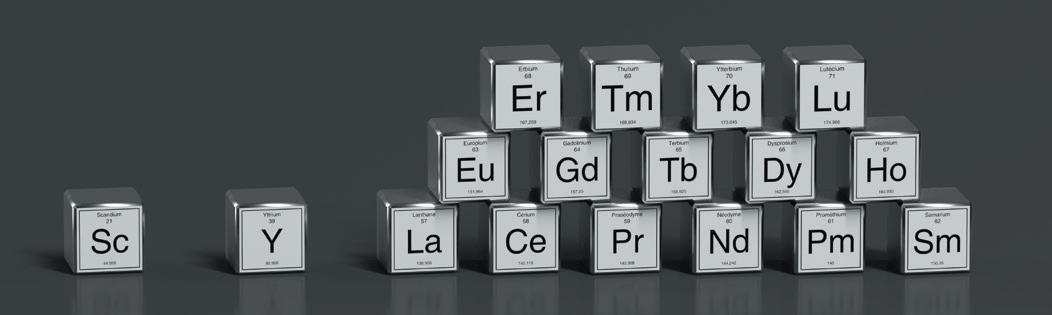

“A hundred years ago, we were using a dozen main metals, and that was it,” said Allison Britt, Director Mineral Resources Advice and Promotion at Geoscience Australia.

“These days, we’re using almost all of the periodic table in some fashion in various technologies. We need to better understand critical mineral supply chains, diversify them and make them much more robust than they have been.”

These minerals are critical across numerous technologies driving energy transition, medical devices, aerospace and even banknotes, and are also crucial for products we regard as everyday, such as stainless steel and electronic appliances.

“The definition we use for critical minerals is that they are metallic or non-metallic elements that are essential to the functioning of our modern technologies, economies and national security, and that there is a risk that their supply chains could be disrupted,” said Ms Britt, who is a commodity specialist and expert in critical minerals.

In addition to minerals listed as critical, others are classed as strategic, and the list varies slightly from country to country, based on local uses and threats.

“I was once in a meeting with a famous American geoscientist discussing what’s a critical resource and what’s strategic,” recalled Dr Chris Vernon, Senior Principal Research Scientist at CSIRO Mineral Resources.

“He said it really simply; ‘It’s stuff you need that you can’t get’. That struck me as a good touchstone!”

The evolution of listing critical minerals

Ms Britt said, for example, “lithium, cobalt and tungsten are regarded as essential to modern life”.

They are all in geological abundance in Australia and on the critical minerals lists of the US, EU, Japan and India.

“Supply chain disruption to those minerals could come in the form of market monopolies – or near-monopolies such as we see with Chinese control of rare earths – or it could be market immaturity, political decisions, social unrest, natural disasters, mine accidents, geological scarcity, and recently we’ve seen pandemic and war.”

War was the reason the US made its first list of critical minerals. During WWI1, five key minerals – tin, nickel, platinum, nitrates and potash – were scarce on its own soil and within two years of the conflict beginning, were becoming difficult to obtain.

“The Americans drew up a list of War Minerals,” explained Ms Britt.

By 1917, the US Geological Survey had reoriented its work to aid the search for minerals needed for the war effort.

“Later they split it into three lists –strategic, critical and essential minerals – but by World War II, the lived war experience had shown those distinctions were largely academic.”

That is, they were all critical in one way or another.

Many critical minerals aren’t necessarily scarce in Australia, but as well as vulnerable supply chains, keeping up volume to meet surging demand from allied manufacturing sectors is a potential issue.

“If you’re relying on imports of all resources, that makes everything critical,” said Dr Vernon.

“Minerals that are on Australia’s critical list are usually major inputs to the economies of our allies and end up in things that we buy back in a finished form. Rare earth elements are on the Australian critical minerals list2, for example, not because we make things out of rare earths here, rather in recognition that allied economies rely on them.”

How an abundant mineral can quickly become critical

“When it came to developing Australia’s first Critical Minerals list, which was published in 2019, the Australian Government’s approach reflected the fact that our mineral economy is dominated by mineral exports, not manufacturing,” said Ms Britt.

“The original list of 24 minerals was based on the strategic needs of our partners – such as the United States, the EU, Japan, the UK and South Korea –combined with Australia’s high geological potential to supply those minerals.”

The 2022 Critical Minerals Strategy 3 published in March by the Department of Industry, Science and Resources saw the addition of high-purity alumina and silicon, both abundant in Australia.

“They are both important for a range of technologies including batteries, quantum computing and semiconductors,” said Ms Britt.

She said the addition of those two to Australia’s list, to bring the total to 26, is a classic example of how the importance of minerals shifts over time.

“They reflect changes in technologies, in geopolitics, supply chains and processing techniques,” said Ms Britt.

“Technically, neither high-purity alumina or silicon are available as

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 21

CRITICAL MINERALS IN FOCUS 1. https://pubs.usgs.gov/circ/c1050/ww1.htm#:~:text=The%20United%20States%20was%20believed,platinum%2C%20nitrates%2C%20and%20potash 2. https://www.ga.gov.au/scientific-topics/minerals/critical-minerals#heading-1 3. https://www.industry.gov.au/data-and-publications/2022-critical-minerals-strategy

minerals in the raw – the base minerals are bauxite and silica sand – but it is a recognition that those are materials that are incredibly important,” said Dr Vernon.

“Silicon has been added in part because there is a global computer-chip shortage. When the chip shortage became apparent, governments scrambled and had a look at the supply chain for computer chips and went, ‘Ah, actually a lot of these chips are made in Japan, South Korea, Taiwan, the US, and Europe, but manufacture of the base substrate material is concentrated in three or four individual manufacturers in China’. That’s a weak point in the supply chain.”

Enter the pandemic for a live demonstration of how a supply chain gets smashed almost overnight.

“When COVID hit China, factories closed down and they stopped producing as much of this high-purity silicon wafer, that’s essential for semiconductors,” said Dr Vernon.

“It was a pretty broad impact. The US can’t make enough of their own silicon wafers for these microchips. Solar photovoltaic panels are also made of high-quality silicon, so while the world is

not running out of silica (quartz and sand), it’s running out of high-purity silicon, because it’s not produced in enough places to keep the supply chain open and viable. That’s why silicon was added to the list this year.”

The demand for certain critical minerals will continue to fluctuate.

“It’s hard to believe today that asbestos and arsenic were once considered critical minerals,” said Ms Britt.

“It definitely keeps people busy trying to forecast what commodities will be regarded as critical minerals in the future! With renewable energy technologies in demand, we might find that Australia adds nickel, copper, tin and zinc to the list.”

All except copper are already on the US Geological Survey’s List of Critical Minerals4, which was first published in 2018 and had 15 added in 2022 to bring it to 50.

“The Australian Government regularly reviews our Critical Minerals list, and those of our partners, to ensure it reflects those changing conditions in technology, economics and geopolitics,” said Ms Britt.

“We want to make sure we are in the best position to build our own domestic capability for critical minerals discovery, processing and supply chains, which is a real opportunity for Australia.”

The critical minerals list is an important signal to markets

Ms Britt said that the addition of the two new minerals to Australia’s list in 2022 means they are now supported by the government’s Critical Minerals Strategy It sends a signal to the resources industry and helps to unlock investment in both mineral exploration, processing and downstream value-adding.

“The strategy includes a range of actions to help build Australia’s critical minerals capabilities,” explained Ms Britt.

The Federal Government’s $2 billion Critical Minerals Facility was announced in 2021 and is already providing loans to the sector. A $50 million virtual National Critical Minerals Research and Development Centre5, hosted by CSIRO in conjunction with Geoscience Australia and the Australian Nuclear Science and Technology Organisation (ANSTO) is another important initiative. It was

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au 22 CRITICAL MINERALS IN FOCUS

announced in March 2022 to help unlock new sources of economically viable critical minerals, develop Australian IP in critical mineral processing, target technical bottlenecks in strategic supply chains and drive collaborative research breakthroughs.

Ms Britt said once a mineral is on the list, companies can apply to the Critical Minerals Facilitation Office for connection to government funding facilities6

“For example, now that high-purity alumina is on the list, a company can apply for a range of financial support for its high-purity alumina project that will help improve access to it, secure supply, or advance its processing,” said Ms Britt.

“If a mineral is not on the list, that’s not an option.”

Australia’s potential as a critical minerals superpower

“The surge of electric vehicles and renewable energy projects around the world is a huge opportunity for Australia,” said Ms Britt.

“People want their cars to be made of materials that have been produced responsibly – they don’t want the cobalt in the battery to have come from child labour, or the rare earths in a motor to have contributed to irreversible environmental destruction. Manufacturers want secure supply of those minerals, and other critical minerals such as lithium, graphite, manganese and vanadium, all of which occur abundantly in Australia.

“The challenge is to value-add to our natural mineral wealth. Australia is a mining superpower, but with a few exceptions, such as the aluminium industry, we haven’t been so good at taking the next steps in the supply chain that would enable us to realise better returns.”

As Ms Britt said, most of our minerals are shipped out in bulk or minimally processed into concentrates or basic metals.

“The high-value critical mineral purification, chemicals and componentry are all created in other countries, and

the technology using these materials and components are manufactured in other countries – then Australia buys it back.”

Dr Vernon and Ms Britt also stressed that value-adding to our minerals onshore will not only bring economic benefits, but it will also bolster global security around these minerals.

“It’s incumbent on us to lengthen and strengthen these critical minerals supply chains,” said Dr Vernon.

“It’s exciting to dig up and concentrate an ore of something that’s scarce, but if you export it in raw form, you’ve lost all control over the supply chain. Valueadding within Australia to strengthen global supply chains is an important aspect to ensure we are not perpetuating the current situation, where some minerals are critical only because there’s a pinch point in the supply chain, and it’s in a country that’s not necessarily transparent in its dealings.”

He calls out two Australian companies that are forging a value-add path for our critical minerals wealth by doing more downstream processing onshore.

“Lynas Rare Earths7 is building a processing facility in Kalgoorlie, creating far more security in the supply chain,” he says.

6. https://www.industry.gov.au/policies-and-initiatives/critical-minerals-facilitation-office

7. https://lynasrareearths.com/wp-content/uploads/2022/02/Lynas-Kalgoorlie-Project-Update-Feb-2022.pdf

8. https://www.iluka.com/getattachment/bf86791e-7a5b-40cd-a38f-0fd6185fdc24/eneabba-rare-earths-refinery-final-investment-(1).aspx

The company is the only producer of separated rare earths at scale outside China.

“Iluka Resources8 is building a refinery in Western Australia which will produce purified rare earths to feed into a rare earths metal refinery, with the product going to magnet makers. Those are both examples of companies lengthening their supply chains.”

Ms Britt said there’s immense scope for more projects like those.

“The growth in the critical minerals sector means we have this opportunity to reinvigorate our own domestic manufacturing sector, and to do more of that value-adding right here in Australia,” she said.

“Any downstream manufacturing needs a reliable feedstock and that’s where Geoscience Australia comes in – we uncover mineral potential which helps companies make those discoveries to provide the raw feedstock that will underpin a lengthened, diversified supply chain manufacturing sector here in Australia.”

For the Australian resources sector, it’s not so much a matter of ‘watch this space’ as watch this list.

www.miningmagazine.com.au Spring 2022 \\ ISSUE 1 23

article was originally published by CSIRO. To view the article or others by CSIRO, visit www.csiro.au/resourceful

This

4. https://www.usgs.gov/news/national-news-release/us-geological-survey-releases-2022-list-critical-minerals 5. https://www.csiro.au/en/news/news-releases/2022/national-critical-minerals-research-and-development-centre

CRITICAL MINERALS IN FOCUS

HOW CRITICAL MINERALS WILL TRANSFORM THE MINING INDUSTRY

By Michelle Goldsmith, Contributing Editor, Mining Magazine

By Michelle Goldsmith, Contributing Editor, Mining Magazine

Minerals are crucial to the technologies enabling the global clean energy transition. As the need for climate action becomes increasingly urgent and efforts to reduce emissions intensify worldwide, demand for certain minerals is expected to soar. The rapid transformation of the global energy sector will cause dramatic shifts in mineral markets – bringing about a new set of challenges and opportunities for mining industry stakeholders.

Spring 2022 \\ ISSUE 1 www.miningmagazine.com.au 24

CRITICAL MINERALS IN FOCUS

Critical minerals underpin a net-zero future

Global energy systems are set to undergo massive transformations over the coming years, as societies transition from the widespread use of fossil fuels to lower-carbon energy technologies. This revolution has already begun – yet it must swiftly gain pace to limit the global rise in temperature to 2°C or under and for countries around the world to meet their emissions reduction targets. The increased uptake of renewable energy generation and storage technologies will require a significant boost in the supply of various critical minerals.

While the exact minerals needed differ by technology, solar PV systems, wind turbines, battery storage and electric vehicles (EVs) generally require significantly more minerals to build than their fossil-fuel counterparts1. Lithium, nickel, cobalt, manganese and graphite are essential for high-performing batteries, while the magnets used in wind turbines and EV motors rely on rare earth elements. Electrification and the expansion of electricity networks necessitate large amounts of copper and aluminium. Meanwhile, the expansion of hydrogen as an energy carrier underpins major demand growth for nickel and zirconium for electrolysers, and for platinum-group metals for fuel cells.

To meet the goals of the Paris Agreement (including a global temperature rise under 2°C, and preferably less than 1.5°C, over pre-industrial levels) mineral supply to the clean energy sector will need to quadruple by 20402. The World Bank has estimated that more than three billion tonnes of minerals and metals will be needed3. Alternatively, to meet the more ambitious target of net zero globally by 2050, the clean energy sector would need six times more minerals by 20404. Either way, satisfying increased demand will require mineral supply far above current production.

The World Bank projects that by 2050 the energy sector’s annual demand for cobalt could be 460 per cent greater than 2018 production5. Similarly, graphite demand could be 494 per cent higher than 2018 levels, lithium 488 per cent, indium 231 per cent, vanadium 189 per cent, and nickel 99 per cent6. These figures refer purely to the quantities required for clean energy technologies, and do not account for the demand for these same minerals for other uses.

In many cases, clean energy growth projections signify drastic shifts in markets for these resources, as the energy sector becomes responsible for a much greater proportion of total demand. IEA (the International Energy Agency) estimates suggest that if the Paris Agreement goals are to be achieved, the clean energy sector will represent over 40 per cent of total demand for copper and rare earth elements by 2040, 60-70 per cent for nickel and cobalt, and almost 90 per cent for lithium7

Energy transition technology is becoming the fastest-growing segment of demand for many minerals. EVs and battery storage have already overtaken consumer electronics as the largest consumer of lithium and are expected to surpass stainless steel as the largest nickel end-user by 20408

The demand trajectory for each resource will depend on the climate policies and technology mixes adopted by different countries and remains subject to various sources of uncertainty. Any shortfall in supply of critical minerals could disrupt the global energy transition, resulting in delays we can ill afford.

Reshaping the mining sector

The push to decarbonise energy systems worldwide will undoubtedly shake up mineral markets and become a decisive force in the future of the mining and minerals sector. Understanding the various push and pull factors driving change, the principles likely to underpin how various parties approach critical mineral supply and key sources of uncertainty will be vital to overcome the challenges and seize the opportunities inherent in the global energy transition.

A successful energy transition, unhampered by critical mineral supply bottlenecks, will rely on effective collaboration between various stakeholders across the globe, including governments, the private sector, industry bodies and NGOs. Whether critical mineral supply can be ramped up quickly enough to meet demand depends on three key factors: how rapidly mining and processing capacity expands, the absolute availability of mineral reserves and resources, and how various geographical and geopolitical risks affect supply9