Keating Freight Lines Country Feedback

INDUSTRY

Carrier: McArdle Freight Feature: Campbell’s

INNOVATION

Fleet: Korkeaniemi Brothers Transport

Spotlight: Mairead Hayes

Showcase: Alternative Fuels & Technology

Workshop: Eaton Endurant XD Pro

Carrier: McArdle Freight Feature: Campbell’s

INNOVATION

Fleet: Korkeaniemi Brothers Transport

Spotlight: Mairead Hayes

Showcase: Alternative Fuels & Technology

Workshop: Eaton Endurant XD Pro

Australia’s leading truck magazine, Prime Mover, continues to invest more in its products and showcases a deep pool of editorial talent with a unique mix of experience and knowledge.

Christine Clancy | COO

With more than two decades of experience as a media professional, Christine has worked in newsrooms across Canada, Vietnam and Australia. She joined the Prime Creative Media team 12 years ago, and today oversees more than 43 titles, including a dozen print and digital transportation titles. She continues to lead a team that focuses on continuous improvement to deliver quality insights that helps the commercial road transport industry grow.

William Craske | Editor

Over the past two decades William has published widely on transport, logistics, politics, agriculture, cinema, music and sports

He has held senior positions in marketing and publicity for multinational businesses in the entertainment industry and is the author of two plays and a book on Australian lm history. Like many based in Melbourne he is in a prolonged transition of either returning or leaving.

Peter Shields | Senior Feature Writer

A seasoned transport industry professional, Peter has spent more than a decade in the media industry. Starting out as a heavy vehicle mechanic, he managed a fuel tanker eet and held a range of senior marketing and management positions in the oil and chemicals industry before becoming a nationally acclaimed transport journalist.

Louise Surette | Journalist

Louise joins Prime Mover after nearly 25 years as a writer. Starting her career as a reporter at the Toronto Star, she has spent much of the last 15 years as a design writer and editor. In 2020, she was shortlisted on the Richell Emerging Writers Prize list. Originally from Nova Scotia, she lives in Melbourne with her two children.

CEO John Murphy john.murphy@primecreative.com.au

Editor William Craske

william.craske@primecreative.com.au

Managing Editor, Luke Applebee

Transport Group luke.applebee@primecreative.com.au

Senior Feature Peter Shields Writer peter.shields@primecreative.com.au

Business Ashley Blachford Development ashley.blachford@primecreative.com.au Manager 0425 699 819

Art Director Blake Storey blake.storey@primecreative.com.au

Design Kerry Pert , Louis Romero, Tom Anderson

Journalists Peter White peter.white@primecreative.com.au

Louise Surette louise.surette@primecreative.com.au

Design Production Michelle Weston Manager michelle.weston@primecreative.com.au

Client Success Salma Kennedy Manager salma.kennedy@primecreative.com.au

Head Of ce 379 Docklands Drive, Docklands VIC 3008 enquiries@primecreative.com.au

Peter White | Journalist

Peter has completed a Bachelor of Media and Communication (Media Industries) degree at La Trobe University, and he brings a fresh perspective to Prime Mover. He gained valuable experience at Upstart, La Trobe’s newsroom, work that has been supplemented by direct industry experience in a Council placement. Peter has a strong interest in commercial road transport, and in contributing to Prime Mover’s efforts in growing the industry.

Ashley Blachford | Business

Development ManagerHandling placements for Prime Mover magazine, Ashley has a unique perspective on the world of truck building both domestically and internationally. Focused on delivering the best results for advertisers, Ashley works closely with the editorial team to ensure the best integration of brand messaging across both print and digital platforms.

03 9690 8766 subscriptions@primecreative.com.au

Prime Mover magazine is available by subscription from the publisher. The right of refusal is reserved by the publisher.

Annual rates: AUS $110.00 (inc GST).

For overseas subscriptions, airmail postage should be added to the subscription rate.

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Copyright

PRIME MOVER magazine is owned and published by Prime Creative Media.

All material in PRIME MOVER magazine is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher.

The Editor welcomes contributions but reserves the right to accept or reject any material.

While every effort has been made to ensure the accuracy of information

Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. The opinions expressed in PRIME MOVER magazine are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

The Hino 700 Series rewrites the rules in safety, emissions and connectivity. It’s our safest truck ever, with an enhanced

“We very rarely trade in a truck. Some people call us up cold asking if we’ve got a truck for sale. We’ve never had any complaints come back from anyone who has bought one.”

FLEET FOCUS

22 Country Feedback

From its home in Shepparton, intrastate refrigerated transport specialist, Keating Freight Lines, has run a fleet powered by Scania for nearly half a century.

32 Fields of Gold

Inverell is known as the “Sapphire City” because of the gemstones found throughout the district where Campbell’s Fuel Service has been supporting its clients for more than 60 years.

36 Snow Business

’Skandi’ furnishings are currently very much on-trend and this would not be happening without the contribution of skill and expertise of a family of forest workers who operate a fleet of top-spec Volvo trucks in possibly the harshest conditions on the planet.

TRUCK & TECH

40 First Contact

Eaton educator Murray Seymour tours the country enlightening dealerships, customers, mechanics and OEMs on Eaton product including the new automated Endurant XD Pro transmission.

44 Parks and Recreation

Environmental Industries relies on a large fleet that contains 40 Isuzu trucks it deploys on major landscaping projects involving many public spaces across Western Australia.

50 Rising to the Occasion

At a time Viva Energy is set to embark on an exciting new era, Mairead Hayes’ team is driving innovation and efficiencies for their customers, who represent a wide spectrum of transport companies including some of the biggest names in the business.

William Craske Editor

William Craske Editor

Nothing stimulates old economies like a crisis, and in the volatile commodities markets, spice, despite surging prices, is in renewed demand. Ongoing disruptions in supply chains following the controversial harvest management change on Arrakis, has left rival governments pointing the nger as tensions in the area showed no immediate signs of easing. Accusations levelled at the Harkonnen by Atreides this week reignited a war of words between the rival houses as members of the Padishah executive council tried in vain to de-escalate a situation one insider, who spoke under condition of anonymity, said “regrettably had reached fever pitch”. It follows a recent announcement made by House Atreides that it would undertake a comprehensive audit of the harvesting eet it acquired through a “doomed” succession plan, as some economists have labelled it, decreed by an Emperor who controversially chose not to open the tender to market. Bulk commodity producers condemned the “cartel activity” having claimed they were disadvantaged by the latest instance of bid rigging. The Imperial Court could not be reached for comment.

In a statement, House Atreides took

exception with the negligent maintenance scheduling of its predecessor which it singled out as the cause for accumulative delays as sagging production was further compounded by what it noted should have been “avoidable” downtime. Extensive replacements required across the eet are now on back order for Wormsign Spotters and Harvesting Crawlers, some of which were approaching 15 million working hours. Meanwhile eet management had no bolt-on solution for thousands of outstanding parts, many of which were still awaiting ful llment, after repeated diagnostic errors were reported on hydraulic clamps used to secure the pressurised in atables that were failing on the Carryalls at “an order of magnitude” per one source. Extraction vehicles, in some cases, have been operational with concerning gaps in the refurbishment history that date back to when the Harkonnen began its spice stewardship nearly 80 years ago.

This is not the rst time the Harkonnen global logistics division has been subject to criticism for its questionable operational practices. Its heavily industrialised home planet, Giedi Prime, is often a target of environmentalists for its failures in adhering to ESG compliance. For its own part the Harkonnen returned re claiming it was not encumbered by contractual obligations to sustain continuity of production and that all future R&M commitments were the responsibility of the current account holder whose lack of due diligence on the task, furthermore, failed to repudiate longstanding allegations made of [Atreides] that it “lacked for self-governance”. Many in the Spacing Guild, who have the monopoly interest in interstellar travel, would appear to agree as it hiked prices again this week for offworld haulage pointing to in ationary pressures. The blame it put squarely at the feet of House Atreides whose languishing returns and growing chorus of detractors

had proven enough for some stakeholders who have nally run out of patience for the much-hyped joint venture with the Bene Gesserit Order. As the sole spice mining operation on Arrakis, House Atriedes is learning rst-hand of the vast operational challenges inherent on the remote planet. The extreme conditions are merciless on equipment in addition to the presence of the indigenous Fremen, whose troubled co-existence with foreign resource interests continues to plague production. At a minimum, Atreides will need to overhaul its disaster response plan in lieu of recent sandstorms and worm events. Fleet renewal and the signi cant investments necessary to reboot spice production will be redistributed from other parts of the business at the risk of weakening its operational synergies. Protective security services including cyber governance systems are already reportedly suffering from underfunding. Though spice melange is still considered the key mineral used to fuel interstellar transport, the scarcity mindset informing the foreign policy of many governments has as much to do with the inability to adequately store, stage, and blend it. Untreated, spice has a limited shelf life. Before it was appointed to replace the Harkonnen as the sole mining interest on Arrakis, House Atreides, given its growing military presence, should have been, according to critics of the transition rst proposed by the Herald of the Change, subject to hefty trade tariffs, a move the Emperor was unwilling to make despite increasing public pressure. Rising operational costs for the logistics, transportation and feeding of the the imperial private army, according to one insider, remains a major drain on the treasury without a war to justify its disproportionate budget.

With driver shortages and increasing supply demands industry-wide, Ron Finemore Transport founder, Ron Finemore, says something needs to change. Ron Finemore Transport is renowned for its safety protocols, new equipment, and for its peak condition late model fleet. However, despite utilising the latest equipment and operating with the safest protocols, Finemore told Prime Mover that the fleet, like the entire industry, is feeling the effects of driver shortages.

“We’ve got a shortage of drivers and an increasing market without enough people to do the work,” he said. “Our company is 100 drivers short, and everybody is short.”

Finemore said the issue comes down to the fact that existing Australian drivers, especially younger ones, are restricted from getting a license.

“Young drivers can’t become a truck driver until they’ve failed somewhere else, because they can’t get a license when they leave school,” he said. “So, they’ve got to go and work somewhere else and then fail there or get sick of it and come back to be a truck driver.”

According to Finemore, the current licensing rules for truck drivers sees age as well as time required holding each license being barriers. In this area, he believes licensing should be based on a driver’s competency.

“We’ve got to make it easier for young people to become a truck driver,”

Finemore said. “If they have the required level of competency, and if they’re working for reputable companies that are responsible for them, they should be able to hold a license restricted to that company that is accountable for them.”

The other problem lies with making heavy line haulage an essential service and gaining access to drivers from overseas.

“You can’t bring people legally into Australia to drive trucks as migrants,” Finemore said. “Under the current visa system, a truck driver is not a skilled occupation. We’ve been trying to get it added to the skilled occupation list unsuccessfully for 20 years.”

While many prime mover OEMs look to move towards autonomous transport solutions such as self-driving trucks to combat these issues, Finemore explains other aspects of the job, such as loading and unloading trucks, are left unresolved. “Somebody’s got to load them, unload them and secure the load,” he said. “Somebody has to do the work at both ends. That’s the issue.”

Finemore is calling on governments to make the changes necessary to “allow the people that want to work in the industry to work in it safely”. In December last year, the Australian Government welcomed transport ministers’ inprinciple agreement to an improved, nationally-consistent approach to the training and licence progression of heavy vehicle drivers. The National Heavy

Silk Contract Logistics has officially opened its new transport facility in Western Australia. The Kenwick site, located five kilometres from Perth’s International and Domestic Airport and 15 minutes inland east of Fremantle Port, sits on an area site of 43,509m². It has direct rail access, some 5000m² container hardstand for stacking boxes up to five high and 16 refrigerated container charging stations. A super awning and extended canopy features

two 86 metre drive-in lanes for loading/ unloading of vehicles without the need to reverse.

“Thanks to the collective efforts and the unwavering support from Silk’s national and local teams, we’re thrilled to announce that we’ve not only completed the project ahead of schedule but also under budget and with valued customers ready to commence,” the company said in a statement.

The 23,615m² warehouse has provision

Vehicle Driver Competency Framework Decision Regulation Impact Statement (Decision RIS) proposed a series of reforms to improve road safety and productivity.

The Government claimed these changes would strengthen heavy vehicle driver skills and knowledge through redesigned learning and assessment requirements specific to each license class. At the time, it was announced that minimum course lengths and behind-the-wheel time would also be made compulsory, while some training and assessment will be delivered online to lower costs and allow license applicants more flexibility. In addition, it was reported that new experience-based license-progression pathways would be introduced to help drivers progress to higher license classes more quickly. Despite this, Finemore said the specific details on these proposals haven’t been released and the timeframe of their arrival is uncertain.

“They’re talking about it happening over a number of years,” he said. “I probably won’t live long enough. Each of the states have their say, so you end up with the lowest common denominator of things happening because we don’t have national regulation.

“You end up with very minimal change in the time it’s going to take to happen. It’s not happening, and that’s the problem. It needs to happen not in a few year’s time, it needs to happen now,” said Finemore.

for 33,000 racked pallet spaces, eight container docks and incorporates four site office facilities including port, distribution, contract logistics and Western Australia operating headquarters.

The Kenwick facility is designed to a 6 Green Star rating. At present there is only 12 of these facilities in Australia. The material handling fleet will be powered by Lithium-Ion batteries charged by a solar panels system.

Linehaul specialist, Brims Transport, has taken delivery of eight new prime movers. The major order will see the independent carrier introduce six new Kenworths and two new Euro 6 DAF trucks. Headquartered at Chinderah in New South Wales, less than 10 kilometres south of the Tweed River, Brims Transport runs general freight predominantly along the east coast of Australia. Three new Kenworth T610SARs along with three Kenworth K200s have joined the fleet as part of a strategic refresh undertaken by the family business now in its 21st year. The majority of operations are devoted to B-double interstate work to Sydney, Melbourne and Adelaide, augmented by local metro distribution centre shuttles on the Gold Coast.

The company is a 24/7 operation with 25 trucks — prime movers all. General Manager Jason Brims took over operations in 2019 following the passing of the founder, his grandfather Ross Brims.

“We were getting over the older trucks in the fleet and it was a good time for us to bring in some new vehicles,” he tole Prime Mover

Brown and Hurley Kyogle facilitated the deliveries which include two new Euro 6 DAF CF530s. These vehicles will

run on shuttles between DCs up to 16 hours a day should they be utilised on a split shift.

“I like them a lot. We introduced the first CF530 six months ago and followed that up with one in the new year with the third delivered this week,” Brims said. “They’re well suited for local work. Some of the sites we go to are a bit tight for bonneted B-doubles and these are smoother, comfy and they roar into the job and come out as required.”

These are not the first Euro 6 DAFs in the fleet. The fleet had a short-lived truck and dog combination but it unfortunately was lost it in the Northern NSW floods

Toll Group has announced the construction of a new, 10,000m2 state-of-the-art healthcare facility at Tullamarine, near Melbourne. Toll is a leading supply chain partner to CSL Seqirus, and the facility is being custom built to support CSL Seqirus’ operations. The warehouse and distribution centre will be situated next to the future CSL Seqirus manufacturing site, bolstering Toll’s tailored support for CSL Seqirus by handling both finished goods distribution and supplying raw materials and packaging to the CSL Seqirus manufacturing facility.

Toll’s facility will be situated adjacent

to the soon-to-be-completed CSL Seqirus plant, a new world-class biotech manufacturing facility in Australia which will supply influenza vaccines to Australia and the rest of the world. The state-ofthe-art facility will use innovative cellbased technology to produce influenza vaccines for use in both influenza pandemics and seasonal vaccination programs – and will be the only cellbased influenza vaccine manufacturing facility in the Southern Hemisphere.

Toll’s warehouse and distribution centre is due to commence operations in August 2024. The new warehouse marks Toll’s commitment to providing

of March 2022. That truck was only six weeks old. “We didn’t get to the first service on that first DAF,” recalled Brims. Meanwhile, the K200s are powered by a 550hp X15 engine with 2050lb/ft of torque riding on Meritor running gear.

“We’ve gone for the 2.8-metre big cabs on these for the driver’s comfort,” he said. The Kenworth T610SAR, however, is a change for some of the drivers who would like the option of operating a bonneted American truck.

“The T610SAR looks bloody awesome and that’s half the reason I got it,” said Brims. “Everyone who has driven one absolutely loves them.”

comprehensive logistics solutions for the healthcare sector. With operations commencing in Tullamarine, Toll aims to enhance efficiency and timeliness through just-in-time services.

“This new facility exemplifies our commitment to delivering high-quality, tailored supply chain solutions to meet the evolving needs of our customers,” said Perry Singh, President, Government & Defence at Toll. In addition to the Tullamarine facility, in April 2023 Toll opened a new warehouse in Richlands, Queensland, further demonstrating its dedication to enhancing healthcare logistics infrastructure across Australia.

Axle-Forward configuration for heavier payloads

Built in Australia for tough Australian conditions

Ground has been broken in Hope Valley by Scania Australia ahead of the construction of its 10th companyowned workshop and new warehouse. The new sales and service outlet aims to be open for business in 2025, capitalising on the increasing sales of Scania trucks, buses, and marine and industrial engines in Western Australia. Last year, Scania set a new benchmark for the brand having sold 1383 vehicles. Manfred Streit, Scania Australia Managing Director was present yesterday to turn the first sod at what will become Scania Hope Valley. “We continue to grow our business in Western Australia. We saw the need for additional company-owned sales and service capacity, as well as access to parts, to support customer uptime,” he said. “The location of the new Hope Valley facility brings us closer to customers in the fast-growing southern

Perth metropolitan area.”

In addition to a new sales and service facility, Hope Valley will be the site of an enlarged regional parts warehouse of 3500m² that will service the needs of Scania customers in the West, including key mining customers located throughout the state and in the busy Pilbara region.

The workshop and parts warehouse are well situated on a spacious and prominent 19,000m² block in a new industrial precinct, close by major road routes for easy access, especially by larger combinations, along with a purpose-built pit that is designed to accept WA-style long vehicles without decoupling.

Large crossovers and hardstands will provide ease of access for vehicles up to 36.5 metres long.

Also included in the facility design is a purpose-built office environment

with dedicated customer areas and impressive space and amenities for the on-site Scania team.

Hope Valley will be Scania Australia’s first true EV-ready facility, with infrastructure in place to handle today’s BEV charging needs and future capacity for high volume vehicle charging. The design of the facility has been undertaken with a focus on sustainability, with particular attention paid to how the site will handle waste across both the warehouse and workshop facilities.

“Our business development trajectory requires us to ramp up our capacity to service our growing fleet of customer vehicles as well as to prepare for the transition to battery electric and alternative fuel vehicles, which will undoubtedly arrive sooner than people think,” said Scania Dealer Director for WA, SA and NT, Michael Berti.

Oil and gas services business, Wild Desert, relies on the Mack Titan platform for its remote outback work. In addition to servicing some of the wells for the five biggest oil and gas companies in Australia, Wild Desert provides transport services and supplies entire camps delivered, set up, stocked and fullystaffed. On short notice they can be asked to pull a camp down, move it a few hundred kilometres, and then set it up again, often in the same day. Based out of Roma in central Queensland, Wild Desert has specialised since 2005 in servicing well sites and providing all the facilities and supplies needed to keep

them in operation. Wild Desert Managing Director David Whiley said that after nearly 20 years the company is more in demand than ever.

“Back in 2005 we saw the opportunity, so we sold a few houses and bought a truck,” he said. “Since then we’ve just been getting busier every year.”

The company’s truck fleet now numbers more than 50 units. Over half of these Mack Titans with another two on order. They transport all manner of equipment and supplies to destinations as far apart as Moomba in South Australia, and the Carnarvon Ranges in Queensland.

“Our trucks are mostly running as AB-

triple or triple roadtrains,” explained Whiley. “Depending on what they’re carrying and where they’re going, they might do anything from 500 to 3,500 kilometres in a trip.”

One of the company’s advantages and why its customer relations remain so strong is that it remains a single-source provider.

“We bring in all our own fuel and parts from Brisbane, and we supply all our own food out of Roma. The only thing we don’t do is fly in the staff – we know our limitations,” said Whiley.

Back in 2006 Whiley purchased a 1998-model Mack Titan and soon realised he’d found the truck he was after. There is history: his father drove Flintstones and R600s.

“The Titan is ideal for what we do. They don’t just look tough, they are tough, they hold up well and we’ve kept ours going for years through multiple rebuilds,” he said. That first Titan is still going strong after 18 years, which is a testament to both the strength of the Mack and the care Whiley takes with his trucks.

The National Heavy Vehicle Regulator (NHVR) has worked with Main Roads Western Australia and the Department for Infrastructure and Transport South Australia, to publish two emergency notices after recent flooding forced the closure of a key rail network.

NHVR Chief Operations Officer Paul Salvati said the notices give consent to increased access for roadtrains up to 53.5 metres, between Port Augusta in South Australia and the Western Australia border, and then internally into WA.

“We have seen massive amounts of rain fall on the WA outback, inundating roads and damaging key networks, and our thoughts are with anyone who has been affected,” Salvati said. “The flooding in the Eyre Highway area has caused damage to the rail network, forcing it closed.

“In light of this, the NHVR has partnered with WA and SA state transport authorities to deliver this urgent emergency notice.”

Salvati said the notice would provide heavy vehicle drivers and operators with increased flexibility and expedited access to critical routes, facilitating the efficient transport of essential supplies and emergency relief for communities cut off by flooding.

“Truckies have had to take huge detours to reach their destination due to this flooding, and the NHVR recognises the importance of delivering essential items to the affected communities,” he said.

“However, we are also urging drivers to exercise caution when travelling through these conditions, prioritising safety above all else.

“Due to the heightened risk and uncertainty, the NHVR will be

proactively patrolling the region to ensure all heavy vehicle drivers are travelling safely.

“We anticipate more trucks on the road during this time, and with the road conditions unpredictable, the NHVR’s priority is safe, efficient heavy vehicle movements.

“The last thing we want to see is overloaded or unsafe truck operations, with compliance paramount during this time,” Salvati continued. “For any driver navigating these challenging conditions, be prepared by taking any necessary precautions, equip yourself and your vehicle appropriately, and always prioritise safe driving practices to ensure a safe and secure journey.

“Operators should carefully brief any drivers who are new to the route, including on the location of rest areas and fuel stops.”

The first Volvo FH Electric sold in Australia has been delivered to Followmont Transport. The prime mover will be tasked with shuttling trailers between Followmont’s Eagle Farm depot, servicing major accounts around Brisbane and running overnight linehaul to the company’s Toowoomba and Sunshine Coast depots.

“We are thrilled to integrate electric trucks into our fleet, advancing our sustainability objectives and pioneering greener logistics solutions and are excited to receive the news that our road network is expanding to make the adoption of EV trucks easier,” said Followmont Transport Managing Director, Mark Tobin.

The delivery coincides with the announcement of a zero-emissions road network for Southeast Queensland which will increase steer axle mass allowances to eight tonnes on the steer axle and 18.5 tonnes on the drive axles for battery electric

heavy vehicles — a vital step to enable the roll out of heavy battery electric vehicle (BEV) transport.

Followmont’s 540kWh, 666hp FH Electric is currently rated to 44 tonnes and has a range of up to 300 kilometres on a single charge. A 60kW charger has also been installed on site at Followmont’s head office for

overnight charging, with plans to install charging solutions further afield as the company seeks to increase reach and range. Followmont has also signaled its intention to invest in electric vehicle competencies for staff to provide in-house expertise for emerging technology.

Red Hawk Mining has announced that it has entered into a strategic partnership with MGM Bulk. The agreement covers the haulage of iron ore from the Red Hawk’s 100 per centowned Blacksmith Iron Ore Project to the Utah Point Bulk Handling Facility in Port Hedland.

The haulage agreement enables Red Hawk and MGM Bulk to work collaboratively through the PreFeasibility Study and Definitive Feasibility Study phases to develop and optimise the transport and logistics strategy, focusing on maximising productivity and reducing unit operating costs.

Following completion of the studies, MGM Bulk has the exclusive right to enter into a Haulage Services Agreement on terms equivalent to those contained in the Definitive Feasibility Study.

MGM Bulk will be responsible for

providing a fleet of 150-tonnerated ultra-quad trucks and drivers plus associated loading and other equipment and infrastructure.

Red Hawk Managing Director, Steven Michael said the company is excited to work with the team at MGM Bulk to establish a haulage strategy optimised for the Blacksmith Project.

“MGM Bulk’s operations in the Pilbara, centred around delivering iron ore into the Utah Point, are second to none,” he said in a statement.

“Their fleet size, quality, operational performance and safety record are critical factors in ensuring the success of the Blacksmith Project. Our PFS team is working closely with MGM Bulk’s commercial and operations team to deliver operating and capital cost estimates with a high degree of certainty, which can easily be translated into an operational haulage contract.”

MGM Bulk, a cornerstone of MGM Group backed by the Giacci Family, continues to set benchmarks in the transport and logistics sector through sustained innovation and a track record of safety and success.

Since its commencement in 2014, MGM Bulk has exhibited swift growth, underpinned by an unwavering dedication to excellence, safety, and customer satisfaction.

With an extensive fleet exceeding 170 prime movers strategically located across five locations in Western Australia, MGM Bulk efficiently manages the transport of more than 15 million tonnes while travelling over 41 million kilometres annually.

“We are immensely proud to be forging a long-term partnership with Red Hawk Mining on the mine-to-port haulage solutions for their Blacksmith Iron Ore Project,” said MGM Bulk CEO, Michael Giacci.

TRATON Group member Navistar is making progress in autonomous driving technology in preparation for the launch of an autonomous commercial pilot program with customers in Texas. Navistar is involved in a new partnership with Plus to integrate its Level 4 autonomous SuperDrive technology stack into International vehicles and other branded vehicles within the TRATON Group including Scania. The high volume and scalability of hub-to-hub operations presents an

immediate addressable market of 25 billion miles of long-distance freight on the US interstate system according to Navistar. The company has strategically selected hub-to-hub operations as the company’s core segment for commercial viability of autonomous implementation. International trucks equipped with SuperDrive by Plus are being validated with a safety driver on routes in the Lone Star state. Customer pilots are expected within the year, with commercial deployments expanding incrementally along strategic US corridors.

“Global partnership with a company like Plus allows us to leverage the technical strides they have made as we work together to focus on the commercial viability of Level 4 autonomous driving,” said Tobias Glitterstam, Chief Strategy and Transformation officer, Navistar. As part of TRATON Group, Scania will also be involved in a new partnership with Plus. Scania’s program launch

The Volvo Group has signed an agreement with Westport Fuel Systems on an injection fuel system technology. Westport’s High Pressure Direct Injection fuel system technology, designed specifically for alternative fuels, is suited for long haul and off-road applications.

The closing of the joint venture is subject to certain closing conditions, including regulatory and government approvals.

Signed in part to accelerate what is described as the commercialisation and global adoption of High Pressure Direct Injection fuel system technology, it is anticipated that the JV will become operational following the formal closing which is expected in the second quarter of 2024.

High Pressure Direct Injection is a fuel system technology which can be applied in vehicles with internal combustion engines to replace greenhouse gasemitting fuels, like diesel, with carbonneutral or zero-carbon fuels like biogas or hydrogen.

“Decarbonisation with internal combustion engines running on renewable fuels, especially with High Pressure Direct Injection, plays an important part in sustainable solutions,” said Lars Stenqvist, Chief Technology Officer Volvo Group.

“HPDI has been on the road in Volvo

comes as customers look for trusted and reliable partners for developing and deploying autonomous vehicles. This new solution from Plus stands out due to its adaptability to customers’ specific routes and transport profiles.

“We are committed to developing fully integrated autonomous solutions. This means technology that is fitted and supported directly from the factory and a solution that is designed to be operated by our customers in their existing infrastructure and operational flows,” said Peter Hafmar, Scania VicePresident and Head of Autonomous Solutions.

The launch and announcement are the latest stage in autonomous research and development for Scania. The company, which has already been testing autonomous transport solutions on Swedish roads since 2021, has plans to expand pilot operations with customers in other European countries during 2024.

trucks for over five years and is a proven technology that allows customers to significantly reduce CO2 emissions in LBG (Liquified Biogas) applications here and now and is a potential avenue for hydrogen.”

Westport will contribute certain HPDI assets and opportunities, including related fixed assets, intellectual property, and business, into the joint venture.

Volvo Group will acquire a 45 per cent interest in the joint venture for the sum of approximately USD$28 million, payable upon closing, plus up to an additional USD$45 million depending on the performance of the joint venture. Headquartered in Vancouver, Canada, Westport serves customers in more than 70 countries as a supplier of advanced fuel delivery components and systems for clean, low-carbon fuels such as natural gas, renewable natural gas, propane, and hydrogen.

From its home in Shepparton, intrastate refrigerated transport specialist, Keating Freight Lines, has run a eet powered by Scania for nearly half a century.

Keating Freight Lines, since long before it operated under its own moniker, has steadfastly identi ed the best truck, regardless of its position in the market, for the job. Indeed, its willingness to introduce European cabovers for fuel ef ciency and safety, long before it was in vogue to do so, goes back to its earliest days when Ken Keating, began carting produce from Shepparton to the markets in Sydney with the purchase of a Mercedes-Benz New Generation 1413. That was in 1969. Three years later, while a 50 per cent partner and responsible for the trucking component of the Geoffrey Thompson Fruit Packing business, Ken purchased his rst Scania, an LB80 SUPER. Not one to do things by halves, Ken added three of these trucks to the eet. It must have been one hell of a sales pitch. As it turns out, the promise of a single platform, with the proprietary Scania engine, gearbox, and drivetrain, was tantamount to a one stop shop for Ken, which is exactly what he had been looking for.

“That impressed him,” recalls Mark Keating, company Co-director and son of Ken. “He fell in love with them straight away.”

For the next ten years Ken sampled several Scanias from the OEM’s range of products, running 110s, 111s and eventually a Scania 141 V8. In that brief period, Ken owned 15 Scania units.

In 1982 Ken and his wife Dorothy (decd) founded Keating Freight Lines. Beginning with the lone Scania, not surprisingly the 141 V8, the eet progressed over the years as it introduced and received great value from the likes of the Scania 112, a P92, several 113s, right up until the latest trucks of today which includes four of the new SUPER range — three new Scania SUPER 460s and one SUPER 560. Aside from an Isuzu rigid, there are 21 Scanias in the eet including three G440s, 12 NTG 450s and three P310 rigids, two of which are twin-steer. A Scania R NTG, along with the new SUPER 560, are used to perform B-double work as required.

“Over all the years of our business we’ve had a Scania in the eet at one time or another,” says Mark. “We moved away from the Scania prime movers in the late ‘80s. That’s mainly because they went through a rough trot with management and then they sent people over from Sweden and it all turned around. We’ve certainly never looked back.” Scania’s R&M Contract is one of the chief reasons for the ongoing partnership. In fact, Keating Freight

Lines, was one of the rst customers of the OEM to commit to a Scania Repair & Maintenance support care package, validating the strength of the relationship, especially when considering a national plan is uncommon for a business of its operational size.

“Although we are relatively small given the bigger eets Scania has on these contracts that’s possibly because we’ve been with Scania for so long,”

says Mark, whose older brother Chris, who sadly passed in 2022, he credits as being the driving force behind this arrangement.

“My late brother ran the whole show here and he did a top job. It was upon bringing in the Scania G440s that the R&M arrangement rst began.”

Most times, according to Mark, when the vehicles come off the R&M schedule, they will get extended another 12 months having clocked around 850,000

kilometres. Despite this the company has little trouble in selling them privately.

“We very rarely trade in a truck. Some people call us up cold asking if we’ve got a truck for sale,” explains Mark. “We’ve never had any complaints come back from anyone who has bought one.” Such an endorsement for the eet management at the business can hardly be restated. It’s something Mark says he’s proud of.

As the trucks come off R&M, the workshop, run by Mark’s nephew Ross, who also services the rigids and trailers, comes into play. He represents the third generation working in the family business. His grandfather Ken, meanwhile, turns 88 this year.

“He comes in most days when he’s feeling up to it and to keep an eye on us — he’s good value,” says Mark. “Steve

[Mark’s oldest brother] and I have been relegated from out running the trucks to being directors of the company now with dad.”

Mark, who has recently turned 60, likes to keep one foot in a vehicle, still driving on occasion to meet over ow. That vehicle, customarily, is a 2005 Scania R580 V8 with a manual transmission. The truck has covered over 1.3 million kilometres. Though technically semiretired it’s still registered as a B-double.

“When I go it goes. It’s a good truck,” says Mark. “Dad keeps saying let’s get rid of it and I keep saying no. Why? Because there’s no more manual transmissions from Scania.”

Scania Australia Managing Director Manfred Streit, at an Anglesea customer drive day, last year called it the “golden truck.”

It certainly wasn’t a comment lost

on Mark.

“I enjoy driving it,” he adds. “Not only does it go well, but it also still sounds great.”

The new trucks in the SUPER range, powered by a new 13-litre six-cylinder Euro 6 engine, are a lot quieter in comparison according to Mark. Having said that he admits they are also rumblier on the exhaust brake than many of the other Scanias chie y due to the dual overhead camshafts that are operating four valves per cylinder with a single piece cylinder head. No engine brake is needed because the engine retarder, optimised to deliver up to 350kW force, is more than adequate. The SUPERs are already reporting edifying fuel gures. While the older NTGs run at about 2.8 kilometres per litre, the new SUPERS, are consistently achieving 3.3 on the corresponding

fuel burn numbers.

“That even includes the SUPER 560,” says Mark. “It runs at the same or even better. That number might come down a little bit, but it doesn’t go below 3.0 when you run it as a B-double.”

The trucks, however, don’t always operate to payload capacity. Running up to 58 tonnes on a B-double route, the task is often fully loaded one way and light on the return trip. Some are coming back with an equivalent weight while others might be carrying empty bottles.

The palletised meat trucks, on the other hand, are right up on their weight. Even so, it doesn’t matter what the application or weight is, the new SUPERs are demonstrating encouraging consistency after more than 80,000km, when it comes to fuel economy. The key point of difference is the new G33CM Opticruise transmission, which Mark contends is where the SUPERs are achieving their strong weekly results which he receives every Monday morning from Scania. “That’s where we’re getting our stellar

gures because you can coast them a lot more without the truck losing momentum,” he says. “At around 100 km/h the transmission maintains revs. The combination of the new gearbox and engine make for a good product.” With all the main controls located on the armrest for the headlights, mirrors and windows, driver acceptance comes easy with the operational and safety conveniences. Mark says the drivers have had a seamless transition to these newest vehicles.

“Everything in the cab they need to access is made handy for them,” says Mark. “As soon as you open the door the truck activates the maxi brakes straightaway. There’s a lot of safety features and in some of these new trucks we take that opportunity to use the Scania training to upskill drivers that have come in between new truck deliveries so that all the drivers are up to speed.”

Founded in Shepparton, a regional epicentre for the Goulburn Valley region, the business moved in its early

years from a leased site in Mitchell Street to a property in Benalla Road which it soon outgrew. Now they are situated on 23 acres in Lemnos next to the Campbells Soup factory. On site there are six warehouses most of which have been leased out.

Not strictly a cold carrier, Keating Freight Lines since its humble beginnings has specialised in transporting groceries. While the business hasn’t undergone any seismic technological changes during its lifetime, Mark observes the small freight that it once would have moved, has all but disappeared. The refrigeration sphere now mostly outpaces the general freight with less than ten per cent of the work being sub-contracted. That once might have been split more evenly. The trailering equipment is of mixed origin. The last ve box bodied trailers have been delivered new by Schmitz Cargobull. The eet runs 18 Thermo King units, 12 of which have GPS tracking and monitoring that allows for the temperatures to be tracked and even changed, remotely.

“We can turn them on and turn them off just from our phones,” Mark says. “The technology is getting good. Instead of Steve having to come in during the night, which he still does anyway, he can look at his phone and see how the refrigeration units are running in case a driver has had freezer on and he’s picked up chiller product and hasn’t changed it, at least we can sit there and change it on our phones and save the product.”

Installation of a solar panel atop the van body to lengthen the battery life of the units given their operation is intensely stop and start, has proven a panacea. Having spent his entire adult life around trucks and transport Mark constitutes a storehouse of knowledge founded on real world experience from an era largely bygone. He rst learned to drive a LB80 Scania in Geoffrey Thompson’s yard.

“I turned the key on, nobody said a word and I backed it onto the truck wash and started washing the truck,” he recalls. “That’s where I taught myself to drive them.”

Mark, as was the custom, started off in

a ute, moved up to a one-tonner and from there he progressed to an 8-tonne International Butterbox.

His rst trip to Melbourne was in a twinsteer single drive MAN. It was “a great truck with the 12-speed on the column, it used to go like the clappers, but a pig of a thing to turn.” Then there was a single drive UD CK45 tted with something best described, as Mark puts it, as a crash box although probably not one technically.

“If you buggered it up, you’d have to stop and start it all over because there was zero chance you’d nd the gears again,” he says. “It was ne once you got used to it.”

He eventually advanced to a V8 Scania 141 just as the business was consolidating its partnership with the OEM.

“A lot of it back then was at top work,” he adds. “The old hands are paying for it now.”

Back when Ken Keating was with Geoffrey Thompson’s he would get Mark and his brothers out of bed in the morning, and they’d go to the depot and

load containers with pears and go home to have breakfast before school. They’d return home after school and following dinner Mark, Steve and Chris would be back at Thompson’s where they’d help load a couple of containers that night and go home to bed. This early exposure to transport operations only whetted a growing appetite it turns out.

Keating Freight Lines commenced business in February 1982. Mark, from his own account, turned up to the yard one day in June that same year. His parents, taken by surprise, demanded to know why he wasn’t in school. He told them he wasn’t going to school anymore. Naturally, they asked Mark what it was he planned on doing going forward.

“I said, ‘I’m going to work for you’ and they said ‘no, you’re not,’” he recalls. After waiting in the backyard for a while his mother, Dorothy, came down to console him.

“She said, ‘I’ve spoken to your father, you can work here on one condition: that you look for another job,’” Mark says. “I’m still looking for another job.”

South Australian family-owned long haul specialty out t, McArdle Freight has bolstered its freight forwarding service with roadtrains powered by the latest Western Star X-Series.

The 6,000-kilometre round trip from Adelaide to Darwin is one driver Paul Freeth undertakes weekly. Life on the road is just that. Man at one with vehicle confronting time and space.

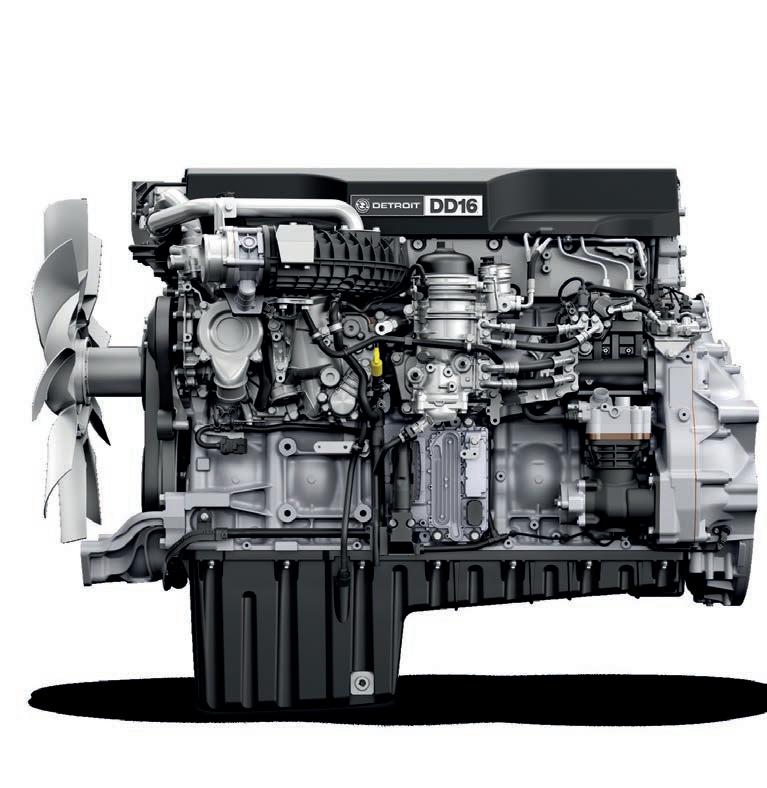

It’s a straight shot more or less beside the meridian 135º East Longitude line, made recently more interesting from the vantage of a new Western Star X-Series prime mover of which Paul was the rst driver at McArdle Freight to be handed the keys. Towing a triple roadtrain, the 49X is more than 100,000 kilometres into its initiation with Paul who, most tellingly, is in awe of the fuel consumption results he’s seeing courtesy of the new Detroit DD16 engine.

The eet is averaging 1.41km/L over the life of the vehicle. Company Co-Owner Travis McArdle veri es this.

“Every load and every week are different, so we just run off an average,” he says. “We’ve seen gures as high as 1.56km/L on a three- or fourtrailer roadtrain.”

Carting general freight to local towns in that vast expanse McArdle Freight also will bring these isolated communities cold produce, more as an exception rather than rule. It moves with greater consistency machinery and waste oil throughout Australia generally all done so on the back of roadtrains.

Origins are always of interest as they aren’t easily shed. From a distinct starting point, we can glean, even at a distance, the conditions that set the table for the successes to come. Back when disco was ghting pub rock for airtime on the radio, The Deer Hunter was showing theatrically in cinemas and the Holden Kingswood wrested back the mantle of best-selling car in Australia, Brian and Lynette McArdle were operating as a lone truck fuel distributor contracting for Ampol. That Chevrolet rigid in 1978 would serve as the foundation for what has since emerged as a formidable long range road carrier with 21 prime movers backed by six depots in South Australia and the Northern Territory. Brian and Lynette’s

three children Jarrad, Tamara and Travis now helm the business whose eet, if it can be said to be de ned by a particular truck brand, is distinguished by Western Star. The new 49X was purchased from South Australia dealer, Wake eld Trucks. McArdle Freight has worked with Wake eld Trucks and Western Star since 1999, and when Travis and his siblings took over the family business from their parents in 2021, they had little hesitation in continuing the partnership. Not only mutual, the values of these family-owned enterprises translate into healthy alliances a quarter of a century later.

“Being able to deal with Wake eld each step of the way ensures ease of business – from new equipment through to the parts and servicing departments,” Travis says. “While we do a lot of our own servicing and repairs, having a parts department understand our eet and requirements enables our workshop to run more ef ciently.”

Based in Burton, McArdle Freight employs two full time mechanics alongside a tyre tter as part of its payroll of 30 staff.

“With this being a new product and having a lot of unknowns, we knew that no matter the outcome, Wake eld would have our back and would always do what’s needed to keep this truck along with our others on

the road,” Travis adds. “Uptime is a very important perspective when it comes to the entire operation, I know I can trust the team at Wake eld Trucks to ensure that uptime is maximised where possible.”

Capable of hauling more than 160 tonnes gross combination mass, the Western Star 49X has a 2-year bumper to bumper warranty, and a 4-year 800,000km engine warranty. That made it a relatively easy decision for Travis to invest in. Paul, who had come out of a Western Star 4964FXC with a Cummins X15 engine, however, took more convincing — around 65,000 kilometres worth.

“From all reports, he does not want to get out of this truck,” says Travis. “Paul is a big boy, if he needs to jump to just be able to touch the roof, that speaks volumes.”

Interstate haulage presupposes a spacious cabin with comfortable sleeping quarters for the driver. The 49X offers a large 72” Stratosphere cab with plenty of storage options and air-conditioning that has stood up to the demands of the outback heat according to Travis.

“The driver comfort and liveability of the Stratosphere is second-to-none,” he says.

“[It’s a] wide cab not just high, featuring storage-a-plenty from cupboards to lockers, to under the bed, you don’t want for

much more.”

The 49X is packed with features that improve driver experience and overall performance. Field of vision is improved by 28 per cent compared to previous Western Star models, while 24-inch wiper blades improve the wiper zone by 37 per cent. Dual-stage intelligent LED headlights are designed to last the truck’s entire lifetime, too.

The drivetrain of this unit is composed of tried and tested components such as NEWAY ADZ-252 drive suspension, Dana D-52-190 drive differentials, an Eaton RTLO-22918B 18-speed manual transmission, a Meritor FL941 front axle and 18,000lb taper-leaf spring front suspension.

The 49X also comes with a series of safety features, including active brake assist to detect moving and stationary objects, side guard assists, adaptive cruise control and brake hold mode.

“Having stepped out of a Legacy model 4900 and into the next generation of 49X, the improvements to driver comfort, truck handling and tech put the 49X above any legacy model Western Star in regard to driveability and operator comfort,” says Paul. “I have always been a Western Star driver at heart. The next generation

of Western Star has only further cemented my opinion that for operability and driver comfort, the Western Star is the truck for drivers. I don’t ever want to drive another prime mover.”

Also included on the 49X are optional higher capacity rectangular fuel tanks and AdBlue tanks of up to 200 litres. Travis says 2,300 litres-plus of diesel and 200 litres of AdBlue gets McArdle Freight as far as it can on the bulk fuel it has in the depot.

“Extra fuel is always a key factor,” Travis says. “Fuel capacity combined with fuel economy means we can go further for cheaper, helping the bottom line.”

The completely revised aftertreatment system has, so far, fared brilliantly.

“We are yet to have a single problem with the aftertreatment system, and it’s currently using an AdBlue percentage of 3.83,” explains Travis. “This has been retrieved, at the minute, through the remote access to the vehicle via Detroit Connect, another great addition.”

While the prospect of the new Western Star 49X hinged on two simple factors – how would the motor hold up, and how would the cab hold up? – both uncertainties have since been answered resoundingly according to Travis. He points to the power and fuel ef ciency of the new 600hp Detroit DD16 powerplant, with its atter torque curve.

“The Detroit DD15 was a great engine but just lacked HP and at times torque,” he says. “With the New DD16 that excuse has been taken away.”

While the legacy Western Star was in his esteem a “great product”, the X-Series has been elevated to another level.

“Western Star simply produces good trucks and deals with any issues quickly,” says Travis. “Our drivers like them, our workshop like them, they have a long life with few major repairs required, and they look nice on the road.”

Inverell is known as the “Sapphire City” because of the gemstones found throughout the district where Campbell’s Fuel Service has been supporting its clients for more than 60 years.

Located in northern New South Wales close to the Queensland border, Inverell is the service hub for the surrounding agricultural region which produces crops such as wheat, barley, oats, sorghum, and wine grapes. Broad acre farming requires reliable supplies of diesel fuel for equipment such as tractors, water pumps, and generators as well as for the road transport which delivers the produce to capital city markets such as Sydney and Brisbane.

Fuel is the lifeblood of any successful farm or agribusiness and it is essential to have a reliable supply of fuel to keep the farming and associated transport operations running smoothly and ef ciently, and in non-metropolitan areas such as the greater Inverell region it’s not as simple as being able to drop by the local servo.

Campbell’s Fuel Service was established by Colin Campbell back in 1959 and today his son Stewart runs the business which services customers across the region including those involved in primary production, transport, commercial and mining industries as well as retail and local government bodies. The company currently employs more than 30 permanent and casual staff. Campbell’s Fuel Service remains an independent family-owned petroleum products business and is a distributor of BP and Castrol fuels and lubricants. More than a mere supplier of products,

Campbell’s Fuel Service is considered by many of its customers as an essential partner. In addition to fuel deliveries, this can also involve the provision of on-site storage tanks to assist in best managing the logistics of on-farm fuel requirements.

Operations are based at the head of ce in Inverell and the customer service extends to the other side of the Queensland border with a depot in Goondiwindi, as well as depots in the New South Wales towns of Moree and Wee Waa, where cotton is a major crop in both areas.

Campbell’s Fuel Service also operates the well-known BP truck stop located on the Newell Highway in Moree.

As well as being committed to providing excellent customer service, Campbell’s Fuel Service behaves as a good corporate citizen and is active throughout the communities in which it operates and proudly supports many charities, sporting clubs and organisations. The Campbell family also have their own farming operation and use repurposed Hino trucks which were formerly tankers and are now tted with stock crates.

Bulk supplies of fuel are delivered to the Campbell depots by Toowoomba-based Maktrans, mostly from the Brisbane terminal but some loads are taken out of Newcastle to service the southern end of the Campbell Fuel Service market. “Partnering with Maktrans works really well because they look after the bulk carting operation from terminal

to depot and we’ve only got to worry about delivering from the depot to the customer,” says Campbell Fuel Service’s Jason Cracknell. “They also run some of our bigger farm deliveries with bulk drops taking the fuel direct from terminal to customer.”

Itself a pioneer in B-double fuel tankers, Campbell’s Fuel Services

retains ownership of the trailers, and Robbie and Angela Hannemann from Maktrans provide their own drivers and prime movers, and also take care of the maintenance on the A and B trailers. In addition to typical B-double con gurations, roadtrain combinations are frequently utilised as well. To perform its own deliveries Campbell’s

Fuel Suppliers has been true to the Hino brand for many years.

“Hino has been a stable brand because it stands up to our local conditions and having a service branch close by is good,” says Jason.

The Campbell family have been a long-time loyal customer of Tait Hino in Inverell, and in the past couple of

years have taken delivery of a number of Hino 3248 model 700 Series in 8x4 con gurations which have replaced earlier Hino models. The latest 480 horsepower trucks have a maximum torque of 2157Nm and are equipped with 16-speed automated transmissions. This speci cation is proving to be wellsuited to rural fuel supply applications.

Underground storage tanks are re lled via hoses using gravity, while the onboard pumping equipment powered by the Hino’s engine is utilised to transfer fuel from the tanker to above ground tanks.

The decision to use Hino trucks took place prior to Jason’s time with the company, but he recalls those initial Hino Rangers were a staple for rural fuel suppliers when they rst came onto the market due to their cost and power, and the Hino brand has since

proved to retain its value.

“I think that particular truck model gave them the great relationship with Hino to begin with, so they’ve carried on from that,” says Jason.

Five of the newer Hino trucks operate out of the Inverell depot, with a remaining Hino Ranger retained as a back-op unit.

The Moree and Goondiwindi operations each run two truck and dog trailer combinations.

“I’m particularly proud of our service

because our order and delivery offering is probably second-to-none,” says Jason.

“We’ve had staff who have been here for 15 and 18 years and I have to say that the Campbell’s Fuel family has been the best business that I’ve worked for in over 28 years since I started my career. They’ve been loyal, giving and honest people to deal with.”

Those types of values are typical in ruralbased businesses and re ect the situation where, unlike the cut and thrust found in

other transport industries, good drivers are able to be recruited and retained as the business expands.

In recognition of the need to be at the forefront of operations, particularly in the dangerous goods transport space, Campbell’s Fuel Service recently quali ed for the ISO quality assurance standard applicable to the petroleum distribution industry.

As the older eet units are progressively replaced with the latest model Hino

trucks, the bene ts of the Hino Connect telematics system are becoming more apparent, particularly in relation to the remote work which is an unavoidable aspect of the business as trucks and drivers deliver fuel and lubricants to properties located at the extreme edges of the areas in which Campbell Fuel Services operates.

“Hino Connect is going to be of bene t to the company to know where our drivers are and how long the trucks have

been onsite,” says Jason. “It’s also now a workplace safety compliance requirement for drivers doing remote work.”

With many clients spread throughout the northwest of New South Wales and the southwest region of Queensland, by using modern equipment and operational methods and a strong dedication to service standards, Campbell’s Fuel Service combines technology with traditional values to drive its continued growth.

’Skandi’ furnishings are currently very much on-trend and this would not be happening without the contribution of skill and expertise of a family of forest workers who operate a eet of top-spec Volvo trucks in possibly the harshest conditions on the planet.

Mika Korkeaniemi was born in Finland. He established Korkeaniemi Brothers Transport four years ago, after decades of operating forestry machines and timber trucks. Mika has recently stepped back from the transport operations, leaving the business in the capable hands of his sons Christoffer and Johannes, and daughter Paulina who all drive the family’s trucks. It’s truly a family enterprise and a younger brother will soon join the team.

Best known in Australia for being the offseason residence of one S.Claus and lots of reindeer, Lapland is the largest and most northern region of Finland and the

extensive forest plantations provide pine timber for construction and furniture purposes, while the timber from the birch forests is used in the manufacture of paper. Sustainability is ensured due to extensive replanting programs and today Sweden has more areas under forest than it did a century ago.

Forestry is a massive business in Lapland, Sweden and Finland and presents some very tough challenges for those who choose to work in the industry. Obviously, weather is the major factor and must be considered in almost every aspect of the operations.

During summer 20 degrees Celsius is considered normal, while in winter

minus 40 degrees Celsius is common. To cope with the extreme cold the hydraulic systems on the trucks are equipped with heaters to maintain the viscosity of the hydraulic uid used to operate equipment such as the cranes. It’s a relatively mild minus 17 degrees Celsius when we boldly venture into the forest to see the Korkeaniemi Brothers operation at work. The access roads – tracks really – don’t appear on any maps or GPS screens and we use dead reckoning, combined with a little luck and numerous phone conversations, to eventually locate Johannes Korkeaniemi three metres off the ground atop the crane operator’s seat which is attached

to the rear of his Volvo FH16’s chassis. Johannes has been communicating with us via the cellphone incorporated into his ear muffs. Thankfully our local driver and guide is Gunnar Hansson who is a sales engineer with the nearest Volvo truck dealership located in the city of Lurlea and is very familiar with driving in these conditions. His all-wheel drive Volvo station wagon is equipped with studded tyres and he drives with such easy con dence that he is quickly dubbed “The Stig”. Out in the forest, step away from the road and you could nd yourself struggling more than waist deep in a snow drift. The relentless wind carries

with it icicles which hit any exposed skin such as your face with what feel like thousands of needles, melting immediately into an icy cold liquid state which manages to run down our neck despite the layers of thermal clothing we are wearing.

The sense of isolation permeating the forest is made even stronger by the stark white landscape, so different from the red tones found in the Australian Outback. There are no truck stops up here, just the occasional lonely roadhouse which is likely to literally be a “house” on the roadside with a few fuel pumps out front. The Korkeaniemi Brothers eet currently includes ve

Volvo FH16 rigids powered by engines rated at 750 horsepower connected to ve axle trailers. The reduction hub drive axles provide a good compromise between off-highway capability and on road fuel ef ciency. There’s also a lone Scania in the eet and two additional Volvo FH16’s are currently on order with 750hp engines and will be connected to trailers with four or ve axles. Winter in Lapland has short days and long nights so an array of powerful LED driving lamps dominates not only the cab grille, but also another rack of powerful lights that are tted above the windscreen. As sunset in winter is at 4.00pm, numerous work lights

are required.

The single tyre axle located behind the drive bogies is steerable and even with studded tyres on the front axle, when the traction chains are tted to the drive wheels the truck tends to understeer and proceed straight ahead regardless of the driver’s input into the steering. To counter this, and to keep the combination on track, Johannes is constantly engaging and disengaging the diff locks and the power divider as well as frequently manually shifting gears. His virtuoso performance on the big Volvo’s driveline controls reminds us of a concert pianist working at his keyboard. The Volvo’s steering wheel is tted with

a spinner knob similar to what is found on many forklifts. This assists Johannes with the steering function as he keeps one hand close to the driveline controls. The snow chains are tted to the front wheels of the drive bogies to achieve maximum drive traction. Fitting the chains is probably quite an acquired skill but Johannes makes it look easy, assisted by the quick release mechanisms which permit the mudguards to be quickly removed and later replaced when the chains are taken off for the main road journey to the mill.

“Putting chains on is better than getting stuck,” says Johannes. The wheel chains also create a unique almost musical

sound, appropriately reminiscent of sleigh bells. Very occasionally a truck will become stuck, either in the winter snow or the mud created by the spring thaw. Johannes is surprisingly philosophical about getting bogged.

“It happens, and depending on where, sometimes it’s fun getting out,” he says.

The two new 750hp Volvo FH16s joining the eet in 2024 will be tted with snow ploughs at the front. Ask Johannes if he considers himself Swedish or Finnish and he diplomatically and emphatically answers, “I’m both!”

Johannes has been driving the family trucks for four years and though he may be only 23 years old, his calm and thoughtful demeanour gives the strong impression that he is mature well beyond his years. Prior to taking up driving duties Johannes operated forest harvesting equipment for the family’s business.

The trucks collect the logs from stockpiles which are established by the operators of the forest harvesting equipment which is used to cut down the individual trees and strip them of the branches. The family own and operate four of these high-tech machines and all members are skilled in their operation.

The cab of Johannes’ FH16 is equipped with an elaborate sound system dominated by a number of large “woofer” speakers. Johannes says he enjoys “all types” of music and his personalised entertainment system would be at home at a music festival instead of hundreds of kilometres north of the Arctic Circle.

The trucks and trailers are equipped with air operated winches which maintain the tension of the load restraint chains even as the loads settle on their way to their destination. Much of the timber is delivered to milling facilities operated by Stenvalls which is a major supplier of Scandinavian timber products and seeks to maximise the useful yield from every log and maintain the sustainability of the forests to the degree of making good use of sawdust and shavings for animal bedding.

When he is operating the crane to load

his truck Johannes is exposed to the elements, unlike the other trucks which have small cabins for the crane operators. This doesn’t stop Johannes from using the jib and claw attachment as if they were extensions of his own limbs as he deftly picks up the logs and places them on the truck and trailer.

Taking notice of the on-board weighing systems the truck and trailer combinations are loaded to a gross weight of 74 tonnes with an overall length of 24 metres.

Mika and his wife Carola, now, have as their main interest the Forest Jewel traditional Scandinavian handicrafts business which they started in 1981 and supplies a wide variety of items such as reindeer skin rugs and bone and antler handled knives and kitchen utensils.

Handmade Forest Jewel is internationally renowned for being the biggest seller of traditional wooden cups with two nger handles which are made from birch wood boules. We meet Mika and Carola

in person at their stall at the annual winter craft market which has been held on the rst Thursday of February in the Lapland town of Jokkmokk since 1605. A tradition, to our count, which has been happening for some 419 years.

Mika Korkeaniemi is a big Viking bear of a man who wears fox fur gauntlets and exudes happiness and friendliness,

in common with Lapland’s most famous resident, the aforementioned Mr Claus. Mika is justi ably proud of his family and the way in which they conduct themselves and the business. He has a natural passion for the forests and is enthusiastic about his sons’ and daughter’s ongoing involvement with their Volvo Trucks.

The flexible and agile Volvo FM Electric. Lower sound and emissions. Excellent ergonomics and visibility. Designed for high-capacity grocery deliveries, container transports, refuse pickups and more within metropolitan areas. To simplify the transition to electromobility, the truck is offered together with solutions for charging, route and range planning and energy status.

Volvo Trucks. Driving Progress The combination is loaded to a gross weight of 74 tonnes.Eaton educator Murray Seymour tours the country enlightening dealerships, customers, mechanics and OEMs on Eaton product including the new automated Endurant XD Pro transmission.

The trap of modern education is it is so often divorced from practical application. In the world of heavy vehicles, theory won’t survive without real world validation. Murray Seymour, as an educator, is certainly quali ed to both teach and train. He brings with him a loaded resume. His extensive background begins in engine reconditioning, mainly on cars and agricultural equipment.

That was followed by a long stint at Detroit Diesel. In 1997, he moved off the tools when he landed with ZF where he was employed as technical support for Victoria and Tasmania. Sales at the time were largely for boats and other bits and pieces. In that role he touched on training with bus operators for the automatic transmissions around Melbourne.

“That was in the days of the overhead projector and transparancies,” he recalls. “I didn’t really have a style per se, but I gave it a crack.”

It was when another colleague, who sat in on one of Murray’s rst sessions, informed him, to his surprise, that he was “really good at it” that the possibility of a career started to take shape.

“The other trainer that day was like a strict school master,” he says. “He didn’t land so well with the audience.”

Murray put his hand up to take over the training manager/trainer with IVECO subsequently revising that program extensively. By 2015, he had moved to Fiat Chrysler mainly supporting Fiat commercial vehicles that mostly went into motorhome applications.

In the wake of COVID, Murray arrived at Eaton Mobility Group, where he is now the Training Manager and Specialist Technical Support. At the same time key players were readying to launch products to market, some of which had been

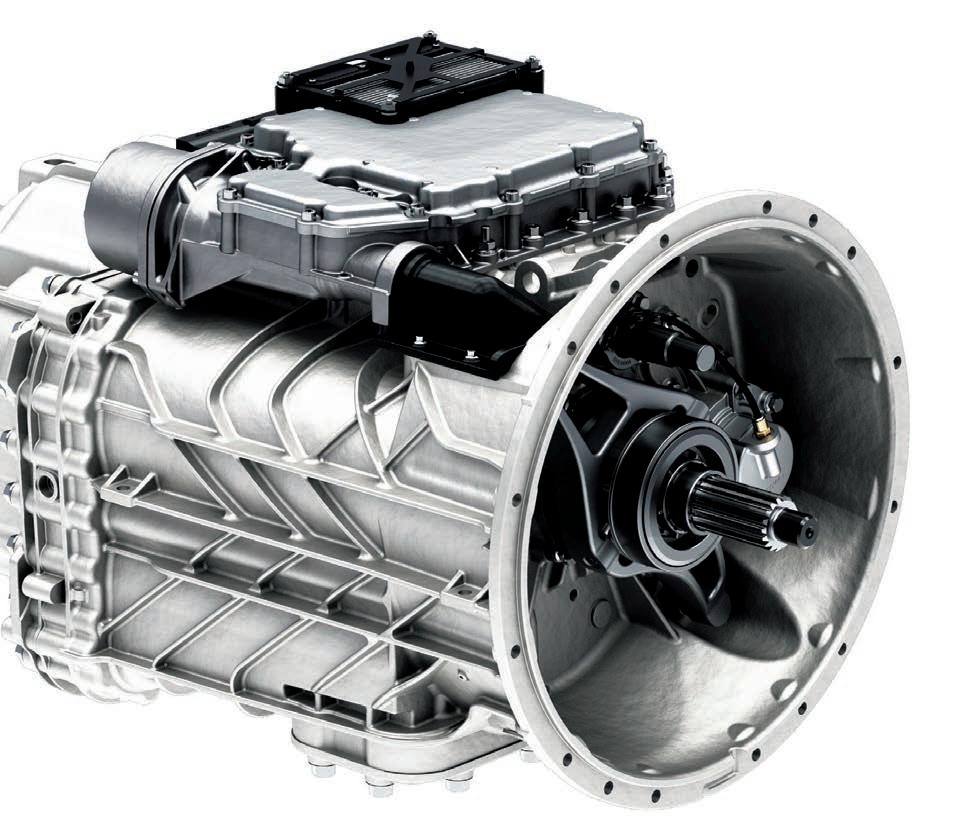

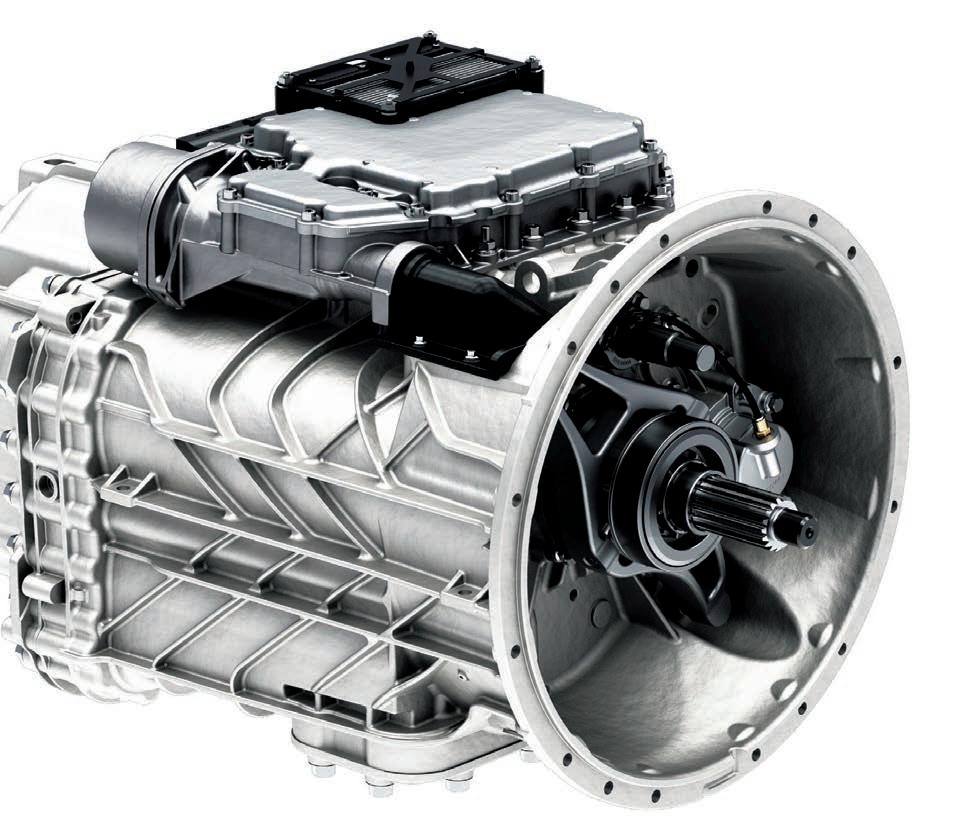

eagerly anticipated prior to the global upheaval. Eaton, whose new automated Endurant XD Pro transmission was one such product, rolled out in the midst of what became a transitional period for both industry and newly manufactured heavy vehicles.

As Eaton’s dedicated trainer, Murray travels the country conducting workshops on both the latest and pre-existing Eaton product in a formalised setting on average every second week. Leading eets and dealerships like Inland Truck Centre, to name one recent example, are often in attendance.

Murray’s rst port of call at Eaton was a

successful training module he created for the RoadRanger transmission, legendary for its role in heavy duty applications. Operators of outback roadtrains still swear by it. Despite the product being well established continuous education is crucial with high staff turnover in industry and people coming in from overseas who have never seen an Eaton transmission before.

The manual version is 25 years old while the automated UltraShift PLUS counterpart, in its current format, has been around for a decade.

“In the older product we will see a large variation in the current knowledge,” says Murray. “There might be people in the training who are a bit wet behind the ears versus people who are experienced who are great to have because you can drag information from their experiences with the product.”

The training program is also a key foundation at Eaton in helping to develop the next generation of truck technicians. Having new products that are purposebuilt clean sheet designs like the Eaton Endurant XD Pro transmissions was an enticement for Murray when he joined Eaton.

“There’s nothing like a new product to create a whole new buzz in the learning environment,” he says. “People pay attention and are generally more interested. That’s a good thing.”

Training on the new Endurant XD has recently begun being rolled out chie y across the Kenworth dealer networks given it is, at present, exclusive to that truck platform in Australia.

“These training sessions across the product range are in high demand,” says Murray.

“So far with the XD Pro product they’re basically sending their experienced mechanics and diagnostic people and service managers because it’s brand new. I’m not having to tailor it too much. Everyone is basically at the same level when we talk. So that’s not really an issue with the new product as it can be for the older product that has been around for some time.”

In his presentation Murray will discuss the technical aspects of the product from weight savings, ratio spreads, to the immediate bene ts it will bring. Also, he touches on the pitfalls particularly in reducing the risk of malfunction caused by incorrect maintenance and handling procedures.

“We talk about some of the pain points we’ve already seen,” Murray says. “For example, making sure when you install a clutch you do it exactly to our instructions in the service manual. If you don’t do it, you will in high likelihood cause a problem for yourself and the owner.”

The Endurant XD Pro Series features a clean, contained design with internal wiring and sensors to minimise exposure and corrosion to wires and connectors for improved reliability. It’s even 102 kilograms lighter than comparable UltraShift PLUS models.

Murray also talks about the pneumatically operated transmission, which makes for a change, as it is not driven by electric Servo motors like the UltraShift PLUS models. Many are the advantages of having hardware purpose-built to match with the automation rather than it being an add-on with a manual transmission as was the case, previously.

“There’s a whole lot of information we go through,” he says. “We examine the power ow through the transmission and when we get to a certain point where interest leads to the guys asking lots of questions, we will pack up the computer and head out to the workshop area depending where

we are.”

At Eaton’s Rowville facility, there’s a purpose-built training room with an overhead gantry. Without stripping it to its last bolt, Murray will pull down the Endurant XD Pro far enough so that those in attendance get to diagnose it and perform external vehicle repairs with con dence. The front covers are removed so that all the different areas that technicians are likely to eventually to see are exposed. The Mechatronic Transmission Module (MTM), in essence the lid of the transmission, is inspected with all the solenoid caps, sensors, pistons, shift forks and rails that action the changing within the transmission. Murray will then pull the rear end of the transmission to look at the range change to set high or low range.