In the current climate and in the period of flux, which we are heading into over the next couple of decades, it is probably a good idea if people in the trucking industry act more like meerkats do in the deserts of Namibia, and less like the hyenas do on the plains of the Serengeti, where it’s dog eat dog.

What on earth do I mean by this? Well, it’s pretty simple, meerkats all have to work together in order to stay alive and avoid their many predators. They all have to eat, but although they will compete for food, they also work cooperatively.

A group will be foraging. somewhere in the bush in Southwest Africa, and one of them will stand up on its hind legs and constantly peer around to see if there is any danger approaching. What they’re doing is keeping an eye on things, seeing how things develop and then after a while they can put the head back down and start to forage for themselves. At the same time, another in the group will stand up and constantly keep an eye on things and see just exactly how things are travelling.

It is a little far-fetched to compare ourselves to this small group of furry animals somewhere in Africa, but we have exactly the same problem. Trucking operators need to work hard to survive, it’s a cut-throat business, margins are extremely tight and you need to keep your eye on the job in hand at all times to ensure that it gets done and gets done efficiently.

Management attention is on keeping

the operation running smoothly. When something else has just appeared on horizon and it would be a good idea for those people running a transport operation to have a good look at what it is, their attention is held by the day to day of the operation.

What is coming is the drive towards zero emissions and what that means is a myriad of technologies, ideas, developments will be coming over the horizon towards the transport industry and we need to keep an eye on them and we need to be prepared for the implications of these changes.

There are many people in transport, who don’t have enough time to have a good look around, examine all the factors and look at all the possible options available to them, or determine how those options compare. They have to keep their attention on the trucking business.

PUBLISHED BY

Prime Creative Media Pty Ltd

ABN 51 127 239 212

379 Docklands Drive, Docklands VIC 3008 Australia

Telephone: 03 9690 8766

Fax: 03 9682 0044

Email: enquiries@primecreative.com.au

Chief Executive Officer: John Murphy

Managing Editor: Geoff Crockett

Editor: Tim Giles

Contributor: Bob Woodward

Correspondent: Will Shiers (UK)

Advertising Manager:

Trevor Herkess: 0411 411 352, trevor.herkess@primecreative.com.au

Client Success Manager: Salma Kennedy, salma.kennedy@primecreative.com.au

Production Manager: Michelle Weston

Circulation & Subscriptions Manager:

Bobby Yung

Head of Design: Blake Storey

Designer: Cat Zappia

Official Media Partners: REGISTERED BY

If the industry works together and acts more like the meerkat, everyone takes it in turns to have a look at this technology and all will end up with some form of group knowledge from which everybody can benefit.

At the end of this process, if the knowledge is shared, everybody has been able to carry on and run their own business and remain profitable. At the same time, a pool of knowledge will have developed which the industry can share, in order to push forward into the new brave new world of zero emissions, without making mistakes which could prove to be extremely costly, or going down the wrong technology route.

Australia Post - ISSN 1445-1158

SUBSCRIPTION

03 9690 8766

subscriptions@primecreative.com.au

PowerTorque Magazine is available by subscription from the publisher.

The right of refusal is reserved by the publisher.

Annual rates: AUS $60.00 (inc GST). For overseas subscriptions, airmail postage should be added to the subscription rate.

DISCLAIMER

PowerTorque Magazine is owned and published by Prime Creative Media.

All material in PowerTorque Magazine is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher.

The Editor welcomes contributions but reserves the right to accept or reject any material.

While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in PowerTorque Magazine are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

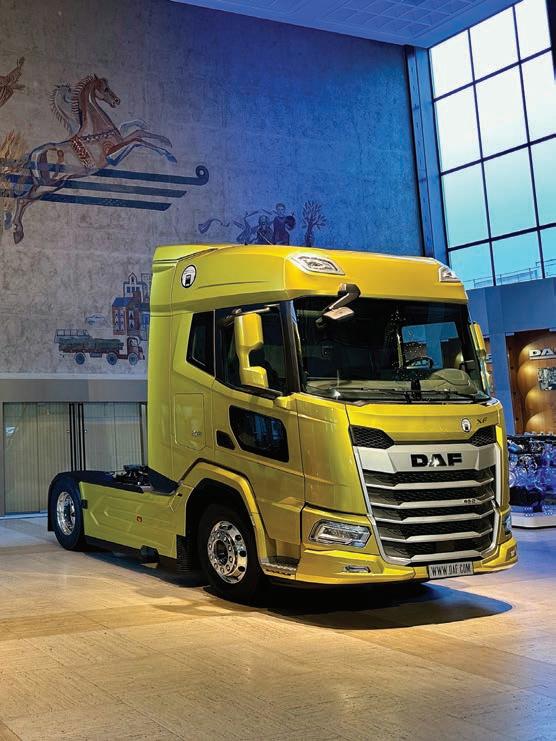

DAF is a versatile all-rounder with the perfect combination of superior comfort and luxury for the driver and maximum vehicle efficiency for the operator.

So, you need a crane truck built to cope with the toughest conditions? There’s a DAF for that!

Whether your needs are distribution, long-distance haulage or construction, the versatility of DAF keeps you moving, and that’s good for business.

DAF.COM.AU

The three contenders for the Truck of the Year Australasia have been announced and the judging process begins on both sides of the ditch.

What the judges for the Truck of the Year Australasia are looking for in these trucks, is their ability to improve the outcomes for the owner, the driver and other road users, and to take the road transport industry forward.

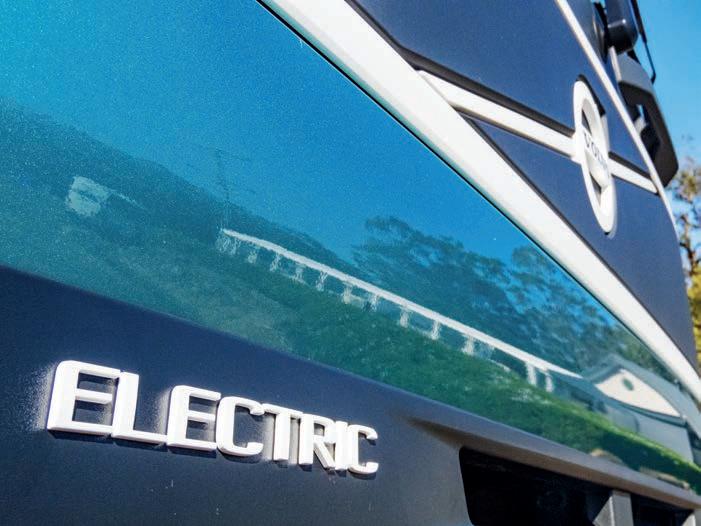

The Volvo heavy duty electric range is now with us and the trucks are in contention for the coveted Truck of the Year Australasia award, to be presented in March in Christchurch New Zealand.

After a period of uncertainty, a reappraisal of the Hino brand and products sees new initiatives taking Hino forward into the next decade.

The entire trucking industry, as well as truck makers are on a steep zero emission learning curve as they grapple with the issues around reducing carbon emissions from trucks towards a zero target.

Developing a hydrogen refuelling station infrastructure is going to be a vital, but challenging task for the Australian economy and the transport industry.

70

PowerTorque’s European Correspondent, Will Shiers, crosses the Atlantic to bring us a glimpse into the future with Volvo’s SuperTruck2

Harald Seidel, DAF Trucks President, speaks to Gianenrico Giffini, President of the International Truck of the Year Jury about the DAF Trucks plans when moving forward towards sustainable transport solutions.

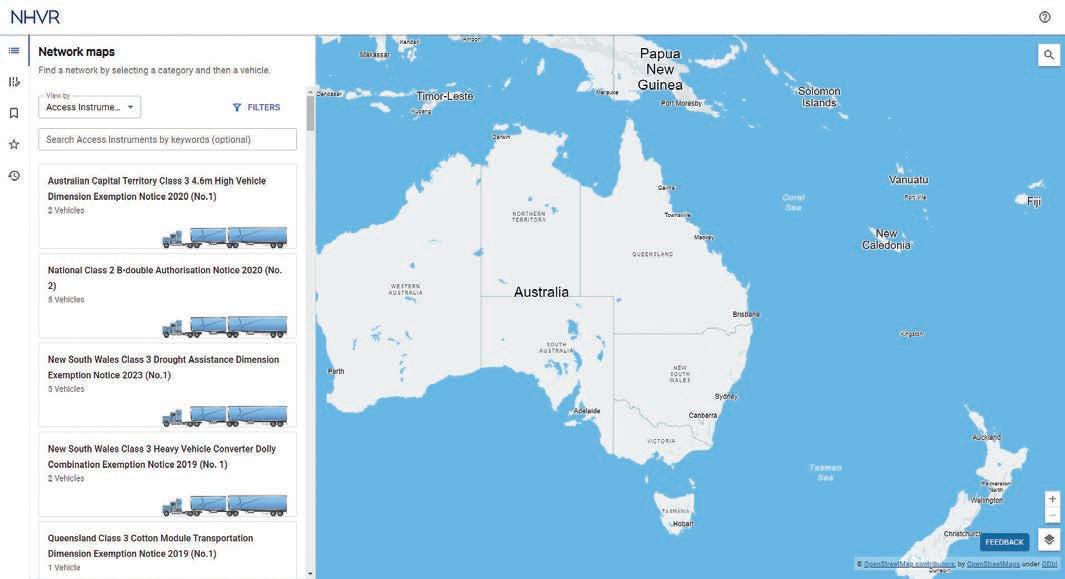

56 USING THE NHVR’S NEW NATIONAL NETWORK MAP

In 2024, the National Heavy Vehicle Regulator (NHVR) is continuing to advance industry standards and improve how truck drivers access routing information on Australian roads.

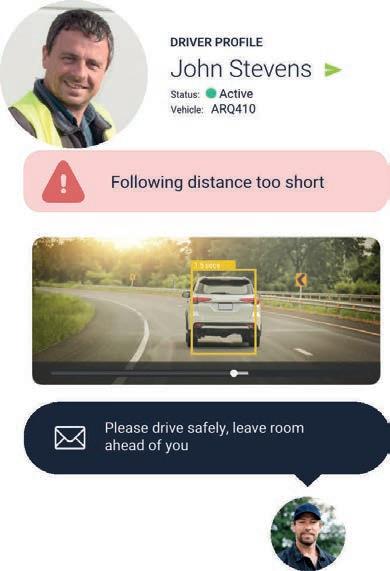

58 DRIVING A SAFER FREIGHT FUTURE

Looking forward to the new technologies on their way, David Smith, Chair of the Australian Trucking Association, sets out the issues.

60 DAISY’S GARDEN SUPPLIES BLOOMS WITH ISUZU

The continued growth through a difficult period of life for landscaping company Daisy’s Garden Supplies almost defies all odds.

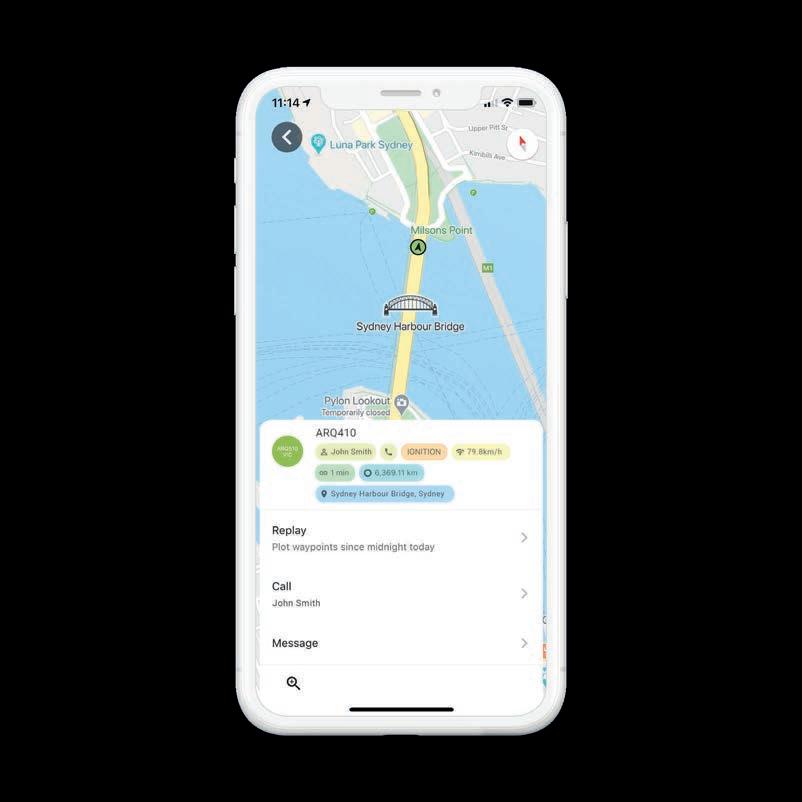

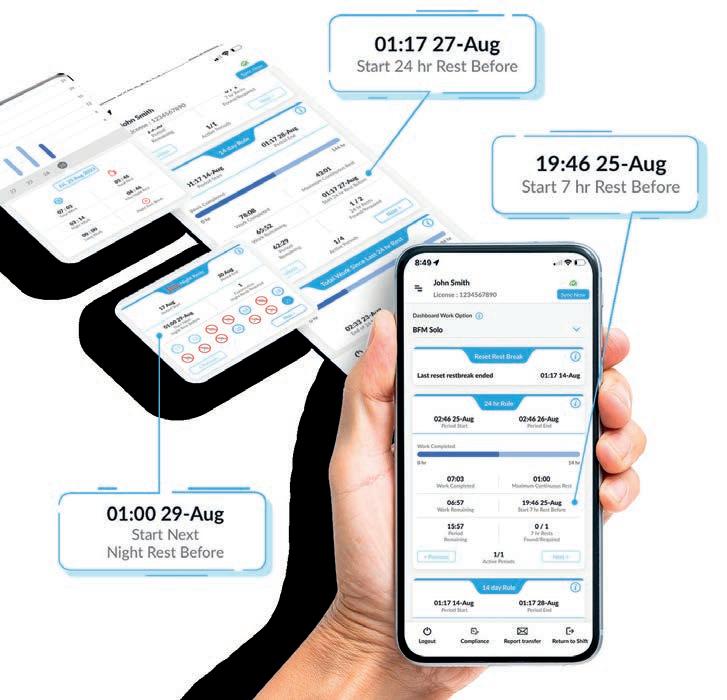

62 NOW IS THE TIME TO GET MOVING ON FUTUREPROOFING YOUR BUSINESS’ TECHNOLOGY

Data and connectivity is vital to the running of a modern trucking operation and on board data on a vehicle can be vital for compliance and/or safety, but some systems can be compromised.

74 LOOKING FOR ‘REAL’ MODULARITY

By the time this edition of PT hits the shelves the memories of 2023 will be dim. 2024 has brought new challenges, reckons Bob Woodward, but the more times change the more things remain the same.

77 TECH KNOW

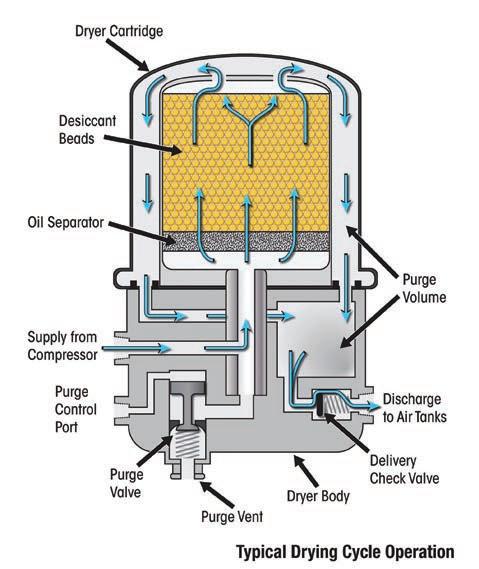

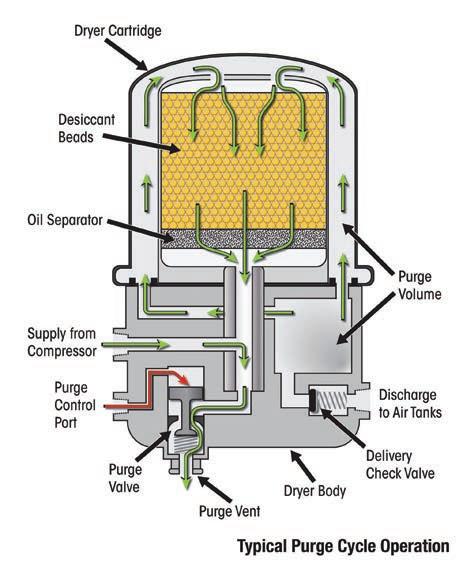

A 36.5m AB-triple may not disassemble to a legal B-double, the 36.5m reference is too short for general freight. Air naturally contains a certain amount of moisture. If left unchecked, this moisture will cause corrosion and damage to pneumatic components, such as brake components, height control valves.

The National Heavy Vehicle Regulator introduced a new National Network Map on December 20, last year to help drivers plot their paths.

CEO Sal Petroccitto says the map aims to give transport operators and drivers greater access to any information they may need about Australia’s roads.

“For the first time, the heavy vehicle industry and road managers will be able to see national road network information in one central location,” he says.

“The new map supports improved heavy vehicle access efficiency and decision making by bringing together the statebased heavy vehicle networks and displaying them in the National Network Map.

“The launch of the new map will provide several key benefits by ensuring there is one single authoritative map to enable the heavy vehicle industry to route their journeys on approved statebased networks and allow for improved cross border access planning.”

Trucks has unveiled its new mighty 780hp FH Aero range, the most powerful offering from the company yet.

Volvo FH16 becomes the most powerful truck in the industry.

Available in diesel, biogas and electric powertrains, the vehicle manufacturer says it is another step forward in efficiency and safety for its

new Volvo FH Aero is our most efficient truck ever as we continue to reduce CO2 from our entire product

range,” says Roger Alm, President Volvo Trucks.

“This is a Volvo truck at its best – a safe, beautifully designed and superior quality truck for tough longhaul tasks, designed for the success of our customers.”

With a suite of new safety features and design changes, the new Aero truck models will be rolled out step by step to markets during 2024-2025 in four versions – the FH Aero, FH Aero Electric, FH Aero gas-powered and FH16 Aero.

The figures show Isuzu once again topping the truck sales rankings in Australia, breaking the record for the most trucks sold in a year in Australia.

However, due to the rise in overall sale, Isuzu’s overall market share has slipped from over 30 per cent last year to 28.6 per cent in 2023.

The ongoing boom in truck sales in Australia saw yet another record breaking total number of trucks over 4,5 tonnes sold again last year, with 47,757 trucks sold in total. This is 3,378 more trucks sold than in the record breaking

2022 total. Isuzu have now been Australian truck market leaders for 35 years, a period in which the organisation here has grown from strength to strength and continues to set the standard for the other truck makers to follow in the market.

While the sales figures in each segment of the market are up on the previous year overall, it is in the heavy duty sector where the most powerful growth is occurring with the heavy duty market jumping from a record 14,966 in 2022 to an even higher 17,569 in 2023.

After a long and storied career with Hino, Takashi ‘Sam’ Suda has stepped down from the position of President and CEO of Hino Australia as of February 1, 2024.

He will be succeeded by Richard Emery, who brings over three decades of sales, marketing and business development experience in the global automotive and trucking industry, including previously as Vice President of Brand and

Franchise Development for Hino.

“Over the last two years, Richard has demonstrated his excellent leadership and management skills,” Sam says.

“He has built strong connections with our dealer partners and provided important strategic direction to our sales operations through a challenging supply environment.

“I am confident I am leaving Hino Australia in his capable hands.”

Glen Dyer has taken the reins as Iveco’s new head of Australia and New Zealand operations effective immediately, the vehicle manufacturer announced this week.

He has been working with the company since 2021, where he came on board as the head of sales and product.

Glen enters the role with nearly 20 years of transport industry experience, starting first with Mercedes-Benz UK as a regional sales manager.

“I’m looking forward to seeing what the future holds for Iveco and will work hard to build on Michael May’s strong foundations, ensuring that we deliver on every level for our customers,” Glen says.

Mitsubishi Fuso has reported a strong sales result for the calendar year for its Daimler Truck brand. It increased its unit sales worldwide in 2023, selling 526,053 vehicles (up one per cent from 2022).

battery-electric range was where they really shone however, increasing sales by 277 per cent on 2022 to 3443

Daimler Truck CEO Martin Daum says he is happy to report a successful year for the brand.

2023 we have again increased our sales despite a

continuously challenging supply situation which prevented even higher sales. We are very confident of achieving our financial ambitions for 2023,” he says.

“Our sales of battery-electric vehicles more than tripled compared to the previous year. We have expanded our product portfolio of battery electric vehicles for our customers in 2023 to ten different models.

“This is the foundation for future growth and underlines our aspiration to lead the transportation of the future.”

Late last year, the federal government announced that fuel quality and noxious emissions standards will result in the transition to Euro 6d vehicles.

The Australian Trucking Association has issued a warning to caravanners and truck drivers alike about the importance of managing fatigue and the use of rest stops.

A recent NHVR survey revealed that 60 per cent of caravanners have used truckspecific rest areas, with 22 per cent doing so regularly.

ATA CEO Mathew Munro says that these spaces need to be available for drivers when they’re on the road, needing to take crucial fatigue breaks.

“Fatigue is one of the most serious factors affecting safety and vehicle crashes on our roads,” he says.

“Truck drivers meticulously plan routes to ensure they can adhere to rest schedules, facing heavy penalties for noncompliance. Nationwide, there is a chronic shortage of dedicated truck rest areas and this problem is made worse when caravans fill these spaces.

“Caravanners and truck drivers have a shared interest in reducing crash risk. It is in caravanner’s own best interests to avoid practices that increase fatigue risk for truck drivers.

“We need greater awareness among caravanners about the seriousness of this issue.”

Consultation with industry and the community has led to new versions of new cars, including SUVs and light commercial vehicles, sold from December 2025 onwards will need to comply with Euro 6d noxious emissions standards.

The government is also reducing the amount of aromatic hydrocarbons in RON 95 petrol, with all petrol vehicles on Australian roads set to be able

government will align previously announced reductions in sulfur limits for all petrol with new and strengthened aromatics limits.

“The federal government has a laser-like focus on bringing down transport costs and emissions,” Federal Climate Change and Energy Minister Chris Bowen says.

“The former government talked a lot about making these changes but wasted years without action, now we’re getting on with the job of delivering better health and cost-of-living outcomes.

“These updates to our vehicle standards will see almost 18

There’s major change at Daimler Truck Australia Pacific coming in 2024, as the company announced sweeping changes to its management structure regarding its truck brands. After keeping its Mercedes-Benz Trucks, Freightliner and Fuso brand lines separate for a number of years, Daimler has removed the positions of individual vice presidents for each truck brand.

Instead, Andrew Assimo, former Mercedes-Benz Trucks Australia

Pacific vice president, will take up the new role of Daimler Truck Australia Pacific vice president, sales and marketing to cover all three brands.

Freightliner Australia Pacific’s former vice president, Stephen Downes will also take up a new role as vice president, service, product, Vehicle Processing Centre (VPC) and elite support, while former Fuso vice president Alex Müller will take on a special projects role.

Heavy Vehicle Industry Australia and NatRoad are forming a key strategic partnership for the upcoming TruckShowX 2024, a major industry decarbonisation event.

HVIA has signed NatRoad as the official industry association partner for the event.

Acting as a spin-off of the Brisbane Truck Show, TruckShowX 2024 will be held at the RACV Cape Schanck Resort in Victoria’s Mornington Peninsula from May 13-14, 2024.

The event aims to explore the future of low and zero-emissions vehicles in the Australia transport industry, as well as technology, equipment, infrastructure and more surrounding the continued move to lower emissions.

There will be an expo showcasing the latest LZEV vehicles, product and services, with the opportunity for on-road driving experiences.

“Partnering with NatRoad for the first TruckShowX in 2024 makes perfect sense,” he says.

“TruckShowX is set to be the

The National Heavy Vehicle Regulator is warning drivers of the risks of wet weather across Australia. CEO Sal Petroccitto stresses the importance of safety and preparedness for truck drivers navigating these conditions.

Drivers can stay ahead of storms by highlighting key measures and equipment they should be taking on their journey.

“First and foremost, heavy vehicle drivers should be ensuring routine vehicle maintenance is

biggest trucking decarbonisation conference held in Australia to date, and NatRoad is undoubtedly the most proactive transport industry association when it comes to leading decarbonisation… their recent industry white paper is a clear testament to that”.

“I believe in the power of

pleasure to welcome NatRoad as a partner.

“Together with our research partner NTRO, we will ensure that this event delivers real value and has an incredibly positive impact for every facet of trucking and heavy freight transport in Australia.”

completed, before travelling to their destination,” Sal says.

“This includes inspecting the vehicle’s tyres, making certain of proper tread depth and inflation, with adequate traction crucial in wet and slippery conditions. Drivers should also be checking

lights, brake lights and turn signals, in addition to testing windshield wipers.

“The NHVR’s number one priority is ensuring the safety of all road users, rain, hail or shine, and these are the safety measures that could save a life.”

The to see a significant investment in 2024 as the WA government commits to rural funding.

Regional WA will receive an additional $178 million in funding in a move that the government says will deliver a major boost to rural transport in the state.

This funding will include reinvesting into four road projects that recently had funding removed during a recent review of the nation’s infrastructure pipeline, with $132 million being funnelled back into them.

These include $48 million for the Moorine Rock to Mt Holland Road Upgrades, $48 million for the Marble Bar Road Upgrade, $29.6 million to continue planning for the Pinjarra Heavy Haulage Deviation project and $6.4 million for the Great Southern Secondary Freight.

“The government is delivering on its commitment to projects that had funding cut by the federal government as part of its review of the nation’s infrastructure pipeline,” says state transport minister Rita Saffioti.

“The state government will provide an additional $132 million to continue four road projects that had funding cut as part of the Federal IAP review, delivering on our commitment to seeing these projects delivered.

Daimler Truck has reached a $1 billion USD (1.49 billion AUD) deal with Silicon Valley-based firm Aeva Technologies to supply sensors for self-driving trucks.

Aeva is known for producing light detection and ranging (LiDAR) sensors which help vehicles gain a detailed view of the road. The sensor can detect objects faster, further away, and with higher accuracy.

Through the collaboration, Aeva will supply its latest Aeva Atlas automotive grade 4D LiDAR technology to Daimler and also collaborate with Torc Robotics, an independent subsidiary of Daimler Truck, to enable SAE Level 4 autonomous vehicle

capabilities.

Torc will use the sensors to guide its virtual driving software and will sell its technology and supporting services as a subscription to customers.

The sensors will eventually end up on Daimler Truck’s Freightliner Cascadia truck platform, integrated into the production process to forgo the need for after purchase retrofitting.

Daimler and Torc have run extensive and successful on-road test programs as well as first customer pilots.

To maximise the safety of autonomous trucks, Daimler’s trucks are equipped with LiDAR, radar and camera sensors.

National Tyre and Wheel (NTAW) has opened a new stateof-the-art distribution facility in Logan City, Queensland, it announced earlier in December.

It will act as an epicentre of NTAW’s business, as it looks to consolidate a number of smaller distribution centres into one large facility.

NTAW Managing Director Peter Ludemann says that the opening is a major step forward for the company.

“From little things, big things grow. Many of our NTAW businesses were started by ambitious entrepreneurs with a vision,” he says.

“We are so proud that this facility represents the combined efforts of the NTAW Group which have grown into a major player in the Australian and New Zealand tyre and wheel market.

“We are very excited that this facility marks yet another step toward delivery a high level of customer service and extensive product range to our customers.”

Waste and skip bin transport company North East Bin Hire has taken delivery of a brand new Isuzu FRR 110-240, christened ‘Skip 8’, to their Albury-Wodonga business.

Owner-operators Tom Hogan and Shannon Miles bought the truck from Blacklocks Isuzu in Wodonga, saying it has been perfect for the job.

“Blacklocks Isuzu are a big part of the community in Albury and working with Richard has been really good,” Tom says.

“With the lifting mechanism on the tray and needing to carry skip bins, payload was extremely important for us with the new Isuzu truck.

“We went with manual transmission for the mixed terrain— that first gear is so low you can pull up hills with no worries.

“In terms of size, the FRR is fantastic, and the manoeuvrability was a huge selling point. It’s great to drive, with a better turning circle than my dual-cab ute.”

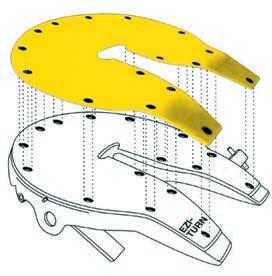

Brake manufacturer Bendix recommends that drivers stay aware of the stresses being put on their brakes driving in difficult conditions. This grows especially more crucial as the carrying capacity of the trucks grows –operating at near full GVM – the brakes on these trucks are under more stress.

Bendix recommends that truckies should regularly:

• Ensure brake fluid levels are correct and changed at OEM-specified intervals

• Inspect brake pads, rotors and calipers for wear or damage

• Check brake shoes and drums for wear, damage and adjustment

• Check brake lines and air hoses to ensure there are no kinks, perished rubbers or other damage

• Ensure that brake components are properly lubricated to prevent corrosion and to provide free operation

• Clean brake components to remove corrosion and debris build-up as required

The three contenders for the Truck of the Year Australasia have been announced and the judging process begins on both sides of the ditch.

It’s that time of year again and, after the successful first year of the Truck of the Year Australasia last year, it’s time to have a look at the trucks which have been released in the past year and come up with contenders for the prestigious title of Truck of the Year Australasia.

As before, PowerTorque is working with NZ Trucking magazine from New Zealand to hone down the contenders to a final winner of the award, which will be presented at the NZTA TMS event in Auckland in March.

Last year’s trophy was presented at the Brisbane Truck Show when the Kenworth K220 was named as the 2023 Truck of the Year Australasia. Now, in 2024, it’s time to start thinking about Truck of the Year Australasia 2024.

There are three strong contenders for the title all of which have a legitimate claim to be the Truck of the Year Australasia. It is the task of our of our judges to pick one winner to receive the trophy and the accolade of being the Truck of the Year in our part of the world.

To be considered for the Truck of the Year Australasia, a truck has to solve problems and issues which trucks elsewhere in the world do not have to deal with. Trucks coming to Australasia have to cope with a very different trucking environment to many of their home countries and have to be adapted accordingly. Often, the trucks which are most successful in our market are those which have been adapted in the best way to make them useful.

Australasia presents truck makers with challenges unlike those that they face elsewhere in the world, trucks are working in the harshest conditions, extreme heat, subzero temperatures and mountainous topography at weights up to and over 200 tonnes in some cases. At the

When examining the three contenders that we have this year, the judges are looking at a variety of factors. Essentially we need to identify the truck which makes the best contribution to the standards of safety and efficiency of freight transport by road in Australasia.

The five judges use their experience to draw out the overall

Choosing contenders can be difficult one. Quite often a truck may appear in Australia but not arrive in New Zealand until a later date, or vice versa. Therefore the trucks which are in contention for the title of Truck of the Year Australasia have become available for purchase in both Australia and New Zealand before December 31 2023.

Here are the three contenders for the coveted Truck of the Year Australasia 2024 award, to be presented in Christchurch, New Zealand in March.

It’s not easy picking a winner. There are no bad trucks on the market, any more, and the speed of technology development in the 21st century has been hard to

keep up with. What the judges for the Truck of the Year Australasia are looking for is for in these trucks, is their ability to improve the outcomes for the owner, the driver and other

road users, and to take the road transport industry forward.

Each of these trucks is on sale in both Australia and New Zealand and they all represent a major step forward

for their respective brands. Each brings considerable innovation to the table and are operating in new territory.

The three trucks chosen by the judging panel of five to be considered for the Truck of the Year Australasia 2024 accolade are, in no specific order: The Volvo Heavy Duty Electric prime mover, the Western Star X Series of models and the Scania Super range.

Each of these contenders brings something new to the table, all are very different from each other and deserve the recognition from the ToYA process for different reasons. The selections also reflect the period of flux we are about to enter, over the next decade or so.

In an industry where the diesel engine was king, we now have a set

of alternative power systems vying to take us into the future. Diesel is not going to be able to deliver on the lower carbon emissions the world is looking for, right now. The electric truck is going to be the first alternative to make an impact, and this has already happened with the heavy duty models from Volvo winning the International Truck of the Year gong in Lyon, France, last November.

This truck is clearly an interim solution for the Swedish brand, but it is an effective one which works well and is part of the first wave of heavy duty electric trucks to arrive on the Australasian truck markets.

We can expect alternatively fuelled trucks to become more important in our truck markets, and therefore, appear more in the ToYA consideration, year-on-year. The market is changing, slowly but surely

and this award will also be changing, as the emphasis shifts away from fossil fuels towards all of the zero carbon solutions which keep popping up around the world.

At the same time as zero carbon trucks are appearing, a truck maker like Scania is driving down fuel consumption on its conventionally powered offering, with the Super brand making a reappearance in the range and a whole new driveline appearing in the Swedish truck maker’s offering.

The re-engineering of the driveline is a major coup for the brand and the results are a substantial improvement in fuel consumption numbers and a much quieter driving experience.

Here’s a few highlights from the test drive review, which appeared in the July 2023 edition of PowerTorque:

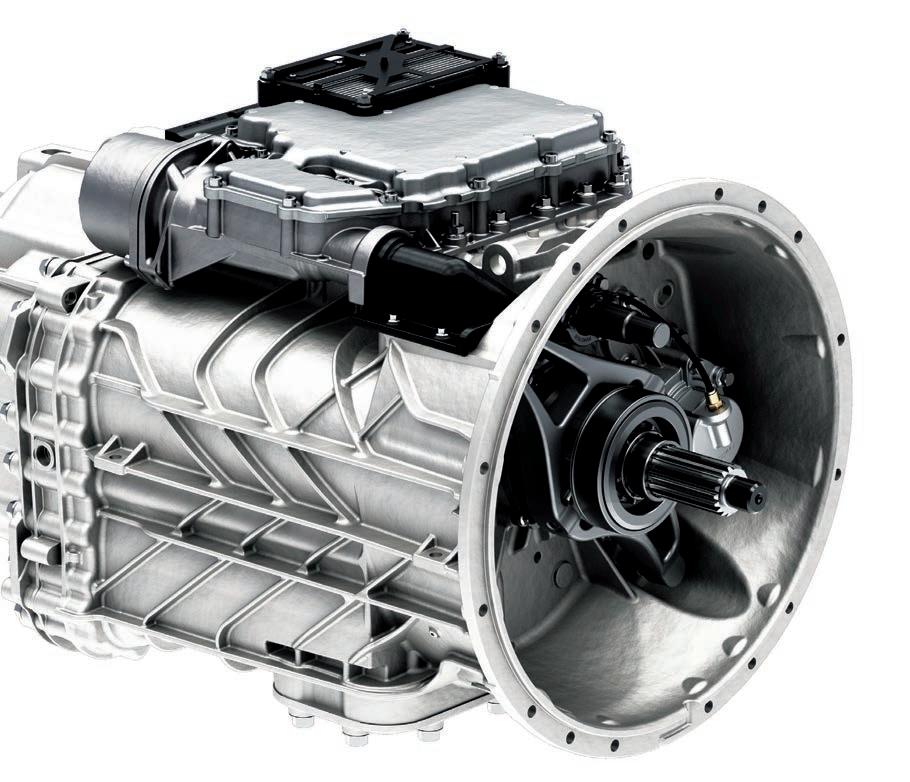

In a change which took many by surprise Scania have broken with a very long tradition and developed an AMT without any synchros. Opticruise has been though many iterations, always with synchros, but this new box is a revolutionary and not an evolutionary step-up.

The 75kg reduction of in the engine weight is complemented by the move to a basic crash box which means the simplifying of the AMT design, so now it’s also 75kg lighter on the 460R. The higher rated AMT fitted to the 560hp 13 litre engine, and also to the higher horsepower V8 engines from Scania, is 60kg lighter. lighter that the previous gearbox.

“This is a new engine and it has changed from the bottom end to the top,” says Benjamin Nye, Director of Truck Sales at Scania Australia. “With a 23 to one compression ratio, this

reduces inefficiencies in combustion from a gas exchange perspective. An interesting fact about this engine is that it has cracked 50 per cent brake thermal efficiency.

“That’s how far we’ve had to push diesel to get to this level. Double overhead cams is a big departure for Scania. Normally, we have used pushrods in the individual heads in the past. Everything’s had to be strengthened to cope with the new compression ratio. Hence the all new engine.”

Apart from the lifting of the compression ratio, the everconservative Scania designers have stuck with tried and tested technology, There’s no VGT or turbo compounding, the designers have simply put together a stronger design with conventional components which can cope with a higher compression ratio.

There’s no EGR, but a two-stage

SCR, the main dose is injected just after the turbocharger exhaust outlet near the exhaust brake flap where the exhaust gas is hot and turbulent. This better atomises the AdBlue for a more efficient clean up of NOx.

High compression engines tend towards higher ignition temperatures, in cylinder, leading to higher NOx and lower PM in the exhaust flow. Therefore a more efficient SCR system is needed and PM levels are more easily controlled.

PowerTorque July/August 2023

For more on this contender: Scan the QR code.

After a long period where its truck offering remained relatively static, the Western Star brand launched a completely new range of trucks bringing all of the latest technologies to its truck offering. The new X Series represents a radical transformation for a traditionally conservative truck brand.

The range change meant a complete redesign from the ground up and a complete renewal of all of the models on offer from Western Star. By moving across to the Daimler North America chassis and a state of the art, electronic system, the trucks are able to offer all of the latest safety systems as well introducing the most up-to-date Detroit engines into Australasia.

The introduction transformed the trucks available from Western Star from a past based on long held traditions, to a set of trucks which could match rivals for technical sophistication and efficiency while still retaining the style and feel of the Western Star models which came before.

Climbing up inside the cabin, The Western Star 4700 tipper and dog is a North American truck and feels, to a certain extent, like its predecessors. There’s enough switches and dials to satisfy the traditionalists and only a relatively small electronic information screen directly in front of the driver, which gives a hint of the arrival of modern technology.

Under the skin, of course, this is a very modern truck. Under the hood is the Gen 5 Detroit DD13 engine putting out 525hp (386kW) and with the classic 1850 ft lb (2508Nm) of torque, when needed. This is the latest iteration of the engine, the state of the art from the Daimler Group.

Axles front and rear come from Meritor and this truck runs with an industry standard 1:3.42 rear axle ratio.

The wiring is multiplexed with the level of sophistication to run the engine, the Detroit DT12 AMT, plus the myriad safety systems which are onboard and mandated from 2025. The DT12 uses the Performance Off-road

package, ideal for this kind of work.

The safety package is the Detroit Assurance Active Brake Assist, which includes active cruise control and automatic emergency braking. The system does have an off switch, and the ACC can bring the truck’s speed down to to zero km/h. It also has ABS, stability control, Safeguard Assist and also the Detroit lane departure warning system with a 15 minute timeout.

This is a thoroughly modern truck, but it is still ‘Western Star enough’ to satisfy those who prefer things a little more old school. Getting that blend of ancient and modern right can be a fine balance, and Western Star seem to have come close to pulling it off.

PowerTorque May/June 2023

For more on this contender: Scan the QR code.

The Volvo heavy duty electric range is now with us and the trucks are in contention for the coveted Truck of the Year Australasia award, to be presented in March in Christchurch New Zealand.

When looking at the contenders for the Truck of the Year Australasia, it was important to look at some of the new technologies coming through and see if there are any, which have reached the point where they look like they are going to be effective and have arrived in the kind of numbers to effect a

change to Australasian trucking.

With the launch of the Volvo, heavy duty electric truck range late in 2023, the Australasian transport industry can see a viable alternative option on a model which is already one of the top selling trucks. The Volvo heavy duty range has been effective and grown in Australasian markets, now the company is offering a zero carbon

emissions alternative to the current diesel range.

Two members of the ToYA jury got a chance to test drive a Volvo FH Electric at the end of 2023. This is a fully electric truck and one which will effectively change the emissions effect of the freight task, but it is an interim technology. This is not going to be the final product which Volvo will be

offering to the market in the long-term as a zero carbon emissions alternative.

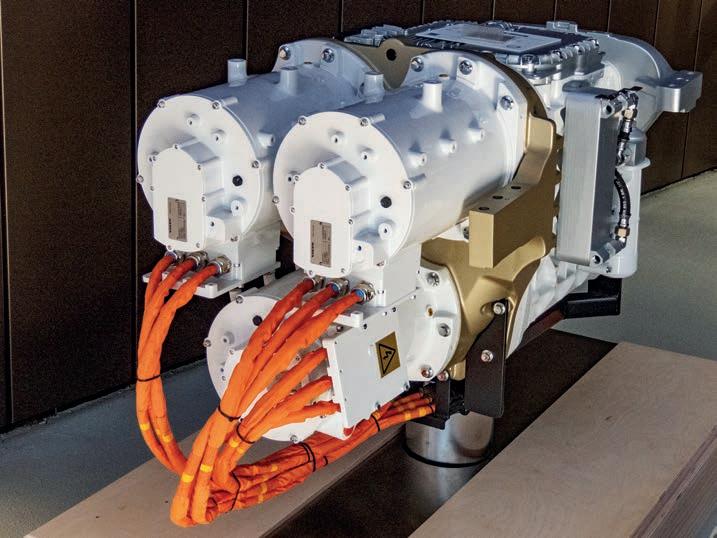

This first iteration of the Volvo heavy duty electric truck is a relatively small change compared to those which may come along down the track. Simply put, the Volvo engineers have looked at the current diesel Volvo FH, and removed the engine and associated accessories, then replaced them with all of the equipment required to create an electric driveline.

Those designers were looking at the large space underneath the cabin where the current engine sits and the outside of the chassis between the front wheels and the rear wheels which is normally home for the diesel tanks and emission control systems.

The electric driveline system needed to be designed so that it fitted into the same cubic space. The resulting design is quite a simple solution. In the engine space is placed all of the control systems, electric power elements, a cooling system, plus three electric motors in a triangular pattern which provide the motive power to drive the transmission

The designers decided to go with the I-Shift transmission which is currently coupled to the diesel engine.

Most of the ratios in this 12-speed AMT will not be needed by this electric truck, but keeping the resilient box, gets the electric truck on the road and working effectively ASAP.

The designers are using a tried and true, trusted transmission, and the only development work needed to be done, was to reprogram the software to transmit the power coming from the electric motors to the rear wheels in a way which uses the performance parameters of the electric motor. The strength of the electric motor is the fact that it provides maximum torque all the way through the rev range.

The I-Shift transmission is imperceptible, it spends a lot of time skip shifting between a few of its 12 gears. It has been programmed to handle the electric driveline with ease. The default setting is for the truck to set off in seventh gear, most of the time.

This is a decision made by the I-Shift after gauging parameters like the data from the inclinometer in the

ToYA Jury members Dave McCoid and Tim Giles

transmission as to whether it is taking of on a slope or flat ground. It also knows how heavy the truck is with data from the air suspension. If it suspects there’s a lot of pudding on board it will drop down into bottom box to take off.

The first trucks to arrive are aimed at single semitrailer work available to run up to 44 tonnes, with the three electric motors providing 666 hp. Volvo will be making these trucks in the Wacol production plant in Brisbane by 2027. The reality of electric trucks, by that time, will have arrived.

The space reserved for the SCR unit and fuel tanks is where the designers have situated as many batteries as

practical. The eternal issue with electric vehicles is range, and the more battery capacity the better.

This FH model has an overall battery capacity of between 450 and 540kWh, depending on whether five or six batteries are fitted. Although plenty of batteries provide range they also also provide a lot of extra mass when compared to the original diesel design. This does create issues for some operations and the option of only five batteries may limit range to a certain extent, but should enable the operator to get better payload capacity

This model is the first cab off the rank, and should be replaced over the next five to nine years with a more mature, layout and design to take Volvo

forward into the brave view world of zero carbon emissions trucking. By that time, Volvo will have developed and finalised the e-axle design which the company displayed at the IAA in Hanover Germany in 2022, but which clearly needs further development before being released onto the market

The e-axle will replace the current differential and rear axle with a larger unit, which will include the differential, electric motor and the transmission all in one piece, at the rear end of the truck. This development will free up space further forward in the vehicle for the electric power system, but it will also free up the space between the chassis members which is currently taken by the driveshaft, where it runs from the rear of the transmission to the differential

Freeing up this space gives Volvo a lot more flexibility, in terms of both the amount of batteries and the distribution of weight across the entire prime mover. This may have the effect of reducing some of the mass on the front axle.

Approaching the truck for this test drive, the vehicle looks very familiar, no different when compared to its diesel predecessor. The giveaway of course is the word electric displayed above the windscreen and a smaller electric badge at the top of grille, on the driver’s side. This message is further amplified by the fact that the

registration number for the truck on test is ELEC FH

Climbing into the driver’s seat feels familiar. We’ve seen all of these all of these controls before in the diesel version, the information screens are also familiar to anybody who has

and the truck is ready to go. This can be quite disconcerting to someone brought up with a diesel heritage

Then the process becomes familiar again, select auto on the shift control to the driver’s left, release the electronic handbrake and then press the accelerator. It is at this point that it all becomes very unfamiliar, as there is no discernible noise as the truck takes off, but the landscape starts to move past

at higher speeds. The air-con fan can be heard and there can be a little wind noise which you would normally never notice in a diesel engine vehicle, but because of the virtual silence inside the cabin, it is all discernible.

Something else which is very discernible is the amount of torque available to the driver, from the second they press their foot onto the accelerator. The driver can feel the

Having driven quite a few electric trucks in test drives in the last couple of years, it has become clear that one of the differentiating elements between trucks, is the way that the software and computers on board control the application of power through the driveline. Without this control the acceleration can be too quick and the driver’s head will smack into the headrest of the driver’s seat.

This system shows its quality in the fact that pressing the accelerator, simply enables the vehicle to move off in a controlled manner, gradually picking up speed until reaching the desired velocity. This truck moves with the smoothness and effortlessness we have come to associate with Volvo in recent years..However, the electric version of the FH does take this to another level.

When travelling on the open highway, it’s simply a matter of sitting in the seat and steering on the route chosen. The electric FH models are all fitted with the Volvo dynamic steering system, which should help drivers get a feel for the dynamics of, what is essentially, a prime mover with more mass over the front axle.

The amount of help and aid the

driver chooses they can minimise the system’s input. It is also possible to choose whereabouts on the lane the driver wants the dynamic steering to place the truck.

The system uses the lane keeping video system, which sounds warnings if the truck drifts over white line, and the dynamic steering uses its image data to keep the truck at a particular position in the lane.

The default setting is to sit the truck directly in the middle of the lane. However, most experienced drivers know this is probably not the best place to be in many situations on Australian roads and prefer to shift closer to the fog line and away from the central white line. The driver can sinply adjust the setting and the dynamic steering will endeavour to maintain this position on the road if it can.

Driver tastes differ widely when it comes to steering feel preferences, apart from the three standard settings, it is possible for the driver to customise the setting of the dynamic steering to suit their preferences

There is an app available from Volvo, which would help a driver to make the adjustments necessary and

for them to get to know how to drive this particular truck and make other adjustments. The app is specific to the chassis number of the vehicle being driven and includes tips and tricks, help with settings, including small videos which show how particular controls or components can be adjusted and used.

One of the critical things in the system on the electric truck, and this is particularly important when you move into the higher mass trucks, is effective regenerative braking, putting power back into the battery as the truck slows. If the system works correctly the truck can regain a proportion of the power it used to get up to cruising speed, back into the battery.

Ideally, braking should be minimised because the regenerative effect slows the vehicle down enough to mean the service brake is only used to bring the truck to a halt. The speeding up and slowing down in traffic should be controllable simply using regen to wash off speed.

Where there used to be an engine brake stalk, there is now a regen stalk, with three positions, auto, off and on. The on position gives the driver the control to bring the regen on when

they think it’s needed, while the auto position engages the regen to suit the road conditions and from monitoring the driver’s behaviour. When the foot touches the brake pedal the regen activates and increases until the point at which the system realised the truck needs more retardation and applies the service brakes.

When the topographical active cruise control is activated, the system uses the trucks knowledge of the terrain to more precisely use the regen brake to maximise recharging and travel over the undulations safely.

On this test drive, ToYA judges PowerTorque’s Tim Giles and Dave McCoid from NZ Trucking drove the FH Electric. The technical information, about the FH model, will be the same for the electric FM model which will offer identical driveline and battery packs. The difference is a smaller, but lower cabin, which for many is better suited to urban driving conditions and freight tasks where the driver is constantly in and out of the cab.

These trucks will start appearing in fleets all over Australia in the coming years. Operators will integrate them in where they can. Numbers will grow steadily, but it will be a long time before they predominate in fleets. These trucks can effectively travel too far from home base. At the moment, 150km from home is the general limit, unless they build in recharging options en route, at customer facilities or can find roadside charging. This means the proportion of the fleet able to electrify will be limited.

Volvo reckon 70 per cent of the freight task can be handled by electric trucks now, so these trucks’ introduction can accelerate and substantial changes in the fleet make up should be able to significantly reduce carbon emissions from road transport over the coming years.

This is a model which will make an impact in Australasian trucking and is therefore a contender for the Truck of the Year Australasia award to be presented at the NZ Trucking Association’s Technology Maintenance Safety event in March 2024.

We’re not all made the same and neither is a Kenworth. With a huge range of options, a Kenworth can be customised for the driver and the task at hand. Drive something to be proud of; a truck that’s uniquely yours.

kenworth.com.au

After a period of uncertainty, a reappraisal of the Hino brand and products sees new initiatives taking Hino forward into the next decade.

As the number two selling truck brand in Australia, Hino tend to keep a relatively low profile. The organisation has worked hard to develop a comprehensive range of trucks to suit Australian conditions and a dealership group to support them.

However, after a few set backs around the pandemic and regulatory issues with emission ratification, the company is looking to develop its offering to the transport industry and get back to the task of offering something to handle just about every task.

“We obviously had some issues in 2022 in terms of supply out of Japan, for various reasons out of our control,” says Richard Emery, Hino President and CEO. “There are some things that we have, entrenched in our business philosophy over the

last couple of years, considering the market circumstances. The market circumstances are positive and we’ve certainly had a strong sales performance.

“It got a bit frustrating, because we certainly could have delivered more over the last two years particularly. It was constrained by local bodybuilder capacity, but that seems to be easing up as we lean into 2024. We’ve had some issues in Japan in 2022 with 300 Series and we took the 500 series off the market for four or five months, as we dealt with the emissions paperwork that we needed to deal with.

“Having got through that, we still have some challenges, as we get into 2024 and beyond. Business is in pretty good shape, and we’ve been concentrating on some things that we’ve had some positive outcomes from.”

In a strong and rising truck market Hino clearly missed opportunities, both in 2022 and 2023 because of these issues. It is coming back with a stronger model mix, bolstered by the return of the 500 Series, which has really bounced back. This truck has been proven to be a good fit in the medium to heavy duty segment of the market, where Hino traditionally performs well.

The 700 Series has never been a strong performer and the latest model had a difficult launch right in the middle of the worst of the COVID confusion. Orders continue to come in, but the global shipping issues slow the process of getting trucks from factory to customer.

The increasing demand for trucks in the economy means customers’ businesses are expanding, so rather than changing their fleet over they’re

putting new trucks on, at the same spending levels on older trucks’ maintenance is growing to keep them going, with a lot of preventative maintenance.

“We’re starting to now move into training on efficiency in our workshops,” says Richard. “We count their steps, and if we can lessen the load on technicians, we can get longevity and get better efficiencies out of it. The shortage of skilled workers in Australia continues to be a challenge in our industry. It’s eased a little bit in the last six to 12 months. There’s more apprentices coming in for sure. It’s kind of still a problem but nowhere near as bad as it was a year ago.

“We invested in a parts distribution centre during the COVID period. That’s proven to be genius. If we hadn’t invested in that new facility, there’s no way we would have kept up with the current parts business. We have also done lot of training making sure our dealers have got a facility that works efficiently and safely so that they can turn the parts stock over quickly.

“We have a system, it’s not AI, but

it allows them to predict what stock they need based on what sort of work they’ve been doing. This ensures they have the right parts are in the right place at the right time.”

Hybrid electric has been a success story for Hino, as truck buyers have started focus on carbon emissions. There has been a significant shift in leasing companies understanding of resale value for hybrid electric, which means the total cost of ownership calculation over the four or five years has changed. Add in the fuel saving

figures, and the numbers look quite attractive to a business. In 2023 Hino took significant orders for hybrid electric, 400 per cent up on the previous year.

The truck sales mix has changed for Hino in recent years with the proportion of heavier trucks, 500 and 700 Series, growing, when compared to the company’s sales figures in the past.

Interestingly, this is not affected by the fact that Hino restricts its direct large fleet business to around the 10 per cent figure.

“There’s more opportunity in that

big, multinational fleet business, but it’s not really what we’re into,” says Richard. “We’re going to put as much business through from small to medium enterprises into our network. Why? Because there’s more margin at the smaller end of the market, and there’s the aggressive nature of those big fleet deals. It’s just not somewhere we want to play.

“There’s a time and place for it and we do have a couple of key customers. Even if we had lots and lots of extra production capacity, I’m not sure we would do it, just to keep that nice balance in our business. We have a couple of key clients who have been with us for a long time, but we’re not out chasing other ones.”

However, the electric hybrid is an area of growth for the brand and quite often chosen by the larger clients. The target for electric hybrid sales in 2024 is 500, if Hino can get the supply. Toyota’s hybrid business continues to go gangbusters, so

getting hybrid componentry from Toyota’s supply chain can be difficult. Australia is Hino’s second biggest hybrid electric market after Japan.

“We think electric hybrid’s time has come,” says Richard. “We also think its window is four or five years, at least, where we think we can take full advantage because it’s the right product at the right time.

“Everyone gets fixated on percentages, but it’s actually how much fuel are you saving and cutting emissions. The bottom line is you’re saving in whatever situation. Now, I will say it’s still a hard sell to some customers, because of the initial cost, which is fair, it’s a reasonable price.

“There is a tunnel vision in the marketplace at the moment, where it’s either this or that and there’s no nuance in between. We’ve got fleets who are saying no, we’ve got to do battery electric. We are saying you could start tomorrow morning with a 20 per cent saving.

“Fleets who are dabbling in battery electric, are tunnel visioned about not considering other options. The Truck Industry Council finds that the government politicians tend to take the attitude of, it’s battery electric or nothing. It’s the only alternative to solve the problem. However, depending on your application, your weight and distance over the next 10 to 15 years, there’ll be a myriad of different drive trains solutions that will vary depending on what you’re using the truck for.

“We’ve got Japan testing battery electric, hydrogen and our hybrid. So we’re playing, we’re investing in all of those things. Each of these will have their time and place, when the stars align for each of those technologies. That’s one of the advantages we have, being part of the Toyota Technology Group, is that they’re continuing to invest in all sorts of different solutions.”

The entire Hino range is now a mature one, with all the models bedded in. 300 Series hybrid electric sales have been boosted as operators become aware of the need to cut carbon emissions and that hybrid offers an automatic 20 per cent plus reduction in emissions to their business. 500 Series has bounced back after a difficult 2022 and 700 Series continues to grow.

Demand for new trucks remains solid and Hino are playing the long game, working in the background to develop a robust operation with a business model able to handle any business environment, robust enough not be thrown off kilter, when a crisis occurs. This includes moving away

says Richard. “We’ve been working really hard over the last two years on this, and we certainly will going forward. We want to create a sustainable and robust business model, grow our capability and capacity.

“We have to make sure that we’ve got another enough capacity and capability in our network to give the customers the sort of or service levels that they require. We’re doing some simplification in our product lineup. There’s an internal term we use, we want to be everything to some customers, not something to lots of customers. We want to really hone in on our key applications and our customer base. We don’t want to be all things to all people.

partner relationships, both at dealer investor level, but also with some of our customers.”

From a sales perspective 2023 was a good year for Hino, with the company coming close to 6,000 truck sales for the year, at 5,909 sales, which equates to 12.4 per cent of total truck market. 2,264 of those sales were in the medium duty market, where Hino have been consistently strong. Meanwhile, in the light duty market, the company hit 2,928 sales, or 18.2 per cent market share.

“We will continue to build brand new infrastructure and facilities, dealership outlets, the number of working bays we’ve got. We are increasing the level of capacity in our parts operations and deepening our

“It could have been much stronger if we’d had the supply situation sorted out, particularly on light duty,” says Richard. “We have an order bank around the 6000 figure of customers waiting for their trucks. 12 months is probably too long for comfort, we’d like to drag that back down. Somewhere between six to nine months would be an ideal situation. Having said that, our customers have

been patient. They’re happy to wait.

“However, we know that it’s stretching the friendship a little, so we need to, during 2024, drag that down a little bit. 12 months ago, many of the brands, not just ourselves were getting to lead out times towards 18 months. There’s some brands that are, on particular models, even further out than that.

“There was a period of time in 2022, when we were delivering 500 or 600 trucks a month but we were taking orders for 800 or 900 which means our order bank was exploding. It’s now evened out, and that’s not suggesting that the business has slowed. I think the growth has slowed, we’ve seen a cooling of the order intake. It’s still at record levels, and customers are

still showing confidence in wanting more supply to meet the contracts and demand for their business.”

Data from the government and from the Truck Industry Council is still suggesting that between now and 2030 the amount of freight tonnage being moved by road in Australia will continue to grow, which will continue to drive demand for more trucks.

The flexible and agile Volvo FM Electric. Lower sound and emissions. Excellent ergonomics and visibility. Designed for high-capacity grocery deliveries, container transports, refuse pickups and more within metropolitan areas. To simplify the transition to electromobility, the truck is offered together with solutions for charging, route and range planning and energy status.

The entire trucking industry, as well as truck makers, are on a steep zero emission learning curve as they grapple with the issues around reducing carbon emissions from trucks towards a zero target.

In the last few years, the entire trucking industry has become increasingly aware of the implications of the drive towards zero carbon emissions from road transport. As happens anytime there are major technological changes coming through in the truck industry various manufacturers will head off

down different technological solution routes.

The trucking industry saw this in the process between 2000 and 2012, when regulations came in to reduce the amount of particulate matter and nitrogen oxides being emitted from truck exhausts, As the truck manufacturers moved quickly from

Euro 2, through 3, 4 and 5, before the current change to Euro 6.

This period saw many different technological options become available and trucking operators were offered different technologies in different combinations across a range of different brands. Since that period of flux and over time, the technical

knowledge has become more mature, to the point there there seems to be a consensus which has settled in the area of lower emission diesel engines, which now tend to use a SCR unit to reduce nitrogen oxides, and a DPF for the particulate matter

These after treatment units have become more sophisticated and more effective over the last 20 or so years. Now, we are embarking on a similar process with the drive towards zero carbon emissions from trucks.

However, this is unlikely to work its way work its way through the system over the next 20 years and come down to one single solution which suits everybody. The chances are that because of the different tasks and the different advantages of each of the technologies, that we are going to end up with a mix of different technologies within the road and transport industry in Australia.

We will be likely to see options all the way across the range of transport tasks. The solutions will probably be in its simplest form, basic battery electric vehicles running around cities and recharging, either overnight or when the opportunity allows, to enable them to fulfil their road transport task.

Over longer distances the jury’s still out but there are a number of different technologies which are likely to be effective. The more futuristic option is the is the hydrogen fuel cell which uses hydrogen through the fuel cell to create electricity to charge the battery, which then drives the truck.

Then we have also the possibility of hydrogen being used in an internal combustion engine (ICE) which can also reduce drastically reduce carbon emissions.

There are also some new fuels, sustainable fuels being developed which may be able to replace diesel in conventional diesel engines.

Plus, we still have other fuel saving technologies like hybridisation, which has proved to prove to be an effective way of reducing overall carbon emissions by at least 20 per cent.

In most cases, when a situation like this developed for an industry like the trucking industry, the most important element required at this point in the process is good information. We are

talking about technologies with which the transport industry is not familiar and has not experienced in the past and it does not fully comprehend how it will behave, working day to day in the industry.

This is also an opportunity for disruptors to come into the vehicle manufacturing industry with new ideas and different options, which may or may not develop into mature practical options, within the industry, down the track.

At the same time the big truck makers are investing multiple billions of dollars into all sorts of technologies all over the world to try and come up with the best most effective solution for the trucking industry in all conditions and areas.

It is into this environment which the Truck Industry Council, which represents the truck manufacturers in Australia, has decided it will need to make an ongoing input to inform truck buyers and those developing technology around trucks, to inform them about the realities of developing these technologies and how it may affect industry performance.

Questions about how this new technology can be integrated into transport businesses and how it can be best utilised, will need to be answered. The industry will also need to know how it can be used to best serve the interests of the transport industry’s customers

The first report has been published

years. As the technology developed, the TIC has decided it will present the reality of historical and current trends in the zero and low carbon technology.

It will also present sales data in the low and zero carbon emissions sector, and this update will become a regular feature in the reporting of heavy vehicle sales in the Australian market, complementing current monthly whole of market sales data.

The trucking industry has been made seriously aware of the need to move toward zero emissions, in many cases by its major customers, who, as large corporates have been tasked with ensuring that their businesses are moving towards carbon zero. The operations which provide services to those businesses are also expected them in the move towards zero carbon emissions.

“Never before has there been such a coordinated effort to transition your Australian truck fleet as there is now from national and state governments and big business down through suppliers, academia and society in general,” says the Low and Zero Emission Truck Market Update. “The momentum is building with the publication of this market update and regular sales reporting going forward.

“The aim is to inform all parties including government and regulators, as well as truck operators with information that assists them to make sound decisions regarding policy and regulations and the adoption and

of Australia. From 2008 to 2021 only 0.1 per cent of all new trucks sold in Australia were low or zero emission trucks.

The real issue before us all in road freight transport at the moment is to strive to ensure ambition meets reality.”

which will be developed in places like China, and Europe will, in fact, work perfectly well in the Australian environment, within our urban areas.

99.9 per cent of those sales were, of course, powered by diesel. 2022 saw the first glimmers of genuine interest in low and zero emission trucks. At the end of June 2023 0.5 per cent of new truck sales were classified as low or zero emission trucks.

The industry can expect this rise to accelerate in the coming years as interest in zero emission vehicles increases and the ability, and the capacity, of the truck manufacturers to supply these vehicles also comes online.

There are particular issues for the Australian truck and trucking industry and this is the fact that the average age of a truck in Australia is 15 years and there are almost 750,000 diesel trucks on our roads.

“There is no option to replace these trucks overnight,” points out the TIC. “There will not be a light switch moment. The starting point in Australia is for all stakeholders to acknowledge the need for a realistic transition plan.

“The role of TIC, as Australia’s peak industry association for truck manufacturers and importers, is to advocate on issues relating to the nation’s heavy vehicle truck fleet on behalf of its members and communicate to stakeholders a realistic pathway to achieving reduced carbon dioxide emissions.

As is mentioned regularly, the Australian trucking industry is very different from most trucking industries around the world, with major differences when compared with elsewhere in the world.

Some solutions are going to be more effective here than they will be elsewhere, just because of the extremely long distances and heavy axle masses at which our trucks currently run. The introduction of low emission technology is very unlikely to actually change the need or the ability of operators to run like vehicles like quad road trains.

These kinds of trucks and trailers are still going to be necessary into the future and the truck and trailer manufacturers are going to need to be able to develop solutions which will work in very hot, dusty, high mass high speed conditions over long distances.

The trucking needs in remote areas are a unique, but, in fact, most of our population live in large cities and there are five times more rigid trucks than articulated trucks on our roads. 70 per cent,(by some estimates 80 per cent) of these trucks operate in urban areas. Even for semis and B-doubles, 30 per cent of all kilometres traveled are in urban environments.

This suggests that the solutions

This will mean that trucks designed for those markets will need to be imported into Australia to solve our issues. However, Australia does have barriers which mean some of these solutions may not be able to run on our roads.

The issue of vehicle width looks like it may become easier to overcome. Currently the ADRs specify a maximum width of 2.5m, as compared to 2.55m in Europe and 2.6m in North America. A campaign by TIC has gained concessions and zero emission trucks are going to be allowed, under some caveats, to run on Australian roads.

This is very important because the Australian truck market is too small for the truck manufacturers of the world to pay for the research and development and to design specific vehicles for our market. It is simply not economically viable, especially when you consider the massive dollars which are already being spent on development of these new technologies. These changes will flow through, but will take time to make any real difference.

“Australian trucks tend to stay on the road for nearly 30 years longer than in comparable markets,” says the TIC report. “The average age of rigid trucks in Australia is 16 years while articulated trucks are typically around 12 years old. This higher age profile

contributes to a slower turnover of the national fleet.

“Approximately 56 per cent of trucks on the road today were manufactured before 2008, with rigid trucks over represented in this aged trucks category. Turnover rates are also also influenced by the composition of Australia’s trucking industry, which is skewed towards small fleets with localised operations, 92 per cent of road transport operators have fewer than five staff and 93 per cent have an annual turnover below $2 million. Just 0.5 per cent of Australia’s truck operators have more than 100 vehicles and around 70 per cent operate only one truck.”

This is the scope of this problem, small operators tend to keep their vehicles longer and are less able to keep up with all the latest modern technology. Whereas the large fleets will be able to make those changes, experiment with and develop their fleets at a faster rate than many of the smaller fleets.

Looking at the different segments into which zero emission trucks are going to be sold, the obvious first cab off the rank is going to be the urban delivery segment which represents the largest share of new truck sales in Australia.

These trucks go all the way from the four and a half tonne small pantech delivering goods around the city centres to the heavier trucks involved in the distribution of supplies for supermarkets, service stations and the rest of the urban economy. Plus there are large construction fleets involved in building projects and large infrastructure projects ,which are happening all across our major cities.

All of these vehicles tend to work on back to base working models. Often they will go out in the morning, do their work all day, come back to a depot at night, this is where the battery electric truck (BET) comes into its own.

If the vehicle is spending a daily period where it’s at back at base, where it can be charged completely,

then this is the this is where a BET will work most effectively.

The next segment to look at is what’s commonly called intrastate. This is basically medium distance transport, which will be hauling freight across cities, but also from cities out into regional areas and between regional areas across Australia.

These trucks will on average, travel greater distances each day than the city trucks. Theymay or may not be able to return back to base every day in order to charge up. In this segment of the market BETs can be effective, but may not be able to be able to provide a solution for all of those freight tasks in this segment of the market.

Then there’s the long distance, long haul trucking environment where vehicles are running freight from capital to capital as well as distributing along rural routes, to regional towns. Then there are the trucks hauling between capital cities and distributing freight interstate capital.

These different segments do not cover the entire trucking industry, but due to cover a very large part of it. Other, more specialist, segments include all of the resources industries which work in remote areas, with high masses, but often on strictly limited routes from mine sites to port, or from ports to industrial areas.

In the coming years, the typical road transport operator in Australia will be having to look at their operation and start to develop a plan for the transition of their operation across to low/zero carbon operation.

There will be a need to fully analyse the way that the operation works and the various different components within that operation. Armed with that data they can then look at the different technology mixes available, concentrating on those which may be required in order to fulfil the needs of the operation.

With simple tasks, the options may be relatively limited and simple. In urban areas, it will be about variations on a theme. BETs are going to be the most likely solution, but for others the decision may be more difficult and getting this technology mix right is

going to be an important requirement for those involved in the trucking industry.

The investment in the technology to move towards zero emissions is expensive and a lot of the technologies are not fully proven in the situations which can arise in the Australian freight task

This means there are going to be some businesses which will dive in and try one one technology or another, in order to see if it will work for their operation. Then there will be others who might just sit back and wait to see how the technology mix which suits them plays out over the next few years.

However, even if the operator has chosen to be one of those who waits and sees, it is important for them to be up to speed on all of the technology options now, to understand how they may or may not develop over time.

As the zero carbon knowledge base increases, it will be important to make preparations in order to make that transition across to zero carbon as it develops.

The industry does need to be prepared, not only understanding the options, but also monitoring how those options play out in the real world. For many there is often more than one option available.

The TIC report gives us a comprehensive guide as to what the options are going to be, or are likely to be, down the track for trucking operators. Some of these options are genuine zero carbon, others are low carbon options which may be a step on the way to zero emissions, or may turn out to be the solution which works in particular operations.

Natural gas has been used in the Australian trucking industry in the past with mixed results.

“More recently biomethane or renewable natural gas, or a processed form of biogas has emerged as a more sustainable variant source from biomass or waste feedstocks, but is entirely compatible with existing CNG infrastructure,” says the TIC report.

“Natural gas requires major vehicle modifications to accommodate a dedicated spark ignited engine or a dual fuel system with diesel. Natural gas in trucks has been available for many years in Australia, but enthusiasm peaked over a decade ago.”

This is a technology which has come and gone for many fleets in Australia, but the technology still exists.

Another development in the move towards zero emissions could be the use to use alternative fuel replacements instead of the current diesel.

“These fuels are referred to as low or zero carbon fuels,” says the TIC. “Despite differences in refining technology, renewable fuels all have one thing in common. They are derived from biomass feedstocks, such as agricultural inputs, canola, corn, soya palm oil, animal fats (tallow) or waste (eg used cooking oil)

“Renewable fuels can typically be ‘dropped in’ to the existing diesel system, at different concentration

rates for different renewable fuels.

Biodiesel can be blended up to 5 per cent under existing Australian fuel quality standards, while some truck OEMs allow up to 20 per cent biodiesel (B20) without modification, or minor modification, to the engine.”

Some truck OEMs allow up to 20 per cent biodiesel without modification. In Australia, biodiesel was widely used in the early 2000s But many facilities have closed.

However, this is this fuel is not the same as renewable diesel, which is also made from biomass that has been more significantly refined and is chemically identical to diesel, making it 100 per cent compatible with diesel drive trains, without engine modification or blending.

For renewable diesel the fact that it can be dropped into the current diesel system means no special refuelling infrastructure is required. These fuels like hydrogenated vegetable oils, HVO, have already appeared on the market and many will be waiting until the price goes down before venturing into the use of these fuels.

“Production of renewable fuels in Australia remains constrained as it tends to result in a more expensive fuel than diesel and therefore doesn’t provide a payback,” says the TIC.

“Variability in lifecycle emissions of biodiesel production has also

led to some criticism of its specific decarbonising outcomes. These two issues have been addressed overseas with accreditation standards national/regional usage targets and carbon credits or similar. Australian governments have failed to implement any of these policy/regulatory measures.

“Bio and renewable diesel fuel use can’t be tracked as a proportion of new truck sales, as any truck, old or new, is a candidate for bio and/ or renewable diesel use. A different measurement metric is required for the usage of these fuels. For example, tracking/accounting of these fuels supply/use to the road transport sector, much in the way mineral diesel fuel use is accounted for in Australia.”

These renewable fuel solutions are ones which can be, quite literally, dropped into the trucking industry and could provide a solution which would certainly take the trucking industry on the road to zero carbon, but may not be able to take us all the way.

On this topic the TIC view is that governments, both federal and state, need to amend regulations and legislate to help these alternatives grow in this market, stating, “These fuels MUST form part of government’s transition strategy for the road freight sector.’

On of the new technologies available, which promised to take trucking the trucking industry to the zero carbon emissions got a lot of attention and has been talked about in industry circles after making an appearance at the Brisbane Truck Show last year.

There was a lot of interest on the Cummins stand, where the engine maker was displaying a fuel agnostic engine which was capable of being used with biogas, diesel or hydrogen. Over the longer term, this may well be one of the routes which the trucking industry can go down on the way towards zero emissions.

“Hydrogen ICE requires modifications to the engine and ultimately achieves lower overall efficiencies in both diesel combustion and fuel cell drive times.,” reports TIC. “While H-ICE does not produce carbon emissions at the tailpipe, it does still produce NOx emissions as a result of the combustion process. These NOx emissions will be capped at the emission standard that is applied when the truck is sold, typically Euro 6, or equivalent.”

Hydrogen is not what could be termed a ‘drop in’ solution. Hydrogen can be used either as a gas or as a liquid, but it can be difficult to manage on a vehicle. There are no H-ICE vehicles yet on sale in Australia.

Hydrogen is available on the market here in Australia but it is not green hydrogen, ie carbon emissions have been produced in its production. Whether it be from it manufacture from natural in the petrochemical industry.

Some small service stations have opened in major cities to supply hydrogen but these are at a very low level, currently. The distribution of hydrogen, especially green hydrogen is expected to take some time to ramp up.