pumpindustry

The road ahead: State of the Industry forecast

Industrial valve market outlook

Performance prediction for slurry pumps

What is the purpose of minimum flow?

FEBRUARY 2015 ISSUE 10

Pump Industry Australia Incorporated

Kevin Wilson – Secretary

PO Box 55, Stuarts Point NSW 2441 Australia

Ph/Fax: (02) 6569 0160 pumpsaustralia@bigpond.com

Ron Astall – President United Pumps Australia & Astech Consulting Services

John Inkster – Vice President Brown Brothers Engineers

Mike Bauer – Councillor Dynapumps

Frankie Camilleri – Councillor John Crane

Martin O’Connor – Councillor KSB Australia

Alan Rowan – Councillor Life Member

Keith Sanders – Councillor Australian Industrial Marketing & Life Member

Ashley White – Councillor Davey Water Products

President’s welcome

What a thrill it has been to have participated in our 50th anniversary year. We marked the occasion in November with seminars in Melbourne and Sydney, our Annual General Meeting in Melbourne and a boat cruise along the Yarra River. To everyone that attended these events, thank you.

As part of our 50th anniversary celebrations, Steve Schofield, the Executive Director of the British Pump Manufacturers Association (BPMA), travelled to Australia to present at our seminars and meet with councillors and members. The feedback from all of our 50th anniversary events was extremely positive, and Steve’s involvement was instrumental to this success.

During his seminar presentations Steve discussed the energy efficiency landscape in Europe and the UK, and focused on some of the work the BPMA and Europump have done in order to help the pump industry’s contribution to meeting mandatory energy efficiency targets. The energy efficiency landscape in Australia will almost certainly start moving in a similar direction, and we have been inspired by the information and experience that Steve has generously shared.

We owe a big thank you to Steve Schofield and to the BPMA for taking the time to make the trip Down Under. In this edition we have an interview with Steve in which he further outlines these energy efficiency opportunities.

Make sure you take the time to read this article.

I was recently privileged to meet with the President of the USA’s Hydraulic Institute, George Harris, and it seems that like the BPMA, we are all facing many similar challenges. George has extended an invitation to the PIA to attend the Hydraulic Institute’s 2015 Annual General Meeting this February; and I will be attending on behalf of the association. I look forward to developing a closer relationship with the Hydraulic Institute.

For 2015, the challenge to us as an association is to involve all members in our activities. I have always valued my involvement in APMA, and now the PIA. This involvement has made me feel a part of the Australian pump industry, has dramatically broadened my knowledge base, has been a major contributor to my understanding of the industry, provided a very useful network of contacts, and best of all, I have made some excellent friends in the ‘trade’.

With my colleagues on the PIA Council, we will be working harder in 2015 to encourage much broader participation from all of our members. That means you! Only by getting involved will you enjoy the benefits of membership.

I look forward to working with you all in 2015.

Ron Astall President, Pump Industry Australia

www.pumpindustry.com.au pump industry | February 2015 | Issue 10 1 PUMP INDUSTRY

pumpindustry

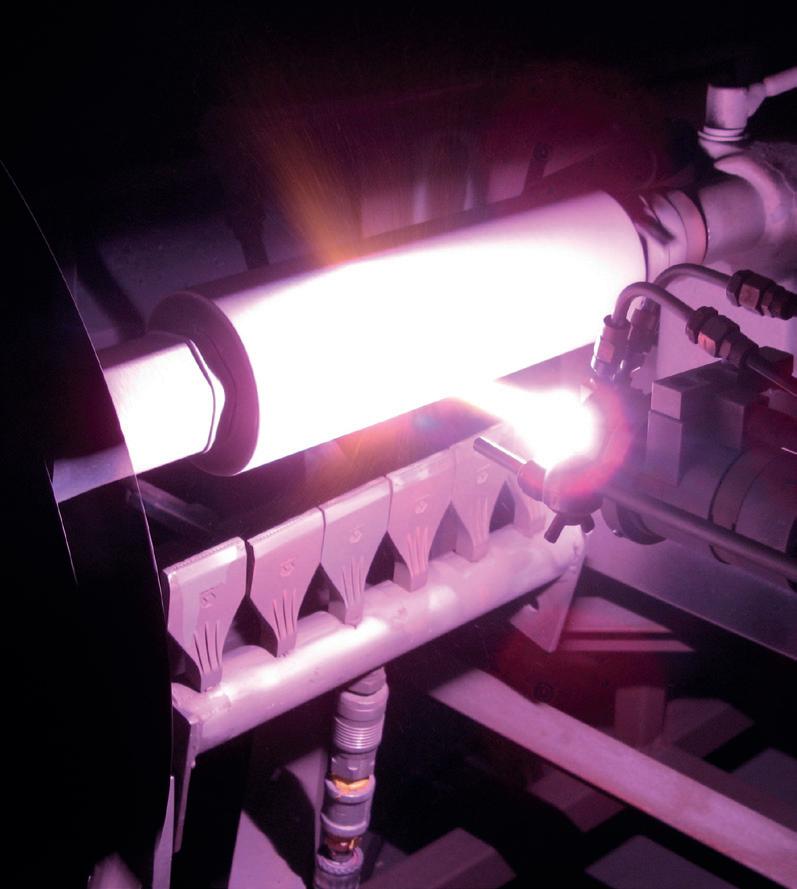

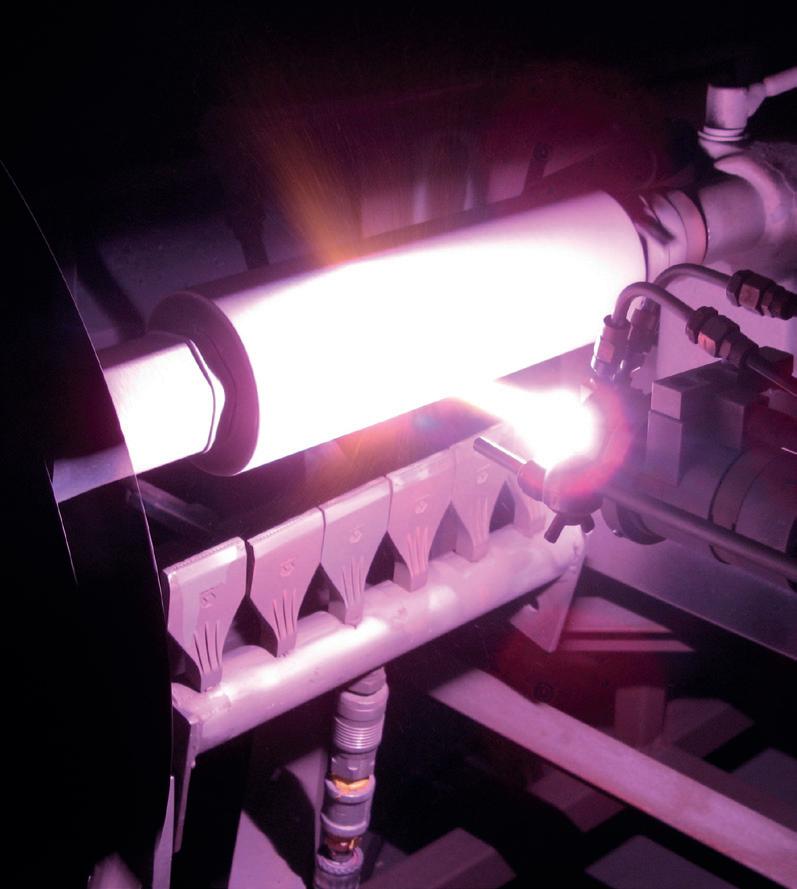

Cover image highlights our State of the Industry feature, which outlines the road ahead for the pump industry in 2015.

3,159

Published by Monkey Media Enterprises

ABN: 36 426 734 954

PO Box 3121

Ivanhoe North VIC 3079

P: (03) 9440 5721

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

pumpindustry.com.au

magazine@pumpindustry.com.au

Publisher and Editor: Chris Bland

Managing Editor: Laura Harvey

Marketing Consultant: Aaron White

Associate Editor: Michelle Goldsmith

Creative Director: Sandy Noke

ISSN: 2201-0270

Editor’s welcome

We have had a great response to the history feature in our November 2014 edition.

We received plenty of positive feedback, but a few people also contacted us to let us know about various companies, people and events that were not covered. If only we’d heard from you earlier!

However, this is all welcome feedback, as it provides us with the opportunity to continue covering the history of the industry in future editions, making it more complete and comprehensive. At Pump Industry, we consider the process of documenting the history of the industry as an ongoing process and one worthy of continued attention.

One notable oversight in our history feature was the relatively small amount of coverage given to Kelly & Lewis. Of course, we covered aspects of this company’s history in various interviews, and a wealth of information is available through Bob Moore’s book, but we should have given it more prominence. We intend to follow up with this in the near future.

I was also surprised and delighted to hear from Bob Pullen, who told me of his experience publishing The Australian Pump Journal in 1968. We weren't previously aware such a publication had ever existed. It seems to have faded from the memory of the industry. But looking over some excerpts from that first edition, it is remarkable how similar it is, in many ways, to this magazine, despite the gulf of 47 years. A more detailed story on the publication will be included in an upcoming edition.

The more people proactively contribute to our features, the more valuable a resource they will be. We invite anyone with what they consider important information to contact us to let us know.

We look forward to another great year working for and with the industry.

Chris Bland Publisher and Editor

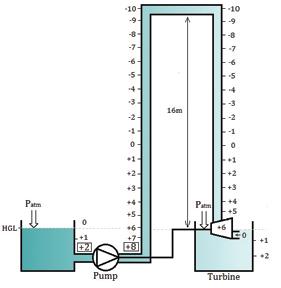

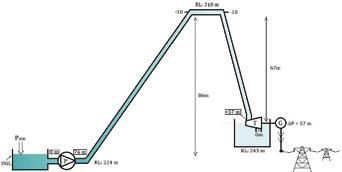

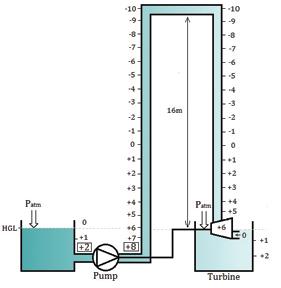

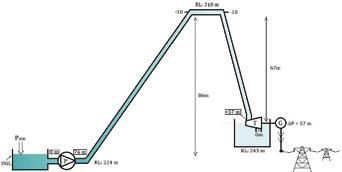

2 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au PUMP INDUSTRY

This magazine is published by Monkey Media in cooperation with the Pump Industry Australia Inc. (PIA). The views contained herein are not necessarily the views of either the publisher or the PIA. Neither the publisher nor the PIA takes responsibility for any claims made by advertisers. All communication should be directed to the publisher. The publisher welcomes contributions to the magazine. All contributions must comply with the publisher’s editorial policy which follows. By providing content to the publisher, you authorise the publisher to reproduce that content either in its original form, or edited, or combined with other content in any of its publications and in any format at the publisher's discretion.

FEBRUARY 2015 ISSUE 10 Performance prediction for slurry pumps The road ahead: State of the Industry forecast

Industrial valve market outlook What is the purpose of minimum flow?

Repair, Re-Manufactur e and Re-Design Ser vice For ALL

Ef ficiency Impr ovement

Reconditioning

Restor e Clear ances

Re- Engineering

P f T ti erfor mance Testing.

Services available include:

• Inspection and trouble-shooting

• Case build up and re-machining

• Aillitfid bi Axial split case facing and reboring

• Axial thrust balancing

• Shaft and bearing API 610 upgrades

• Mechanical Seal upgrades to API 682

• Bearing housing & back cover retrofit

• Lube system upgrades

• Composite Wear Parts

• Tighter clearances

• Hydraulic Re-Rating

• Ridtti Rapid prototyping

• Driver upgrades (MEPS compliance)

• Baseplateadaptors and rebuilding

• Custom Spare Parts

• Rotating Element balancing

• ASME & AS1210 qualified Welding

• Hydrostatic Testing

• Performance Testing

• FFT Vibration

types of Centrifugal Pumps

analysis A.B.N. 37 006 317 979 EMAIL unitedpumps@unitedpumps.com.au http://www.unitedpumps.com.au/ 31 WESTERN AVENUE SUNSHINE, VICTORIA 3020 P.O. BOX 348, SUNSHINE, VICTORIA 3020 •PHONE +613 9312 6566 •FAX +613 9312 6371

4 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au CONTENTS 32 STATE OF THE INDUSTRY Pumps in 2015: challenges, opportunities and the road ahead 32 36 Slurry pumping Performance prediction for slurry pumps ................................. 36 38 Coating The use of protective coatings on pump components 38 42 Repair & Maintenance The revelation 42 45 Energy Efficiency Energy efficiency: the business opportunity we must embrace 16 Suction specific speed and vibration performance (part 2) 45 Measuring energy wastage reduces operating costs .............. 50 51 Valves Forecast: industrial valve market for the power industry 51 54 Pipes & piping systems Pressure recovery in hydraulic systems 54 58 Technical What is the purpose of minimum flow? 58 MAIN FEATURES 16

29

pumpindustry

5 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 President’s welcome 1 Editor’s welcome 2 News briefs 6 Acquisitions ............................................................. 10 Index 64 32 10 PIA News The PIA remembers David McLiesh 11 Industry gathers for seminar and AGM 12 Members toast 50 good years 14 19 PIA member news A grape success 20 Stevco welcomes new director ................................... 22 Moving water is our business 23 Balancing centrifugal pump impellers ....................... 24 Safer wastewater pumping 25 26 Industry news New year, new look ..................................................... 26 Sliding vane pumps for transport and terminals 27 Specialist pump solutions from SPX 28 Innovative from the beginning 29 For hydraulics, think HYDAC 30 31 Ask an expert Progressive cavity pumps 31 60 Pump pioneers Geoff Daniels 60 62 Pump school What are the various methods for controlling the rate of flow in centrifugal pumping systems? Is there an impact on efficiency? 62 REGULARS ISSUE 10 | FEBRUARY 2015 38 51

BG Group sells QCLNG pipeline

BG Group will sell its wholly-owned subsidiary QCLNG Pipeline to APA Group for approximately US$5 billion.

QCLNG Pipeline owns a 543 kilometre large-diameter underground pipeline network linking BG Group’s natural gas fields in southern Queensland to a two-train liquefied natural gas (LNG) export facility at Gladstone on Australia’s east coast.

The pipeline was constructed between 2011 and 2014 and has a current book value of US$1.6 billion. Tariffs payable on the pipeline are set to provide a fixed rate of return on the asset base with the primary tariff components escalating annually with US inflation indices. For the year ending 31 December 2016, the pipeline tariff is expected to deliver to APA Group EBITDA of approximately US$390 million.

The sale is conditional on the start of commercial LNG deliveries from the QCLNG export facility at Gladstone and on partner consent. BG Group and its partners have firm capacity rights in the pipeline for 20 years, with options to extend.

The transaction is expected to be completed in the first half of 2015. BG Group states that the post-tax profit of approximately US$2.7 billion will be used to reduce net debt and to fund future growth investment.

Andrew Gould, interim Executive Chairman of BG Group, commented: “We are pleased to have entered into an agreement for the sale of this high-quality infrastructure with a bidder the calibre of APA Group.”

“The sale of the QCLNG pipeline is in line with our strategy to focus on BG Group’s core areas of oil and gas exploration and production and LNG. The timing reflects QCLNG’s advanced stage of development; we are now on the verge of delivering the world’s first large-scale project using natural gas from coal seams as a feedstock for LNG,” Mr Gould said.

BG Group is reviewing its reference conditions, long-term price assumptions, and business plans in light of recent movements in commodity prices, particularly oil. Any impact of changes to these assumptions on the carrying value of assets within the Group’s portfolio will be reflected in the 2014 fourth quarter results.

Persephone project approved

The North West Shelf (NWS) Project participants have approved the Persephone Project off the northwest coast of Australia.

The Persephone Project is the third major gas development for the NWS Project in the past six years, demonstrating the joint venture’s commitment to maximising the value of Australia’s largest operating oil and gas project.

The project will involve a two-well, 7km subsea tieback from the Persephone field to the existing North Rankin Complex. The total investment for the project is expected to be approximately $1.2 billion, with project start-up expected in early 2018.

Woodside CEO Peter Coleman said the Persephone Project would leverage Woodside’s core capabilities to unlock undeveloped resources and help maintain offshore supply to the Karratha Gas Plant. “The NWS Project celebrated 30 years of domestic gas production and 25 years of LNG exports in 2014 and the approval of Persephone is the next step in continuing this success story.”

6 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au Pump Industry News Briefs Get all the latest news at www.pumpindustry.com.au

The QCLNG pipeline during construction.

Woodside CEO Peter Coleman.

Gorgon and Wheatstone projects progress

Chevron Australia has released updates on the progress of the Gorgon and Wheatstone LNG projects.

The Gorgon Project is now 87 per cent complete. All LNG Train 1 and common modules required for first gas are on their foundations and work is continuing on their connections. Delivery of modules for Train 2 is also continuing with 11 of the 17 modules on their foundations.

LNG Tank 1 is now awaiting product. LNG Tank 2 is expected to achieve that same status shortly. The five turbine generators are all installed and the jetty is essentially complete. In addition, 11 of 17 Train 2 modules have been received and installed.

Seven of the ten wells at the Jansz-lo field and seven of the eight wells at the Gorgon field are ready to produce. The Jansz-lo field is now connected to the LNG plant following the final tie-in welds between the offshore and cross-island

pipeline systems. The Gorgon pipeline system is being prepared for a similar tie-in.

The Wheatstone Project is 49 per cent complete. The Materials Offloading

Facility is 100 per cent operational. And, the upstream drilling campaign, the fabrication of the platform, site preparation and construction of the LNG tanks are all on schedule.

7 www.pumpindustry.com.au pump industry | February 2015 | Issue 10

The Gorgon LNG loading wharf is almost complete.

Pump Industry News Briefs

Weir Group to close five factories

International engineering company Weir Group has announced that it will be closing five of its smaller manufacturing factories over the course of 2015.

The company also intends to consolidate a number of service centres, alongside other workforce reductions and cease certain lower margin activities.

The changes are the result of a review undertaken in the third quarter to identify opportunities to reduce costs, increase customer responsiveness and efficiency while aligning resources globally to capture end-market opportunities.

A Weir Minerals spokesperson told Pump Industry that these changes are unlikely to have considerable impact on the company’s Australian facilities.

“There will be small changes in New South Wales with the existing elastomer facility at Somersby to shift to the Artarmon manufacturing facility.”

Weir Group stated that: “Manufacturing activities will be consolidated into larger existing facilities, which will require a small amount of capital expenditure. These actions are expected to deliver annualised benefits of £35million, of which approximately £20million will be realised in 2015.

BassGas milestone achieved

A milestone has been achieved in the BassGas Mid Life Enhancement (MLE) project with the successful lift of the export compression and condensate pumping modules into place on the Yolla offshore platform.

The lift was completed safely during a planned maintenance shutdown by the specialist heavy-lift vessel, the Sapura 3000. BassGas was due to recommence production in late December 2014.

Origin Chief Executive Officer Upstream Paul Zealand said, “We are pleased to have safely completed the module lift, which is an important first step in Stage 2 of the BassGas MLE project aiming to extend the production life of the Yolla field.

“The team is now focused on preparations for drilling the Yolla-5 and Yolla-6 wells, including the arrival of the drill rig, the West Telesto.”

Once the Yolla-5 and Yolla-6 wells are drilled and tied in, they will extend production from the Yolla field through the BassGas production facility at Lang Lang, Victoria.

The Yolla platform is located in Bass Strait, approximately 140km off shore from Kilcunda, Victoria.

New pump station caters for hospital growth

A contract has been awarded to build a $1 million sewage pump station in West Mackay, Queensland.

Mackay Regional Council Water and Sewerage portfolio councillor Frank Gilbert said that due to growth at Mackay Base Hospital and surrounding residential areas, the current sewage pump station on Bridge Road could no longer accommodate demand.

“The hospital has recently undergone a major expansion and its size and future capacity will be greater than the current SPS can accommodate,” he said.

“Dormway Pty Ltd who have been awarded the tender will construct a new sewage pump station at the site and address all operational and legislative requirements.”

The works include the construction of a new pump station, converting the existing SPS in to emergency storage, building a new switchboard platform above the Q100 flood level and replacing the damaged sewer near the hospital’s helipad.

Failure to implement these upgrades increases the risk of system overflows, operational failures and safety incidents in a high risk area. Dormway Pty Ltd will begin upgrading the Bridge Road Sewage Pump Station early in 2015.

Construction begins on $47.8 million wastewater scheme

Sydney Water has officially commenced a $47.8 million project to upgrade the wastewater system of the towns of Galston and Glenorie in NSW.

The project will allow around 625 households in Galston and Glenorie to connect to the new wastewater system by mid-2015.

“This investment is an example of the NSW Government’s commitment to improving infrastructure across the state,” said NSW Minister for Natural Resources, Lands and Water Kevin Humphries.

“This project follows the 1,944 households provided with a sewer connection for the first time in Bargo, Buxton, Douglas Park, and Wilton in July this year as part of the $157 million Priority Sewerage Program.

“The new scheme will provide enormous benefits to the local community by reducing risks to public health, improving public amenity and protecting the environment.”

“Today’s announcement is a huge win for the residents of Galston and Glenorie and is the result of the tireless advocacy of the Member for Hornsby Matt Kean.”

8 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

all the latest news at www.pumpindustry.com.au

Get

WA EPA issues fracking advice for shale and tight gas

The Environmental Protection Authority in Western Australia has issued updated advice on how and when it will assess proposals that involve hydraulic fracturing for shale and tight gas.

The Environmental Protection Bulletin on 'Hydraulic fracturing for onshore natural gas from shale and tight rocks' replaces advice issued in 2011.

Hydraulic fracturing, commonly known as fracking, is a process that uses fluids and other materials that are pumped under high pressure into gas-bearing rock formations in order to open fractures or cracks to create a path for the gas to flow.

The majority of exploration work in WA is for shale and tight gas. Shale gas is found in shale formations and requires hydraulic fracturing to be extracted. Tight gas is trapped in compacted sandstone and limestone and only requires hydraulic

fracturing in some circumstances to be extracted.

WA EPA Chairman Paul Vogel said the updated bulletin defined the circumstances under which the EPA would assess a proposal, and also sets out the EPA’s expectations on the information required to conduct a thorough environmental impact assessment. He said while this will not replace scoping for individual proposals, the EPA believed it was important to provide early advice to proponents considering larger-scale proposals.

“There is great interest in the community about the potential environmental impacts and risks of hydraulic fracturing, the regulation of this activity and the knowledge base of the hydrogeology of the target area,” Dr Vogel said.

“It is essential that in preparing for the potential future referral of a larger-scale trial or full production-scale proposal, that the studies undertaken and information provided to the EPA are robust and sufficiently comprehensive to enable a thorough assessment of the environmental impacts and risks.”

Dr Vogel said the bulletin only addressed hydraulic fracturing for shale and tight gas. He said the EPA would develop further guidance if hydraulic fracturing for coal seam gas was likely to be considered in WA.

9 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 Serious

solutions Axial and mix flow propeller pumps Non-clog centrifugal pumps Vertical turbine pumps Toll free 1800 646 885 www.pomonapumps.com.au manufactured and tested locally

pumping

Flowserve acquires global pump manufacturer

International flow control products and services company Flowserve has signed a US$372.5 million agreement to acquire a Netherlands-based global provider of engineered vacuum and fluid pumps.

The acquired company, SIHI Group, provides engineered vacuum and fluid pumps, with associated aftermarket parts and services, primarily serving the chemical market, as well as the pharmaceutical, food and beverage and other process industries.

SIHI has operations across Europe, the Americas and Asia and anticipates FY2014 sales of approximately €280 million (US$350 million) with EBITDA of approximately €30 million (US$37.5 million) and gross margins approaching 30 per cent.

Flowserve expects to double SIHI’s EBITDA by 2017 as well as support IPD’s target margins of 14-15 per cent, following the impact of non-cash purchase price accounting, as well as transaction, integration and

optimisation expenses.

“We are excited about the acquisition of SIHI, which is consistent with Flowserve’s ongoing growth strategy to add complementary assets to our portfolio and then accelerate their growth and leverage our operating platform,” said Mark Blinn, president and chief executive officer of Flowserve.

“The expected combination of SIHI’s solid installed base, with its leading position as a supplier of vacuum and fluid pumps, ability to enhance our chemical ISO pump strategy, engineering and manufacturing experience, strong gross margin profile, opportunity to leverage increased scale and both revenue and financial synergy potential make SIHI a natural fit for Flowserve that exceeds our disciplined financial requirements which drives solid long-term value for our shareholders.”

KETO Pumps makes US acquisitions

KETO Pumps, the global mining pumps and systems company, has finalised the acquisition of three businesses in North America. These companies are RPM Services, of Salt Lake City, Utah; Arizona Pump & Machine, of Tucson, Arizona; and Bakersfield Machine Company, of Bakersfield, California.

These acquisitions are part of the dynamic expansion plans of KETO Pumps to become a leading business in the supply and service of pumps and related equipment to mining and associated industries.

“KETO has an excellent track record of reducing our customers' cost of business in our core markets of Africa and Australia. We wanted to bring this same ethos to the market across the Americas and couldn’t have found better partners than RPM, BMC and APM,” said CEO of KETO Pumps Chris Neil.

“The mines as well as chemical and oil & gas plants of the south-western states require suppliers who can react quickly. That’s only possible by being local to our customers and these three facilities allow us to offer the best service in the industry.”

Commenting on the acquisition, Ty Meyer of BMC remarked, “We’re excited to become part of the global KETO Pumps family. Their added products and range of impressive pump upgrades will enable us to offer our customers even more value.

“Bakersfield Machine Company was established in 1914 and we’ve expanded out of California into Arizona and Utah in the last ten years. Under KETO ownership we see lots of growth potential at our existing sites and potentially into new areas too.”

Halliburton to acquire oilfield services company

Halliburton will acquire oilfield services company Baker Hughes Incorporated. The agreement has been unanimously approved by both companies’ Boards of Directors, and will involve a stock and cash transaction valued at $34.6 billion.

The agreement will combine two highly complementary suites of products and services into a comprehensive offering to oil and natural gas customers. On a pro-forma basis the combined company had 2013 revenues of $51.8 billion, more than 136,000 employees, and operations in more than 80 countries around the world.

“We are pleased to announce this combination with Baker Hughes, which will create a bellwether global oilfield services company and offer compelling benefits for the stockholders, customers and other stakeholders of Baker Hughes and Halliburton,” said Dave Lesar, Chairman and Chief Executive Officer of Halliburton.

“The transaction will combine the companies’ product and service capabilities to deliver an unsurpassed depth and breadth of solutions to our customers, creating a Houston-based global oilfield services champion, manufacturing and exporting technologies, and creating jobs and serving customers around the globe.”

Martin Craighead, Chairman and Chief Executive Officer of Baker Hughes, said, “This brings our stockholders a significant premium and the opportunity to own a meaningful share in a larger, more competitive global company. By combining two great companies that have delivered cutting-edge solutions to customers in the worldwide oil and gas industry for more than a century, we will create a new world of opportunities to advance the development of technologies for our customers. We envision a combined company capable of achieving opportunities that neither company would have realised as well – or as quickly – on its own, all while creating exciting new opportunities for employees.”

10 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au NEWS - ACQUISITIONS

The PIA remembers David McLiesh

by Ron Astall, PIA President

The PIA was saddened by the passing of David McLiesh in November 2014.

Those who worked with him will remember his wry, selfdeprecating sense of humour and good-natured approach as a manager and mentor.

David was born in Fyfe, Scotland, and was the youngest of three children. He joined Harland Engineering in Alloa, Scotland, at the outbreak of World War II, where he was a hydroelectric engineer.

In the early 1950s, Harland Engineering’s involvement in the Snowy Mountains Scheme in Australia led to David being asked if he had ever thought of emigrating to Australia. His initial reaction was “What have I done, am I to be subjected to transportation?”

Having been given only three days to decide, he moved to Melbourne to join Harland Engineering Australia, which later became Indeng Pump Division, and was involved in a number of hydroelectric projects including the 7.2MW Keepit Dam Project.

He married the ‘much younger’ Meredith in 1956, who was told at the time that she risked being a widow for many years because he was so much older. As we now know, David defied this prediction by reaching the grand age of 95.

Living initially in Hawthorn and then Surrey Hills, Meredith and David raised Kate, Patrick, Hilaire and Sarah in a loving family environment complete with many pets including stray cats rescued from Indeng Pumps’ works.

He served as the Indeng Pump Division General Manager for many years, retiring in early 1984. He served with distinction as APMA president in the early 1980s and was instrumental in planning the highly successful APMA Canberra convention.

David’s strong musical interests were a constant source of joy for himself and to others; he was choir master for four years at Kew Presbyterian Church, taught singing and music, played the violin and the cello, and was a distinguished and loved presenter on the 3MBS classical music radio station for many years after retirement.

A compassionate man with a strong social conscience, both David and Meredith were actively involved in many community projects and social causes.

Those of us who attended his funeral shared in a moving and tender celebration of David’s life with Meredith, Patrick, Sarah, Kate and Hilaire and he was remembered as generous and outstanding man.

Our thoughts remain with David’s family and loved ones.

11 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 PIA NEWS

Industry gathers for seminar and AGM

As part of the PIA’s 50th anniversary celebrations in November 2014, the association hosted two informative seminars in Melbourne and Sydney, covering developments in new technology and energy efficiency. The PIA also held its Annual General Meeting following the Melbourne seminar.

The keynote speaker for the seminars was Steve Schofield, Director and Chief Executive of the British Pump Manufacturing Association. At both seminars Steve delivered two presentations, both of which focused on the work Steve and the BPMA have been doing in the area of energy efficiency. One of Steve’s presentations covered the energy efficiency gains that can be made by assessing and improving already operating pump systems; while the other covered the work the BPMA has done in establishing the Certified Pump System Auditor (CPSA) scheme,

which is a regulated means by which to act on the energy efficiency savings presented by pump systems. (For more on Steve’s presentations, see page 16).

Other speakers included Tony Kersten of Grundfos, who continued the energy efficiency theme with his presentation on pumps for building services. Tony also discussed the efficiencies that can be made through assessing pump systems and making better product selections. He confessed that it’s a topic close to his heart and one he feels very passionate about.

Attendees also enjoyed presentations on a range of new products. Michael White of Mono Pumps discussed their new InviziQ pressure sewerage pump; Jurgen Mrozek of Xylem Water Solutions also discussed wastewater pumping products.

Technical papers also made up the seminar program, with Malcolm Robertson of Robertson Technology discussing pump testing using the thermodynamic method, and Tim Cocking of AFH presenting a paper on metering pumps.

12 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

PIA NEWS

Keith Sanders, Ron Astall and Kevin Wilson.

Tim Cocking.

Tony Kersten. Members at the AGM.

Gabriel Balan of John Crane Australia concluded proceedings with a presentation on a new seal design which has been used to solve problems in the field.

Both seminars involved some stimulating question and answer sessions, and were useful in providing background into issues and product solutions that are being developed to meet the specific needs of Australian pump users.

In Melbourne the seminar was followed by the PIA’s AGM. Members were welcomed by President Ron Astall, who noted it was a privilege to be in the President’s chair as the association celebrated its 50th anniversary.

Ron reflected on the previous 12 months for the association, noting that the three executive officers for the association have continued to play a considerable role in the association’s achievements. “Much of what we have achieved in the last few years would not have been possible without the hard work of these gentlemen,” he said.

“Energy conservation and efficiency looms large over us all. We have been extremely proactive in our focus on pumping and system efficiency, and this will continue to be a focus.”

Ron Astall, PIA President

Ron also used his address to emphasise the importance the association places on energy efficiency. “Energy conservation and efficiency looms large over us all,” said Ron. “We have been extremely proactive in our focus on pumping and system efficiency, and this will continue to be a focus.”

Board appointments were also made, with Ron Astall and John Inkster both re-elected to their respective positions of President and Vice President unopposed. Mike Bauer, Frankie Camilleri, Martin O’Connor, Alan Rowan, Keith Sanders and Ashley White were elected as councillors unopposed.

The AGM was followed by a cocktail party at the Hotham Room of Mercure Hotel. Steve Schofield was the distinguished guest, and this gave members who were not at the seminar the opportunity to chat with Steve.

BPMA has excellent contacts in Europe with Europump and in the US with the Hydraulic Institute. It is hoped that the PIA can continue to foster this relationship for the benefit of members in Australia, particularly at a technical level.

13 www.pumpindustry.com.au pump industry | February 2015 | Issue 10

PIA NEWS

Members toast 50 good years

PIA Members gathered in Melbourne to celebrate 50 years of the PIA at the AGM, which was followed by a cocktail party, and a boat cruise along the Yarra River.

14

pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

Ken Kugler and Keith Sanders.

PIA NEWS

Alan Rowan, John Link and Ron Astall.

Chris Bland and Tony Kersten.

John Inkster and Mike Bauer.

15 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 PIA NEWS

Scenes from the Yarra River cruise.

Steve Schofield and Aaron White.

Steve Schofield, Ron Astall, Keith Sanders, Tony Kersten and Martin O’Connor.

Boat cruise attendees.

Energy efficiency: the business opportunity we must embrace

British Pump Manufacturing Association Director and Chief Executive Steve Schofield was a special guest during the PIA’s 50th anniversary celebrations last November. During his time in Australia, Steve spoke about the benefits that can be realised through conducting energy efficiency audits, and the BPMA’s efforts to date to establish a Certified Pump System Auditor training program – which now has the potential to be rolled out in Australia.

Steve’s role as a director of the BPMA sees him travelling the world to discuss energy efficiency opportunities in pumps and pump systems. A considerable amount of his current work has been focused on the Energy Savings Opportunity Scheme (ESOS), which has come about as a result of the UK Government transposing the Energy Efficiency Directive (EED) into national law.

An effective common framework

The EED establishes a common framework of measures for the promotion of energy efficiency within the European Union in order to ensure the achievement of the Union’s 2020 20 per cent headline target on energy efficiency and to pave the way for

further energy efficiency improvements beyond that date.

All 28 EU countries are thus required to use energy more efficiently at all stages of the energy chain – from the transformation of energy and its distribution to its final consumption.

The new Directive will help remove barriers and overcome market failures that impede efficiency in the supply and use of energy and provides for the establishment of indicative national energy efficiency targets for 2020.

ESOS: steps towards meeting the target

The UK’s ESOS regulations came into force on 17 July 2014 and are a mandatory energy assessment and energy saving identification scheme for

large businesses (and their corporate groups).

The energy audits will become mandatory from December 2015, in buildings, industrial processes and transportation and have the potential to increase businesses' profitability and competitiveness by identifying costeffective savings which, if implemented, will improve energy efficiency. The scheme is estimated to lead to £1.6billion net benefits to the UK, with the majority of these being directly felt by businesses as a result of energy savings.

BPMA involvement

Given the amount of energy consumed by pumps, and the potential for energy efficiency gains within pumps and pump systems, Steve and the BPMA have

16 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

ENERGY EFFICIENCY pumpindustry Mining, oil & gas •Power generation • Pump manufacturers and suppliers•Water and wastewater •Rural pump distributor or irrigation•Building services•Chemicals, manufacturing and food in print and online

worked to develop a Certified Pump System Auditor Scheme (CPSA).

Through the CPSA, pump engineers are being trained in assessing the efficiency of pump systems, and in providing recommendations to improve the efficiency of systems.

The CPSA scheme has established BPMA as the body to train and certify personnel who undertake pumping system assessments, which are now referenced in UK Government Energy Strategy documents.

The CPSA accreditation is achieved by attending a four-day residential course. Upon completion of the course, and then satisfactory completion of a pump system audit, ‘Certified Pump System Auditor’ status is achieved.

According to Steve, “The objective of the scheme is to help improve the levels of professionalism in the sector by creating a universally recognised and respected industry ‘standard’ for individuals assessing the performance of a pumping system.”

PUMPS AND ENERGY USE

Pumps are the largest consumers of global motive power

Pumping System improvements can deliver up to 40 per cent reduction in energy costs - and therefore improve user bottom line

BPMA's CPSA scheme has been designed to help by equipping people with the skills to conduct a Pumping System Audit in accordance with ISO/14414

17 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 ENERGY EFFICIENCY

Steve Schofield presents at the PIA November seminar in Melbourne.

e

“The objective of the CPSA scheme is to help improve the levels of professionalism in the sector by creating a universally recognised and respected industry ‘standard’ for individuals assessing the performance of a pumping system.”

Engineers who achieve CPSA status receive a BPMA-CPSA photo registration card which identifies that the cardholder is approved to carry out pump system audits; and have their photo, individual and company details recorded on the CPSA specific area of the BPMA website (www.bpma-cpsa.co.uk).

Accreditation is also transferrable to and recognised in the United States. CPSA-registered engineers will be re-assessed every three years by the BPMA.

In principle the CPSA scheme can be transferred to another country. The CPSA is owned by the BPMA but the QSPSAT part of the training is owned by American Don Casada, who is one of BPMA’s lecturers. Steve said that the BPMA is in early discussions with the Hydraulic Institute in the US to see if the CPSA could be franchised to them.

Why is energy wasted in pumping systems?

The new regulations and emphasis placed on the energy efficiency savings that can be made in pump systems of course raises the question: why is so much energy wasted in pumping systems?

According to Steve, there’s a number of factors at play, which, when combined, can result in the system that is on the whole highly inefficient. These include:

• Poor system design

• Incorrect pump selection

• Pump-system mismatching

• Inefficient pump control

• Lack of pump and system maintenance

• No systematic auditing process.

During an audit, all of these factors are taken into

Steve Schofield, BPMA Director and Chief Executive

consideration to establish the best course of action for the system in question.

Many long-established pump systems will have some degree of inefficiency that can be corrected. Two of the most striking examples uncovered by the scheme include an assessment of Tyte & Lyle, London, where it was noted that correcting inefficiencies in the pump system could result in a 94 per cent reduction in electricity costs; and an assessment of GSK Ltd, Scotland, which similarly found that correcting inefficiencies in the pump system could result in a 96 per cent reduction in electricity costs.

Steve noted that these are extreme examples of some of the inefficiencies that have been uncovered, but nonetheless they do highlight the fact that significant savings can be made through the scheme.

The work of the BPMA in developing the CPSA scheme has the potential to make a serious contribution to the EED mandated 2020 20 per cent headline target on energy efficiency.

Scheme potential in Australia

The BPMA and PIA are currently considering ways to roll out the scheme in Australia. The CPSA course is run at regular intervals in the UK, and Australian qualifying pump industry professionals have the option to attend the course to develop their knowledge.

Steve pointed out though that the CPSA scheme has taken off in the UK and Europe because of the legislation that has been developed around energy efficiency.

Without legislation, Steve maintained it would be very difficult to convince large organisations that they should undertake audits of their pump systems – and then take the next step to make an investment in modifications to the system

18 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au ENERGY EFFICIENCY

SUBSCRIBE FREE TODAY HURRY! FREE OFFER WON’T LAST SUBSCRIPTION INCLUDES www.pumpindustry.com.au/subscribe pumpindustry • Print magazine • Online version • Pump Industry e-news

and sometimes new equipment – even if it does have the potential to rapidly pay for itself through reduced electricity consumption.

Steve’s advice to the PIA and the Australian pump industry is that serious lobbying of government ministers will be required in order to start the process of educating policy makers about the energy savings that can be achieved by operating properly designed pump systems.

Once legislation is developed and in place, there exists a real opportunity for the Australian pump industry to manufacture, source, supply and install the equipment that will provide large businesses with the energy efficiency gains that are clearly there for the taking.

It’s been a long process in the UK and across Europe, and no doubt to make the same kind of progress in Australia, we have a similarly long journey to legislation and action ahead of us.

The benefit we have is the example being set by the EU energy efficiency directive and the proven energy savings already being made by the BPMA through the CPSA scheme.

As Steve says – energy efficiency is a business opportunity that we cannot ignore. Those that do so will be left behind by others that don’t make the same mistake.

Need to know: energy audits

ESOS Energy Audits have the potential to increase businesses profitability and competitiveness by identifying cost-effective savings which, if implemented, will improve energy efficiency.

The scheme is estimated to lead to £1.6 billion net benefits to the UK, with the majority of these being directly felt by businesses as a result of energy savings.

ESOS is the UK Government’s approach to transposition of Article 8 (4) of the EU Energy Efficiency Directive, which requires all large (non-SME) enterprises to undertake energy audits by 5 December 2015 and every four years thereafter.

HYDROVAR®, the modern variable speed

drive taking pumping to a new level of flexibility and efficiency.

• Motor or wall mountable

• Fully programmable on site

• Software specifically designed for pump operation, control and protection

• High level hardware design

• More flexibility and cost savings

• Energy savings up to 70%

• Simple mounting “clip and work”

• Multi-pump capability up to 8 pumps

19 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 ENERGY EFFICIENCY

Melbourne: (03) 9793 9999 Sydney: (02) 9671 3666 Brisbane: (07) 3200 6488 Email: info@brownbros.com.au Web: www.brownbros.com.au

Steve Schofield during his Melbourne visit, November 2014.

Call us today for a Hydrovar® technical brochure to see how we can deliver your pumping solutions. DELIVERING PUMPING SOLUTIONS 09/14

pump

A grape success

When engineers at a major Australasian wine maker were struggling to overcome pump clogging problems in their main wastewater sump, Pump Systems were able to provide the solution in the form of a Vaughan self-priming chopper pump.

The pump clogging problems in the main wastewater sump were being caused by heavy loadings of leaves, plastics, string and strapping. The original self-priming trash pump recommended for the application simply could not cope with the continuous stream of high concentration solids coming through the system. In an effort to ease the clogging problems, a screen was installed on the suction line to the pump to filter out suspended material. However, screening the waste only caused more trouble, as the material would become ‘blanketed’ over the screen, thereby restricting flow and starving the pump. To make matters worse, high amounts of diatomaceous earth in the waste stream, a highly abrasive powder used during the wine

filtration process, was causing rapid wear to pump parts.

Tired of having to continually unblock the existing pump and screen, the winery contacted solids handling pumping specialists Pump Systems Ltd about a Vaughan self-priming chopper pump. After a detailed analysis of the application and piping system, Pump Systems Ltd proposed a Vaughan model SP4C-089 self-priming chopper pump, direct-coupled to a 7.5kW, 4-pole speed electric motor. Because Vaughan chopper pumps are designed to chop and reduce all solids as they enter the pump suction, retrofitting a Vaughan chopper pump would eliminate any previous clogging risk, while at the same time allow for the safe removal of the existing suction screen. In addition,

the extremely hard and wear-resistant heat-treated internals of the Vaughan chopper pump would offer far superior abrasion protection.

Since delivery to the plant in 2009, the new Vaughan SP4C self-primer has been running almost continuously without issue and, most importantly, zero instances of clogging. Being a surface-mounted pump, maintenance personnel have easy hands-on access to the pump for routine checks, all of which can be carried out externally without having to disassemble the pump or enter the pit. Over time, as wear occurs, internal cutting clearances can be reset via adjuster screws located on the back of the pump casing and bearing housing. This simple procedure not only helps to maintain optimum clog-free

20 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

PIA MEMBER NEWS PUMP INDUSTRY PARTNER SOLUTIONS FLEXIBLE RISING MAIN FLEXIBORE 100 FLEXIBORE 100 22 Industry Place Bayswater VIC 3153 Australia Phone: +61 3 9720 1100 Email: sales@crusaderhose.com.au www.crusaderhose.com.au INSTALL YOUR BORE PUMP ALONE

performance, but effectively ‘delays’ the wear process, further extending pump service life and reducing parts turnover. Vaughan self-priming chopper pumps are in use throughout Australia, New Zealand and Singapore in various severe-duty solids pumping applications ranging from sludge, rag and grit handling in the municipal sector, to pumping difficult pulp and paper and fisheries process wastes. Vaughan self-primers are available in 4”, 6”, 8” and 10” discharge sizes for flow rates up to 1,350m3/hr and re-prime suction lifts of up to 6.7m.

Over the past 20 years and through their experiences at numerous installations, Pump Systems Ltd has been able to demonstrate that Vaughan chopper pumps can bring significant cost savings. In most cases, retrofitting a Vaughan chopper pump into a problematic area improves the whole process and will be self-financing, with payback periods of less than one year, thereafter minimising the effect to budget holders.

For more information on Vaughan chopper pumps, contact authorised Australian distributor, Pump Systems Ltd or visit

VAUGHAN CHOPPER PUMPS

For more than half a century, the patented chopping action of the VAUGHAN® Chopper Pump has solved some of the world’s toughest solids pumping problems. With the unique ability to chop all solids at the pump suction, VAUGHAN® Chopper Pumps can handle higher solids concentrations than standard non-clog pumps, providing peace of mind for critical applications.

AUTHORISED DISTRIBUTOR:

PUMP SYSTEMS LTD

Freephone: 1800 121 452

Email: sales@chopperpumps.com.au

WWW.CHOPPERPUMPS.COM.AU

21 www.pumpindustry.com.au pump industry | February 2015 | Issue 10

www.chopperpumps.com.au.

✓ Fast payback on investment ✓ In use throughout Australasia ✓ GUARANTEED not to clog UNMATCHED RELIABILITY

The Vaughan chopper pump installed on site.

✓ Capacities of up to 880 L/s ✓ Multiple configurations available ✓ Discharge sizes from 3” up to 16”

PIA MEMBER NEWS PUMP INDUSTRY PARTNER SOLUTIONS

Stevco welcomes new director

James Blannin has joined the team at Stevco as a director of the business, looking after business development for the seal and pump business in Melbourne’s north and west.

James has been part of the pump industry for a number of years. His most recent position prior to his new role at Stevco was as a branch manager selling mostly positive displacement pumps for coating applications including automotive paint, polyureas, epoxy, and adhesives in both plural and single component.

Energetic and technically minded, with great customer service focus, James looks forward to working alongside

Steve Russell and the rest of the team to grow Stevco Victoria.

Fellow Stevco director Steve Russell is thrilled to have James join the team at Stevco.

“It’s great to have James on the team here at Stevco bringing in new experience, product knowledge and some new approaches to the future of Stevco,” said Steve.

Comprehensive range of:

• Centrifugal Pumps

• Multistage Pumps

• Submersible Pumps

• Rotary Lobe Pumps

• Circumferential Piston Pumps

• Helical Rotor Pumps

• Mechanical Seals

• Inpro Labyrinth Seals

• Gland Packings

22 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

PIA MEMBER NEWS PUMP INDUSTRY PARTNER SOLUTIONS

Melbourne (03) 9408 3875 | vicsales@stevco.com.au www.stevcovic.com.au water problems...? pump and seal it with Stevco SS PV Stevco Seals & Pumps Victoria Pty. Ltd.

Rainer Wiemann handing over to James Blannin.

Moving water is our business

For 70 years Franklin Electric has been quietly and efficiently moving water around residential, agricultural, industrial and mining applications across the world.

Franklin Electric commenced operations in Bluffton Indiana in 1944 as an electric motor manufacturer and evolved to develop the encapsulated 4” submersible motor for bringing clean drinking water into home across the USA. This design, primarily still in use today, expanded with larger kW motors to include 6” and 8” submersible borehole motors up to 150kW.

In 1962, Franklin Electric arrived in Australia, supplying the water industry in the domestic irrigation, industrial and mining markets.

Over the years as the applications expanded, Franklin products evolved to enable solutions for numerous applications including golf course water, irrigation for crops, mines pit dewatering, ore processing, commercial building pumps, constant flow and constant pressure systems, water boosting, hot water up to 90°C and cold water, fresh, saline and sea water, on shore and offshore.

Franklin products are installed and successfully operating around Australia, from the water fountain in Albert Park Lake in Melbourne, manganese and zinc mines in Queensland, to diamond, gold and iron ore mines in Western Australia,

sugar cane watering in Bundaberg and providing water for livestock around the country. Franklin pumping products are also delivering solutions, reliability and trusted performance around the world, from South Africa to Kazakhstan, China, Brazil, Mexico, Mongolia, Portugal, Saudi Arabia, Canada, Fiji, Indonesia and the United States to name a few.

Franklin pumping and motor products include cast iron and ductile iron pump ends suitable for the rough and tumble of many industrial, agricultural and mining applications. They also provide a range of full stainless steel pumps for commercial, industrial and potable water applications. Franklin’s broad range of pumping solutions include end suction, horizontal or vertical multistage pumps, and a wide, comprehensive range of submersible borehole pumps and motors for almost every application. Every pump needs to be driven by a reliable motor and Franklin offers the best industry performance. Their proven design with encapsulated windings and Kingsbury thrust bearings, along with their water block leads, provides the high level of reliability that keeps pumps operating.

The millions of motors made by Franklin ensures quality and peace of mind. To suit many applications, Franklin offer a Standard Water well construction further complemented with full 304SS motors, complete 316SS and 904L motor constructions up to 400kW.

Add the energy efficiency of their solar pump range and array systems, on or off the grid; and Franklin Electric can move water to meet your demands.

Water can be the enemy of many areas at times, but with Franklin's Pioneer Pump range of trailer and skid-mounted self-priming centrifugal pumps, huge volumes of water can be moved up, down or over and away.

Couple the pumps with full control, monitoring and remote SCADA systems, and Franklin Electric offers complete Systems Solutions that ensure durability, reliability and performance wherever you operate whether locally or globally.

For more information on Franklin Electric’s products and service call 1300 FRANKLIN (1300 372 655) and visit www.franklinwater.com.au.

23 www.pumpindustry.com.au pump industry | February 2015 | Issue 10

PIA MEMBER NEWS PUMP INDUSTRY PARTNER SOLUTIONS

Balancing centrifugal pump impellers

Vibration caused by imbalance in rotating machinery, including pumps, is an important engineering problem. It is generally agreed that balancing the rotating components of a centrifugal pump is critical, especially after a coating or repair, even a minor one. It should be a high priority when a centrifugal pump is being overhauled.

Because excessive vibrations are generally the outcome of a system malfunction, reducing rotor vibrations generally increases the service life of the rotating machinery. Increased vibration levels generally indicate a premature failure, which means that the equipment has started to destroy itself. Generally higher amplitude vibration levels are indicative of faults developing in mechanical equipment. It is expected that all pumps will have some vibration due to turbulent liquid flow, pressure pulsations, cavitations, or pump wear. The magnitude of this vibration will be amplified if the vibration frequency approaches the resonant frequency of the pump, foundation or piping components.

The sources of vibration in centrifugal pumps can be generally categorised into

three types: mechanical, hydraulic, and peripheral causes.

Mechanical causes can include unbalanced rotating components, damaged impellers, non-concentric shafts or sleeves, thermal growth, worn or loose bearings, drive misalignment, erosion and corrosion, damaged or rubbing parts, pipe strain, or inadequate foundations.

Hydraulic causes of vibrations can include internal recirculation, turbulence in the system, air entrapment, water hammer, product vaporisation, or operating the pump at other than the best efficiency point.

Peripheral causes may include the impeller vane running too close to the pump, operating the pump at a critical speed, harmonic vibration from nearby equipment, or temporary seizing

of seal faces if you are pumping a non-lubricating fluid.

It is critical to reduce vibration in centrifugal pumps because this has a major effect on the performance. Pump reliability is a critical factor for commercial and industrial facilities to reduce their maintenance costs and unscheduled downtime, while increasing the equipment return on investment.

Precision Balancing has been offering in-house and on-site dynamic balancing and vibration analysis services since 1989 and has the equipment, skills and experience to satisfy your industrial balancing requirements. Precision Balancing strictly adheres to the requirements of the relevant ISO standard, and all jobs are tracked through its system and are issued with a certificate of compliance.

24 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au PIA MEMBER NEWS

For more information on industrial balancing services and standards visit www.precisionbalancing.com.au. Imbalance is a common source of faults in rotating assemblies, pumps and fans. Balance Matters! Precision Balancing can help! (03) 9758 7189 precisionbalancing.com.au

A Gorman-Rupp V Series pump. Easily accessible for monitoring and service.

Safer wastewater pumping

The whitepaper has been prepared by engineered pump solutions provider Hydro Innovations, and has been designed as a guide on ways to improve or even eliminate some of the dangers associated with working on or around wastewater pumps.

Firstly, they maintain that using Gorman-Rupp self-priming centrifugal pumps eliminates the dangers of working over heights and working over water usually associated with pumping wastewater with submersible pumps. Because the pumps are located high and dry above the wet well, operators do not have to be exposed to the dangers of open wet well pits when monitoring, inspection or maintenance is necessary. A correctly engineered solution will also eliminate the need for working in confined spaces.

Also, because maintenance can occur while the pump is still connected to the pipe system, and no cranes or lifting devices are needed, the dangers of working with heavy swinging weights and cranes are eliminated. And when pump clearances need to be adjusted, Gorman-Rupp V Series pumps allow operators to make adjustments externally, without removing the pump from service and without having to come into contact with the pumped fluid. To adjust submersible pump clearances, operators need to open wet well lids, use a lifting device and man handle pumps that are covered in the pumped fluid (which could be corrosive, contain sharps or be full of bacteria).

The Gorman-Rupp Ultra V Series pump has been built with operator safety as a high priority. These pumps feature pressure relief valves, burst disc flap valves that can uniquely be replaced without opening the pump, and the safest fill port cover of any self-priming pump on the market. These features and others, separate Gorman-Rupp as the leader in selfpriming pump technology.

For the complete whitepaper on wastewater pump operator safety, go to www.pump-stations.com.au or call Hydro Innovations on 02 9898 1800.

25 www.pumpindustry.com.au pump industry | February 2015 | Issue 9

PIA MEMBER NEWS PUMP INDUSTRY PARTNER SOLUTIONS

New year, new look

SEEPEX has recently undergone a makeover, unveiling a new website and a new logo to match.

The new look reaffirms the company’s objective to provide its customers the highest quality solutions. The rebranding efforts began in November last year, and are now being rolled out across the company’s key communication platforms.

The website offers an initial glimpse into the new SEEPEX identity. SEEPEX is now written in capital letters and the new logo looks powerful, confident and modern. It further communicates that SEEPEX is not just a manufacturer of progressive cavity pumps, but a world leader in complex application and customer-specific solutions.

With more than 700 employees in twelve offices worldwide and customers

in over 60 countries, SEEPEX is fulfilling its vision of gaining a top market position and reputation.

In recent years, SEEPEX has vigorously invested in its future:

2012 – Expansion of the American ISO 9001-2008 certified subsidiary including new production, warehousing and office facilities.

2012 – New subsidiaries in Australia and Russia.

2013 – Modernisation of stator manufacturing areas for increased operational efficiency in the American facility.

2014 – German headquarter expansion, including a new office

building, which follows the philosophy ‘all things flow’ in its architecture and design, to enable close cooperation and efficient processes.

Global communication today is digital, and the internet connects colleagues and customers around the world.

The new website is a resource and education platform for finding custom solutions. SEEPEX is proud to expand its digital reach via the new website and is looking forward to continuing to globally supply products and services for nearly every industry requiring fluids handling and processing solutions.

WHY REPLACE WHEN YOU CAN ADJUST?

SEEPEX Smart Conveying Technology extends the life of your stator. Adjustment of the retaining segments takes just 2 minutes and restores 100% pump performance.

Tests have shown up to 3x stator life compared to conventional progressive cavity pump design Join the smart revolution and test our innovation “Smart Conveying Technology”.

SEEPEX Australia Pty. Ltd. Tel +61.2.4355 4500 pvila@seepex.com

www.seepex.com

26 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

INDUSTRY NEWS PUMP INDUSTRY PARTNER SOLUTIONS

Visit the new SEEPEX website at www.seepex.com.

Sliding vane pumps for transport and terminals

Sliding vane pumps are a popular pump design for applications requiring flow rates of 75-1,000LPM. They are excellent for pumping (loading and unloading) of low viscosity fluids such as diesel, petrol, biodiesel, chemicals and industrial solvents.

As sliding vane pumps have no internal metal-to-metal contact and are able to self-compensate for wear, they maintain high performance through the lifespan of the pump for the non-lubricating liquids. Sliding vane pumps can run dry for a short period of time; they can also tolerate small amounts of vapour. All-in-all, the sliding vane design combines low cost with high reliability and easy maintenance.

The sliding vane principle is simple. A slotted rotor is supported in a cam. The rotor is placed close to the wall of the cam so a crescent shaped cavity is formed. The clearances are precise and minimal. Vanes, also known as blades, slide in and out of the rotor slots to seal off a volume between the rotor, cam and side plate. The blades sweep the fluid to the opposite side of the crescent where it is squeezed through the discharge point.

Hurll Nu-Way, as a supplier of vane pumps to the Australian industry for

over 30 years, continues to broaden their product range to meet the demands of their customers for petroleum products and industrial solvents.

Sliding vane pumps for industrial applications offer the following features:

• Self-adjusting sliding vanes which maximise pumping performance

• Simple and cost effective maintenance: by simply removing the pump head, internals can easily be replaced without disturbing the piping

• Ability to handle small amounts of vapour

• Excellent suction lift which is great for clearing suction and discharge lines

• Internal relief valve or optional air operated valve (AOV) for high and low flow control

• Adjustable internal relief valve options.

Hurll Nu-Way offers sliding vane pumps, ideal for bulk pump loading and unloading, fuel oil delivery trucks, and transport applications of such liquids as petrochemicals, gasoline, fuel oils, diesel, aviation fuels, biofuels, ethanol, solvents and many more.

Hurll Nu-Way has capabilities to configure and assemble custom-made pump sets and additional components to suit your particular application.

Handling fuels or fluids?

27 www.pumpindustry.com.au pump industry | February 2015 | Issue 10

INDUSTRY NEWS PUMP INDUSTRY PARTNER SOLUTIONS

The Most Advanced AODD Today Visit www hnw com au or call our Customer Service line on 1300 556 380 Distributed in Australia by Hurll Nu-Way scan to watch the video

Hurll Nu-Way’s new sliding vane pump.

Contact

Hurll Nu-Way for a broad range of pumping solutions.

Specialist pump solutions from SPX

SPX is a leading manufacturer of centrifugal, power and steam-driven reciprocating pumps for both onshore and offshore applications in the hydrocarbon processing market.

SPX pumps are designed to API standards and are utilised in refineries, gas plants, offshore oil platforms, FPSOs and pipelines around the world.

Novaplex vectorcreatiN g space with offset pump heads

With its laterally and angular offset pump heads, the effective and space saving technology of the NOVAPLEX Vector sets new standards. This is why the NOVAPLEX Vector is ideally suited for mounting in tight areas. This triplex process pump with its innovative design is suitable for use in EOR (Enhanced Oil Recovery) and Oil & Gas as well as many more applications in the chemical and petrochemical industries.

To learn more, visit us at www.spx.com.au

Contact us at Tel: (03) 95899222 or Email: ft.aus.cs@spx.com

Pump packages are commonly supplied as complete engineered solutions inclusive of advanced API seals and sealing systems, lubrication systems, instrumentation and various drive train options.

When customers buy from SPX they have the peace of mind knowing that they are going to get a product or solution that is high quality, reliable and efficient, backed by an organisation with strong capabilities in service and support.

Trust in the quality of SPX products has been the foundation of their business success for more than 100 years.

SPX has the advantage of being a large global manufacturer of a broad range of industrial equipment and systems. If a customer is looking to purchase a pump from SPX, they may also need a mixer or a heat exchanger. With SPX, customers can purchase all of these components or an entire processing line from a single, trusted supplier.

SPX also takes a global approach to their aftermarket services. Generally speaking, if a customer buys a pump in Europe, SPX will support it in Asia, the Americas or in India, for instance. SPX understands that this kind of support network is important to customers.

The quality of the people SPX has behind their solutions is also part of the key to the company’s success.

Their engineers have an incredible wealth of experience that enables them to effectively meet all of the technical requirements of a job and often push the envelope of a product to meet the particular specialised requirements of an application, providing added value to the customer.

One of the reasons SPX win competitive contracts is because they’re able to put their most knowledgeable experts directly in front of the customer and demonstrate that they know how to solve their issues and optimise their processes. That's the kind of expertise that customers tend to trust and value the most.

28 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au

INDUSTRY NEWS PUMP INDUSTRY PARTNER SOLUTIONS

For more information about SPX, visit www.spx.com.au.

Innovative from the beginning

Tsurumi’s name is renowned in the world of electro-submersible dewatering and sewage pumps. The Japanese company, founded in 1924 as a manufacturer of agricultural style vertical shaft pumps, has come a long way in the last 90 years.

Founded by the Sugimoto family, Tsurumi has built a reputation not only for quality and value, but for innovation, delivering features that provide for longevity, reliability and genuine performance.

Tsurumi was introduced to Australia by Pacific Pump Company, a division of the old Tutt Bryant Group. The first Tsurumi’s were initially sold under the ‘Pacific Frogmen’ brand name. The company’s focus on construction, mining, quarrying and related industries opened up markets for Tsurumi submersible dewatering pumps.

Warwick Lorenz, now Managing Director and proprietor of Australian Pump Industries, was the very young manager of Pacific Pump and orchestrated the original launch of the product.

“We could see that the product was a winner from the very beginning,” he said. “The pumps were so far ahead of anything else on the market and suited even the rough, tough applications in construction and quarrying. Hire companies loved them too,"

The product that Pacific launched back in the 1970s was quite revolutionary with new lightweight, dry type motors in place of the old conventional oil filled electric motors. From there, Tsurumi went on to include an integrated thermal protector that would prevent motor burnout in the event of running dry.

As Tsurumi grew the product range, they continued to innovate. New ideas like integrated float switches and vortex style impellers to aid solids handling followed progressively.

Better by design

Today Tsurumi offers not only the biggest manufacturing capacity but also possibly the world’s largest range of submersible pumps. The pumps incorporate unique features to provide longer pump life, less breakdowns and ultimately lower costs.

“Tsurumi’s product range provides Australian Pump with a huge opportunity. We dropped retail prices by 40 per cent in the first month that we took on the franchise, three years ago,” said Mr Lorenz.

The results have been staggering in terms of re-awakened market recognition, a huge increase in volume and general acceptance that Tsurumi is a submersible pump global leader.

“We are currently working with Tsurumi on a number of projects that will meet the specific needs of Australian users,” said Mr Lorenz. “For example, we are jointly developing a range of 1,000 volt mining pumps in response to demand from the Australian mining industry."

29 www.pumpindustry.com.au pump industry | February 2015 | Issue 10

INDUSTRY NEWS PUMP INDUSTRY PARTNER SOLUTIONS

Further information on the complete Tsurumi range is available online at www.aussiepumps.com.au.

For hydraulics, think HYDAC

HYDAC Australia is your supplier of, and partner for, various hydraulic pump types.

HYDAC Australia offers a range of hydraulic pumps with a focus on providing a higher level of efficiency.

Designed with specific applications in mind, these HYDAC pumps were developed, manufactured and tested in product-oriented laboratories.

HYDAC offers the following range of pumps: axial piston pumps (PPV), vane pumps variable displacement (PVV), vane pumps fixed displacement (PVF), external gear pumps (PGE), internal gear pumps (PGI) and screw pumps (HSP).

Their axial piston pumps (PPV) have proven to be highly efficient over an exceptionally long lifecycle. They are designed for use in industrial and mobile applications, and have full through-drive capability.

Their multiple-flange drive-shaft combinations are available in SAE J744 and ISO 3019, and among other

advantages, these pumps have a large range of speed, a tight through-flow range and short control time.

In the vane pump category, a highlight is the new high pressure vane pump model (PVV103), which is well-suited to heavy duty operations such as mining. They run silently and have a long lifecycle, high efficiency, modular controller program and adjustable displacement volumes.

The range of external gear pumps (PGE) have a very narrow, stage-specific displacement flow and a large range of flange and shaft designs, while the internal gear pumps (PGI) are characterised by exceptionally low noise, low pulsation and a large range of speed. Both internal and external gear pumps are also available in multiplecombination pumps.

For

HYDAC’s hydraulic screw pump (HSP) produces very low vibration and pulsation, and can be coupled, if desired, with a reliable electric motor and an integrated pressure relief valve. It can be used in cooling, transferring fluids and lubrication.

1300 449 322.

30 pump industry | February 2015 | Issue 10 www.pumpindustry.com.au INDUSTRY NEWS PUMP INDUSTRY PARTNER SOLUTIONS

more information about HYDAC Australia, visit www.hydac.com.au or call

The pump industry relies on expertise from a large and varied range of specialists, from experts in particular pump types to those with an intimate understanding of pump reliability; and from researchers who delve into the particulars of pump curves to experts in pump efficiency. To draw upon the wealth of expert knowledge the Australian pump industry has to offer, Pump Industry has established a panel of experts to answer all your pumping questions.

Progressive cavity pumps

Our progressive cavity pump expert is Peter Vila, Managing Director of seepex Australia.

Peter has been involved with pumps for

35 years. He spent the first five years repairing them and the subsequent 30 years directly in technical sales, and for the past 15 years he has been predominately involved in one way or another with seepex progressive cavity pumps.

What do you feel are the most important considerations when selecting and installing a progressive cavity pump?

There are three key factors to consider when selecting and installing a progressive cavity pump:

Consider the pumped media.

As with all pump selections, when choosing a progressive cavity pump, the properties of any pumped media must be carefully considered. What is the chemical composition? Viscosity? Pumping temperature? Solids content?

Nature and size of solids? Is it shearsensitive? Abrasive? Potentially hazardous?

What are the process requirements?

Again, this is not really different to the basic criteria for selecting all pump designs. Flow rate and discharge pressure as a minimum, together with an overview of suction conditions.

For example, lift or flooded? Inlet pressure? Temperature? Industrial or hygienic product handling? Mode of control – DOL/VVVF/other?

Are there any installation and/or environmental considerations?

This is an area where many variables are possible. Fixed or portable? Horizontal or vertical? Dry or semi-submersible?

Reversible flow? Indoor/outdoor? Harsh or hazardous environment? Specific customised drive? Special sealing requirements for product containment? Overpressure and/or dry-run protection? (It may surprise you to hear that over-pressure and dry-run, along with incorrect pump selection, are the most common causes of premature failure on progressive cavity pumps.)

With due consideration to the above information, it is possible to confidently configure a progressive cavity pump which is fit for purpose. Special care should be taken when selecting pump

speed, giving due consideration to pumped media – viscosity, solids content and abrasiveness. It’s quite common for the uninitiated to select a smaller pump running faster, with a view to saving a few dollars on the initial purchase, only to find their maintenance costs have soared out of control due to an inappropriate pump selection. Typically consider 300-350RPM as a guideline when initially selecting the suitable speed for a progressive cavity pump, then adjust down, or up, from this point, depending upon pumped media characteristics. It’s not uncommon to see progressive cavity pumps running as low as 75-100RPM on media with high viscosity or solids content, or at the other end of the scale, up to 1,000-1,500RPM on easily handled media with high lubrication properties. The important thing is to ensure you have the necessary information and experience to make a confident selection, or failing this, that you have the contact details of a reliable source and can seek their assistance.

For more information on progressive cavity pumps, please contact seepex Australia on (02) 4355 4500 or pvila@seepex.com.

31 www.pumpindustry.com.au pump industry | February 2015 | Issue 10 ASK AN EXPERT

Pump Industry is seeking qualified experts in various areas of pumping to join our Expert Panel. If you're an expert in your field, or know an expert, contact Laura Harvey at laura.harvey@monkeymedia.com.au.

Pumps in 2015: challenges, opportunities and the road ahead

by Laura Harvey, Pump Industry Managing Editor

Looking back on 2014, the year provided a mixed bag for the Australian pump industry. Downturns in traditionally strong industries, such as mining, have had an impact on many businesses; but an increasing awareness of, and focus on, energy efficiency and sustainability from pump end users is providing new opportunities for many businesses. The year ahead is shaping up to present similar challenges and opportunities. Pump Industry spoke with some of the major players in the industry to prepare our outlook for the industry in 2015 and beyond.

The year that was

Our respondents all agreed that the key event impacting the pump industry in 2014 was the downward trend for the Australian mining industry, impacted by flow-on effects from the mining tax and falling commodity prices.

While the mining tax was officially abolished in September 2014, our respondents noted that it will take a while for the industry to recover, with time needed for investors to see the value in the industry again.