VOLUME 117/1 | FEBRUARY 2025

CRUSHING AND SCREENING

BHP INDUSTRY INSIGHT

DIGITAL MINING

VOLUME 117/1 | FEBRUARY 2025

CRUSHING AND SCREENING

BHP INDUSTRY INSIGHT

DIGITAL MINING

CELEBRATING AN INDUSTRY WORKHORSE

Stable and reliable could be two words to describe the Australian resources industry, one which is backed by steady geopolitics and a technological fervour to achieve constant improvement.

The sector’s competitive undercurrent is driving all operators to be better, whether that involves boosting productivity, reducing costs, improving environmental stewardship, and/or making mines safer.

But as more and more nations understand and unlock their mineral endowment, there’s greater international competition than ever before.

While China has long been a mining forerunner, whether they are extracting minerals themselves or participating in downstream endeavours, the likes of Indonesia, India and countries in South America and Africa are positioning themselves as capable mining partners.

Indonesia has flooded markets with its lower-grade nickel, throwing pricing out of whack and hindering Australia’s proud nickel industry, while Argentina and Bolivia are becoming emerging lithium jurisdictions.

The Democratic Republic of Congo, Zimbabwe and Mozambique are just three African nations flaunting their critical mineral potential.

More than ever, downstream manufacturers are spoiled for choice when it comes to material supply, which means Australian miners need to up their game to remain competitive.

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY

MANAGING EDITOR PAUL HAYES

EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

ASSISTANT EDITOR

ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

JOURNALISTS

OLIVIA THOMSON

Email: olivia.thomson@primecreative.com.au

KELSIE TIBBEN

While Federal and State Governments are integral to providing accessible regulatory environments, Australian mining companies must demonstrate why they remain a supplier of choice.

Miners must unlock greater operational efficiencies to lower costs and bolster their bottom line. Only then can they reliably navigate undulating fiscal environments and be trusted by downstream partners.

Enter Australia’s METS industry, which provides the solutions and technologies to enhance operations.

In the February edition – our first issue of 2025 – we showcase the METS companies enabling improved crushing and screening practices in the mining sector.

Here, the likes of Sandvik, Metso, XCMG, McLanahan and MAX Plant take centre stage. Caterpillar adorns the cover with its D11 dozer. In doing so, we celebrate the role of dozers as integral support machines.

Elsewhere in the February edition, BHP president Australia Geraldine Slattery offers her 2025 outlook for the Australian mining industry, while we also spotlight three emerging uranium players coming through the ranks.

Happy reading.

Tom Parker Editor

Email: kelsie.tibben@primecreative.com.au

DYLAN BROWN

Email: dylan.brown@primecreative.com.au

CLIENT SUCCESS MANAGER

JANINE CLEMENTS

Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT

Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGERS

JAMES PHIPPS Mob: 0466 005 715

Email: james.phipps@primecreative.com.au

As one of the world’s premier original equipment manufacturers, Caterpillar needs no introduction.

A company which innovates equipment to support all aspects of a mine, the February edition of Australian Mining gives Cat the opportunity to spotlight its dozer range.

Cat has a range of track and wheel dozers from which to choose, with the track range starting at the D1, with 59.7 kilowatts (kW) of power, and extending to the D11, with 634kW of power.

This includes the D6 XE – Tier 4/Stage V, the world’s first high-drive electric-drive dozer. Boasting longer service intervals, fewer moving parts and fewer maintenance tasks, the D6 XE can reduce maintenance costs by up to 12 per cent and support up to 35 per cent more fuel efficiency.

The D11 – in all its glory – graces the cover of this issue.

Cover image: Caterpillar

ROB O’BRYAN Mob: 0411 067 795 Email: robert.obryan@primecreative.com.au

ART DIRECTOR MICHELLE WESTON michelle.weston@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl

The ifm radar distance sensor delivers accurate measurements, even in precipitation, fog, dust and dirt — ensuring safety, uptime and increased throughput.

Smart access control Applications Include:

Conveyor monitoring

Monitoring of surroundings and collision avoidance

Distance control and height measurement

Vehicle positioning

With enhanced benefits delivered by

8 DECISION-MAKER

BHP: Champions of competition

BHP president Australia Geraldine Slattery detailed the Big Australian’s 2025 outlook while speaking at the Melbourne Mining Club in December.

14 COVER STORY

A mining workhorse

What makes dozers an essential component of the mining industry, and what types of dozers are commonly used?

16 CRUSHING AND SCREENING

A gold-standard performance

A new Sandvik crushing and screening plant is delivering greater efficiency and operational safety at the Agnew gold mine.

28 CRUSHING AND SCREENING

Crushing solutions for any mine site

Rapid Crushing & Screening

Contractors has a strong track record of providing tailored solutions that boost productivity.

36 COMMODITY SPOTLIGHT

Emerging uranium players Australian Mining spotlights three Australian-based companies with bright uranium futures.

38 EQUIPMENT

Embarking on global growth

Backed by an expansion of its local and international facilities, Schlam is continuing its expansion in Australia and beyond.

40 ESG

Busting sustainability myths

As the mining industry navigates the clean energy transition, FLS calls on miners to take a pause to optimise operations.

67 M&A

Shifting dynamics

As the Australian mining industry embarks on 2025, M&A activity is unlikely to slow down.

68 M&A

The next lithium giant Australian Mining looks at what Rio Tinto’s acquisition of Arcadium Lithium means for the global lithium industry.

REGULARS

3 COMMENT

6 FOLLOW THE LEADERS

80 PRODUCTS

82 EVENTS

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, FEATURING CAPRICORN, RAMELIUS AND ILUKA.

Capricorn Metals chief executive officer (CEO)

Kim Massey retired from his role in January 2025, with current chief operating officer (COO) Paul Criddle succeeding him.

Throughout his tenure at Capricorn, Massey oversaw the company’s transition from a gold exploration company to a low-cost gold producer through the Karlawinda gold mine in Western Australia. Massey also oversaw Capricorn’s growth projects, namely the Mt Gibson gold project in WA.

Prior to that, Massey was chief financial officer at Regis Resources from 2009 to 2019, where he played a key role in financing and developing the Duketon gold project in WA.

While Massey retired as Capricorn’s CEO, he remains a part-time consultant to ensure a smooth leadership transition.

“I would like to thank Kim Massey for his invaluable contribution to Capricorn over the last five years,” Capricorn executive chairman Mark Clark said.

“The growth of Capricorn to a high-quality, low-cost gold producer with an enviable growth outlook whilst delivering exceptional shareholder returns is a great credit to Kim’s tenure as CEO. We look forward to his continued involvement as a consultant to the company.”

Criddle has overseen a range of operational highlights since joining Capricorn in May, including

Karlawinda’s ore reserves increasing to 1.43 million ounces (Moz) of gold and Mt Gibson’s ore reserves increasing to 2.6Moz.

Bringing over 20 years’ experience in the mining industry, Criddle will become Capricorn’s CEO on February 3.

Ramelius Resources has appointed a new COO and expanded its executive team through multiple recruitments.

In November, Ramelius’ long-standing COO Duncan Coutts revealed he would step down to pursue other opportunities, but would stay at the company until early December to support a smooth leadership transition.

Coutts will soon be replaced by Tim Hewitt, a mining engineer with over 30 years’ experience.

Hewitt’s most recent role was at Gold Fields, where he served as vice president – mining, vice president – technical, general manager of the St Ives and Gruyere operations, and mining manager of the Granny Smith mine.

Prior to his time at Gold Fields, Hewitt worked as a mining manager at LIHIR Gold, St Barbara and Newmont.

Ramelius has recruited Peter Ganza as its general manager – projects. Ganza is currently Ramelius’ acting COO and will stay in that role until February 2025, when Hewitt will officially start working at the company.

As general manager – projects, Ganza will focus on the Rebecca-Roe gold project and the Eridanus cutback/mill expansion at Mt Magnet.

Ramelius has appointed Kim Boekeman, who has over 20 years’ experience working in human resources, as its new executive general manager –human resources (HR).

Boekeman’s previous HR roles at Rio Tinto, BCI Minerals, BP, Assala Energy, and ANZ will provide insight on an executive level to ensure Ramelius remains a desirable place to work. Boekeman will commence her role on February 17.

Ramelius has also promoted current general manager – business development Alan Thom to chief development officer.

Iluka Resources announced the retirement of its chairman Rob Cole in December.

Cole, who joined Iluka’s board in March 2018 and became chair in April 2022, has stepped down effective December 13 due to health reasons after taking temporary leave.

Iluka acting chair Andrea Sutton praised Cole’s leadership during his tenure, highlighting significant milestones under his guidance, including the demergers of Deterra Royalties and Sierra Rutile, as well as Iluka’s strategic shift into rare earths.

“At his AGM address in May, Rob reflected on Iluka’s resilience and commitment to delivering sustainable value,” Sutton said.

“His personal contribution to this commitment has been unwavering, on

behalf of the board, I thank Rob for his outstanding leadership and service to the company.”

Arafura Rare Earths has announced the appointment of Tommie van der Walt as chief projects officer, which took effect on January 20.

Van der Walt brings extensive experience as a mining executive and has capability in project delivery and operational leadership, bolstered by a career spanning exploration, construction, and operations in complex environments.

In his previous role as Newmont’s regional project director for Africa, Van der Walt developed a multi-country growth strategy and successfully delivered the $US1.7 billion ($2.77 billion) Ahafo mega-project on schedule, enhancing production capacity and efficiency.

More recently, he served as chief operating officer at Ionic Rare Earths, overseeing the development of the Makuutu rare earths mine in Uganda and a chemical plant in Belfast.

“Tommie’s technical expertise, strategic vision, values-based leadership, and emphasis on operational excellence position him well to lead delivery of the Nolans (rare earths) project,” Arafura said.

Van der Walt’s appointment follows the decision of chief operating officer Stuart Macnaughton to step down for personal reasons. AM

BHP PRESIDENT AUSTRALIA GERALDINE SLATTERY DETAILED THE COMPANY’S 2025 OUTLOOK WHILE SPEAKING AT THE MELBOURNE MINING CLUB IN DECEMBER.

It’s no secret that Australia has one of the strongest mining sectors globally.

Backed by its abundance of metals and critical minerals, Australia’s mining industry has gone from strength to strength over the years.

Leading the pack is BHP, which has just come off a massive 2024 full of operational milestones and production records.

Australian Mining recently gained insight into the BHP engine room when BHP president Australia Geraldine Slattery spoke at the Melbourne Mining Club in December.

Here, she discussed the importance of a competitive mining industry and the Big Australian’s plans for its flagship commodities.

Staying competitive Competition is at the heart of an industry’s ability to innovate and provide the best products and services.

This is especially true in the Australian mining industry, where it’s competing with countries that can supply resources and critical minerals at faster

rates due to less stringent environmental, social and governance standards.

Slattery said Australia is key to the global energy transition, labelling the movement as “one of the great industrial shifts in history”.

“All of us here know that shift will not occur without the minerals Australia provides,” Slattery said.

Slattery cautioned that Australia cannot take its history for granted, highlighting challenges in skills availability, technology adoption and global investment appeal.

When speaking about labour shortages, Slattery said nearly half of the global skilled engineering workforce will retire in the next decade.

“We know we don’t have enough graduates in mining-related fields to replace them,” Slattery said.

“Part of the solution lies in expanding Australia’s workforce participation –and this highlights the fundamental importance of the entire industry’s work to build a more diverse and inclusive workforce.”

Slattery called for enhanced research and design efforts, pointing out that Australia ranks 23rd

globally in innovation and 20th in digital readiness.

“There is, I believe, a shared recognition that in mining, nextgeneration technologies will make our exploration, development and operations safer, more sustainable and more productive,” she said.

Slattery also urged for permitting processes to be streamlined.

“For Australia, the principles should be clear: put in place a riskbased permitting system that ensures processing timelines are certain and outcomes are reliable,” she said.

“(Mining is) not only integral to our way of life, but it’s also integral to our economy and to our livelihoods. (It) underpins our healthcare and education systems, and way of living.”

Australia has been the world’s largest iron ore producer for several years.

Despite being a vital component for steel manufacturing, Slattery said iron ore demand will likely decrease in the

“As China reaches its later stage of urbanisation, we expect to see steel demand coming off,” Slattery said.

“We expect prices to moderate between now and the end of the decade as new supply comes into the market and the demand for steel declines.”

Slattery shed light on the outlook for BHP’s Western Australian Iron Ore (WAIO) business, which is bolstered by

“Western Australia Iron Ore is the lowest-cost and most-efficient iron ore miner globally and has held that position for a couple of years,” Slattery said. “That provides us with resilience through a changing market, and we really see the benefit of that in margins.

“In terms of growth, we’re growing modestly. We produced 287 million tonnes (Mt) during FY24, trending to 305Mt in terms of mediumterm guidance.

“We recently sanctioned a sustaining mine, Western Ridge Crusher, just a few months ago. (We’re continuing) to look at growth but nothing is decided past the 305Mt.”

With high-grade iron ore projects such as the Simandou deposit emerging in west Africa, BHP has a plan to keep WAIO competitive.

“Being the lowest-cost producer positions us very well,” Slattery said. “Maintaining that position of resilience is fundamental to our ability to maintain strength.

“The Pilbara in WA has really shown itself over the decades to be incredibly resilient, both from the private sector but also with the support of the State Government.”

BHP expects copper demand to grow by 70 per cent by 2050 due to factors such as machinery electrification, the global energy transition and more digital infrastructure coming online.

Luckily, the company has the operations to meet this demand.

Copper production was up four per cent for BHP in the September 2024 quarter, due to higher grade and recoveries from the Escondida mine in Chile. Escondida also produced about 1.13Mt of copper during FY24, its highest production in four years.

These stellar results further solidified BHP’s copper aspirations, with the company viewing the base metal as a kingmaker commodity.

The Big Australian is ready to further feed copper demand via the Prominent

Hill and Carrapateena assets it inherited from OZ Minerals, as well as its Olympic Dam operation and Oak Dam deposit. Its Chilean assets, Escondida and Spence, will also play a major role.

“We’re anticipating and planning for a world where we may be able to double copper output (at Copper South Australia) over the next 10 years,” Slattery said.

“We’ve got 13 rigs in exploration (at Oak Dam), actively looking at how we can advance studies for that.”

Of all commodities, nickel arguably had the most challenging 2024.

With faltering prices caused mainly by a supply surplus and an increase in supplies from countries like Indonesia

and China, Australian nickel miners had to weather several storms.

This included BHP, which suspended its Nickel West operations and West Musgrave project in October 2024. The company intends to review the decision by February 2027.

“The surplus in the market creates quite an overhang,” Slattery said. “Despite growing demand, the overhang

will probably take us to the end of the decade.

“I wouldn’t necessarily subscribe to the view that Australian nickel is dead. I think if there’s a supportive price environment and an opportunity to reset the cost basis and the competitiveness through technology and a modernised supply chain, I think that’s certainly very plausible.”

When BHP suspended its nickel division, it committed to redeploying employees to other BHP operations.

“We’re pleased to share that about 700 of our Nickel West colleagues are heading to our iron ore assets, but also Copper South Australia and the Queensland metallurgical coal assets,” Slattery said.

“That’s been good for our employees, and it’s been good for the company.”

Whitehaven Coal officially took ownership over the Daunia and Blackwater metallurgical coal mines in Queensland, which were previously owned by BHP, in April 2024.

Despite this $US4.1 billion ($6.58 billion) divestment, BHP held onto its five other Queensland coal mines: Broadmeadow, Caval Ridge, Goonyella Riverside, Peak Downs and Saraji.

“(With) the metallurgical coal business, we see continuous strong demand, particularly from India,” Slattery said.

“Forty per cent of our coal goes to India and we make up a significant part of their imports. We’ve high graded the portfolio to really concentrate our assets because we think that’s where there’s more tightness in the market, and that higher-grade coal contributes to more energy-efficient steelmaking.

“We think the blast furnace will prevail for many years to come, notwithstanding the efforts between ourselves and some of our biggest steel customers to advance green steel and lower-carbon steel.

“As we transition to that future, it’s our view that metallurgical coal … will play a core role.”

As it embarks on 2025, BHP will continue prioritising the safety of its people and engagement with Traditional Owners and communities.

“Beyond that, (we’re) working with the sector and policy makers to inform the settings that will allow Australia to compete for capital,” Slattery said.

BHP will also continue investing in technology, with 50-60 per cent of its mines now autonomous.

“The opportunity to go beyond the 1.0 to the 2.0 of autonomy in terms of the smart mine, I think that’s an area that offers enormous opportunity,” Slattery said.

“We know the interaction between vehicles and people is where most of our injuries and, tragically, fatalities occur. Whether it’s separation or detection, (autonomous technology) is an area that can prevent these occurrences.

“One of the other areas we have deployed technologies in is exploration, through bringing together geological data sets and data analytics to either move the pace or (gain) insights, but also in our partnerships with accelerators and startups, who are often more agile than big companies in advancing and trialling technologies.”

As a new year begins, BHP will continue to grow its business to feed the global energy transition and beyond, with ‘future-facing’ commodities such as copper and potash to remain key drivers.

Public opinion of the Australian resources industry has ebbed and flowed over time.

But as the need to transition to renewable energy becomes entrenched in the public’s consciousness, mining –especially the mining of critical minerals – has seen a step change in attitude.

The mining industry is no longer the hulking unknown in the background, having certified its importance in recent years – a change backed up by a recent citizen survey.

Conducted by Australia’s national science agency CSIRO and Voconiq, the ‘Australian attitudes toward mining’ report examines the public’s outlook on the industry, providing crucial insights for policymakers, industry leaders and communities.

“The idea behind the report was to have a large representative sample of the Australian population,” Voconiq chief executive officer and co-founder Kieren Moffat told Australian Mining.

“We collected about 88 per cent of the data using a panel-based collection method, then we opened the floor to anyone 18 years and over who wanted to have their say. This was to make sure that anyone who wanted could participate, and it led to interesting findings.”

This latest survey is the third instalment in a decade-long program of research, providing an update on national surveys conducted in 2014 and 2017.

Over 6400 participants were surveyed for this edition, with a focus on critical and energy transition minerals. Overall, it was found public trust in the mining industry has improved from 2017.

“The best way to know how people feel about something is to ask them directly, and that’s what this survey does,” CSIRO Mineral Resources science and deputy director Louise Fisher told Australian Mining.

“And by doing the survey repeatedly, we get a longitudinal dataset that lets us understand how those attitudes to mining are changing over time, and also what factors are driving that change.”

The survey found that 73 per cent of respondents acknowledge that access to critical minerals is essential for achieving net-zero emissions, while 72 per cent believe mining will support Australia’s future prosperity.

However, concerns remain around the potential environmental impacts of mining operations. The survey found that 61 per cent agree mining can have negative environmental impacts, and issues around dust, water

quality and community health remain significant concerns.

“It was great to see the improvements of people’s attitudes on a number of key issues, like the need for mining to produce more critical minerals,” Moffat said.

“Citizen perspectives are so important because mining is a national resource that’s managed by governments and conducted by industry. Surveys like this allow governments and industries to hear concerns directly from the community.

“In the age of social media, it’s more important than ever to have a moment of clarity and speak to those people that aren’t necessarily the loudest voices – those that are simply out there in the community.”

Fisher said the survey provides recognition of the role the mining industry must play in decarbonisation.

THE SURVEY FOUND THAT 73 PER CENT OF RESPONDENTS ACKNOWLEDGE THAT ACCESS TO CRITICAL MINERALS IS ESSENTIAL FOR ACHIEVING NETZERO EMISSIONS, WHILE 72 PER CENT BELIEVE MINING WILL SUPPORT AUSTRALIA’S FUTURE PROSPERITY.”

“The conversation around net-zero and ESG (environmental, social and governance) principles in mining is one that’s become a lot more focused and prominent in the last few years,” she said.

“Ongoing demonstration by the industry on how they’re going to address that challenge in the mining space is going to be important in sustaining trust.

“It will be an interesting data point for us to track over time.”

THE 2024 ITERATION OF THE REPORT FOCUSED ON THE CONTINUED NEED FOR CRITICAL MINERALS.

Overall, the majority of survey respondents agreed that mining contributes positively to both Australian employment rates and way of life; 78 per cent said mining provides employment opportunities for young people, while 70 per cent agreed the industry had helped improve necessary infrastructure like transport.

After completing sections focused on the positive benefits and negative impacts of mining, participants were asked to respond to the following statement on a seven point scale, where higher scores indicate greater agreement: ‘Considering the benefits and costs associated with mining, it is worthwhile to peruse mining in Australia.’

The result of 5.3 indicated a strong agreement with the sentiment.

Fisher said the result can show miners that they’re heading in the right direction.

“The data tells us that there is community expectation that mining companies are ensuring their workplaces are safe and diverse, and they’re managing their environmental impacts effectively,” she said.

“The industry shouldn’t rest on this positive sentiment; they need to scrutinise it to ensure they continue demonstrating improvement.”

“They can look at this data and ask themselves, ‘What are we doing as a company, and how does that line up with what the community is telling us they want?’

For Moffat, the survey results serve as a set of action points mining companies can use to ensure they’re meeting the needs of their local communities.

“This report provides a blueprint for social acceptability and social license to operate,” Moffat said. “We’re now seeing local communities have the power, the agency and the capacity to ensure their relationship with mining companies remains strong, productive and ensures miners are meeting expectations both locally and nationally.” AM

DOZERS ARE AN ESSENTIAL COMPONENT OF THE MINING INDUSTRY, BUT WHAT MAKES THEM SO IMPORTANT – AND WHAT TYPES OF DOZERS ARE COMMONLY USED?

While trucks and loaders are key transporters of ore on a mine site, support machines such as dozers take on much of the grunt work by pushing and excavating valuable material.

A seamless dozer operation can be the central ingredient to a more productive mine, enabling other machinery to go about its business without a hitch.

Dozers can assist in constructing and maintaining haul roads and safety berms, mine reclamation and clean-up of blast areas, while dozer ripping is a popular and cost-effective alternative to accessing ore when blasting is not possible.

The most efficient ripping operations are those that cut with the grain, though it’s important to understand the strata to support the best ripping patterns. Cross ripping can be an effective technique to navigate difficult spots.

Operators must be mindful of ripping up slopes or on side-slopes – ripping downhill can be the most effective approach, best capitalising on the dozer’s weight and horsepower.

Australian Mining takes a closer look at track and wheel dozers and spotlights a Tier 1 original equipment manufacturer in the process.

Widely used across the Australian mining industry, track dozers have long been a reliable support machine, offering the right weight-to-horsepower ratios to push large loads.

Miners turn to track dozers when they’re working in varying and difficult terrain, including rough and muddy ground, with the tracks providing stronger traction and stability in these environments.

The tracks evenly distribute the dozer’s weight, providing higher pushing power and greater traction in rough terrains.

Wheel dozers have become an increasingly popular option for miners looking for speed and manoeuvrability, with the machines benefited by articulated steering and higher visibility.

Deployed in the right applications, wheel dozers can reduce fuel and undercarriage costs and capably push lighter loads across long distances.

Wheel dozers can swiftly clean up around shovels and trucks and complete jobs at multiple sites, with applications including stockpiling, road maintenance and reclamation, to name a few.

According to Caterpillar strategy manager Kent Clifton, operators must analyse their site-specific conditions before opting for either a track or wheel loader.

If operators are consistently pushing 70–110 per cent blade loads and don’t require mobility, Clifton said, track dozers are often the best option. But if mobility is required and the blade load is up to 70 per cent, a wheel loader is often the best option.

Caterpillar dozers

Cat offers a range of track and wheel dozers, with the track range starting at the D1, with 59.7 kilowatts (kW) of power, and extending to the D11, with 634kW of power.

This includes the D6 XE – Tier 4/ Stage V, the world’s first high-drive electric-drive dozer. Boasting longer service intervals, fewer moving parts and fewer maintenance tasks, the D6 XE can reduce maintenance costs by up to 12 per cent and support up to 35 per cent more fuel efficiency. The electric drive also enables the D6 XE to cut carbon emissions by up to 20 per cent.

The machine is also fitted with Cat’s Grade and Assist technology, boosting productivity and supporting ease of operation.

814, 824, 834, 844 and 854 models. Many major mining operations opt for the 844 and 854 models, while midsized operations opt for the 834 dozer.

wheel dozer can be dependent on the size of the trucks and loading tools being used.

“For example, one of the keys when you’re working on a truck dump is that you need to keep up with the trucks,” he said.

trucks running on the haul road. You want to get them back as quickly as you can to the loading tool, so you have to size the wheel

the capacity to do that clean-up work.” so big that you’re obstructing the

As the resources industry evolves, dozers remain a key component

of a mine’s support fleet, enabling primary vehicles such as haul trucks to carry out their work seamlessly. Caterpillar understands this equation, offering a leading range of track and wheel dozers to support any mining operation AM

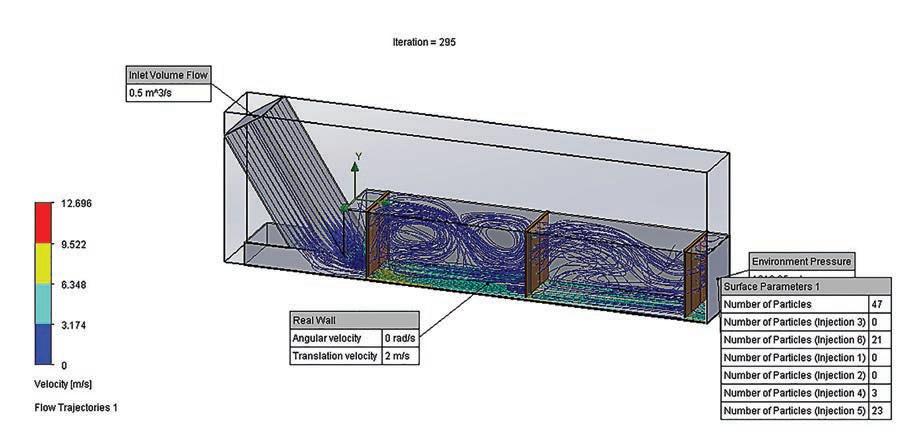

A NEW SANDVIK CRUSHING AND SCREENING PLANT AT GOLD FIELDS’ AGNEW GOLD MINE IN WA IS DELIVERING GREATER EFFICIENCY, THROUGHPUT AND OPERATIONAL SAFETY.

Gold Fields Limited is one of the world’s largest gold mining companies with nine operating mines, located in Australia, South Africa, Ghana, Peru and Chile.

The Agnew gold mine is one of four Australian gold mines operated by Gold Fields. The site is situated approximately 375km north of Kalgoorlie and has a long history of gold production dating back to the late 1970s.

The mine is best known for its underground operations, primarily targeting the Agnew and Lawler gold deposits. Ore is extracted using a combination of underground and surface mining and is then processed on-site.

Around 2018, with the mine expanding into a third underground source, there was a need to increase plant throughput. The 21-year-old tertiary crushing circuit, which was suffering from poor reliability, was unable to meet the demand.

Gold Fields metallurgy manager Reg Radford is the company’s technical expert in the field of processing metallurgy. He works with process managers across all Gold

Fields sites in Australia to assist in optimising operations.

Radford could see that the crushing and screening circuit was not in keeping with the company’s broader standards.

“It was working to its limits, and if you compared it to other Gold Fields sites, it was not to the standard that would be accepted elsewhere,” he said. “It didn’t meet our criterion for a well-organised, safe, professional gold processing operation.

“The equipment was old, and there was little or no spare parts availability. From a metallurgical perspective, it was being pushed to its limits to deliver the tonnage required. At best it was giving us an 8–10mm output, which was putting pressure on the downstream grinding circuit.”

The age and complexity of the existing plant also meant that access for operation and maintenance was difficult, presenting potential safety concerns.

The existing crushers were reaching end-of-life, and rather than just replacing them, it was decided to build an entirely new crushing and screening circuit.

To do this, and address various other concerns regarding the existing plant, a comprehensive upgrade project, known as the Agnew Stage 1 upgrade, was conceived.

The initiative examined bespoke and modular designs that could replace the existing plant. The project aimed to improve site water drainage and dust management (by installing a fine ore bin) while minimising disruptions during construction and commissioning.

Fields manager – processing Tristan Freemantle was appointed as project director for the upgrade at Agnew. A veteran of the gold and copper industry, Freemantle originally worked for Barrick Gold and then transferred to Gold Fields around 12 years ago. Since then, he has worked across several of Gold Fields’ Australian sites and is currently based at Gruyere, a joint venture project with Gold Road Resources in the Yilgarn area of WA.

“Agnew’s mine life had been extended for a further eight years, so upgrading the crushing and screening circuit was important to increase our processing capabilities: we needed to be in a position to process more ore from the new third mine coming online,” Freemantle said.

Gold Fields has enjoyed a longstanding relationship with Sandvik, with the company having Sandvik crushers installed at both their St Ives and Granny Smith operations. After considering a bespoke solution, the Gold Fields team chose to go with a Sandvik modular plant.

“We needed a circuit that was simple, low maintenance and reliable, but also wanted the best crushers and screens that we could get,” Freemantle said.

“Sandvik showed a willingness to work with us within our parameters. Initially, it was just the crushers and screens, but in the end, they presented a complete plant design, which was modular and comparable with the bespoke designs we were considering.

“Sandvik was also able to accommodate our desire to manage our own electrical and process control design.”

A key to the successful implementation was Sandvik’s expertise in crushing and modular plant design combined with the screening know-how

The scope of supply included a Sandvik reciprocating plate feeder, grizzly screen, jaw crusher, and two cone crushers, as well as a Schenck Process double-deck banana screen fitted with Screenex screening media. Sandvik also provided bins, chute work, associated wear protection, and conveyors.

The innovative plant design eliminated the need for two screening stations and associated conveyors when compared with other proposed designs.

“Having a single vendor was an advantage,” Radford said. “Sandvik’s initial designs and 3D models were quite detailed and comprehensive, which was encouraging. It gave us confidence in the circuit because we knew exactly how the proposed layout would interact with the existing plant.”

A significant challenge for the project team was that Gold Fields needed the new plant to be installed in parallel with the old one so that, ideally, there would be zero downtime.

downtime, was a very important part of the brief.”

“Agnew can’t afford to be down for two or three weeks,” Radford said. “The mill is pushed to its limits, so it has little ability to catch up.

“Solving this problem – where we could build the new circuit and how to tie it in – was a good part of the success story. Commissioning on-

To accommodate this requirement, the team decided to move the run-of-mine (ROM) pad and build the new circuit on the site of the old ROM pad. While this achieved the brief of zero downtime, it introduced a new challenge.

The geology of the ROM pad was untested, and some contractors

foundation would be required to support the crushing and screening plant, greatly increasing both the build time and cost.

In the end, working with Gold Fields geotech consultants, Sandvik’s design team resolved this problem by delivering a support structure for the new circuit that was strong and rigid enough to reduce the concrete

The new crushing and screening plant has now been running for more than 12 months, and the Gold Fields team is very happy with its performance.

“It’s going very well,” Freemantle said. “The Schenck screen is performing well, and the Sandvik crushers have an intuitive automation system that was easy to integrate with our process control.

“The new plant was designed for a two-million-tonne-per-annum (Mtpa) throughput, which is oversized for the current throughput of 1.3Mtpa.

“This means the crushers can be run tighter, producing smaller product. During the design stage, the crusher output was set at 8mm, but it’s now regularly producing less than 6.5mm.

“The finer feed has improved downstream mill performance, increasing the maximum throughput rate from 155 to 170 tonnes per hour.”

A comminution crushing and grinding survey completed in October 2023 indicated that the new circuit is around 18 per cent more energy efficient than the previous one.

“Also, we were able to centralise the control room duties, where we now have one operator in one control room, and the crushers run pretty much automatically with extensive CCTV around the circuit,” Freemantle said.

“Previously, the crushers had their own control room, and the operator relied heavily on visual line of site monitoring.”

Safety has also improved considerably with the simpler design, modern instrumentation, and improved automation. The new circuit effectively

At Dredge Robotics we understand that downtime is costly. That’s why we’ve designed a fleet of globally unique dredging robots that can rapidly and thoroughly clean and inspect water assets while they remain in full service.

Designed and built in Australia for the harshest of conditions, our proprietary robotic dredging technology is a genuine game-changer for the mining sector.

Eliminating the need for human entry, these machines allow maintenance tasks to be performed outside of shutdown windows, delivering significant savings and reducing asset downtime.

Extensively proven in the mining industry, our capabilities include:

• Removal of deep compacted mud from process tanks.

• Safe removal of mud, weeds and aquatic plants from lined ponds.

• Operation in corrosive and extreme pH environments (pH 1 to pH 14).

If you’re looking for a smarter way to manage your water assets, contact the friendly team at Dredge Robotics today.

www.dredgerobotics.com.au info@dredgerobotics.com.au +61 8 9418 5753

6 Sphinx Way, Bibra Lake, Perth, WA, 6163

The best business partnerships are the ones that evolve into a genuine friendship.

Such is the case for Lincom Group and Doyle Group’s CAMM Quarries business, companies that have been working together to deliver the ultimate in crushing and screening production for the past 25 years.

So when CAMM needed to increase production and efficiency across its North Queensland operation, the company knew to turn to Lincom to get the job done.

“CAMM needed equipment that was capable of producing higher tonnes per hour,” Lincom area sales manager – North Queensland and PNG Erwin Koch told Australian Mining. “But they wanted to be able to expand their production without going back to the drawing board while also bringing down cost of tonne per hour.”

While other companies may have balked at the task, Lincom took it in stride.

First, Lincom sat down with CAMM to discuss and understand the needs and expected outcomes of the quarry.

Jeffrey Doyle was thrilled with the final result.

Once that was in place, it was time to develop aggregate flow charts to provide theoretical production rates and yields. Then, the upgrades began.

primary jaw crusher on site from the PT400X to the PT600PS; the 1000 Maxtrak cone crushers to the

“With the guidance of Lincom and Powerscreen, we decided that with the introduction of new and larger equipment we could crush more tonnes per hour which consequently reduced

“Consistent reliability and production have been sorted by this modification,” Doyle said. “The aggregate plant may run for three eight-hour days per week rather than the six 10-hour days previously.”

For Koch, a major highlight from

Christmas parties together.”

Turning customers into long-term friends and partners is the bread and butter of Lincom operations because the machinery isn’t forgotten about as soon as it reaches site.

“We need to have ongoing conversations about the machinery,” Koch said. “We don’t just deliver it and then forget it’s there.

“CAMM put a lot of trust in Lincom for this project, and we worked together

“The after-sales support is just as important as the before-sales support. And we get a real kick out of seeing the machines work for our customers and hearing stories about what they have been able to achieve with them.”

For both Lincom and CAMM Quarries, trust isn’t just a word; it’s an ethos that has seen both companies thrive.

“There’s nothing better than helping people achieve their goals,” Koch said. “Watching a client go from an inquiry to a customer to a part of the family never gets old, but you need strong trust in each other to get to that point.”

For CAMM Quarries, which is now regularly achieving a boost in production and a reduction in cost of tonne per hour, the investment in Lincom has been a big success.

“We continually monitor our hourly throughput to ensure feed rates are maintained and machines are running at the optimum,” Doyle said.

“Hourly rates are tracked and communicated to supervisors and plant operators; you would be surprised of the difference this can make in a day.” AM

Australia’s first R 9400 E!

Liebherr-Australia

Scan here to watch now!

Step into the future of mining with Fortescue and Liebherr as they pioneer electrification in Australia's mining industry. Highlighting our groundbreaking partnership and the deployment of Australia’s first electric excavator, the Liebherr R 9400 E.

WITH DECADES OF INDUSTRY KNOWLEDGE AND A DESIRE TO MAKE ITS CUSTOMER’S LIVES EASIER, METSO IS HELPING TO REVOLUTIONISE THE CRUSHING AND SCREENING INDUSTRY.

Alot can happen in a century.

Industries rise and fall, cities transform, and companies like Metso help to reshape the mining industry as we know it.

During the past century, Metso has been at the forefront of crushing applications. From the primary crusher stage down to fine crushing and pebble applications, the company is renowned for its benchmark crushing solutions –and it has no plans of slowing down.

“Metso takes pride in the deep knowledge of our people and our strong customer service commitment,” Metso crusher technology manager –capital equipment Troy Barry told Australian Mining

“In Australia for example, we have an impressive footprint of service locations and experts, including our recently opened Karratha Service Centre, Metso’s largest service centre globally.

“We also have a particularly strong team of crushing experts here in Australia, some with over 30 years of crushing expertise – working closely with our expert global design and engineering teams.”

Having been involved in the industry for as long as it has, Metso

“Metso includes a full digital offering for its XM crusher series, comprised of SmartCone, SmartStation and Mineral Crusher Pilot (MCP) automation,” Barry said.

“We deliver intelligence from the simple connection of our IC (integrated control) system at a local level through to the full connection of the operator’s control suite, and all the way to expert global teams remotely monitoring and evaluating the crusher performance.”

The ability to remotely monitor and evaluate a crusher’s performance allows Metso’s teams to be in constant contact with the machine, able to recommend changes to optimise performance in real time.

“This advanced technology extends the time between maintenance intervals and allows for a more continuous operation,” Barry said.

Recognising that each customer has differing crusher requirements, Metso always adapts its approach to suit.

“Our end targets are always based on the customer’s requirements,” Metso senior manager, crusher technical support Neale Baigent told Australian Mining

“With our chamber optimisation program for instance, each crushing process is unique and feed material properties change over time.

we select optimal alloys, choose or design chamber geometry to maximise wear life and performance.”

The chamber optimisation program is an evolution borne from customer demand, as it’s now also available to non-Metso crushers.

“Based on our results from this program, customers wanted our chamber optimisation also across nonMetso crushers, which is what we now do,” Baigent said.

In terms of evolution, the new poly-cer product, part of Metso’s protective wears portfolio, gives up to

ceramics, reinforced with steel. This ensures both strength and performance,” Baigent said.

“Installation of Poly-Cer is easy and safe, with plug-in, bolt-in installation for most crushers.”

As the company evolves, Metso’s crushing capabilities are always increasing, with the XM series a particular highlight for Barry.

“The entire premise of the XM series is giving the customer the highest performance equipment to achieve optimisation,” he said. “Our up to 25 years warranty protects the customer’s investment and is unheard of in the industry.”

Barry said Metso’s drive to change means it has been able to stay at the forefront of innovation.

“The recently launched XM crusher series combines resilient engineering, unmatched warranties and a new digital package,” he said. “It combines the toughest and most advanced mechanical parts with the latest in digital technologies and automation. And by using the most robust crushers available on the market, the XM series enhanced the Nordberg MP cone crusher and the Superior MKIII primary gyratory with the most extreme duty parts, increasing wear life.”

As Metso looks to the next century, it’s clear this crushing behemoth isn’t slowing down anytime soon.

“As we look to the future, we continue to develop our alloys, product offerings and services,” Baigent said.

“We are always looking to improve and innovate in anticipation of our customers’ needs– after all, the best new developments come from feedback and challenges faced by our customers.”

From CNC machines to robotic arms, MASPRO is using automation to transform our production process, enabling us to consistently deliver superior parts and components for mobile mining machinery with unparalleled efficiency. Our advanced facilities leverage cutting-edge technology to optimise production processes, ensure the highest standards of quality and meet the demands of modern industry.

XCMG’S NEW XPE1215 MOBILE JAW CRUSHER IS POISED TO CHANGE THE GAME IN CRUSHING AND SCREENING.

When it comes to mining and construction machinery, XCMG is a name synonymous with innovation, durability, and excellence.

Leading the charge in the Australian market, XCMG has proudly introduced the XPE1215 mobile jaw crusher, a game-changer in the world of crushing and screening.

Designed for efficiency, reliability, and unmatched performance, the XPE1215 is here to redefine industry standards.

Built for power and precision

At its core, the XPE1215 is engineered to handle the toughest of tasks.

With its impressive jaw capacity, this mobile crusher is equipped to handle large-scale operations, processing substantial volumes of material with ease.

Whether it’s mining, construction debris, or quarrying, the XPE1215 tackles the job head-on, ensuring maximum productivity on every project.

Key specifications:

• Jaw size: Optimised for high-capacity throughput, reducing downtime and increasing efficiency

• Motor power: Enhanced motor systems ensure smooth operation, even under heavy load conditions

• Mobility : Designed for rapid deployment and ease of transport, this crusher adapts seamlessly to diverse terrains and work sites.

the XPE1215 leads

The XPE1215 isn’t just another mobile jaw crusher; it’s a class apart. Here’s why the XPE1215 is a premium option:

• Innovative design: Incorporating advanced engineering, the XPE1215 boasts a user-friendly interface, making operations straightforward and efficient. Maintenance has never been easier, thanks to its accessible design and quick-service capabilities.

• Energy efficiency: Sustainability is at the heart of XCMG’s innovations. The XPE1215 reduces energy consumption without compromising performance, helping operators achieve cost savings and meet environmental goals.

• Durability under pressure: Built with high-quality materials, this crusher is made to withstand Australia’s harshest conditions. From searing heat to rugged terrains, the XPE1215 remains reliable, ensuring years of dependable service.

• Precision and consistency: The crusher’s advanced jaw technology delivers uniform particle sizes, enhancing the quality of the output.

While the XPE1215 takes centre stage, there’s much more to come from XCMG.

XCMG is gearing up to redefine the crushing and screening industry, with an expanded lineup of advanced machinery set to debut in 2025.

These forthcoming innovations are not only tailored to meet the specific demands of the Australian mining and construction landscape but are also engineered with global best practices in mind, ensuring they deliver superior performance, durability, and efficiency.

XCMG’s commitment to innovation means these new models will incorporate advanced automation, improved energy efficiency, and enhanced material handling

capabilities to support operations of all sizes.

Whether tackling challenging terrain or increased throughput in highdemand environments, XCMG’s 2025 lineup promises to push boundaries and set new benchmarks in crushing and screening technology.

Crushing it with XCMG

The XCMG XPE1215 mobile jaw crusher is not just a piece of equipment – it’s a statement. It’s a declaration that XCMG is here to push the boundaries of what’s possible in mining and construction machinery.

As the industry look towards 2025, XCMG’s commitment to excellence ensures the future of crushing and screening is brighter than ever. AM

We are now better equipped than ever to help you to optimise your comminution and material handling operations for maximum performance, safety and efficiency. Our industry leading expertise in crushing, screening, feeding, loading and wear protection allows us to bring you an unrivalled equipment line-up. We underpin this unique offering with our expert process knowledge, full range of digital tools, high quality OEM spare parts, consumables and life-cycle services.

Scan the QR code to discover why we are the industry’s partner in eco-efficient mineral processing.

MAX PLANT HAS REVOLUTIONISED THE AUSTRALIAN MINING INDUSTRY BY DELIVERING TAILORED MINERAL PROCESSING SOLUTIONS THAT PRIORITISE SPEED, FLEXIBILITY AND PROFITABILITY.

Australian mining companies are constantly looking for more efficient, cost-effective solutions with quick turnaround times to commence or expand their operations.

This is particularly the case with mineral processing operations.

Enter MAX Plant, an Australian business with a reputation for providing tailored solutions designed to meet the unique needs of the Australian mining sector.

These solutions enable operational readiness and revenue generation faster than traditional mineral processing plants.

MAX Plant was founded in 2006 by Craig Pedley, who built the business by listening to customers’ needs and creating tailored solutions. Over the years, it has grown into the global business it is today.

“Our focus is on delivering maximum flexibility, maximum profitability, maximum ease of setup, and maximum time saved for our customers. That’s where the MAX Plant name originated,” Pedley said.

In 2006, while tendering for a project, a valued customer in the Murchison region of WA faced short project deadlines and tight material specifications.

The company approached MAX Plant to design, manufacture and install a modular mineral processing plant to handle its iron ore mineral processing needs, resulting in the creation of the very first MAX Plant.

“This project laid the foundations for a strong and lasting relationship with our first customer, that continues to this day,” Pedley said.

“Over time, we’ve developed a comprehensive range of MAX Plant equipment that significantly reduces the time from design to dirt on the ground.

“Our library now boasts thousands of machines we’ve designed, manufactured and installed, enabling us to create the perfect plant for each project and tailor it specifically to the needs of each client.

“Our ability to deliver within tight timeframes is reinforced by being a family-owned business with manufacturing in Western Australia.”

Through his decades of experience in the mining industry, Pedley understands that relationships are critical to the success of any business.

“Relationships last forever if it’s a win–win for both sides,” he said.

A business which started with Pedley listening closely to customer needs has gone global, serving the needs of mining and quarrying industries in Australia and beyond.

MAX Plant prides itself on selling solutions, not equipment. As an original equipment manufacturer (OEM), the company works with customers to design a solution for their project, before then manufacturing and installing it.

But MAX Plant is not your average OEM, offering comprehensive end-toend solutions that position the company as a project partner, focusing on delivering tailored, turnkey solutions.

Partnering with MAX Plant makes clients feel they have a trusted partner by their side – a mineral processing expert that can attend to any of their needs.

MAX Plant is known for its agility, offering solutions that adapt to any process. This means MAX Plant equipment can be reconfigured as a project evolves, whether a customer is processing single materials, needs a fullscale operation for a range of material sizes, or needs to move its plant between several sites.

This is all part of MAX Plant being a family business, where employees are celebrated and looked after.

“You can’t build a company by yourself,” Pedley said. “MAX Plant has been built around the people that work in and for the company. That’s not just your employees but your suppliers and your customers – it’s the whole package that must go together.”

MAX Plant general manager Michael Colvin echoed Pedley’s sentiments.

“The design process is at the heart of what we do,” he said. “Our talented team places a strong emphasis on understanding the customer’s vision and project requirements. From there, we

“Being part of that journey, from concept to completion, is truly inspiring.”

Over the years, MAX Plant has become a trusted leader in designing, manufacturing, and installing modular and mobile mineral processing plants. This includes crushing and screening, feeders, rock breakers, conveyor systems, heap leaching, sampling systems, eco mixes, electric-powered mobile crushers and screens, dust suppression solutions, plant lighting, and the list goes on.

These solutions are the result of MAX Plant’s dedication and expertise, working collaboratively to transform customer visions into reality.

This spirit of teamwork and

As they have been for nearly a century, Cat ® Dozers are built with you in mind — and today’s Large Dozers are no exception. Leveraging a design philosophy focused on addressing your challenges, Cat D9, D10 and D11 dozers are built to Go The Distance — again and again.

You need a dozer that is reliable and available.

So, we increased uptime by extending oil change and fluid intervals, and by using all Cat components that work together to deliver high availability.

You need a dozer that is easy to service.

So, we added enhancements like easy-access radiator cleanout doors, replaceable push-arm bearing inserts and a single plane cooling system, which reduces maintenance downtime. And when it’s time for service, the global Cat dealer network provides expertise plus fast and efficient parts fulfillment.

You need a dozer that is fuel efficient.

So, we incorporated features like the new stator clutch torque converter, which boosts efficiency and reduces fuel usage. High-horsepower reverse speeds up non-productive traveling to reduce cycle time, while load-sensing hydraulics are more efficient than the previous system.

You need a dozer that can go the distance.

So, Cat dozers are infused with features that extend component lives and deliver longer undercarriage life. They deliver maximum productivity and long life through multiple rebuilds — for a low total cost of ownership.

Rapid Crushing & Screening Contractors, one of Australia’s premier mining services companies, has inspired innovation in the crushing and screening sector for the better part of 50 years.

Rapid’s modular and mobile plants have proven themselves in refining a wide array of commodities, from iron ore and gold to lithium and other critical minerals, with the company’s client base boasting several Tier 1 miners.

This includes the Greenbushes lithium mine in southern Western Australia, the world’s largest hard-rock lithium mine.

The company’s extensive expertise and adaptable crushing and screening solutions have been instrumental in meeting Greenbushes’ demanding production requirements.

Utilising its fleet of mobile and fixed plants, Rapid has tailored its services to align with Greenbushes’ high output. This includes handling the crushing of spodumene ore to precise specifications, ensuring a seamless feed into downstream processing circuits.

Rapid’s advanced crushing and screening technologies have enabled the company to effectively address fluctuations in production needs.

Additionally, Rapid’s focus on reliability and its ability to provide on-site support have been critical in maintaining Greenbushes’ productivity.

This partnership underscores Rapid’s ability to support large-scale mining

projects through specialised, scalable solutions, whether a client requires one part of a circuit or an end-to-end crushing and screening solution.

Rapid also has a strong track record in the Pilbara, recently working with Pilbara Minerals at its flagship Pilgangoora lithium mine.

In May 2024, Rapid delivered a crushing and screening infrastructure package to Pilgangoora, which will support Pilbara Minerals with a large pipeline of expansion projects.

Rapid’s competitive edge lies in its ability to design and implement solutions tailored to individual project needs, with the company constantly evolving its crushing and screening capabilities, delivering fast, mobile setups that can be easily relocated, reducing project lead times.

Rapid predominantly runs Metsobased crushers across its operations, including the Jonnson L160, one of the world’s largest mobile jaw crushers.

Weighing over 190 tonnes, the Jonnson L160 is used as the primary jaw crusher at many mine sites across Australia.

Rapid also has an extensive fleet of cone crushers with most tracked units based on Metso’s HP300 or HP400 machines.

Machinery is at times designed, manufactured and maintained by Rapid’s in-house manufacturing company, Irvine Engineering. This enables Rapid to safeguard the quality of its materials and workmanship, as well as the reliability of supply.

This strategic partnership not only ensures the highest standards of performance and durability but also reinforces Rapid’s commitment to delivering exceptional value and customer satisfaction.

Rapid’s solutions have proven especially critical in remote mining regions where key infrastructure is limited and operational challenges abound.

Safety and environmental responsibility are cornerstones of Rapid’s operations, with crushing and screening processes often posing mechanical hazards, dust issues and environmental risks.

Rapid addresses these challenges

Additionally, Rapid has an unyielding focus on safety, regularly auditing its systems and providing comprehensive training to its team.

Rapid’s approach aligns with the broader goals of the Australian mining sector, which increasingly prioritises sustainability and environmental stewardship. The company’s emphasis on compliance and innovation reinforces its standing as a responsible contractor.

As the mining industry continues to evolve amid the clean-energy transition, the demand for premium crushing and screening solutions is expected to grow.

Rapid is well-positioned to meet these needs, leveraging its decades of experience to deliver tailored, innovative,

MAXIMUM PAYLOAD. LONGER ASSET LIFE

The Schlam Hercules open-cut haul truck body continues to improve the payload capacity of all classes of haul trucks operating in hard rock mines across the world.

Engineered to meet the specific challenges of hard rock mining, the unique Hercules curved design offers a lighter body, combined with outstanding strength and durability.

As we grow, we remain committed to exceeding our customers’ expectations - with a network of manufacturing hubs and service centres, consistently delivering products built to our exacting quality and safety standards.

Maximise your payload productivity with the Schlam Hercules dump body.

schlam.com/hercules

THERE ARE SEVERAL FACTORS THAT MUST BE CONSIDERED WHEN SELECTING SCREENING EQUIPMENT FOR A MINING OPERATION.

Choosing the right screening equipment is essential for mining operations looking to optimise efficiency, enhance material quality, and meet production targets.

Screening equipment isn’t a one-sizefits-all solution; every operation has unique requirements, and understanding these needs is critical to selecting the most suitable machine.

Asking the right questions can help ensure the equipment meets operational demands and delivers long-term value.

Here are eight key factors to consider when selecting and sizing screening equipment.

The cornerstone of equipment selection is understanding the volume of material to be processed, typically measured in tonnes per hour (tph). Manufacturers rely on this figure to recommend appropriately sized equipment.

Matching the equipment to the operation’s capacity ensures efficiency and minimises downtime. Overestimating or underestimating throughput can lead to unnecessary wear or underperformance.

A detailed particle size distribution is fundamental to selecting the right screening equipment as it defines the size range of materials that need to be separated.

This data includes the proportions of particles above, below, and near the desired cut point, as well as the maximum particle size in the feed stream.

Supplying accurate information ensures manufacturers can recommend equipment that meets the specific needs of the application, addressing not only the required separation but also factors like operational variability.

Providing details on oversize and halfsize particles relative to the cut point is especially beneficial as it gives a more comprehensive view of the feed material. This allows manufacturers to optimise equipment design and ensure consistent performance, delivering a solution tailored to the operation’s requirements.

Understanding material density allows manufacturers to account for factors like material flow characteristics and

value under real-world conditions.

Moisture level of feed material

Moisture content is a key factor in screening performance, particularly for finer particles. High moisture levels can affect material flow and screening efficiency, causing clogging or sticking that can disrupt operations.

Understanding the moisture content of the feed material allows manufacturers to account for these variables when recommending equipment, ensuring optimal performance and consistent throughput.

cut points are required

Whether the goal is a single separation or multiple, understanding cut point requirements is essential.

Some operations may require straightforward separations, while others require more complex configurations to meet their production goals.

Equipment such as vibrating screens and rotary trommels can be designed to accommodate various cut points, ensuring precise particle size separations tailored to specific needs.

No screening device is 100 per cent efficient, but understanding the acceptable level of efficiency for a given application is critical. Pre-crusher screens, for example, may prioritise throughput over precision, while classifying screens for finished products demand higher efficiency.

There’s a world of difference between 80 per cent and 95 per cent efficiency, so it’s important to ensure the right balance of performance and cost.

Certain additional features can be crucial in meeting specific operational needs and improving screening efficiency.

For example, water spray systems can be used to wash material for a cleaner separation, while specialised drive mechanisms enhance performance and help minimise wear.

Other options, such as screen heating and ball tray decks, can further support the production of cleaner products.

Communicating these requirements allows manufacturers to recommend the most appropriate equipment tailored to your operational goals and challenges.

open area, which can affect the size of the screening unit. It can also affect the number of decks on a vibrating unit or the diameter and length of a trommel.

Previous experiences with specific media types may inform your preference, but consulting with a manufacturer can help ensure the most effective choice for your application.

Partnering with an experienced manufacturer is important when selecting screening equipment. McLanahan, for example, brings 190 years of experience designing and manufacturing screening solutions for mining operations worldwide.

Even if you’re not an expert, a trusted manufacturer can guide you, and by answering these eight questions, you equip them with the insights needed to recommend the best solution for your application.

As mining operations continue to seek greater efficiencies, investing time in understanding screening needs upfront can yield significant longterm benefits. AM

artin’s energy-efficient electric, pneumatic and hydraulic vibrators are ideal for a wide range of bulk material processing applications, including: conveying, screening, product sizing, draining, compaction, dewatering — plus bin, hopper, chute, and railcar evacuation.

Our Screen Vibrators are designed for separating rock and gravel, silica and sand, plus a variety of other bulk materials. These electric vibrators serve as a direct retrofit for Derrick® screen shakers and require no modifications or adapters. All Martin vibrators are constructed with the highest quality housings and internal components for dust-tight, water-tight IP66 protection.

AUSTRALIAN MINING TAKES A LOOK AT GENESIS MINERALS’ PLANS TO BECOME A LEADING GOLD PRODUCER IN 2025.

While other commodities felt the sting of faltering prices in 2024, the gold price remained high and consistent.

From October 2023, the precious metal traded above the $US1900 ($3056) per ounce (oz) mark for almost six consecutive months, reaching $US2400/ oz for the first time in April 2024.

The price continued to increase steadily throughout the rest of 2024, regularly notching new records.

These market conditions have been welcomed by Genesis Minerals, a Western Australian gold producer with operations across the state’s two premier gold districts: Leonora and Laverton.

Genesis’ producing assets include the Admiral, Ulysses and Gwalia operations, all situated in Leonora. The company acquired the Gwalia gold mine from St Barbara in July 2023 in what Genesis described as the creation of “a leading Australian gold house”.

Genesis continued its inorganic growth by acquiring Patronus Resources’ Bruno-Lewis and Raeside gold projects in Laverton and the remaining 20 per cent in Dacian Gold, both of

which will allow the company to ramp up production and deliver new ore sources to feed both the Leonora and Laverton mills.

“From what was essentially a concept three years ago based on an ‘open for business’ strategy in the Leonora district, (Genesis managing director) Raleigh Finlayson and his team have successfully executed a series of acquisitions and developed assets to create a gold producer with growing significance,” Genesis non-executive chairman Anthony Kiernan said in November 2024.

“Following the acquisition of St Barbara’s Leonora gold assets in late FY23 (the 2022–23 financial year), the company delivered strong gold production from the Gwalia underground mine, reflecting the implementation of several improvement projects to enhance operational efficiency.”

The five-year plan Genesis’ five-year plan spans from the beginning of FY25 until FY29.

The strategy will see Genesis increase gold production over the five-year period from 140,000oz in FY24 to 325,000oz in FY29.

Genesis unveiled its five-year strategic plan in March 2024, with the company targeting 1.3 million ounces (Moz) of total gold production up to FY29.

Australian Mining breaks down what this plan entails, what Genesis has achieved so far, and what it aims to accomplish in 2025.

The company hopes to maintain an average production profile of 335,000oz per annum from FY29.

As part of this plan, Genesis has already met its FY24 production guidance of 130,000–140,000oz. It’s also positioned to achieve its FY25 guidance of 190,000–210,000oz.

“The new Admiral open pit was brought online following declaring commercial production from Admiral in May this year,” Kiernan said.

“We also cut the portal at our new shallow Ulysses underground mine, with current development rates boding well for fast-approaching production. This saw Genesis achieve the mid-point of our production guidance for FY24, delivering 134,451oz of gold at an all-in sustaining cost of $2356/oz.

“Importantly, this was achieved with a very strong safety record, including zero lost-time injuries.”

Genesis’ strategy is bolstered by its 15.2Moz in mineral resources and 3.3Moz in ore reserves, with the amount of ore reserves providing the company with a potential 10-year production outlook.

“It is clear we now have the reserve to underwrite our future as a major ASX gold producer with annual production of 300,000oz per annum and more,” Finlayson said in March 2024.

“We also have long mine life and operational diversity on both the mining and processing fronts.

“Importantly, these new robust models show there is huge scope for ongoing growth in the inventory and forecast production rates, with mineralisation open across the assets and drilling continuing to return exceptional results.”

In September 2024, Genesis brought forward the restart of its Laverton mill by six months to capitalise on strong gold prices.

The Laverton mill officially restarted in October, allowing Genesis to increase its FY25 production outlook to 190,000–210,000oz at a reduced allin sustaining cost (AISC) of $2200–2400/oz.

The restart coincided with Genesis producing 36,020oz at an AISC of $2628/oz during the September 2024 quarter, a steady increase from the 34,617oz produced in the June quarter and 30,473oz produced in the March quarter.

Genesis viewed the early Laverton mill restart as the first step of its fiveyear growth strategy.

“This early restart at Laverton has very positive implications for our fiveyear plan, opening up the potential to achieve our 2029 production target of 325,000 ounces per annum ahead of schedule, and supporting our longerterm aspirational production goal of increasing production to 400,000oz per year,” Kiernan said.

Genesis is also growing its operations through drilling programs at Gwalia and Admiral, both of which have delivered strong assays and, according to Finlayson, demonstrate the scope to steadily convert resources to reserves.

“This will make our mine plans even more robust, paving the way for higher mined grades and increased mining rates, all of which will help accelerate the planned organic growth to 325,000oz and beyond,” Finlayson said in November 2024.

To keep its operational momentum going, Genesis will accelerate underground development at the Ulysses gold mine.

company cut the portal in the March 2024 quarter and production is expected to begin soon.

Genesis will also complete early development works and open pit and underground optimisation studies at Tower Hill, extensional drilling and underground studies at Hub, and reevaluate Westralia as a bulk open pit opportunity.

“Our confidence in the company’s ability to meet its targets is underpinned in part by the significant benefits derived from our in-house mining services

division, Genesis Mining Services,” Kiernan said.

“Our in-house mining division and the quality of its personnel provides certainty, operational flexibility and efficiency in our day-to-day business, and is central to ensuring we have the skills and experience when and where they are required.”

Driven by an ambitious ‘ASPIRE 400’ (accountable, sustainable, people first, integrity, results and empower) vision, Genesis is poised to strengthen its position as a leading gold producer in 2025.

“The achievements of the past year have been excellent,” Kiernan said.

“Our management team, staff and contract partners have worked diligently to deliver safe production increases, effective and successful asset acquisition and a pipeline of growth opportunities … we have laid the foundations for a high-quality ASX gold producer offering both scale and growth.”

Genesis Minerals’ ascent has seen it join the upper echelons of the ASX, entering the same territory as Perseus Mining and De Grey Mining, which is set to be acquired by Northern Star. AM

MINING TRANSACTIONS, WHICH TOTALLED $27 BILLION IN FY24, ARE SHAPING COMPANY STRATEGIES.

IN AN EVER-CHANGING AND EVOLVING LANDSCAPE, HOW DOES THE AUSTRALIAN MINING INDUSTRY TACKLE GROWING COMPETITION AND INCREASING PRESSURES TO DECARBONISE?

BHP president Australia Geraldine Slattery has painted the current mining landscape in Australia as being at a defining moment.

Speaking at the QUT Business Leaders Forum in November, Slattery said Australia “sits at a crossroads” amid strengthening global competition.

“Competition grows globally,” she said. “The developing world is full of innovation. There is an abundance of investment capital in every region. Emerging countries are investing in the skills and capabilities of their own people. Europe, the US, and Australia all face new competition.

“And then there are the business headwinds: inflation, labour shortages, economic uncertainty, threats to shipping routes, (and) regulatory barriers in every industry.

“All this amounts to a world that is harder – not easier – to navigate. A world where even decades of past growth and success can no longer be taken for granted.”

However, there is work that can be done to maximise investment and activity in the modern mining world.

According to PwC national mining leader Marc Upcroft, it starts by achieving alignment between key stakeholders – even if it is challenging.

“It’s hard to get all of them lined up,” he said. “Even if they are, the next challenge will be to keep them aligned.”

For Upcroft, the most pressing alignments include mining companies and markets, government support, and global economic stability.

“Getting the government properly in a zone of long-term, genuine support and creating the right environment for economic activity generally is critical,” he said.

Deal alignment in a changing market

The surge in mining transactions, which totalled $27 billion in the 2023–24 financial year (FY24), has been a major factor shaping company strategies.

Upcroft noted the growing trend of large-scale deals transforming

companies as part of their strategic planning. However, aligning buyer and seller expectations remains a challenge, particularly in commodities like lithium and coal.

“The lithium market has been through a turbulent period, with prices skyrocketing and then falling sharply,”

Upcroft said.

“This has taken confidence out of the buyer side, though we are starting to see some transactions happen again.”

On the topic of coal, Upcroft pointed out the limited pool of potential buyers, especially given the trend of motivated sellers realigning portfolios.

“There’s always a healthy gap between what the seller is trying to achieve and the buyer’s goal to capitalise on a lower price,” he said.

The mining sector’s role in the energy transition has placed new pressures on companies to decarbonise operations while maintaining financial and operational stability.

Upcroft acknowledged the difficulty of balancing these competing demands.