Engineering, Construction & Maintenance WATER | SEWER | ELECTRICITY | GAS | NBN www.utilitymagazine.com.au Issue #6, May 2015

MEETING THE CHALLENGES

MICROTUNNELLING RULE BOOK REWRITING THE OF THE MOD ER N NE TWORK PAT McCAFFERTY INSPECTING ASSETS FROM THE INSIDE RECYCLING TALKS WATER

10ML Recycled Water Storage Facility

Cranbourne South, Victoria

Completed: April 2015

Comdain is a leading national infrastructure engineering and asset management services business specialising in the Water, Gas and Irrigation sectors.

6 Program & project planning, management and consultation.

6 Design - Concept and detailed.

6 Construction - Pipelines, pump stations, treatment plants, pressure control facilities, metering and storages.

6 Operations & Maintenance - Civil, mechanical and electrical.

6 Control & Monitor - SCADA and telemetry.

Intelligent Doers, Dependable Delivery comdaininfrastructure.com.au

Will your plant and operations survive a cyber attack?

E

ver ywhere it ma t ters , we de liver

RISK MANAGEMENT

Discover and remediate security gaps in your critical systems before an attack occurs

COST- EFFECTIVE SOLUTIONS

Practical, cost-effective treatment of cyber threats benchmarked against your industry

OPERATIONAL RESILIENCE

Strengthen organisational security and resilience so you can maintain availability

PROTECT REPUTATION

Protect your organisation’s reputation and compliance by managing your security risks

PLAN FOR THE FUTURE

Get actionable intelligence on the state of your organisation’s security so you can plan for the future

Will your plant and operations survive a cyber-attack?

With the cost of cybercrime now exceeding AUD 2 billion and affecting over 50% of Australian organisations, traditional IT defences will not protect your operations from a cyber-attack. Avoid becoming part of the statistic. Thales’s vulnerability assessment service is helping utility providers understand the real risk of cyber-attack and how to position themselves to handle the added security challenges of merging operational and information technology environments. Supported by over 40 years experience, Thales delivers cyber security solutions used by 90% of the world’s largest global banks to give you a solution the world already trusts. With security in our DNA, Thales products, services and solutions provide you with the information, services, equipment and control needed to understand the threats your business faces so that we can commit to delivering the results you need, whatever it takes. Call us. Get started 1800 ALL CYBER or by email cybersecurity@thalesgroup.com.au

BUSINESS CONTINUITY

Identify single points of failure to ensure your business continuity

thalesgroup.com.au

TFROM THE EDITOR

he Federal Government’s Energy White Paper has been released, providing clarity on the government’s focus for the industry in the years to come. It has mostly been good news for utilities in the electricity and gas space, with the privatisation of electricity assets and the introduction of cost-reflective tariffs, two major reforms that have been welcomed by the industry.

The concept of domestic gas reservation was also shut down, much to the relief of many operating in this market - most of whom have long maintained that the fundamentals of free markets should be the guiding principles to solve our domestic gas supply issues, as opposed to market intervention.

It’s an exciting time for anybody working in the energy industry, and the dynamics of the market change from week to week. Soon we’ll be able to provide all consumers with detailed energy usage information, drilling down to the costs associated with various household appliances at specific times. Consumers will be able to use this information to better manage costs, and utilities will be able to use this information to incentivise customers to manage demand in the network.

At the same time, solar storage technologies are being embraced for the benefits they will be able to offer in managing demand, as loads on our network are immense.

The evolution of the energy industry has provided us with somewhat of a ‘theme’ for this issue of Utility. Two of the global technology buzzwords of recent times, the Internet of Things (IoT) and Machine-to-Machine (M2M) technology are presenting exciting opportunities to utilities. In this issue we look at how utilities can benefit from M2M and IoT technologies - and consider the consequences for those who don’t innovate quickly enough.

We also look at recent innovations in recycled water and its uses; the evolution of mapping and GIS technology within utilities; and advances in CCTV for the condition assessment of underground assets.

Further upstream, the exploration and production of oil and gas in Australia continues to evolve, with the sector increasingly investigating unconventional sources of oil and gas for domestic and export markets. To represent this burgeoning industry, we’ve launched a new publication, Unconventional Oil & Gas. Monkey Media will be launching this new magazine, and showcasing this edition of Utility, at the APPEA conference in Melbourne from May 17-20. If you’re at the show, make sure to pop past Booth 336 to catch up with the Monkey Media team. If you can’t make it, you can check it out at www.unconventionaloilandgas.com.au.

Chris Bland Publisher and Editor

Publisher and Editor Chris Bland Managing Editor Laura Harvey Associate Editor Michelle Goldsmith Marketing Director Amanda Kennedy Marketing Consultants Aaron White Cynthia Lim Creative Director Sandy Noke Graphic Designer Alejandro Molano Monkey Media Enterprises

Box

ABN: 36 426 734 954 PO

3121 Ivanhoe North VIC 3079 P: (03) 9440 5721

2203-2797 Published by Cover image shows an AusNet Services employee maintaining part of the utility’s extensive network of assets.

F: (03) 8456 6720 monkeymedia.com.au info@monkeymedia.com.au utilitymagazine.com.au info@utilitymagazine.com.au ISSN:

ISSUE 6 Engineering, Construction & Maintenance WATER SEWER ELECTRICITY GAS NBN www.utilitymagazine.com.au Issue #6, May 2015 UTILITY MAGAZINE MAY 2015 MEETING THE CHALLENGES MICROTUNNELLING RULE BOOK REWRITING THE OF THE MODERN NETWORK PAT McCAFFERTY INSPECTING ASSETS FROM THE INSIDE RECYCLING Austeck pleased announce its partnership with German pioneer Kummert GmbH and the introduction the Kummert crawler into Australia Free Call 1800 287 835 austeck.com CRAWLER EVER NEED... F-200 130mm – 1500mm TALKS WATER

REDUCE YOUR MUD AND HANDLING COSTS WITH THE THUNDERSTORM 1

MUD CLEANING SYSTEM.

The Thunderstorm 1 features a lined 5,700 litre split tank with three 12.7 cm (5 inch) cones and three oilfield type screens on double linear motion shakers, offering a cleaning capacity of up to 454 litres per minute (120 GPM).

Developed by industry leaders Sharewell HDD and supported by Vermeer’s Australian dealer network, you can count on the Thunderstorm 1 to extend your uptime and bring productivity and profit to your gas, water and sewer projects.

More drilling, less waiting

Mud cleaning efficiency

More drilling, less waiting

Mud cleaning efficiency

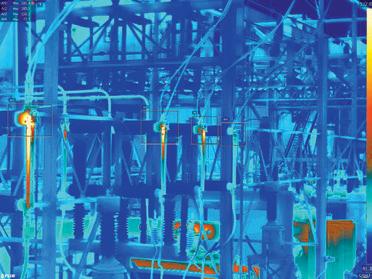

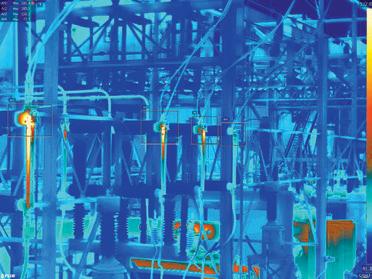

Vermeer and the Vermeer logo are trademarks of Vermeer Manufacturing Company in the United States and / or other countries. © 2015 Vermeer Australia. All Rights Reserved.

VermeerAustralia

THUNDERSTORM® 1 BY SHAREWELL HDD

Small footprint

THUNDERSTORM ® 1 BY SHAREWELL HDD. GET EQUIPPED. /

WWW.VERMEER.COM.AU | 1300 VERMEER WWW.VERMEERWA.COM.AU | 1800 195 558 (WA & NT) INTRODUCING THE

MANAGE MUD. MAXIMISE MARGIN

Lined tanks for longevity

COAL SEAM GAS

Managing CSG water: extracting benefits from by-products.......... 33

The challenge of managing the water that is a by-product of the coal seam gas production process has been a major consideration for all of the major CSG-LNG projects currently underway in Queensland. Together with SunWater, the QCLNG project has developed a unique solution which allows produced water

David Leitch spends his days analysing trends in utility markets, and forecasting the impacts of new technologies on the sector. Here, he shares his thoughts on how the energy sector will respond to the challenges new technologies, such as solar and storage, present those who manage networks and distribution.

6 20 30 33 MAPPING, GIS & SURVEYING GIS: The future of asset management 20

Bormann

to

Water staff interact with the GIS, and its important

in the future of utility asset management. Surveying as easy as X,Y,Z ......... 24 Developing confidence in underground asset data 26

Senior Asset Information Analyst John

spoke

us about how SA

place

to be

to

36 38 WATER PIPELINES Modernising a rural water network 36 ENERGY

The changing face of energy networks

38

put

use in the community.

NETWORKS

......................

MICROTUNNELLING Rewriting the microtunnelling rulebook 30 Tunnelling through installation challenges.................................... 32 64 M2M Connecting the utility information dots 64 68 PROJECTS Harbouring a connection 68 70 WATER RECYCLING Are we ready? 70 74 STORAGE Energy storage and the grid 74 CONTENTS

48 55 CCTV, CONDITION ASSESSMENT AND INSPECTION Why arm crews with thermal imaging cameras? ....................... 55 CCTV leads to best practice asset management 56 Making the most of mobile CCTV ................................ 60 A better perspective: inspection for utility assets 62 ISSUE 6 7 41 DEMAND MANAGEMENT Incentivising innovation, encouraging demand management ................................ 41 Peak versus average demand loads: managing the load 44 The evolution of distribution transformer monitoring ............. 47 AusNet Services .......................... 78 In each issue Editor’s welcome ................................................. 4 A word from the ENA .......................................... 8 News briefs ......................................................... 12 Advertisers’ index .............................................. 88 Editorial schedule .............................................. 88 Utility magazine is bringing together experts on various fields to answer all your questions UTILITY IN PROFILE 86 78 i SMART METERS Smart meter data: the only limit is your imagination ................................. 48 As utilities around the world continue the adoption of smart metering technologies, Australian utilities need to keep pace or run the risk of falling seriously behind. The key ingredient for a truly smart water metering system 52 82 NBN Adding to the mix 82

A WORD FROM THE ENA

JOHN BRADLEY CHIEF EXECUTIVE OFFICER – ENERGY NETWORKS ASSOCIATION

Utility professionals know how hard it can be to capture the public imagination when it comes to infrastructure regulation, planning and asset management.

As American comedian John Oliver, the host of Last Week Tonight, said recently: “The problem is when our infrastructure is not being destroyed by robots and/or saved by Bruce Willis, we tend to find it a bit boring.” Oliver bemoaned America’s lack of interest in an infrastructure maintenance backlog, wondering if it was because “no one has made a blockbuster movie about the importance of routine maintenance and repair”. His own movie trailer, complete with A-list actors, is worth googling, if only for the tagline, “Infrastructure: if anything exciting happens, we’ve done it wrong”.

There is a lot at stake. Australia’s utility industry provides essential public infrastructure that is the backbone of economic development, social cohesion and community services. Our electricity and downstream gas sectors contribute $24 billion to Australia’s GDP each year, enabled by almost one million kilometres of electricity network and 80,000km of gas pipelines.

Internationally, the Australian institutional and regulatory framework for energy has been well regarded, benefiting from transparent and independent institutions; evidence-based economic regulation without political influence; and a separate rule-making authority in the form of the Australian Energy Market Commission (AEMC). With some interruptions, Australia has maintained reasonably bipartisan support for competitive markets, prudent deregulation, and private capital investment which relies on investment certainty and low levels of sovereign risk. It must also rank as one of the most constantly reviewed regimes in the world. A strength of the regime is that it has clear procedures for evaluating policy and regulatory changes by the AEMC and the Council of Australian Governments (COAG) Energy Council. At times though, the succession of

overlapping reviews has resembled Trotsky’s dream of ‘permanent revolution’ – particularly in an industry which has five-year regulatory cycles and 50-year asset lives.

Australia has seen 17 major regulatory reviews in the energy network sector since 2010, including not only fundamental changes to electricity rules and guidelines by the responsible agencies but two Senate Committee inquiries, a Productivity Commission review and independent panels on key elements of regulation.

The incredible disruption in energy supply chains caused by technology, energy use and new markets will require policy and regulatory reforms that harness, and stimulate innovation. These trends are not only disrupting the business model of energy networks and other service providers – they are challenging policy and rule-making institutions like the AEMC and the COAG itself, the Australian Energy Regulator (AER) and Australian Energy Market Operator (AEMO).

Energy market governance will soon come under the spotlight in the longplanned review for energy ministers chaired by Dr Michael Vertigan AC, Euan Morton and Professor George Yarrow. It’s an important opportunity to ensure Australia’s energy institutions are fit for the disruptive challenges to come. These institutions will be influential in removing barriers to innovation in both new markets and in regulated services. They will also determine if Australia maintains investor confidence essential in an industry that remains capital intensive under all future scenarios.

Consumers have a direct interest in maintaining a stable investment environment for network infrastructure simply because it means a lower bill. Ongoing network infrastructure investment remains fundamental even in the most decentralised energy futures assessed by the CSIRO and others. A recent University of Sydney study by Khalilpour and Vassallo has again confirmed that widespread disconnection is not realistic in the

future, even with falling technology costs, because of the value the grid provides to customers with distributed energy resources.

In this dynamic environment, a first priority for the Governance Review will be to preserve, in the AEMC, the capacity to provide a clear, coherent vision for energy reform, which is reflected with sufficient clarity in a rules framework supporting investment. In turn, AER and AEMO should be positioned to perform their distinct, complementary roles in applying the rules and implementing reform, rather than being expected to confront fundamental market design or competition policy issues in a reactive manner, responding to market trends.

Of course, if energy policy makers are scrambling to rethink policy and regulatory frameworks in the face of disruption, then they are certainly not alone. The Harper Review of Competition Policy released in March highlights that new services like Uber are not only disrupting the traditional taxi service but challenge conventions on what consumer protections are sought, or needed, by informed, consenting customers.

The ENA supports a consistent, principles-based approach to regulation of new business models, which avoids creating unnecessary barriers to entry and ensures a level playing field for providers of equivalent services. Consumer protection frameworks will require review to ensure they remain fit-for-purpose in the face of new sales models for solar, storage or other services. Not only do such services change the physical and financial features of a customer’s energy supply, the extent of choice itself may permit a re-evaluation of the need for consumer protection for consenting customers.

See our website www.ena.asn.au for recent submissions on The Regulation of New Products and Services and the publication, Evolving a Future Ready Regulatory Framework.

8

Contract Management Solutions for Utilities

Contracts repository

Strategic sourcing

Contractor management

Business process workflow

Capital program management

Payment management

The preferred choice for many of Australia’s utilities companies, extract more value out of your agreements while reducing risk and increasing compliance. A comprehensive suite of contract and contractor management modules in Open Windows CONTRACTS ensure that the contracts being signed are the contracts being delivered.

Modules include tender management, KPI management, payment and variation management, insurance management, risk determination and mitigation, as well as program management tools and external CONTRACTS Portal. Open Windows CONTRACTS can be integrated with your ERP, document management and financial management systems.

openwindows.com.au

THE CHANGING FACE OF UTILITY OWNERSHIP AND MANAGEMENT

As the energy industry continues to undergo major changes, the ENA is bringing together key stakeholders to discuss how we can best manage and adapt to the changes that are currently sweeping through the industry.

Globally, energy businesses are responding to the disruptive potential of a range of converging forces and energy networks, from electricity to gas, are evolving to meet significant shifts in regulation, technology and consumer expectation.

While operating in a dynamic new environment of prosumers and distributed energy resources, home automation, energy efficiency, falling demand, and increased consumer engagement on price and technology, the centralised energy grid remains responsible for delivering safe, reliable and affordable energy.

At the same time natural gas networks face a number of challenges, from uncertain wholesale gas markets, changing industrial demand profiles and increasingly intense competition in appliance markets. Against these challenges, the abundance of gas in Australia creates opportunities to develop alternative transport fuel options, support low emission power generation and provide choice in cooling, space and water heating and cooking appliances to residences and businesses.

ENA’s 2015 Seminar Series will explore key issues for the energy supply sector, from the transformation of the energy system, the position of gas as a fuel of choice, regulation in a dynamic environment and the management of the assets that underpin the safe and reliable delivery of energy to over 13 million customers.

The first event of the ENA’s 2015 Seminar Series, Energy Transformed: Pathways and Connections will feature keynote speeches from John Pierce, Chair of the AEMC and Brattle Group’s, Dr Toby Brown.

Mr Pierce will address the seminar on the benefits to consumers of the transformation of the energy system drawing on AEMC’s significant policy reform agenda since the delivery of the Power of Choice Review in November 2012.

With strong national momentum on the need for network tariff reform Dr Brown will provide an international perspective on the innovation underway in network tariff design that is fundamental to the transformation of the electricity grid, where prices could fully reflect a two-way exchange of value and services between network service providers and customers.

In June, Gas 2015: Customers, Choices and Challenges will bring together stakeholders representing consumers, appliance manufacturers, major gas users and gas networks to discuss the role of Australian gas distribution networks in securing Australia’s energy future. It will feature discussions on supply, competition and community interest and the future of gas network regulation in new energy markets.

These seminars will give you the opportunity join Australia’s leading energy businesses that are facilitating the transformation of the nation’s energy system for consumers and to share innovations and expertise from the businesses serving the industry.

The seminar will also provide unique insights into the changing face of utility ownership in Australia and how network utilities are responding to energy market transformation with a panel of CEOs including Vince Graham (Networks NSW), Merryn York (Powerlink QLD), Tim Rourke (CitiPower and Powercor) and Frank Tudor (Horizon Power). It will include leading industry experts to discuss the shifts in international business models for utilities as the sector deploys new technology and services, as well as the new markets and opportunities which will be enabled by integrated distributed energy resources and demand management services.

Energy Transformed: Pathways and Connections will be held at the Australian National Maritime Museum in Sydney on Thursday 7 May 2015.

Gas 2015: Customers, Choices and Challenges will be held at the Hotel Windsor in Melbourne on Friday 12 June 2015.

For more details about the ENA 2015 Seminar Series, including program details and registration go to www.ena.asn.au/events.

ENA 10

Your asset intelligence partner. Our tailored and integrated solutions give you the insight to optimise the performance of your assets.

The potential uses for UAV inspection are vast. Select Solutions provides UAV inspection services to leading infrastructure and asset owners where traditional methods are unsafe, impractical or inefficient.

UAV inspections will prove valuable for:

Electricity Generation, Transmission & Distribution Assets

Rail Networks

Telecommunication Assets

Water infrastructure including waterways, dams, tanks, spillways

Facilities Inspections

Select Solutions is one of the first major service providers to the essential infrastructure sector to attain CASA certification and employs fully qualified UAV operators and professional aircraft pilots.

With our vast in-house capability and experience, inspection services can be easily packaged for any business, industry and requirement.

Whether your project is large or small, the experienced team at Select Solutions can support you in leveraging this new and versatile technology.

For more information about Select Solutions phone 1300 SELECT web www.select-solutions.com.au

Creating Value | Delivering Results

Operators Certificate No. 1-10VNX4 Australian Government Civil Aviation Safety Authority

INDUSTRY RESPONDS TO ENERGY WHITE PAPER

The Australian Government has released its Energy White Paper, detailing its approach to energy policy framework, which has been met by a largely positive response from energy industry groups.

The Energy White Paper outlines three main outcomes it seeks to achieve:

• Increasing competition between generators and retailers

• Increasing energy productivity and efficiency

• Increasing infrastructure investment for the energy sector, including for global export projects.

Some of the initiatives that the Government will undertake in order to achieve these aims include encouraging the privatisation of state and territory electricity assets; and introducing costreflective electricity tariffs, under which consumers are increasingly charged according to what it actually costs to

Asupply energy at the time it is used.

A national energy productivity improvement target will also be determined as part of the development of a National Energy Productivity Plan. The White Paper outlines a potential national target of up to 40 per cent improvement by 2030.

And the government will commission an Australian Competition and Consumer Commission inquiry will look at the effectiveness of competition in the gas market, in response to ongoing concerns about market transparency.

The White Paper also shoots down the concept of domestic gas reservation policies, stating “The Australian Government does not support reserving gas for domestic use. Reservation would result in less profitable production, attracting less investment, thereby reducing supply and raising costs.

Current gas exploration moratoriums in New South Wales and Victoria were also

and built on trust.

addressed, with the White Paper noting that in the current market “unnecessary state regulatory barriers are limiting much-needed new gas supply”.

The White Paper has been largely welcomed by energy industry groups, including the Energy Networks Association (ENA), the Australian Petroleum Production and Exploration Association (APPEA), the Australian Pipeline and Gas Association (APGA) and the Energy Retailers Association of Australia (ERAA).

ENA CEO John Bradley said the White Paper provides a sensible policy framework to enable consumers to take control of their energy use with new information, fairer pricing and emerging technologies.

“The Energy White Paper has rightly focused on the need to modernise Australia’s outdated electricity tariff structures, to reward customers who use off-peak energy and avoid unnecessary

With over 60 years experience in Australian manufacturing, we’ve built excellence and innovation into everything we do.This is why B&R is the most trusted brand for enclosure and cabinet solutions.

brenclosures.com.au National Sales: 1300 Enclosures (1300 362 567)

12 NEWS

investments,” Mr Bradley said.

“We welcome the Government’s commitment for the COAG Energy Council to deliver a concrete implementation plan for electricity tariff reform by the end of this year.

He also said the ENA supports the focus in the Energy White Paper on ‘technology neutral’ policy settings, recognition of the need for investment certainty, and the avoidance of unnecessary Government intervention in energy markets which increases costs to consumers.

APPEA Acting Chief Executive Paul Fennelly welcomed the White Paper’s focus on establishing Australia’s energy industry as an attractive place for international investors.

“Policies that enhance Australia’s attractiveness as a place to do business and encourage industry to increase domestic gas supplies can deliver

Relationships | Expertise | Solutions

APPEA believes that the paper’s advocacy for establishing effective regulation that allows for the sensible, responsible and timely approval of resource projects is a step forward.

APGA Chief Executive Cheryl Cartwright noted that while the association is “enthusiastic” about the positive impact on the economy of increasing gas exports, it doesn’t want the local gas market to be overlooked as a result.

APGA also reacted positively to the White Paper’s recognition that a market-based response, rather than a gas reservation policy, is the best way to meet gas demand.

“If there’s a shortage in a market, or if the price is high, the market should respond; current higher prices and intensive demand should encourage an increase in supply, so we welcome a review of competition in the wholesale

ERAA General Manager Regulatory and Public Affairs Alex Fraser welcomed the White Paper’s proposal to streamline the energy market and to drive competition and innovation. “The ERAA supports changes outlined in the White Paper to promote competition and empower consumers. In particular, where this is supported by a reduction in regulatory barriers and the introduction of new technologies,” she said.

The main criticism of the White Paper has come from groups who note that the report offers little discussion on the role renewable and storage technologies can play in Australia’s future energy mix. Energy Supply Association of Australia Chief Executive Matthew Warren described the report as “incomplete until it directly considers and addresses climate change policy, along with its impact on the economy and the energy sector”.

Environmental Consulting Solutions

Hydrographic Technology

Our Infrastructure team remain at the cutting edge of solutions driven technology with the use of remote sensing boat technology to deliver hydrographic mapping.

Aerial Survey Solutions

Unmanned Aerial Vehicle (UAV) Mapping

We complement our traditional surveying services with aerial surveying using UAVs, delivering orthorectified imagery and digital elevation models in all common CAD and GIS formats.

Cutting Edge Technology

Vehicle Mounted LIDAR

This solution overcomes the challenges of mapping linear features to a high level of accuracy and is being used with great success as part of our service delivery on the NBN project.

Rapid Response Services Terrestrial Scanning

Our rapid response survey units use the latest in GPS, robotic total station and digital leveling technology to deliver acurate and cost effective solutions for a broad range of projects and market sectors. Visit our website to find out more.

Terrestrial scanning is our preferred method of survey for projects requiring a high level of accuracy. We can assist you with extracting information, or simply provide the point cloud to you directly. Our team of over 40 surveyors means that we can be on site, to most places in Melbourne, within 24 hours. www.taylorsds.com.au

NEWS

Infrastructure

SHORTLIST ANNOUNCED FOR NORTH EAST GAS INTERCONNECTOR

A shortlist of companies vying to construct the North East Gas Interconnector, which will connect the Northern Territory with the East Coast, has been announced. The Victorian Government is now confident that the project will go ahead.

A panel of experts has spent a month assessing the proposals and has nominated the following four companies to go through to the final stage of the process, which will close in September 2015 with a successful proponent being announced shortly thereafter.

The four shortlisted companies are:

• APA Group

• DDG Operations Pty Ltd (DUET)

• Merlin Energy Australia Pty Ltd

• SGSP (Australia) Assets Pty Ltd (Jemena).

NT Chief Minister Adam Giles said “The North East Gas Interconnector is a critical piece of economic development infrastructure and a priority major project for the Territory Government.”

It will link the NT to the East Coast via a route between either Alice Springs and Moomba or Tennant Creek and Mount Isa.

The quality of the submissions through the Government’s competitive process for the pipeline’s construction has been so high that the Territory Government now feels it is inevitable that this vital pipeline will be built.

It is estimated that the Territory has more than 200 trillion cubic feet of gas resources in six onshore basins – potentially enough gas to power Australia for more than 200 years and reserves almost 20 times the size of the Ichthys LNG Project. There is also more than 30 trillion cubic feet of gas offshore.

Australia’s most advanced HDD contractor... AHD Delivers, every time

Experienced staff

The latest equipment

Technologically innovative T: (03) 9439 93 73 W: www.ahdtrenchless.com.au NEWS 14

•

•

•

ELECTRICITY REFORM PROGRAM FOR WA

WA Energy Minister, Mike Nahan, has announced a State Government electricity reform program aimed at reducing the high cost of electricity within Western Australia.

Following an industry review, Dr Nahan said the Western Australian Government would begin taking the necessary steps to limit future electricity price increases and reduce the requirement for subsidy of the industry that is forecast to cost the State more than $500 million in 2014-15.

The ENA has welcomed the response with CEO John Bradley stating that customers will benefit from nationally consistent economic regulation of networks.

One of the main reforms will also be introducing choice of electricity retailers for household and small business customers.

“The benefits of competition

between energy retailers are already evident in gas services where Alinta and Kleenheat compete vigorously for household and small business customers with attractive price offers,” the Minister said. “Households and small businesses should have the same opportunity for choice and better prices in their purchase of electricity services. It is also expected that Synergy will be free to retail gas to small business and residential consumers once full retail contestability is introduced.”

The Government will also transfer regulation of the Western Power electricity network to the Australian Energy Regulator (AER), which regulates electricity networks in all other Australian states and territories. This will provide the benchmarks and incentives for Western Power to meet national best practice standards in operations, efficiency and cost.

This transfer to the AER is a significant step toward the realisation of national reform agenda set over a decade ago.

“It will also increase the transparency of Western Power’s technical rules and rule change processes, and include Western Australia in the national discussion around how to respond to the opportunities and other impacts of technological change in the sector,” Dr Nahan said.

Reforms will also be developed to increase transparency and efficiency in WA’s wholesale electricity market. The Government will not split the Stateowned electricity business Synergy and Western Australia will not join the national electricity market.

“There are opportunities for large improvements in the performance of the Synergy business. This is our focus, rather than further structural changes to the State’s electricity corporations.”

15 NEWS

ACTEW WATER TO REPLACE 18,000 WATER METERS

ACTEW Water is undertaking a major water meter replacement program across the ACT that will see more than 18,000 residential water meters replaced by the end of 2017.

The program will focus on replacing all 20mm water meters that are 18 years or older, as well as an upgrade to some service connections. It will also replace the existing isolation tap meter with a new, user-friendly ball valve at the meter.

The replacement program will ensure better accuracy from the older meter readings and will enable customers to isolate their own water supply, as well as monitor their usage with much more ease. The new meters will also improve future meter maintenance processes which are carried out by ACTEW Water.

The replacement program will be staged one suburb at a time, with the older suburbs being targeted first –Kaleen being the first suburb listed on

the program. Field crews will spend a number of weeks working through each suburb.

An ACTEW Water Spokesperson said that the proactive replacement program is a way of ensuring that customer water usage is monitored accurately.

“Water meters wear with age and usage, just like any other mechanical device and in some suburbs across Canberra, some meters are well over 20 years old. We are keen to replace these meters for our customers to ensure their water usage is being monitored correctly, as well as making it easier for them to monitor their own usage and turn off their water supply much more easily if they need to do so,” she said.

Ms Drake also asked that customers assist ACTEW Water in the meter replacement by ensuring that their domestic water meter has a one metre clearance from any obstructions, to

allow ACTEW Water staff enough room to complete the replacement as quickly as possible.

“Once customers receive their initial letter in the mail notifying them that ACTEW Water will be attending their property soon, they should head out to their water meter to ensure that it is clear from any leaves or shrubs,” she said.

“This will allow us to complete the works much more efficiently,” she concluded.

If water meters are located underneath driveways or concrete footpaths, ACTEW Water has an obligation to restore customer’s land as soon as practicable to a similar condition before operations began.

Australian written, internationally applicable. Comprehensive, expert information about drilling best industry practice. Well-illustrated, practical information in clear terms about the “what,” “how,” and “why” of drilling. An ideal resource for small and large drilling operations; hydrogeologists, geos, environmental, geotechnical,

NEWS

The Drilling Manual, Fifth Edition

Box 742 LANE COVE NSW 2066

(02)

3444 / +61 2 9428 3444

(02)

Australian Drilling Industry Training Committee Ltd

2015

NOW

civil and mining engineers. PO

Ph:

9428

Fax:

9428 3555 Email: office@aditc.com.au Web: www.aditc.com.au

Order your copy of this New

edition

ITS PipeTech Pipeline Rehabilitation & Construction Water Sewer RoadRail Local Government Mining & Energy NSW and Head Office: Telephone: (02) 8603 2000 Email: enquiries@itspipetech.com.au Queensland Office: Telephone: (07) 3630 2333 Email: enquiries@itspipetech.com.au WA Office: Telephone: (08) 9408 1648 Email: enquiries@itspipetech.com.au www.itspipetech.com.au

Tunneline

Pressureline

CIPP UV cured

Repairs + Maintenance

Pipe bursting

CCTV + Robotics

BOARDS OVERHAULED IN VIC WATER REVIEW

The boards of Victoria’s 19 water corporations will be overhauled as part of a review of the state’s water industry.

The Victorian State Government has announced that all 135 board positions will be spilled and go through an expression of interest process.

Sixty-five of the positions were already set to be reviewed in September, however others weren’t expected to change until 2017. All current board members have been encouraged to participate in the expressions of interest process.

The new boards are expected to be in place by October 2015.

Victorian Minister for Environment,

Climate Change and Water, Lisa Neville, has thanked the boards of each corporation for their contributions to date and said the review was intended to ensure the water corporations have the best people with the right skills to deal with the environmental and economic challenges of the future.

“Preserving the future of our water supplies requires a new vision and that calls for a fresh and balanced approach, starting at the top,” she said.

“Victoria needs diverse and highly skilled people to deal with the environmental and economic challenges of the future – climate change, rainfall variability and rapid population growth.”

The current Victorian Government, which came into power in December 2014, has already made a number of changes to water policy in the state, including:

• Abolishing the Office of Living Victoria and transitioning to a collaborative approach

• Requiring water authorities to ensure they face the challenges of climate change including rainfall patterns

• Considering all sources of water including the Wonthaggi desalination plant, which can provide 150 gigalitres of water

• Investigating the water needs and priorities of local communities.

Future of Urban Water

Arup is actively collaborating with the water industry to nurture and facilitate innovation and inspire a progressive water sector. This has been demonstrated through new approaches such as our partnership with Sydney Water to develop the highly regarded ‘The Future of Urban Water’ report, which outlines four different scenarios for how water authorities will manage the resource and how consumers will access and pay for it.

Contact:

Daniel Lambert, Water Business Leader, Australasia

daniel.lambert@arup.com

NEWS

We shape a better world | www.arup.com

Main Outfall Sewer Redevelopment, Melbourne, Vic © Arup 2015 - Best Engineering Firm >$200m 18

Kordia Solutions Australia has successfully achieved Federal Safety Commission (FSC) Accreditation, having met the requirements of the Australian Government Workplace Building and Construction WHS Accreditation Scheme.

The Scheme applies to contracts for building work valued at least $4 million and awarded under Australian Government funded projects that meet the following thresholds: For directly funded projects, the project has a value of at least $4 million; and for indirectly funded projects, the Australian Government contribution to the project value is at least $10 million or at least $6 million and represents at least 50 per cent of the total project value, with head contracts being $4 million or more.

“Congratulations on an excellent performance in achieving accreditation after just a single audit – very few companies have achieved that result,” said Federal Safety Commissioner, Alan Edwards.

Kordia now appears on the FSC Accreditation Register, which lists contractors who are currently accredited and therefore eligible to undertake building work that falls within the scope of the Scheme.

“This accreditation clearly demonstrates and provides a level of

confidence to our customers, suppliers, partners, staff and subcontractors that Kordia operates a very compliant and most effective Workplace Health and Safety Management System that can obviously pass even the most stringent of external assessments”, said Kordia Chief Executive Officer, Ken Benson.

The achievement of this accreditation now provides the business with both current and future opportunities to bid for and undertake Federal Government contracts.

Kordia is a company with scale in terms of resources, partnerships and infrastructure to design and deploy challenging, complicated and critical networks.

Kordia’s business is the delivery of a wide range of engineering and technical services to network and infrastructure owners in Australia and New Zealand. To find out more, visit www.kordia.com.au.

KORDIA SOLUTIONS AUSTRALIA ACHIEVES FEDERAL SAFETY COMMISSION ACCREDITATION TEN TIMES more lifts. HALF the man hours.

Work faster, safer, smarter with Vacuworx Lifting Systems.

For over 15 years Vacuworx has been manufacturing the safest, most efficient lifting equipment for heavy-duty pipe, plate, slab, concrete barriers, and HDD drill stem.

• Full inventory available for immediate purchase or rental in Brisabane.

• Quick-coupler available for attachment versatility.

• Faster load and unload cycles means less downtime for your workers.

• Parts, service, and technical support available 24/7 365 days a year. Visit vacuworx.com or contact our Brisbane office for information.

NEWS

0498 101 888 | australia@vacuworx.com | vacuworx.com UM_Half_Jan.indd 1 12/17/14 4:54 PM 19

the future of ASSET MANAGEMENT

Since its development began almost 30 years ago, SA Water has developed its geographic information system (GIS) into a robust network that is used for a wide variety of applications. Last year we spoke to the organisation about the development of their system; and recently, Senior Asset Information Analyst

John Bormann spoke to us about how SA Water staff interact with the GIS, and its important place in the future of utility asset management.

The GIS is integral to the functioning of SA Water, and is used in many different ways across the organisation. There are different levels of users, ranging from basic viewing and printing to complex spatial analysis and editing. Systems administration is another important function the GIS provides.

“I have been using SA Water’s GIS since 2002,” said Senior Information Analyst John Bormann. “I started in the GIS Management team within the Information Services department, undertaking systems administration work, supporting other users, and performing tasks and analysis too difficult for regular or light GIS users. The great thing about starting there

was I had a small amount of project support work, where I had problems of my own to work on, but supporting the rest of the corporation’s near-100 full desktop GIS users and 2,000 web based GIS users (both internal and external to the corporation) gave me exposure to a broad range of utility GIS related work.

“In 2009 I moved into the Asset Management team, which is the primary support area for corporate usage of the GIS. This means I still get to do an extremely broad spectrum of GIS work, but without the systems administration aspects.”

The GIS has a vast functionality, and can be used for many different applications. Mr Bormann has used the

GIS to assist SA Water staff on a wide range of projects, which include:

• Prioritising main replacement or rehabilitation and optimising shut-off blocks

• Preparing fire response plans in a state disaster

• Valuing the network for financial purposes

• Auditing SA Water’s customer database to find lost rates

• Analysing work order information to relocate depots and find unknown hotspots of high resource allocation

• Optimising sewer mains cleaning programs

• Determining areas of SA Water land with impassable gradients

GIS 20

MAPPING, GIS & SURVEYING

for 4WD vehicles

• Managing pipeline CCTV

• Mapping out weed spraying

• Network preparation plans for the Adelaide Clipsal 500 event.

THE FUTURE OF ASSET MANAGEMENT?

The GIS is particularly essential when it comes to managing assets, as it allows data to be quickly accessed, edited, and analysed.

“I can barely fathom how we would operate in the long term without a GIS,” said Mr Bormann.

“At SA Water the GIS is the pipe asset register, so the system is used in conjunction with failure (works management) data within sophisticated

BENEFITS FLOW THROUGH TO CONTRACTORS

SA Water’s GIS is also utilised by external parties, who can access a condensed version of the web mapping environment.

“Our metropolitan alliance partner, Allwater, uses our GIS. The Metropolitan Fire Service (MFS), Country Fire Service (CFS), plumbers, surveyors, land agents and other interested parties have access to a reduced version of our web mapping environment,” said Mr Bormann.

“They receive a guide on how to use it and can contact our Customer Service Centre, which then relays the request to us, if someone needs assistance. We receive very few calls, as there are only a couple of hundred external users.”

Allowing these external parties access to the GIS enables them to access the relevant data without needing to contact SA Water.

“Benefits include a reduction in Dial Before You Dig requests and other infrastructure queries that may have come through our Customer Service Centre,” he said.

21

statistical models to develop failure curves on top of being used to fuel Key Performance Indicators to prioritise action on shut-off blocks for water mains.

“The GIS is also used to maintain the sewer mains cleaning program and score the performance of pipes to increase or reduce cleaning regimes. In SA Water’s Land Management area, mobile GIS is used to accurately map issues that contain vegetation, to pass on to contractors.”

According to Mr Bormann, the asset management team have seen a variety of benefits since they began using the GIS, most particularly the creation of a robust water mains replacement program, the ability to proactively manage the sewer mains cleaning program, and an automated valuation process.

CONTINUING TO EVOLVE

Though SA Water’s GIS is one of the most advanced and extensive in the Australian utility sector, new initiatives are constantly under consideration to further evolve its effectiveness and range of functionality.

“We have a project to implement a unified mobility solution, but the first version doesn’t include GIS. Future revisions will include a GIS component so workers don’t need to travel back to a depot to use the web mapping system to generate a shutdown, repair or recharge plan. This solution will also allow workers to accurately position the point of failure, improving the quality of analysis using this data (sewer mains cleaning program, water mains replacement/rehabilitation program).

“I would also like to see automated

lodgement of as-constructed plans into our GIS to speed up appearance of infrastructure on Dial Before You Dig requests and improve the quality of the data coming in to the system by increasing QA checks of data entering the system. A project to provide the functionality is already underway.

“Longer term, we would like to have survey accurate data and couple this with a mobility solution that includes an augmented reality component to ‘x-ray’ our subsurface infrastructure. Given our data’s placement relative to land parcel boundaries and capture methods dating back to 1986, there is little we can do in the short term to achieve this.”

SA Water also intends to develop the GIS to allow for live updates from the field.

“In the future we would like field operators to be able to change attributes like whether a valve is opened or closed or those that require a QA workflow to be triggered. It would also be useful to capture missing assets like fire plugs, isolating valves and maintenance holes, but with these additions going to a staging area, rather than performing the edit on the live production data.”

NOT JUST FOR THE EXPERTS

Despite its intimidating range of functionality, the GIS is very userfriendly. SA Water’s internet GIS is called the ‘AquaMap’, and users can access its data through the Geocortex Silverlight web viewer. ArcGIS Desktop is a more complicated software platform, used primarily by editors, asset managers, and other high-end users. Employees who need to use the GIS for more complex activities have access to a multitude of training and

SCREEN SHOT SHOWS HOTSPOTS FROM THE PAST THREE OR FOUR YEARS OF CHOKES AND OVERFLOWS IN THE SA WATER NETWORK, CAUSED SPECIFICALLY BY FAT BUILD-UP.

education options.

“Our web mapping system, Geocortex, which runs alongside ArcGIS for Server, is fairly simple and requires little to no training to use. Regular training sessions are held by Asset Management during the year if people want to attend.

“Use of ArcGIS Desktop is carried out by people already trained, or they attend an ESRI course, or they’re assisted through a self-learning phase conducted by Asset Management. The tools aren’t as complicated as they used to be, the real learning curve is understanding the data.”

PROACTIVE ASSET MANAGEMENT

Perhaps the most useful aspect of the GIS is its ability to allow asset managers like Mr Bormann to proactively assess and circumvent potential problems across SA Water’s vast network of assets. Particular procedures have been built into the system to ensure that assets are regularly and appropriately assessed.

“If a shut off block has three or more unplanned outages within a rolling 12 months, it triggers a KPI that elevates its assessment on SA Water’s mains replacement program. Sewer events similarly trigger entry to the CCTV program and/or cleaning program with varying levels of cleaning types and frequency.”

This proactive and responsive system

22 MAPPING, GIS & SURVEYING

SA WATER’S SENIOR ASSET INFORMATION ANALYSTS, JOHN BORMANN AND DAVID PARSONS REVIEW GIS DATA.

helps asset managers in the forward planning of their asset requirements.

“In more purely proactive terms, SA Water maintains two complementary models for water mains replacement – NESSIE and PARMS. PARMS is a Water Services Association of Australia (WSAA) initiative, carried out by the CSIRO and since maintained by WISER Analysis. These models, especially PARMS, take in GIS and failure data and help form the forecasting and replacement program.”

The continued success of the GIS is dependent on it being continuously updated to reflect changes in the system. Certain safeguards have been built into the system to ensure the integrity of the data it provides.

“Within the web mapping system there is a option to immediately notify the GIS edit team (within Asset Management) of a required correction, e.g. missing information, updated valve status. As for new infrastructure,

part of the asset handover process is received by the GIS edit team of as-constructed data. Without it, the contractor cannot receive final payment.”

THE BENEFITS OF GIS FOR UTILITIES

Given its huge functionality, user-friendliness, and potential for further development, the GIS represents a powerful opportunity for the modern utility. For Mr Bormann, the biggest benefits are the ability to easily update plans and maps with new data and the ease of assessing and valuing underground assets.

“I don’t understand how a utility, at least, a large utility could operate today without a GIS. Without it, we’d still be

updating hard copy plans, we wouldn’t have as accurate a picture of asset performance and asset valuation would be far less accurate. Given that the vast majority of our assets are underground, I don’t see how we could survive without it in the long term. I think we could survive for a short time, based on operator knowledge and hard copy plans, but performance would be severely impacted.”

MAPPING, GIS & SURVEYING SCREENSHOT OF ADELAIDE’S SA WATER CONNECTIONS. 23 THE AMAZING VS-4 SMARTVALVE Australian designed and manufactured from 316 stainless steel • Simple on-site servicing • Rated 18 Bar • Seals at atmospheric pressure • Guaranteed anti-hammer at all times • Auto throttled against premature closing • References and testimonials available • Selling Aus, NZ and USA. Export opportunities available. USE THIS AD FOR A FREE TRIAL For more information: and click on the video Odour Technologies Pty Ltd enquiries@odourtechnologies.com.au Tel 61-7-3287 7020 Mob 0414 861 000 International Patents and Patents Pending www.vs-4.com

SURVEYING

AS EASY AS X,Y,Z

Stockton Drilling Services was recently called to the site of the New Royal Adelaide Hospital to help confirm the exact position, profile and orientation of a series of ducts installed as part of the project.

As part of the New Royal Adelaide Hospital (NRAH) construction, SA Power Networks (SAPN) needed to install a series of 160mm and 140mm link ducts between the new hospital and its Hindley and Whitmore substations.

South Australian Direction Boring (SADB) was then engaged to install the trefoil configurations by horizontal directional drilling in lengths of approximately 700m to 1,000m.

After the ducts were installed and the hauling bays established along West Terrace and North Terrace, it was found that the hauling tensions of the 67mm OD power cables were much higher that initially calculated.

Stockton Drilling Services was contacted to see if their gyro survey tool could be used to confirm the exact position, profile and orientation of the ducts between the hauling

24

STOCKTON DRILLING SERVICES MANAGING DIRECTOR CHARLES STOCKTON PUTS THEIR NEW GYRO SURVEY TOOL TO THE TEST.

MAPPING, GIS & SURVEYING

bays. These exact measurements of bend radius could then be used to recalculate the hauling tensions required for the cable installation. Stockton mobilised within two days, and immediately commenced surveying the 13 sections.

Stockton used their DuctRunner gyro-surveying equipment, a patented gyroscope-based inertial measurement system designed for autonomous recording of positional data. The tools take an accurate X, Y, Z positional reading approximately every 10mm along the route. This data is then used to not only confirm the position, but also the grade and radius of the installed pipeline.

The survey data was made available to view on site immediately after completion of survey runs. X, Y, Z and bend radius plots of the survey line

STOCKTON

can be viewed on the site laptop and screen prints obtained. The complete survey files were then processed overnight and exported as CSV files containing X, Y, Z, bend radius, azimuth and pitch.

The 13 pipe sections were surveyed in just seven days. This new information then provided SADB with the knowledge required for them to undertake modifications of any tight or restrictive sections and for them to determine where additional lubrication points would be needed. This application of the gyro survey tooled ensured the successful installation of all the cables with the required timeframe.

25

MAPPING, GIS & SURVEYING

DRILLING SERVICES MANAGING DIRECTOR CHARLES STOCKTON PUTS THEIR NEW GYRO SURVEY TOOL TO THE TEST.

DEVELOPING CONFIDENCE IN UNDERGROUND ASSET DATA

One of the biggest challenges facing utilities today is managing their buried assets, and understanding and updating the data available on these assets. We spoke to Charles Moscato, Yarra Valley Water’s Spatial Information Manager, about some of the inherent challenges that come with managing an enormous catalogue of buried assets, and some of the unique technologies he is utilising to help make the task easier.

Yarra Valley Water is Melbourne’s largest water and sanitation business, providing water supply and sewerage services to over 1.7 million people and over 50,000 businesses in the city’s northern and eastern suburbs.

According to Charles Moscato, Spatial Information Manager at Yarra Valley Water, one of the key challenges the utility – and indeed all utilities – face, is having confidence in the

asset data available to them. In many cases asset data can be decades old – meaning assets won’t always be located where a utility thinks they are.

To this end, Yarra Valley Water has recently been working with Augview, developers of an augmented reality software application, which allows users to see a 3D visual representation of buried assets, overlaid on top of a camera view of a particular location.

“Augview has been fantastic and it’s simple to use. By using a tablet or smartphone, we can point to a location and very quickly see what assets are underground.

“The real beauty of this system will be when we start to get other authorities providing their asset information – that’s when we’ll start to see the real benefits.

“Having the ability for operators to quickly use the product, to give them

MAPPING, GIS & SURVEYING 26

confidence on whether or not there are assets within the area – whether they are ours, or whether they belong to another utility – would be a huge benefit to our crews,” he said.

“Not only that – if there are assets in a particular area, we can also see where they are, how deep they are, and how far each asset is away from other assets.

“With all that information available to us, we’ll actually be able to very quickly respond to incidents and over time, gain more confidence in our data.”

The benefits of the system extend beyond being able to visualise the existing assets in a particular area –the system can also be used to update existing asset data to make it more accurate if and when required.

“Where we don’t have the accuracy of our data, we’ll be able to actually go in and use this system to record where the location is not right, and feed that information back to be updated in the core GIS system,” said Mr Moscato.

COLLABORATION BETWEEN UTILITIES

Mr Moscato believes there are many benefits utilities can experience by teaming up and sharing their asset data.

“If we work together and put some tight measures around what is it that we’re actually doing with the data, and have some level of trust between the authorities, then it’s for the greater good of all utilities to have this information shared.

“If we can actually have the feedback mechanism by which utilities not only review the accuracy of their own asset data, but also that of all the other utilities in a given area – be it gas, electricity, water or telecommunications – how could that be anything but advantageous for all parties involved?

“As utilities provide one another their data, they’ll actually quickly start to see the extra benefit of having all utilities using the same sort of products – such as Augview – to feed

this information back,” he said.

“I think this is an excellent win/ win situation – we have the ability to be a role model for the industry, to showcase how good this technology can be.

“We could actually have a system in place to improve our data accuracy and improve the safety of our operators. What’s not to like about that?”

UNDERSTANDING DATA ACCURACY

Another challenge for utility asset

managers, according to Mr Moscato, is the fact that many utilities today are using asset data that was captured in the 1980s or earlier – when data capture methods were not as advanced as they are today.

He believes there needs to be a greater understanding of when various asset data sets where captured, so that utilities and asset owners can have a realistic expectation of just how accurate that data can be.

“If we had the ability to put some measures in place to quantify how accurate our data is, we’ll actually

MAPPING, GIS & SURVEYING www.dwaus.com.au Sydney • (02) 477-7115 Adelaide • (08) 8329-5300 Melbourne • (03) 9357-9929 Townsville • (07) 3719-2203 Brisbane • (07) 3719-2203 Darwin • (08) 8329-5300 Perth • (08) 9359-1500 American Augers & Trencor Now Proudly Distributed by Ditch Witch Australia Australia’s Pipeliners Deserve Australia-Wide Support! ALL Your Needs - ONE Convenient Source Honoured to be the ONLY National Provider of Both Outstanding Brands!

start to build some metadata underneath our data. For example, in areas where data has been captured from the 1990s onwards, we know we’ve got very accurate data that’s been captured by digital means and provided in a CAD format. We know we have a higher level of accuracy for that data.

“For any data captured prior to that, it needs to be understood that there are restrictions with the way that data was captured and hence the accuracy

ABOUT AUGVIEW

against it.”

Mr Moscato believes that with a product like Augview, which can incorporate GPS coordinates into existing asset data, major improvements in asset data can be made.

SEEING THE BENEFITS

Mr Moscato said he’s excited by the improvements products like Augview are able to offer when it comes to managing vast networks of

underground assets.

“I’ve seen firsthand how effective a product such as Augview can be out in the field, whether being used to actually capture asset data, or to visualise the assets that are underground in any particular area.

“We look forward to continuing to work with Augview and other utilities to improve the quality of asset data available - which then helps us to best manage our networks and provide the best service to our customers.”

Augview is both a mobile GIS, allowing users to view and edit their asset data from the field; and an augmented reality application, which allows users to visualise underground objects as 3D assets in a life environment they wouldn’t ordinarily see.

Augview software, used on a smartphone or tablet, connects directly to one or more GIS web servers over a secure internet connection. Geographic asset data is then requested from the web server and displayed either as a map, text or as a 3D visualisation. Asset information can then be edited directly by the user in the field and the data on the server is updated immediately and without any additional administrative overhead.

With a modern user interface, Augview has been designed using familiar layouts and concepts that allow staff to leverage their existing knowledge of everyday smartphone and tablet applications. Augview provides all the power of a mobile GIS, in a way that a non-GIS user can understand and work with effectively.

MAPPING, GIS & SURVEYING 28

Tunnelcorp provides trenchless services to the infrastructure, pipeline and mining sectors throughout Australia.

•Laser guided microtunnelling

•Laser guided pipe jacking

•Box culvert jacking

·for pedestrian/cycleways and ·for road and rail underpasses

•Auger boring

•Shaft sinking

•Tunnel support canopies

•6,000 tonne jacking system

All things Trenchless Turnkey Contracting. Project Management. Design and Consulting. Equipment Hire. Phone: 1300 TUNNEL (886635) Email: contact@tunnelcorp.com.au

www.tunnelcorp.com.au

THE MICROTUNNELLING

Edge Underground has always been an innovator in the field of microtunnelling, and two recently completed projects highlight the fact that Edge is a company that’s always willing to push the boundaries of what trenchless technologies can achieve.

UNDER THE BEATEN TRACK

Working with Gippsland Water on its $13million Warragul sewer upgrade, Edge Underground completed the delicate process of burrowing more than 100 metres underneath Princes Way and a railway line to make way for a new wastewater pipeline in Drouin, Victoria.

The 4km sewer line will allow residential and industrial properties near Burke and Howitt Streets to finally be connected to the sewerage system, rather than relying on septic tanks.

The new sewerage system will also cater to expected future growth in the Warragul region.

The job involved almost 1,500m of microtunnelling, ranging from 324GRP to 711GRP.

“The ground conditions and this risk of failure led to Gippsland Water and their consultant, GHD, to specify for slurry and displacement microtunnelling,” said Edge Underground Founder and Managing Director Stuart Harrison.

“We discussed the capabilities of the Vermeer AXIS vacuum microtunnel method, and Gippsland Water and GHD liked what they heard. It was the ability of the system in a wide range of conditions, ranging from clays with a range of gravel and cobbles to wet running sands, that really impressed our partners.”

Many challenges had to be overcome in order to deliver a tight tolerance in vastly changing ground conditions. The use of a 350mm pilot shot as a form of geotechnical sample proved to be a significant factor in delivering a successful project without requiring any additional shafts. The lines ranged from 40-150m in length.

The works, which followed more than two years of planning and design in consultation with V/Line and VicTrack, were successfully completed by Edge Underground over two nights without any impact to train services.

The benefits that Gippsland Water and the local community have seen thanks to the innovative use of microtunnelling cannot be overstated.

“We have now successfully completed two of the three critical sections of this final phase of the $13million Warragul central trunk sewer replacement project,” said Paul Clark, General Manager of Customer Service and Communications at Gippsland Water.

“This investment allows for future development of the Warragul township along with fast-growing areas to the west and south of Warragul,” Mr Clark continued.

“Previously unsewered properties close to the Warragul CBD will also be serviced,” he added.

“We’re delighted to be close to finishing this major project for the Baw Baw and Warragul community. It will allow for future growth and prosperity in the region as well as provide a more reliable and efficient sewerage solution for our local customers,” concluded Mr Clark.

The new sewer main also has the capacity for emergency storage within the pipeline system which means Gippsland Water is able to decommission two existing pump stations currently located on the western edge of Warragul.

Howitt Street is the next major set of works to be conducted as part of the project, with the entire 4km stretch of new underground sewer main on track for completion in June 2015.

30 MICROTUNNELLING Utility Partner Solutions

TRENCHLESS WINS OUT

In recent years, Townsville City Council has also been working with Edge Underground and the Vermeer AXIS vacuum microtunnelling system. The system has been used on a number of projects, including the recent Corbett Street Trunk Sewer Extension project.

The project involved the supply and construction of approximately 450m of 300mm gravity sewer, from the existing 300mm sewer on the southern side of Ingham Road through to the existing 300mm sewer on the southern side of Woolcock Street.

The project involved microtunnelling under Woolcock Street and the North Coast Railway Line, which was completed by Edge Underground using the Vermeer AXIS system.

Mr Harrison said that the results achieved by the innovative system have impressed the council, and inspired them to utilise microtunnelling as an installation method more than ever before.

“So popular has the system been that as a result, projects which previously would have been completed by traditional open cut installation methods are now being mictrotunnelled by choice,” he said.

“It’s exciting to see that councils and utilities are starting to really appreciate and enjoy the social, environmental and economical benefits microtunnelling can offer.”

Projects that Edge Underground has completed for the council involve pipes ranging in diameter from 150-600mm, and ground conditions have ranged from sand, sandy silty clays and rock. All of the projects that Edge has undertaken have been completed within tolerance, on time and on budget.

ABOUT US

Edge Underground is a precision microtunnelling contractor that operates in Australia and the USA. With a focus on innovative technology and expertise, Edge Underground designs and enhances the performance of trenchless equipment.

•

SERVICES

OUR

Microtunnelling

Jacking

• Pipe

Boring

• Thrust

Boring

BORING SPECIALISTS

8 www.edgeunderground.co

• Laser Tunnel

GUIDED

( 0458 000 009 * stuart@edgeunderground.co

Find out more about keyhole pipeline installation www.keyholepipeline.com.au

TUNNELLING THROUGH INSTALLATION CHALLENGES

Two of Melbourne’s major metropolitan water utilities have recently used microtunnelling to install new sewers, experiencing the benefits this no-dig technology can offer.

Both Yarra Valley Water and South East Water called upon the team at Pezzimenti Trenchless for major new sewer installations.

Yarra Valley Water called the crew out to Glenroy in Melbourne’s north for assistance on the Glenroy Branch Sewer. This new sewer was designed to relieve the existing Glenroy sewer network.

MFJ Constructions was the lead contractor for the project, and Pezzimenti was engaged to install 950m of 427mm Hobas GRP jacking pipe by microtunnelling.

When the Pezzimenti crew arrived on site, they found that ground conditions consisted of basalt, sandstone and clays. It was a heavily trafficked residential area, with two schools along the path of the

sewer line to be installed. The sewer was to be installed at depths between 6-9m.

The microtunnelling installation was completed without incident in December 2014, with client and contractor both happy with the works completed by the Pezzimenti Trenchless crew.

South East Water also recently engaged the services of the Pezzimenti team, in their case during the installation of the Ryan Road Branch Sewer in Pakenham, located 56km south-east of the Melbourne CBD.

Azzona Drainage and Smec Urban were the lead contractors for this project, a new branch sewer to cater for future residential growth in the area.

The scope of the microtunnelling works was for the installation of 1,100m of 450 and 500mm Flowtite GRP Jacking pipe,

and 160m of 700mm RC Jacking Pipe by microtunnelling.

The sewer was to be installed at depths between 6-10m in ground conditions which consisted of clay and wet sandy clays.

A unique aspect of this particular project was that 50 per cent of the works were completed through the Pakenham Golf course, all of which was done without interrupting play during the course of the installation. The Pezzimenti team finished their involvement on site in January 2015, with client and contractor pleased with the results.

As trenchless technologies such as microtunnelling become more commonplace on the job site, utilities are well placed to take advantage of the unique benefits these technologies offer.

32 MICROTUNNELLING Utility Partner Solutions

Unit 2 / 85 Heatherdale Road, Ringwood Vic 3134 PO Box 2500, North Ringwood Vic 3134 P: (03) 9872 4596 | F: (03) 9872 3293 | E: info@pezztrenchless.com.au Still the market leaders in laser guided microtunnelling Bore diameters from 325mm up to 2800mm Used for gravity sewers, water mains, storm water, gas and electrical conduits. Specialists in “free bore”, sleeve boring and pipe jacking in all sizes The Next Generation in Trenchles Technology

MANAGING CSG WATER: EXTRACTING BENEFITS FROM BY-PRODUCTS

The challenge of managing the water that is a by-product of the coal seam gas production process has been a major consideration for all of the major CSGLNG projects currently underway in Queensland. Together with SunWater, the QCLNG project has developed a unique solution which allows produced water to be put to use in the community.

In February, SunWater commissioned the Woleebee Creek to Glebe Weir Pipeline, which will transport up to 36,500 megalitres of treated coal seam gas water per year from the QCLNG project for beneficial use by industrial and agricultural industries.

Construction of the pipeline was completed in 2014, with the pipeline and pump station commissioned in late 2014. Final interface commissioning was carried out in early 2015 with QGC’s infrastructure and water treatment plant.

Operation of the pipeline and the first supply of treated water commenced in February 2015. This water was pumped to Glebe Weir, boosting overall water supply to the Dawson Valley Water Supply Scheme (WSS).

SunWater Industrial Pipelines

General Manager Tim Donaghy said the milestone was great news for local customers, and indeed for the coal seam gas industry.

“This marks the beginning of beneficial use by irrigation and

industrial customers from both the pipeline and the Dawson River,” Mr Donaghy said. “Water is extracted as part of the coal seam gas production process. It is treated to a high standard at QGC’s Woleebee Creek Water Treatment Plant using ultrafiltration and reverse osmosis, and is monitored by both QGC and SunWater to ensure it meets strict compliance requirements before it is released.

“The beneficial use of the treated water has been approved by the Department of Environment, and is reflected in the revised Fitzroy Basin Resource Operations Plan.

“The treated water, which is included as part of the scheme supply and announced allocations for the Upper Dawson sub-scheme, will be extracted by customers through their existing pumps and infrastructure, and measured through existing flow meters.”

BUILDING THE PIPELINE

The Woleebee Creek to Glebe Weir Pipeline is located approximately halfway between the Queensland

towns of Theodore and Miles. The town of Wandoan, on the Leichhardt Highway was used as a central location during the construction of the pipeline.

Features of the pipeline system include:

• 150m of 1,400mm diameter mild steel cement lined (MSCL) suction main, connecting to QGC’s storage and outlet

• The Woleebee Creek pump station adjacent to QGC’s storage

• Approximately 120km of buried MSCL pipeline ranging in diameter from 914mm to 1,067mm (typically using rubber ring spigot and socket jointing system)

• A 5ML balancing storage located partway along the pipeline

• Associated pipeline infrastructure, and pipeline outlet structure for discharge to Cockatoo Creek

• 900m of 804mm diameter pipe connecting to the discharge structure.

Other major control structures and features along the pipeline include

33 COAL SEAM GAS

standpipes, surge tanks, air valves, scour valves, isolating valves, control valves, flowmeters, and customer offtakes.

The pump station houses five main pumps, though will typically operate in a three duty and two standby pump configuration.

The pump station will pump up to a maximum of 113ML per day, with the pipeline discharging up to a maximum of 100ML per day to Glebe Weir (both are approval limits, and noting customers may take supply from the pipeline before the remaining volume is discharged).

The pipeline operates as a pumped pressure pipeline up to the balancing storage, and then a gravity pipeline section to the outlet. Treated water is discharged from the outlet to Cockatoo Creek, approximately 600m upstream of SunWater’s Glebe Weir on the Dawson River.

Water stored at the weir is then released periodically, and used by customers downstream – predominantly irrigators – within the Dawson Valley WSS.

DELIVERING THE WATER

The pipeline has two types of customers:

• Pipeline users who take water directly from the pipeline

• River users who take water stored in the Glebe Weir pond or water discharged from the weir and extracted from downstream weirs or the Dawson River.

Existing customers along the Dawson River within the Dawson Valley WSS – from Glebe Weir to the end of the Upper Dawson subscheme – who have medium priority (supplemented) allocations, will automatically receive the benefits of additional water added to the scheme.

These customers, typically irrigators, receive announced allocations through the year as a proportion of their annual maximum water entitlement volume and in accordance with available water supply volumes and calculations provided in the Resource Operations Plan.

These calculations will take into account additional volumes to be made available to the scheme by the discharge of treated water from the pipeline, potentially improving both reliability and maximum entitlement volumes.

EXTRACTING THE BENEFITS

The water being supplied from the QCLNG project is treated to a very high standard, utilising ultra-filtration and reverse osmosis, allowing SunWater to supply water for beneficial use and in accordance with its environmental approval conditions and stringent water quality requirements.

Water quality and the receiving environment is monitored at a number of locations to ensure ongoing compliance.