Strategic Planning and Budget Trends for the Fiscal Year

8 VISION FEDERAL MARKET FORECAST 10 THE DEBT LIMIT DEAL 17 FEDERAL BUSINESS FORECAST SCORECARD ALSO INSIDE: Summer 2023

Give us a call at 571-405-2661 to connect with a specialist. Dedicated to a thriving GovCon industry. With over $2B in commitments, our support for the financial needs of government contracting firms dates back decades. AtlanticUnionBank.com

PSC

David J. Berteau President & CEO berteau@pscouncil.org

Stephanie Kostro Executive Vice President, Policy kostro@pscouncil.org

David Broome Executive Vice President, Government Relations broome@pscouncil.org

Joe Carden, CAE Senior Vice President, Marketing & Membership carden@pscouncil.org

Paul Foldi Vice President, International Development foldi@pscouncil.org

Melissa R. Phillips, CMP Director, Operations phillips@pscouncil.org

Robert Piening, CPA, CGMA Vice President, Accounting & Finance piening@pscouncil.org

Michelle Jobse Director, Vision Forecast jobse@pscouncil.org

Cassie Katz Director, Marketing katz@pscouncil.org

Andrea Ostrander Vice President, Events ostrander@pscouncil.org

Pheniece Jones Director, Media Relations jones@pscouncil.org

Jean Tarascio Director, Events tarascio@pscouncil.org

Donald Baumgart Manager, Vision Forecast baumgart@pscouncil.org

Karen Holmes Office Manager holmes@pscouncil.org

Christian Larsen Senior Associate, Public Policy larsen@pscouncil.org

Sebastian Herrick Director, Public Policy herrick@pscouncil.org

James Millar Associate, Research millar@pscouncil.org

Laila Hammonds Associate, Membership lhammonds@pscouncil.org

Daniel Boddie Associate, Digital Marketing boddie@pscouncil.org

Cole Model Sponsorship Associate model@pscouncil.org

Professional Services Council Service Contractor / Summer 2023 / 3 17 8 FEDERAL BUSINESS FORECAST SCORECARD VISION FEDERAL MARKET FORECAST Cover shutterstock.com/pogonici

STAFF

Service Contractor is a publication of the Professional Services Council 4401 Wilson Blvd., Suite 1110 Arlington, VA 22203 Phone: 703-875-8059 Fax: 703-875-8922 Web: www.pscouncil.org All Rights Reserved For advertising or to submit articles or items for the Member News section, contact: Pheniece Jones jones@pscouncil.org THE DEBT LIMIT DEAL 10 5 Setting the Stage: Strategic Planning During Increased Uncertainty 4 President’s Letter 7 Member News 13 Bill Tracker Summer 2023

PRESIDENT’S LETTER

Welcome to summer, 2023! Each year at this time, PSC engages in at least two competing dynamics. First, there are actions that are part of the annual cycle of budgets and contracts. In parallel, there are new initiatives and priorities from Congress and the administration, shaping the future and responding to current conditions.

This summer, we have an abundance of work on both fronts. Each creates its own uncertainties, and dealing with both takes strategic planning tied to actual actions. Our summer issue covers both.

The end of Fiscal Year 2023 (FY23) is nearly upon us, though Congress and the White House remain far apart FY24 funding. As a result, we are virtually guaranteed to start FY24 on October 1, 2023, under a Continuing Resolution, or CR, for the 18th time in the last 20 years.

How long will the government operate under CRs? Might we see another government shutdown? You can read more of my thinking, and what you can do to prepare, in “The Debt Limit Deal: What to Watch for This Year” on page 10.

The uncertainty of FY24 funding underscores the need for service contractors to ramp up strategic planning. In “Setting the Stage” on page 5, Pierre Chao outlines five questions that companies should ask and answer as part of that process. Though he focuses on defense, his principles apply to contractors for civilian agencies as well.

2023 brought a return to divided government, defined as at least one house of Congress under the majority of the party that is not in the White House. Nearly 30 of the past 42 years have been under such arrangements, adding emphasis to the need to follow legislation that ultimately must pass a Republican House and a Democratic Senate. Our regular Bill Tracker, which begins on page 13, is a good place to start.

Strategic planning and following congressional action on funding bills are essential elements of success for government contractors, small or large. It is also important to know on what agencies plan to use those funds. For that, PSC provides additional information and support.

Each year, we issue a scorecard that examines most of the business forecast information from federal agencies. Assessing

each agency against 15 key attributes, we tell you which forecasts are the most complete, accessible, navigable, and up-to-date. See a summary of this year’s report, starting on page 18.

You can also visit www.pscouncil.org and search “Business Forecast Scorecard” for the full report results and the supporting comments from the government itself.

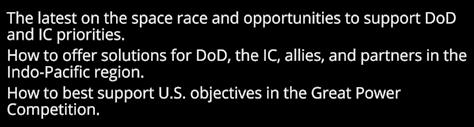

Agency forecasts are not all that companies need. They also need reliable data and program insights from their government customers. PSC’s annual Vision Federal Market Forecast provides that each year. While the results of this year’s process will not be available until November’s conference, you can take a peek at the process behind the reports in the summary that starts on page 8.

Strategic planning also benefits from face-to-face interaction with government leaders across the agencies. In June, PSC held our annual Acquisition Conference, where in-person speakers engaged with our attendees on issues ranging from speed of contract award and government-industry collaboration to emerging cybersecurity rules. For the first time since Covid hit, our speakers were there, live on stage.

PSC continues to hold conferences and events that you can attend in person or virtually. Plan now to attend the Defense conference in October and the Development conference in November.

The government contracting industry continues to be a key element of every agency’s success, and PSC continues to work with our members to address challenges in many areas: in Congress providing funds, in agencies obligating those funds, in awarding contracts on schedule, and in finding and keeping enough great workers in the federal total workforce. Look for more insights and updates on these issues and more in our next edition.

As always, I welcome any feedback, considerations or questions about PSC’s advocacy efforts and how we can best work with industry to accomplish mission goals across the government.

For now, we wish you a safe summer season.

David J. Berteau, President and CEO

4 / Service Contractor / Summer 2023 Professional Services Council

Setting the Stage: How the Defense Industry Can Approach Strategic Planning During Increased Uncertainty

A conversation with Pierre Chao, Founding Partner, Renaissance Strategic Advisors

The defense industry continuously looks at the landscape and assesses if we’re at a pivot point regarding defense budgets. You’ve heard about tectonic plate shifts in the marketplace that occur. Once in a generation or so, a major inflection point in the industry occurs, and I think that’s one of the key questions that everybody is asking from a defense strategic standpoint. Are we in a pivotal turning point?

The last major pivot point was the terror attacks on 9/11 which created a really significant shift, not only in terms of total spending on national security but also for the redefinition of national security to include domestic security. There was also a shift in terms of where money was going and created entire new institutions to support that that shift (e.g., the creation of the Department of Homeland Security).

In today’s world, the war in Ukraine has triggered some shifts to the extent that are we returning back to a period of where we’re in a different global threat environment than where we’ve been in the last year. The defense industry hasn’t seen this since the end of the Cold War relative to state on State conflict.

So we would argue there’s five key strategic questions that most companies should be asking and or are asking, as we consider these topics.

The first strategic question. Do you believe that defense budgets are going up or down? What’s interesting is that I think, as you go around Washington, DC there’s still quite a lot of debate going on, whether the broader macroeconomic environment and deficits that you know, will put downward pressure on the budgets. And will it become a Lucy and the football sort of a situation where the other parts of the environment, whether that’s the national security pressures, the pressures for recapitalization, the messaging that’s actually coming out of the Pentagon itself in terms of a need for a new generation of technologies and spending that’s putting the upward pressure is that overcome or not?

It’s probably one of the most fundamental questions that you can answer to the extent that they are higher. There’s hiring, there’s capital investment, there is a recapitalization frankly of the industrial base as well as R. And D. spending decisions to be

Professional Services Council Service Contractor / Summer 2023 / 5 continued pg. 6 shutterstock.com/gopixa

made over the next 12 to 18 months. If we think that we are in an upward trajectory in the past, when budgets have gone, when upcycles have gone, they have gone, and you know, in other words, there’s usually not a stagger stop. And if one believes that we are in an upwardly sloping environment, and that we are in a new outcome then seeing a trillion dollar defense budget, is not that crazy.

On the other hand, if you don’t believe that budgets are going to go off the normal oscillating and curves in terms of the ups and downs this would indicate that you know the downside. It’s got a couple of 100 billion dollars below where we are today. So that’s why it’s such a critical question to answer. It’s the primary question. I would note that: I’ve been doing this poll now for the last six months. This is probably the most bullish group that I’ve seen out of most groups in town. So I take that as an interesting sort of point.

ultimate numbers is a reliance on Congressional plus-ups that creates a particular environment. In terms of how to position yourself to protect programs, how to see growth, versus one where the entire desires of the building are manifested inside the budgets, and there’s, limited, tweaking. And over the last 40, 50 years you’ve seen this balance of power shifting back and forth between those that were very congressionally driven budgets. I’d refer back to Congressman Aspen days, for example, versus other environments, say the Reagan build up that was driven by the administration. It’s a strategic question that in terms of how much to rely on the presidential budgets versus “I really need Washington operations to step in and drive things forward.”

The second strategic question that you’ve got to ask is given the spending that is underway where will it be allocated? What will go on underneath the top line? Will those dollars end up supporting and sustaining and modernizing existing platforms? Will we invest in the old or the current quote unquote, or is it going to disproportionately favor new technologies, new environments? There is considerable discussion and talk about innovation and the need to bring in new technologies. And yet, when you actually look at the raw dollars for sustaining current platforms, current systems and extending the production lines versus a shift towards very heavy R.&D towards a new generation of technologies, and how long that takes.

So it’s certainly a strategic question, because if you’re a second or third-year supplier into the primes it feeds into the questions of which programs do I support? Where do I invest? Do I lean forward or lean into this debate of old versus new?

The third strategic question we think you should be asking is will this environment over these budget decisions be Pentagon administration driven or congressionally driven to the extent that if it’s an administrations that puts out certain budget dollars or requests and they’re modest relative to an upturn and the only way that you get to these

The fourth strategic question, and we heard a lot of elements of this from Dr. Carlin’s conversation is will the growth and the opportunity be more driven by US budgets or international budgets? So is this upturn going to be domestically driven, or internationally driven? We say that because if you were to take all the promises made, for example, by the European countries in the wake of the Russian Russians invasion of Ukraine and take it on all at face value that they will increase, defense spending, that sum total increase over the next 5 years is almost a trillion dollars of incremental spending which is really significant. It would be a level of spending that has not been seen in decades versus taking a look at what US defense budgets could be doing, which may be about equivalent size, let alone what’s going on in in Asia. And the increased defense spending that you’re seeing, coming out of Japan, for example, South Korea, and others. And so, while the last few cycles have favored just focusing in on US defense spending and the industry has typically turned to international sales usually in downturn, or when things slow down. Depending on what your view is of that global growth that would dictate, potentially, very different strategies, in terms of which markets to be addressing and not. It was striking again in the exchange between Dr. Carlin and David, on how much was spent on international. And the phraseology, that is embedded inside the National Defense Strategy which talks a lot about reliance on the Allies and a common set of capabilities etc., speaks to a far more kind of global market from that perspective or global opportunity hen perhaps we’ve seen in a while for high end weapon systems and platforms. It also then derives into industrial strategies in terms of do I need capabilities actually overseas, or do I address them via joint ventures and partnerships co-development? And I need the entire policy framework to get aligned in order to do that.

As a side note, for example, that there was a conversation about having to get it and sort of working. And yet, for well over a decade, there has been a US, UK, and Australia, a defense technology sharing treaty that was passed but hasn’t been really used. And so I think the keep pushing of the environment it’s going to be critical to it’s opening up that. And once again everybody will have to answer the question of do I believe there’s going to be equal opportunity internationally versus domestically, in terms of setting up the strategy.

6 / Service Contractor / Summer 2023 Professional Services Council

shutterstock.com/Dilok Klaisataporn from pg. 5

And then the fifth question you’ve got to ask yourself is Ukraine the precursor, or the harbinger of future fights or not? It is certainly an event that is waking up the world. It’s an event that is creating that tectonic plate shift. But the issue becomes, is it? Is it the equivalent of the poor war right before that was not a proper signal of what a conflict looks like, as we head into the First World War to the extent of First World War. It ended up being a very different fight than that one versus the Spanish Civil War where concepts like, let’s create and other things. We’re being tested out there and it very much turned out to be the harbinger of how you know the Second World War was going to be fought. So which lessons from Ukraine are relevant, not relevant in the next conflict, which ones will be, in terms of how the fight occurs. It’s a pretty important question to be asking. There’s lots being written today about lessons learned about what we should take, not take, and I think we need to sort of pay very, very close attention in terms of making sure that we understand, you know which lessons we should be taking forward as enduring or universal ones versus very specific to the to the fight at hand. So, these are the five questions. I think answering them, then gives the guidepost in terms of how you want to be setting strategy or driving strategy. As many CEO and senior manager

teams and boards will sit there and say it’s nice to ask the questions, and you need certain answers, but you can’t wait for 100% clarity. There are decisions to be made today in terms of capital allocation, in terms of M&A activity, in terms of investment decisions on R&D, in terms of where to place bets relative to technology, that we have to accept the imperfect data that we have in order to move forward because there is a risk of if you wait too long in order to make those decisions, then the upturn will be behind us in many ways.

Mr. Chao is a founding partner of Renaissance Strategic Advisors and a co-founder of Enlightenment Capital. He brings three decades of aerospace/defense strategy management consulting, investment banking, equity analysis, investing, and policy analysis expertise. Prior to establishing RSAdvisors, Mr. Chao was the Director of Defense-Industrial Initiatives at the Center for Strategic and International Studies, a Washington D.C.-based, non-partisan defense and foreign policy think tank, from 2003-2007; where he still remains as a Senior Associate.

MEMBER NEWS

Abt Associates became the first company in the world to be certified against the new NSF/ANSI 391.1 standard, which was developed at the request of GSA to ensure sustainability in federal supply chains for professional services.

CSA Associates announced it has appointed Greg Blue as chief financial officer. Before joining CSA, Blue held the same position at Cydecor, Inc., overseeing accounting, budgeting, project control and human resources.

Travis Johnson was appointed as the new Chief Financial Officer and Luis German joined as its new Chief Information Officer.

Issued a new report Proactive Risk Management in Generative AI which examines the ethics, accountability, and trust associated with the use of generative AI.

The Washington Post named Chemonics a 2023 TOP WORKPLACE for the Washington, D.C. Region.

Nathan, a Cadmus Company, was awarded the Best Emerging Markets Actionable Economic Development Solutions Provider 2023-USA award for ethical finance by the British reference Wealth & Finance International.

As part of the 44th Telly Awards, Creative Associates won a Gold for its video Trauma-Informed Education, a Silver for its video Using Artwork to Overcome Trauma, and a Bronze for a video about Mali called Artisans for Peace.

MEMBER OPPORTUNITIES: Help PSC Plan the 2024 PSC Annual Conference

PSC will soon be ramping up its planning for the 2024 PSC Annual Conference. Each year we work to fill our conference agenda with relevant and valuable speakers and sessions. Our committee plays an integral role in this planning effort. If you are interested in learning more, email Jean Tarascio, Director of PSC Events, at tarascio@pscouncil.org.

Professional Services Council Service Contractor / Summer 2023 / 7

Federal Market Forecast

by PSC Staff

The Annual Vision Federal Market Forecast is the only non-profit federal market forecast that addresses the defense, civilian, and federal IT markets. Get involved in the Vision forecast by joining a study team. Participate in exclusive, faceto-face meetings with government agency planners and decision makers, think tank experts, and Wall Street analysts to discuss issues facing the federal market, future programs and budgets. Be the first to discover the details on the direction of the market and where future money and opportunities exist before the forecasts are revealed at the November Vision Conference. Work with seasoned professionals within your customer space and expand your professional network!

VISION CONFERENCE

Nov 15-16, 2023

Day 1: Westin Gateway Arlington, VA

Day 2: Virtual https://www.pscouncil.org/vision

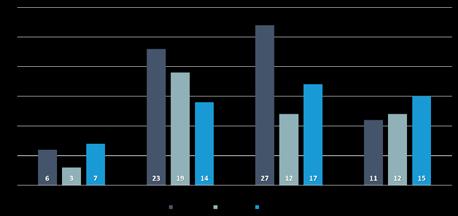

Vision 2023 includes 23 study teams

+5 HHS OpDiv Teams

(CDC, CMS, FDA, NIH, OS & Small OpDivs)

+8 DHS Component Teams

(CBP, CISA, FEMA, HQ, ICE, TSA, USCG & USCIS)

Total # of Vision Volunteers

• 310 returning Vision Volunteers

• 210 new Vision Volunteers

• These more than 500 volunteers, come from over 160 companies.

• PSC Board of Directors engagement plays a significant role

• 41 of 74 (55.40%) companies with a PSC BoD member, participate.

• 252 Vision Volunteers come from companies with a PSC BoD member, accounting for 48% of volunteers.

To learn more or to get your colleagues involved, please contact Michelle Jobse at Jobse@pscouncil.org or Donald Baumgart at Baumgart@pscouncil.org

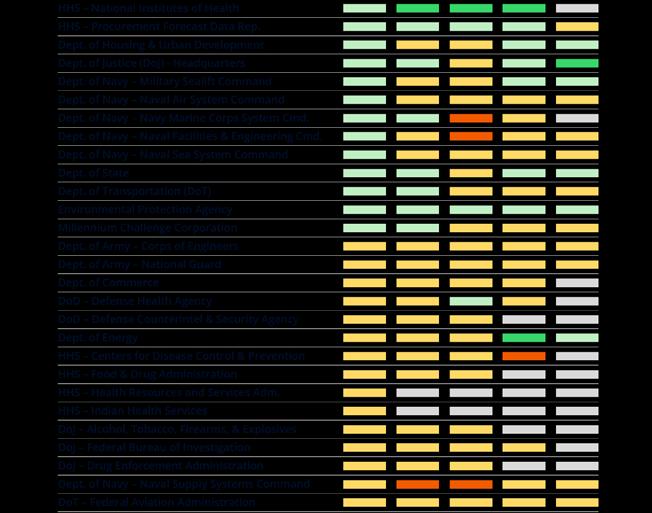

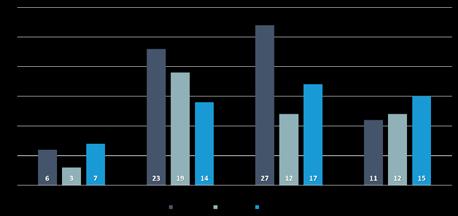

Teams: Past and Present (Defense)

8 / Service Contractor / Summer 2023 Professional Services Council

Vision by the Numbers 3

Teams: Past and Present (Civilian)

Teams: Past and Present (Gov Wide)

Professional Services Council Service Contractor / Summer 2023 / 9

Vision by the Numbers 4

Vision by the Numbers 5

The Debt Limit Deal: What to Watch for This Year

by David Berteau, President and CEO, PSC

This past January, Congress and the White House began to wrestle with the debt limit crisis, beginning when Treasury Secretary Janet Yellen notified Congress that the U.S. would reach the statutory debt limit of $31.4 trillion on January 19.

This set off the latest debt limit crisis, one in which the government came perilously close to national default but in the end avoided it. On June 3, just two days before likely default, the president signed into law the Fiscal Responsibility Act of 2023 (the FRA), ending this episode of the crisis.

Along the way, the Professional Services Council was active in urging Congress and the White House to reach an agreement. Even more importantly, PSC pushed for the Office of Management and Budget to develop plans and issue guidance to agencies on how to manage contracts and invoice payments in the event of default.

This article, however, focuses on the impact of that agreement on the world of government services contracting. We look at what the FRA might mean for government funding for next year. Facing considerably uncertainty, we suggest a few key events and outcomes that readers should watch.

Defense Funding

Past debt limit deals have sometimes been based on Congress and the administration agreeing on caps on future spending, and the FRA does that. For Fiscal Year 2024 (FY24), the law caps defense funding at $886 billion, the level of the President’s Budget Request (the PBR). This level is 3.3 per cent above FY23’s level and assumes an annual 2.4 per cent inflation rate (which is likely to be less than actual inflation for the fiscal year).

At the time of this writing, Congress is sticking with those caps for authorization and appropriations bills in both the House and the Senate. Senate Republicans have argued publicly

that defense needs to be funded at a higher level. There is also talk of a supplemental for Ukraine spending and possibly for support for Taiwan as well, though House Speaker Kevin McCarthy, who controls such things, said he would not bring a supplemental bill to the House floor for a vote.

What to watch for

Contractors should monitor defense bills for changes in the programs that matter to them and for amendments to these bills as they go through the legislative processes of floor votes and conference-like actions between the House and Senate.

Contractors should also watch for action on a Ukraine supplemental, which could become a vehicle for more defense spending, including funds to cover inflation above the 2.4 per cent level in the president’s request.

Non-defense Funding

Beginning with the 2011 Budget Control Act, Congress linked defense funding levels to the aggregate funding levels of the nondefense agencies. That link is severed by the FRA, which essentially capped non-defense spending at levels near last year, FY23.

shutterstock.com/24Novembers

10 / Service Contractor / Summer 2023 Professional Services Council

In the House of Representatives, however, those caps have already been violated. The FY24 funding targets, the allocations, for each of the 12 appropriations subcommittees are set in the aggregate not at the FY23 levels but equal to FY22, some 15 per cent lower. The cuts are not evenly distributed, however, so for some of these subcommittees and the agencies whose funds they appropriate, these cuts are massive.

The Senate has hewed more closely to the FRA cap but has also distributed its allocations unevenly across subcommittees.

Table 1 shows the percentage change from FY23 for each House and Senate appropriations subcommittee.

The table, however, does not show how these subcommittees will divide funds among specific agencies. For example, the steep cuts allocated to the subcommittees for Commerce, Justice, and Science (CJS) must be allocated to the Departments of Commerce and Justice, including the FBI, and NASA, along with other smaller agencies. For one or more of those agencies to be funded at or near their current level (FY23), others will be cut even more deeply.

What to watch for

Contractors should study appropriations bills to see how funding reductions are distributed among the agencies and how those reductions affect specific programs and contracts. Pay particular attention to areas on which the two houses of Congress differ. Those are the places for discussion and compromise and will help determine whether Congress and the White House can agree on a final FY24 spending bill.

Continuing Resolutions

What if the two sides of Congress fail to reach agreement on funding for each agency? Republicans hold the majority in the House of Representatives, and Democrats in the Senate, though both majorities are quite small, meaning that a tiny handful of members can change the outcomes of key votes.

FY24 starts in less than three months. If Congress does not agree on a final FY24 appropriations, it either passes a temporary spending bill, known as a continuing resolution or CR, or the federal government shuts down.

This table compares FY23 enacted appropriations with House and Senate allocations by subcommittee

CRs happen nearly every year, usually at the funding level of the prior year, FY23 in this case.

Table

FY24

Allocations

FY23 Enacted Subcommittee House Change Senate Change from FY23 from FY23 Defense +3.6% +3.2% Energy, VA, Homeland Security +0.7% -0.3% All Other Non-Defense (8 subcommittees) -30.2% -6.9% Total -8.2% -0.8%

1.

Appropriations

and

continued

12 Professional Services Council Service Contractor / Summer 2023 / 11

pg.

In addition, the first CR historically extends into November or December, buying time to negotiate a full-year appropriation. Short CRs of a week or less may follow, but if Congress does not reach agreement, an additional CR would go into the calendar year 2024.

There is a new angle this year. Under the FRA, if a CR is still in effect on January 1, all agencies will face a one per cent across-the-board funding reduction, effectively a sequestration of roughly $16 billion.

What to watch for

Contractors should prepare for a CR this October and monitor progress in Congress toward a deal on a full-year appropriations bill. Absent such a deal, watch for additional CRs, perhaps extending into calendar year 2024.

Along the way, federal agencies may defer obligating funds even at the CR level, pending the one per cent sequester in January. When agencies are uncertain about future funding, they often husband current funds. Contractors should watch agency actions to see if they hold back in case of further reductions.

Conclusion

The debt limit deal seemed to stabilize FY24 spending levels for defense and non-defense agencies, but that agreement has

weakened, and many agencies face potential cuts well below last year’s spending level.

The impacts of CRs, particularly if Congress were to pass sequential CRs extending into next January and beyond, are uneven. For defense, a CR at FY23 levels means foregoing the 3.3 per cent increase currently being pursued by Congress. For many non-defense agencies that face deep cuts below last year’s level, CRs at the FY23 level might provide higher funding levels than a full-year FY24 appropriation would.

This would create a challenge for both Congress and the White House. Under CRs, defense could lose while nondefense agencies gain. Under a full-year FY24 appropriation, defense could gain while many non-defense agencies lose.

How this dilemma plays out might be complicated by next year’s presidential race. It’s possible that Congress will pass CRs that last the entire year or longer. Agency actions from past CRs ae inadequate for CRs that last for a year or more. In preparation, PSC has urged agencies to develop different guidance for contracts in a long-term CR.

Along the way, contractors should prepare for uncertain impacts on federal agencies and current and future contracts. PSC will continue to work for outcomes that help our government customers improve their ability to achieve their missions.

12 / Service Contractor / Summer 2023 Professional Services Council

shutterstock.com/Sergey Nivens

from pg. 11

Bill Tracker: 118th Congress-First Session (2023)

H.R. 170 The Domestic Security Using Production Partnerships and Lessons from Yesterday/ “Domestic SUPPLY” Act, Griffith (R-VA)

SUMMARY Would establish a program to promote domestic manufacturing of personal protective equipment (PPE) for infectious diseases and other public health emergencies and would require PPE purchased by the federal government to be manufactured in the U.S.

STATUS Referred to the Committees on Energy and Commerce and Oversight and Accountability on 1/9/23.

H.R. 399 Small Business Advocacy Improvements Act, Luetkemeyer (R-MO)

SUMMARY Would expand the functions and duties of the Office of Advocacy of the Small Business Administration to include additional international work.

STATUS Passed the House (voice vote) on 1/25/23.

H.R. 675 Secure Space Act, Pallone (D-NJ)

SUMMARY Would prohibit the Federal Communications Commission from granting licenses or access to U.S. markets for satellite systems from certain communications equipment or services providers.

STATUS Reported by the Committee on Energy and Commerce on 4/25/23.

H.R. 825 Banning Operations and Leases with the Illegitimate Venezuelan Authoritarian Regime Act / “BOLIVAR” Act, Waltz (R-FL)

SUMMARY Would prohibit contracting with persons that have business operations with the Maduro regime.

STATUS Referred to the Committee on Oversight and Accountability on 2/2/23. Related bill: S.257

H.R. 826 Supply Chain Security and Resilience Act, Wild (D-PA)

SUMMARY Would establish a Supply Chain Resiliency and Crisis Response Office within the Department of Commerce that will monitor the supply chains for critical goods or services and collaborate with v arious stakeholders to respond to disruptions in those supply chains

STATUS Referred to the Committee on Energy and Commerce on 2/2/23.

H.R. 832 Giving Disadvantaged Businesses Opportunities for Success Act, Garcia (D-IL)

SUMMARY Would make a number of changes to policies impacting disadvantaged businesses at the Department of Transportation.

STATUS Referred to the Committees on Transportation and Infrastructure and Small Business on 2/6/23.

Professional Services Council Service Contractor / Summer 2023 / 13

NEW NEW Newly introduced since last issue Major action taken since last issue Bill became law since last issue

Bill Tracker: 118th Congress-First Session (2023)

H.R. 1149 Countering Untrusted Telecommunications Abroad Act, Wild (D-PA)

SUMMARY Would require the Department of State to report on the prevalence of certain Chinese telecommunications equipment in U.S. embassies and in the networks of U.S. allies.

STATUS Passed the House (410-8) on 4/19/23.

H.R. 1538 Emerging Business Encouragement Act, Carson (D-IN)

SUMMARY Would require the head of each federal agency to establish goals for contracting with a certain percentage of “emerging business enterprises” for each fiscal year.

STATUS Referred to the Committee on Small Business on 3/10/23.

H.R. 1659 Department of Veterans Affairs IT Modernization Improvement Act, Takano (D-CA)

SUMMARY Would require the Department of Veterans Affairs to enter into a contract for the independent verification and validation of certain modernization efforts of the Department, including the Electronic Health Record Modernization Program, the Financial Management and Business Transformation Program, and supply chain modernization programs, among others.

STATUS Referred to the Committee on Veterans’ Affairs on 3/17/23.

H.R. 1744 Transparency in Government Contracts Act, Castro (D-TX)

SUMMARY Would require the Small Business Administration to disaggregate data on federal contracts awarded to small business concerns in certain reports.

STATUS Referred to the Committee on Small Business on 3/23/23.

H.R. 2726 Small Business Payment for Performance Act, Stauber (R-MN)

SUMMARY Would allow small businesses to request an equitable adjustment for certain change orders on military construction contracts and requires the federal government to pay at least 50% of cost occurred from the change order upon receipt of the equitable adjustment.

STATUS Referred to the Committee on Small Business on 4/19/23.

H.R. 2811 Limit, Save, Grow Act, Arrington (R-TX)

SUMMARY Would increase the federal debt limit and provide for changes to and decreases in discretionary spending.

STATUS Passed the House on 4/26/23.

14 / Service Contractor / Summer 2023 Professional Services Council

NEW NEW Newly introduced since last issue Major action taken since last issue Bill became law since last issue

Bill Tracker: 118th Congress-First Session (2023)

H.J. RES.7 Relating to a national emergency declared by the President on March 13, 2020, Gosar (R-AZ)

SUMMARY Would terminate the national emergency declaration for COVID-19.

STATUS Became Public Law No: 118-3 on 4/10/23.

S. 135 Preventing Government Shutdowns Act, Lankford (R-OK)

SUMMARY Would automatically approve a continuing resolution upon a lapse in appropriations and withhold funding for certain activities until appropriations are enacted.

STATUS Referred to the Committee on Homeland Security and Governmental Affairs on 1/30/23.

S. 257 Banning Operations and Leases with the Illegitimate Venezuelan Authoritarian Regime Act / “BOLIVAR” Act, Scott (R-FL)

SUMMARY Would prohibit contracting with persons that have business operations with the Maduro regime.

STATUS Ordered to be reported by the Committee on Homeland Security and Governmental Affairs on 3/29/23. Related bill: H.R.825.

S. 917 Securing Open Source Software Act, Peters (D-MI)

SUMMARY Would require the Cybersecurity and Infrastructure Security Agency to take a number of steps to address the use of open source software by the federal government, critical infrastructure entities, and others.

STATUS Signed into law on 2/22/22, P.L. 117-88.

S. 931 Strengthening Agency Management and Oversight of Software Assets Act, Peters (D-MI)

SUMMARY Would direct federal agencies to generate software inventories, assess the software they use, and report that information to the Government Accountability Office and the Congress.

STATUS Ordered to be reported by the Committee on Homeland Security and Governmental Affairs on 3/29/23.

S. 933 Federal Data Center Enhancement Act, Rosen (D-NV)

SUMMARY Would require the Office of Management and Budget to work with federal agencies to develop minimum requirements for new federal data centers regarding cybersecurity and resiliency.

STATUS Ordered to be reported by the Committee on Homeland Security and Governmental Affairs on 3/29/23.

Professional Services Council Service Contractor / Summer 2023 / 15

NEW NEW Newly introduced since last issue Major action taken since last issue Bill became law since last issue

Released June 2023

Professional Services Council Service Contractor / Summer 2023 / 17

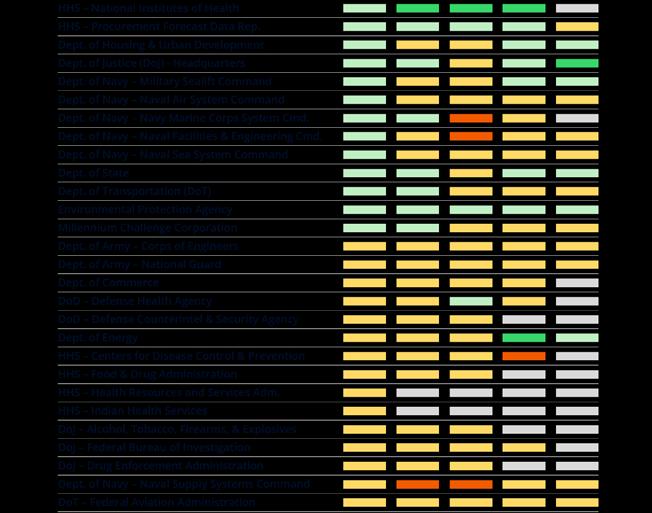

Federal contractors, including PSC’s 400+ member companies, rely on agency procurement forecasts to (1) conduct business planning and (2) beter focus capabili�es development on the needs of their federal government customer(s).

• The fi�h edi�on of PSC’s annual Federal Business Forecast Scorecard examined publicly available procurement forecasts from 70 federal agencies and sub-components.

• PSC is pleased to report general improvement in those procurement forecasts across the U.S. Government since the release of the 2022 PSC scorecard. That said, there remains addi�onal room for improvements, as some agency forecasts s�ll include incomplete, inconsistent, or outdated informa�on (e.g., five agencies surveyed do not have publicly accessible forecasts).

• Of course, publicly available forecasts represent only one way in which the federal government engages its exis�ng industry partners and atracts new entrants to the federal marketplace. The government’s acquisi�on officials con�nue to engage in market research, par�cipate in industry days, and update opportuni�es. PSC and its member companies appreciate such efforts for meaningful engagement.

• We also note that an accessible, navigable procurement forecast is par�cularly important for companies who are unable to par�cipate in such outreach, as well as those companies who are beginning to explore whether they should enter the federal market. Agencies’ web-based business forecasts can play a pivotal role in atrac�ng new entrants – or reatrac�ng contractors who le� the federal market – into work with the U.S. Government.

• PSC respec�ully offers this Scorecard as a resource for agencies who would like to understand how industry uses procurement informa�on. What kinds of �mely, relevant informa�on does industry seek? How can agencies improve forecasts so they can access needed capabili�es? We look forward to con�nuing our dialogue with acquisi�on officials as they prepare their next acquisi�on business forecasts.

18 / Service Contractor / Summer 2023 Professional Services Council

Model for Success: OPM

The Office of Personnel Management (OPM) received the highest score in PSC’s 2023 Federal Business Forecast Scorecard. Leveraging the “Acquisi�on Gateway” system, OPM’s procurement forecast benefits from that system’s func�onality – e.g., mul�ple ways to sort informa�on quickly – so industry partners can more easily iden�fy specific contrac�ng opportuni�es. This system is shared with the Departments of Jus�ce and Labor, as well as last year’s top scorer, the General Services Administra�on. OPM’s forecast is regularly updated, populated with useful informa�on to support companies' decision-making, and frequently goes above and beyond to provide accurate, �mely informa�on to its industry partners.

Professional Services Council Service Contractor / Summer 2023 / 19

Honorable Men�on: Department of the Navy

The U.S. Department of the Navy (DoN) earned an honorable men�on in the 2023 Scorecard, working closely with PSC and the contractor community throughout 2022 and 2023 to assess and improve its forecas�ng. In addi�on to previous improvements, DoN volunteered addi�onal Navy contrac�ng en��es to be assessed; these organiza�ons also received good scores. Moreover, PSC commends DoN for its responsiveness to contractor’s needs, as it rapidly and competently improved forecast informa�on. We encourage DoN to con�nue this posi�ve trajectory by upda�ng forecast informa�on more frequently for each opportunity within their website and ensuring all contrac�ng offices adopt and maintain high forecas�ng standards demonstrated by those assessed in 2023

The Department of the Navy understands the importance of providing forecasts to our industry partners. The Navy and Marine Corps are dedicated to delivering the best capabilities to the warfighter at the best price to the taxpayer. Providing realistic forecast of our future requirements enables our industrial partners to make key business decisions and position themselves to do business with the Navy, which is vital to achieving our mission. We look forward to the continued partnership with industry and we are very pleased with this recent recognition from PSC.

Ms. Cindy R. Shaver Deputy Assistant Secretary of the Navy (Procurement) Assistant Secretary of the Navy for Research, Development and Acquisi�on

20 / Service Contractor / Summer 2023 Professional Services Council

Honorable Men�on: Department of Homeland Security

The Department of Homeland Security (DHS) earned an honorable men�on in the 2023 Scorecard. Over the last 5 years, PSC has given consistently high marks to DHS components’ forecasts. Unifying DHS components under a single Acquisi�on Planning Forecast System (APFS) has helped improve the quality and consistency of DHS forecasts across the board. PSC commends DHS for providing frequent updates to this system as well as incorpora�ng a transparent log of updates to individual opportuni�es within APFS. We encourage DHS to con�nue this posi�ve trajectory by including more comprehensive descrip�ons of forecasted opportuni�es within their website.

At DHS, it’s no secret that we’re committed to engaging with industry in meaningful ways. We’re pleased, but certainly not surprised, to see that each of the DHS organizations reviewed for the scorecard received the highest rating. Our dialogues with industry have enabled us to make impactful changes to our processes and tools, including our Acquisition Planning Forecast System, which have benefited not only our industry partners but also the Department. Thank you, PSC, for this recognition.

Mr. Paul Courtney Chief Procurement Officer Department of Homeland Security

Mr. Paul Courtney Chief Procurement Officer Department of Homeland Security

Professional Services Council Service Contractor / Summer 2023 / 21

Needs Improvement: USDA

Over the last 5 years of assessing forecasts, PSC has determined that U.S. Department of Agriculture’s (USDA’s) opera�ng divisions have several areas for improvement. Considering that USDA spends a significant por�on of its budgets on contracted goods and services, PSC encourages the Department to provide a more frequently updated, detailed procurement forecast, including but not limited to a “date modified” column of informa�on for each opportunity. Addi�onally, the USDA could benefit greatly by increased engagement with contractors, and PSC, on ways to improve its forecast; such outreach would highlight the importance of more detailed informa�on about an�cipated award dates and length, contract vehicle informa�on, program buying office, and award type so that USDA could beter access needed capabili�es from their contrac�ng partners.

22 / Service Contractor / Summer 2023 Professional Services Council

How Does Industry Use Business Forecasts?

How Does Industry Use Business Forecasts?

To provide federal customers with more �mely, comprehensive, and thoroughly researched solu�ons when final Requests for Proposals (RFPs) are released, companies rely on the accuracy, comprehensiveness, and �meliness of an agency’s business forecast, especially though not limited to the publicly available website. O�en, resource alloca�on and teaming decisions are made well in advance of the RFP release. A useful forecast provides excellent, ac�onable informa�on that can enable interested en��es to determine poten�al staffing requirements, project needs, and costs. While PSC and the services contrac�ng community fully recognize that spending priori�es o�en change on short no�ce, significant course correc�ons tend to be the excep�ons rather than the rule in the services sector.

To provide federal customers with more �mely, comprehensive, and thoroughly researched solu�ons when final Requests for Proposals (RFPs) are released, companies rely on the accuracy, comprehensiveness, and �meliness of an agency’s business forecast, especially though not limited to the publicly available website. O�en, resource alloca�on and teaming decisions are made well in advance of the RFP release. A useful forecast provides excellent, ac�onable informa�on that can enable interested en��es to determine poten�al staffing requirements, project needs, and costs. While PSC and the services contrac�ng community fully recognize that spending priori�es o�en change on short no�ce, significant course correc�ons tend to be the excep�ons rather than the rule in the services sector.

Professional Services Council Service Contractor / Summer 2023 / 23

© 2023 Professional Services Council Define Requirements Architect Concept Acquisi�on Strategy Prepare DRFP Prepare RFP Source Selec�on Develop Strategic Roadmap Analyze Alterna�ves / Seek Sources Release RFI Release DRFP Release RFP Evaluate Responses Business Capture Planning Focused R&D Study Teams White Paper, RFI Response, Win Strategy / Compe��on Analysis / Bid No Bid, Customer Contact Plans DRFP Ques�on Genera�on Final Proposal Development and Produc�on Orals, Demos, BAFO Government Project Milestones Industry Forecasts Reviewed Here Award

© 2023 Professional Services Council Define Requirements Architect Concept Acquisi�on Strategy Prepare DRFP Prepare RFP Source Selec�on Develop Strategic Roadmap Analyze Alterna�ves / Seek Sources Release RFI Release DRFP Release RFP Evaluate Responses Business Capture Planning Focused R&D Study Teams White Paper, RFI Response, Win Strategy / Compe��on Analysis / Bid – No Bid, Customer Contact Plans DRFP Ques�on Genera�on Final Proposal Development and Produc�on Orals, Demos, BAFO Government Project Milestones Industry Forecasts Reviewed Here Award

Scorecard Methodology

Due to the number of agencies and subcomponents tracked and to be as objec�ve as possible, PSC staff take a “snapshot” of agencies’ web-based forecasts at the beginning of the second quarter of the government’s fiscal year (i.e., January). PSC staff then begin the assessment process.

• Using 15 key atributes used by services contractors who seek to make go / no-go decisions based on available informa�on, one assessor reviews each agency’s forecast and assigns point values in accordance with those atributes. Of note, each atribute is weighted in accordance with its rela�ve importance to industry; PSC has veted these atributes with contractors and government officials, as well as internally within PSC.

• Other PSC staff then conduct a “blind” reassessment process wherein they are unaware of the score already assigned to an agency's forecast. This step encourages objec�vity. In the event of a discrepancy between the two assessments for a par�cular forecast, the staff discuss their perspec�ves and resolve the discrepancy.

• Finally, PSC compares total scores of the assessed agencies side-by-side, determining the distribu�on of scores into Good, Fair, Needs Improvement, or Not Found. These cleavage points o�en “pop out” during the assessment process.

24 / Service Contractor / Summer 2023 Professional Services Council

PSC’s 15 Key Atributes for a Successful Business Forecast

1.Searchable Spreadsheet

At a minimum, forecasts should be available in Excel format. Because PDFs are o�en difficult to read and sort, it is also difficult to extrapolate data; this complicates a poten�al bidder’s ability to iden�fy opportuni�es. The use of a PDF may also indicate that the agency does not frequently update the forecast. PSC’s Federal Business Forecast team awards addi�onal points for advanced Electronically Sortable Informa�on (ESI) systems which go above and beyond Excel.

Why this maters: Excel or an ESI format allows industry to easily search for and organize opportuni�es and allows agencies to update forecasts more easily.

2.Date Modified

Agencies should indicate the last modifica�on date for each opportunity. This informs users whether the informa�on is recent or has changed since last viewing.

Why this maters: Without a date modified, contractors may be uncertain if informa�on has changed. When uncertain, poten�al bidders spend addi�onal resources on inquiries to determine relevancy and �meliness of informa�on provided; since respondents to these inquiries are most o�en government officials, this also creates addi�onal work for agencies.

3.Forecast Update Frequency

PSC’s Federal Business Forecast team evaluates forecasts on frequency of publica�on. Agencies should update procurement forecasts at least twice a year.

Why this maters: Poten�al bidders may lose confidence in the forecas�ng tool’s accuracy and efficacy if informa�on appears outdated. They are less likely to expend resources for proposal prepara�on, possibly reducing compe��on for an agency’s opportuni�es.

4.Project Descrip�on and Contract Number

The PSC team evaluates forecasts on the existence and comprehensiveness of a project descrip�on and if the agency has assigned a contract number to the opportunity. To the greatest extent prac�cable, forecasts should include details on place of performance, type and scope of work, technical requirements, poten�al security clearance requirements, and other relevant opportunityspecific informa�on.

Why this maters: With a more detailed descrip�on of the work required, companies can determine if an opportunity fits their capabili�es, requires teaming, and is a good use of their resources to track and pursue.

5.Dollar Value (Base + Op�ons)

The PSC team evaluates forecasts on whether the tool lists opportunity-specific dollar values, as well as the specificity of dollar values (e.g., base and op�on year values).

Why this maters: Poten�al bidders consider poten�al award value and structure of an opportunity to assess their own compe��veness and poten�al return on investment and to priori�ze opportuni�es for tracking and pursuit.

6.Program or COR Contact Informa�on

Agency forecasts should specify a point of contact for each opportunity with an individual’s (not generic or office) email address and telephone number. The PSC team awards addi�onal points if the forecast tool indicates an individual point of contact and addi�onal “back-up” points of contact.

Why this maters: Poten�al bidders and the agency benefit when a specific government individual can address ques�ons about the opportunity. Lis�ng an email and telephone number helps make a specified point of contact more readily available, as does the inclusion of addi�onal points of contact.

Professional Services Council Service Contractor / Summer 2023 / 25

7.Program Office & Buying Ac�vity

PSC’s Federal Business Forecast team evaluates forecasts on whether they specify program office and buying ac�vi�es for each opportunity.

Why this maters: Knowing which program office and buying ac�vity is responsible for the procurement helps poten�al bidder understand the government’s requirement and develop offer strategies, including but not limited to poten�al teaming arrangements.

8.PSC

& NAICS Codes

When evalua�ng a forecast, the PSC team looks for specific NAICS and/or PSC code for each opportunity. Forecasts receive full points for including a NAICS code and PSC code, with par�al credit awarded for having one, but not the other listed.

Why this maters: This informa�on helps companies narrow their search for opportuni�es that would benefit from their capabili�es.

9.New Start or Recompete with Incumbent

Does the forecast specify the incumbent for each opportunity, or does it indicate which opportuni�es are new / have no incumbent?

Why this maters: Knowing ahead of �me that an opportunity is a new start or a recompete – and if the later, knowing the incumbent – provides poten�al bidders with key insight into how best to posi�on themselves for a successful pursuit.

10.Set Aside and Type

PSC’s Federal Business Forecast team evaluates whether the tool specifies set asides, and if so, what types (e.g., 8(a), WOSB, VOSB, etc.)

Why this maters: Including the specific set aside type allows small businesses to iden�fy opportuni�es for which they may qualify and reduces the likelihood of large companies expending resources on opportuni�es for which they are ineligible.

11.Contract Vehicle (e.g., IDIQ, BPA)

Forecasts should indicate a par�cular contract vehicle for each opportunity.

Why this maters: Understanding the intended contract vehicles helps poten�al bidders assess the opportunity’s fit within their business model (e.g., develop prime and sub strategies) and exper�se.

12.Ac�on / Award Type

The team evaluates whether the forecast specifies each opportunity’s award type (e.g., compe��ve, sole source, mul�-award) and contract type (e.g., fixed price, �me and materials, incen�ve fee).

Why this maters: Knowing the award type helps poten�al bidders assess if their qualifica�on and compe��veness for the structure.

13.An�cipated Solicita�on Release Date

Forecasts should specify the an�cipated solicita�on release date for each opportunity.

Why this maters: Knowing this informa�on helps poten�al bidders plan and prepare resources, including teaming arrangements that can take significant �me to nego�ate.

14.An�cipated Award Date

Does the forecast specify the an�cipated award date and / or fiscal year and quarter?

Why this maters: Knowing this informa�on allows poten�al bidders to an�cipate workload and manage resources (e.g., personnel, facili�es).

15.An�cipated Award Length

PSC’s Federal Business Forecast team evaluates whether the forecast includes award length.

Why this maters: Knowing the contract term / period of performance allows poten�al bidders to evaluate each opportunity within their exis�ng workload and resources.

26 / Service Contractor / Summer 2023 Professional Services Council

Professional Services Council Service Contractor / Summer 2023 / 27 (Continued)

28 / Service Contractor / Summer 2023 Professional Services Council (Continued)

For More Informa�on

View this report online at www.pscouncil.org/scorecard.

If you have ques�ons about the Scorecard or would like to engage with PSC further, please contact policy@pscouncil.org.

Interested in par�cipa�ng in next year’s Scorecard?

Contact policy@pscouncil.org.

About PSC

PSC is the voice of the government technology and professional services industry. PSC’s more than 400 member companies represent small, medium and large businesses that provide federal agencies with services of all kinds, including informa�on technology, engineering, logis�cs, facili�es management, opera�ons and maintenance, consul�ng, interna�onal development, scien�fic, social, environmental services, and more. Together, the trade associa�on’s members employ hundreds of thousands of Americans in all 50 states. Follow PSC on Twiter @PSCspeaks. To learn more, visit www.pscouncil.org.

Professional Services Council Service Contractor / Summer 2023 / 29

30 Professional Services Council For more information on PSC membership, contact membership@pscouncil.org. NEW Q1

MEMBERS WELCOME

PSC

pscdefenseconference.com Great Power Competition: Modernizing the Defense Ecosystem October 19, 2023 12 p.m. - 6 p.m. ET The Westin in Arlington, VA & Virtual

Professional Services Council

4401 Wilson Blvd., Suite 1110 Arlington, VA 22203

2023

FedHealth Conference

MAY 24 | North Bethesda, MD & Virtual

Federal Acquisition Conference

WWW.FEDHEALTHCONFERENCE.ORG

WWW.FEDACQUISITION.ORG

JUNE 22 | Arlington, VA & Virtual WWW.PSCDEFENSECONFERENCE.ORG

Defense Conference

OCT 19 | Arlington, VA & Virtual

Development Conference

NOV 9 | Arlington, VA & Virtual

Vision Federal Market Forecast Conference

NOV 15-16 | Arlington, VA & Virtual

Annual Members Meeting & Holiday Reception

DEC 7 | Arlington, VA

WWW.DEVELOPMENTCONFERENCE.ORG

WWW.VISIONFORECAST.ORG

WWW.PSCOUNCIL.ORG

SPONSORSHIPS AVAILABLE! VIEW OPTIONS AT WWW.PSCOUNCIL.ORG/SPONSORSHIPS

PSC CONFERENCES

Mr. Paul Courtney Chief Procurement Officer Department of Homeland Security

Mr. Paul Courtney Chief Procurement Officer Department of Homeland Security