Our governments are scrambling to address housing affordability. The media is all over it. Academics are quoted as experts. Poverty advocates have their own ideas. So do the providers of rental housing. Who’s right? What will work? Magic bullet? Cumulative affect of many new initiatives? Rather than the politically expedient or sensational hashtag headlines, solutions must be factbased and evidence driven.

Toronto’s Vacant Home Tax was imposed with the belief that there is an abundance of empty homes that investors are sitting on. By definition investors seek return on their capital and aside from lot assembly, non-revenue generating assets are not their preference. It would have been simpler to have the city owned water department check and identify the homes where no one flushed a toilet for 6 months running. But that wouldn’t have made the news, nor would it have created a bunch of government paper-pushing jobs. What was the carbon footprint resulting from mailing of all those yellow sheets?

The Underused Housing Tax is an annual 1% tax on the ownership of vacant or underused housing in Canada. The tax usually applies to non-resident, non-Canadian owners. In some situations, however, it also applies to Canadian owners. First you determine if it affects you, then if you have an exemption (type, location, etc), and whether you need to file a new tax form, and finally if the taxman gets paid. This one is stackable with Toronto’s VHT. Wonderful tweetable stuff. So complicated and convoluted that they’ve extended the deadline.

The new Federal Prohibition on the Purchase of Residential Property by Non-Canadians Tax has a long title to make it self-explanatory, without boring details. Great sound byte … read the title, then move on to a cat video. Oops, maybe this one stops some rental development because 10% of the project capital is not Canadian. Punish the global markets for creating housing unaffordability! Really? In a housing supply shortage the answer does not include making it more difficult to finance new supply. They made some recent amendments to correct some of the problems.

From our perspective the easiest path with the greatest results is by encouraging purposebuilt rental development to achieve the biggest bang. Provide sufficiently large exemptions to greenlight projects. The more you give, the more you get. It really depends on how much you really want it, versus just saying the right things to the masses. More importantly, this is entirely fact-based and evidence driven. Unfortunately, it lacks the apparent modern prerequisite of a five star political tweet.

Thanks for attending our Chair’s Lunch! As the warmer weather approaches, our Spring HOPE Food Drive is launched, soon followed by our scholarship applications. I look forward to seeing you at our golf fundraiser.

Philip Sarvinis | Bill Gladu | Jeremy Horst | Michael Pond | Duncan Rowe

Jack Albert | Beau Gaudreau | James Cooper | Michael Park | Tim Van Zwol

Publisher Nishant Rai

Account Executive Justin Kreslin

Editorial Daryl Chong

Creative Director / Designer Scott Clark

Office Manager Geeta Lokhram

Published By: GTAAOnline is published monthly by RHB Inc. on behalf of the Greater Toronto Apartment Association (GTAA) and is distributed online through controlled circulation to the GTAA membership.

Please contact the Publisher for advertising dates and rates. Opinions expressed are those of the authors and do not necessarily reflect the views and opinions of the GTAA Board or management. GTAA accepts no liability for information contained herein. Opinions expressed in articles are those of the authors and do not necessarily reflect the views and opinions of the GTAA Board or management. GTAA and RHB Inc. accept no liability for information contained herein. All rights reserved. Contents may not be reproduced without the written permission from the publisher.

P.O. Box 696, Maple, ON L6A 1S7 416-236-7473

All contents copyright © RHB Inc.

Services WE provide:

Transparent Collections

Staff Training Services

AR Management

AR Consulting

Call Services

Credit Bureau reporting

Listings through Yardi

Live Login to your accounts

In-house and former tenant collections

Cyber insured

Floriri Village Investments Campus One

John Aiello (647) 244-3012

info@floririvillage.com floririvillage.com

Construction/Repair/Emergency Services

Simon Zarzour (647) 288-0827

szarzour@studenthousing.com live-campusone.ca

CanMar Contracting Amar Kitchen & Millwork Services Devman Group

Mark Lecce (416) 674-5040 markl@canmarcontracting.com canmarcontracting.com

Amar Sheraj (416) 432-5040 amarsheraj@gmail.com

Cullen Patterson (905) 604-0555 cullen@devmaninc.com devmaninc.com

Christina Lee (437) 292-0176 chlee@bgmultifamily.com bgmultifamily.com

James Harvey (647) 234-9400 jimh@dajica.ca dajica.com

Todd Morrison (905) 460-2552 tmorrison@atdoor.ca atdoor.ca

Sonya Mills (416) 450-7678 sonyamills@luxerone.com luxerone.com

Charlie DiPietro cdipietro@merrit.ca

Dino DiPietro (416) 238-5782 ddipietro@merrit.ca merrit.ca

Mike Norris (905) 669-5154 mike@norrisfc.com norrisfireconsulting.com

Trevor Boodoo (905) 564-7711 trevorb@staybrite.ca

David Thomas (416) 663-2677 david@alarmboss.com alarmboss.com

On August 10, 2022, the Province of Ontario introduced Bill 3, Strong Mayors, Building Homes Act, 2022 (“Bill 3”) to the Ontario Legislature. Bill 3 indicated will provide the mayors of Toronto and Ottawa new tools to advance provincial priorities defined by regulations, including building 1.5 million new homes over the next ten years and the construction and maintenance of infrastructure to help build housing faster.

Bill 3 received Royal Assent on September 8, 2022, and the new powers for the Mayor of Toronto (and Ottawa) came into force on November 23, 2022.

Bill 3 amended the City of Toronto Act, 2006 (“COTA”), the Municipal Act, 2001 and the Municipal Conflict of Interest Act, to provide specific powers and duties to mayors (“Heads of Council” per the legislation) that were previously provided to city councils for the City of Toronto and the City of Ottawa. The Province has indicated these powers will be extended to other municipalities in the future.

Toronto’s Mayor is now provided with the POWER to:

• Establish Committees of Council, assign their functions, and appoint the Chairs and Vice-Chairs;

• Appoint Chairs and Vice-Chairs of Local Boards for prescribed boards;

• Appoint and assign duties to a City Manager;

• Hire or dismiss a head of any division or the head of any other part of the organizational structure (with several exclusions);

• Determine the City’s organizational structure;

• Ability to delegate some of the listed new powers to City Council and/or the City Manager;

• Direct City staff to undertake research, provide advice to the Mayor and City Council on City policies and programs and to implement Mayoral decisions related to the powers under Bill 3.

Of special note, the Mayor has the power advance and/or prevent interference with Provincial Priorities, which include:

• Building 1.5 million new residential units by December 31, 2031;

• Constructing and maintaining infrastructure to support housing, including, transit, roads, utilities, and servicing;

• The power to veto a by-law if the Mayor is of the opinion that all or part of a bylaw could potentially interfere with a provincial priority. Use of this veto would nullify (not amend) Council’s decision. If the Mayor gives notice within 2 days, the veto must be exercised within 14 days of decision by Council or Committee. Conversely, Council may override a veto by a vote of 2/3 of members of Council;

• The power to require City Council to consider a matter at a meeting that could potentially advance a prescribed provincial priority.

Other new powers:

• Mayor to present the City’s annual budget to City Council. Council has the power to amend the budget. The Mayor may then veto such amendments. The veto can be overturned by a 2/3 vote of members of Council.

To add flavour, on November 16, 2022, the Provincial government introduced Bill 39 the Better Municipal Governance Act, 2022 that proposes additional Mayoral powers. The provisions related to Mayoral powers include:

• The mayor to propose and amend certain municipal by-laws related to prescribed provincial priorities and enable Council to pass the by-law if more than one-third of members of Council vote in favour;

• Allow the provincial Cabinet to prescribe the provincial priorities for which the new mayoral bylaw powers could be used and allow the Minister of Municipal Affairs and Housing to make regulations that establish rules related to the by-law power;

The introduction of special powers and duties for the Mayor supersede and make redundant several provisions of the Toronto Municipal Code and other by-laws, so city staff will undertake a review of the affected code chapters for alignment with the new legislation.

Without surprise, these bestowed powers were not well received by a majority of City Councillors who formally submitted a joint letter of opposition to Premier Ford the Minister of Municipal Affairs and Housing asking for the legislation to be reconsidered, and stated “Toronto City Council should be governed by majority rule, and any changes to Toronto’s governance should be decisions made by City Council and local residents.”

Five former Toronto mayors – David Crombie, John Sewell, Art Eggleton, Barbara Hall, and David Miller – submitted a letter to (at the time) Mayor Tory calling the powers “undemocratic”.

At the time, Mayor Tory advised that he would only use these new powers for good, not evil …

And for even more spice, a new Mayor will be elected in a city wide by-election on June 26, 2023. Will candidates campaign promising to forsake SuperMayor powers, or embrace them as intended? We’ll find out in a few months.

Ontario’s multi-residential sector remains one of the most resilient segments of commercial real estate capital markets. Notwithstanding broader market volatility, investor sentiment for multifamily assets remains positive. Through Q2 2023, values have weathered the impact of higher borrowing costs and are well-positioned to counteract higher inflation and interest rates through stable and continued cashflow growth. Please see below for a summary of recent deals as of Q2 2023. For additional info on cap rates, current valuations, and market trends in a changing investment landscape, please reach out to a member of our team.

605 Units | $306,612 Per Suite

Closed March 2023

SOLD FOR $185,500,000

169 Units | $295,858 Per Suite

Closed December 2022

SOLD FOR $50,000,000

For more information, please contact:

David Montressor * Vice Chairman (416) 815-2332

david.montressor@cbre.com

* Sales Representative

Tom Schuster * Associate Director (416) 847-3257

tom.schuster@cbre.com

40 Delisle Avenue, Toronto

100 Units | $445,000 Per Suite

Closed March 2023

SOLD FOR $44,500,000

69

26 Units | $326,923 Per Suite

Closed January 2023

SOLD FOR $8,500,000

Scan to receive Apartment Listings and Market Research 2 & 4 Hanover Road, Brampton 2303 Eglinton Avenue East, Scarborough Old Mill Terrace, EtobicokeThe second term of the provincial government involves housing, and specifically addressing the supply shortage. Bill 23, the omnibus More Homes Built Faster Act, 2022 includes wide sweeping changes with the goal of building 1.5 million new homes in the next 10 years.

It focuses on construction in Ontario’s main municipalities. It even requires each of 29 municipalities across the province to develop and submit a plan on how they will reach their assigned quota. For Toronto, 285,000 new homes (19% of the provincial total) are targeted by 2031. Mississauga’s target is 120,000 and Brampton’s is 113,000 new homes.

By First LastThe Bill also focuses on the reduction of fees and charges to provide an incentive to develop the much needed new housing stock. The City of Toronto estimates that these reductions would result in a $230 million annual loss in development charges and parkland dedication revenue, and negatively impact the City’s ability to provide the services necessary to support growth over the long term.

Ironically, Toronto (and similarly most other local municipal governments) view this through a singular perspective of direct fees. They have not quantified, or even taken into consideration the broader negative effects of not having sufficient housing – of all types, for all budgets – on local prosperity and quality of life. This narrow view lacks vision.

The legislation supports regulatory changes to provide certainty regarding inclusionary zoning (‘IZ’) rules, with a maximum 25-year affordability period, a five per cent cap on the number of inclusionary zoning units, and a standardized approach to determining the price or rent of an affordable unit under an inclusionary zoning program.

This would define ‘affordable housing’ across the province; to offset Toronto’s income-based definition that was adopted in 2021. Affordable will be 80% of market rent (or average purchase price), and the Ontario government will start publishing a regular bulletin setting the averages.

Note that GTAA was successful in negotiating an exemption from IZ for purpose-built rental (‘PBR’) for the initial period in Toronto, as well as an ongoing exemption in other local municipalities. These newly introduced cap of max 5% of units, 25-years, elimination of fees (DC, CBC, Parkland) for affordable and IZ units largely benefits condominium (ownership) development which were subject at varying degrees to IZ across the GTA.

Ontario is also taking action to help streamline the construction and revitalization of our aging rental housing stock, which in some cases is many decades old, and often energy inefficient. As it stands, under the Municipal Act and City of Toronto Act, municipalities may enact bylaws to prohibit and regulate the demolition or conversion of multi-unit residential rental properties of six units or more. These by-laws vary among municipalities and can include requirements that may limit access to housing or pose as barriers to creating housing supply.

Ontario is reviewing feedback received through a consultation on potential regulations to enable greater standardization of these municipal by-laws, while ensuring that renter protections and landlord accountabilities remain in place.

PBR construction received reduced development charges of up to 25 per cent, and conservation authority fees for development permits and proposals are temporarily frozen.

Specifically, the DC discount for PBR is based on number of bedrooms:

• 25% DC discount for 3 bedrooms

• 20% DC discount for 2 bedrooms

• 15% DC discount for 1 bedroom or smaller.

It reduces the parkland requirements for higher density residential developments to help lower costs thereby encouraging construction.

Fees will be frozen at the site plan/zoning application stage for cost certainty, provided building permits are obtained within two years.

For many apartment owners with ‘towers in the park’ the potential for infill development is assisted as the maximum community benefits charge would be based on the land value of just the new units.

Ontario is calling on the federal government to come to the table and work together on potential GST/HST incentives to support the building of more homes. This could take the form of rebates, exemptions or deferrals of GST/HST to support both new ownership housing development and new rental housing

development.

Currently, property tax assessments for affordable rental housing are established using the same basis as regular market rental properties. Ontario will explore potential refinements to the assessment methodology used to assess affordable rental housing so that it better reflects the reduced rents that are received by these housing providers. In addition, Ontario will consult with municipalities on potential approaches to reduce the current property tax burden on multi-residential apartment buildings in the province.

Regarding the Rental Replacement policies enacted by a few municipalities, the province acknowledges the intention the preserve affordable rents and protect tenants, but also recognizes that these policies may prevent renewal and limit the supply of new rental.

The provincial Bill 23 made changes to Section 111 of the City of Toronto Act to allow the Minister to make regulations imposing limitations on the City’s ability to prohibit and regulate the demolition and conversion of residential rental properties. Toronto’s rental demolition by-law has been in force since 2007 and Official Plan rental replacement policy has been in effect since 2006.

To date, the Minister has not released any regulations, or changes.

The next article provides an overview of GTAA’s position on rental replacement policies and recommendations to the province on how to embrace this as an opportunity.

Building Envelope Repairs

Parking Structure

Roof Assessment & Replacement

Window Upgrades

Site Improvements

Interior Upgrades

In December 2022, GTAA provided comments to the provincial government as part of their consultation and information gathering process. The following contains a summary and are some excerpts from GTAA formal submission.

We agreed that rental is chronically undersupplied, and requires immediate attention.

Immediate action is urgently needed to address the near absence of new purpose-built rental development across the GTA. We applaud our provincial government for a series of initiatives to reverse decades of inaction.

We stated no opposition to Rental Replacement as a concept.

Rental replacement bylaw requirements alone, do not significantly hinder the production of new rental housing. GTAA and our members generally support the continuation of rental replacement requirements that return existing residents to new and improved units, at their old monthly rents (plus guideline), in similar units (by bedroom count) to continue to live in a familiar neighbourhood and take full advantage of any updated amenities available in the new modern building.

The objective is increasing our purpose-built rental stock, and our government’s initiatives are indeed goaloriented to achieve this societal benefit.

We suggested that rental replacement should be viewed as a huge opportunity that should be embraced. Our government’s recognition of this huge opportunity is the first step in unlocking, otherwise locked, land and housing potential. There are thousands of small apartment buildings on sites that are already zoned for current multi-family residential use. Most of these buildings are more than 50 years old, and the entire community is accustomed to their location and use, thereby allaying any NIMBYesque sentiment. Many of these sites have abundant surface parking and ancillary-use land. Intensification and modernization could be the low hanging fruit, and an important piece in fixing our housing crisis puzzle. Some tweaking would definitely help.

Some minor refinement to municipal rental replacement bylaws, combined with some financial exemptions and discounts could help generate tens of thousands of new rental units, which has not occurred for a very long time.

Backed by Toronto Planning’s data which quantified that the current production of new rental shortfall is 2,500 units each year (over the past 10 years), and the City’s conclusion that,

“it is very unlikely that this level of rental development could be achieved consistently in the future without expanded policy and program support for the rental housing sector.”

Looking immediately to the west GTAA highlighted that the situation in Mississauga is equally distressing. Mississauga’s current rental stock is 30,322 units contained in 337 buildings that are 2-storeys or taller, with 6 units or more. This serves a population of more than 766,000 residents (2016).

Based on Urbanation reports, only 3 new purpose-built rental buildings have opened since 2005 in Mississauga, adding a mere 484 units to the purpose-built rental stock in the past 16 (perhaps more) years. Five new rental projects are due to open by 2024, adding 1,180 units. This is grossly insufficient for a growing city.

GTAA restated the financial impacts imposed by municipalities:

Anything and all things that increase expenses deter new purpose-built rental housing. This includes development charges, parkland dedication fees, community benefits (and former Section 37) charges, property taxes, HST, and requirements under various municipal rental replacement policies. The cumulative effect has stymied mass production for far too long. Upheaval is gravely needed. Incentives via exemptions, discounts, and goal-oriented structuring could create the proper environment to, after nearly half a century, spur largescale purpose-built rental production.

Then we summarized how to improve and embrace this opportunity:

The requirements of (Toronto’s and other) municipal Rental Replacement By-laws increase the financial challenges facing new rental production. As stated GTAA Members understand the policy objectives and support the continuation of rental replacement bylaws, which are generally reasonable, with some recommendations for consideration.

Our recommendations:

Predictable and calculatable

• Requirements should be formalized across the province so that they are consistent, predictable, and without surprises, to allow for greater cost certainty.

Replacement unit sizes

• Matching the old with new number of bedrooms is reasonable, however modern design and cost of construction have reduced unit sizes in general. Current replacement by-laws allow for a very small variation in square footage. We recommend that modernization allows that the rental replacement units be “the same size as typical new market units in the same new building”.

Consideration of new permanent rental units

• When an old low density building is replaced with a modern higher density building, the result is a net gain in permanent rental units. This net gain should be recognized as a societal benefit, and as such qualify for exemptions or discounts in municipal fees associated with residential development. A goal-oriented system using a sliding scale with greater incentives for larger multiples of increase (new building doubles number of current rental units = bonus; tripling = large bonus; quadrupling = larger bonus, etc) would be effective in quickly adding rental stock.

Off-site replacement units

• Each project is unique, and not all sites allow for sufficient intensification to make the pro forma ‘work’. Consideration to allow for the

rental replacement units to be off-site, but reasonably close, would allow for additional new net gains in rental units, rather than permanently locking many old, low density buildings ‘as is’ forever. Off-site in new and existing buildings would allow for sooner return to the neighbourhood rather than waiting for years of construction.

The chronic undersupply that has existed for decades was starting to turn the corner. But coming out of the pandemic new challenges have emerged and they all negatively affect rental project viability. In addition to the supply chain interruptions and increased construction costs, we’re now experiencing rapidly rising interest rates and financing challenges. Thousands of rental units in the proposal phase have paused and some completely cancelled. If more rental is desired, incentives (not disincentives) are needed.

In July 2022, Toronto City Council approved a new Development Charges By-law, which included the following:

16. City Council request the Federal and Provincial Governments to take urgent action to avoid the loss of rental housing supply currently in development, and to engage with the City’s Rental Housing Opportunities Roundtable to consider additional measures and incentives ensuring sufficient purpose-built rental housing supply in Toronto.

Toronto City Council has joined the chorus in asking for our provincial government to take action to make rental happen.

Intensification of existing apartment sites is the path of least resistance with the local community. While some would rather not see added density, most would welcome a new, modern, well-designed rental building on the same site. This adds a new housing option for: aging homeowners who would prefer to stay in the same neighbourhood, but had limited rental options in the past; young families who wish to live in established neighbourhoods with schools; newcomers in areas with familiar surroundings; students near campuses. People can change their rental accommodations as their needs change when the supply is plentiful.

Rental replacement requirements can be maintained and used as an incentive to create abundant new purposebuilt rental housing across Ontario.

GTAA thanked our provincial government for acknowledging our decades-long under-production and for creating policy incentives to address this problem. We are at a critical point and immediate action is required. GTAA and our Members would build tens of thousands of new rentals units if the projects were viable. During the rental boom (1960s and 1970s) we opened 200,000 rental units. We helped build this city and are ready to participate in large volumes again.

GTAA Chair Laura Holland (standing) hosted our annual luncheon in support of our Charitable Foundation on Thursday, February 9, 2023.

Laura and Margaret Herd, Chair, GTAA Charitable Foundation (seated) welcomed a record smashing turnout of 99 guests. This sold-out event required the use of the entire Village Lofts at Bayview Village. We started as normal, but as the crowd trickled in the power went out. We learned afterwards that a dishwasher pipe burst, and water shorted out an electrical panel. The back-up lights kicked in for our cocktail reception, but those too went dark after an hour. We were seated and served a delicious multi-course meal, by candlelight and open window shades, but kind of in the dark. Everyone made the best of the situation. “Thank-you” to everyone who donated to our Foundation! Your ongoing support helps many in need, and the recipient organizations routinely send notes of appreciation.

We wish to thank all of our Charitable Foundation’s Major Sponsors. Most have been generously contributing every year for many years, and their direct contributions were essential when our usual fundraising events were cancelled during the pandemic years.

This past (fiscal) year (ended on June 30, 2022) our Charitable Foundation donated $135,000 to charities and via our annual scholarships to grade 12 apartment residents.

All the proceeds from the lunch go directly to our Charitable Foundation. The GTAA picks up the tab for the food, and the cocktail reception. This allows for a charitable donation tax receipt for 100% of your contribution. Keep this in mind for next year’s lunch.

On behalf of the GTAA Chair and the GTAA Charitable Foundation, “THANK YOU” for attending our annual lunch, and for your support. Please join us in thanking all of donors for their continued support! We look forward to lunching with you next year.

PLATINUM SPONSOR

GOLD SPONSOR

SILVER SPONSOR

In the span of just a few months governments have enacted new laws and imposed financial penalties in hopes that the individual or collective impacts will lower the cost of housing.

Toronto’s Vacant Home Tax (“VHT”) is an annual tax levied on vacant Toronto residences, payable beginning in 2023. It is one per cent of the property’s Current Value Assessment.

A property is considered vacant if it was not used as the principal residence by the owner(s) or any permitted occupant(s), or was not occupied by tenants for a total of six months or more during the previous calendar year.

Toronto’s VHT only applies to residential units that are in the Residential Taxable (“RT”) class. Therefore, multi-residential buildings (“MT” class) are excluded from the VHT.

The City advised GTAA that they only sent notifications to properties with an RT component. This would include condominiums as they are taxed the same as single detached houses. It is possible (but not common) that some component of your apartment building falls into the RT category. Note that 6-plexes (and smaller) are taxed in the RT category; whereas 7 units or more are MT.

The Federal Underused Housing Tax Act states that newly built housing units are not subject to the Underused Housing Tax, all private corporations – therefore all builders and developers that are not publicly owned – are now required to file an Underused Housing Tax return (UT-2900) each year. This requires residential property owners (with some exceptions), including those with no foreign ownership, to file an annual UHT return for each housing unit owned on or after December 31, even where no tax is payable.

Contact your accountant for details and requirements. Federal Prohibition on the Purchase of Residential Property by Non-Canadians Act came into force on Jan 1, 2023. This Act prohibits non-Canadians from purchasing residential property in Canada, for the next two years. Immediately below is a summary from the original Act, followed by some Amendments that came into force on March 27, 2023.

The prohibition is directly and indirectly. Canadian corporations which are controlled by a foreign person or corporation, such as a foreign parent company, are considered non-Canadians and are therefore prohibited from purchasing residential property. The direct or indirect ownership of shares or interests of the entity representing 3% or more of the value of equity or 3% or more of the entity’s voting rights.

Underpopulated areas are exempt … however, no parts of the GTA are considered underpopulated.

A “residential property” is defined in the Act and Regulations as any real property or immovable that is:

a. a detached house or similar building containing not more than three dwelling units;

b. a part of a building that is a semi-detached house, rowhouse unit, residential condominium or other similar premises that is intended to be a separate parcel or other division of real property; and

c. land that does not contain any habitable dwelling and is zoned for residential use or mixed use.

The 3% foreign money maximum can be a challenge in today’s global economy. Land assemblies that involve investment pools from various sources may unintentionally contravene the Act. It’s complicated. The government recognized the obvious challenge, and enacted Amendments on March 27, 2023 which include:

• Section 1, Paragraph (a) of Regulations, being the definition of “control”, which was previously set out as follows: “direct or indirect ownership of shares or ownership interests of the corporation or entity representing 3% or more of the value of the equity in it, or carrying 3% or more of its voting rights” has been revised such that the threshold for “control” is increased from 3% to 10%.

• Section 2, Paragraph (b) of the Regulations, which previously exempted only Canadian publiclytraded companies, has been revised to clarify that any Canadian publicly-traded entity, including partnerships and real estate investment trusts, are exempt from the Act’s prohibitions.

• Section 3(2) of the Regulations, which extended the definition “Residential Property” in the Act to apply to land without a habitable dwelling that is zoned for residential or mixed use has been repealed. As a result, the Act will no longer apply to such lands (including vacant lands and commercial developments).

• Section 4(2) of the Regulations, dealing with exceptions to the definition of a “purchase” under the Act, has been expanded to include a new Section 4(2)(e) providing a new exception regarding the ability of non-Canadians to acquire residential property for the purpose of development. We’ve included below some guidance provided by CMHC on their interpretation of the term “development”.

• Finally, Section 5(b)(i) to (iii) of the Regulations have been repealed and replaced to clarify the conditions for a temporary resident to legally purchase residential property.

Please review the amended Act and associated Regulations for exact details HERE.

Bill 109, More Homes for Everyone Act, 2022, received Royal Assent on April 14, 2022. The legislation amended six statutes, including the Planning Act, Development Charges Act and the City of Toronto Act, 2006.

The Bill alters local decision making with respect to the development application process and has the potential to move the decision making to the Ontario Land Tribunal. A significant impact of the legislation is the requirement for the City to refund development application fees for Official Plan Amendment/ Zoning By-law Amendment, and Site Plan Control applications if prescribed timelines for approval or decision-making are not met. The legislation came into effect on January 1, 2023 and is anticipated to have a material financial impact on the City, especially if they don’t streamline their internal operations.

Transformation of Toronto’s development review service will now be delivered through a new teambased operating model, comprised of staff from various divisions and review partners. This should enable a more coordinated and collaborative review process to reduce the administrative burden on staff and applicants, support better workflow and timeline management, and monitor data and Key Performance Indicators. City staff will continue to work to implement legislative changes and transform the development review process as a new Development and Growth Division is established in 2023.

In addition to systemic changes, a series of early improvements, including changes to the Preliminary Report process for Official Plan Amendment and/ or Zoning By-law Amendment applications, new approaches to community consultation, and testing of an improved pre-application consultation process are underway.

Toronto’s staff report summarizes that:

Bill 109 is based in large part on the premise that reduced housing affordability is primarily a function of an increase in population and a lack of housing supply. The stated purpose of the legislation is to reduce “red tape”, accelerate development application review timelines, and streamline the approvals process.

Then it opines:

Bill 109 fails to recognize that the planning approval process is a fundamentally iterative one in which the public, applicants, city divisions, external agencies and provincial Ministries collaborate in an effort to achieve good city-building outcomes.

The City of Toronto characterizes the legislative development application review timelines prescribed by Bill 109 as ‘punitive’ while builders and prospective builders welcome and long overdue improvements. In an implementation update report, City staff stated: “the legislation will severely hinder the City’s ability to recover the cost of its development review service, particularly as the City does not have sole control over the legislated review timeline. This risk likely cannot be fully mitigated in 2023, and must be balanced against the “long-term risks to city-building that will arise if thorough review, stakeholder engagement, and careful consideration of the City’s strategic priorities are overlooked in the name of legislated timeline management.”

And generally concludes that:

“legislated review timelines do not take into consideration the inherent characteristics of development planning in Toronto given the complex urban environment, and ignore the reality that positive results are commonly achieved through collaboration that inevitably takes more time. As such, Bill 109 will severely hinder the City’s ability to fully recover the cost of its development review service.”

Nonetheless, moving forward the City of Toronto identified 150 new permanent positions that are needed to improve adherence to legislated timelines while ensuring high-quality review outcomes. The anticipated cost of these new permanent positions in 2023 is $14.148 million to be drawn from the Development Application Review Reserve Fund throughout 2023.

The development industry is optimistic that 150 new additional staff and impact of a well defined refund schedule will speed up the process at City Hall.

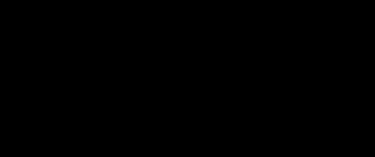

The City of Toronto offered that they would not appeal the decision – which quashed two sections of the bylaws which made a landlord financially responsible for housing displaced tenants – if the GTAA rescinded our cost recovery application (for legal costs). We took the offer and the win.

The City did not appeal and sent GTAA a $20,000 cheque to cover the administrative court costs. We thought you would like to see it.

Local Food Banks are seeing a tremendous increase in client visits and need your help.

Our Food Bank partners – Daily Bread, North York Harvest and Mississauga Food Banks – prefer financial donations. They can leverage volume purchasing, obtain healthier options, especially perishable fresh produce. With cash they can provide a nutritious meal for $1! This goes a very long way. Let’s help them raise funds to make a difference.

GTAA has distributed posters, details and some instructions. Please display the posters in your buildings and office; add donation links to your website, newsletter and on social media; email the link to your friends. Everyone is welcome to participate, including GTAA Supplier Members.

Our hearing was in October 2022, and we received a favourable decision in November. Recall that Justice Perell’s decision in our application against the City, stated:

In his ruling, Justice Perell wrote in his conclusion (highlights are GTAA’s):

“the City of Toronto does not have the legislative authority to require a landlord to provide emergency social services. It follows that just s.2 of By-law 1750-2019 and just the provisions of the Vital Service Disruption Plan that require an apartment owner/ operator at its own expense to provide emergency social services should be quashed; however, the rest of By-law 1121-2019 and of By-law 1750-2019 and of the Vital Service Disruption Plan are sound.”

They are slowly updating their bylaws and forms.

We proudly offer our 9th Annual Scholarship to recognize the commitment of our young residents to local initiatives that work towards building safe, healthy and enriching communities.

This is to help cover tuition fees for the first year of post-secondary education/training at a recognized university, college, trade school or apprenticeship program.

GTAA will provide details, printable poster for display, and more in mid-May.

Those who have been following the current political dangers facing rental housing providers realize that vacancy decontrol is at risk. The federal Liberal government has made commitments to amend the Income Tax Act to require landlords:

• to disclose in their tax filings the rent they receive pre- and post-renovation, and

• to pay a proportional surtax if the increase in rent is “excessive”.

That could effectively take away vacancy decontrol in Ontario. The federal government also wants to stop “renovictions”, and to curb “excessive profits” on investment properties.

Hard-line tenant activists also want the federal government to pressure the provinces to eliminate above-guideline-increase applications (AGIs), and to impose unit-based rent control across Canada on rental providers of all sizes. In the near future, some key issues will be addressed in two different forums.

In the House of Commons, the “HUMA Committee” is the primary parliamentary body for MPs from all parties to provide scrutiny and oversight of the Minister of Housing and his portfolio. The Committee has decided to study the “financialization” of rental housing and its impacts. (Tenant activists’ complaints about financialization are part of the driving force behind their attack on rental housing.)

CFAA has been in contact with leading members of the HUMA Committee to ensure that the rental housing industry is well represented by articulate and knowledgeable speakers who can push back against the tenant activists’ erroneous claims and counter-

By John Dickie, CFAA Presidentproductive “solutions”. The hearings may take place in the second half of April, or somewhat later than that.

The National Housing Council (NHC) was launched in November 2020 to advise the federal government on housing policy. In accordance with the National Housing Strategy Act, the newly appointed Federal Housing Advocate asked the NHC to establish a review panel to hold public hearings on the human rights impacts of corporate investment in housing.

The Advocate said “Canada is seeing a growing trend of financial firms using housing as a commodity to grow wealth for their investors. Financialization often sees these firms acquiring rental buildings and increasing rents or decreasing services to maximize profits. This trend is not only contributing to unaffordability across the country – it is also denying people their fundamental human right to affordable, dignified, and safe housing.”

CFAA has asked to appear as a witness before the Review Panel. GTAA, FRPO and other associations and rental housing providers will likely do so as well.

The Review Panel intends to receive written submissions first, and then to hold oral hearings. Each stage of their process will likely take about three months.

GTAA has already worked closely with CFAA to provide input to the NHC on the right to housing, and how rental housing providers of all sizes currently assist in the realization of the right to housing.

CFAA expects to make a robust submission to the Review Panel on “financialization”, the value of the market system and the valuable contribution of rental housing providers of all sizes toward the realization of the right to housing. Among other points, CFAA intends to make sure the NHC Review Panel knows that for-profit landlords of all sizes provide housing for a great many low-income and vulnerable renters, and that without us, those people would be much worse off.

CFAA will also put forward positive solutions which governments can adopt and fund to ensure that everyone’s housing needs are properly addressed. We all need to work together to solve Canada’s current housing issues, and blaming and attacking rental housing providers is not the way to do it.

Here are five practical ways to improve building performance while also reducing energy use, enhancing tenant comfort and lowering emissions.

1. Get a checkup

There are two easy ways to know if building systems are inefficient: one is to compare current and historical energy use and the other is to compare current energy use to similar buildings in the portfolio. Higher energy bills, multiple mechanical failures and increased comfort complaints from residents can all be warning signs of inefficient equipment.

Not sure which building systems are inefficient? The Enbridge Gas Affordable Multi-Family Housing program provides up to $8,000 per building for a detailed energy assessment completed by a thirdparty company, up to $40,000 per housing provider.

2. Stay in the know about incentives

The program also offers free expert advice and up to $200,000 in financial incentives to support upgrades to high-efficiency equipment that saves energy, lowers operating costs and reduces greenhouse gas emissions.

Eligible buildings include social and municipal housing, shelters, co-ops and eligible private marketrate multi-family buildings with low-income tenants. Buildings must be four storeys or higher.

Incentives vary based on service area: for energyefficient boilers, the average incentive is $22,000; for make-up air units, incentives are up to $26,000; water heater incentives are up to $2,000; for in-suite energy and heat recovery, incentives are up to $250 per unit. Ask your Energy Solutions Advisor about our exclusive limited-time offer. Until Sept. 30 2022, we’re offering double the incentives on select condensing make-up air units.

3. Focus on ventilation

As a result of the pandemic, adequate ventilation has become an important concern for the health and safety of residents. Many buildings are looking for more efficient make-up air units, which are either natural gas powered or run off boilers that heat the building. These devices help reduce energy costs by reusing the heat from outgoing air to pre-heat fresh incoming air.

4. Take advantage of free upgrades

As part of the program, buildings can also receive free in-suite upgrades such as low-flow showerheads, aerators and heat reflector panels.

If your building was built before 1980 and is heated by hot water radiators/ convectors, you may be losing a significant amount of heat through exterior walls. We can help with free heat reflector panels, professionally installed at no cost to you. Heat reflector panels are quickly and easily attached to the wall— they reflect heat back into the room and improve resident comfort.

5. Learn from leaders

See affordable multi-family building retrofit success studies on the Enbridge Gas website to inspire ideas about energy-efficiency projects for your own building. You’ll hear directly from peers and have the opportunity to learn from their experiences, like this Simcoe County Housing Corporation affordable multifamily building:

“In addition to reducing operating costs, our new equipment purchases have also allowed us to reduce our carbon footprint, and reducing our carbon footprint is helping the county meet its long-term energy reduction targets,” says Brad Spiewak, Maintenance Project Manager, County of Simcoe.

The first step is to connect with an Enbridge Gas Energy Solutions Advisor—they’ll provide expert advice to point out the biggest savings opportunities. They can also provide a cost-benefit analysis, estimate annual natural gas savings and present incentive quotes. This is a free service, with no cost to the multi-family housing provider.

To confirm your interest in the Affordable MultiFamily Housing program, contact an Enbridge Gas Energy Solutions Advisor at 1-866-844-9994 or energyservices@enbridge.com. Visit enbridgegas. com/affordable for program details, testimonials and more.