PUBLISHING

Publisher / General Manager

Jules Kay

Associate Publisher / Head of Brand & Marketing

Richard Allan Aquino

Publishing Assistant / Marketing Relations Manager

Tanattha Saengmorakot

EDITORIAL

Editor

Duncan Forgan

Deputy Editor

Al Gerard de la Cruz

Digital Editor

Gynen Kyra Toriano

Editorial Contributors

Liam Aran Barnes, Bill Charles, Steve Finch, George Styllis, Jonathan Evans

CREATIVE & MARKETING

Head of Creative

Ausanee Dejtanasoontorn (Jane)

Senior Graphic Designer

Poramin Leelasatjarana (Min)

Digital Marketing Executive

Anawat Intagosee (Fair)

Senior Manager, Media & Marketing Services

Nate Dacua

Senior Executive, Media & Marketing Services

Piyachanok Raungpaka

Senior Product Lifecycle & Brand Manager

Marco Bagna-Dulyachinda

REGIONAL SALES & DISTRIBUTION

Director of Sales

Udomluk Suwan

Head of Regional Sales

Orathai Chirapornchai

Australia

Watcharaphon Chaisuk

Cambodia

Phumet Puttasimma

China (Mainland, Hong Kong, Macau)

Kai Lok Kwok

Yiming Li

India & Australia

Monika Singh

Indonesia

Wulan Putri

Malaysia

June Fong

Jess Lee

Philippines

Marylourd Pique

Maria Elena Sta. Maria

Singapore

Alicia Loh

Thailand

Kritchaorn Rattanapan

Vietnam

Nguyen Tran Minh Quan

Sponsorships

Priyamani Srimokla

Distribution Manager

Rattanaphorn Pongprasert

General Enquiries

awards@propertyguru.com

Advertising Enquiries petch@propertyguru.com

Distribution Enquiries ying@propertyguru.com

Essentials to keep you cosy and comfortable in whichever hemisphere you are celebrating

Design Focus:

The

Ivan

Mohammed Adib channels childhood curiosity and an aversion to design homogeny into his work for Dewan Architects + Engineers

Neighbourhood Watch: Bukit Timah

The sought-after Singapore neighbourhood offers lifestyle amenities, green space, and new residential projects

Special feature: Movement with meaning

Governments around Asia are spending billions to fuel infrastructure development to boost real estate and economic growth

Special Feature: Too much pressure

Marriage is out, and singlehood is in as young Asians subvert convention to explore alternative paths in real estate

Dispatch: Third time lucky?

Time will tell if the return to power in Thailand of the Shinawatras will lift the country’s ailing real estate sector

Special Feature: A world of opportunities

Shifting consumer preferences, and fluctuating economic policies mean commercial real estate investors in Asia must remain agile

Dispatch: Golden times

Stimulus measures have sparked a surge in homebuying activity around China, but many are sceptical the shift will endure

Another year has flown by! The swift passage of time has long captivated scientists, philosophers, and writers alike, as we try to make sense of how quickly the months slip past.

If 2024 felt like it passed in a flash, it certainly did so with intensity, especially here in Asia, where the real estate landscape witnessed transformative events as well as quieter shifts that promise to influence the industry for years to come.

In this final issue of the year, we pause to reflect. Through a special series of features, we examine the key trends and developments that have reshaped the property sector over the past twelve months.

From headline-grabbing changes in commercial real estate markets to the demographic shifts prompting sea changes all over the region, this issue brings you a varied mix of stories that zoom in on some of the region’s hotbutton issues.

Other highlights in this closing issue of the year include a discussion with Ivan Lam of leading advisory firm Charter Keck Cramer on how Asians can negotiate regulatory framework in Australia, an exploration of one of Hokkaido’s most exciting projects, and a feature on Dewan Architects + Engineers, a name renowned for architectural excellence in Asia.

This collection of insights captures the dynamic spirit of another packed year filled with momentum and change.

Duncan Forgan Property Report duncan@propertyguru.com

Introducing Paramount Petals, a one-stop living solution where residents can access all their essential needs, from daily necessities to healthcare, in Greater Jakarta

An exciting new township in western Greater Jakarta offers an ideal setting for those seeking a better quality of life in Indonesia.

Spanning an area of around 400 hectares, Paramount Petals is envisioned as an improved alternative of living to metropolitan Jakarta. Leading developer Paramount Land conceived the township as a solution to long-overdue urban challenges such as traffic congestion, various environmental issues, poor access to education and employment, and more.

Expertly crafted by world-class masterplanner AECOM, this development integrates residential, commercial, business, education, healthcare, and entertainment spaces. It is strategically located in the golden triangle of Tangerang Regency, offering easy access to major developments, economic hubs, and public transport.

The integrated city framework promotes secure, self-sufficient neighbourhoods and enhanced lifestyles, while creating local employment opportunities. Over time, it aims to drive improved connectivity, economic growth, and sustainable development for the community.

Launched in July 2021, Paramount Petals has reached impressive milestones in its three-year journey. The handover of the first two landed house clusters, Aster and Canna, was completed on schedule, with 85% progress by June 2024, followed by the third cluster, Gardenia. Now home to over 300 households, the neighbourhood continues to grow rapidly.

On its third anniversary in July 2024, Paramount Petals marked a milestone with the groundbreaking ceremony

for direct toll access and the Bitung toll gate modification on the JakartaMerak toll road. This joint project with the Tangerang Regency government and Jasa Marga Related Business (JMRB) will alleviate traffic congestion, particularly on the Bitung main road that serves industrial and logistics hubs.

The direct toll access connects the Jakarta-Merak exit toll road and Jakarta Outer Ring Road (JORR) to Paramount Petals’ Main Boulevard, linking North, West, and South Petals for easy commuter access. Set to open by the end of 2025, the new road will offer efficient, hassle-free travel to places including but not limited to SoekarnoHatta International Airport, the Port of Merak, and metropolitan Jakarta.

Each house in Paramount Petals is thoughtfully designed for a wide range

of property seekers, from millennials to families. Its tagline, “Lovable Living,” embodies a vision of a self-sustaining, close-knit community amid green spaces and urban infrastructures. Access to a whole variety of facilities is arranged closer to the doorsteps while allowing residents to interact with nature on a daily basis, such as exercising outdoors, walking, and gardening.

Currently in the first 25 hectares development in South Petals, the self-contained community is already equipped with facilities such as the Marketing Gallery, Bethsaida Clinic, Paramount Petals Estate Management, a convenience store, and more. The construction of the 4,135-squaremetre community club is also nearing completion and will open by year-end. Future developments include a modern market, hotels, hospitals, educational facilities, parks, and more.

Driven by thorough research into the property market, Paramount Petals has seen strong demand for its housing products. Earlier this year, the first premium landed house cluster, Lily, was introduced in a joint venture with Jasa Marga Related Business. Each unit offers exceptional in-unit amenities, surrounded by greenery, while the project itself is centrally located just 4.5 kilometres from the direct toll access project.

Paramount Land’s pioneering concept for Paramount Petals began with the development of Gading Serpong, an established economic hub in Tangerang, now home to over 120,000 people, not including commuters. This modern, self-sustaining township spans 1,200 hectares, covering landed houses, shophouses, hospitals, schools, universities, hotels, commercial areas, and entertainment hubs.

As Gading Serpong’s property value grows steadily, Paramount Land brings its vast and long experience to expand the property business with new townships like Paramount Petals. The company’s constant commitment and integrity have become key ingredients to transforming such a vision into

a blueprint—from masterplan to masterpiece.

As more residences and infrastructures are developed within, Paramount Petals aims to expand its property portfolio. The township’s first commercial shophouses, Calico Square, sold out within moments of launching, prompting Paramount Land to grow its commercial and business hubs to stimulate economic activity, create jobs, and attract investment.

Paramount Petals is envisioned as the next Gading Serpong. It offers a lovable living space where residents can celebrate the richness of life, embrace a healthy and sustainable lifestyle to pass that on to future generations— while providing property investment opportunities all in one place.

Good tech tidings to give to you and your kin

ZUCK ON YOU

Meta’s Quest 3S headset offers an accessible entry point to the virtual world with its mixed reality capabilities, vibrant graphics, colour cameras, and even a free Batman game. A great gift for tech enthusiasts looking to explore VR

USD299.99, meta.com

For the teens and tweens in your life, try gifting the Purple Ladybug Prismic 3D Puzzle Lantern. This DIY kit, available in shapes like unicorns and bears, includes USB-powered LEDs for a magical glow and a fun, hands-on building experience.

From USD21.99, amazon.com

The Earfun Air Pro 4 earbuds offer impressive sound quality, noise cancellation, and up to 11 hours of battery life. Compatible with Apple and Android devices, these affordable earbuds are ideal for high-performance wireless audio, whether that’s a song or a call.

From USD89.99, myearfun.com

Give the gift of peace with Loop earplugs, designed to reduce noise by 27 decibels. Made of soft, reusable silicone, these earplugs come with a carrying case, making them ideal for frequent travellers andsleepers.

From USD24.95, loopearplugs.com

Ideal for budding digital artists, the Wacom Intuos drawing tablet has a paper-like feel, making it great for sketching, animation, photo editing, or even just doodling. Available with Bluetooth connectivity, it’s a versatile gift for creatives of all levels.

From USD59.95, wacom.com

Festive furnishings to make your home jolly this holiday season

LAY IT ALL OUT

Get ready for Christmas dinner with the Saybrook table by Raymour & Flanigan. Featuring an 18-inch extension leaf and seating for six, this beauty stretches up to 80 inches to accommodate guests. It’s crafted from kiln-dried wood, plywood, and hardwood, pairing a warm tabletop with offwhite legs.

USD1,899.95, raymourflanigan.com

HO AND BEHOLD

Puleo’s Royal Majestic Douglas fir Christmas tree stands tall at 7.5 feet, showcasing a natural look with lifelike polyethene branch tips and subtle nuances of colour that suggest growth. Pre-lit with warm, clear incandescent lights, this tree casts a beautiful glow for the holiday season.

From USD545.59, puleointl.com

LOVE FROM SIAM

The 2024 edition of Anthropologie’s 12 Days of Christmas dinnerware collection showcases the enchanting designs of Phannapast Taychamaythakool. The Thai artist’s stoneware dessert plates bring Victorian and Renaissance folklore to life with hand-illustrated animals and intricate motifs—adding a touch of whimsy to holiday dinners.

GBP192, anthropologie.com

Complete your holiday décor with The White Company’s 180-centimetre faux garland, a showstopping combo of fir branches, twigs, pinecones, and white berries. Its prelit LED lights add an ecofriendly touch while hooks make it easy to drape above doors or on the mantel.

GBP95, thewhitecompany.com

YULE SEE

Inspired by the classic poem “A Visit from St. Nicholas”, Williams-Sonoma’s ‘Twas the Night Before Christmas collection includes goblets and glasses with hand-applied decals like Santa’s List and Sleigh. Finished with a 24-karat gold rim, the durable glassware adds a touch of elegance to any gathering.

From USD79.95, williams-sonoma.com

Stylish essentials to keep you cosy and comfortable in whichever hemisphere you’re celebrating

Gather around the Solo Stove Mesa tabletop fire pit for a great outdoor experience on cold days. Available in various colours and sizes from 5.1 to 7 inches, this fire pit is perfect for toasting marshmallows or just setting the mood without the hassle of smoke.

From USD69.99, solostove.com

The Salomon QST Blank ski is a goto for powder enthusiasts. Designed for intermediate to expert skiers, it features a lightweight poplar wood core and a balanced waist width, generating excellent responsiveness on the slopes with a well-designed tip and tail rocker.

USD799.95, salomon.com DETAILS | Style

The POC Vitrea are some of the finest eyewear on the slopes. The goggles are suitable for larger faces, with oversized frames that maximise both horizontal and vertical visibility. With swappable lenses for different lighting conditions, these goggles keep your vision sharp on any terrain.

EUR230, poc.com

For those summering in the Southern Hemisphere, the Tommy Bahama beach chair is a must-have. Very portable with padded backpack straps and a light aluminium frame, this polyester chair adjusts to five positions and includes built-in pouches for the ultimate convenience.

From USD89.50, tommybahama.com

Beat the heat with the Yeti Hopper Flip 8 cooler, your companion during warmweather outings. This compact, strong cooler can hold about 11 cans and keep refreshments chilled for hours. Featuring Yeti’s signature HitchPoint Grid, the cooler is easy to customise with other beach essentials.

USD200, yeti.com

The onsen villas of Aki Niseko offer a blend of modernity and luxury that celebrates Hokkaido’s heritage

BY AL GERARD DE LA CRUZ

Beneath Japan’s futuristic veneer—and layers of powder snow—lies Hokkaido, the ancestral homeland of an indigenous people with millennia of history.

Aki Niseko, a new villa development, proudly draws its architectural and spiritual inspiration from the island, once known as Ezo, famed for its mineral-rich onsen (hot springs). The development is the latest in a long line of premium developments in Upper Hirafu Village in Niseko, appealing to property seekers in the winter sports hub.

From amenities to services, the project is designed to stand out on multiple levels.

In 2015, Takuetsu Co., Ltd. acquired the 10,046-squaremetre site, chosen for its expansive views of Mount Yotei and proximity to the Grand Hirafu Ski Resort—just 200 metres from the village’s main gondolas, eliminating the long commute for skiers.

The site was a secluded, slope-side sanctuary in the making, close enough to Niseko’s diversions but far enough from the crowds.

“Niseko has the best powder snow in all of Asia,” says Chiaki Kanayama, chairman and CEO of Takuetsu Co., Ltd. “From the moment we first experienced Niseko, we were determined to create the best luxury vacation villas in all of Asia to complement Niseko’s exceptional qualities.”

H2 Group, best known for its HakuLife Collection which includes Hakuchōzan and HakuVillas, took a hands-on approach to the project’s creation. Managing everything from the design to the project schedule, the group has been deeply involved in Aki Niseko’s journey.

In an area dominated by condominium developments, the villas of Aki Niseko are purposely conspicuous outliers. Their cuts are unusually humongous, each unit spanning well over 400 square metres and spread over four storeys with five ensuite bedrooms.

“We considered a couple of different concepts for the site, but we finally decided to launch with an onsen villa estate concept,” Kanayama says. “We felt that was the most unique and irreplaceable real estate product in the market.”

Collaborating with design practice Land Architects Co., Ltd., H2 Group embraced Japanese sensibilities and an alpine aesthetic for this project. A contemporary take on Japanese louvres, undulating on the exteriors with black stone accents, serves as a tribute to the iconic powder snow drifts of Niseko.

“The design philosophy behind Aki Niseko embraces the Japanese concept of wabi-sabi, which celebrates the beauty in imperfection and the natural world while blending it with modern luxury,” says Sotaro Kagami, CEO of Land Architects Co., Ltd.

In the summer of 2019, while planning the Fujian Tulou scenic area in China, Kagami had developed an interest in projects blending natural and cultural resources, which soon led to Land Architects’ collaboration with Takuetsu.

Conforming to wabi-sabi’s quintessentially organic textures and ageless materials, the designers mashed Japanese earth tones with a Western material palette. Staples of vernacular architecture, from natural wood to stone, are used throughout the properties.

Design practice Nomura Co., Ltd. wove patterns inspired by the Ainu, the indigenous people of Hokkaido, into the villas. These geometric and nature-inspired motifs appear in art, décor, furnishings, and textiles, including the rugs and scatter cushions.

The design cues ground Aki Niseko in Hokkaido’s cultural roots. The project emerged on the heels of the Ainu being officially recognised as an indigenous people in 2019.

“These intricate designs pay homage to the local history and traditions, adding an authentic cultural layer to the modern aesthetic of the development,” says Kagami.

Each villa is crowned by a private rooftop onsen, a “very rare” feature in the village, emphasises H2 Christie’s International Real Estate, which handled sales for the project.

Securing this feature and government approvals for construction was a coup for the team. “Aki is amongst the last new developments to have onsen,” says Kanayama. “We were successful in obtaining one of the last few licences for onsen drilling in Upper Hirafu.”

THE DESIGN PHILOSOPHY BEHIND AKI NISEKO EMBRACES THE JAPANESE CONCEPT OF WABISABI, WHICH CELEBRATES THE BEAUTY IN IMPERFECTION AND THE NATURAL WORLD WHILE BLENDING IT WITH MODERN LUXURY

AS ONE OF THE LAST RESIDENTIAL PROJECTS IN ITS AREA TO SECURE AN ONSEN DRILLING LICENCE, AKI NISEKO OFFERS AN IMMERSIVE JAPANESE EXPERIENCE, ALLOWING RESIDENTS TO DIP INTO THE THERAPEUTIC BENEFITS OF NATURAL HOT SPRINGS

With the licence, Aki Niseko is able to offer a more exclusive alternative to the experience in public hot springs. “This distinction enhances Aki Niseko’s reputation as a premier alpine retreat, appealing to those who want a more intimate connection with the region’s natural surroundings,” says Kanayama.

Just like the tourists flocking to Hokkaido, Aki Niseko is a truly international endeavour, a multilingual operation bringing together developers and architects from Japan, China, and beyond. Nikken Sekkei Ltd. was brought on as a civil consultant, with Shintaiheiyo Co., Ltd. leading the civil construction efforts.

“Developments of this scale and impact always require close collaboration with the government,” Kanayama says.

The project began construction in earnest in 2023. The first of 11 villas is set to be completed this winter, with the full estate to be finished by 2027.

While amenities like massage rooms are not built into every villa, the team focused on creating a members-only clubhouse. At 1,200 square metres, the clubhouse covers a gym, indoor pool, spa, café, cigar lounge, yoga studio, kids’ club, and social spaces.

“None of the developments in Hirafu have considered a clubhouse as part of the overall offering,” says Kanayama. “We consider the clubhouse a critical part of extending the villa ownership experience. It makes the estate completely unique in Hirafu.”

Given Niseko’s continental climate, each villa is outfitted with high-performance insulation and underfloor heating, dispensing with the chore of snow clearance. These features, along with the 360-degree fireplace, another unique luxurious amenity in the area, make the villas an authentic winter haven.

“Niseko snows nearly non-stop for three months,” says Kagami. “To have an outdoor space that is usable, heated floors are a must.”

Designed with weather-resistant materials, the villas’ rooftop spaces defy the cold. Here, the onsen integrates with outdoor amenities such as a firepit, in addition to the bar and lounging area. The area affords occupants a panoramic vantage point of the mountains.

“The outdoor spaces are not just seasonal amenities but year-round extensions of the living experience, offering both relaxation and immersion in nature,” says Kagami.

NISEKO’S PANORAMIC MOUNTAIN VISTAS YEAR-ROUND FROM WEATHERRESISTANT, HEATED SPACES

Aki Niseko is designed to cater to Niseko’s growing yearround tourism. Air-conditioned and optimised for warmer months, the villas effortlessly transition into summer homes. Rooftop gardens replace firepits as gathering spaces du jour while large windows and outdoor terraces frame views and maximise sunlight and airflow.

“The integration of indoor and outdoor spaces at Aki Niseko was a key focus in the design process, aiming to create a seamless flow between the luxury interiors and the surrounding natural beauty,” says Kagami. “The goal was to ensure that residents can enjoy Niseko’s stunning landscape and climate year-round, whether in the comfort of their villas or outside in thoughtfully designed communal areas.”

Another differentiator for Aki Niseko lies in its human element. Modeled after the HakuLife approach, Aki Niseko is set to provide white-glove, hotel-like bespoke services for residents. Private chefs, butlers, chauffeurs, and a concierge team are available to tend to needs, providing a level of attention unseen in developments of similar scale.

“The feedback from property seekers has been overwhelmingly positive,” says Kanayama. “Many guests have been so impressed by the HakuLife service that some have expressed interest in building their own holiday homes and retaining the HakuLife team to provide personalised service when they are in-house.”

Aki Niseko will be eventually subsumed as part of the HakuLife Collection. Phase 2 has already begun, with more luxurious offerings planned in the years ahead.

Distilling centuries of history and progress into almost a dozen villas is a feat. In so doing, Aki Niseko is creating spaces that feel refined and foreign but are still rooted in their Japanese setting.

This tension, veering between digital-age luxury and aboriginal tranquillity, is part of Aki Niseko’s charm.

“The long-term goal is to have owners and guests of Aki feel that they are part of something special,” says Kanayama.

Aki Niseko may evoke images of honeymooners or young families, but it was thoughtfully designed with multigenerational living in mind. As Japan faces an ageing population and retirees from abroad search for ideal second homes across Asia, the villa complex addresses a growing demand for residences that cater to different generations under one roof.

“The decision to make Aki Niseko suitable for multigenerational living was influenced by emerging demographic and market trends,” says Chiaki Kanayama, chairman and CEO of Takuetsu Co., Ltd.

“There’s a growing demand from families seeking destinations where grandparents, parents, and children can all enjoy a shared experience while still having their own space.”

To achieve this balance, Aki Niseko combines private, secluded living quarters with well-planned communal areas. The villas, with layouts of up to 446 square metres for the initial units, offer ample space for family gatherings while maintaining privacy.

For residents of a certain age, the team recognises that convenience is key. Private chefs are available to prepare anything from gourmet meals to aprèsski snacks in the open-plan kitchens, equipped with large wooden slab counters and commercial-grade cooktops.

The design also upholds peace and comfort. The team soundproofed spaces, delineating private zones that ensure quiet for occupants. They also installed mood lighting, universal outlets, and an integrated speaker system, among other modern amenities, complementing the unit’s heritage-honouring design.

“This delicate balance between wabi-sabi and contemporary design ensures that Aki Niseko’s villas not only harmonise with their natural surroundings but also provide a serene, luxurious retreat for residents,” says Sotaro Kagami, CEO of Land Architects Co., Ltd.

Ivan Lam of property advisory firm Charter Keck Cramer specialises in helping overseas clients navigate Australia’s complex real estate dynamics

BY BILL CHARLES

AUSTRALIAN CITIES LIKE SYDNEY REMAIN ENTICING PROSPECTS FOR OVERSEAS INVESTORS

Significant cultural differences can affect negotiations. Foreign buyers may also struggle with accessing reliable local market information, which is crucial for making informed decisions

As executive director of international business at Charter Keck Cramer, Ivan Lam has spent the past decade driving innovation in Australia’s property and investment sectors. Lam’s background in retail and business banking, particularly in Asian banking, has helped him drive business development and foster international client relationships, with a focus on the AsiaPacific region.

Charter Keck Cramer is Australia’s leading independent property advisory firm and seeks to help its clients improve their operational efficiencies and navigate complex market dynamics. Lam draws on his extensive industry knowledge and strategic vision to help deliver strong client outcomes.

Lam also serves as the national vice president of the Hong Kong Australia Business Association (HKABA), where he champions initiatives to strengthen trade and investment ties between Australia and Hong Kong.

He also serves as a board advisor for CIX Capital, an Australia-based investment management company that specialises in commercial real estate finance and advisory services. There, he provides strategic guidance to enhance investment opportunities and drive capital growth.

We sat down with Lam to discuss the Australian real estate sector, including the unique challenges of buying and managing property there, the countries making substantial investments in the country, and the outlook for 2025.

What are some of the main challenges that overseas clients typically face when purchasing property in Australia?

The first is understanding the complex regulatory framework, including the requirements set by the Foreign Investment Review Board (FIRB). Additionally, there can be significant cultural differences that affect negotiations and expectations around property transactions. Foreign buyers may also struggle with accessing reliable local market information, which is crucial for making informed decisions. Finally, securing financing can be a challenge, as many

Australian banks have stringent lending criteria for nonresidents.

How important are Chinese buyers in the Australian property market? And how has that shifted with China’s softening economy?

Chinese buyers have historically been a significant force in the Australian property market, driven by factors such as capital preservation, passing on advantages to the next generation, and lifestyle aspirations. However, we’ve seen a shift with the recent softening of China’s economy and increased capital controls. While interest has declined, the market is evolving with a more diverse range of buyers from countries like India, Southeast Asia, and the Americas stepping in. This diversification could stabilise the market and potentially lead to new opportunities, but it also means

that Australian developers and agents must adapt their strategies to attract a broader spectrum of investors.

What other countries are key buyers of Australian real estate?

Beyond China, we’re witnessing substantial interest from several countries. The United States, United Kingdom, India, Malaysia, Vietnam, Singapore, Hong Kong, and New Zealand are notable players in the Australian property market. These investors are often attracted by Australia’s strong economic fundamentals, lifestyle, similar time zones (for New Zealand and Asian countries), politically stable and educational opportunities, especially in the capital cities.

What is unique about the process for foreign buyers who want to purchase real estate in Australia?

The process for foreign buyers in Australia is unique primarily due to the FIRB approval requirement. Buyers must submit an application detailing their identity and investment intentions, which is a crucial step for compliance. Additionally, foreign buyers are generally restricted to purchasing new properties or vacant land, limiting their options compared to domestic buyers.

Understanding these regulations is critical for successful transactions. It’s also important to note the substantial FIRB fee, which is based on the purchase price. However, many developers targeting the overseas market often provide rebates or may offer a New Dwelling Exemption Certificate, allowing the ultimate overseas purchaser to bypass the FIRB approval process altogether.

Do you advise clients on sustainable aspects of real estate? What are the key considerations, in your opinion?

Sustainability is an increasingly vital consideration in real estate. I advise clients to evaluate properties based on their energy efficiency, use of sustainable materials, and water conservation measures. Additionally, I encourage clients to consider the location’s environmental impact, including proximity to public transport and green spaces. Properties that are energy-efficient not only have a lower environmental footprint but also appeal to a growing segment of environmentally conscious buyers and tenants.

What types of properties are most popular among overseas investors, and why?

Apartments in urban areas tend to be the most popular among overseas investors due to their potential for rental yields, or for their children to stay while they are studying in Australia. Additionally, house-and-land packages in emerging suburban areas are gaining traction, appealing to those looking for long-term investments and capital growth. These property types are attractive because they often come with amenities and are located near essential services, which is appealing for both rental and resale opportunities.

Are there any restrictions or regulations that foreign buyers should be aware of?

Foreign buyers should be aware of several key regulations, including the requirement to obtain FIRB approval before any purchase and the application of additional taxes, such as the foreign buyer surcharge in some states. Established residential properties are generally off-limits, emphasising the need for foreign investors to focus on new developments or vacant land.

What financing options are available to foreign buyers?

Foreign buyers have various financing options available to them, including loans from Australian banks and international banks or lenders in their home countries. However, these options often come with stricter requirements, such as higher deposit amounts and proof of income. Some buyers might choose to engage financial advisors, or brokers, familiar with both local and international lending practices, can help streamline this process.

What areas or regions do you see as having the most potential for growth in the Australian property market?

Regions such as Southeast Queensland, particularly Brisbane and the Gold Coast, are gaining attention due to infrastructure developments and population growth.

Additionally, areas around all major capital cities that are undergoing urban renewal are showing promise. Regional centres are also becoming increasingly attractive as remote work becomes more common, allowing people to seek lifestyle options outside major urban centres.

How can overseas investors manage their property remotely?

Overseas investors can manage their properties remotely by employing local property management services. These professionals handle everything from tenant relations to maintenance issues. Additionally, utilising technology, such as property management apps and online communication tools, can help keep investors informed about their properties’ performance.

CHINESE AND OTHER ASIAN BUYERS HAVE HISTORICALLY BEEN A SIGNIFICANT FORCE IN THE AUSTRALIAN PROPERTY MARKET

What resources or services do you offer to help clients conduct due diligence on a property?

We equip our clients with a range of comprehensive resources for conducting due diligence. This includes access to detailed market research and tailored pre-purchase advice for example. Our goal is to ensure clients are well-informed and confident in their investment decisions, backed by insights from our expert team.

What advice do you have for overseas clients who are considering entering the Australian property market for the first time?

For overseas clients venturing into the Australian property market for the first time, my foremost advice is to engage in thorough research and seek professional guidance. It’s essential to understand local market dynamics, legal

frameworks, and financial implications. I also highly recommend visiting Australia to gain firsthand experience of the properties and neighbourhoods being considered, as this will provide invaluable context for their investment decisions.

What is on the horizon for you and Charter Keck Cramer as we head into 2025?

As we look toward 2025, Charter Keck Cramer is committed to enhancing our services by integrating advanced data analytics and sustainability initiatives into our consultancy. Our goal is to empower clients to navigate the evolving market landscape while prioritising responsible and impactful investment strategies. We envision positioning ourselves at the forefront of innovative solutions that meet the diverse needs of both local and international investors.

Mohammed Adib channels childhood curiosity and an aversion to design homogeny into his work for Dewan Architects + Engineers

BY LIAM ARAN BARNES

As a young boy, Mohammed Adib spent his weekends bolting between cranes, girders, and scaffolding, shadowing his contractor father through construction sites. Kicking up dust in oversized boots and a hard hat slipping over his eyes, he jumped at any task the workers handed him.

“I spent all my spare time on building sites,” Adib recalls. “Those early days ignited my fascination with how people interact with spaces and structures.”

Now, as chief design officer at Dewan Architects + Engineers, Adib channels childhood curiosity into redefining urban landscapes. Since joining Dewan in 2017, he has been tasked with unifying the firm’s design language across all projects and offices. By cementing strategic partnerships and exploring new markets, such as Saudi Arabia, he has positioned Dewan at the forefront of the region’s architectural renaissance in recent years.

Adib’s journey, like his designs, is defined by movement. Educated in the UK and Spain, he transformed a gap year into a global expedition, working at 11 architectural firms across multiple countries.

“Architects are natural nomads,” he says. “Travel is our greatest source of inspiration.”

Adib’s exposure to diverse architectural styles and cultures instilled in him the importance of designing buildings that reflect their surroundings. While working in Europe, North Africa, and the Middle East, he noticed that designs disconnected from their environments often felt impersonal and out of place. This experience cemented his opposition to cookie-cutter architecture, which prioritises uniformity over local context.

“I’m really against globalised designs,” Adib says. “Architecture should enhance its surroundings, not overshadow them, and it must balance beauty with practicality.”

It is a philosophy that defines Dewan’s projects. Take Port de la Mer in Dubai, for instance. Inspired by Mediterranean fishing villages, the project balances pedestrian-friendly avenues, open public spaces, and sweeping marina views. But adapting the charm of a Mediterranean village to meet Dubai’s market demands wasn’t without its trials. The project required extreme standardisation to ensure quality and speed in construction, especially given a tight budget.

While Port de la Mer exemplifies Dewan’s ability to adapt, Qiddiya in Saudi Arabia represents the firm’s ambition to push the boundaries of design and technology. Tasked with delivering one of the most complex Building Information Modelling (BIM) projects ever developed, Dewan’s team synchronised intricate design elements across multiple

MOHAMMED ADIB OF DEWAN ARCHITECTS + ENGINEERS DRAWS INSPIRATION FROM DIVERSE ARCHITECTURAL STYLES TO CREATE SINGULAR DESIGNS

I’m really against globalised designs. Architecture should enhance its surroundings, not overshadow them, and it must balance beauty with practicality

disciplines in real time, ensuring precision and sustainability targets were met.

Such large-scale projects highlight the growing need for efficiency and precision, which Dewan addresses through its innovative approach to design technology. Beyond individual projects, the firm is fully embracing the industry’s technological transformation.

Through their Modern Architecture and Design (MAD) department, Dewan is exploring groundbreaking innovations such as 3D printing, offsite manufacturing, and artificial intelligence. These advancements optimise workflows, enhance quality control, and automate routine processes, allowing architects to focus more on the creative elements that define their projects.

“Technology is revolutionising how we approach design,” Adib explains. “It frees us from mundane tasks, giving us the freedom to focus on the creative and human aspects of architecture.”

Under his guidance, the firm’s portfolio has expanded to include urban masterplans, cultural centres, and major residential developments throughout the Middle East. This work reflects his belief that architecture must serve both people and the planet, placing Dewan at the forefront of sustainable urbanisation in one of the world’s fastest-growing regions.

Still, navigating new markets comes with its own set of hurdles. Rapid expansion into places like Saudi Arabia requires balancing Dewan’s design principles with each region’s regulatory landscape.

“Every market has its challenges,” Adib says. “In Saudi Arabia, the cultural and architectural transformation is massive. We’ve had to adapt to new regulations and evolving client expectations.”

Another challenge is promoting sustainable practices in regions where the concept is still emerging. Convincing clients of the long-term environmental value of sustainable design isn’t always easy.

“There’s often tension between short-term costs and long-term environmental impact,” he adds. “Part of our role is to show how sustainable practices protect the environment and offer operational savings over time.”

Dewan’s strategy has been to remain creative, and forward-thinking. The firm is currently focusing on off-site and modular construction methods, actively reducing both the use and quantity of concrete, while exploring the potential of timber construction, amongst other innovations.

“We’re moving into an era where architecture must be flexible,” Adib explains. “With rapid technological advancements and shifting societal needs, buildings should be like living organisms—capable of adapting and responding.”

For Adib, flexibility is key not only in design but also in anticipating future challenges. Dewan’s projects are increasingly focused on creating sustainable, resilient structures that can meet the demands of both today and tomorrow, whether that’s through reducing carbon footprints, embracing new technologies, or fostering stronger connections between people and their environments.

Indeed, what began as a childhood fascination with construction has evolved into a lifelong commitment to human-centred design for Adib. Under his leadership, Dewan is shaping skylines and creating spaces that connect people with their cities, reflecting both the needs of today and the uncertainties of tomorrow.

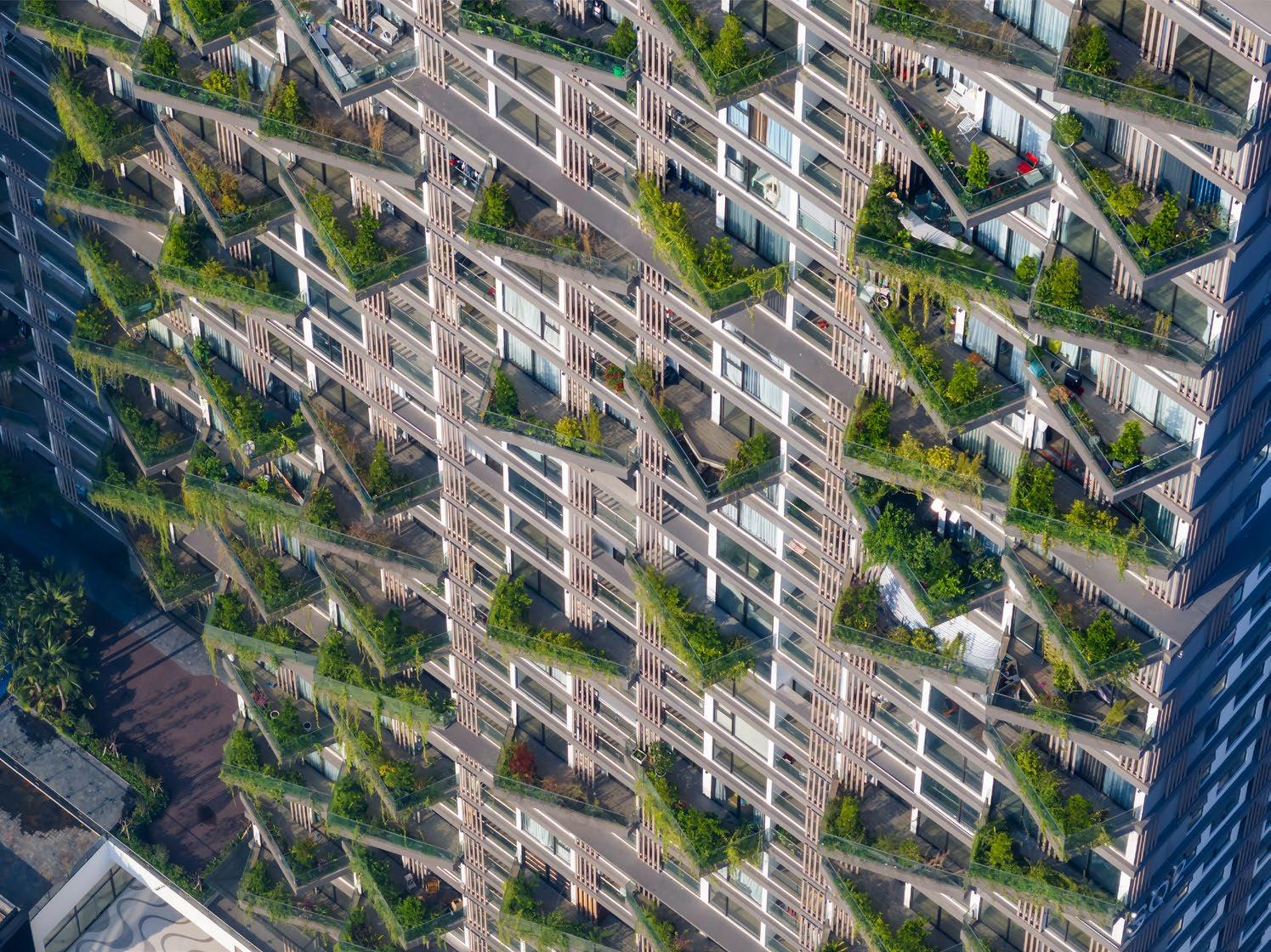

Inspired by the organic shape of a leaf, Nomura Bank’s residential project in Hanoi weaves natural elements— wind, sunlight, and water—into its design. Six towers arranged in a radial layout provide panoramic views and enhance ventilation, rising from an organic podium that integrates with surrounding green spaces and vertical gardens. Balancing traditional and modern Japanese design principles, this sustainable development fosters a deep connection with nature while providing urban amenities, according to Adib. “Each tower becomes a leaf in the greater canopy of the city,” he says, “creating an oasis of calm in the urban landscape.”

An architectural tribute to Vung Tau’s coastal legacy, the Vung Tau Hotel takes inspiration from the area’s history as a trio of villages called Tam Thắng (Three Boats). Three interconnected towers, positioned for expansive ocean views, incorporate a façade inspired by Mũi Nghinh Phong (Cape of Welcome Breeze). “Triangular geometries reflect the rhythmic movement of waves,” says Adib, enhancing the connection between the building and the natural landscape.

Designed with biophilic principles, the 78,087-square-metre development, set against Phuket’s western coastline, will include two hotels, 134 branded condominiums, and 625 residential units. Each space offers ocean views while ensuring privacy through innovative design and cascading greenery. “Layan Verde’s philosophy of ‘see but not be seen’ invites residents into a sanctuary of solitude amidst nature,” says Adib. The project’s first phase is anticipated to be completed in 2027, setting new standards in sustainable, luxury living.

Dubai’s first freehold community in Jumeirah, Port de la Mer, channels Mediterranean coastal charm, drawing inspiration from Italian and Spanish architecture. Dewan Architects crafted the masterplan around a superyacht marina, evoking the feel of Porto Montenegro. Six zones with terracotta and yellow-toned buildings bring an authentic seaside atmosphere to life, complemented by amenities like pools, gyms, and beach access. “We wanted Port de la Mer to echo the vibrancy and authenticity of Mediterranean waterfront living,” explains Adib. “Vibrant piazzas, waterfront boutiques, and dining options create a lively urban environment at the water’s edge.”

Incorporating urban and rural elements, Sol Forest integrates urban aesthetics with the tranquillity of the surrounding countryside, creating a vertical green haven. Each apartment offers a view of verdant façades, providing natural shading and echoing Vietnamese community culture.

“Our aim was to bring the essence of nature to the heart of the city,” says Adib, “making Sol Forest both a residence and a green retreat that aligns with the client’s vision for sustainable urban living.”

Embodying Vietnam’s cultural depth and the Year of the Dragon’s symbolism, Dragon Tower is a collaborative effort by Dewan and TTAS, designed for government offices near West Lake. Shaped like a dragon’s head, it stands as the tallest structure in the vicinity. “The scale-inspired façade echoes Vietnam’s historical narratives, embodying resilience and adaptability,” explains Adib. Elevated on stepped platforms to mitigate flooding, Dragon Tower’s design fosters interaction with the landscape, merging tradition with modern urban solutions.

BY JONATHAN EVANS

One of Singapore’s most sought-after neighbourhoods, Bukit Timah offers lifestyle amenities, green space, and new residential projects

Watten House

A 180-unit high-rise on Shelford Road from UOL Group Ltd in collaboration with Architects 161 and Index Design, this project due for completion in Q4 2026 is conceived as a sequel of sorts to UOL’s acclaimed MeyerHouse. With commanding views and proximity to prestigious schools, Watten House is inspired by traditional Asian courtyards, lying adjacent to each other and interspersed with pools, gardens, ponds, walking trails, and a jacuzzi from Danish landscapers Henning Larsen. Inside, the apartments of three bedrooms or more have private elevators and maximise space with balconies and marble flooring, with the overall look intended to blend with its environment.

Its name proclaiming its greatness even before opening in July 2025, this luxury twin-tower development from DP Architects emphasises both grandeur and a sense of calm, looking over Bukit Timah Nature Reserve and holding over 200 spacious three-bedroom apartments. Landscaping group Salad Dressing Architects have gone to town with the exteriors, animating the chevron-shaped building with an “environmental deck”, waterfalls, planters, water features, roof gardens, jacuzzi, and a sky garden; a clubhouse laced with gold mesh has a kitchen island designed by Zaha Hadid. Inside it’s all chandeliers, marble flooring, Miele appliances, Villeroy & Boch fittings, and double-door fridges; smart features run throughout.

Bar Black Sheep

Fifteen years old and tucked away on Cherry Avenue next to a residential block, here’s a real hidden treasure. It’s an unconventional set-up—not just a gastropub, but a one-stop shop: a mini-food court with TV, books, music, a water feature, a landscaped garden, and a car park. The busy bar serving “craft, draft, and unique wine” is complemented by a Spanish food stall (La Mesa). The 50/50 mix of locals and chilled-out foreigners sups European beers among the potted shrubbery and benches, and the whole enterprise exudes the genial informality of a Goan-style resort bar. There are also live music events and DJs, events such as International Curry Week, plus subsidiary outlets in Kent Ridge’s University Cultural Centre, Robertson Quay, and nearby Cluny Court.

For years now, Bukit Timah has been a sought-after urban escape. Its over-riding tranquility and numerous citycentre links ensure Bukit its enduring popularity with well-heeled locals and expatriates. The area’s natural assets are enhanced by Bukit Batok, an old quarrying ground, encouraging vigorous hikes through this busy but beautiful neighbourhood that’s augmented by new real-estate additions from big-name developers.

Dubbed “Little Guilin” by locals for its resemblance to the Chinese city’s scenic Elephant Trunk Hill, the Poh Kim Quarry public park is the distinguishing beauty spot of Bukit Batok, a small town a short walk south of Bukit Timah. Winston Churchill described his army’s 1942 surrender to the Japanese at what’s now an exhibition space, Memories at Old Ford Factory, as the “largest capitulation” in British military history (the Nissan company took over the base after their conquest). Once dominated by rubber and pineapple plantations, the area became industrialised after World War II. Built from the igneous rock that’s prevalent in the area, Poh Kim was heavily quarried for granite until the 1970s, when the government started to promote it as a beauty spot.

It can be surprising to find expansive green lungs in a tiny country with 6 million residents, and spaces like this see Lee Kuan Yew’s vision of a “garden city” come to its full fruition—a diversity-rich rainforest around Singapore’s highest point. The 1.7 square-kilometre reserve’s other main features include the Eco-Link BKE, which allows pangolins, mousedeers, and macaques to traverse the Bukit Timah Expressway into Central Catchment Nature Reserve. The primary forest gathers plant, animal, and insect species such as giant trees, along with rare birds like the Asian fairy bluebird and the greater racket-tailed drongo, with its distinctive whistle and plumage. Interactivity is encouraged with an exhibition hall, nature walks, guided tours, and bird-watching huts, as well as opportunities to help with the reserve’s conservation efforts.

This family-run enterprise on ultra-affluent Greenwood Avenue collects several market stalls, a store, the extravagant Clipper Bar, and a seafood restaurant under one roof. It brings the convenience of fresh catches— from the familiar halibut to the elusive monkfish—to locals straight from the fishrich waters surrounding Singapore. The restaurant serves international cuisines with imagination and exquisite plating, varying in style from Japanese to West Asian—even fish burgers and sandwiches —complemented by choice wine lists. More rarefied items come from Russia (caviar), Japan, South Korea, Oceania, Mauritius, South Africa, France, the Netherlands, Canada, and Chile. There’s also a bedazzling array of cheeses, truffles, oils, sauces, flavourings, tinned seafood, fine mushrooms, and breads. A second outlet sits by the scenic surroundings of Quayside Isle on Sentosa Island.

Marriage is out, and singlehood is in as economically squeezed young Asians subvert convention and explore alternative paths in real estate

BY AL GERARD DE LA CRUZ

The age-old edict of “go forth and multiply” is resonating less and less with younger generations.

According to the United Nations, women are having one fewer child than they did in 1990. The University of Washington’s Institute for Health Metrics and Evaluation also predicted this year that 97% of countries would fall below the replacement fertility rate by 2050.

Single-person households comprised the fastest-growing household type globally from 2010 to 2019, with nearly half of this growth concentrated in Asia Pacific, according to Euromonitor International.

South Korea’s fertility rate has dipped below 1.3 for two decades, the longest stretch among OECD countries. As of 2023, nearly 42% of South Koreans lived alone, giving rise to the term bihon, the choice to forego marriage.

Japan, meanwhile, has the dubious honour of having the world’s oldest society. It is plagued by ills such as hikikomori (extreme social withdrawal) and kodokushi (lonely deaths), which raises concern among landlords.

In 2023, Singapore’s fertility rate dropped to 0.97, marking the first time it has fallen below 1. Whereas housing units once accommodated three to five people, family sizes in the city-state are now even smaller, according to Dr Nai Jia Lee, head of real estate intelligence, data, and software solutions at PropertyGuru Group.

“Low fertility is associated with the financial costs of child-raising, pressures to be an excellent parent, or difficulties managing work and family commitments,” he says. “Uncertain economic conditions and climate change probably also lead to a shift to smaller household sizes and increase in number of singles.”

Spread by economic pressures, an “epidemic of despair” has dissuaded many from procreating, according to recent research by neuroscientists at the University of Pennsylvania.

Following the COVID-19 pandemic, movements like tang ping or “lying flat” gained traction, forcing China’s youth to reassess life choices amid disillusionment with employment.

The high costs of living in urban centres, including rent, utilities, and daily expenses, can strain finances, making it challenging to save for a home

In 2021, China recorded 239 million single people over the age of 15. A year earlier, the average age of marriage had risen to 28.67, compared to 24.89 in 2010, prompting President Xi Jinping to advocate for a “new culture of marriage and childbearing” in yet another step away from the one-child policy.

“Traditionally, marriage in China was viewed as a social obligation, but contemporary attitudes now prioritise personal happiness and compatibility,” says James Woo, co-head of valuation for China at Colliers.

The prospect of homeownership, let alone childbirth, can feel unattainable in China where the residential price-toincome ratio stands at 29.59.

“The high costs of living in urban centres, including rent, utilities, and daily expenses, can strain finances, making it challenging to save for a home,” says Woo. “Many young professionals face job instability, making it harder to commit to long-term financial obligations like a mortgage.”

Housing costs also deter childbearing in Seoul where jeonse (rental deposit) can cost around KRW423 million (USD309,000). This year, South Korea invited overseas Filipino workers in a pilot program to assist with childcare, promoting procreation to locals, but the results have been mixed so far.

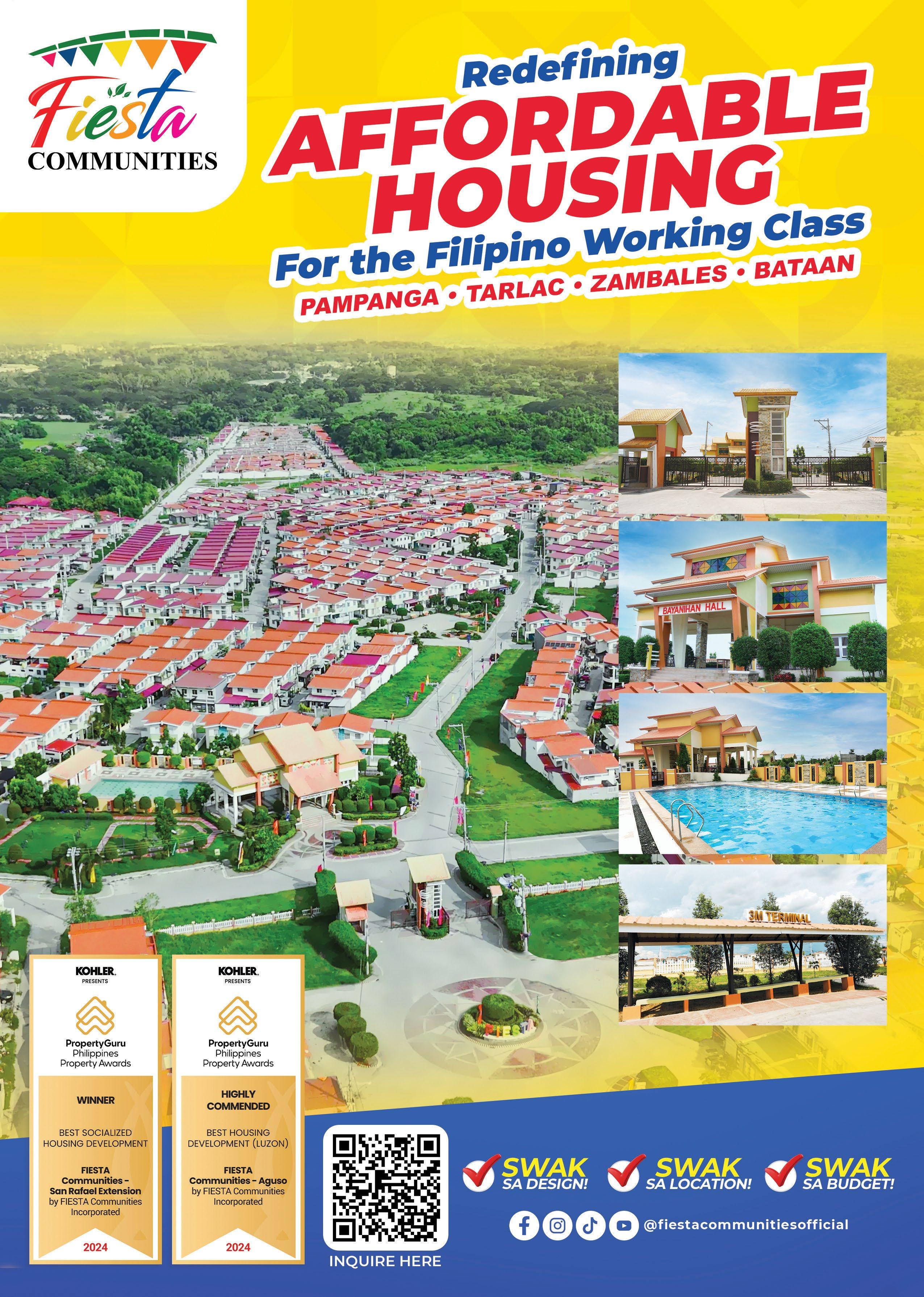

Although the Philippines tops Southeast Asia in the number of singles, around 64% of its populace are aged 15 to 64, placing it in a demographic “sweet spot.”

“Developers are cashing in on this young, millennial, Gen Z-dominated workforce,” says Joey Roi Bondoc, associate director of research at Colliers Philippines. “They’re banking on the potential of their salaries to increase in the years to come. If they receive greater wages, they’ll have

greater capacity to purchase residential units.”

Singledom will likely marshal demand for more affordable residential products, compelling developers to rethink their portfolios in favour of smaller cuts. In markets like metropolitan Manila, where unsold ready-for-occupancy units have numbered around 21,000, singles offer developers an opportunity to clear their lower mid-income inventories.

“It makes sense right now for developers to aggressively capture demand from the singles, from the young workers, especially because these are projects that will likely cater to them, given their income levels at this point,” says Bondoc.

Similar shifts are occurring in neighbouring Indonesia, Southeast Asia’s most populous country, where around 128,000 fewer people married from 2022 to 2023.

“Over time, this trend may lead to a structural shift in the housing market with a reduced focus on large family homes,” says Vivin Harsanto, head of advisory at JLL Indonesia. “Developers and policymakers may need to innovate further to meet the unique needs of this demographic, potentially leading to new property types and ownership models.”

Taking such an innovative approach, Singapore has experimented with co-living models for independent seniors. Earlier this year, the Housing & Development Board (HDB) launched its first tender for “silver co-living proposals” to support elders living alone.

Similarly, developers in China have redirected their focus on shared housing models and rentals, especially those featuring multi-functional living spaces, instead of family-oriented abodes.

“If the trend continues, we may see a stabilisation or even a decrease in property prices in certain segments of the market, especially where demand for larger homes declines,” says Woo.

Enhancing employability enables singles to afford homes in the future. However, the International Labour Organisation (ILO) reports that 20% of people aged 15 to 24 worldwide are not engaged in employment, education, or training (NEET) while youth unemployment stands at 13%, a 15-year low.

Bridging the skills gap between the needs of a country’s primary industries and the quality of graduates from tertiary institutions is essential.

In the Philippines, a services-oriented economy, the IT-BPM sector is aiming to scale up and capture a larger share of the global knowledge process outsourcing (KPO) market. However, a mismatch between applicant skills and KPO hirers has left the sector reliant on low-paying call centre jobs. Higher-value roles in software development, engineering, medical transcription, and financial and accounting services remain out of reach for many Filipinos.

“Until we see that gap being closed, we won’t see a substantial increase in the salaries of these outsourcing employees,” says Joey Roi Bondoc, associate director of research at Colliers Philippines. “That will somehow hinder them from acquiring residential units, whether it’s a house-and-lot outside Metro Manila or a condominium unit within the capital region.”

ILO notes that young adults aged 25 to 29 in low-income countries are three times likelier to face job insecurity than their counterparts in high-income nations. Youth unemployment in Asia was markedly higher in 2023 than in 2019.

SINGAPORE IS EXPERIMENTING WITH CO-LIVING MODELS FOR INDEPENDENT SENIORS AS IT TRIES NEW PROPERTY OWNERSHIP MODELS

SINGLE-PERSON HOUSEHOLDS COMPRISED THE FASTEST-GROWING HOUSEHOLD TYPE GLOBALLY FROM 2010 TO 2019

When they are not addressing the root of declining birthrates, governments across Asia are creatively responding to the residential needs of singles.

Local governments across China have recently introduced subsidies and incentives for first-time homebuyers, including singles.

Singlehood may also foment the rise of self-contained townships and mixed-use, master-planned communities, with spaces tailored to the unmarried. “Urban areas may see densification as more singles opt for city living with enhanced services and amenities,” says Harsanto.

Despite individualism gaining currency across Asia, obligations towards family still weigh heavily on singles. Some men in China reportedly linger in rural “bachelor villages” while in Singapore, some singles bypass the HDB’s offerings for pricier private homes, all to be near ageing elders.

“The lack of new flats near their parents often nudges them to the resale of the private market,” says Dr Nai Jia. “It is also interesting to note that the factor that influences their decision includes future capital gains.”

Taking care of parents can compete with time and resources needed for having children, compounding the decline in birthrates, he adds.

From 20th-century fears of overpopulation to today’s pronatalism, the discourse on reproduction has evolved, but those earlier concerns were not unwarranted. A Lancet study suggests that if the global population decreases to 7.1 billion by 2100, carbon emissions could drop by 41%.

In Shanghai, where the average marriage age has risen to 30.6 for men and 29.2 for women, municipal authorities recently announced measures to relax housing purchase restrictions. The new directive supports non-Shanghai-registered singles in purchasing homes by lifting previous requirements that mandated marriage and five years of social security.

Financial institutions are also stepping up, providing resources and workshops to educate young singles on budgeting and saving, as well as mortgage options. The efforts empower the youth to make informed decisions about homeownership.

In Singapore, the Housing & Development Board (HDB) is broadening residential options for unmarried individuals, now able to purchase tworoom flexi flats across all types of build-to-order (BTO) projects. Additionally, financial grants are available for singles purchasing HDB flats, depending on their income eligibility.

Some lenders in China are easing income verification requirements under more flexible mortgage policies and offering co-signing options to help singles qualify for loans. The loosened requirements come as China’s major commercial banks realise plans to cut existing mortgage rates from October.

The phenomenon known as kodokushi or “lonely death” in Japan has led to nearly 40,000 individuals dying alone at home during the first half of 2024.

While inducing procreation is problematic, especially on a boiling planet, the reverse is equally concerning. A shrinking workforce can undermine the global economy.

“To be honest, most countries try to solve this problem through migration,” says Dr. Nai Jia. “It is an inevitable journey that all countries will go through.”

Amid heated debates on migration, one voice risks getting lost in the noise: that of childbearers. As nations grow wealthier and access to contraception widens, women choose to have fewer children, making them vital to economies with labour shortages.

“As more women enter the workforce and attain higher education, they gain financial independence, leading them to prioritise personal and professional development over traditional roles as wives and mothers,” says Woo.

New norms and mores will undoubtedly emerge with the growing acceptance of childlessness, supplanting conventional concepts of domesticity. Future generations, regardless of gender, will then have to decide whether homeownership is still worth pursuing.

“My advice to singles is to think about their main motivation for purchasing residential property and untangle all the secondary objectives,” says Dr Nai Jia.

Such tragedies, which often remain undiscovered for days on end, are not limited to Japan. Granted, almost 40% of households consist of just one person in Japan, but lonely deaths are spreading across Asia. As populations age and traditional family structures erode, many independently living adults are left without social structures as they age.

In Singapore, around 37 lonely deaths occurred last year alone. Historically, authorities have tackled this issue by developing public housing for ageing people and creating inclusive communities where young and old residents can coexist.

One initiative is Kampung Admiralty, a groundbreaking 11-storey development featuring approximately 100 flats for seniors. With an active ageing hub, childcare centre, and a variety of facilities, this modern take on the kampung or village serves as a haven for multiple generations.

Over time, Singapore’s approach to combating senior loneliness has shifted. Urban planners are now resorting to, among others, the concept of “ageing in place,” integrating seniors in developments conveniently located near public transport hubs.

“By ageing in place, the community ties are stronger and allow them to age with friends,” explains Dr Nai Jia Lee, head of real estate intelligence, data, and software solutions at PropertyGuru Group.

Shifting consumer preferences, evolving regulatory environments, and fluctuating economic policies mean commercial real estate investors in Asia must remain cautious yet agile

BY GEORGE STYLLIS

When the US economy shows signs of slowing, concerns ripple globally, often impacting Asian economies. However, while last year’s fears of a US-led global recession loomed large, the reality proved different. Asia experienced a boost in exports as the US economy regained strength. However, commercial real estate in the region presents a mixed outlook, with some markets flourishing and others grappling with structural challenges.

Asia’s growth potential has always been resilient, but shifting consumer preferences, evolving regulatory environments, and fluctuating economic policies mean commercial real estate investors must remain cautious yet agile.

Japan has been a standout in the commercial real estate market, bucking the global trend. In 2023, while commercial property values dropped by 44% globally, Japan’s real estate market grew by an impressive 4%, thanks largely to its lowinterest rate environment. The Bank of Japan’s sustained commitment to low rates has helped attract both domestic and foreign investment, driving demand for high-quality assets in core markets.

Hotels and multifamily units have emerged as the hottest sectors, outpacing warehouses, which faced labour shortages and escalating construction costs. As a result, Tokyo has become a magnet for cross-border capital flows, as investors seek stability in a market offering relatively

Asia’s commercial real estate sector illustrates the region’s varied economic landscape, with some markets showing resilience or growth and others facing structural challenges. Investors are watching closely to navigate these opportunities and challenges

high yields. Tokyo remains the only Asian city providing both rental growth and a positive spread of real estate yields over borrowing costs, a rare advantage highlighted by Ada Choi, head of Asia Pacific research at CBRE.

China’s commercial real estate market faces headwinds, contrasting sharply with Japan. With Beijing’s vacancy rate reaching nearly 20% and Shanghai’s around 15%, concerns about an overextended property sector persist. Before the pandemic, the average vacancy rate stood at 10%, underscoring the structural shifts in demand. The rapid urbanisation and supply surge in recent years have led to oversupply, particularly in office and retail spaces.

S&P recently warned of significant risks for Chinese banks heavily exposed to commercial real estate, underscoring the potential impact of a slowing economy, high vacancy rates, and reduced mortgage activity on China’s real estate landscape. The Chinese government has implemented several measures to stabilise the market, yet recovery remains uncertain. “A decelerating economy could further dampen office demand, driving retail vacancy rates higher as consumer spending softens,” says Gary Ng, senior economist at Natixis.

Australia’s commercial property market shows early signs of resurgence. In Q2 2024, transaction volumes hit AUD11.8 billion, reflecting a modest 5% year-on-year decline, a significant improvement over previous quarters’ doubledigit decline. Urban centres like Sydney and Melbourne are leading this gradual recovery, with the potential for further stabilisation as investor confidence returns. Notably, sectors such as life sciences and data centres are drawing increased interest, as these assets demonstrate resilience and high growth potential. Benjamin Martin-Henry, head of real assets research for Pacific at Hall and Wilcox, views the trend as a “promising resurgence following two challenging years.” This sentiment reflects the broader appetite for specialised real

estate sectors that are increasingly considered as recessionproof or adaptable in a high-inflation environment.

Singapore’s retail sector is capitalising on a robust tourism recovery, bolstered by a new visa-free scheme with China. Orchard Road, the city’s premier retail strip, has seen several major openings, including Nike’s largest store in Asia and Hoka’s first standalone store. Retail continues to thrive despite the e-commerce trend, with online sales accounting for only 14% of total retail sales as of August 2024. Singapore’s real estate landscape benefits from its strategic position as a gateway to Southeast Asia, attracting significant foreign investment. Physical retail remains popular, especially experiential segments like food and beverage, which constituted 46% of new openings in October 2024, as noted by Xian Wang Yong of Cushman & Wakefield. The city-state’s focus on experiential retail has led to the creation of vibrant spaces designed for social interaction, reinforcing its appeal as a retail investment hub.

The Philippines, which recorded the fastest economic expansion in Southeast Asia last year, reported a Q2 GDP growth rate of 6.3%. While the government’s ban on Philippine Offshore Gaming Operators (POGOs) may impact the office market, experts believe the effect will be limited. Colliers projects the office vacancy rate in Metro Manila will rise to 22.2%, a manageable increase as traditional firms and IT companies fill the gap left by POGOs. “Today, POGOs account for less than 11% of office space demand, a fraction of their pre-pandemic influence,” observes Mikko Barranda of Leechiu Property Consultants. Manila’s growing BPO (business process outsourcing) sector continues to fuel demand for office space, mitigating the impact of regulatory shifts and enhancing the market’s overall resilience.

Thailand’s commercial property sector is booming, driven by expectations that the country will lead in electric vehicle (EV) manufacturing. The launch of the One Bangkok mixeduse complex, with plans for over 900 stores and two luxury hotels, reflects the country’s bullish outlook.

Every year, Southeast Asia seems to unveil a new mall, each one bigger than the last. This year was no exception.

Icon Mall in Sanur, Bali, has eclipsed Living World Mall in Denpasar to become the island’s largest mall since its opening this summer. Developed by PT Grha Hatten Duasatu in collaboration with Cinema XXI, Icon Mall Bali covers a gross floor area of 38,570 square meters, ranking it among the largest in the region. It boasts Southeast Asia’s largest indoor floating market, a butterfly park, and an edible garden.

The mall features over 200 shops, restaurants, and cafes, including big-name fashion brands such as Coach, Calvin Klein, and Tommy Hilfiger. Sanur has long carried the label of a “boring” destination, earning the unflattering nickname “Snore” for its quiet offerings. But the government is eager to revamp this image. The mall is part of a broader effort to revitalise Sanur, aiming to shed its reputation as a retirement haven.

“Investments from both the government and private sector are focused on making Sanur a more attractive tourist destination without losing its charm,” says a spokesperson for ICON Bali.

With the Thai government providing incentives for EV production, JLL predicts that Thailand’s EV industry growth could catalyse a USD6.5 billion real estate market by 2030, supporting facilities and infrastructure linked to EV production. This trend underscores the strategic alignment between Thailand’s real estate sector and its industrial ambitions, showcasing a model for integrating manufacturing growth with commercial real estate.

Though Cambodia’s economy is expected to grow by 5.8% this year, the real estate sector faces a 39% decline in approved development permits, indicating a broader construction slowdown. The primary factors include rising construction costs and stricter regulations aimed at controlling speculative investments. However, the opening of commercial projects like the Maritime Tower in Phnom Penh and the Maline Office Park suggests that demand for quality office space remains. Foreign direct investment, particularly from China, continues to play a crucial role in sustaining Cambodia’s commercial sector. This trend will likely continue as foreign investments in the country’s commercial sector increase, with Phnom Penh emerging as a key destination for Southeast Asian commercial real estate.

As Asia enters 2025, all eyes are on global interest rate trends. In September, the US Federal Reserve cut rates to between 4.75% and 5%, prompting regional investors to watch for potential impacts on borrowing costs. Meanwhile, China’s economic growth will significantly influence regional real estate dynamics. Investors are particularly focused on China’s policy shifts, as these could signal broader trends for the rest of the region. Nonetheless, Simon Smith, head of Asia Pacific research at Savills, believes the region can “carve its path,” with diverse investment opportunities regardless of external pressures.

Asia’s commercial real estate sector illustrates the region’s varied economic landscape. Investors are watching closely to navigate these opportunities and challenges, adjusting strategies to Asia’s unique mix of growth potential and economic risks. The region’s adaptability and market diversification offer a promising future for those able to read the shifting dynamics effectively, allowing for targeted investments that align with both local and global trends.

DANANG’S TOURISM POTENTIAL HAS BEEN ENHANCED BY THE INCLUSION OF THE DESTINATION IN VIETNAM’S MICHELIN GUIDE

Despite boasting one of Southeast Asia’s most exciting cuisines, Vietnam has traditionally struggled to compete with Thailand and Japan in the high-end dining arena. Visitors to Ho Chi Minh City are familiar with the crunch of fresh spring rolls and the spicy flavours of banh mi, but fine dining here hasn’t gained the same recognition as in cities like Bangkok, Tokyo, or Hong Kong, which collectively hold dozens of Michelin stars—at least until recently.

In 2023, Vietnam officially joined the ranks of the Michelin Guide for notable dining destinations. Since then, seven restaurants have earned Michelin stars. Among them is Akuna, led by Australian chef Sam Aisbett, whose Ho Chi Minh City restaurant has impressed diners with creative dishes like shaved squid with local samphire and ginger-poached crocodile tongue.

“My inspiration comes from bustling markets bursting with freshness to hidden local gems that even Google Maps can’t find,” Aisbett says.

Aisbett’s accolade, along with those of other standout venues like Gia in Hanoi and La Maison 1888 in Da Nang, reflects Vietnam’s growing culinary reputation. This rise in recognition aligns with a predicted record-breaking year for tourism, as the World Travel & Tourism Council estimates that travel and tourism spending in Vietnam could reach VND771 trillion (USD31 billion) this year.

Governments around Asia are spending billions to fuel infrastructure development to boost real estate and stimulate economic growth

BY LIAM ARAN BARNES

IN HANOI, THE CITY’S FIRST METRO LINE HAS SPURRED GROWTH IN HOUSING MARKETS

Infrastructure is the backbone of connectivity. Projects that enhance connectivity positively impact residential demand for both sales and rentals

Every morning, Rahmat Suryadi, a graphic designer in Jakarta, endured a gruelling three-hour commute from his home in Bekasi to his office in the city centre. The relentless traffic drained his energy and left him with little home life.

He recalls how the daily grind took its toll: “I’d come home exhausted, missing dinner and time with my kids.”

But in August 2023, everything changed with the launch of the Indonesian capital’s new Light Rail Transit (LRT) system, a project aimed at easing the city’s notorious traffic congestion. Rahmat’s twice-daily ordeal was transformed into a smooth 45-minute train ride.

“The LRT has been a lifesaver. I arrive at work energised and make it home in time to see my kids before bed,” he adds.

The 41.2-kilometre driverless LRT connects central Jakarta to satellite cities like Bekasi and Depok, supporting Indonesia’s goal to reduce road traffic by 20%. Beyond cutting commute times, it has increased property values around transit hubs, with some areas seeing a 15% rise since the LRT’s launch, according to analysts.

Jakarta’s push for improved connectivity reflects a broader Asian infrastructure boom, with governments investing billions to stimulate economic growth. The Asian Development Bank estimates that the region will require USD1.7 trillion annually until 2030 to meet infrastructure demands.

“This surge in infrastructure is reshaping how cities function, with significant impacts on housing markets. Infrastructure is the backbone of connectivity,” says Christine Li, head of research for Asia Pacific at Knight Frank. “Projects that enhance connectivity positively impact residential demand for both sales and rentals.”

Rahmat’s experience highlights how expanding transit lines can drastically reduce commute times, but the benefits extend beyond transportation. In Hanoi, the city’s first metro line, particularly the Cat Linh-Ha Dong line, has also spurred growth in housing markets. During its trial operations 2018, apartment prices in nearby areas rose by 33%, according to Century 21. This trend continued after the line became fully operational in 2021, with property values increasing by more than 55%.

Similarly, Bangkok’s expanding transit network is transforming suburban areas, improving accessibility to the city centre and driving a surge in housing developments.

In 2023 and 2024, the suburban property market experienced a notable increase in project launches, fuelled by ongoing expansions of mass transit lines like the Pink, Yellow, and Orange lines. By Q3 2023, 80% of newly completed condominium units were in midtown and suburban areas.

In Singapore, transit expansions are also transforming housing markets. “Transit line expansions will reduce the ‘lottery effect’, granting broader access to prime public housing and easing price pressures on resale HDBs (Housing Development Board flats) in core districts,” explains Kristin Thorsteins, managing partner at Portman Investment and chairperson of the PropertyGuru Asia Property Awards (Singapore) judging panel.

Much like expanding transit lines, airports are turning underdeveloped regions into thriving economic hubs across Asia.

“Airports are no longer just magnets for luxury projects; they’re driving broader economic growth by improving accessibility and attracting a wider range of businesses,” says Thorsteins. These developments are raising property values, creating jobs, and boosting demand for housing.

Vietnam’s USD14.5 billion Long Thanh International Airport is expected to significantly increase property values in nearby areas by 2025, turning the region into a major real estate hub. Similarly, the New Manila International Airport in the

Philippines, set to handle 100 million passengers annually, is spurring real estate growth in Bulacan and Greater Manila as improved connectivity attracts businesses and residents.

India’s Navi Mumbai International Airport has already driven up property values by as much as 20% in nearby areas like Ulwe and Panvel. Meanwhile, Phnom Penh’s new international airport is positioning Cambodia’s capital as a regional business hub, fuelling demand for housing, retail, and mixed-use developments.

While many cities are benefitting from unrestrained growth, Singapore presents a more complex case. Changi Airport’s Terminal 5 expansion will reinforce its status as a global aviation hub, but strict regulations have tempered the real estate market, particularly in the luxury segment.

Thorsteins explains that, while enhanced accessibility appeals to international buyers and high-net-worth individuals, “the ‘mother of all cooling measures’—a 60% stamp duty on most foreign buyers—has sharply curtailed demand for luxury property.”