4 minute read

Figure 8. Data classification

Research methods | 81

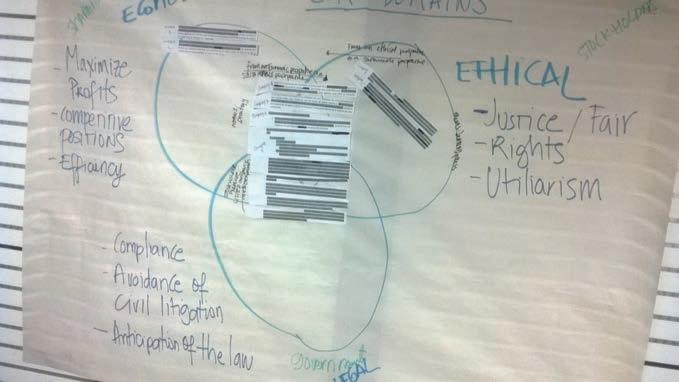

perspective) or environmental strategy classification systems employed for the present work. Author evaluated data to determine how well it matched with the ESA and ESA factor types (Reay & Jones, 2016). Theoretical framework became a tool to interpret the adoption of environmental strategies and its main influencing factors in large Colombian firms.

Subsequently, all the fragments thus identified were detached from their original sources and grouped according to the classification in question, to the finest possible level of detail (e.g., profit, compliance or societal manager’s perspective). This was done manually in each one of the case studies (e.g. Bank or Chemical Company or Association, etc.) (Figure 10).

Figure 8. Data classification

• Analysis and interpretation

In the next step, the data that had been previously grouped according to classification was interpreted and analyzed using the proposed theoretical model, which related environmental strategies to specific ESA factors. Accordingly, these data were separately displayed for each case study in a visually coherent and integrated way. This allowed checking on a case-by-case basis for the matching between ESA factors and environmental strategies.

Case studies

This chapter presents the characterization of ESA and ESA factors in seven case studies of different large firms operating in Colombia. The case studies were built from analysis of interviews and public document, aiming to identify the factors and strategies of each of the studied companies. The case studies represent the empirical reality to test the propositions about the co-occurrence configuration between the adoption of environmental strategies and influencing factors.

4.1. Bank

Bank is a Colombian company established in the market by local investors in the 1970s. Over the years, Bank’s portfolio has evolved from savings and mortgage loan products to consumer and commercial products. By 2010, Bank had issued preferential shares to leverage its growth and expanded its operations in different countries in South America. In 2018, Bank reported a net income of 3 billion USD. Bank has 16,000 employees who support the operation of 592 branches in the country.

• Observed environmental strategies

The environmental practices of Bank were associated with the development of green financial products and the implementation of green processes in addition to their commitment to voluntary programs, environmental reporting and sustainability benchmarking (See Table 9).

Bank has developed green financial products such as 1) green lending to incorporate environmental due diligence into the lending process and 2) green bonds in support of climate-smart projects. Green lending constituted a sustainable choice aimed at financing customers to guarantee cleaner production processes, more efficient energy consumption and the generation of renewable energy (Sustainable Report, 2017).

With respect to green bonds, in 2017, Bank issued the largest green bond of any Latin American financial institution (USD $149 million) to support the construction of climate-smart projects, such as green office buildings (IFC, 2017a).

Bank has also implemented greener processes towards the improvement of operational efficiency and energy consumption at their branches.

84 | Carlos Fúquene Retamoso

Since 2013, Bank has implemented an energy-efficient program in offices and branches to reduce environmental footprint of their operations. This program has included the development of criteria for the acquisition of more efficient technologies, the design of technical specifications for brand signboards to include environmentally friendly elements and the implementation of efficient lighting systems (Bank Sustainability Report, 2017).

In addition, Bank has committed to voluntary programs such as Protocolo Verde and the UN Global Compact. Protocolo Verde is a cooperative program between ASOBANCARIA (the Colombian banks association) and the government to achieve standardization in the banking industry for the adoption of environmental practices focused on 1) green financing, 2) green due diligence in financing evaluation and 3) ecoefficiency (Asobancaria & Ambiente, 2012). Bank has provided visible leadership in defining the Protocolo Verde terms since the beginning of the voluntary program in 2012. The UN Global Compact is also a voluntary initiative based on the implementation of UN sustainability principles on behalf of managers of organizations.

Bank performs sustainability benchmarking by being listed on the Dow Jones Sustainability Index (DJSI), where it has been listed since 2014. The DJSI is a benchmark for sustainable companies across 60 countries and represents the top 10% of the largest 2,500 companies in the S&P Global BMI based on long-term economic, environmental and social criteria (RobecoSAM, 2017).

Bank has also adopted environmental reporting initiatives, such as the Carbon Disclosure Project (CDP), which is a global self-reporting initiative for CO2 emissions to promote climate change compensation activities.

The current survey did not observe any environmental practices performed to achieve social license from communities. Additionally, no specific environmental regulations or community hearing processes applicable to financial activities were detected. Bank mitigates the environmental impact associated with its financial services by paying for utility services. Finally, Bank projects related to communities were developed unilaterally and corresponded to philanthropic activities, environmental and social causes and SME development (Bank Sustainability Report, 2018).

In relation to philanthropic subjects, Bank has developed a program to teach children and young people how to properly manage their free time through recreational, cultural and artistic activities that strengthen their personal values (Bank Sustainability Report, 2018).

Environmental causes include the support of environmental interest groups and employees´ voluntary programs in environmental education.