8 minute read

More oil crops needed

INTERNATIONAL MARKET REVIEW

More oil crops needed

Vegetable oils have witnessed price rises for the past few months. Will supply be able to keep up with demand and how will producers respond? John Buckley

Historic oilseed, oil and meal stock drawdowns during this marketing year remain the key driver of yet more, across-theboard price increases for the oils and fats complex in the opening months of 2021.

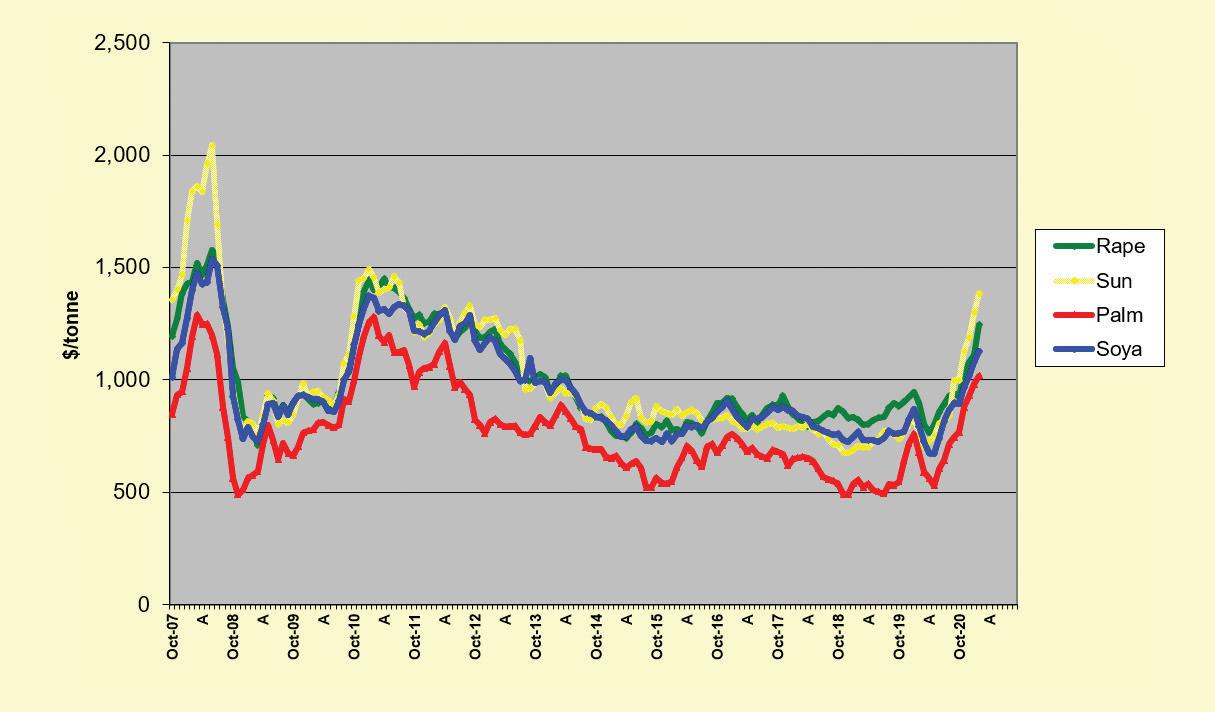

Multi-year price highs (see Figure 1, right) have been further inflated by hopes that vaccination roll-outs will release the global economy from the shackles of COVID-19, recapturing the growth in food and transport fuel use of vegetable oils. Inflation fears have also helped stoke speculative interest in agricultural commodities.

How far the boom continues will also depend heavily on producer response and, as always, that most unpredictable element – the weather.

But for all the main feedstocks, the key question in coming months remains: can supply keep up with demand?

Low soyabean stocks

CBOT soya futures have reacted to the threat that stronger demand will tighten seasonal carryover stocks even more than expected, especially in the USA itself.

Rain holding up a probable record soya harvest in Brazil has also supported the bullish move. Yields there may no longer be threatened by an earlier drought but quality might be and its stocks are unusually low after ‘over-selling’ the last crop, resulting in yet more importer demand switching back to the USA.

The latter’s carryover stocks are arguably emerging as the main flashpoint, now forecast to plummet to just 3.25M tonnes by September from last year’s 14.3M tonnes and 2018/19’s 24.7M tonnes. The smallest stock since 2013/14 equals just 3.5% of demand, a worryingly low ratio.

The global soyabean stock position is not much better – 83.4M tonnes at the close of 2020/21 would be the lowest since 2015/16’s 77.4M tonnes. World soya crush in 2015/16 was just 264M tonnes; this season, it is forecast to reach * Palm is refined

Figure 1: Crude vegetable oil prices at decade highs (US$/tonne, monthly averages)

322M tonnes. Soyabean futures, it might be noted, peaked in 2015/16 at around US$12/bushel. Recently, they went well past US$14.

Overall this season, crushers in Europe are estimated to have paid about 38% more than in 2019/20 for their soyabeans while product prices are up by about 30% for oil and 44% for meal. By comparison, seasonal average sunflowerseed costs have jumped 54%, sunflower oil 51% and sunflower meal 44%. Rapeseed costs have risen by 17%, canola oil 23% and rapeseed meal 39%. Palm oil costs have also averaged about 42% more.

Amid worryingly hot, dry weather, some Argentine private crop estimates have recently dropped as low as 44M tonnes versus the US Department of Agriculture (USDA)’s projection of 47.5M tonnes.

Even if Brazil gets a record 130-135M tonnes crop, US farmers will need to at least match the big acreage increase expected of them this spring. The USDA’s recent annual Outlook Forum came up with a planted area forecast of around 90M acres (36.4M ha) versus last year’s 83.1M acres (33.6M ha).

That could pave the way for a crop even larger than the two record 120M-plus harvests seen prior to 2019. Yet even that could indicate only modest easing in next season’s US carryout stocks. The snug supply outlook also suggests weather will remain at the front of market factors in coming weeks and months.

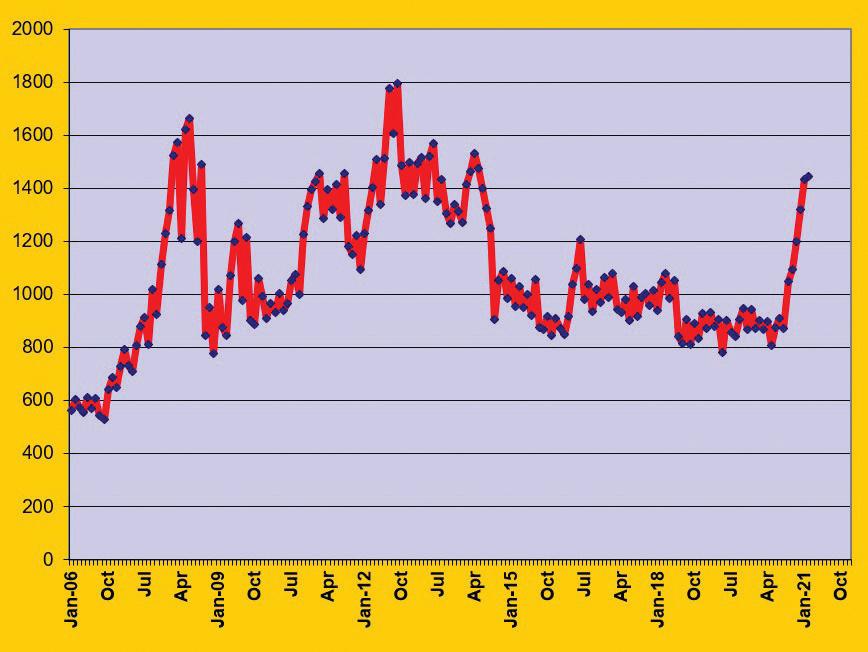

Soya has also drawn support from firmer energy markets, helping CBOT oil futures hit a new multi-year peak of over US$1,200/tonne in March (see Figure 2, p18). However, one downside risk factor not to rule out is the possibility that fresh outbreaks of African swine fever in China may spoil the largest soya consumer/ importer’s stated goal of a return to normal import demand by mid-year. The USDA has already trimmed its Chinese crush forecast from 99M to 98M tonnes.

Palm oil exports fall

Importers have recently shown signs of balking at increasingly expensive palm oil prices, which saw 13-year highs on Bursa Malaysia futures in March. It is a reminder that, for many developing countries, palm remains a choice based on value. At the same time, production may be on the road to recovery after COVID lockdowns, excessive wet weather and other seasonal factors resulting in months of output under-performing forecasts.

January was a particularly depressing month for Malaysia, as its palm oil exports fell by a massive 42%, far more than production (down 15.5% on the month).

All the big buyers – India, China, Europe, Pakistan – cut intake. February started more promisingly with hopes of a strong recovery ahead of the seasonal rise in consumption for Ramadan. However, trade deflated as the month wore on, finishing 5.5% down.

Import declines were also seen by China (-26%) and Pakistan (-46%), putting their year-to-date imports down by 40% and 70% respectively. However, top buyer India’s February imports held steady.

Malaysian exports to the EU also rose by 11% on the month but fell almost 38% on the year. That left Malaysia’s total u

Figure 2: CBOT soyabean futures (US$/tonne) Figure 3: Winnipeg canola futures, 2015-2021 (C$/tonne)

January/February exports 20% lower than in the same period last year.

Malaysia’s early March export data from cargo surveyors was not encouraging, showing a 22% on-the-month slump. However, some analysts thought that a weakening Malaysian ringgit versus the US dollar might revive trade in the second half of March.

Some observers expected Indian importers to step up purchases amid improved processing margins. However, the high palm price was also reported to be encouraging India’s efforts to boost its own oilseed production by raising levies on palm oil imports. In early February, India was reported to have re-jigged taxes to apply an effective 30%-plus levy on crude palm oil, cutting the latter’s tax advantage over soya and sunflower oils from 8.25% to 2.75%, a move some Malaysian traders think could continue to cut demand for palm oil, especially for shipments from March onwards.

Palm oil prices have weathered demand threats with support from the strength in other oils and from signs that energy market recoveries could feed into palm biofuel demand. Only a few months back, crude oil was languishing in the upper US$30s/barrel. Recently it has been well over US$60/barrel. Top palm oil supplier and consumer, Indonesia, has applied higher taxes on the oil to help subsidise its vast biodiesel programme.

Global rapeseed stocks plummet

There has been no ascent in recent memory like that seen on this season’s rapeseed/canola chart. After several years apparently shrugging off slowing production and tightening stocks, the bellwether Winnipeg futures contract finally sprang to life with a near vertical upside move from C$500 at the start of 2020/21 to over C$800/tonne recently (see Figure 3, above).

Government body Agriculture Canada recently cut its estimate of the country’s end-season canola stock from an already low 1.2M tonnes to just 700,000 tonnes, a 77% drop. The Canadian Grain Commission noted that exports had risen by 35% for the year to date to nearly 6.4M tonnes. Domestic crush is also going much faster than expected and the revival in energy markets is offering support to rapeseed’s own large biodiesel sector.

The EU is eking out its second disappointing crop (around 17M tonnes against 20.7M tonnes just two years back). With crush going stronger than expected (at a forecast 23.4M tonnes), EU ending stocks may fall to around 700,000800,000 tonnes or half the level of two years ago. Even with COVID curbing fuel usage, Europe is expected to need record rapeseed imports during 2020/21, with French analyst Strategie Grains raising its forecast for the bloc’s intake by 800,000 tonnes to 6.7M tonnes.

Australia’s larger current crop (4M tonnes versus last year’s 2.33M tonnes) is expected to have to make a much larger contribution this season after a smaller than expected harvest from key supplier Ukraine, which has experienced some early-season drought problems.

What could alter the balance next season is if Canadian farmers respond to these high prices with a larger than expected sown area. The 25% discount quoted on new crop November rapeseed futures in Winnipeg suggests the situation will loosen or that other oils – chiefly palm and soya – might be in improved supply by then. Some analysts also suggest the 2020 Canadian crop estimate might be revised up, as has often happened in the past.

In terms of trade, strong Chinese imports of rapeseed oil were reportedly tightening the squeeze on supplies in mid-March when Winnipeg and Paris futures markets hit record highs. European crushers have been trying to fill some of the gaps in Chinese imports which have resulted from Beijing’s political spat with traditional top supplier Canada.

As well as 130,000 tonnes of rapeseed oil already shipped, EU exporters have reportedly sold China another 200/300,000 tonnes. The USDA estimates that China’s 2020/21 imports will be 3M tonnes for rapeseed, and 1.8M tonnes for rapeseed oil.

Sunflower oil prices rise

Sunflower oil prices have continued their upward trajectory in the last few months, encouraged by increases in rival oils and dwindling stocks in the wake of last year’s disappointing crops in the former Soviet Union. Globally, production fell by about 4.75M tonnes from the record 2019/20 peak, reducing production of the oil by about 2M tonnes or 9%.

Hopes will be pinned heavily on farmers responding to the increase in sunflower seed value – prices were recently as high as 60% over those seen this time last year.

Last year, Ukrainian producers raised their sunflower planted area by a modest 2% but were thwarted by weather, which cut global average yields by some 11%. Recent Ukrainian export prices for sunflower oil rose to US$1,710-1,725/ tonne.

Russian sunflower seed prices, meanwhile, hit record levels recently amid a strong rise in oil export values. As in Ukraine, Russia sowed more last year but yields fell, reducing the crop by almost 12% or 1.8M tonnes. ● John Buckley is OFI’s market correspondent