8 minute read

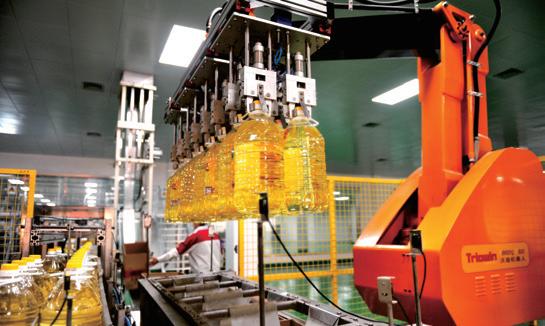

Photo: United Soybean Board

A COVID success story A COVID success story

Sales of soyabean oil expanded during the COVID-19 pandemic, with biodiesel use growing in the USA and imports increasing in key markets such as South Korea and India. Is this trend set to continue? Diana Yordanova

With global markets and daily consumer habits disrupted for almost a year due to the ongoing global COVID-19 pandemic, some oils and fats sales have grown – and a key example is soyabean oil.

This is true worldwide, from North and South America, to Africa, Asia, and Europe.

In the USA, where soyabean oil has historically been the largest feedstock for biodiesel in volume and market share terms, this key use expanded sti ll further in 2020.

Figures from the US Energy Informati on Administrati on (EIA) show that in May 2020, 805M pounds of soyabeans were used as biodiesel feedstock; compared to 659M pounds in May 2019.

COVID-19 lockdowns are the reason why. “Declining restaurant traffi c and structurally lower demand in the HRI [hotel, restaurant, insti tuti onal food service] sector limited the availability of yellow grease or used cooking oil as a feedstock,” vice president of market intelligence for the United Soybean Board and the US Soybean Export Council (USSEC), Mac Marshall told Oils & Fats Internati onal.

Waste oil collecti ons were disrupted by the disease and meat plants – major suppliers of biodiesel feedstock – were shut down because of COVID outbreaks.

“In the early stages of the pandemic, pork processing was operati ng at signifi cantly reduced capacity, which limited the availability of white grease as a feedstock,” explains Marshall.

William McNair, the director of oil and human proteins at the USSEC, adds that soyabean oil sales have also benefi ted from a positi ve reputati on for health, especially as the pandemic prompted consumers to make healthy dietary choices.

This trend has come as concerns rise over the environmental impact of palm oil, aff ecti ng its sales.

As a result, soyabean oil prices have risen to levels not seen since 2014. In January 2021, the oil’s US sales price reached a record US$0.45/lb (453g) compared with US$0.24/lb in April 2020 when the coronavirus had started spreading, United States Department of Agriculture (USDA) stati sti cs show.

Looking at world soyabean oil demand, the US government reported that 59.6M tonnes were sold worldwide during the October 2019-September 2020 marketi ng year (MY), compared with 56.7M tonnes for the same period in the previous year.

This has been good news for American producers. “Last season (MY2019/2020), the US exported record levels of soyabean oil, primarily to South Korea and throughout Central America,” says Marshall. “Domesti cally, 2020 was a record year for crush volumes and the producti on of oil has increased.

“Through November 2020, US soyabean oil producti on is up 2.8% over 2019,” says Marshall. And sales may conti nue to rise, notes McNair, given that the US and European economies conti nue to be depressed by COVID-19 while other regions, notably in east Asia, have started living a relati vely normal life, with standard consumer consumpti on.

Fluctuating market in China

The USSEC programme manager for human uti lisati on focusing on the ‘greater’ China region (including Taiwan), Jinrong Qian, confi rms that ti ght supply has caused the Chinese soyabean oil market in 2020 to fl uctuate.

In the early stage of the pandemic outbreak, China’s demand and imports dropped. Demand for biodiesel was u

depressed by low crude oil prices due to a price war between Saudi Arabia and Russia. “This hit soyabean oil and palm oil future prices hard,” she says.

Delayed South American soyabean imports disrupted by COVID-19 further complicated the situation.

“In addition, diplomatic pressures have also disrupted supplies, for instance between China and Canada, over the extradition hearings (at America’s request) in Vancouver of Meng Wanzhou, the CFO of Chinese tech giant Huawei,” says Qian.

“As China and Canada are in an awkward relationship, rapeseed imports decreased significantly.”

Despite the difficulties, the Chinese government claims it is now controlling the pandemic and is focusing on building up its own soyabean oil production, now approaching peak season.

According to the Chinese office of USSEC, in 2020, the average price of China’s refined first-grade soyabean oil was CNY6,659 (US$1,035)/tonne, 15% up on 2019 prices.

Higher demand in South Korea

There is a similar story of increased demand for soyabean oil in South Korea, with imports increasing from 351,000 tonnes in 2019 to 391,000 tonnes in 2020, the USSEC country director for North Asia and Korea, Hyung Suk Lee, told Oils & Fats International.

Similarly, South Korean soyabean crushing has also gone up from 1.26M tonnes in 2019 to 1.33M tonnes in 2020. As demand for delivered food and pre-cooked meals that only need to be reheated have been on the rise, mayonnaise production (a key soyabean oil consumer) has also increased, Hyung Suk Lee adds.

Indian imports rise

USSEC’s technical consultant for south Asia, Ratan Sharma, highlights that COVID-19 reduced restaurant capacity and restrictions on social gatherings continue to “keep the consumption levels of edible oils low” in India which “in turn will support the downward trend in their imports.”

However, soyabean oils have bucked this trend in south Asia as well – with imports to India increasing by almost 10% to 3.4M tonnes for the past year, 300,000 tonnes more than in 2019.

Optimism in Argentina

Such increases in demand are, of course, good news for major soyabean exporters, such as Argentina, where the industry has kept up with expanding orders and is optimistic about future sales.

The president of the Chamber of the Oils Industry of the Argentine Republic and the Cereal Exporters Center, Gustavo Idigoras, says that the sector reacted quickly once trading partners lifted any COVID 19-linked trade restrictions last year.

Today, according to statistics from Idigoras, Argentina’s main worldwide buyer of its soyabean oil-based biodiesel is the EU, with an annual quota of 1.2M tonnes.

India is also a crucial market for Argentine soyabean oil, with annual purchases usually exceeding 1.5M tonnes.

“Currently the international soyabean market is experiencing good prices, sustained by Chinese demand as well as from southeast Asian countries that are increasing their consumption of vegetable proteins.

“Argentina is the world’s leading exporter of soyabean oil and meal, and is therefore in a position to promote itself in this growing market,” Idigoras stresses.

Soyabean crush up in Europe

Other producers are benefiting and this includes those in Europe. Statistics from FEDIOL, the EU vegetable oil and protein meal industry association, show that soyabean crush volumes in the EU (and the UK), increased from 13.7M tonnes in 2019 to 14.6M tonnes in 2020.

FEDIOL director-general Nathalie Lecocq stresses that “the EU oilseeds processing sector is adaptive to market changes. In this case, it has responded to increased demand for soyabean meal in the EU, with increased soyabean crushing, thereby producing more soyabean oil.”

Imports to Europe, however, have been steady. EU and UK imports of soyabean oil for 2019 were 1.2M tonnes, worth €833M ($1bn). For January-October 2020, (excluding the UK), imports totalled 958,000 tonnes, worth more than €677M (US$820M).

A note from Polish agro-supplies company AGRO-V said in 2019-2020 that the volume of its imports of soyabean oil to Poland significantly increased – up to 33% of all imports handled by the company. But the proportion of trades covered by deliveries to other EU countries decreased from 45% to 32% of its total sales, adds AGRO-V.

Future growth?

Will this general global expansion of soyabean oil production and sales continue, post-COVID?

A majority of market commentators think it will, at least in the shorter term.

“If the pandemic has taught us anything, it is the importance of ensuring continued supply throughout the value chain – and during this pandemic, soyabean oil has been a consistent and reliable feedstock,” says Marshall.

His colleague, McNair, stresses that soyabean is a versatile crop, also used for meat production, alternative food (non-meat) products and animal feed – so demand is more reliable, encouraging largescale production.

This will only be augmented by growing demand for soyabean oil as biodiesel feedstock. And demand for new high oleic soybean oil (HOSO) – with qualities competing with olive oil and offering an extended shelf life – is growing in the USA and Canada, where it is being considered by large fast-food chains.

South Korea’s soyabean oil consumption forecasts for 2021 are also positive, says Hyung Suk Lee. And Idigoras stresses that Argentina has sufficient crushing capacity to increase production and exports as internal consumption remains rather low.

His country is “in a position to compete in the scenario of better prices and higher demands.”

Ratan Sharma is less bullish about demand in India, which will depend on how well the government contains COVID-19.

In Europe, however, regulatory issues might restrain biodiesel-based consumption. The revised EU Renewable Energy Directive (RED II) is restricting the manufacture of biofuels from food and feed crops, including soyabean-based biodiesel. And with the directive under review again through the European Green Deal programme of the current European Commission (EC), regulatory controls may tighten further.

In October 2020, the European Parliament called on the EC to prohibit products that contribute to the destruction of forests, explicitly mentioning soya. But whether such measures have an impact on soyabean oil trade in Europe remains to be seen.

Today, soyabean oil prices are still climbing and demand is robust – it would be a good bet that this market will continue to grow worldwide. ● Diana Yordanova is a freelance journalist