AILWAY G E

SERVING

THE RAILWAY INDUSTRY SINCE 1856 WWW.RAILWAYAGE.COM APRIL 2023

PERSPECTIVES

CEO

SEPTA, METRO-NORTH

Facing Our Biggest Challenges NJT,

CP, KCS Form Three-Nation Network

How They Came to Be in 1983 COMBINATION HISTORIC

Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 224, No. 4. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the publisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2023 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON

April 2023 // Railway Age 1

railwayage.com

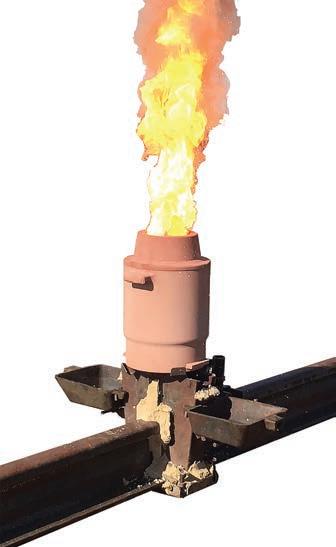

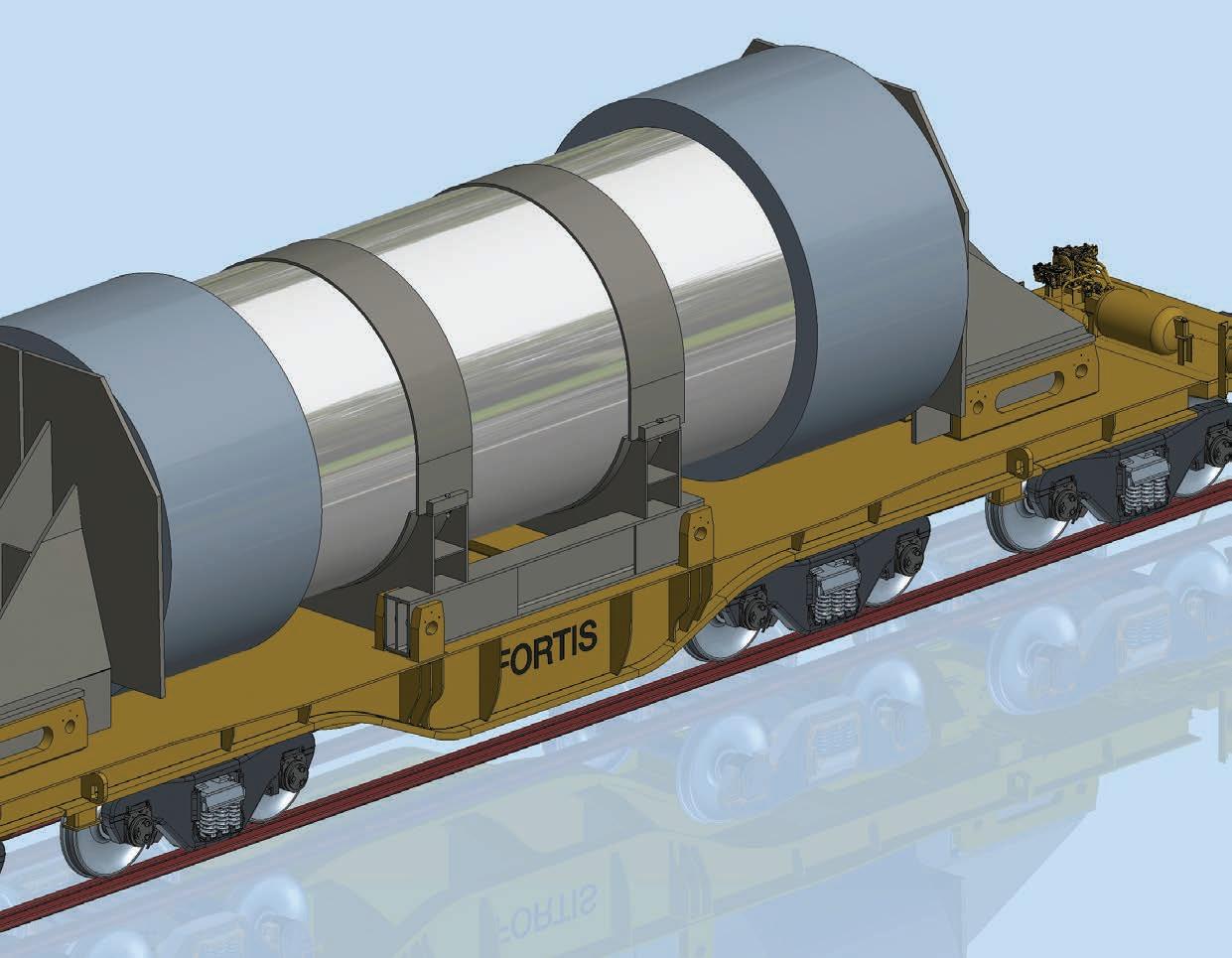

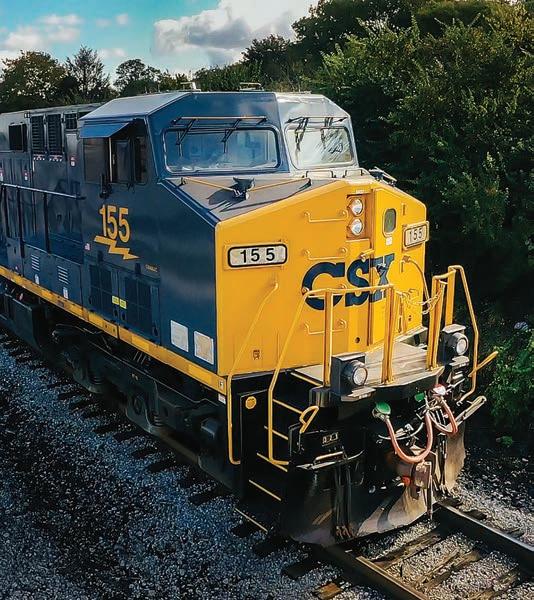

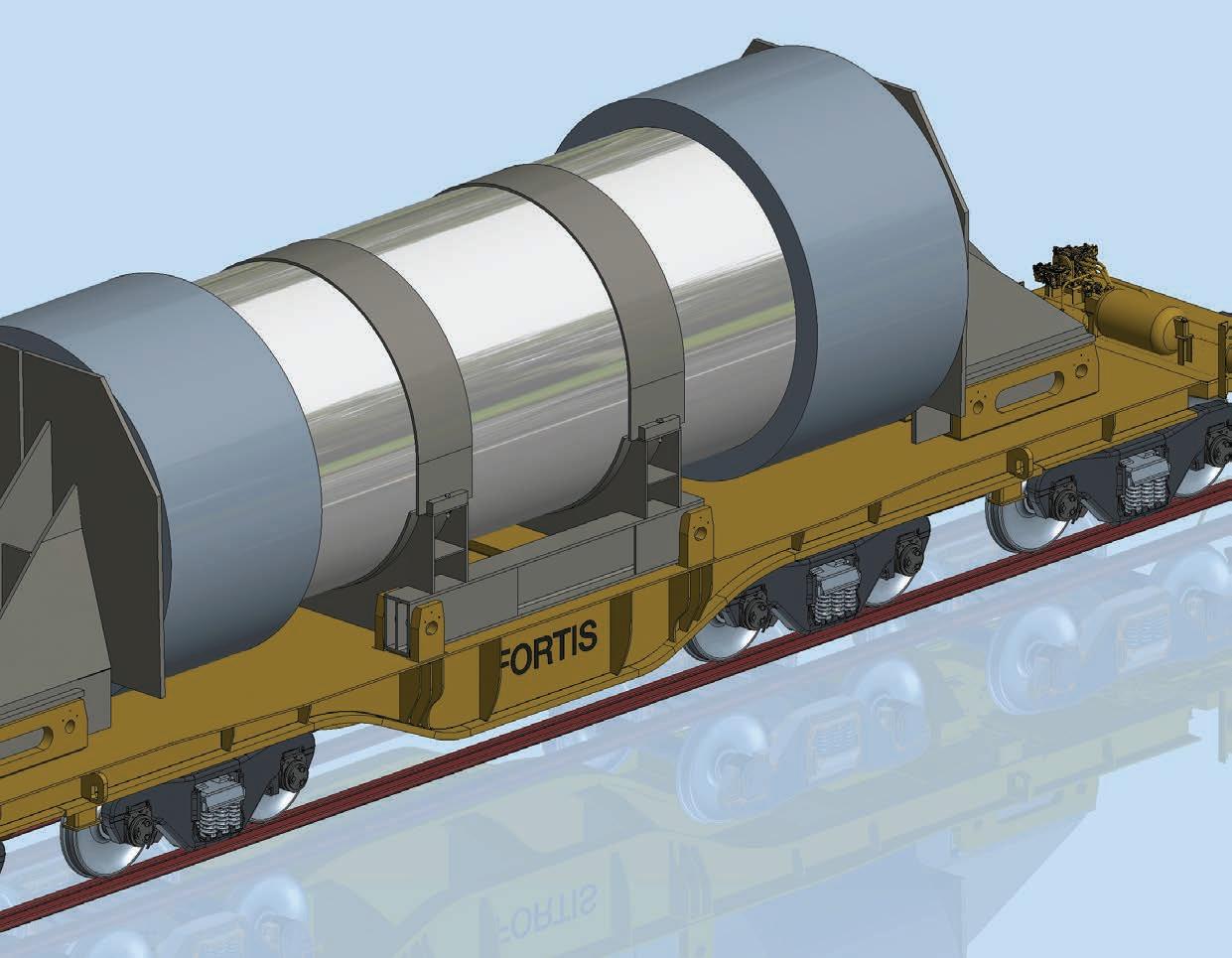

N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning subscriptions to Subscription Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740; FAX +1 (847) 291-4816. Printed at Cummings Printing, Hooksett, N.H. ISSN 0033-8826 (print); 2161-511X (digital). FEATURES 11 13 40 45 52 56 59 Historic Combination CP+KCS=Transnational CPKC CEO Perspectives Facing Our Biggest Challenges Railinc Freight Car Review Fleet is Trending Larger Tech Focus – M/W Crossties: Active Sleepers Passenger Rail Focus NJT, Metro-North, SEPTA at 40 Timeout for Tech Welding Physics and CWR TTC Operated by ENSCO Fortis Prototype Fabrication, Testing COMMENTARY 2 9 64 From the Editor Financial Edge ASLRRA Perspective DEPARTMENTS 4 6 8 61 62 62 63 Industry Indicators Industry Outlook Market People Professional Directory Classifieds Advertising Index COVER PHOTO Double-headed, single-line service: Canadian Pacific and Kansas City Southern—CPKC. Canadian Pacific photo April 2023 52 AILWAY GE New Jersey Transit

I Respectfully Disagree With Your Dissent

One for the history books:

At the time of this writing, we are two weeks away from a traditional “final spike” ceremony, the most significant one in 154 years. This one, at Knoche Rail Yard in Kansas City on April 14, marks creation of North America’s first transnational railroad—the joining of Canadian Pacific and Kansas City Southern into CPKC (Canadian Pacific Kansas City). In Surface Transportation Board parlance, it’s the official “control date.” But it really marks the “wedding of the century,” as far as railroads are concerned.

We all know that the STB voted 4-1 to bless the marriage, which in my opinion—I can say this now without reservation—is a “home run” that makes a whole lot of sense for economic, operational and environmental reasons I don’t need to get into. Read the 212-page STB decision. It’s laid out in detail, with all the bases covered. Pardon the baseball analogy—it’s opening day for the Major Leagues, Yankee Stadium for me (go Bronx Bombers ... uh, Kansas City Royals!)

Board Member Robert Primus, who happens to hail from Madison, N.J., 16 miles from my hometown of Newark, N.J., cast the lone “no” vote. No doubt his reasons were carefully and thoughtfully considered. CPKC to Primus probably looks more like a risky bunt than a home run. I respectfully disagree with his dissent.

“When I hear the word perfect, certain milestones come to mind,” Primus says in his opening dissent paragraph. “Don Larsen’s perfect game (pitching for the Yankees!) in the 1956 World Series against the Brooklyn Dodgers; Rocky Marciano’s perfect 49-0

AILWAY GE

SUBSCRIPTIONS: 1 (402) 346-4740

EDITORIAL AND EXECUTIVE OFFICES

professional boxing record; the perfect season of the 1972 Miami Dolphins ... What doesn’t come to mind are railroad mergers. Far from it, to be honest. And yet we have been told the transaction ... is just that. According to the Applicants, there will be no detriment to the public interest—no disruption of service, no significant harm to surrounding communities, and no consequences from allowing even further concentration of economic power in the freight rail industry ... Not only do I not share the Applicants’ optimism, but I disagree with the Board’s approval of this transaction.

“[M]y objections to the transaction are threefold. First, the transaction will further concentrate control over the nation’s railroads, which have already experienced massive consolidation in recent decades—a development that has not been favorable to rail customers or the network as a whole. Second, in the absence of a service assurance plan (which would have been required under the current rules), the decision does not adequately guard against merger-related service disruptions, at a time when rail service in general has been historically poor. Third, the transaction will harm communities along the path of the newly combined network. Because these detriments to the public interest outweigh the expected benefits, I dissent.”

Again, I respectfully disagree. Does my opinion really matter, at the end of the day? Not really. I’m simply an observer, hopefully an informed one. But I do feel fortunate that, in my 30-plus-year career with 167-year-old Railway Age, I get to experience a historic event, as one of my predecessors did in 1869.

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200

www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Peter Diekmeyer, Alfred E. Fazio, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors Kevin Smith ks@railjournal.co.uk

David Burroughs dburroughs@railjournal.co.uk

David Briginshaw db@railjournal.co.uk

Change

address

reach us six weeks in advance of next issue date. Send both

new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) +1 (402) 346-4740, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director. Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

Member of:

Robert Preston rp@railjournal.co.uk

Simon Artymiuk sa@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 1 (402) 346-4740

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

2 Railway Age // April 2023 railwayage.com

FROM THE EDITOR

the

Patent

ABI/Inform.

WILLIAM C. VANTUONO Editor-in-Chief Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and

Engineering Index Service. Name registered in U.S.

Office and Trade Mark Office in Canada. Now indexed in

of

should

old and

WHEN YOUR BUSINESS RELIES ON RAIL, RELY ON US.

TrinityRail ® is North America’s leading railcar equipment and services provider. With a comprehensive platform of leasing, manufacturing, maintenance and professional services, you can rely on TrinityRail to fully deliver trusted expertise, innovative solutions and supply chain optimization. Learn more at TrinityRail.com.

Industry Indicators

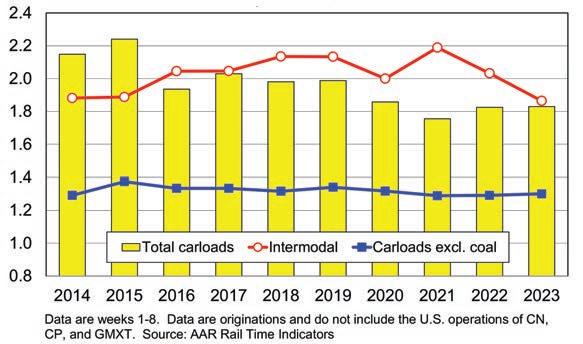

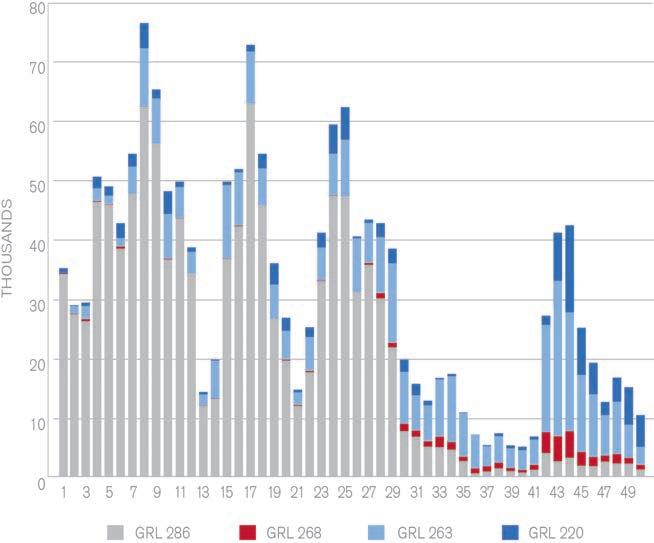

COAL, CHEMICALS, GRAIN PULL NON-INTERMODAL CARLOADS DOWN, BUT INTERMODAL DOWN, TOO

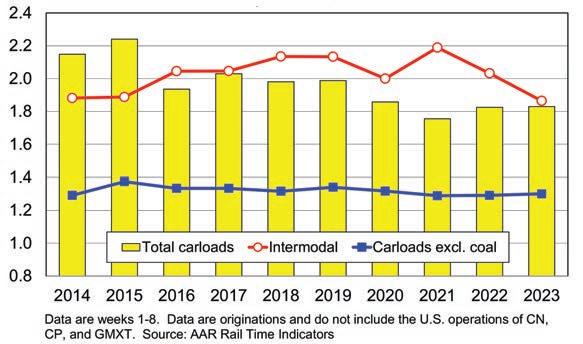

“Coal, chemicals and grain combined account for more than half of U.S. non-intermodal rail volume. When all three are down, it’s extremely likely total carloads are down too,” the Association of American Railroads commented last month. “That’s what happened in February 2023 compared with February 2022: Total carloads fell by 15,101 carloads, or 1.6%. Coal by itself was enough to take total carloads into negative territory. In February, coal carloads fell by 16,648, or 6.1%, from February 2022. That’s coal’s biggest monthly percentage decline in two years. Excluding coal, carloads rose 0.2% in February. Carloads of chemicals were down 6,298 (4.6%) in February, their sixth straight decline. (It was a tough comparison month—February 2022 was the second-best month ever for chemical carloads.) Carloads of grain fell 9.7%, or 9,227 carloads, in February. U.S. intermodal volume fell 8.4% in February, its 12th straight decline.”

Railroad employment, Class I linehaul carriers, FEBRUARY 2023

(% change from FEBRUARY 2022)

TRAFFIC ORIGINATED CARLOADS

FOUR WEEKS ENDING FEBRUARY 25, 2023

(train and engine) 50,858 (+7.99%) Executives, Officials and Staff Assistants

8.114 (+6.65%) Professional and Administrative

10,086 (+2.58%)

Maintenance-of-Way and Structures 28,454 (+2.31%)

Maintenance of Equipment and Stores 17,851 (+3.87%)

Transportation (other than train & engine)

4 Railway

//

railwayage.com

Age

April 2023

Intermodal MAJOR U.S. RAILROADS BY COMMODITY FEB. ’23FEB. ’22% CHANGE Trailers 56,31376,929-26.8% Containers 887,666 953,401 -6.9% TOTAL UNITS 943,9791,030,330 -8.4% CANADIAN RAILROADS Trailers 0 0 Containers 236,622256,490 -7.7% TOTAL UNITS 236,622256,490 -7.7% COMBINED U.S./CANADA RR Trailers 56,31376,929-26.8% Containers 1,124,288 1,209,891 -7.1% TOTAL COMBINED UNITS 1,180,601 1,286,820 -8.3% FOUR WEEKS

Source: Rail Time Indicators, Association of American Railroads

ENDING FEBRUARY 25, 2023

Transportation

TOTAL EMPLOYEES: 120,210 % CHANGE FROM FEBRUARY 2022: +5.19%

4,847 (+2.19%) Source: Surface Transportation Board

MAJOR U.S. RAILROADS BY COMMODITY FEB. ’23FEB. ’22% CHANGE Grain 85,86095,087-9.7% Farm Products excl. Grain 3,4363,085 11.4% Grain Mill Products 38,62336,6355.4% Food Products 26,38525,2534.5% Chemicals 131,554137,852-4.6% Petroleum & Petroleum Products42,64836,81515.8% Coal 258,053274,701-6.1% Primary Forest Products 4,3474,681 -7.1% Lumber & Wood Products 12,25413,935-12.1% Pulp & Paper Products 20,91121,754-3.9% Metallic Ores 14,26015,287-6.7% Coke 12,470 13,364 -6.7% Primary Metal Products 36,31433,9576.9% Iron & Steel Scrap 16,93215,4939.3% Motor Vehicles & Parts 53,81149,4228.9% Crushed Stone, Sand & Gravel 76,03367,21213.1% Nonmetallic Minerals 11,62213,089-11.2% Stone, Clay & Glass Products 26,70527,851-4.1% Waste & Nonferrous Scrap 13,40114,341-6.6% All Other Carloads 20,12521,031-4.3% TOTAL U.S. CARLOADS 905,744 920,845 -1.6% CANADIAN RAILROADS TOTAL CANADIAN CARLOADS 316,809 287,40710.2% COMBINED U.S./CANADA RR 1,222,553 1,208,252 1.2%

TOTAL U.S./Canadian CARLOADS, FEBRUARY 2023 VS. FEBRUARY 2022

1,222,5531,208,252 FEBRUARY

Short Line And Regional Traffic Index

TOTAL U.S. Carloads and intermodal units, 2014-2023 (in millions, year-to-date through FEBRUARY 2023, SIX-WEEK MOVING AVERAGE)

April 2023 // Railway Age 5 railwayage.com

2023

2022 Copyright © 2023 All rights reserved.

FEBRUARY

CARLOADS BY COMMODITY ORIGINATED FEB. ’23 ORIGINATED FEB. ’22 % CHANGE Chemicals 55,122 45,03622.4% Coal 20,287 18,768 8.1% Crushed Stone, Sand & Gravel 24,174 17,97034.5% Food & Kindred Products 12,017 11,035 8.9% Grain 25,644 30,527-16.0% Grain Mill Products 8,436 7,13318.3% Lumber & Wood Products 8,491 9,088-6.6% Metallic Ores 3,162 2,743 15.3% Metals & Products 19,062 16,68514.2% Motor Vehicles & Equipment 9,069 7,81216.1% Nonmetallic Minerals 2,480 2,391 3.7% Petroleum Products 2,359 1,81130.3% Pulp, Paper & Allied Products 14,624 15,791-7.4% Stone, Clay & Glass Products 13,023 11,05617.8% Trailers / Containers 35,272 40,998-14.0% Waste & Scrap Materials 11,474 9,40122.1% All Other Carloads 64,655 61,986 4.3% AILWAY GE Visit http: //bi t.ly/rai l jobs To place a job posting, contact: Jerome Marullo 732-887-5562 jmarullo@sbpub.com ARE YOU A RAILROAD OR SUPPLIER SEARCHING FOR JOB CANDIDATES? RA_JobBoard_1/3Vertical.indd 1 7/27/21 3:02 PM

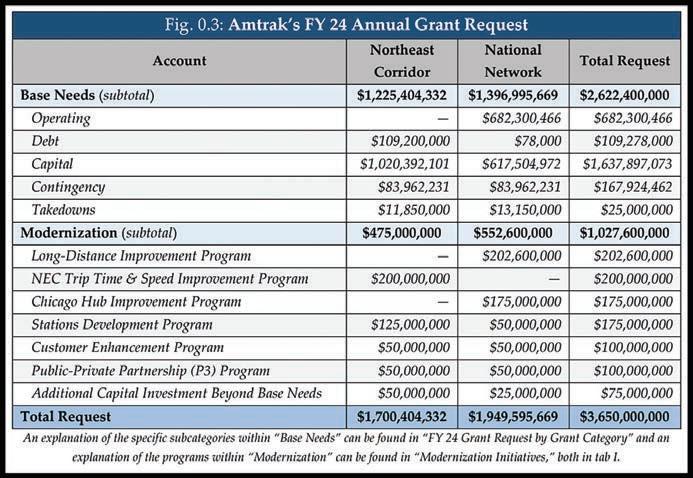

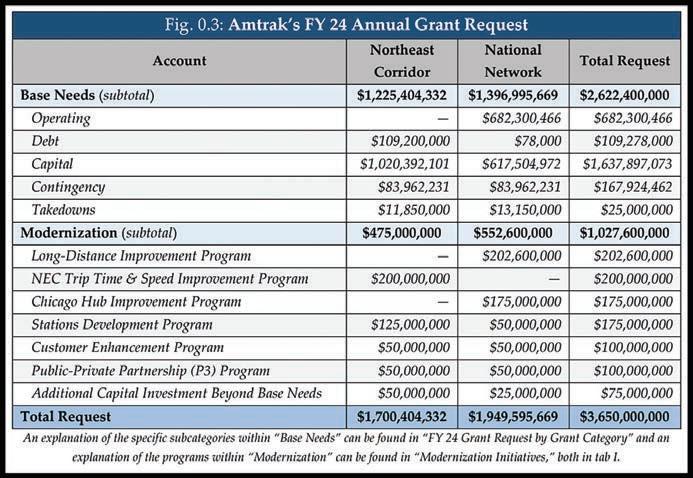

Amtrak FY24 Grant Request: $3.65 Billion

AMTRAK HAS ISSUED ITS FISCAL YEAR (FY) 2024 GENERAL AND LEGISLATIVE (G&L) ANNUAL REPORT FOR CONGRESS, IN WHICH IT SEEKS $3.65 BILLION IN TOTAL GRANT FUNDING, INCLUDING $1.70 BILLION FOR THE NORTHEAST CORRIDOR (NEC) AND $1.95 BILLION FOR THE NATIONAL NETWORK (NN). This is consistent with the FY24 annual appropriations authorized under the Infrastructure Investment and Jobs Act (IIJA).

“Thanks to the support of Congress and the enactment of the IIJA, Amtrak has now begun a new era of investment to improve our service and to expand our network to serve more people with more trains in markets where intercity passenger rail can make a difference,” Amtrak CEO Stephen Gardner said. “Through modern infrastructure, new fleets of trains, upgraded technology and a new generation of dedicated employees, Amtrak is committed to delivering reliable, high-quality, and modern services to the tens of millions of Americans who ride our trains and on behalf of the various federal and state partners that support in serving the traveling public.”

Gardner noted that Amtrak’s overall financial performance in FY22 “improved significantly, continuing our trend of recovery since the COVID-19 pandemic.” Total ridership came in at 22.9 million—71% of FY19 levels—and the railroad’s adjusted operating earnings “exceeded our estimates, led notably

by a nearly 50% growth in revenue compared to FY21 as our strategy of attracting new riders, aggressively managing sales and pricing, and broadening our customer base produced results,” he explained.

Despite this, ridership and operating revenues were “outmatched by the strong headwinds of rising costs, which meant substantial operating losses remained,” Gardner reported. “In particular, operating costs increased as we restarted services across our network while high-value NEC business travel was slow to recover, which had an outsized effect on our revenues. To support a historic increase in the number and size of capital projects now being advanced with IIJA funding, the company began a multi-year increase in investments associated with hiring and training, financial controls, and other company-wide needs, which is adversely impacting our adjusted operating earnings. This was on top of general inflationary pressures that adversely affected many aspects of Amtrak’s business in FY22: The company’s costs per available seat-mile rose by more than 15% from FY19 levels.”

Gardner added that Amtrak hired roughly 3,700 new employees in FY22 “to rebuild our ranks and restore service across our network, allowing us to return all of our Long-Distance trains back to pre-pandemic levels and restart nearly all of our suspended State-Supported short-distance corridor routes, while also introducing a record number of new or

expanded services, including in Vermont, Virginia and Massachusetts.”

Gardner pointed out that Congress provided the $1.70 billion and $1.95 billion authorization levels for the NEC and NN grants, respectively, in November 2021. Since then, he said, “Amtrak has been able to forecast ridership, revenue and our annual needs with a much greater degree of confidence, and while $3.65 billion remains an appropriate top-line funding total, the specific needs of the NEC and the NN have shifted as revenues and expenses have changed.”

To give Congress “the most transparent and helpful view of Amtrak’s needs and of where federal investment can be applied,” Gardner said, the railroad has broken down its FY24 grant request into “base needs” and “modernization.” Base needs represent “the minimum funding level needed to operate trains, maintain the railroad for the year, carry out core functions necessary to avoid long-term deterioration to assets and services, and make a limited number of high-priority, high-impact strategic investments for our future.” Modernization represents “various initiatives that will enable Amtrak to improve the railroad and our customers’ experience for the 21st century and ensure our long-term health.”

In the IIJA, Congress set authorized (recommended) annual funding levels— non-binding targets that inform, but do not control, the yearly appropriations process— for Amtrak’s NEC and NN grants in FYs 22-26. Separately, the IIJA also provides $22 billion in guaranteed additional funding (a supplemental appropriation) for the same five-year period to support specific, discrete capital needs on the NEC and NN. In FY24, this totals $4.4 billion, including $1.2 billion for the NEC and $3.2 billion for the NN. By law, this IIJA funding must be used for specified purposes, and cannot be used to operate trains or backfill other near-term needs typically covered by annual appropriations.

“In other words, IIJA dollars were always intended to supplement, not replace, regular annual grant funding—and if sufficient annual appropriations are not provided in FY24, Amtrak may be unable to sustain current service levels on the NEC and NN,” Amtrak noted. “Accordingly, consistent with Congress’ intent, Amtrak is seeking the total authorized level of FY24 annual grant funding—$3.65 billion—in addition to the guaranteed capital funds provided by the IIJA.”

6 Railway Age // April 2023 railwayage.com Industry Outlook

Amtrak

Greenbrier: $580MM in Orders

The Greenbrier Companies last month reported receiving orders for 4,500 new railcars during the fiscal second quarter ended Feb. 28, 2023, for which it provided preliminary results. At an aggregate value of $580 million, the orders for tank cars, autoracks, boxcars and covered hoppers “were consistent with Greenbrier’s expectations for the period,” according to the manufacturer. It noted that certain orders “are subject to customary documentation and completion of terms.” Greenbrier also reported that it expects revenue of approximately $1.1 billion, deliveries of 7,200 units, and GAAP EPS of $0.95 to $1.00 per share during its fiscal second quarter. “Our order activity and financial performance in the second quarter demonstrate Greenbrier’s market-leading position in freight railcar sales, leasing and services,” Greenbrier CEO and President Lorie L. Tekorius said.

WORLDWIDE

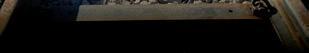

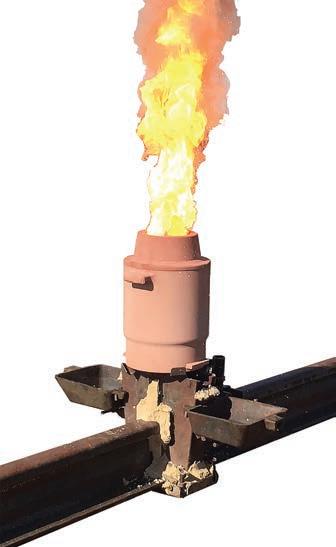

TRANSGABONAIS Operating Company (Setrag) has awarded a one-year contract to ENSCO to conduct track geometry measurement on the 402-mile railway linking the port of Owendo in Libreville and Franceville, Gabon, Africa. When the measuring system has been installed on a Setrag railway vehicle, ENSCO will train Setrag personnel to operate the system. The standard-gauge line carries around 9 million tons of freight and 330,000 passengers per year. Setrag launched a US$643 million project to rehabilitate the entire railway in 2016. Track upgrading started in 2017, and so far, 143 miles of track has been renewed. The railway suffered a major landslide between Offoué and Booué on Dec. 24 that halted train services. The line reopened to freight on Feb. 8 and passenger services were restored on March 30.

NORTH AMERICA

Enterprise Content Delivery Network (eCDN) provider NETSKRT SYSTEMS and BAI, soon to be rebranded as BOLDYN NETWORKS, will work together to enhance rail passengers’ onboard Wi-Fi experience, including offering them ondemand and live video streaming services. BAI will integrate Netskrt’s eCDN for Rail solution, which “deploys content delivery intelligence in the cloud and video caches on each train,” with their connected transport solution to give rail operators a “seamless, easy-to-deploy and manage connectivity solution.”

TRANSMETRIQ, a RAILINC brand that provides rail shipping optimization software, has added advanced fleet insight capabilities to its Asset Manager offering. The new Lease Management module, TransmetriQ says, “expands visibility from asset location, health and status into lease-related analysis and reporting, and provides railcar owners and lessees with a central location for storing detailed lease information, enabling users to generate insight from varied data sources, improving planning, and ensuring accurate billing.” The module provides “improved management capabilities for lessees and

lessors including tracking lease renewal dates and terms, reconciling billing to lease terms, managing asset deployment, identifying repair cost responsibility, and analyzing lease term compliance (e.g., mileage).” This new functionality, the company says, “allows users to analyze private lease data, in addition to the location and health data they are accustomed to seeing from Railinc and TransmetriQ, while providing a new, morecomprehensive picture of their fleet and operations. Shippers that lease or own their rail equipment need information that enables the safe and efficient use of their fleets. Asset Manager is designed to provide insights that help shippers gather and act on that vital fleet information, helping them improve cost control, car availability and complex data management.” According to TransmetriQ Product Manager-Asset Manager Gregg Phillips, “The new Lease Management module addresses a lack of visibility to lease information and siloed data, which can frustrate leasing managers. Lease Management enables tracking of key lease details and incorporates characteristics of individual users’ leases into the metrics they track for asset performance, improving fleet insights.”

8 Railway Age // April 2023 railwayage.com Industry Outlook William C.

Vantuono

market

Rail Equipment Finance 2023 Key Takeaways

In i ts 37th iteration, Tony Kruglinski’s Rail Equipment Finance Conference (REF) once again took place at the oasis in the desert: The LaQuinta Resort and Club in LaQuinta, Calif. Held in the shadow of the East Palestine derailment but before the calamity associated with the Silicon Valley Bank disaster, REF 2023 was in full force with more than 400 conference attendees. Following is a summary of what was discussed at this year’s REF, with key takeaways (KT).

Jose Maria Liberti, Clinical Professor of Finance, Northwestern University Kellogg School of Management, discussed the M&A market for rail. Transportation is an early M&A market mover before interest rates start to rise. As a result, industrial investors manage margin compression through tightening economic cycles, and buy back shares when M&A is unavailable. KT: From 2009 through 2021, Union Paci c returned 763% vs. 214% for the S&P TMI.

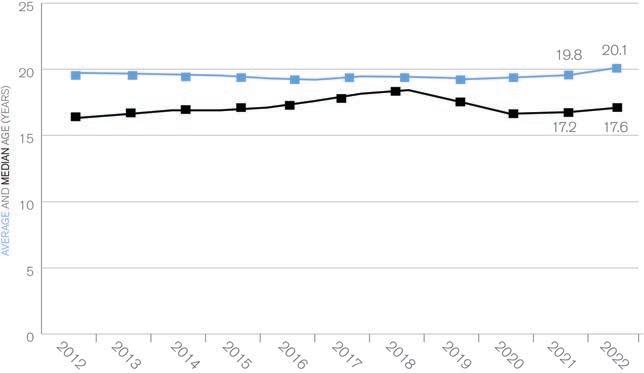

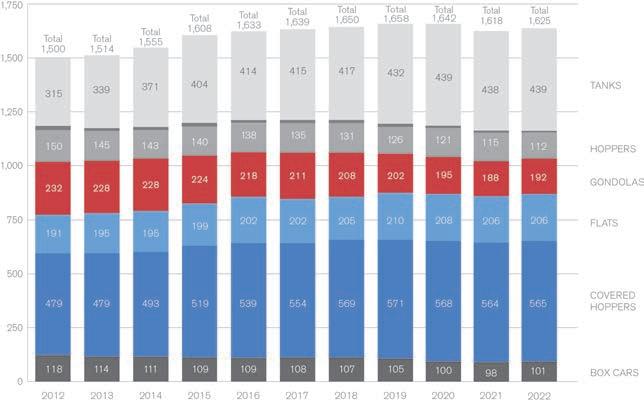

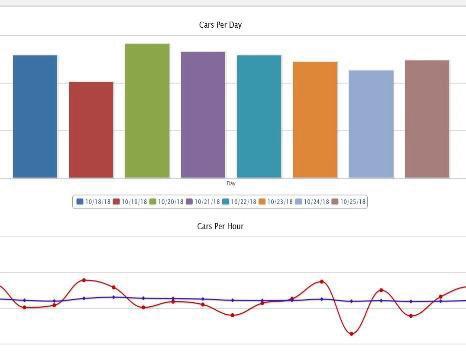

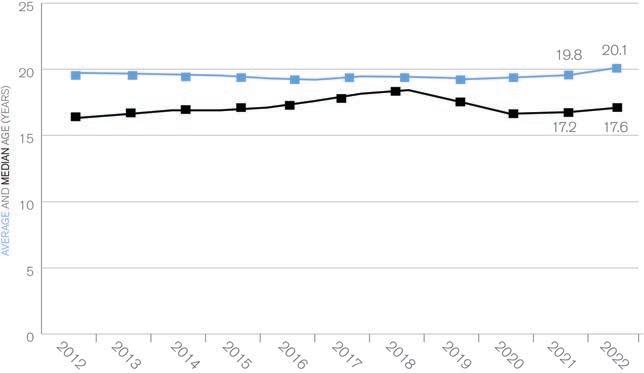

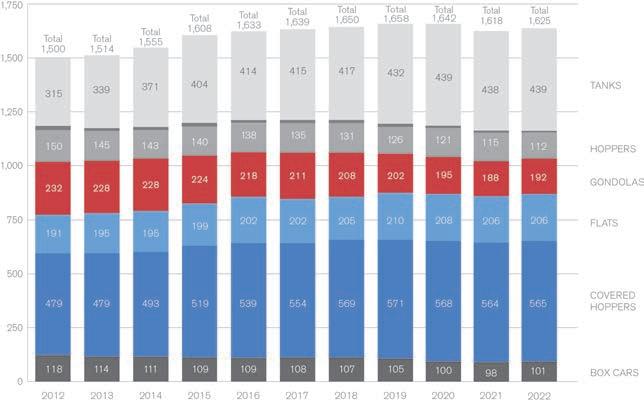

David Humphrey, from Railinc, covered changes in the national freight car eet. Year-over-year national eet increases were less than 1%. ed largest increases were mill and coil gondola railcars and boxcars. KT: e national eet average age is 20.1 years and steady; 20.1 years equals 40% of railcar interchange life (see p. 40).

Robert Pickel, from National Steel Car, noted a volatile delivery cycle with deliveries in a narrow range near the annual railcar attrition rate. KT: Expect 42-45,000 cars built in 2023, impacted by component supply and labor challenges.

Eric Starks, from FTR Transportation Intelligence, noted a discordant U.S. economy with increasing GDP, low credit card delinquencies, high cash reserves, 6.3% CPI year-over-year, and an in ationary service economy. KT: While new railcar orders are holding steady, expect lower railcar utilization resulting from lower freight demand.

Graham Brisben, from PLG Consulting, noted decreases in crude and re ned fuel loadings while chemical loadings are a bright spot. Downstream products (chemicals, ethanol and NGLs) cannot replace loadings lost from coal declines. KT: Rail needs to move minerals for battery production to

support EV growth. e In ation Reduction Act (IRA) will shi U.S. energy consumption in the next eight years.

Edward Murphy, from Standard & Poor’s, noted a potential recession and showed decreasing railroad ORs while service has declined. KT: Post-recession, S&P is watching increasing truck driver shortages, supply chain emissions reductions and post-pandemic nearshoring.

Stefan Loeb, from Watco (now with NS), discussed how short lines increase North American carload business. Worsening North American systemwide service, limited 2022 short line carloads, with many loads lost to trucks. KT: PE investment in short line railroads indicates growth and opportunity and will drive pro ts.

Daniel Anderson, from TrinityRail, noted a 20% age gap between the tank railcar eet and the national eet resulting from acceleration of younger tank railcar attrition, a changing commodity mix and de-emphasization of crude oil from 2019. KT: e IRA and EVs can decrease railbased fuel loads. Renewable fuel investments may o set this.

Adriene Bailey, from Oliver Wyman, discussed North American rail’s need to increase market share through service improvements (think better than 2018 and 2019). Executives and regulators need a better vision to generate successful long-term growth. Rail needs to convince its investors that growth is the only future. KT: Public/private partnerships are necessary for the required pivot moving rail to the next business cycle.

Ron Sucik, from RSE Consulting, discussed the historic shi of 50% of 4Q22 container imports (boxes) from the West to East Coasts. is helped end the West Coast container ship jam. Nearshoring could reduce Asia-originated shipments 20% by 2025. 2023 intermodal growth looks tepid, with the highest unused vessel capacity since a er the pandemic’s start. KT: e projected 2H2023 rebound has headwinds; Gulf and Eastern container moves negatively impact intermodal loads.

Je Blake, from e David J Joseph Company, discussed steel market trends leading to more domestically sourced steel to reduce China’s steel market dominance.

20 million nominal tons of projected capacity from new electric arc furnaces is commencing in 2023, increasing U.S. demand for scrap steel. KT: China may become a net exporter of scrap by 2025.

John Ward, from the National Coal Transportation Association, noted that longer cycle times (from delays or crew unavailability) negatively impacted 2022 coal volumes, that Wyoming coal mining companies lost $100 million revenue, and negative consequences from railroad coal car caps all resulted from rail service-related problems. Coal-generated power replacement continues to be challenged as supply chain disruptions impact renewable buildouts. KT: 62,000 MW of coal- red generation are due for retirement from 2023-2028.

Ross Corthell, from Packaging Corporation of America, David Horwitz, from GATX Corporation, and Adam Simeon, from Union Paci c, talked boxcars. e UP boxcar eet increased 18% from 2020 and is 7% newer than the eet; 35% of the boxcar eet reaches regulatory obsolescence between 2022 and 2030. Larger-capacity cars could mean that the replacement cycle requires fewer new cars. e boxcar manufacturing backlog is into 2024, with 11,925 projected deliveries from 2023 to 2027. Boxcar replacement investor economics remain challenging. Growthoriented shippers may struggle aligning car capacity to product and legacy facility loading requirements. Boxcar pricing has doubled since the early 2000s. KT: In 2022, the national boxcar eet grew by more than 1,000 cars for the rst time in 15 years. Boxcar eet tonnage capacity is higher than in 2016 (most recent peak capacity). However, from 2008 to 2027 (projected), the total eet will be reduced by 39%.

Edward Biggs, from Biggs Appraisal, Sean Hankinson, from AITX Rail, Pat Mazzanti, from Railroad Appraisal Associates, and Greg Schmid, from Residco, led the railcar valuation panel. Estimated FMVs have increased or stayed level from 2022 values except for coal cars (surprising considering recent strength in that market) and 30,000gallon non-coiled, non-insulated “ethanol” tank railcars (more limited use a er May 1, 2023). KT: In a strong lease market for

April 2023 // Railway Age 9 railwayage.com Financial Edge

Financial Edge

railcars, survey participants rated industry health seven out of ten.

Paul Titterton, from GATX Corporation, discussed GATX’s long, successful history in railcar leasing. GATX has maintained a core focus on safety, employee longevity, nancial stability and consistent business plans. Keeping the customer at the center of business is a core corporate value. KT: With 125 years of experience, even as business fundamentals stay consistent, GATX knows that railcar leasing’s subtleties and nuances are always changing.

Anthony Hatch, from ABH Consulting, began REF’s day two discussing potential impacts of the East Palestine derailment. He discussed the need for improved service and growth to placate hungry investors, highlighting current labor market challenges and impacts. Short line railroad sales are expected to continue in 2023. KT:

e U.S. DOT estimates U.S. freight movements will increase 30% by 2040, from 19.3 billion tons to 25.1 billion tons.

Perennial REF favorite Sergio Rebelo, MUFG Bank Distinguished Professor of International Finance, Northwestern University Kellogg School of Management, gave a U.S. economy update. Declining birth rates and an aging workforce continue to stress the U.S. labor pool. On the supply side, prices on electronic components (e.g., semiconductors) remain o -trend high even a er reduced freight costs. Rebelo discussed in ation and the Federal Reserve’s potential to overshoot (under-deliver) its in ation targets while striking a balance for the economy. KT: World trade as a percentage of GDP is projected to decrease. Rare earth mine production (commodities necessary for batteries) favors China and Asia vs. the U.S. and Europe.

Ross Corthell, from Packing Corporation of America, Roger Jimenez, from Tokai Carbon, and Eric Monger, from KBX Rail, discussed the shipper point of view on rail freight and railcars. All parties felt that the time for excuses related to why service continues to be so poor has passed and needs to be replaced by action from the railroads to improve service. Technology is something that is on the shippers’ minds, both as it relates to railroad service and to providing assistance in handling a dicult hiring environment. KT: Panelists felt that e ectively addressing car supply issues could not be e ectively addressed until rail service normalizes.

Patrick Kurtz, from AITX Rail, discussed the covered hopper railcar market. In the grain market, the eet has an 8% capacity slack, with most large-capacity cars in full utilization. ere is greater slack in plastic pellet hoppers. Small-cube hoppers are experiencing a “dead cat bounce.” KT: A 26% reduction in 4,000- to 5,000-cubic-foot covered hoppers o set by jumbo car growth means more cubic capacity from smaller car count increases.

David Humphrey, of Railinc, led Wednesday’s “Power-Power-Power” sessions covering the locomotive eet. e locomotive eet average and median age increased, due to decreased new builds. KT: e percentage of new and rebuilt units per year added/ adjusted in Umler has remained fairly constant over six years.

Mike Cory, from CFG Consulting Inc., and Don Graab, from Triangle Brothers and Associates, discussed locomotive use in North America. e lack of growth in loadings is partly responsible for the weak new-locomotive demand cycle, perpetuating the rebuild cycle. Questions were raised about timing for implementing scalable hydrogen as an alternative fuel. KT: In discussing the alternative fuel transition, the railroads will need a cohesive strategy not based primarily around biodiesel.

Glen Rees, from Cummins Inc., discussed the push to zero emissions from the perspective of an engine manufacturer. Cummins is leading the move to zero emissions with investment in the broadest spectrum of alternative fuel options: battery, fuel cell, and its fuel-agnostic engine. KT: “Intermediate action can be taken to reduce emissions in the short term, which a ords time for technology … to meet the goal of carbon-free by 2050.”

Robert Bremmer, from Wabtec, discussed the market for new locomotive products with emphasis on the current FLXdrive locomotive and a future with hydrogen powered locomotives. Bremmer emphasized the rebuild market and its technical improvements. Wabtec has a roadmap for the future of locomotive technology leading into 2030 and beyond and sees opportunity for real and signi cant CO2 reductions. KT: Right now, several solutions exist to lead North American rail to an attractive and environmentally sound alternative-fuel future.

Stuart Biggs, from Biggs Appraisal, discussed the changes in the locomotive

eet consistency that show a signi cant decrease in SD60 and SD70 locomotives in operation year-over-year. KT: ere were approximately 450 rebuilds performed in 2022 by Wabtec and Progress Rail/EMD.

Pedro Santos, from CNGmotive Inc., provided an update on alternative locomotive fuel strategies. Generally, there are limited options for North American rail to achieve carbon-neutral and carbon-free locomotive fueling: hydrogen, renewable natural gas and eMethane. Santos discussed the challenges of using liqui ed vs. compressed hydrogen. KT: Liquid hydrogen is 20 degrees F above absolute zero (–460 degrees F). If there was a liqui ed hydrogen spill, the commodity discharge would actually liquify the air!

Jason Kuehn, from Oliver Wyman, focused on North American rail’s challenges in contemplating the alternative fuel switch. With SAF and renewable diesel competing for the same feedstock and an estimated gap of 1.7 billion gallons of more demand than there is of potential supply through 2030, the 2025 goal of net-zero emissions seems distant. Harnessing the regenerative braking power of locomotives could provide a much-needed improvement to the emissions puzzle. KT: e largest new-locomotive builder in North America is Siemens Mobility, albeit all its units are for passenger service.

Pat Mazzanti, from Railroad Appraisal Associates, Rick Ortyl, from Metro East, and Greg Schmid, from Residco, discussed locomotive valuation. Generally, the locomotive market is so er than in 2022. e demand cycle, concerns about the alternative-fuel transition and the worry that certain models lack longevity weighs on the marketplace. KT: On some newer units, secondary market sales are adding valuation clarity.

Great speakers! Great content! anks to all the speakers and attendees.

Got questions? Set them free at dnahass@ rail n.com.

10 Railway Age // April 2023 railwayage.com

DAVID NAHASS President Railroad Financial Corp.

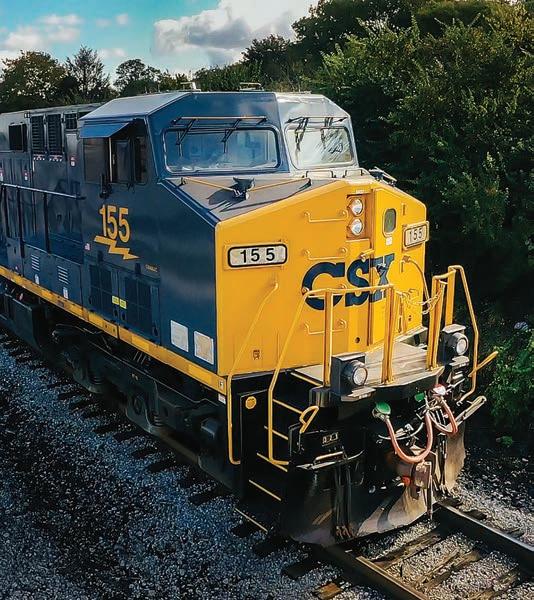

CPKC, A HISTORIC COMBINATION

It’s ‘Clear Track Ahead’ from the STB. Now, the hard work begins.

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

March 15, 2023, will be reported in the history books as a momentous day for the North American rail industry. On that Wednesday, as widely expected, the Surface Transportation Board, in a 4-1 vote, approved, with certain conditions, Canadian Paci c’s acquisition of Kansas City Southern to form Canadian Paci c Kansas City (CPKC), North America’s rst transnational railroad. STB Member Robert Primus was the only dissenter in a decision that authorized CP to exercise control of KCS, which will o cially occur April 14, 2023. e CPKC executive leadership team, led by President and CEO Keith Creel, is in place, tasked with the hard work of integrating two unique yet highly compatible companies.

Headquartered in Calgary, Alberta, Canada, CPKC will remain the smallest of six U.S. Class I railroads by revenue, and have a much larger and more competitive network, operating approximately 20,000 miles of rail and employing close to 20,000 people. Full integration of CP and KCS is expected to happen over the next three years, “unlocking the bene ts of the combination.”

CP President and CEO Keith Creel, Railway Age’s 2021 Railroader of the Year and, with KCS President and CEO Pat Ottensmeyer, 2022 Co-Railroader of the Year, extended

“sincere gratitude to the STB and sta for their hard work as part of the comprehensive review of the combination.”

“ is decision clearly recognizes the many bene ts of this historic combination,” Creel said. “As the STB found, it will stimulate new competition, create jobs, lead to new investment in our rail network, and drive economic growth. ese bene ts are unparalleled for our employees, rail customers, communities and the North American economy at a time when the supply chains of these three great nations have never needed it more. CPKC will connect North America through a unique rail network able to enhance competition, provide improved reliable service, take trucks o public roads, and improve safety by expanding CP’s industry-leading safety practices.”

“ is important milestone is the catalyst for realizing the bene ts of a North American railroad for all of our stakeholders,” said Ottensmeyer. “ e KCS Board of Directors and management team are very proud of the many contributions and achievements of the people who have made KCS what it is today, and we are excited for the boundless possibilities as we move forward into the next chapter as CPKC.”

Keith Creel will become President and CEO of CPKC. Subject to formal appointment by the new company’s Board of Directors, CPKC’s 11-member executive leadership

team, all reporting to Creel, are:

• Nadeem Velani, Executive Vice President and Chief Financial O cer.

• John Brooks, Executive Vice President and Chief Marketing O cer.

• Mark Redd, Executive Vice President and Chief Operating O cer.

• John Orr, Executive Vice President and Chief Transformation O cer.

• James Clements, Executive Vice President Strategic Planning & Technology.

• Je Ellis, Executive Vice President Chief Legal O cer and Corporate Secretary.

• Warren Erdman, Executive Advisor Strategic Projects.

• Laird Pitz, Senior Vice President and Chief Risk O cer.

• Mike Foran, Senior Vice President Network & Capacity Management.

• Chad Rolstad, Vice President of Human Resources and Chief Culture O cer.

• Oscar Augusto Del Cueto Cuevas, KCSM President, General Manager and Executive Representative.

Pat Ottensmeyer will continue as an advisor to Creel throughout 2023 “to ensure continuity on key initiatives predominantly involving the combined company and Mexico.”

STB DECISION HIGHLIGHTS

“ e Board expects that this new single-line service will foster the growth of rail tra c,

April 2023 // Railway Age 11 railwayage.com

Stephen C. Host

shi ing approximately 64,000 truckloads annually from North America’s roads to rail, and will support investment in infrastructure, service, quality and safety. e transaction is also expected to drive employment growth across the CPKC system, adding more than 800 new union-represented operating positions in the United States,” STB said in its 212-page decision. “Of additional importance, the merger will foster new Amtrak passenger rail opportunities, as applicants have committed to support Amtrak’s existing plans for expanded service on the new railroad’s lines.

ese commitments, along with CP’s strong record as an Amtrak host railroad, have won Amtrak’s endorsement of the merger.

“ is transaction is ‘end-to-end,’ meaning that there are little to no track redundancies or overlapping routes. It will reduce travel time for tra c moving over the single-line service, which should result in increased incentives for investment, and it will eliminate the need for the two now-separate CP and KCS systems to interchange tra c. is will enhance eciency, which in turn will enable the new CPKC system to better compete for tra c with the other larger Class I carriers. It is not surprising that there is substantial (though not unanimous) shipper support for this transaction—the Board has received more than 450

support letters. It is also not surprising that the other Class I railroads seek conditions, and other remedies that appear aimed at protecting their own tra c from competition with CPKC and at limiting the ability of the combined CPKC to meet its potential. Consistent with the Board’s policy to protect competition and not competitors, the Board is denying those requests while also ensuring that existing competitive gateway options are preserved.

“Even end-to-end mergers, however, can pose competitive risks, and indeed this decision overturns prior agency precedent that did not su ciently recognize such concerns. To address any potential anti-competitive harm, the Board is imposing numerous conditions designed to protect competition. And with these conditions, the merger should not reduce any shipper’s competitive options. e Board establishes a detailed obligation to keep gateways—that is, connection points between the CPKC system and other railroads—open on commercially reasonable terms, thereby preserving e cient routing options via other railroads that were available to shippers before the merger.

“To help enforce that obligation, the Board will require CPKC to justify in writing, upon customer request, rate increases over a certain level on interline movements, subject to the

gateway obligation. If disputes arise over whether CPKC’s actions are commercially reasonable, CPKC must a ord rail customers an arbitration option to resolve disputes, but the Board also will remain available to expeditiously decide gateway-related disputes. In this way, this decision seeks to enable a more e cient and competitive CPKC system, while minimizing CPKC’s ability to wield new market power to the detriment of its shippers.

“In addition, the Board has engaged in an extensive and thorough environmental review ... e Board recognizes that, although most localities would prefer less rather than more train tra c, any tra c that CPKC diverts from trucks and from other railroads will produce more trains traversing areas that are currently served by either CP or KCS. is transaction, however, should ultimately enhance safety and bene t the environment.”

“ e Board concludes that this merger will not increase safety risks in any meaningful way beyond whatever level of risk exists from the current daily train movements through the communities served by CP and KCS. Indeed, approval of this transaction may even enhance safety for the nation as a whole.

“ e Board is establishing an unprecedented seven-year oversight period along with extensive data-reporting requirements. is will enable the Board to closely monitor whether Applicants are in fact preserving ecient interline options for shippers at a ected gateways, thus protecting competition ... e Board recognizes that some in the shipping community and among antitrust commentators are not satis ed with the consolidation among Class I railroads that occurred following the Staggers Rail Act of 1980, and the Board itself has done its best to address how the Class I railroads behave today.

“Indeed, there is an ongoing debate about whether there has already been too much consolidation in the rail industry. Regardless of which side one takes in that debate, the Board is charged by Congress with reviewing the proposed merger in light of the state of the industry as it actually exists. Given the current realities and the limited opportunities to provide meaningful competition for the largest Class I railroads ... the Board concludes that this transaction should improve rather than degrade the performance of the industry. It is for these reasons that the Board approves the merger.”

12 Railway Age // April 2023 railwayage.com cover story

CPKC Transnational Network Canadian Pacific

CEO PERSPECTIVES

North America’s rail industry is sharply focused on the future as the 21st century is well into its third decade. For this special report, the industry’s thought leaders, the chief executives of leading North American companies, have crafted exclusive, insightful essays for Railway Age on growing and sustaining our vibrant industry, which has helped shape our society and is the backbone of transportation. Each has provided an answer to the single-most critical question: What is the biggest challenge facing the North American rail industry?

14 Katie Farmer, BNSF

16 Tracy Robinson, CN

18 Joe Hinrichs, CSX

20 Jack Hellmann, Genesee & Wyoming

22 Alan Shaw, Norfolk Southern

24 Lance Fritz, Union Pacific

26 Patty Long, Railway Supply Institute

28 Dan Smith, Watco

30 Keith Creel, Canadian Pacific

34 Ian Jefferies, Association of American Railroads

35 John Newman, Progress Rail

36 Marc Buncher, Siemens Mobility

38 Peter Gilbertson, Anacostia Rail Holdings

railwayage.com

Bruce Kelly

Rail Must Evolve to Remain Relevant

By Katie Farmer, President and CEO, BNSF Railway

hat all of us know with certainty is the important and essential role that railroads serve in supporting the economy and the American way of life. at was never more apparent than during the pandemic.

What o en isn’t seen with such clarity is that change is and has been a constant in our industry over time. And that change has never been more evident than over the past few years. We have been confronted with tremendous change of a magnitude and frequency that none of us has experienced before.

e past three years exposed strains in the supply chain that we hadn’t experienced before—we saw points of vulnerability that had never been tested before. We are at a natural in ection point where we know that if we are going to remain competitive and remain relevant, we must evolve.

e good news is that we are in an industry that has been evolving since its inception almost 200 years ago. We know how to do this.

It starts with people. e most important

Wasset of any railroad and the reason that any of us are successful is our people.

Any conversation on evolving with our people must start with safety. It is the bedrock of what we do. We remain committed to achieving our safety vision of a workplace free of accidents and injuries. And we know that vision is achievable with our people and continued innovation and improvement in technology.

What we also know a er the past three years is that the future of work has changed.

e workplace has fundamentally shi ed and will continue to change.

If we are going to continue to attract the best and brightest to our industry, we need to nd the solutions that meet the needs of our employees while providing consistent and reliable 24/7, 365 day a year service for our customers.

To remain relevant—we must be open to change—and equally committed to nding the answers.

At the end of the day, we want our company and our industry to not only be a great place to work but a great place to have a long career and deliver on our promise to

our customers.

at promise to our customers also needs to evolve for our industry to remain competitive. To remain relevant.

We recognize at BNSF that to continue our long history of growth with and for our customers—we must continue to improve the experience for our customers by o ering a better service product, more transparency, and increasing the ease of doing business. And we must work to adapt our product to the demands of the new supply chain.

We are fortunate to be in an industry with a long history of evolving our product and the value proposition it provides our customer.

There are many examples of this in BNSF’s history, such as our grain shuttle network, which changed the way producers move their grain to export markets. Crude by rail, which made what was essentially trapped oil economically viable thanks to rail’s flexibility and short ramp-up time. Perhaps the best example is the incredible growth of our intermodal network.

ere are countless examples across the industry of that same theme. Seeing an unmet customer need and evolving the service product to seize the opportunity and grow the business.

We know where the industry needs to evolve and adapt as our employees, our customers, and the supply chain itself evolves. However, at BNSF, there is one thing we will never change. Our bias for growth.

It is incredibly important during times of rapid change and disruption, for our customers as well as our employees, to see consistency in how we approach our business—who we are and who we will always be at BNSF.

What will never change is that BNSF is committed to having the capacity, the equipment and the people that allow us to say “yes” to new business opportunities.

I have never been more optimistic about BNSF or the industry. I know our best days are in front of us. e sustainability and the economy of rail are the perfect answer for the direction in which the supply chain is evolving. And I have no doubt we’ll be as essential and relevant in the future as we are today and have been for well over a century.

14 Railway Age // April 2023 railwayage.com

PERSPECTIVES

CEO

BNSF

We’re committed to safe, efficient and sustainable service for the freight-rail journey ahead. gwrr.com

CEO PERSPECTIVES

The Industry Must Collaborate as a Single Supply Chain

By Tracy Robinson, President and CEO, CN

Rail built our continent. It has been at the heart of settling far-off regions and moving goods since the time of the steam engine. It has always been and will always be a critical component of our continent’s economic infrastructure. We have evolved greatly since the days of the steam engine and our operations have followed suit. Today, we are complex and interwoven in elaborate relationships and competing globally

However, our modern industry faces significant challenges that threaten our

global competitiveness. Chief among these challenges is our ability to collaborate as a single supply chain. As the resiliency of our supply chain continues to be tested, the absence of collaboration may hamper North America’s ability to keep competing globally in the years to come. We believe that this challenge also creates an opportunity where all actors of the supply chain can win together.

We also believe that this can be an area for governments to use their position as arbitrators and regulators for positive influence. By leveraging their role, governments can encourage

collaboration by bringing the right actors to the table. They can also help coordinate investments in the North American supply chain to ensure its long-term competitiveness by identifying systemic bottlenecks and targeting them for necessary upgrades. This collaboration amongst supply chain actors will encourage further coordination amongst partners, break down silos and improve fluidity, ensuring that goods and people can move quickly and efficiently.

The entire supply chain and customers would benefit from this cooperative approach. Sharing data and increased transparency would allow different parts of the supply chain to anticipate and correct any issues that may arise as we would reduce or eliminate unnecessary delays and create an environment where everyone wins.

As an industry, we have demonstrated that you can have some of the most efficient railways in the world, providing top-notch service while leading the way in innovation. We have even been able to reduce our emissions and improve our fuel consumption, and deploy new and innovative technology while moving goods faster than ever before. Canada in particular has also achieved these feats while offering some of the best freight rates in the world.

While the challenge of global competitiveness is not new, the ever more complex evolution and shifting of trade patterns will require a new approach. Promoting and enabling collaboration amongst supply chain partners can provide a clear path forward for the rail industry to continue investing and serving as a critical component of our continent’s economic infrastructure.

We want to work with our partners to enable the next level of growth. Policymakers must recognize the strategic importance of the rail industry as a means for our continent to compete globally and take action to ensure its long-term success for the North American economy and the millions of people who rely on it every day. At CN, our commitment will continue to be pushing for collaboration while once again striving to provide the best rail service and leading the way in innovation and sustainability.

16 Railway Age // April 2023 railwayage.com

CN

MOVING THE WORLD TAKES A COMMITMENT JUST AS BIG.

And it all starts close to home.

At Norfolk Southern, we are commi ed to supporting the cities and towns that our tracks connect. We are commi ed to building a more sustainable future. And we are commi ed to delivering the essential freight that keeps the world moving. From our remediation e orts in East Palestine to the investments we make in all of our communities, we are dedicated to building a brighter tomorrow for all.

NorfolkSouthern.com

© 2023 Norfolk Southern Corp.

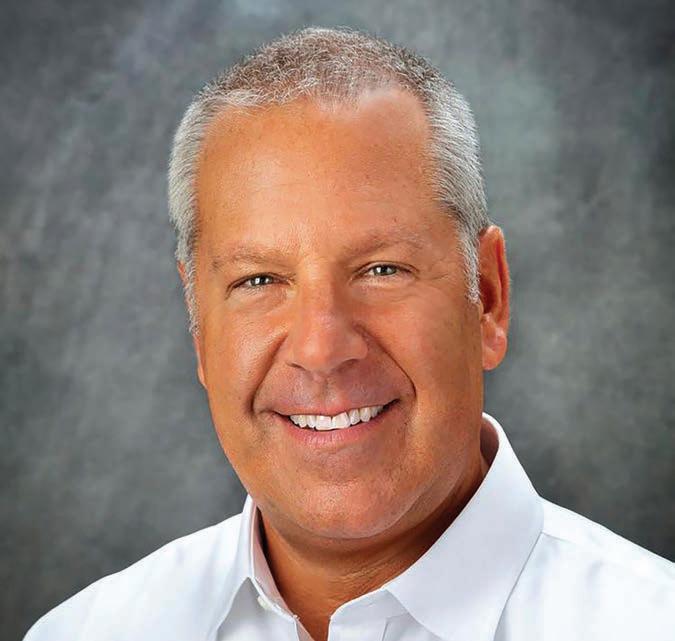

CEO PERSPECTIVES

Investing in People to Deliver Growth

By Joe Hinrichs, President and CEO, CSX

Last year, Railway Age asked CEOs for their thoughts on how we can grow the rail industry’s top line. I did not arrive at CSX until later in the year, but when I looked back at the responses, I found myself in total agreement with the theme that ran throughout every one of them: We grow by leveraging improved service and our environmental advantages to win market share from trucks.

This year, as I think about the biggest challenge facing our industry, it comes down to a single word—delivering. Speaking for CSX, we know that we need to grow the business, but the question is how we are going to deliver that growth. I believe we have some great answers that are already being put into practice and are starting to provide results.

Growth is driven by service. The principles of scheduled railroading produced

dramatic improvements at CSX before the pandemic upended the global economy in 2020. Supply chain congestion and labor shortages overshadowed much of the progress we had made, but the foundation remained intact, and over the past six months we have succeeded in replenishing our train-and-engine workforce and restoring network fluidity.

So far in 2023, our operating performance metrics have largely returned to pre-pandemic levels, and we are providing some of the best service in our railroad’s history.

To me, what is most exciting about our service performance is how we are accomplishing it. The most significant, sustainable impact we are having on service is coming from our efforts to build trust with our employees and improve their work experience. We are engaged in transforming our culture to create a self-reinforcing cycle that occurs when employees

see how providing great service directly benefits their work experience.

For example, last year at this time, on any given day CSX had an average of more than 200 T&E employees stuck at a location for more than 30 hours. ey couldn’t be home with their families, and they couldn’t maximize their productivity and earnings. is year, that number is down to just 50—and we will keep working to reduce that further. Much of the improvement is the result of the success of our T&E hiring e orts throughout 2022, and much of it is also due to a more uid network. But the “X” factor that elevated the improvement from good to great was the e ort from our leaders to get out in the eld and listen to our front-line employees and work to solve the problems they raised. We made sure everyone in our company knew who provides the service we get paid for—our front-line employees. I believe that if you want to build trust, you must invest your time in building relationships. It starts with our employees.

After last year’s difficult and contentious rail labor negotiations, we recognized that our railroad could never achieve its full potential if the distrust between our front-line workers and the company continued. We could not deliver transformational growth if we continued to be a house divided against itself. So we took what we learned from our visits to the field and what we heard from unions during the bargaining round to meet with labor and take a fresh approach to addressing issues.

The result has been a series of agreements with our labor unions on providing paid sick leave, adjusting our attendance policies, as well as other process and policy changes, both large and small, that have demonstrated how we are committed for the long haul to improving the work experience of our employees. Improving their work experience does have a small cost component, but we believe it is an excellent investment, because it rewards the people who are ultimately responsible for delivering our service product to our customers. And when the employees who create value for our customers feel valued, included, respected and more engaged in our railroad’s mission, our service improves—and the self-reinforcing cycle

18 Railway Age // April 2023 railwayage.com

Two

photos: CSX

is set in motion. Our industry faces other challenges, and economic uncertainty will continue to impact volumes. But these are business challenges that we are confident can be

handled effectively as we work together as ONE CSX team. The game changer, we believe, is a cultural transformation in our ONE CSX workforce that engages our employees and enables us to deliver on

our growth potential by providing better service to our customers. This improved service gives us the permission to talk about growth with our customers. And so the cycle continues …

April 2023 // Railway Age 19 railwayage.com

CEO PERSPECTIVES

Any Mode, Any Material, Any Market Transportation Material Handling and Storage Logistics watco.com Partner with us — and discover your competitive edge

CEO PERSPECTIVES

Regaining Momentum, Re-establishing Credibility

By Jack Hellmann, CEO, Genesee & Wyoming

The b iggest challenge facing the North American rail industry in 2023 is to regain our momentum and re-establish our credibility after a period of turmoil that has included inconsistent rail service, workforce uncertainty, new public concerns around the safety of rail transportation, and persistent regulatory scrutiny. Rising to meet these challenges, we will need to not only embrace pragmatic operational enhancements but also target new technologies that make us even safer, even more environmentally friendly, and even more committed to providing our

customers with the transparency and ease of rail experience that they deserve.

The magnitude of opportunity for rail freight is immense, and I can’t recall a more compelling outlook for the North American industrial economy. Whether it is due to increasing customer focus on low-carbon transportation, de facto U.S. industrial policy that is supporting infrastructure investment, massive new semiconductor facilities, accelerated development of the electric vehicle industry, or customers focused on shorter, simpler supply chains with increased local investment, we have profound reasons for optimism.

But to achieve this promising future amidst a revitalized North American economy, the challenges of this moment must be addressed with unwavering commitment: commitment to safety, which is a prerequisite for attracting great people and guaranteeing our social franchise in the communities in which we operate; commitment to our people, showing the next generation of railroaders that we are the employer of choice; commitment to our customers to provide reliable and transparent service worthy of the digital age; and commitment to innovation, embracing technologies that make us safer, smarter and more efficient.

Thankfully, we have some critical attributes on our side. Rail is the safest and most environmentally friendly form of surface transportation. Moreover, the low-friction physics of the steel wheel on steel rail already generates an economic efficiency that is superior to even the grandest visions of autonomous longhaul road transport. And with innovations in the fuel used in our locomotives (e.g., G&W’s Freightliner in the U.K. now runs a train for a major ocean carrier that is powered by green biofuels) as well as advances in locomotive technology (whether battery, hydrogen or both), the inherent advantages of rail should only strengthen in a carbon-reduced world.

At G&W, we also believe that rail can successfully compete against shorthaul trucking, filling our short lines with new traffic, adding rail jobs, and increasing road safety, which is why we are a strategic investor in a start-up company called Parallel Systems that would introduce autonomous, batterypowered bogies to handle container movements from ports.

Finally, we’ve all seen the importance of supply chain visibility over the past three years, and that is why we are partners in the RailPulse coalition, which aims to provide customers accurate realtime updates on the location, health and status of their railcars across the North American freight rail network.

The future for rail is bright, and as we address the challenges of 2023, we will prove that adversity only makes us stronger for the journey ahead.

20 Railway Age // April 2023 railwayage.com

Genesee & Wyoming

ADVANTAGE YOUR

We have the solutions you need regardless of what you're moving. With more capacity, industry-leading performance and shorter routes, we are always innovating. CP’s exceptional freight solutions are built to help you move your business forward.

cpr.ca

CEO PERSPECTIVES

Safety First, Safety Always

By Alan Shaw, President and CEO, Norfolk Southern

After the train derailment in East Palestine, Ohio, Norfolk Southern promised to make it right. For the people in that close-knit village and nearby towns, that means cleaning the site safely and thoroughly; testing the air, water and soil; helping families whose lives were disrupted; and investing in the community for the long-term.

Part of making it right also means enhancing safety as a company and as an industry. Norfolk Southern may own the track in East Palestine, but the responsibility of making the rail industry safer is something we must all own.

I’ll be the first to praise rail as the safest, most effective way to move freight, a view I share with NTSB Chair Jennifer Homendy, who recently said: “Despite recent accidents, I want to be clear that rail remains one of the safest means of transportation. For transport of some classes and quantities of hazardous materials, there is no safer alternative.” She’s right, of course, but ‘no safer alternative’ doesn’t mean we’re satisfied. We need to work together to build on our industry’s strong safety record. An industry-wide comprehensive approach is essential, including railcar owners, car manufacturers, leasing companies, equipment manufacturers and the

railroad companies. We can make rail even safer, but it’s going to take all of us, making changes inside our organizations and cooperating to enact meaningful, fact-based change for the industry.

For our own part, we’ve taken several steps in the right direction. In addition to joining the Federal Railroad Administration’s Confidential Close Call Reporting System (C3RS), which builds upon our own long-standing Close Call Experience Program, we’ve implemented a plan enhancing the safety of our operations. That plan involves strengthening our early-warning systems and our technology to identify issues before they become problems.

Beyond working together as an industry, we also need to work with lawmakers proposing rail safety legislation. We support legislative e orts that will improve outcomes for our industry, our customers and the communities we serve.

We also believe there’s a significant opportunity to better support first responders. Norfolk Southern recently expanded its existing training programs with the creation of a new regional training center to serve first responders in Ohio, Pennsylvania and West Virginia. People from all three states rushed to the derailment site on Feb. 3, and I’m profoundly grateful for their help that day. We’re expanding first responder training in other ways too, including our Operation Awareness & Response program, which travels our 22-state network, training approximately 5,000 first responders each year to safely respond to rail incidents. We are committed to improving safety, which means the men and women who support us need our support in return.

The same goes for our people. I am proud to represent more than 19,700 Norfolk Southern employees who work every day to offer a safe and effective means of transporting freight. Part of showing my gratitude for their hard work and dedication means fostering a culture of trust, collaboration and transparency. We want our people to be engaged, speak up, and be part of the solution. Rising to this challenge, a challenge we all face, means working together to think about safety first—safety always.

22 Railway Age // April 2023 railwayage.com

Norfolk

Southern

THIS IS BNSF.

Going the extra mile for our customers and our communities.

bnsf.com/ThisIsBNSF

Measuring Success by the Impact on the Many, Not the Few

By Lance Fritz, Chairman, President and CEO, Union Pacific

As I am in the last of my 23 years at Union Pacific, it is stunning to reflect on the change in our industry and at our company over the course of my career. I am forever proud of my time and the

team at Union Pacific, but never more so than in these three years since COVID19 first emerged. Despite the myriad of challenges that confront our industry, there are three guideposts I have found to be the best path to success.

Number one is delivering safe,

consistent, reliable service day in and day out. We are nothing without it and it is the foundation of our ‘Serve, Grow, Win – Together’ strategy. Union Pacific is at the forefront of innovative technology, such as our cutting-edge APIs that offer seamless customer and supply chain integration; and our commitment to safety is unrelenting and ever-present, reflected in our industry-leading employee personal injury rate, which has seen double-digit improvement year over year. We know from recent events in the industry that this is more important than ever before.

Once we know we are running a safe, consistent and reliable railroad, we pressure test every idea and every decision against every stakeholder—customers, employees, communities and shareholders. Employees must be fulfilled in their work and feel valued; customers must feel like Union Pacific is helping them win in their markets; communities must feel like we are helping them solve their critical problems; and shareholders must be rewarded with returns that encourage further investment. If I have learned anything, it’s that any choice that appears to pit one stakeholder against another is a problem. We have the best employees and best rail franchise in the country, and with that comes the ability, and the obligation, to meet more than one objective at a time.

As leaders, as a company and as an industry, we have had to become more agile. What our employees value has changed. Lengthy labor negotiations overshadowed 2022, but Union Pacific ended the year with historic wage increases—our craft professionals received a 24% pay boost pushing average railroad salaries to $110,000 a year by 2025—and ensuring continued equal pay for women and people of color.

What our customers need has also changed. Inflation, supply chain challenges and fuel prices dominated how every company across the country, and the world, operated. Union Pacific harnessed the power of our network to serve our customers in new and exciting ways. We are reinvesting in our infrastructure with innovative technology to improve our network’s efficiency,

24 Railway Age // April 2023 railwayage.com

Union Pacific

CEO PERSPECTIVES

productivity and service.

What our communities desire has changed as well, and we have needed to respond. We must be active participants in communities where we work and live, but we also have a bigger responsibility to our planet—and Union Pacific is an active participant in finding a solution. A net-zero future is one we all share, but at Union Pacific, we are making a meaningful and measurable difference, committing to reduce absolute scope 1 and 2 GHG emissions from our operations 26% by 2030 against a 2018 baseline on our path to net-zero emissions by 2050.

And when we do all this right, we are also being responsive to our owners—the shareholders. Union Pacific is delivering as the only U.S. Class I railroad that experienced volume growth in 2022, with the best return on investment capital and the second-best Operating Ratio in the industry.

The world is more dynamic and expects more from us. Putting our stakeholders

at the center of our decision making helps us find the best solution. Ensuring every employee goes home safely, helping our customers get their jobs done,

supporting and connecting our communities and building on our growth track record are what define Union Pacific and why I know our future is bright.

April 2023 // Railway Age 25 railwayage.com CEO PERSPECTIVES

Bruce Kelly T tal Solutions Partner totaltrackmonitoring.com 1.630.320.1381 L.B. Foster provides award-winning wayside technology to monitor safety, increase network velocity, and enable the Digital Railway. Rockfall Monitoring » Accurately detects and remotely alerts controllers of obstructions on track » LIDAR optical fence increases railroad network velocity Mk-IV WILD » Measures wheel impacts, train weight, lateral forces, and truck hunting » Continually monitors rail vehicle health, reducing the likelihood of derailments to ensure safety TOTAL TRACK MONITORING STAY IN GEAR WITH RAIL GROUP NEWS ROUND-UP of NEWS STORIES FROM: RAILWAY AGE, RT&S and IRJ RAIL GROUP NEWS From Railway Age, RT&S and IRJ https://railwayage.com/newsletters RA_RailGroupNews_Fourth_InGear_2022.indd 1 1/10/22 12:43 PM

When Consensus Is Staring You in the Face: An Invitation to Partnership

By Patty Long, President, Railway Supply Institute

As a society, and all too often in our nation’s Capitol, we spend our time focused on differences—difference of opinion, policy priorities, funding levels—rather than seeing the areas in front of us where we can clearly agree. Consider the almost unanimous belief in

the benefits of moving people and products by rail. Objectively and statistically, rail is the safest, most sustainable, most economical and most efficient mode of transport.

Recognizing this, a bipartisan majority in Congress passed legislation in November 2021 to invest more than $100 billion U.S. taxpayer dollars in the rail industry,

as 297 members of Congress (228 in the House and 69 in the Senate) voted for the Infrastructure Investment and Jobs Act (IIJA), a $1.2 trillion investment overall. They understood that it would create jobs, promote more sustainable movement of people and products, and update a system that is key to our country’s economic health and national security.

Fast-forward 18 months, and our critical industry is behind the eight ball. The once-in-a-generation opportunity to modernize U.S. infrastructure is slipping away under the weight of extreme inflation that threatens the U.S. transit industry and its domestic supply chain. At the same time, U.S. modal share for freight rail continues to decrease.

And who should care? The answer is a comprehensive ecosystem that begins with the American public and includes dozens of industries and the organizations that represent them.

On the passenger rail side, there are organizations that should be working together to ensure that infrastructure investments continue to fuel job creation, economic growth and keep a once-healthy supply chain intact. Proven solutions such as more efficient procurement and inflation adjustments have already made a difference for other industries such as defense.

And, while the RSI has started this discussion with the American Public Transportation Association (APTA), there are many others that need to be at the table, including, but not limited to, Associated General Contractors (AGC), American Road & Transportation Builders Association (ARBTA), American Society of Civil Engineers (ASCE), AFL/ CIO, and the Sierra Club.

On the freight side, the percentage of goods moving by rail is decreasing even as rail transportation is shown to be safer, more cost-effective, and more sustainable. But, we are losing on service, flexibility and transparency.

I can track my Domino’s pizza from the oven across town to my front door, and get a tracking number from the USPS to see the status and location of my package to grandma, but no one can tell me when my boxcar full of critical parts rolling across the Midwest is going to arrive at its

26 Railway Age // April 2023 railwayage.com CEO PERSPECTIVES Railway Supply Institute

destination. That has to change, and we have the technology to change it.

Don’t get me wrong: I’m not naïve to the challenges of consensus. But the process begins with the acknowledgement that we all want the same outcome. And we do!

Shippers want to move their goods by rail for the reasons I’ve shared. Class I’s and short line railroads (many familyowned) want their business to succeed and thrive. Rail suppliers that build and own the freight railcars, maintain the track and develop the communications and signals want to invest in new cars and technologies to further improve safety, sustainability and logistics. Environmental groups (and most humans I know) want fewer greenhouse gas emissions. Labor wants more jobs. And the U.S. taxpayer supports spending less on maintaining roads while decreasing traffic congestion and highway fatalities.

More rail is the proverbial rising tide that lifts all our boats. We need to sit

down together and determine how to improve our collective fates. To those I’ve mentioned (and others I’ve inadvertently left off), this is a personal invitation to partnership. Let’s check our differences and our egos at the door and focus on the bigger picture to fuel collective growth and progress.

Patty Long has more than 30 years of

experience in the manufacturing trade association world, having held senior positions with the National Association of Manufacturers, the National Asphalt Pavement Association and the Plastics Industry Association. RSI is the largest and only trade association representing the full supply chain for the North American railroad system.

April 2023 // Railway Age 27 railwayage.com CEO PERSPECTIVES

countoncsx.com CSX brings first-class service and a technologically enhanced shipping experience across our extensive rail network that reaches nearly two-thirds of the U.S. population.

you’re ready to move your business forward, count on CSX. Safe Shipping. Sustainable Solutions. CSXT-001634_RailwayAge-CEO-InterviewIssueMarch2023-7x4.85_RsG.indd 1 3/22/23 9:57 AM

Bruce Kelly

If

CEO PERSPECTIVES

People Matter Most

By Dan Smith, CEO, Watco

Ib elieve all Railway Age readers will agree: There is no greater transportation system in the world than the North American freight rail network. No

other transportation mode moves as many different commodities, as much volume, over greater distances, safer and more efficiently, than our North American freight rail network. But without

the great men and women who make it happen each day—those who work the ground and those who support them— this great network would be useless. It is the people who matter most

Recently, I have watched, read and listened to harsh criticisms of our industry. But times of challenge bring opportunity. The opportunity in front of us now is real. We have a chance to show the resiliency and dependability of our great industry. We can do that by demonstrating every day what all of us already know: People matter most.

There is no doubt we all suffer, especially our customers, when our industry stumbles. Whether caused by man, machine or an act of God, no industry works harder to improve and overcome while continuing to meet the needs of our customers. The show must go on— even during times of immense challenge. I know the great people within our industry will always rise above the challenge and seize the opportunity. They always do, even when it isn’t simple, and even when it costs more than it should.