AILWAY G E

POST-PANDEMIC PERIL?

Budgets Stretched Thin as Ridership Recovers. What’s Next?

CEO PERSPECTIVES

Notable Safety

Accomplishments

RAILINC

RAILWAY INDUSTRY SINCE

WWW.RAILWAYAGE.COM APRIL 2024

SERVING THE

1856

Fleet Size Increase

FREIGHT CAR REPORT Total

Greenbrier’s innovative Titan Series DoorsTM are built from an advanced high-strength steel and provide twice the yield strength of standard steel—increasing the durability and longevity.

INNOVATIVE DESIGNS. LIFETIME SAVINGS. LIFETIME PARTNER.

on a 2024 internal standard boxcar door repair model derived from interviews with boxcar repair experts

the average lifetime

door repair-related

55% when compared to

LEARN MORE AT www.gbrx.com/doors PATENT PENDING One Centerpointe Dr., Suite 200, Lake Oswego, OR 97035 | marketing.info@gbrx.com | www.gbrx.com

*Based

The Titan Series DoorsTM reduce

plug

costs by

regular steel boxcar plug doors.*

April 2024 // Railway Age 1 railwayage.com Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 225, No. 4. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the publisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2024 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning subscriptions to Subscription Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740; FAX +1 (847) 291-4816. Printed at Cummings Printing, Hooksett, N.H. ISSN 0033-8826 (print); 2161-511X (digital). FEATURES 11 38 42 49 55 CEO Perspectives Notable Safety Accomplishments Passenger Rail Focus Post-Pandemic Peril? Tech Focus – M/W Crossties: What’s New, What’s Next Railinc Freight Car Report Total Fleet Size Increase TTC Operated by ENSCO FURSST for Safety and Security COMMENTARY 2 8 9 60 From the Editor Watching Washington Financial Edge ASLRRA Perspective DEPARTMENTS 4 6 7 57 58 59 Industry Indicators Industry Outlook Market People Professional Directory Advertising Index COVER PHOTO Passenger rail action in Chicago. Photo by William Beecher. April 2024 42 AILWAY GE Narstco

One Massive Ship is All it Took

Last month’s horrific, tragic marine accident that sent Baltimore’s Francis Scott Key Bridge tumbling into the the dark, dank waters of the Patapsco River serves as a shocking reminder of our infrastructure’s vulnerability. The 47-year-old steel truss structure collapsed like an Erector Set kicked over by a rambunctious toddler when the 95,000-gross-ton, 10,000-TEU, 948-foot containership Dali slammed into a bridge pier at just the right angle following a vessel-wide power failure.

A mayday call from the Dali’s wheelhouse cleared the bridge of vehicular traffic moments before the collision, but alas, eight souls—construction workers filling in potholes—went into the water. Six did not survive. That the bridge strike took place at 1:30 AM is fortunate indeed. Imagine if it had taken place during rush hour.

At this writing, the Port of Baltimore— the 20th biggest in the nation overall in 2023 in total tons (according to the Bureau of Transportation Statistics), an important link in the global supply chain, and site of several major CSX and Norfolk Southern facilities—is closed to marine traffic. The 1.6-mile Key Bridge, on the I-695 Baltimore Beltway, will of course be rebuilt, but it will be some time before the wreckage is cleared and the shipping channel is reopened. Both railroads got busy immediately ramping up alternatives and adjusting operations. If there was ever a time to demonstrate our industry’s storied resilience, this is it.

Transportation analysts are fairly

confident that the accident will not have long-lasting effects on freight rail. “While Baltimore is the second largest export coal port, it’s the 15th largest container port in North America and the seventh largest on the East Coast—just 6% of L.A./Long Beach, for example,” noted Scott Group of Wolfe Research. “So, the impact on intermodal volumes should be relatively modest, and traffic can be diverted to other ports.

“Meanwhile, Baltimore is the largest port handling auto imports in the U.S., but Norfolk Southern noted to us that auto volumes can move to other facilities such as the nearby Sparrows Point Terminal, which is on the open-water side of the bridge. So, outside of coal, we don’t expect a material impact on volumes for CSX or NS. We also don’t expect a material impact on overall freight rates, truck or ocean.”

The accident should have a ripple effect on Capitol Hill insofar as the National Transportation Safety Board and Surface Transportation Board are concerned, especially in this Presidential election year. “With the East Palestine derailment, Baltimore bridge collapse and Boeing mishaps of Senate concern, there is reason to confirm NTSB Chair Jennifer Homendy quickly to keep her fully focused on safety investigations, which would be a win also for Patrick Fuchs and STB stakeholders supporting his second five-year term,” Capitol Hill Contributing Editor Frank N. Wilner observes. See Watching Washington, p. 8, for more insight.

Member of:

Omaha, NE 68102 (212) 620-7200

www.railwayage.com

ARTHUR J. McGINNIS, Jr.

President and Chairman

JONATHAN CHALON

Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO

Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK

Executive Editor mluczak@sbpub.com

CAROLINA WORRELL

Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures

Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN

Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Peter Diekmeyer, Alfred E. Fazio, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, Joanna Marsh, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith ks@railjournal.com

David Burroughs dburroughs@railjournal.com

Robert Preston rp@railjournal.com

Simon Artymiuk sa@railjournal.com

Mark Simmons msimmons@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

2 Railway Age // April 2024 railwayage.com FROM THE EDITOR WILLIAM C. VANTUONO Editor-in-Chief Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service. Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform. Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) 847-559-7372, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage. POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA. Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director. Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

AILWAY GE

847-559-7372 EDITORIAL AND EXECUTIVE OFFICES Simmons-Boardman Publishing Corp. 1809 Capitol Avenue

SUBSCRIPTIONS:

PERFORMANCE ON TRACK®

Keyway Tie: Concrete that thinks like wood

- Allows random replacement of wood ties with standard MOW equipment

- Immediately strengthens gauge and permits adjustment of up to +/-0.4 inches

- Available in optimized versions for heavy haul, commuter, and metro applications

- Increases service life of adjacent wood ties

- Matches modulus of wood tie track

- Lower ballast pressure compared to standard concrete tie track

- Guard rail and transition ties available

With the acquisition of CXT’s concrete tie business, voestalpine Railway Systems Nortrak offers fully integrated systems solutions from specialty trackwork, concrete turnout ties, concrete crossties, fastening, to signaling systems manufactured in North America.

voestalpineRailwaySystemsNortrak

ww

w.v oe st alpi ne.c om/ n ort rak

» » » » » » »

Industry Indicators

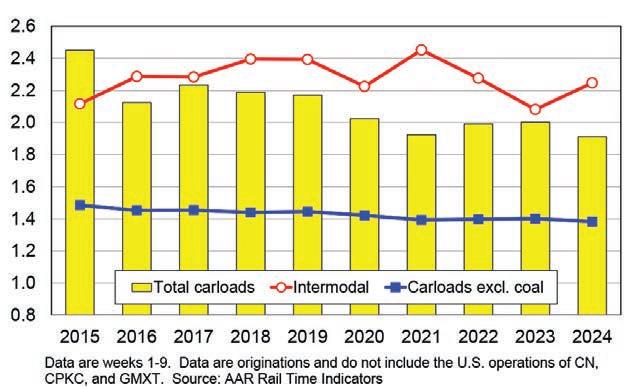

’U.S. RAIL TRAFFIC RECOVERED IN FEBRUARY AFTER SEVERE WEATHER CONSTRAINED VOLUMES’

Railroad employment, Class I linehaul carriers, FEBRUARY 2024

(% change from FEBRUARY 2023)

%

FROM FEBRUARY 2023: +2.63%

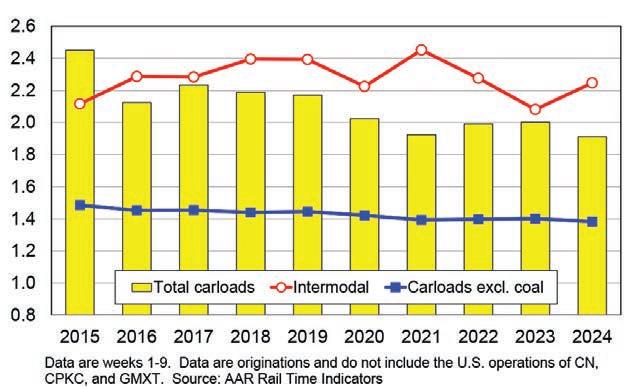

“Total originated carloads on U.S. railroads averaged 221,387 per week in February, up from 205,034 in January,” the Association of American Railroads reported last month. “Total carloads were down 1.3% from February 2023. That’s a big improvement from January’s 7.2% decline. In February 2024, 13 of 20 carload categories saw gains. Motor vehicles and parts led the way, with their U.S. carloads up 12.3% over February 2023. Chemicals did well: Carloads averaged 33,429 per week, up 5.1% over 2023 and the second highest weekly average for any month in our records that begin in 1988. U.S. carloads of grain rose 6.3%, reversing January’s 12.8% decline. Carloads of grain mill products were the most since March 2010. On the negative side, carloads of coal, nonmetallic minerals, and crushed stone and gravel all were down year-over-year by double digits for the second month in a row. The Energy Information Administration recently reported that coal accounted for 16% of U.S. electricity generation in 2023. It has been many decades since coal’s share was that low. Excluding coal, U.S. carloads were up 3.3% in February, their third-best year-over-year gain in the past two years. Meanwhile, U.S. intermodal originations in February 2024 were up 10.9% over 2023. That’s their biggest percentage gain in 32 months and the sixth straight gain of any size. Intermodal averaged 260,078 units per week in February 2024, the second most in 16 months.” Source:

Transportation (train and engine)

52,867 (+3.95%)

Executives, Officials and

Professional

(+3.56%)

Maintenance-of-Way and Structures

(+1.13%)

Maintenance of Equipment and Stores 18,231 (+2.13%)

Transportation (other than train & engine)

4,928 (+1.67%)

Source: Surface Transportation Board

TRAFFIC ORIGINATED

Vehicles & Parts

101,33293,0948.8%

4 Railway Age // April 2024 railwayage.com

Rail Time Indicators, Association of American Railroads Intermodal FOUR WEEKS ENDING MARCH 2,

2024

Staff Assistants 8,131 (+0.21%)

and Administrative 10,445

28,775

TOTAL EMPLOYEES: 123,377

CHANGE

FOUR WEEKS ENDING MARCH 2, 2024 BY COMMODITY FEB. ’24FEB. ’23% CHANGE Grain 135,258128,5795.2% Farm Products excl. Grain 13,47517,444-22.8% Grain Mill Products 48,10446,408 3.7% Food Products 46,47744,2924.9% Chemicals 192,313185,1523.9% Petroleum & Petroleum Products 89,778 84,1826.6% Coal 270,509304,765-11.2% Primary Forest Products 7,6467,6280.2% Lumber & Wood Products 23,89923,5081.7% Pulp & Paper Products 29,87930,291-1.4% Metallic Ores 65,33365,765-0.7% Coke 17,630 18,683 -5.6% Primary Metal Products 54,45855,004 -1.0% Iron & Steel Scrap 25,74824,3885.6% Motor

CARLOADS

Minerals

Clay & Glass

Crushed Stone, Sand & Gravel 94,987103,722-8.4% Nonmetallic

15,91616,655-4.4% Stone,

Products 42,51540,2125.7%

Nonferrous Scrap

Other Carloads

TOTAL NORTH AMERICAN CARLOADS 1,322,430 1,335,005 -0.9%

NORTH AMERICAN BY COMMODITY FEB. ’24FEB. ’23% CHANGE Trailers 44,58660,481-26.3% Containers 1,324,513 1,189,209 11.4% TOTAL UNITS 1,369,0991,249,690 9.6%

NORTH AMERICAN RAILROADS

NORTH AMERICAN RAILROADS

Waste &

15,90515,2784.1% All

31,26829,9554.4%

MAJOR

MAJOR

MAJOR

TOTAL North American CARLOADS, FEB. 2024 VS. FEB. 2023

1,322,4301,335,005

Short Line And Regional Traffic Index

TOTAL U.S. Carloads and intermodal units, 2015-2024 (in millions, year-to-date through FEBRUARY 2024, SIX-WEEK MOVING AVERAGE)

April 2024 // Railway Age 5 railwayage.com

FEBRUARY

Copyright © 2024 All rights reserved.

FEBRUARY 2024

2023

CARLOADS BY COMMODITY ORIGINATED FEB. ’24 ORIGINATED FEB. ’23 % CHANGE Chemicals 56,631 50,77711.5% Coal 25,184 19,778 27.3% Crushed Stone, Sand & Gravel 22,832 23,487-2.8% Food & Kindred Products 13,492 11,330 19.1% Grain 29,684 25,21717.7% Grain Mill Products 8,401 7,893 6.4% Lumber & Wood Products 9,842 8,18520.2% Metallic Ores 2,556 3,244-21.2% Metals & Products 19,877 18,516 7.4% Motor Vehicles & Equipment 10,345 8,76118.1% Nonmetallic Minerals 2,340 2,373-1.4% Petroleum Products 2,544 1,99427.6% Pulp, Paper & Allied Products 15,017 13,61510.3% Stone, Clay & Glass Products 13,116 11,90410.2% Trailers / Containers 34,197 34,951-2.2% Waste & Scrap Materials 11,421 11,019 3.6% All Other Carloads 61,062 64,628-5.5% AILWAY GE Visit http: //bi t.ly/rai l jobs To place a job posting, contact: Jerome Marullo 732-887-5562 jmarullo@sbpub.com ARE YOU A RAILROAD OR SUPPLIER SEARCHING FOR JOB CANDIDATES? RA_JobBoard_1/3Vertical.indd 1 7/27/21 3:02 PM

Industry Outlook

Biden FY25 Budget Request Boosts Rail Funding

PRESIDENT JOE BIDEN ON MARCH 11 RELEASED HIS FISCAL YEAR (FY) 2025 BUDGET REQUEST, OUTLINING HIS ADMINISTRATION’S PRIORITIES FOR THE NEXT YEAR. It proposes increased funding for public transit and passenger rail.

President Biden is seeking $16.8 billion for public transportation, a $198 million increase from the FY 2024 enacted level, according to a March 12 APTA report. When combined with the advance appropriations included in the Infrastructure Investment and Jobs Act (IIJA), the President requests $21.1 billion for public transit in FY 2025.

“The Budget request includes $2.4 billion for the Capital Investment Grants (CIG) program. When combined with IIJA funding, the Budget provides $4 billion for CIG projects in FY 2025. According to the American Public Transportation Association (APTA), it “provides more flexibility with these available CIG funds by eliminating the specific IIJA allocations for New Start, Core Capacity, Small Starts, and Expedited Project Delivery Pilot Program projects in FY 2025.” The Budget proposes funding for 14 New Start projects and four Small Start projects in 11 States.

Communities are currently requesting more than $45.1 billion of CIG funds in FY 2024 and subsequent years to cover construction of 66 projects in 24 states.

The President’s Budget proposes new policy provisions for several public transit grant programs. Among them:

“To address the projected operating

budget shortfall caused by fare revenues remaining lower than pre-pandemic levels and COVID-19 relief funds expiring, the Budget proposes allowing § 5307 Urbanized Area Formula funds to be used for operating expenses,” according to APTA. “To use this authority, grant recipients must certify to the Secretary of Transportation that the recipient will ensure a maintenance of effort comparable to the most recent fiscal year for projects funded by Urbanized Area Formula grants. In addition, the Budget proposes to allow highway funds (including unobligated balances) transferred to the Federal Transit Administration (FTA) in FY 2025 to be used for operating assistance.”

President Biden is requesting $3.2 billion for passenger and freight rail programs, a $180 million increase from the FY 2024 enacted level. When combined with the IIJA’s advance appropriations, the President is seeking $16.4 billion for passenger and freight rail in FY 2025.

The Budget request includes $2.5 billion for Amtrak, the same amount as the FY 2024 enacted level. When combined with the IIJA’s advance appropriations, the President is seeking $6.9 billion for Amtrak, including $4.5 billion for National Network grants and $2.4 billion for Northeast Corridor grants. The Budget also provides $100 million for Federal-State Partnership for Intercity Passenger Rail grants; $250 million for Consolidated Rail Infrastructure and Safety Improvement (CRISI) grants; and no new funding for Railroad Crossing Elimination grants. These amounts are in addition to the

$8.8 billion provided for these competitive rail grant programs pursuant to IIJA advance appropriations.

The President’s Budget also proposes new policy provisions for several passenger rail grant programs:

For Federal-State Partnership for Intercity Passenger Rail grants, the Budget proposes a Federal share up to 90% for projects benefiting an “underserved community.” The Budget also sets aside not less than $15 million for a grant to Washington Union Station with a Federal share of 100%, according to the association.

For CRISI grants, the Budget proposes to allocate $20 million for grants to States for State rail planning activities; allow any State, county, municipal, local and regional law enforcement agency to be an eligible recipient for trespassing prevention projects; for projects benefiting an underserved community, eliminate the statutory preference for projects where the Federal share of the total project costs does not exceed 50%, and provide a Federal share up to 90%; and retain up to $5 million to establish a National Rail Institute.

The President’s Budget proposes to eliminate the preference for projects that maximize benefits (pursuant to a cost-benefit analysis) for certain CRISI-eligible projects including: regional rail and corridor service development plans; safety program or institute designed to improve rail safety; research for rail-related capital, operations, or safety improvements; workforce development and training activities; and research, development, and testing to advance and facilitate innovative rail projects.

For the Railroad Crossing Elimination grant program, the President’s Budget proposes to eliminate the project selection criteria for improving the mobility of people and goods; for projects benefiting underserved communities, provide a Federal share of up to 90%; eliminate the state limitation (i.e., no more than 20% of grant funds available may be selected in any single state) in grant funds award distribution; and increase the set aside for grants for Highway-Rail Grade Crossing Safety Information and Education programs from 0.25% to 2.25% and include nonprofit organizations as eligible recipients.

William C. Vantuono

6 Railway Age // April 2024 railwayage.com

Market

Thales Canada Lands STM CBTC Contract

Société de Transport de Montréal (STM) has awarded Thales Canada a contract for a CBTC (communications-based train control) system for the Montreal Métro Blue Line. Thales’ SelTrac™ G8 technology—the first CBTC system to be deployed on the STM network— will be installed on the entire existing, 12-station Snowdon to Saint-Michel Blue Line and the new 6-km (3.72-mile), five-station Saint-Michel to Anjou eastward extension. The contract includes design, manufacturing, installation and testing, as well as five years of maintenance. Thales describes SelTrac™ G8 as “Green CBTC,” a “customer-selectable and configurable option. SelTrac™ is inherently energy-efficient due to the high level of automation with CBTC. We developed Green CBTC to further optimize energy usage for metro operators, providing energy savings of 14-18%. Green CBTC is a package of tools and services designed to accelerate recovery from disruption, maximize regenerative braking, minimize peak power consumption and visualize energy use during timetable construction. It is an optimized solution, lowering installation and life cycle costs, flexible architecture and evolutionary hardware platforms. SelTrac™ G8 is agnostic to communication networks. Enhanced services improve maintainability and increase availability.”

WORLDWIDE

GRUPO RAS, a Uruguay-based multinational integrated logistics company with more than 30 years of experience, announced March 13 an order for three C23EMP locomotives from WABTEC, “marking a crucial step for Grupo RAS as it enters the Uruguayan railway market.” The C23EMP locomotives are designed for reliable light-axle-load operations on narrow-gauge tracks. The locomotives are equipped with fuel-efficient, electronically-fuel-injected 12-cylinder FDL engines. Wabtec will manufacture the locomotives at its plant in Contagem, Brazil. The locomotives are expected to be delivered by late 2025, marking the commencement of Grupo RAS’s rail operations in Uruguay. The investment, Wabtec says, “aligns perfectly with Grupo RAS’s vision to become a key operator within Uruguay’s revitalized national railway network.”

NORTH AMERICA

THE BRANDT GROUP OF COMPANIES last month announced a major expansion to its material handling equipment dealer in a move that the company says is expected to generate $500 million in new revenue and up to 300 jobs over the next three years. The company’s acquisition of Cervus Equipment in 2021 included material handling operations from Alberta through Manitoba. Now, Brandt has announced its intentions to “deepen and expand its commitment to the material handling industry in Canada.” The company will expand nationwide, “creating a new and separate division that will deliver tailored solutions and after-sales support to customers from coast to coast.”

SACRAMENTO REGIONAL TRANSIT

DISTRICT (SACRT) is exercising an option with SIEMENS MOBILITY for nine additional S700 low-floor LRVs for its 43-mile, 53-station system, bringing the total number on order to 45. SacRT initially awarded Siemens a 20-car contract in 2020, which included an option for up to 76 more, to replace older cars that had reached the end of their useful life. Siemens had previously provided 36 U2A vehicles in the late

1980s. In 2021, SacRT ordered eight more Siemens S700s; and last fall, it ordered an additional eight. The new S700s have atplatform boarding at every door and allow riders with mobility devices to board using a deployable ramp at the two center doors instead of using a mini-high ramp. Also, each LRV features four dedicated wheelchair locations. The new low-floor cars are part of SacRT’s Light Rail Modernization Project, which includes station modifications to accommodate them and the addition of a passing track to provide 15-minute service to Folsom-area stations. Siemens has already delivered the initial 20 S700s to SacRT’s light rail facility in north Sacramento, where they are undergoing testing. They are expected to begin entering service on the Gold and Green lines this summer. The Blue Line will continue to operate the current high-floor LRVs, which still require riders with mobility devices and those unable to climb stairs to use the mini-high ramps at the ends of the station platforms. SacRT said it will begin construction on Blue Line station platforms to meet the height requirements of the new LRVs in late 2024; construction is slated for completion by 2027.

April 2024 // Railway Age 7 railwayage.com

Canada

Thales

Watching Washington

Not So Fast on Oberman’s STB Successor

With t he voluntary departure of Surface Transportation Board (STB) Chairperson Martin J. Oberman expected by May, President Biden is mulling ve potential Democratic nominees for the opening. e President separately will name a new chairperson.

Given the decision-making in uence of the Senate’s second ranking Democrat— Majority Whip Dick Durbin of Illinois—it’s understandable that four contenders have Chicago area ties, re ecting also the city’s reputation, as poet Carl Sandburg said, as “player with railroads and the nation’s freight handler.” Chicago’s Oberman is a product of Durbin’s in uence as is STB Chicago-rooted Democrat Karen Hedlund.

Politics is a contact sport, however, and Senate Republicans are unlikely to allow con rmation of a Democratic successor before the November election. Oberman’s departure gives the STB a 2-2 party split, so con rming a third Democrat to the ve-person board would hand Democrats a majority in a possible Trump Administration.

Biden still is likely to make a nomination, because also in politics, one never knows.

On Biden’s list are Chicago Metra board member Melinda Bush; Chicago Transit Authority President Dorval Carter Jr.; former House Transportation & Infrastructure (T&I) Committee Chairperson Peter DeFazio of Oregon; former congresswoman Marie Newman of a nearby-Chicago county; and Chicago-rooted Senate Commerce Committee sta er Melissa Porter. Except for Porter, all tote problematic baggage.

• Melinda Bush, 67, a former labor union leader, joined Chicago Metra’s board in 2023. Previously, she was vice chair of the state senate’s transportation committee. In earning an Illinois Environmental Council 100% favorable voting record, she supported passage of a Coal Ash Pollution Act opposed by energy interests and was active with the Environmental Justice movement.

• Dorval Carter, 65, was named CTA president in 2015. Previously, he was chief of sta to Obama Administration Transportation Secretary Anthony Foxx and assistant chief legal counsel at the Federal

Politics is a contact sport, and Senate Republicans are unlikely to allow confirmation of a Democratic successor before the November election. oberman’s departure gives the STB a 2-2 party split.”

Transit Administration. As reported by Chicago media, Carter is faulted for numerous alleged CTA ills and for rarely riding the trains.

• Peter DeFazio, 76, gained the T&I chair based on seniority—not personality. He distinguished himself by being shut out by fellow Democrats during nalization of the 2021 $1 trillion bi-partisan Infrastructure Investment and Jobs Act that he derided as “crap.” He has a strong allegiance to labor. Recently, DeFazio registered to lobby on behalf of trucking interests.

• Marie Newman, 59, was a one-term (2021-2023), politically le House member, having dealt a Democratic primary defeat to moderate Dan Lipinski to gain a Chicagoarea seat held by Lipinski and his father for 38 years. A Green New Deal supporter, she served on the House Rail Subcommittee. Until leaving o ce, she was the subject of a House ethics probe into allegations she “may have promised federal employment to a primary opponent for the purpose of procuring political support.” Newman currently heads a Chicago non-pro t organization.

• Melissa Porter, 48, is Senate Commerce Committee deputy sta director. Previously, she was general counsel to the Chicago Metropolitan Agency for Planning, a Department of Transportation senior associate counsel, and the Federal Railroad Administration’s chief counsel.

And how about Republican STB member Patrick J. Fuchs, whose rst term will expire Dec. 31? Renominated in January for a second term, he has no opposition from labor, railroads or shippers—the latter

having used “calm,” “solid,” “transparent” and “seriously thoughtful” to describe him while citing his “deep understanding” of regulatory issues.

Traditionally, Democratic and Republican nominees are paired for Senate con rmation, as were Fuchs and Oberman in 2019. But since a Democratic Oberman successor likely will not gain a con rmation vote before November, the safest path for Fuchs is a pairing with National Transportation Safety Board (NTSB) Chairperson and Democrat Jennifer Homendy, renominated in March for separate terms as a member and chairperson. (Unlike the STB, where permanent chairpersons are appointed by the President from among Senate-con rmed members, NTSB chairpersons are separately Senate-con rmed.)

With the East Palestine derailment, Baltimore bridge collapse and Boeing mishaps of Senate concern, there is reason to con rm Homendy quickly to keep her fully focused on safety investigations, which would be a win also for Fuchs and STB stakeholders supporting his second ve-year term.

Wilner’s new book, Railroads & Economic Regulation, is available from SimmonsBoardman Books at www.transalert.com, 800-228-9670.

8 Railway Age // April 2024 railwayage.com

N. WILNER

Hill Contributing Editor

FRANK

Capitol

REF 2024: Tight Market Feeds Mixed Temperament

At the Rail Equipment Finance Conference (REF) in March 2024, a tight rental market combined with lower new car build levels and listlessness in merchandise, grain and coal loadings to create a mixed temperament. Here’s a rundown of the key presentation takeaways.

Day 1 keynote Je rey Korzenik (Chief Economist from Fi h ird Bank) discussed the possibility of the economy’s so landing (continuing cautious optimism with ongoing risks) then pivoted engagingly to discussing the U.S. workforce’s labor challenges and the opportunity for companies to hire secondchance employees (primarily those with minor felony convictions). Korzenik covers the topic in his book Untapped Talent. Key takeaway: e birth rate in the U.S. sits at 1.6% and needs to be at 2.1% to maintain the population (due to infant mortality).

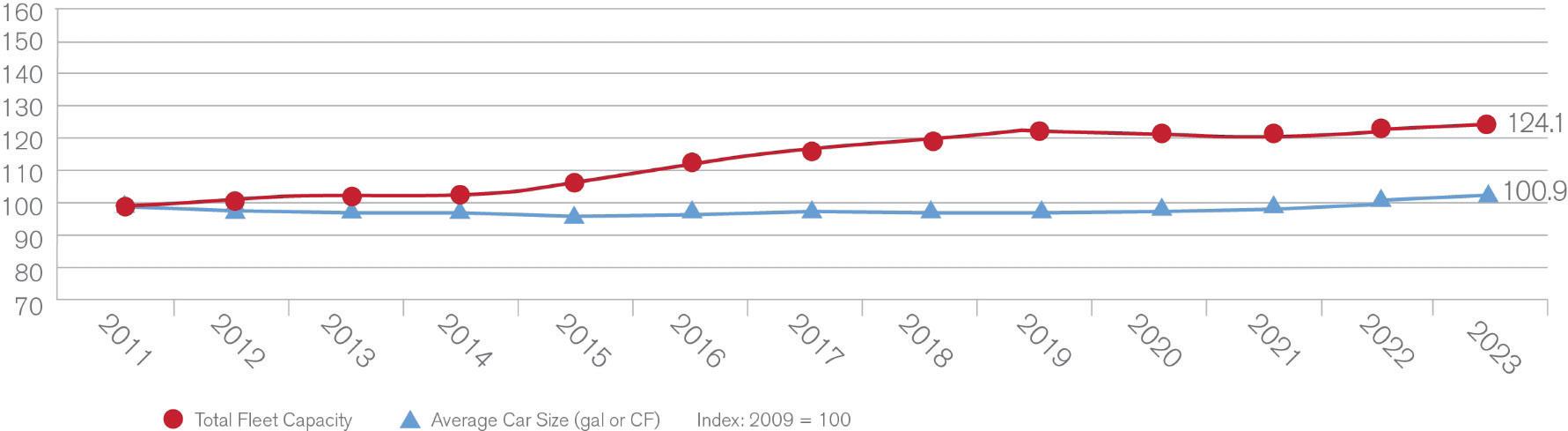

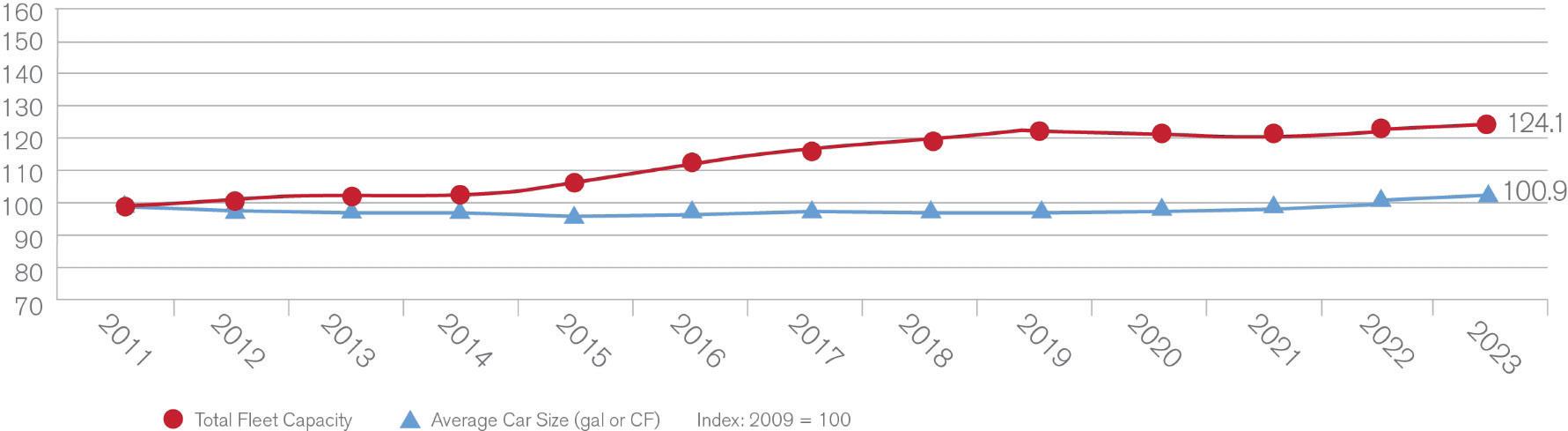

David Humphrey (Railinc), REF’s “railcar guru,” updated statistics on the North American railcar eet and its YOY changes (see p. 49). Key takeaways: e national eet increased to 1.637 million; there are 52,883 covered hoppers and 32,523 boxcars reaching full interchange life over the next 11 years, beginning in 2025.

Robert Pickel (National Steel Car Ltd.) discussed factors stressing the new car market. Inquiries and orders remain reasonable, while labor and supply chain challenges persist. Pickel follows prevailing 2024 production forecasts of new car production in the mid 40,000s.

Eric Starks (FTR Transportation Intelligence) noted a somewhat stagnant economy. Starks reported an early 2024 strengthening of imported container activity. Key takeaways: Starks does not currently see data supporting Red Sea and Panama Canaldriven increases in West Coast port tra c; and current data indicates so ness in railcar demand right now.

Graham Brisben (PLG Consulting) discussed the energy and chemical landscape for rail. Key takeaways: EIA estimates that globally renewable energy will out-generate coal by 2025; demand for biodiesel has made the U.S. a net soybean oil importer; polyethene’s “second wave” is complete with a third wave so ly under way; and U.S.-based rare mineral mining is

a potential rail growth story.

Jarrett Bilous and Geo Wilson (Standard and Poor’s) updated the domestic economic picture. Key takeaways: S&P sees low recession risk; an improvement in freight indexes is an economic positive while other contradictory factors (ISM New Orders Index) are showing weakness; and per-carload railroad revenue continues to increase post pandemic.

Jason Kuehn (Oliver Wyman) noted rail maintains e ciency in freight moved per tonmile but generates half the freight revenue per diesel gallon. Key takeaways: A gallon of renewable diesel costs $8.05 to produce—it is being o set by $4.52 of government incentives. Right now, rail does not have a solution to address the North American road locomotive eet, more than 50% of which will need upgrades before 2040.

Ron Sucik (RSE Consulting) tackled the intermodal market. Sucik noted early 2024 intermodal tra c increases are the h month of YOY West Coast tra c improvements. 2024 tra c is expected to exceed 2022 levels. Key takeaways: Nearshoring will continue to be an impact factor even as manufacturing moves to a just-in-time delivery focus.

John Ward (National Coal Transportation Association) updated the coal market. Key takeaways: Coal’s energy generation share is expected at 15% (from 17% in 2023) in 2024 and 13% in 2025. Coal- red generation capacity of 2.3 GW will retire in 2024 with more capacity retired in 2025. Even with small declines in rail loadings, Coal shippers remain concerned about railroad service.

Clint Pella (Union Paci c) discussed the national eet’s changing demographics and decreasing railcar specialization. Car type variety has decreased rapidly since 2010 while total eet size has been increasing. Key takeaway: Pella sees standardization creating customer, railcar owner and railcar operator supply chain certainty. Standardization o ers opportunity for asset optimization and service consistency.

Daniel Anderson (TrinityRail) discussed the tank railcar market and rea rmed tanks as the national eet’s second-largest car group and the largest lessor-owned segment. Tanks are the youngest major car group resulting from decreases in the average retirement age.

Key takeaways: Tank tra c has been volatile; tank car compliance (think HM-216 and HM-246) will impact car supply/availability. Bio and re ned fuels and chemical growth are market positives.

Johanna Biggs (Biggs Appraisal) identi ed that eets for covered hoppers (>5,000 cf), 117J tanks and boxcars grew most in 2023. On the appraisal panel led by Pat Mazzanti (Railroad Appraisal Associates), Ed Biggs (Biggs Appraisal), Greg Schmid (RESIDCO) and Bryan Vaughn (Modern Rail Capital), FMV values were higher across most car classes except for older grain and coal cars. ere were some mixed opinions on older tank values. Small-cube hopper values increased. Biggest market gainers? Boxcars, plastic pellet hoppers and PD covered hoppers.

Paul Titterton (GATX) kicked o Day 2 at REF. Titterton discussed what the railcar industry may have learned from collective history and that the current railcar and leasing cycle is di erent from those in the past. Key takeaways: Titterton illustrated how lease pricing has diverged from both railcar demand and the railcar eet replacement rate. He sees less volatility in the future with consistency in current fundamentals.

Independent analyst Tony Hatch addressed whether Norfolk Southern will survive the Ancora onslaught and all other things railroad. Key takeaways: Even with lackluster loads and earnings, railroads continue to pivot to growth unable to shake ongoing in uence of the “Cult of OR”; short line railroad growth continues as a positive story; rail could add $61 billion in revenue with limited capex spending; and technological innovation continues with implementation rapidity expected to increase.

Doug Driscoll (Genesee & Wyoming), David Horowitz (GATX), Anthony Petrillo (Packaging Corporation of America) and David Sellers (Greenbrier) talked boxcars. Key takeaways: Shippers, railroads and car owners must collectively convert more boxcar loads from truck to rail. e boxcar market shows lower loadings and some weakness, but a rebound is expected.

e car-hire system remains an issue; the national boxcar eet enhances utilization but challenges remain, as it continues needing investment and rightsizing;

April 2024 // Railway Age 9 railwayage.com Financial Edge

Financial Edge

technology can impact freight demand.

Patrick Kurtz (AITX) discussed covered hoppers. Kurtz discussed the negative impact of a third bumper crop in Brazil on grain loadings but has some positive e ect on milled product loading increases. Kurtz sees some PD eet replacement needs. Key takeaway: Covered hopper eet segments show reasonable utilization; food product loadings have been weaker vs. nonfood loadings. Kurtz highlighted discordance between hopper carload growth and eet growth.

Day 3 at REF is for locomotives. David Humphrey of Railinc led with a locomotive eet discussion. Key takeaways: Without signi cant new builds or eet growth, the national locomotive eet ages every year; even thinking optimistically about locomotive unit longevity, more than 7,000 (from a total eet of 37,600) locomotives may need replacement by 2030. (Details in the May issue.)

Don Grabb (Triangle Brothers) discussed how, overall, Class I railroads do not have a cohesive strategy to replace diesel as the primary fuel for locomotives. Key takeaways: Timing for a systemic change in how locomotives would be fueled could require more than a decade of time to address 25% of the eet. Furthermore, Class I executives concerned with other problems connected to railroad operations do not have concerns about the future of diesel fuel as a priority.

Pedro Santos (HGmotive) discussed HGmotive’s e orts to lead the transition to hydrogen as a locomotive fuel. is will utilize HGmotive’s hydrogen tender for linehaul rail service. Key takeaways: Undeveloped hydrogen in Canada and renewable energy in the Southeastern U.S. have the capacity to o er zero-carbon hydrogen-based fueling solutions. Santos is watching geological hydrogen as the potential game changer for the future of low carbon fueling.

Matthew Findlay (CPKC) discussed the railroad’s hydrogen locomotive program. Findlay said that diesel accounts for 92% of CPKC’s carbon emissions. He noted that zero-emission locomotive modi cation was the next phase in locomotive rebuilding. CPKC has determined that hydrogen fueling can be completed in a reasonable timeframe and at a reasonable cost if the supply of hydrogen is available for the use. Key takeaways: With validated technology, CPKC will continue to move along the road

of carbon neutrality, adding electrolyzers and a larger eet of fuel cell locomotives and tenders. CPKC sees a pathway to reduce carbon emissions on this pathway.

Glen Rees (Cummins Inc.) updated Cummins’ work using a variety of strategies to engage in carbon emissions reductions for motive power. Cummins sees a need to be exible pursuing alternate fuel strategies while maintaining exibility to use renewable or biodiesel, renewable or bio natural gas and hydrogen, with a focus on promoting a fuel-agnostic engine. Key takeaways: Rees reminded the audience that “getting to zero [emissions] is not a light switch”; and Cummins sees available grant money to assist in the switch to a carbon-neutral fuel platform for railroads, including short lines.

Robert Brenner and Peter omas (Wabtec) updated Wabtec’s new products and alternative fuel strategies. Wabtec recognized the pressure on North American rail to move quickly to change railroad emissions, and sees potential for the CARB locomotive emissions regulation to spread beyond California. Wabtec is ready to address a multitude of replacement fuel and emissions reduction strategies from repowering to batteries to fuel cells. Key takeaway: A future with battery-powered linehaul locomotives was unlikely. Wabtec is preparing for a multimodal solution of biofuels, battery, hydrogen and emissions reduction.

Andrew Anderson (Progress Rail) discussed his company’s point of view on the path toward carbon reduction and curtailment. Progress Rail is working on a hybrid style locomotive that would convert existing diesel locomotives to the hybrid model with an improvement in tractive e ort. Key takeaway: Progress sees that all biodiesel types can be used in existing combustion engines and is evaluating the long-term maintenance expense impact.

Michael Hart (Sierra Northern Railroad) discussed his short line’s use of, and successes with HFC (hydrogen fuel cell) locomotives in California. Hart detailed sister company Sierra Energy’s FastOx® system, which creates green hydrogen through the high-temperature waste burning. He sees the turnkey opportunity to place FastOx® wherever biomass feedstock can generate hydrogen. Key takeaway: Hart sees an abundance of locations

for FastOx® that could bene t short line railroads looking to make a conversion to hydrogen.

Jason Kuehn returned to discuss the timing and process for the necessary fuel transition for North America. Kuehn notes that with the U.S. planning carbonfree by 2050, any new Tier 4 locomotive has a 26-year maximum useful life. North American rail is challenged by the time and money for any plan requiring transition in a limited timeframe. Kuehn prioritizes eet modi cation over new-product transition. is conserves time and cost. Key takeaway: While noting how little the industry has changed in ve years, Kuehn sees hydrogen in the lead for replacing linehaul locomotives, while battery hybrids have a larger share in switching.

Stuart Bigs (Biggs Appraisal) noted that locomotive rebuilds added signi cant increases to the number of AC4400 locomotives YOY. Key takeaway: ere are approximately 4,000 Wabtec locomotives potentially available as remanufacturing candidates.

In the nal panel of the day, Pat Mazzanti and Greg Schmid returned to the stage along with Rick Ortyl (MetroEast Industries) to discuss locomotive values. In the rst half, the panel discussed locomotives built in the 1960s and 1970s. e market perspective remains strong as use in industrial service remains cost-e ective. On the newer six-axle eet, valuations were higher YOY for all AC traction locomotives that are capable of being rebuilt or that were 2004-built or younger. Key takeaway: Contrary to recent years, the audience felt that Class I railroads with a xed price purchase option on newer locomotives (2008 or younger) would purchase those units since they are likely Tier III-compliant and within the CARB rules age threshold.

REF 2025 is March 2-5, 2025 (www.railequipment nance.com). See you in La Quinta!

Got questions? Set them free at dnahass@ rail n.com.

10 Railway Age // April 2024 railwayage.com

DAVID NAHASS President Railroad Financial Corp.

NCEO

PERSPECTIVES

orth America’s freight rail industry is sharply focused on the future as the 21st century is well into its third decade. For this third annual special report, the freight rail industry’s thought leaders— the chief executives of leading North American companies–have crafted exclusive, insightful essays for Railway Age on growing and sustaining our vibrant industry, which has helped shape our society and is the backbone of transportation. Here are what they believe are their organizations’ most significant achievements in safety.

12 Katie Farmer, BNSF

14 Tracy Robinson, CN

16

18 Joe Hinrichs, CSX

20 Alan Shaw, Norfolk Southern

22

24

26 Michael Miller, Genesee & Wyoming

28 Ed Quinn, R. J. Corman Railroad Group

30 Dan Smith, Watco

32 Ian Jefferies, Association of American Railroads

34 Chuck Baker, American Short Line & Regional Rail Association

35 Lorie Tekorius, The Greenbrier Companies

36 Jean Savage, Trinity Industries

April 2024 // Railway Age 11 railwayage.com

Bruce Kelly

Keith Creel, Canadian Pacific Kansas City

Jim Vena, Union Pacific

Peter Gilbertson, Anacostia Rail Holdings

Our Safety Vision is Achievable

By Katie Farmer, BNSF

All of us at BNSF will remember 2023 for our work together that delivered industryleading record safety results. We had the fewest number of injuries and lowest injury frequency and

severity rates in our company’s 175-year history. Our employee injury rate went down by more than 20%, and our injury severity rate decreased by nearly 35% as well, year-over-year.

Our achievements are always put in the context that our work is not done

until we reach our safety vision of an accident- and incident-free workplace. That vision and path to zero starts with the elimination of fatalities and life-altering injuries, which we accomplished in 2023 in operating our railroad without loss of life.

This is a credit to our multiple teams approaching one another about safety, building strong intentional relationships and making wise decisions with safety as the foundation. These teams are proving that our safety vision is not aspirational. It is, with hard work and focus, achievable.

We believe it’s no coincidence we were able to achieve this milestone the first year after finalizing our Transportation Safety Agreement with a portion of our transportation workforce, which further strengthened collaboration and communication between management and our employees.

The first-of-its-kind agreement also includes risk identification and mitigation programs that enable our frontline supervisors to shift away from discipline events and instead have a more proactive, coaching approach with employees.

Another ingredient in our success is BNSF’s ability to reach agreements with all our union partners, which paves the way for 100% of our union workforce to have access to work/rest agreements. That means, if employees want a schedule with rest days, they can have one. This marks an important step forward in supporting the well-being of our employees, ensuring a more balanced and efficient work environment.

We believe supporting our people as best we can while improving work/ life balance pays dividends toward the overall success of our rail operations.

We have also continued to make progress in driving down the number of train accidents on our railroad. We know we will continue reducing accidents through our investments in training, process improvement and new technology.

We have continued to make advancements, thanks to the development and use of wayside detectors, track and equipment inspection technologies and

12 Railway Age // April 2024 railwayage.com

PERSPECTIVES

CEO

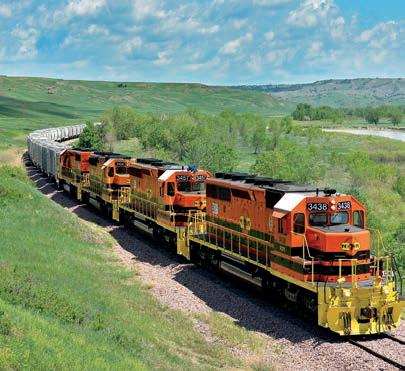

BNSF (two photos)

train control technology. The results of our efforts are reflected in our industry-leading performance over the past several years and a record start once again in 2024.

Our monumental achievement in safety is a credit to the commitment and passion for safety demonstrated by everyone at BNSF. We owe our thanks to those on the front lines serving customers every day, whose dedication to safety made our performance possible. We will

build upon last year’s safety achievements in 2024 and everyone across our company remains aligned in our commitment to safety and ensuring everyone goes home safely at the end of the workday.

April 2024 // Railway Age 13 railwayage.com

CEO PERSPECTIVES

No one moves like us. From safety to sustainability, CSX is on the cutting edge. When you’re ready for first-class service and a seamless shipping experience delivered by one of the nation’s leading Class I railroads, look no further than CSX. MoveWithCSX.com

CEO PERSPECTIVES

Safety is Our Core Value

By Tracy Robinson, CN

Safety is at the core of everything we do at CN. Leaning back into scheduled railroading has allowed us to optimize our resources while never compromising on safety. Streamlining our operations has not only improved our performance but has allowed for a more consistent and disciplined approach to our operations, resulting in noticeably improved safety through reduced accidents and incidents across our network.

In 2023, CN saw a record low injury frequency rate of .96 (per 200,000 personhours), an improvement of 13% over the previous year. While we are proud of the hard work our team put in for this achievement, we can never celebrate safety when, in that same year, two of our team members didn’t make it home to their loved ones.

It’s a stark reminder that although we have come a long way, we have more work to do.

e best way for us to honor our fallen colleagues is to continue to prioritize safety, every minute of every day. is takes leadership and a safety culture that embraces and embeds commitment, not simply compliance.

e team at CN aims to be the safest railroad in North America. at’s why we believe that safety in our industry must continue its evolution. It must evolve beyond rules compliance to a way of life ingrained in our culture. Over the past decade, we have started to see a shi toward a culture that puts safety at the heart of railroading.

At CN, we aspire to ZERO: zero serious injuries, zero fatalities and zero harm. We believe that by providing the leadership, training, and resources necessary, we can achieve this ambitious goal.

processing to nd at-risk wheelsets. Additionally, we have installed powerful sensors and AI technology into our Autonomous Track Inspection Program (ATIP) railcars, positioned on regularly scheduled trains, enabling 24/7 track inspection at normal speed. In 2023, our 11 ATIP cars inspected more than one million track-miles. ese added layers of protection allow CN to correct issues in real time.

Field employees participate in regular hands-on training and daily job safety brief ings. Our eld employees also have a mobile technology application that enables real-time and voluntary, con dential reporting of near misses or safety hazards while helping CN take action and create a safer working environment. is feedback loop with our eld employees is so important. It allows us to better under stand and track how the terrain is changing along our network. It also drives home that we all have a role to play in safety.

Technology advancements are enabling us to do great things. However, we need to focus on making sure everyone knows how this applies to them and how to use the tools to keep them safe.

Since 2021, CN operation employees have completed more than 8,800 Safety Leader ship training courses, from workshops to in- eld training. At the heart of these courses is a simple tenet: Leaders create the culture that determines the behavior, and behavior drives safety. is is how we build a safety culture based on values versus compliance.

In 2023, we had thousands of employees participate in CN’s rst Safety Week. e week was an opportunity to have meaningful discussions about safety and recognize each others’ achievements and e orts to stay safe. Senior executives were deployed across the network and engaged with eld employees as we all recommitted ourselves to a culture of safety and looking out for one another. I rmly believe that this is how we foster a culture of continuous safety improvement, building leadership and accountability amongst our teams.

Technology has been a game-changer for safety. We continue to increase our technological capabilities to nimbly assess, direct and x potential hazards. At CN we have an extensive wayside detection network, utilizing more than 24 million data points per day on more than 2,800 detectors that are constantly monitoring our trains’ health. CN has also installed acoustic bearing detectors, which can identify bearings at risk before they begin to fail. We are embarking on a new journey with Broken Wheel Detectors, which use a combination of sensors, machine learning, and AI image CN

At CN, we have an enormous privilege and responsibility to help move the economy across our network. While we have seen a major shi in safety across the industry, I rmly believe that the more we all put safety at the core of our operations, the more we can deliver better results for our clients and capitalize on new growth opportunities. But most important, we are making sure our colleagues get home safe and sound.

14 Railway Age // April 2024 railwayage.com

WE’RE FORGING THE FUTURE OF RAIL WITH THE STRENGTH OF 20,000

Innovation is driven by the power of many. That’s why we build our foundation on the strength of our people. It is their skill and dedication that move the weight of the world for our customers, drive growth in our communities, and chart a new course for our industry.

We’re proud to recognize the experienced, dedicated railroaders at Norfolk Southern as they deliver safe, reliable, and resilient service to all.

NorfolkSouthern.com

© 2024 Norfolk Southern. All Rights Reserved.

Home Safe, Every Day

By Keith Creel, Canadian Pacific Kansas City

Safety is foundational to everything we do at CPKC. We are working to bring a new standard of safety to the North American rail landscape. Canadian Paci c’s (CP) proven culture of safety combined with Kansas City Southern’s (KCS) likeminded approach make it possible for CPKC to operate at the apex of rail safety. at is our commitment and our obligation. Our culture at CPKC is one of excellence that we adhere to 24/7, 365 days a year.

In 2023, CPKC led the industry with the lowest FRA-reportable train accident frequency among Class I railroads, building on CP’s legacy of 17 consecutive years leading the industry.

rough our Home Safe program, which reinforces our culture of safety, and through cutting-edge technologies and innovation, we work to protect our railroaders, our communities, our customers and the environment. CPKC railroaders embrace safety as a journey, not a destination. Whether it’s on the ballast or in the o ce, our railroaders are committed to performing their work safely and to always trying to do better today than they did yesterday.

In 2023, we introduced our Home Safe program to railroaders across our combined network south of Kansas City, including in Mexico, and provided refresher training across the network where Home Safe has been a key component of our safety culture for many years. Home Safe is an initiative

designed to strengthen our safety culture by tapping into the human side of safety and promoting both safety engagement and feedback. Home Safe training sessions end with each employee making a commitment to reinforce our Home Safe actions and take responsibility for their own safety, as well as that of their coworkers.

Since we began our journey as CPKC, we have continued to develop and leverage innovations and technologies that help to improve safety and performance across our network. In 2023, approximately 60% of CPKC’s capital investment went to basic replacement and safety infrastructure. For example, we continue to invest in our broken rail detection system, which runs an electric current though the rail to detect problems. is enhances safety and track speed and improves cycle times and fuel e ciency at a fraction of the cost of Centralized Tra c Control. CPKC also recently added another remote inspection portal to our network, this time in British Columbia, to perform technology-based train inspections.

Rail transportation is the safest way to transport hazardous materials over land. We work closely with all stakeholders in the supply chain that is involved in the transportation of hazardous materials, including shippers, receivers, and everyone in between to transport these essential products safely and securely. We also work with railroad supply companies and governments to develop programs and standards to help protect communities.

We are legally required to transport hazardous materials as part of our common carrier obligations, on reasonable terms and conditions, and do so in accordance with all applicable laws, including safety and environmental protection regulations.

At CPKC we also understand the importance of serving as rail safety ambassadors and modeling safe behaviors around the railway for our family, friends and co-workers. CPKC supports Operation Lifesaver in Canada and Operation Lifesaver Inc. in the U.S. and Mexico to promote rail safety education. Railway police work diligently with Operation Lifesaver state and provincial agencies and local law enforcement to share rail safety messages year-round and by participating in community outreach activities and Rail Safety Week.

16 Railway Age // April 2024 railwayage.com

CEO PERSPECTIVES

Canadian Pacific Kansas City

Committed to safety.

Focused on service.

Driven by sustainability.

cpkcr.com

CEO PERSPECTIVES

Our Job is Never Finished

By Joe Hinrichs, CSX

All of us at CSX share one value above all others—and that is doing everything we can to protect the safety of our employees and the communities where we operate. It is part of the fabric of our ONE CSX culture of teamwork and communication, and it is what drives our collective e orts to help make CSX the safest railroad in the country.

We are proud of the strides our railroaders have made in enhancing safety over the past year. In 2023, the team achieved a 12% year-over-year reduction in our Federal Railroad Administration (FRA) personal injury rate and a 1% improvement in our FRA train accident rate. Moreover, CSX

has achieved record safety performance in recent years.

While we are proud of our progress, two incidents in the summer of 2023 resulting in the deaths of two newly hired railroaders reminds us that our e orts must continue. Following these incidents, we reevaluated our safety approach. is included extensive review and enhancements to our safety programs and technologies, rea rming our commitment to safe operations.

TRAINING AND MENTORSHIP

vital rules and equipment handling procedures, ensuring that every member of our team is equipped with the knowledge and skills necessary to navigate their roles safely and e ectively.

We also partnered with the International Association of Sheet Metal, Air, Rail and Transportation Workers—Transportation Division (SMART-TD) to extend the duration of safety training for our new conductors in Atlanta. By extending initial classroom training from four weeks to ve, we are providing trainees with immersive experiences in real-world scenarios, emphasizing practical eld tasks crucial for safe operations. In addition, we looked at the on-the-job portion of training and added additional job starts prior to trainees graduating to a marked-up conductor.

While training is an important step in giving our employees the tools and knowledge they need, ongoing reinforcement of safety is just as important to cultivate a strong safety culture. Recognizing this, we enlisted the help of our union partners and assigned mentors throughout the system to observe, coach and guide our new hires. We also started bringing mentors in from the eld to our Atlanta training facility to co-lead new hire training and provide feedback to our instructors on what they are experiencing in the eld. ese mentors are playing a critical role in guiding and reinforcing safety protocols. ey ensure our new hires fully understand our safety best practices and help ingrain safety into the daily operations of our entire workforce.

Mentorship doesn’t end with new hires. We have also been hosting Safety Summits where senior eld leaders collaborate with employees at all levels, evaluating current safety approaches and developing strategies for improvement; and conducting Management-Labor Safety Tours, with frontline managers and local labor representatives engaging in safety discussions with employees to strengthen local safety conditions.

We brought in experts from a leading safety rm DEKRA to help develop new training to build skills for proactive hazard identi cation and exposure mitigation. CSX believes that we need to go beyond traditional training on operating rules in order to provide our employees, management and cra , the necessary skills to identify hazards and self-mitigate risk. is training was rst

We took the extraordinary step of recalling all of our conductor trainees to their home terminals for intensive half-day sessions. ese sessions were designed to reinforce CSX

18 Railway Age // April 2024 railwayage.com

rolled out to our dedicated team of mentors and senior operational eld leaders. In addition, in 2023, CSX received approval of our FRA Risk Reduction Program, which aligns to our ongoing work of mitigating risk throughout the workplace.

PROACTIVE SAFETY MEASURES

Every incident is preventable, and our proactive safety measures empower employees to be vigilant, and to speak up when they see something that doesn’t look right. One example of this is our intended participation in the FRA’s Con dential Close Call Reporting System that allows employees to report unsafe events and conditions without fear of discipline. e system supplements the internal processes we already have in place to allow employees to anonymously report safety concerns. CSX is engaged in discussion with our union leadership and FRA to adopt a similarly structured program that exists in our industry.

While prevention is critical, in the event of an actual emergency, a swi response

can save lives. CSX held more than 60 rst responder training sessions in 2023, reaching more than 6,000 individuals, preparing them to handle potential emergencies on and around railroad property.

TECHNOLOGY AND INFRASTRUCTURE INVESTMENTS

Our investments in technology and infrastructure have also been important to making the job of safety easier and more efficient.

CSX has consistently increased its annual investment in core infrastructure, allocating signi cant resources to track, bridge, and signal projects. We have made upgrades to hot bearing detectors and acoustic bearing detectors to better facilitate early detection of potential issues; and established our third automated train inspection portal, which enables comprehensive inspections of moving trains in real-time.

Our eet of autonomous track assessment cars gathers critical data on track conditions, allowing for timely assessments

CEO PERSPECTIVES

and expedited repairs when necessary. Additionally, our extensive drone safety program utilizes unmanned aerial vehicles to perform various tasks, including aerial mapping, facility inspections, and accident investigations.

A CONSISTENT EFFORT

Of course, our safety progress has not been without challenges. Despite our best efforts, we lost three employees on our railroad in 2023; and in February, yet another. It’s a heart-wrenching reminder that the job of making our railroad safe for our employees, customers, and neighbors is never finished. No matter how much our safety metrics improve, we cannot get complacent.

From simple measures like eld visits to robust training programs and technology initiatives, our ONE CSX team remains committed to working together at every level of our organization—and with stakeholders across the industry—to keep safety at the forefront of our operations.

CELEBRATING 175 YEARS of service and innovation. We are proud to move America’s freight.

April 2024 // Railway Age 19 railwayage.com

BNSF.com

Delivering the Gold Standard

By Alan Shaw, Norfolk Southern

At Norfolk Southern, ensuring safe operations is a shared responsibility across our organization. ere is not one single solution when it comes to safety. We rely on our combined e orts and essential partnerships to deliver on our commitment.

With a comprehensive approach, we took a close look at our operations over the last year. We made signi cant adjustments to our network design and how we build trains, tightening makeup standards to better manage weight distribution and reduce the risk of incidents. We are expanding our wayside detection network – announcing that we will add approximately 250 hot bearing detectors, accelerating the deployment of acoustic bearing detectors, and are working closely with manufacturers to test and deploy new technology.

at technology included partnering with the Georgia Tech Research Institute to develop cutting-edge Digital Train Inspection Portals. e portals utilize machine visioning and marry advanced technology with human expertise. Comprised of a collection of cameras and stadium lighting, the portal captures thousands of ultra-high-resolution, 360-degree images of railcars passing through

at track speed. ose cameras photograph what is di cult for the human eye to detect and the data is passed along to our AI team. Leveraging advanced algorithms, we analyze the images with a high degree of accuracy. Immediate and potential issues are agged and transmitted to our Network Operations Center for our experts to address. Twenty will be deployed across our network.

To further ensure the safety and resilience of our operations, we invested more than $1 billion in infrastructure improvement projects across our system in 2023. Notably, our Engineering team set a company record in consecutive years, laying more than 550 miles of new rail, directly facilitating the reduction of trackcaused derailments.

Norfolk Southern’s safety initiatives all align with our strategy unveiled in December 2022, and are guided by the Six-Point Safety Plan we released last March. Together, we have reduced our Federal Railroad Administration (FRA) mainline accident rate year-over-year and to nearly half of what it was in 2022 and is among the best of the North American Class I rails.

We have a balanced approach to safe service, continuous productivity improvement, and smart, sustainable growth. By investing in our infrastructure, technology, and our colleagues,

we’re enhancing safety and charting a better way for our company and the rail industry.

We’re also engaging our workforce, labor leaders, regulators, and communities. Last year, we hired Atkins Nuclear Secured as an independent consultant to help take our safety performance to the next level. With extensive experience that includes the Nuclear Navy, they have helped us develop a roadmap to further our safety culture.

Beginning on my rst day as CEO, I made it a priority to visit frequently with my cra colleagues. Our candid conversations build relationships and are critical to enhancing the safety culture of our company, and I am appreciative of the engagement of our railroaders. I’m also proud to have partnered closely with our labor unions, co-authoring a letter alongside 12 of the leaders of our largest unions, publicly rea rming our shared commitment to safety.

We have committed to leading from the front on safety. Norfolk Southern was the rst Class I railroad to announce a partnership with the FRA in which we co-developed and launched a Con dential Close Call Reporting System pilot program. rough the program, railroaders may con dentially report safety concerns to be reviewed by a joint committee composed of Norfolk Southern and labor representatives. Together, they will identify and implement safety improvements with the FRA’s guidance.

Our commitment extends to those who help protect our communities. In 2023, Norfolk Southern trained more than 5,400 rst responders through our Operation Awareness & Response (OAR) program. Our Safety Train traveled throughout our network providing hands-on training events in 15 cities. Since 2015, we have trained more than 45,000 rst responders and anticipate an additional 4,000 in 2024.

With local o cials in East Palestine, Ohio, we broke ground last September on a regional First Responder Training Center. It builds upon our OAR program and will provide ongoing, free training for rst responders from Ohio, Pennsylvania, West Virginia and the greater region.

Rail remains the safest way to ship freight on land. We want it to be even safer. With our innovative strategy, the skill and dedication of our railroaders and essential partnerships throughout the industry, we’ve made signicant progress. More work remains. At Norfolk Southern, everything starts with safety, and we are committed to being the gold standard.

20 Railway Age // April 2024 railwayage.com

PERSPECTIVES Norfolk Southern

CEO

Investing in Safety at Union Pacific

By Jim Vena

Every day, we work with very large, heavy equipment to move products and materials across 23 states with gateways connecting the continent. One mistake can prevent an employee from returning home or seriously impact the communities where we operate. That is why safety is the first and most important part of our Safety, Service and Operational Excellence strategy for growth. At Union Pacific, we

have a goal to become the best at safety and we are making progress to get there. We are investing in our people, changing our culture, continuing to improve our infrastructure and equipment, and using technology to propel these efforts.

Safety is not a new area of focus for us, and we have made substantial strides:

• We had zero work-related fatalities in 2023.

• In 2023, we also reduced year-overyear serious injuries by 15%.

• Serious derailments on Union Pacific’s network declined 26% in 2023 compared with 2019, while average maximum train length grew.

• And, during the past 10 years, trackrelated derailments declined 28%.

These results are important, and indicative of the plans we have in place, but I realize we have more work to do.

We are investing in a safety culture where employees know they have the right to speak up if they see something unsafe, to stop a process or activity if they have concern, and to look out for one another. Our Union Pacific team researched thousands of serious safety incidents and used those findings to refresh our safety strategy. Approximately half of Union Pacific’s serious injuries are related to six choices individuals make each day on or near railroad equipment, affecting their personal safety, the safety of their colleagues and the communities we serve.

We call these the “Go Home Safe” choices, and we rolled out new policies and training to help employees prevent these potentially life-threatening behaviors.

In addition to changing our culture, we are also investing in technology and in our infrastructure. Technology is equipping us with information to assess risk, improving our operations and making us safer. We have thousands of wayside detection devices across our system which generate more than 16 million data points per day, helping us identify when a train should be stopped for inspection or repair, repaired at the next location, or repaired at a planned maintenance event.

Innovation is also critical in how we build trains and the routes we traverse. We do this by simulating and replicating the forces trains experience based on the terrain they travel, and then taking that data to improve the way we build and connect trains on our network.

We’ve put technology into the hands of our front-line employees, equipping them with mobile devices that put critical information at their fingertips. These tools include visualization capabilities that enable them to see the condition of tracks, locomotives and cars in real

22 Railway Age // April 2024 railwayage.com

PERSPECTIVES Union Pacific (two photos)

CEO

time. Some features help them prioritize important tasks and even give them the ability to throw switches and protect tracks. Converting highly manual processes into ones infused with technology reduces physical risks and helps our workforce adapt.

We also continue to make infrastructure investments as a normal component of safeguarding our operations for the customers and communities we serve.

• Last year, our Engineering team replaced 3.4 million ties, 5 million feet of rail, and invested in purchasing or repairing thousands of vehicles and work equipment.

• Our Mechanical team performed 13 million inspections and completed more than three million maintenance tasks, including more than 90,000 wheelset changes.

• Our Locomotive department performed more than 1.6 million inspections and completed 6.5 million maintenance tasks.

We are determined to improve safety and are invested in every way. We know that as we improve our culture, practices

From the dawn of the rail transportation to the futuristic driverless rail systems, Union Switch & Signal throughout history has been the leading switch, signal and dispatch company in the rail industry. This book covers every aspect of the USS company from the founders to the signal and switch machinist and assembly to the switchboard operators and the control centers and every employee that contributed to building the USS. Safety on the Rails will give the reader the whole story of the USS company’s leadership in safety and signaling for the transportation industry. Hard bound,192 pages.

and overall system, we will succeed and win—for the employees, customers and the communities counting on us.

April 2024 // Railway Age 23 railwayage.com CEO PERSPECTIVES

BKRER $69.00 +$16.85 shipping - single copy. Railroads & Economic Regulation (An Insider’s Account) 800-228-9670 www.RailwayEducationalBurau.com Visit our web site or call today! 1809 Capitol Ave., Omaha, NE 68102 Nearshoring: Best Practices for Shipping to and from Mexico Upcoming Webinar

Commitment to Safety Excellence

By Peter A. Gilbertson, with Herman E. Crosson, Chief Safety and Compliance Officer, Anacostia Rail Holdings

In the dynamic and challenging world of rail transportation, safe operations are key to attracting and protecting employees, as well as earning the right to serve communities and customers.

Anacostia Rail Holdings Company (ARH) has emerged as a center of excellence in safety, setting new standards

and achieving durable success in some of the most complex markets in North America. Through a combination of strategic initiatives, technology, dedicated employees and continuous improvement, Anacostia has elevated safety standards and reaped measurable returns on its investments. Safety is paramount to ARH’s key strategies and actions that

have propelled our success.

ARH railroads operate in demanding environments, including the Ports of Los Angeles and Long Beach, shared freightpassenger corridors in New York City and Chicago, in military facilities and hosted Class I operations. ose operations present daily challenges for our employees and their dedication and expertise are key to our measurable safety improvements.

Central to ARH safety achievements are its core values of Resources, Education, Belief, and Accountability. By investing in resources, providing comprehensive training programs, belief in safety principles, and holding each other accountable for our actions, ARH has fostered a strong safety culture that permeates the organization. New York and Atlantic’s industry leading safety training resulted in a 66% reduction of reportable injuries since leaving the pandemic and Northern Line Railroad has one reportable injury in 11 years.

A key Anacostia safety strategy is the implementation of localized safety action plans. Safety Action Plans are tailored to address speci c safety risks and concerns in each operational area, ensuring that proactive measures are taken to prevent incidents. By working together and addressing safety concerns, ARH nips potential problems in the bud and reinforces its commitment to safety as a core value and provides measurable success. PHL received the ASLRRA 2021 and 2022 President Safety Award for railroads over 250,000 manhours. Chicago Southshore’s Track Team has not experienced a reportable injury in more than 13 years.

e ARH Safety Process starts with safety culture assessments, which evaluate and improve safety practices. e assessments allow us to identify strengths and weaknesses, measure safety performance, and facilitate employee buy-in and engagement. Safety culture assessments pinpoint factors that may be contributing to incidents, allowing us to implement safety initiatives that reduce accidents and create a safer work environment.

Safety assessments are conducted internally and externally. We rely on external auditors, from the ASLRRA Short Line Safety Institute to provide unbiased insight into Anacostia safety practices.

Improving safety requires continuous

24 Railway Age // April 2024 railwayage.com

PERSPECTIVES

CEO

Anacostia Rail Holdings

education and training. is includes external outreach, such as hazmat training for rst responders, internal training, such as our recent class on derailment prevention, and the use of Federal Railroad Administration subject matter experts as a resource for feedback and best practices.

A guiding principle for ARH’s safety e orts is the belief in the adage that “an ounce of prevention is worth a pound of cure.” rough safety culture assessments, investing in preventive maintenance programs and technology, and exceeding the industry standards, ARH ensures that potential safety hazards are identi ed and addressed before they escalate into serious issues. ese actions de ne roles and set expectations for leaders.

Leadership is crucial to Anacostia’s safety commitment. Leaders must lead with a consistent, company-wide, and plainspoken safety message that de nes who we are and what quali es ARH managers to lead safety. By emphasizing the importance of follow-up, follow-through, and keeping

commitments, ARH’s leadership team sets the tone for a culture of accountability and excellence in safety performance.

In addition to investing in people and processes, ARH prioritizes investments in

CEO PERSPECTIVES