AILWAY G E

SERVING THE RAILWAY INDUSTRY SINCE 1856

Union Pacific Leverages State-of-the-Art Rail Inspection Technologies

COLD WEATHER COMBAT Preparing for Winter’s Inevitable Onslaught

REAL-TIME RESOURCES

BNSF Brings Locomotive Health to New Levels

FROM THE EDITOR

Descansa En Paz, Amigo Mío Pat

Iwish I wasn’t writing this column.

On July 28, I, and many others in our industry close to him, learned that our colleague and friend Pat Ottensmeyer had died unexpectedly. He was 67.

To say that Pat changed railroading is an understatement. He was honored twice as our Railroader of the Year, first in 2020 and then jointly in 2022 with Keith Creel for putting together the historic merger of Canadian Pacific and Kansas City Southern. In a fitting tribute, flags across the CPKC transnational network in Canada, the United States and Mexico were lowered to half staff.

“It’s hard to capture in words the sense of loss I and our CPKC family feel about the loss of Pat,” Keith Creel told me. “All who knew him as a professional and railroader had nothing but respect and admiration for the material impact he made across so many aspects of our industry. True leaders always leave their organizations better. Pat’s legacy will forever reflect that for many organizations, especially the KCS, where he served until his recent retirement.

“Personally, if you had the honor to have enjoyed a friendship with Pat as I did, words will never capture what a class gentleman and human being he was. The manner he cared for others, served others and always treated others set an example few could ever meet, much less have a chance to exceed. Our hearts are broken processing the loss of Pat. Focusing on the joy of knowing him and the memories we shared will have to be where we find the

strength to press forward. He will forever be missed but never forgotten.”

“Pat was a generational leader,” said John Orr, who worked closely with him as Executive Vice President Operations at Kansas City Southern during the CPKC merger process. “He had everything— emotional intelligence, people commitment and genuine humility.”

Immediately after the 2016 Presidential election, Pat “went to Washington D.C., right into the lion’s den, and got to work educating lawmakers, staffers, trade groups—anyone who would take a meeting,” Orr recalled. “He helped people understand the value KCS meant to U.S. farmers, suppliers and industry. The popular ‘anti-Mexico-trade’ noise was difficult. He pushed hard on USMCA and crossborder trade security. He invested resources to create best-in-class railroad cross-border standards. Pat kept a humble, confident tone in every employee and Capitol Hill discussion. He bore the weight quietly on his shoulders. He was selfless and loyal, brilliant and articulate. He had a voice that was respected, educated and deeply needed.”

Descansa en paz, amigo mío Pat.

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service.

Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform.

Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) 847-559-7372, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of

Publishing Corp. is prohibited. Address requests for permission on bulk orders to the

Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will

keeping or return of such material.

Member of:

AILWAY GE

SUBSCRIPTIONS: 847-559-7372

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

JENNIFER McLAWHORN Managing Editor, RT&S jmclawhorn@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Bob Cantwell, Alfred E. Fazio, Gary Fry, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, Joanna Marsh, David Nahass, Jason Seidl, Ron Sucik, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors

Kevin Smith ks@railjournal.com

David Burroughs dburroughs@railjournal.com

Robert Preston rp@railjournal.com

Simon Artymiuk sa@railjournal.com

Mark Simmons msimmons@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 847-559-7372

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

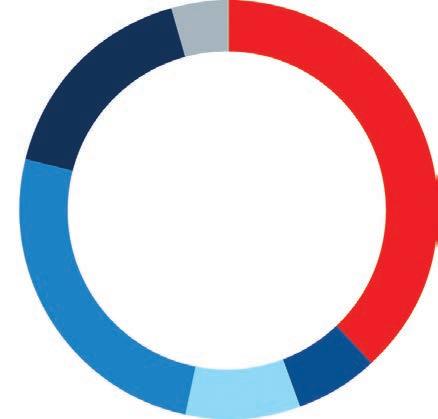

Industry Indicators

‘ECONOMY CHUGGING ALONG DESPITE ECONOMIC UNCERTAINTY’

“In June 2024, the rail freight industry painted a nuanced picture, mirroring the broader economic landscape where some sectors were thriving while others faced challenges,” the AAR reported last month. “Intermodal volumes continued to grow, driven by robust consumer spending and increased port activity, marking a bright spot in the industry. However, total U.S. carloads remained stagnant compared to previous years, primarily due to ongoing long-term declines in coal shipments. This decline is buoyed by an uptick in other sectors, including chemicals, motor vehicles and petroleum products, underscoring the industry’s resilience amid headwinds and economic uncertainties. Other indicators, such as railcar storage data, offer further insights into the economic landscape. Fewer freight cars in storage suggest an increased demand for rail transportation, indicating that more goods are being moved. June rail traffic continued the trends we’ve seen throughout the first half of 2024. Total U.S. rail carloads have decreased by 4.5% in the first six months of 2024 compared to the first six months of last year and are down 1.7% from June 2023. Meanwhile, intermodal volume was the highest in eight months. U.S. railroads originated 1.07 million intermodal containers and trailers, marking an 8.7% increase from June 2023 and the tenth consecutive year-over-year gain.”

Railroad employment, Class I linehaul carriers, JUNE 2024

(% change from JUNE 2023)

TOTAL EMPLOYEES:

% CHANGE FROM JUNE 2023: –0.95%

Transportation (train and engine) 52,342 (+0.25%)

Executives, Officials and Staff Assistants

(–3.46%)

(–4.14%)

Maintenance-of-Way and Structures

(+0.31%)

Maintenance of Equipment and Stores

17,485 (–4.42%)

Transportation (other than train & engine)

5,030 (+2.80%)

Source: Surface Transportation Board

Industry Outlook

Potential Implications of Loper Bright for the Rail Industry

THE SUPREME COURT HAS RECENTLY RESHAPED ONE OF THE FUNDAMENTAL PILLARS OF ADMINISTRATIVE LAW—THE CHEVRON DOCTRINE, UNDER WHICH AGENCIES RECEIVED A LEVEL OF DEFERENCE IN INTERPRETING AMBIGUOUS STATUTES. This sea change in administrative law has significant implications for regulators and regulated entities alike, including in the rail industry.

The Supreme Court’s decision is likely to change the way that agencies like the Surface Transportation Board (STB)—the rail industry’s economic regulator—approach statutory interpretation and regulatory policy, and it will change the landscape for railroads, rail shippers, and other stakeholders affected by STB regulations. It is not clear yet how the world of rail regulation will change, but it is clear that change is coming.

The Chevron doctrine—named from the Supreme Court’s 1984 decision in Chevron v. Natural Resources Defense Council instructed courts to give administrative agencies a level of deference in interpreting ambiguous statutory language. It set forth a two-step test. At step one, courts were to determine whether Congress has “directly spoken to the precise question at issue.” If Congress had, then that answer controlled. If Congress had not directly spoken to a question, then courts were to move to the second step, which determined whether the agency had reached a “reasonable” or “permissible” construction of the statute. If it had, then the agency’s reasonable construction controlled (even if there were other

reasonable constructions available). The Chevron doctrine was a crucial part of the regulatory landscape for decades, giving agencies enormous deference on legal interpretations, especially for ambiguous or broadly worded statutes.

But Chevron deference is no more. The Supreme Court’s decision in Loper Bright v. Raimondo and Relentless v. Department of Commerce held that Chevron was incompatible with the Administrative Procedure Act (APA), which gives federal courts alone the responsibility to interpret constitutional and statutory provisions. Under Loper Bright, it is now for the courts to determine the “best” reading of ambiguous statutes rather than acceding to an agency’s “permissible” interpretation.

There is, however, room for some deference to agencies. For example, Loper Bright does not change anything about the deference to policymaking and fact-finding that is mandated by the APA. Further, the Court acknowledged that there may be cases where an agency is authorized by statute to exercise a degree of discretion. And when a court is determining the best interpretation of a statute, it may look to agency interpretations for guidance.

The Loper Bright decision will have important implications across a range of industries, including the rail industry. Several key policy debates before the STB have turned on statutory meaning, from the proper role of revenue adequacy to the circumstances under which the Board can order reciprocal switching.

For the STB, it will have to defend its statutory interpretations—not just as a reasonable interpretation, but as the best interpretation. But arriving at the best interpretation can be a complicated endeavor. Unlike some other federal agencies, the STB—as the successor to the Interstate Commerce Commission (ICC)—administers some statutes that have their origin from more than 100 years ago. But the agency’s statutory authority has gradually decreased over time through deregulatory reforms— principally the Staggers Rail Act of 1980, which led to the financial rehabilitation of the industry, and the ICC Termination Act of 1995, which abolished the ICC and formed the STB. Further, the extensive body

of ICC precedent may be highly relevant to statutory interpretation going forward. As the Court explained, administrative interpretations “issued roughly contemporaneously with enactment of the statute and remained consistent over time” are entitled to “great respect.”

For railroads and other stakeholders, Loper Bright changes the playing field, but may not upend it. The Court emphasized that it was not calling into question prior cases that relied on Chevron. Prior decisions upholding specific agency action would remain subject to statutory stare decisis, ** and therefore have some degree of protection. But the decision nonetheless will likely provide opportunities for stakeholders to engage, advocate, and litigate issues relating to existing rules and ongoing policy debates. At the end of the day, the post- Loper Bright world is not a world in which every policy is suddenly open to reconsideration. But it is a world in which regulatory questions will turn less on how to convince regulators to adopt policies that are a plausible interpretation of a statute, and more on how to determine the best interpretation of what Congress actually intended.

– Allison Davis

Allison Davis is a railroad regulatory lawyer who draws on her extensive government experience to help railroads achieve their business goals while complying with their regulatory responsibilities. Davis represents railroads in connection with rulemaking and other proceedings before federal agencies, such as the STB and the Federal Railroad Administration. She is a counsel with Sidley Austin LLP, and earned her J.D. from Boston College Law School, where she graduated cum laude. She previously held several high-level positions at the STB, including as a senior advisor to two STB chairmen, and eventually served as the Director of the Office of Proceedings. The author notes that she has represented parties before the STB on issues pertaining to revenue adequacy and STB-ordered access.

**The legal principle of determining points in litigation according to precedent.

Sidley Austin LLP

SEPTA Taps Hitachi Rail for Market-Frankford M5 Fleet Contract

Southeastern Pennsylvania Transportation Authority (SEPTA) has awarded Hitachi Rail a contract to supply 200 new M5 rapid transit cars for the Market-Frankford Line in Philadelphia. The base value of the contract, which includes an option for up to 40 more, is $724.3 million. Deliveries are due to begin in 2029 for completion by year-end 2031. Hitachi said the new trains will offer improved accessibility, capacity and reliability when they replace the current fleet of M4 trains that have been in service for nearly 25 years. The new fleet will have designated spaces for wheelchairs, strollers and bicycles, wide gangways between the cars to ease passenger flow and improve security, and digital real-time wayfinding displays. Regenerative braking will reduce energy consumption. The new fleet is partially funded by a $317 million Federal Transit Administration grant awarded in February under the second round of its Rail Vehicle Replacement Program. This is the largest competitive federal grant ever won by SEPTA. STV in March was selected by SEPTA to lead the procurement for the new M5s. “The fleet will be delivered from our new state-of-the-art railcar factory in Hagerstown, Md., confirming Hitachi Rail’s commitment as a local player in the U.S. market and creating new economic opportunities in Philadelphia and across the Northeast,” said Luca D’Aquila, Chief Operating Officer and head of vehicles at Hitachi Rail.

WORLDWIDE

WABTEC and INDIAN RAILWAYS (IR) on July 25 celebrated the launch of locomotive service operations at the Gooty Maintenance Shed in southern India’s Andhra Pradesh. The facility complements Wabtec’s existing locomotive maintenance operations in Roza and Gandhidham. It also marks a new service model: leveraging existing IR infrastructure and staff. The company is contracted for the next three years to maintain an IR fleet of up to 250 Wabtec freight locomotives at Gooty. Wabtec said it will support Evolution Series locomotives from series 501 to 750 (4,500 HP and 6,000 HP) providing regular maintenance, supervision, material and warehouse management, shop control, logistics and remote diagnostics. The fleet will be deployed along the South Central, Central Railway, and East Coastal Railways, hauling coal, cement, foodgrains, fertilizers, iron ore and containers.

NORTH AMERICA

THE GREENBRIER COMPANIES and NATIONAL STEEL CAR have delivered 100 new purpose-built steel coil railcars (50 units each) to ANACOSTIA RAIL HOLDINGS (ARH) subsidiary CHICAGO SOUTH SHORE & SOUTH BEND RAILROAD (CSS). The 48-foot, 115-ton-capacity, transverse-style cars can each hold up to five steel coils. The cars are equipped with covers for all-weather transport, and their transverse troughs hold coils securely in place with no need for dunnage or blocking. This purchase will bring the size of the CSS railcar fleet to nearly 700. CSS serves coil steel producers in the Midwest including Cleveland-Cliffs, Inc. at Burns Harbor and U.S. Steel’s Midwest Plant in Portage, both in Indiana. The new equipment, CSS noted, “will transport shipments moving to locations all across the North American rail network with ready interchange to all Class I railroads and many other short line and regional railroads. Because the equipment is owned by CSS, it will be immediately available for customers to reload as soon as it returns from a previous delivery. This significant investment supports more efficient and reliable logistics for steel coil and manufacturing supply chains.”

NEW JERSEY TRANSIT (NJT) last month ordered 36 additional Multilevel III railcars from ALSTOM TRANSPORTATION. The purchase, NJT said, continues to advance the agency’s plan to phase out the oldest single-level railcars (Comet Is, IIs and IIIs) from its statewide fleet. The Multilevel IIIs are self-propelled, multi-voltage AC OCS (catenary) electric multiple-units (EMUs). They will offer a range of benefits over the single-level railcars they will replace, according to the agency. Vehicle maximum speed will increase to 110 MPH. The cars will be compliant with current federal safety regulations and be equipped with Positive Train Control (PTC). Other amenities will include USB charging ports for customers and new, onboard information displays. The contract, according to NJT, utilizes options on the existing contract with Alstom Transportation at a cost not to exceed $170 million plus 5% for contingencies, subject to the availability of funds. NJT already has orders in for 138 new Multilevel III vehicles, which are in production. The first of these vehicles is scheduled to arrive in New Jersey for testing later this year. Exercising this option will bring the fleet size to 174 units.

Watching Washington

Congressman Nehls’ Masquerade Ball

Ah eap of chutzpah was served up last month by House Railroad Subcommittee

Chairperson Troy Nehls (R-Tex.) at a hearing more masquerade ball than inquiry into rail safety. Imagine Nehls costumed as duplicity, the American Chemistry Council (ACC) as hypocrisy, and rail labor as false reality. By Nehls’ design, railroads were spectators

Fraudulently billed “Examining the State of Rail Safety in the Aftermath of the Derailment in East Palestine, Ohio,” Nehls instead introduced H.R. 8996, the Railroad Safety Enhancement Act, with threadbare relevance to the subject matter; lacking evidentiary foundation; ignoring an impressive rail safety record—99.99% of rail-hauled hazmat arrives without incident; and binding Nehls more closely politically to Senator and Vice Presidential candidate J.D. Vance (R-Ohio), co-sponsor of S. 576, the Railway Safety Act of 2023, which Nehls largely duplicated.

No matter that Nehls previously termed S. 576 “overly broad” and “needlessly prescriptive.” Nehls and Vance are populists—solicitous of blue-collar workers while publicly pummeling big business. It now matters to Nehls’ political career that Vance may become Vice President and President of the Senate.

Conspicuously absent at the hearing was the Association of American Railroads (AAR). This was Nehls’ doing, over objection of his senior, Sam Graves (R-Mo.)—a trustworthy factfinder and advocate of bi-partisanship—who chairs the parent House Transportation & Infrastructure Committee.

AAR President Ian Jefferies, a former Senate staffer and no stranger to absurd political theater, could have—rather than submit a statement for the record— been in attendance and raised his hand to testify, when, on cue from Nehls, Rep. Derrick Van Orden (R-Wisc.), in costume as mendacity, excoriated railroads for their Nehls-choreographed absence. Nehls had invited three railroad CEOs, knowledgeable that on industry

issues, the AAR speaks on their behalf— and they so declined. Even Graves so-reminded Nehls. “Ethical” is not a Nehls-preferred label.

Nehls swims in self-created controversy. He is under House Ethics Committee investigation for misuse of campaign contributions; attended President Biden’s State of the Union address wearing a T-shirt decorated with Donald Trump’s mugshot; was ordered by the U.S. Army to cease wearing a Combat Infantryman badge for which he didn’t qualify; and in 1998 was fired by the Richmond, Tex., Police Department after collecting 19 violations of departmental regulations, including destruction of evidence and misleading superiors.

Abstemious public servants meticulously consider proposed mandates through a speculum reflecting expert advice, benefit/cost analysis and risk assessment to navigate a best-path forward. H.R. 8996 and S. 576 follow a populist paradigm.

A toady ACC—representing folks making things that go BOOM!, and which railroads must haul safely under a common carrier obligation—issued a press release supporting Nehls’ legislation.

Asked if that means support of the bill’s two-person train crew mandate, which has no evidenced linkage to rail safety, the ACC, hypocrisy writ large, said it has no position. Yet crew size

redundancy translates to higher freight rates. As the ACC is an advocate of regulatory actions to force freight rates lower, ACC’s “what, me worry?” strategy would push railroads back toward revenue inadequacy, meaning reduced investment in safety-focused technology. It is not an outcome ACC advocates for its members.

The ACC’s hypocrisy is writ larger in supporting other provisions, such as additional locomotive and car inspections for which neither benefit/cost analysis nor risk assessment has been made; and other mandates entailing substantial costs for problems unidentified. Rail labor’s support focuses solely on a false reality that redundant headcounts should never decline.

For sure, there are positive provisions— increased investment in grade-crossing elimination and close-call reporting. The way forward is not sneaking a sophistic, politically motived, populist themed bill through the chaos of a closing congressional session or its short lame-duck aftermath. The issues are ripe for collaborative consideration, with provisions vetted as to economic efficiency and safety necessity included in a Surface Transportation Reauthorization bill in the 119th Congress next year.

A starting point is setting goals (performance standards) rather than mandates, so as to encourage, through competition among railroads, new and emerging technologies. Absolutely, technology moves faster than the ink can be applied on prescriptive regulations.

Wilner’s new book, Railroads & Economic Regulation, is available from Simmons-Boardman Books at https:// www.railwayeducationalbureau.com/, 800-228-9670.

FRANK N. WILNER

Contributing

Capitol Hill

Editor

Nitro Powers Network Fluidity

Progress Rail’s Nitro Suite ef ciently manages density, capacity and pacing to bridge the gap between planning and actual operations. Each Nitro Suite solution integrates well with existing systems to ease implementation. The Nitro Suite includes:

> NitroMP - Movement planning that ensures immediate reaction to operational issues to improve overall network uidity.

> NitroPacing - Pace trains to save fuel without losing capacity.

> NitroYard - Plan yard activity to optimize arrivals, scout locomotives, loading, unloading and train formation.

Combining arti cial intelligence and modern software engineering is one more way we help your railroad increase network uidity every day.

Follow this QR code for an in-depth look at the Nitro Suite.

We keep you rolling.

AILWAY GE

W OMEN IN RAIL

Nov. 5 & 6, 2024 Chicago, IL

CONNECT. INSPIRE. INNOVATE.

We’re returning to Chicago with an expanded event!

Railway Age and RT&S are proud to recognize the growth in leadership roles for women in the railway industry. Our second annual Women in Rail Conference is now a two-day event, filled with instructive panels, an awards luncheon, and a local transit tour.

Join a diverse group of railroaders with a shared commitment to our industry’s future.

PROGRAM HIGHLIGHTS:

•Furthering industry inclusivity and showing allyship

• Advancing your career—from asking for a raise to developing new skills

•Understanding the latest regulatory and legislative happenings

•New tech innovations and the latest applications

SUPPORTING ORGANIZATIONS

•How mentorship can change your journey

•Building a safety culture

•Railway Age’s Women in Rail / RT&S’ Women in Railroad Engineering awards luncheon

•Tour of Metra’s rebuild shop and training center

Michael Miller

India L. Birdsong Terry

Ronnie Hakim

Michelle Bouchard

Financial Edge

A CARB By Any Other Name

It’s t he dog days of summer. Most of the country is sweltering under extraordinary heat (it was 127 degrees on July 5 in Death Valley), extreme rain (Hurricane Beryl dropped six inches of rain in one day at Houston’s major airports and knocked power out to 3 million Texans) or both. As the month rolls on, the nation will immerse itself in the 2024 “summer showcase” events: the RNC, the 2024 Paris Summer Olympics and the DNC (now Joe Biden-free!).

The headline acts sell the tickets so to speak. Even if you were forced to sit idle while CrowdStrike created global computing havoc, no one is looking forward to spending summer nights watching re-runs of Penn & Teller: Fool Us (128th ranked broadcast program).

Environmental issues often model the TV circuit. The headlines usually come off the Left Coast out of the California Air Resources Board (CARB). But this summer is bringing all kinds of redirects—recently the environmental news (putting aside the SCOTUS “Chevron Doctrine” decision, see p. 6) is coming from the Right Coast. In late May, Vermont passed into law a “Climate Superfund” bill. In early June, the New York State Assembly passed a similar bill (currently sitting on Gov. Hochul’s desk). Similar bills are working in Maryland, Massachusetts and California.

A Climate Superfund bill requires fossil fuel companies to compensate a state for climate change damage resulting from the fossil fuels they produce. For companies producing fossil fuels, this doesn’t sound “super” or “fun.”

In theory, states will use the proceeds of the bill to finance projects to offset the impact of climate-related disasters. The cost for these projects will therefore not be borne by the taxpayer. The New York law estimates charging $3 billion over 25 years.

The news made some local waves without catching national attention, possibly because superfund bills are likely to end up in the laps of the SCOTUS where the limitations of the Constitution’s 10th Amendment (powers assigned

to the states) will be hotly debated.

Andy Blumenfeld, Data Analytics Director, McCloskey by OPIS, recently took the podium at The Coal Institute’s 2024 Summer Trade Seminar. In addition to a deep knowledge of the landscape for U.S. power generation and the prospects for coal in 2024 and beyond, Blumenfeld has a great handle on the regulatory issues for power generation including current EPA thinking on power generated emissions. He had the following to say about superfund bills:

“It should not surprise anyone that the first ‘superfund club’ states look like the same states following California’s new rules for electric vehicles. I believe the most difficult part for the states to defend will be the reach-back provisions that establishes a penalty for historical emissions.”

When asked if he felt that the EPA could reject the Climate Superfund laws, Blumenfeld noted:

“This is a states vs. federal question, which is a political hot-point at this time. The Biden EPA is more likely to be handsoff, but a Trump Administration could move to block this legislation. This is best exemplified by the first Trump Administration attempt to revoke California’s automobile emission standards in 2019. Regardless of which Administration, this legislation will be challenged in court.”

Why does this matter for North American railroading? It is not a stretch to see the destination of the flying canary in this coal mine. If the superfund bills stick to big energy (New York is looking at you, Aramco, Exxon, Chevron, BP, Pemex, Shell and Peabody), don’t be surprised that publicly and privately held carbon emitters such as Class I railroads are next in line for the shakedown.

The superfund bills, much like the recently rejected Manhattan congestion pricing charge, represent the ongoing trend of states to treat law and politics like a food mill, spinning issues and deficits around until they find someone willing (more accurately someone they can force) to pay to cover budget deficits and funding gaps (other than the

It is not a stretch to see the destination of the flying canary in this coal mine. If the superfund bills stick to big energy, don’t be surprised that publicly and privately held carbon emitters such as Class I’s are next in line for the shakedown.”

“taxpayer”). The harsh reality is that the taxpayer (a.k.a. the consumer) always foots the bill.

Worse still, like the legalization of marijuana, casinos and the lottery, don’t be surprised if every state jumps on this bandwagon. No state legislator can stand the heat in the kitchen of “why are other states getting something and we’re not?” That includes Florida Gov. Ron DeSantis. Yes, you can write “climate change” out of the state budget but you’ll never eliminate chasing opportunities to increase the tax revenue.

One interesting thing to watch will be if states working on superfund bills opt not to join in ratifying CARB’s locomotive policies in favor of the superfund shakedown.

Got questions? Set them free at dnahass@railfin.com.

DAVID NAHASS President Railroad

LIGHT RAIL 2024

PRESENTED BY RAILWAY AGE AND RT&S

PLANNING, ENGINEERING AND OPERATIONS

Join Railway Age and RT&S at a premier event: Light Rail 2024, our annual conference on light rail transit.

LRT, North America’s fastest-growing passenger rail mode, employs a full range of technologies and operating practices. Light Rail 2024, developed for transportation professionals in planning, operations, civil engineering, signaling and vehicle engineering—as well as students at the undergraduate and graduate level—will o er a comprehensive review of the specialized technical, operational, environmental and socio-economic issues associated with LRT in an urban environment.

The conference concludes with a special tour of the San Diego Trolley, the first modern LRT system in the United States.

Key Sessions

•Engineering for Operations

•Capital Program Management

•Dealing with Extreme Weather Events

•Project Updates on Major New-Builds and Expansions

•Alternative Propulsion Technologies

•Customer Interfaces – Fare Collection, Communications, Security

•Funding Challenges

NOVEMBER

13 & 14

The Westgate Hotel San Diego, CA

DISCOVERING, PREDICTING, RESOLVING TRACK DEFECTS

BY DAVID C. LESTER, ENGINEERING EDITOR

With more than 32,000 miles of track covering 23 states in the western two-thirds of the U.S., those charged with inspecting and maintaining track at Union Paci c (UP) have their work cut out for them. From maintaining track geometry or discovering existing or potential rail defects, the team is inspecting some part of the railroad 24/7 with visual inspection, rail-bound vehicles (geometry cars), Hi-Rail

vehicles or autonomously with locomotiveor boxcar-mounted vehicles. e arrival of autonomous inspection is perhaps the most exciting because track folks can rest a little easier, knowing numerous vehicles all over the railroad are inspecting constantly and relaying track condition information back to headquarters.

Stephen Ashmore, AVP of Engineering Infrastructure, says, “We’ve seen a major shi in how we gather data about rail wear and determining when it should be replaced. Curves are a good example.

Before the advent of new technology, we would have crews out on the rail, or ‘boots on the ground,’ if you will, making quality measurements but there was a little subjectivity in the measurements. In addition, having people on the ground around the railroad is a safety issue (potential risk of slips, trips and falls), so that is greatly improved by people on equipment. With the new technology, Union Paci c’s work is now more data driven as we gather a tremendous amount of data and leverage it through analytics, helping us generate

All photos: Union Pacific

How Union Pacific leverages state-of-the-art inspection technology.

more precise predictions around when rail should be replaced. ese tools have allowed us to be very e ective with the railroad’s capital spend.”

Drew Bokenkamp, AVP of Engineering, says, “Maintenance and track and bridge teams complete our major track renewal programs. We’ve got this massive infrastructure, and I always tell people we’ve got the best team in the business.” Bokenkamp adds that “it used to take us a long time to get across the railroad to get measurements but now with new technology, we

can get measurements faster and make more real-time replacement decisions.” is has changed dramatically in the past few years. It used to be that track folks would have to go out and measure every little point on the curve, which took a long time. Now that they no longer must do that, they’re available to do other things that are more useful. Ashmore points out that UP generates its machine learning and other replacement algorithms in-house, while it relies on partners for others and uses some developed by the

UP grinds about 20,000 miles of rail per year, and when planning the annual program, engineers look at data gathered from crewed and uncrewed vehicles, some visual inspection, and replacement history of the rail. In addition, the railroad uses data to configure its lubrication program so it can be very surgical around how much lubrication is used and where that lubrication is placed, both at top-ofrail and gage face.

e railroad uses several types of vehicles

Federal Railroad Administration (FRA).

ATGMS System in Fox River shows the laser being emitted from the system to measure track.

Greg Wilson reads data in the back of a DC-56 ultrasonic track inspection vehicle near Chicago.

From left, Track Supervisor Demarcus Thompson and Assistant Foreman Jeffrey Smith perform a routine track inspection, measuring rail gauge on the Commuter Operations Service Unit outside Chicago.

for track inspection. A crewed Hi-Rail system, one crewed traditional track geometry car, ten automated locomotive systems and three boxcar systems. Most inspection miles are completed by locomotives and boxcars. Locomotives are especially e ective because their weight puts the rail under additional strain for more accurate data collection. Since UP began its automated track inspection program, approximately ve years ago, defects are down 85%. It’s important to note that when a railroad begins an automated inspection program, it will likely have an uptick in defects simply because more equipment is out on the road looking for them. A er a cycle where the entire railroad has been covered at least once, the number of defects drops precipitously. is data can also be used for predictive purposes. Ashmore says, “If you run vehicles over the track frequently, you can get enough data to predict almost to the day when a section of rail needs to be replaced.”

A couple of years ago, UP did a pilot program with a waiver to determine how the data quality from visual inspections compares with the quality of automated inspections and it found that the more

runs it makes with the automated equipment the more it learns about how to solve problems. “We used to view the rail-bound geometry car as coming to your territory once per year to inspect and provide a report card on how you’ve been doing with visual inspections. Now, it’s become more of a tool to help us nd defects. is is one reason our number of defects has dropped so much during the past few years,” says Bokenkamp.

UP reports that it is not using groundpenetrating radar on any large scale. Ashmore says, “we use it in spot applications where we are trying to get more information about what’s going on if, say, we have a spot in the roadbed that takes longer to dry a er a rain storm than areas around it. However, the data can be a bit unreliable and challenging to work with, so we don’t use it as o en.”

While lasers have been an e ective tool for a variety of applications over the years, they are used in LIDAR (light detection and ranging) applications quite a bit today. is technology creates a visual image or map of about any perspective (i.e., rocks and vegetation along with railroad) by ring a laser at an object and then seeing

how long it takes for the object to re ect the light back to where it was generated. Ashmore says, “this technology gives us a tremendous amount of data and we use the data for vegetation assessment, rock fall assessment, rail wear inspections, and ballast inspections.”

For rail flaw detection, UP relies on ultrasonic detection, which looks for anomalies that could lead to a rail break. The data is gathered by either a railbound geometry car or a Hi-Rail vehicle, then analyzed. If the data shows areas of concern, they will be addressed by the track maintenance department.

Drones have come into use over the past several years, says Bokenkamp, and they are being used for several tasks. “Drones are used for bridge inspections, spot applications, site assessments, rock fall risk areas. e also help us build project plans, and y over safety sensitive or potentially risky areas, with some of these applications still part of a pilot program.” Drones are particularly helpful for assessing situations a er major storms. UP can take the visual data provided by the drone and determine what materials it will need to make repairs. “We can use drones to look

Derrick Beard inside a DC-56 ultrasonic inspection vehicle near Chicago.

UP TRACK INSPECTION

at certain locations we can’t get to because of an obstacle (i.e., fallen rocks and trees) a er storms,” says Bokenkamp.

Bokenkamp adds that “regarding storm events, we plan for those. We know they’re coming and place materials and tie things down before the storm arrives. Storm recovery is a quicker than ten years ago because of new large-scale efforts, such as shipping materials by train to get it right to where it’s needed. If we find water over the rail, we document those locations and strengthen that infrastructure to prevent the same thing from happening in the event of another storm. We also do a lot of brush cutting using helicopters, particularly in the south, to reduce the likelihood of fallen trees and vegetation blocking the railroad.”

Thermal misalignments, often referred to as sun kinks, are a problem for every railroad, but after gathering data and doing research in a crewed geometry car or Hi-Rail vehicle, the railroad knows specific kinds of days and locations where

there’s potential for a misalignment. This is another example of getting lots of data, especially for curves, to see where a misalignment might be a possibility. Once the railroad identifies such a location, a team goes to the location for visual analysis and testing afterward. “We’re always trying to get the right rail neutral temperature and changing weather conditions make it difficult,” says Bokenkamp. “Multiple factors can contribute to a thermal misalignment, so we must leverage all the data changes we find. However, the best line of defense is visual inspection and research is pointing toward autonomous inspection and how we can identify potential thermal misalignments via data.”

Bokenkamp adds that the plethora of new tools and industry-changing technology helps a great deal with personal safety. Instead of having “boots on the ground,” most of the people on track installation and maintenance teams are aboard some types of machinery. In

UP TRACK INSPECTION

addition, this new technology has helped UP reduce derailments by 28% during the past ten years and by 30% during the past year. Bokenhamp also says, “The main points around this new technology are that data has helped us put tools and resources in the right place, and we’ve

A Century on Track

ZF Rail Technology | 1924 – 2024

improved overall safety.”

Ashmore concludes by saying, “The entire industry has worked on pushing this technology. I’m very proud what we’re doing at Union Pacific and of the industry’s ability to come together and adopt these changes.”

ZF at InnoTrans Berlin, 24–27 Sept 2024, Booth 180, Hall 20

One of UP’s two Plasser American EC-5 Track Geometry Cars is named in honor of retired Vice President Engineering William E. Wimmer, Railway Age’s 2007 Railroader of the Year.

RESOURCES REAL-TIME

BNSF’s approximately 7,500 locomotives comprise the North American rail industry’s largest eet. e average age of its high-horsepower road eet is 15.5 years—among the youngest of the “Big 6”—leaving many more years of active duty until replacement or rebuilding/upgrading (the latter option preferred by Class I’s, given the high cost of new EPA Tier 4-compliant units) is required. A typical BNSF locomotive will travel up to 4.8 million miles in its service lifetime, according to the railroad.

Leveraging onboard, real-time health monitoring for improving utilization, lowering fuel consumption, and reducing road failures that can impact service and

disrupt network uidity is essential to maintaining a state of good repair and keeping BNSF’s 32,833-mile (Association of American Railroads 2023 Fact Book, Miles of Road Operated, as of 2022) network rolling.

Railway Age spoke with BNSF General Director Locomotive Utilization Ryan Knox and General Director Strategic Fueling Matt Feldman for this article. Each leads a team of experts responsible for the railroad’s eet, working closely with such suppliers as Wabtec and Progress Rail/EMD on certain monitoring functions.

“We’ve partnered with Wabtec to develop Power Advisor, a web-based application that is leveraging onboard technology to monitor locomotive component health,” explains Knox. “It’s very close to real-time

data. ere’s a remote data collection that takes place o the locomotive that is sent to Wabtec’s GPOC (Global Performance Optimization Center) for evaluation. We worked closely with Wabtec to tailor and create what we call ‘buckets’ for risk levels. Each component has a certain weighted value to it that will either increase or decrease health scores, based on failure probability calculations.”

e scores are color-coded—green, yellow, orange or red—for simplicity and visibility. A score of 80 to 100 would be green (similar to “clear” on a wayside signal), indicating a very low probability of failure. A score of 71 to 79, yellow, indicates a medium failure probability. A score of 41 to 70, orange, indicates a high probability

BNSF brings remote locomotive health monitoring to new levels.

the horsepower is needed to crest the hill, or before going into a heavily congested part of our railroad. We’ll monitor these health scores before power meets that point of no return. at allows us an opportunity to, proactively, either set a locomotive out and add a new locomotive, or redirect a locomotive to a shop before it fails. We can add a locomotive to eliminate the risk of service interruption down line. We found this has been very helpful in reducing service interruptions across our network.

status and performance in real time) or Uptime Suite (Progress Rail’s analytics platform) notes of any kind, we will be able to see all the information we need to diagnose or monitor locomotive component health. We have full visibility into all the onboard diagnostics—fuel readings traction motor temperature and speeds, inlet temperatures, you name it. We can see it all on one screen.”

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

of failure. Anything below 40, red, is very high, indicating that a component is on the verge of failure.

“All of this gets pumped into a health dashboard that allows us visibility to multiple reports,” says Knox. “We can view a pie chart: How many components are low? How many fall into each one of those categories? is helps our ability to improve locomotive assignments that increase the odds of mission success. We call this the ‘front end.’ ere’s real-time or near-real-time noti cations of anything that happens enroute.

“We’ve established ‘points of no return’ all throughout our network. For example, a point will be the nal locomotive data source before we climb a grade where all

“ is tool allows us to quickly diagnose an issue. We have real-time diagnostics that my team can tap into to review. In the past, we would have to talk to the crew, walk them through reviewing the diagnostics, and go through a process of elimination, if you will, to nd out what is wrong with the locomotive and then make a decision. Now, more o en than not, we see something before it actually becomes an issue. It allows us the opportunity to mitigate that risk. When mechanical components do fail, it allows us to quickly diagnose the problem, therefore providing us the opportunity to decrease service interruption duration.”

Knox runs the Locomotive Utilization Group, which manages locomotive assignments. In BNSF’s Fort Worth NOC (Network Operations Center), there are three mechanical desks—North, South, Central—sta ed 24/7. ere are dedicated Wabtec and Progress Rail desks also sta ed 24/7.

“All ve desks sit and work together to address locomotive issues on line, 24/7,” Knox says. “ ese partnerships have been great. We’ve seen a lot of improvement. A er Power Advisor was developed and matured, we found ourselves going to multiple systems to chase down certain types of information. We created a data feed that the tool can leverage, interfacing with PTC and DP (distributed power) systems and wayside defect detection systems.

“We spun another tool o Power Advisor called Train Analysis. We can punch in one locomotive number or the train ID, and it’s going to bring up the health of the entire consist and tell us everything we need to know about it. If there are DP alarms, or something happening on a locomotive issued by Wabtec, any faults, any EOA (Wabtec Expert On Alert centralized remote monitoring of locomotive health

Working with Wabtec, Knox’s team developed a specialized tool for diagnosing UDEs (undesired emergency brake applications). “We know the speed at which air travels,” he explains. “We know the distance because we know the number of cars and locomotives in the train. We know if there’s an ETD (end-of-train device), the number of head end and DP units or helpers [on the rear]. We developed this algorithm that can detect where in the train is most likely to be the source of an air issue, based on air brake propagation. at started with an idea many years ago, when I used to work on the mechanical desk. I would always ask the crew, did the rear go rst or the head end? en I’d ask them, how long until the head end went if the rear went rst? at gave me a ballpark of where to start having the crew look to identify the issue.

“Talking with Wabtec and their technical team, I said, if I was able to gure out a rough location in my head, why can’t we use the speed, travel and all these other measures to create an algorithm to give us a lot more accuracy? We started with ETD trains, where the accuracy of the source of the issue is somewhere within a ve-car range. We can direct a crew straight to that section of the train, quickly get the issue resolved and expedite recovery. e next phase is working on the same ability with DP trains.”

Matt Feldman heads “strategic fueling e ciency” initiatives like low fuel alert and energy management systems. e latter involves Wabtec and Progress Rail products.

Developed internally, the low fuel alert system provides far more information than when fuel level drops below a certain threshold. “Most of our road eet is equipped with fuel sensors that are sending us real-time levels in the fuel tanks,” says Feldman. “But that’s not very helpful if you don’t know how far a locomotive is from its next scheduled fueling and the likelihood of running out of fuel before it gets there. With our system,

we’re looking at locomotive location, the next scheduled fueling location, the HPT (horsepower per ton) on the train, and the current fuel level. We compare those parameters with all the other locomotives over the past several years that have run on the same route going to the same scheduled fueling location on trains with the same HPT to calculate for every locomotive a probability of running out of fuel before it reaches its next location. We generate a low fuel alert if it’s above a threshold probability, categorized as low, medium or high priority. When the NOC gets that low fuel alert, they can look specically at that train and determine if they need to make a plan to fuel it before its next scheduled fueling location.

Supplier Spotlight

Find the right vendors for your business in the Railway Age Buyer's Guide. Search for products, research vendors, connect with suppliers and make confident purchasing decisions all in one place. RailwayResource.com

“We may determine there’s an opportunity to stop the train at a crew change point before its next scheduled fueling event and dispatch a DTL (direct to locomotive) fuel truck—moving the next scheduled event from where it is currently scheduled to the crew change location right before that. If we’re going to fuel at a place we don’t

In BNSF’s Fort Worth NOC (Network Operations Center), there are three mechanical desks—North, South, Central—staffed 24/7.

normally fuel, it’s going to be DTL truck. But we also do DTL fueling in yards, where the locomotive just can’t get to a platform to fuel.”

“ is initiative is about preventing service interruptions and maintaining network velocity, not reducing fuel costs,” Feldman notes. “For example, it reduces the risk of having to dispatch a DTL truck to where it wouldn’t normally go to fuel a stopped train that might be blocking other trains, and maybe having to recrew that train. e key to the success of this program is correctly agging locomotives and fueling them before they run out, but also minimizing false positives. We don’t want to be introducing additional fueling events because that just slows down the system and creates unnecessary congestion. is system does a much better job than what was available in the past of correctly identifying locomotives that truly are at risk of running out of fuel, and not falsely agging ones and creating unnecessary work events.”

BRIDGE INSPECTION TRUCK

A typical BNSF locomotive will travel up to 4.8 million miles in its service lifetime, according to the railroad. Here, ES44DC 7762 leads a four-unit lashup on Cajon Pass.

October 17 & 18, 2024

Hilton Baltimore Inner Harbor

Baltimore, MD

END 9/13

Railway Age | Parsons Next-Gen Train Control is an essential gathering for communications, signaling, and IT professionals — whether your focus is transit, main line passenger, or freight. Sessions will offer in-depth technical information on current CBTC and PTC projects. We’re also expanding our exploration of the fast-growing artificial intelligence-based technologies utilized to enhance efficiency and safety. Between sessions, develop vital business relationships during networking breaks.

Sponsorships: Contact Jonathan Chalon, 212.620.7224, jchalon@sbpub.com

Learn More: www.railwayage.com/nextgen

Speakers Include

Carl Walker VP Engineering, C&S, PTC & Dispatch Systems CSX

Bala Rama Iyer Dir. Engineering and Construction Maryland Transit Administration

Michael Barfoot Sr. Dir., Operations & Regulatory Affairs Railway Assn. of Canada

Andy Byford SVP High-Speed Rail Development Programs Amtrak

Michael Morgan Dir., Rail Construction Program City of Ottawa

Cathy Campbell-Wilson VP Bechtel

Supporting Organizations

Maryam Allahyar Wyrick Dir., Office of Research, Development & Tech. Federal Railroad Administration

Santos IT Dir. Cybersecurity Arch. Competence Center Amtrak

Mike Palmer Dir. Rail Operations & CBTC Parsons

Arturo

COMBAT COLD CLIMATE

Railroads and suppliers work year-round to prepare for winter’s onslaught well before it becomes a problem.

BY CAROLINA WORRELL, SENIOR

EDITOR

Railroads are vulnerable to weather conditions that can slow or cripple operations and the ow of goods and people across large portions of their networks. Recent winters have proved that innovation is needed in critical areas of train operation and track functionality to counter the e ects of sub-zero temperatures that worsen when joined by

high levels of liquid or frozen precipitation. e following railroads and suppliers share how they combat the cold weather season, including use of innovative technologies.

CPKC

At CPKC, signi cant resources are mobilized each year to forecast and plan for winter, and then mitigate the impact to the greatest extent possible while maintaining safety,

wherever winter conditions materialize on the network. CPKC has achieved signi cant winter operating improvements during the past decade since the company successfully adopted and executed the Precision Scheduled Railroading (PSR) operating model, the Class I notes in its latest Winter Contingency Report. Planning begins each summer as the railroad starts analyzing weather data and forecasts for the upcoming winter. CPKC

WINTER PREPAREDNESS

analyzes predictive meteorological modeling to help forecast conditions expected during the upcoming winter, including the type, severity and geographical reach. “Although forecasts are predictions that can never be relied on, they are a critical planning tool that helps CPKC prepare for winter conditions,” the railroad notes.

Once weather models are analyzed, CPKC then develops speci c winter plans for each region, subdivision, rail yard and facility across the network. CPKC strategically places assets and resources (i.e. snow removal equipment and sand) in locations across the network to improve CPKC’s ability to respond quickly to winter weather. CPKC also develops winter contingency plans for Operations employees, Engineering and Mechanical personnel and Operations Centers in Calgary and across the network.

CSX

In preparation for winter operations, CSX’s mechanical team has utilized historical data points to understand the key opportunities to enhance the reliability of its locomotive eet and eliminate out of service events for certain failure modes during winter conditions. is analysis, CSX says, has led to mechanical making speci c engineering modi cations to internal air sources and the associated air routing. is modi cation is being implemented on the high-horsepower locomotive eet.

CSX adds that it continues to focus on

employee safety ahead of, during, and a er any adverse winter weather events to ensure the Class I is prepared to respond to any operational issues. Additionally, CSX says it is ensuring that all necessary equipment is staged and ready to be deployed in the event of a signi cant winter weather event.

“We have tested two new switch heaters in the Bu alo Terminal area that seem very promising,” CSX tells Railway Age. Additionally, the Class I has also purchased more than 200 additional generators to ensure it mitigates the impact to operations in case of widespread power outages. “From an R&D perspective speci cally, we’re also looking at reducing the size of switch heaters while keeping the same level of e ectiveness,” CSX says.

FRAUSCHER SENSOR

TECHNOLOGY USA INC.

“Winter and signaling systems o en don’t mix,” Frauscher tells Railway Age. “Technology dependent on shunting can face many challenges in winter, particularly issues caused by snow, ice, road salt and deteriorated ballast. Frauscher wheel sensors are water and dust proof (IP68 rated) and are not a ected by any of these common winter conditions. is high level of reliability can be depended upon in all situations—from vital applications, such as primary train detection to non-vital applications, such as triggering AEI readers, hotbox detectors and vision systems. Whether the applications are vital or non-vital, the reliable operation of all these systems is crucial to

maintaining smooth operations throughout the winter months.”

Railroads operating in areas that experience winter weather may conduct a “health check” of equipment, rail and ballast to head o potential issues, the company tells Railway Age. “For railroads that utilize technology dependent on shunting for proper operation, careful examination of areas that have experienced issues in the past should be reevaluated. For these problem areas, a ‘spot x’ solution is available with Frauscher wheel sensors and axle counters, since Frauscher’s equipment can be overlaid with the legacy system to alleviate shunt issues in areas where snow, ice, road salt and deteriorated track and ballast cause reliability concerns. Frauscher systems are compatible with all track circuits and solid state interlockings, allowing seamless integration, and an installation process that is quick and does not require large sections of a line to be shut down for commissioning.”

Frauscher now o ers Frauscher Insights, a central data platform for rail operations that can be of particular bene t in the winter. Insights “collects, processes, and enriches train detection data from various sources.”

HOTSTART

Hotstart has a variety of products that are designed speci cally for locomotive idle reduction, the company tells Railway Age. e APU5 product line runs o the onboard locomotive fuel supply to provide the locomotive

Hotstart’s APU5 product line runs off the locomotive fuel supply to provide coolant and oil heat, battery charging, and cab heat.

Many Thermon customers have been purchasing its Hellfire 400, 900 (pictured) and 905 switch heater packages.

Power Drives Inc.’s PowerHouse™ Hybrid saves five to nine gallons of fuel per hour as compared to an idling locomotive.

WINTER PREPAREDNESS

with coolant and oil heat, battery charging, and cab heat without the need for shore power. Additionally, Hotstart supplies shore power systems and battery chargers in numerous con gurations for a variety of applications. “Saving on fuel is not the only bene t of equipping a Hotstart. Our products reduce the number of restarts on locomotives equipped with AESS, therefore limiting engine wear and tear,” the company says. According to the company, several customers have secured local/state/federal funding to equip their locomotive eets with Hotstart’s EPA U.S. SmartWay-veri ed equipment. Government funding, such as the Diesel Emissions Reduction Act (DERA), assists railroads to procure idle reduction technologies that decrease fuel costs, emissions and engine wear. Such programs, allow railroads to install equipment in advance of the winter months and avoid unfavorable fuel costs and emissions.

NEW YORK AIR BRAKE

Knorr Bremse subsidiary New York Air Brake (NYAB) o ers the VV1000-T Oil Free Compressor and the LD-1000 Air Dryer with three-stage ltration system to ensure freight train air brakes perform reliably in all weather conditions. “In the wintertime, there may be less water to compress out of the air, but there’s still enough to do damage if you don’t remove it properly,” says Michael Stroder, Product Line Manager. “And the stakes are higher because of freeze-ups. So, it’s important that all the systems along the line that remove water are operating properly.”

NYAB recently updated the diagnostics for its CCB (Computer Controlled Brake) product line “to identify a failed component faster, get it replaced and get the unit back into service,” reports Vince Guarrera, Senior Product Line Manager. Similar diagnostics for the VV1000-T and LD-1000 are in development and expected to launch “in the near future.” Among the goals: to have the diagnostics guide maintainers through troubleshooting, so that only the correct and necessary repairs are performed.

NYAB also o ers the DB-60 II Control Valve with Brake Cylinder Maintaining (BCM), which in December 2022 earned unconditional approval from the Association of American Railroads. If there is a brake cylinder leakage, the BCM feature will allow for continued air supply. Moore says NYAB is continually improving the valve’s internal components, including the reliability of the rubber seals at lower temperatures, when rubber can contract and become less pliable.

On the R&D side, NYAB has teamed with Nexxiot on the “digitalization” of brakes. With Nexxiot’s battery-powered sensors installed on railcars, remote access to NYAB products will be possible for real-time status and health monitoring.

POWER DRIVES INC.

PDI’s PowerHouse™ Hybrid is a U.S. EPA SmartWay-veri ed locomotive idle reduction technology that heats and circulates engine coolant and oil maintaining a uid temperature above 100 degrees F, thereby allowing the operator to shut down the prime mover.

According to the company, the PowerHouse™ Hybrid, developed in response to customer needs, saves ve to nine gallons of fuel per hour as compared to an idling locomotive. It also eliminates wear and tear on the locomotive engine and reduces noise and harmful emissions. e PowerHouse™ Hybrid can be powered in one of two ways—it can run o the locomotive batteries for up to seven days without starting the engine or it can be plugged into an external 120 VAC power source. When the PowerHouse™ Hybrid is powered by 120 VAC power, the integrated charging system charges the batteries.

According to PDI, one Class I customer entered into a three-year contract to acquire these units on an ongoing basis to equip a signi cant portion of its eet. Another customer installed 50 units, recording fuel savings of more than $1.5 million in one winter season.

RAILS COMPANY

Rails Co. produces a variety of railway switch snow removal devices, from low pressure (LP) and high pressure (RT) gas bar and manifold heaters, which can operate manually or automatically via add-on ignition, to hot air blowers in electric, gas and oil con gurations. e hot air blowers and control panels use common industrial components “to better assure customers the availability of replacement parts.” e company also designs and produces custom tubular electric heater control panels (THR) in AC and DC con gurations, for use with Rails Co tubular electric heaters (TH) and other brands. “Our crib heaters are available with slip hinges for easier installation and removal,” the company tells Railway Age. Rails Co. can also build blowers and control panels to incorporate a customer’s own PLC, Radio or SCADA hardware.

RAILWAY EQUIPMENT COMPANY

RECo products, such as track switch heaters and remote monitoring systems, are designed to “ensure smooth railway operations during harsh weather conditions,” the company tells Railway Age. “With our remote monitoring capabilities, you are able to troubleshoot remotely and know if your units are running as intended to ensure the switches stay clear during winter conditions.”

ReCO says customers “are increasingly seeking advanced monitoring solutions and

RECo products, such as track switch heaters (pictured) and remote monitoring systems, are designed to “ensure smooth railway operations during harsh weather conditions.”

WINTER PREPAREDNESS

energy-e cient products, re ecting a shi toward technology integration and sustainability. ere is also signi cant interest in our new redundant switch heater, which was developed to use both natural gas/propane and electric—the rst redundant system in the industry. ere have been numerous track switch heater and remote monitoring system installations in the past two years, enhancing winter preparedness. We have seen a shi toward our GHAB Concentrator, which can aid in monitoring up to 12 switch heaters in one location and feed this information to the central o ce, providing real-time heater status updates. We’re also focusing on developing more sophisticated monitoring systems and eco-friendly heating solutions to meet evolving customer needs. We are particularly excited about testing our new induction heating system this winter.”

THERMON

ermon’s array of snow-clearing devices are designed to reliably withstand even the harshest winter storms, the company tells

Railway Age. By o ering a variety of options, such as electric elements, hot air blowers and high velocity ambient air blowers, “we ensure that our customers have their selection of high performing products that are appropriate for their applications,” ermon says. “Our SCDs are designed with safety, e ciency and quality in mind to carry our customers through the winter and result in less maintenance, decreased down time for railroads and increased dependability that our equipment will keep their lines running.”

ermon says it recently had a customer install two new Hell re 900 units in Nebraska to prepare for the upcoming winter season. Since then, and throughout the summer, many of the company’s customers have been purchasing its Hell re 400, 900 and 905 packages to get ready for the upcoming fall and winter weather. Additionally, ermon says it has sold a “plethora” of its electric SwitchBlade heaters, new standardized HCP control panels designed for increased exibility and uptime, and Horizontal Air Curtains, as well as HACs for

Hot Box Detectors so customers can “be as prepared as they can be to face the elements.” ermon is working on its next generation of Hell re, with trials expected to take place later this year/early next year. “We are innovating our current design to include updated components, expanded communication capabilities, OLED character display and organized status LEDs, as well as a new forward-thinking design.”

WABTEC

Common problems encountered during winter season occasionally occur within the power consist, says Wabtec, whose Train Analysis Tool remotely collects key parameters from all the locomotives in a consist. Analytics are used to identify the root cause of issues impacting propulsion and braking performance. e results are presented to “Diesel Doctors” at the Wabtec’s Mechanical Help Desk as a “Sense.” Senses help a Diesel Doctor quickly identify the root cause of problems reported by the train crew and provide feedback on how to resolve them.

For example, to accelerate identifying frozen blowdown valves, Wabtec incorporated analytics in the Train Analysis Tool to provide a Sense when it detects a possible frozen unit. Frozen engine blocks and locomotive components are a recurring winter problem for railroads, Wabtec tells Railway Age. Locomotives will occasionally not dump coolant water in below-freezing temperatures due to various failure modes. When this happens, the water expands into ice and can cause catastrophic engine damage. In many cases, railroads can spend more than $1 million per year on freezerelated damages.

Wabtec is launching a patent-pending “new and improved” Max Drain Guru Valve that is signi cantly better performing than legacy designs. According to Wabtec, it also provides much better tamper resistance and has a proprietary T-handle attached to a magnetic ag to provide a clear indication when a valve is disabled. e new valves are available in Standard (DL2.1) and SAE (Magnum) thread sizes and at handle and

dome handle styles.

Other technologies that Wabtec o ers to help customers in winter operations include Advanced Rail Cleaner (ARC) Traction Antilock Braking System (TABS), and Sub-freezing AESS for increased fuel e ciency. Wabtec has been expanding its AESS solutions by developing new summer/winter algorithms to optimize fuel savings, shutdown time, and increase cold weather shutdown availability across customer platforms.

ZTR

“At ZTR, we understand the unique challenges that winter and harsh environmental conditions pose to rail operations,” the company tells Railway Age. “One of our key innovations, KickStart, is designed to specifically address these challenges and ensure reliable locomotive performance even in the most demanding conditions. KickStart’s supercapacitor Starting Assist technology provides “reliable engine starts, battery life extension, reduced downtime and

WINTER PREPAREDNESS

maintenance costs, fuel e ciency and emission reduction and proven performance.”

Notable examples of projects ZTR has undertaken in the past few years to help customers prepare for winter and harsh weather conditions include installation of air dryers to remove moisture from air brake systems. is, the company says, prevents freezing and ensures reliable brake performance in cold weather, critical for maintaining safety and operational e ciency.

In another project, ZTR says it ensured that locomotive headlamps were equipped with adequate heating to prevent snow and ice buildup. is measure, the company says, “is vital for maintaining visibility and safety during winter operations, reducing the risk of accidents caused by impaired vision.”

Additionally, ZTR has installed devices to keep magnet valves warm, preventing them from freezing. “ is ensures consistent performance of the magnet valves in harsh weather conditions, contributing to overall locomotive reliability and e ciency,” the company says.

Railway Equipment Co excels in manufacturing robust switch heaters, ensuring operational reliability and safety during harsh winter conditions. Our Sno-Net technology allows railroads to remotely monitor these heaters, providing maintenance teams with a crucial advantage during cold winter days and nights.

Chicago Union Station is a busy place. Trains come and go throughout the day, from early morning until a er midnight. Most of those trains are operated (directly or under contract) by Metra, Chicagoland’s regional rail agency that serves suburban towns in Illinois, but not in Indiana. Amtrak controls the station and has an operating presence there, but its skeletal network of long-distance trains (seven per day plus one triweekly train to and from the Windy City) and a Midwest corridor network that has shown little

growth over the past half-century account for only a small fraction of station use.

In this article, I will look at Amtrak’s services in the region when it was founded and today, at e orts to expand services, and at a major reason why the region’s passenger train network is not as comprehensive as riders and their advocates had hoped. (Hint: As usual, it’s about politics).

In a half-century of riding Amtrak trains (as well as some pre-Amtrak riding), I have watched the Midwest network grow and retrench, while observing plans that did not come to fruition, and sometimes reporting about them. I have

visited every stop on Amtrak’s Midwest routes, except Milwaukee Airport and Sturdevant, Wis., along with some places in Michigan where logistics render a visit impossible, or nearly so.

CORRIDORS DENIED

On May 1, 1971, Amtrak began operations, and two-thirds of the trains that had le their points of origin the day before had done so for the last time. What appeared on the map to be a somewhat-comprehensive network of corridor-length routes in the region and was

New Amtrak Siemens Venture cars at Chicago Union Station.

still does not allow customers to choose from di erent departure times. So, running two round trips per day would not elevate a line to “corridor” status. ere must be at least three daily departures in each direction, and they must be su ciently far apart to give riders a clear choice of departure times throughout the day. By that de nition, Amtrak operates four corridors from Chicago: to Milwaukee, Pontiac through Detroit, St. Louis, and Carbondale, the latter having lost its third daily round trip from time to time.

BUILDING THE “NETWORK”

HOPES UNFULFILLED NETWORK OF

BY DAVID PETER ALAN, CONTRIBUTING EDITOR

actually a hodge-podge of trains that happened to survive the discontinuances of the previous decade, was swept away. ere were few survivors. Milwaukee service remained at four round trips. Detroit service went from three to two daily round trips, as did the historic Alton route to and from St. Louis. e Illinois Central had run six trains each way between Chicago and Carbondale, of which only two survived. Elsewhere in the region, there was one daily train between St. Louis and Kansas City, an extension of the National Limited between New York and St. Louis, which was discontinued in

1979. ere was also a single daily train to Indianapolis and Cincinnati, which is now the triweekly Cardinal. e Floridian ran to Florida south of Indianapolis until 1979. Other longdistance trains ran from Chicago, and still do.

For this article, I will de ne a “corridor” in a practical sense: in terms of the exibility o ered to potential riders through a choice of departure times. A route with one daily departure in each direction is not a corridor. Two trains that allow riders at intermediate stops one daily departure toward each endpoint is an improvement over the single round trip, but

ere are more Amtrak trains in the Midwest than there were a half-century ago, and almost all the improvements occurred in Illinois. e Prairie State experimented with routes to places like Peoria and Decatur, but they did not last long. e state added the Illinois Zephyr to Quincy, and now runs two trains on that line, although the Quincy station is located almost ve miles from the center of town and its riverfront. In 2006, the state increased service on the line to Carbondale and the Lincoln Service to St. Louis. On the former line, a second train to Carbondale was added, with the City of New Orleans also on the route. On the latter line, the number of trains to and from St. Louis went from two to four, plus the Texas Eagle. at is a marked improvement, although there is still a long midday service gap. It was at that time that a second Quincy train was added, allowing day trips from Chicago to its stops.

Because those trains are state-supported, as are other trains in the region, they are subject to state politics, including politically mandated budget pressure. When the COVID-19 pandemic was at its worst and every long-distance train that was available to non-motorists and motorists alike had been reduced to tri-weekly schedules, Midwest trains su ered, too. During that time, only one daily round trip on each route was still running, in addition to a tri-weekly long-distance train, if one happened to use that stretch of rail as a segment of its longer route. at also happened to the Wolverine Corridor in Michigan and the Missouri trains between St. Louis and Kansas City. Since that time, service on those routes has returned to pre-COVID levels.

Ridership is strong, too, according to Amtrak Chicago spokesman Marc Magliari. He told Railway Age: “Amtrak and our state partners are pleased with the Amtrak Midwest network’s ridership recovery in

PASSENGER RAIL FOCUS: AMTRAK MIDWEST

the post-COVID-19 period. ese trains are contributing to our projected new record nationally in this Amtrak scal year.”

One recent service enhancement is the addition of the Borealis, a second frequency between Chicago and St. Paul that started service May 21, 2024. While any service enhancement is better than the previous situation with less service, that addition could have done better when it comes to providing riders with a choice of departure times when combined with that segment of the Empire Builder schedule. e two trains leave each endpoint only about three hours apart, and if Train 8 is su ciently late, the two trains can leave St. Paul at about the same time. A di erent schedule, with the Borealis leaving Chicago early in the morning, turning at St. Paul in mid-a ernoon and arriving back at Chicago in the late evening, would give riders a clear choice of departure times, and such a schedule could run with a single trainset covering both directions.

Current reports indicate that the new train is very popular, but it’s too early to determine the reason for this. It could be that just having another train sends an encouraging signal to potential riders that Amtrak and the states care about improving service, a variation of the Hawthorne E ect. If that’s the case, the mere act of adding trains will spur increased ridership and revenue.

SOME DISAPPOINTMENTS

Whatever hopes that advocates for riders have harbored over the years for a comprehensive region-wide network of passenger trains has never come to fruition. During the early days of the Obama Administration, the feds o ered grants for “high-speed rail” projects to the states, even though the trains would run no faster than 110 mph. Gov. John Kasich in Ohio

turned down the grant to build the “3C+D” corridor that would have served Cleveland, Columbus, Dayton and Cincinnati. Scott Walker, his counterpart in Wisconsin, rejected funding that would have started service to Madison, with a connection providing an additional route from there to St. Paul, Minn. At least Walker was willing to work with Illinois o cials to keep the Milwaukee service going.