AILWAY G E SERVING THE RAILWAY INDUSTRY SINCE 1856 WWW.RAILWAYAGE.COM DECEMBER 2022 NOTCH 8 TO THE GOLDEN RUN Making the Right Decision at the Right Time TIMEOUT FOR TECH Enduring—Yet Not Everlasting— Bridges PROCEED WITH CAUTION 2023 OUTLOOK

We live in a world of uncertainties and scarcities. But there’s no shortage at FreightCar America when it comes to customer dedication. You’re not asked to “take a number” or fit into our schedule. Instead, we listen to you, applying our century of expertise to design the ultimate railcar and relationship. We believe customers deserve our best. That’s why we serve you with an “A-Team” that includes leaders of engineering, manufacturing and commercial teams all focused on you. Uncompromised dedication is purpose-built in every FreightCar America railcar and customer relationship.

For more information on FreightCar America, scan the QR code.

FREIGHTCARAMERICA.COM

Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 223, No. 12. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the pub lisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2022 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning

to Subscription Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740;

+1 (847) 291-4816.

December 2022 // Railway Age 1 railwayage.com

Printed at Cummings Printing,

(print);

FEATURES 10 16 21 24 Rails Beware 2023 Freight Rail Outlook Tech Focus – M/W Grade Crossing Surfaces Notch 8 to the Golden Run Right Decisions, Right Time Timeout For Tech Twelfth in a Series COMMENTARY 2 8 9 32 From the Editor Financial Edge Watching Washington ASLRRA Perspective DEPARTMENTS 4 6 7 29 30 30 31 Industry Indicators Industry Outlook Market People Professional Directory Classifieds Advertising Index COVER PHOTO Bruce Kelly DECEMBER 2022 16 AILWAY GE Omega Industries Inc.

subscriptions

FAX

Hooksett, N.H. ISSN 0033-8826

2161-511X (digital).

Super Chief Memories

ost of you are aware that I have several extra-curricular interests—motors ports, performance cars (classic and modern), jazz music. Well, I con fess that my love of railroading involves much more than my day job reporting on 1/1 scale trains. I’m into the small stuff as well; these days it’s 1/48th scale, O gauge. Surprised?

Over the years, I’ve built and operated HO (1/87th) and N (1/160th) gauge layouts and rolling stock, first on my own, later with my sons. I came to Railway Age in 1992 indirectly because of my involvement with the North Jersey Coast Model Railroad Club in Elberon, N.J. Long story short, one of the club’s found ers, Lou Cooke of Rumson, N.J., had been an officer of the Jersey Shore Commuters’ Club (JSCC), which leased a private car that operated on what is now NJ Transit’s North Jersey Coast Line. Lou had told me that the club, established in 1933 when the Pennsylvania Railroad ran the trains, had survived through the Penn Central and Conrail years, and was still running on NJT. In 1991, I tracked down the car and met long-time Railway Age Publisher Robert G.

MLewis. A year later, he hired me.

I was the JSCC’s last president, having the sad task of shutting it down in 2013. But that’s another story, for another column.

If you read my September column, you know that I trace my railway heritage to a few of my Italian ancestors, and that my first exposure to trains was riding PCC cars on the Newark City Subway with my dad, the late Dr. William J. Vantuono (1927-1996). But there’s another person I need to acknowledge: my uncle, Alberto Vaccaro (1943-2001), my mom’s younger brother. It was he who assem bled the Lionel electric train set my parents gave me for Christmas in 1963. (I still have those trains—and they still run well.)

“Uncle Albert” had Lionel trains in his basement, and he would frequently run them for me. My favorite was the Santa Fe Super Chief set with twin EMD F units in the famous “Warbonnet” silver and red with yellow trim scheme first used in 1937. I was fascinated with how the pilots (unlike the full-size version) would swing out on sharp curves, to keep the couplers centered.

Maybe because the image of my uncle’s Lionel Super Chief speeding through 027 curves was engraved in my childhood mind, or maybe because EMD’s F and E units in that scheme are simply beautiful, the Santa Fe’s premier passenger train remains my favorite. The example you see at left is part of a newer Lionel A-B set that hauls eight streamliners on my basement layout. It’s a beauty!

Railroads of all sizes will always be associ ated with the Holiday Season. It’s a grand tradition. From all of us at Railway Age, Happy Holidays, and a safe, healthy, prosper ous and peaceful 2023.

WILLIAM C. VANTUONO Editor-in-Chief

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service. Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform.

Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) +1 (402) 346-4740, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

POSTMASTER: Send changes of address to: Railway Age, PO Box 239, Lincolnshire, IL 60069-0239, USA.

Photocopy rights: Where necessary, permission is granted by the copyright owner for the libraries and others registered with the Copyright Clearance Center (CCC) to photocopy articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying for other than personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director. Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safe keeping or return of such material.

Member of:

AILWAY GE

SUBSCRIPTIONS: 1 (402) 346-4740

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO

Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER

Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

HEATHER ERVIN Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing

2 Railway Age // December 2022 railwayage.com FROM THE EDITOR

Art

Graphic Designer: Hillary

Corporate Production Director:

Production Director: Eduardo

Marketing Director: Erica Hayes Conference Director: Michelle

Circulation Director: Joann Binz INTERNATIONAL OFFICES 46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945 International Editors Kevin Smith ks@railjournal.co.uk David Burroughs dburroughs@railjournal.co.uk David Briginshaw db@railjournal.co.uk Robert Preston rp@railjournal.co.uk Simon Artymiuk sa@railjournal.com CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 1 (402) 346-4740 Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

Editors David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Peter Diekmeyer, Alfred E. Fazio, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason H. Seidl, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Director: Nicole D’antona

Coleman

Mary Conyers

Castaner

Zolkos

Move with purpose

When rail is essential to your business, Railserve keeps you on the right track. As the leading provider of On-Site Rail Services in North America, we safely and efficiently move railcars and provide material handling services within industrial, manufacturing, and production plants. Partner with Railserve for simplified rail solutions.

Railserve is 1 of 12 companies that make up the Rail & Leasing Group within Marmon Holdings, Inc. Together we provide custom and comprehensive industrial rail solutions.

railserve.biz

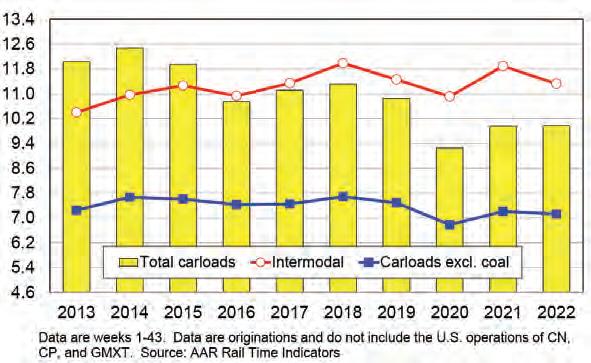

‘OCTOBER IS USUALLY A

TOP MONTH FOR CARLOADS,

AND

THAT’S THE CASE IN

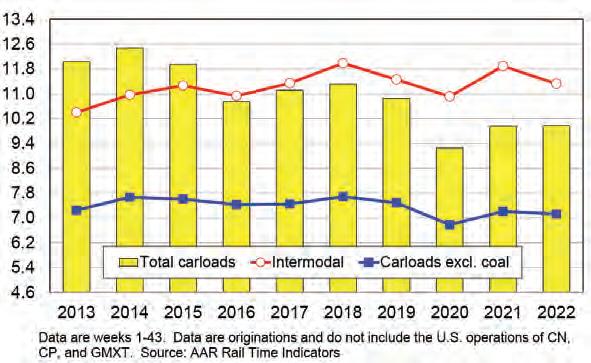

2022’ “Total originated U.S. carloads averaged 238,019 per week in October 2022, the most since May 2021 and up 0.5% over October 2021,” the Association of American Railroads reported last month. “In October, seven of the 20 carload categories we track had gains. In 2022 through October, total carloads were up 0.1% over the same period in 2021; up 7.8% over 2020; and down 8.0% from 2019. Coal led the way in October, with carloads up 5 .8% over October 2021. Other commodities with carload strength in October included crushed stone and gravel; motor vehicles and parts; and petroleum products. Commodities doing less well in October included chemicals; primary metal products; and paper. Carloads of grain averaged 24,745 per week in October 2022, the most in a year. Excluding coal, carloads fell 1.4% in October and were down 1.2% year to date. U.S. intermodal volume fell 1.4% in October 2021, its 14th decline in the past 15 months. Through October, intermodal in 2022 was down 4.8% from 2021, up 3.8% over 2020, and down 1.2% from 2019.”

Grain 98,97899,844-0.9% Farm Products excl. Grain 3,2793,1763.2% Grain Mill Products 37,77937,903-0.3% Food Products 27,05326,7271.2%

Chemicals 124,160130,355-4.8%

Petroleum & Petroleum Products40,39738,3905.2%

Coal 272,776257,8395.8%

Primary Forest Products 4,7454,23112.1%

Lumber & Wood Products 12,17913,809-11.8%

Pulp & Paper Products 18,58021,975-15.4%

Metallic Ores 23,07724,760-6.8%

Coke 13,723 14,347 -4.3%

Primary Metal Products 30,52735,172-13.2%

Iron & Steel Scrap 16,46617,299-4.8%

Motor Vehicles & Parts 58,46752,46911.4%

Crushed Stone, Sand & Gravel 89,06980,45410.7%

Nonmetallic Minerals 12,10814,097-14.1%

Stone, Clay & Glass Products 32,36233,111-2.3% Waste & Nonferrous Scrap 15,47515,912-2.7%

All Other Carloads 20,87425,083-16.8%

TOTAL U.S. CARLOADS 952,074 946,953 0.5%

CANADIAN RAILROADS

TOTAL CANADIAN CARLOADS 331,015 315,4364.9%

COMBINED U.S./CANADA RR 1,283,089 1,262,389 1.6%

4 Railway Age // December 2022 railwayage.com

Indicators

Industry

Source: Rail Time Indicators, Association of American Railroads Intermodal MAJOR U.S. RAILROADS BY COMMODITY OCT. ’22OCT. ’21% CHANGE Trailers 57,32881,573-29.7% Containers 1,005,094 995,944 0.9% TOTAL UNITS 1,062,4221,077,517 -1.4% CANADIAN RAILROADS Trailers 0 0 Containers 282,638280,3780.8% TOTAL UNITS 282,638280,3780.8% COMBINED U.S./CANADA RR Trailers 57,32881,573-29.7% Containers 1,287,732 1,276,322 0.9% TOTAL COMBINED UNITS 1,345,060 1,357,895 -0.9% FOUR WEEKS ENDING OCTOBER 29, 2022 Railroad employment, Class I linehaul carriers, OCTOBER 2022 (% change from OCTOBER 2021) Transportation (train and engine) 49,569

Executives, Officials and Staff Assistants

Professional and Administrative

Maintenance-of-Way and Structures

Maintenance of Equipment and Stores

Transportation (other than train & engine)

Surface Transportation Board TOTAL EMPLOYEES: 118,208 % CHANGE

OCTOBER

ORIGINATED CARLOADS

U.S. RAILROADS BY COMMODITY

’22OCT. ’21%

(+5.47%)

7,954 (+9.97%)

9,888 (+1.45%)

28,442 (+0.67%)

17,639 (+2.11%)

4,716 (+0.90%) Source:

FROM

2021: +3.53% TRAFFIC

MAJOR

OCT.

CHANGE

WEEKS ENDING OCTOBER 29, 2022

FOUR

December 2022 // Railway Age 5 railwayage.com TOTAL U.S. Carloads and intermodal units, 2013-2022 (in millions, year-to-date through OCTOBER 2022, SIX-WEEK MOVING AVERAGE) TOTAL U.S./Canadian CARLOADS, october 2022 VS. october 2021 1,283,0891,262,389 october 2022 oct0ber 2021 Copyright © 2022 All rights reserved. Short Line And Regional Traffic Index CARLOADS BY COMMODITY ORIGINATED OCT. ’22 ORIGINATED OCT. ’21 % CHANGE Chemicals 49,930

Coal

Crushed Stone, Sand & Gravel

Food & Kindred Products

Grain

Grain Mill Products

Lumber & Wood Products

Metallic Ores

Metals & Products

Motor Vehicles & Equipment

Nonmetallic Minerals

Petroleum Products

Pulp, Paper & Allied Products

Stone, Clay & Glass Products

Trailers / Containers

Waste & Scrap Materials

All Other Carloads

AILWAY GE Visit http: //bi t.ly/rai l jobs To place a job posting, contact: Jerome Marullo 732-887-5562 jmarullo@sbpub.com ARE YOU A RAILROAD OR SUPPLIER SEARCHING FOR JOB CANDIDATES? RA_JobBoard_1/3Vertical.indd 1 7/27/21 3:02 PM

50,811-1.7%

21,964 14,18754.8%

30,075 23,59727.5%

11,934 11,324 5.4%

32,316 31,555 2.4%

7,503 7,443 0.8%

9,064 9,475-4.3%

2,989 2,946 1.5%

18,344 17,646 4.0%

10,009 8,15222.8%

2,247 2,497 -10.0%

2,235 1,84021.5%

16,579 17,444-5.0%

15,979 15,208 5.1%

44,878 51,727-13.2%

11,518 12,102-4.8%

73,726 72,500 1.7%

Industry Outlook

parties acknowledged the assistance of the mediators in their latest document, saying they “greatly appreciate the diligent efforts of the Board-appointed mediators over the past several months to facilitate this settlement.” While they expressed their expectation that certain undisclosed conditions required for the settlement would be met during the coming months, they concluded by saying that they would file a joint status report before June 30, 2023, if the terms of the settlement had not been fulfilled by then.

Gulf Coast Agreement Reached

Slightly more than one week before the final hearing scheduled before the Surface Transportation Board (STB) concerning proposed Amtrak service between New Orleans and Mobile, the parties apparently settled their differences.

Amtrak, CSX, Norfolk Southern (NS) and the Port of Mobile late last month filed a Joint Motion (Docket No. FD-36496) to hold the Nov. 30 hearing, and a Dec. 7 meet ing at which the STB would render its decision, in abeyance, saying, “The Parties have agreed to settlement terms that, when fully implemented, will lead to a complete resolution of this proceeding.”

The Board approved that request on Nov. 22, issuing a decision enabling the parties “to effectuate the conditions of the settlement agreement.” STB’s unanimous decision is classified as Document No. 51507, which recounts procedural history.

“The Board appreciates the successful efforts of Amtrak, CSX, NS, and the Port to settle this important case,” said Chair Marty Oberman. “I particularly want to acknowl edge the significant progress that has been made in achieving a settlement under [chief executives Joe Hinrichs, above, right, and Alan Shaw, above, left, with Amtrak chief executive Stephen Gardner] the new leader ship of CSX and NS [respectively], which I expect brought a fresh constructive approach to resolving the matter. The Board has stated many times our strong preference for private parties to operate in good faith and to amicably resolve disputes on their own

whenever possible to obviate the need for Board action. The settlement of this case will hasten the return of passenger rail opera tions in the Gulf. This will result in a substantial public benefit by providing a public transportation option for Gulf Coast residents and visitors alike and will have a very positive impact on the economy of the region. I look forward to the parties inform ing us of the specific infrastructure improvements that will be made to the rail network as a result of the settlement. Finally, I would like to extend the Board’s thanks to the mediators in this case. Board staff worked with mediators from the Federal Mediation and Conciliation Service to medi ate this case, and we are grateful for all their hard work.”

The dispute was brought before the Board in 2021. Since then, there had been a public hearing in February and an 11-day eviden tiary hearing (essentially a trial, with witnesses) last spring. Potential host rail roads CSX and NS vigorously opposed Amtrak’s petition throughout the proceed ing. The Alabama State Port Authority, which operates the Port of Mobile and its rail division, the Terminal Railway Alabama State Docks (TASD), later received permis sion from the Board to intervene on the side of the potential host railroads.

The Board ordered mediation in the case after the portion of the trial in May, and the mediation efforts continued through the summer, even though the parties filed briefs in July that essentially reaffirmed the argu ments that they had made previously. The

The original document contained repre sentations from the parties, but they were redacted from the public version, so the specifics are currently undisclosed. “We have collectively reached an agreement to support passenger and freight service in the Gulf Coast Corridor,” the parties said in a joint statement. “Due to the confidential nature of the settlement agreement, the parties are not able to provide further comment at this time.” Still, the announcement that a settle ment has been reached has brought an air of hopeful expectancy to those concerned.

Until the settlement was announced, it appeared that the matter would remain contentious. Both sides argued their cases strongly, even in July, while mediation was ongoing. The STB had scheduled the final hearing for Nov. 17 and 18, postponing it two weeks (as requested in Document 305618, filed Nov.10), in the hope that the mediation process could settle the matter.

The Gulf Coast case has national implica tions, as it tested a provision in Amtrak’s enabling legislation, the Rail Passenger Service Act of 1970, that requires freight railroads to provide access to Amtrak trains in exchange for being relieved of their common-carrier obligations to operate passenger service. The future of Amtrak’s entire ConnectsUS plan, with proposals to open many new lines on host freight rail roads by 2035, could ride on this case.

The major contested issues were how much infrastructure must be built along the route to accommodate the new passenger trains as well as existing freight service, and at what cost, and where a station will be located in Mobile. Until additional informa tion about the settlement is released, the specter of a multi-year wait before passenger trains again call at Mobile and four towns along the Mississippi Gulf Coast seems to be evaporating. – David Peter Alan

6 Railway Age // December 2022 railwayage.com

Norfolk Southern; Amtrak; CSX

Toronto’s Ontario Line Advances

The Connect 6ix consortium has landed a C$9 billion contract for the Ontario Line Rolling Stock, Systems, Operations and Maintenance (RSSOM) package. Connect 6ix will design, build, finance, operate and maintain the RSSOM package for a 30-year term. The contract includes C$2.3 billion for capital costs and C$6.7 billion for short-term construction financing and transaction costs; train costs; and 30-year operations and maintenance, lifecycle, and long-term financing. Connect 6ix comprises Plenary Americas, Hitachi Rail, Webuild Group (Salini Impreglio Canada Holding Inc.), Transdev Canada Inc., IBI Group Professional Services (Canada) Inc., Astaldi Canada Design & Construction Inc., Salini Impreglio Civil Works Inc., NGE Contracting Inc., National Bank Financial Inc. and Sumitomo Mitsui Banking Corporation. The 9.7-mile Ontario Line is a planned TTC rapid transit line linking the Ontario Science Center and Exhibition/Ontario Place.

WORLDWIDE

SOLIDARITY TRANSPORT HUB (CPK), the company advancing forward Poland’s largest infrastructure program centered on a new airport between Warsaw and Łódz, has signed three design contracts worth $66.5 million for the first route of a 1,240-mile network of mostly high-speed lines being built as part of the project. The first route runs for 87 miles from Warsaw to Łódz via the new airport, where preparatory construction work is due to start next year,. It will be Poland’s first high-speed line.

NORTH AMERICA

AMTRAK is moving forward on a $1.5 billion replacement of the 116-year-old Susquehanna River Rail Bridge to “improve railroad efficiency on the Northeast Corridor (NEC).” Two new fixed-span double-track bridges will replace the current double-track Susquehanna River Rail Bridge—the longest moveable bridge on the NEC—used by Amtrak, Maryland Area Regional Commuter (MARC) rail and Norfolk Southern (NS) to support more than 110 passenger and freight trains daily. Overhead power, signal, safety and security systems will also be modernized as part of the replacement project. “The bridge was built by the Pennsylvania Railroad at the turn of the 20th century, and while it was well-constructed and remains safe, it is a significant bottleneck on the NEC,” said Amtrak Executive Vice President Capital Delivery Laura Mason. “Once complete, both new bridges will reduce trip time and improve reliability for passenger and freight trains that rely on this critical connection.” The existing bridge has a 90-mph speed restriction, result ing in “capacity and reliability constraints.” Maximum operating speeds on this section of the NEC typically range from 110-135 mph. The new two-track fixed-span bridges that

will replace the existing double-track move able bridge, along with five miles of additional track realignment and construction, will address this issue. In the coming months, Amtrak plans to issue several RFPs (requests for proposals) for contracts that, with the FRA and the Maryland Department of Trans portation/Maryland Transit Administration (MDOT/MTA), it plans to award in 2023. The contracts include a Construction Manager at Risk (CMAR) contract for bridge construc tion, and a Design-Bid-Build (DBB) contract for enabling works. MDOT/MTA, as a funding partner for the project, has commit ted $3 million toward a recently awarded design grant. Amtrak says it and MDOT/MTA are “in discussions about jointly pursuing additional grant funding for the cost of con struction under the Federal State Partnership Program.” The Susquehanna River Rail Bridge was identified on the FRA’s recently released NEC Project Inventory list and, according to Amtrak, is “one of several major infrastruc ture projects [our] newest department, Capital Delivery, is advancing.” Earlier this year, procurement launches were announced for replacement of the B&P Tunnel in Mary land and the Connecticut River Bridge.

December 2022 // Railway Age 7 railwayage.com Market

Connect6ix

What a Difference a Day Makes

The editorial staff at Railway Age follows the “old school” code of the postman emblazoned on New York’s City General Post Office. “Neither snow nor rain …” (you know the rest) keeps the RA team delivering the goods month in and month out.

The postman’s code originates in the writings of Herodotus in his description of an ancient Persian courier service (where let’s face it, there wasn’t much snow about which to be concerned. There wasn’t much electricity either, so maybe the gloom of night was a more relevant complement). Were one to read the original Herodo tus, one might find him as the original advocate of the “next man up” strategy of professional sports teams that is frequently advocated today.

One must inevitably wonder what Herodotus would make of the situation between labor and the railroads as North American rail sits on a generational preci pice of not “delivering the goods” due to the impending strike.

It feels like a strike, backed immedi ately by a return-to-work order from the legislative branch (enforcing the Railway Labor Act), is inevitable for the first time in 31 years! But the cost in lost profitability, fluidity and efficiency is enormous.

What makes this all the more frustrat ing is that what seems to be the biggest of the remaining outstanding issues is provid ing more “emergency” paid sick days to workers. This issue was left behind by the Presidential Emergency Board (PEB), even though it was requested by the unions. The PEB excuse? The unions had never asked for this in prior contract negotiations.

#headscratcher

Workers in the field generally cannot “work from home.” This is the crux of the issue. More paid sick days require more workers and more expense, and can impact operations and service. All parties in the railway supply chain, customers and employees, understand why the economics of this issue matters.

The railroads have attempted to redirect the conversation to being about the largest

short-term increase in compensation over the changing lifestyle of the American worker. The raise is important, the paid sick days are important, the opportunity to handle family or personal emergencies is important. (“Next man up?” Ha! Try, “Get back to work”!)

Unfortunately for the unions, consumer sentiment is generally unkind. While the other unions won’t cross the picket line, union solidarity is not a priority in people’s lives—less so when it impacts their pocket book and weakens an already fragile supply chain. Supply chains stressed by low water levels in the Mississippi may feel additional economic strain. That’s one reason why a quick turnaround for the go-back-to-work order matters.

Many readers will see this article before the final strike decision, and there is plenty of time for change, but expectations are high for the message to be delivered to rail road management (who has, one would guess, more than eight days of paid sick leave per year).

It’s your recession. Own it.

Generally, opinions about the likeli hood of a recession in the U.S. range from absolute certainty to 50/50. It seems better than Europe, where the odds are even more likely. A recession will likely bring job losses, which will mean a weakening of consumer demand and a theoretical weak ening of railcar loadings in 2023.

It could also lead to the furloughing of railway workers (Surprise! That was another big strike-related issue).

Economic trepidation makes consumers of rail assets more hesitant to place orders for new railcars, even when the replacement cycle has been exceeding the build rate. Based on 3Q22 ARCI numbers, quarterly new car orders were about 10,000 units. (Don’t be bamboozled by the 25,000 rail cars listed in the ARCI data; 15,000 of those cars are for a GATX order announced in October, and they will be delivered between 2023 and 2028.)

That is the lowest quarter since 3Q21. It’s unfortunate news for an industry in need of some good news. As reported in

economic

last month’s Financial Desk Book, the criti cal mix of interest rate increases and low service performance from the railroads has led to continued increases in demand for existing railcars. The threat of a recession, by weakening the order book, might have the added effect of lengthening current high lease rates and low railcar inventory.

These same concerns can be made worse with consequential and collateral strikerelated reverberations. A quick resolution would be the right circumstance to close out an issue that has been dominating the news cycle for some time.

Happy Holidays to readers of Railway Age and “Financial Edge.” A peaceful, safe and joyful end of 2022, and best wishes for a successful 2023.

Got questions? Set them free at dnahass@ railfin.com. But please save them until 2023!

DAVID NAHASS President

Financial Edge 8 Railway Age // December 2022 railwayage.com

Railroad Financial Corp.

trepidation makes consumers of rail assets more hesitant to place orders for new railcars.”

Will Bureaucrats Invade the C-Suite?

What is going on with Class I railroad labor relations and customer service?

In negotiating amend ments to national labor agreements, carri ers handed their unions a public relations victory by steadfastly resisting a request for paid sick leave. The flimsy defense was that the unionized workforce already has paid vacation and personal leave days, even though such absences require advance permission, while illness arrives randomly. Harsh railroad attendance policies fare no better in the public’s eye than those Elon Musk sought at Twitter.

Separately, the Big Four—BNSF, CSX, Norfolk Southern (NS) and Union Pacific (UP)—are twisting the tail of the Surface Transportation Board (STB) with such persistently egregious customer service failures as to run a high-probability risk of regulators rolling back economic freedoms essential to long-term revenue adequacy (see cover story, p. 10).

Although railroads brag of pivoting to growth, rail market share has steadily eroded. Increasingly, unflattering media reporting focuses on alleged botched imple mentation of Precision Scheduled Rail roading (PSR); STB’s inquiry whether a surge in UP embargoes is personification of PSR problems; rising rail freight rates; and a showering of cash on shareholders by the Big Four (BNSF indirectly, to Berk shire Hathaway shareholders) as extracted from motive power and freight car moth balling, employee layoffs and reductions in service quality and quantity, said to cause rail-dependent businesses to plead for STB emergency service orders.

STB Chairperson Martin J. Oberman speaks of a “Class I service meltdown” largely born out of imprudent headcount reductions. Sounding a tad like self-proclaimed Demo cratic socialist Sen. Bernie Sanders (I-Vt.), Oberman cites management’s obsession with lower operating ratios and duopolies that “cannot be expected to serve the best inter ests of the economy and the public as distin guished from serving solely the profit interests of their owners.” The STB’s role, he says, is “to ensure that the public interest is protected.”

Oberman hands a pass to smaller Class I railroads CN, Canadian Pacific and Kansas City Southern, saying they have “not presented anywhere near” the problems alleged of the Big Four.

Association of American Railroads Presi dent Ian Jefferies told Congress, “Railroads recognize that their service over the past year has not been at a level their custom ers deserve and expect.” Not to be ignored as a cause is a global pandemic, ubiqui tous worker shortages affecting all indus tries, and a fiduciary responsibility of rail management to “right-size” as economic conditions, such as a looming recession, dictate. Yet what the STB factually and impartially concludes is what matters.

To justify a spring 2022 public hearing (“Urgent Issues in Freight Rail Service”), the STB cited “inconsistent and unreliable rail service, unfilled car orders, delays in transportation for carload and bulk traffic, increased origin dwell time for released unit trains, missed switches and ineffective customer service assistance.”

Nearly half the American Chemistry Council’s members still report rail service failures, with 60% saying their rail freight rates increased. A survey by consultancy Oliver Wyman revealed an inability of rail roads to provide information on freight location or reasons for transit delay.

Comes most recently the Freight Rail Customer Alliance (FRCA) and National Coal Transportation Association (NCTA), representing some 3,500 electric utility, chemical and alternative fuel companies,

many of which have limited or no effective transportation alternatives to rail. They say rail service failures have burdened 38% of their members with at least $20 million each in additional expenses.

The FRCA and NCTA calculated a “metric of unmet demand,” saying that “allowing railroads to profit from their service inadequacies constitutes bad public policy and a perversion of the competitive market principles that the railroads purport to espouse.”

Coal shippers say that after investing in their own railcars—“often at the rail carri ers’ direction”—they are prevented by rail roads from utilizing those cars, stranding investment and creating “additional shipper incurred costs for storing the railcars.”

How, and how soon, offending railroads recalibrate and restore a level of service minimally acceptable to regulators and shippers will determine how far the STB extends its regulatory reach. Third-party involvement—as a response to deep and festering stakeholder frustrations—is never economically most efficient and carries unintended consequences. The thought of bureaucrats occupying C-suites is quite unspeakable.

FRANK N. WILNER Capitol Hill Contributing Editor

December 2022 // Railway Age 9 railwayage.com

Watching Washington

How, and how soon, railroads recalibrate and restore a level of service minimally acceptable to regulators and shippers will determine how far the STB extends its regulatory reach.”

RAILS BEWARE

BY FRANK N. WILNER, CAPITOL HILL CONTRIBUTING EDITOR

So it was 1,000 centuries ago or longer that the first trans portation-rate-and-service kickabout originated—a haggling over the barter to entice one primitive human to carry the belongings of another along a trail.

One might look skyward, ask Alexa, consult a Ouija board, interrogate a cab driver, or enquire of a bartender and find themselves no closer to defining equitable rates of exchange or minimum service standards than our forebearers.

Modern humans sought to bridge the divide between liberty and leviathan through economic regulation—some times more of it, sometimes less—but no matter the direction, it begat only judicial appeals and more legislative tinkering. The notion (aside from sports) of what is “fair” or “out of bounds” is, say shipper attorneys Michael F. McBride and Robert D. Rosen berg, “the quintessential challenge.”

Expect in 2023 and extending into 2024 STB actions affecting railroad economic affairs by probably the most active and intense crop of rail regulators in the 135-year history of the Surface Trans portation Board (STB) and its Interstate Commerce Commission (ICC) predeces sor. The actions are being underlaid with the product of fact-seeking public hear ings, extensive stakeholder testimony, data collection and considerable Boardmember travel to eyeball sources of railshipper conflict.

Guiding—through control of the docket—the five-member STB is 77-yearold President Biden-designated Chairper son Martin J. Oberman, seeking a fourth public legacy. He already is celebrated as a Chicago Democratic alderman who bucked and then survived, through re-election, the Democratic political machine. Earlier, as general counsel to the Illinois Racing Commission, and later as chairperson of commuter rail system Chicago Metra, Oberman earned plaudits for purging improper conduct.

His current quest is to level the playing field perceived as favoring railroads in their dealings with shippers—especially those lacking effective transportation alternatives (so called “captives”).

The number of shipper grievances resolved depends, of course, on the

mutually exclusive adjectives, “intend ing” and “succeeding,” as outcomes first will turn on Oberman having a concur ring majority; then on surviving review by a judiciary increasingly distrustful of regulatory agency interpretation of legis lative intent.

Under Oberman’s tutelage, the STB has documented subpar rail service as a precursor to instituting—perhaps as early as 2024—minimum customer-service standards that Oberman wants forged with “strong jaws and sharper teeth.” Railroad market power also is an STB concern— more so since release of a Board rate study showing inflation-adjusted rail rates rising between 2004 and 2019.

COMPETITIVE ACCESS

As for the current STB docket, pending is a proposed rule establishing a process for shippers to obtain two-railroad competi tion at sole-served shipper facilities.

This Reciprocal Switching remedy requires, under certain circumstances, that a railroad with sole physical access to a shipper facility, switch, for a regulated fee, freight cars to or from that facility on behalf of a nearby second railroad lacking physical access. With a prospect of tworailroad competition for the line-haul, such access is anticipated to encourage improved service.

Reciprocal switching could also partially solve a shipper complaint that sole-serving railroads engage in monop oly pricing. Board precedent is that a through rate usually need not be broken into multiple parts. Reversing precedent would allow shippers to challenge the “bottleneck” rate while seeking competi tive line-haul rates from points where two railroads have a physical interchange.

MERGER QUESTION

Also soon to be revealed is whether the STB will approve a merger application of Canadian Pacific and Kansas City South ern—and what rail-competition preserv ing conditions will be attached to what would be CPKC, the first single-line rail road linking Canada, the U.S. and Mexico. Owing to their being the smallest of seven Class I railroads, the STB exempted the applicants from demonstrating that the transaction will enhance rail competition.

December 2022 // Railway Age 11 2023 OUTLOOK

Bruce Kelly

STB plotting active and intense 2023.

The Decision Makers

DEMOCRAT & CHAIRPERSON

Martin J. Oberman

A trial attorney, was a Chicago alderman, legal counsel to the Illinois Racing Commission and chairperson of Chicago Metra. First term expires Dec. 31, 2023.

DEMOCRAT

Robert M. Primus

With a marketing degree, was a House of Represen tatives chief of staff and congressional lobbyist. He awaits Senate confir mation to second term.

DEMOCRAT

Karen J. Hedlund

An attorney, was a Federal Railroad Administration deputy administrator and Federal Highway Admin istration chief counsel. First term expires Dec. 31, 2025.

REPUBLICAN

Michelle A. Schultz

An attorney, was deputy legal counsel to the Southeastern Pennsyl vania Transportation Authority. First term expires Jan. 11, 2026.

REPUBLICAN

Patrick J. Fuchs

Was a White House Office of Management and Budget policy analyst and adviser to Senate Commerce Committee Republicans. First term expires Jan. 17, 2024.

The applicants are required only to demon strate a preservation of rail competition. Unlike prior Class I mergers, there are no over lapping or parallel routes, as the two connect only in Kansas City.

STB-imposed merger conditions could include requiring a combined CPKC to maintain interchanges with other railroads. The STB also may retain oversight of premerger service promises and impose routing mandates to alleviate predicted increased rail congestion in Chicago and Houston.

Other pending proceedings include arbi tration to resolve rate disputes; handling of service emergencies; reporting requirements to reveal origin and destination car-handling delays; possible revocation of regulatory exemptions; review of the methodology deter mining railroad revenue adequacy; if Precision Scheduled Railroading is the cause of a surge in Union Pacific imposed embargoes—from 47 in calendar 2017 to 886 for just the first 10 months of 2022; and revisions to an anti quated Uniform Rail Costing System (URCS)

RATE PROTECTION

Were it not for the existence of captive ship pers and dual rail duopolies—BNSF and Union Pacific in the West; CSX and Norfolk Southern in the East (sandwiching smaller north-south Class I railroads)—free-market

advocates might succeed in eliminating all railroad economic regulation. It is for rail shippers with limited or no transportation alternatives that STB-administered statutory protection is in place.

Blame economists for developing—as a means of protecting captive shippers from “unreasonable” freight rates and service degradation—a methodology so complex and costly that its perfection at doing the job has become the enemy of the good.

A Stand-Alone Cost (SAC) test, designed to protect captive shippers from bearing the cost of rail facilities or services from which they derive no benefit, requires a shipper to design a hypothetical most efficient stand-alone rail road tailored to that shipper’s specific needs. The cost to shippers of doing so—as it requires teams of experts in multiple disciplines—can exceed $5 million, thus sabotaging the protec tion intended by statute.

Former STB member Deb Miller criticized the “granularity” of the SAC test, citing argu ments “as trivial” as the type of wiring needed for yard lighting and the number of stalls required in restroom facilities, which, she said, forces the STB “to make determinations that, while based on evidence and expertise, seem far removed from the core question at issue”— rate reasonableness.

The 2015 Surface Transportation Board

Reauthorization Act—STB Member Patrick Fuchs having been a drafter while a senior Senate Commerce Committee staffer— instructed the agency to develop “simplified and expedited” methods for determining rate reasonableness when a SAC test exceeds what the complaining shipper might recover.

SIMPLIFYING SAC

The Board is expected soon to issue a final ruling on two simplified procedures—Final Offer Rate Review (FORR) and an alterna tive voluntary arbitration process. Each would apply only to shippers whose maximum recovery in the two years prior to filing the complaint does not exceed $4 million—and likely encompass most non-repetitive chemi cals and grain shipments.

FORR, as recommended by an internal STB Rate Reform Task Force, would require rail road and shipper simultaneously to submit to the Board final offers that include an analysis of the challenged rate. The STB would choose one of the offers without modification.

An alternative—but requiring voluntary agreement by both parties—would have a trained neutral third party, with subject matter expertise, make a binding arbitration determination subject to subsequent limited review by the STB and courts.

STB FORR determinations would

12 Railway Age // December 2022 railwayage.com 2023 OUTLOOK

MORE THAN PARTS. PERFORMANCE.

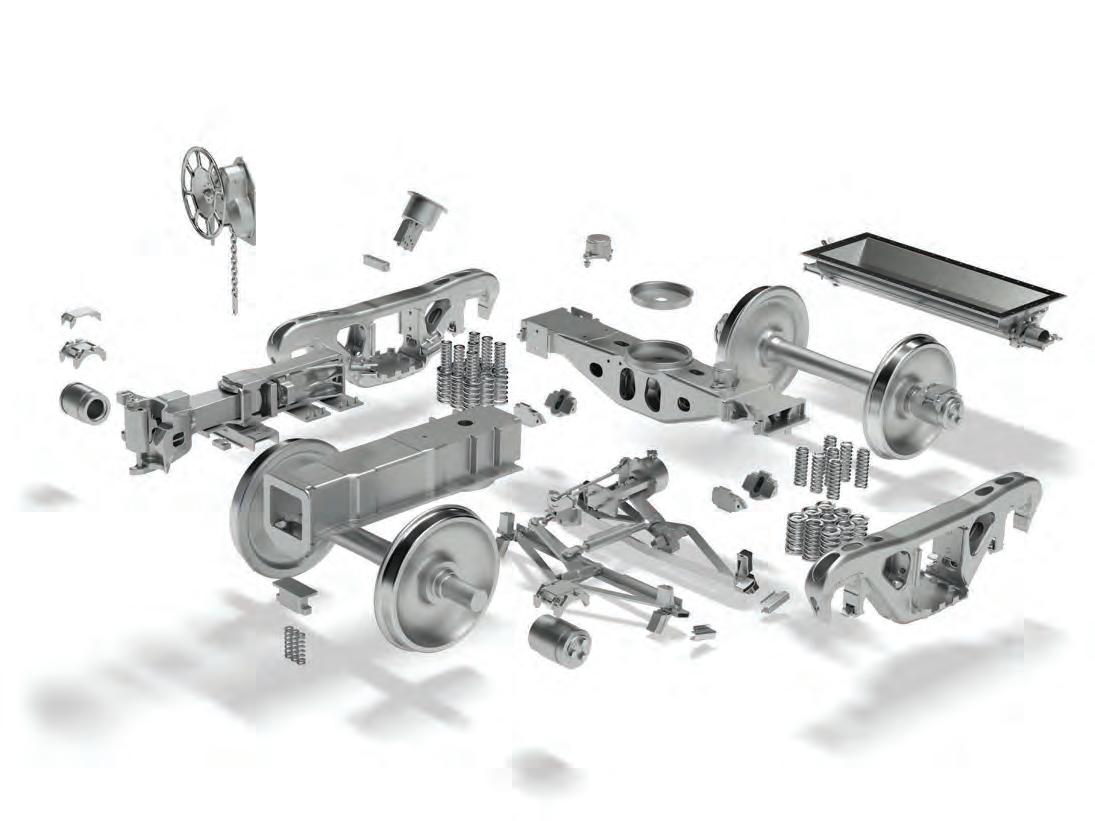

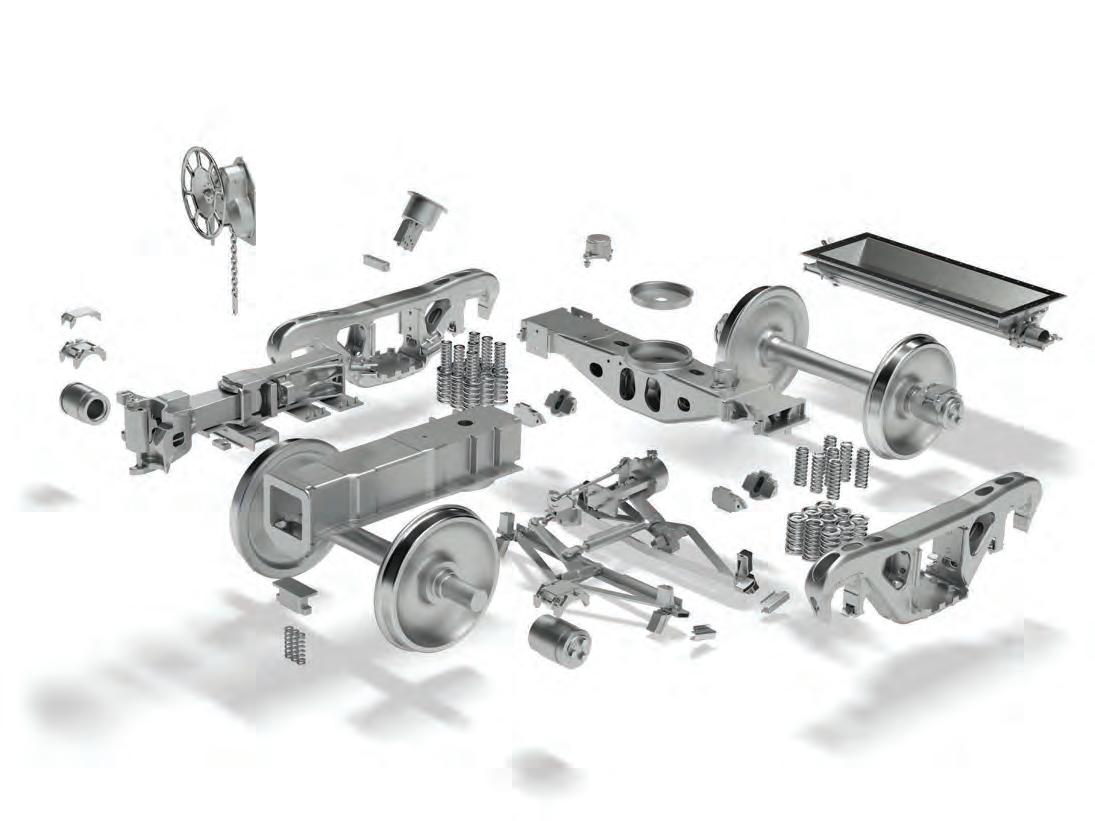

Amsted Rail, the global leader in fully integrated freight car systems for the heavy haul rail market.

FREIGHT | TRANSIT | DIGITAL amstedrail.com TRAIN SMARTER

establish precedent, while voluntary arbi tration would be confidential and have no precedential value, save for limited STB or court review. Shippers say confidentiality of voluntary arbitration awards blocks them from sharing with each other railroad case strategy, while railroads, party to each arbi tration, would benefit in future arbitrations by knowing shipper and expert witness strategy and arbitrator predilections. Each side faces a risk of precedent in STB FORR determinations, although a shipper loss merely puts it in the same position as before bringing the complaint.

EMERGENCY SERVICE

A ruling is expected in 2023 on an STB initiative to require a railroad facing a Board-determined service emergency to take independent action to solve the problem or be subject to Board-directed action.

FIRST-MILE/LAST-MILE

Frequent reports of railroad car-handling delays between local railroad serving yards and a shipper loading or receiving facility— known as “first-mile/last mile”—invited a Board initiated order, following a two-day public hearing, on whether additional

reporting requirements are justified. Shipper complaints of inconsistent and unreliable rail service—unavailability of empty cars for loading, delays in switching cars to and from shipper facilities and failure of railroads to communicate delays and their reasons— prompted the Board action. If reporting doesn’t lead to improvement, further action should be expected.

URCS REVISION

The Uniform Rail Costing System (URCS) is an accounting allocation method used for a variety of regulatory functions, includ ing determination of maximum reasonable rates. Elements are more than a century old, with former STB Chief Economist William F. Huneke comparing URCS to “a classic car lacking modern GPS and satellite radio” and from a time when railroads, not ship pers, owned most freight cars and line hauls were shorter as railroads had not merged away most rail-rail (intramodal) competi tion. The STB is seeking public comment on an independent consultant’s report, “Alter natives to URCS.”

EXEMPTIONS

Lurking in the wings is a rulemaking

revoking ICC and STB exemptions of certain commodities and classes of traffic, such as intermodal, from economic regulation. Revocations would restore STB oversight of rates and service, with the threat thought sufficient to moderate market power abuse and intentional service degradation.

REVENUE ADEQUACY

Another lurking rulemaking is whether—as requested by railroads—to change Board procedures for Class I railroad revenue adequacy determination. Shippers are skep tical as railroads voiced no complaints when the methodology found them not to be revenue adequate. Shippers cite Wall Street reporting and the railroads’ own annual reports as evidence railroads have long been revenue adequate, and that perhaps the determination should be made by better qualified Wall Street firms.

In reporting on STB actions, and as we have observed previously, what distinguishes the Senate-confirmed members of this Board is they are not separated by ideology or poli tics. Rather, each consistently has displayed commitment to civility, facts, transparency, ethics and compromise—the fundamentals of independent agency public service.

14 Railway Age // December 2022 railwayage.com

Bruce Kelly

Powering your fleet ahead.

CIT Rail leverages deep experience and one of the youngest, most diversified railcar and locomotive fleets in the industry to help you keep your business on track for success. With a long-standing commitment to providing creative railcar leasing solutions, we can help you free up capital for your growth priorities.

Get started today at citrail.com ©2022 First-Citizens Bank & Trust Company. All rights reserved. CIT and the CIT logo are registered trademarks of First-Citizens Bank & Trust Company. MM#12025

TECH FOCUS – M/W

BY MARYBETH LUCZAK, EXECUTIVE EDITOR

MAKING THE GRADE

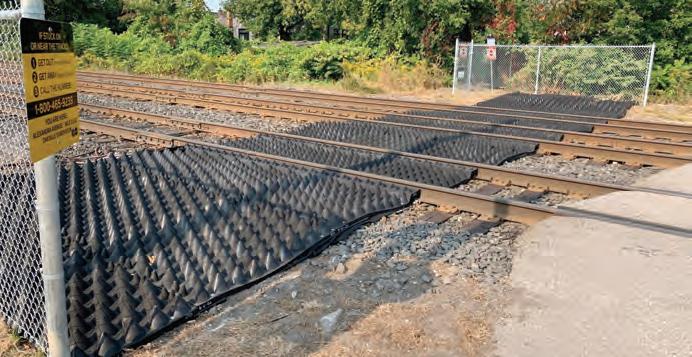

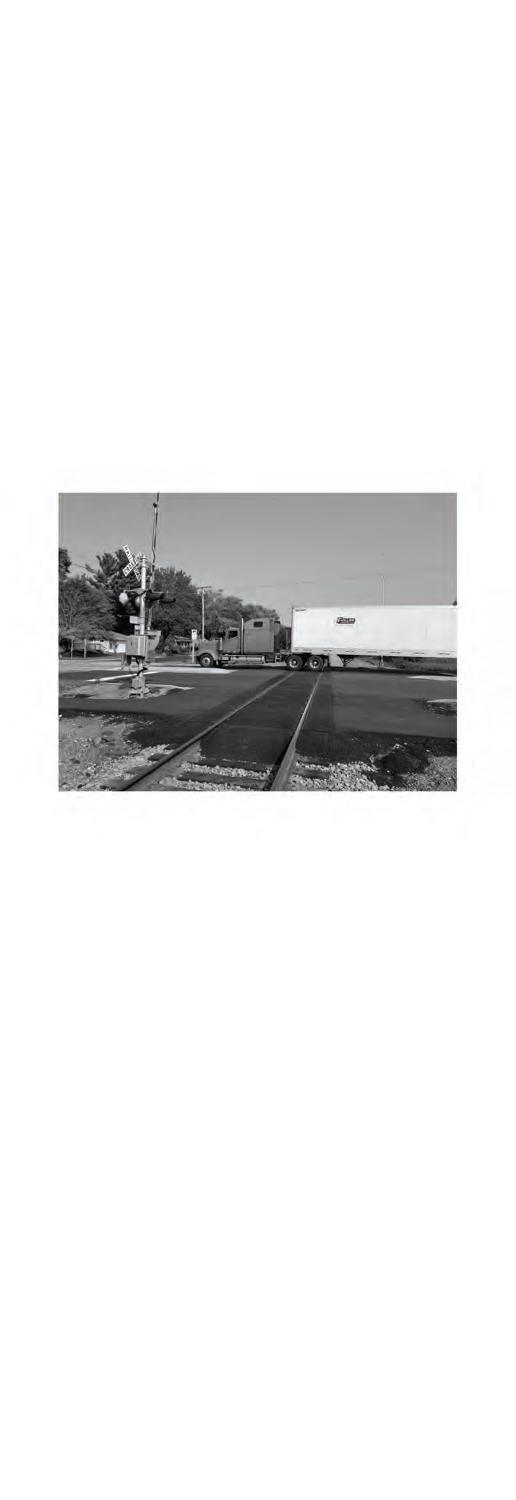

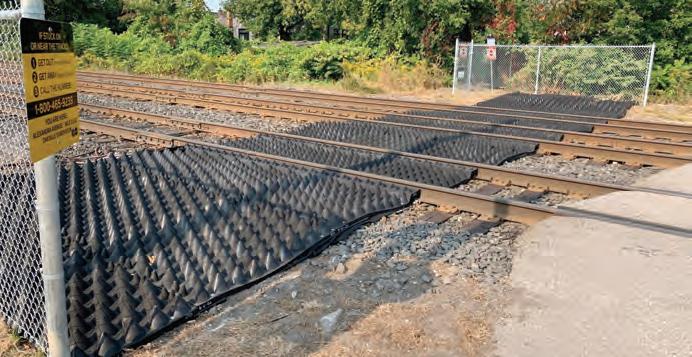

Concrete. Rubber. Compos ite. Timber. Grade crossing surface suppliers provide a number of solutions for the rail/road interface to with stand the long-term pounding of freight and passenger trains while providing a safe, smooth ride for motor vehicles, and to prevent trespassing.

While projects for Class I, II and III railroads and transit agencies are most common, those for intermodal and indus trial applications are on the rise today. For the latest market trends and products in the pipeline, Railway Age turned to Ameri can Concrete Products, HiRAIL Corpora tion, L.B. Foster, Oldcastle Infrastructure, Omega Industries Inc., Omni Products Inc., and TieTek Global LLC for their insights.

Here’s how 2022 is wrapping up and what’s in store for 2023 and beyond.

AMERICAN CONCRETE PRODUCTS

American Concrete Products precast cross ings manufactured at plants in Nebraska, Kansas and Texas are in high demand, according to Vice President of Railroad Sales and Service Buz Hutchinson—especially for use at intermodal facilities being built or upgraded with longer sidings, and at manu facturing facilities just beginning to ship by rail or boosting those shipments. The company recently completed a project for a plastics producer in Chillicothe, Mo.

With this growth, customers are more frequently asking for shorter lead times as well as reduced pricing, Hutchinson reports. To support this, American Concrete

Products is currently “looking at mate rial changes that may allow us to increase the length of the written warranty— now 12 years—or to change the material without affecting the life expectancy of our product,” he says. The company may consider using stronger concrete, such as polymer concrete, and less steel, as steel costs have tripled in some cases. The work will be part of a long-term controlled study.

HIRAIL CORPORATION

HiRAIL Corporation crossing surfaces are manufactured from 100% molded rubber and incorporate recycled tires. Current market conditions remain strong in all sectors, from Class I’s, short lines and transit agencies to contractors and industry, accord ing to Director of Sales and Marketing Jim

16 Railway Age // December 2022 railwayage.com

Omega Industries Inc.

How suppliers are ensuring that crossing surfaces withstand heavy rail and road traffic—and meet customer expectations.

Overfelt. “Like most businesses, we are cautiously optimistic that long-term demand will remain strong; however there is some concern with the slowing economy and how this will affect our customers’ crossing budgets,” he tells Railway Age.

The company is continuing its work devel oping new full-depth rubber crossing profiles to fit new concrete tie designs and new fasten ing systems. “The majority of the concrete ties produced domestically are not flat or rectangu lar-shaped like a timber tie,” Overfelt explains. “Most concrete ties have an area that slopes down from the rail seat toward the middle of the tie that meets a flat section in the middle. Over the course of many years, the concrete tie manufacturers have made these areas differ ent lengths. As these dimensions change, we change to make our product fit the contour of the concrete tie. Our design capabilities allow the client to use the same concrete tie profile throughout their entire system and not have to transition to flat concrete ties or timber ties for their crossings. On top of the changes in shape, there have also been new fastening systems

introduced that require us to add more clear ance. Consequently, we end up changing our design to fit these requirements. We also seem to be getting more inquires for direct-fixation track crossings, which require a lot of the same design capabilities that we use for concrete or steel tie crossings.”

HiRAIL

L.B. FOSTER

L.B. Foster is the North American distributor of the Rosehill Rail grade crossing panel and anti-trespass panel systems made from raw materials reclaimed from truck and car tires. “Our suite of products accommodates applica tions for heavy duty, light use, road-rail vehicle

December 2022 // Railway Age 17 railwayage.com TECH

– M/W HiRAIL Corporation

FOCUS

Omni_12_22.indd 1 11/29/22 12:33 PM

To fit new concrete tie designs and fastening systems,

is developing new full-depth rubber crossing profiles like this one for a railroad in the southern U.S.

access and pedestrian crossings suitable for all rail, sleeper/tie and fastening combinations,”

General Manager, Transit Products Sarah McBrayer tells Railway Age.

Anti-trespass panels not only serve as a physical and visual deterrent to prevent pedestrian foot traffic and animal cross ings, but also “are proven to reduce inci dents by up to 80%,” according to McBrayer. They can be used in conjunction with grade

crossing panels or as a stand-alone product at stations, on bridges and overpasses, around pedestrian crossing areas, and as an alter native to cattle guards or other livestock or wildlife crossing prevention systems. L.B. Foster recently installed them at a remote U.S. transit agency station to prevent hikers from accessing the track near a popular trail head access point, and it wrapped up a threeyear project for a Canadian transit agency

implementing the panels at a number of high-risk pedestrian crossing areas.

How are market conditions today for L.B. Foster offerings? The company “did see a delay on some planned projects over the past couple of years due to COVID and reduced ridership, but these projects have picked back up in the latter part of this year,” says McBrayer, who notes that longer-term, as markets continue to rebound from the pandemic and supply chain shortages, there will be “a refocused effort on safety initiatives.”

Customers, she adds, are looking for “lowmaintenance safety products that can reduce pedestrian crossing incidents.” L.B. Foster’s “sustainable, environmentally friendly, 100% recycled tire product is also plus,” she says.

OLDCASTLE INFRASTRUCTURE

At Oldcastle, demand continues for its Heavy Duty Crossings for port, intermodal and industry, as well as Standard Duty Crossings for the rail transit sector, according to National Accounts Manager, StarTrack Rail Products Wayne Wendel. The precast concrete products

18 Railway Age // December 2022 TECH FOCUS – M/W

MORE THAN TRUCKS Over four decades of renting yellow iron equipment for railroad and transit industries. R ENTAL SY STEMS, INC. PHILADELPHIA 800.969.6200 DENVER 800.713.2677 DANELLA.COM/RENTALS

Pictured: One of L.B. Foster’s anti-trespass panel installations in Canada.

L.B. Foster

do not require crossties or ballast; include a rubber rail groove for access without disas sembly, abrasion strips, embedded Pandrol shoulders, and galvanized e-clip fasteners; and offer a diamond-plate anti-skid surface.

“We are currently working on projects for the Port of Long Beach, and at various loca tions for BNSF, Union Pacific, Norfolk South ern and CN,” Wendel tells Railway Age . “We are also working on projects for New Jersey Transit, RTD (Denver, Colo.), and Metro Transit (Minnesota), to name just a few.”

While raw materials and supply chain issues are still affecting production, he says, they do seem to be lessening. The company is “currently working toward stabilizing and diversifying our raw material chain, and getting stock levels back up to better respond to demand. Oldcastle is constantly looking for innovation, not just in the rail sector, but in all of the markets we serve,” according to Wendel.

OMEGA INDUSTRIES INC.

Omega has also seen raw material costs “skyrocket over the past two years, though

price increases don’t seem to have affected grade crossing panel demand,” the company tells Railway Age. “As long as there are highway/rail grade crossings—and there are an estimated 200,000 public crossings in the U.S.—demand for surface maintenance mate rials will continue.”

Like highways, bridges, crossties and rail, grade crossing surfaces eventually wear out and need to be replaced. “Many crossings that were upgraded 20-25 years ago are start ing to wear, and the cycle is beginning again,” according to Omega, which says annual demand should continue.

Railroads and rail contractors are more often asking for “speedy delivery,” Omega reports, so “short lead times have been key.”

The company is currently supplying crossing panels to the Class I’s as well as a host of short lines and contractors, as well as the Dallas Area Rapid Transit (DART) Silver Line in Texas; Southwest Light Rail in Minnesota; Metro Foothill Gold Line in Southern California; and Sound Transit in Seattle, Wash.

What products are in the pipeline? “We are

currently testing new concrete additives that will increase panel durability and minimize water penetration and reinforcement corro sion,” Omega reports. “We’ve replaced our galvanized steel lifting eyes with stainless steel, and are in the process of replacing galvanized steel lag screw liners with non-corrosive, nonconductive polyresin liners.” On the R&D side, the company continues “to watch for new concrete technologies and practices, so we can provide our customers with a durable, longlasting product.”

OMNI PRODUCTS INC.

Omni Products manufactures a variety of panels, including the ECR (Embedded Concrete-Rubber), which is designed with the rubber flange seal molded into the face of the steel-clad, steel-reinforced concrete panels, and the IC (Improved-Concrete), which incorporates rubber RailGuard panels with precast concrete panels.

Work for the first half of 2022 was slower than normal, Rob Greenside, Sales ManagerMidwest, South Central and West Coast, tells

December 2022 // Railway Age 19 railwayage.com

M/W

TECH FOCUS –

RAIL NEWS DELIVERED TO YOU AT HIGH SPEED ROUND-UP of NEWS STORIES FROM: RAILWA RAIL GROUP NEWS From Railway Age, RT&S and IRJ https://railwayage.com/newsletters T tal Solutions Partner lbfoster.com 1.800.255.4500 L.B. Foster provides essential products and accessories for freight and transit rail. Our innovative solutions are developed to address safety and critical railroad operating needs. Learn more about how we Keep Your World Moving. > Rail Products > Allegheny Rail Products > Transit Products > CXT® Concrete Ties > Rockfall Monitoring > MK-IV WILD > Anti-Trespass Panels > Grade Crossing Monitoring > Flood Monitoring > Avalanche Monitoring > PROTECTOR® X > KELTRACK® OnBoard Spray System > KELTRACK® Friction Modifiers > On-Board Solid Sticks > Gauge Face Grease > Field Services TOTAL TRACK MANAGEMENT TOTAL TRACK MONITORING TOTAL FRICTION MANAGEMENT QtrPage_SolutionsAd_Dec22.indd 1 11/22/2022 9:36:59 AM

Railway Age. More than 50% of the company’s larger jobs planned for the year were postponed until 2023, due to raw material and truck ing price increases. “Steel costs rose continuously from April until July,” says Greenside, who adds that costs have since stabilized and are expected to remain constant at least until early 2023. Product deliv ery logistics have been a challenge, too, he says, because much of the company’s jobs are not in urban areas “or where truck drivers could make a ‘swing by’ to pick up another load, thereby making it worth their while. But, I think this year was just an exception, not the rule. I think our longer-term outlook is going to be positive as far as market conditions go.”

Greenside reports that Omni uses a solid virgin, molded rubber—not extrusion—for its crossing panels. The company manufactures it for the IC product and specifies it for the ECR product. Why? Because it “is going to last longer, and when it’s installed, you don’t have any issues with rubber coming apart or tearing,” he says.

Now that it’s winter, the company is “outsourcing as many of its products as possible to build up an inventory so that we’ll be ready [for projects] as soon as the weather breaks in spring,” Greenside says. And “trying to improve manufacturing methods in order to meet customer delivery times is going to be something that we, or anybody else for that matter, is going to have to improve on in the future,” he adds.

TIETEK GLOBAL LLC

A subsidiary of EFG Composites, TieTek Global offers a “Complete Composite Highway-Rail Grade-Crossing System” compris ing Endurance®-XL Composite Panels and TieTek® Engineered Polymer Composite Cross Ties. The use of TieTek composite crossties under Endurance composite crossing panels extends the service life of Endurance Composite Crossings, according to Vice President, Sales and Marketing Linda Thomas. “Endurance-XL Composite Crossings utilize durable, recycled polymer materials and can be installed in a wide variety of applications,” she says. “Panels are supplied in 8-foot, 1-1/2-inch lengths for 19-1/2-inch tie spacing, and manufactured in 6-foot, 7-1/2-inch and 8-1/4inch heights for use with most rail sizes and fastening systems. The panels can be lagged down to 8-foot, 6-inch or 10-foot treated wood or TieTek composite crossties. Panels are supplied pre-drilled with an option for drilling on-site for installation on curved track or when routine maintenance is required. Optional rubber flangeway filler, lag screws and TieTek composite ties complete the package.”

Driving product demand today are not only transit, port and industrial growth and new infrastructure projects, but also user “corporate sustainability goals and the desire to utilize durable ‘green’ products with a proven performance history,” Thomas says. Endurance crossing panels and TieTek ties both can be recycled “at the end of their useful lives,” she adds. TieTek Global plans to reintroduce Endurance-XL Plus grade crossings early next year.

TTC/ENSCO

To evaluate and demonstrate emerging safety technologies, the U.S. DOT Transportation Technology Center (TTC) is planning a “grade crossing test bed” in Pueblo, Colo. While new site manager ENSCO, Inc., isn’t able to provide details yet to Railway Age, the test bed is expected to launch in 2023. Stay tuned.

20 Railway Age // December 2022 railwayage.com

RIGHT DECISIONS, RIGHT TIME, RIGHT AUTHORITY

BY SONIA BOT, SHEPPARD NARKIER AND DAVID SHERR

This is Part 1 of a three-part series based upon our new book, Dynamic Multi-Level Decisioning Architecture: Making the Right Decisions at the Right Time, With the Right Author ity for Sustained Competitiveness and Relevance. It’s about how all industries, including the rail industry, its partners and adjacent competitors, are evolving in the throes of digital disruption and other external forces, and the role people play in decision-making at all levels of an organiza tion. Decision-making needs to flow better upwards and downwards, tying the board room to the railroad yards, transloading facilities, tracks—the whole rail network and transportation ecosystem.

The bigger story is about each stakeholder needing a better understanding of how to make the right decision at the right time with better, more-focused knowledge, applying hard-earned wisdom to make better decisions with better and traceable outcomes. It’s about the convergence of two long-standing silos, OT (operational technology) and IT (infor mation technology), becoming the corner stone of effective innovation in large, complex firms like railroads, which need to meet the increasing impact of disruptive forces. The

need to address this convergence affects a wide range of disciplines to unveil a much broader scale of end-to-end systems—from the sensors in the field to the boardroom. Outof-date, isolated data that lacks context causes major paralysis.

Wisdom is needed for managing the expo nentially increasing complexity gap organiza tions face. It means seeing within the context of systems and root causes. Real-time decisionmaking becomes possible from the sensors on the ground sending to the boardroom data transformed into information yielding knowl edge, while accounting for the unpredictable external forces and the internal realities that organizations face. This approach provides senior executives with ability to understand the effects that their decisions have on their orga nizations in a much shorter timeframe, rather than the typical several quarters.

Decision-making in today’s environment needs to be reexamined. Organizations are subject to forces that require some form of response and require a change in how they operate. They include market, technologi cal, economic, ideological, moral, ethical, legal, regulatory, political, governmental, psychological, sociological and environmen tal. Most organizations are dynamic and respond to change. However, disruption to

business models is rapidly increasing, espe cially from new technologies. The ability to confidently respond to this increasing wave of change requires reimagining how decisions are enabled. If a company only needs to learn to master one thing, then learn to master decision-making.

DEFINING DECISIONING

Decisioning systems are making a real come back because they can be made more prac tical and easier to use. The data that these systems consume is increasing dramati cally. Operational information technology convergence—OT/IT convergence—is the cornerstone that enables making the right decision at the right time with the right level of authority and scope. Executives must ask if their strategic and tactical objectives are being translated into the right actions through all the layers of management and operations with the right impact. The question facing leadership is how to create a virtuous cycle of relevant decision-making from the board room to the ground level and all the levels in between. This requires a timely and meaning ful feedback loop to understand if the execu tive decisions are making a crucial difference. Those carrying out these decisions need to know that they have the right information to

December 2022 // Railway Age 21 railwayage.com

NOTCH 8 TO THE GOLDEN RUN

PART 1: FROM SENSORS TO THE BOARDROOM

BRUCE KELLY

meet the objectives. Real-time insight changes every aspect of decision-making from the boardroom to the ground floor. Leverag ing exponentially increasing information and knowledge interconnects suppliers and partners and consumers and even disruptive competitors. It transforms the ecosystem.

This opportunity is not free and it’s not easy, especially for long-established compa nies with an aging infrastructure and an aging operations portfolio that have tech nical debt. There’s also something called enterprise debt or enterprise drag. The real question is, do organizations respond fast and effectively enough in the right areas with the correct investments?

We’ve all heard and experienced “analy sis paralysis,” which emerges from the fear that information and knowledge available to make informed decisions is lacking, contra dictory or stale. This creates uncertainty that ranges from the ground through every layer of management as it rolls up to the boardroom. Most organizations have invested heavily in all manner of analytic and data-gathering capabilities. Imagine the frustration they feel when they have those results and wonder why what they’ve spent doesn’t add up yet.

Economic and business conditions are driving shippers to use more modes and more complex routing scenarios across geographies and various regulations. Meanwhile, the carri ers typically focus on their internal sphere and often are unaware of the impacts they have downstream or at their handoff points. Endto-end delivery goals become fragmented, and this increases the risk of not meeting

obligations and achieving business goals. This fragmentation highlights the importance of supply chain execution and convergence, and the ability to work together across functional domains such as merchandising, transporta tion, warehousing and manufacturing.

A key element of the solution is a real-time decisioning framework that incorporates secure digital twins for mediating OT/IT convergence while also leveraging the myriad of new technologies like AI, machine learn ing, multi-cloud and IoT (internet of things). Coupled to this is the Business Environment as a Service (BEaaS) platform, where provid ers and consumers participate in building and evolving an ecosystem over time and where they benefit by providing and consum ing the services. It’s a control system with an active feedback loop that presents the oppor tunity to control chaos. Organizations can assign varying levels of authority to effectively execute what needs to be done to sustain their competitiveness. Staged investment in these technologies can be strategically introduced so that subsequent phases can be paid for by savings obtained in prior phases.

For example, in a transload facility, unpre dictable forklift failures are a bottom-line cost. However, workflow interruption affects top line revenues and incurs reputational loss. Top line impacts are even greater and more significant than bottom line costs. Using sensor-equipped forklifts as input for promoting an analytics-driven deci sion culture extends data and information through to knowledge, wisdom and useful insights. You can apply the same principles to locomotives. Each equipment category has its specific idiosyncrasies, but predictive analyt ics, safety and maintenance principles apply universally. For example, you can use the same machine learning equation to predict mishaps using asset-specific parameters for highways or railways.

Another example: The rail industry has defined five stages for autonomous vehicles globally. Most industries are in the early stage two of automated vehicle maturity. Humans must be very diligent, especially in poor weather conditions or heavy pedestrian and vehicle traffic in urban areas. Autono mous vehicle manufacturers do have one top competitive priority: achieve as close to level five autonomy as possible. This is a long, hard road, and railroads need to work with what they can do safely. They may not be cutting

edge in some cases. Some of the challenges are real-time handling of vehicle health and supporting autonomous systems. The vehicle must understand and react to chang ing conditions in milliseconds. This requires a large deployment of sensors and cameras to capture and transmit data in nanoseconds. The processing capacity to interpret these diverse sets of data streams has to be very large and will keep growing. Prediction and reac tion algorithms must leverage the established wisdom of prior situations, such as road worker protection. All of this must be placed in the context of how to invest in a strategy that creates the opportunity to continually stay ahead of your competition.

Railroads represent a classic example of vertical and horizontal integration. The former has long been the choice to boost economies of scale. The current state of disruption raises questions about how effec tive heavy vertical integration will be going forward. When niche players are entering from adjacent markets to provide services and products that are highly specialized, they also can pivot their offerings very quickly due to their smaller sizes. This is especially signifi cant when one considers that the startup costs of innovation have dropped precipitously, allowing more adjacent startups to enter the market. These players can eat away at your competitive advantage slowly without getting noticed until it’s too late. That’s why horizon tal integration is a strategic advantage, and why focusing on the core business is what will win the day.

Information tends to get buried in spread sheets or crammed into slide decks and PDF reports. Occasionally, some messaging massaging is done so that a bit of knowledge can be gleaned by decision-makers. The final step is often hard to accomplish. A large gap exists between the use of information and the creation of knowledge that decision-makers can apply to leverage wisdom. But with the emergence of feasible machine learning and use of rich graphing techniques and advanced visual rendering, the era of knowl edge-centric decision-making has been maturing over the past decade. Effective use of this technology is becoming a competi tive advantage. The need to bridge the gap with greater speed is a vital step in creating sustainable sets of services and products that fend off unexpected competition.

Wisdom is earned through life experience.

22 Railway Age // December 2022 railwayage.com

8

NOTCH

TO THE GOLDEN RUN

NOTCH 8 TO THE GOLDEN RUN

The largest impact wisdom provides is hard decision-making, amid pervasive ambiguity where information is not only incomplete, but also possibly contradictory. Wisdom is knowing how to handle ambiguity, recog nizing and managing the multiple possible outcomes from a set of operational events. Knowledge alone will not be able to uncover the latent needs of the key stakeholders— employers, customers, clients, suppliers and partners. Wisdom integrates the values and cultures of an organization, especially as it relates to its tolerance for change. It requires changes to processes and skills, while employ ing a safety net for people.

We really need to integrate wisdom and insights in real time. This is a gap that orga nizations need to close, particularly as they modernize their architectures in the push for digitalization of businesses. We strongly encourage people to overcome the bias to status quo inertia in their organizations. This is important because the next disruptor may not be obvious before it’s too late, and you are left behind irrelevant and unprofitable.

Sonia Bot, chief executive of The BOT Consulting Group Inc., has played key roles in the inception and delivery of several strategic businesses and trans formations in technology, media and telecommunications companies world wide. By utilizing methodologies in entrepreneurship, business precision, Lean Six Sigma, system and process

engineering, and organizational behavior, she’s enabled organizations to deliver breakthrough results along with providing them a foundation to continue to excel. Sonia’s contributions to the rail industry are as a leader and a visionary who is passionate in taking railroading into the next generation. Within the Digital Business Transfor mation context, she leads high-stakes mandates where new business models are created and enabled by digital technologies. She was instrumental in PTC implementation on CN’s U.S. lines. Her approaches on the evolution of railroading and transportation are game-changers that drive innovation and competitive advantage for adopt ers in a changing industry.

Sonia can be reached at sdbot@ botgroupinc.com or www. botgroupinc.com.

Sheppard Narkier, a CTO and Senior Enter prise Architect, is routinely tasked with complex, diffi cult transformation projects in a range of industries including demanding Capital Markets environments. Shep pard was recruited into 11 unique roles including Chief Technical Architect at a global investment bank, CTO of a global consultancy, and Chief Scientist at a startup. He has defined the archi tecture and rules systems for several application and infrastructure design

platforms resulting in seven awarded patents. As a facilitator of change, he has driven the organizational transfor mations aligning systems develop ment structures, processes, and data repositories with their strategic goals. A pioneer in cloud strategy, he devel oped IP in several companies to guide enterprises toward staged migration to hybrid multi-cloud across a range of horizontal and vertical scenarios. He has also employed multidisciplinary Design Thinking in recent engage ments. Sheppard can be reached at shep.narkier@candlewall-llc.com.

David Sherr is in his sixth decade as a practitioner, thought leader, and executive in entrepreneur ship, system design and development, and enter prise architecture. He has worked in six world-class financial institutions where he held CTO and VP positions and consulted in technology strategy for Fortune 100 companies. Currently, David is heading an IoT startup to build predictive maintenance analytics for industrial assets. As an inventor, he is named on six patents covering enter prise data management, Web services architecture, IoT Digital Twins, and, most recently, software-designed network resource provisioning archi tecture. David can be reached at david@freddy.io or www.newglobal enterprises.net/SCA.

December 2022 // Railway Age 23 railwayage.com

your

Our Head Wash Repair welding process provides a cost-effective and efficient solution to repairing railhead defects. pandrol.com Design.indd 1 21/04/2021 09:56:50

Keeping

track healthy

TIMEOUT FOR TECH

RAILWAY BRIDGES

By Gary T. Fry, Ph.D., P.E., Vice President, Fry Technical Services, Inc.; and W. N. Marianos, Jr., Ph.D., P.E., Structural Engineer

elcome to “Timeout for Tech.” Each month, we examine a tech nology topic that professionals in the railway industry have asked to learn more about. This month, I am joined by co-author and structural engineer W. N. Marianos as we consider railway bridges.

By 1870, at least 50,000 miles of railway existed in the U.S. By 1890, railway mileage had more than tripled, exceeding 160,000 miles. Roughly 110,000 miles of railway had been built in those 20 years— enough to encircle the Earth 4.5 times!

And, of course, many bridges were built. Bridges are essential to a railway, allow ing us to build optimally routed tracks that cross major rivers and small streams, deep canyons and shallow swales (Figures

W1 to 4). Railway bridges come in many span configurations often incorporat ing multiple types in a particular bridg ing solution—arches, girders, trusses, and trestles. They have been made from a variety of different materials—wrought iron, steel, concrete, stone, wood, and combinations of these. As dictated by the local needs along the railway, one bridge to the next can vary greatly in length from a short, single span of less than 15 feet to a multi-mile trestle comprising hundreds of spans. It can be estimated that roughly 2,700 total miles of bridge spans were built between 1870 and 1890—a little under 2% of the 160,000 miles that comprised the U.S. railway network at that time.

We will focus our attention at the “Gateway to the West,” St. Louis, Mo., and describe the essential features in the service life of a successful

supercentenarian railway bridge that, up until its replacement this year, crossed the Mississippi River.