AILWAY G E

SERVING THE RAILWAY INDUSTRY SINCE 1856

MOTIVE POWER NEXT-GEN

Examining, Evaluating Options

SHORT LINE OF THE YEAR

Napoleon, Defiance & Western

REGIONAL OF THE YEAR

ArcelorMittal Infrastructure

Canada Railway

WWW.RAILWAYAGE.COM

MARCH 2023

WHO SAYS LESS IS MORE? MORE IS MORE.

Marmon On-Site Services means one team, one point of contact, and a custom solution for gate-to-gate on-site and mobile rail services. No company o ers more to make your operations more e cient. We keep your world moving forward.

Marmon On-Site Services Companies

Marmon On-Site Services Companies

Railway Age, USPS 449-130, is published monthly by the Simmons-Boardman Publishing Corporation, 1809 Capitol Avenue, Omaha, NE 68102. Tel. (212) 620-7200. Vol. 224, No. 3. Subscriptions: Railway Age is sent without obligation to professionals working in the railroad industry in the United States, Canada, and Mexico. However, the publisher reserves the right to limit the number of copies. Subscriptions should be requested on company letterhead. Subscription pricing to others for Print and/or Digital versions: $100.00 per year/$151.00 for two years in the U.S., Canada, and Mexico; $139.00 per year/$197.00 for two years, foreign. Single Copies: $36.00 per copy in the U.S., Canada, and Mexico/$128.00 foreign All subscriptions payable in advance. COPYRIGHT© 2023 Simmons-Boardman Publishing Corporation. All rights reserved. Contents may not be reproduced without permission. For reprint information contact PARS International Corp., 102 W. 38th Street, 6th floor, New York, N.Y. 10018, Tel.: 212-221-9595; Fax: 212-221-9195. Periodicals postage paid at New York, N.Y., and additional mailing offices. Canada Post Cust.#7204564; Agreement #41094515. Bleuchip International, PO Box 25542, London, ON

March 2023 // Railway Age 1

railwayage.com

N6C 6B2. Address all subscriptions, change of address forms and correspondence concerning subscriptions to Subscription Dept., Railway Age, PO Box 239 Lincolnshire IL 60069-0239 USA; railwayage@omeda.com; or call +1 (402) 346-4740; FAX +1 (847) 291-4816. Printed at Cummings Printing, Hooksett, N.H. ISSN 0033-8826 (print); 2161-511X (digital). FEATURES 9 14 16 17 41 44 52 56 59 Short Line of the Year Napoleon, Defiance & Western Regional of the Year ArcelorMittal Infrastructure Canada Railway Honorable Mention Aberdeen Carolina & Western Next-Gen Motive Power Examining, Evaluating Options Follow the Megawatt-Hours Hydrogen, Battery, or ... ? Tech Focus – Mechanical Couplers, Cushioning, Draft Gears Passenger Focus Northern California Timeout for Tech Anthropomorphic Materials MxV Rail R&D Wheel/Rail Friction RCFS Testing COMMENTARY 2 64 From the Editor Financial Edge DEPARTMENTS 4 6 7 61 62 62 63 Industry Indicators Industry Outlook Market People Professional Directory Classifieds Advertising Index COVER PHOTO Progress Rail EMD® Joule SD40JR battery-electric. Progress Rail photo March 2023 14 AILWAY

©ArcelorMittal Infrastructure Canada

GE

AILWAY GE

SUBSCRIPTIONS: 1 (402) 346-4740

Politics Pre-empting East Palestine

e interrupt this special report on the National Transportation Safety Board’s ongoing investigation into Norfolk Southern’s Feb. 3, 2023 derailment at East Palestine, Ohio, to clue you in on some same-old, same-old political initiatives from Washington, D.C., where, in a truth vs. fiction battle, fiction almost always gets the spotlight

I’ll begin with what I and many others in this industry see as the basics. The derailment, fire and release of hazardous materials into the environment and its effects on the East Palestine community are serious. The NTSB has determined a probable cause—a freight car wheel bearing burnoff—released its findings in a preliminary report, and should produce a final, detailed report within the next year or so. Until then, there is not enough information to make a final, truthful, fact-filled, research- and science-based decision on what exactly happened, and what the industry needs to do to prevent a future occurence. Norfolk Southern, as I see it, is doing everything it can to help the community recover and move on.

Unfortunately but not unexpectedly, there are those who have grabbed hold of this awful accident and attempted to get ahead of the NTSB. They’ve turned it into a vehicle to advance their own agendas, political or other, spreading, either from lack of knowledge, compromised ethics or both, bad information and exaggerations. The truth, which takes time to ascertain, is getting buried under a pile of political pronouncements and attempts to resurrect old, abandoned proposed regulations—namely, ECP brake requirements for

WHHFTs (high-hazard flammable trains) and minimum crew size legislation that have, in my opinion, little or nothing to do with safety or science. You can take that to the next Capitol Hill hearing.

One example is the “bipartisan” (a seldomheard word) Railway Safety Act of 2023, whose stated purpose is “to enhance safety requirements for trains transporting hazardous materials, and for other purposes.”

Sens. J. D. Vance (R-Ohio), Marco Rubio (R-Fla.), Josh Hawley (R-Mo.), Sherrod Brown (D-Ohio), and Bob Casey and John Fetterman (D-Pa.) introduced this bill. It includes “new safety requirements and procedures for trains carrying hazardous materials like vinyl chloride.” These include advance notice from railroads to state emergency response officials about hazmat-carrying trains, preventing blocked grade crossings, new rules for train size and weight, higher maximum fines for safety violations, addressing wheel bearing failure risk by ramping up detection and inspection, and requiring “well-trained, twoperson crews aboard every train.”

Brown told CNN that the people of East Palestine “don’t want politicians coming in and disrupting things. They want action. They want solutions. That’s what J.D. Vance and I are doing.”

“I ... I ... I”: “Pay attention to what I’m doing for you! Re-elect me in 2024!”

Politics, or a genuine interest in protecting constituents? I’ll go with the former.

This bill will most likely end up right where it belongs: in the round file, dead as a doornail.

EDITORIAL AND EXECUTIVE OFFICES

Simmons-Boardman Publishing Corp. 1809 Capitol Avenue Omaha, NE 68102 (212) 620-7200 www.railwayage.com

ARTHUR J. McGINNIS, Jr. President and Chairman

JONATHAN CHALON Publisher jchalon@sbpub.com

WILLIAM C. VANTUONO Editor-in-Chief wvantuono@sbpub.com

MARYBETH LUCZAK Executive Editor mluczak@sbpub.com

CAROLINA WORRELL Senior Editor cworrell@sbpub.com

DAVID C. LESTER Engineering Editor/Railway Track & Structures Editor-in-Chief dlester@sbpub.com

HEATHER ERVIN

Ports and Intermodal Editor/Marine Log Editor-in-Chief hervin@sbpub.com

Contributing Editors

David Peter Alan, Jim Blaze, Nick Blenkey, Sonia Bot, Peter Diekmeyer, Alfred E. Fazio, Michael Iden, Don Itzkoff, Bruce Kelly, Ron Lindsey, David Nahass, Jason H. Seidl, David Thomas, John Thompson, Frank N. Wilner, Tony Zenga

Art Director: Nicole D’antona

Graphic Designer: Hillary Coleman

Corporate Production Director: Mary Conyers

Production Director: Eduardo Castaner

Marketing Director: Erica Hayes

Conference Director: Michelle Zolkos

Circulation Director: Joann Binz

INTERNATIONAL OFFICES

46 Killigrew Street, Falmouth, Cornwall TR11 3PP, United Kingdom 011-44-1326-313945

International Editors Kevin Smith ks@railjournal.co.uk

David Burroughs dburroughs@railjournal.co.uk

David Briginshaw db@railjournal.co.uk

Robert Preston rp@railjournal.co.uk

articles herein for the flat fee of $2.00 per copy of each article. Payment should be sent directly to CCC. Copying

personal or internal reference use without the express permission of Simmons-Boardman Publishing Corp. is prohibited. Address requests for permission on bulk orders to the Circulation Director.

Railway Age welcomes the submission of unsolicited manuscripts and photographs. However, the publishers will not be responsible for safekeeping or return of such material.

Member of:

Simon Artymiuk sa@railjournal.com

CUSTOMER SERVICE: RAILWAYAGE@OMEDA.COM , OR CALL 1 (402) 346-4740

Reprints: PARS International Corp. 253 West 35th Street 7th Floor New York, NY 10001 212-221-9595; fax 212-221-9195 curt.ciesinski@parsintl.com

2 Railway Age // March 2023 railwayage.com FROM

EDITOR

Railway Age, descended from the American Rail-Road Journal (1832) and the Western Railroad Gazette (1856) and published under its present name since 1876, is indexed by the Business Periodicals Index and the Engineering Index Service. Name registered in U.S. Patent Office and Trade Mark Office in Canada. Now indexed in ABI/Inform. Change of address should reach us six weeks in advance of next issue date. Send both old and new addresses with address label to Subscription Department, Railway Age, PO Box 239, Lincolnshire IL 60069-0239 USA, or call (US, Canada and International) +1 (402) 346-4740, Fax +1 (847) 291-4816, e-mail railwayage@omeda.com. Post Office will not forward copies unless you provide extra postage.

Send changes of address to: Railway Age, PO Box 239,

Photocopy rights: Where necessary, permission is

Center

to

THE

WILLIAM C. VANTUONO Editor-in-Chief

POSTMASTER:

Lincolnshire, IL 60069-0239, USA.

granted by the copyright owner for the libraries and others registered with the Copyright Clearance

(CCC)

photocopy

for other than

The Railway Educational Bureau BOOKS

- Railroad Resources -

Development and Operation of New York's IRT and BMT

by Alfred E. Fazio, P.E.

How would early 20th-Century experts such as William Parsons, Frank Sprague, Fred Lavis and Bion Arnold handled some of today’s challenges facing light rail operation? Read along as Fazio uncovers this premise by exploring the various issues and tactics used when the NYCTA assumed control of the BMT and IRT lines. This book concludes with a series of historical case studies concerning Hudson-Bergen Light Rail’s Bayonne Flyer and “three roads,” BART operations, and the Washington METRO’s capacity challenges. Hardcover, 350 pages.

BKNYIRT $65.95

General Railroader: The Unfiltered Genius and Controversy of Four-Time CEO Hunter Harrison

• BKHUNTER • $27.99*

Diesel-Electric Locmotives • by Walter Simpson

• BKDIESEL • $50.00

Mechanical Department Regulations • (Parts 210, 215, 216, 217, 218, 221, 223, 224, 225, 229, 231, & 232)

• BKMFR • $34.50

Train Wreck: The Forensics of Rail Disasters

• Soft Cover • BKTW • $24.95*

American Steam Locomotives, Design and Development, 1880-1960 • BKASL • $40.00*

The Railroad: What It Is, What It Does5th Edition • BKRRNN • $49.95

Emergency Responder's Guide to Railroad Incidents • BKERGRAIL • $33.00*

Amtrak: Past, Present, Future • by Frank N. Wilner • BKAMTRAK • 37.95 *

Operations Managing Railroad Transportation • BKMRT • 39.95*

Railway Operations and Control - Third Edition • BKROC • $39.95*

Railroad Operations and Railway Signaling

• BKRORS • $28.00

Single Car Air Brake Test Procedures Manual

Updated 2018. Everyone using the Single Car Test Device to check their air brake system will benefit from this manual. Compliant with the latest Code of Air Brake System Tests for Freight Equipment: AAR Standard S-486.

The book is divided into two sections: Test Procedure Flowcharts and Job Aids. The Test Procedures Flowchart section is derived from the current code. The Job Aid section contains inspection, adjustment and testing information for the components found on a freight car. It was derived from procedures supplied by product manufacturers. Softcover, spiral bound. 172 pages.

BKSCTD $42.95

Freight Car

The Double Stack Container Car Manual • BKDOUBLE • $21.95

The Basics of Railroad Wheels • BKWHEEL • $28.95

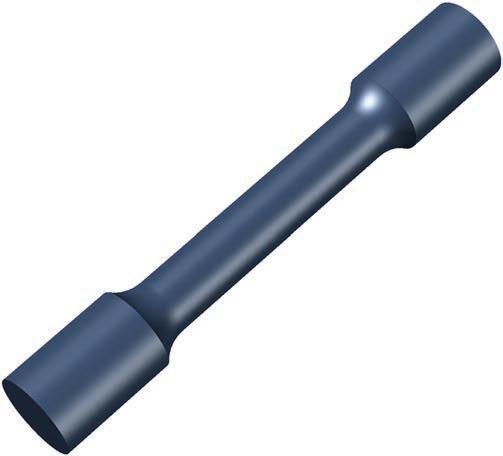

Guide to Freight Car Couplers and Draft Gear Systems • BKCDG • $74.95

Doorway to Safety With Boxcar Doors • BKBD • $28.95

Freight Cars: Lettering and Marking • BKK2CBK • $28.95

Guide to Freight Car Trucks • BKFCT • $98.95

Locomotive

Guide to Locomotive Mechanical Maintenance - SD & GP Locomotives • BKGLMM • $41.95

Guide Locomotive Electrical Maintenances • BKGLEM • $51.95

Fuel Saving Techniques for Railroads - The Railroader's Guide to Fuel Conservation • BKFUEL2 • $34.95

Guide to North American Diesel Locomotives

• BKGNADL • $27.99*

Reference and Dictionaries

Dictionary of Railway Track Terms • BKRTT • $38.95

Railway Age's Comprehensive Railroad Dictionary - Second Edition • BKRD • $39.95

Your Guide to Railway Signals

by Frederick J. Aubertin

by Frederick J. Aubertin

Your Guide to Railway Signals is an excellent guide for training signal personnel especially railway cross-function managers, supervisors, and support personnel. High-quality graphics and diagrams have been used throughout this book. Complies with all standards and commonly used practices. includes chapters on Track Circuits, Basic Crossings, Gate Crossings, Microprocessor-Based Crossings, Switch Circuit Controller (SCC) and Electric Locks, Switch Machines, Relay-Based and Processor-Based CTC, and Testing Locking Circuits Soft cover, 370 pages.

BKYGRS $109.95

Track

Basic Principles of Track Maintenance • BKTMB • $140.00

The Art and Science of Rail Grinding • BKGRIND • $159.95

Railway Geotechnics • BKGEOTECH • $200.00*

Transit Development and Operation of New York's IRT and BMT • by Al Fazio • BKNYIRT • $65.95

Urban Transit: Operations, Planning, & Economics • by Vukan R. Vuchic • BKUTOPE • $155.00*

Shipping Rates:

Add the following shipping and handling if your merchandise subtotal is:

up (Appropriate charges applied)

visit www.transalert.com

To order, call 1-800-228-9670 or

The Railway Educational Bureau 1809 Capitol Ave., Omaha NE, 68102 (800) 228-9670 I (402) 346-4300 www.RailwayEducationalBureau.com UP TO $10.00 $6.10 $11.00 10.01 - 25.00 10.50 18.25 25.01 - 50.00 14.30 23.85 50.01 - 75.00 16.05 29.75 75.01 -100.00 19.10 38.85 100.01 - 150.00 21.75 50.50 150.01 - 200.00 25.45 67.45 200.01 - 300.00 30.90 83.65 300.01 - 400.00 36.30 100.60 400.01 - 500.00 41.85 117.15 500.01 - 600.00 47.75 133.40 600.01 - 700.00 53.60 153.35 700.01 &

U.S.A. CAN U.S.A. CAN

Industry Indicators

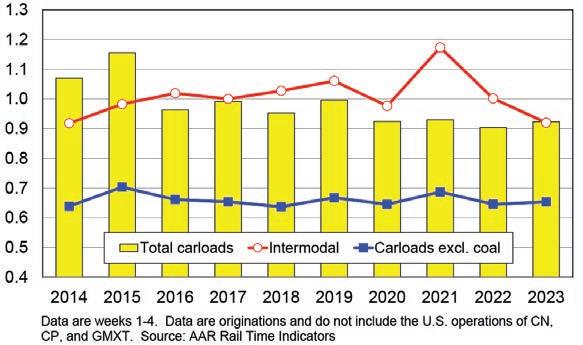

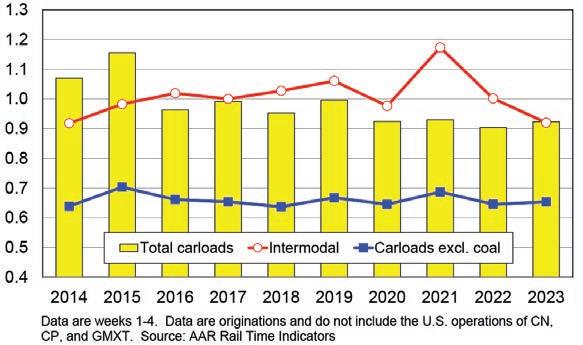

‘U.S. RAIL TRAFFIC STARTED 2023 WITH BOTH DISCOURAGING AND ENCOURAGING ASPECTS’

“On the encouraging side, total U.S. carloads rose 2.2% in January 2023,” the Association of American Railroads commented last month. “January 2022 was the worst January for total carloads in our records that begin in 1988. Still, growth is better than a decline. January 2023 was the best January on record for crushed stone and sand, in part due to growth in frac sand. Automotive traffic, though not yet back to pre-pandemic levels, grew a solid 13.4% in January. Carloads of coal grew 4.6% thanks in part to restocking at power plants, while carloads of petroleum products were up 12.3% and were the highest in 20 months. Grain carloads were the second-highest for a January (behind 2021) since 2011. All told, 12 of the 20 carload categories we track saw gains in January.”

Railroad employment, Class I linehaul carriers, JANUARY 2023

(% change from JANUARY 2022) Transportation (train and engine) 50,313 (+9.93%)

Executives, Officials and Staff Assistants 7,998 (+6.75%) Professional and Administrative 10,081 (+2.22%)

Maintenance-of-Way and Structures 28,205 (+2.68%)

Maintenance of Equipment and Stores

17,794 (+4.98%)

Transportation (other than train & engine)

4,854 (+4.03%)

Source: Surface Transportation Board

TRAFFIC ORIGINATED CARLOADS

4 Railway Age // March

railwayage.com

2023

Intermodal MAJOR U.S. RAILROADS BY COMMODITY JAN. ’23JAN. ’22% CHANGE Trailers 55,11780,199-31.3% Containers 864,811 921,172 -6.1% TOTAL UNITS 919,9281,001,371 -8.1% CANADIAN RAILROADS Trailers 1 0 Containers 237,329247,983-4.3% TOTAL UNITS 237,330247,983-4.3% COMBINED U.S./CANADA RR Trailers 55,11880,199-31.3% Containers 1,102,140 1,169,155 -5.7% TOTAL COMBINED UNITS 1,157,258 1,249,354 -7.4% FOUR WEEKS ENDING JANUARY 28,

Source: Rail Time Indicators, Association of American Railroads

2023

TOTAL

EMPLOYEES: 119,245 % CHANGE FROM JANUARY 2022: +6.27%

MAJOR U.S. RAILROADS BY COMMODITY JAN. ’23JAN. ’22% CHANGE Grain 96,92394,5672.5% Farm Products excl. Grain 3,2682,88513.3% Grain Mill Products 37,60437,1571.2% Food Products 25,79024,4065.7% Chemicals 121,756137,397-11.4% Petroleum & Petroleum Products42,57037,90912.3% Coal 270,383258,4304.6% Primary Forest Products 4,3384,433-2.1% Lumber & Wood Products 11,463 13,402 -14.5% Pulp & Paper Products 20,54721,784-5.7% Metallic Ores 20,92119,4667.5% Coke 13,031 12,725 2.4% Primary Metal Products 33,72534,807 -3.1% Iron & Steel Scrap 16,36415,8513.2% Motor Vehicles & Parts 53,22246,92913.4% Crushed Stone, Sand & Gravel 79,66564,97122.6% Nonmetallic Minerals 11,98713,421 -10.7% Stone, Clay & Glass Products 26,15627,641-5.4% Waste & Nonferrous Scrap 14,25513,6874.1% All Other Carloads 19,72822,001-10.3% TOTAL U.S. CARLOADS 923,696 903,869 2.2% CANADIAN RAILROADS TOTAL CANADIAN CARLOADS 320,549 271,95817.9% COMBINED U.S./CANADA RR 1,244,245 1,175,827 5.8%

FOUR WEEKS ENDING JANUARY 28, 2023

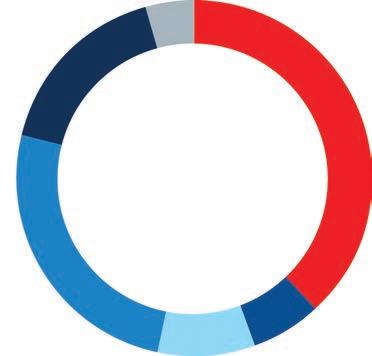

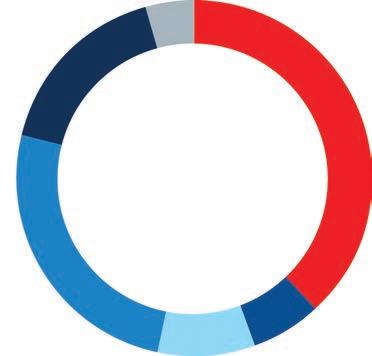

TOTAL U.S./Canadian CARLOADS, JANUARY 2023 VS. JANUARY 2022

1,244,2451,175,827

Short Line And Regional Traffic Index

TOTAL U.S. Carloads and intermodal units, 2014-2023 (in millions, year-to-date through JANUARY 2023, SIX-WEEK MOVING AVERAGE)

March 2023 // Railway Age 5 railwayage.com

JANUARY 2023 JANUARY 2022 Copyright © 2023 All rights reserved.

CARLOADS BY COMMODITY ORIGINATED JAN. ’23 ORIGINATED JAN. ’22 % CHANGE Chemicals 58,621 49,61718.1% Coal 21,744 14,76147.3% Crushed Stone, Sand & Gravel 23,932 17,90833.6% Food & Kindred Products 12,660 10,84416.7% Grain 31,417 30,822 1.9% Grain Mill Products 9,050 7,95513.8% Lumber & Wood Products 9,195 8,450 8.8% Metallic Ores 2,815 2,919 -3.6% Metals & Products 20,622 16,11228.0% Motor Vehicles & Equipment 9,832 8,14020.8% Nonmetallic Minerals 2,953 2,24031.8% Petroleum Products 2,428 1,92626.1% Pulp, Paper & Allied Products 18,929 18,481 2.4% Stone, Clay & Glass Products 13,703 10,99924.6% Trailers / Containers 38,089 41,358-7.9% Waste & Scrap Materials 12,490 10,43219.7% All Other Carloads 71,221 62,646 13.7% AILWAY GE Visit http: //bi t.ly/rai l jobs To place a job posting, contact: Jerome Marullo 732-887-5562 jmarullo@sbpub.com ARE YOU A RAILROAD OR SUPPLIER SEARCHING FOR JOB CANDIDATES? RA_JobBoard_1/3Vertical.indd 1 7/27/21 3:02 PM

Fritz Stepping Down as UP Chief Executive

JUST WHEN YOU THOUGHT THINGS WERE GETTING REALLY INTERESTING IN THE RAILROAD INDUSTRY, along comes another hedge fund trying to grab hold of a Class I, turn it upside down and shake it violently, hoping current leadership falls out.

This latest Wall Street-induced drama has strong shades of hedge fund TCI’s cancelled bid to take over CN in 2021 and replace thenCEO JJ Ruest with former CN and Union Pacific COO Jim Vena, 63, during the Canadian Pacific vs. CN battle to acquire Kansas City Southern (which CN lost). This time it’s Soroban Capital Partners, which in a 43-page presentation to UP’s Board of Directors, said Vena should replace Chairman, President and CEO Lance Fritz immediately. UP countered by revealing an “active leadership succession planning process” that has been under way since March 2022.

This battle, however, is a bit different than the CN saga. Soroban said, at least for now, it’s not looking for a proxy fight. It merely wants to replace Fritz with Vena.

“Following discussions between the Board and Mr. Fritz regarding the path for identifying Union Pacific’s next CEO, in March 2022 the Board engaged a leading outside consultant and subsequently formed a task force of directors composed of each of the Board committee chairs in November 2022,” UP said in a Feb. 26 announcement. “The Board is seeking a CEO with a strong track record of success and expertise across safety,

operational excellence, enhancing and driving customer service, innovation, employee culture, and sustainability. The Board is focusing the process on highly qualified candidates both within the industry and adjacent industries to identify a CEO capable of leading the company for a long-term tenure. The Board expects to name a successor who will assume the position in 2023.”

UP added it “has considered shareholder input and will continue to do so. The Board has been actively engaging with Soroban Capital Partners since 2017. In recent conversations, Soroban indicated it intended to move discussions to a public level. The Board decided it is in the best interests of all shareholders to provide a public update on its ongoing succession process and expected timing.”

In “moving discussions to a public level,” Soroban, which holds an approximate $1.6 billion stake in UP, pulled no punches excoriating Fritz and portraying Vena as a savior who will deliver “roughly $18 EPS and a $400 stock price by 2025” at UP. Under Fritz, a 22-year UP veteran who assumed the CEO post in 2015, “UP has repeatedly and significantly failed to reach its potential,” Soroban said.

Borrowing from TCI’s now-closed CN playbook, Soroban said UP “has the best rail franchise in North America. Despite this, under current leadership, UP has been the worst–performing Class I railroad, ranking the worst in every key railroad operating

metric: safety, volume growth, revenue growth, cost management, EBIT growth and total shareholder return. Key constituents have understandably lost confidence in Lance Fritz’s ability to lead the company. Shareholder returns have been the worst in the industry.”

There’s much more: “Employees are disgruntled: Among all S&P 500 companies, UP is rated by employees as the worst place to work and has the lowest employee CEO approval rating (ranked 500th out of 500 in both). The company is not delivering on its commitment to customers, and the Surface Transportation Board has singled out UP as providing the worst service among the Class I railroads. The U.S. economy needs an efficient rail network to flourish, as railroads are the lifeblood of the U.S. economy. UP, one of the largest and most interconnected transportation assets, has the most inefficient rail network, which has exacerbated the U.S. supply chain crisis. The environment is negatively impacted, as UP is not fulfilling its potential as a decarbonization enabler. Lance Fritz has continually failed to meet the annual incentive compensation targets set by the Board. Simply put, UP is not reaching its potential as North America’s best Class I railroad. Management’s poor track record results in the company not reaching its full earnings power and trading at a meaningful discount to its Canadian railroad peers and other high-quality industrial companies, thus significantly impairing shareholder value creation.”

It appears that UP is trying to call Soroban’s bluff, just like CN did—successfully—with TCI, eventually installing Tracy Robinson as CEO. “The Board is grateful to Lance for his unwavering leadership, dedication and oversight in driving our company forward over the past eight years as CEO,” said Michael McCarthy, Lead Independent Director of the Board. “Lance created an environment that has allowed Union Pacific to make a measurable impact with our customers, communities and employees alike. He has capably led our company during a time of significant challenge and change, positioning Union Pacific to deliver long-term sustainable value for shareholders and customers. We are immensely grateful to have Lance’s continuing leadership and support and know he will ensure a smooth transition.”

6 Railway Age // March 2023 railwayage.com Industry Outlook

– William C. Vantuono Union Pacific

Lance Fritz, UP

SEPTA: New Alstom LRVs

Southeastern Pennsylvania Transportation Authority (SEPTA) last month awarded a contract to Alstom Transportation, Inc., for 130 new Citadis™ light rail vehicles, with an option for up to 30 more. The base order is valued at approximately $714 million. The move—part of SEPTA’s Trolley Modernization program—will replace the Authority’s existing fleet, which has served riders since the 1980s. The contract follows the Request for Proposals (RFP) release in May 2022. The new LRVs will be longer and have higher capacity to move more riders, according to SEPTA, which noted that they will feature low floors and ramps; wider pathways; audio and visual messaging systems; and designated open space for wheelchairs, walkers, strollers and bicycles. Deliveries are expected to begin in 2027 and wrap up by the end of 2030.

WORLDWIDE

Zurich, Switzerland-based ABB has reached an agreement to sell its Power Conversion division to ACBEL POLYTECH INC. , a designer and manufacturer of switching power supplies, for $505 million in cash. The transaction is subject to regulatory approvals and is expected to be completed in second-half 2023, the company said. ABB said it acquired the Power Conversion division, formerly LINEAGE POWER, as part of the GE INDUSTRIAL SOLUTIONS acquisition in 2018, and the division is not core to ABB. It generated revenues of roughly $440 million and income from operations of approximately $50 million in 2022, “with a clear focus on the North American market,” according to ABB. Upon closing the transaction with AcBel Polytech Inc., ABB said it expects to record “a small non-operational book gain in income from operations on the sale.”

NORTH AMERICA

Chattanooga, Tenn.-based BOHR ELECTRONICS is supplying CSX with fully furnished electrical cabinets—AC and HVC cabinet shells with new and remanufactured components—for its GP40-3 locomotive rebuild program. “We’re excited that we can again partner with CSX to support this overhaul,” said Bohr Electronics CEO Dan Marks, who last fall took over leadership of the ALDERMAN ENTERPRISES company, which manufactures and remanufactures electrical and electro-mechanical locomotive parts and components. “These Bohr-reengineered electrical cabinets will offer CSX reliable motive power for years to come.” In a related development, Bohr Electronics in April 2022 purchased K&L ELECTRONICS, a locomotive electrical component repairer and supplier based in Searcy, Ark.

The CANADIAN GOVERNMENT has issued an RFQ (Request for Qualifications) for the High Frequency Rail (HFR) project for the Québec City-Trois-Rivières-Montréal-Ottawa-Peterborough-Toronto corridor. “The purpose of the RFQ is to identify and qualify up to three top candidates who will be invited to participate in the Request

for Proposals (RFP) process, anticipated to begin in summer 2023,” Canada’s TRANSPORTATION SAFETY BOARD (TSB) said. “The procurement process will help select a private developer partner to work in collaboration with VIA HFR, the newly created subsidiary of VIA Rail, to design and develop the HFR project.” The RFQ, the next step following the Request for Expressions of Interest that opened in March 2022, launches the formal procurement process. It includes, according to TSB: “the context and features of the HFR project (e.g., current challenges in the corridor, purpose of the project, and objectives); the procurement process, including the evaluation criteria regarding how proposals will be evaluated, security requirements for candidates, funding support for proposal development during the RFP process, and key principles of the commercial agreement for the execution phase; the key players in the project (e.g., VIA HFR, private developer partner, VIA Rail, Government of Canada) and how they will work together; and project outcomes that the private developer partner will be expected to meet or exceed (e.g., shorter journey times, more frequent departures, more reliable service, etc.).”

March 2023 // Railway Age 7 railwayage.com MARKET Alstom

ContactPatriotRail | | MultipleinterchangeswithClassIrailroads Closeproximitytocustomers 24/7CustomerService 1.855.955.RAIL(7245) PATRIOTISABEST-IN-CLASS,premiershortlinerailoperatorpartneringwithcustomerstomeet theirtransportandbusinessneedsthroughflexible,customized,andsolution-drivenstrategies. Offeringreliablerail,storage,transloading,andotherancillaryserviceexpertisebuiltonthenonnegotiablecorevalueof safety,Patriotisaone-stoplogisticsstrategicadvisor,supporting customerswithcapitalandoperationalplanning,costreduction,anddedicatedserviceexcellence. Principalshippersanchoringeachline Locatednearmajorhighwaystoefficiently servetransloadingmarkets patriotrail.com MCVR GCW FSR RNA MSCI MSO NDW GS GET Patriot RailHQ YOURPREMIERRAILPARTNER RailLocations RailServices DSRR VRRC ISW EWR KTR KJRY DTR PRY WBRY |

NAPOLEON, DEFIANCE & WESTERN RAILROAD

Railway Age’s 2023 Short Line of the Year is the Napoleon, De ance & Western (NDW), a railroad that has gone from “worst to rst” with character and grit, nearly $13 million in recent public and private investment, and now with a bright business outlook.

“On behalf of the Patriot Rail team, we deeply appreciate this recognition across all short lines in the United States,” Patriot Rail President and CEO John E. Fenton said. “Not long ago, the NDW faced bleak abandonment, but with the strong support of so many stakeholders building on the nancial

commitment of the Ohio Rail Development Commission (ORDC) and the Federal Railroad Administration (FRA), we have revitalized this railroad. e new NDW and the bene ts it will deliver to customers and communities in Ohio exempli es what can be accomplished everywhere with dedicated partnership and public/private investment in short line railroads.”

NDW traces its roots back to the Wabash Railroad, established in 1855 to ful ll the vision of Indiana and Ohio business leaders to form an unbroken railway connecting Toledo, Ohio, with the Mississippi River. e Wabash served an important role during the

Civil War hauling troops, food and supplies, and subsequently survived the Great Depression and both World Wars. Known as the “Heart of America,” it served as a key economic driver for the Midwest.

Later in the 20th century, divestment, abandonments and deferred maintenance devastated the line, leading to the unfortunate distinction as the “Worst Railroad in America.”

“ e exceptionally degraded tie conditions and worn rail resulted in trains moving at a walking speed and o en derailing three times on a single run,” according to Patriot Rail Vice President Robert Turnauckas.

March 2023 // Railway Age 9 railwayage.com

Short Line of the Year

&

Napoleon, Defiance

Western

Short Line of the Year

Today, NDW’s 58.2 miles of right-ofway runs from Woodburn, Ind., to Liberty Center, Ohio, interchanging with Norfolk Southern at Woodburn and CSX at Deance, Ohio. It handles primarily aggregates, chemicals, food products, plastics, lumber, pulpwood and particleboard.

In September 2022, NDW became part of Jacksonville, Fla.-based Patriot Rail Company, a er Patriot acquired short line holding company Pioneer Lines.

NDW’s prior owners forged partnerships with multiple stakeholders and especially the ORDC, enabling multiple grants to put the short line on a path to restoration and further investment. More than $9.5 million in public and private grant investment— including a 2020 Consolidated Rail Infrastructure and Safety Improvements (CRISI) award of $4.1 million from the FRA— covered the replacement of 29,000 ties and 13 miles of rail on the 29-mile Woodburnto-De ance alignment.

“ is award from Railway Age underscores the power of partnerships,” ORDC Executive Director Matthew Dietrich said. “With NDW’s vision and willingness to commit the necessary resources to make critical infrastructure improvements, we established a win-win successful partnership for the bene t of the railroad, their customers and employees, our communities, and the state. is is a well-deserved honor, and we look forward to continuing the partnership into the future to rebuild the NDW’s entire line.”

e now-completed CRISI grant and other investment enabled upgrading NDW’s Woodburn-De ance segment from FRA excepted track to Class 1 safety status, allowing the railroad to operate longer trains at two-to-three times previous speeds to better serve customers. NDW, once a contender for the highest derailment rate of any rail line in the U.S., has achieved zero reportable derailments and zero reportable incidents on the rehabilitated alignment since the completion of the project in July 2022.

With an improved railroad, NDW revamped its marketing strategy to grow current customer carloads and attract new business. NDW forti ed strategic relationships with state and local economic development agencies and started new conversations with current customers to rebuild con dence in the line.

“ e NDW means a lot to Campbell’s Soup,” said Gavin Serrao, Regional Logistics Manager for Campbell’s Soup Napoleon. “ e CRISI project completed last year meant a lot to us in terms of having e cient and timely deliveries of our cars and it also opened up a lot more future opportunities for growth.”

An improved online presence and a media blitz at each milestone of the reconstruction helped to create excitement about the railroad, according to NDW. Strategic engagement plans began to draw new business to the line, while

jobs in the community.”

“NDW’s commitment to helping customers meet their needs and investment in revitalizing the rail services illustrates their dedication to transforming the railroad industry,” TKI Executive Vice President Russell Sides said. “We are proud to partner with the NDW and Patriot Rail as we work together to safely and e ciently deliver essential nutrients to farmers, and we look forward to our continued partnership.”

TKI and APG investments, coupled with renewed line con dence, are expected to drive an 18% year-over-year increase in NDW carloads in 2023.

“ ere’s still work to be done,” Fenton said. “ e rst CRISI award was a great outcome, and we found an amazing partner with the ORDC. Together, we look to nish the job and improve the remainder of the line.”

ORDC’s current pending CRISI request with NDW would bring the De ance-toNapoleon segment up to FRA Class 1 track status, elevating safety, e ciency and capacity.

town halls ampli ed NDW’s commitment to the community and highlighted services the railroad could o er to local businesses. “All of these e orts showed immediate results,” Turnauckas noted. “Last year, Tessenderlo Kerley, Inc. (TKI) broke ground on a new multimillion-dollar fertilizer plant, and APackaging Group (APG) announced plans to construct a $49 million, 800,000 square-foot facility along NDW; both are slated to create more than 150

“Short line railroads such as the NDW help drive the economy in every part of America, creating jobs, protecting the environment, improving safety, and reducing the burden of heavy freight on highways,” Fenton added. “At Patriot Rail, we will continue to leverage the deep rail expertise of our team to provide outstanding service to our customers. e entire short line rail sector looks forward to the opportunity to build more choice, resiliency, and sustainability for rail shippers in states across the nation through the same kind of dedicated public-private investment partnership that made the NDW Woodburn-to-De ance transformation such a success.”

10 Railway Age // March 2023 railwayage.com

NDW achieved zero FRA-reportable derailments and incidents on its rehabilitated right-of-way.

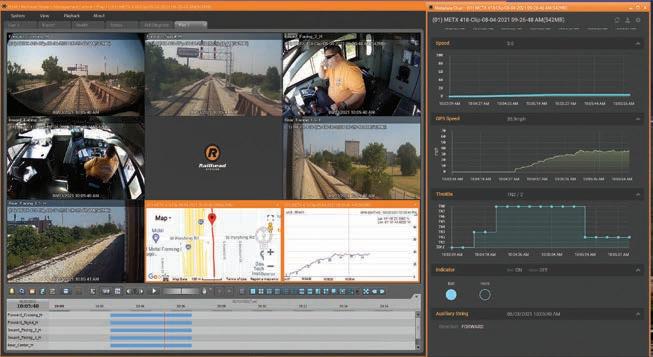

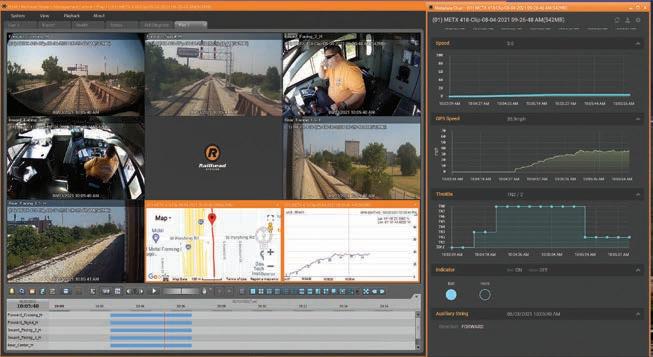

LET RAILHEAD DATA GUIDE YOUR WAY

Railhead’s Fleet Wide Tracking software and video solution easily integrates and synchronizes with other on-board systems to aggregate data in an easy-to-use back office. Whether the goal is to capture fuel usage, gather event recorder data or capture video, Railhead can help your railroad improve safety and save money with our scalable and modular approach.

DRIVE EFFICIENCY

TECHNOLOGY RH-UG6W-75DC KE-6VGLED Locomotive Control Stand Light LED Headlight & Ditch Light LET RAILHEAD LIGHT YOUR WAY LOCOMOTIVE LED LIGHTS KE-NBLL Locomotive Number Board LED Locomotive LED KE-MCC 30 Watt Bayonet LED Replacement for Cab Light 800.235.1782 www.railheadcorp.com sales @railheadcorp.com TO LEARN MORE

WITH

Sustainable solutions to power your railway

EMD® Joule GT38H Hybrid

EMD Joule SD40JR Battery Electric

Progress Rail provides industry-leading exibility for use of bio and renewable diesel. The family of EMD® Joule Battery-Electric locomotives is the broadest available and comes as newly constructed locomotives or as modernizations for your existing eet. We offer battery capacities from 2.4 up to 14.5 MWh (the most available in the industry) all tailored to meet your railway’s operation. And hybrid battery-electric / diesel con gurations equipped with EMD or Cat® engines are just around the corner.

When it comes to sustainable solutions, we’ve got you covered

230008

We keep you rolling.

EMD Joule GT38JC Battery Electric

ARCELORMITTAL INFRASTRUCTURE CANADA RAILWAY

The ArcelorMittal Infrastructure Canada (ArcelorMittal) Railway in northern Quebec has earned Railway Age’s 2023 Regional Railroad of the Year award. Launched in 1960 and owned by global steelmaker ArcelorMittal, it is an independent system that operates 260 miles of single track. The railroad links the Mont Wright iron ore mine to PortCartier with a branch to the Fire Lake iron ore mine, and includes 20 bridges and five tunnels following rock slopes

and rivers. Some 50% of the main line is curved, with a maximum curvature of seven degrees. The maximum loaded grade is 0.40% while the maximum empty grade is 1.34%. Its busiest section tops 85 million gross tons.

Each year, ArcelorMittal Railway hauls approximately 26 million tons of iron ore concentrate and 15 million tons of raw ore as well as supplies for the mine and timber for a third-party sawmill. For several years, a combination of long (210-car) and short (160-car) trains were used, but since 2022, only long trains are

used. Consequently, six 210-car trains now leave every 1-1⁄2 days for the northern mining complex to haul back iron ore concentrate. Each carries 27,000 tons, for an average ratio of 9,000 tons per locomotive (two at the head end and one at the rear).

ArcelorMittal Railway runs 1,260 railcars out of a fleet of 1,323—whose average age is more than 40 years—with an availability of 95% and utilization of 94%. ECP braking is used on its railcars and distributed power on consists.

The availability of its fleet of 37

14 Railway Age // March 2023 railwayage.com

©ArcelorMittal Infrastructure Canada

locomotives has also increased by 10% in the last year, thanks to a focus on reliability and a robust maintenance program, ArcelorMittal says.

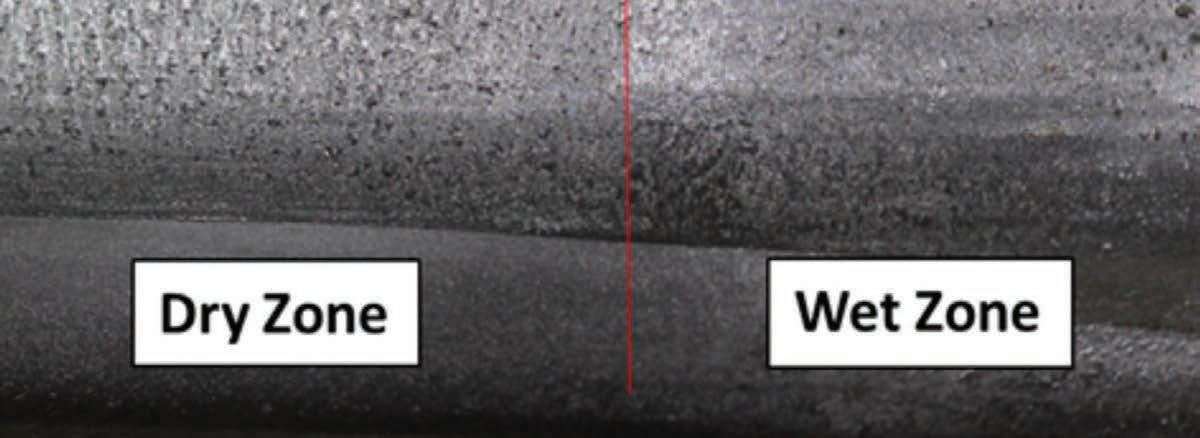

The railroad’s rolling stock shops perform all services, including wheel reprofiling. Average wheelset life is 750,000 miles, it reports, with some reaching more than 1 million miles.

Despite a challenging environment, the railroad’s overall track condition “is considered excellent by various internal and external audits,” according to ArcelorMittal. “A very limited number of slow

orders enables a constant and optimized cycle time.”

The railroad’s maintenance-of-way program includes what it describes as “intensive” rail grinding and lubrication as well as annual replacement of more than 2,400 tons of rail and 25,000 ties in a tight window—mostly during the summer before the freezing season.

ArcelorMittal says it promotes “a culture based on empowerment and increased risk assessment from frontline workers, who use various prevention tools to reduce exposure to risk, such as pre-work analysis, equipment inspection forms, clear operational procedures, and post-trauma matrixes.”

“We are deeply honored to receive this award, which highlights the outstanding work of our teams to operate a worldclass railway,” says Michael LaBrie, General Manager of ArcelorMittal Infrastructure Canada. “Above all, we must emphasize a remarkable performance in health and safety to protect our workers, which has translated into zero lost-time injury since January 2021. We are all very proud to see our efforts recognized by the major players in the North American rail industry.”

Increased technology integration for its railroad is at the heart of ArcelorMittal’s vision for the future, the company

says. The railroad is currently collaborating with the RAIL Center of Excellence at Cégep de Sept-Îles, a technical college in Quebec, to develop a predictive-maintenance database for its rail infrastructure. ArcelorMittal uses a hi-rail vehicle to inspect track twice weekly. Outfitted with Pavemetrics’ automated technology, millions of high-resolution, threedimensional images of the rail and its components are sent to the database. The college analyzes the data and produces a report that railroad employees can view on a dashboard. GPS positioning shows where defects are located, allowing employees to predict component lifespan and to intervene in a targeted manner, boosting safety and reliability.

Additionally, ArcelorMittal recently bought from Railhead Corp. a new remote monitoring and 4K video recording system for its railroad, providing real-time monitoring and access to locomotive data.

March 2023 // Railway Age 15 railwayage.com Regional of the Year

ABERDEEN CAROLINA & WESTERN RAILWAY

Railway Age in 2023 recognizes Aberdeen Carolina & Western Railway (ACWR) with a Short Line Honorable Mention. Since its purchase by Robert Menzies in 1987, ACWR has grown from 34 miles of track, with one locomotive and two customers, to 150 miles of track today, with 36 locomotives and more than 20 customers that manufacture or distribute such commodities as plastics, poultry, dimensional lumber, wood chips, aggregate, brick, butane, ethanol and propane. 2022 served as a springboard to further growth for the central North Carolina short line.

ACWR completed the acquisition of Norfolk Southern’s Piedmont Division, which had been under a lease-purchase option by the short line since 1989. e 104-mile line between Gulf and Charlotte, N.C. consolidated ACWR’s holdings along with its Sandhills line, which connects in Star, N.C., and runs through Pinehurst to Aberdeen, where ACWR interchanges with CSX.

Also in 2022, the short line invested $10 million on multiple track expansion and improvement projects and saw rail tra c increase 7% (approximately 500 carloads) from 2021. It attributed the success to:

• Tripling the size of its Midland, N.C. Downtown transload site. Heni Transportation operates it, transloading chemicals.

• Construction and August launch of the Midland Logistics Park. is 70-acre development includes three additional properties for rail customers, ranging from four to 15 acres, and is anchored by ACWR’s Midland Transload Yard, which can accommodate 200 railcars for transload, storage, distribution of raw materials, and nished goods, with space and equipment to handle many bulk transload commodities as well as truck self-transload operations. It is equipped with a central scale house for tenant use. Several major plastic distributors have begun operations, consolidating their Charlotte operations in Midland.

e project was a collaborative e ort of ACWR, its customers, and the North Carolina Department of Transportation (NCDOT) Rail Division, which provided several grants.

• Strong shipments from existing customers and addition of multiple new ones. Among the new: Charlotte Pipe and Foundry, which announced in 2020 a move from downtown Charlotte to a new $325 million plant on 428 acres in Oakboro, N.C. ACWR’s maintenanceof-way and construction crews supported building the plant’s rail infrastructure. Once operations begin this year, it is projected to add 3,000 new carloads, both inbound and outbound rail tra c, per year to ACWR tra c.

ACWR is now at work on six additional projects: two are passing sidings to

accommodate unit train tra c to improve the overall uidity of the line, and four involve ACWR-owned properties, totaling 350 acres.

e short line is preparing four properties for rail-served development through partnerships with six county economic development directors and the North Carolina Railroad, which is providing “site readiness” grants. Additionally, using a $27 million CRISI grant awarded by FRA in 2020, ACWR will begin work this year on track upgrades and infrastructure improvements, allowing for increased speed, capacity and safety.

Rounding out 2022, ACWR unveiled corporate train F-unit locomotives purchased from NS (pictured above), which feature a dynamic new paint scheme. Lionel has replicated these locomotives and several ACWR corporate railcars for model train enthusiasts and the public.

“Years from now, we will look back on 2022 and remember this as the year we built the foundation for our next generation of growth,” ACWR Director of Business Development Paul Hoben said.

16 Railway Age // March 2023 railwayage.com

Chris Aumen

NEXT-GEN MOTIVE POWER

Transitioning from steam to diesel took more than 20 years. Moving to zero emissions will probably take much longer.

BY WILLIAM C. VANTUONO, EDITOR-IN-CHIEF

Be it battery-electric, hybrid, biofuel, hydrogen fuel cells, or improvements to the tried-andtrue diesel-electric, the motive power market is glowing with clean, green technologies. e most widely used terms are “decarbonization” and “zero emissions.”

“Railroads are working diligently to develop lower and ultimately zero-emission technologies that deliver an even more sustainable future,” the Association of American Railroads notes. “Railroads are taking active steps to further reduce emissions associated with current locomotive technology and move toward lower and zero-emission technologies that are still in research, development and demonstration phases. Numerous railroads have active demonstration programs for alternative fuel locomotives that hold great promise as tomorrow’s lower or even zero-emission solutions.”

All of this will take time—lots of it. e railroad industry has been around for nearly 200 years (167 of them documented in the pages, print or electronic, of Railway Age).

e diesel-electric locomotive, which will remain the industry’s primary source of motive power for many years to come, rst

appeared in 1920. Will railroad historians in the 22nd century consider 2023 (or thereabouts) a milestone year, the beginning of a major move away from the diesel-electric? Or will another 10 to 20 years of development and testing, followed by 10 to 20 transitional years, push back that date in history?

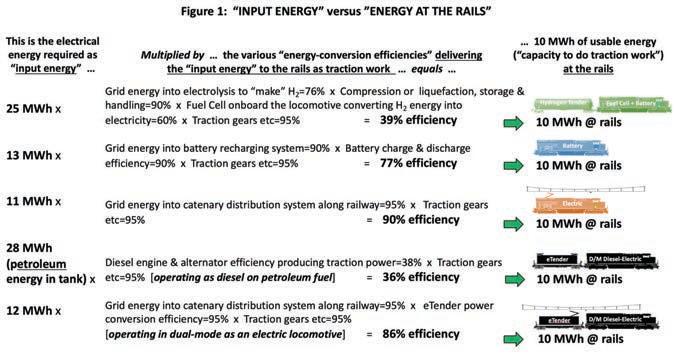

In this article, three professional engineers from HDR o er their perspective (p. 19). Elsewhere in this issue (p. 41), veteran railroad locomotive specialist and Railway Age Contributing Editor Mike Iden o ers his views (including the bene ts of electrication), based on decades of experience.

We’ve also talked with Progress Rail, Wabtec and Cummins about the evolving market for alternative propulsion.

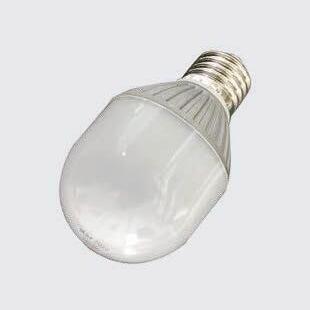

PROGRESS RAIL

Progress Rail, a Caterpillar company, is embracing all forms of alternative propulsion technologies. e brand that got its start as Electro-Motive Corporation in 1922 and as EMD (Electro-Motive Division of General Motors), jump-started dieselization in 1941 with the FT. Today, Progress Rail sees an evolving market for its EMD® product line, including battery-electric, hybrid and HFC (hydrogen fuel cell) propulsion, as well as

diesel-electric locomotives fueled with biodiesel blends, renewable diesel, a hydrogen/ diesel blend, or even straight hydrogen. e possibilities are vast, and there is no “one size ts all” solution.

“We are proactively developing cutting edge solutions—focusing on our customers’ interests and their ability to obtain funding for additional investments,” says Senior Vice President of International Sales, Technology & Marketing Paul Denton. “ ere are several options along the path of emissions reduction that are emissions-friendly and do not require railroads to replace their investment in diesel engines.”

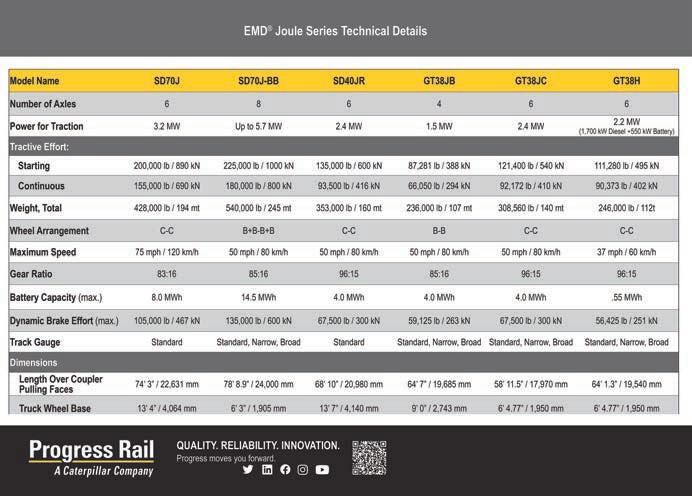

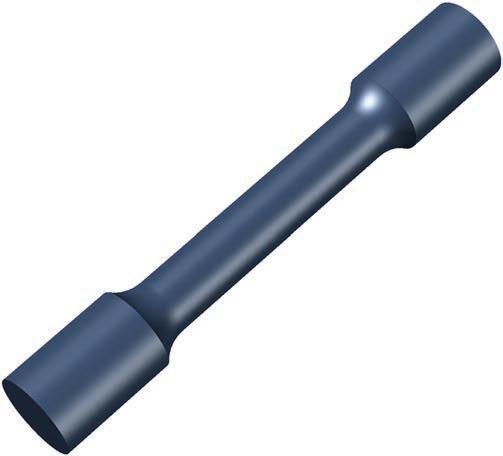

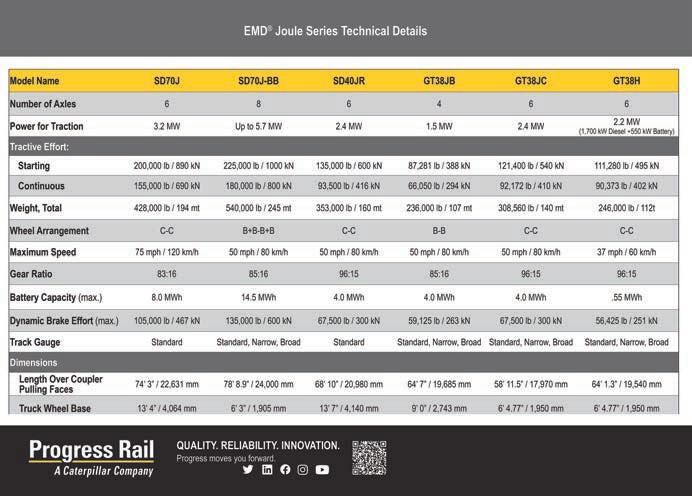

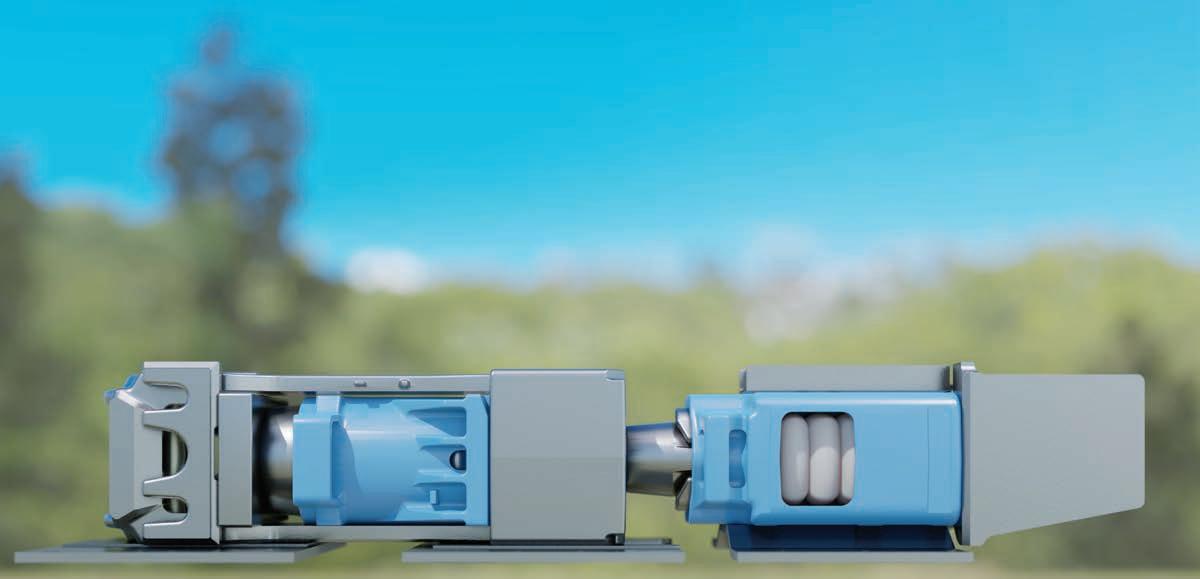

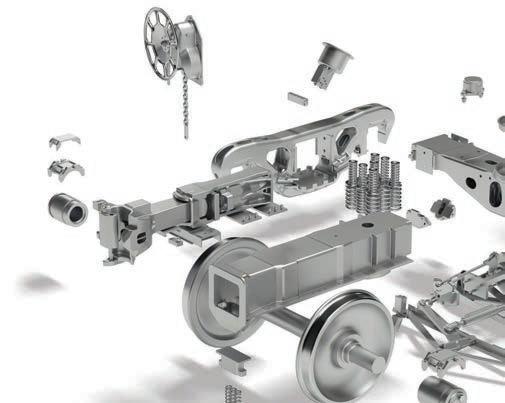

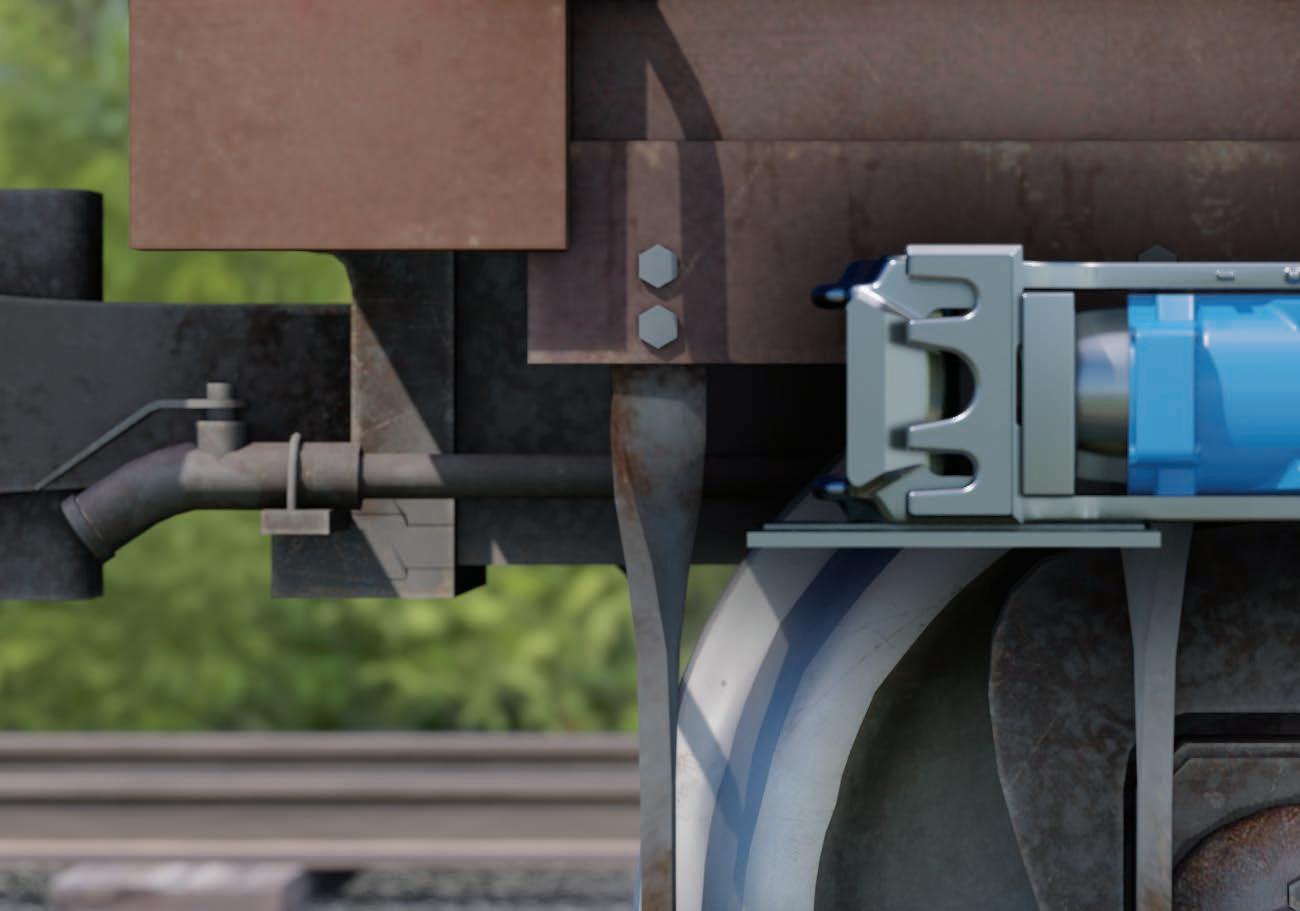

e crown jewel of Progress Rail’s alternative propulsion initiatives is aptly named the EMD® Joule. Available in ve con gurations, new or repowered (“R” nomenclature)—SD70J (6 axles, 8.0 MWh maximum battery capacity); SD70J-BB (8 axles, 14.5 MWh); SD40JR (6 axles, 4.0 MWh); GT38JB (4 axles, 4.0 MWh); GT38JC (6 axles, 4.0 MWh)—these units all feature regenerative braking for battery recharging (see chart, p. 18, for additional technical speci cations). Customers can specify what they desire in MWh, up to the maximum rating. e modular EMD® Joule Charging Station

March 2023 // Railway Age 17 railwayage.com

Progress Rail

Left to right: Progress Rail EMD® GT38H hybrid, SD40JR Joule battery-electric, and GT38JC Joule.

provides stationary charging in 700- and 1,400-kW con gurations.

In Southern California, BNSF will be taking delivery next year of up to four SD70Js with charging stations for continuous operation. eir 8 MWh of storage capacity will make them “the most powerful battery-electric locomotives in North America.” BNSF’s acquisition is funded in part by CARB (California Air Resources Board) and EPA grant funding.

At 14.5 MWh, the SD70J-BB o ers the largest known battery capacity in the industry. BHP Western Australia Iron Ore will be testing two beginning early next year. e test will include regenerative braking (also called “energy capture”) charging using the rail network’s natural topography to reduce overall power demand. On the downhill run to BHP’s Port Hedland export facility from the mine in the Pilbara, the locomotives will capture energy from regenerative braking and use it to help power empty trains back to the mine. FMG/FFI (Fortescue Metals Group) will take delivery this year of two units for its Australian iron ore mining operations, which are currently under manufacture at the Progress Rail facility in Sete Lagoas, Brazil.

Brazil’s Vale S.A., a metallurgical and mining rm, was among Progress Rail’s initial partners for its rst battery-electric locomotive. “In conjunction with Caterpillar, our engineering teams designed a locomotive for that application,” says Senior Vice President of Engineering Mike Ramm.

“ at project, which resulted in the GT38J, a meter-gauge/low clearance version of the SD40JR, started our journey into batteryelectric,” he adds.

e newest iteration of the Joule line is a standard-gauge unit for Paci c Harbor Line, currently testing at MxV Rail in Pueblo, Colo. “Battery locomotives are ideal for certain railway applications,” notes Ramm. “Yard service is a perfect example, which is why PHL expressed interest to acquire the SD40JR for its operations.”

Progress Rail selected LiFePO4 (lithium iron phosphate) batteries. “When you look at battery locomotives in the industry, much of it comes down to battery chemistry and how it is being used,” says Ramm. “Do you want faster discharging/charging for highly cyclic applications, or something that is more stable? Batteries have a nite life, like in cell phones. When you repeatedly charge and discharge them, battery life goes down, which is also true for locomotives.”

Hybrid propulsion, which uses a combination of diesel engines and battery, is another solution from Progress Rail. Brazilian logistics/transportation rm Rumo Logística will take delivery early this year of two EMD® GT38H intermediate-power locomotives, the rst hybrid locomotives in revenue freight service. ese use modular architecture to accommodate various energy sources, retain the capability of their diesel counterparts, and are capable of both regenerative and external battery charging. “We see hybrid locomotives

as one of the bridge technologies to helping customers conserve fuel and reduce emissions,” says Ramm.

For longer-distance line-haul, high-power applications, HFC shows promise, provided its limitations can be managed. “A hydrogen fuel cell vehicle is, at its core, an electric vehicle with electric traction motors and a battery system,” explains Director of Advanced Energy Michael Cleveland. “ e battery system is recharged or supplemented by the fuel cell, which takes in hydrogen from onboard storage and extracts oxygen out of the air. It is analogous to a battery. One of the limitations of fuel cells is they do not perform well with load uctuations. A freight locomotive can go from Notch 8 to idle in a couple of minutes, for example. e way to mitigate that is to couple the fuel cell with a battery system that can manage load uctuations.”

“We are taking what we are learning with batteries and incorporating it with fuel cells. Hydrogen contains about 20% of the energy by volume of diesel fuel, so an external hydrogen tank, a tender, will be needed to support longhaul operations, which is essential to the Class I’s,” notes Cleveland. “Hydrogen has some challenges, but the fact that the only ‘exhaust’ is water makes it an attractive option.”

In December 2021, BNSF, Chevron U.S.A. Inc., and Progress Rail entered a memorandum of understanding (MOU) to demonstrate an HFC locomotive. e goal is “to con rm the feasibility and performance of hydrogen fuel for use as a viable alternative to traditional fuels for line-haul rail,” Progress Rail said. “Hydrogen has the potential to play a signi cant role as a lower-carbon alternative to diesel fuel for transportation, with hydrogen fuel cells becoming a means to reduce emissions.”

“As a division of Caterpillar, we are deeply involved in the energy transition across our entire business. Our investments in technology—from hydrogen, to battery, to electric, and even hybrid locomotives—are being jointly developed with our parent company,” comments Denton. “When we couple our powertrain innovations to our existing technology stack for fuel savings, such as Talos energy management and our Nitro Suite of yard and network optimization decision support tools, we contribute signi cantly to our customers’ ability to operate more eciently and safely, while helping them achieve their ESG goals.” (Continued on p. 21.)

18 Railway Age // March 2023 railwayage.com

FOCUS – MECHANICAL

TECH

RAIL FLEET DECARBONIZATION OPPORTUNITY: WHAT DOES IT MEAN FOR YOU?

BY MARCIN TARASZKIEWICZ,

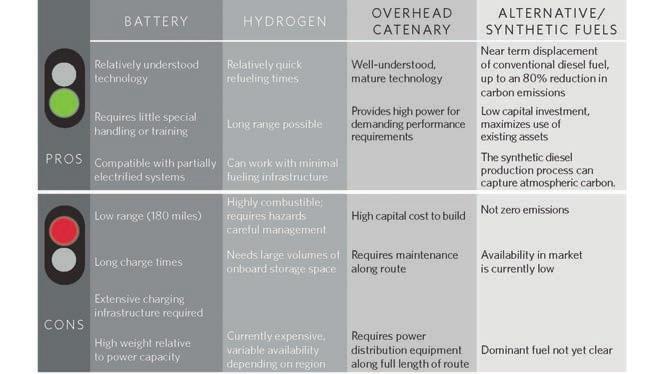

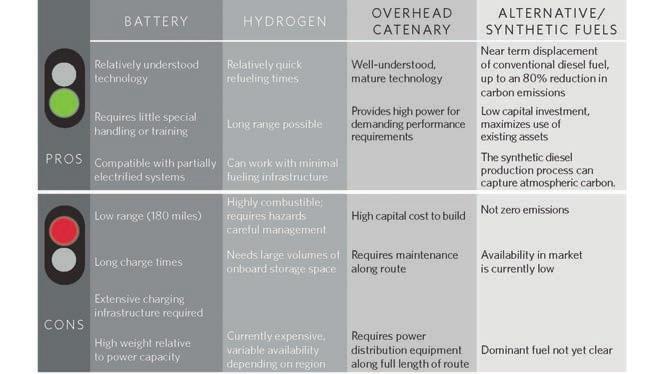

It’s an exciting time for rail fleets and operations. Society’s decarbonization efforts around the globe have created impetus in the rail industry to further reduce its carbon footprint. Technology is improving to make zero emissions a realistic goal. Yet, there is no one-size-fits-all answer to transitioning rail operations to achieve net zero emissions.

Passenger and freight railroads have different mixes of diesel vs. electric locomotives and infrastructure. Different parts of the country have various enabling electric power infrastructure and each rail organization has a unique state of readiness for change. Despite the challenges, now is the time to start planning for the future of rail decarbonization in your fleets.

WHY ZERO EMISSIONS?

The awareness of human impact on the earth’s environment is at an all-time high. There is considerable pressure in all sectors to minimize or fully eliminate greenhouse gas emissions. Though rail is a cleaner mode of transportation than traditional trucking, freight and passenger railroads are not immune from scrutiny of their efforts to reduce or eliminate greenhouse gas emissions.

There are four main reasons why railroads should seriously consider converting their rail fleets to zero-emissions equipment:

•Societal Shift: There has been a push for zero-emissions across transportation and other industries, including rail. Investors, clients and the general public are pushing to accelerate the pace of this change.

•Perception: Although rail produces only 2% of U.S. greenhouse gas emissions, all transportation modes risk being perceived as a “dirty” option so long as carbon-based fuels are widely used.

• Mandates: Several U.S. states have already implemented or are considering zero-emissions mandates or targets for all land transportation, including railroads. This will force rail operators to plan for decarbonization of their equipment fleets.

• Equity: Communities near maintenance facilities, rail yards and the rightof-way are disproportionally affected by emissions from locomotives. Reducing and eliminating emissions will not only aid in reducing greenhouse gases but also will improve local air quality and health in these communities.

RAIL DECARBONIZATION TECHNOLOGIES

There are several approaches to decarbonizing rail fleet operations. One of the oldest means of powering rail vehicles without tailpipe emissions is external power via overhead catenary. This form of power delivery is mature and well understood, but it carries several significant disadvantages that make this a less desirable choice for many rail operations.

Newer technologies, such as batteries and hydrogen fuel cells, offer the promise of emissions-free on-board power with no additional infrastructure requirement along the right-of-way. However, neither of these technologies is yet fully mature, and both currently have limitations that would preclude their use in some applications.

Many long haul or freight operators are looking to interim technologies, such as hybridization, alternative fuels or a combination to reduce emissions until zeroemissions technologies can fully replace current combustion power plants.

Using battery-electric locomotives in freight rail yards and ports is a good example of an interim technology. While battery-electric locomotives fall short on range for heavy long-haul freight, they can reduce emissions in urban areas where many such rail yards exist.

There are many factors that affect the feasibility of each technology—from operating requirements such as speed and payload capacity to environmental conditions including temperature and topography. The local availability of energy sources, either electrical power or hydrogen, can also be a deciding factor in the selection of an appropriate source of power.

When considering the benefits and drawbacks, sometimes the best solution is a combination of two or more technolo-

gies, depending on the existing conditions, terrain and other factors.

An example of a successful selection of zero-emissions technology is San Bernardino County Transportation Authority’s Zero Emissions Multiple Unit train, or ZEMU for short. This is a trainset design for commuter train service in the Los Angeles area, the first of its kind in North America to be a hydrogen-battery hybrid vehicle and zero emissions.

While battery power was initially considered the preferred technology for this train, operation simulations showed that this was not an ideal choice for this train primarily due to service range requirements for this vehicle. After an analysis of the service requirements against the capabilities of existing zero-emissions technologies, it was decided that a hybrid system consisting of both batteries and hydrogen fuel cells was the optimal approach to meeting service requirements.

Key Considerations: Supporting Infrastructure and Utilities: Of course, moving from diesel to any other fuel source has ramifications beyond simply purchasing a different locomotive. Planning must consider the supporting infrastructure, facilities and maintenance practices, as well as recharging or refueling strategies and cost modeling for electricity rates.

Infrastructure Considerations: Integrating new technologies into a fleet will likely require existing facilities to be modified— or new facilities built—to support the new fueling or charging requirements. Charge or fueling times (or down time), routes, charging and fueling infrastructure and

TECH FOCUS – MECHANICAL March 2023 // Railway Age 19 railwayage.com

P.E., WILL KIRBY, P.E., AND CHRIS RAND, P.E., HDR

operations should be modeled and understood with new technologies. For battery-powered trains, it’s not a 1:1 conversion. Charging takes more time than refueling, so organizations often need to purchase more electric vehicles than their combustion fuel counterparts. With hydrogen-powered trains, safety considerations for fueling infrastructure will dictate allocation of space adjacent to the right-of-way that ensures safety while meeting fueling requirements.

Staff Considerations: It’s best to involve staff early in the process so they understand the technology and provide feedback about how changes can be supported in maintenance and operations. Staff can help evaluate how new tasks can be made easier, more productive and safer for the organization, assess configuration of equipment, and facilitate the transition to new operations.

Energy Sourcing Considerations: Operating electric locomotives requires significantly more electricity than a diesel fleet. This means that planners should coordinate very early with the local utility, and possibly the applicable regional transmission organization (or similar), to ensure that the facility can access the required amount of power without disrupting the regional grid.

A thorough study and modeling process of a charging strategy should be conducted to determine the load that will be required from the grid. It should also consider the use of off-peak charging and facility

optimization when possible. If the utility is not able to provide the necessary quantity of power without significant infrastructure upgrades, the rail organization can explore installing its own energy generation. Recent legislation has extended tax credits for renewable generation, making this an attractive option for many.

For hydrogen-powered vehicles, the availability of nearby hydrogen production sources is vital. In some areas, hydrogen is already or will soon be produced on a scale that will ensure an abundant and easily obtainable supply. However, many areas still do not have local hydrogen production facilities. Since land transport is currently the main means for transporting hydrogen from its production source to the end user, this might not be a practical, reliable or cost-effective option for many rail operations at this point. Trucking emissions could also offset the benefits of eliminating emissions from the rail equipment.

TIPS FOR PLANNING SUCCESS

Rail organizations envisioning a decarbonized future can set themselves up for success with a robust planning process. Best practices include:

Perform service simulations to confirm viability: Implementing new technologies always comes with some risk. It’s important to select the right technology to meet operating service goals. There are a lot of factors that influence the energy requirements, and the best way to determine those requirements is to perform simulations via modeling. The results will help you

select the right propulsion technology for your operation.

Engage stakeholders to identify issues: Main stakeholders include regulators, utilities, first responders and the public along the right-of-way. A constant dialog with regulators is critical to communicate expectations and requirements, particularly for safety, to avoid surprises and ensure a timely deployment of new technology trains into revenue service. First responders need to understand the key features of the technology that impact how they handle the equipment in an emergency. The general public should understand that the technology is safe for people living along the right-of-way and appreciate the community benefits of decarbonization.

Involve staff: Staff will need new procedures to support different technologies as well as training for operations and maintenance. New technology equipment requires new processes and new skills. Early engagement and sufficient training time is key for true buy-in and workforce success.

MOVING INTO THE FUTURE

The rail industry has an opportunity to accelerate its decarbonization efforts. The key to capitalizing on this opportunity is effective planning and preparation so that the right technology is selected for the job. In the U.S., there is now funding available to help rail organizations transition to zero-emissions technology.

Plans built by looking at current zeroand low-emission technology opportunities, forecasting what the future will look like, understanding gaps, and then creating a customized strategy will set up railroads to implement a successful fleet decarbonization shift.

Marcin Taraszkiewicz, P.E., is HDR’s rail and transit vehicle technology lead. Will Kirby, P.E., is a transportation sustainability leader at HDR. Chris Rand, P.E., is a railroad facilities program manager at HDR.

20 Railway Age // March 2023 railwayage.com

TECH FOCUS – MECHANICAL

WABTEC

“We’re trying to create options for our customers,” says Wabtec Executive Vice President and Chief Technology O cer Eric Gebhardt. “We’re looking at biofuels and renewable fuels. We have our FLXdrive battery locomotive, and also hydrogen. On top of that, we’re driving more e ciency through diesel engine modi cations—5% lower fuel consumption, 5% less carbon, etc.”

Wabtec currently has more than 40 locomotives operating with various blends of fuels, for example, 20% biodiesel and 80% renewable diesel. What’s the di erence between biodiesel and renewable diesel? “Biodiesel is close to diesel, but with more waxes and para ns and other elements,” Gebhardt explains. “It’s chemically di erent. Renewable diesel is hydrogenated, so it’s a pure form of the diesel molecule. In fact, it’s actually a little too pure, so it requires additives to improve viscosity. We’ve approved up to 5% biodiesel and up to 30% renewable diesel for our locomotives, and we’re trying to get to 20% biodiesel and up to 100%

renewable diesel. Both types come from the same feedstocks.”

FAME (Fatty Acid Methyl Ester) is the generic chemical term for biodiesel derived from renewable sources. It is used to extend or replace mineral diesel and gas oil used to fuel on- and o -road vehicles and static engines. FAME consists of acids created during the transesteri cation of vegetable oils and animal fats to create biodiesel. ese high molecular weight oils and fats react with short chain alcohol in the presence of a catalyst, usually potassium hydroxide, to produce lower molecular weight esters.

“We need to understand what engine parts would have to be changed out burning these di erent types of fuels—things like hoses and seals,” explains Gebhardt. “We want to understand the deterioration factors, the impact on fuel injection systems, for example, to stay within current emissions compliance standards. Fuel injectors have very precise passages. We need to make sure we can reach the NOx and particulate matter requirements. We’re working with our customers through

eld tests, inspecting these units to make sure we know what the maintenance intervals need to be. We’re less concerned about the metals (internals). We don’t think any of those would be a large concern, with the right lubricity (the measure of friction reduction) and viscosity (the measure of a uid’s resistance to ow) additives. We’re paying close attention to how elastomers and hoses, the rubber components, will interact. We have a program with the Class I’s, and we don’t see any reasons why we won’t be successful with this. Longer term, it’s going to be important for our customers to understand the availability and cost of these fuels. Some parts of the U.S. have signi cant subsidies—California, for example. e price points might vary in di erent parts of the U.S.”

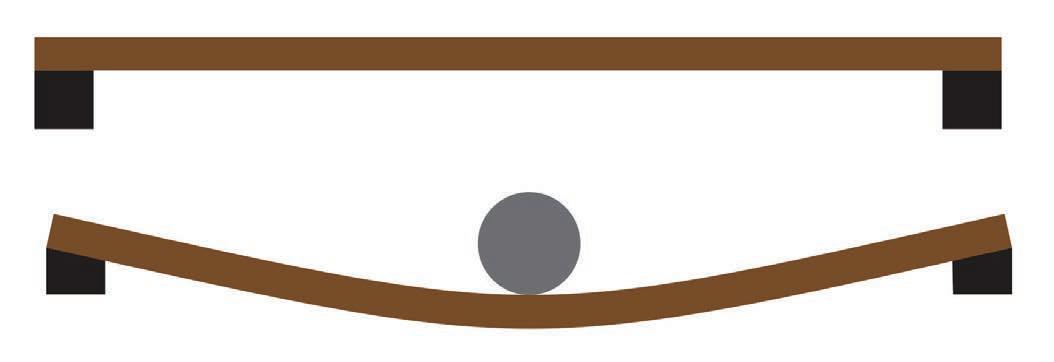

e FLXdrive program is progressing to the next level. e 2.4 MWH “version 1.0” successfully tested with BNSF between Barstow to Stockton, Calif., registering an 11% fuel savings operating in a consist with two dieselelectrics, vs. a three-unit diesel-electric. “We now have two new iterations,” says Gebhardt.

TECH FOCUS – MECHANICAL March 2023 // Railway Age 21 railwayage.com

(Continued from p. 18.)

TECH FOCUS – MECHANICAL

“ e rst is what we call the FLXdrive 2.0, with 7 MWh, the rst two of which are shipping at the end of this year to Australia for a trial with BHP Western Australia Iron Ore (in the same trial as Progress Rail’s SD70J-BB).” is will be followed by the FLXdrive 2.5,

which replaces the NMC (nickel-manganesecobalt) batteries with GM’s Ultium NCMA (nickel-cobalt-manganese-aluminum) technology manufactured by Ultium Cells LLC, a joint venture of GM and LG Energy Solution. “We’re utilizing the Ultium designed for

the Hummer truck,” says Gebhardt. “We’ll ruggedize it. e batteries have individual cells; a module consists of a stack of cells. Several modules create a pack. One weighs more than a ton, but they have a lot of energy capacity. We’ll take the Hummer pack and

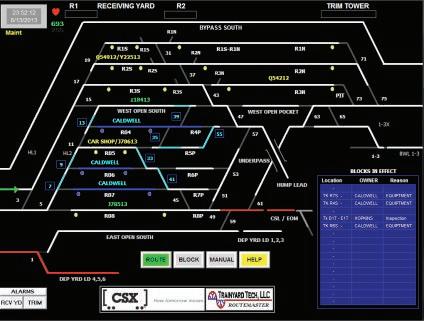

CLASSMASTER™

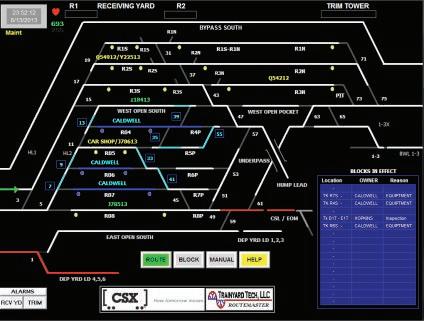

The Hump Yard ProcessControl System in 22 classification yards across the US and Canada featuring:

• AutomaticCalibration

• Graphic Playback

• Realtime Hump List Display

• Pinpuller Scoreboard Display

• Automatic Report Generation

• Loggers –Daily, Event and I/O

• Electronic Track Blocking

• AEI Integration and List Verification

• Remote Diagnostics

•

ROUTEMASTER™

The NX Control System in 12 locationsproviding Entrance–Exit andTrain Control Operation for Receiving,Pullback and Departure Yards featuring:

• NX Route Control – Receiving and Pullout Yards

• 4G Wireless Control

• Track Circuit-Less Shove Operation

• Realtime status of all yard devices

• Logger –Daily,Event and I/O

• Individual Switch Control

• State-of-the-art Lightning Protection

• Graphic Playback

INNOVATIONS

, switch and track occupancy detection using wheel detectors. Provides data essential for maintaining a High Performance yard. sophisticated reporting tool to simplify troubleshooting, analyze yard. Reviewing Up-to -the-minute historical performance.

22 Railway Age // March 2023 railwayage.com

Wabtec

Wabtec Hydro Locomotive concept with hydrogen fuel tender.

stack 42 inside the locomotive, and that gets us to 8-plus MWh.”

“It’s not how much power you have when you start or end the route,” says Gebhardt. “It’s the fact that you’re regenerating the electricity. ere are parts of the route that have high standard deviation, in terms of grade. You can generate a lot of energy with a train that might have 10,000, 20,000 or 30,000 trailing tons. If you think about the 2.4 MWh hour version that one saves about 11%, with an 8 MWh unit we could save 20% or 30% on fuel usage, depending on track standard deviation.”

Wabtec’s venture into hydrogen includes HFC as well as burning hydrogen inside an internal combustion engine. e company is working with GM to utilize its Hydrotec fuel cell technology in a hybrid unit, with batteries supplying traction power. e fuel cells would be trickle charging the batteries. “ e game-changing part of fuel cells is e ciency,” says Gebhardt. “We’ll be working toward 65% e ciency, compared to 40%-42% with an internal combustion engine. Fuel

cells have that signi cant advantage, which should be achievable over the next decade or so. We have to make sure that we understand how to provide enough fuel for those fuel cells. Right now, the energy density, volumetric energy, of hydrogen is low. If we’re going to o er a main line solution, it will have a tender car. Our locomotives carry about 5,000 gallons of diesel. One kilogram of hydrogen is equivalent to one gallon of diesel, roughly, in energy content (expressed as DGE, diesel gallon-equivalent). To get that same amount would require a tender car with about 7,000 kilograms of hydrogen. at amount provides more range than 5,000 gallons of diesel. Because of the volume, we’ll need a tender. But we are operating with LNG tenders in Florida and Mexico, so we understand how to work with them, and with liquid and gaseous fuels.”

Burning hydrogen in an internal combustion engine will be similar to LNG. “We’re working with Argon and Oak Ridge National Labs on this as part of a Department of Energy grant,” explains Gebhardt. “We’re

looking at di erent con gurations to see how much of a blend of hydrogen with diesel for energy content we can get to. Our goal is to get into the 90%-plus range, to stay with compression ignition, avoiding spark plugs. Part of that has to do with what our customers are looking for. Spark ignition has shorter maintenance intervals. Compression ignition is more robust, with longer maintenance intervals. Spark ignition with hydrogen or LNG is maybe an easier solution, but it does require more maintenance.”

CUMMINS

Among the world’s largest diesel engine manufacturers, Cummins has established a major presence in the North American diesel-electric locomotive market in partnership with Siemens, whose Charger series of passenger locomotives utilize the Cummins Tier 4 QSK95 high-speed engine. Smaller variants of the QSK series are used in DMUs and freight switcher locomotives. Longterm, the company’s o cial decarbonization strategy is called Destination Zero, “which

TECH FOCUS – MECHANICAL March 2023 // Railway Age 23 railwayage.com

www. PowerRail.com Phone: 570-883-7005 Email: Sales@ePowerRail.com Proudly Celebrating 20 Years of Keeping Locomotives Running! Come see us at the 2023 ASLRRA Conference & Expo! Booth 530

TECH FOCUS – MECHANICAL

is about achieving net-zero emissions by reducing greenhouse gas (GHG) emissions and supporting customer transitions to decarbonized power,” says Innovation Lead, Industrial Markets Brian Olson.

Cummins’ alternative fuel initiatives took ight a er it purchased, for $290 million, Canada-based Hydrogenics in 2019. e company intends to become a major player in HFC, battery-hybrid and “fuel-agnostic” (hydrogen, natural gas, diesel and biofuels including HVO) heavyequipment engine technology.

“We’ve looked across our rail engine portfolio, and we think there will be unique adoption times for alternative fuels and di erent types of propulsion, whether it’s full electrication, fuel cells, dual-fuel engines, hydrogen fuel combustion or a diesel alternative equivalent,” says Freight Rail Business Manager Tyler Hodge. “Each market is going to have a di erent adoption curve associated, based largely on the infrastructure to support it, as well as the maturity and energy density of the technology. With respect to rail in general,

we still see a long runway for the internal combustion engine, or ICE—a nickname that has become quite popular.”

“Even broader than rail, we’re seeing di erent markets adopt at di erent rates,” adds Olson. “For example, the passenger car market is adopting at a certain rate vs. some of our industrial markets. Shorter, captive systems like transit routes are going to adopt technologies faster because the infrastructure challenges are easier to overcome, whether it’s battery charging or fuel cells, or even installing overhead catenary lines. In rail and some of the other industrial markets, the longer routes, especially in areas with low population, may not make sense to build out the infrastructure, and we see that evolving slower.

“Our near-term focus is making sure that products can meet the railroads’ decarbonization goals. at includes alternative fuels like HVO (hydrogenated vegetable oils, used to make renewable diesel). We recently completed a multi-year test with 100% HVO on the QSK95—a big breakthrough. We plan

The Bi-directional “Gate Gard” from Western-Cullen-Hayes, Inc

•Economical

•Easy-install,low maintenance

•Accomodates Arms to 40’ Long

to roll that out on the rest of our high-horsepower engines in the rail market.

“We’re currently testing higher biodiesel blends of up to 20% on our T4 products. at seems to be where the industry is moving. Next is a B20 blend, maybe part HVO/part diesel. We’re investing today in our current products to understand the life cycle and maintenance implications. We want to make sure that, with the repower trend in the freight market, whether it’s line haul locomotives or switchers, and the regulatory pressures that are coming from states like California, we have products that are easy to change out. It will take years for the rail infrastructure to meet the needs of hydrogen or methanol or battery, because the network is vast and disparate.”

“To replace all diesel locomotives between now and 2050, you’d really have to start tomorrow, based on their life cycle,” says Olson. “ is is why we are investing in technologies and solutions that can allow customers to buy our QSK95 today, but still have a path to a carbonneutral fuel in the future.”

-directional allows for o

The Bi-directional “Gate Gard” with Swing Away Adaper allows for a gate arm to pivot ineither direction when struck by a vehicle, returningthe gate arm to its position without the damaging rebound other spring loaded adaptersgenerate. Permits the gate armto be replaced orrepaired parallel to the road, keeping maintainers safely out of traffic.

adapters generate. r repaired ermits arm to

24 Railway Age // March 2023 railwayage.com

WESTERN-CULLEN-HAYES, INC. 2700 W. 36th Place • Chicago, IL 60632 (773) 254-9600 • Fax (773) 254-1110 Web Site: www.wch.com E-mail:wch@wch.com Engineering News: The Weekly RT&S Email Newsletter SUBSCRIBE AT: www.rtands.com/engineeringnews Get The Inside Scoop ON AND OFF THE TRACK

Freight Rail’s Digital Future Is Just Around the Bend

January 2023

By David Schaar,

By David Schaar,

Andrey Timofeev, Pallavi Kansal, Luke H. Young, and Grant Zeller

Andrey Timofeev, Pallavi Kansal, Luke H. Young, and Grant Zeller

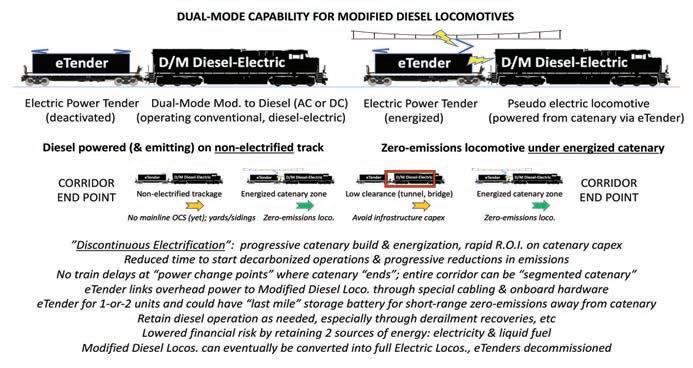

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.